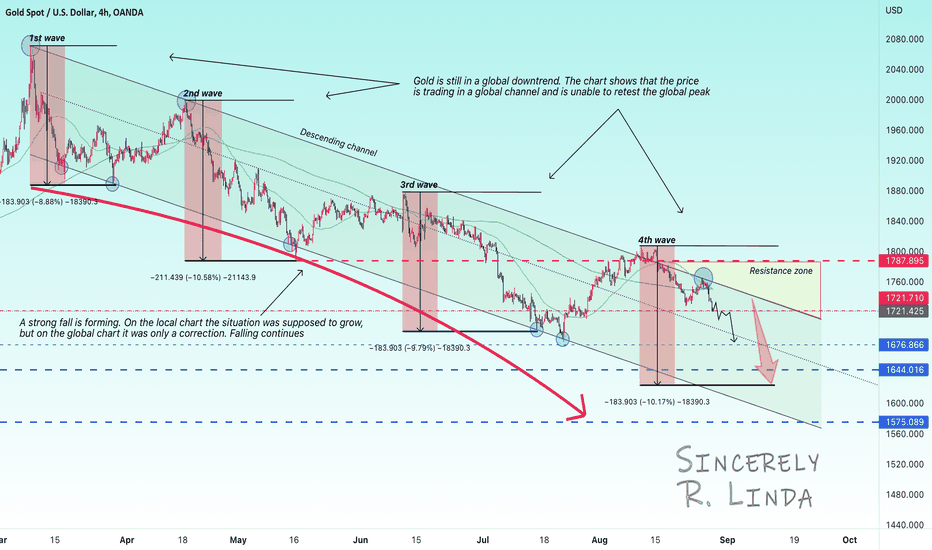

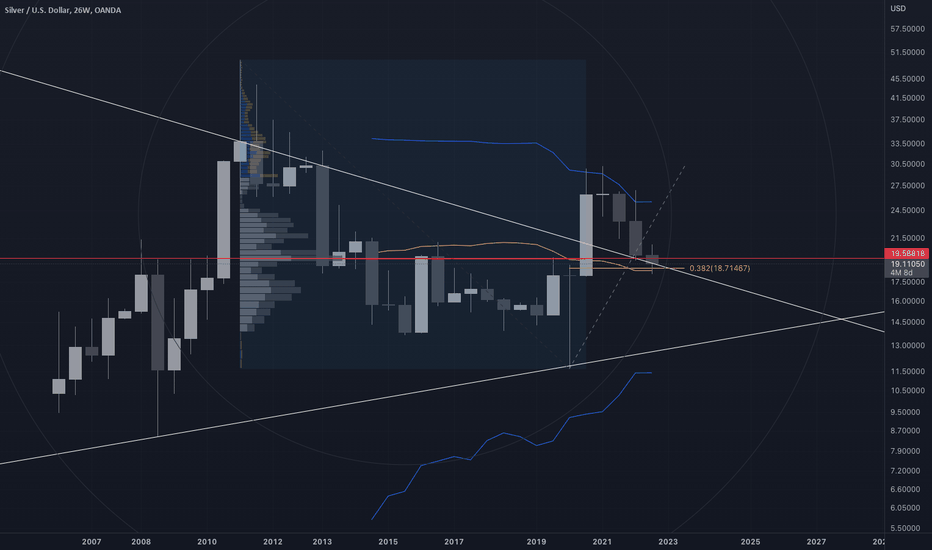

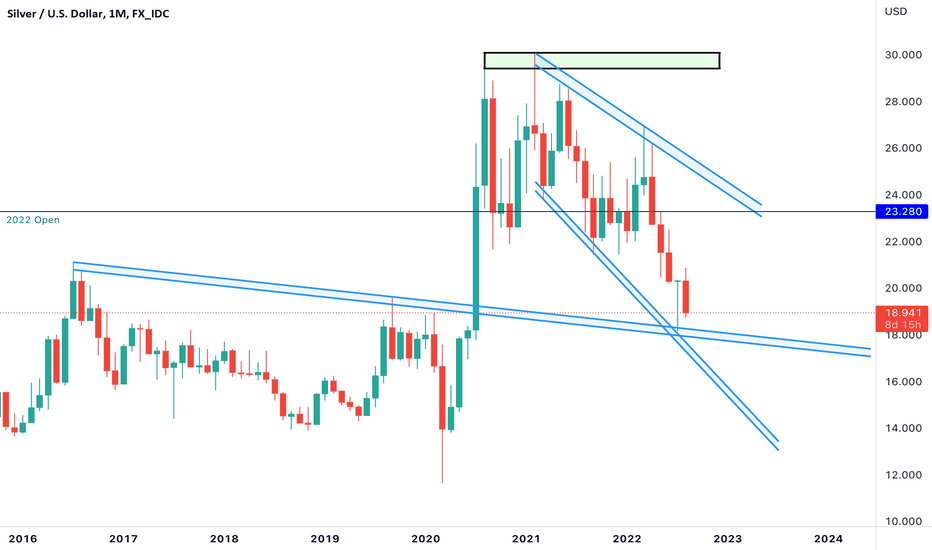

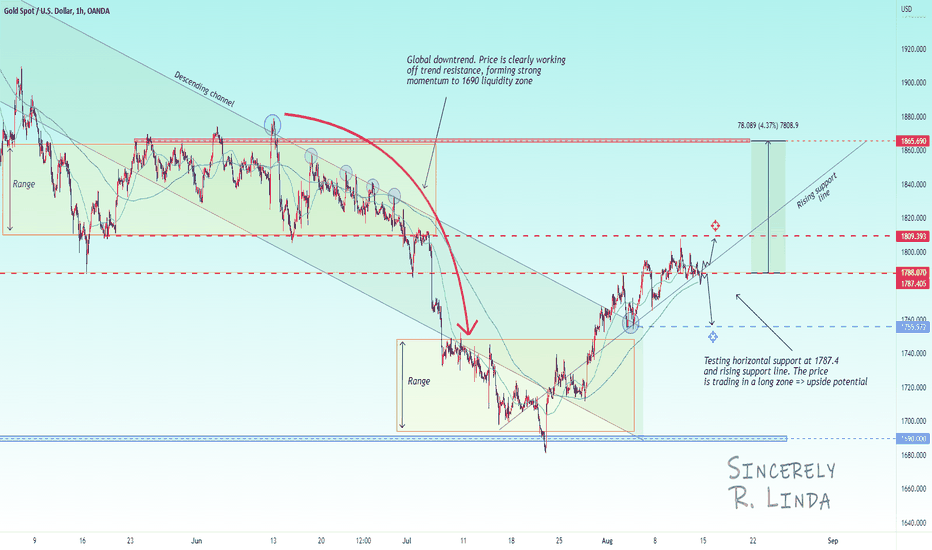

RLinda ! GOLD -> Global market is Bearish GOLD is still under the pressure of the bear market. On the local chart the situation was interesting with the development of bullish preconditions, but unfortunately the world market is not going to recover yet.

On the chart, I marked a price channel, the price tested the resistance and started to form a pullback and movement in the phase of the fourth wave. The movement of the waves is about the same distance, so you can probably assume the medium-term target for the price is the lower boundary of the expected end of the wave.

I assume that the fall will continue, the movement has just begun and it is worth to focus on the strong zones and strong resistance levels, to enter the market by trend.

Regards R. Linda!

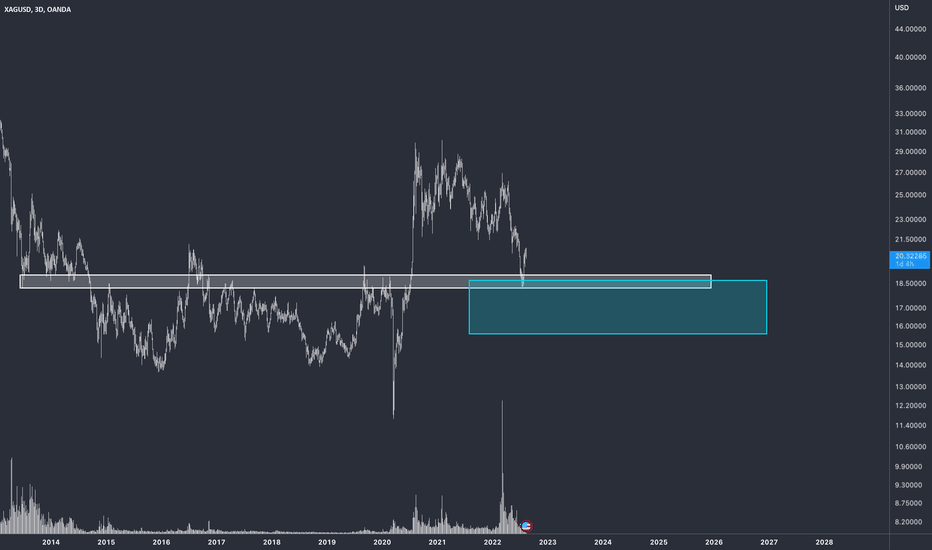

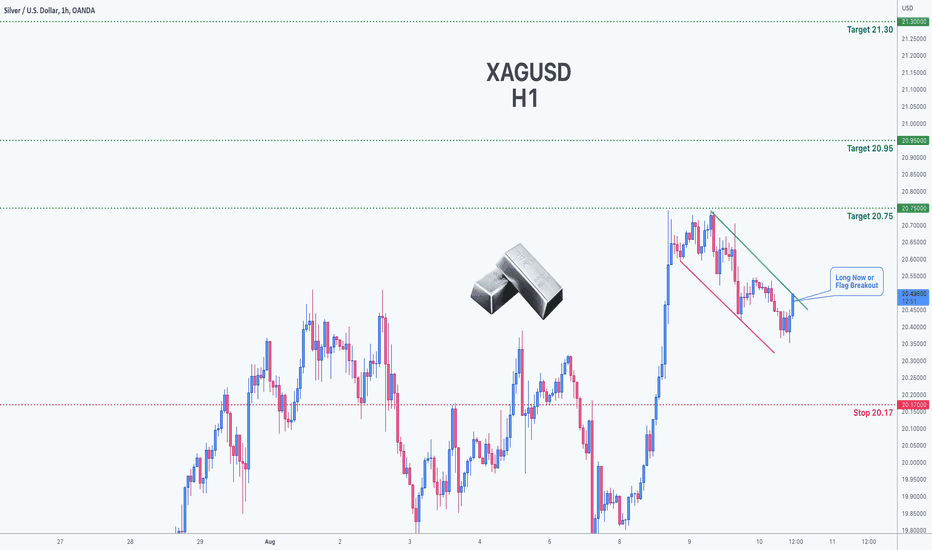

XAG

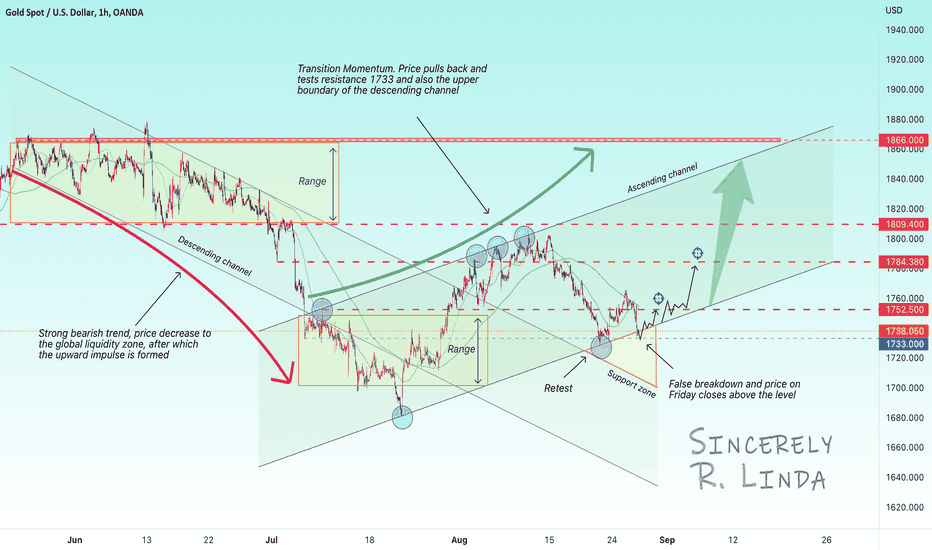

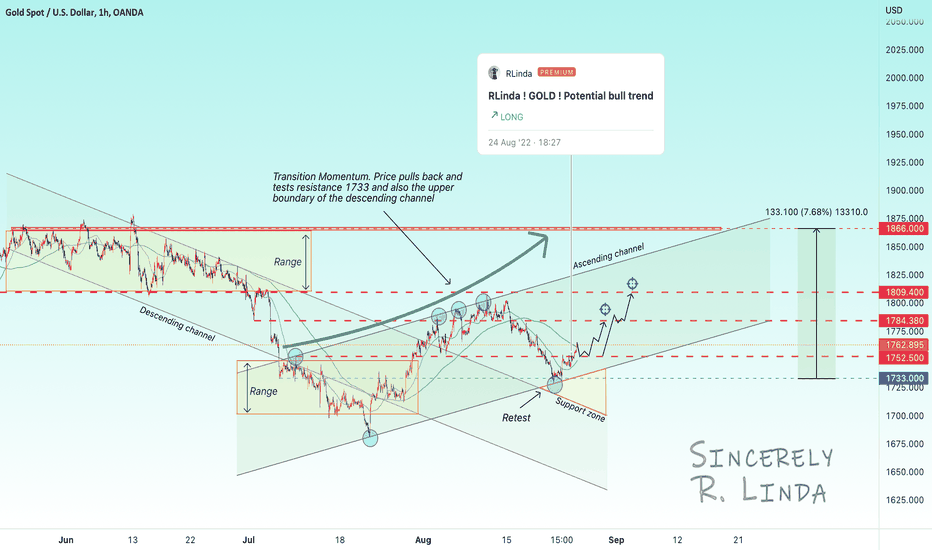

RLinda ! GOLD -> Review for the new weekGOLD: As we can see on the chart, the gold was able to change the global bearish trend and on the retest (price pullback) we saw confirmation of the upward price channel.

On Friday the price was able to make a false break of the support zone at the close, after which the price returns to the channel and closes above the trend line.

I assume that if the situation since the opening of the trading session persists and the gold manages to stay above the support zone, we will have a huge upside potential. Short-term target - resistance 1752, medium-term target - resistance 1784.

Sincerely R.Linda!

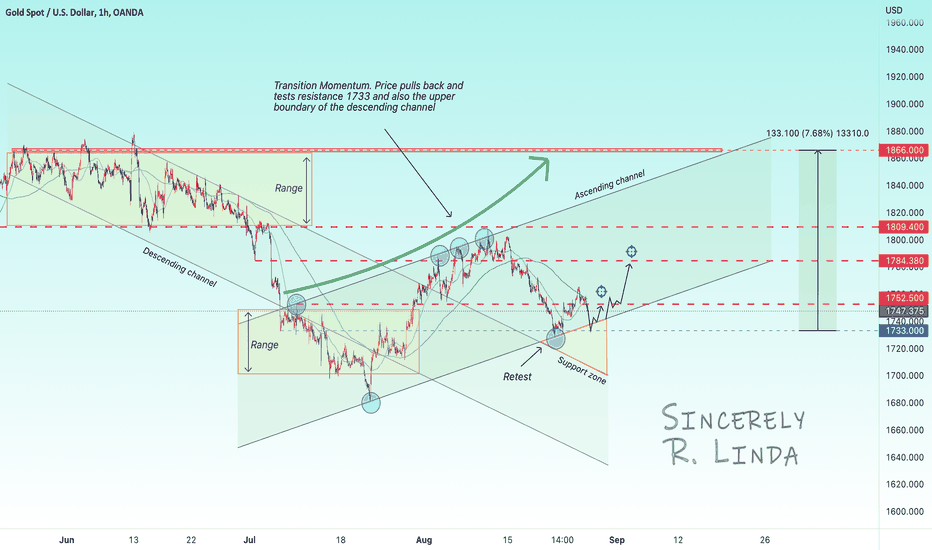

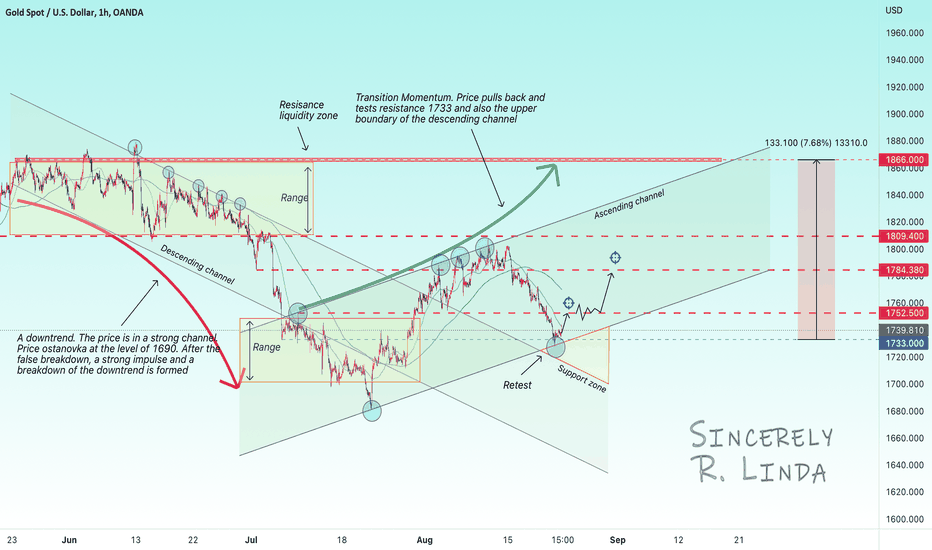

RLinda ! GOLD -> Pullback. Retest of channel supportGold. The price makes a false break of the resistance 1752.5 and forms a pullback back to the support zone. We expect developments near the 1733 zone. The global trend is rising, the price is in an uptrending price channel, after strong moves up and down the price needs to gain energy for further maneuvering.

Earlier the price changed the trend to rising and formed a pullback to the support zone, thereby testing the new support of the global uptrend price channel. After the retest, I expect growth to continue.

I assume that the growth after the pullback may continue. The short-term target for the pullback is the resistance of 1752.5, the medium-term target is the far level of 1784.38.

Regards to R.Linda!

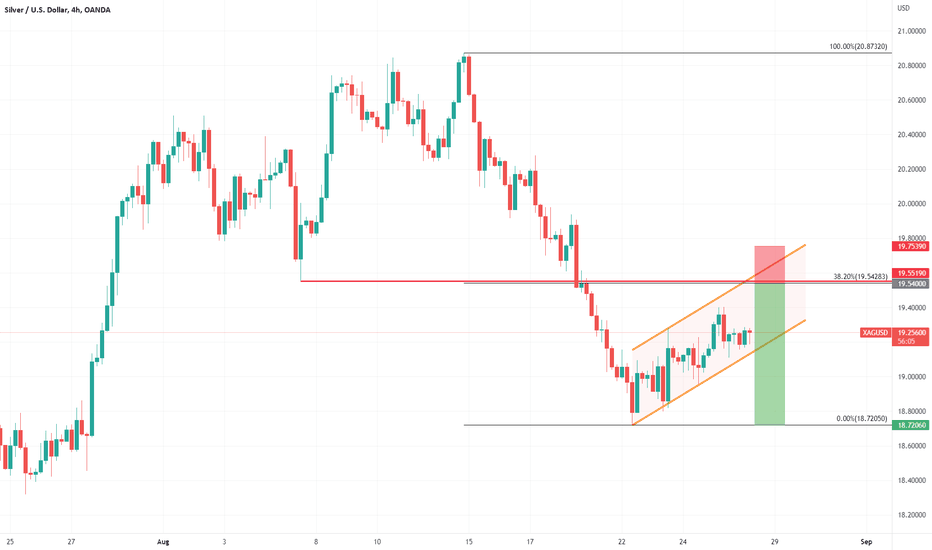

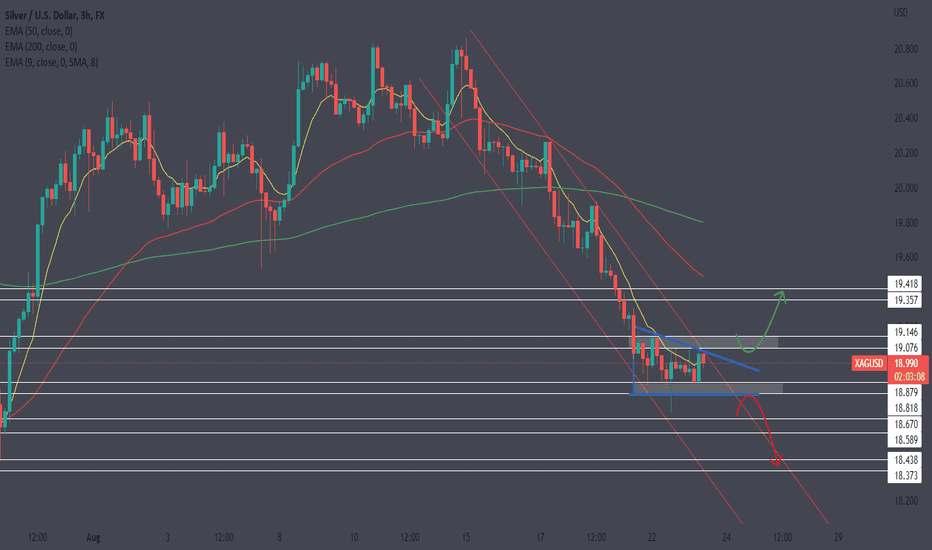

Medium term bias remains bearish on SilverSilver - Intraday - We look to Sell at 19.5400 (stop at 19.7539)

The medium term bias remains bearish. We have a 38.2% Fibonacci pullback level of 19.5428 from 18.7205 to 20.8732. There is scope for mild buying at the open but gains should be limited. Preferred trade is to sell into rallies.

Our profit targets will be 18.7206 and 18.5000

Resistance: 19.4035 / 19.5428 / 19.9370

Support: 19.1078 / 18.9555 / 18.7981

Risk Disclaimer

The trade ideas beyond this page are for informational purposes only and do not constitute investment advice or a solicitation to trade. This information is provided by Signal Centre, a third-party unaffiliated with OANDA, and is intended for general circulation only. OANDA does not guarantee the accuracy of this information and assumes no responsibilities for the information provided by the third party. The information does not take into account the specific investment objectives, financial situation, or particular needs of any particular person. You should take into account your specific investment objectives, financial situation, and particular needs before making a commitment to trade, including seeking advice from an independent financial adviser regarding the suitability of the investment, under a separate engagement, as you deem fit.

You accept that you assume all risks in independently viewing the contents and selecting a chosen strategy.

Where the research is distributed in Singapore to a person who is not an Accredited Investor, Expert Investor or an Institutional Investor, Oanda Asia Pacific Pte Ltd (“OAP“) accepts legal responsibility for the contents of the report to such persons only to the extent required by law. Singapore customers should contact OAP at 6579 8289 for matters arising from, or in connection with, the information/research distributed.'

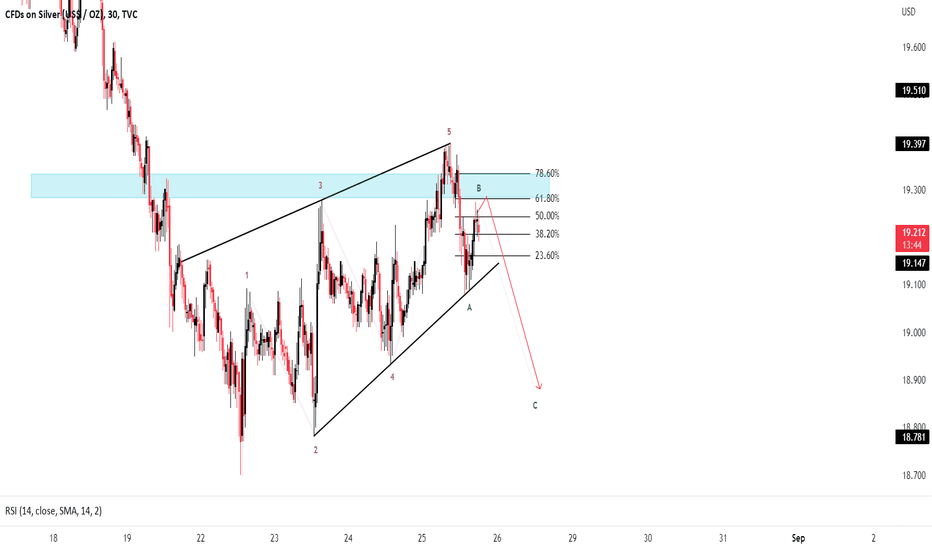

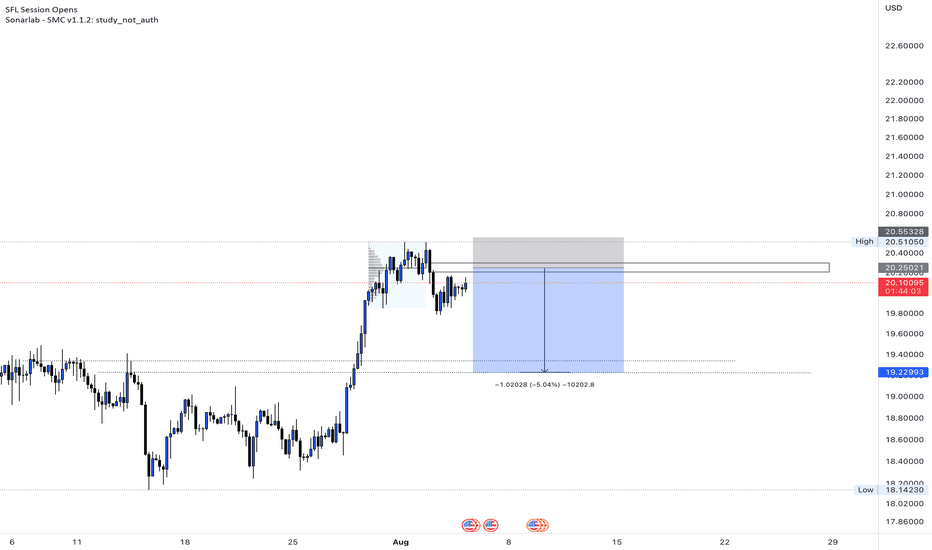

XAG/USD - Silver Next Move 25 - AugustXAG / USD ( Silver / U.S Dollar ) Technical Analysis Chart Update

Time Frame - M30

According to the Pattern it is Following the RISING WEDGE and its rejecing from the Lower Trend Line #LTL

Another reason for Sell is ELLIOT WAVE it has completed the Impulsive waves and Making its " B " corrective wave after that it will follow Sell trend to complete its " C " corrective wave and its possible that it will reject from the Fibonacci level 78.60%

If it rejects with the Strong Bearish Price Action it will be Good for Sell

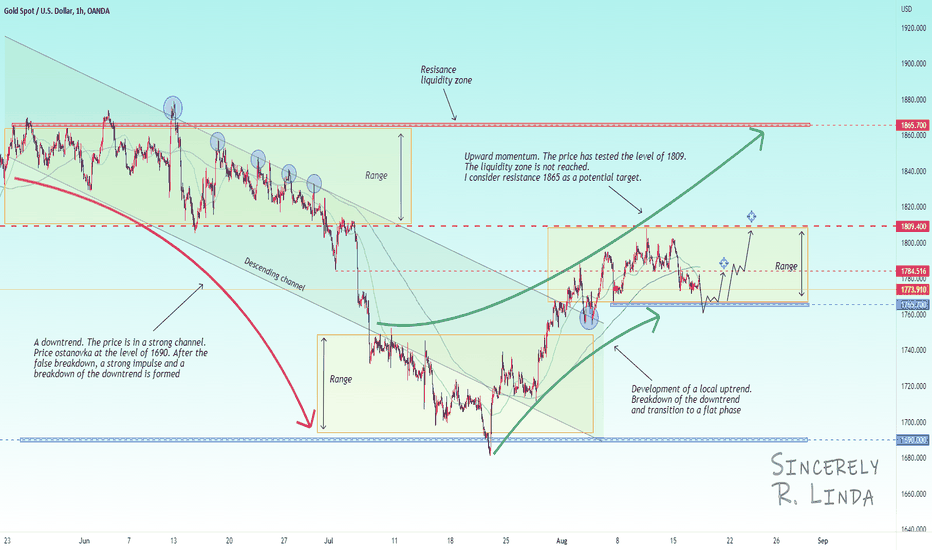

RLinda ! GOLD -> There is bullish potential in the marketGOLD: We see the change of the global trend from downtrend to uptrend, as well as we timely determined the formation of the global uptrend channel and the points where you can look for a convenient entry into the market. We can say with a degree of probability that the market is in an uptrend and expect further growth.

On the chart you can see how the price breaks through the resistance, turning them into support and forming a strong momentum.

I assume a continuation of the rise in the price of gold. The nearest short-term target is resistance 1784.38, and the medium-term target is the level, which the price did not reach on August 10 - resistance 1809.4

Regards R. Linda!

RLinda ! GOLD ! An upward channel appearsGold is forming an interesting picture. As we can see on the chart, today's price testing of the upper boundary of the downtrend resistance and support 1733 confirmed the presence of a wide uptrend channel on the chart.

Let me remind you that earlier the price broke the global downtrend, which lasted quite a long time.

The resistance level of 1752, which plays a key role in the uptrend, is ahead of the price. If the price breaks through this level, we have the potential for a big rise.

I assume, since we have the confirmation of the uptrend channel, there are all chances that the price will continue its growth up to the upper boundary, but we will be guided by the local targets.

Regards R. Linda!

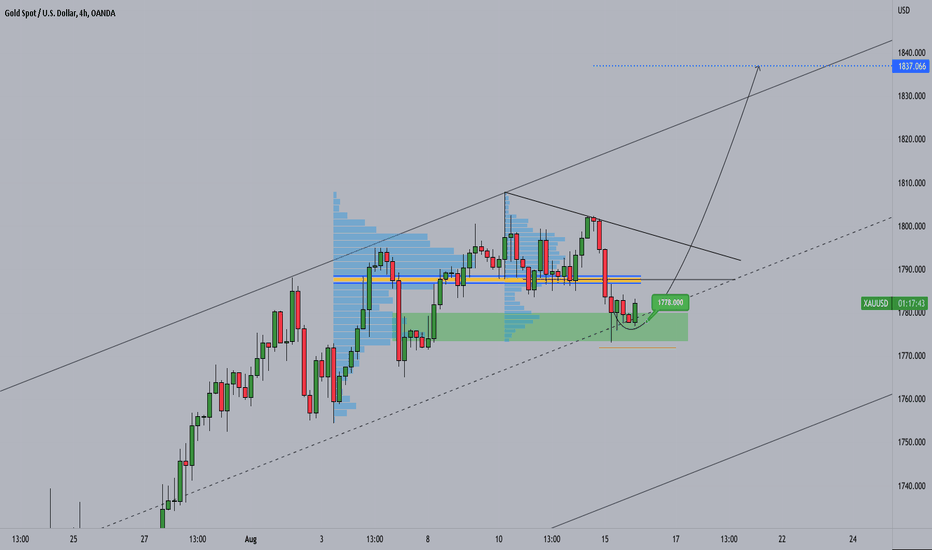

GOLD ! What to expect from the price after testing the support🤔Gold is trading within a sideways range of 1809.4 - 1765. The price continues to correct to the support zone.

Earlier the price was able to break the global downtrend and we saw a strong move up to 1809 resistance.

At the moment the price has moved into a consolidation phase. There is a support level ahead of the price, I believe it is an important boundary for further price reaction.

I assume, since we have a local uptrend, the support levels are more important points for reversal. I think a pullback will follow from the level of 1765.7. The short-term target is resistance 1784.5, the medium-term target is resistance 1809.4.

Regards R.Linda!

GOLD ! 2 scenarios: growth and decline. What will happen next?🤔The situation is logical and interesting at the same time. The price breaks through the resistance of 1787.4 and consolidates above this level for a long time, making false breakdowns downwards.

Under the price passes the formed ascending support line, above which the price is at the moment.

The situation is stalemated by the fact that the price cannot go up and cannot renew the local tops, i.e. there are two scenarios: growth after a false break-down of the level and support line. Or a break-down and formation of correction. What to expect further?

Sincerely R. Linda!

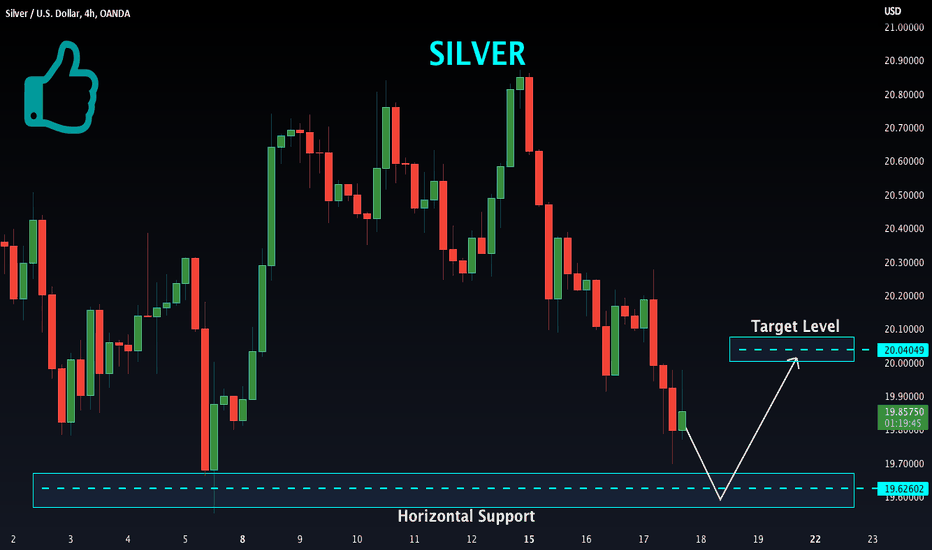

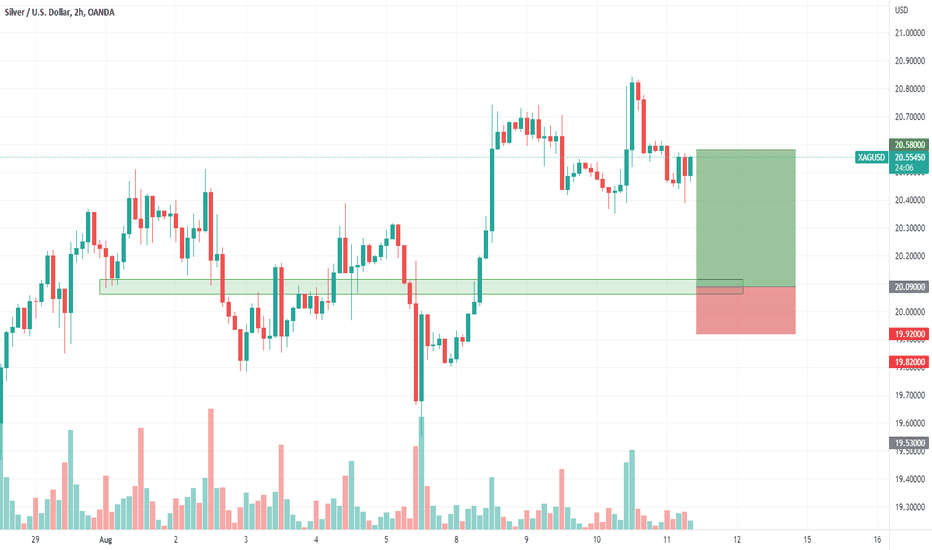

The Silver BulletSilver - Intraday - We look to Buy at 20.09 (stop at 19.92)

Preferred trade is to sell into rallies. There is scope for mild selling at the open but losses should be limited. Daily signals are mildly bullish. Further upside is expected although we prefer to set longs at our bespoke support levels at 20.10, resulting in improved risk/reward.

Our profit targets will be 20.58 and 21.20

Resistance: 20.83 / 21.50 / 26.00

Support: 20.40 / 20.10 / 18.93

Risk Disclaimer

The trade ideas beyond this page are for informational purposes only and do not constitute investment advice or a solicitation to trade. This information is provided by Signal Centre, a third-party unaffiliated with OANDA, and is intended for general circulation only. OANDA does not guarantee the accuracy of this information and assumes no responsibilities for the information provided by the third party. The information does not take into account the specific investment objectives, financial situation, or particular needs of any particular person. You should take into account your specific investment objectives, financial situation, and particular needs before making a commitment to trade, including seeking advice from an independent financial adviser regarding the suitability of the investment, under a separate engagement, as you deem fit.

You accept that you assume all risks in independently viewing the contents and selecting a chosen strategy.

Where the research is distributed in Singapore to a person who is not an Accredited Investor, Expert Investor or an Institutional Investor, Oanda Asia Pacific Pte Ltd (“OAP“) accepts legal responsibility for the contents of the report to such persons only to the extent required by law. Singapore customers should contact OAP at 6579 8289 for matters arising from, or in connection with, the information/research distributed.'

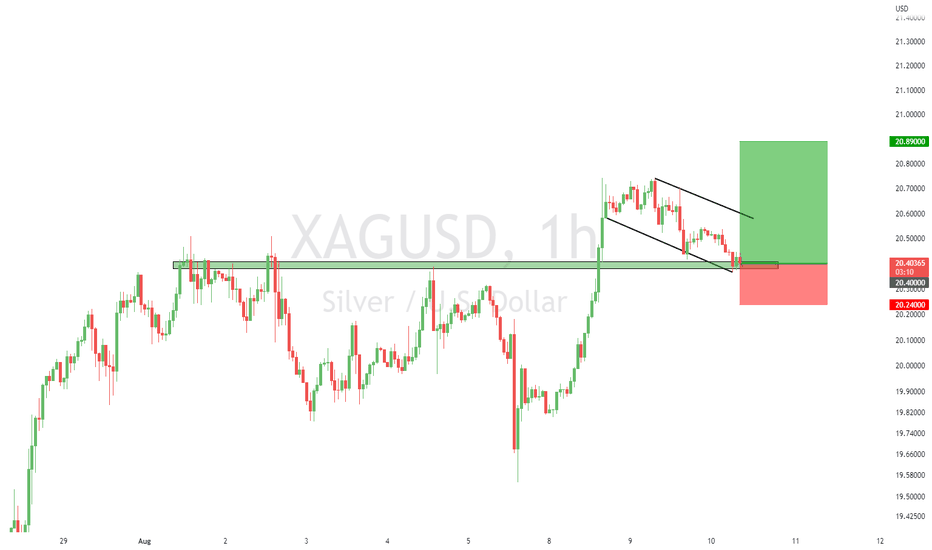

Jamie Gun2Head Trade - Buying Silver Trade Idea: Buying Silver

Reasoning: Bullish price action on the intraday, corrective move lower, looking for gains to be extended today

Entry Level: 20.40

Take Profit Level: 20.89

Stop Loss: 20.24

Risk/Reward: 3.06:1

Disclaimer – Signal Centre. Please be reminded – you alone are responsible for your trading – both gains and losses. There is a very high degree of risk involved in trading. The technical analysis , like all indicators, strategies, columns, articles and other features accessible on/though this site is for informational purposes only and should not be construed as investment advice by you. Your use of the technical analysis , as would also your use of all mentioned indicators, strategies, columns, articles and all other features, is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness (including suitability) of the information. You should assess the risk of any trade with your financial adviser and make your own independent decision(s) regarding any tradable products which may be the subject matter of the technical analysis or any of the said indicators, strategies, columns, articles and all other features.

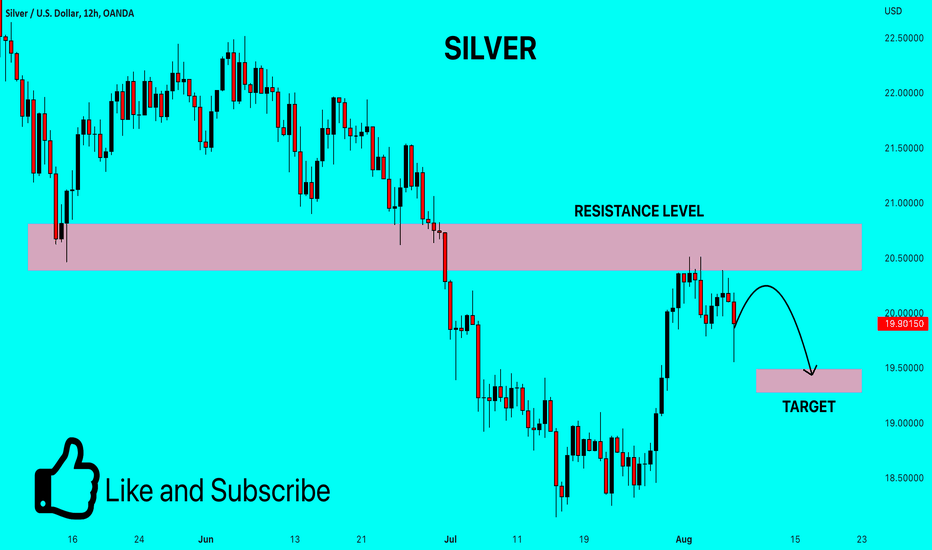

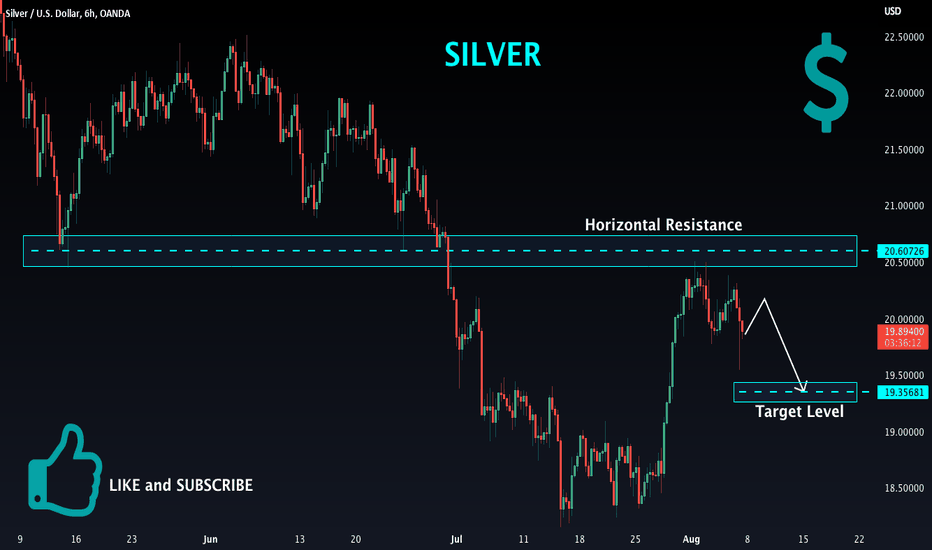

SILVER Will Fall! Sell!

Hello,Traders!

SILVER has retested the horizontal resistance

And after it failed to breakout the level

The price has established a double top

With the lower high which makes us bearish

Thus making us expect a further move down

Sell!

Like, comment and subscribe to boost your trading!

See other ideas below too!