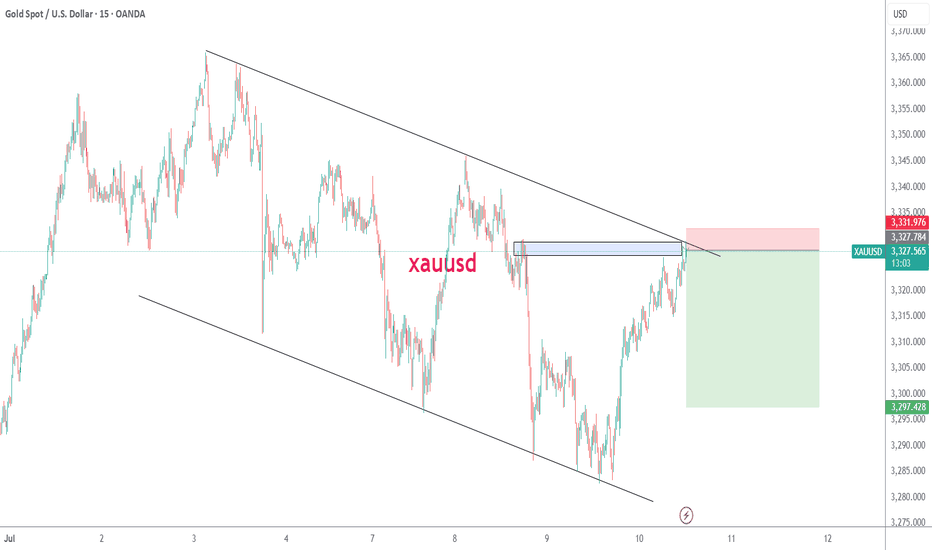

Gold fluctuates, continue to short at 3345 during the dayTrump's trade policy continues to stimulate risk aversion. Although the Federal Reserve's meeting minutes are neutral, they can potentially provide support for gold. Yesterday we gave the short positions of 3321 and 3333, which have generated profits so far. At the same time, it should be noted that the 4H MACD indicator has the potential demand to form a golden cross. In the short term, there is a certain suppression force at 3330-3335. If the Asian and European sessions repeatedly test this position but fail to break through effectively, you can go short without hesitation. If you want to go short again during the day, you can consider 3340-3345 and defend 3350. The lower 3310-3305 is a relatively strong support area during the day. If the Asian session retreats to this point, you can consider going long, with the target looking at 3330-3335.

OANDA:XAUUSD

Xauusdanalysis

Perfect prediction, pay attention to the high short entry pointTrump extended the tariff agreement to August 1 and began to collect tariffs again. Although it eased market tensions, his remarks will not be extended after the expiration, and he issued a tariff threat, which increased global trade uncertainty and pushed up risk aversion. There was no clear direction coming out of the Fed's meeting minutes last night, but the potential bias was bullish.

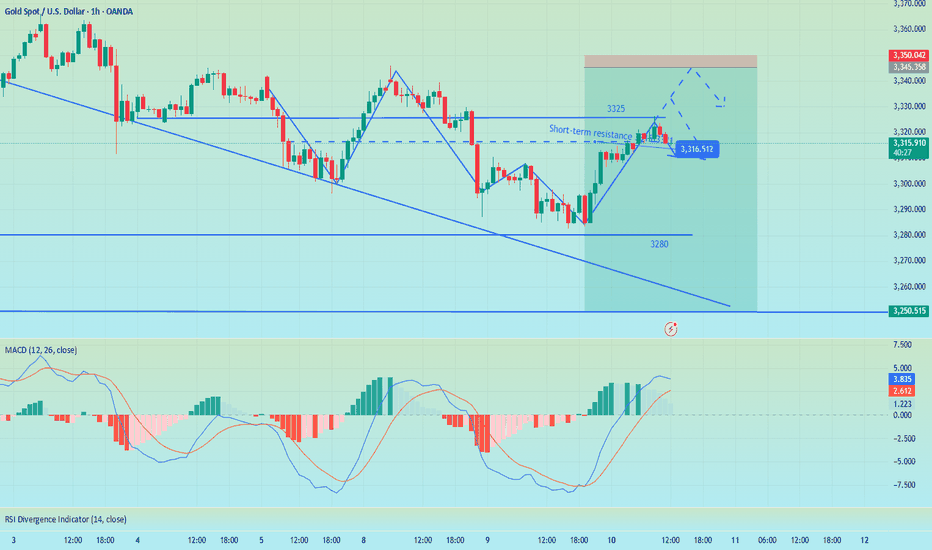

At the beginning of the Asian session this morning, I also indicated that gold would rise and then fall. At present, it has reached the highest point near 3325 and then began to retreat, but the 4H golden cross has just been formed. There is still a certain pressure above 3333. If the gold price repeatedly competes for this position, we can continue to short without hesitation. The second short position today is near 3340-3345. There is potential momentum for the bulls in the short term. If the European session continues to fluctuate below 3333, then the entry of short positions will be slightly more stable. Yesterday, short orders were given at the key points of 3321 and 3333, and TP looked at 3310. If the bulls re-emerge below 3310-3305, you can consider short-term long positions and target 3330-3335.

Gold rebounds as expected, NY focuses on the Fed meeting📰 News information:

1. Federal Reserve meeting minutes

📈 Technical Analysis:

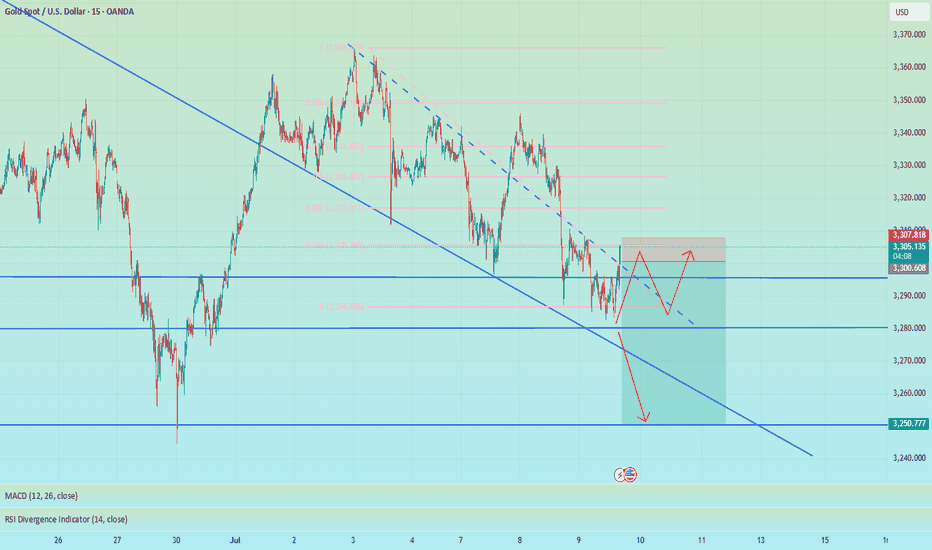

Gold fell into a narrow range of fluctuations during the European trading session. As I said this morning, gold is expected to rebound in the short term and the bullish momentum needs to be released. From a technical perspective, the overall market is still in a volatile pattern. The support at the 3280 level below is still a key point that needs attention in the short term. The European session has repeatedly tested this area. If it falls below this support, it is expected to touch the 3250 level as I said. While guarding against gold diving during the NY session, the upper resistance of 3315-3321 cannot be ignored to prevent bullish retaliation.

🎯 Trading Points:

SELL 3315-3321-3333

TP 3300-3290-3280-3250

In addition to investment, life also includes poetry, distant places, and Allen. Facing the market is actually facing yourself, correcting your shortcomings, facing your mistakes, and exercising strict self-discipline. I share free trading strategies and analysis ideas every day for reference by brothers. I hope my analysis can help you.

OANDA:XAUUSD PEPPERSTONE:XAUUSD FOREXCOM:XAUUSD FX:XAUUSD FXOPEN:XAUUSD TVC:GOLD

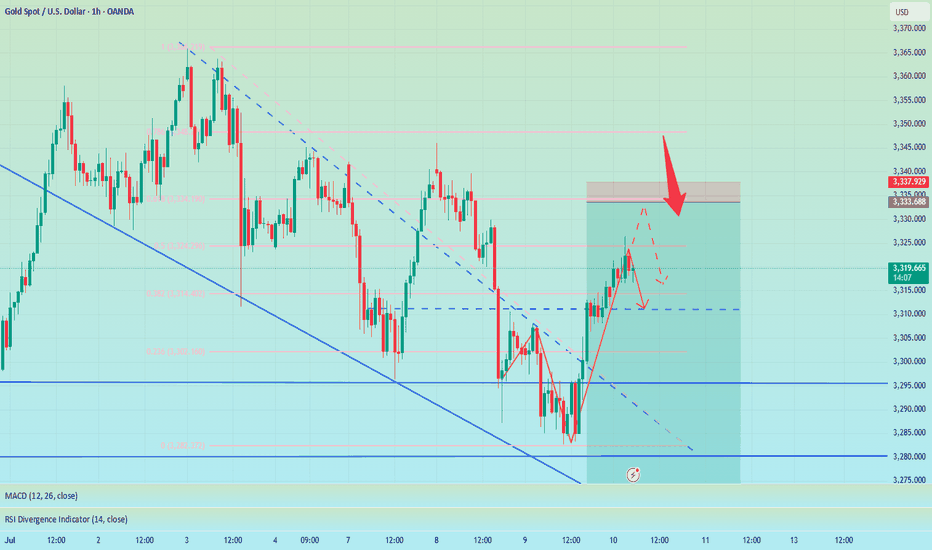

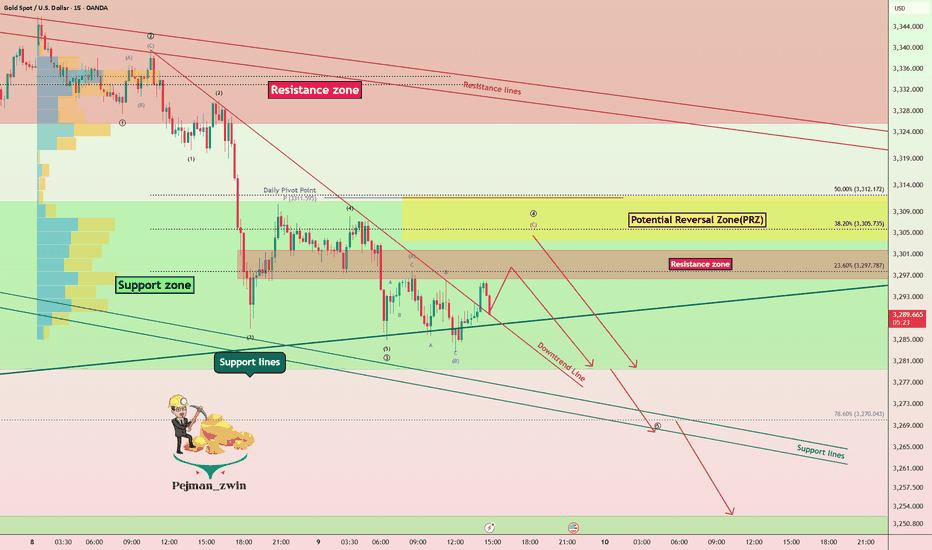

Support Under Siege – Is Gold Ready for Another Leg Down?As I expected in the previous idea , Gold ( OANDA:XAUUSD ) rose to $3,343 on the 1-hour time frame , but failed to break the Resistance zone($3,350-$3,326) and started to fall with relatively good momentum .

Do you think Gold can finally break the Support zone($3,312-$3,280) and Support lines , or will it rise again?

Gold is currently trading in the Support zone($3,312-$3,280) and near the Support line s. It has also managed to break the downtrend line .

In terms of Elliott Wave theory on the 15-minute time frame , Gold appears to be completing a main wave 4 . The main wave 4 appears to follow Double Three Correction(WXY) . Also, the main wave 3 is extended due to the high downward momentum.

I expect Gold to start falling again by entering the Potential Reversal Zone(PRZ) or Resistance zone($3,302-$3,296) and eventually breaking the Support zone($3,312-$3,280) and Support lines, Gold's falling targets are clear on the chart.

Note: Stop Loss (SL) = $3,313

Gold Analyze (XAUUSD), 15-minute time frame.

Be sure to follow the updated ideas.

Do not forget to put a Stop loss for your positions (For every position you want to open).

Please follow your strategy; this is just my idea, and I will gladly see your ideas in this post.

Please do not forget the ✅ ' like ' ✅ button 🙏😊 & Share it with your friends; thanks, and Trade safe.

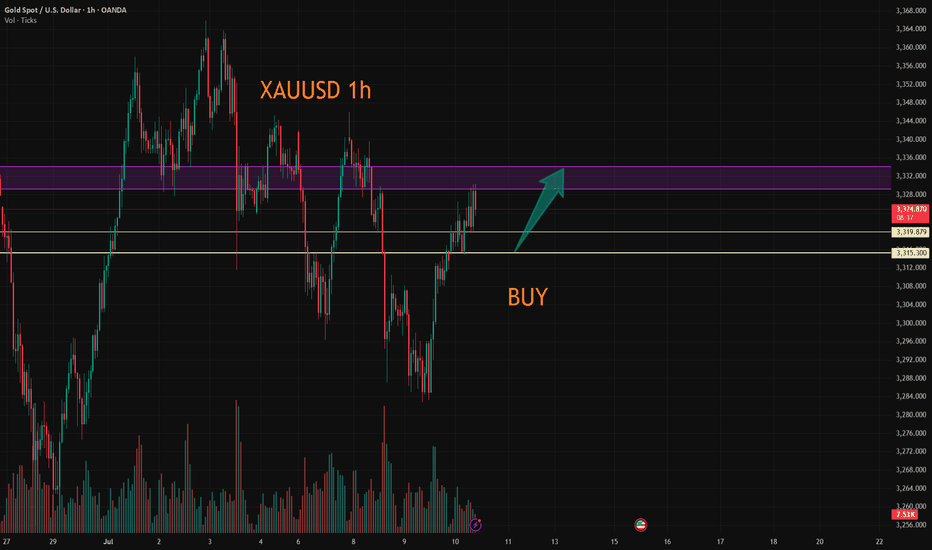

XAUUSD:Wait for 3315-19 to go long.

The market is experiencing short-term narrow-range fluctuations. There is a certain level of pressure at 3330. I tend to view it more positively as a breakthrough.The trading range for today has narrowed.

Trading Strategy:

BUY@3315-19

TP3329-34

I will closely follow up on every trading strategy I develop. If you are unsure about how to conduct a trade, you can simply come to me for help.

More detailed strategies and trading will be notified here ↗↗↗

Keep updated, come to "get" ↗↗↗

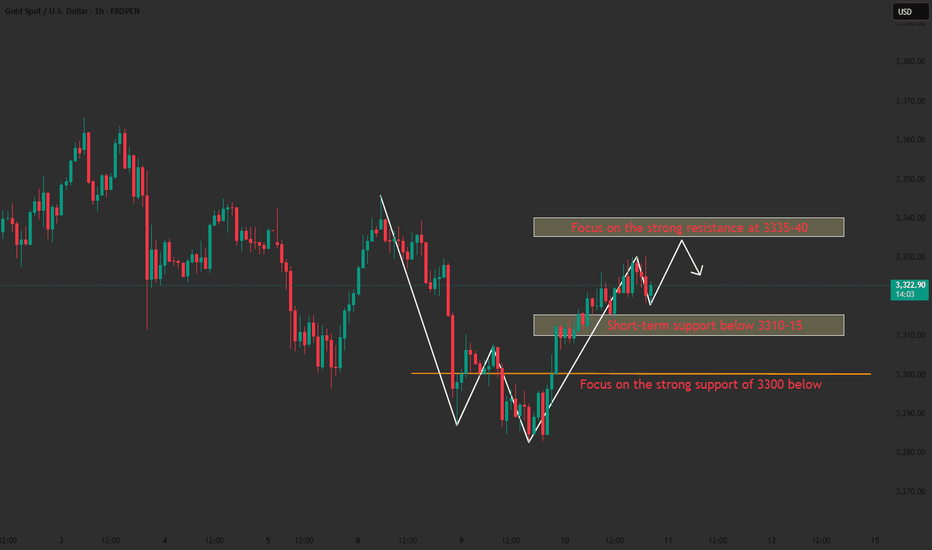

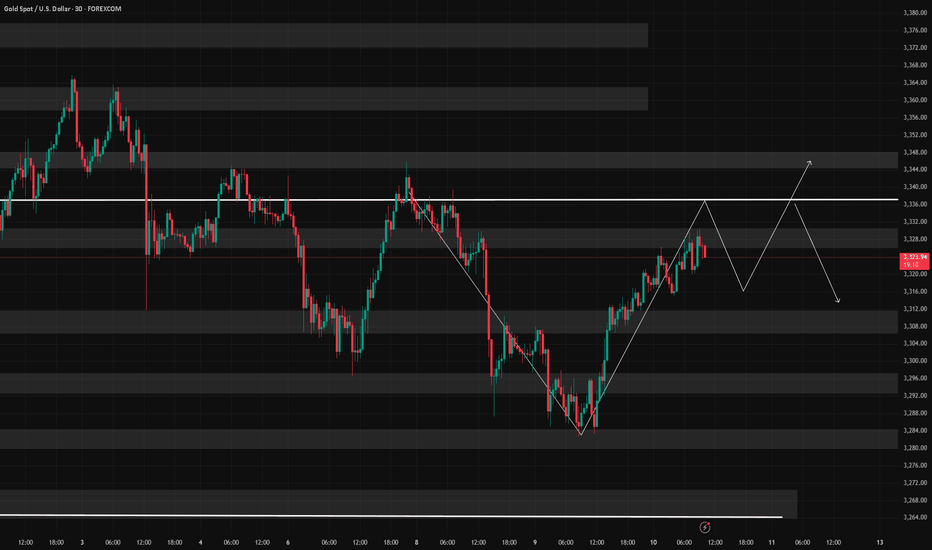

Key point layout suggestionsThe current gold market is showing a weak rebound pattern. Although there was a small rebound on Wednesday, if it cannot stand above 3330, the overall trend will still be weak.

From the daily level, the support level is 3300 and the resistance level is 3335. The price is oscillating between the middle and lower tracks of the Bollinger Bands, and there is a possibility of upward or downward breakthrough.

Focus on the H4 cycle trend: if the rebound can stand above 3330, the price may further rise to 3335 US dollars;

Once it stands at 3335, it can be basically confirmed that the callback is over, and the subsequent challenge of 3345 resistance level may be repeated.

It is recommended to adopt a long-on-dip strategy near the support level, focusing on the support strength of the 3310-15 area below; the resistance level of 3335-3340 should be paid attention to above.

In terms of specific operations, if the price rebounds to the 3335-3340 range, short selling can be considered; if it pulls back to the 3310-3315 range, long selling can be considered.

7/9: Focus on Selling Gold on ReboundsGood evening, everyone!

Apologies for the late update today—I had some matters to attend to. I hope your trades are going smoothly.

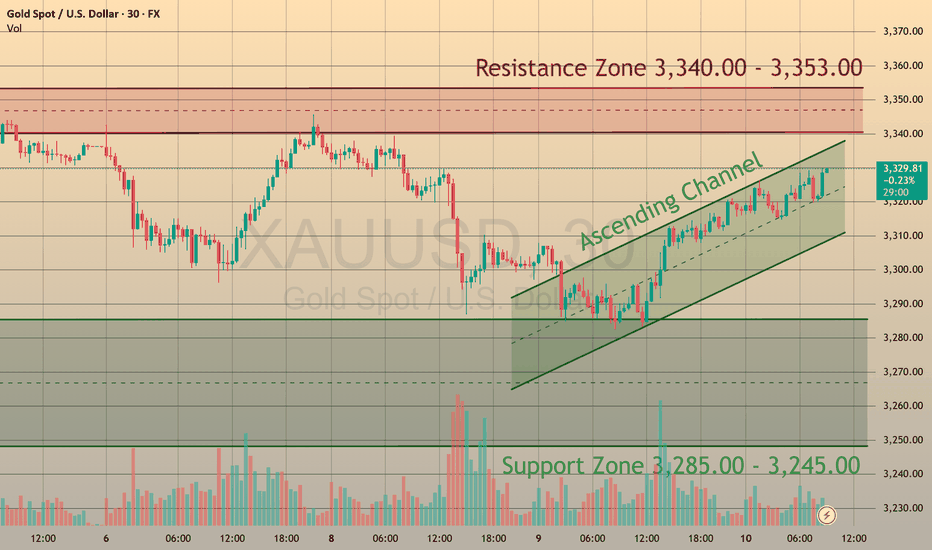

Yesterday, gold found support around 3284 and continued to rebound during today’s session, reaching as high as 3330. The key resistance at 3321 has now been broken and is currently acting as a short-term support level. However, based on the current price structure, this level is likely to be retested multiple times, and some consolidation may follow.

The next major resistance lies between 3337 and 3343. In the absence of strong bullish momentum, the preferred short-term strategy remains selling on rebounds, especially near resistance zones.

⚠️ Additionally, the U.S. Initial Jobless Claims data will be released during the New York session tonight, which may cause increased volatility and potentially whipsaw price action. Be cautious with position sizing, and avoid emotional trades or chasing price action during news releases. Patience and discipline will be key.

XAUUSD Analysis todayHello traders, this is a complete multiple timeframe analysis of this pair. We see could find significant trading opportunities as per analysis upon price action confirmation we may take this trade. Smash the like button if you find value in this analysis and drop a comment if you have any questions or let me know which pair to cover in my next analysis.

Gold Extends Gains Amid Uncertainty FOREXCOM:XAUUSD

XAUUSD is currently moving within the $3,270 – $3,360 range 📈, holding steady under buying pressure over the last few hours ⏳.

🌏 During today’s Asian and early European sessions, gold climbed to around $3,330 🥇, extending gains as investors monitored trade tensions and absorbed the latest FOMC Minutes 🗂️. A weaker U.S. dollar 💵⬇️ continues to support gold, attracting safe-haven flows 🛡️ amid ongoing market uncertainty.

📊 Meanwhile, the Fed’s June meeting minutes 🪙 revealed disagreements among officials 🤔 on the timing and scale of potential rate cuts 🔻. While most anticipate some easing later this year, views range from cuts as early as July to no cuts until year-end. The Fed maintains a cautious, data-driven approach 🧭, citing tariff-related inflation risks, slowing consumer spending, and a strong labour market as key factors for their policy outlook.

👀 We will continue to monitor gold closely for potential breakout or reversal signals within this range. Stay tuned for updates!

GOLD Intraday Chart Update For 10 July 25Hello Traders,

as you can see that GOLD is stuck in tight range between 3300-3330 all eyes on clear breakout for now

further only market will break clearly 3345 level then we will consider market will move further advance below 3300 GOLD will move towards 3250

Scalping Range 3300 - 3330 for the short time period

Disclaimer: Forex is Risky

Gold Bounces Strongly from the Bottom XAUUSD: Gold Bounces Strongly from the Bottom – Is This the Start of a Breakout?

🌍 Macro Overview – Gold’s Movement and Market Sentiment

Gold recently experienced a strong bounce from the 3.282 USD/oz low, reaching 3.317 USD/oz. This movement has sparked some optimism, but let’s take a look at the key macroeconomic factors that might be influencing gold:

📉 US bond yields have decreased, signaling that market risk aversion is returning

💵 The USD remains strong, but buying interest in gold in Asia is increasing as confidence in fiat currencies begins to wane

🇪🇺 The EU is accelerating negotiations with the US on tariffs ahead of the August 1st deadline. If these talks fail, gold could benefit

🏦 The Fed continues to maintain interest rates, but the market is betting on a potential rate cut in September if inflation remains controlled

📊 US unemployment data and the Fed's speech tonight will be key, as the market is anxiously waiting for clues on the Fed’s next move

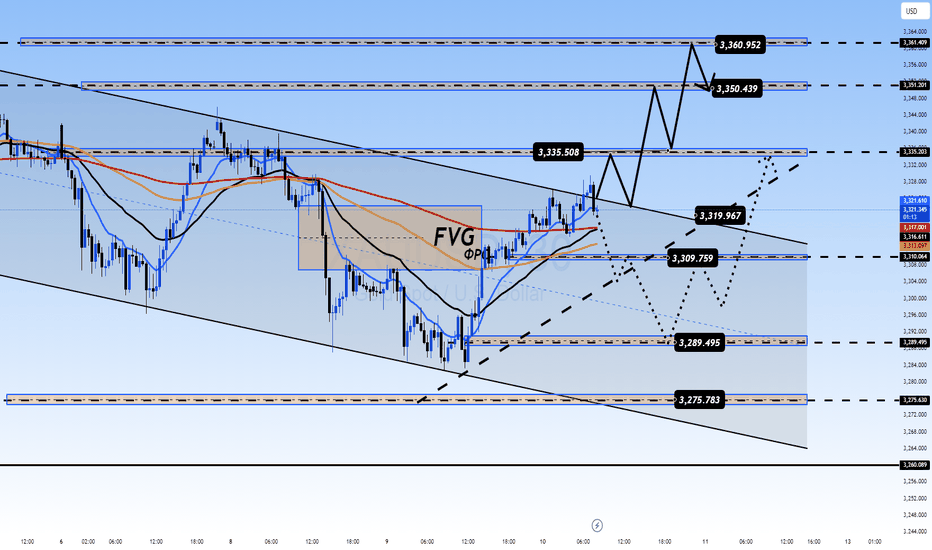

📊 Technical Analysis – Gold Approaching Key Resistance Levels

Gold is trading within a descending channel, but there are clear signs of a potential breakout after testing the lows.

Key resistance levels are found around 3330 – 3340, which will be crucial for determining if gold can continue its upward movement.

The Fair Value Gap (FVG) has appeared between 3310 – 3320, suggesting that if buying pressure continues, a breakout above these levels is likely.

🎯 Trading Strategy for Today – Focused on Clear Entry Points

🟢 BUY SCALP:

Entry: 3310 – 3308

SL: 3304

TP: 3314 → 3318 → 3322 → 3326 → 3330

🔵 BUY ZONE (safer entry points):

Entry: 3290 – 3288

SL: 3284

TP: 3294 → 3298 → 3302 → 3306 → 3310 → 3320 → 3330

🔴 SELL SCALP (if price hits resistance levels):

Entry: 3335 – 3337

SL: 3342

TP: 3330 → 3325 → 3320 → 3315 → 3310 → 3300

⚫ SELL ZONE (strong resistance at 3360-3362):

Entry: 3360 – 3362

SL: 3366

TP: 3356 → 3352 → 3348 → 3344 → 3340 → 3336 → 3330

📌 Note:

Always set SL and TP appropriately to protect your account, especially in a market that might experience significant volatility today.

Watch volume during London and New York sessions to gain clearer insights into market direction. If gold breaks above resistance, a strong breakout could follow.

💬 Gold has bounced back strongly, but is this the start of a larger rally, or just a temporary correction? What’s your take on today’s trend? Share your thoughts in the comments below!

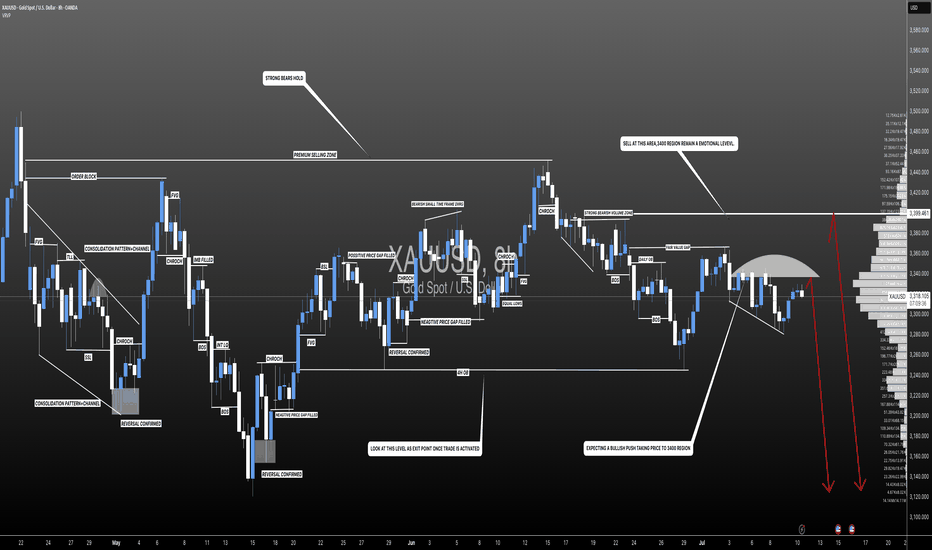

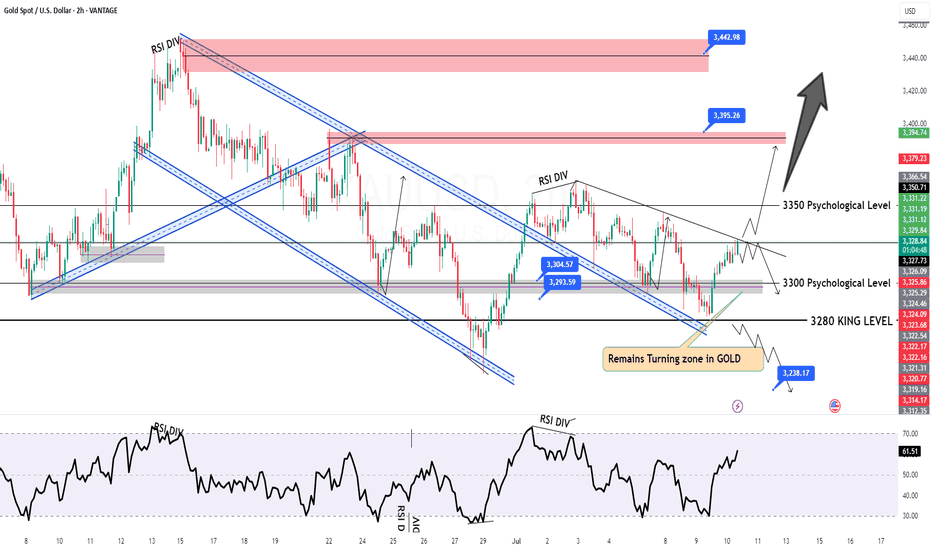

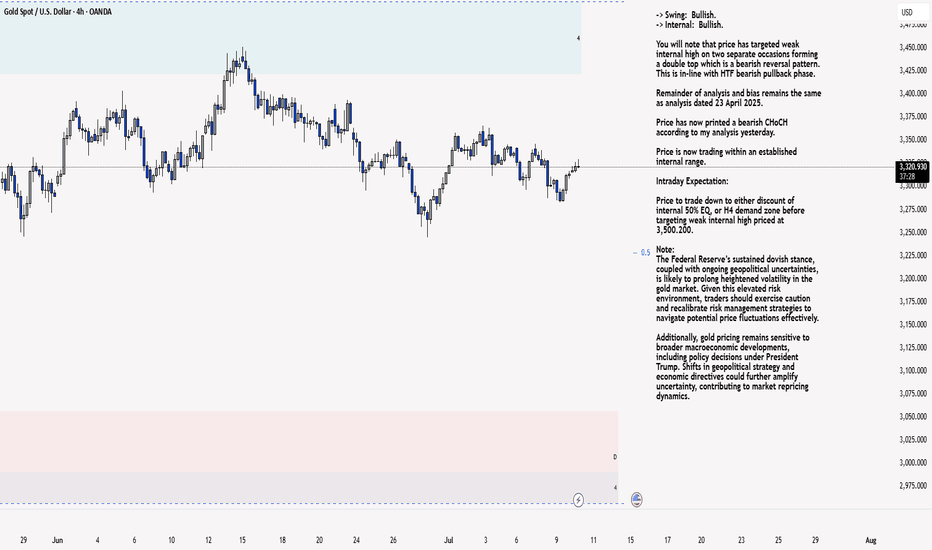

XAU/USD 10 July 2025 Intraday AnalysisH4 Analysis:

-> Swing: Bullish.

-> Internal: Bullish.

You will note that price has targeted weak internal high on two separate occasions forming a double top which is a bearish reversal pattern. This is in-line with HTF bearish pullback phase.

Remainder of analysis and bias remains the same as analysis dated 23 April 2025.

Price has now printed a bearish CHoCH according to my analysis yesterday.

Price is now trading within an established internal range.

Intraday Expectation:

Price to trade down to either discount of internal 50% EQ, or H4 demand zone before targeting weak internal high priced at 3,500.200.

Note:

The Federal Reserve’s sustained dovish stance, coupled with ongoing geopolitical uncertainties, is likely to prolong heightened volatility in the gold market. Given this elevated risk environment, traders should exercise caution and recalibrate risk management strategies to navigate potential price fluctuations effectively.

Additionally, gold pricing remains sensitive to broader macroeconomic developments, including policy decisions under President Trump. Shifts in geopolitical strategy and economic directives could further amplify uncertainty, contributing to market repricing dynamics.

H4 Chart:

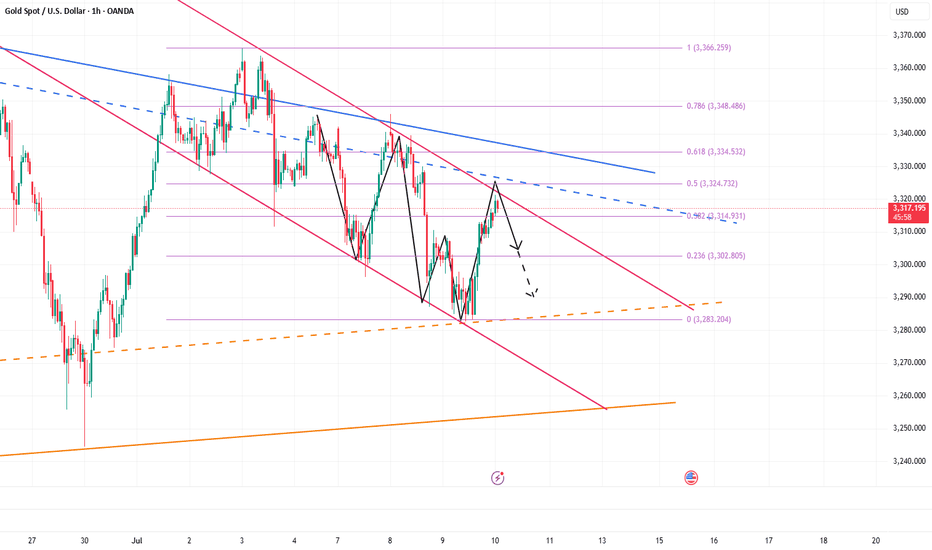

M15 Analysis:

-> Swing: Bullish.

-> Internal: Bullish.

H4 Timeframe - Price has failed to target weak internal high, therefore, it would not be unrealistic if price printed a bearish iBOS.

The remainder of my analysis shall remain the same as analysis dated 13 June 2025, apart from target price.

As per my analysis dated 22 May 2025 whereby I mentioned price can be seen to be reacting at discount of 50% EQ on H4 timeframe, therefore, it is a viable alternative that price could potentially print a bullish iBOS on M15 timeframe despite internal structure being bearish.

Price has printed a bullish iBOS followed by a bearish CHoCH, which indicates, but does not confirm, bearish pullback phase initiation. I will however continue to monitor, with respect to depth of pullback.

Intraday Expectation:

Price to continue bearish, react at either M15 supply zone, or discount of 50% internal EQ before targeting weak internal high priced at 3,451.375.

Note:

Gold remains highly volatile amid the Federal Reserve's continued dovish stance, persistent and escalating geopolitical uncertainties. Traders should implement robust risk management strategies and remain vigilant, as price swings may become more pronounced in this elevated volatility environment.

Additionally, President Trump’s recent tariff announcements are expected to further amplify market turbulence, potentially triggering sharp price fluctuations and whipsaws.

M15 Chart:

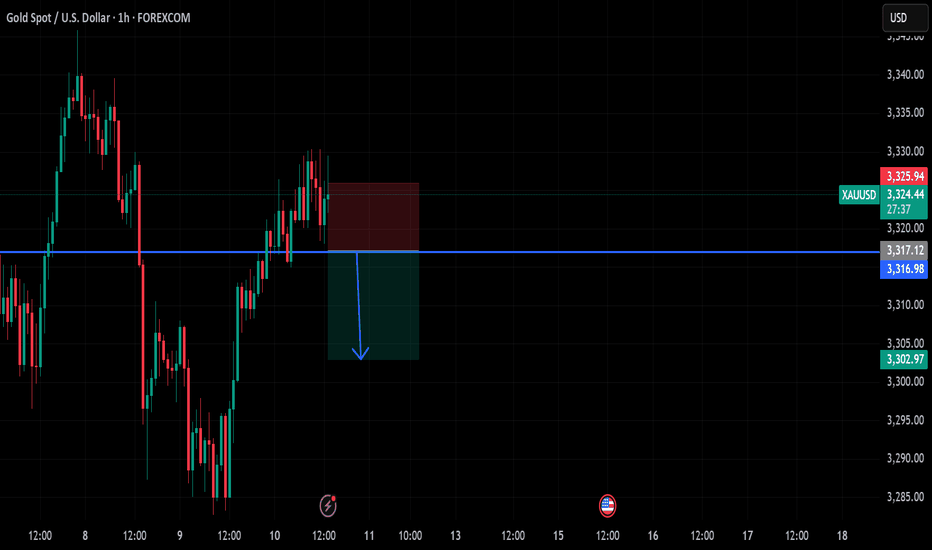

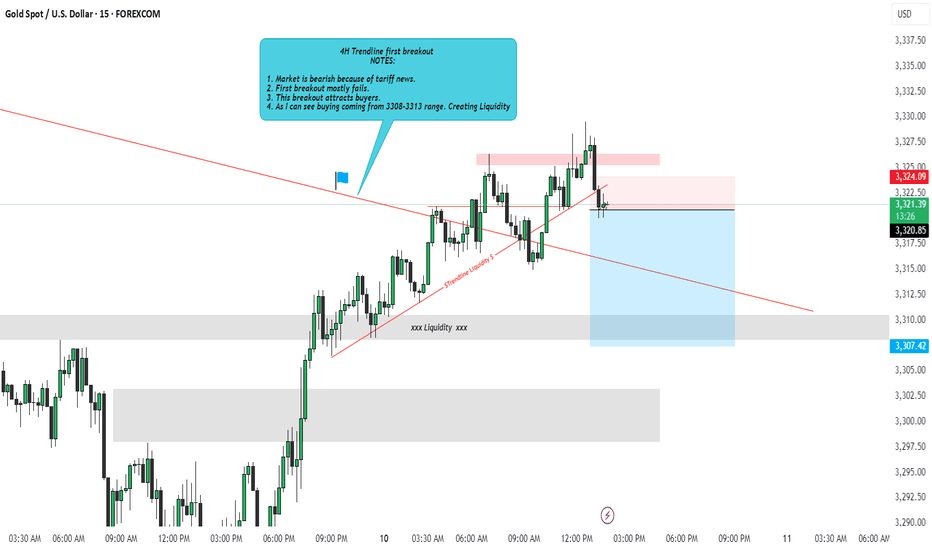

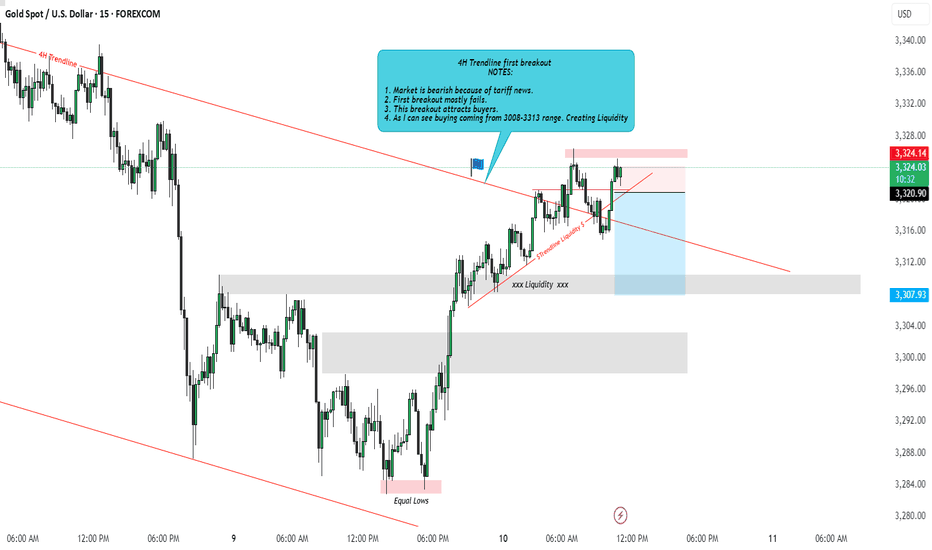

XAUUSD Idea: 4H Trendline First Breakout - Liquidity PlayFOREXCOM:XAUUSD

🔍 Analysis Overview:

Price has just broken above a 4H descending trendline for the first time. However, I remain cautious due to the following key observations:

📌 NOTES:

The broader market sentiment is still bearish due to recent tariff-related news, which often fuels risk-off behavior.

Historically, the first breakout of a strong trendline often fails, trapping early buyers.

This breakout is likely attracting buy-side liquidity, giving institutions an opportunity to hunt stops.

My observation shows buying interest started around the 3308–3313 range, suggesting smart money accumulation and a possible trap.

📉 I'm watching for a fake breakout and potential reversal targeting the liquidity zones marked below around 3307 and possibly lower.

The liquidity sweep below equal lows could offer a better risk-reward setup.

💡 Conclusion:

If price fails to hold above this breakout and shows signs of rejection, I will be anticipating a return towards the previous demand zone for a liquidity grab.

#XAUUSD #GoldAnalysis #SmartMoneyConcepts #LiquidityGrab #ForexTrading #TrendlineBreak #MarketPsychology #TradingSetup #SMC #PriceAction

Don’t be too optimistic, gold may change its face at any time!Gold continued to rebound to around 3320, and it seems to have completely stood above 3300. The bulls are recovering. Should we chase gold in a big way? In fact, due to the disruption of news such as the Federal Reserve's interest rate decision and tariffs, the gold market has clearly shown the characteristics of frequent switching between long and short positions and discontinuity between long and short positions. Therefore, even if gold rebounds to a certain extent, it is difficult for the market to stand unilaterally on the bull side.

In the short term, gold began to retreat from around 3366, reaching a minimum of around 3283, with a retracement of $83; and currently it has only rebounded from the low of 3283 to around 3320, and the rebound is even less than 50%. Gold bulls are not as strong as imagined; although gold continues to rebound, before regaining the 3325-3335 area, it can only be regarded as a technical repair of the sharp drop, and cannot be completely regarded as a reversal of the trend. So after the rebound of gold, gold bears may counterattack strongly at any time.

Therefore, in short-term trading, after gold rebounds, you can consider shorting gold with the 3325-3335 area as resistance, and the first entry area worth paying attention to is 3320-3330.

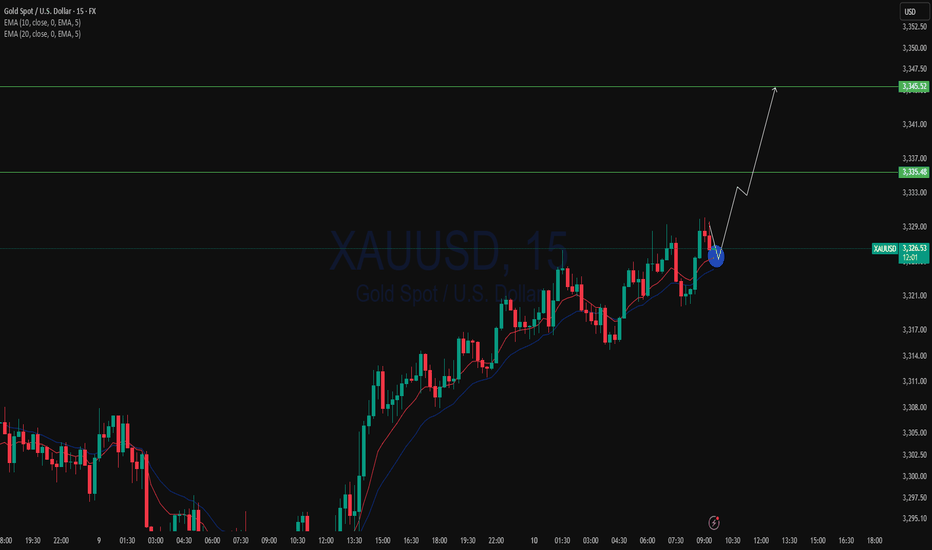

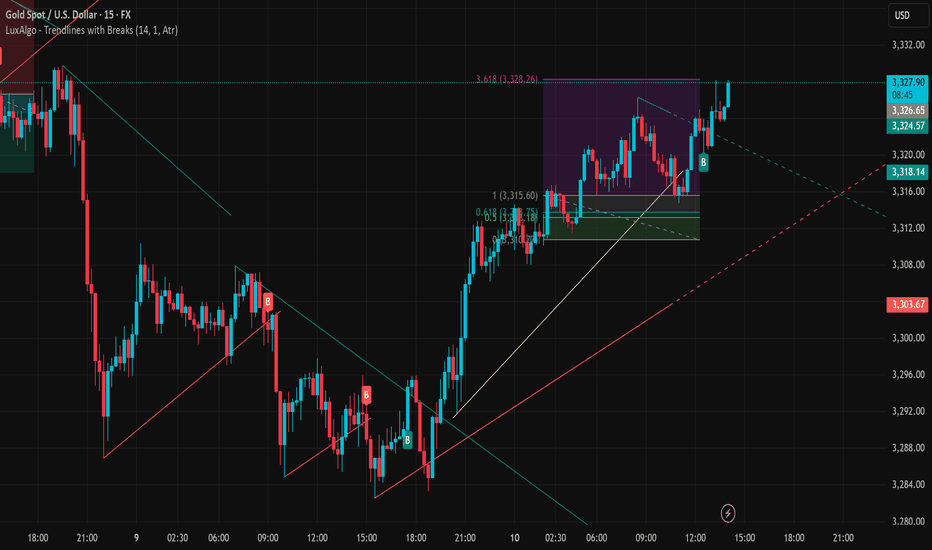

XAUUSD Loses Short-Term Support – Deeper Decline May FollowAt the current moment, gold (XAUUSD) has made a significant breakout, surpassing the key resistance zone at 3,326 USD and is now trading around 3,328.94 USD. This breakout confirms that the short-term bullish trend remains strong.

1. Short-Term Trend: Bullish Momentum Expands

After holding the key support zone around 3,311 – 3,315 USD (aligned with the 0.618 Fibonacci retracement), XAUUSD bounced back and broke above the previous high at 3,326 USD. The current uptrend is confirmed by higher lows and a clear breakout candle from the recent consolidation.

2. Updated Support and Resistance Zones:

Immediate Support: 3,318 – 3,320 USD, near the rising yellow trendline and breakout retest zone.

Next Resistance Target: No clear barrier on the 15-min chart, but psychological levels and Fibonacci extensions suggest 3,332 – 3,335 USD could act as the next upside targets.

3. Price Action Highlights:

The breakout candle closed strongly above the 3.618 Fibonacci extension level (3,326.26 USD), showing solid buying pressure.

A bullish signal ("B") from LuxAlgo was triggered near the minor pullback at 3,318 USD, adding further confirmation.

4. Key Technical Signals:

Price has broken out of the purple rectangle consolidation zone, expanding its trading range.

The 0.618 Fibonacci level at 3,311.78 USD continues to act as firm support.

The ascending yellow trendline remains intact, providing dynamic support to the bullish trend.

5. Suggested Trading Strategy:

Buy on Pullback: Consider long positions around 3,318 – 3,320 USD if price retests this zone with bullish confirmation.

Breakout Continuation Buy: A firm close above 3,330 USD with high volume could signal a move toward 3,335 – 3,340 USD.

If price falls below 3,315 USD and closes weakly, the bullish momentum may begin to fade.

XAUUSD is in an extended bullish phase after breaching the 3,326 USD resistance. As long as price holds above the 3,318 – 3,320 USD zone, there is room for the uptrend to continue.

Do you think gold will break above 3,330 USD? Drop your thoughts in the comments and let’s discuss trading strategies together!

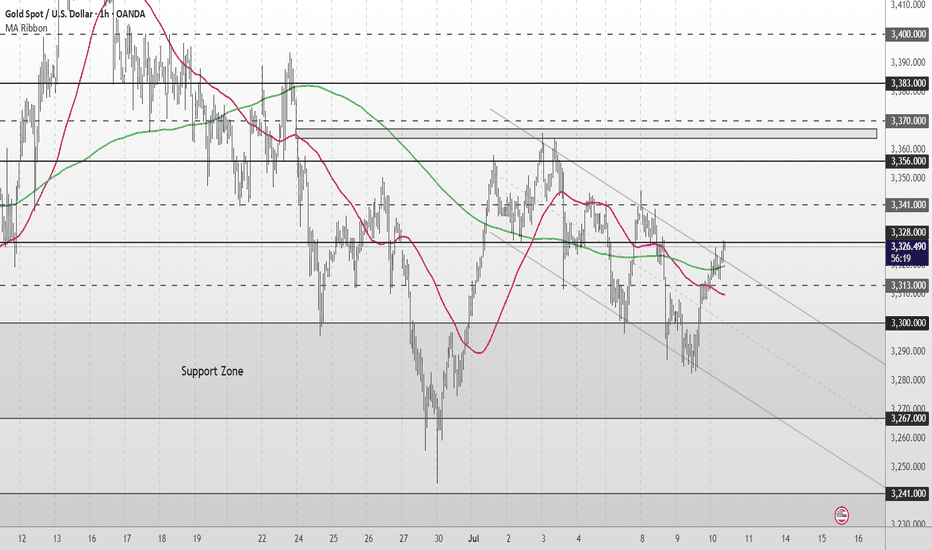

Gold Short Term OutlookGold continues its short-term recovery after bouncing from the Support Zone and reclaiming the $3,300 level. Price is now testing the $3,328 resistance zone, with both the 50MA and 200MA converging just below price.

A confirmed break and hold above $3,328 would open the door to higher resistance levels. However, failure to clear this zone could lead to a retest of the Support Zone. If that fails to hold, a deeper retracement toward the HTF Support Zone may follow.

📌 Key Levels to Watch

Resistance:

‣ $3,328

‣ $3,341

‣ $3,356

‣ $3,383

Support:

‣ $3,313

‣ $3,300

‣ $3,267

‣ $3,241

🔎 Fundamental Focus

All eyes on U.S. unemployment claims today

Expect volatility around the release – stay sharp.

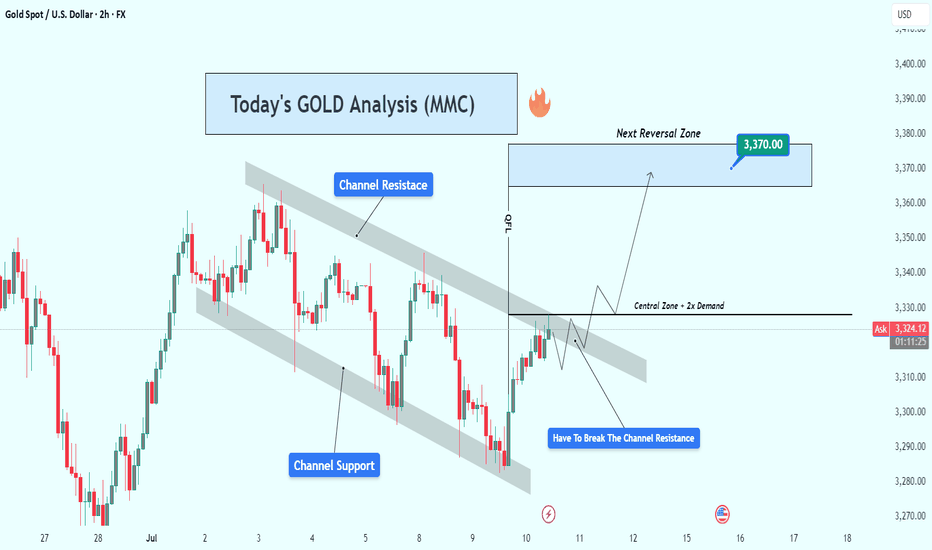

Gold (XAUUSD) Analysis : Bullish Structure Setup + Target🧠 Gold (XAUUSD) Technical Analysis

Gold has recently been trading within a clearly defined descending channel, which has governed price action over the past several sessions. This structure is characterized by a series of lower highs and lower lows, forming well-established channel resistance and channel support levels. However, recent bullish pressure has led price to aggressively test the upper boundary of this channel, signaling the potential for a structural breakout.

We are now at a technical inflection point, where a successful breakout and retest could mark the beginning of a significant trend reversal and short-to-medium term bullish move.

🔍 Key Technical Levels & Zones

🔷 Channel Resistance (~3,325)

The price is currently testing the descending trendline acting as channel resistance.

This area has previously rejected price several times, increasing its significance.

A confirmed break and close above this level may shift the market bias from bearish to bullish.

🔷 Central Zone – Dual Demand (~3,325–3,330)

This horizontal zone intersects with the channel resistance and aligns with two previous demand zones, now acting as a key decision area.

The market must validate this zone as new support before any sustained upward movement can occur.

🔷 Next Reversal Zone – Target (~3,370)

The next major area of interest lies around 3,370, a zone identified by previous swing highs and visible liquidity pools.

This level is likely to act as a magnet for price if bullish structure is confirmed.

📈 Price Structure Outlook

The potential breakout is supported by a strong bullish impulse off the channel support, followed by a series of higher lows suggesting growing bullish momentum. The projected movement scenario is as follows:

Break above the channel resistance

Retest and confirm the central zone as support

Continuation toward the 3,370 reversal zone

This would complete a classic break–retest–continuation pattern.

✅ Trade Considerations (Not Financial Advice)

Entry Type Entry Condition Target Stop Loss

Aggressive Break & 2H close above 3,330 3,370 Below 3,320

Conservative Retest & bullish confirmation above 3,325 3,370 Below 3,310

Risk Management:

Use position sizing aligned with your risk tolerance (max 1–2% per trade).

Monitor volume closely during breakout and retest for confirmation.

⚠️ Invalidation Scenario

If price fails to break above the channel and is rejected strongly, especially with a bearish engulfing or long upper wick, the downside could resume. In such a case, price may revisit the channel midline or even the lower boundary around 3,290.

📝 Summary

Gold is at a critical juncture, testing long-standing channel resistance.

A break above and successful retest of the 3,325–3,330 zone could lead to a rally toward 3,370.

This setup reflects a potential shift in structure from bearish to bullish on the 2H timeframe.

XAUUSD Idea: 4H Trendline First Breakout - Liquidity PlayFOREXCOM:XAUUSD

🔍 Analysis Overview:

Price has just broken above a 4H descending trendline for the first time. However, I remain cautious due to the following key observations:

📌 NOTES:

The broader market sentiment is still bearish due to recent tariff-related news, which often fuels risk-off behavior.

Historically, the first breakout of a strong trendline often fails, trapping early buyers.

This breakout is likely attracting buy-side liquidity, giving institutions an opportunity to hunt stops.

My observation shows buying interest started around the 3308–3313 range, suggesting smart money accumulation and a possible trap.

📉 I'm watching for a fake breakout and potential reversal targeting the liquidity zones marked below around 3307 and possibly lower.

The liquidity sweep below equal lows could offer a better risk-reward setup.

💡 Conclusion:

If price fails to hold above this breakout and shows signs of rejection, I will be anticipating a return towards the previous demand zone for a liquidity grab.

#XAUUSD #GoldAnalysis #SmartMoneyConcepts #LiquidityGrab #ForexTrading #TrendlineBreak #MarketPsychology #TradingSetup #SMC #PriceAction

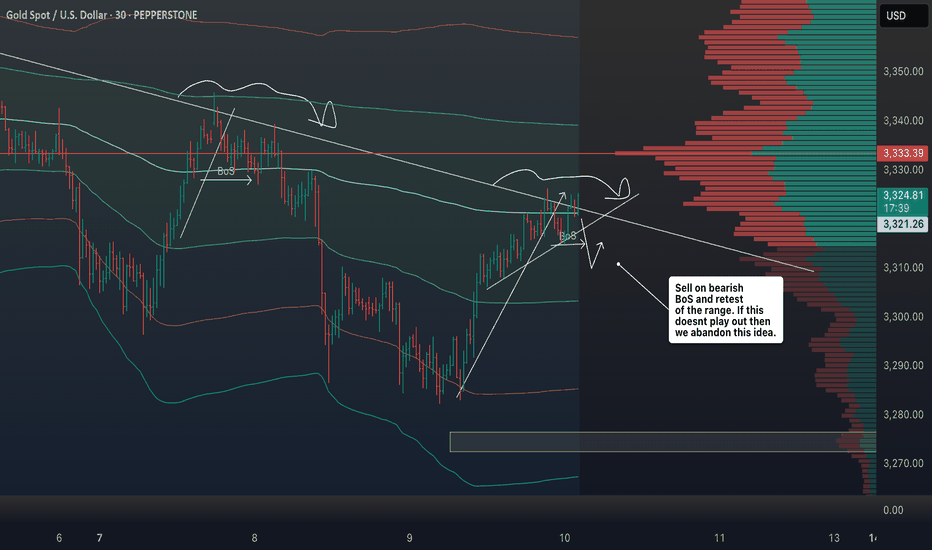

Waiting for the Perfect Entry: XAUUSD Market Structure Breakdown🔍 Taking a look at XAUUSD today: it’s clearly in a downtrend 📉 on the 4H chart, with consecutive lower highs and lower lows 🔽.

📌 My bias is bearish, and I’m patiently waiting for price action to set up for an entry 🎯.

If we get a break of market structure 🧱, followed by a retest and failure of the current range high 🚫, that could present an opportunity 👀 — not financial advice ⚠️.

Trump blasted Powell again. Interest rates remain unchanged.Information summary:

Trump blasted Powell on Wednesday, saying that the current interest rate is "at least 3 percentage points higher" and once again accused Fed Chairman Powell of "making the United States pay an extra $360 billion in refinancing costs each year." He also said that "there is no inflation" and that companies "are pouring into the United States," and urged the Fed to "cut interest rates."

During the U.S. trading session, gold also showed a significant rebound momentum, rebounding from a low of 3285 to above 3310 in one fell swoop. As of now, gold has stood above 3320.

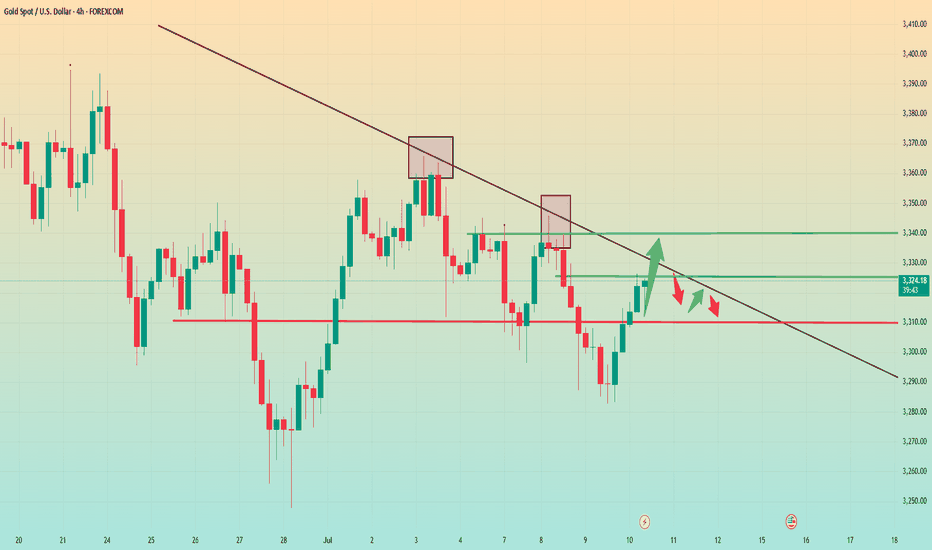

Market analysis:

From the daily chart:

It can be seen that the first suppression position above gold is currently at 3325, followed by around 3345. Gold did not close above 3320 on Wednesday, which means that even if gold is currently above 3320, as long as today's daily line closes below 3320, it is still in a bearish trend. On the contrary, if the closing price today is above 3320, then the subsequent test of the suppression position near 3345 may be further carried out.

Secondly, from the 4-hour chart, the current suppression position above 4 hours is around 3330-3335. Therefore, today we should focus on this position. If we cannot stand firm and break through the range suppression here in the 4-hour chart, we may retreat again in the future. The key support position below is around 3310, which is the opening price today. If the price is to retreat, it is likely to fall below 3310. But it may also remain above 3310 for consolidation.

However, as long as it falls below 3310, I think the low point near 3285 may be refreshed, so pay attention to this.

Operation strategy:

Steady trading waits for 3310 to fall and break through to short, and the profit range is 3385 or even lower.

Aggressive trading can short near 3340, with a stop loss of 3350.