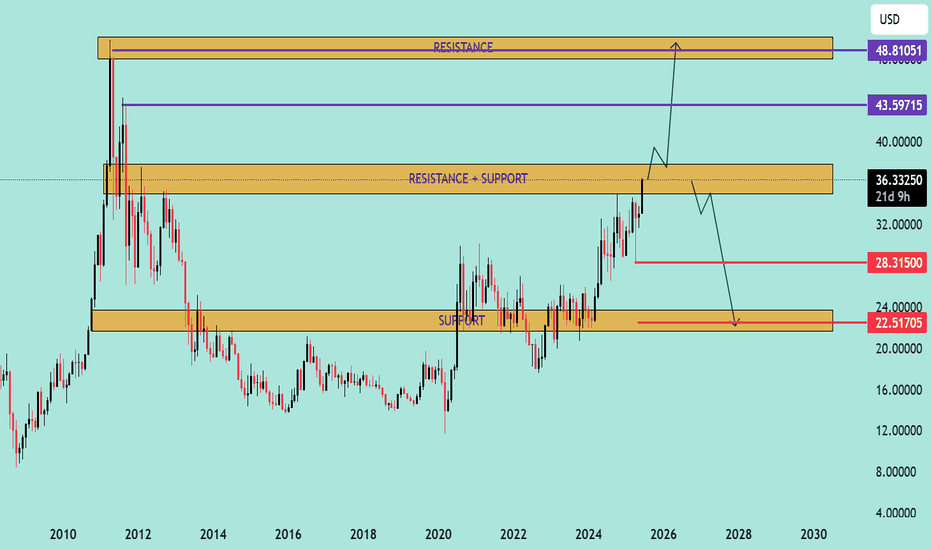

XAG/USD (Silver) Monthly Analysis – Major Resistance Test Incomi🔍 XAG/USD (Silver) Monthly Analysis – Major Resistance Test Incoming 💥🪙

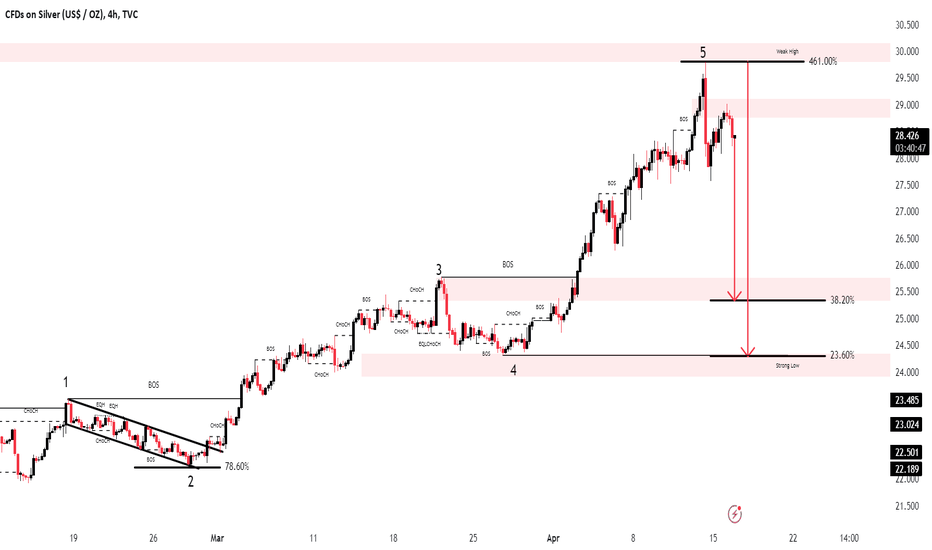

📊 Overview:

This monthly chart of XAG/USD (Silver vs. US Dollar) reveals a critical technical juncture, where price action is testing a multi-year resistance-turned-support zone around $36.27. The chart is structured with major zones of support and resistance, and it includes a potential bullish extension followed by a bearish correction scenario.

📌 Key Technical Levels:

🟧 Support Zone: $22.50 – $24.00

🟨 Resistance-Turned-Support Zone: $34.00 – $36.50

🟪 Major Resistance: $43.60 – $48.80

🔼 Bullish Scenario (Preferred Path):

Current Price: ~$36.27 is at the upper edge of a crucial S/R flip zone.

📈 A breakout above this zone could propel silver toward the next resistance target at $43.60, with a potential full extension to $48.80.

✨ Momentum and historical breakout behavior from this region suggest strong buying interest if breached convincingly.

🔽 Bearish Scenario (Rejection Path):

🔄 If silver faces rejection at the $36.27 zone, it may retrace towards:

🟥 $28.31 minor support (intermediate target),

🔻 followed by a deeper correction to the $22.50–$24.00 support zone.

🔁 This would complete a classic retest of broken support, allowing accumulation before any further long-term rally.

🧠 Strategic Notes:

⚠️ Macro-driven: Silver is highly sensitive to inflation, Fed policy, and industrial demand.

📅 Long-term chart suggests cyclical behavior, with consolidation phases followed by aggressive trends.

📌 Traders should monitor weekly closes around $36.27 to confirm breakout or rejection.

✅ Conclusion:

Silver is at a make-or-break zone 🧨. A breakout may lead to a multi-year high, but failure here opens the door for a healthy pullback. The next few candles will be decisive for long-term positioning.

📉 Watch for rejection wicks at resistance

📈 Monitor volume on breakout attempts

📊 Plan for both outcomes: breakout or retest

Xagusdanalizi

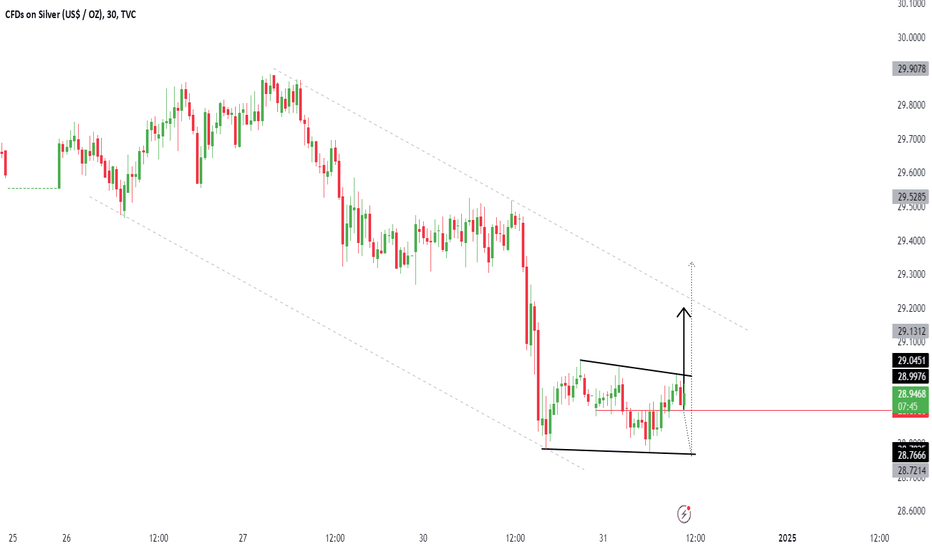

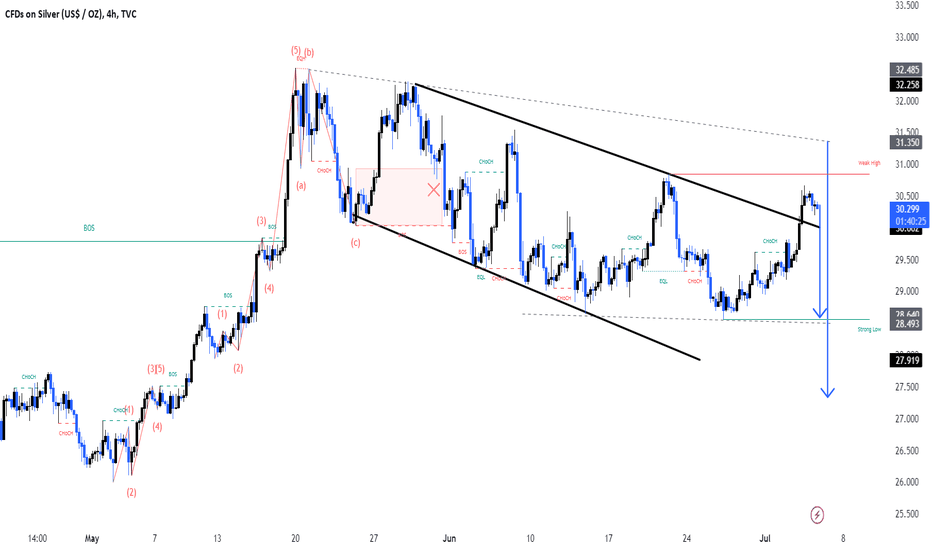

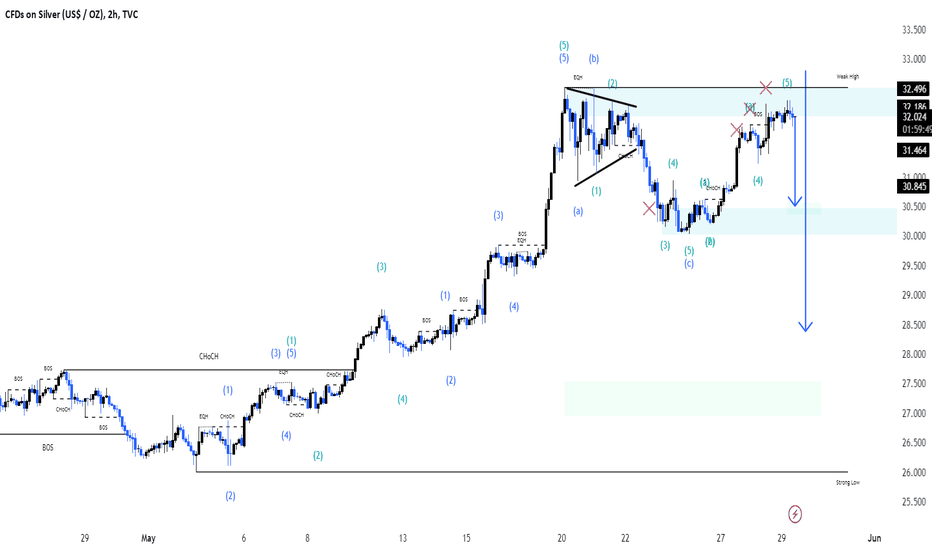

XAG/USD Rejection Looming at Key Resistance – Bearish Reversal 🔍 Chart Analysis – XAG/USD

1. Trend & EMAs:

The chart shows two key exponential moving averages:

📈 EMA 50 (Red): 33.1940

📉 EMA 200 (Blue): 32.8684

Price is currently above both EMAs, indicating a short-term bullish trend, but a possible bearish rejection is forming near resistance.

2. Key Zones:

🟥 Resistance Zone: 33.45 – 33.60

Price has repeatedly tested this zone and reversed, suggesting strong selling pressure.

Multiple wicks into this zone show buyer exhaustion.

🟩 Support Zone: 32.60 – 32.85

Strong demand observed here with consistent bounces.

The EMA 200 also aligns with this support, reinforcing its strength.

3. Price Behavior & Pattern:

🧱 Repetitive Bearish Drops: Marked by blue rectangles, suggesting a pattern of sharp sell-offs after touching resistance.

🔁 Potential Double Top Pattern forming near the resistance zone, a classic bearish reversal signal.

🧭 The projected path suggests:

A short-term retest of the resistance.

Followed by a pullback toward the support zone around 32.60.

Breakdown below support could open further downside potential.

📌 Summary:

⚠️ Short-Term Outlook: Bearish bias if resistance holds.

📍 Key Level to Watch: 33.60 (breakout) and 32.60 (breakdown).

🔄 Trade Plan:

Consider short entries near 33.45–33.60 resistance zone with stops above 33.65.

Target around 32.65–32.60 support zone.

📊 Indicators in Play:

EMA confluence supports trend analysis.

Price structure and rejection patterns suggest likely mean reversion to support.