XAG/USD Analysis: Slight Bearish Bias Expected on 14/10/2024.The XAG/USD (Silver to US Dollar) pair is likely to exhibit a slight bearish bias today, driven by a combination of fundamental and technical factors. The global silver market is influenced by economic data, investor sentiment, and broader financial market trends. In this article, we provide a detailed analysis of the factors likely to drive XAG/USD lower, while optimizing for SEO ranking with relevant keywords.

1. Stronger US Dollar

The primary factor putting pressure on XAG/USD is the strengthening US dollar. Despite some recent softness, the US dollar index (DXY) remains elevated due to positive US economic data, particularly in the labor market. The recent release of robust non-farm payrolls (NFP) and a steady unemployment rate has reinforced the Federal Reserve's stance on keeping interest rates higher for longer. With the prospect of higher interest rates, the dollar is maintaining its appeal as a safe-haven asset, which tends to weigh on silver prices.

2. Rising US Treasury Yields

In tandem with a strong US dollar, US Treasury yields continue to rise, further pressuring precious metals like silver. Higher yields make non-yielding assets like silver less attractive to investors. The yield on the 10-year Treasury note is nearing multi-year highs, suggesting continued demand for safer, interest-bearing assets over riskier commodities such as silver. As long as yields remain elevated, silver prices are likely to stay under pressure, contributing to a bearish outlook for XAG/USD.

3. Silver's Role as an Industrial Metal

Silver is not only a precious metal but also an important industrial commodity . Given its extensive use in industries such as electronics, renewable energy (solar panels), and manufacturing, any slowdown in global economic growth tends to dampen demand for silver. Recent concerns over a potential slowdown in China’s economic growth—a major driver of global industrial demand—could lead to weaker silver prices. If demand for industrial silver weakens, this would likely contribute to a bearish trend for XAG/USD.

4. Geopolitical Tensions Easing

Silver, like gold, is often viewed as a safe-haven asset during times of geopolitical uncertainty. However, the easing of recent geopolitical tensions, particularly in the Middle East, has diminished the demand for safe-haven assets. This shift in sentiment could lead to further downside pressure on silver as risk-on market conditions prevail. If tensions continue to de-escalate, silver could see reduced buying interest, further supporting a bearish bias.

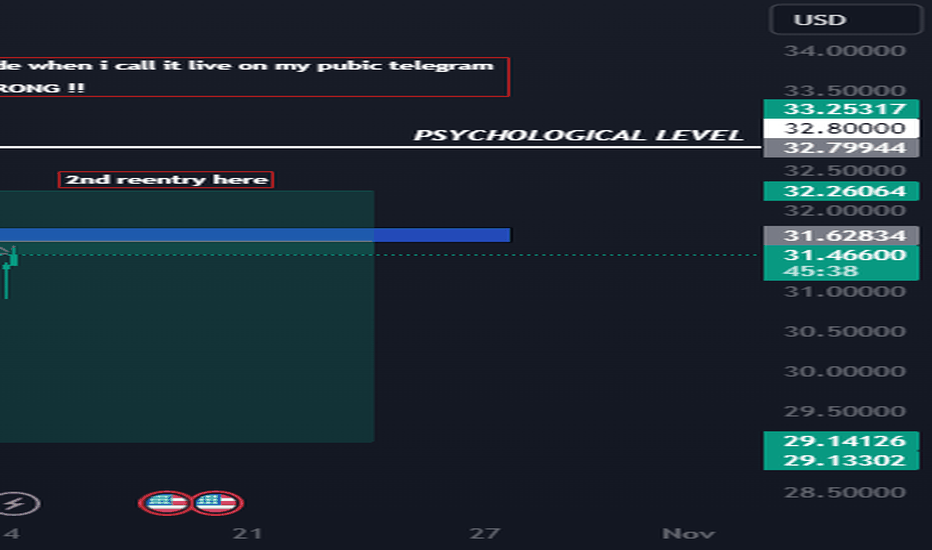

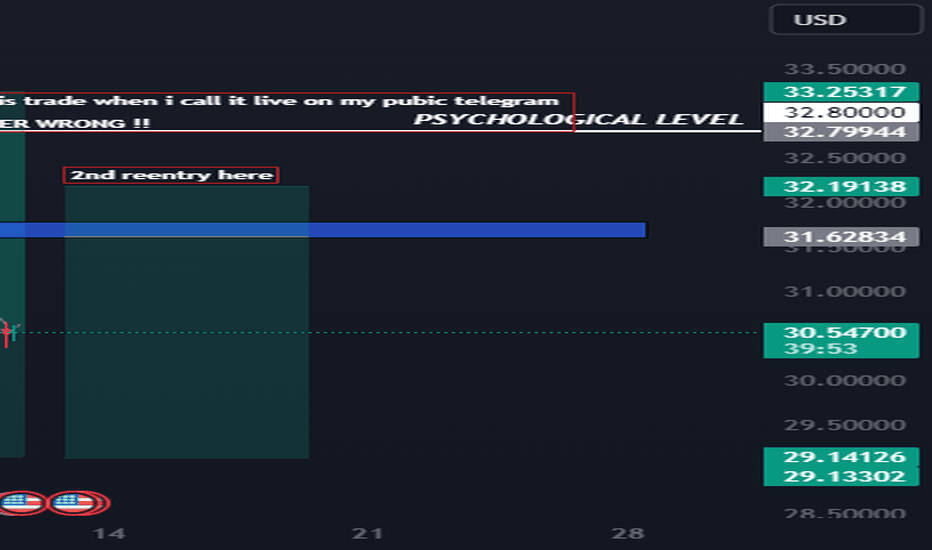

5. Technical Analysis of XAG/USD

From a technical perspective, XAG/USD is currently trading below its 50-day moving average, signaling a bearish trend . The pair is hovering near support around the $21.50 level, but a break below this level could open the door to further downside, potentially testing the $21.00 psychological support level. RSI (Relative Strength Index) is showing bearish momentum, while MACD (Moving Average Convergence Divergence) is also trending lower, indicating continued selling pressure.

6. Key Data Releases to Watch

Traders should pay attention to the following data releases, which could influence XAG/USD today:

- US Retail Sales Data: A stronger-than-expected result could boost the US dollar, further weighing on silver prices.

- Fed Speakers: Any hawkish comments from Federal Reserve officials regarding future rate hikes could add to the bearish sentiment for silver.

- China's Industrial Output: Slower growth in China’s industrial production could reduce silver demand, pushing prices lower.

Conclusion

Overall, XAG/USD is expected to exhibit a slight bearish bias today , driven by a stronger US dollar, rising Treasury yields, weakening industrial demand, and easing geopolitical risks. The technical outlook also supports a downside move, with key support levels in focus. Traders should remain cautious and monitor economic data releases that could impact silver’s price action throughout the day.

Keywords for SEO Ranking:

- XAG/USD analysis,

- XAG/USD bearish bias,

- Silver to USD analysis,

- US dollar strength,

- US Treasury yields impact on silver,

- Silver as an industrial metal,

- China economic slowdown and silver,

- Precious metals analysis,

- Technical analysis XAG/USD,

- Silver price forecast,

- Safe-haven assets,

- Geopolitical risks in silver market,

- US retail sales impact on silver,

- Federal Reserve rate hikes impact on silver,

- Trading silver in 2024.

Xagusdbearishbias

Bearish Bias Amid Stronger USD and Global Uncertainty on Silver.On October 10, 2024, the XAGUSD (Silver to USD) pair is likely to experience a slight bearish bias due to a combination of fundamental factors and current market conditions. For traders focusing on the silver market, today’s trading session will be influenced by several key economic drivers that point to a possible decline in silver prices.

Key Drivers Supporting XAGUSD Bearish Bias:

1. Strengthening US Dollar on Hawkish Fed Expectations

The US Dollar continues to show strength amid renewed expectations that the Federal Reserve may resume its hawkish monetary policy stance. Recent US economic data, particularly stronger-than-expected employment and manufacturing figures, have led to speculation that the Fed might hike interest rates further to control inflation. As the USD strengthens, precious metals like silver tend to weaken due to their inverse relationship.

Keywords: US Dollar strength, hawkish Fed, Federal Reserve interest rate hikes, USD impact on silver, XAGUSD weakness

2. Rising US Treasury Yields Pressuring Silver

With US Treasury yields climbing to new highs, investor preference for higher-yielding assets like bonds is reducing the appeal of non-yielding assets such as silver. As yields rise, silver tends to become less attractive as a safe-haven investment, contributing to the bearish outlook for XAGUSD. Traders are closely monitoring US 10-year Treasury yields, which have been a key pressure point on precious metals.

Keywords: US Treasury yields, silver price pressure, XAGUSD bearish, rising yields impact on silver, bond market vs silver

3. Weak Industrial Demand for Silver

Silver is not just a precious metal; it also has significant industrial demand. However, recent global economic data points to a slowdown in manufacturing activity, especially in key markets such as China and Europe. This has dampened industrial demand for silver, which is heavily used in electronics, solar panels, and other industrial applications. The reduced demand from these sectors is weighing on silver prices, contributing to the bearish outlook.

Keywords: silver industrial demand, manufacturing slowdown, XAGUSD industrial use, silver vs manufacturing, China silver demand

4. Geopolitical Uncertainty and Safe-Haven Flow into Gold

While silver is often viewed as a safe-haven asset, it has been overshadowed by gold in recent months due to heightened geopolitical uncertainty. Investors seem to be flocking more towards gold as a safer alternative, leaving silver lagging behind. The geopolitical tensions in Europe, Middle East, and other regions have added to this trend, reducing the safe-haven demand for silver.

Keywords: geopolitical uncertainty, silver vs gold, XAGUSD safe-haven demand, gold outshines silver, silver price drop

Technical Outlook for XAGUSD

From a technical perspective, XAGUSD has struggled to break above key resistance levels around $23.50. The Relative Strength Index (RSI) indicates that the market is leaning towards the overbought territory, signaling potential downside momentum. If silver fails to maintain support at $23.00, a decline towards the $22.50 level could materialize, confirming the bearish bias for the day.

Keywords: XAGUSD technical analysis, silver price support, XAGUSD RSI, XAGUSD resistance levels, silver price trend

Conclusion

In light of the strengthening US Dollar, rising US Treasury yields, weaker industrial demand, and safe-haven flows favoring gold over silver, the outlook for XAGUSD remains slightly bearish today. While silver may find some temporary support from short-term safe-haven buying, the overall market sentiment points towards a bearish bias for the session.

Traders should be cautious of upcoming US inflation data, as it could introduce volatility, but current fundamentals suggest downward pressure on XAGUSD.

Keywords: XAGUSD forecast, XAGUSD bearish bias, silver price analysis, silver market today, XAGUSD live trading, silver price forecast, XAGUSD daily analysis, XAGUSD technical outlook, silver forex trading

This analysis provides an insight into why XAGUSD may experience bearish price movement today, supported by both fundamental and technical factors. Stay updated with the latest market analysis on TradingView for live silver trading opportunities.

Keywords: XAGUSD live updates, silver market insights, XAGUSD trading strategy, daily silver analysis, XAGUSD forecast TradingView

Slightly Bearish Bias Expected on XAGUSD today 09/10/2024.XAGUSD Analysis for 09/10/2024: Slightly Bearish Bias Expected

In today's analysis of XAGUSD (silver to USD), the market appears to be leaning towards a slightly bearish bias based on the latest fundamental factors and current market conditions. As of 09/10/2024, several critical drivers are influencing the precious metal's price, suggesting that downside momentum could dominate the day. This article highlights the key reasons behind the potential bearish outlook for silver.

Fundamental Factors Supporting Bearish Bias

1. Strengthening US Dollar

One of the most significant factors weighing on XAGUSD today is the strengthening of the US Dollar. The US Dollar Index (DXY) has been rising, supported by robust US economic data and expectations that the Federal Reserve may continue its hawkish stance. A stronger USD typically puts pressure on commodities like silver, as it becomes more expensive for investors holding other currencies, leading to reduced demand.

2. Rising US Treasury Yields

Alongside the stronger US Dollar, US Treasury yields have been climbing, reflecting investor expectations for continued high interest rates. Higher yields tend to increase the opportunity cost of holding non-yielding assets like silver, leading to selling pressure in the silver market.

3. Weakening Global Demand for Safe-Haven Assets

Silver, like gold, often benefits from its status as a safe-haven asset in times of uncertainty. However, recent improvements in global risk sentiment have reduced the demand for such assets. The relatively calm geopolitical landscape and better-than-expected economic data from key regions like the US and China have shifted investor attention away from safe havens, contributing to the bearish outlook for silver.

Technical Outlook for XAGUSD on 09/10/2024

- Support and Resistance Levels

XAGUSD is currently facing resistance around the $23.00 level, with key support lying near the $22.50 level. A break below the $22.50 support could trigger further downside momentum, reinforcing the slightly bearish bias for today.

- Moving Averages

The 50-day Moving Average (MA) has turned slightly downward, indicating bearish momentum. Additionally, the Relative Strength Index (RSI) is trending lower but still above the oversold territory, suggesting that there is room for further downside before a potential rebound.

Impact of Market Sentiment and Commodity Outlook

- Commodity Price Pressure

Commodities, in general, have been under pressure as global growth concerns and rising interest rates weigh on demand. Silver, being both an industrial and precious metal, is particularly sensitive to changes in economic outlooks. If growth expectations continue to moderate, it could limit the industrial demand for silver, further pushing prices lower.

- Geopolitical Stability

The relatively stable geopolitical environment has also played a role in reducing demand for silver as a hedge against uncertainty. Unless new tensions emerge, this stability could continue to weigh on safe-haven demand.

Conclusion

In summary, the outlook for XAGUSD today, 09/10/2024, appears to be slightly bearish. A combination of factors, including a stronger US Dollar, rising US Treasury yields, and lower demand for safe-haven assets, are all contributing to downward pressure on silver prices. From a technical perspective, the metal is facing resistance at $23.00, and a break below $22.50 could open the door to further losses.

Traders should monitor key support levels and consider potential short positions if silver continues to trade under pressure. However, it's essential to remain cautious and watch for any sudden shifts in market sentiment or global events that could alter this outlook.

---

Keywords for SEO:

XAGUSD analysis, silver price forecast, XAGUSD bearish bias, US Dollar strength, rising US Treasury yields, safe-haven demand, silver technical analysis, support and resistance levels, XAGUSD 09/10/2024, precious metals market outlook, silver trend, XAGUSD trend, forex trading, commodity market analysis, silver to USD, XAGUSD trading strategy, forex forecast, trading silver today.