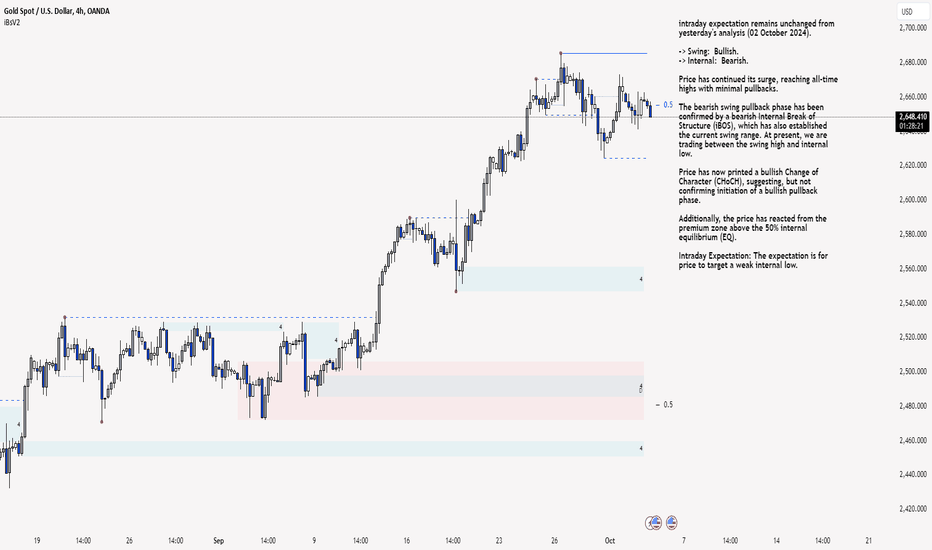

XAU/USD 03 October 2024 Intraday AnalysisH4 Analysis:

intraday expectation remains unchanged from yesterday's analysis (02 October 2024).

-> Swing: Bullish.

-> Internal: Bearish.

Price has continued its surge, reaching all-time highs with minimal pullbacks.

The bearish swing pullback phase has been confirmed by a bearish Internal Break of Structure (iBOS), which has also established the current swing range. At present, we are trading between the swing high and internal low.

Price has now printed a bullish Change of Character (CHoCH), suggesting, but not confirming initiation of a bullish pullback phase.

Additionally, the price has reacted from the premium zone above the 50% internal equilibrium (EQ).

Intraday Expectation: The expectation is for price to target a weak internal low.

H4 Chart:

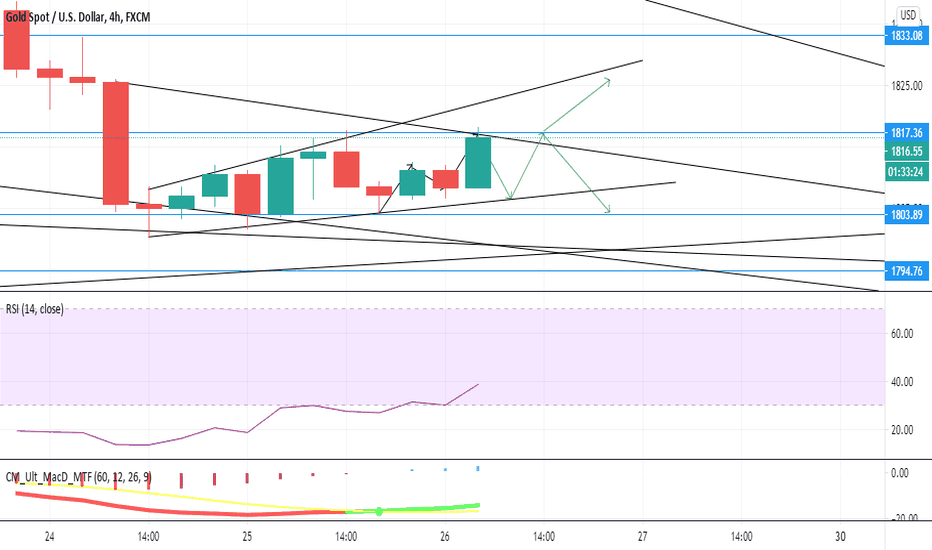

M15 Analysis:

-> Swing: Bullish.

-> Internal: Bearish.

Price met expectations by targeting a weak internal low and printing a bearish Internal Break of Structure (iBOS).

As previously mentioned, price action remains erratic, driven by ongoing macroeconomic data and heightened geopolitical tensions.

Since last analysis, price has printed a double bearish iBOS, aligning with the H4 bearish pullback phase as expected.

An internal range has been established, with the price reacting from the extreme high of this range.

Intraday Expectation: The price is expected to target a weak internal low.

With rising geopolitical tensions, Gold is likely to remain highly volatile in the short term.

M15 Chart:

Xaudaily

XAU this weekDear all wolfy friends :

What I see is buyers power to reach higher prices for next days but for sure there would be a structure( battle of the sellers and buyers). so on this condition I suggest you to play on buy if you are a trend trader but what if power goes for down trend?

if power goes for downtrend im sure we are in correction prices after there be a good structure for down trend we can play as seller.

I will update this till next monday and if get good position share it with you. let us hunt