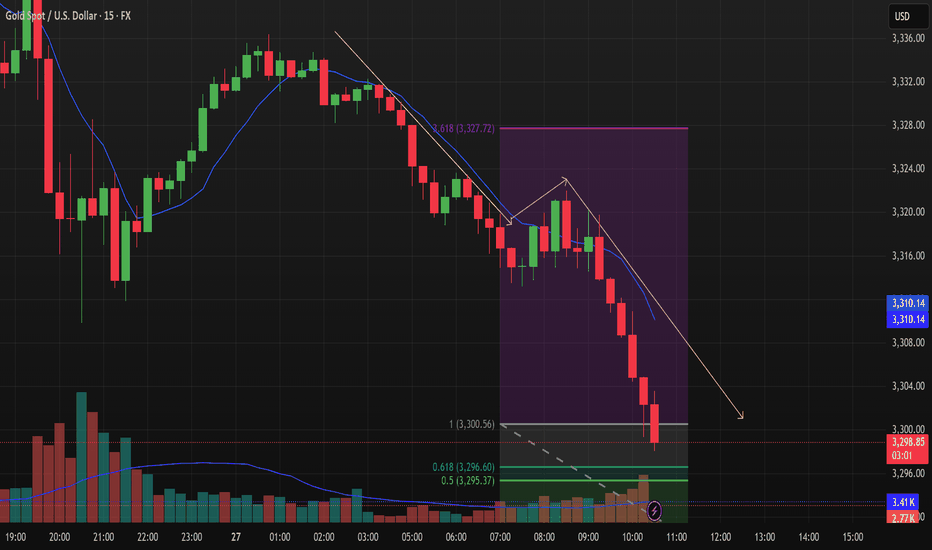

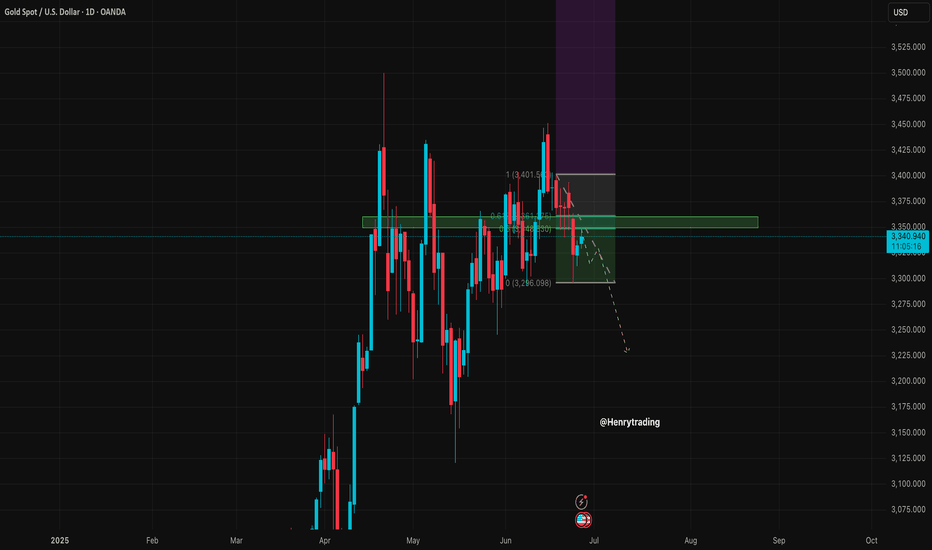

XAUUSD: Bearish Trend, Key Support at $3,295Market Overview

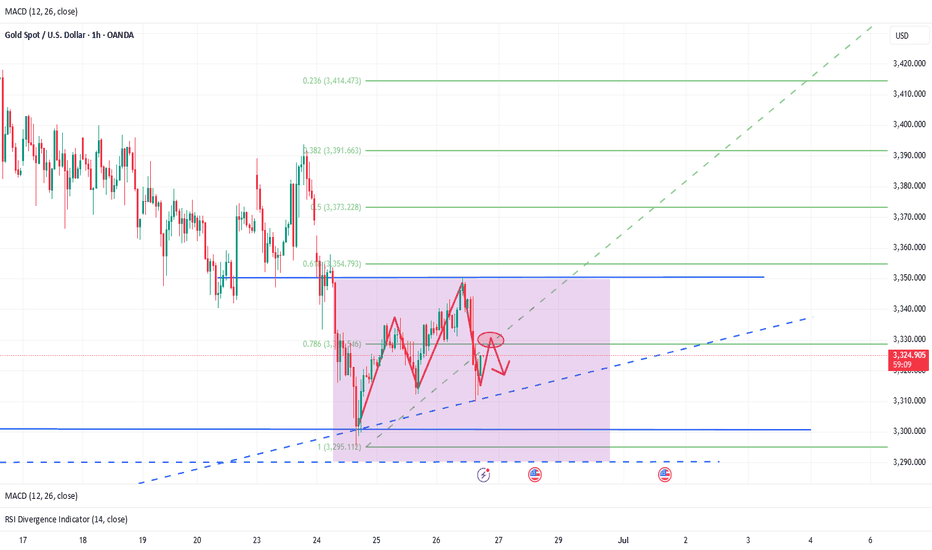

In today’s trading session (26/06/2025), XAUUSD shows continued downward momentum. Gold prices are currently hovering around $3,302.05, with a slight drop of 0.01%. The intraday price range has been tight, between $3,330.00 and $3,350.00, indicating a battle between the buyers and sellers around the short-term equilibrium zone.

Recent price action suggests that after a brief recovery, gold is once again encountering resistance at the $3,350.00 level. In the coming hours, a decisive breakout either above this resistance or below current support will dictate the market’s next move.

Key Technical Levels to Watch:

Support Levels: The first significant support is at the $3,295.37 level (50% Fibonacci retracement), with the next support at $3,296.60 (61.8% Fibonacci retracement), followed by a crucial level at $3,300.56.

Resistance Levels: The primary resistance area lies around $3,350.00, with the second resistance at $3,327.72, which coincides with the 3.618 extension of the previous price swing.

Price Action Analysis

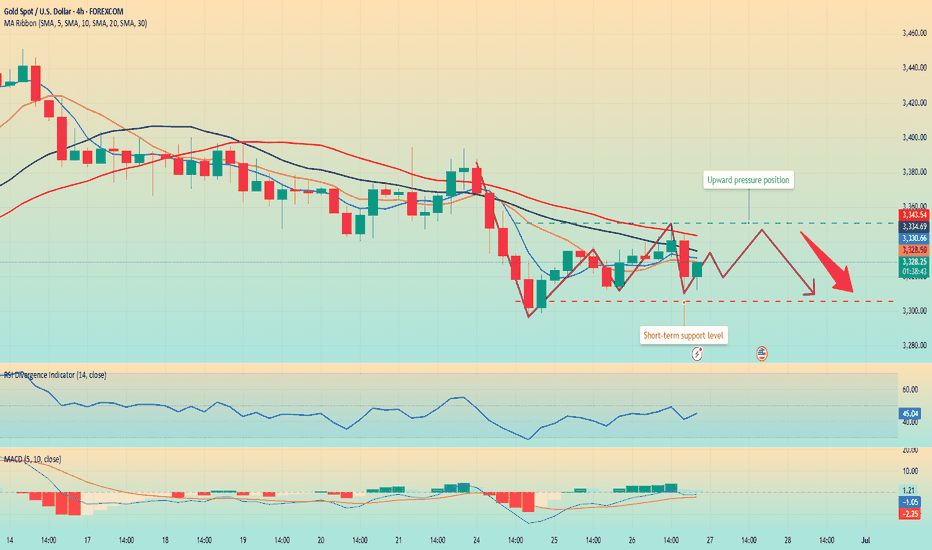

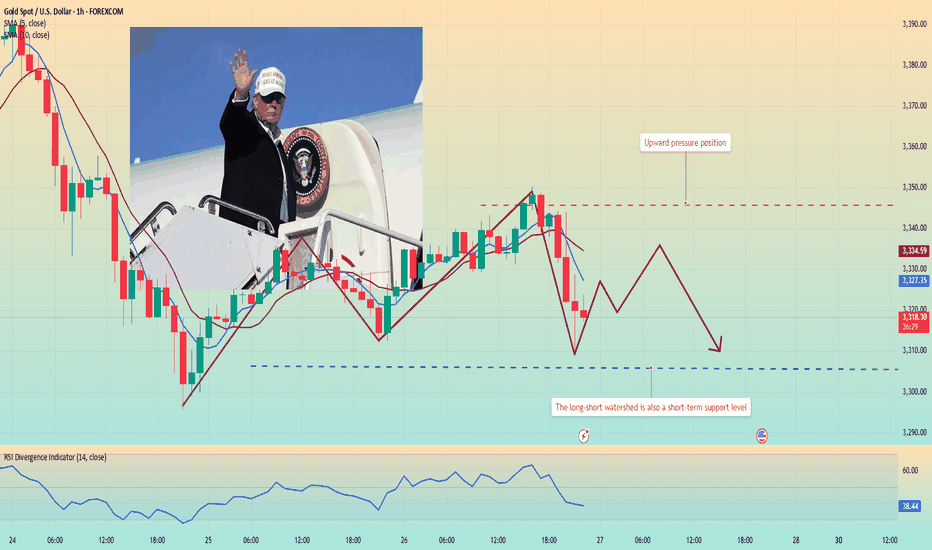

As seen in the chart, XAUUSD is currently trading below both the 50-period (blue) and 200-period (yellow) moving averages, indicating a strong bearish trend. The price action is forming a series of lower lows and lower highs, reinforcing the downtrend.

Bearish Trend Continuation: A break below the support at $3,295.37 could signal further downside towards $3,290.00 or even $3,275.00. The yellow trendline indicates the overall bearish direction, and any failure to hold above $3,300.00 could trigger additional selling pressure.

Fibonacci Retracement Levels: Price is testing the 50% and 61.8% Fibonacci levels. A rejection at these levels could cause a pullback towards lower support zones, confirming the bearish outlook for the short term.

Volume Analysis

The volume chart shows relatively low volatility, with decreasing volume during the price pullbacks. This suggests that there is not enough buying interest to push the price higher, and the market may be more inclined towards bearish continuation in the near term.

Market Sentiment

Currently, the market is undecided. The recent price action suggests that traders are waiting for a confirmation of direction. The next few hours are critical in determining if the downtrend will continue or if we will see a short-term bounce at one of the key support levels.

Trading Strategy

Short Position: A break below $3,295.37 would be an excellent opportunity to short XAUUSD with a target at $3,290.00, and further down to $3,275.00.

Long Position: Only consider long positions if XAUUSD manages to break above $3,350.00 decisively, with the next target near $3,375.00.

Conclusion

XAUUSD remains under pressure, and unless there’s a strong reversal at support levels, the bearish momentum could continue in the short term. Traders should monitor the key levels mentioned above closely to adjust positions accordingly.

Xauusdanalysis

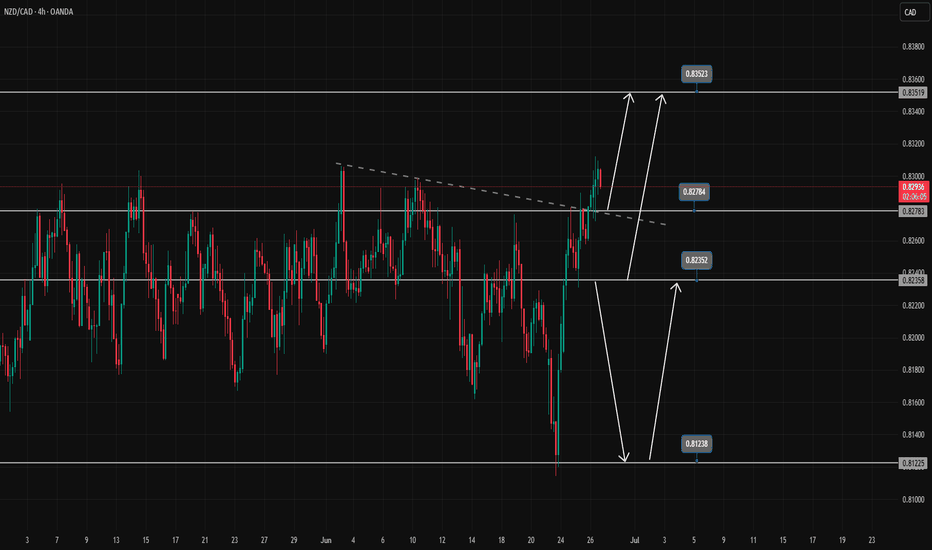

Is the NZDCAD uptrend still strong?NZDCAD has broken the trendline structure and is heading towards the resistance at 0.83500

0.827 has become a confluence of support and trendline. The pair is looking for more buying momentum at the support zone.

2 zones to watch are 0.827 and 0.823

If the 0.823 zone is broken, the uptrend is broken and the market turns to a downtrend. The target of the downtrend and the market finds the bottom of last month around 0.812.

Confirm SELL signal when breaking 0.823

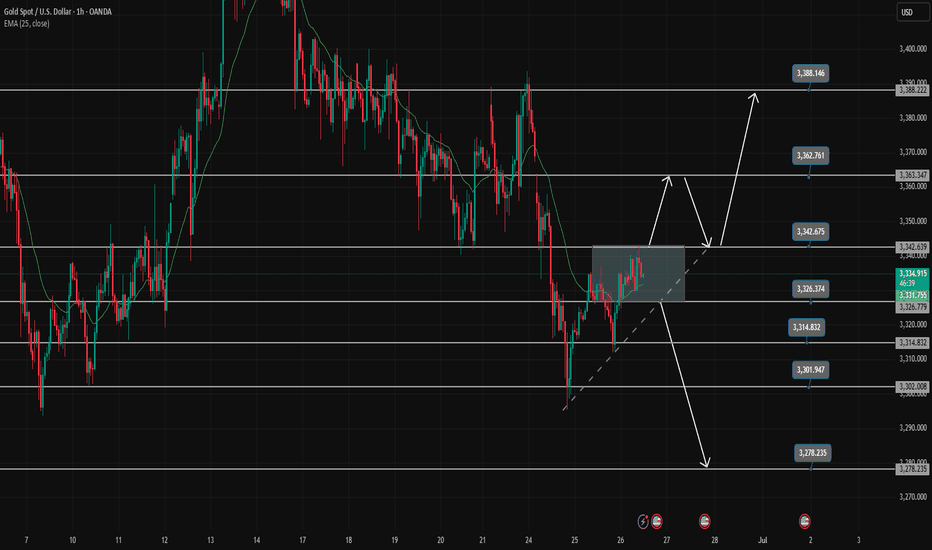

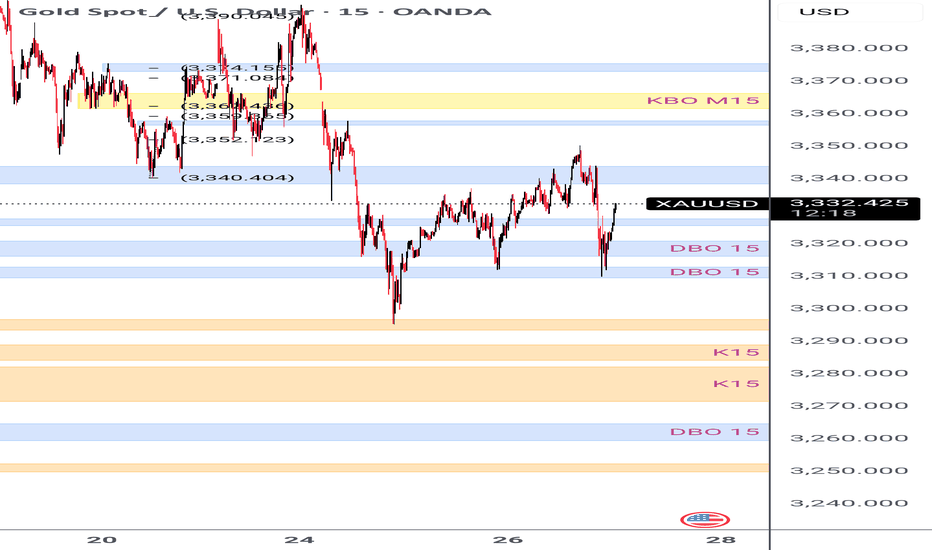

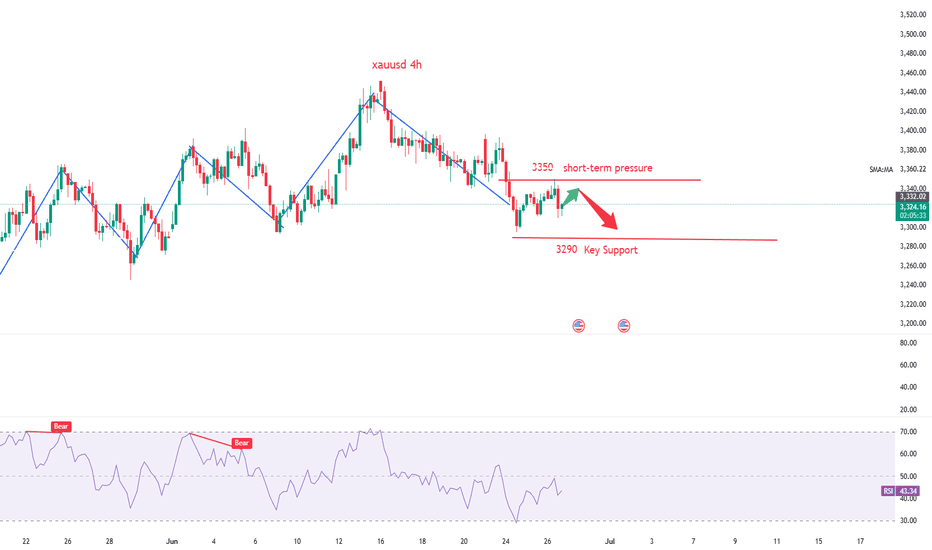

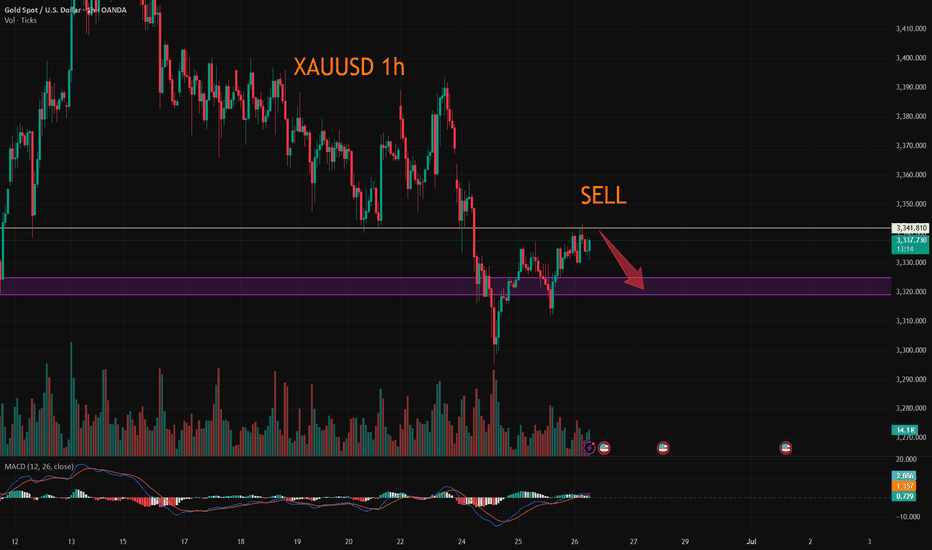

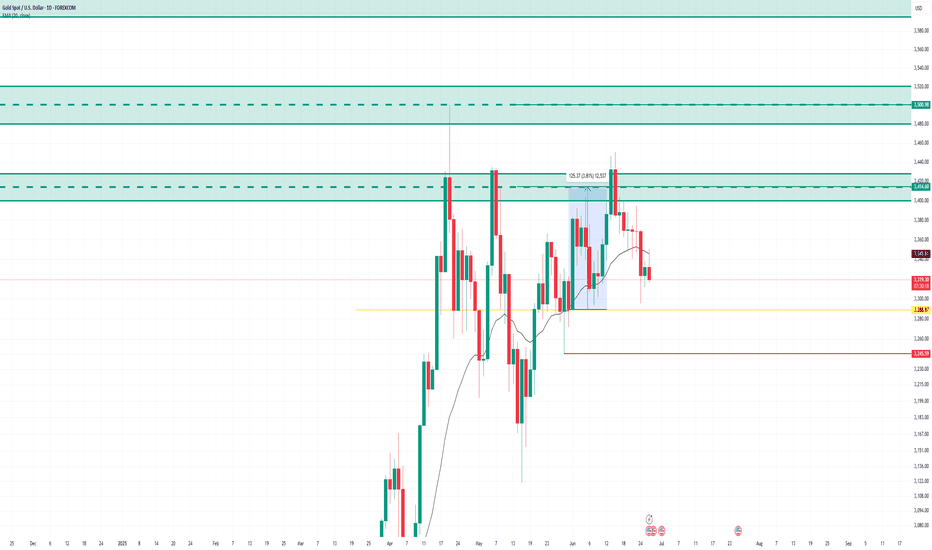

Gold Trading Strategy June 26✏️ D1 candle shows a recovery but not significantly. Gold is currently reacting at the key resistance zone of 3342.

The immediate support zone that the price is heading toward is 3326. This forms a breakout range between 3326 and 3342.

A bullish channel may form if there is a strong price reaction at 3326. Conversely, if 3326 is broken, it could confirm a continuation of the downtrend targeting 3302 during the European and US sessions today. The bearish target could even extend to 3278.

📈 Key Levels

Breakout Range: 3326 - 3342

Support: 3326 - 3314 - 3302 - 3278

Resistance: 3342 - 3363 - 3388

📊 Recommended Trade Setups

BUY: 3302–3300 | SL: 3297

SELL: 3363–3365 | SL: 3369

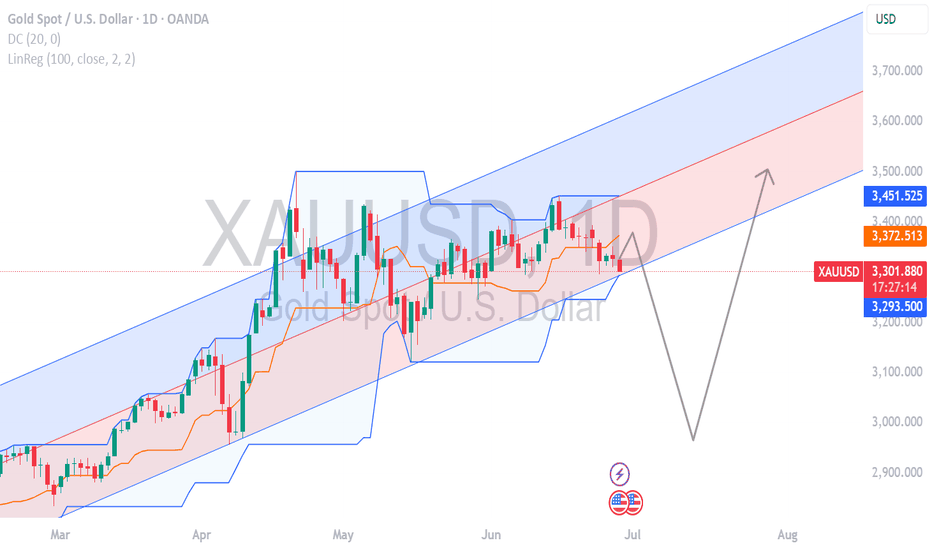

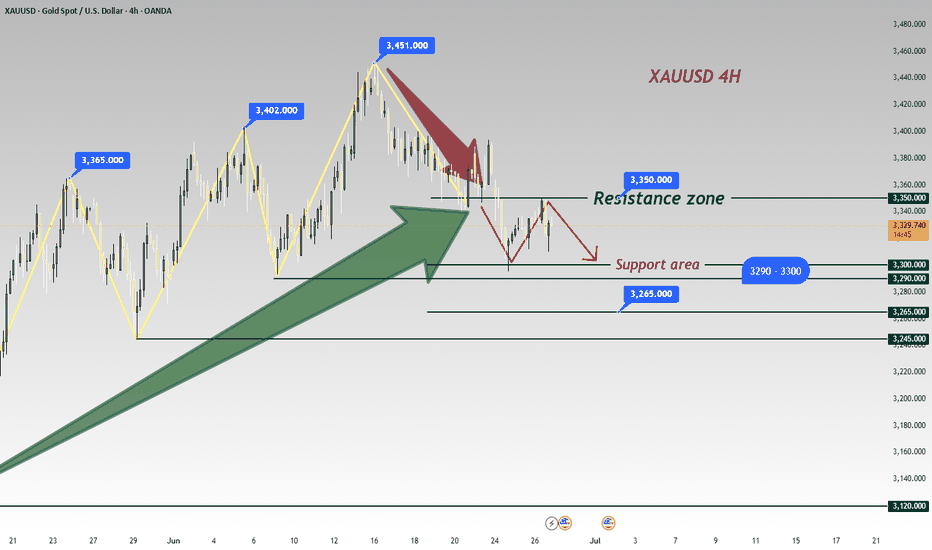

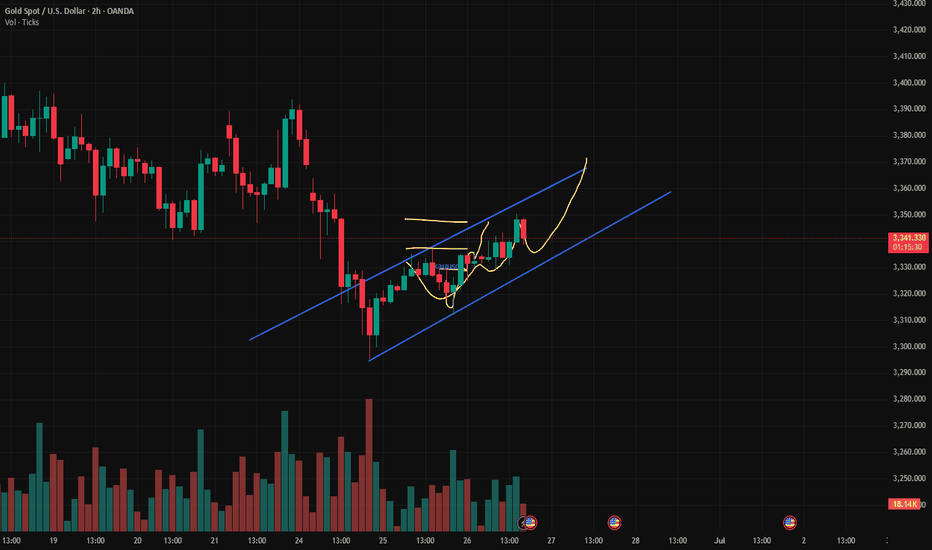

XAUUSD GOLD buy holdXAUUSD GOLD BUY NOW – LONG TRADE SETUP ACTIVE 🟡📈

Gold has pulled back to a key support area and is now showing signs of strength at the current price of $3301.

This zone is acting as a strong base for buyers, signaling a potential bullish continuation in the coming sessions.

We are entering a LONG position with a favorable risk-to-reward ratio, supported by market structure and technical confirmation.

🔹 Current Price: $3301

🎯 Target Levels: First target at $3350, extended target at $3400+

🛑 Stop Loss: Recommended below $3275 to protect capital

As long as price holds above the support zone, bulls remain in control.

Patience, discipline, and proper risk management are key — let the trend do the work.

Gold is poised for upside — time to ride the wave!

GBPAUD Refuses to Make New Weekly HighsFailed to trade above the resistance zone of 2.101

Currently, the weak reaction at the trendline suggests that it will be difficult for the pair to push higher.

If the trendline breaks, the downtrend may extend toward 2.08100 — a level where buyers are likely to step back into the market.

We are waiting for further price action around the 2.081 support zone to look for new trade signals.

If this level is broken, 2.061 will become the next target for all SELL positions.

On the contrary, if the price bounces from 2.081, strong buying momentum could emerge and potentially break through the 2.101 resistance, targeting 2.110.

Bulls and bears are anxious? Rebound continues to empty📰 Impact of news:

1. Initial unemployment claims data

📈 Market analysis:

Gold is in a sideways consolidation near 3320 in the short term. The market has no clear direction for the time being, and the long and short positions are in a tug-of-war. The hourly line rebounded to 3328 and then fell back again, suggesting that there is still room for short-term retracement. The current operation needs to focus on key points: if it rebounds to the 3320-3330 resistance area, you can consider entering short positions again. If the market continues to decline, focus on the 3300-3290 support range. If it stabilizes, long orders can be arranged. The overall idea is to maintain a volatile market. Before effectively breaking through 3350 or falling below 3290, high-altitude and low-multiple is still the main strategy.

🏅 Trading strategies:

SELL 3320-3330

TP 3310-3300-3290

BUY 3310-3300

TP 3320-3330-3340

If you agree with this view, or have a better idea, please leave a message in the comment area. I look forward to hearing different voices.

OANDA:XAUUSD FX:XAUUSD FOREXCOM:XAUUSD FXOPEN:XAUUSD TVC:GOLD

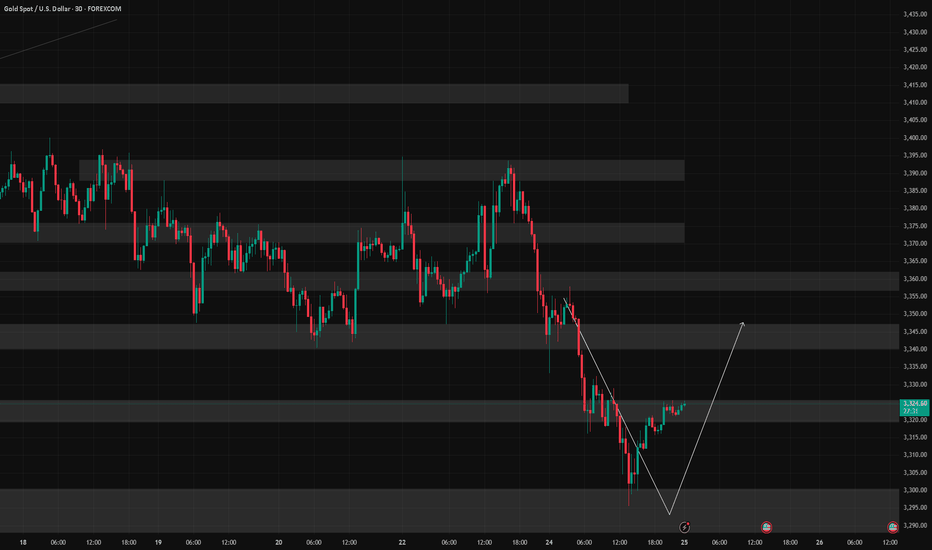

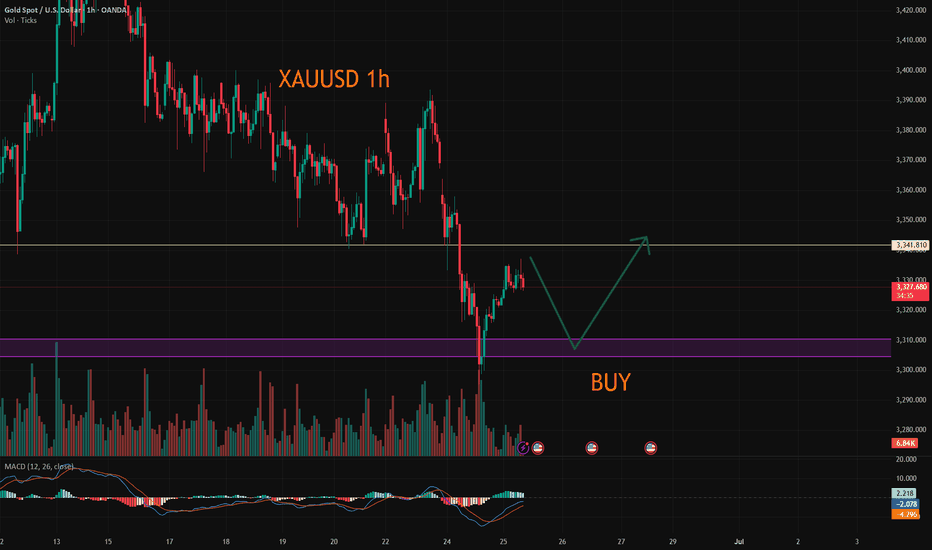

6/25 Gold Analysis and Trading ViewGood morning, everyone!

Gold experienced a sharp decline yesterday. Technically, the conditions for a rebound are in place, but since a solid bottom structure has yet to form, a retest to the downside is likely during today’s session.

Key levels to watch:

Resistance zone: 3336–3348

Support zones: Primary support at 3313–3303, with additional support around 3296–3282

Today’s overall strategy remains buying on dips as the primary approach, with short opportunities near resistance as a secondary option.

Key scenario to monitor:

If the price drops to around 3280 but fails to rebound toward 3336, and the daily close ends below 3300, then the buy-on-dip strategy will likely continue into tomorrow.

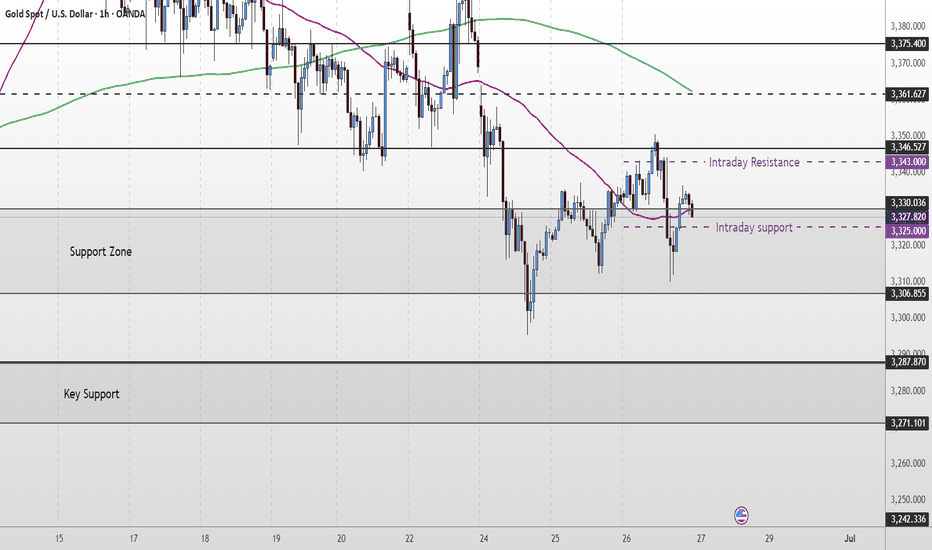

Gold Short Term OutlookYesterday’s chart analysis played out well.

Price broke above the MA50 and tested the $3,346 resistance zone. However, this zone failed to hold, and gold dropped aggressively toward the $3,306 support.

Once again, price is trending below both the 50 and 200 moving averages, indicating continued bearish pressure.

For now, the $3,306 support is holding. Bulls need to break above $3,330-$3,346 for higher levels to open up.

🔑 Key Levels:

Resistance:

$3,346 • $3,361 • $3,375

Support:

$3,306 • $3,287 • $3,271 • $3,242

Gold: Resistance Validated, Short at 3340-3350 Tomorrow📈 Gold Trading Recap & Tomorrow's Strategy: Resistance Holds, Short Opportunities Persist

💎 Today's newly updated live short strategy hit the TP target successfully! As mentioned earlier, when gold failed to break the support level, we anticipated it to range around 3330—today's trades were precisely centered on this logic. The 3350 resistance was also validated firmly during the session.

💎 Expect further upside in tomorrow's Asian session—recommend continuing short positions within the 3340-3350 range 🚀

🚀 Sell@3350 - 3345

🚀 TP 3335 - 3325 - 3315

Accurate signals are updated every day 📈 If you encounter any problems during trading, these signals can serve as your reliable guide 🧭 Feel free to refer to them! I sincerely hope they'll be of great help to you 🌟 👇

XAUUSD:Today's trading strategy

On Tuesday, the news that Trump announced a ceasefire between Iran and Israel dampened the risk aversion sentiment. Subsequently, the news that expectations of interest rate cuts had slowed down led to a further decline in gold prices. During the trading session, it once fell below the 3,300 mark. After the impact of the news weakened, it eventually rebounded to around 3,323, approaching the position where we first entered the market yesterday. Currently, there is no logic in the market. From a technical perspective, The resistance level above is at 3340-45, and the support level below is at 3305-10. We can conduct transactions around this range

Trading strategy:

SELL@3340-45

TP:3310-04

BUY@3305-10

TP:3335-40

More detailed strategies and trading will be notified here ↗↗↗

Keep updated, come to "get" ↗↗↗

Seize the rebound opportunity and prepare to short goldGold continued to rebound as expected and has now extended to above 3340. In the short term, it tends to fluctuate and rise. In the previous trading idea overnight, I emphasized that everyone should not take the risk of shorting gold near 3330. Now it seems that this reminder is completely necessary. Although gold continues to rebound, the overall performance of the bulls is still not strong, and the upper side is still under pressure in the 3350-3360-3370 area. So I still advocate that you can consider shorting gold in the 3350-3360 area after the rebound.

The Premium privilege of my account will end in 10 hours. Friends in the channel have already made a lot of money by following my trading strategy. Friends who have not joined yet can join and receive the latest trading strategies and trading signals as soon as possible to escort your trading!

Gold is sideways. Is a new trend brewing?Information summary:

On June 23, Trump announced that Iran and Israel reached a comprehensive ceasefire, but the asymmetric terms of the agreement caused the conflict to continue. Israel launched another air strike on Iran, and Israel threatened to kill Iranian senior officials. The uncertainty of geopolitical risks continues to support gold prices.

Market analysis:

From the 4-hour chart, the MA5-day and 10-day moving averages show signs of upward divergence, and the K-line stands firm on the moving average support and fluctuates upward. In the short term, pay attention to the breakthrough and decline of the 3350 pressure level. The current market's downward momentum has weakened, and the overall market remains volatile. We need to be wary of the risk of short-term adjustments after continuous surges. Be alert to the short-term adjustment risks after continuous highs.

Operation strategy:

Short near the price rebound of 3345, stop loss 3355, profit range: 3330-3320.

Gold rebounds under pressure, continue to go short.In the early morning, gold directly continued its bullish correction pattern. In the European session, it reached around 3336 at the highest, then continued to pull back in the US session, hitting around 3312 at the lowest and temporarily stopping there. It showed the intention to start a second rebound correction and closed at 3332. Opening at 3333, it rebounded and has oscillated near the highest of 3340 so far. The upper resistance to pay attention to is at 3342-48. If it fails to rebound, break through and stand firm above, the gold bears still have room for a pullback. The recent market trend is basically consistent - bottoming out and rebounding. In operation, continue to maintain the strategy of shorting when under pressure.

you are currently struggling with losses,or are unsure which of the numerous trading strategies to follow,You have the option to join our VIP program. I will assist you and provide you with accurate trading signals, enabling you to navigate the financial markets with greater confidence and potentially achieve optimal trading results.

Trading Strategy:

sell@3335-3340

TP:3300-3295

Gold fluctuates at high levels, intraday trading points📰 Impact of news:

1. Initial unemployment claims data

📈 Market analysis:

Gold has begun to show signs of bottoming out in the short term in the past two days. Since the daily line bottomed out and pulled up, the daily line closed positive yesterday, and the bulls began to counterattack, and the 1H low was rising. If it doesn't fall further in the short term, it will most likely bottom out and rebound. The upper pressure is at the Bollinger middle track of 3355, which is also the high point of Tuesday's decline. If gold breaks and stabilizes at this price, it will have a larger upward space, and the upper side will look at 3385. In the 4H chart, MACD temporarily forms a golden cross, which is a bullish signal; but the BOLL track pressure is still there, and gold bears still have momentum in the short term. Therefore, on the whole, in the short term, gold should pay attention to the 3350-3360 resistance above. If it encounters resistance under pressure here, it can consider shorting. Pay attention to the 3330-3320 support area below.

🏅 Trading strategies:

SELL 3350-3360

TP 3340-3330-3320

BUY 3330-3320

TP 3340-3350

If you agree with this view, or have a better idea, please leave a message in the comment area. I look forward to hearing different voices.

TVC:GOLD FXOPEN:XAUUSD FOREXCOM:XAUUSD FX:XAUUSD OANDA:XAUUSD

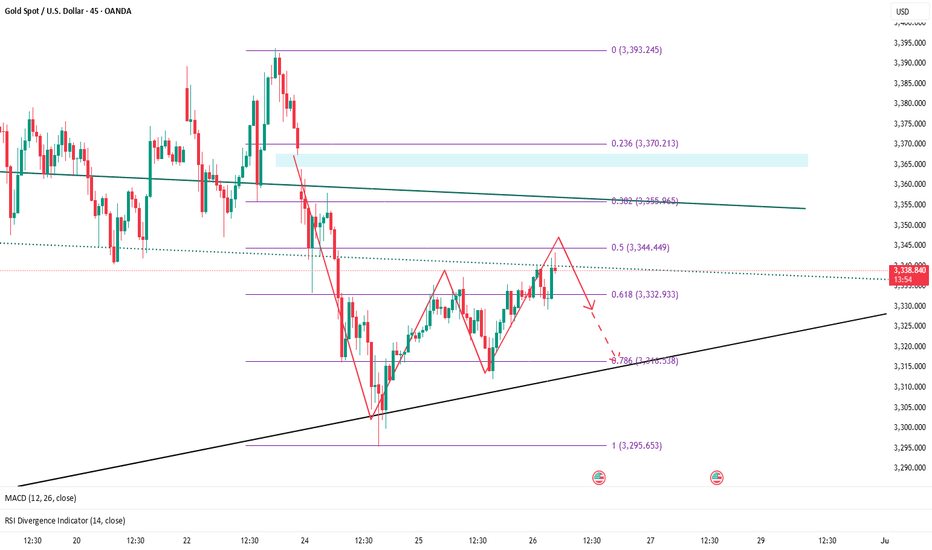

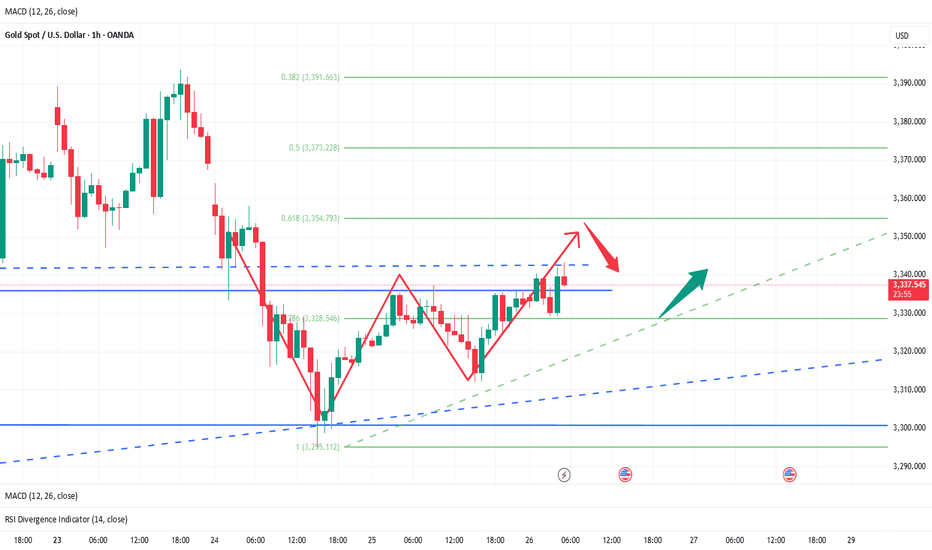

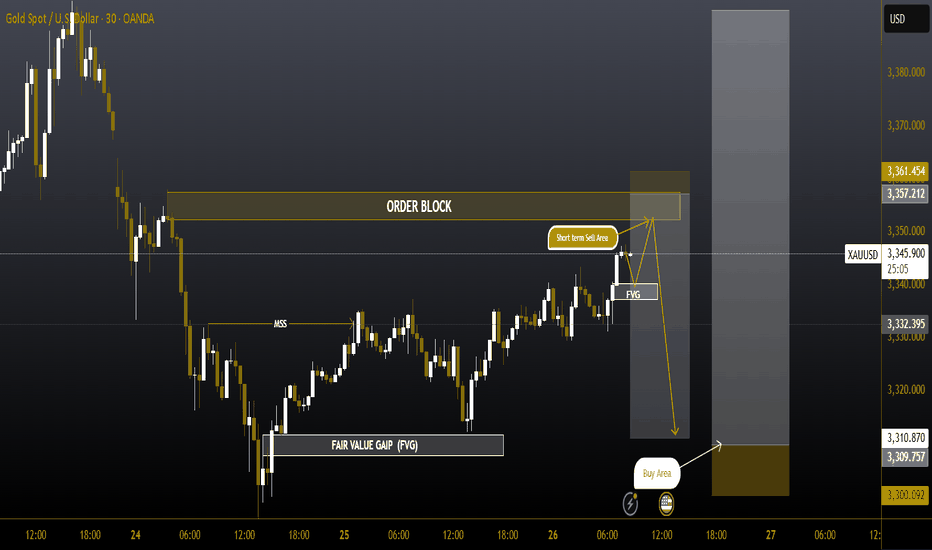

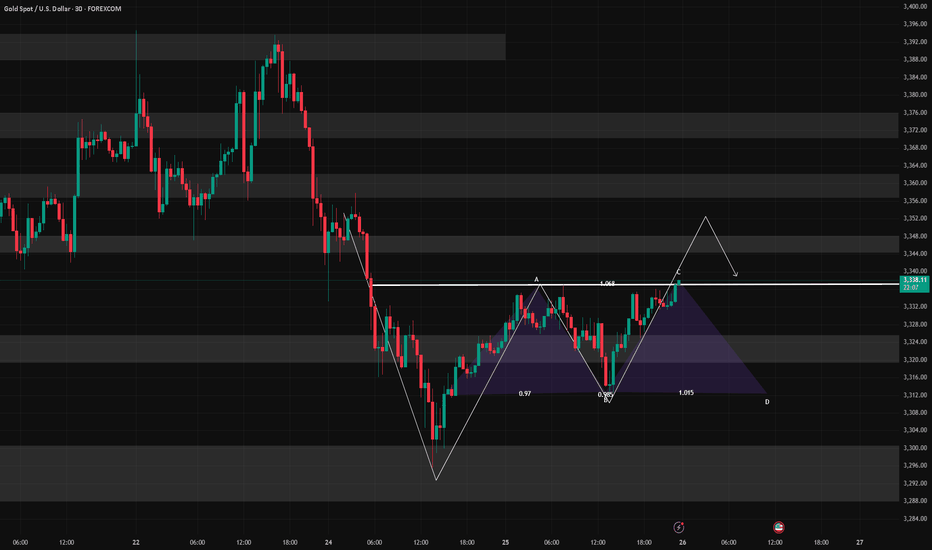

#XAUUSD #GOLD 30Min 📉📈 #XAUUSD 30m Analysis – Dual Setup Scenario

We’re monitoring two potential trade setups depending on how price reacts at key levels:

🔴 Sell Setup:

Price is entering a Sell-Side Order Block Zone between 3350–3360, aligned with a Fair Value Gap (FVG). This premium zone is likely to act as strong resistance, with potential rejection targeting downside liquidity near 3310 — an ideal area for short positions.

🟢 Buy Setup:

If price sweeps below and taps into the Liquidity Zone / Demand Area around 3305–3311, we’ll watch for a bullish reversal from this discount zone. This area offers a favorable setup for long entries, aligning with institutional buying levels.

📌 Be sure to mark these key zones on your chart for enhanced clarity and execution.

💬 What’s your outlook on Gold? Share your thoughts below 👇

Gold volatility intensifies. Waiting for direction?The price of gold fluctuated greatly this week, which means that the end point of sentiment will not disappear so easily for the time being; in the short-term K-line pattern, there are continuous ups and downs. If you want to trade steadily, you can wait and see for a while.

From the hourly chart, the MA5-day and 10-day moving averages cross downward, and the RS indicator hovers around 40.7. This shows that the market trend is weak. The current price has bottomed out near 3310 and rebounded to fluctuate around 3320. The price may continue to decline after a slight rebound.

Today, focus on the long opportunities near 3305 and the pressure position above 3345.

Quaid has always believed that only by insisting on detailed analysis of the market and reducing losses, can we slowly accumulate the principal of the account.

Good luck to everyone.

XAUUSD:Short sell at 3340-45

Today's trading needs to narrow down the range. There are signs that the center of gravity below is gradually moving upward. During the Asian session, the highest point reached around 3343. Friends who have already bought short positions here can wait for 3320-25 to take profits and exit. Those who haven't bought can wait for 3340-45 to short, with the target also being 3320-25

Trading strategy:

SELL@3340-45

TP:3320-25

It can be considered to go long when it reaches around 3320-25

More detailed strategies and trading will be notified here ↗↗↗

Keep updated, come to "get" ↗↗↗

6/26 Gold Analysis and Trading ViewGood morning, everyone!

Yesterday, gold rose to around 3336 before pulling back, then revisited the same level again. The buy-on-dip strategy performed well, delivering solid profits.

At today’s open, prices have moved slightly higher but remain near resistance. Technically, there’s potential to test the 3350 area, and if the move is strong, a rally toward 3370 is also possible.

If gold reaches this zone, it may present a favorable short-term selling opportunity. Therefore, today's trading strategy should focus on range-based trading between 3326-3368, selling near resistance and buying near support.

Key levels to watch:

Resistance: 3348–3352

Support: 3326–3318

Lastly, be mindful: if a trending move emerges, adjust your strategy accordingly and avoid counter-trend trades. Stay flexible and manage risk wisely.

XAUUSD has been in a strong free fall following the sell strategXAUUSD has dropped sharply in a free fall, perfectly following the sell strategy from 3348–3350.

We have won.

Trading Strategy for XAUUSD OANDA:XAUUSD

Based on the current price structure and short-term bias, here are two tactical trade setups:

Sell Setup – If Price Rejects Resistance

Entry: 3,348 – 3,350 USD

Stop-loss: 3,357 USD

Take-Profit 1: 3,340 USD

Take-Profit 2: 3,335 USD

Take-Profit 3: 3,330 USD

Buy Setup – If Price Holds Support

Entry: 3,328 – 3,330 USD

Stop-loss: 3,320 USD

Take-Profit 1: 3,338 USD

Take-Profit 2: 3,340 USD

Take-Profit 3: 3,348 USD

Important: Always set a stop-loss in every trade to manage risk effectively.

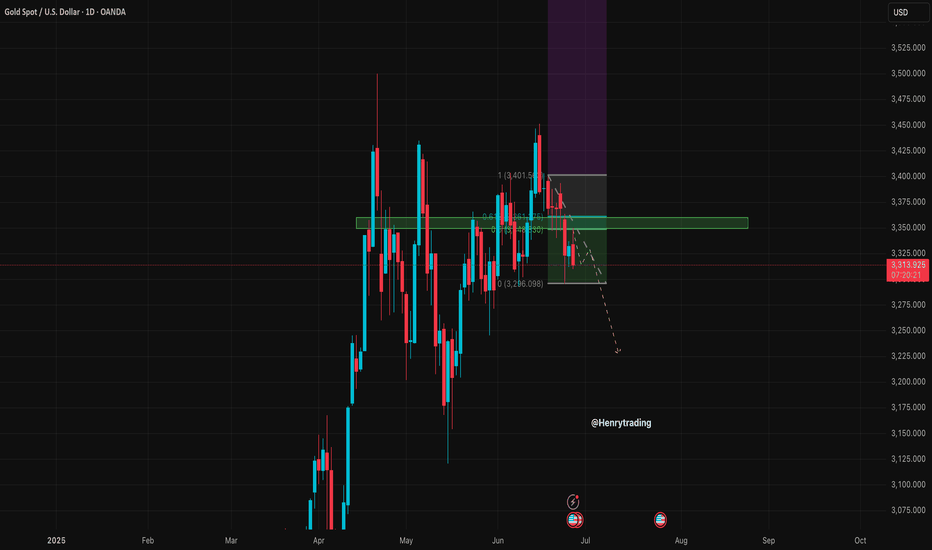

XAUUSD Trading Strategy for June 26–27, 20251. Market Overview

In today’s session (June 26, 2025), XAUUSD OANDA:XAUUSD (gold spot) is trading around 3,339.6 USD, posting a modest +0.22% gain compared to the previous day. The intraday range has been confined between 3,330 – 3,350 USD, reflecting a tug-of-war between buyers and sellers in this short-term equilibrium zone.

Following a recent corrective move, demand has reappeared around the 3,330 USD support. However, the recovery momentum is currently facing resistance near 3,350 USD, and the market will require a clear breakout to establish the next directional move.

2. Technical Analysis

Price Behavior

- Gold is moving sideways within the 3,330 – 3,350 USD range, which has acted as both support and resistance in recent sessions. It is also a high-liquidity zone, indicating indecision among market participants.

- The rebound from the 3,291 – 3,317 USD support zone is still ongoing, but there is no confirmation yet of a completed downtrend or trend reversal.

RSI Indicator

- The RSI (14) is currently fluctuating within the neutral zone (49–54), suggesting a lack of strong momentum in either direction.

- A sustained move above 55 could signal the return of bullish strength.

3. Key Technical Zones

Resistance:

- 3,350 USD: Frequently rejected intraday, immediate resistance to watch

- 3,373 – 3,392 USD: A major confluence of the Fibonacci 0.618 retracement and previous supply zone from last week

Support:

- 3,330 USD: Intraday support and equilibrium zone

- 3,291 – 3,317 USD: Strong structural support in case of further pullback

4. Trading Strategy for XAUUSD OANDA:XAUUSD

Based on the current price structure and short-term bias, here are two tactical trade setups:

Sell Setup – If Price Rejects Resistance

Entry: 3,348 – 3,350 USD

Stop-loss: 3,357 USD

Take-Profit 1: 3,340 USD

Take-Profit 2: 3,335 USD

Take-Profit 3: 3,330 USD

Buy Setup – If Price Holds Support

Entry: 3,328 – 3,330 USD

Stop-loss: 3,320 USD

Take-Profit 1: 3,338 USD

Take-Profit 2: 3,340 USD

Take-Profit 3: 3,348 USD

Important: Always set a stop-loss in every trade to manage risk effectively.

Ps: XAUUSD remains in a short-term consolidation phase, oscillating within a narrow range of 3,330 – 3,350 USD. A breakout beyond this range will likely define the market's direction heading into the New York session. Traders are advised to monitor price action closely within these levels and wait for clear confirmation before executing any positions.

Stay tuned for more daily gold strategies, and don’t forget to save this analysis if it helps refine your trading plan.

Analysis by @Henrybillion