Bitcoin: BTCUSD New Trading Realities in a 'grown-up' worldTrading Bitcoin in the new Realities of 'Mainstream'

When Reality Bites - How to Deal with it Dispassionately - or Miss up to 50% of all opportunities...trading for Adults in a grown-up world

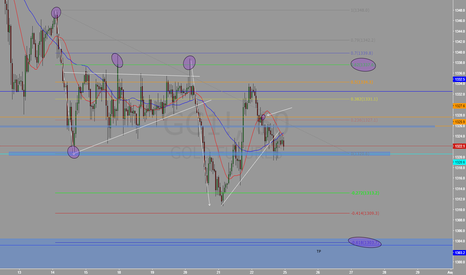

For those who like pattern spotting there have been three or four very good sell points off the Coinbase chart. Maybe 80%

of the few people who read this will have Bull hats on, are inherent, full-on bulls. Only 10 to 20% will be bears. If one or

the other we will miss 50% of all trading oppotunites, roughly. Who was looking for sell signals recently (after that RHS

failure) ? No, because most of us are bulls we're only looking for positive signals. Try to be dispassionate about Bitcoin -

that is not easy, being as we're humans. We're programmed to want to join the herd. A bison gets FOMO too, that's why he

wants inside the herd and not out. Penguins too. But we are not penguins. We need to stop acting like one. Agreed? We

need to be like doctors who will get sued for giving the wrong diagnosis, however bad that might be. The patient wants

truth not platitudes. That's how we need to view Bitcoin. If we love it too much we cloud judgement and lose trade

opportunities. So strive to be dispassionate. Or it will cost you roughly half of all opportunities. Look at the trail Bitcoin has

left...get down off your horse and look...look how good those sells were on the breaks...how the first two break and then

come back to retest the little dynamic from the underside and that's the sell with stops say 50 higher (never touched) and

then look at the third and last arrow in the sequence - the market is moving fast at this point and there is no retest this

time. And then the series of highs running right into the resistance line at 12472. Each was a fantastic near term

opportunity to mine another 1000 points minimum out of this monster, and the last 2 breaks were 2000 points - that's 6000

points in breaks in 3 days. That is 60% of total value of Bitcoin right now. How crazy is that? You NEED to be Ok with shorting

as well as going long to survive this market. You are not going to get every one, but half would have been good, very good.

And look how simple the patterns are ! That ain't rocket science is it? One single line of dynamic support (upside

doesn't really matter too much in a downtrend), we just need to get a line under the counter-rally - behaves very

differently, obviously, in a slower market at top half of chart than in fast market where patterns are obscured in the noise

more easily.

World

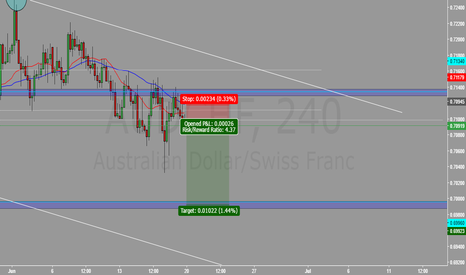

Gold like HellI'm thinking about getting short a bit higher. Maybe I want to trade for Weekly close lower. I wait to see price action around this exact level , Daily Support and see what's going on in there. Then if I see Rally or something like that plus rejection of it's highs , I will get in short. Guys , you need to know that you cannot write your strategy down , it's losing strategy , Best strategies are not exact , you have to feel them. Market is always changing , so , Dont be exact in your strategies , Add simplicity to your strategy as well. Be great observer , market is talking , you just have to listen to him.

BUY STAWKS (Part 2)Global stocks bounced as expected. Higher highs on their way.

SPX - 2150 / 2160

DAX - 10380 / 1399

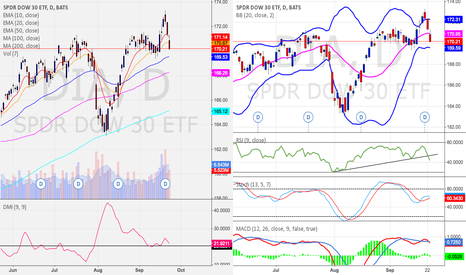

****IMMINENT STOCK MARKET CRASH AT HAND??????******STRANGE******I have not one clue about why this market is behaving the way it is right now . . . The exponential moving averages and the simple moving averages on the DIA suggest that the market is very bullish. MOREOVER, if one takes a look at the ADX indicator, the RSI indicator, the Stochastics indicator, and the MACD indicator, all of these indicators suggest a pullback on a Daily chart. HOWEVER, although the indicators suggest a pullback, strangely enough they tell a different story on a weekly chart. MOREOVER, on a weekly chart the indicators display massive divergence in this market that has been building up for SEVERAL MONTHS!! Furthermore, now that the month of October and November are quickly approaching, then perhaps one would need to consider some precaution, for it may be possible that this weekly scale divergence may unfold during the coming months . . .

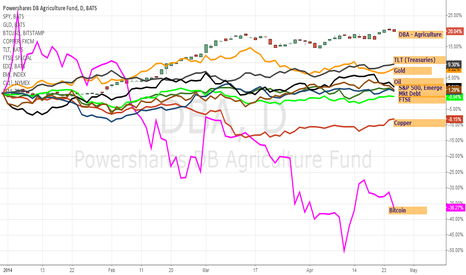

Agriculture is Outperforming EverythingAgriculture is outperforming everything: US debt, emerging markets equity and debt, US equities, FTSE, gold, oil, copper, bitcoin....pretty much everything. I'm not buying because I've got other opportunities I'm focused on, but I think this trend still has legs.

www.informedtrades.com