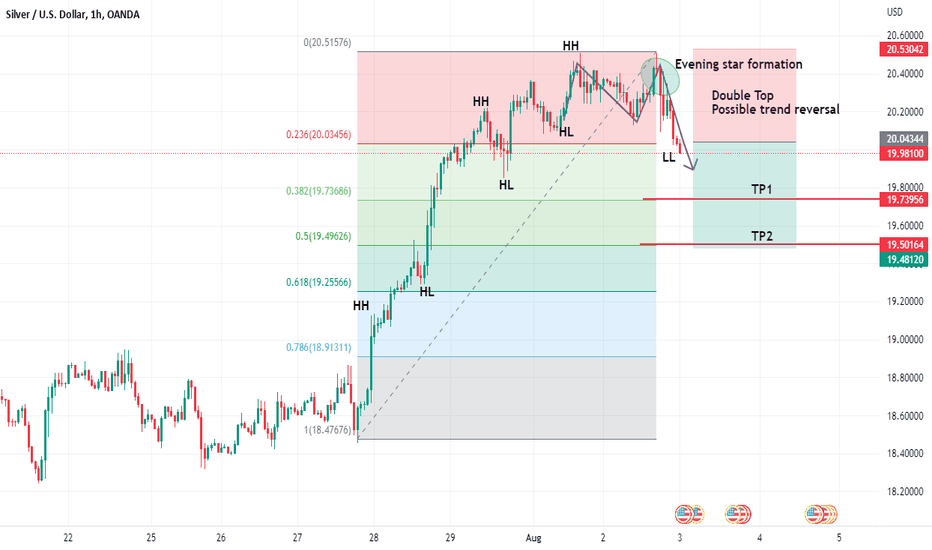

Silver is showing resistance on the levels of 20.50 Silver is showing resistance on the level of 20.50 and further formation of evening star and double top is an indication that it can retrace itself to 19.50 according to fib levels but keep in mind on daily level its higher high and higher low is still intact

XAG

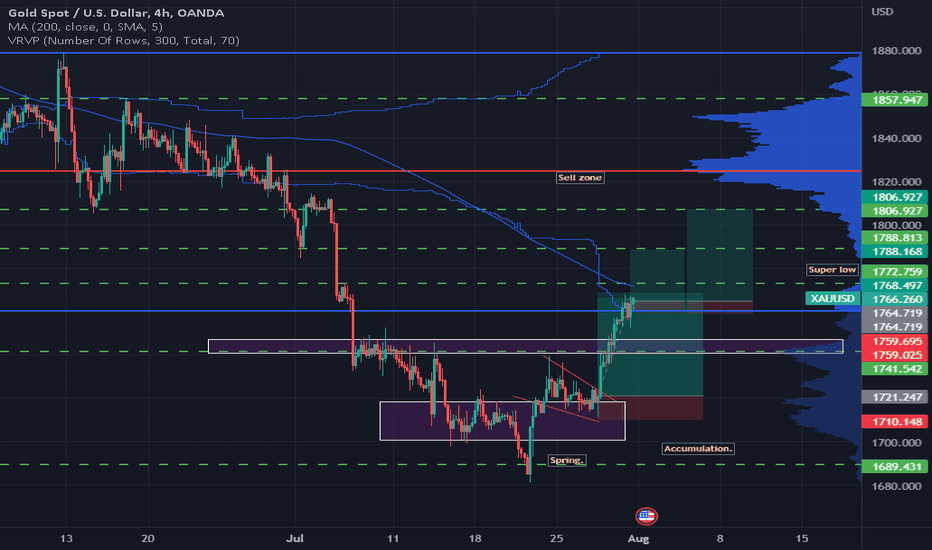

XAUXAU has done brilliantly since the last post with a rise of around $50, price now forms an inside bar on the 4H, an inside bar is often found in impulsive moves what it represents is a lower time frame consolidation so when we see as a green hammer/pin it can signify a good chance of imbalance continuing so because of this we have to look for previous levels of balance in the market, where will price stall?

I have labelled a few targets I believe we can hit, I could have added another setup with a slighty higher TP, but I think it is best to start closing out the long positions a bit quicker, so keep an on the 4H chart and LTF and when you see obvious signs of the market deteriorating then we have to act accordingly.

Longer term I believe the continued rate hikes will continue to close the gains XAU saw in the super inflation, I still believe DXY Index will climb considerably higher in the long term, so we can keep an eye for shorts if we enter a distribution phase.

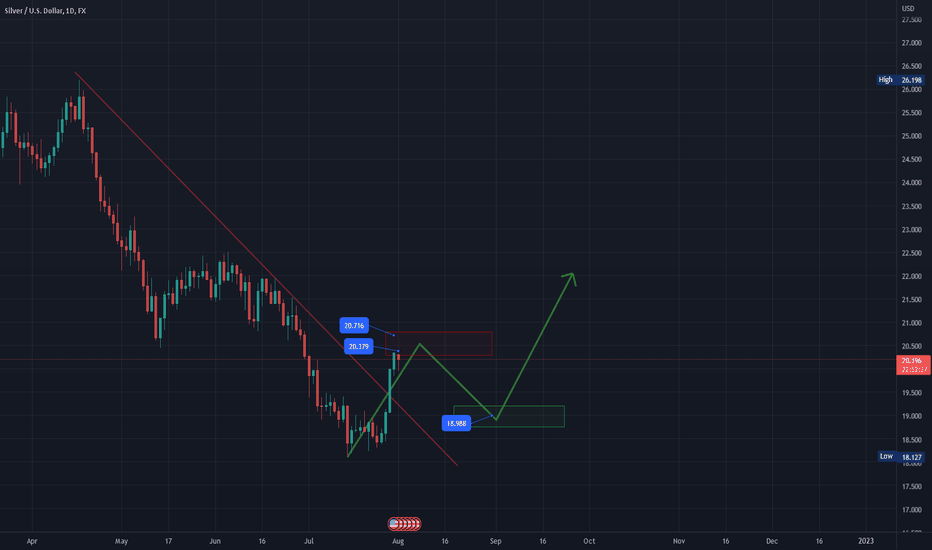

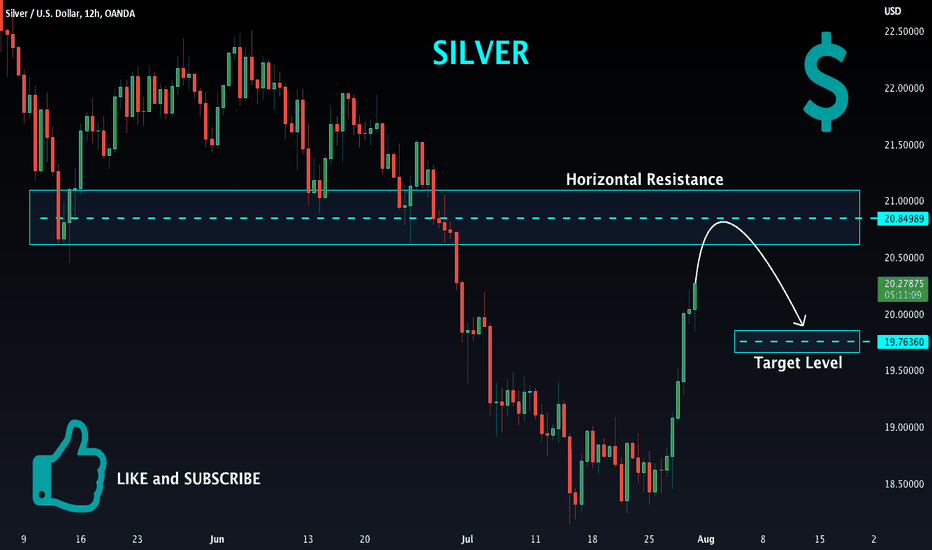

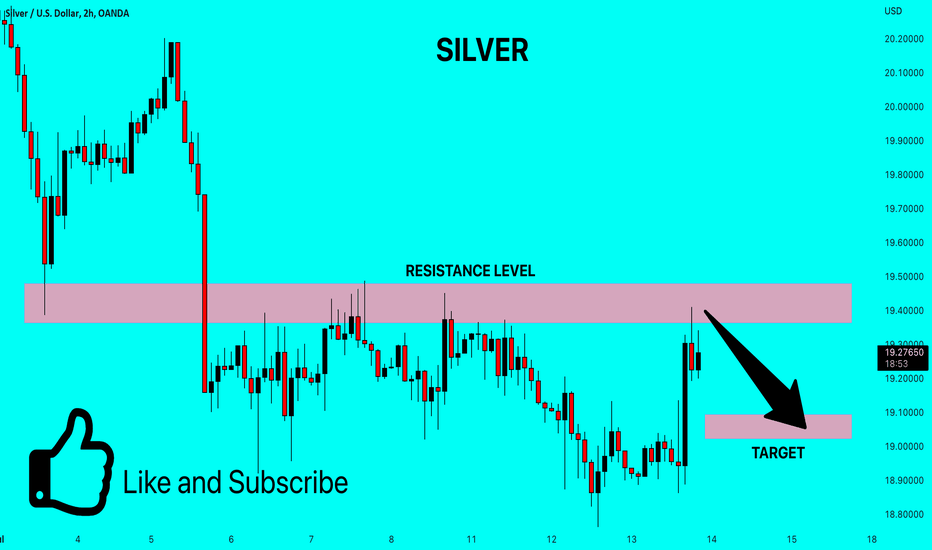

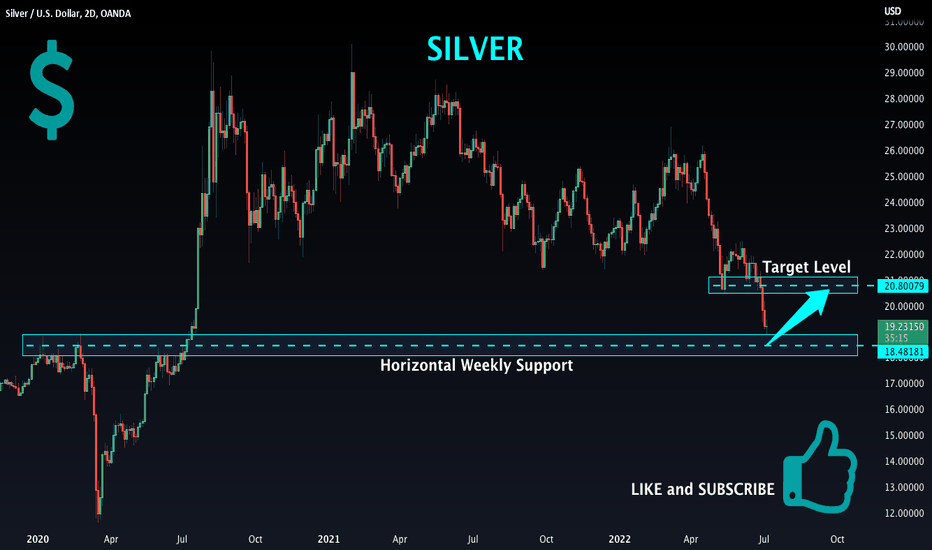

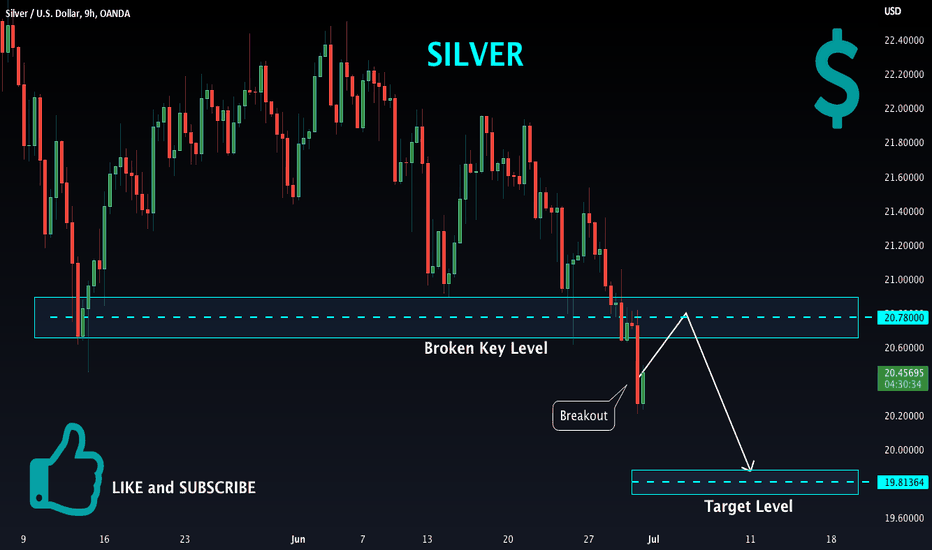

✅SILVER BEARISH SETUP|SHORT🔥

✅SILVER is about to retest a key structure level

Which implies a high likelihood of a move down

As some market participants will be taking profit from long positions

While others will find this price level to be good for selling

So as usual we will have a chance to ride the wave of a bearish correction

SHORT🔥

✅Like and subscribe to never miss a new idea!✅

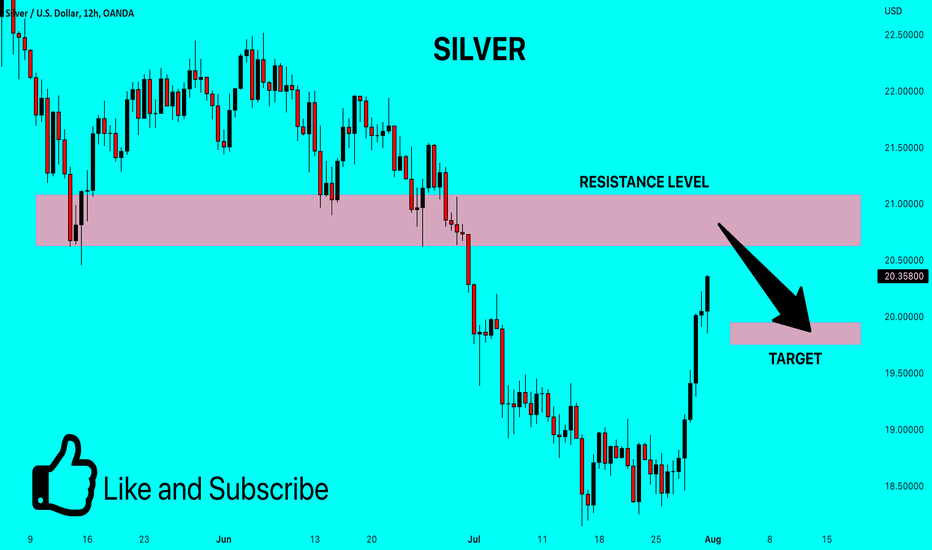

SILVER Resistance Ahead! Sell!

Hello,Traders!

SILVER is going up from the support

Just as I predicted in my previous analysis

But the resistance level is ahead of us

So I think we will see a move down

After the price retests the level

Sell!

Like, comment and subscribe to boost your trading!

See other ideas below too!

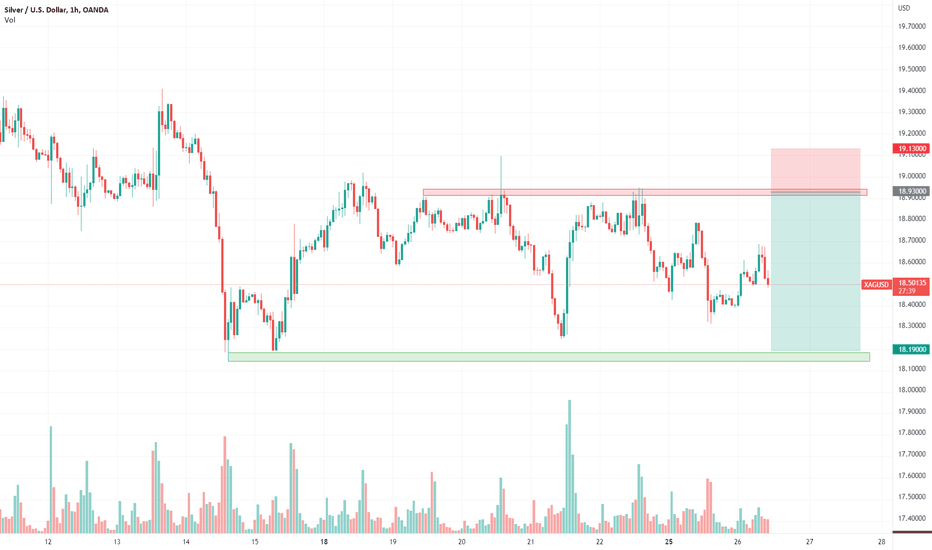

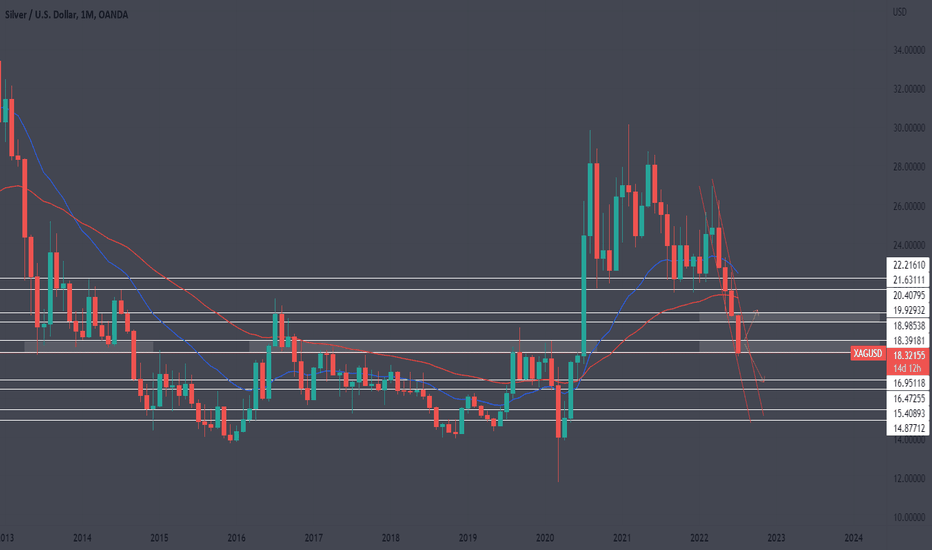

Extended attempts higher are expected to fail on SilverSilver - Intraday - We look to Sell at 18.93 (stop at 19.13)

There is scope for mild selling at the open but losses should be limited. Trading within a Bearish Channel formation. We look to sell rallies. Early optimism is likely to lead to gains although extended attempts higher are expected to fail.

Our profit targets will be 18.19 and 18.00

Resistance: 19.03 / 19.40 / 20.21

Support: 18.42 / 18.31 / 18.14

Risk Disclaimer

The trade ideas beyond this page are for informational purposes only and do not constitute investment advice or a solicitation to trade. This information is provided by Signal Centre, a third-party unaffiliated with OANDA, and is intended for general circulation only. OANDA does not guarantee the accuracy of this information and assumes no responsibilities for the information provided by the third party. The information does not take into account the specific investment objectives, financial situation, or particular needs of any particular person. You should take into account your specific investment objectives, financial situation, and particular needs before making a commitment to trade, including seeking advice from an independent financial adviser regarding the suitability of the investment, under a separate engagement, as you deem fit.

You accept that you assume all risks in independently viewing the contents and selecting a chosen strategy.

Where the research is distributed in Singapore to a person who is not an Accredited Investor, Expert Investor or an Institutional Investor, Oanda Asia Pacific Pte Ltd (“OAP“) accepts legal responsibility for the contents of the report to such persons only to the extent required by law. Singapore customers should contact OAP at 6579 8289 for matters arising from, or in connection with, the information/research distributed.'

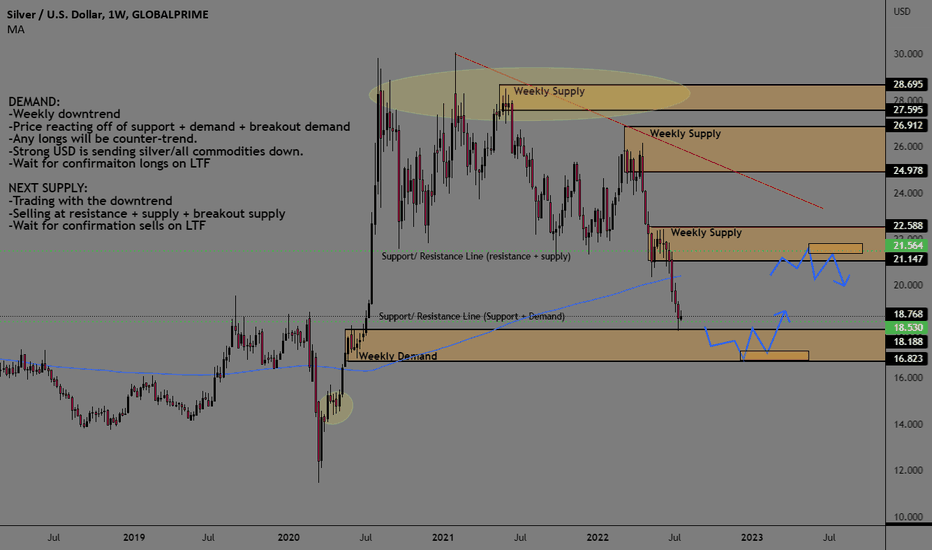

SILVER XAGUSD Supply And Demand AnalysisDEMAND:

-Weekly downtrend

-Price reacting off of support + demand + breakout demand

-Any longs will be counter-trend.

-Strong USD is sending silver/all commodities down.

-Wait for confirmaiton longs on LTF

NEXT SUPPLY:

-Trading with the downtrend

-Selling at resistance + supply + breakout supply

-Wait for confirmation sells on LTF

Let me know your thoughts...

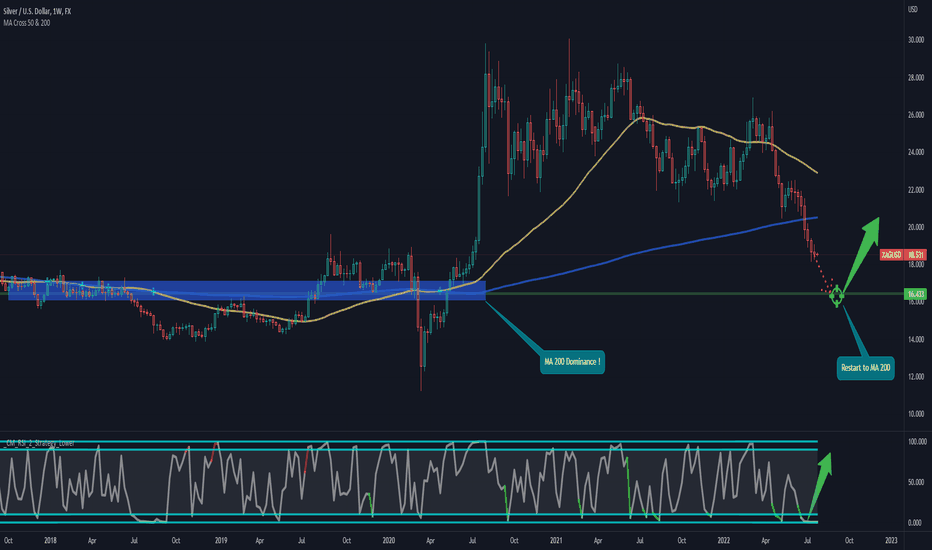

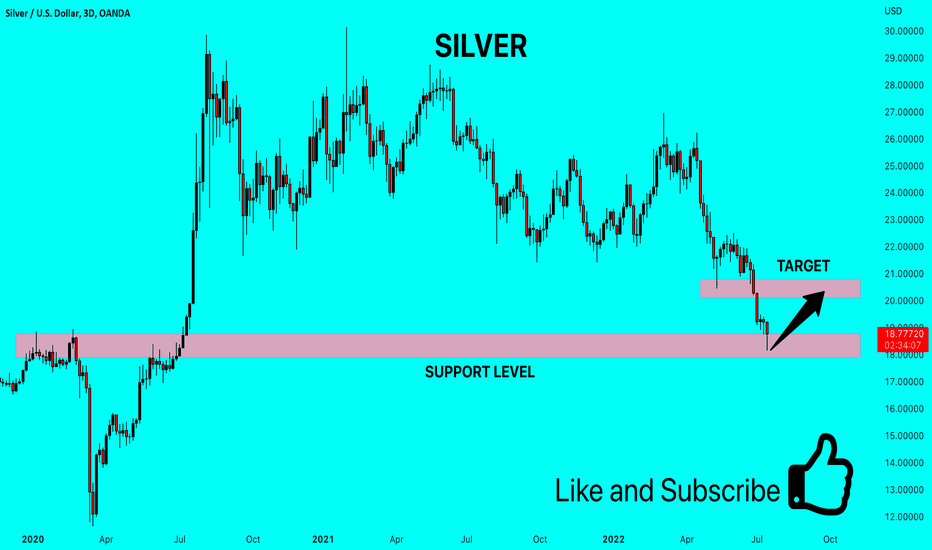

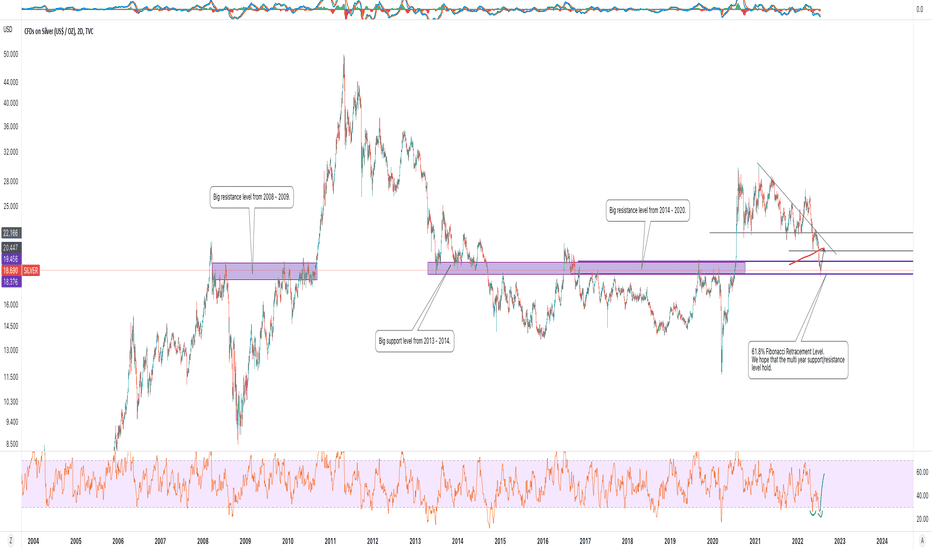

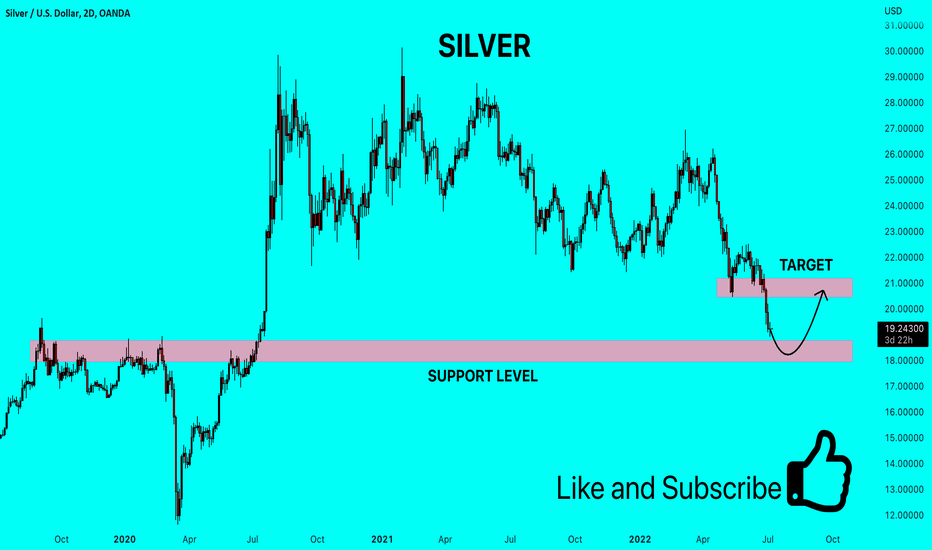

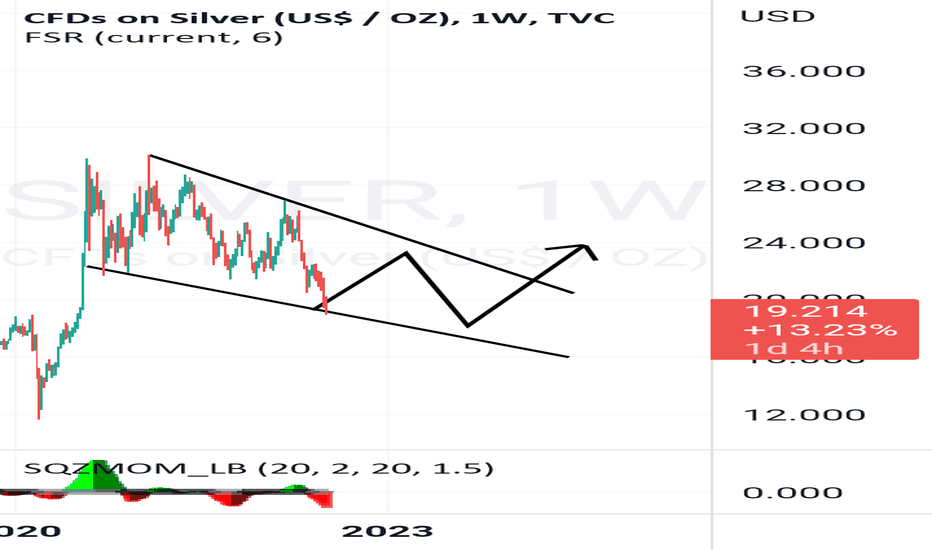

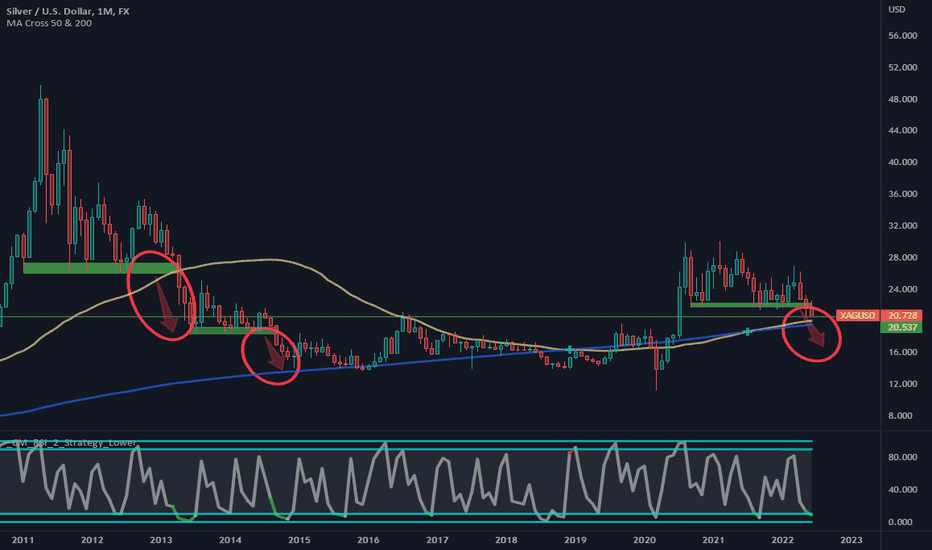

Big Moment For SilverHi, this is my new update for Silver. Silver has lost 32% of its value since March 2022 and I expect we have reached the bottom. If we look at the purple rectangles we see that the area between $18 - 19.50 always acted like support and resistance level in different periods. In July 2020 we broke the multi year resistance level (2014-2020) and we never backtested. I think now we have finally backtested it like a support level and at the same time we have reached a 61.8% FIB retracement level. We also have an oversold RSI level and I expect we are going to make a double bottom in the RSI like I drew and that will give us a bullish momentum. In the short term I expect we are going from $18 - 20.50 to backtest the 200 weeks moving average and I will update you guys in the near future.

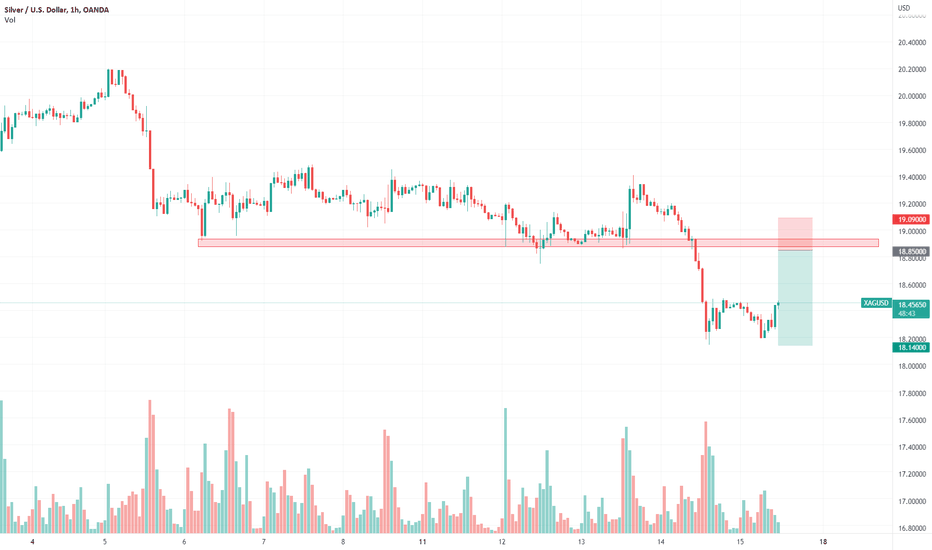

Silver under pressure and further downside is expectedSilver - Intraday - We look to Sell at 18.85 (stop at 19.09)

The medium term bias remains bearish. Previous support level of 18.74 broken. A weaker opening is expected to challenge bullish resolve. Bespoke resistance is located at 18.85. Further downside is expected although we prefer to set shorts at our bespoke resistance levels at 18.85, resulting in improved risk/reward.

Our profit targets will be 18.14 and 17.90

Resistance: 18.74 / 18.85 / 19.41

Support: 18.14 / 18.00 / 17.90

Risk Disclaimer

The trade ideas beyond this page are for informational purposes only and do not constitute investment advice or a solicitation to trade. This information is provided by Signal Centre, a third-party unaffiliated with OANDA, and is intended for general circulation only. OANDA does not guarantee the accuracy of this information and assumes no responsibilities for the information provided by the third party. The information does not take into account the specific investment objectives, financial situation, or particular needs of any particular person. You should take into account your specific investment objectives, financial situation, and particular needs before making a commitment to trade, including seeking advice from an independent financial adviser regarding the suitability of the investment, under a separate engagement, as you deem fit.

You accept that you assume all risks in independently viewing the contents and selecting a chosen strategy.

Where the research is distributed in Singapore to a person who is not an Accredited Investor, Expert Investor or an Institutional Investor, Oanda Asia Pacific Pte Ltd (“OAP“) accepts legal responsibility for the contents of the report to such persons only to the extent required by law. Singapore customers should contact OAP at 6579 8289 for matters arising from, or in connection with, the information/research distributed.'

$XAG - Keep an eye!$XAG - Keep an eye!

Precious metals have had an ugly time within the market, when it comes to rate hikes decisions stronger dxy leading commodities to weaken further, but now we are at key areas when it comes to HT and that's interesting. As I always state HT = ST movement.

Regarding support areas of $XAG if $18 doesn't hold we head further lower to $17 and that can easily be achieved but this area of support we've tested for yrs and that's why it really matters and sure we could look at metals miner we could even look further to get the best R/R for XAUXAG to seek out further validation. I'm personally on side line for now.

There has been various headlines regarding, lot of buyers when it comes to physical precious metal buying for 'inflation' hedge...

Have a great weekend

TJ

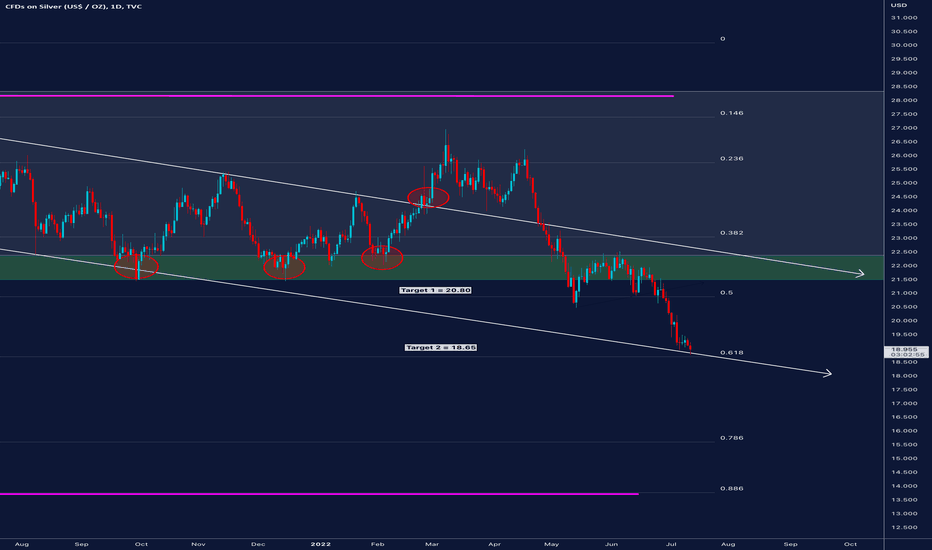

Silver approaching Target 2 at .618 FIBSince losing market structure support in the $21.50- $22.35 area, Silver has been sliding downward to the 0.5 FIB level. After a few tests of this level (approx $20.80) price action declined down to the .618 FIB Level and with in roughly 0.30 of my 2nd target.

Price action has began to form a channel now with multiple lower touch points.

As long as the dollar continues to strengthen (against other currencies) it's likely we can expect assets such as Silver, Gold and Bitcoin to slide downward.

Target 3 if needed would be the next lower FIB level. With the indicators pretty close to cooling off on the lower time frames and the .618 holding we could look for a bounce back up to the .5 Level.

I personally do not trade paper metals. I purchase physical metals as my hedge again USD and Crypto. So the short term price does not personally concern me and I am not looking to play a bounce. I am simply looking for the best entry prices to stack more Silver.

If you are looking for a swing trade consider looking to the FIB levels or ranging inside of the channel for your bounce.

If you love Silver Stacking or Gold leave a comment below! :)

XAGUSD is about to complete pattern or bulltrap??After checked multiple timeframes, pivote zones and checking liquidity in chart I'm still not very sure if XAG will start bullish trend or can be just a bulltrap to complete just 5th Elliot wave. Even that will publish this idea as LONG for the time being.

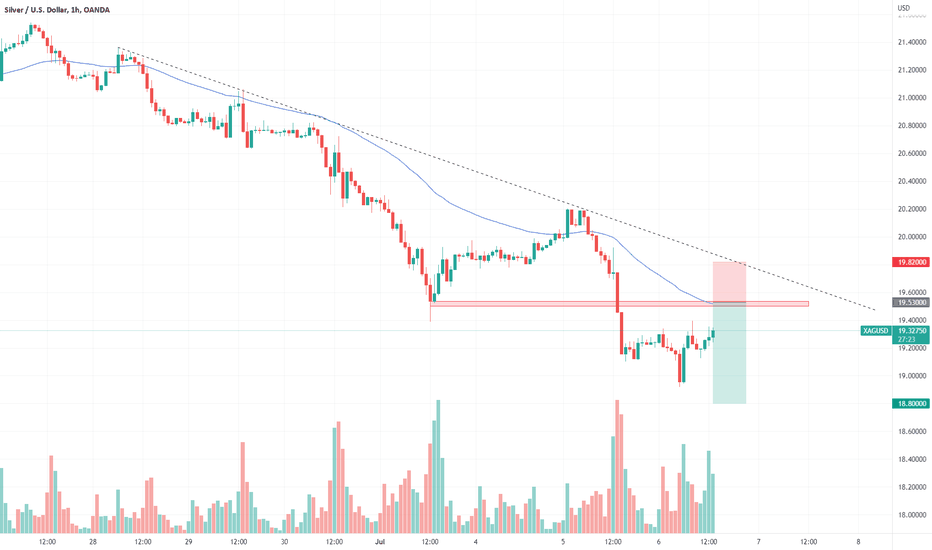

Silver lining up for further downside?Silver - Intraday - We look to Sell at 19.53 (stop at 19.82)

Preferred trade is to sell into rallies. The medium term bias remains bearish. 50 1hour EMA is at 19.60. Daily signals are bearish. There is scope for mild buying at the open but gains should be limited.

Our profit targets will be 18.80 and 18.50

Resistance: 19.60 / 20.90 / 24.00

Support: 18.80 / 17.00 / 15.00

Risk Disclaimer

The trade ideas beyond this page are for informational purposes only and do not constitute investment advice or a solicitation to trade. This information is provided by Signal Centre, a third-party unaffiliated with OANDA, and is intended for general circulation only. OANDA does not guarantee the accuracy of this information and assumes no responsibilities for the information provided by the third party. The information does not take into account the specific investment objectives, financial situation, or particular needs of any particular person. You should take into account your specific investment objectives, financial situation, and particular needs before making a commitment to trade, including seeking advice from an independent financial adviser regarding the suitability of the investment, under a separate engagement, as you deem fit.

You accept that you assume all risks in independently viewing the contents and selecting a chosen strategy.

Where the research is distributed in Singapore to a person who is not an Accredited Investor, Expert Investor or an Institutional Investor, Oanda Asia Pacific Pte Ltd (“OAP“) accepts legal responsibility for the contents of the report to such persons only to the extent required by law. Singapore customers should contact OAP at 6579 8289 for matters arising from, or in connection with, the information/research distributed.'

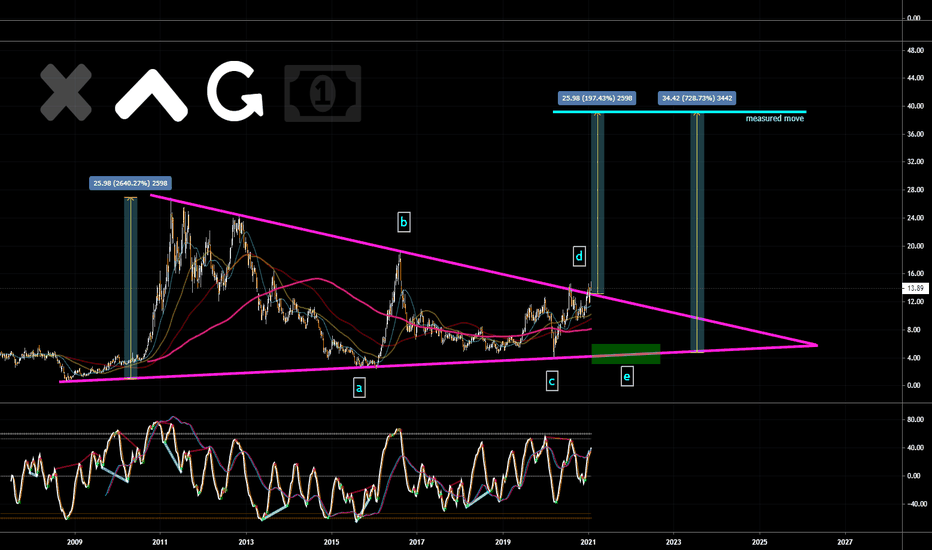

FIRST MAJESTIC SILVER - PRESSURE BUILDINGThis is a weekly chart of AG, First Majestic Silver Corp. I like to call this pattern a giant compression wedge - it's just a simple descending triangle. But considering this is on the weekly timeframe, it's a mammoth-sized wedge. I like the pattern but I really like the company. I'll try to focus on the technical analysis, but First Majestic looks incredibly well positioned for what's unfolding in the metals market. They have their ducks in a row.

If you follow my ideas, then you'll know how I feel about precious metals. I believe we're facing a perfect storm that will propel precious metals & miners to incredible levels. The monetary circus, supply & demand, inflation, gold:silver ratio, and the commodity cycle are just a few of the ingredients in the recipe.

I'm torn about direction. Equities, the dollar, precious metals, and the miners are in a pivotal place. The dollar looks like it's trying to find a bottom. It's possible that the metals, miners, and equities get pushed down hard again.. potentially another crash. Having another crash in equities, metals, miners, etc.. would be my preferred path because I suspect that it wouldn't last long.. Inflation is coming but don't rule out another deflationary hiccup. I like to buy stuff cheap and so I'll be thrilled to have another discount. Watch the dollar. I think we're going to know soon.. and watch First Majestic. It would be incredible to have it tag (E) of this wedge. The measured move of this pattern is somewhere around 39-40 but a move from $4.00 to 40 is a 10x compared to the 2x it is from current prices.

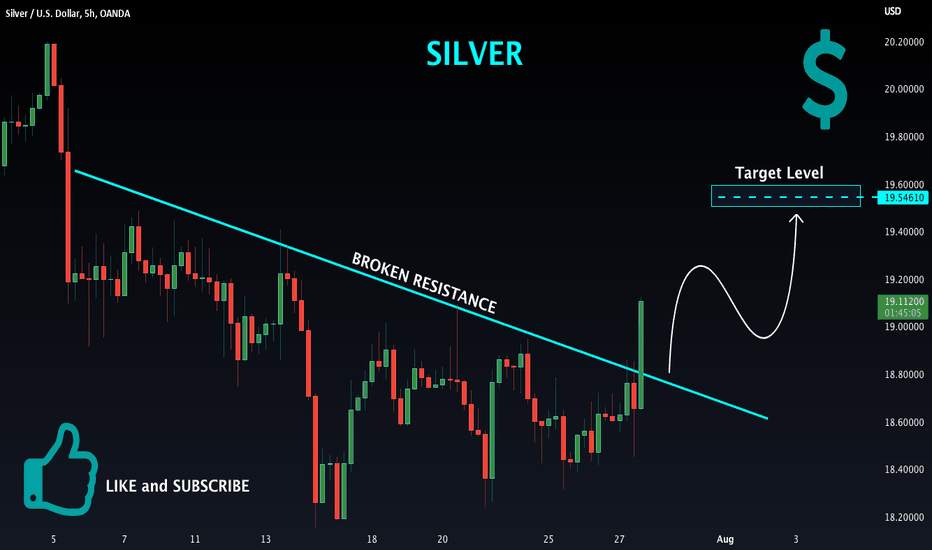

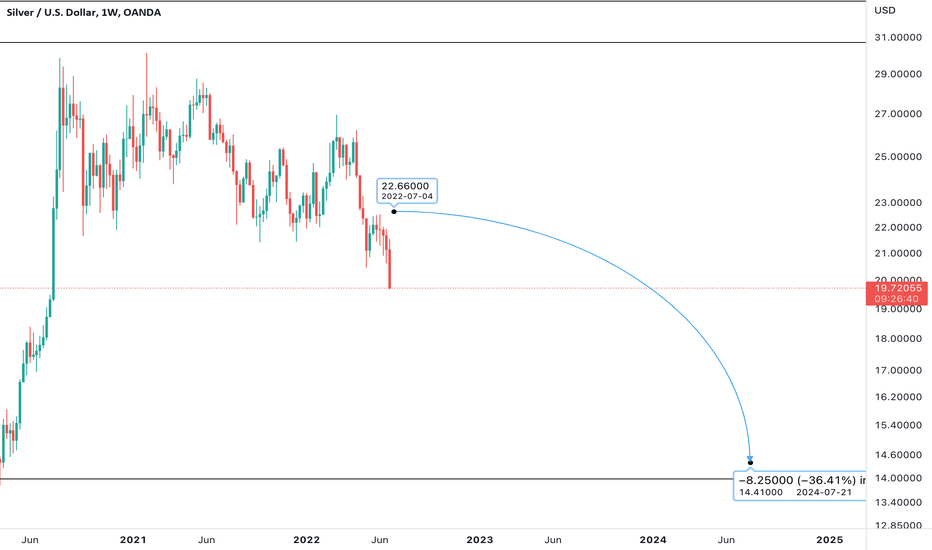

SILVER Will Keep Falling! Sell!

Hello,Traders!

SILVER is trading in a downtrend

And the price broke a strong horizontal support

Which turned into a resistance level

And I believe that after the pullback and retest

We will see bearish continuation

Sell!

Like, comment and subscribe to boost your trading!

See other ideas below too!