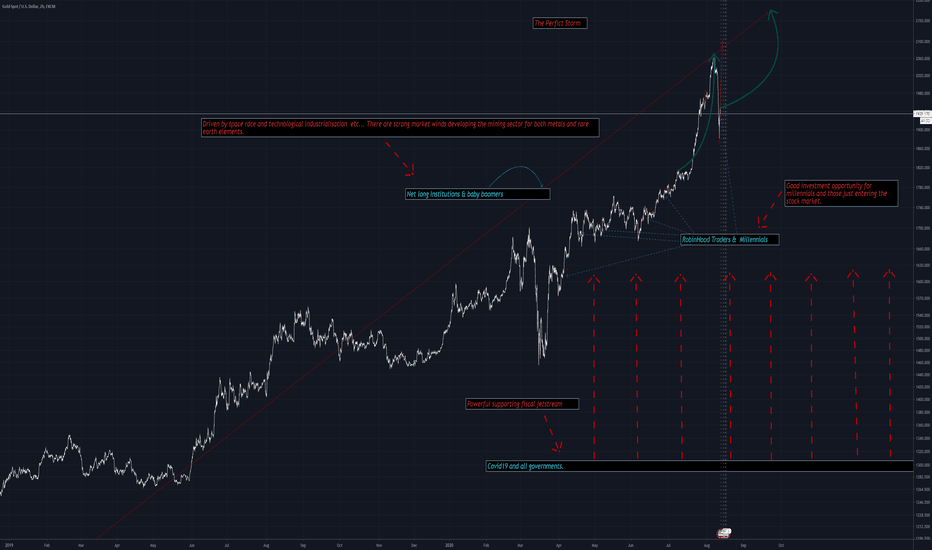

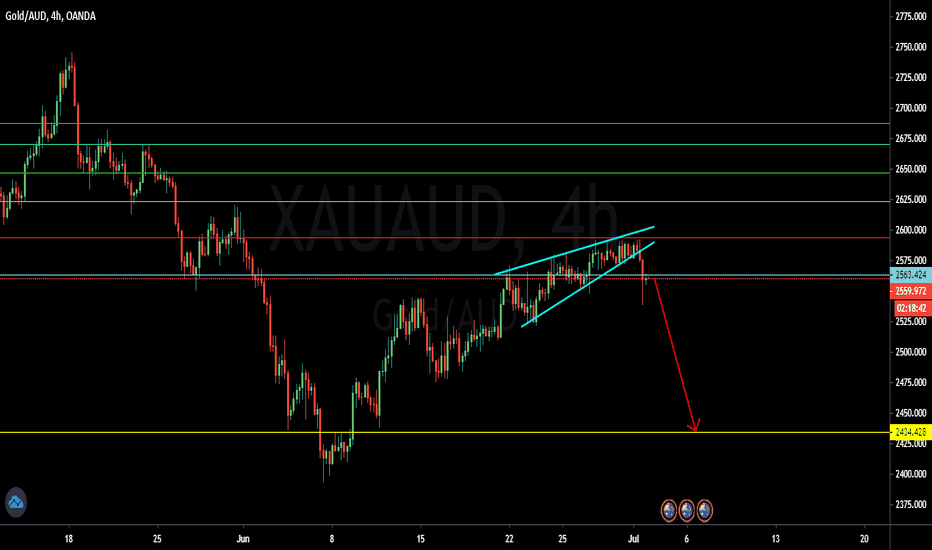

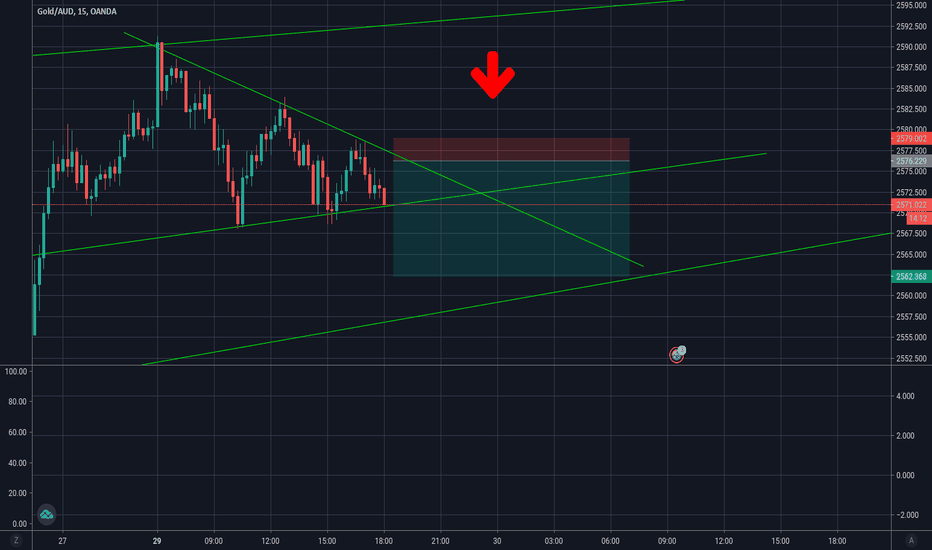

The Big Short, Just like the movie... Update #2 WOW, Today was a GREAT battle between the Bulls & Bears! After great success with the start of The Big Short I got caught in the crosshairs of this great consolidating battle being tugged back and fourth, Stop loss after stop loss. Finally i just had to take a step back, Breathe! Go for walk, Open your eyes. Let the battle commence whilst you sharpen your sword and get ready, Get ready for the war because the battle is just temporary. After a short break I re enter short but so the battle continues until finally...A bear, small little red bear just pops his little head out from under the bull and pulls its legs from underneath it with one big ROAR! And with the roar, A Big Bearish Flag to assert its dominance. Letting the Bulls know, We aint playing! And so comes the 2nd target of The Big Short 1850, 1800. Like i say this isnt over for the Bulls but for the meantime Bears are clearing the smoke and showing the fundamental median price value of gold behind the hype.

Continued year by year growth, 2008-2011 crisis, BIG Bull Run, BIGGER Bear Run, Year by year growth, 2019-2021 Crisis, BIG Bull Run, BIG... Bear Run... To be continued. For now B1GFUDG3 OUT!

Disclaimer: I am not advising anyone to take any trades nor am i providing market direction or certainty, Please do your own analysis and use the correct risk management.

'' PS... Learn to master your emotions, Once you get greedy, You start loosing. '' B1GFUDG3''

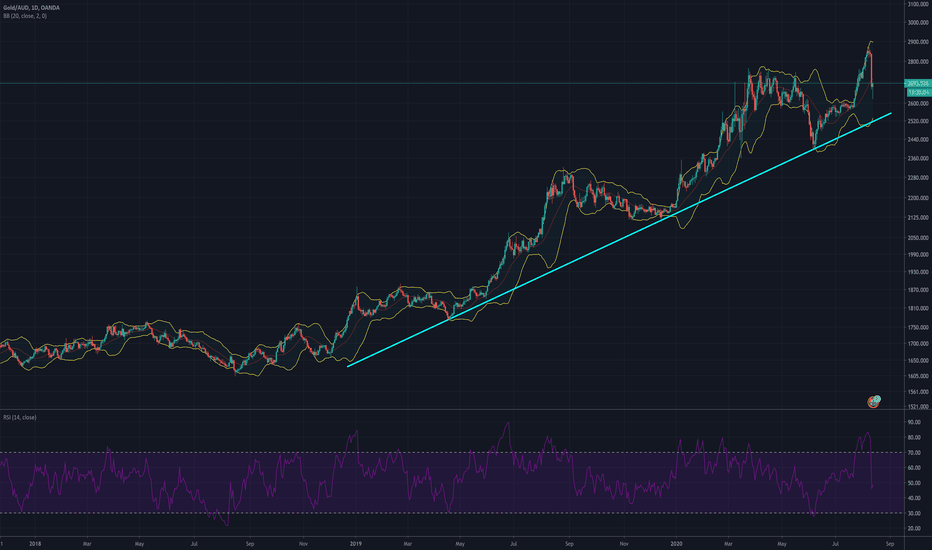

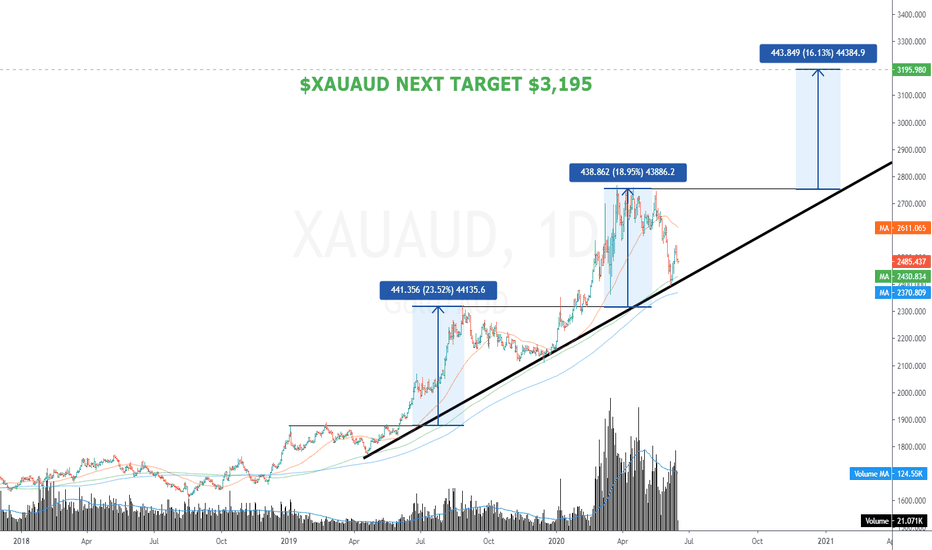

GOLD/AUD

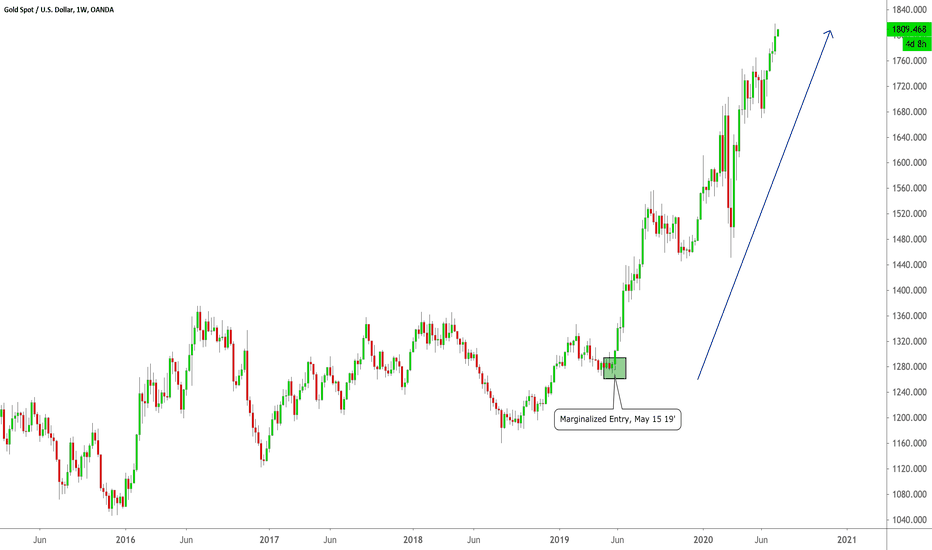

Only Safe To Long The rise in gold is being driven by many deep market factors. There is a strong drive to industrialize by all nations, there is a space and technological race developing between nations, also covid is accelerating this trend with fiscal stimulus from all nations. New (millennials) and life long value investors (Baby Boomers) are converging in a self supporting trend. There are many forces driving this trend forward, too many to mention, but this is a terrible time to be anything but long on Gold, it's next to impossible to predict a bottom or even a leveling out in these conditions.

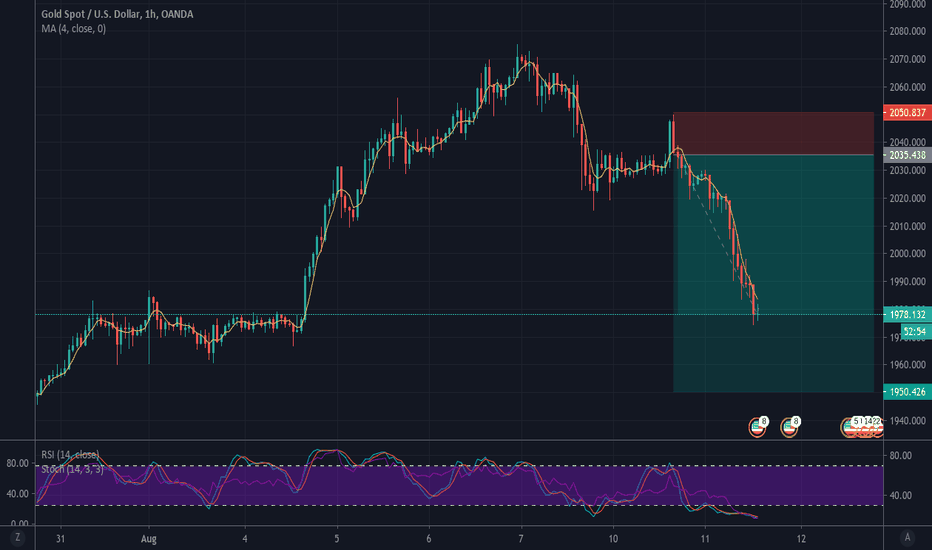

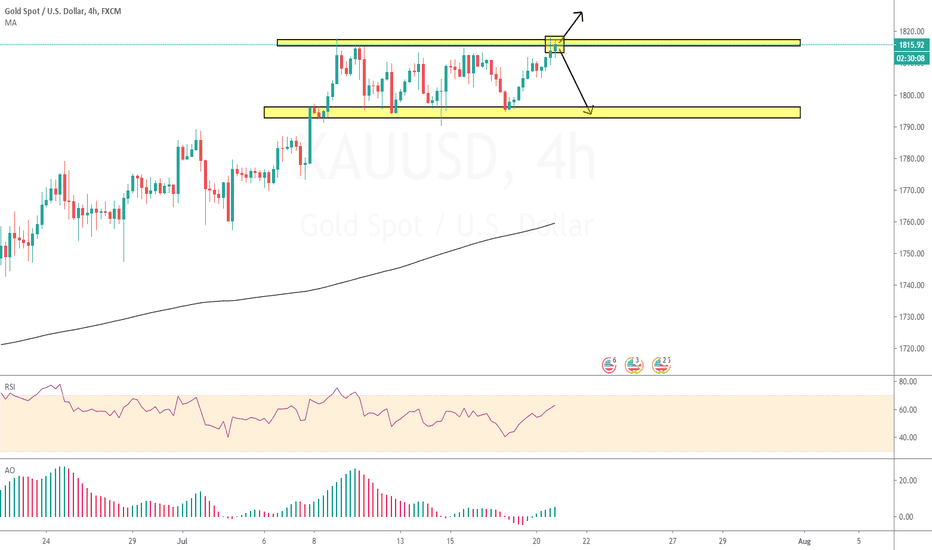

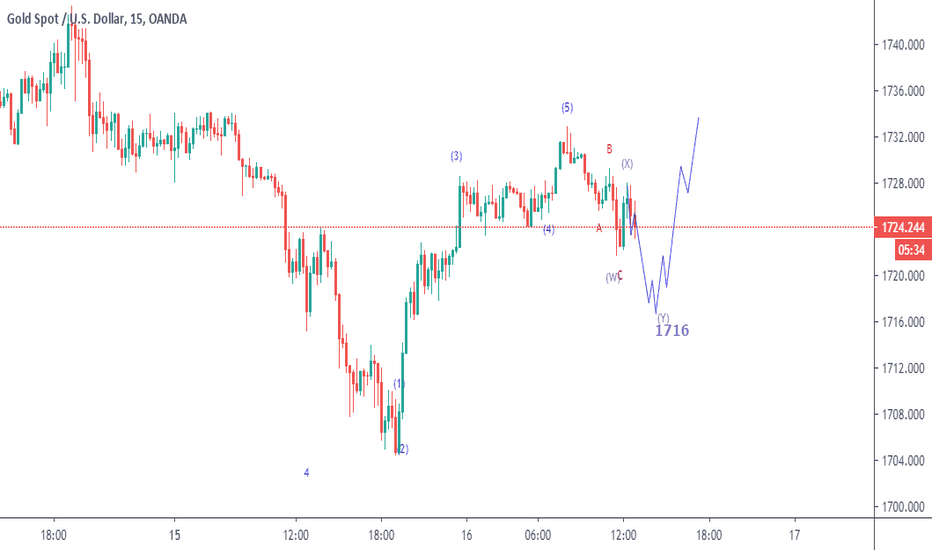

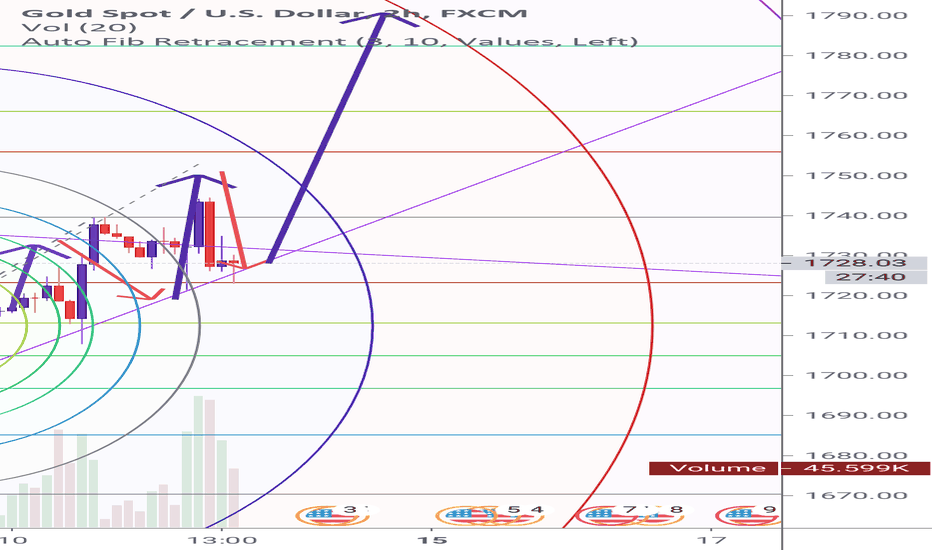

XAUUSD [4H] Break or not dont miss it 🔥🔥🔥🔥XAUUSD Break or not dont miss it 🔥🔥🔥🔥

Please stay tuned. Absolutely missed

Because at this point this candle is very important

If candle do not break through the resistance, open for Sell.

But if candle break through the resistance, wait for the candle to shorten and follow Follow buy.

LIKE LIKE LIKE PROFIT 🍺🍺🍺🍺🍺🚀🚀🚀🚀🚀

Gold Continues it's Natural Climb From my major entry and call long in May of last year, we've had nice gains on every reentry , sticking with a solid buy buy-only strategy. Why? Bond yields are lower--and heading lower-- real economic growth is slowing. With J.P. Morgan, Citi, and WellsFargo to release earnings tomorrow, I will be sticking to this long only bias for the foreseeable future. WIll post my next entry, as always.

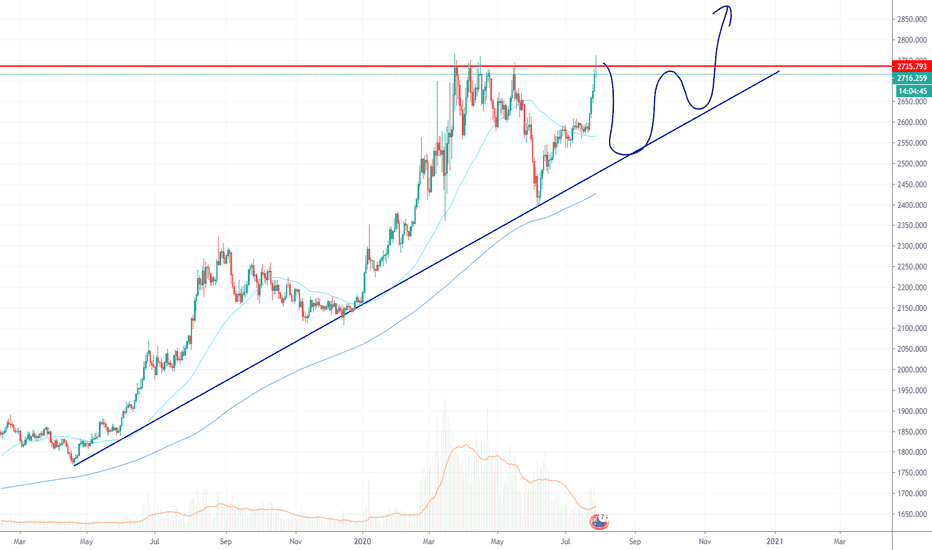

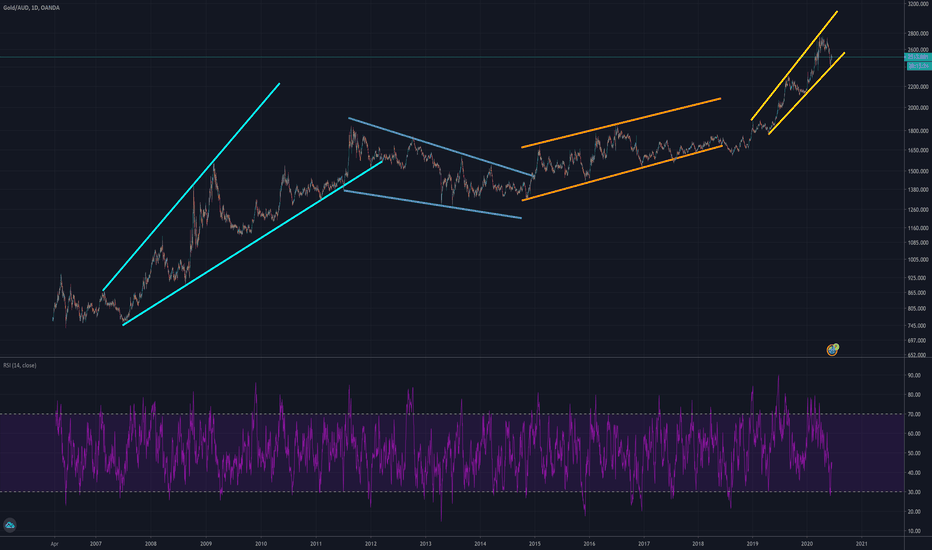

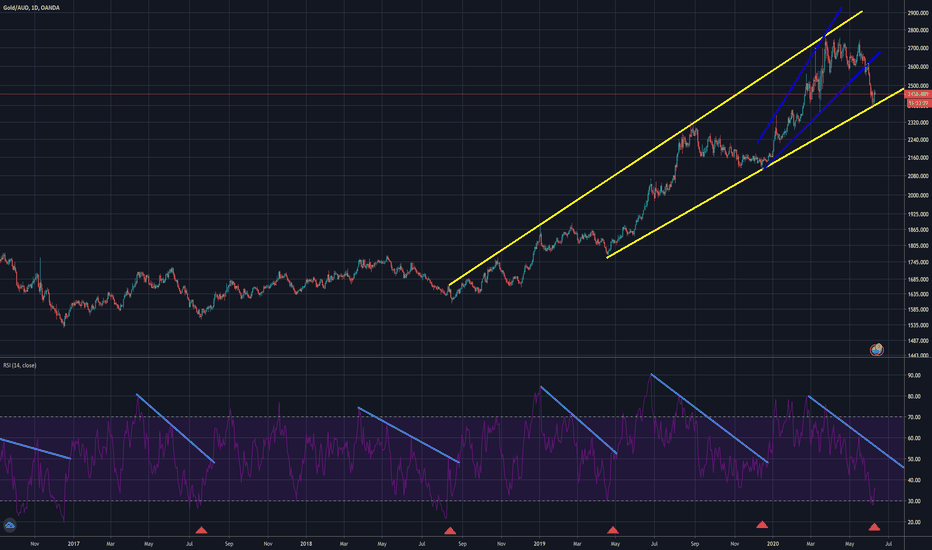

Gold (AUD) since 2007- Secular bull market.Gold (AUD) has been in a secular bull market since the early 2000s

Four easily identified formations (last 3-4 years each). The current formation still has a way to go to be 3-4 years old.

Ascendening Broadening wedges, Falling wedge, Up channel, Slight ascendening broadening wedge or Up channel (current formation).

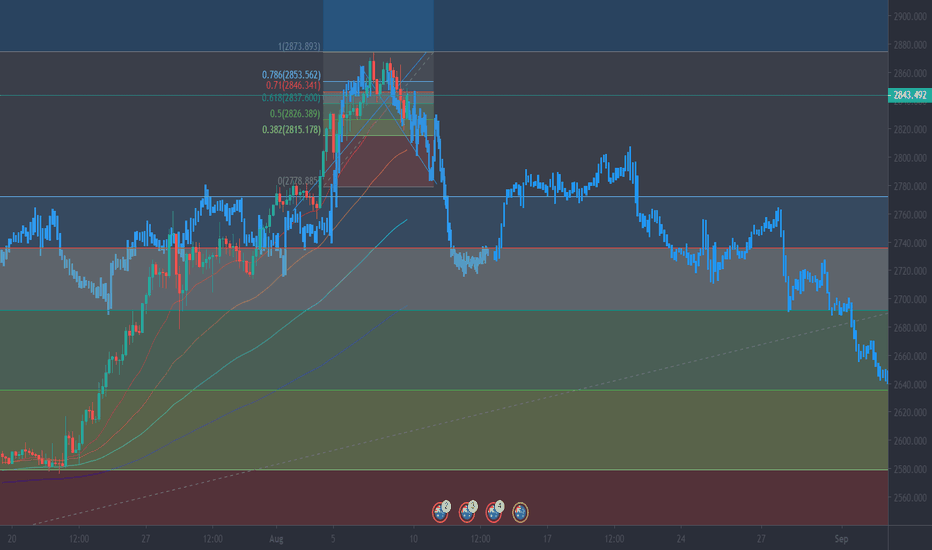

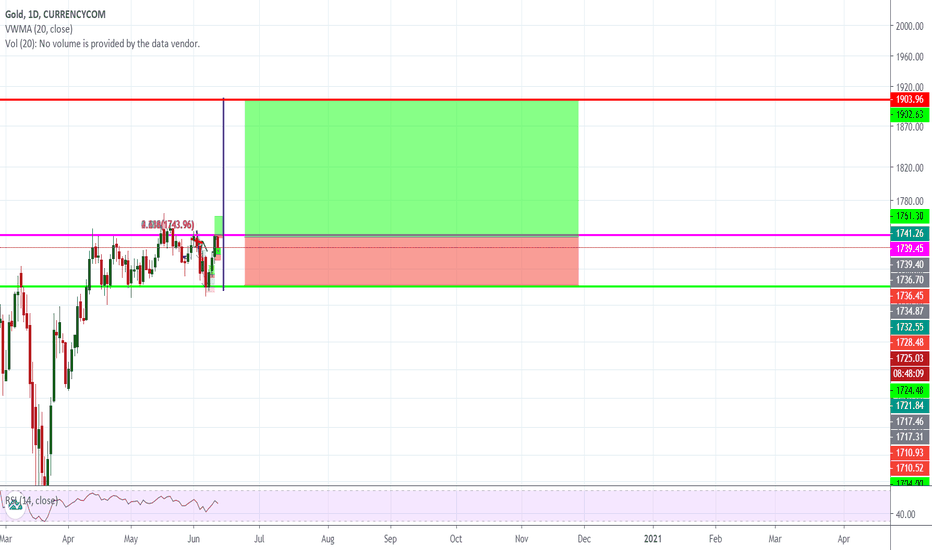

GOLD analytiqueGold in the coming days will break the resistance axis 17461.30 and reach to 1903.96 after seeing a sharp decline on Mars 20

Gold (AUD) daily- Clear breakout from Ascendin' Broaden' WedgeGold (AUD) daily- Clear downward breakout from Ascending' Broadening Wedge (ABW). Price target is horizontal red line. Temporary relief at purple UpTrend line.

Regarding the 52% of ABW that break out downwards. 81% of those act as Reversals of the prevailing trend- Thomas Bulkowski.

thepatternsite.com

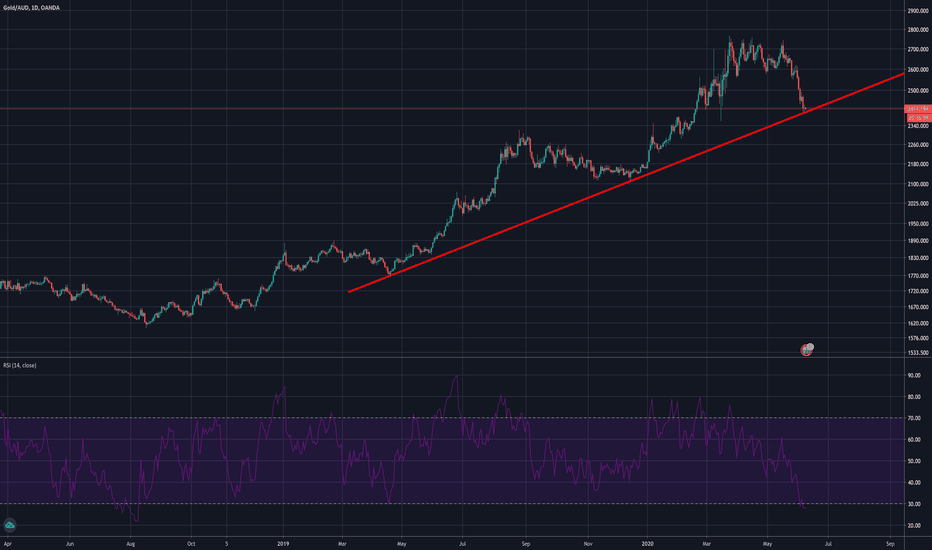

Gold (AUD) daily- Downward breakout from Ascend' Broaden' Wedge.Gold (AUD) daily- Downward breakout from Ascendening Broadening Wedge (ABW).

81% of AWB breakouts occurs in the direction leading up to the ABW. However, this is that 19% of cases.

Note: We are at Oversold RSI's under 30. History shows, when the RSI hits these levels, usually prices bounce back up.

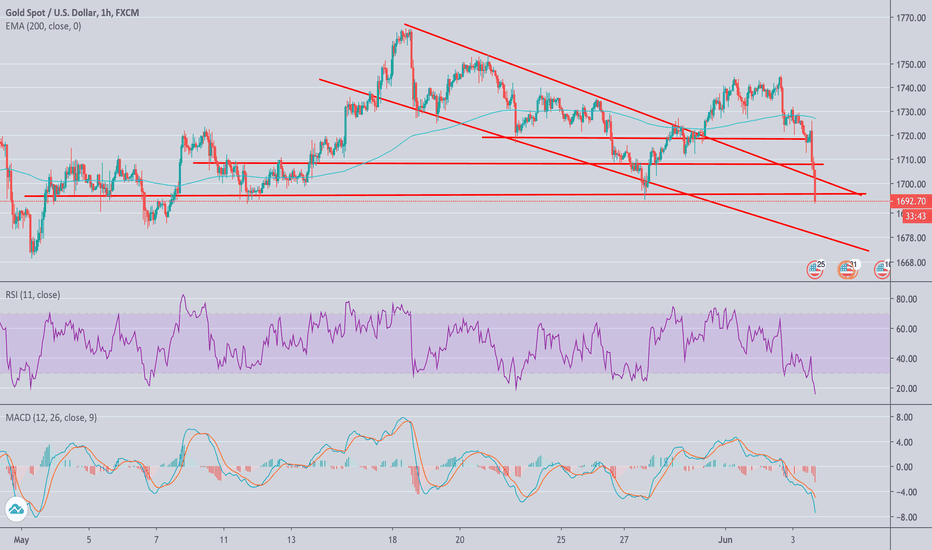

GOLD IS MELTINGIf we can see an hourly candle close below 1693, we are on a road trip down to the 1675 mark. Good economic news confirmed yesterday & today resulting in big dogs selling their gold and investing their money back into currencies now the Covid-19 uncertainties are past the worst. It truly has become a bear's market.

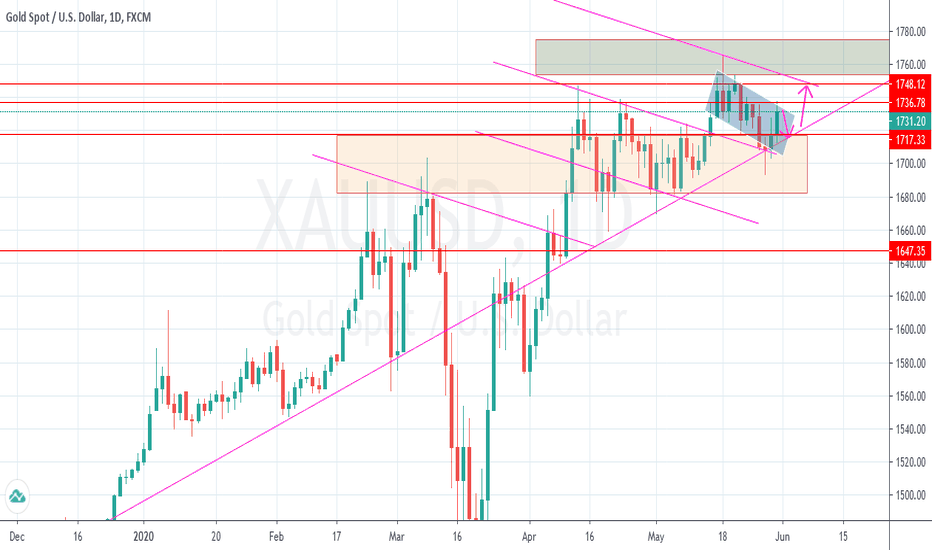

Gold against Dollar, XAUUSD weekly analysis from June 1 to 5Weekly chart suggest a bullish week with a long tail pinbar at the Ist week of June, may the bulls take control on wednesday before the price retest the area of 1720, and push the price higher to 1748 area ..where it finds the resistance zone at 1751 area and may bring the price down to 1738.. it may the roller coaster experience this week on price action for Gold.

Note - Analysis based on Technical aspect, it may subjected to differs when fundamentals involves...