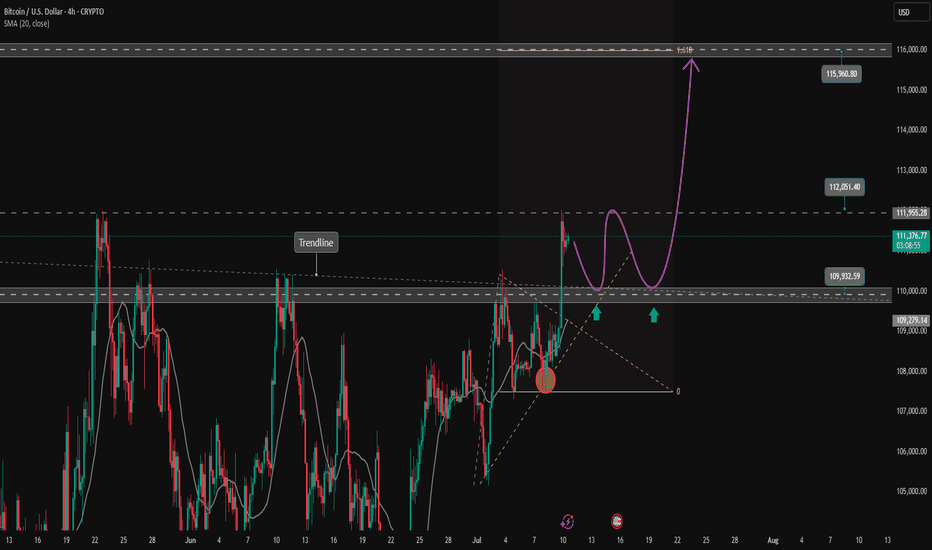

BTC's increasing fomo force will push the price up furtherCRYPTO:BTCUSD just broke the important resistance zone and trendline around 110000. This price increase to create a new ATH will create a large amount of FOMO in the market pushing BTCUSD to increase more than half. 116,000 FIbonacci extension points are considered the immediate Target for the uptrend.

Waiting for retests to the support zone for the trend-following BUY strategy.

Support: 110000-107500

Resistance: 116000

Buy zone: 110000 ( support + trendline)

Buy Trigger: break above 112000

Leave your comments on the idea. I am happy to read your views.

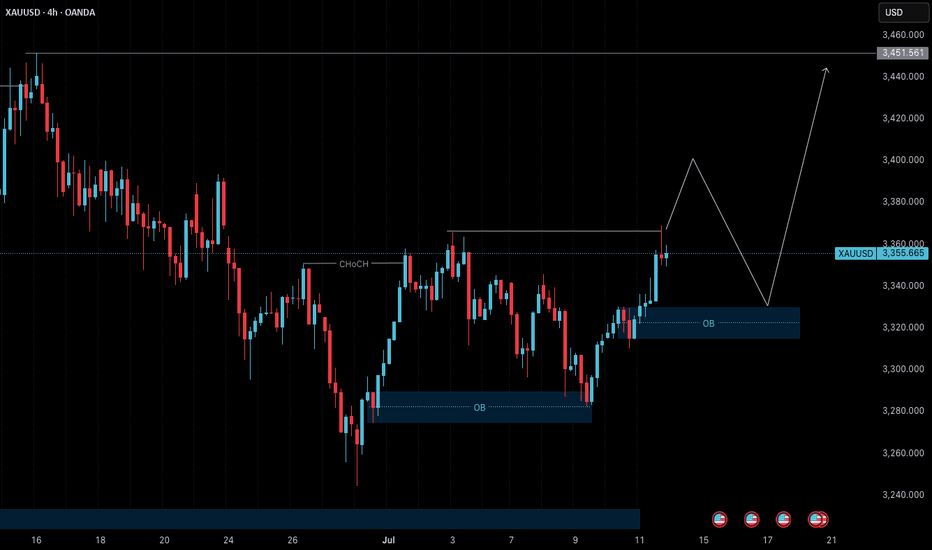

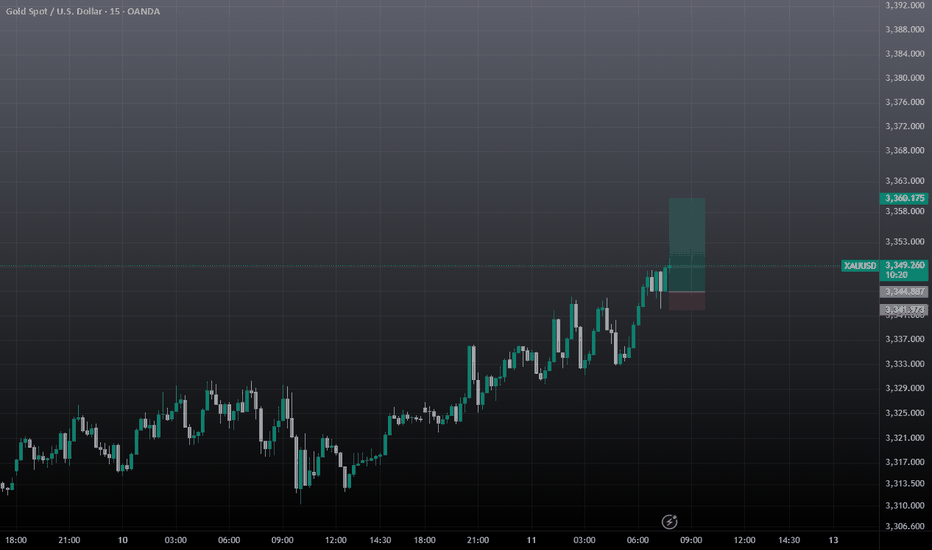

Xauusdanalysis

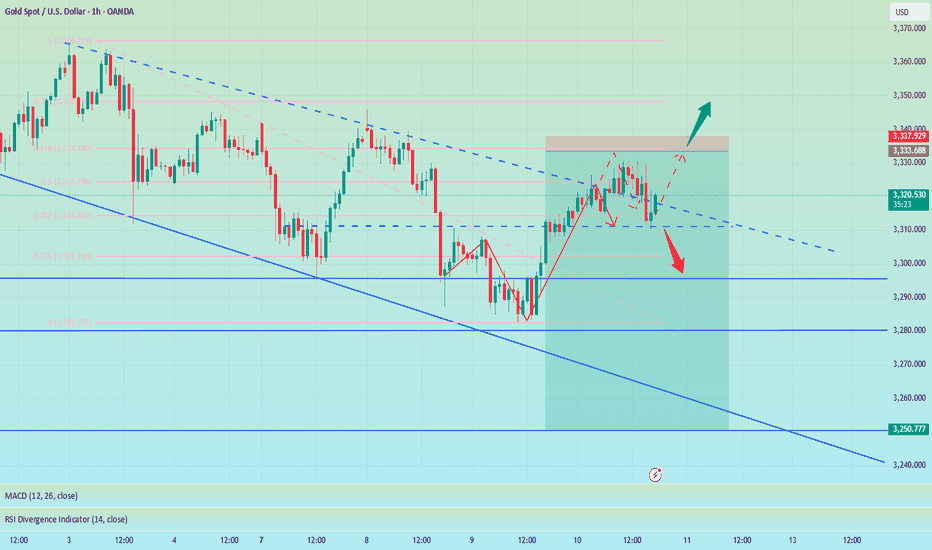

Gold – H4 Structure at Key Decision Point | July 14 Outlook🟡 Gold (XAUUSD) – July 14 Outlook | Key Reaction Ahead at 3366

Gold closed Friday at 3355.665 , after facing resistance from the H4 swing high (3366) .

While price failed to break that level during the session, the last H4 candle closed as a bullish spinning top , signaling indecision — but with slight bullish pressure.

As we head into Monday’s open, the next move could be pivotal in determining the direction of the upcoming H4 trend leg.

🔮 Key Scenarios to Watch

1️⃣ Bullish Scenario (Preferred Bias):

If the market opens above 3366 , creating a clean Break of Structure (BoS) , it would confirm the continuation of the H4 uptrend.

→ In this case, we will watch for a retest of the 3320 Order Block (OB) — a potential long setup zone.

→ If price gives another BoS after the first, it may also present a continuation entry opportunity, depending on structure.

2️⃣ Rejection / Bearish Case:

If the market fails to break 3366 , we’ll step back and observe how M15 reacts.

→ Consolidation could follow before any significant BoS.

→ In this scenario, patience is key — we’ll wait for either confirmation of a deeper pullback or a structure shift on lower timeframes.

3️⃣ Consolidation Possibility:

There’s also a strong possibility that price consolidates between the H4 swing high (3366) and the 3320 OB before making a structural decision.

→ A tight range can trap both buyers and sellers — so it’s crucial not to act prematurely.

🧭 Trade Bias Summary

✅ If BoS (above 3366):

→ Bullish bias confirmed

→ Look for long on OB retest (e.g., 3320 zone) or next M15 structure break

⚠️ If No BoS:

→ Step back, observe M15

→ Wait for structure clarity before forming bias

🔁 If Range Forms (3366–3320):

→ Stay out until market resolves direction

→ Let breakout + retest guide the next setup

🧠 Final Thoughts

This analysis is shared for educational and structural observation purposes only — not as trade advice or recommendation.

The goal is to track price behavior around key zones and adapt based on how structure confirms or invalidates bias.

📖 Let the market reveal its intention — not with emotion, but through structure.

We don’t predict the breakout — we prepare for both outcomes.

📘 Shared by @ChartIsMirror

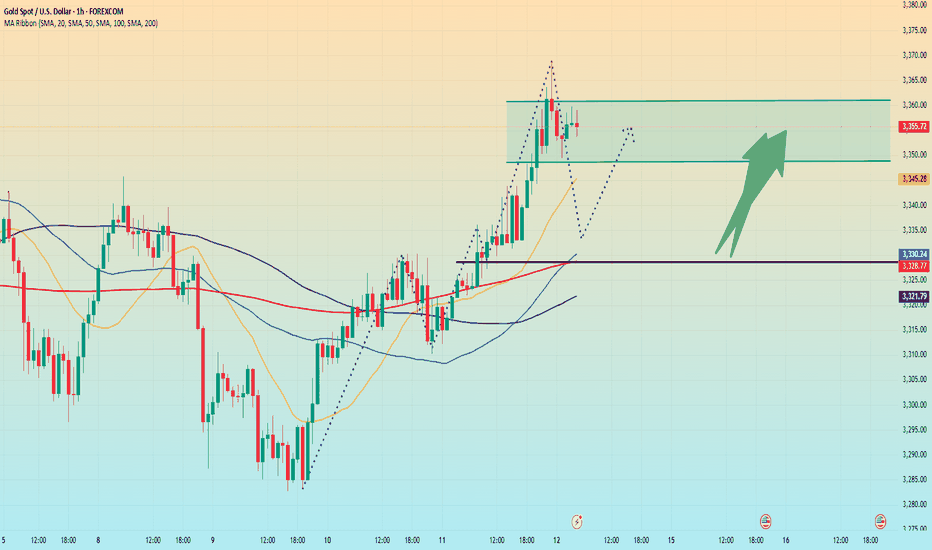

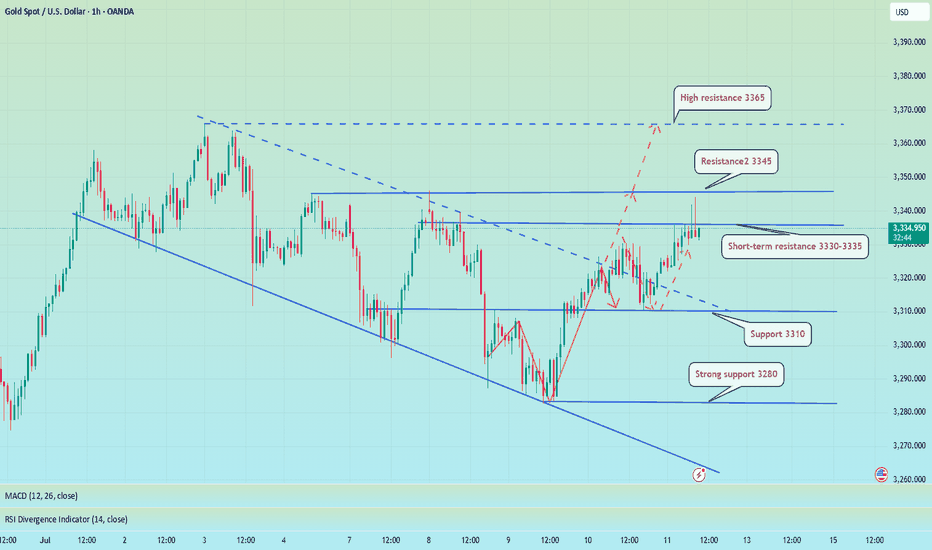

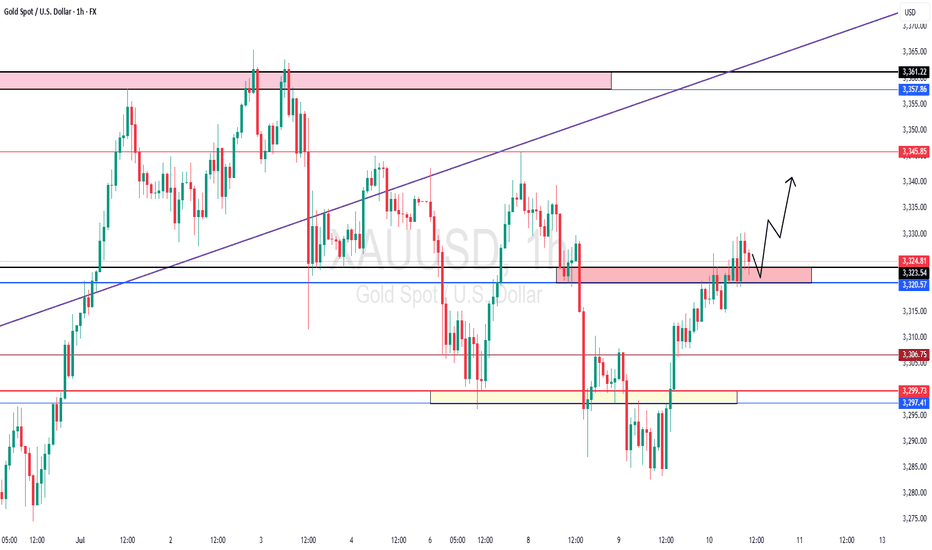

Gold breaks through. Will it continue?After breaking through the position predicted by Quaid on Friday, gold rose strongly and finally maintained the fluctuation range of 3345-3360 that I predicted. Gold bulls are now strong. If there is no major change in the news over the weekend, the price will likely continue to rise after a slight decline at the beginning of next week. I think we can still follow the strategy of Dutou.

The 1-hour moving average of gold continues to diverge with a golden cross and upward bullish arrangement, and the bullish momentum of gold is still there. The current strong support level of gold has also moved up to around 3330. After gold broke through 3330 over the weekend, the price fell back to 3330 and stabilized and rose twice. In the short term, this position has formed a strong support.

There is a high probability that the price will have a small correction at the beginning of next week. We can continue the bullish strategy after the price falls back.

Market transactions should abandon personal preferences. Preconceived subjective consciousness will eventually be taught a lesson by the market. The market is always right. We should follow the fluctuations of the market. Instead of having a head full of random thoughts. There are always traces of market changes, and you need to have the ability to discover them or follow those who have the ability. The market changes rapidly, so pay attention to more timely changes.

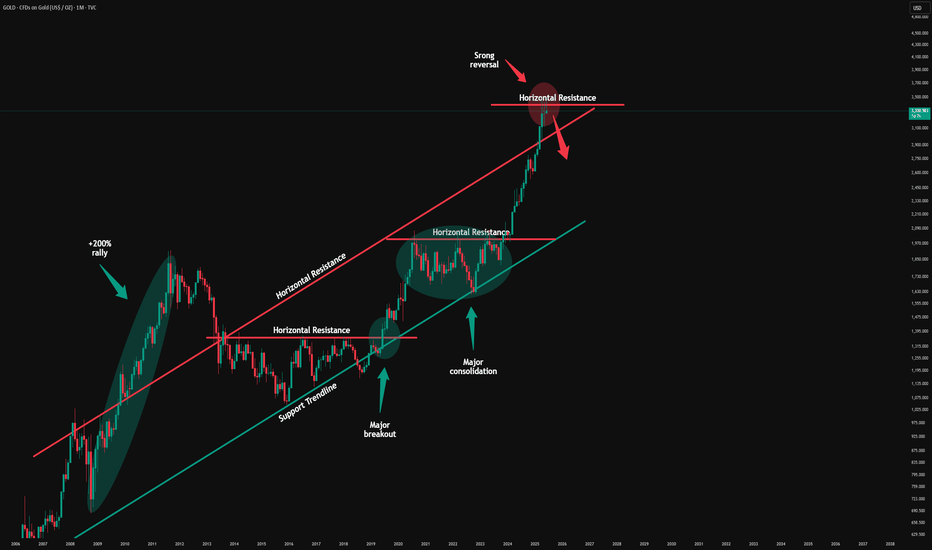

Gold - This is the official top!Gold - TVC:GOLD - might top out soon:

(click chart above to see the in depth analysis👆🏻)

Since Gold confirmed its rounding bottom in 2019 it rallied more than +200%. Especially the recent push higher has been quite aggressive, squeezing all bears. But now Gold is somehow unable to create new all time highs, which could constitute the a top formation.

Levels to watch: $3.500, $3.000

Keep your long term vision🙏🙏

Philip (BasicTrading)

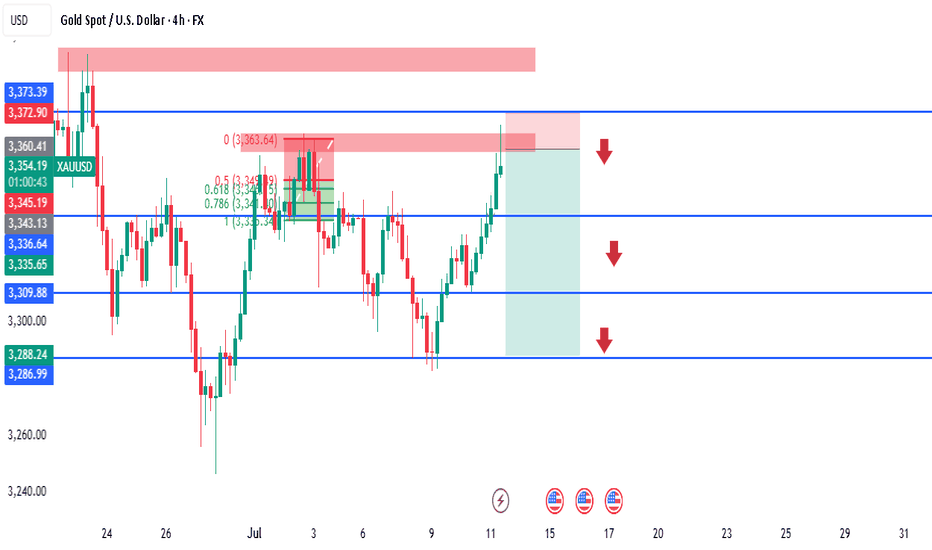

XAUUSD 4H SMC Analysis – Sell Opportunity Near Supply Zone Price is currently tapping into a 4H supply zone around 3353–3360, a strong area of previous sell-off and imbalance. We're expecting a potential reaction and rejection from this area, aligning with the following SMC confluences:

🔻 SMC Confluences:

Price swept short-term liquidity above previous highs (liquidity grab).

Price now tapping into a mitigation zone within premium pricing.

Bearish order block aligned around 3360.

FVG (Fair Value Gap) filled between 3345–3360.

Fibonacci 0.5–0.618 zone respected.

🎯 Sell Setup:

Entry: 3355–3360 (Confirmed reaction)

SL: Above 3373 zone (liquidity sweep buffer)

TP1: 3343 (short-term structure)

TP2: 3309 (previous support)

TP3: 3288 (strong 4H demand)

📌 Watch for M15–H1 bearish CHoCH (Change of Character) or BOS (Break of Structure) as confirmation before entry.

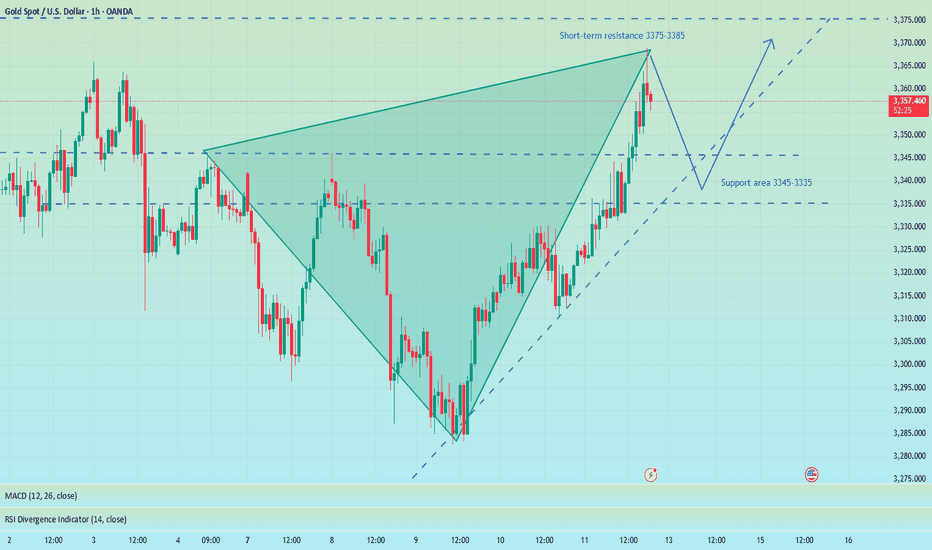

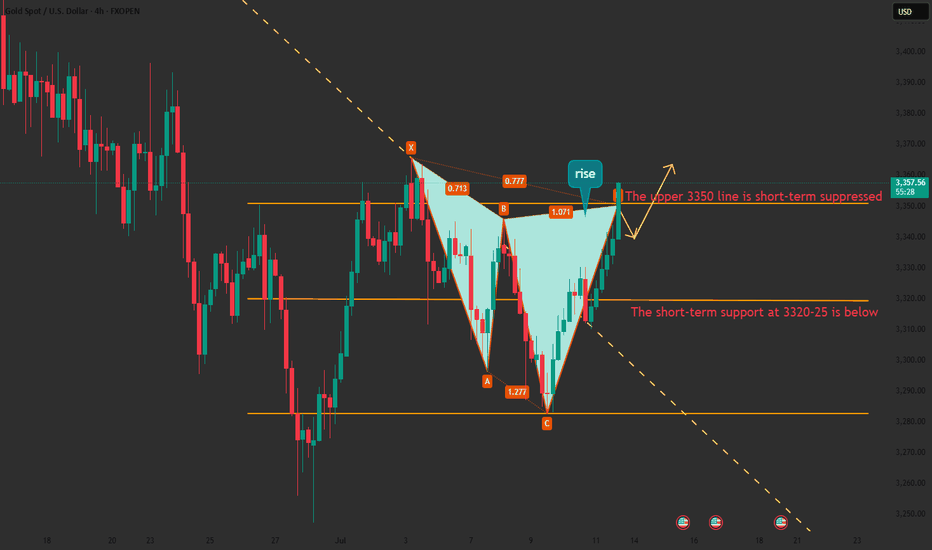

Precisely look at 3365 and pay attention to the pullback chanceAt present, gold has risen as expected and reached the highest level near 3368. The upper 3375-3385 constitutes a short-term resistance level. At present, the bullish momentum is still relatively strong, and the short-term support structure below has been formed. I still maintain the views of the previous transaction and wait for a second trading opportunity when it pulls back below. Although the 1H chart shows that the current trend remains strong and the retracement is small, it is necessary to remain cautious - even if the market is strong, it is not recommended to chase long easily, and the risk of a deep correction in the gold price must be guarded against. First, pay attention to the support area of 3345-3335 below. If it falls back to this level, you can consider going long with a light position.

OANDA:XAUUSD

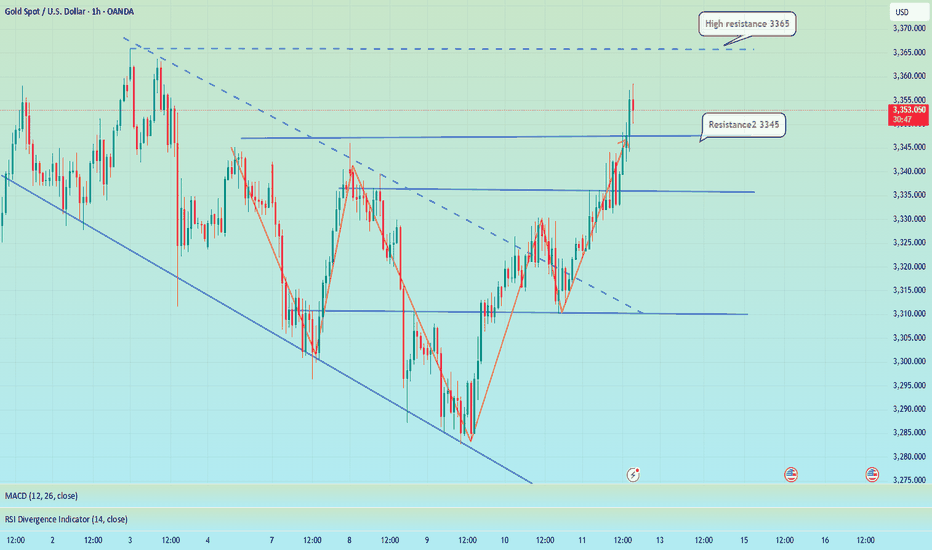

Continue to try to find the top of the band to short goldGold maintained a slow and volatile rise structure during the day. The highest has reached 3348, and it is only a step away from 3350. Will gold continue its upward momentum as usual?

In fact, it was beyond my expectation that gold could break through 3345 in the short term. According to my original expectation, the intraday high of gold was almost around 3345. Although the rebound of gold exceeded expectations, it is currently located near the resistance of 3348-3350, so I will definitely not give priority to chasing gold at high levels in short-term transactions.

Moreover, gold is currently in the resistance area of 3348-3350. The volatility of gold has converged, and the upward momentum has declined. As gold continues to rebound and faces the key resistance area again, the bulls are relatively more cautious. In this context, this resistance area may act as a catalyst, and the bears will react, leading the decline in gold. However, as gold rebounds and the support below gradually stabilizes, we can appropriately reduce the expectation of gold's decline and adjust the decline target to the 3330-3320 area.

So for short-term trading, I will still short gold based on the resistance area, trying to find a swing top in the 3340-3350 area, and look at the target area of 3330-3320.

The idea remains unchanged, NY3360-3365 is emptyThe idea remains unchanged during the NY period. Although gold has currently reached a high of around 3348, it has not stabilized above it. If gold successfully breaks through 3350 in the short term, it may reach 3360 or 3365. In the 4H cycle, it presents a step-by-step upward pattern. The K-line is temporarily fluctuating sideways near the upper track. At the same time, 3345 has formed a double top pattern. Combined with Thursday's low of 3310, an inverted triangle oscillation range of 3345-3310 is formed in the short term. This week's trend needs to pay close attention to the breakthrough direction of this range. Short-term long positions can be taken after the trend is confirmed.

XAUUSD@3330-3320 long TP 3345-3365

OANDA:XAUUSD

Breaking through 3350, the bullish trend remains unchanged📰 News information:

1. Pay attention to the impact of Trump administration tariffs

📈 Technical Analysis:

Possible interest rate cuts and tariffs in the fall continue to stimulate risk aversion. Currently, the 3300-3285-3310 points form a head and shoulders bottom pattern. The bullish momentum is relatively strong in the short term. Our short trade near 41 has hit the stop loss. As I wrote before, gold may continue to rise to 3360 or 3365 after breaking through 3350. The current RSI indicator is seriously oversold, so be cautious when operating in a unilateral trend in the short term. The safe way is to wait for a pullback to 3345-3340 to go long

🎯 Trading Points:

BUY 3345-3340

TP 3360-3370-3400

In addition to investment, life also includes poetry, distant places, and Allen. Facing the market is actually facing yourself, correcting your shortcomings, facing your mistakes, and exercising strict self-discipline. I share free trading strategies and analysis ideas every day for reference by brothers. I hope my analysis can help you.

TVC:GOLD FXOPEN:XAUUSD

Bulls rise, beware of Friday's black swan📰 News information:

1. Pay attention to the impact of Trump administration tariffs

📈 Technical Analysis:

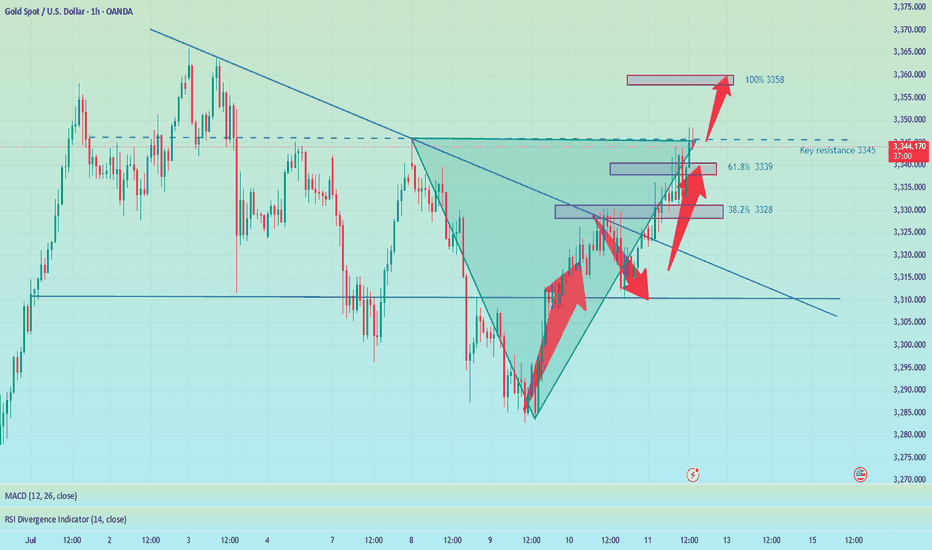

Gold rose as expected and touched around 3344, which was in line with our judgment last night. However, from the market point of view, the K-line entity did not stand firmly above 3335. There are only two possible scenarios for the subsequent trend of gold. One is to stand directly above and test the 3345 resistance again, and the other is to fall in the European and American markets due to timeliness and retest the key support of 3310. At present, the upper positions are 3345 and 3365 respectively. If 3345 is repeatedly not broken and the European market falls with acceleration, then the 3310 area will still need to take back the long positions, which can be defined as a long wide-range wash. 3330-3320 is a very critical support position, and 3310 is a strong support. Therefore, the best position for shorting during the day is around 3335-3345, with the target at 3330-3320. Consider long positions after falling back and getting support here.

🎯 Trading Points:

SELL 3335-3345

TP 3330-3320

BUY 3330-3320

TP 3345-3365

In addition to investment, life also includes poetry, distant places, and Allen. Facing the market is actually facing yourself, correcting your shortcomings, facing your mistakes, and exercising strict self-discipline. I share free trading strategies and analysis ideas every day for reference by brothers. I hope my analysis can help you.

OANDA:XAUUSD PEPPERSTONE:XAUUSD FOREXCOM:XAUUSD FX:XAUUSD FXOPEN:XAUUSD TVC:GOLD

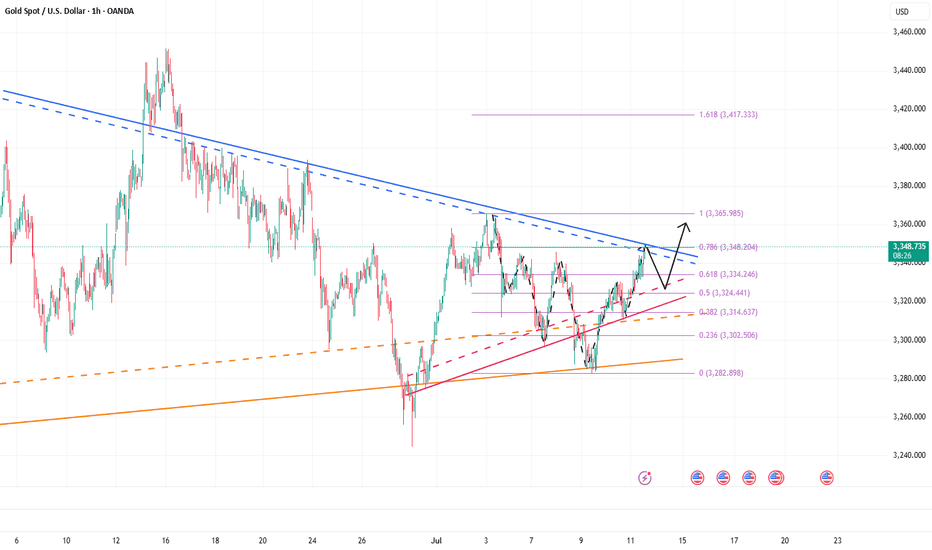

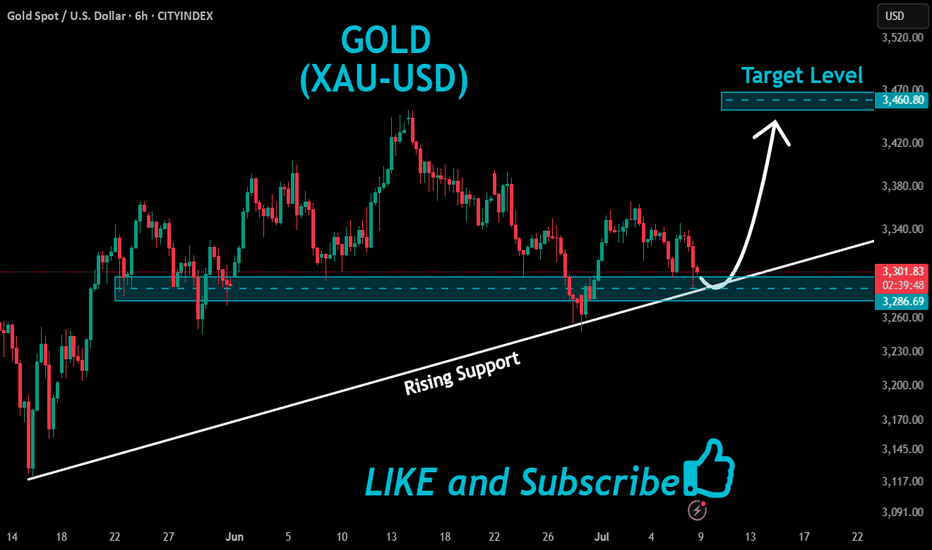

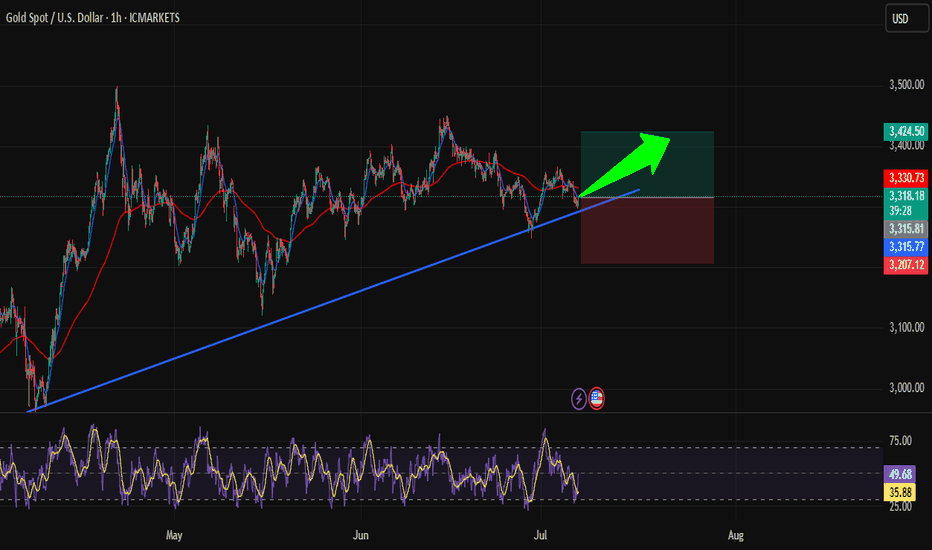

Is Gold (XAU/USD) Ready to Bounce? Bullish Setup on Key TrendlinHi traders! , Analyzing XAU/USD on the 1H timeframe, price is currently bouncing off a long-term ascending trendline, showing signs of a potential bullish continuation:

🔹 Entry: 3318

🔹 Take Profit (TP): 3424

🔹 Stop Loss (SL): 3207

After testing the ascending trendline multiple times, gold is once again showing bullish rejection near support. Price remains above the key trendline and is attempting to form a higher low within the broader uptrend.

The RSI is recovering from oversold territory (currently around 49), which suggests weakening selling pressure and possible buildup of bullish momentum.

If the structure holds, the target at 3424 aligns with a previous resistance area and a natural extension of the upward channel. The risk-reward is favorable with a strong technical confluence backing the setup.

⚠️ DISCLAIMER: This is not financial advice. Every trader is responsible for managing their own risk and strategy.

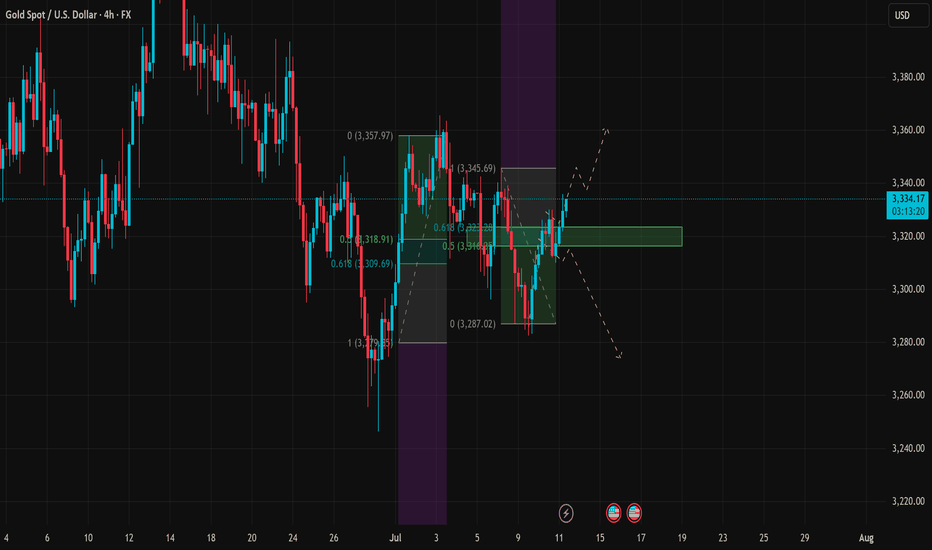

The rebound is under pressure and the retracement is furtherFrom the 4-hour analysis, the support below today is around 3309-16.

The short-term bullish strong dividing line is around 3295-3301. The overall bullish rhythm of high-altitude and low-multiple continues to remain unchanged.

Before the daily level falls below the 3300 mark, any retracement is a long opportunity, and short positions against the trend should be cautious.

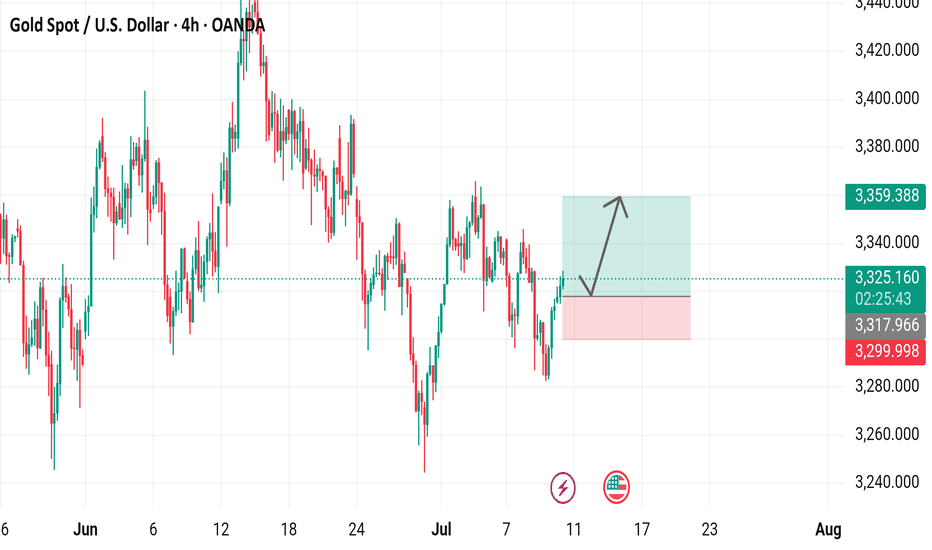

Gold Spot / U.S. Dollar (XAUUSD) 4-Hour Chart4-hour chart from OANDA shows the price movement of Gold Spot (XAUUSD) with a current value of $3,325.625, reflecting a $11.925 increase (+0.36%). The chart highlights key levels including a sell price of $3,325.290 and a buy price of $3,325.960, with a spread of 67 points. Technical analysis includes a resistance zone around $3,359.388 and a support zone near $3,317.966, with recent price action showing a potential upward trend from a low point. The chart spans from June to early August 2025.

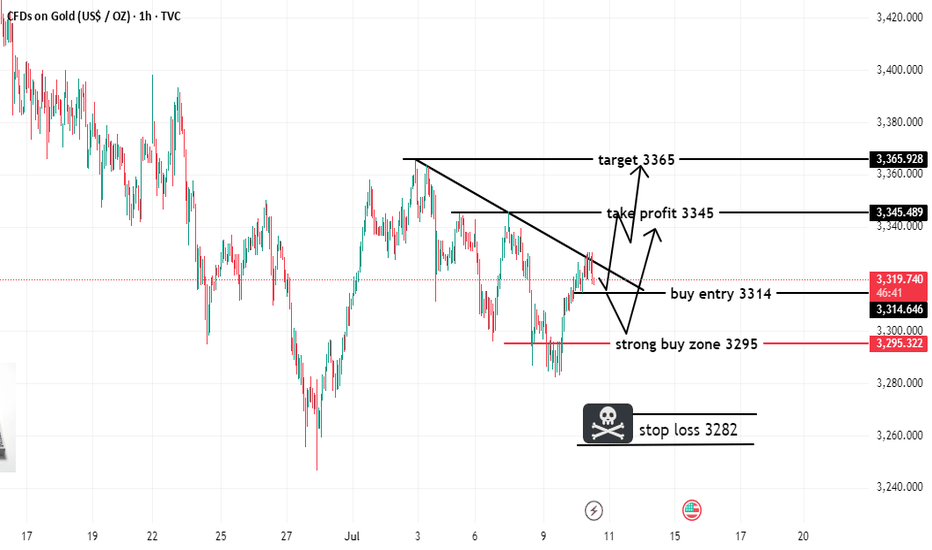

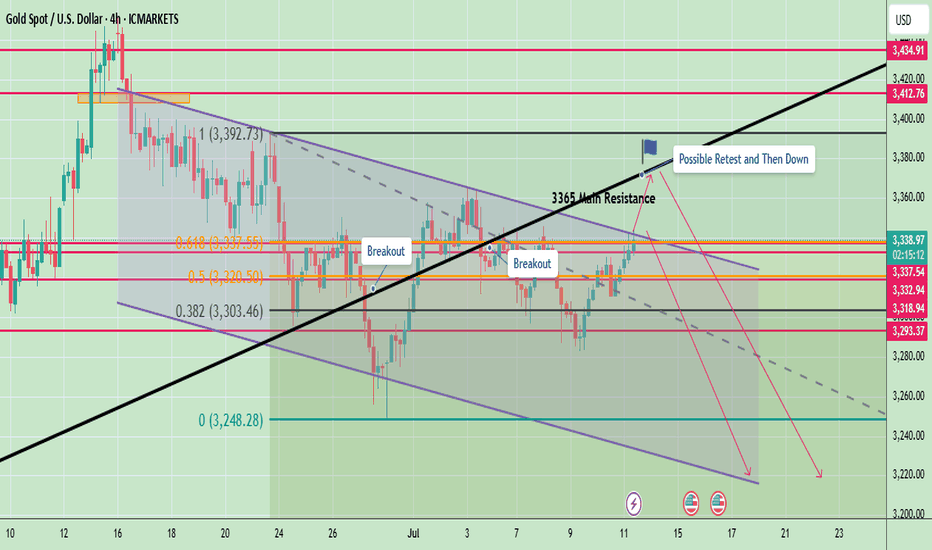

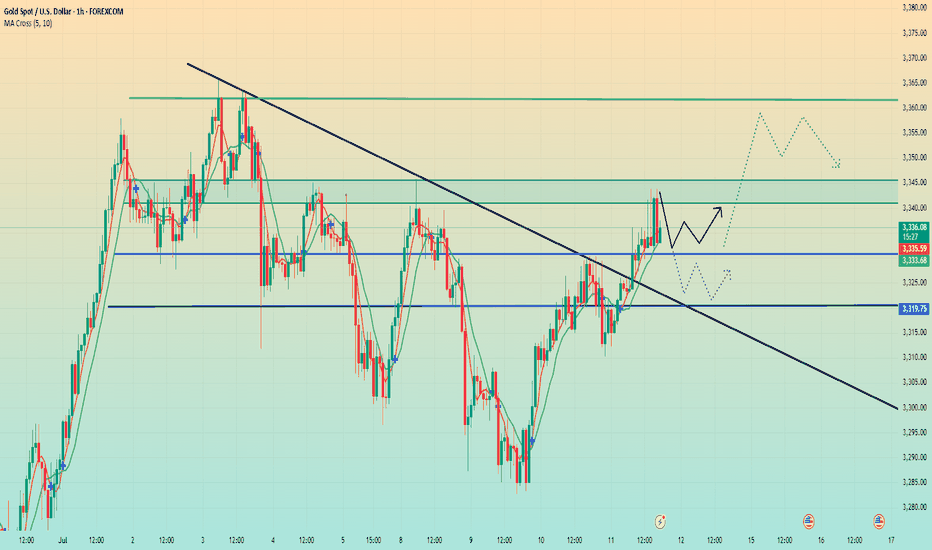

Gold Possible Retest of $3,365 Before Downside MoveGold is currently trading around $3,335, approaching a critical resistance level at $3,365, which has been marked as a “Main Resistance” on the chart. The recent price movement shows a strong bullish rebound from the $3,293–$3,300 support zone, breaking above two key trendlines labeled "Breakout."

The chart suggests a potential “retest” of the $3,365 resistance before another downward move, as marked by the annotation "Possible Retest and Then Down." This idea is reinforced by the broader descending channel pattern visible from late June, indicating that the larger structure still favors bearish continuation unless a strong breakout occurs above $3,365.

⚠️ Bearish Confluence

Price is inside a corrective channel, repeatedly failing to sustain above prior highs

$3,365 has held firm multiple times as resistance — a strong horizontal and trendline convergence zone

Price is still well below the swing high at $3,392

🟩 Bullish Scenario (If Invalidation Occurs)

If price breaks and closes above $3,365, it would invalidate the current bearish structure and open the door for upside targets like:

$3,392 (previous high)

$3,412

Possibly $3,434, which is a longer-term diagonal trendline resistance

At present, gold is in a corrective upward move within a broader bearish channel. The zone between $3,337–$3,365 will be key. A bearish rejection here would confirm downside continuation, with price potentially targeting $3,265–$3,220. However, a bullish breakout above $3,365 could invalidate the bearish view and suggest strength returning toward $3,392 and above.

Note

Please risk management in trading is a Key so use your money accordingly. If you like the idea then please like and boost. Thank you and Good Luck!

GOLD - at cut n reverse Region? what's next??#GOLD .. perfect ride as per our last idea regarding gold and now market just above his ultimate area/region.

that is around 3320-23

keep close and if market hold it then further bounce expected otherwise not..

NOTE: we will cut n reverse our position below 3320 on confirmation.

good luck

trade wisely

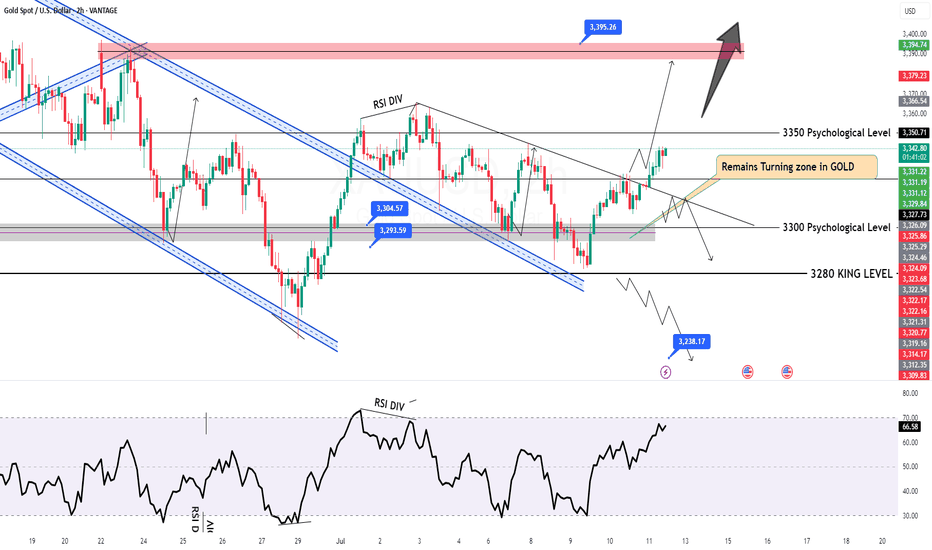

XAUUSD Approaches Key Resistance – Will 3,345 Hold or Break?As of July 11, 2025, gold (XAUUSD) is showing a mild recovery around 3,331 USD, following a rebound from the 3,318–3,322 USD support zone. This move comes amid a wave of macroeconomic data and global monetary policy expectations that continue to weigh heavily on gold’s intraday direction.

1. Key Fundamentals Impacting XAUUSD Today

Dollar Index (DXY) remains strong near 106.0 – sustaining pressure on gold due to a firm greenback.

U.S. 10-year Treasury yields are holding above 4.36%, reflecting persistent market expectations that the Fed may keep interest rates elevated in the near term.

June CPI data (YoY) came in at 2.4%, slightly below forecast (2.5%), increasing hopes for a potential rate cut in Q4 – a short-term bullish catalyst for gold

Geopolitical tensions remain subdued, limiting safe-haven inflows into gold in the medium term.

Upcoming U.S. PPI data this week could trigger volatility, depending on whether it surprises to the dovish or hawkish side.

2. Technical Analysis – XAUUSD on H4 Timeframe

Support zone: 3,316 – 3,322 USD, aligning with the 0.5–0.618 Fibonacci retracement of the latest bullish leg.

Resistance zone: 3,345 USD – a confluence of previous highs and 0.618 Fibonacci level of the prior correction wave.

EMA outlook: Short-term EMA is turning upward, indicating potential bullish momentum building.

RSI: Recovering toward 60 but not yet overbought – a sign of healthy upside potential, though confirmation is still needed.

3. Trade Scenarios to Consider

Bullish Breakout Scenario (if price breaks 3,345 USD):

Entry: Buy on H4 candle close above 3,345 USD

Target: 3,357 – 3,370 USD

Stop-loss: Below 3,322 USD

Bearish Rejection Scenario (if price fails at 3,345 USD):

Entry: Sell on bearish reversal candlestick (e.g., pin bar, engulfing) at 3,345 USD

Target: Revisit support at 3,318 – 3,309 USD

Stop-loss: Above 3,350 USD

Gold is trading in a decision zone between short-term support and a major resistance barrier. While macro fundamentals are slightly leaning bullish after soft CPI data, strong dollar strength and high bond yields still cap upside momentum. Traders are advised to wait for price confirmation at 3,345 USD before committing to directional setups.

Follow for more daily gold trading strategies, and save this analysis if you found it useful!

GOLD H2 Intraday Chart Update For 11 July 2025Hello Traders

Today we have weekly closing & all eyes on weekly closing initially

2nd 3350 Psychological level remains watchable if GOLD break 3360 level successfully today then it will move towards 3390 else we have remains selling opportunities from TOP

below 3360 level market will move towards 3315

Disclaimer: Forex is Risky

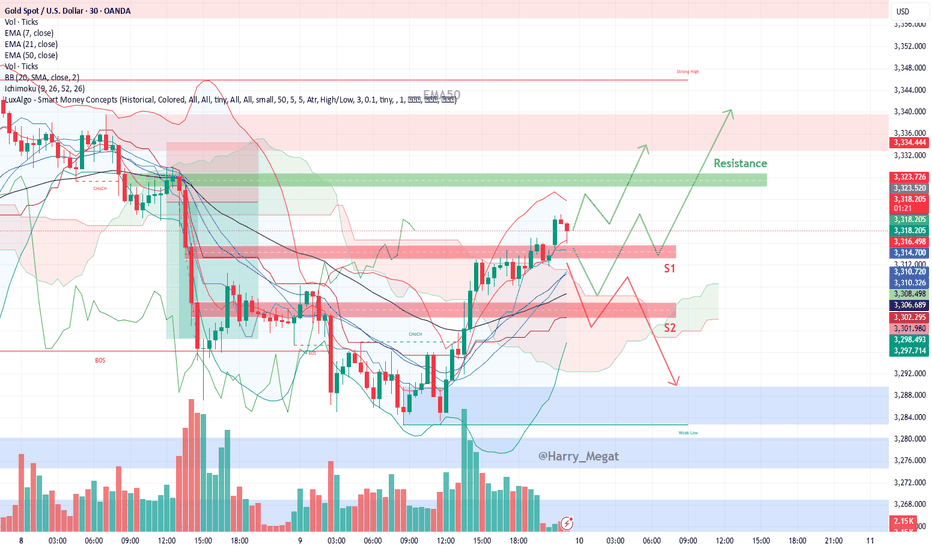

XAU/USD (Gold) chart EMA-based structureXAU/USD (Gold) chart EMA-based structure :

Trend Overview:

* **Short-term bias is bullish**, as price has broken above recent structure and is currently forming higher highs and higher lows.

* Price is **above the 7, 21, and 50 EMAs**, which are aligned bullishly and sloping upward — confirming upward momentum.

Key Levels:

Current Price:** \~\$3,319

* Trading just below **a strong resistance zone** (highlighted in green), indicating a potential challenge ahead for bulls.

Resistance Zone: \~\$3,323–\$3,336

* This area has previously acted as a **supply zone**, where price was rejected.

* Bulls need to break and hold above this level for continued upside toward **\$3,340+**.

Support 1 (S1):** \~\$3,314–\$3,310

* A recent breakout zone; if price retraces, this could be **retested as support**.

* If held, it may offer a **bullish continuation** setup.

Support 2 (S2):** \~\$3,302

* If S1 breaks, price may fall further to this **deeper demand zone**.

* A loss of this level would likely **shift short-term bias bearish** and target lower lows.

Scenarios

Bullish Path:

* Price holds S1 → pushes up → breaks resistance (\~3,323–3,336)

* Target: **\$3,340+**, then possibly \$3,350+ if momentum continues

Bearish Path:

* Price breaks below S1 and EMA support → retests S2 (\~3,302)

* If S2 fails, potential drop to **\$3,284–\$3,276 zone** (previous weak low zone)

Conclusion:

* **Bulls in control** short term as long as price stays above **EMA cluster (\~3,310–3,306)**

* A clean break above **\$3,336** confirms bullish continuation

* Break below **\$3,302** shifts bias bearish

The price fell back. Watch out for a breakthrough.After reaching the resistance position near 3345 predicted by Quaid, the price fell back slightly, and the price fluctuated around 3335 so far.

From the hourly chart, before the price stabilizes at 3345, it is likely to maintain a range of 3330-3345. 3330-3345 is a temporary range. If it stands firm and breaks above 3345 again, the fluctuation range will become 3345-3360.

On the contrary, if it falls below 3330, the range may drop to 3320-3330. However, as long as the downward trend does not fall below 3320, gold will still maintain a bullish trend. If the price breaks down below 3320, today’s trend will be reversed.

As long as it is above 3320, gold will maintain a bullish trend today.

On the last trading day of this week, I wish all traders a good harvest.

Gold fluctuates, consolidation in the 3330-3310 range📰 News information:

1. Waller meeting on interest rate cuts

2. Trump tariff issues

📈 Technical Analysis:

Waller will participate in the meeting in more than two hours and pay attention to whether there is any news of interest rate cut. The key is to operate around the 3330-3310 range. Continue to pay attention to the support of 3310-3305 at night. If gold falls below 3310,-3305 again, the downward trend will continue, and it is expected to touch 3280 again, or even 3250. If it rebounds above 3330, it is likely to continue to rise.

In addition to investment, life also includes poetry, distant places, and Allen. Facing the market is actually facing yourself, correcting your shortcomings, facing your mistakes, and exercising strict self-discipline. I share free trading strategies and analysis ideas every day for reference by brothers. I hope my analysis can help you.

TVC:GOLD FXOPEN:XAUUSD FX:XAUUSD FOREXCOM:XAUUSD PEPPERSTONE:XAUUSD OANDA:XAUUSD