XAUUSD LONG IDEAHello there all,

Sorry about my chart colourways haha changing every new post, I just cannot seem to stick with one lol. 😂

Here's the XAUUSD forecast for long idea.

Please do let me know if you are seeing what I'm seeing or have a different perspective on it, I would love to see your analysis.

Please do drop the chart link below on comment section, I would love to see it

LETS GOO!!

This is not financial advice. 🙂

Thanks all

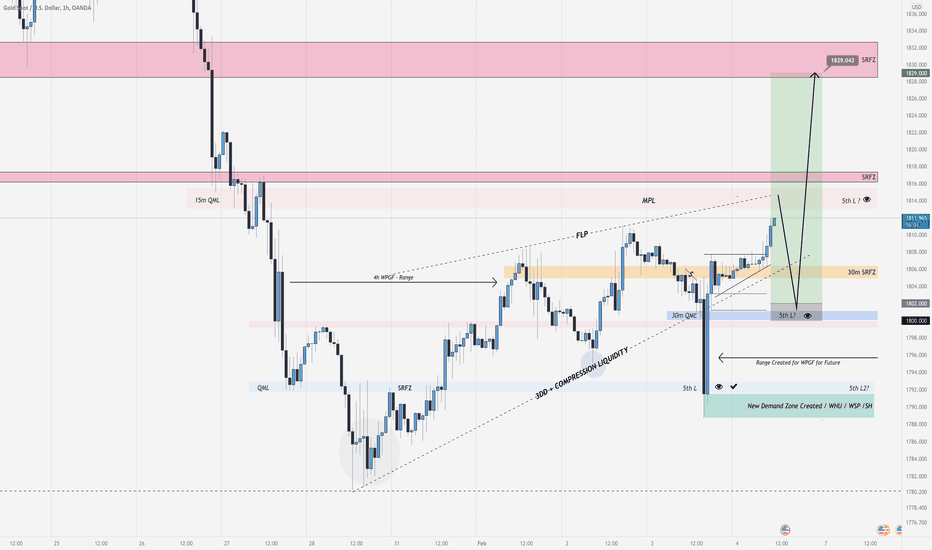

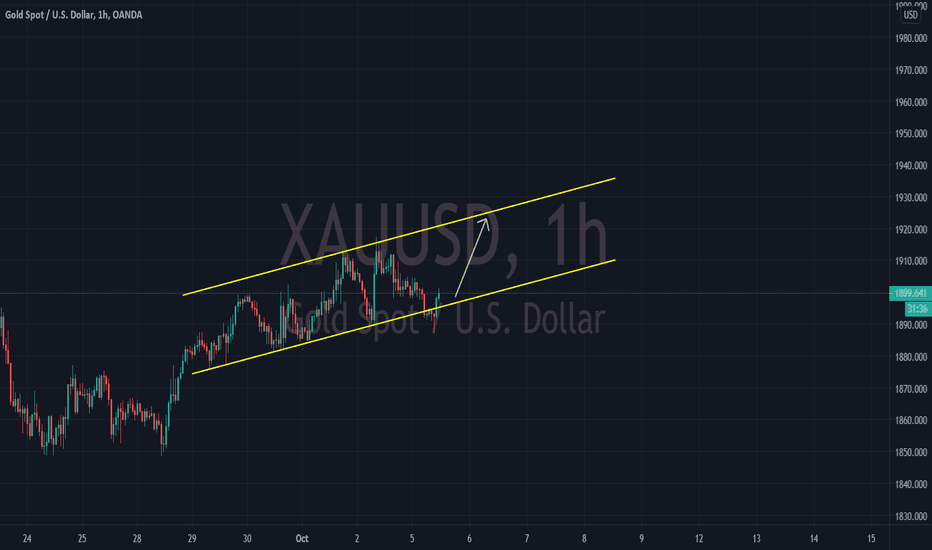

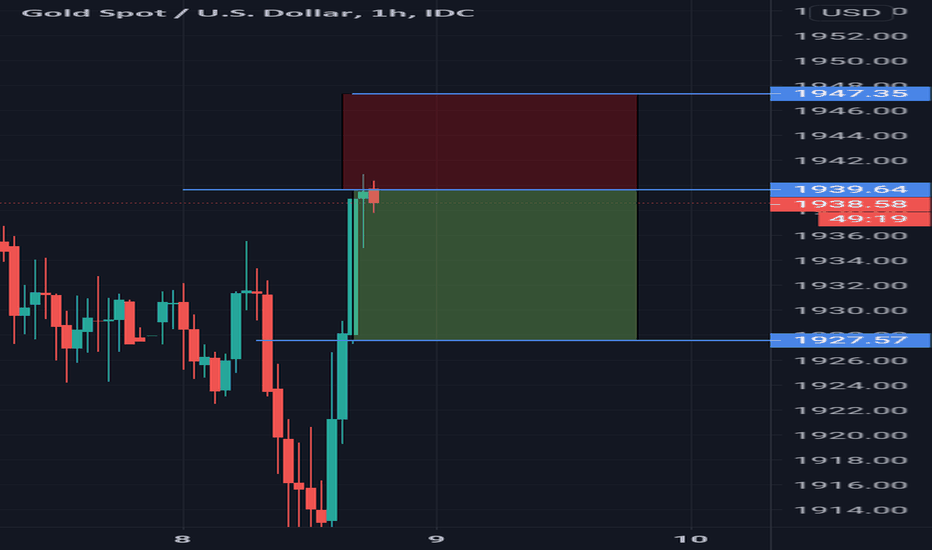

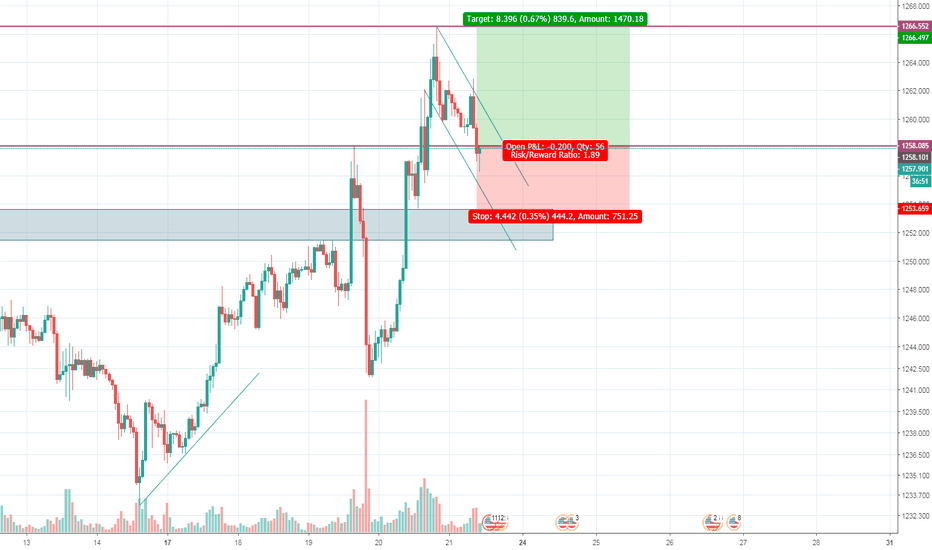

Xauusd1h

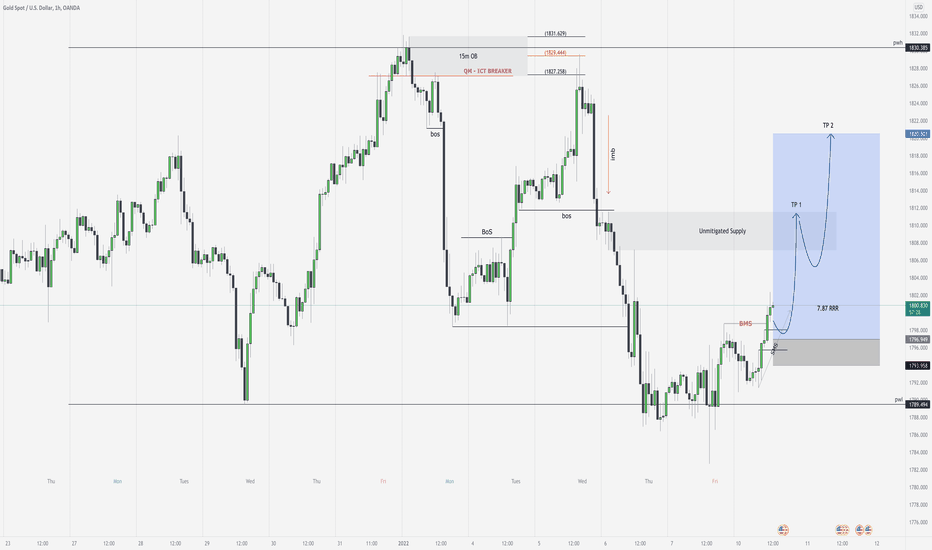

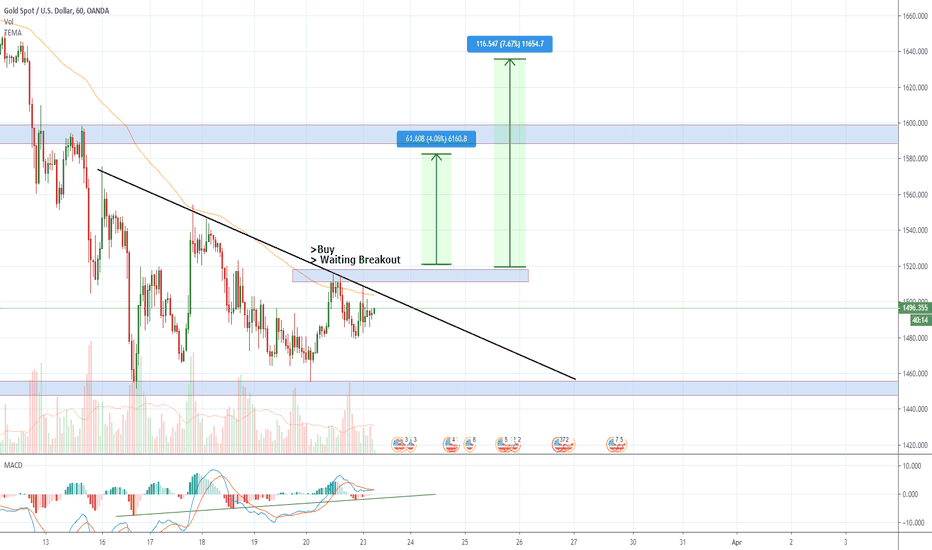

XAUUSD LONG IDEAHello there all,

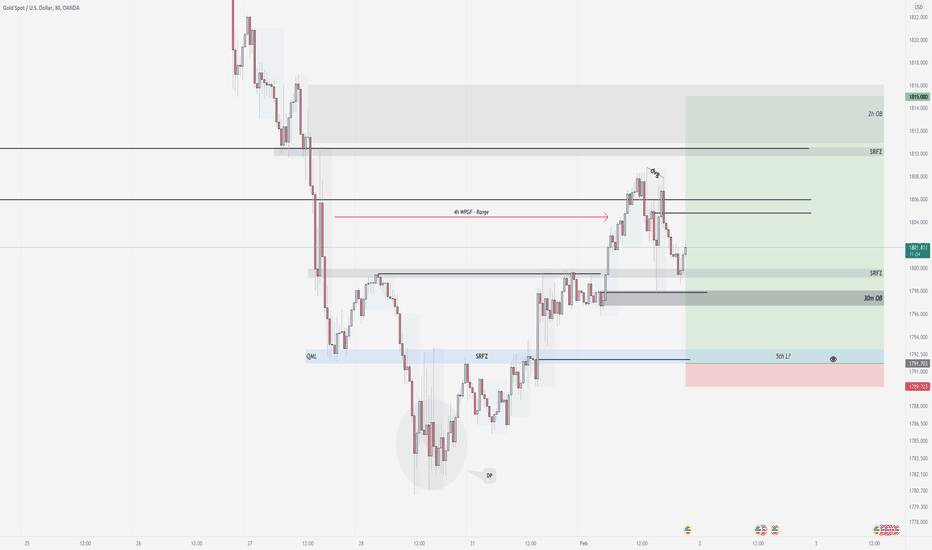

Here's the XAUUSD forecast for long idea.

Please do let me know if you are seeing what I'm seeing or have a different perspective on it, I would love to see your analysis.

Please do drop the chart link below on comment section, I would love to see it

This is not financial advice.

Thanks all :)

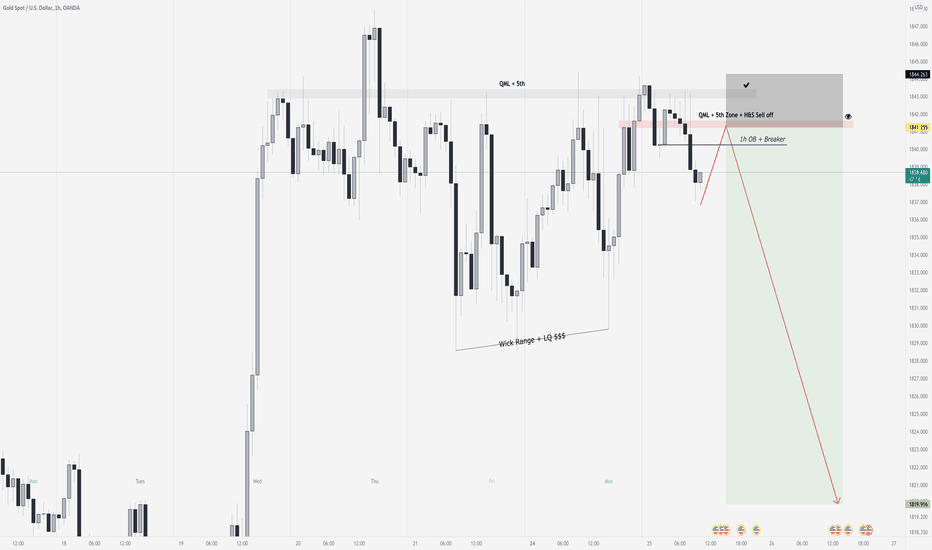

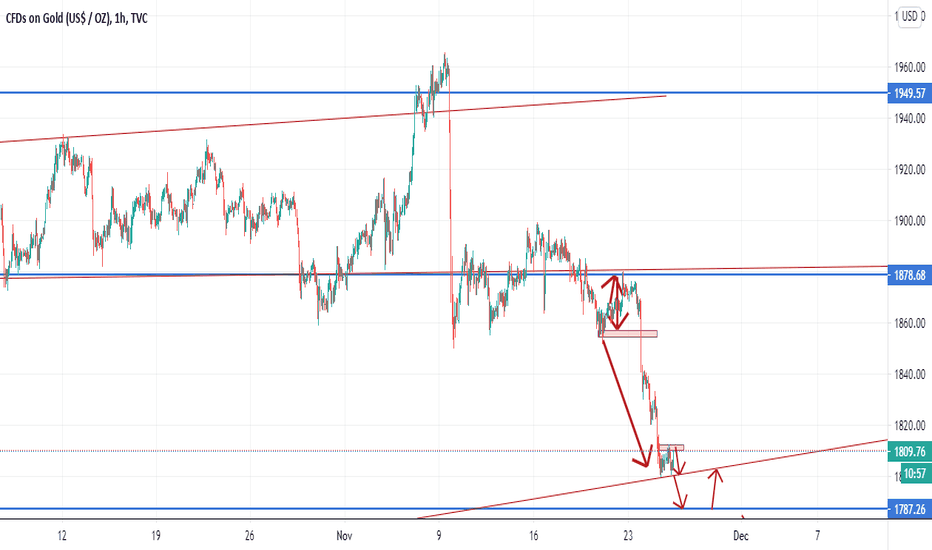

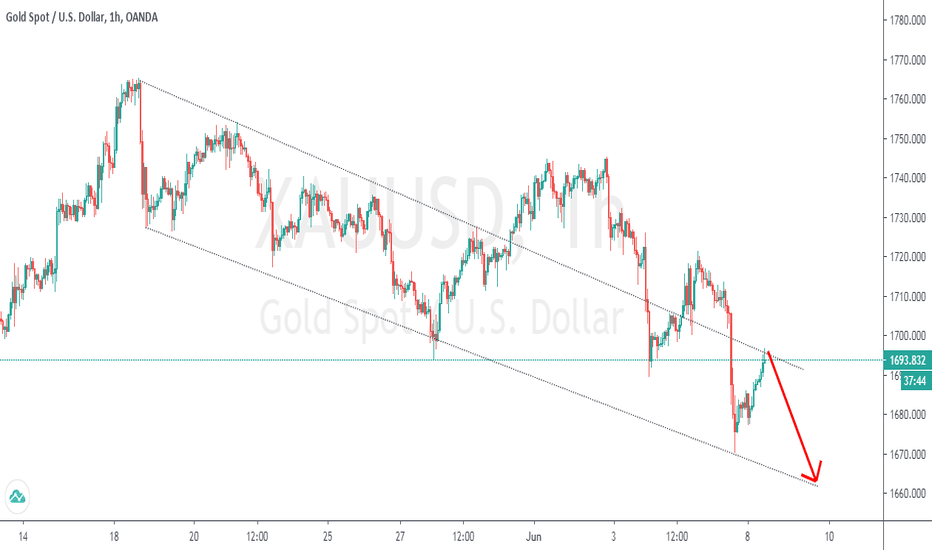

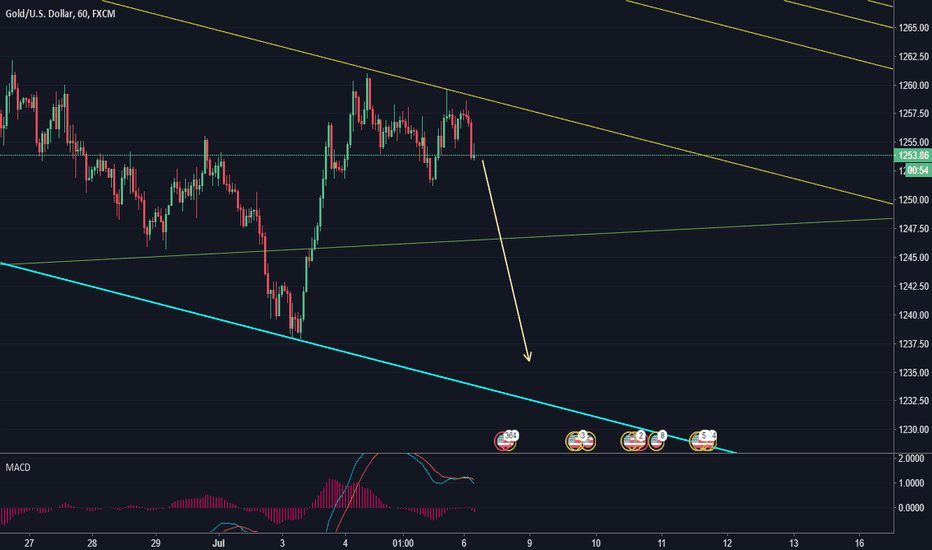

XAUUSD SHORT IdeaHello there all,

Here's the XAUUSD forecast for short idea.

Please do let me know if you are seeing what I'm seeing or have a different perspective on it, I would love to see your analysis.

Please do drop the chart link below on comment section, I would love to see it

This is not financial advice.

Thanks all

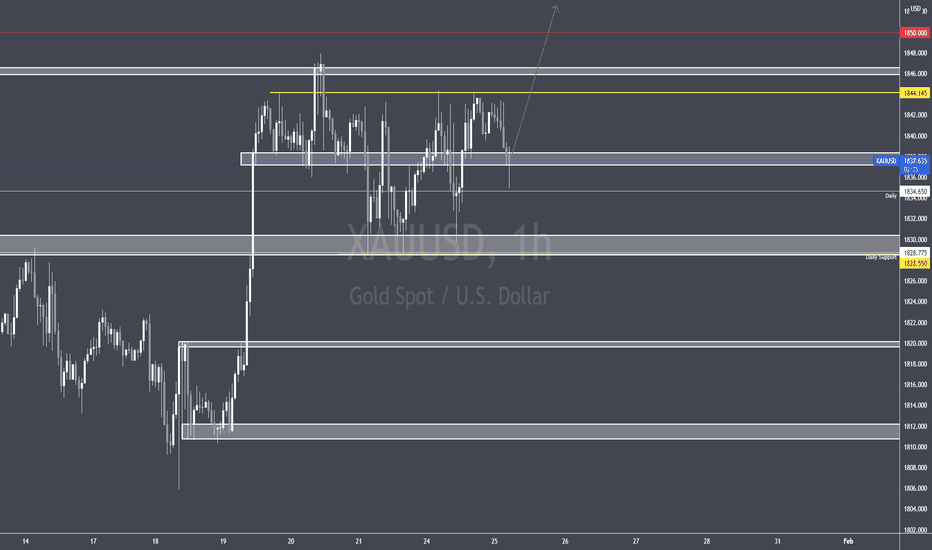

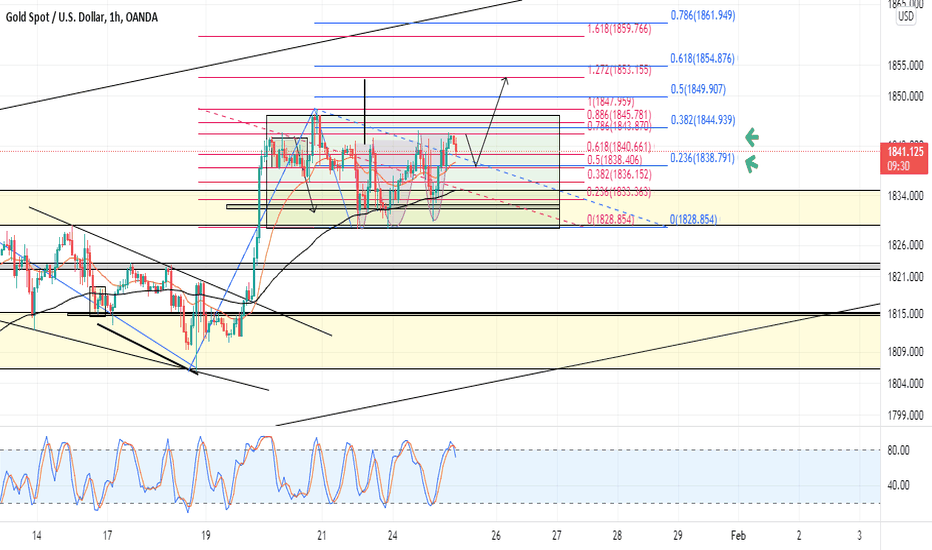

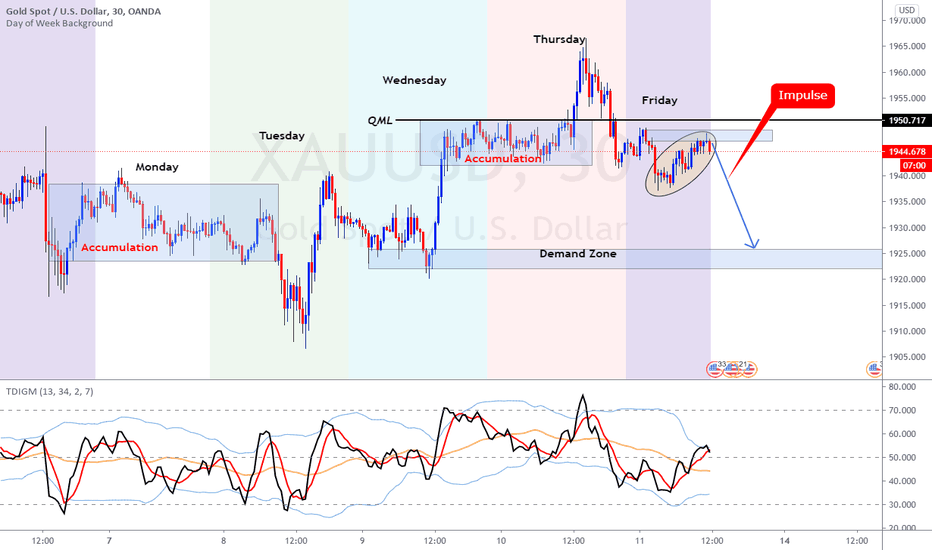

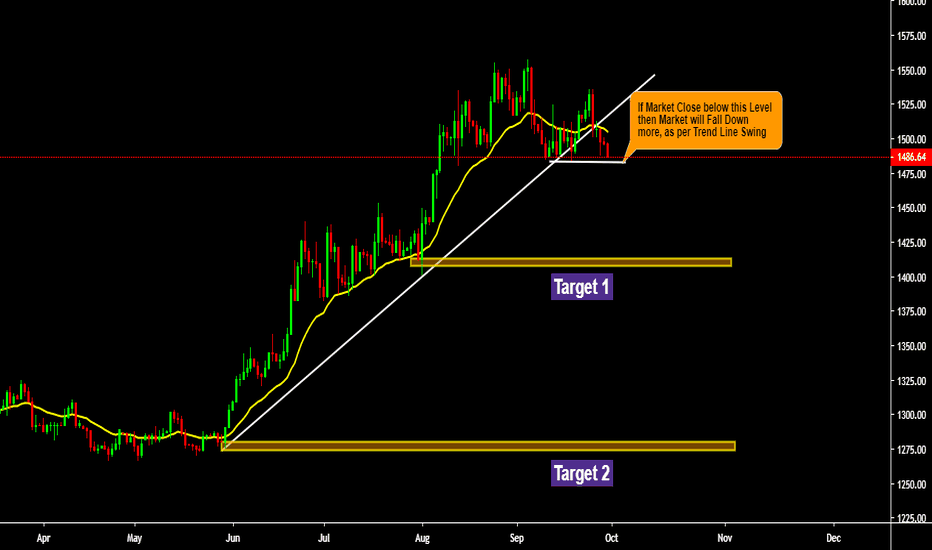

XAUUSD- FOMC WEEK 2- As you can see I have marked out multiple support zones on the 4H, Gold is heavily bullish looking at Price Action, it does not want to go lower, any low dips are being bought up

- Price seems to be holding the 1837 levels

- Taken longs from the last spike down @ 1835 pre NY , these are risky buys, I have placed my positions at BE

- Targets remain - 1845/1850/1860

- Again I will stress to please be careful trading FOMC week.

XAUUSD - short termin XAUUSD - 1H, I found a consolidation area and triple bottom, there is indication XAUUSD will make a new higher low after going down and reach fibonacci cluster (0.5 & 0.236), and waiting for confirmation to rebound over the neckline of triple bottom.

But if it's going down more than 1838, I will waiting for support retest.

Overall, XAUUSD still on bullish phase, and looking for long buy.

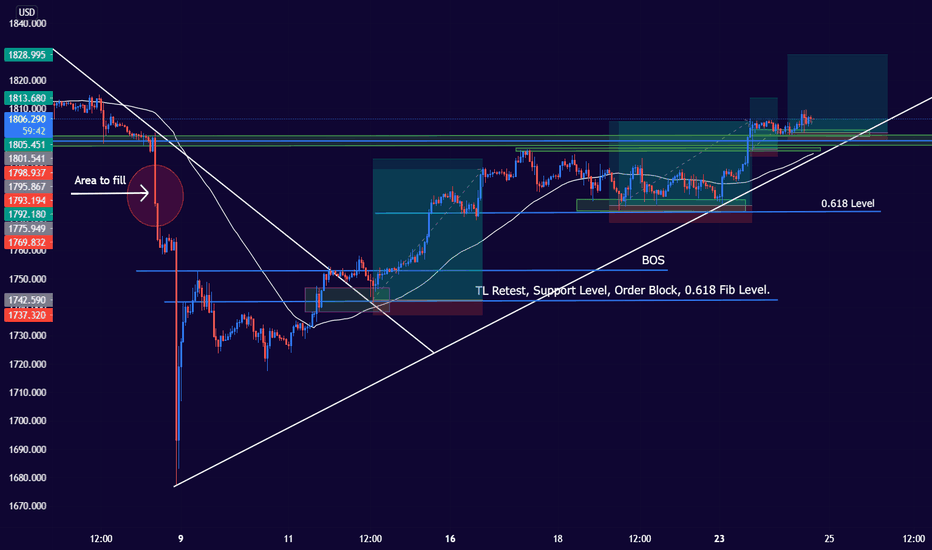

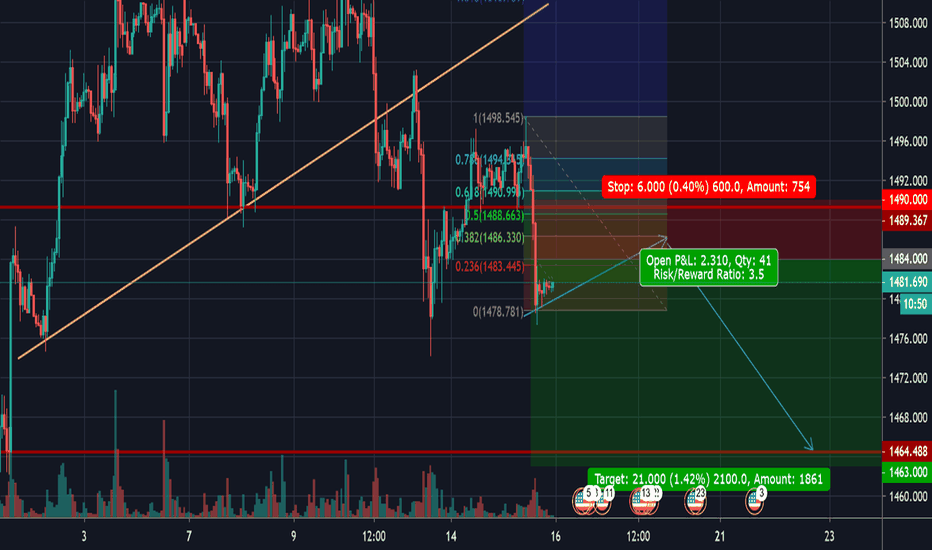

XAUUSD Setups and Analysis Just sharing some of my setups. The main one is the one with all the confirmations. The other setups didn't need as much analysis because the trend was very bullish. The first setup needed a ton of confirmation because of how powerful the sellers were previously, had to make sure it wasn't a fake-out or was going to continue on downwards after a short retest upwards. I've started using some bits and pieces of other strategies I've seen people use and it seems to work extremely well.

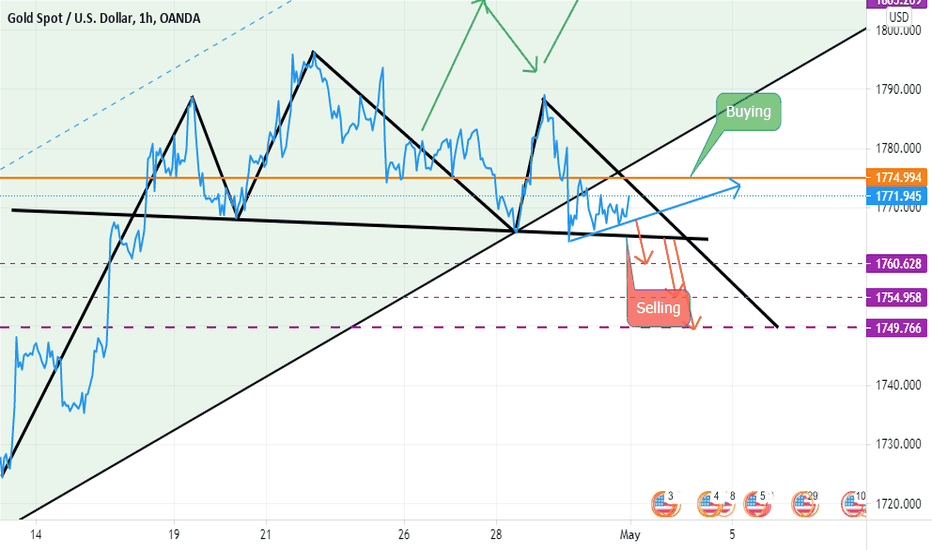

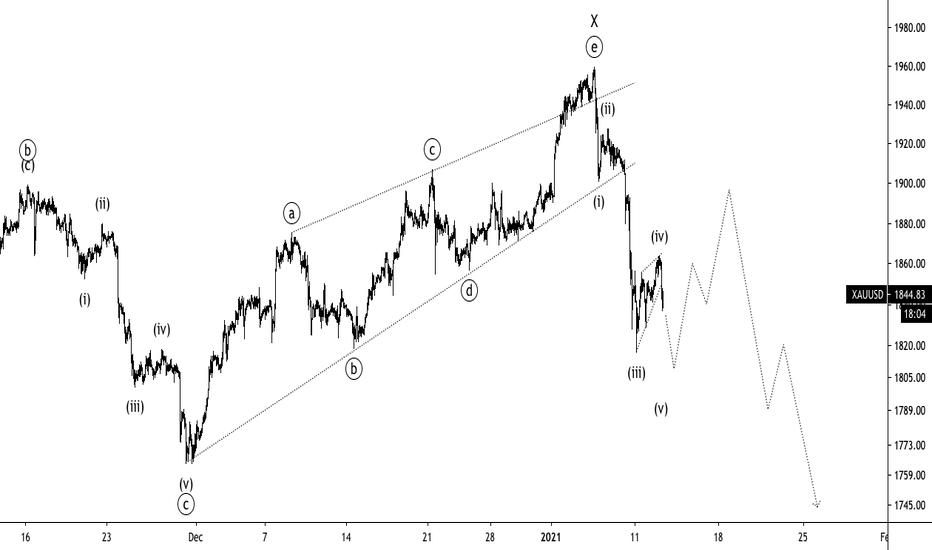

Small Retest then Sell againAfter hits the full target, now we wait to complete the small retest then there would be a sell opportunity again to 1800.

Then we can wait to break down below 1800 to reach 1787,after that it will be a great to think of Strong buy.

Coming weeks is very important to Gold. Before Christmas vaccine matter will be prevail and the risk of both short/buy go high.

Best

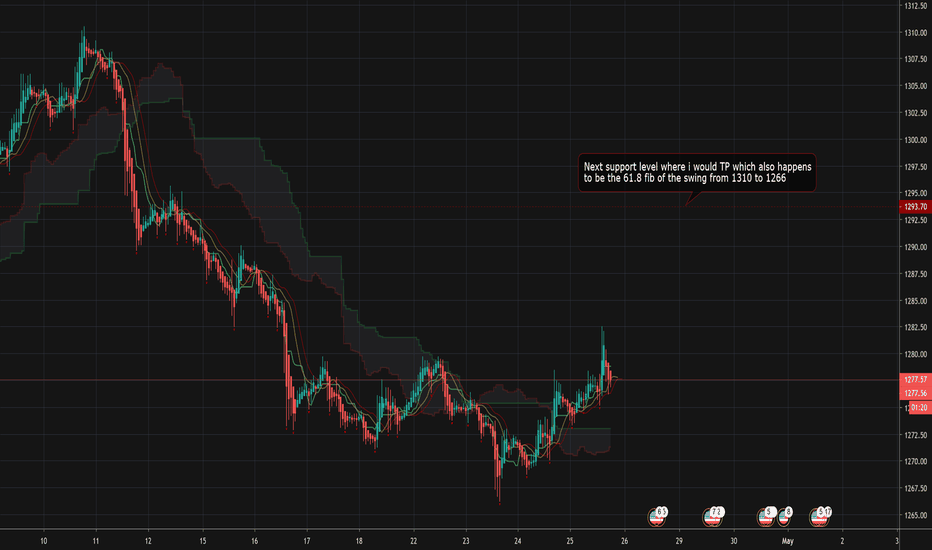

XAU/USD tries to bypass 1,323.00 againXAU/USD tries to bypass 1,323.00 again

Contrary to expectations, the exchange rate failed to sneak below the combined support formed by the lower trend-line of a junior ascending channel and the 200-hour SMA. In other words, bulls made one more, though unsuccessful, attempt to push the bullion through the upper boundary of a four-month long dominant descending channel. In larger perspective, the pair is still expected to make a fully-fledged rebound from this boundary even though the current horizontal movement might last for another two weeks because of support provided by the 61.8% Fibonacci retracement level at 1,311.48. On hourly chart a combination of the weekly PP, the 55- and 100-hour SMAs most probably will prevent the pair from falling below the 1,316.00 mark during this trading session. However, this scenario might be altered due to fundamentals, such as the US PPI data release.

XAU/USD fails to break below 55-hour SMA XAU/USD fails to break below 55-hour SMA

In result of the previous trading session the exchange rate slipped to the lower trend-line of a junior ascending channel, as expected. Although the pattern has been broken, the further plunge still seems unlikely, as the southern side is reliably covered by a combination of the updated weekly PP at 1,316.13 and the 55- and 100-hour SMAs. For this reason, the pair is likely to make one more attempt to reach the upper boundary of a dominant five-month long descending channel. Due to absence of any significant data releases the rate might spend most of this week fluctuating between the above trend-line from the north and technical indicators from the south. In larger perspective, bears are projected to take the lead for notable amount of time.