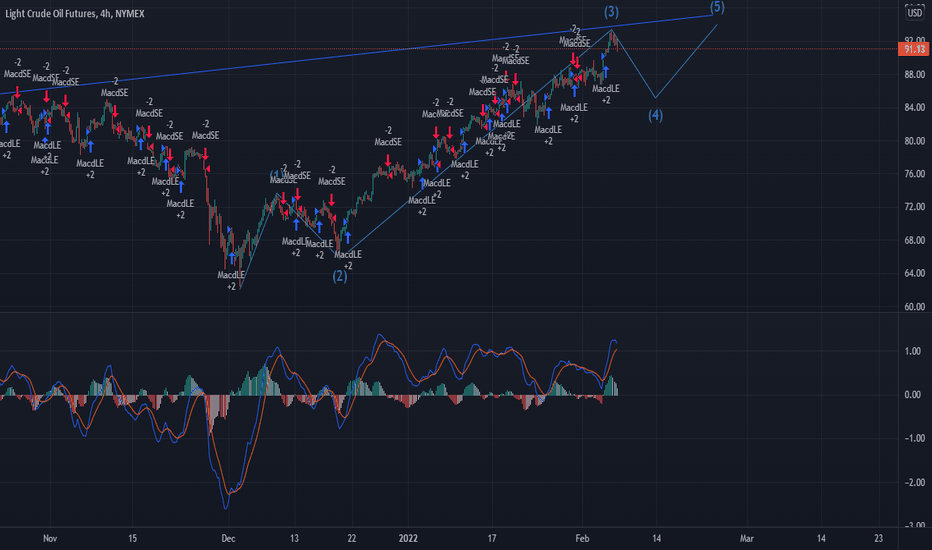

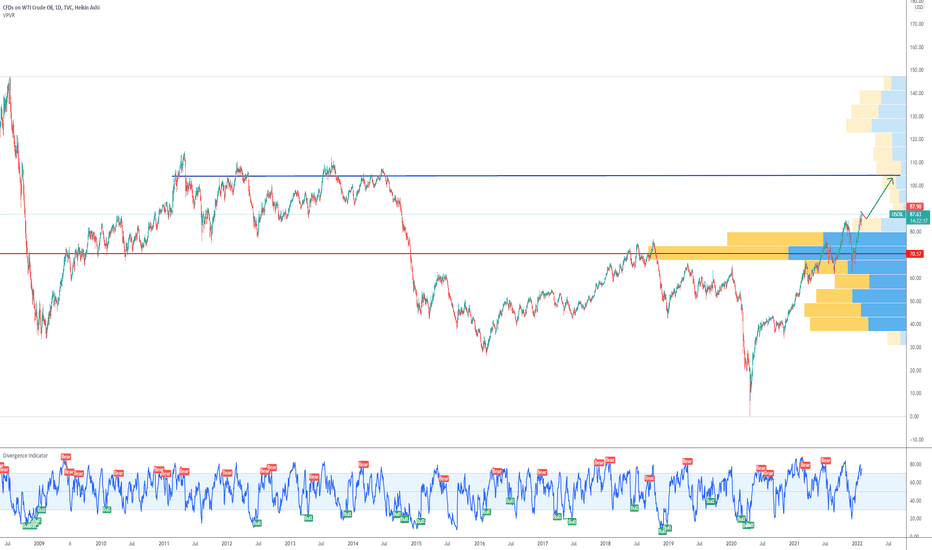

Overdue correctionWTI has been in a very long Wave 3 for almost two months, despite the lack of fundamental catalyst, we will see a correction down to $84.88 before resuming an upward trend, before demand destruction clashes with a failed breakout/start of corrective waves and oil gets genuinely into trouble again - then we can see $50s by late 2022

Wticrude

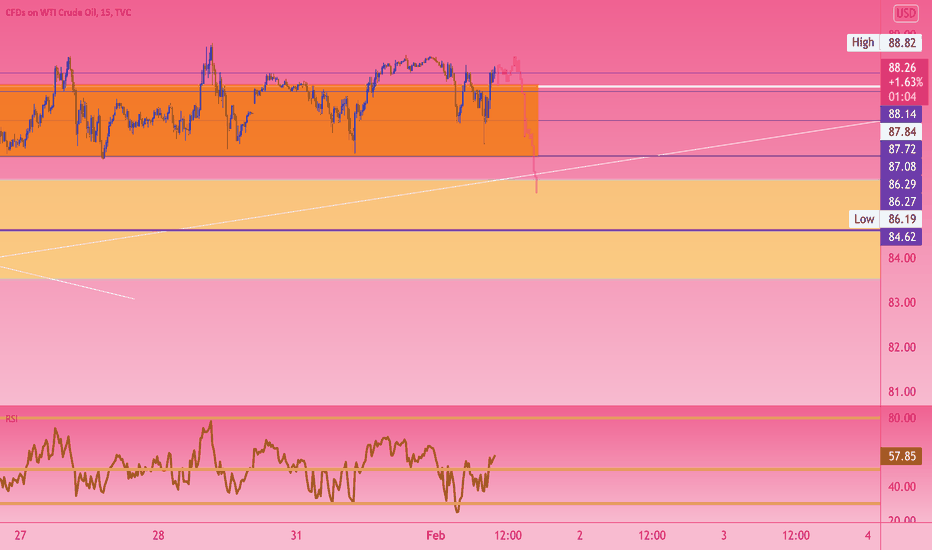

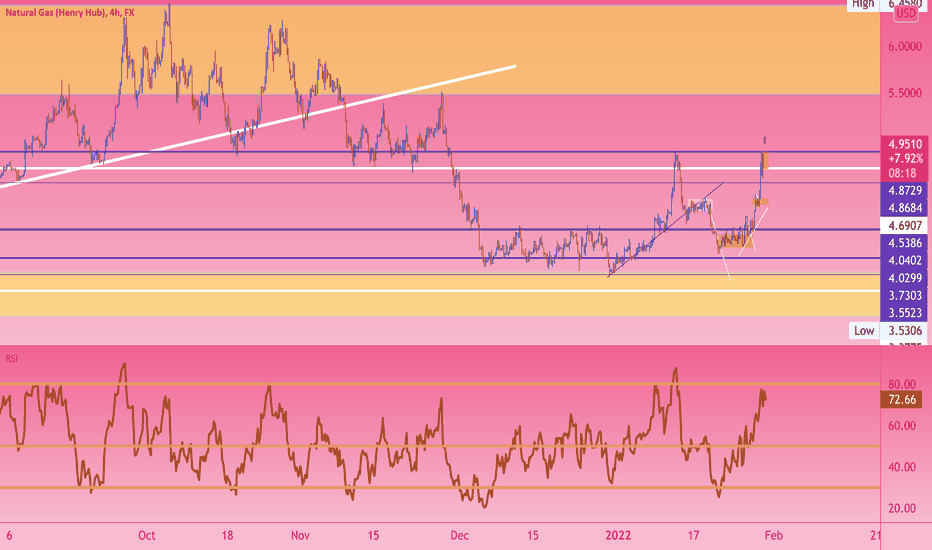

Technical analysis update: WTI oil (17th January 2022)WTI oil continues to march higher and we continue to maintain a bullish outlook on oil. Our view is supported by a combination of bullish technical and fundamental factors. Currently, we will observe whether USOIL will manage to break above the major resistance at 85.39 USD which will further bolster the bullish case for WTI oil. We would like to set a new short-term price target for USOIL to 85 USD per barrel. Our long-term price target is 90 USD per barrel.

Technical analysis - daily time frame

RSI is very bullish and due to perform crossover above 70 points (into overbought zone). We expect such a phenomenon to be accompanied by further rise in price. However, after completion of crossover we think it is likely that price will retrace lower before continuing towards a price tag of 90 USD per barrel. MACD and Stochastic are also bullish. DM+ and DM- signal bullish trend. Additionally, ADX exhibits growth which suggests that the prevailing bullish trend is gaining strength. Overall, the daily time frame is bullish.

Technical analysis - weekly time frame

RSI is bullish. Same applies to MACD and Stochastic. DM+ and DM- performed bullish crossover recently. ADX undergoes reset as it declines. Overall, the weekly time frame is bullish.

Support and resistance

Major resistance sits at 85.39 USD while major support lies at 61.76 USD. Support 1 sits at 80.81 USD and Support 2 at 78.28 USD.

Please feel free to express your own ideas and thoughts in the comment section.

DISCLAIMER: This analysis is not intended to encourage any buying or selling of any particular securities. Furthermore, it should not serve as a basis for taking any trade action by an individual investor. Your own due diligence is highly advised before entering trade.

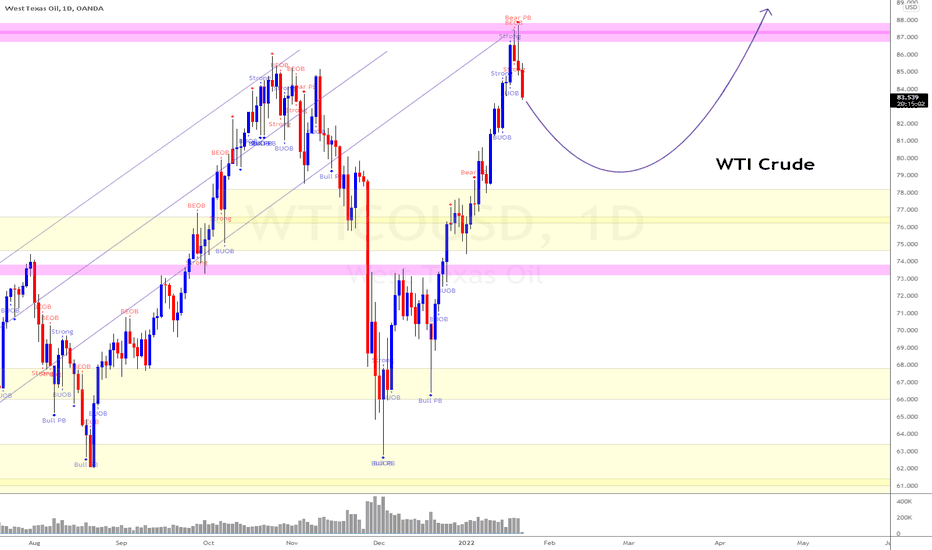

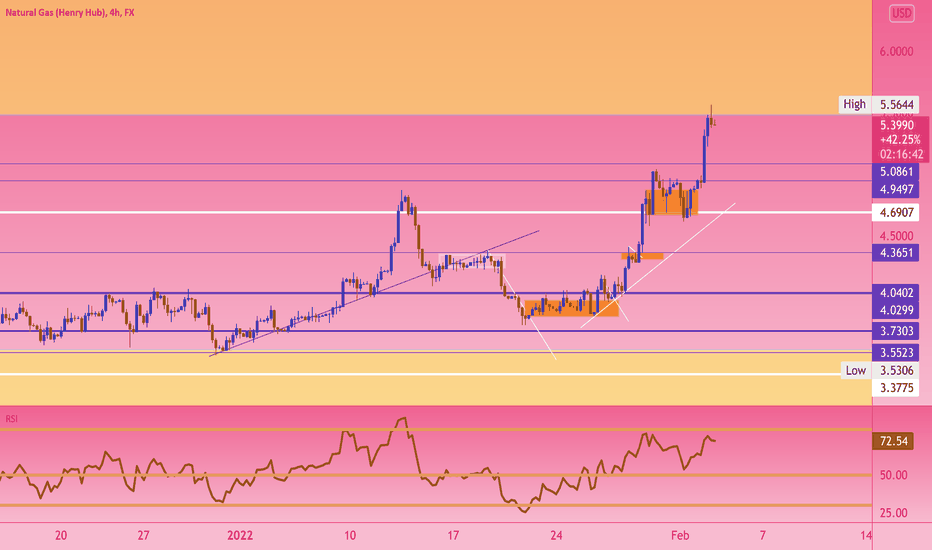

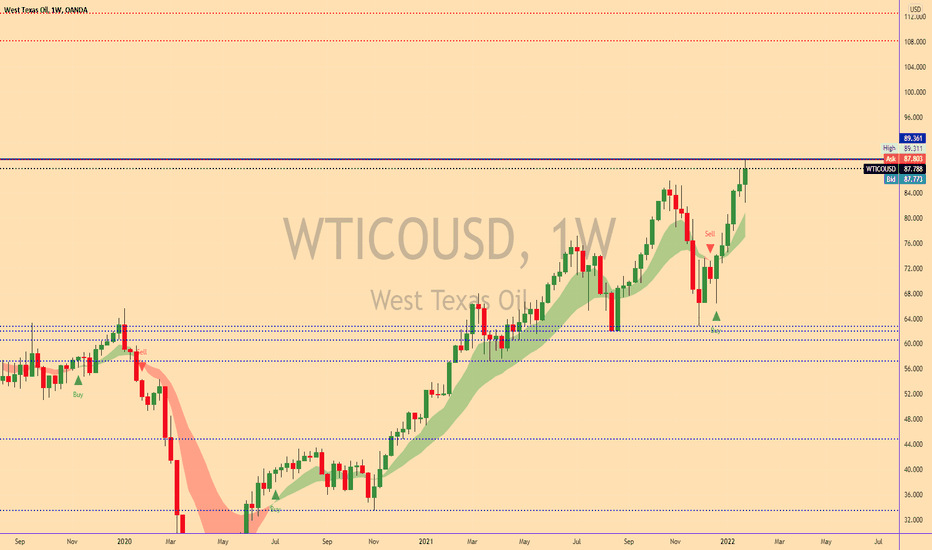

WTI Crude Oil (Precursor of the inflation is HERE)View On WTI Oil (21 Jan 2022)

We had a strong swing up to break past the prev high of $86.

Now the oil price is taking some breather and pulling back.

But I reckon the BULLish side is still in play and the current pullback will not last.

It can swing to $79 or even $75 region but one should consider buying in only.

Be patience and time it well.

DYODD, all the best and read the disclaimer too.

Feel Free to "Follow", press "LIKE" "Comment".

Thank You!

Legal Risk Disclosure:

Trading foreign exchange or CFD on margin carries a high level of risk, and may not be suitable for all investors.

The high degree of leverage can work against you as well as for you. Before deciding to trade foreign exchange you should carefully consider your investment objectives, level of experience and risk appetite.

The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose.

You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor.

DISCLAIMER:

Any opinions, news, research, analyses, prices or other information discussed in this presentation or linked to from this presentation are provided as general market commentary and do not constitute investment advice.

Sonicr Mastery Team does not accept liability for any loss or damage, including without limitation to, any loss of profit, which may arise directly or indirectly from use of or reliance on such information.

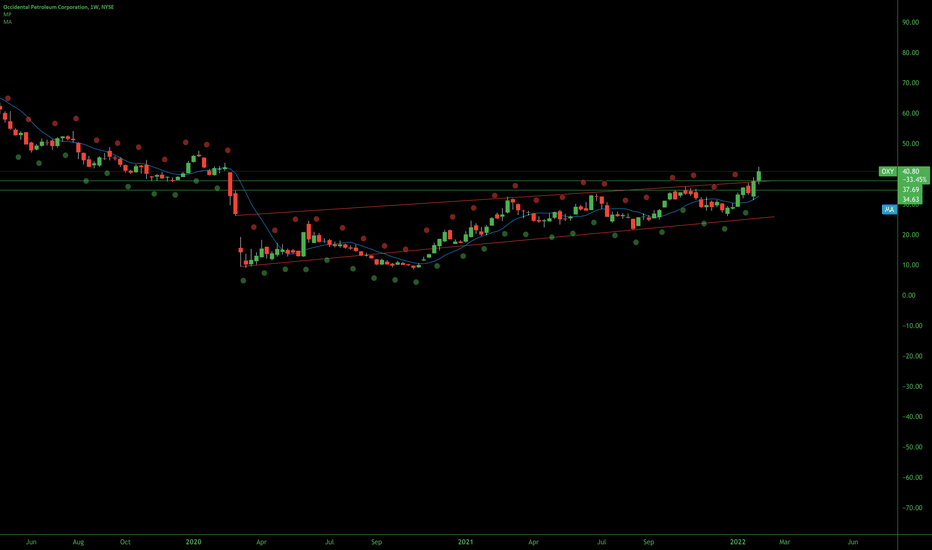

Oxy Short Oxy looks like it may have ran up and hit its head on the goal post, should take a breather here. I got some 40.00$ puts for 3/25, looking for a quick trade. Gonna cash out with anything better than a 20% gain. PS I work in The Permian Basin, we are super busy. Long term Oxy will test the break out and head higher. This is just what I'm doing, the only thing you should do is comment back if I'm right or wrong lol, do not copy this trade.

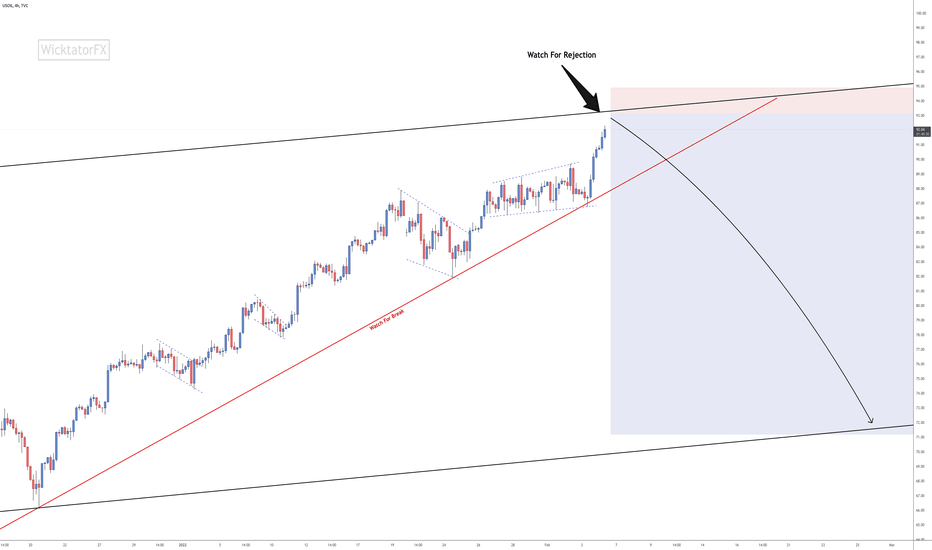

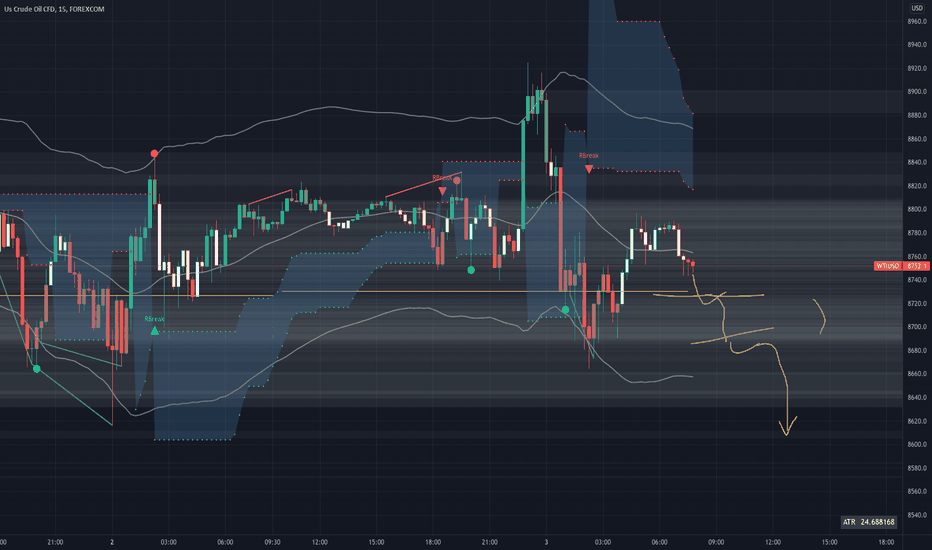

USOIL - Time For Shorts ✅Following on from our last post on USOIL, we mentioned how USDCAD is inverted correlated to USOIL and USDCAD made a particular price action that is being repeated on USOIL.

See that post below:

We are now approaching the third touch of the channel where we are anticipating a rejection.

Trade Idea:

- Watch for rejection of the channel

- Risk entry on rejection. Safe Entry on break of the ascending red trendline

- Stops outside the channel

- Targets: 82, 72, actively manage the rest if we break the channel

Goodluck and trade safe!

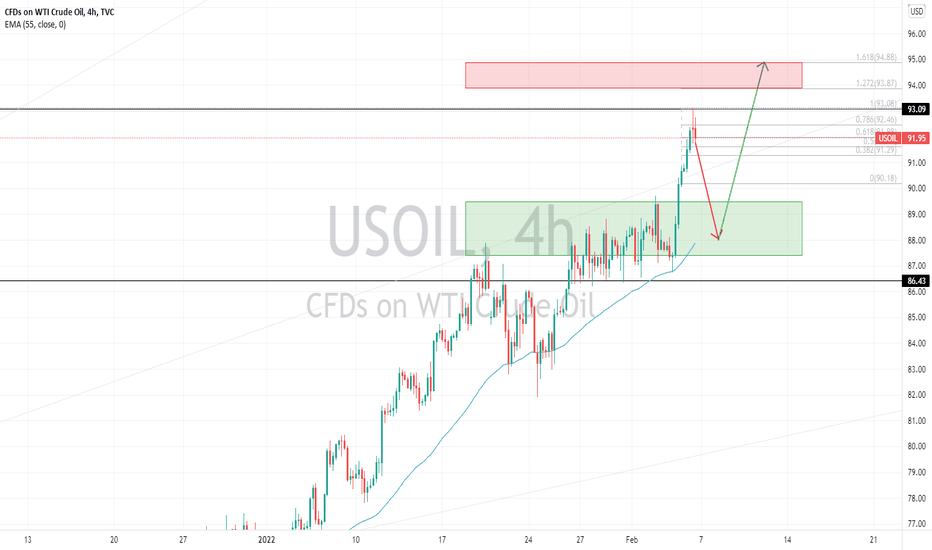

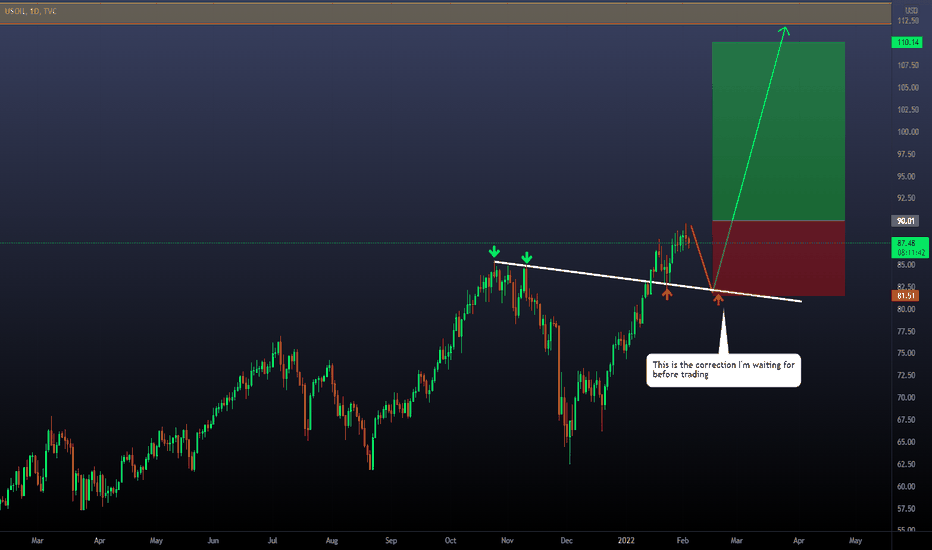

The correction I want to see before trading on USOIL This is an update on the post I made last week regarding the correction I want to see before trading (you can see the full post on the "link to related ideas")

The concept of the setup is pretty simple. The price has already behaved in similar ways in the current area in the past, and the last thing I need to observe to say "This is ready" is the correction I have defined on this chart. Of course, if this doesn't happen, then I will not be able to trade, and that's the end of the story. However, if the filter happens, I know ill be in front of a high-quality setup.

PAST SITUATIONS:

The setup is like this . If the expected correction happens, I will set pending orders on a new local high, stop loss below the correction and target on the next weekly resistance level. This setup can take around 150 to 200 days. The risk I will be taking in this situation is 3% of my trading capital.

Thanks for reading! Feel free to share your view and charts in the comments.

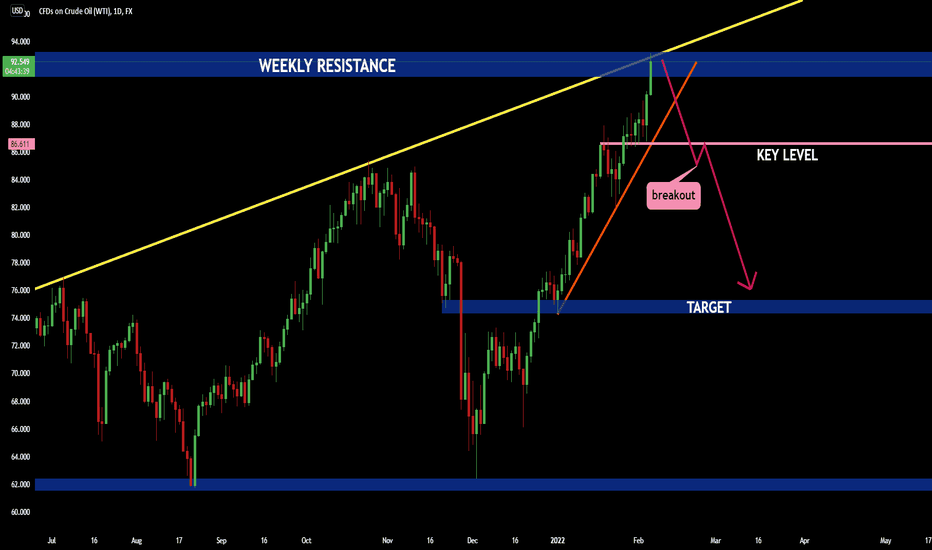

WTI Crude Oil Technical Analysis & Trade IdeaWTI Crude is currently range bound however there is indication of weakness coming into the chart. I'm looking at a potential short opportunity if we get the setup. I need to see a break and re-test of a daily key level. If we break these levels there's a decent price gap we could trade through down to a weekly key level. Not financial advice.

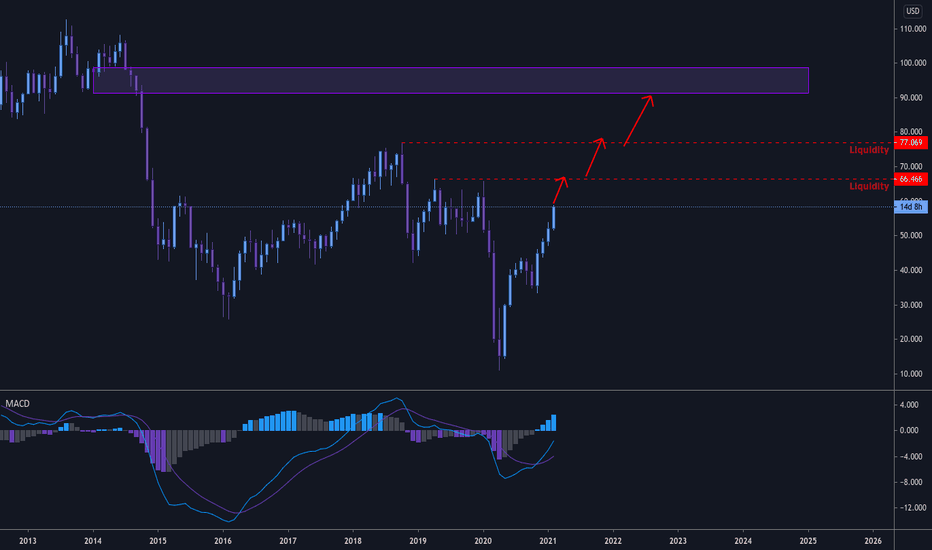

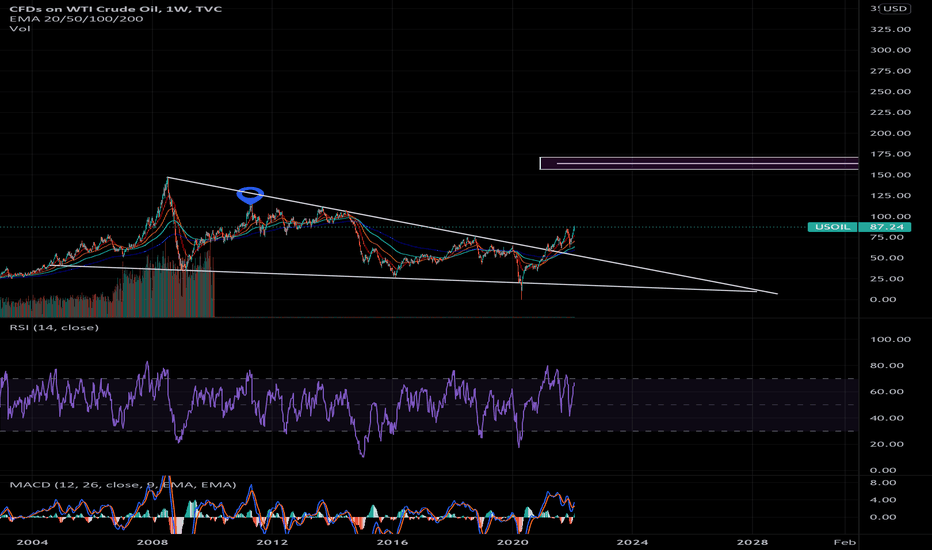

USOIL Price Target for this yeari see a return to the $104 level sooner or later this year caused by the supply concerns and political tensions in Eastern Europe and the Middle East.

There is a possible disruption to European energy supplies because of Russia - Ukraine border crisis.

Crude oil prices will likely stay at the 7 year high since OPEC+ will keep the existing policy of gradual increase of production.

Looking forward to read your opinion about it.

Oil looking to make big rise in 2022Crude oil just broke out of long time falling wedge pattern at around the $60.00 area as seem on chart. With inflation at 20 - 30 year highs, war looming, and talks of strikes at the refineries the target of $162.95 area could easily happen. This will cause sky high gasoline prices going into Q2/summer and continuing throughout fall/Q3, I am assuming.