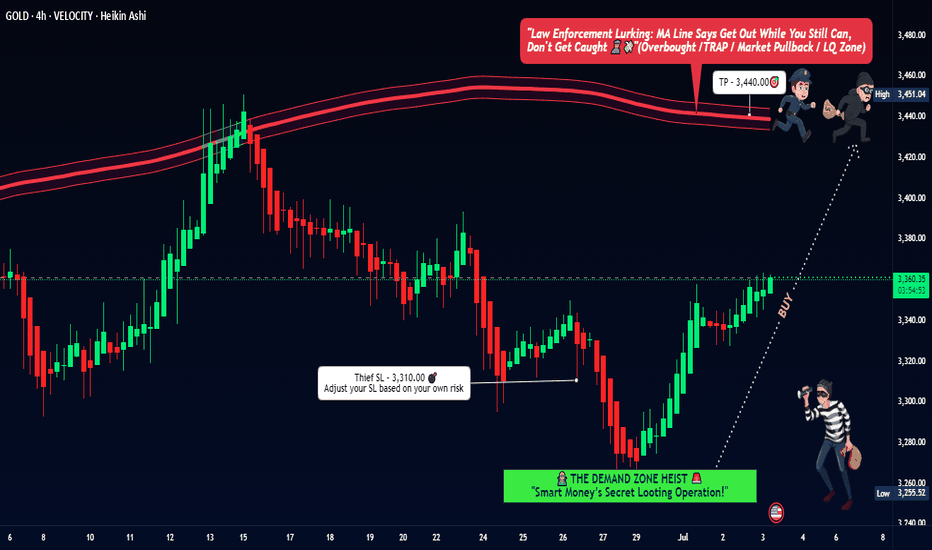

"The Great Gold Heist" – XAU/USD Master Plan🏆 "The Great Gold Heist" – XAU/USD Master Plan (High-Risk, High-Reward Loot!) 🚨💰

🌟 Attention, Market Robbers & Money Makers! 🌟

Hola! Oi! Bonjour! Hallo! Marhaba! 🤑💸

🔥 Based on the legendary Thief Trading Strategy (technical + fundamental heist tactics), here’s our blueprint to STEAL massive profits from the XAU/USD (Gold vs. Dollar) market! 🔥

🎯 The Heist Plan (Long Entry Setup)

Entry Point 📈: *"The vault is UNLOCKED! Swipe bullish loot at any price—but for a cleaner steal, set Buy Limits within 15-30M recent swing lows/highs. ALERT UP! ⏰"*

Stop Loss 🛑: "Thief’s SL hides at the nearest swing low (4H TF: 3310.00) OR below the last daily candle wick. Adjust based on your risk appetite & lot size!"

Target 🏴☠️: 3440.00 (or escape early if the cops—err, bears—show up!)

⚡ Scalper’s Quick Loot Guide:

"Only scalp LONG! Rich? Go all-in. Broke? Join the swing traders & rob slow ‘n’ steady. Use Trailing SL to lock profits!"

📊 Market Status:

XAU/USD (GOLD) – Neutral (But Bullish Sneak Attack Likely! 🐂💥)

"The heist is ON, but watch for traps—overbought zones, consolidation, and bearish robbers lurking!"

🔍 Pro Thief Moves:

✅ Fundamentals Matter! (COT Reports, Geopolitics, Macro Data, Sentiment—check our Bii0 for the full loot list!) 🔗👉🏻☝🏻 klik lin.kk

✅ News = Danger! Avoid new trades during releases. Trail your SLs to protect stolen cash! 📰🚨

💖 Support the Heist Crew!

"Hit the BOOST BUTTON 💥 to strengthen our robbery squad! More boosts = easier money steals daily!"

🚀 Stay tuned—another heist drops soon! 🐱👤💎

Xausdanalysis

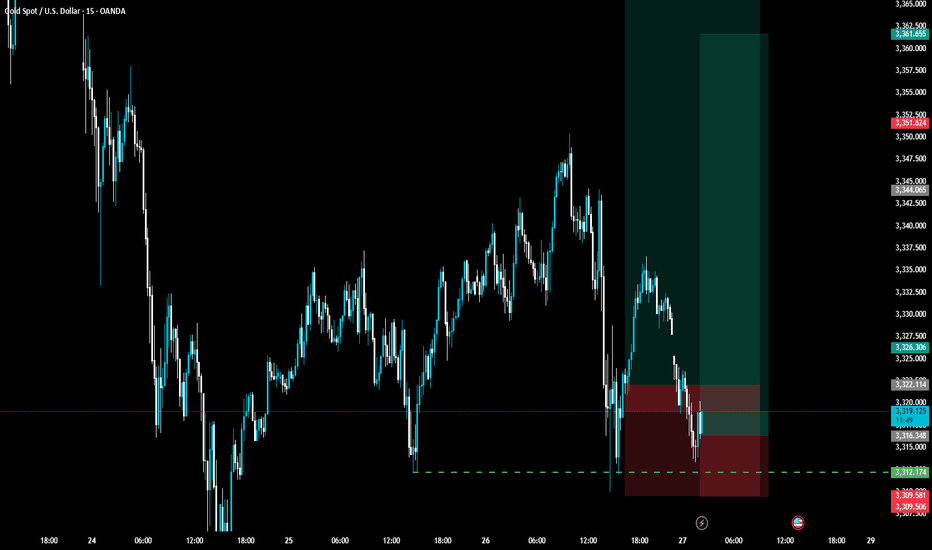

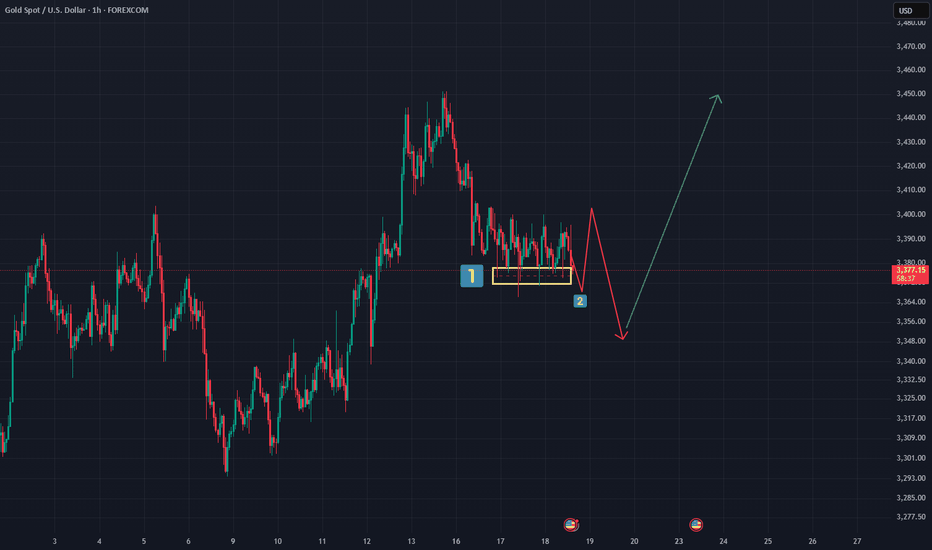

Gold’s in a Trap — And That’s Exactly Why You Should Be CarefulGold is stuck in a tight sideways range. It’s been bouncing between $3,370–$3,380 for two days now. Everyone sees it. Every trader watching gold knows this level acted as support — and judging by the candle shadows, buyers are getting aggressive here.

So if you're purely technical — yeah, looks like a solid buy right now.

But here’s the twist…

___________________________________________________________

I’m not buying.

And I’ll tell you why — because it's too obvious.

When something screams "buy" from every chart and every textbook, that’s when you pause and ask yourself:

“Am I about to walk into a classic setup… or actually catch a real move?”

Because history shows us — these textbook setups often play out like this:

Motivation → Encouragement → Payback. (See Chart 2)

It goes like this:

Price breaks a visible high or low (Motivation)

Traders jump in and get some pips(Encouragement)

Then — brutal reversal (Payback)

Only then will everything get off the ground, and it will be fast, so that the "unnecessary" passengers who were "dropped off" should not have time to return to this train. So why are they "unwanted"? Well, here's one possible answer: because retail tends to hold losing trades too long , but gets spooked early on winners. We’re wired that way.

So what happens when everyone starts booking profits after a small bounce?

You get limit sell orders piling up , slowing momentum — sometimes even flipping the trend.

And then what do big players do?

Then come back in — buying at higher levels, averaging their positions. Not the best case scenario....

Key Takeaway:

______________________

Here’s my advice — especially if you’re in this game long-term:

1. Avoid those super obvious setups everyone else is jumping into.

2. Instead of asking, "Why should I open a trade now?"

Try asking: "Why shouldn’t I open a trade now?"

p.s.

If you liked this kind of deep-dive — follow along. We don’t just read charts. We read the market behind them.

Conclusion:

_________________________

📍 Gold is testing a key zone — but don’t let the crowd pull you in.

🧠 The first quick impulse is often a trap

📈 Stay sharp, stay ahead.

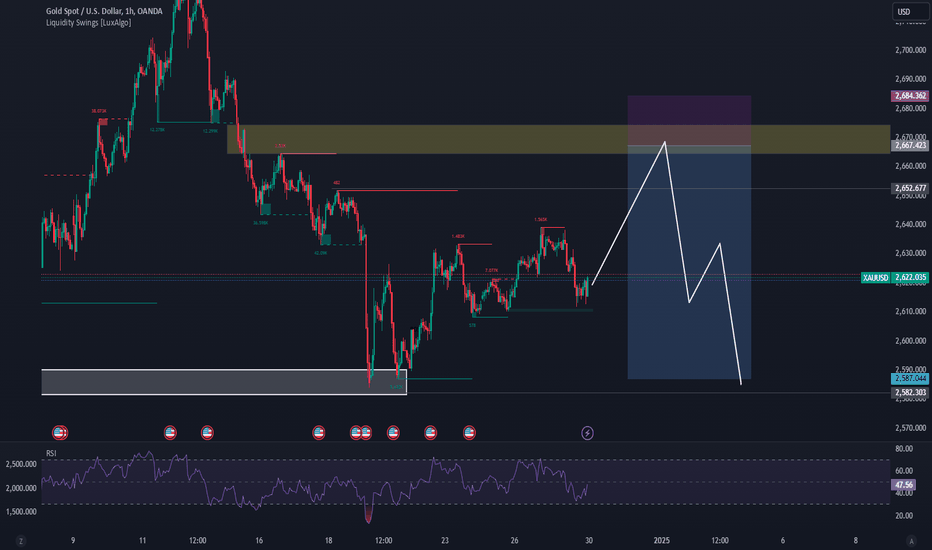

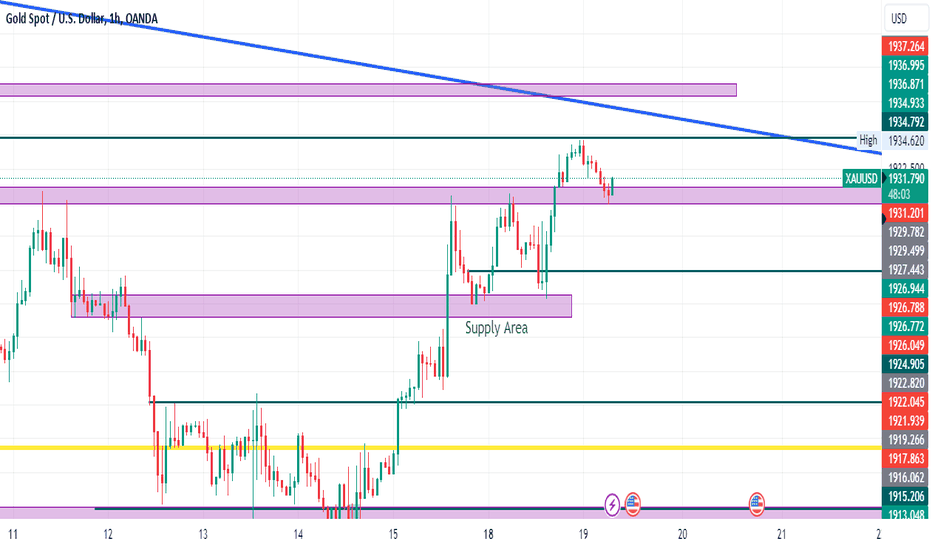

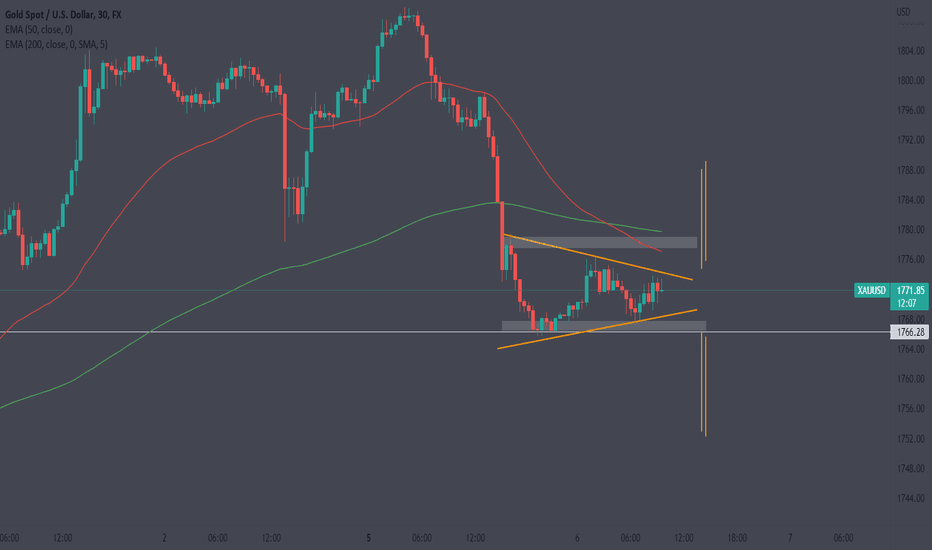

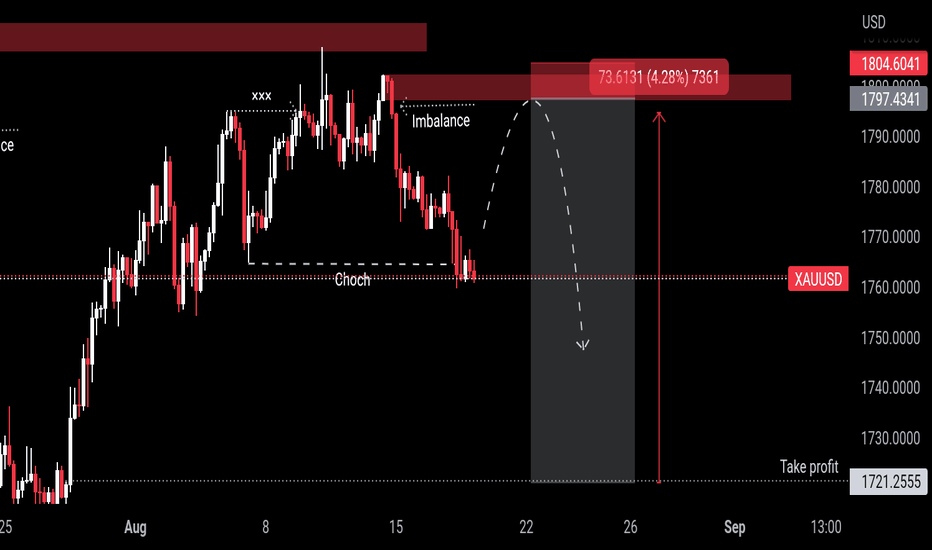

#XAUUSD 1HBased on the 1-hour analysis, I’m watching for a selling opportunity around the key resistance levels of 2673.00 and 2671.00.

Targets: 2662.00 / 2640.00 / 2625.00

However, with the major NFP event coming up today, there's potential for an upward spike. Avoid placing advance orders for now and wait for solid bearish confirmation before entering.

#XAUUSD

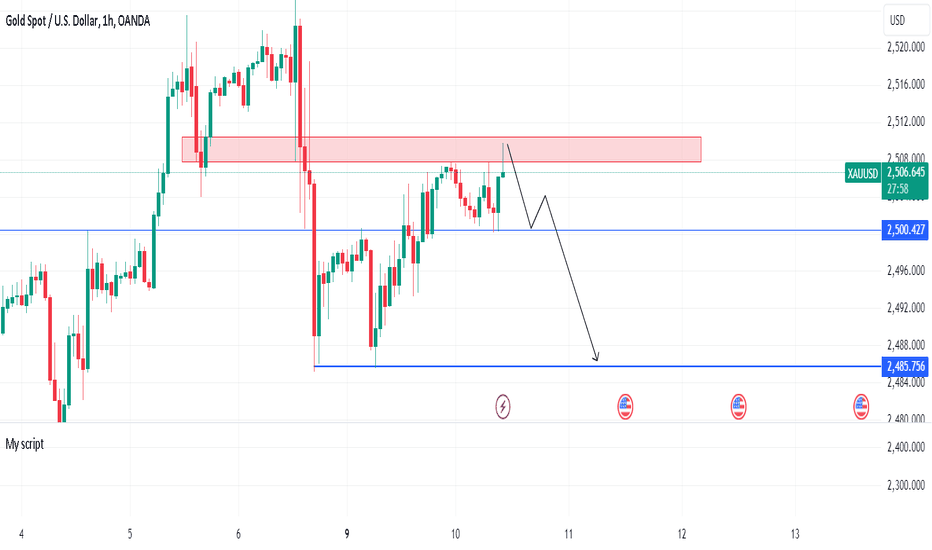

#XAUUSD 1HBased on the 1-hour analysis, the price is consolidating near the resistance area. I'm personally looking for a selling opportunity around the 2509.00 zone.

There’s a chance the price could drop directly from here without testing our zone.

Avoid placing advance orders for now and wait for strong bearish confirmation before entering.

#XAUUSD

XAUUSD - GOLD - Scalping Mode! 5th AugLet's see what the market has to offer.

Disclaimer:

This is simply my personal technical analysis, and you're free to consider it as a reference or disregard it. No obligation! Emphasizing the importance of proper risk management—it can make a significant difference. Wishing you a successful and happy trading experience!

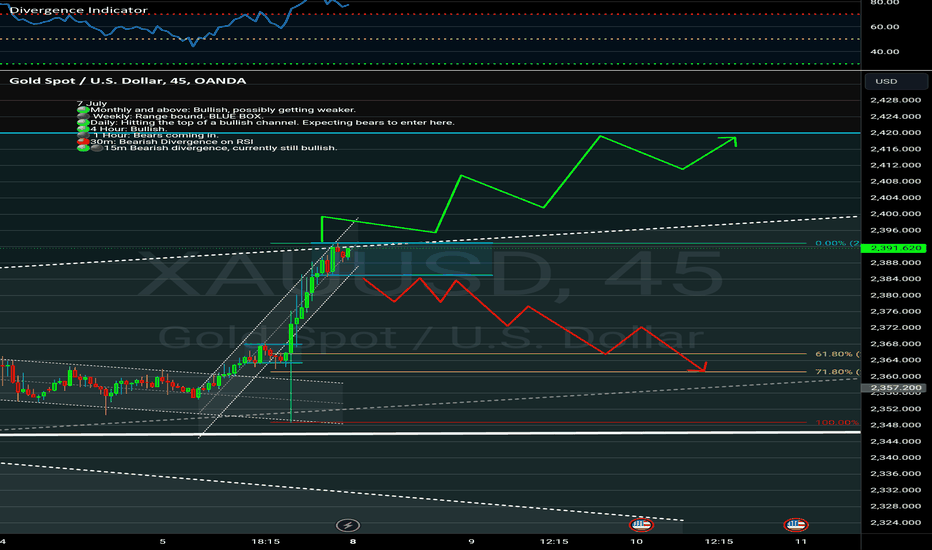

XAU-USD Bearish divergence intraday.Hi traders.

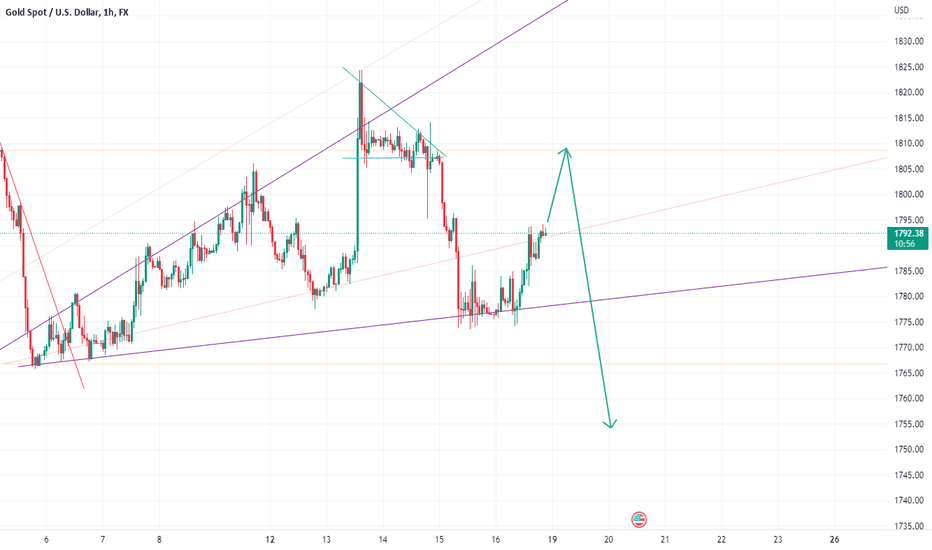

1 Hour and below has bearish divergence taking place. A slow breakdown in price. We have hit the upper bound resistance in a bullish channel. I expect a short term reversal. We must wait for a breakout of the channel before attempting a short down to $2360 zone.

On the other hand, price could push hard out of the intraday channel to $2420

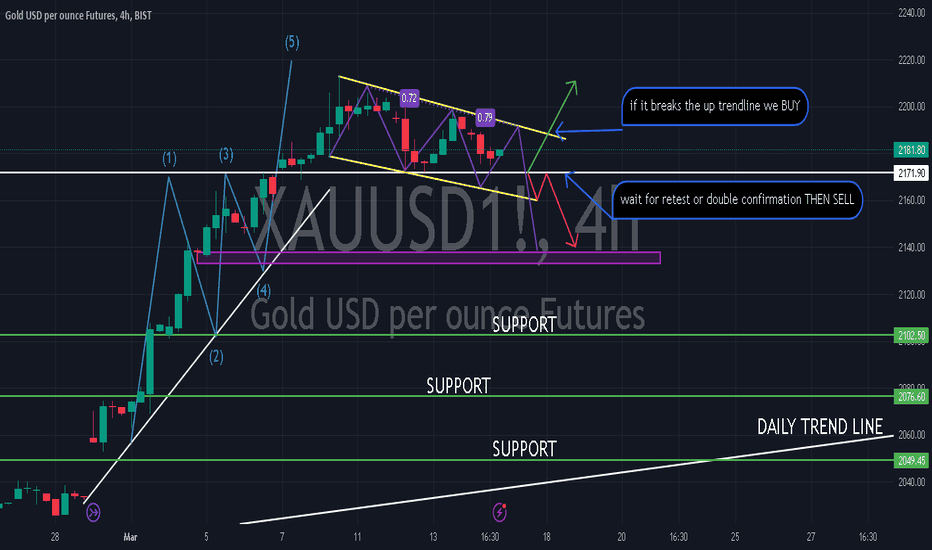

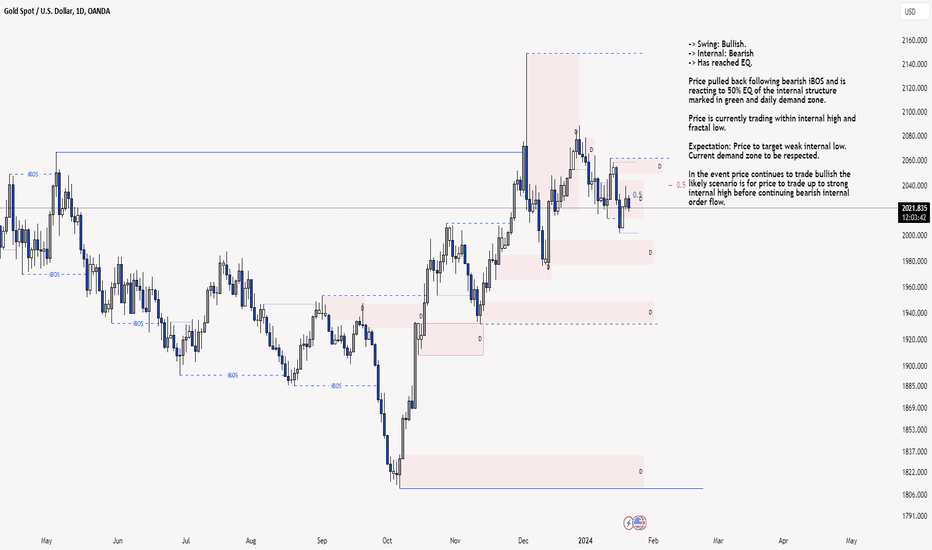

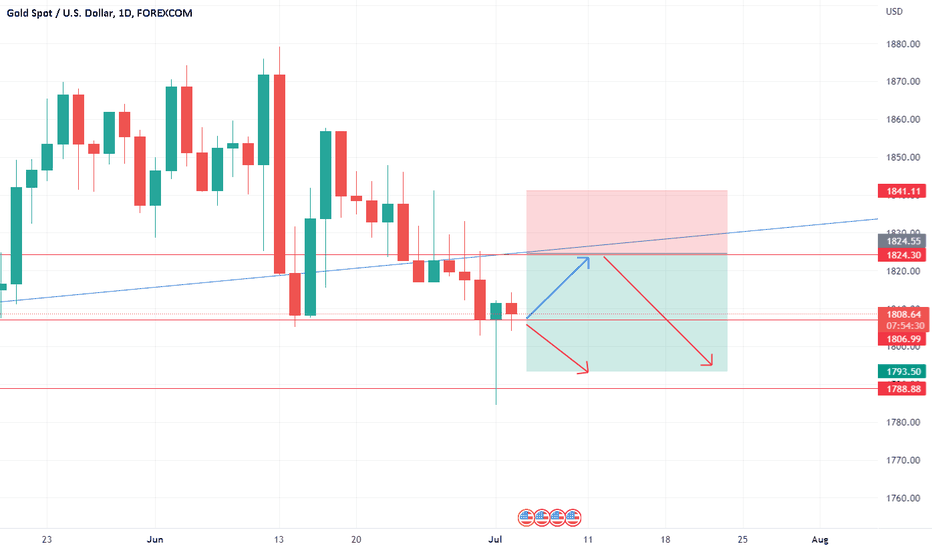

XAU/USD 22 Jan 2024 Daily Analysis-> Swing: Bullish.

-> Internal: Bearish

-> Has reached EQ.

Price pulled back following bearish iBOS and is reacting to 50% EQ of the internal structure marked in green and daily demand zone.

Price is currently trading within internal high and fractal low.

Expectation: Price to target weak internal low. Current demand zone to be respected.

In the event price continues to trade bullish the likely scenario is for price to trade up to strong internal high before continuing bearish internal order flow.

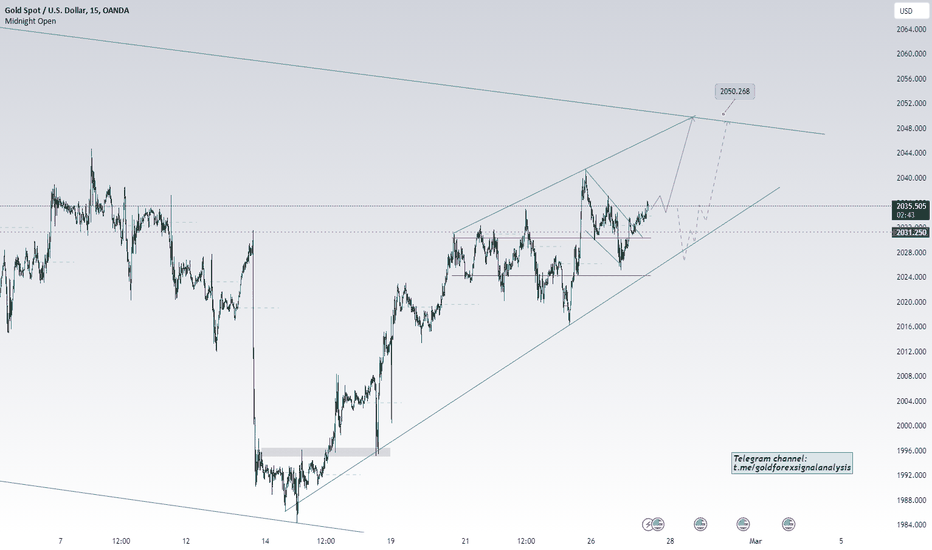

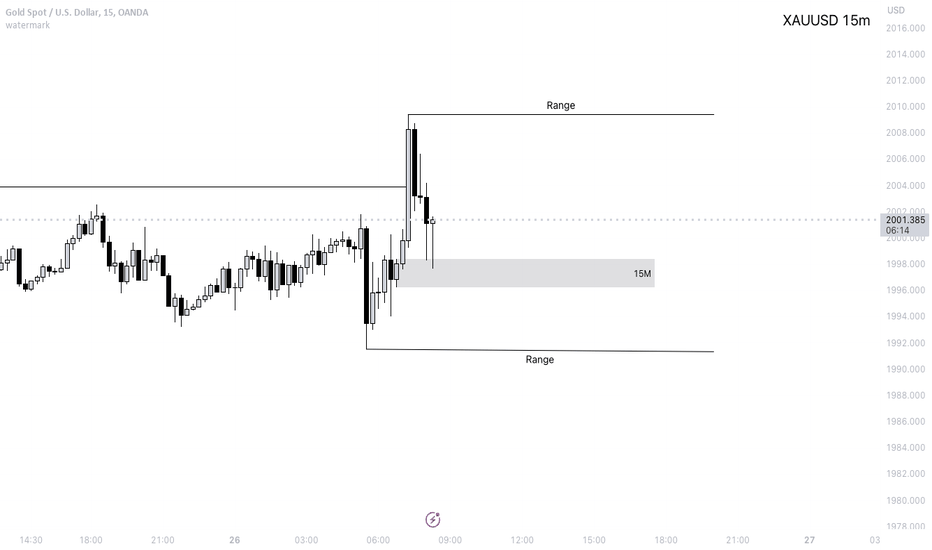

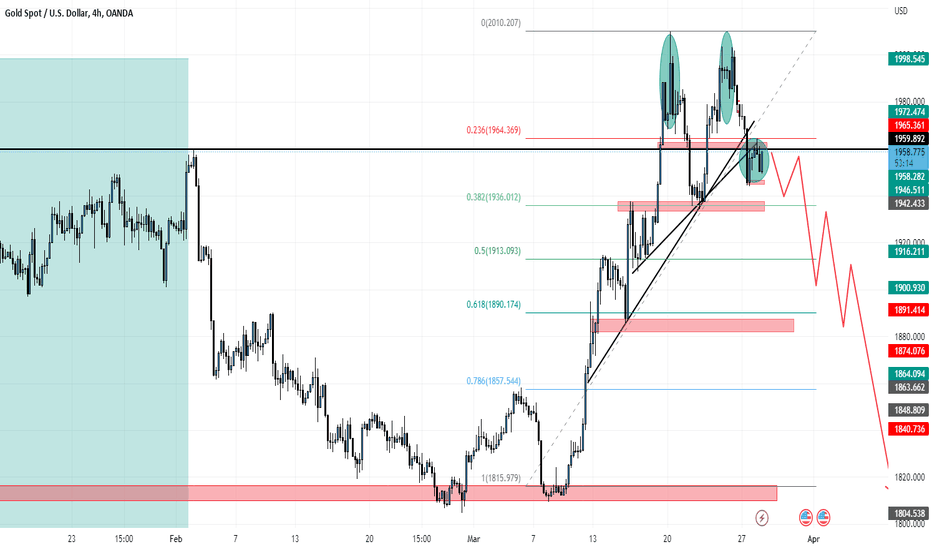

XAUUSD 26/04/2023Currently, on the 15-minute timeframe chart, we are within a bullish range that ranges from 2009 to 1991, with the former being the liquidity point of the range. Therefore, we could expect a bullish reaction in the zone ranging from 1998 to 1996. As long as the price does not close below this zone with a bearish candle, we can say that the zone is being absorbed in lower timeframes, and we can move down to lower timeframes to position ourselves in bullish ranges.

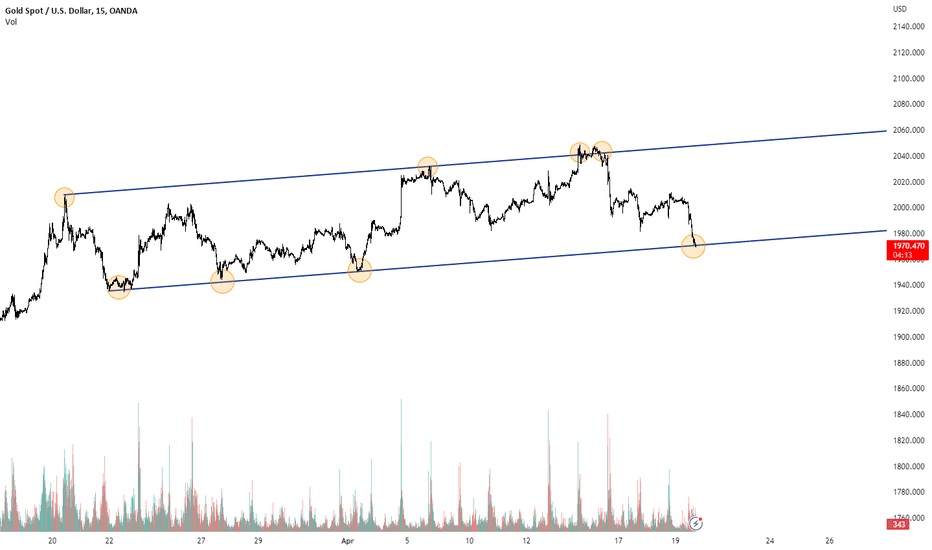

Gold Spot Bulls Can Show The PresenceHello Friends,

On my last analysis it was suggested 2048 - 2050 can bring bears on charts till 1980 - 1970. Today we have witnessed 1970 now this is a support, an important support infect.

So those who are shorts should look to book gains or at least adopt risk management. For details of That analysis please go though my previous research on GOLD.

I believe short covering base pull back from here can be seen till 1981 - 1986.

Closing US session above 1986 would shift control to ST to bulls.

For MT to LT please review my previous details research.

Happy Trading.

XAUUSD

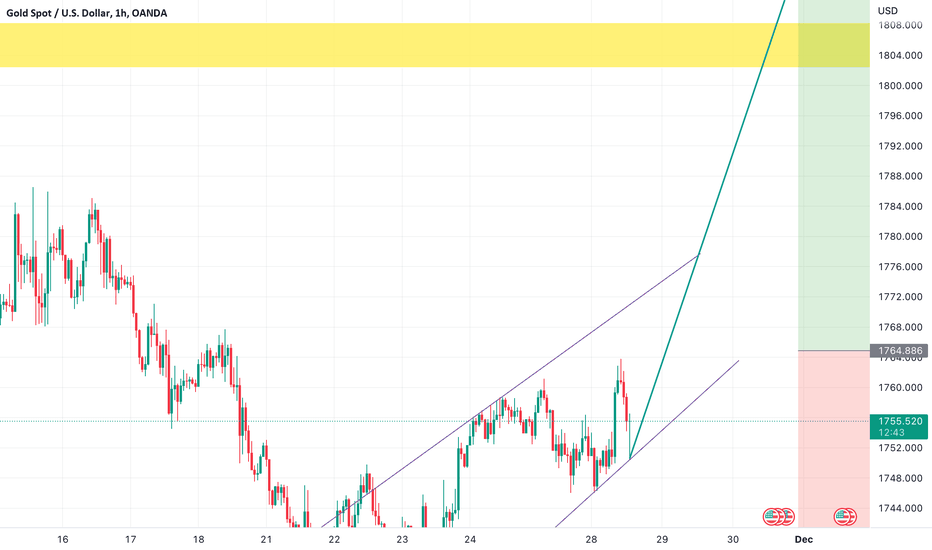

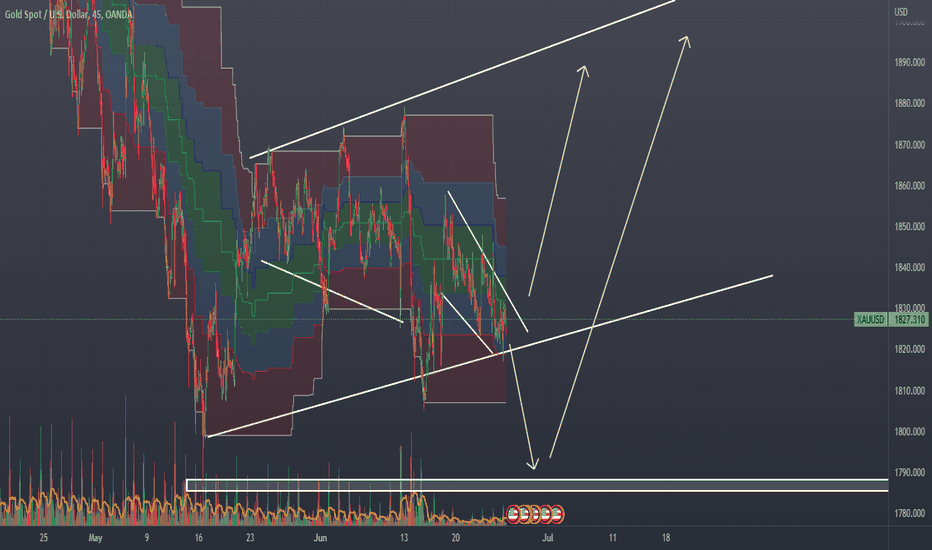

on this 1H time frame. There is a possibility that the Bull trend will form after this ranging market.

Right now it is best to wait until Late Tuesday or Wednesday or possibly Thursday to have a clearer 1H timeframe.

I am hoping this trend breaks the 1808.00 price.

I am seeing a continuing BULLISH TREND that can break the 1870 price.

If there was a time to back up gold , it is now.