7/3: Focus on Short Positions, Watch Support Near 3320Good morning, everyone!

Yesterday, gold tested support near 3328 but failed to break below it effectively. The price then rebounded toward the 3350 level. At today’s open, gold briefly extended to around 3365 before pulling back.

Technically:

On the daily (1D) chart, the price remains capped by the MA20, with no confirmed breakout yet.

Support levels below are relatively dense, and moving averages are increasingly converging, suggesting a breakout in either direction is approaching.

Key intraday support lies in the 3321–3316 zone.

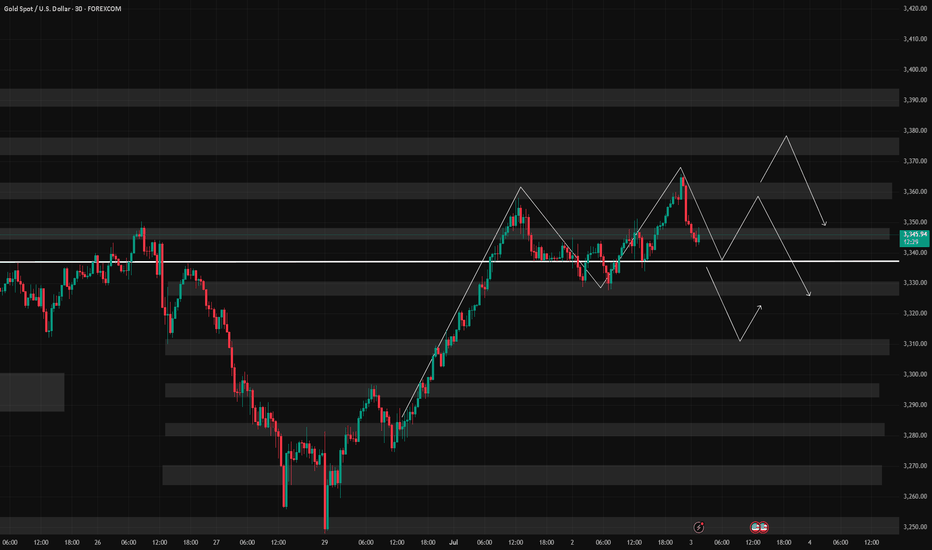

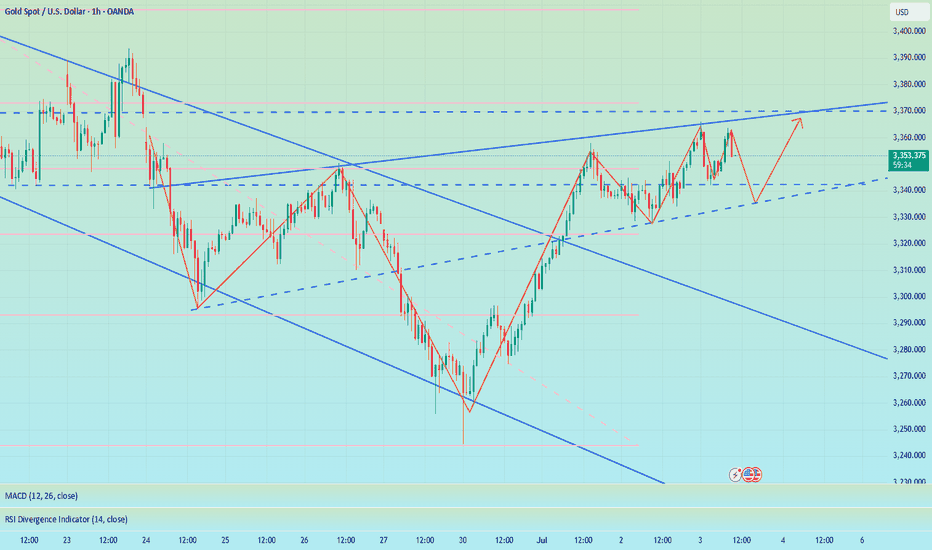

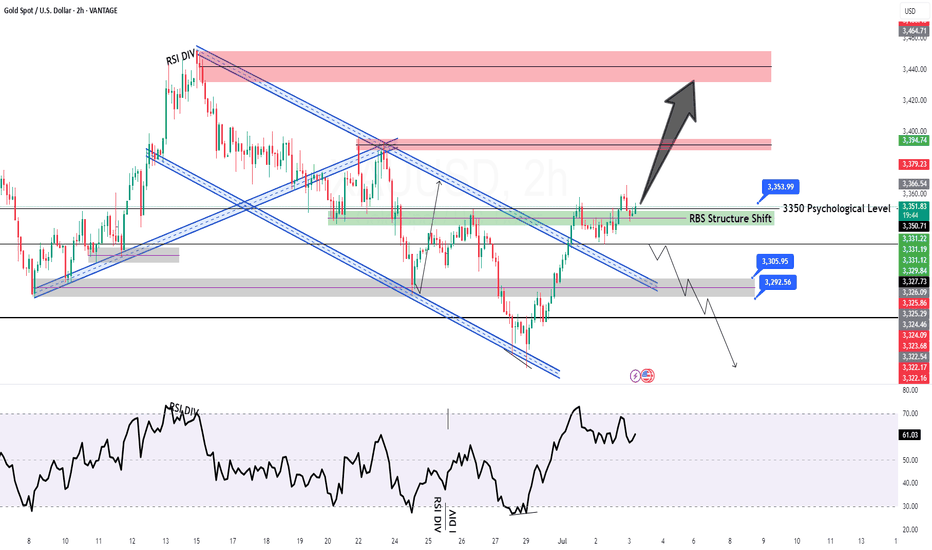

On the 2-hour chart, we are seeing the first signs of a bearish divergence, indicating a need for technical correction. Much like Tuesday’s setup, there are two possible scenarios:

If 3342–3334 holds, the price may extend slightly higher, intensifying divergence before pulling back;

If 3337 breaks, we could see a drop toward 3320, where correction would occur through a direct decline.

From a fundamental perspective, several high-impact U.S. data releases are scheduled for the New York session, which may increase volatility and make trading more challenging.

Trading suggestion:

For most traders, the safest approach is to wait for data to be released, then look for oversold rebounds or overbought corrections following sharp market reactions.

This style requires patience and strong risk control—avoid being overly aggressive or greedy, as such behavior can easily lead to trapped positions or even liquidation.

Xauusdanalysis

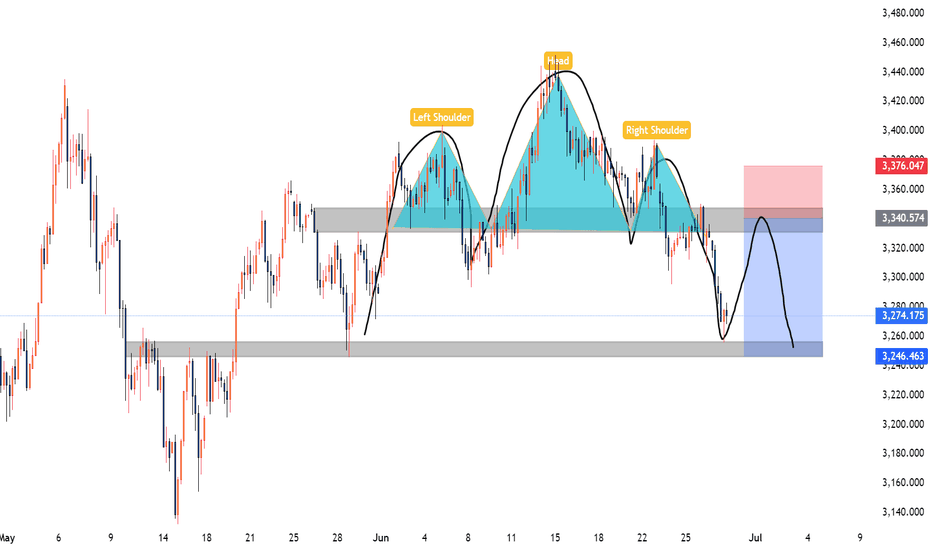

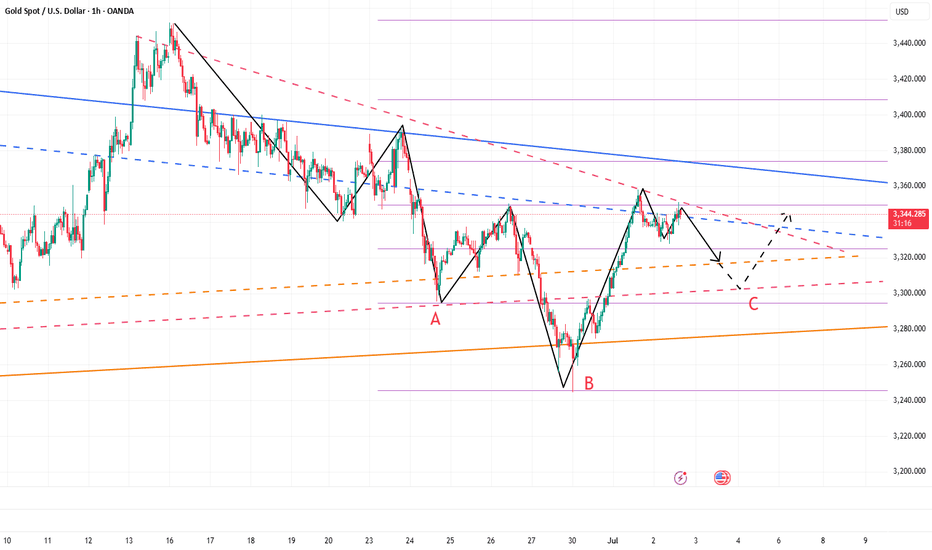

XAUUSD Weekly Analysis 30 June 4 July 2025Gold has formed a Head and Shoulders (H&S) pattern on the H4 timeframe. While the pattern is not perfectly symmetrical, it is still valid and clearly recognizable. The price has broken below the neckline, confirming a potential shift in market structure to the downside.

Analysis Insight:

The 3340–3350 area, previously a support zone, is now acting as resistance following the neckline break. A pullback to this zone may present a high-probability short opportunity for swing traders, especially if price shows rejection or bearish structure in that zone.

Trade Type: Swing

Trade Setup – Sell on Retracement:

Bias: Bearish on confirmation of retracement rejection

Entry Zone: 3340 – 3350

Stop Loss: 3376 (above right shoulder/high)

Take Profit: 3320/3300/3285/3260

Risk-Reward Ratio: Approximately 1:2

Kindly follow, share, like, support and comment.

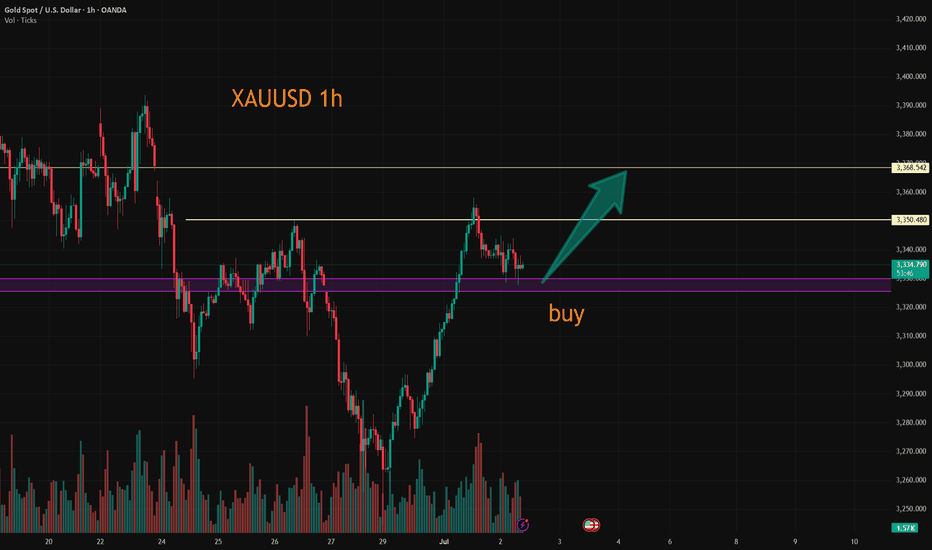

Buying the Dip or Catching a Knife? My Gold Setup Explained.Entered a long position on XAU/USD from the 1H demand zone following sharp intraday selling into a key support level. With gold hovering near $3,300 and a significant testimony from Fed Chair Powell on deck, the setup aligns with both technical rebound potential and fundamental uncertainty that could fuel upside.

The goal here is to play the liquidity vacuum left after aggressive positioning was cleared, with tight invalidation and asymmetric reward.

Technicals:

• Entry aligned with prior price inefficiency and confluence of multiple demand zones

• 1H structure shows clear deviation below the range with immediate buy-side response

• EMA channel flattening, indicating potential compression ahead of expansion

• First target: $3,352

• Risk-managed with defined stop-loss below $3,260

Execution Note: This is not a “hold forever” trade. It’s an opportunistic reaction to unwind + sentiment imbalance.

Fundamentals

• Gold saw a 25% surge in 2024 due to safe-haven demand and dovish policy, but enters 2025 under pressure from:

▫️ A strong USD

▫️ Higher cost of carry

▫️ Speculators taking profit

• Fed policy remains the core variable:

▫️ A hawkish tone from Powell could weigh on price

▫️ Rate cuts would likely revive bullish momentum

• Central bank demand remains supportive

• Geopolitical tensions (Russia-Ukraine, Israel-Iran) could trigger safe-haven bids again.

Bearish headwinds:

• Waning bullish momentum per RSI divergence

• Reduced rate cut expectations post-election

• Powell’s testimony could revive volatility either way.

This is a short-term tactical long, not a macro bet. With sentiment temporarily overextended and key support defended intraday, this is a high R/R window to exploit Powell-related volatility.

Let’s see how price reacts into $3,350+. Any sustained strength there would open room toward $3,400, while failure would confirm a retest of $3,260s.

Note: Please remember to adjust this trade idea according to your individual trading conditions, including position size, broker-specific price variations, and any relevant external factors. Every trader’s situation is unique, so it’s crucial to tailor your approach to your own risk tolerance and market environment.

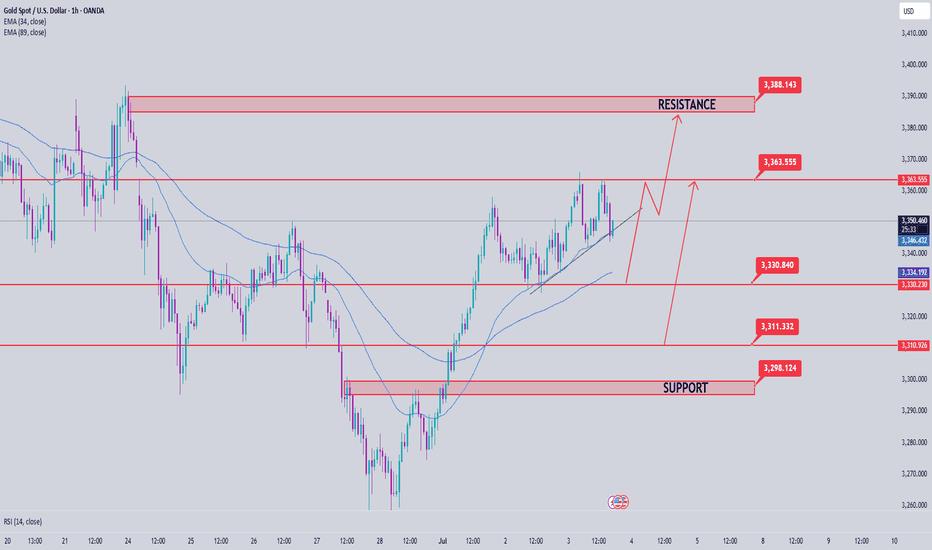

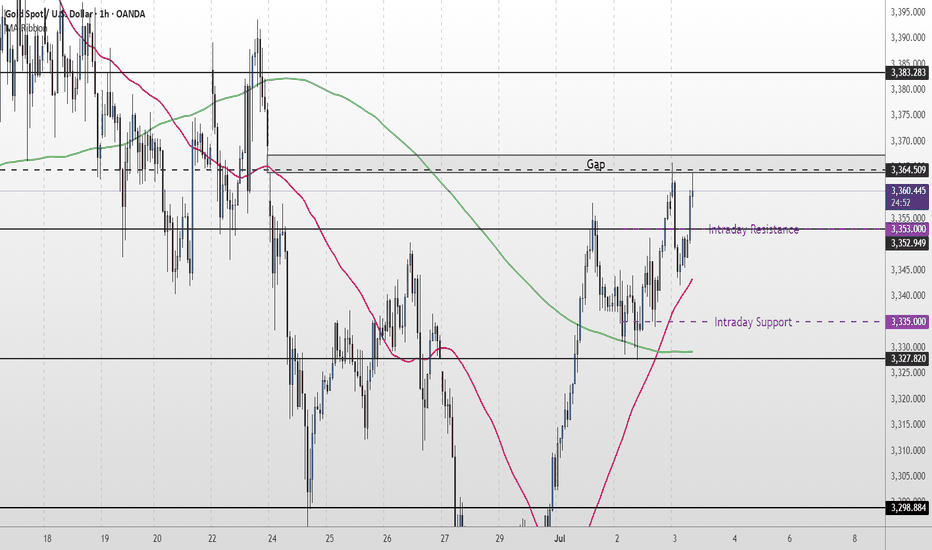

Gold Price Analysis July 3GOLD Technical Analysis - D1 Frame

On the D1 frame, the uptrend is still being maintained with momentum towards the price gap zone. During the European session, selling pressure started to appear around the resistance zone of 3365 - showing that this is the area where the sellers are making counter-moves.

On the chart, the gold price is accumulating and forming a triangle pattern, indicating the possibility of a strong movement phase.

If the price breaks the upper border of the triangle (above the 3363 zone), it will likely open up an opportunity to approach the next resistance at 3388.

On the contrary, if it breaks the lower border (below the 3330 zone), the correction trend may be triggered, heading towards deeper support zones.

Important Zones:

Resistance: 3363 – 3388

Support: 3330 – 3311 – 3297 – 3277

Trading Strategy:

BUY Breakout: When price breaks above 3363

SELL Breakout: When price breaks below 3330

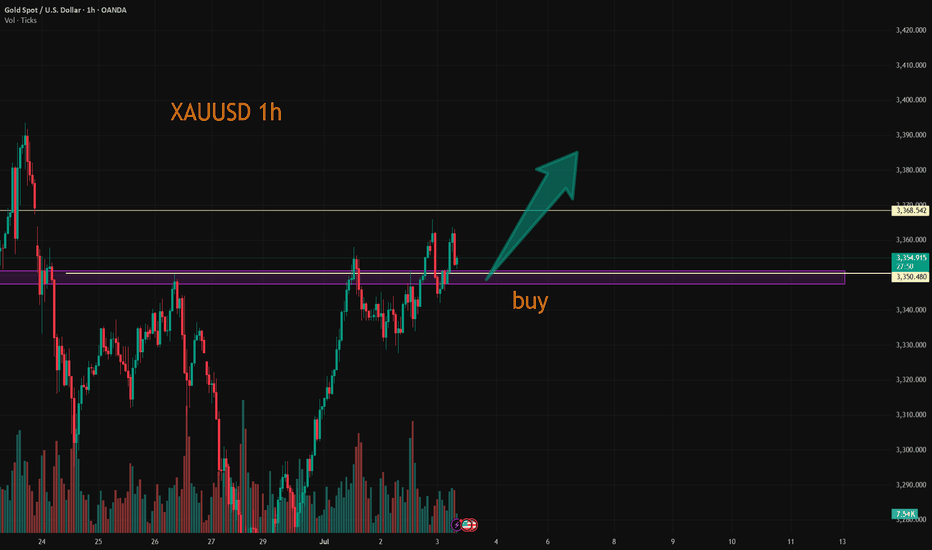

XAUUSD:A long trading strategy

The highest gold price in the Asian session reached 3365.4, which is already our mid-line target range. If you have completed and left the market, congratulations, because I personally set the TP point of 3368, so it did not touch, the trend of the past two days is appropriate rewithdrawal after strengthening, the high is also gradually rising, the overall long trend has not changed. For today's data, the probability will make gold prices continue to rise, trading ideas or to do the main.

Trading Strategy:

BUY@3347-51

TP:3365-70

This TP range is also the target range of the median trader, for friends who do not have automatic stop profit, you can take a profit manually at that time.

More detailed strategies and trading will be notified here ↗↗↗

Keep updated, come to "get" ↗↗↗

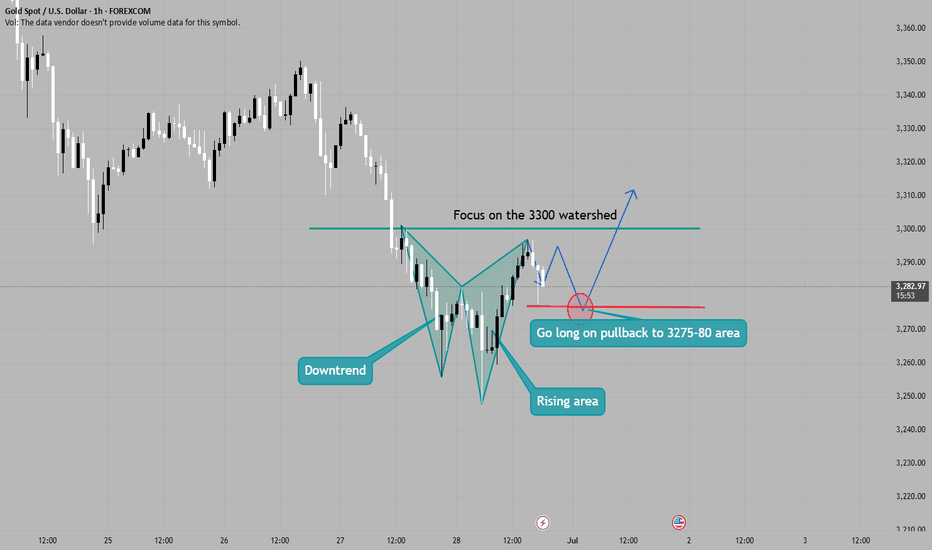

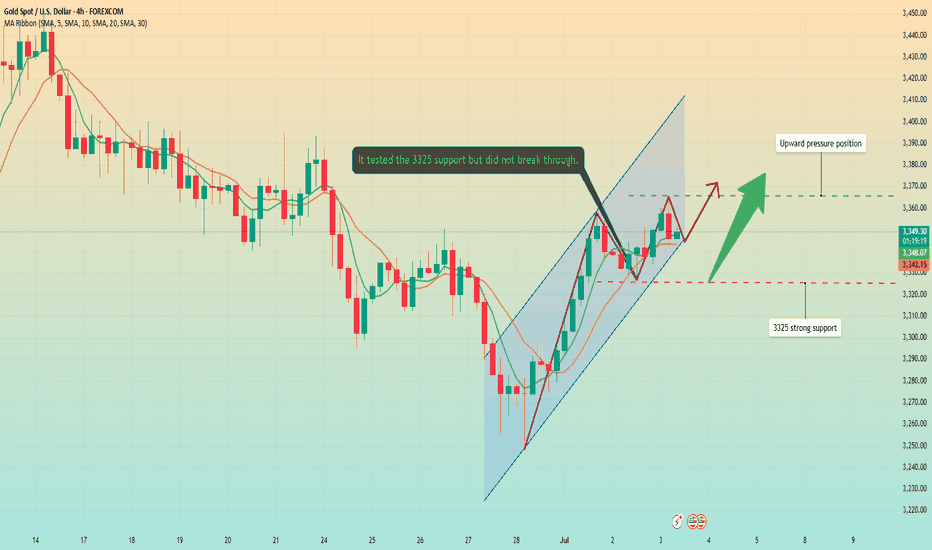

Non-agricultural week gold long and short game!From the 4-hour trend of gold, the key position of 3300 is the core basis for judging the short-term trend. The current 4-hour watershed is in the 3300 area. The gains and losses of this position will determine the direction of the short-term trend. Before it breaks through effectively, the short-term pressure judgment is maintained; if it breaks through, it is necessary to turn to the daily resistance level. The MACD indicator crosses and the short-term momentum column continues to increase, indicating that the price has further downward momentum. The price of the 4-hour cycle runs along the downward channel. Although the MACD indicator forms a cross below the zero axis, the short-term energy column shows a shrinking trend. There is a technical oversold rebound demand in the short term.

Who will be the winner in the battle between bulls and bears?From the analysis point of view, the short-term resistance above is around 3295-3301, and the pressure at 3315-3316. Focus on the pressure at 3324, the long-short watershed. In terms of operation, the rebound will continue to be the main short and look for a decline. The short-term support below is around 3250-3255. Relying on this range, the main tone of high-altitude participation remains unchanged.

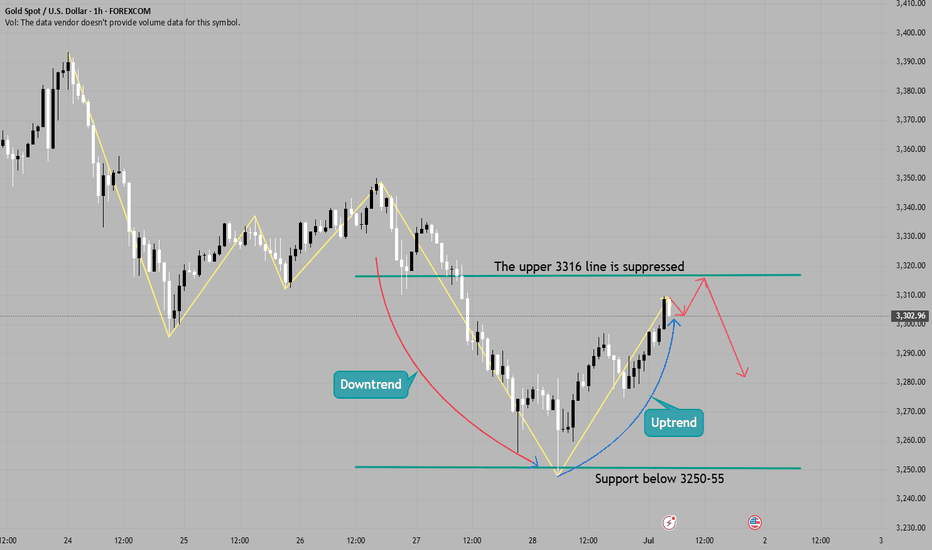

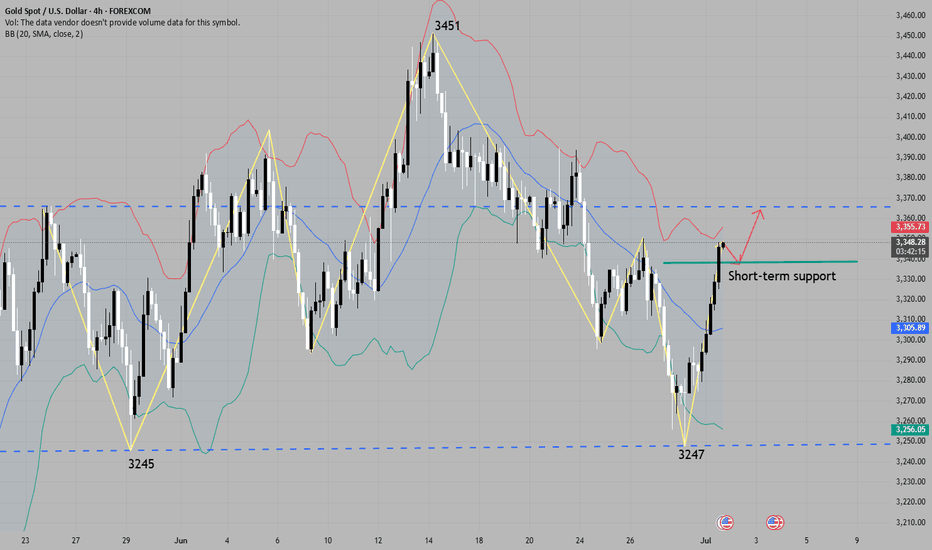

Gold is unilaterally upward during the dayGold, the general trend is as described in the morning analysis. The price fell from the 3452 high point in this round. On Monday, it rebounded quickly after parallel attack and defense near 3245. The article emphasizes that the short-term strength will continue. The high point of the week may appear around Thursday's non-agricultural data. The medium-term top idea of 3500-3452 is still maintained;

It actually opened unilaterally upward from 3303 during the day and is now reported at 3340; the bullish pattern of each cycle is good, and there will be a high in the evening; short-term support is 3338, strong support is 3332; short-term resistance is 3350-3356, strong resistance is 3365-3374;

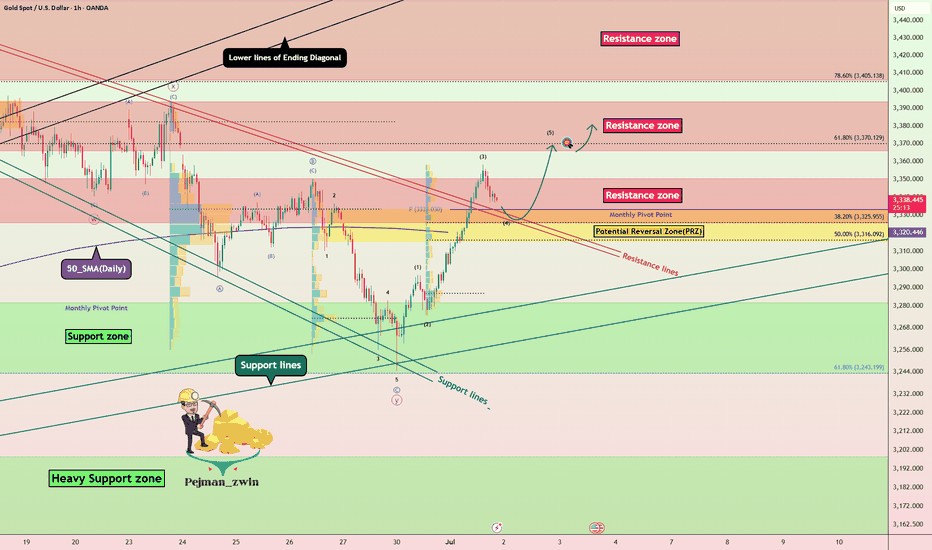

Gold Breakout Retest – Will PRZ Trigger the Next Rally?Gold ( OANDA:XAUUSD ) attacked the Resistance lines and Resistance zone($3,350-$3,326) as I expected in yesterday's idea .

Gold seems to have broken the Resistance zone($3,350-$3,326) and Resistance lines and is pulling back to this zone.

In terms of Elliott Wave theory , Gold appears to have completed wave 3 and is currently completing wave 4 .

I expect Gold to have a chance to rise back to the Resistance zone($3,394-$3,366) after entering the Potential Reversal Zone(PRZ) .

Note: Stop Loss (SL) = $3,297=Worst SL

Gold Analyze (XAUUSD), 1-hour time frame.

Be sure to follow the updated ideas.

Do not forget to put a Stop loss for your positions (For every position you want to open).

Please follow your strategy; this is just my idea, and I will gladly see your ideas in this post.

Please do not forget the ✅ ' like ' ✅ button 🙏😊 & Share it with your friends; thanks, and Trade safe.

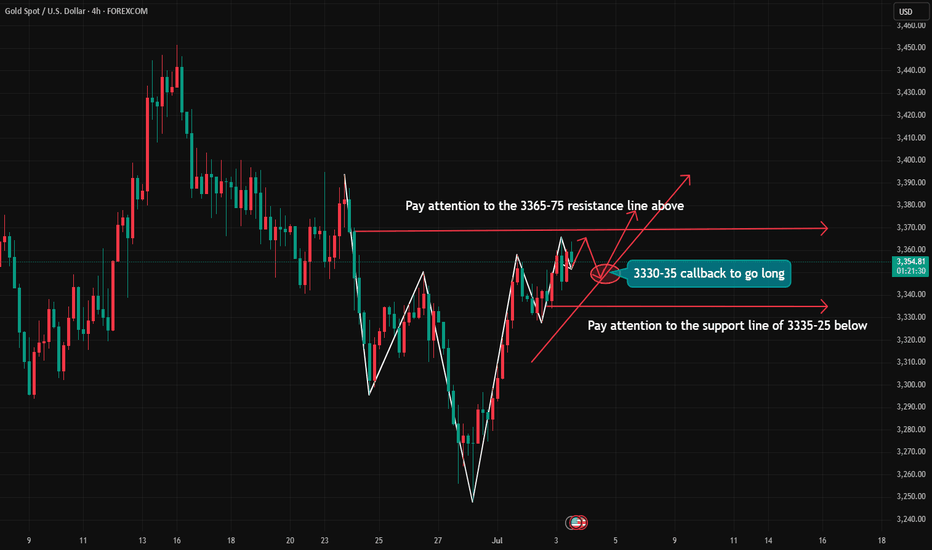

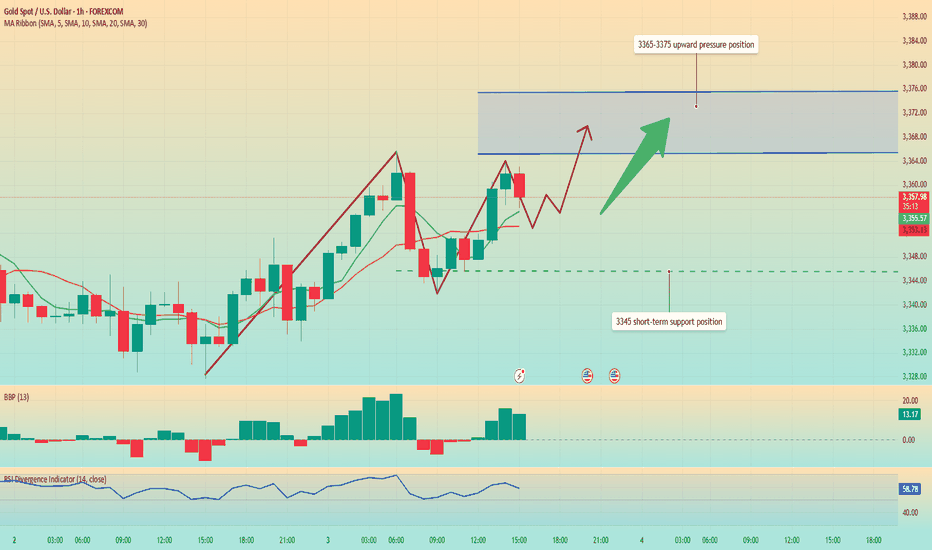

Gold non-farm payrolls are coming soonThe 4-hour level shows that the gold price turned to high-level fluctuations after testing the upper rail yesterday. There is still room for upward movement after the structure is completed. The 1-hour moving average system shows a golden cross divergent bullish arrangement, indicating that there is sufficient short-term upward momentum. In the morning, the gold price continued to rise and hit a new high for the stage, and the trend maintained a bull-dominated pattern. Although there was a correction in the US market yesterday, it stopped falling and stabilized at the key support level of 3330 and broke through the previous high, further confirming the short-term strength. Therefore, Weng Fuhao believes that once the correction to the upper area of 3335-3330 constitutes a dip opportunity. The intraday operation strategy recommends that the correction is mainly long and the rebound is supplemented by short. The short-term support below focuses on the 3335-3330 range, and the short-term resistance above is 3365-3375.

XAUUSD:Today's Trading Strategy

Gold retreated in the sub-session, I have personally increased my long position near 3331, the overall trend is bullish unchanged, the median strategy is patient to rise. If you are trading short, you can go long at 3325-3330 and leave at 3340-45. The same can be said if you want to solve the problem; Trade according to your trading preferences and risk tolerance.

More detailed strategies and trading will be notified here ↗↗↗

Keep updated, come to "get" ↗↗↗

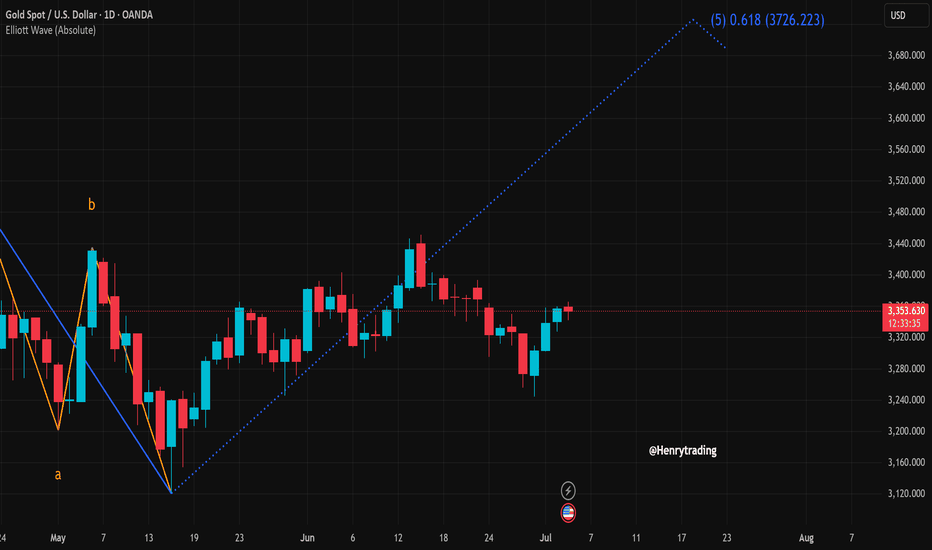

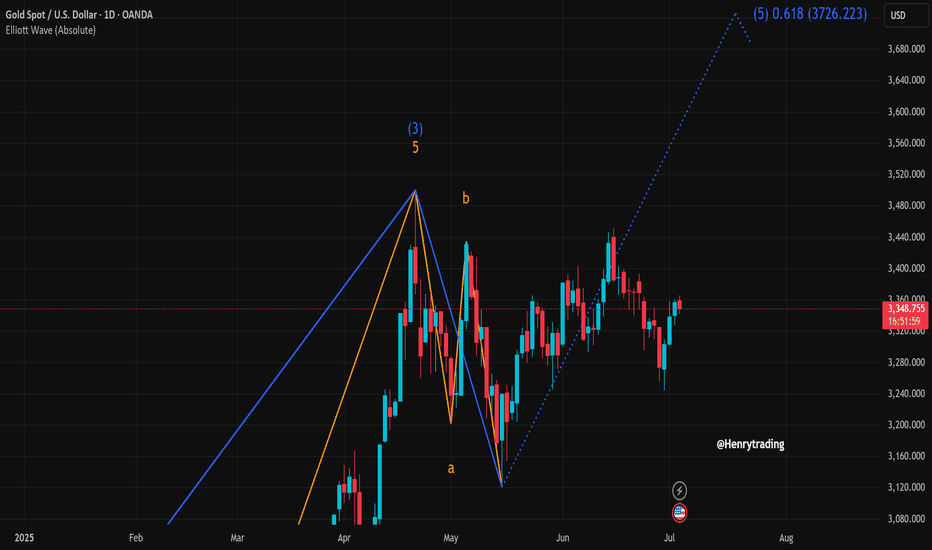

XAUUSD Set for Strong Bullish Wave – Targeting 3,726?Gold (XAUUSD) is showing signs of a bullish recovery after a recent correction between the 3,290–3,340 USD zone. On the daily chart, a clear Elliott Wave formation is unfolding, with the price potentially entering wave 5 aiming for the 0.618 Fibonacci extension at 3,726 USD.

Clear Wave Structure:

The a-b-c corrective wave appears to have completed in mid-May.

The price is now in wave 3 and preparing for a potential extension in wave 5.

Candlestick and Buying Momentum:

Recent candles show strong buying pressure with four consecutive bullish sessions.

The current upward momentum is testing the 3,352 resistance – a breakout could open the path to 3,450 and eventually 3,726 USD.

Support & Resistance Levels:

Immediate support: 3,320 – 3,330 USD

Key resistance: 3,450 USD (recent swing high)

Extended target: 3,726 USD (Fibonacci 0.618 from wave 2 low to wave 3 peak)

Suggested Trading Strategy:

Favor buy on dip strategy, waiting for a minor pullback to the 3,330–3,340 area before entering long.

Set stop-loss below 3,300, with targets at 3,450 and 3,726 USD respectively.

Conclusion:

The XAUUSD chart suggests a potential strong bullish wave according to the Elliott Wave framework, with a breakout likely leading to the 3,726 USD zone. Traders should closely monitor price action around the 3,350 level for confirmation of continued upward momentum.

What’s your view on this analysis? Drop a comment and let’s discuss your trading strategy together!

Gold trend analysis and layout before NFP data📰 News information:

1. Initial jobless claims and NFP data

2. The final decision of the Federal Reserve

📈 Technical Analysis:

Due to the Independence Day holiday this week, the NFP data was released ahead of schedule today, while the policy differences within the Federal Reserve have brought uncertainty to the market. Judging from the market trend, the 4H level shows that the gold price tested the upper track yesterday and then turned to high-level fluctuations after coming under pressure. In the short term, the structure still has bullish momentum after completing the accumulation of power. Although there was a correction in the US market yesterday, it stopped falling and rebounded near 3335, further confirming the strength. At present, the upper resistance in the European session is at 3365-3375, and the short-term support is at 3345-3335 below. Intraday trading still requires good SL to withstand market fluctuations. In terms of trading, it is recommended to mainly go long on callbacks

🎯 Trading Points:

SELL 3365-3375

TP 3350-3340-3335

BUY 3335-3330-3325

TP 3350-3360-3375

In addition to investment, life also includes poetry, distant places, and Allen. Facing the market is actually facing yourself, correcting your shortcomings, confronting your mistakes, and strictly disciplining yourself. I hope my analysis can help you🌐.

FXOPEN:XAUUSD PEPPERSTONE:XAUUSD FOREXCOM:XAUUSD FX:XAUUSD OANDA:XAUUSD TVC:GOLD

Data is about to be released. Trend change?Affected by the ADP employment data, gold prices broke through 3345 and continued to fluctuate upward to 3365 US dollars. This trend fully shows that the position of 3345 US dollars is the watershed between long and short.

From the 1-hour chart, the overall market is still fluctuating upward. Although it has fallen slightly, I think it is accumulating momentum for a second rise. ADP employment data is negative for the first time. Non-agricultural employment data will be released in 3 hours. The market expects 110,000 jobs. I think the data that may be released will be worse. The number of jobs will decrease and the unemployment rate will also increase, which will drive gold prices to continue to rise.

From a technical perspective, the RSI indicator is currently hovering around 58.7, showing strong upward momentum. MA5-day and 10-day moving averages form a golden cross and continue to rise. The current upward high has not appeared. The gold price may refresh the intraday high of 3365 again.

At present, the upward pressure focuses on 3365-3375 US dollars. The support level is around 3345, which is also the turning point for the upward movement of the MA5 daily moving average.

Operation strategy:

Buy near 3350, stop loss at 3340, and profit range 3370-3375.

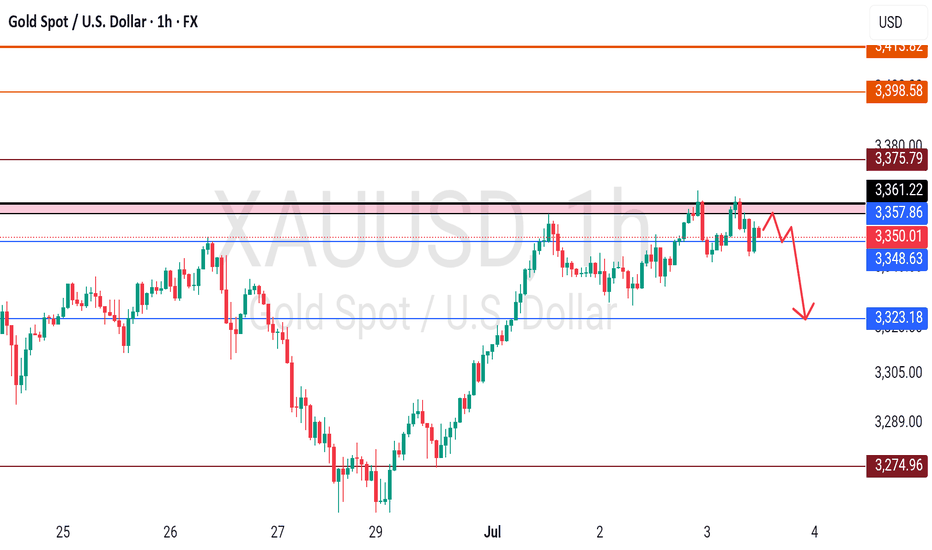

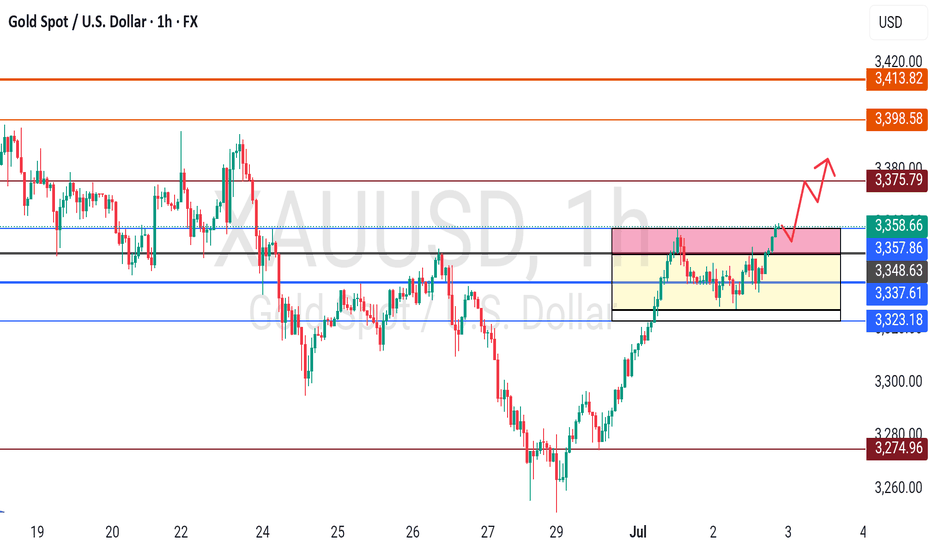

Gold Short Term OutlookYesterday, we highlighted that gold had reclaimed the 200MA and that the $3,327 support level needed to hold for further upside. Since then, price has steadily climbed and is now testing the $3,364 resistance — a level that also aligns with an unfilled gap.

Price action remains bullish for now, with price holding firmly above both the 50MA and 200MA.

If buyers manage to clear and hold above $3,364, we could see further upside toward $3,383 and $3,400, with possible extension into $3,418.

However, if price fails to break above $3,364, we may see a pullback into the $3,335–$3,327 zone. A break below there could open the door for a deeper drop into $3,298 or even $3,270.

📌 Key Levels to Watch:

Resistance:

$3,364 • $3,383 • $3,400 • $3,418

Support:

$3,352 •$3,335 - $3,327 • $3,298 • $3,270

🧠 Fundamental Focus:

📌 ADP Non-Farm Employment Change

📌 Initial Jobless Claims

📌 ISM Services PMI

📌 ISM Non-Manufacturing PMI

⚠️ With multiple red folder events on the calendar, expect elevated intraday volatility. Manage risk accordingly.

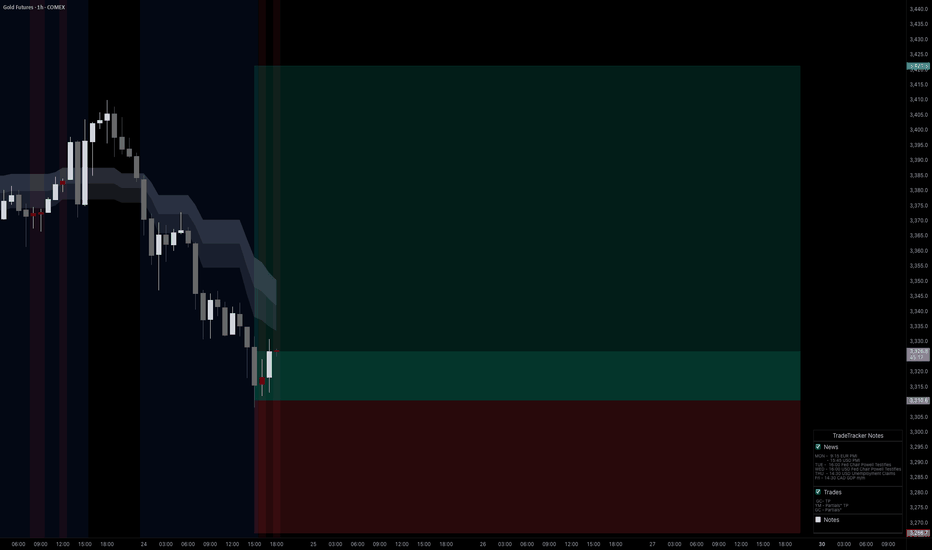

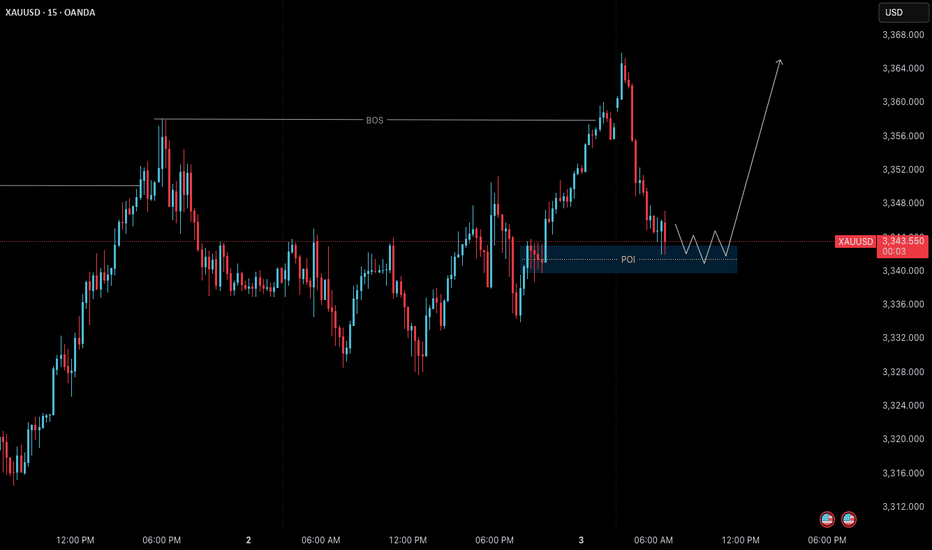

XAUUSD – July 3 Live Setup | Price at M15 POIGold has been moving in line with our bullish bias over the past few sessions.

Yesterday’s break above the 3358 M15 level gave us a clean Break of Structure (BoS) — confirming short-term bullish momentum within the larger framework.

After this strong push upward, the market is now retracing.

Price is currently entering a high-probability pullback zone: 3340–3342 (M15 POI).

This is a textbook base structure setup — where we wait for price to return to a valid zone after structure shift, and only act after confirmation on the lower timeframe.

🔍 Setup in Play:

Current Bias:

• M15 Trend: Bullish

• H4 Context: Bullish (after recent HTF shift)

• Market State: Pullback phase after BoS

Key Zone in Focus:

• 3340–3342 – M15 POI (zone of interest for continuation)

We are not entering blindly .

We are waiting for confirmation on M1 — specifically:

✅ ChoCh (Change of Character)

✅ Followed by a micro BoS

Only then do we consider a long entry — and even then, risk must be managed through proper R:R and structure anchoring.

🎯 Target:

If M1 confirmation occurs, the expected short-term target is 3365 — the next clean M15 structural high.

⚠️ Risk Conditions:

If price breaks below the POI without M1 confirmation — or aggressively violates the zone — the setup is invalid.

In that case, we simply step aside and reassess.

This is process-driven execution:

No need to predict.

No need to chase.

Just observe, confirm, and execute with structure.

📖 This is how we let the chart do the work.

The process protects us.

Structure invites us.

Stillness refines us.

📘 Shared by @ChartIsMirror

Author of The Chart Is The Mirror — a structure-first, mindset-grounded book for traders

GOLD H2 Intraday Chart Update For 3 July 2025Hello Traders,

Main event of is day NFP and all eyes on 3400 Psychological for now, right now market sustains around 3350 Psychological level for downward move GOLD still need to break 3324 level in order to go further down above 3324 LEVEL GOLD is still remains Bullish

Remember: It's NFP day

Disclaimer: Forex is Risky

Non-farm data is coming. Upward breakthrough?Information summary:

ADP data supports the rise of gold. Secondly, the weaker-than-expected non-farm data has triggered people's hope that the Federal Reserve will cut interest rates earlier. The gold price hit the 3360 mark, then fell back slightly, and is currently fluctuating around 3350.

This Friday is the Independence Day holiday in the United States. The non-farm data will be released on Thursday. Today, we will focus on this data, which will trigger a new trend.

Market analysis:

From the 4-hour chart, gold is currently in a suppressed state. However, it is not ruled out that it will be supported at the bottom as before, and then break through the upper suppression position again with the help of non-farm data.

Therefore, the most critical position today is not above, but near the support of 3325 below. On Wednesday, the support near 3325 was tested many times but did not break down. If the price remains above this position today, the probability of an upward breakthrough is very high.

Based on the current market conditions and the data to be released soon, Quaid recommends that everyone wait and see for a while and wait for the new trend to come. Of course, according to the current forecast data, this will support the rise of gold. A radical approach can also try a long strategy around 3345.

Elliott Wave Analysis of XAUUSDOn the daily chart of XAUUSD, we are witnessing a clearly defined Elliott Wave structure, with the potential formation of an extended wave (5) targeting the $3,726 region — aligned with the 0.618 Fibonacci extension. This is a key technical signal that could capture the attention of both long-term investors and strategic swing traders.

1. Elliott Wave Overview:

Wave (3) concluded at the peak around $3,365, followed by a textbook a-b-c corrective pattern.

Waves "a" and "b" are clearly identifiable, with wave "c" appearing to have completed.

The current price action suggests a rebound from the bottom of wave c — a strong indication of a possible start to wave (5).

2. Wave (5) Target Zone:

The Fibonacci 0.618 extension projects a target near $3,726 — a significant price level the market could approach if bullish momentum builds up.

This level also serves as a psychological resistance zone, so expect possible volatility as the price nears this area.

3. Price Behavior & Confirmation Signals:

Recent candlestick formations reveal renewed buying interest, with multiple bullish candles showing long bodies and lower wicks.

Holding above the key support around $3,300 is crucial for confirming the formation of an uptrend.

A breakout above the $3,365 high (wave (3) peak) would be a strong signal that wave (5) is in motion.

4. Suggested Trading Strategies:

Buy limit: Consider entries around the $3,310 – $3,320 support zone on a retest.

Buy breakout: Trigger entries if price breaks decisively above $3,365 with strong volume.

Take profit: Gradually scale out positions around the $3,680 – $3,726 area.

Stop loss: Place stops below the wave c bottom — under $3,245.

5. Conclusion:

XAUUSD is currently in a sensitive phase with a high probability of a bullish breakout. The Elliott Wave structure shows that there is still considerable upside potential. However, traders should maintain strict risk management, as wave (5) formations often involve significant price swings.

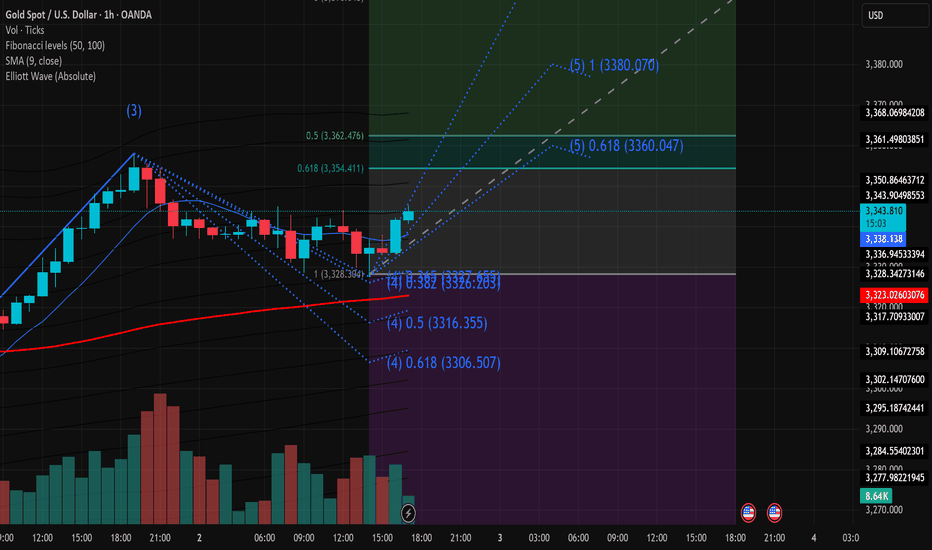

XAUUSD Technical Analysis – 02/07/2025On the 1-hour chart, Gold (XAUUSD) has just confirmed the completion of corrective wave (4) around the 3,328.3 zone, which aligns with the 1.0 Fibonacci level and EMA9 support. Currently, price is rebounding with increasing volume, signaling that buying momentum is returning.

Key Technical Highlights:

Elliott Wave Structure:

Wave (4) found support at 3,328.3.

Wave (5) targets are forming, with Fibonacci extensions pointing to:

0.618: 3,360.05

1.0: 3,380.07

=> These are critical resistance zones to watch.

Fibonacci Retracement Zones:

The current rebound is heading toward the 0.5 and 0.618 retracement levels of the previous down leg, located at 3,362.4 and 3,354.4 – short-term upside targets.

Volume Analysis:

Rising volume on bullish candles confirms a legitimate buying interest, supporting the upward movement.

EMA9 Breakout:

Price has broken above the EMA9 at 3,338.2, shifting short-term trend bias to bullish.

Suggested Trading Strategy:

Favor Buy on Dip entries near the 3,340–3,342 zone if a minor pullback occurs.

Short-term targets: 3,354 – 3,362

Extended target: 3,380

Suggested stop loss below 3,328.0 to manage risk.

Conclusion:

A bullish impulse is forming following the end of wave (4). If price holds above 3,340 and breaks through the nearby Fibonacci resistance levels, wave (5) could extend towards the 3,380 area. This is a pivotal moment to watch for a confirmed short-term uptrend.

I have shorted gold as expected and held on patientlyEven under the influence of the ADP data, which is bullish for the gold market, gold has not effectively broken through 3350, and even showed signs of falling back after rising several times. The resistance above is becoming more and more obvious, which may further weaken the market's bullish sentiment and confidence, thereby strengthening the dominance of the bears.

Although gold has not effectively fallen yet, from the perspective of the gold structure, even if gold wants to rise, it still needs to be backtested and support confirmed before rising, and the current retracement is far from enough, so gold still has a need for structural retracement; and before the NFP market, gold rose slowly but was far from enough to break upward, and there was no volume support, so the illusion of gold rising may be to lure and capture more bulls;

Therefore, out of caution, I try to avoid chasing gold at high levels; and I believe that shorting gold is still the first choice for short-term trading at present. And I have executed short trades in the 3340-3350 area according to the trading plan, and held it patiently. I hope that gold can retreat to the 3320-3310-3300 area as expected.