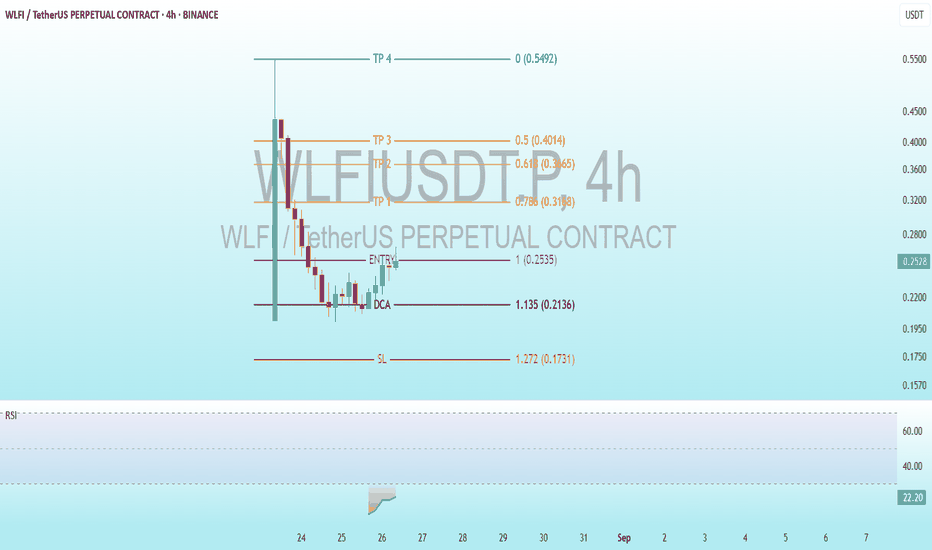

Wlfiusdtlong

$WLFI Shocking Crash & Rebound Potential Exposed!BINANCE:WLFIUSDT.P

Entry Level: Marked at 1 0.2535 0.2560 USDT, indicating the intended entry point for a long position.

DCA (Dollar Cost Averaging): Set at 1.135 (0.2136) USDT, suggesting a level to add to the position if the price dips further.

Take Profit (TP) Levels:

TP1: 0.786 (0.3198) USDT

TP2: 0.618 (0.3665) USDT

TP3: 0.5 (0.4014) USDT

TP4: 0.0 (0.5492) USDT

Stop Loss (SL): Set at 1.272 (0.1731) USDT, above the entry to limit potential losses.

The price has dropped significantly below the entry and DCA levels, suggesting the strategy may need adjustment or that the stop loss has been triggered.

Technical Indicators

RSI (Relative Strength Index): The RSI at the bottom shows a sharp decline, moving into oversold territory below 30 (23 - 24). This indicates the price may be oversold and could see a potential reversal or consolidation soon.

Observations

The take profit levels are structured with decreasing targets, indicating a strategy to secure profits as the price moves lower from the entry.

The RSI entering oversold territory aligns with the sharp price drop, hinting at a possible bounce or stabilization if buying interest returns.

Conclusion

The chart outlines a trading strategy with a defined entry, stop loss, and multiple take profit levels for a long position in WLF/USDT perpetual futures. The significant price drop and oversold RSI suggest the price may be nearing a support level, potentially offering a buying opportunity near the current price or DCA level if bullish momentum resumes.