XAUMO XAUUSD (Gold Spot) ANALYSIS | AUG 01, 2025 | CAIRO TIME GMThis is a stealth bullish accumulation day. Market maker completed a fake drop and now prepping breakout. Play long bias from control zone with stop-hunt fade backup. Schabacker would call this a false breakdown spring + congestion base rally.

XAUUSD (Gold Spot) ANALYSIS | AUG 01, 2025 | CAIRO TIME GMT+3

🔍 Multi-Timeframe Technical Breakdown (Daily → 5m)

1️⃣ Price Action & Patterns

Daily: Bullish rejection tail forming (pin bar) off VAL (3,288). Strong buyer defense.

4H: Classic bullish engulfing off VAL support. High rejection wick to downside. Micro-structure shows market maker trap.

1H: V-shape recovery seen. Absorption bar confirmed via footprint delta spike.

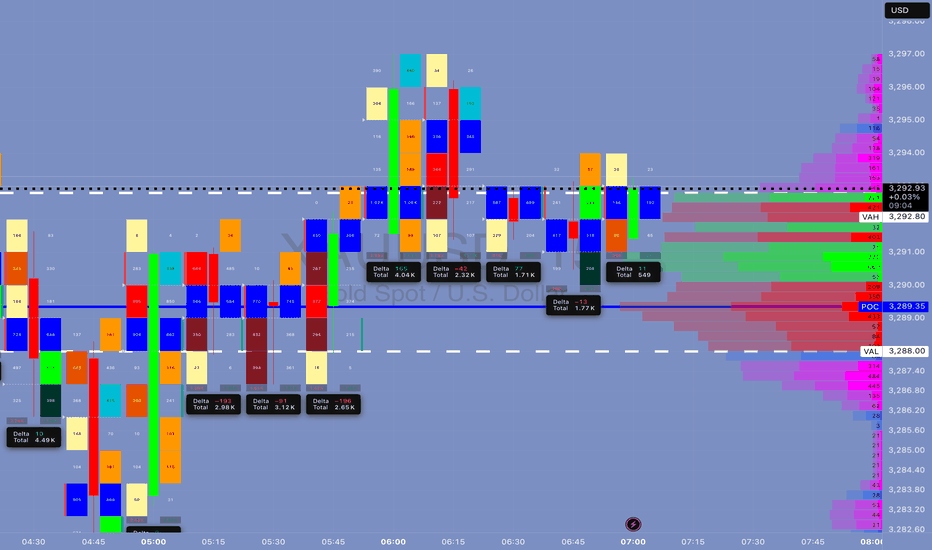

15m: Buyers stepping in at POC (3,289.35), stealthy buying—confirmed by divergence between delta & price.

5m: Accumulation in box range between 3,289–3,292. High absorption on bid side, low offer lifting—sign of stealth long build.

2️⃣ Volume & Delta Footprint

POC Cluster across all TFs: 3,289.00–3,291.50 is the control zone.

Volume Node Rejection at 3,288 = confirmed buyer base.

Delta: Absorption → sellers hitting bids but no follow-through = market maker trap → bullish implication.

Volume Spike at 3,288 = fakeout move likely manipulated to hunt stops.

3️⃣ Support/Resistance

VAL: 3,288 🔥 Strong Demand Zone

POC: 3,289.35–3,291.75 🧠 Smart Money Zone

VAH: 3,292.80 🎯 Break above confirms momentum

Res. Extension: 3,296.20, 3,300

Fibonacci Confluence: 3,288 = 61.8% golden retracement from recent rally

5️⃣Volatility

Compression near VAH = Volatility Expansion imminent.

Expect Breakout in next 1–2 hours (likely post 09:00 Cairo Time – Kill Zone)

6️⃣ Market Maker Philosophy

Last 3 days show liquidity vacuum trap below 3,288.

MM has triggered stop hunts to shake weak longs.

Building long inventory stealthily under POC.

Expecting rally trap to suck in breakout buyers → then retrace → final breakout continuation.

🧨 JEWEL TRADE ENTRY (Highest Probability)

📈 Order: Buy Stop

🎯 Entry: 3,293.10

🛑 Stop Loss: 3,287.70

💰 Take Profit: 3,302.40

📊 Confidence: 87%

🧠 Justification: Breakout of VAH/Golden Zone + High Volume Node = Trend Shift Confirmed

This is for EDUCATIONAL PURPOSE ONLY, and not financial advise.

Xaumovisionindicator

MACRO CONTEXT & NEWS FLOW IMPACT — "WHY THE HELL IT MOVED"🔥 I. MACRO CONTEXT & NEWS FLOW IMPACT — "WHY THE HELL IT MOVED"

Yesterday’s move was a classic institutional fakeout followed by controlled accumulation. Today is retest day. Watch VWAP and order flow like a hawk. Don’t chase, wait for reversion and load at value.

📅 Date: July 30, 2025

📰 Event:

US Employment Cost Index: Lower than expected

Core PCE: Cooled off

Market Implication: Fed easing is now on the table.

DXY Weakens → Real yields drop → Gold gets bought like crazy.

👊 Institutional Logic:

Rate-sensitive assets (Gold, Bonds) exploded after the release.

Algorithmic reaction to macro signal: DXY down → XAU bid hard → MegaBar explosion.

BUT institutions needed liquidity to enter big → they faked a breakdown first.

That’s institutional deception 101.

📉 II. DAILY CHART ANALYSIS — THE BIG BOYS' GAMEBOARD

🗺️ Structure:

Price dropped from 3,355 to 3,258 in 3 days — a high-velocity markdown.

On July 30, Price printed a Megabar reversal (Massive range, delta-flush, volume spike).

VAH = 3,294.90 capped upside.

POC = 3,288.91, and VAL = 3,282.90 held beautifully.

🔍 Institutional Pattern:

This is a classic “Flush > Absorb > Mark-up” sequence.

Textbook from “Technical Analysis and Stock Market Profits”:

“Volume confirms intention, range confirms commitment. A wide bar with climax volume at low implies the exhaustion of sellers and transfer of ownership.”

🔑 Key Daily Stats:

📉 Delta Flush: -584K

🔁 Reversal Delta: +70K

🔊 Volume spike: >450K (Well above 30-day volume MA)

💡 Inference:

This bar did not print because of retail buying. It’s smart money rebuying from panic sellers.

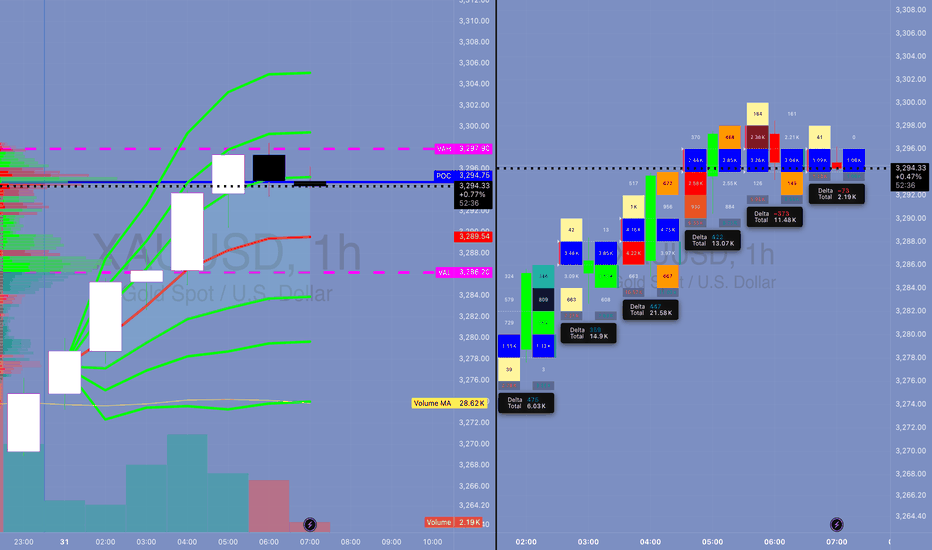

⏱️ III. 4H / 1H TIMEFRAME: ORDERFLOW & REACCUMULATION

📌 4H Chart:

📍 Megabar with -191K delta near 3,258 (Volume: 191.14K)

Immediate absorption by dark blue and green delta bars — this was not retail reversal.

VWAP reversion in play — price gravitates toward 3,294 (VWAP anchor zone)

🔁 1H Chart:

Rapid stair-stepping: Each hourly candle had higher lows and strong deltas.

Volume built from super-POC 3,289 to super-VWAP 3,295.25.

Final hour: exhaustion wick → distribution into resistance.

🧠 Institutional Tactic:

They used Volume by Price congestion to hold price between FVRP bounds:

Low Volume Nodes (LVNs) = acceleration zones

High Volume Nodes (HVNs) = consolidation + absorption zones

🔍 IV. 15M / MICROSTRUCTURE — WHERE THE GAME WAS REALLY PLAYED

🔬 VWAP Stack Analysis:

VWAP: 3,294.61

D-VWAP: 3,289.30

Super-VWAP Cluster held price in check — real institutional price magnet.

🔄 Delta Flow (15m):

Delta climbed from -3.15K → +3.21K in 1.5 hours.

Imbalance flipped bullish near POC.

🎯 FPVR Mapping (Volume Profile Right Side):

Thickest distribution volume occurred at 3,287 – 3,295

Value tightly packed = fair price.

Institutions are loading in value, not chasing.

⚙️ V. INDICATOR & MOMENTUM SIGNALS — INSTITUTIONAL CONFLUENCE ZONES

Tool Signal

VWAP Anchored VWAP tagged and respected — classic institution level

SMA50 Capped daily move (3,342) — still a long-term bearish lid

HMA5/9 Bullish crossover on 15m/1H – signals momentum alignment

Volume MA Volume climax confirms effort at lows, signaling phase change

🔩 VI. TECHNICAL SEQUENCING OF EVENTS (STEP BY STEP)

Asia Session: Tight range, price floats around VAL (3,282)

London Session: Fake breakdown to 3,258 – traps late shorts

NY Pre-News: Choppy price action within FRVP range

Macro News Drop: Megabar → -191K delta flush

Next Candle: Delta flips +21.2K → Absorption confirmed

Price Walks Up: Controlled bid to VWAP

End of Day: Distribution at VAH → price capped by VWAP band

💣 Final move = algorithmic mean reversion + VWAP auction completion

🧬 VII. ADVANCED ORDERFLOW INTERPRETATION

⚔️ MEGABAR (The Trap Setup):

Volume = 191K+

Delta = -191K (yep, full-on flush)

What happened?

→ Late shorts + stop runs + SL hunters got rekt.

→ Institutions absorbed, switched algo, and reversed.

🧱 FVRP (Fair Value Range Profile):

Defined by VAL (3,282.90) and VAH (3,294.90)

Institutions play inside this range for risk efficiency

They accumulate low and distribute high within it

🔄 Delta Rotation:

Delta Rotation = Shift from Negative Accumulation → Positive Distribution

Classic rotation confirms phase transition

🧠 VIII. INSTITUTIONAL OBJECTIVE (WHAT THEY WANTED)

Primary Goal: Create liquidity void below → Enter large long positions

Secondary Goal: Return to VWAP zone and unload

Tertiary Goal: Signal to market: "We're in control, stay out or get punished"

This is textbook Volume Profile Auction Theory in motion.

🎯 IX. HYPOTHETICAL TRADE SETUP (EDUCATIONAL PURPOSE ONLY)

🧾 Trade Plan: Institutional VWAP Reversion Play

Order Type: Buy Limit

Entry: 3,287.00

Stop Loss: 3,279.00 (below VAL & invalidation)

Take Profit: 3,300.00 (Super-VAH zone)

Confidence: 85%

R/R: 1:1.6

💡 Justification:

Entry at POC + SMA50 cluster

Stop below structural invalidation zone

Target near major supply

This is the exact playbooks funds run during reaccumulation rotations

🧠 X. EDUCATIONAL TAKEAWAY — WHAT YOU SHOULD LEARN

Volume is truth. If volume spikes at lows, it’s not weak hands — it’s smart money flipping.

VWAP is magnet. Everything mean-reverts back to VWAP in controlled auctions.

Delta tracks aggression. Sharp delta reversals = algorithm switch.

Megabar = signal. Huge candle + volume + delta = possible phase shift.

FRVP = roadmap. Price doesn’t move randomly — it moves to balance imbalances.

🔚 CONCLUSION — YESTERDAY’S LESSON

July 30, 2025 wasn’t just a bullish day — it was a textbook institutional deception-reversion cycle. If you understand:

How the news was used

How the megabar printed

How the volume clustered

How the VWAP held

… then you’re not trading blindly.

You’re trading with the damn architects of the market.