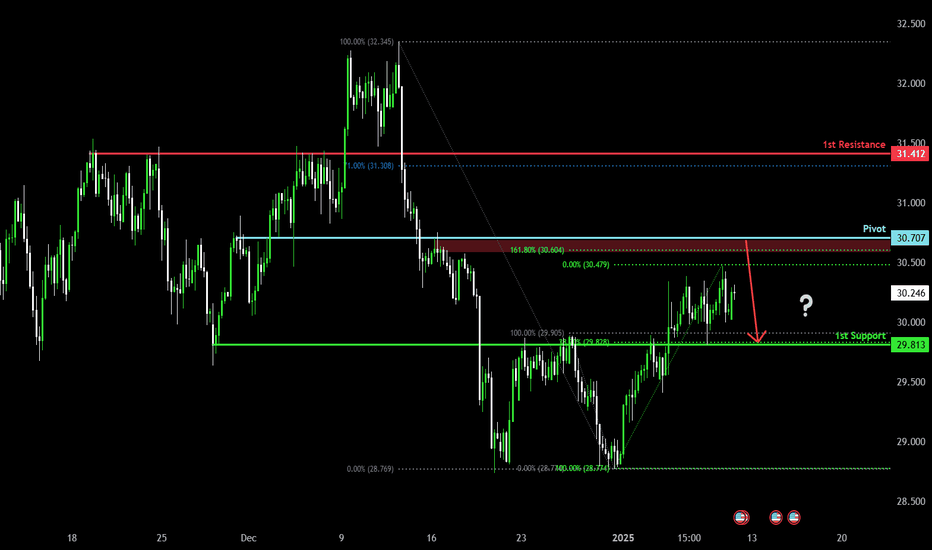

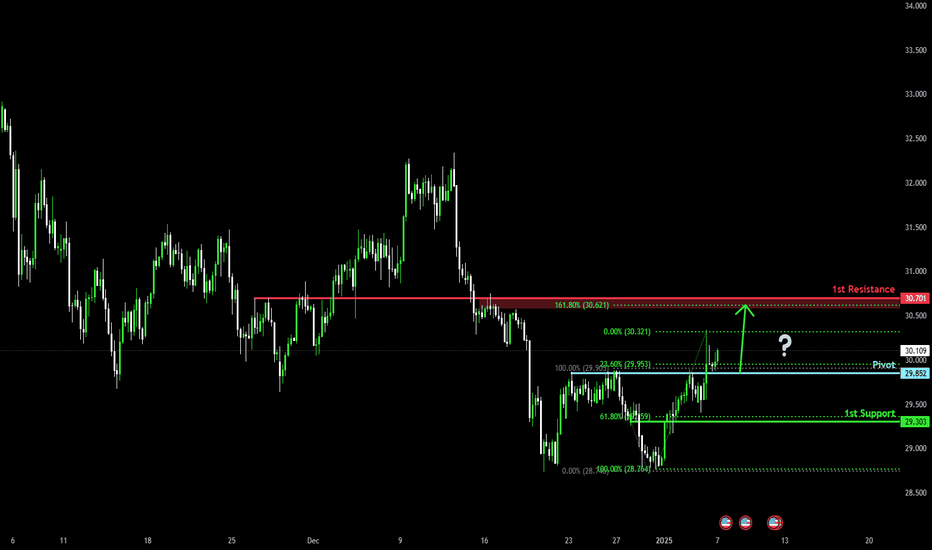

Bearish reversal off overlap resistance?The Silver (XAG/USD) is rising towards the pivot which acts as an overlap resistance and could reverse to the 1st support which has been identified as an overlap support.

Pivot: 30.70

1st Support: 29.81

1st Resistance: 31.41

Risk Warning:

Trading Forex and CFDs carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading Forex and CFDs may not be suitable for all investors, so please ensure that you fully understand the risks involved and seek independent advice if necessary.

Disclaimer:

The above opinions given constitute general market commentary, and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.

XAG

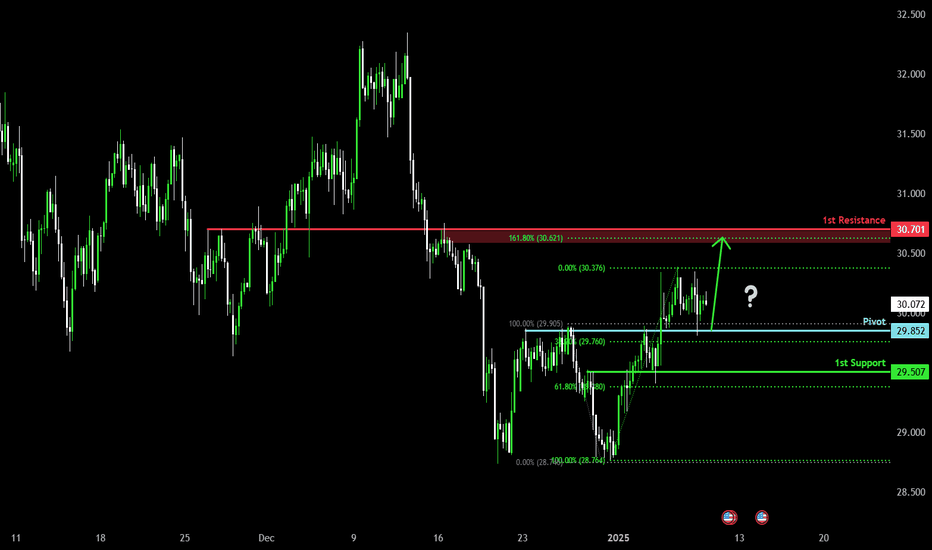

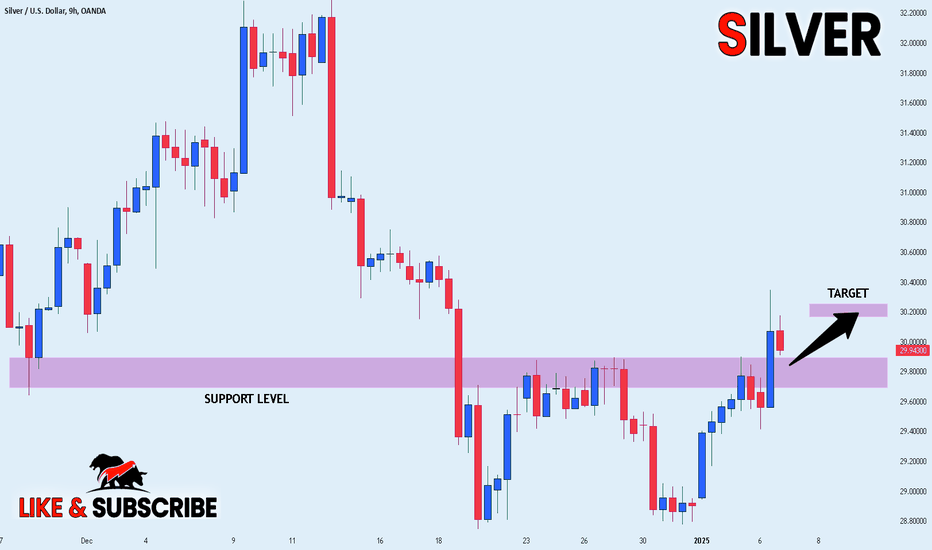

Potential bullish rise?The Silver (XAG/USD) has reacted off the pivot which acts as a pullback support and could bounce to the 1st resistance which has been identified as an overlap resistance.

Pivot: 29.85

1st Support: 29.50

1st Resistance: 30.70

Risk Warning:

Trading Forex and CFDs carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading Forex and CFDs may not be suitable for all investors, so please ensure that you fully understand the risks involved and seek independent advice if necessary.

Disclaimer:

The above opinions given constitute general market commentary, and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.

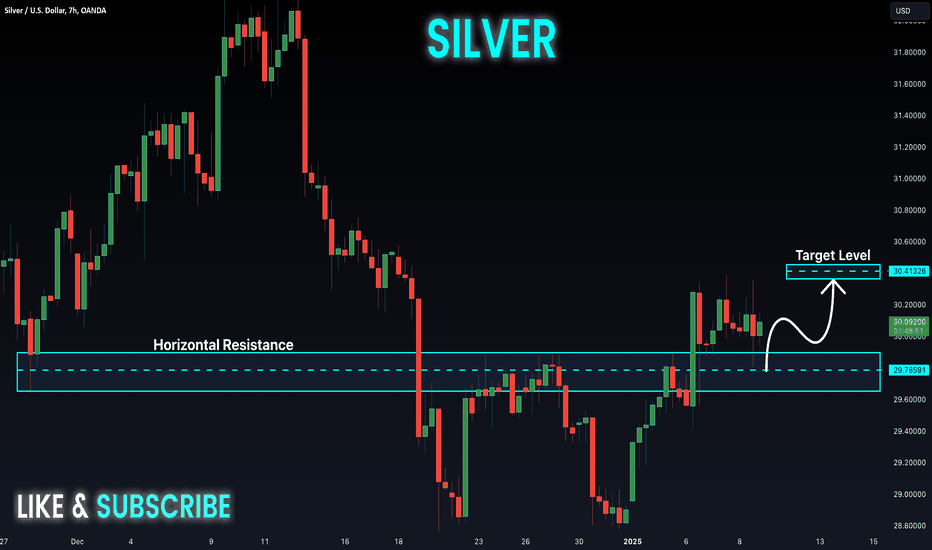

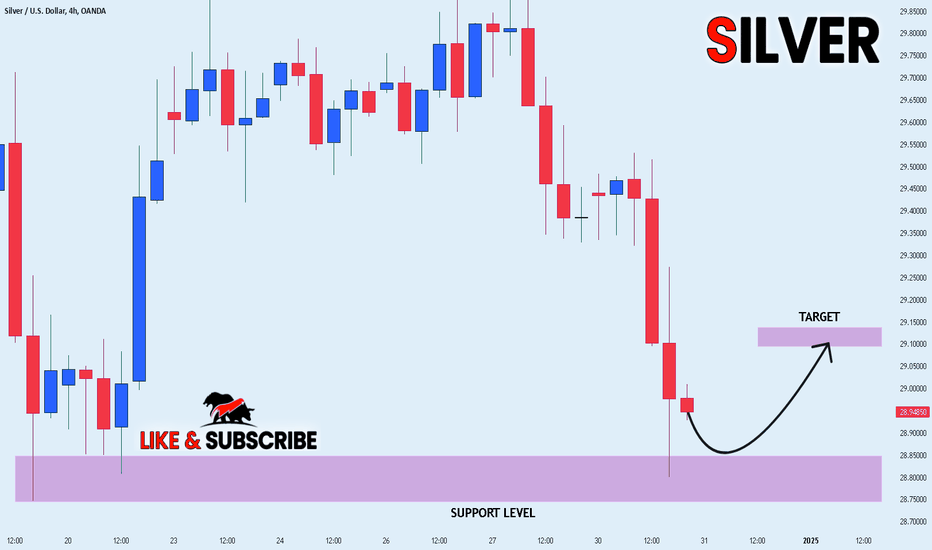

SILVER Bullish Bias! Buy!

Hello,Traders!

SILVER is trading in a local

Uptrend and the price is

Consolidating above the

The horizontal support

Level of 29.89$ so we are

Locally bullish biased

And we will be expecting

A further bullish move up

Buy!

Comment and subscribe to help us grow!

Check out other forecasts below too!

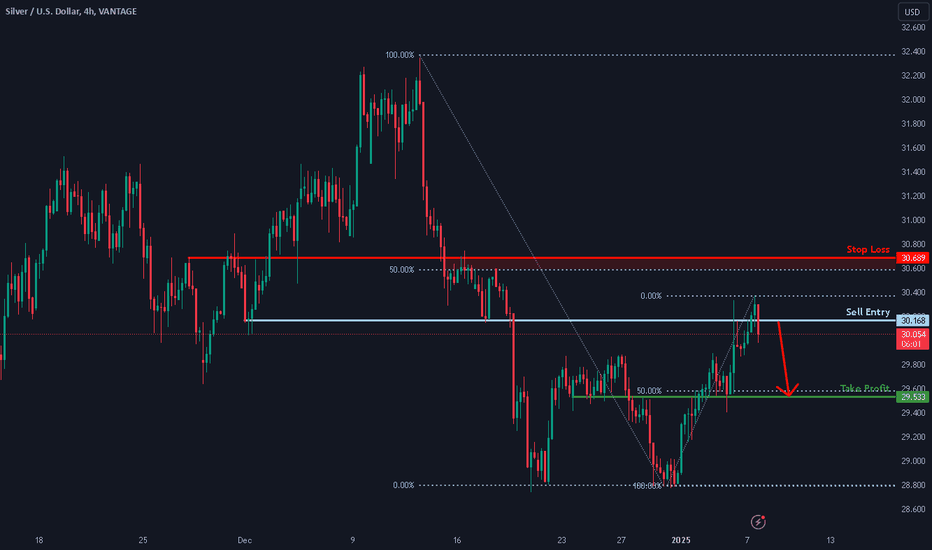

Bearish drop?XAG/USD is reacting off the resistance level which is a pullback resistance and could drop from this level to our take profit.

Entry: 30.16

Why we like it:

There is a pullback resistance level.

Stop loss: 30.68

Why we like it:

There is an overlap resistance level that is slightly above the 50% Fibonacci retracement.

Take profit: 29.53

Why we like it:

There is an overlap support level that lines up with the 50% Fibonacci retracement.

Enjoying your TradingView experience? Review us!

Please be advised that the information presented on TradingView is provided to Vantage (‘Vantage Global Limited’, ‘we’) by a third-party provider (‘Everest Fortune Group’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by Everest Fortune Group.

Potential bullish rise?The Silver (XAG?USD) has reacted off the pivot and could potentially rise to the 1st resistance which has been identified as an overlap resistance.

Pivot: 29.85

1st Support: 29.30

1st Resistance: 30.70

Risk Warning:

Trading Forex and CFDs carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading Forex and CFDs may not be suitable for all investors, so please ensure that you fully understand the risks involved and seek independent advice if necessary.

Disclaimer:

The above opinions given constitute general market commentary, and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.

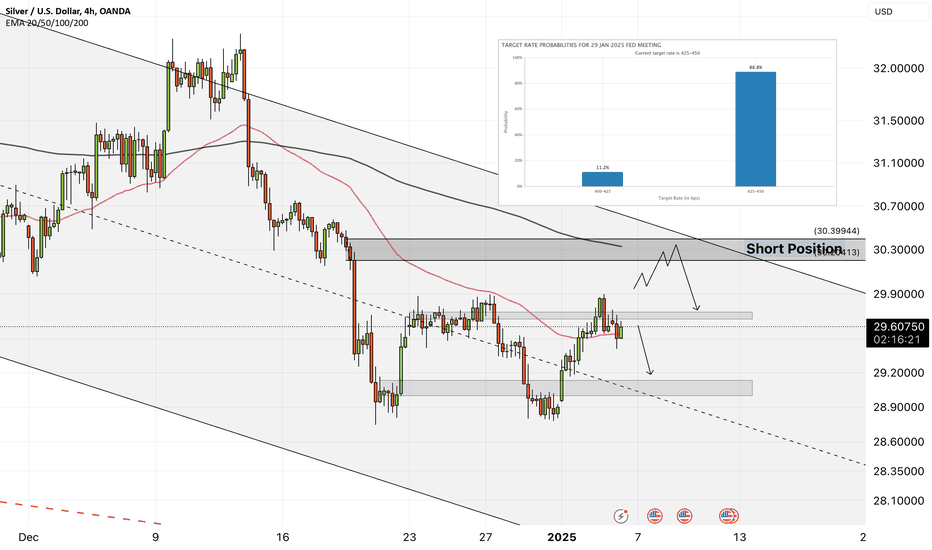

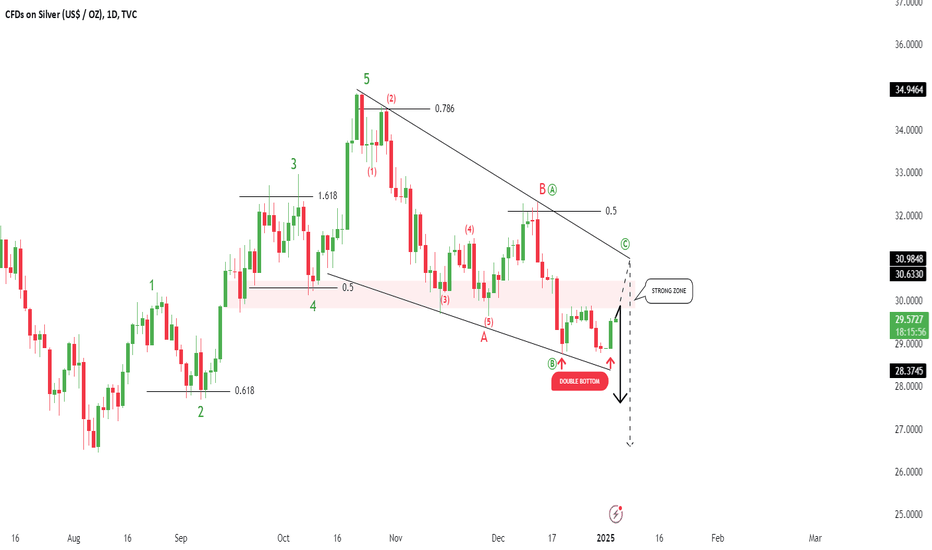

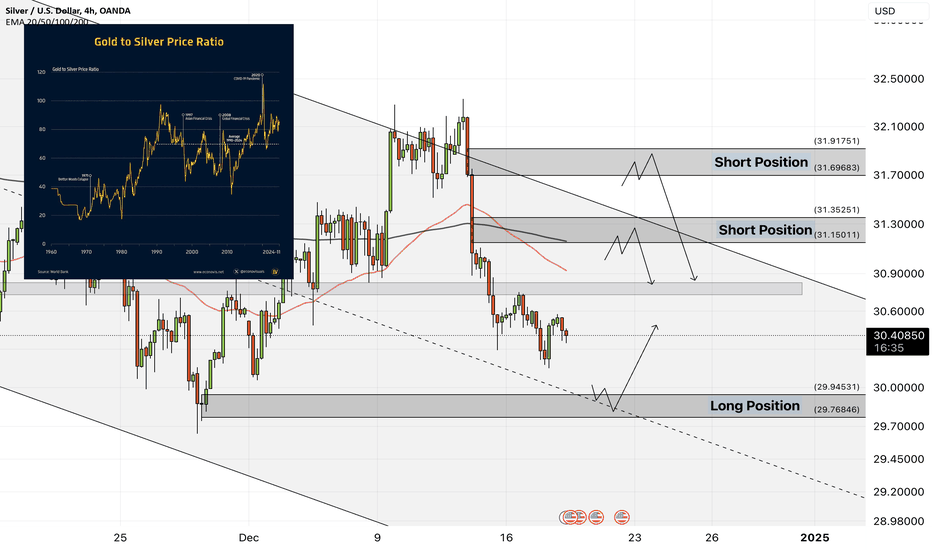

XAGUSD - Silver, waiting for the start of the upward trend?!Silver is located between EMA200 and EMA50 in the 4-hour timeframe and is moving in its descending channel. If the decline continues, we can see a support limit. Stabilization of silver above the resistance range will provide us with the path of silver up to the supply zone, where we can sell in that range with a suitable risk reward.

In 2025, it might be wiser to adopt a contrarian approach, as the upcoming year has the potential to be one of the most turbulent, especially in the commodities market. The return of Donald Trump as the President-elect of the United States brings the threat of disrupting global trade flows through the imposition of heavy tariffs on U.S. imports. With a Congress led by Republicans, there seems to be little to restrain him this time. Furthermore, there remains significant uncertainty regarding the economic trajectory of China, the world’s second-largest economy and the biggest buyer of commodities.

Historically, the dollar tends to perform strongly in January and February. Interestingly, last month also saw a 2.6% rise in the DXY index, breaking a seven-year streak of December weakness. This performance suggests that macroeconomic factors and expectations around Trump’s policies were strong enough to counteract the usual seasonal drag. As the year begins with a positive phase for the dollar, any shift in the current narrative sustaining the dollar’s strength through the end of the year would require a significant change in economic dynamics.

The U.S. dollar started 2025 with a slight dip but quickly resumed its upward trend, as the fundamental drivers of the U.S. economy remain intact. The Federal Reserve, adjusting its projections downward, indicated that there might only be two rate cuts in 2024. This stance has further widened the yield gap between the U.S. and other major economies, as central banks in other regions move towards more accommodative monetary policies.

Kugler, a member of the Federal Reserve, recently stated that the U.S. economy ended 2024 in good shape, exhibiting solid growth. He noted that the Federal Reserve is likely to take its time before implementing future rate cuts and sees no urgency in this regard. Meanwhile, questions remain about whether inflationary pressures will continue to persist.

Kugler also highlighted improvements in productivity and labor supply, which have played a key role in strengthening the economy. He emphasized that the labor market still appears stable, with the current unemployment rate remaining at historically low levels. Even as the labor market cools gradually, real wages remain elevated. Overall, while the labor market is slowly losing heat, it continues to demonstrate resilience. Similarly, the disinflation process is steadily progressing at a consistent pace.

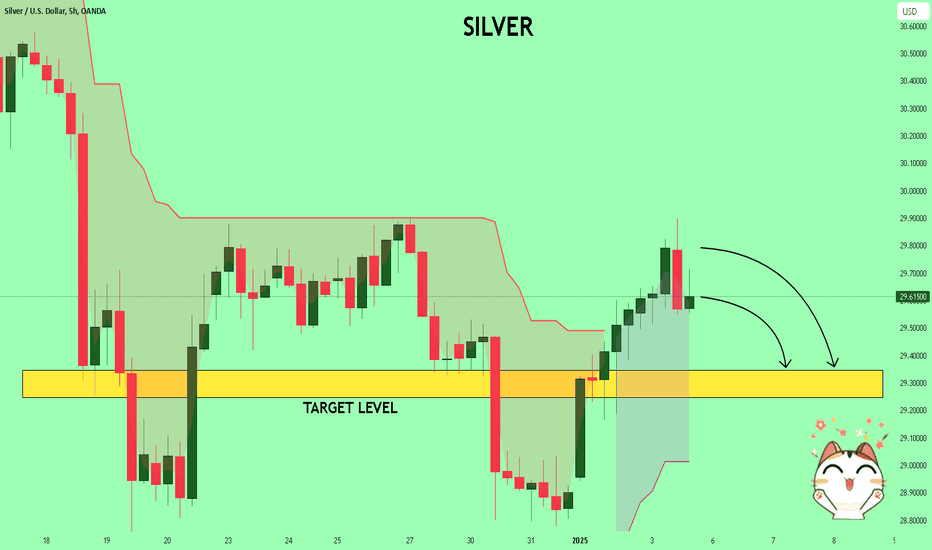

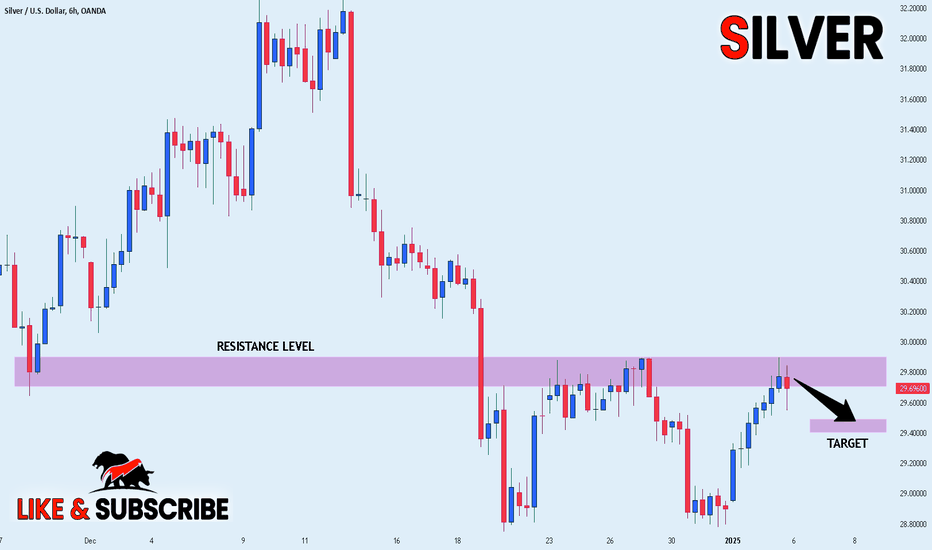

SILVER: Potential Short! SELL!

My dear friends,

Please, find my technical outlook for SILVER below:

The instrument tests an important psychological level 29.80$

Bias - Bearish

Technical Indicators: Supper Trend gives a precise Bearish signal, while Pivot Point HL predicts price changes and potential reversals in the market.

Target - 29.30$

About Used Indicators:

Super-trend indicator is more useful in trending markets where there are clear uptrends and downtrends in price.

———————————

WISH YOU ALL LUCK

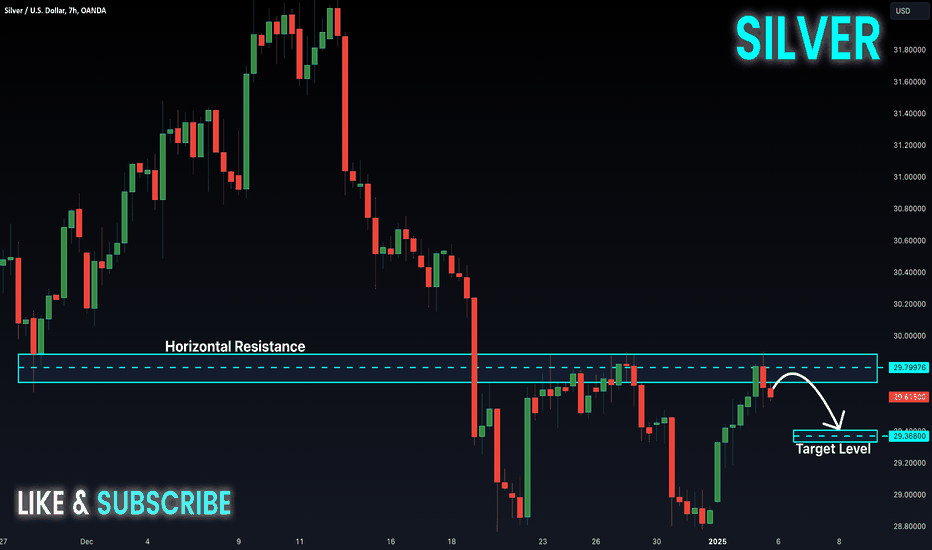

SILVER BEARISH BIAS|SHORT|

✅SILVER made a bullish

Rebound from the support

Level below at 28.77$ just

As I predicted in my previous

Analysis but the price has

Retested a horizontal

Resistance level of 29.90$

So we are locally bearish

Biased and we will be expecting

A local bearish correction

SHORT🔥

✅Like and subscribe to never miss a new idea!✅

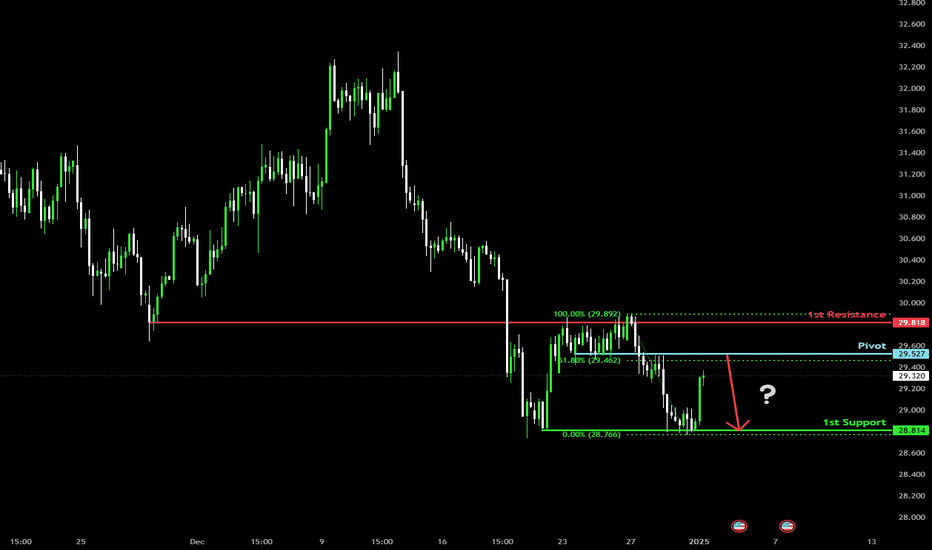

Heading into 61.8% Fibonacci resistance?The Silver (XAG/USD) is rising towards the pivot which is an overlap resistance that lines up with the 61.8% Fibonacci retracement and could drop to the 1st support which acts as a pullback support.

Pivot: 29.52

1st Support: 28.81

1st Resistance: 29.81

Risk Warning:

Trading Forex and CFDs carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading Forex and CFDs may not be suitable for all investors, so please ensure that you fully understand the risks involved and seek independent advice if necessary.

Disclaimer:

The above opinions given constitute general market commentary, and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.

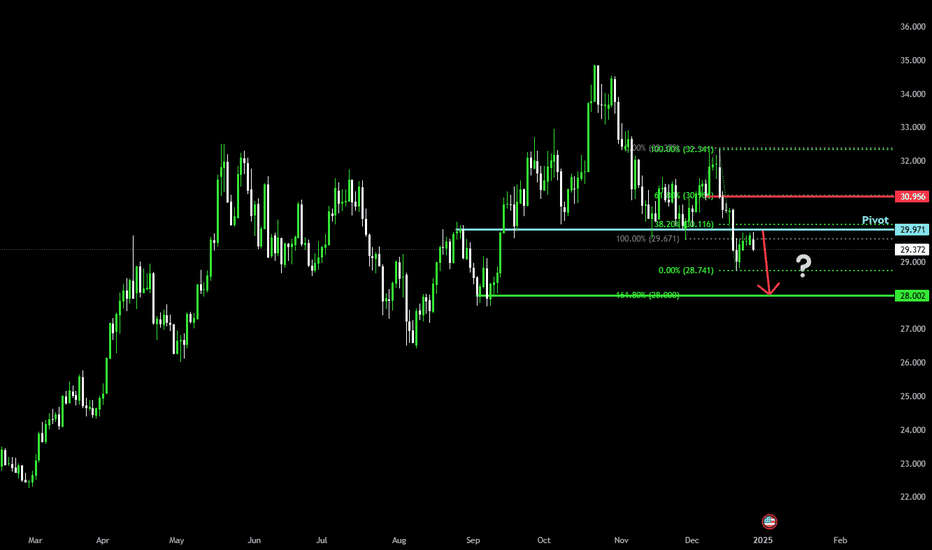

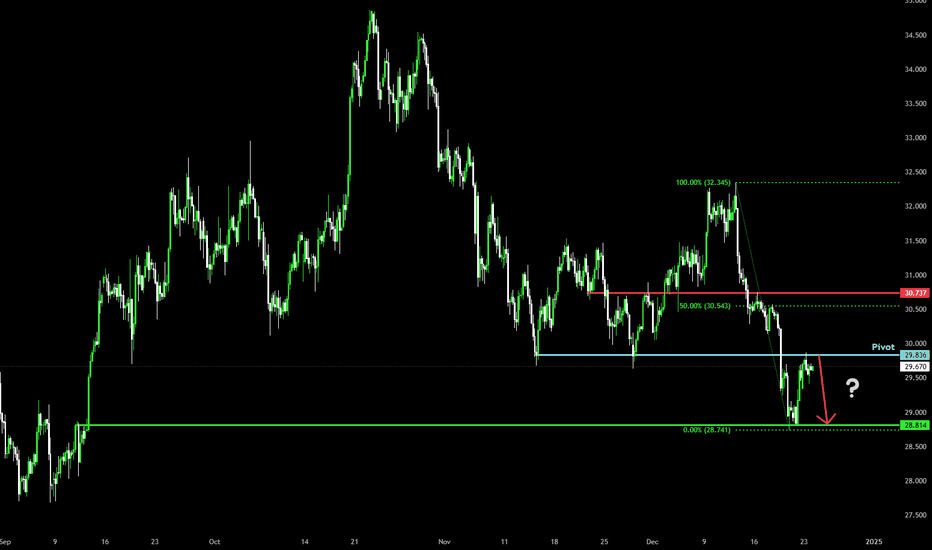

Bearish drop off 38.2% Fibonacci resistance?The Silver (XAG/USD) is reacting off the pivot which acts as an overlap resistance and could drop to the 1st support which has been identified as a pullback support.

Pivot: 29.97

1st Support: 28.00

1st Resistance: 30.95

Risk Warning:

Trading Forex and CFDs carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading Forex and CFDs may not be suitable for all investors, so please ensure that you fully understand the risks involved and seek independent advice if necessary.

Disclaimer:

The above opinions given constitute general market commentary, and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.

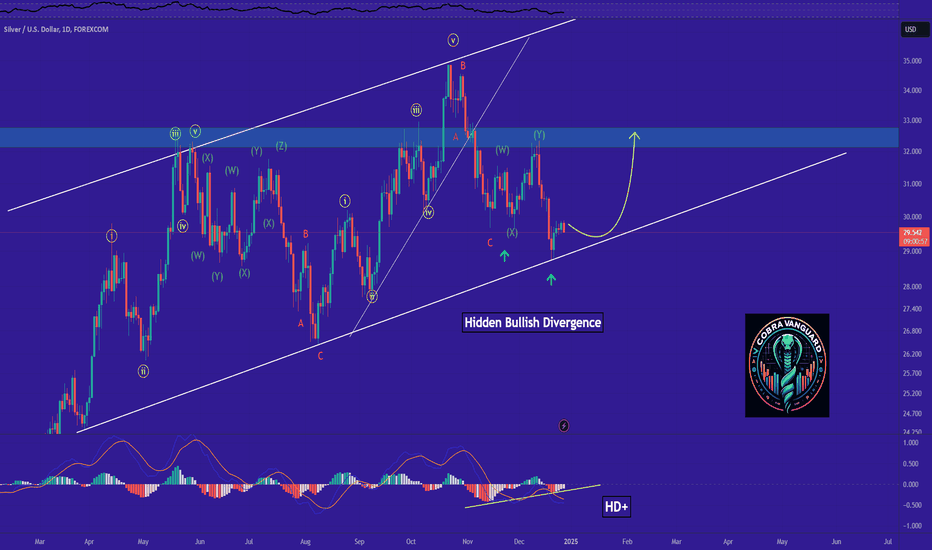

SILVER Outlook after the Dip. What to expect NOW?As you can see, the price has repeatedly hit the trendline and then increased. This time, the same situation has occurred, so the trendline can be relied upon. Additionally, a hidden bullish divergence is visible, indicating a potential price increase.

Give me some energy !!

✨We spend hours finding potential opportunities and writing useful ideas, we would be happy if you support us.

Best regards CobraVanguard.💚

_ _ _ _ __ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _

✅Thank you, and for more ideas, hit ❤️Like❤️ and 🌟Follow🌟!

⚠️Things can change...

The markets are always changing and even with all these signals, the market changes tend to be strong and fast!!

Could the Silver drop from hereThe price is reacting off the pivot which has been identified as a pullback resistance and could drop to the 1st support level which acts as a pullback support.

Pivot: 29.83

1st Support: 28.81

1st Resistance: 30.73

Risk Warning:

Trading Forex and CFDs carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading Forex and CFDs may not be suitable for all investors, so please ensure that you fully understand the risks involved and seek independent advice if necessary.

Disclaimer:

The above opinions given constitute general market commentary, and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.

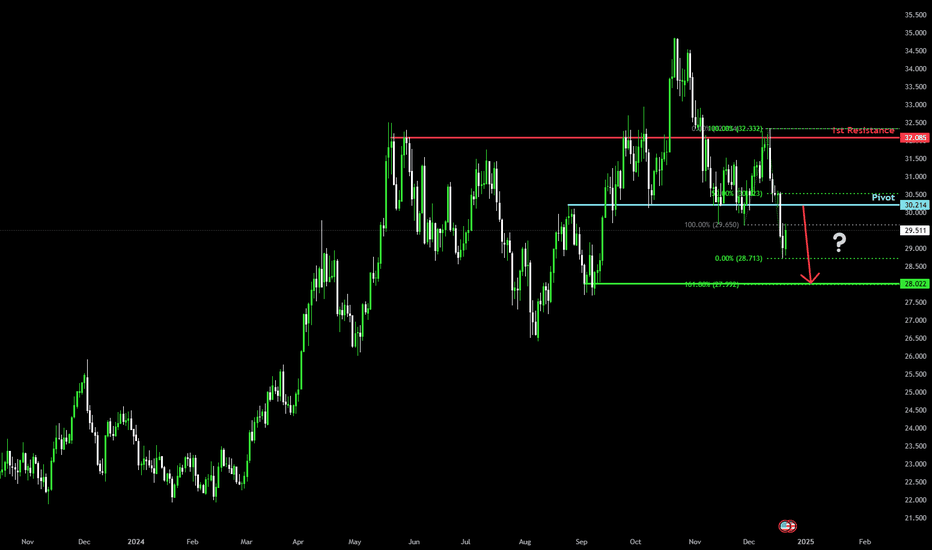

Heading into overlap resistance?The Silver (XAG/USD) is rising towards the pivot and could reverse to the 1st support which acts as a pullback support.

Pivot: 30.21

1st Support: 28.02

1st Resistance: 32.08

Risk Warning:

Trading Forex and CFDs carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading Forex and CFDs may not be suitable for all investors, so please ensure that you fully understand the risks involved and seek independent advice if necessary.

Disclaimer:

The above opinions given constitute general market commentary, and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.

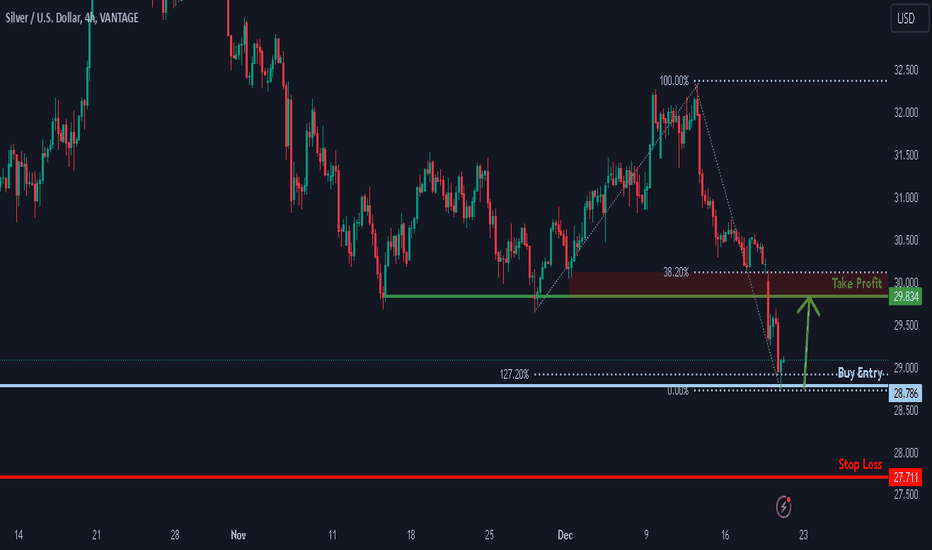

Could the Silver rise from here?The price is reacting off the support level which is an overlap support that lines up with the 127.2% Fibonacci extension and could rise from this level to our take profit.

Entry: 28.78

Why we like it:

There is an overlap support level that lines up with the 127.2% Fibonacci extension.

Stop loss: 27.71

Why we like it:

There is a pullback support level.

Take profit: 29.83

Why we like it:

There is a pullback resistance.

Enjoying your TradingView experience? Review us!

Please be advised that the information presented on TradingView is provided to Vantage (‘Vantage Global Limited’, ‘we’) by a third-party provider (‘Everest Fortune Group’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by Everest Fortune Group.

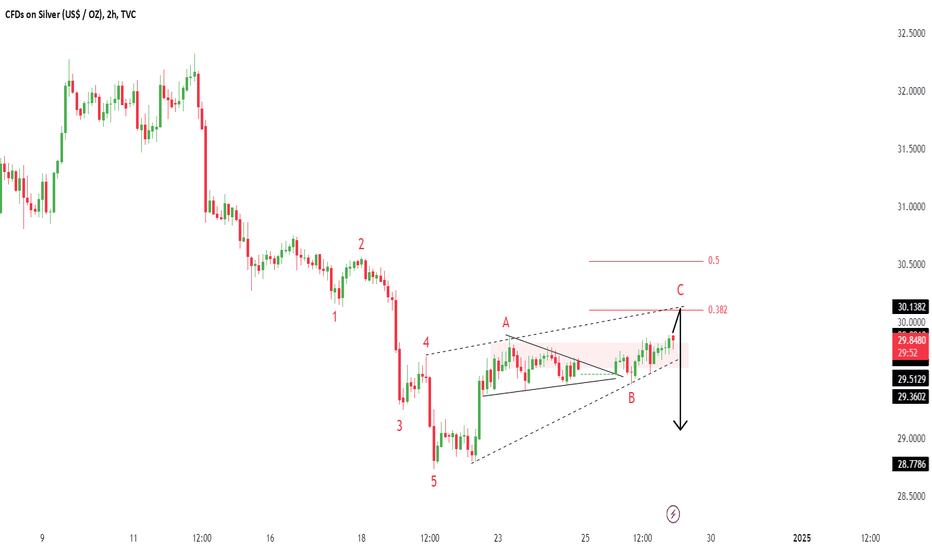

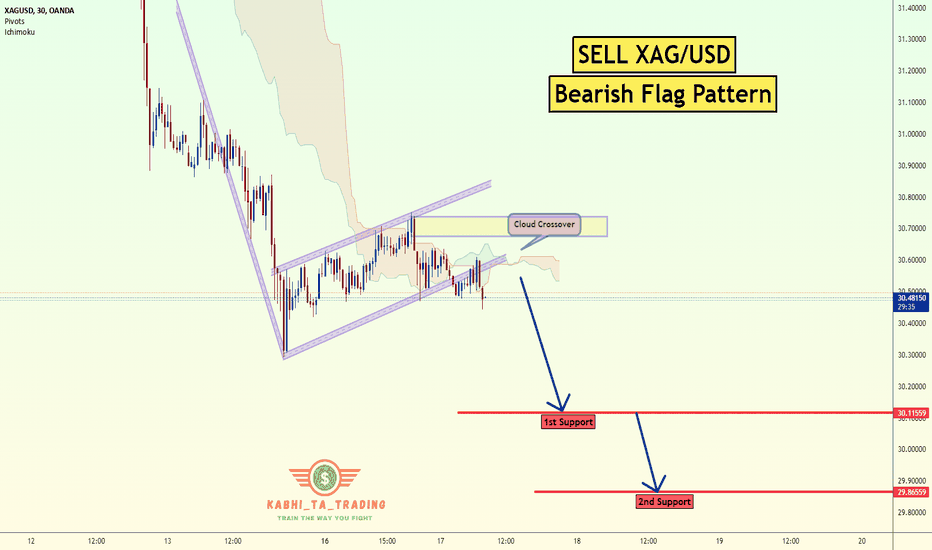

Silver XAG/USD Bearish FlagThe XAG/USD pair on the M30 timeframe presents a potential selling opportunity due to a recent downward breakout from a well-defined Flag pattern. This suggests a shift in momentum towards the downside in the coming Hours.

Key Points:

Sell Entry: Consider entering a short position around close to the breakout level. This offers an entry point near the perceived shift in momentum.

Target Levels:

1st Support – 30.11

2nd Support – 29.86

Your likes and comments are incredibly motivating and will encourage me to share more analysis with you.

Best Regards, KABHI FOREX TRADING

Thank you.

XAGUSD- silver, waiting for the correction process to continue?!Silver is below EMA200 and EMA50 in the 4H timeframe and is moving in its descending channel. If the decline continues, we can see the demand zone and buy within that range with the appropriate risk reward. Stabilization of silver above the resistance range will provide us with the way for silver to rise to the supply range.

With the Federal Reserve beginning its interest rate cuts in September and expectations for this trend to continue, markets are now shifting their focus toward determining the neutral rate. The neutral rate refers to the benchmark interest rate in a normal economic cycle that neither accelerates economic growth nor slows it down.

Federal Reserve officials have emphasized that predicting this rate is currently not feasible. They insist that it is necessary to observe how economic data reacts to each stage of rate cuts before making any conclusions about the neutral rate. Nevertheless, bond market fluctuations suggest that this rate may be higher in the current cycle compared to previous ones. On average, FOMC members estimate a long-term neutral rate close to 3%, although this figure remains uncertain.

According to a recent Reuters survey of economists, the yield on 10-year U.S. Treasury bonds is expected to decline to 4.3% within three months and 4.25% within a year. These figures were 4.25% and 4.1% in the November survey, and 3.8% and 3.75% in October.In a note from Citi, it was stated that demand for gold and silver is likely to remain strong until U.S. and global economic growth stabilizes. Additionally, buying these precious metals as a hedge against declining equity values will persist until U.S. interest rates reach the neutral level.

This week, besides the FOMC’s decision on interest rates, other key economic data will be released. These include the GDP report, the Personal Consumption Expenditures (PCE) index, and the latest findings on consumer sentiment.

Bloomberg has reported that Wall Street’s perspective on the U.S. dollar is shifting. Policies introduced by Donald Trump and further rate cuts by the Federal Reserve in the second half of 2025 could weaken the dollar’s strength. Analysts from Morgan Stanley to J.P. Morgan predict that the U.S. dollar will peak by mid-next year before entering a downward trajectory. Similarly, Société Générale has forecasted a 6% decline in the dollar index by the end of 2025.

Bloomberg also noted that Jerome Powell, the Federal Reserve Chair, is expected to announce another quarter-point rate cut. However, the bigger question is what signals the Fed will provide regarding the future policy path and whether this will heighten tensions between Jerome Powell and President-elect Donald Trump.

Following a full percentage point reduction in borrowing costs since mid-September, Powell and his colleagues are expected to pause rate cuts for now. The Federal Reserve is likely to maintain a holding pattern during its January meeting and reassess inflation and labor market conditions in March.

This approach could lead to friction between the FOMC and Trump’s White House. Known for his preference for low rates and frequent complaints when he feels rates are not low enough, Trump’s arrival in office just over a week before the January meeting may amplify these tensions.

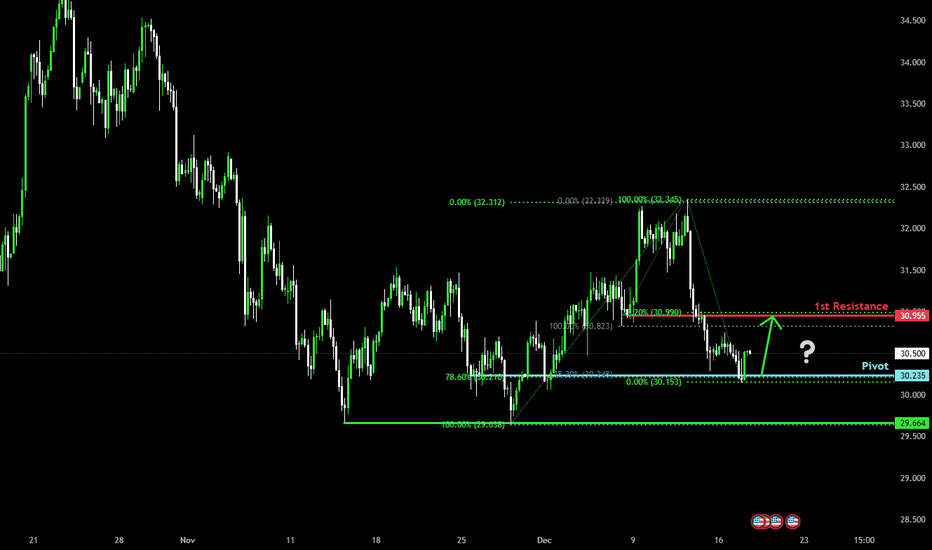

Potential bullish rise?The Silver (XAG/USD) has reacted off the pivot and could bounce to the 1st resistance which is a pullback resistance.

Pivot: 30.23

1st Support: 29.66

1st Resistance: 30.95

Risk Warning:

Trading Forex and CFDs carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading Forex and CFDs may not be suitable for all investors, so please ensure that you fully understand the risks involved and seek independent advice if necessary.

Disclaimer:

The above opinions given constitute general market commentary, and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.