Key Event Today – FOMC Interest Rate DecisionAs risk-off sentiment cools, gold bulls failed to take control yesterday, resulting in a stalemate with the bears.

From the 4H chart perspective, bearish momentum currently appears stronger,

though bulls are not giving up easily.

Currently, price is rebounding off the 4H MA60 support,

with immediate resistance from the MA20 around 3405.

As time progresses, this resistance is likely to shift lower,

so for now, we’ll treat $3400 as the primary reference point.

For bulls to regain dominance,

they must hold steady above 3405,

and more importantly, protect the support at 3386–3378 during any pullback.

🔔 Key Event Today – FOMC Interest Rate Decision

Today’s trading will also be influenced by the Federal Reserve’s rate decision,

which, based on current expectations, is likely to weigh heavily on bullish sentiment.

📌 Strategy for Today:

Main Bias: Sell the rebound

Secondary Approach: Buy on pullbacks if strong support levels hold

Key support levels to monitor:

⚠️ 3382 zone (minor support)

🔻 Most critical: 4H MA60 around 3366

Stay cautious during the FOMC announcement window, and remember — in volatile markets, reacting with discipline is more important than predicting perfectly.

Xausudlong

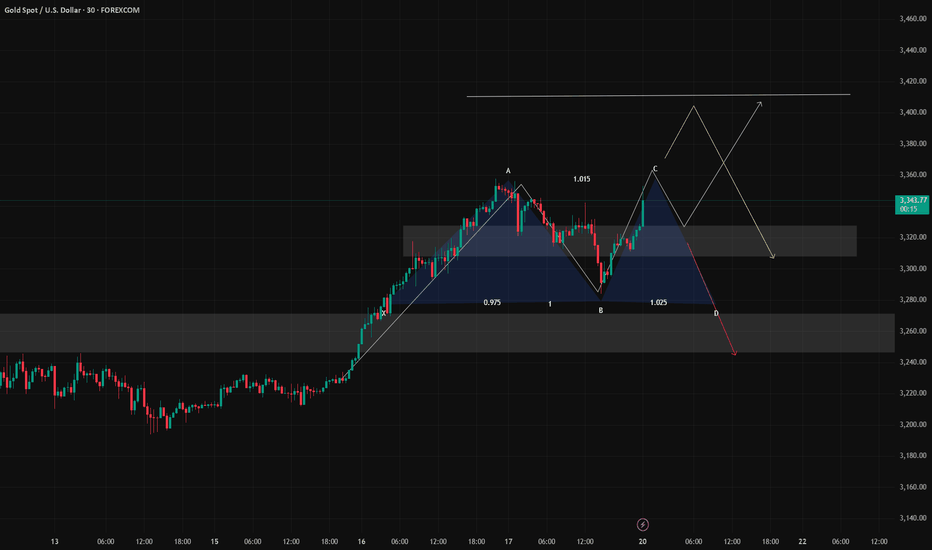

6/17 Gold Analysis and Trading SignalsGood morning!

Yesterday, gold opened with a gap-up and surged to around 3451, but failed to sustain above key resistance. After another failed attempt to break higher, prices gradually turned lower and finally broke below 3400, finding short-term support near 3382.

The primary driver of this decline was a waning of geopolitical risk sentiment, which had previously fueled the rally. Additionally, the market is now pricing in expectations that the Fed will keep rates unchanged, a factor that was likely preemptively reflected in price.

🔍 Fundamental Focus:

Today’s U.S. session will feature a key news release, which may prove decisive for gold’s next directional move. With yesterday’s advance pullback, market dynamics are likely to be more volatile today. We recommend caution, especially ahead of the announcement.

📉 Technical View:

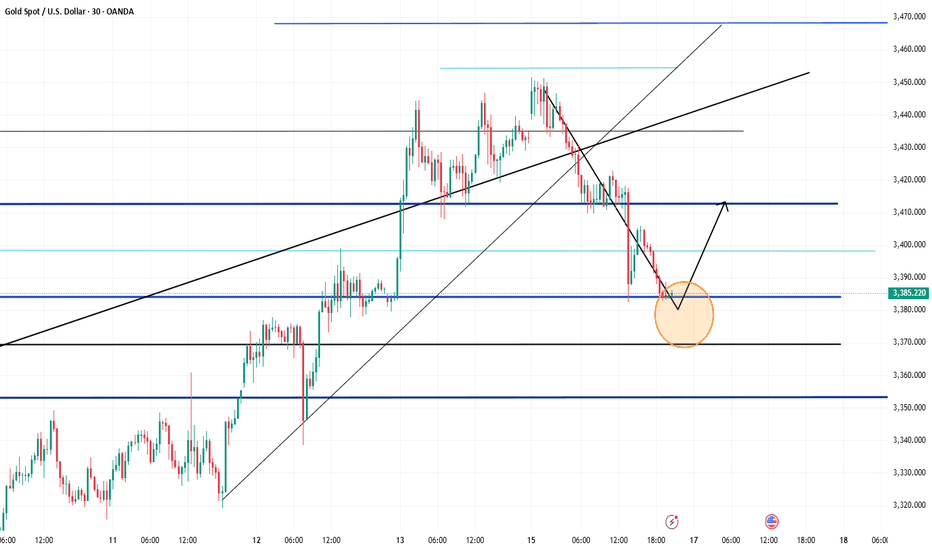

Gold is currently in a post-decline consolidation phase.

The main resistance lies between 3430–3450, while 3415 on the 30-minute chart also presents a short-term cap.

For those entering long positions, target zones should remain conservative, ideally around 3412–3418, and then be adjusted depending on volume momentum and breakout structure.

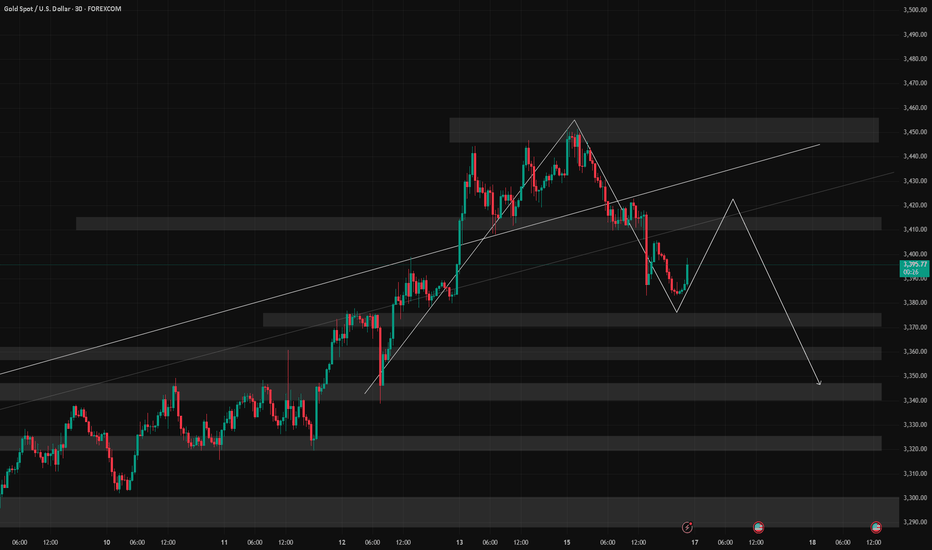

📊 Weekly Structure Outlook:

The weekly chart shows that gold is at a key trend inflection point.

If no additional bullish catalysts emerge, the market is likely to develop into a bearish consolidation, with the next major downside target around 3200.

📌 Trading Plan (For VIP):

✅ Sell Zone: 3436–3466

✅ Buy Zone: 3347–3323

✅ Flexible Trade Zones: 3428 / 3415 / 3403 / 3392 / 3378 / 3362 / 3354

Fed Rate Decision May Trigger a Decline in Gold PricesDespite heightened tensions in the Middle East providing safe-haven support, gold failed to break through the 3450–3455 resistance zone today and instead pulled back to the 3400–3386 support area.

This decline was mainly driven by two factors:

Iran expressed willingness to resume nuclear talks, easing geopolitical tensions and weakening safe-haven demand.

Growing expectations that the Fed will keep rates unchanged this week strengthened the DXY, reducing gold's appeal.

That said, inflation concerns persist, offering medium-term support to gold. On the technical front, the 3378–3340 consolidation zone may serve as secondary support, while stronger trend support lies in the 3310–3289 range—a level that may only be tested under extreme bearish conditions.

For now, the primary support to watch is 3386–3373, with short-term rebound resistance around 3400–3420.

Trading Suggestion:

Ahead of the Fed’s rate decision tomorrow, consider buying on dips, as today’s decline may lead to a technical rebound. Then reassess the market’s response to key support and resistance levels to determine further action.

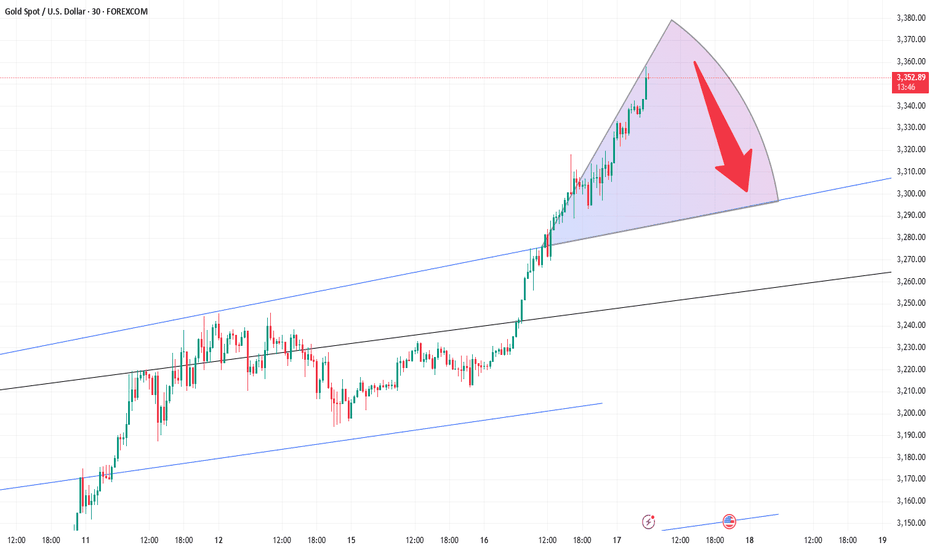

Watch Out for Weekly-Level ResistanceAs news of Israel's strike on Iran’s nuclear facility continues to spread, a surge in risk-off sentiment has driven noticeable gains across safe-haven assets. The escalation of tensions in the Middle East has clearly become a key trigger for current market sentiment. Should the conflict intensify further, oil and other safe-haven assets may see continued upside; conversely, if tensions ease, the retreat of risk aversion could lead to price corrections.

From a technical perspective, gold is currently facing downward pressure from the weekly trendline. If geopolitical tensions persist, gold may potentially rally toward the 3500–3550 range. However, without stronger fundamental support, a significant correction could follow once that level is reached.

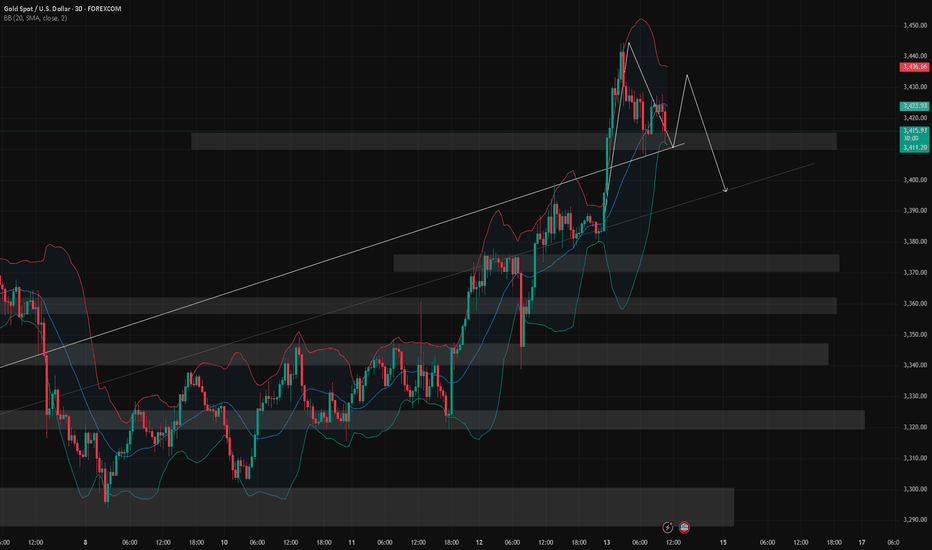

On the intraday chart, the price has now broken below the middle Bollinger Band on the 30-minute timeframe and is near lower band support around 3413. MACD and moving average alignment suggest there may still be room to test the 3396–3388 trend support zone. The 1-hour chart remains in a consolidation phase, and while a short-term rebound is possible, selling at higher levels appears to be the safer strategy for today.

As it is Friday and given the geopolitical uncertainties, the potential for weekend risk is significantly higher. It is recommended to reduce exposure before the market closes. If you choose to hold positions over the weekend, be sure to set appropriate stop-losses to mitigate unexpected developments.

6/12 Gold Analysis and Trading SignalsGood morning, everyone!

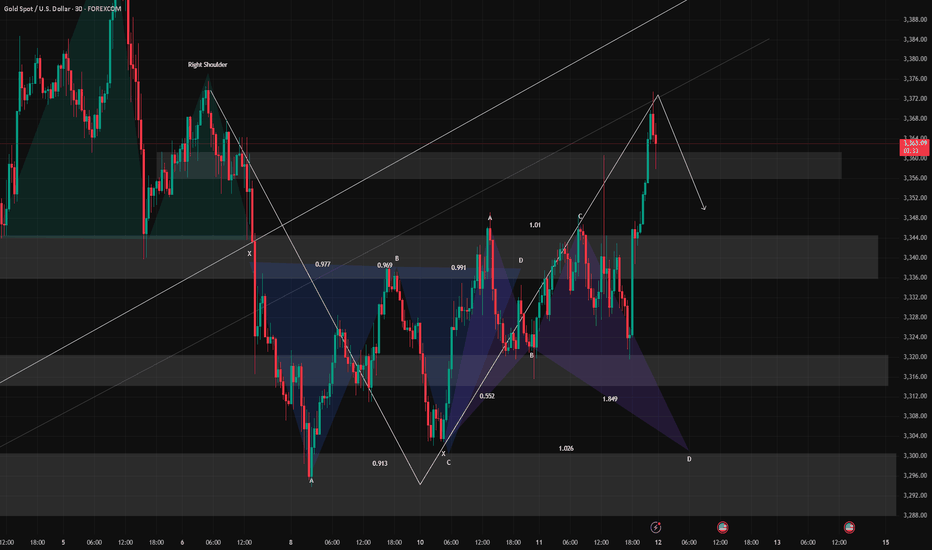

Gold rebounded after dipping to around $3320 yesterday, following a pullback from our previously defined sell zone (3358–3373). Early today, price broke above 3360, reaching a high of 3373, exactly within the resistance zone we expected. The initial rejection from this level aligns well with our plan.

📈 Technical Analysis:

Watch closely whether 3373 can be broken with strong volume. If so, the next key resistance lies around 3385.

However, if price reaches this level without first testing the 3352–3346 support, a rejection is likely. In such case, 3385 may serve as a temporary top and a potential short entry point.

🧭 Trend Structure:

On the 4H timeframe, the bullish momentum remains intact. The last two candles suggest strong buying pressure. If today's fundamentals are supportive, a test of 3400 or higher is possible.

On the 1D chart, the market is still in a technical correction phase. The bounce near 3300 was supported by the long-term trendline. However, if price drops back below 3340 and stays there, a trend reversal becomes more likely.

Focus on the 3314–3296 support zone. If that breaks, a deeper drop is likely, possibly $100 or more, pushing price toward 3200–3190. The decline may unfold as a slow grind or sharp breakdown.

📊 Fundamental Watch:

Today’s Initial Jobless Claims data could have greater-than-usual impact due to the recent CPI release.

The Federal Reserve's Quarterly Financial Accounts Report is also due today and may affect broader market sentiment.

📌 Today’s Trading Recommendations:

✅ Sell Zone: 3385–3403

✅ Buy Zone: 3331–3321

🔄 Intraday Scalping Levels:

3376 / 3358 / 3346 / 3334

The golden earthquake storm is coming!In terms of news: Major events over the weekend include the conflict between Russia and Ukraine, the sudden change in the situation between India and Pakistan, and the progress of Sino-US negotiations: Although India and Pakistan announced a truce, India's surprise attack turned the agreement into a joke. The high-level economic and trade talks between China and the United States are still continuing in Geneva, and it is difficult to have clear results in the short term. The war between Russia and Ukraine is still in a stalemate. The superposition of multiple events has injected uncertainty into the market.

Technical aspects:

Pay attention to the pressure in the 3360-3380 area. If it stands firm at 3346, it can fall back to arrange long orders. If it directly breaks below 3300 at the opening, pay attention to the support near 3280 - this position is likely to be lost, and effective support depends on the downward pattern formed after the 3260 break, and the ultimate target is 3200.

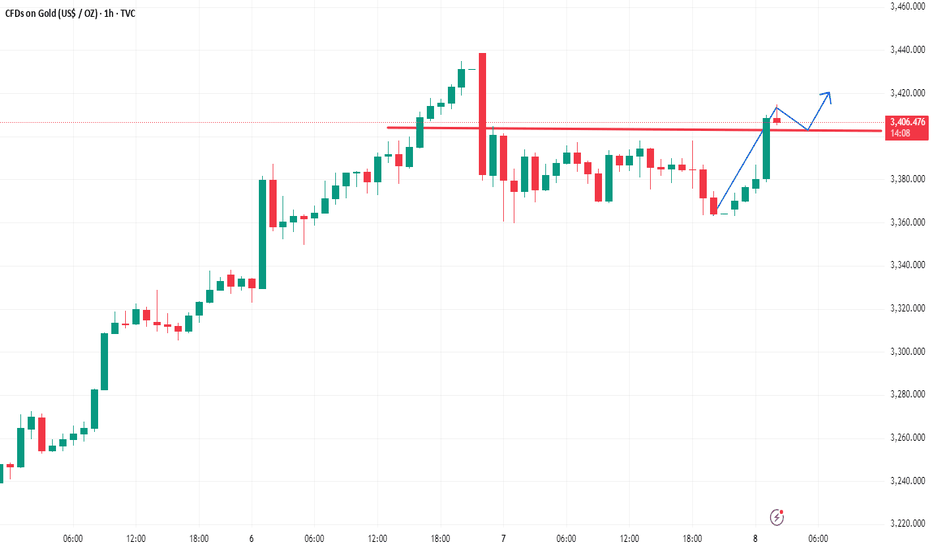

Gold breaks through 3400, the upward trend will continue

The Federal Reserve's interest rate decision will keep the interest rate unchanged, which is in line with the psychological expectations of most people in the market. The current price of gold still continues to fluctuate at high levels, but in terms of the general direction, gold bulls have actually not changed, and bulls are still in a strong phase.

If gold breaks through 3400 strongly in the short term, then you can go long gold on dips above 3400. If gold rebounds, focus on the pressure near 3430.

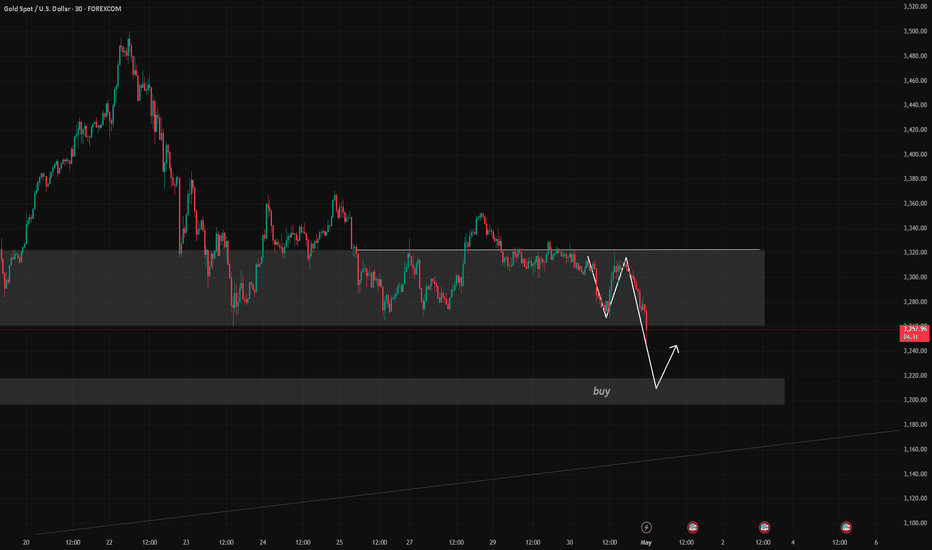

5/1 Gold Trading SignalsGold failed to show a decisive move yesterday as expected, and the market continues to trade within a tight range between 3260 and 3300, resulting in limited profit opportunities.

As of this update, price remains in sideways consolidation, with 3260 having been tested for the fifth time, indicating that this support level may be weakening.

🔍 Technical Outlook:

Given that current price levels are closer to the 3220 key support zone, it's more likely that the market will dip lower to test support before any meaningful rebound.

The inability to break above 3300 strengthens the case for a near-term bearish move.

✅ Trading Recommendations for Today:

🔻 Sell Zone (Short Entries):

3310–3330

🔺 Buy Zone (Long Entries):

3230–3200

⚠️ Manage position sizes carefully, and wait for confirmation of support before committing to larger entries.

4/21 Gold Trading StrategyGood morning, everyone! A brand new week begins—wishing us smooth trades and great success ahead.

Looking back to last Thursday, our gold short strategy hit the mark perfectly. Prices dropped nearly $60 as expected, and we captured around $45 in profit from that move. Overall, we secured over $200 in profit space last week—an excellent performance.

Today, gold opened higher and continues to climb. Technically, bulls still have room to push higher, with 3360 as a key resistance level. However, judging by the current momentum, we may even see a test of 3400. That said, trading is about precision, not perfection. If prices approach 3380 and the upward momentum stalls, it may be time to watch for a pullback. On the other hand, if strength continues, holding some light long positions remains a relatively low-risk strategy.

Trading Strategy for Today:

📉 Sell in the 3380–3410 range

📈 Buy in the 3307–3280 range

🔁 Flexible trades between 3360–3330 / 3272–3315

Gold: A textbook example of an extreme short squeeze!📌 Gold has surged over $400 in just six trading days—a textbook example of an extreme short squeeze!

Yesterday, gold broke above the 3300 psychological barrier and is now trading above 3360. While safe-haven demand driven by escalating trade tensions is part of the reason, such a rapid and steep rally is clearly unsustainable.

⚠️ If you enter at these levels and get trapped, trying to "hold and hope" could result in facing $100+ of price swings—a dangerous gamble for most traders.

👉 Experienced traders might manage this volatility with scalping or short-term strategies to mitigate losses or even turn a profit.

❌ But if you don’t have that level of skill, don’t chase this rally blindly.

✅ Suggested approach:

Scale into short positions gradually, or

Wait for clear topping signals before going short

Missing this rally isn’t the end—some of the best opportunities come during corrections. Profit potential remains strong on the way down.

🎯 Bearish targets:

Short-term: 3312 → 3291 → 3250

Mid-term: 3196 → 3137

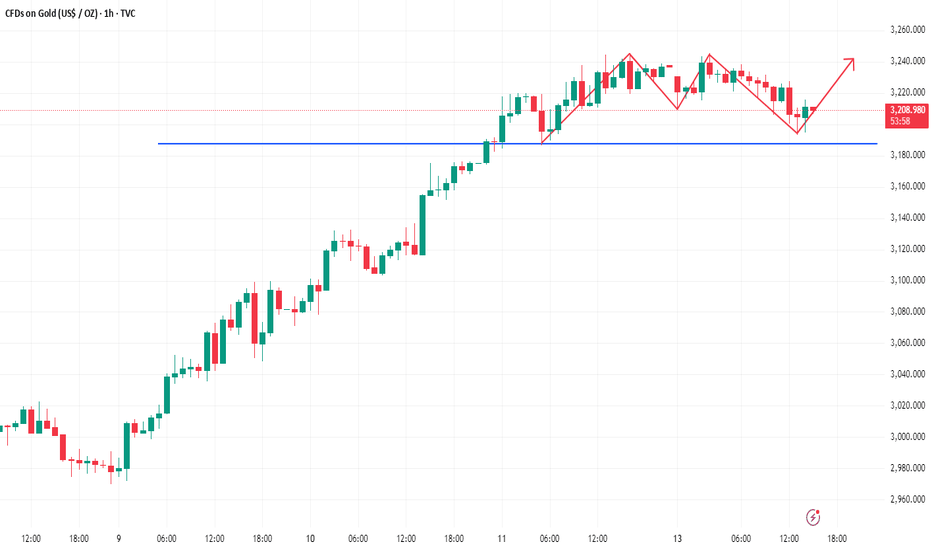

Can we continue to go long on gold?The 1-hour moving average of gold is still in a bullish arrangement with a golden cross, and there is still no sign of a turnaround, so the gold bulls are still strong, and now gold is just falling back. The short-term support of gold is 3193, and the gold US market continues to be bullish.

Trading ideas:Gold long around 3208 sl:3193 tp:3225

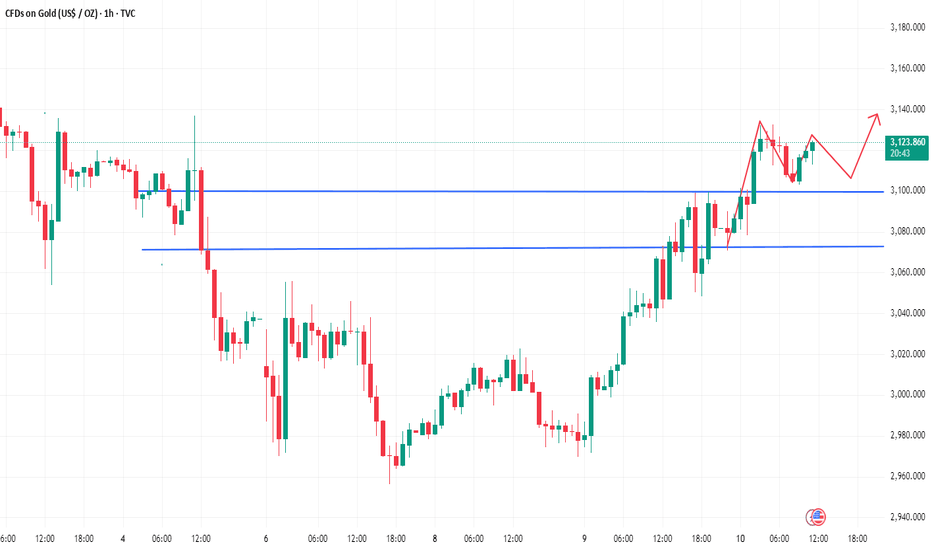

Gold is strong, wait for a pullback to go longThe 1-hour moving average of gold has formed a bullish arrangement with a golden cross upward, and gold is now supported near 3100. If gold can stand firm at 3100 after the data, then we can continue to go long on dips.

Trading ideas: Buy gold near 3100, stop loss 2990, target 3130

Gold: CPI Data Trading ViewsToday's signals for XAUUSD / BTCUSD / GBPUSD all hit their targets!

Congrats to everyone who followed—great profits all around!

🕒 Reminder: CPI data will be released in 1.5 hours.

Before that, we may see:

A quiet, ranging market, or

A pre-release pricing-in scenario that leads to sharp volatility ⚠️

Trading Suggestions:

✅ If you want to avoid unnecessary risk, it’s better to pause trading and wait for the data release

✅ If you're holding positions, please:

Manage your risk carefully

For large positions, consider partial closing or adding SL

Post-CPI Strategy Outlook:

Price has reached key resistance zones

If the data is bullish, further upside may be limited due to:

Proximity to recent highs

Remaining selling pressure in the market

Therefore, focus on:

High-level short entries or low-level long entries

Avoid blindly chasing the market—don’t go long at the top or short at the bottom

To sum it up:

Control your emotions, manage your positions wisely.

The 30 minutes after the CPI release will separate winners from losers!

Gold: Watch for Selling OpportunitiesGold remains under pressure around the 3100 level, where previous trapped buyers are creating significant selling pressure. The heavier resistance zone lies between 3127–3146, so if you’re holding long positions, don’t be greedy — this is a crucial area to watch!

Tomorrow during the U.S. session, we’re expecting major economic data and headlines. The market will likely see high volatility, and instead of a clear one-way trend, there’s a higher chance of a two-way sweep (both up and down).

Trading Advice for Tomorrow:

Avoid chasing price or getting caught in emotional trades.

Control your position size — even if you end up holding during turbulence, a small and managed position won’t hurt you. You might even come out profitable.

But if you enter with full margin and no risk control, the result could be heavy losses or even blowing your account. This is my honest advice!

During the Asian and European sessions, the technical outlook favors short positions. Consider selling around the 3103–3123 zone, with support levels at:

3078 / 3066 / 3051 / 3027 / 3011

I will release updated strategies for the U.S. session tomorrow based on key data releases. Stay tuned and feel free to reach out if you have any questions.

Good luck and trade safe!

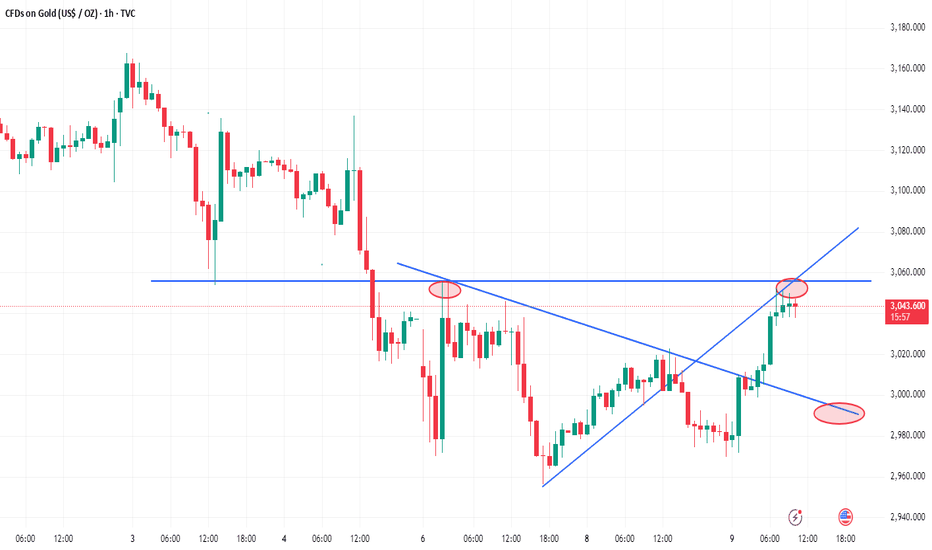

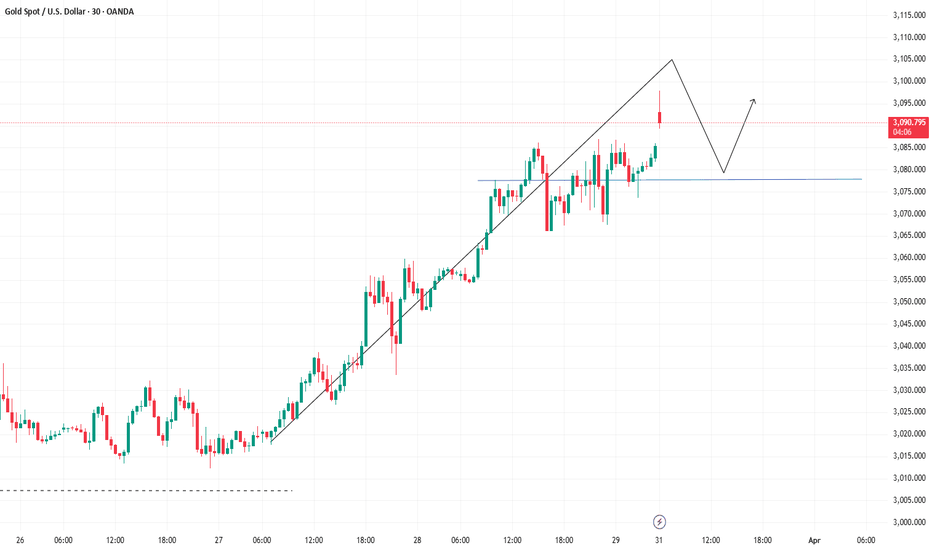

Gold 3055 is very important!gold chose to break upward and is currently trading around 3043. For the next market, Monday's high of 3055 is very important. If gold stands above 3055 again, then the hourly chart will be a double bottom pattern, and the next rebound target will continue to advance towards 3115. On the contrary, if it cannot stand above 3055, then the market is still expected to fall back!!!

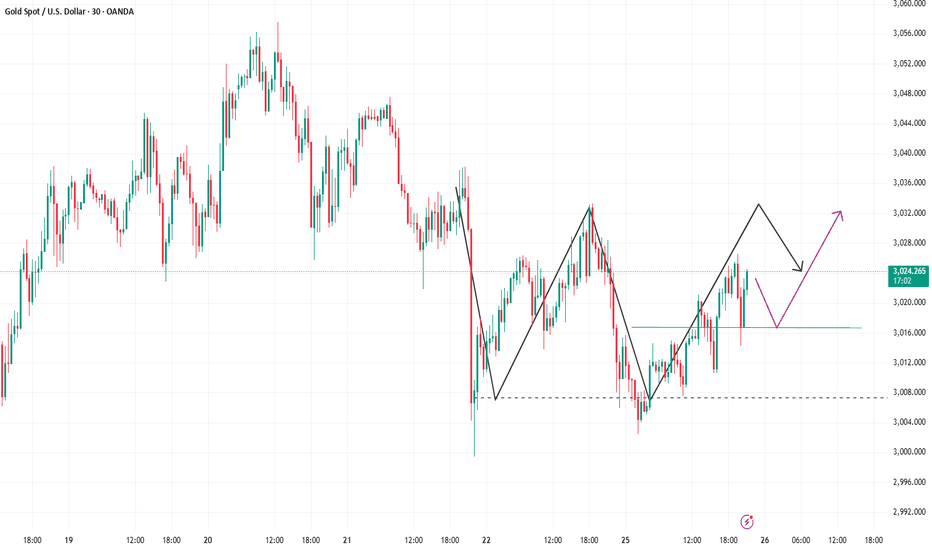

#XAUUSD: Last Sell Idea Dropped +300 Pips, Bias Changed? XAUs price behaviour has deviated from previous analysis, which had anticipated a +300 pips increase. However, we now anticipate the price to continue its upward trend, potentially reaching another record high. Our next target price range is estimated to be between 3170$ and 3200$.

We extend our best wishes for your successful trading endeavours. To enhance your trading outcomes, we strongly recommend employing accurate risk management techniques.

Team Setupsfx_

🚀❤️

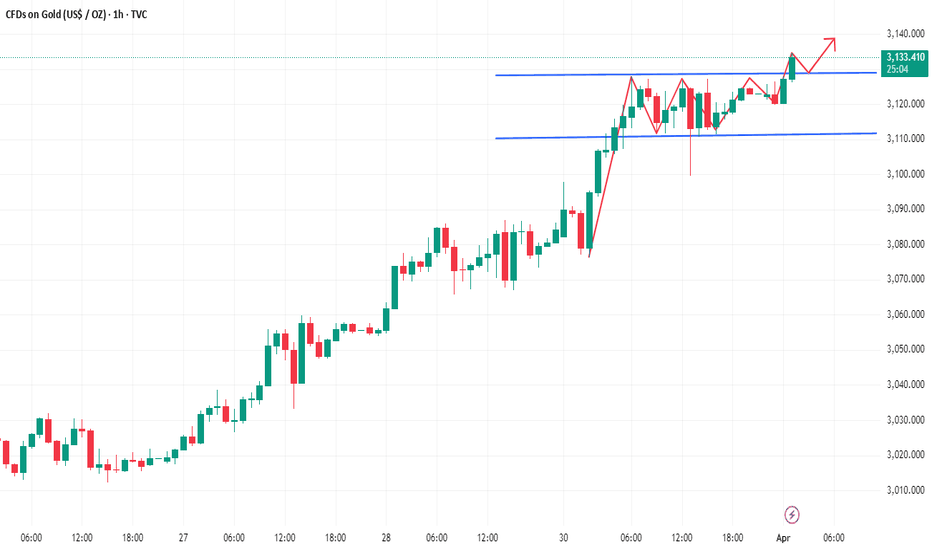

You can't make money from such a simple market?After gold stepped back, it hit a new high again. Gold bulls continued to be strong. Gold broke through 3127 again, so the bulls are even better.

The gold 1-hour moving average continues to cross upwards and diverges. The support of the gold 1-hour moving average has moved up to 3096, but gold is now far away from the moving average, so wait patiently for adjustments and then step back to continue to buy. The gold 1-hour lowest yesterday fell to around 3100 and then stabilized again, so today gold will continue to buy on dips above 3100.

Trading ideas for reference:

Go long near gold 3110, sl: 3100, tp: 3130

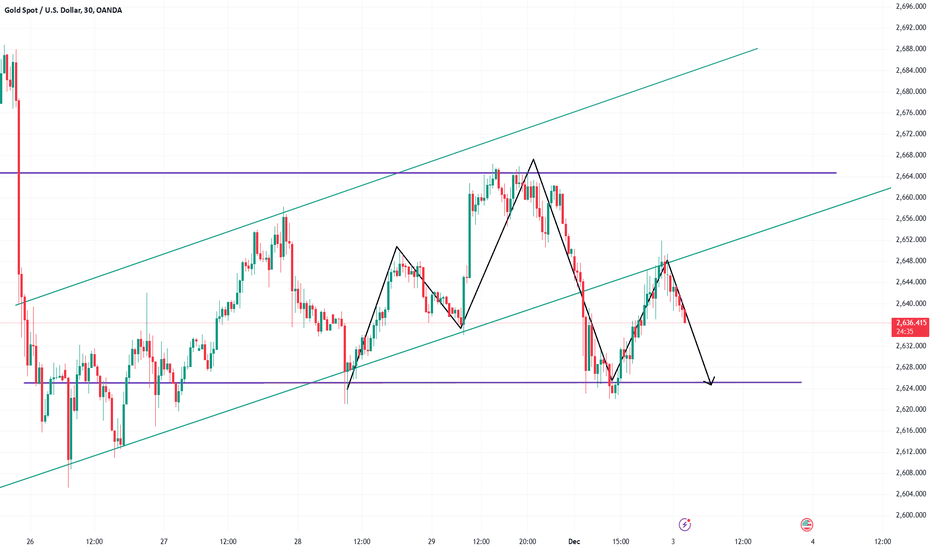

Gold Price Analysis: Key Support at 2635Today, we made two successful long trades on gold. The first target was 2635-2643, and the second target was around 2650. Both targets were hit, and we enjoyed substantial profits. Now, gold has retreated below 2640, with weak support around 2635. If the price can stabilize around this support level, an upward move is expected. However, if the price breaks below this level, we could see a head and shoulders pattern forming, and the price might return to around 2625.

Currently, the market is experiencing low volatility, and the key trading opportunities for this week will likely come between Wednesday and Friday. A large amount of data will be released, which could lead to significant fluctuations in gold prices, offering even more favorable opportunities for trading.