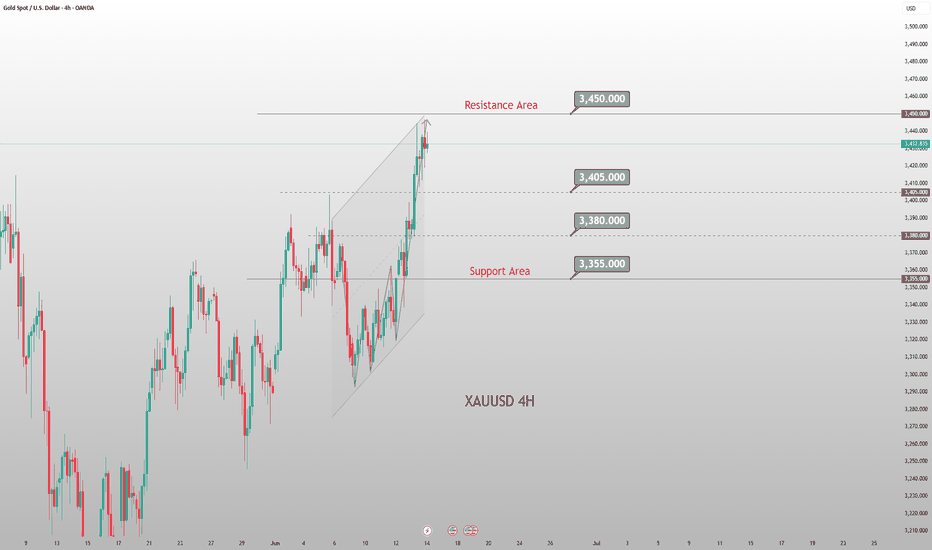

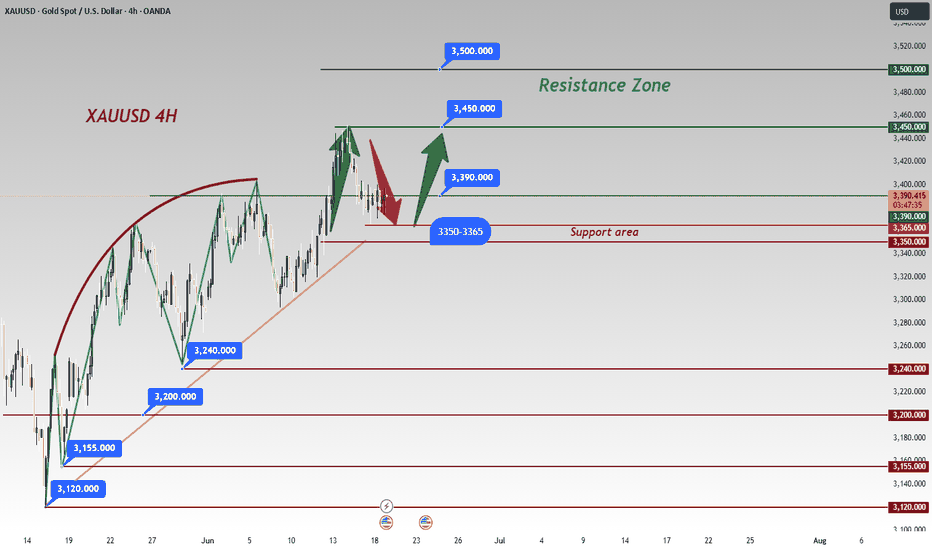

Middle East tensions rise; gold may hit new highs next weekThe Middle East situation has continued to escalate over the weekend, indicating that gold may witness a rally at Monday's opening. On Friday morning, risk aversion surged rapidly, pushing the gold price to around 3,444, followed by a pullback. During the European session, the price quickly retreated to around 3,408 before rebounding—our strategy to go long near 3,410 at the time proved profitable. In the U.S. session, gold mounted a second rally, peaking at around 3,446 before entering a pullback and consolidation phase. However, from a fundamental perspective, the overall trend remains bullish; thus, buying on dips remains the primary trading approach.

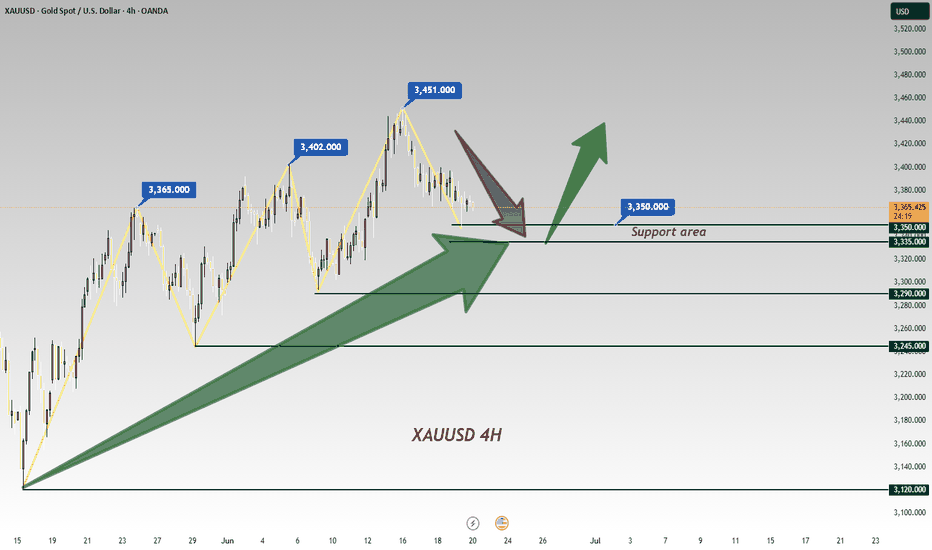

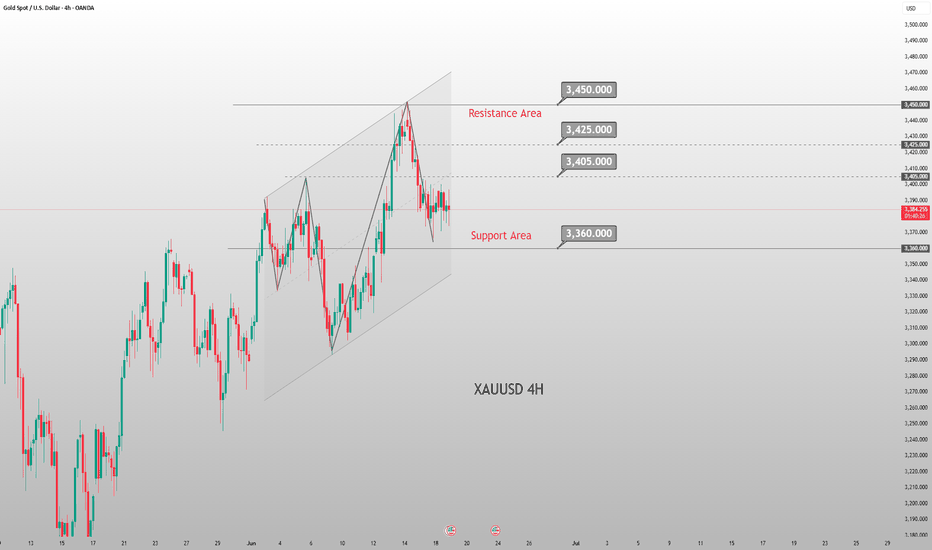

From a 4-hour technical view, immediate support lies in the 3,405–15 range, with key support at the recent resistance-turned-support zone near 3,375–80. When gold pulls back, traders should focus on longing near these levels. The critical bullish pivot for short-term traders has shifted up to the 3,345–50 zone; as long as gold holds above this level on the daily time frame, the dip-buying strategy should be maintained.

XAUUSD

buy@3405-3415

tp:3340-3360

Investment itself is not the source of risk; it is only when investment behavior escapes rational control that risks lie in wait. In the trading process, always bear in mind that restraining impulsiveness is the primary criterion for success. I share trading signals daily, and all signals have been accurate without error for a full month. Regardless of your past profits or losses, with my assistance, you have the hope to achieve a breakthrough in your investment.

Xauusdbuy

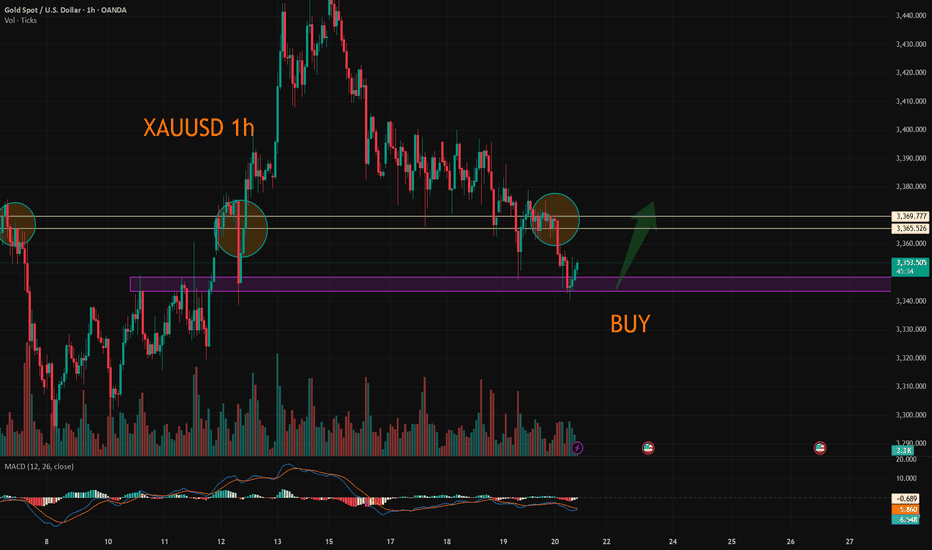

XAUUSD Trading Signals: Buy Dips at 3335-3345 Amid Bear Trap💡 Trading Framework In-Depth Analysis:

The Fed's policy statement failed to stir volatility (markets had fully priced in dovish expectations 💨);

Weekly market pattern: Asian sessions consistently saw rallies 📈, followed by profit-taking pullbacks in subsequent sessions 📉;

Tactical entry logic: Use intraday highs in Asian trading as resistance references for long positions 🎯.

📊 Technical Validation & Risk Anchors

⚠️ Key Warning: Geopolitical bullish signals ignored → classic "bear trap" characteristics (bear trap 🚫);

⏳ Timing Strategy: Asian session highs form ideal resistance levels—recommend entering on pullbacks to the 38.2% Fibonacci support level 🎯.

⚡️⚡️⚡️ XAUUSD Precision Trading Signals ⚡️⚡️⚡️

🚀 Long Entry Range: 3335-3345 (stop loss can be set below 3325)

🚀 Take-Profit Target Range: 3360-3370 (partial profit-taking at first target 3360 recommended)

📢 Service Value-Added Notes

✅ Core trading signals updated daily in the morning (validated across 4-hour/daily double-timeframes);

✅ Refer to signal logic at any time during trading for sudden situations 🧭 (with historical win-rate statistics attached);

🌟 Wishing you smooth trading Next week — seize pullback opportunities to position 👇

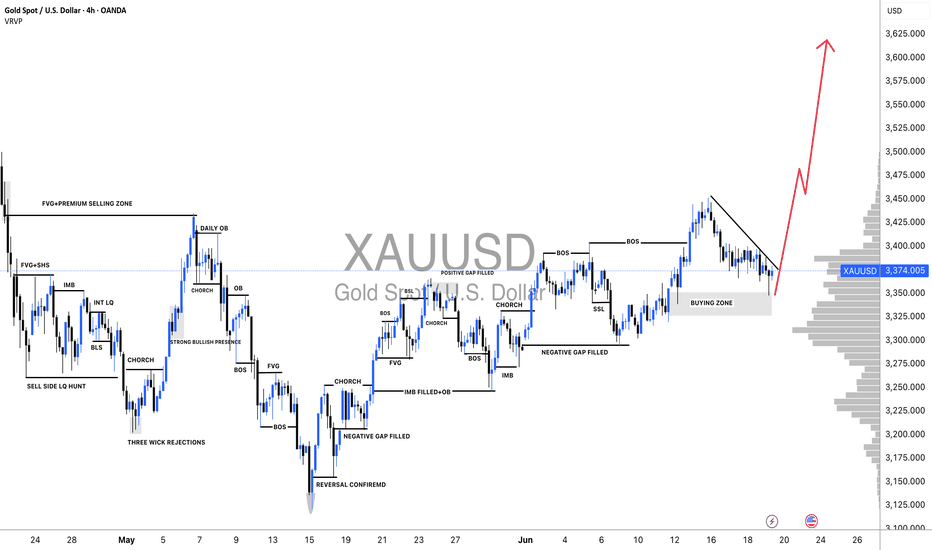

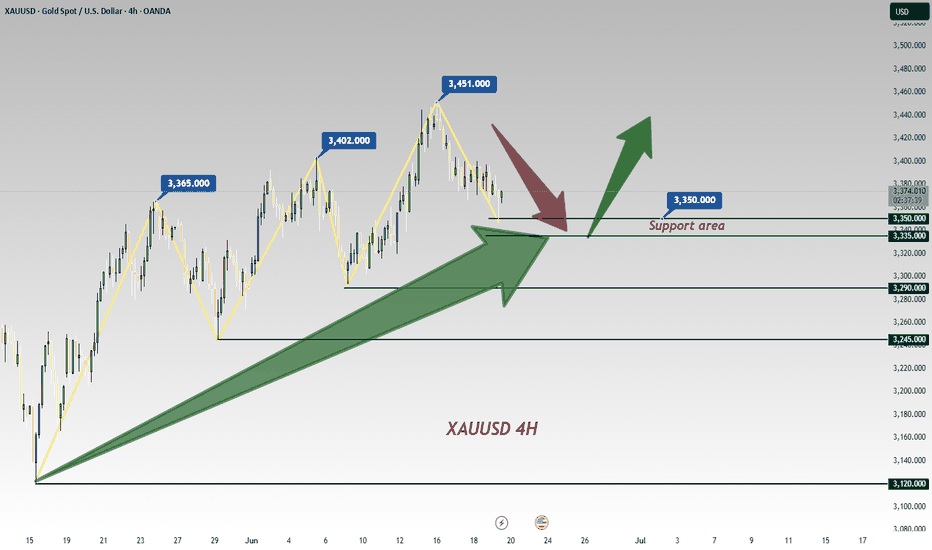

GOLD H4 Chart Weekly Update For 23 - 27 June 25Hello Traders,

welcome to the weekly update, as you can see that market was in range last week

as for now 3400 Psychological remains in focus if market breaks 3400 successfully the GOLD will rise towards 3440

only breaks below 3330 GOLD will leads towards 3250 possibly

FED Chair Powell Testifies due in the upcoming week

USPCE PRICE INDEX due on Friday

Disclaimer: Forex is Risky

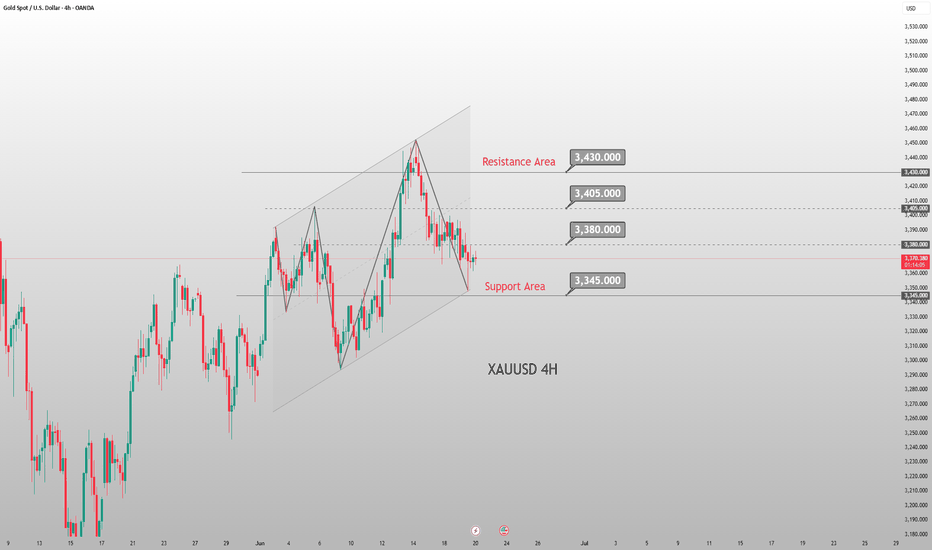

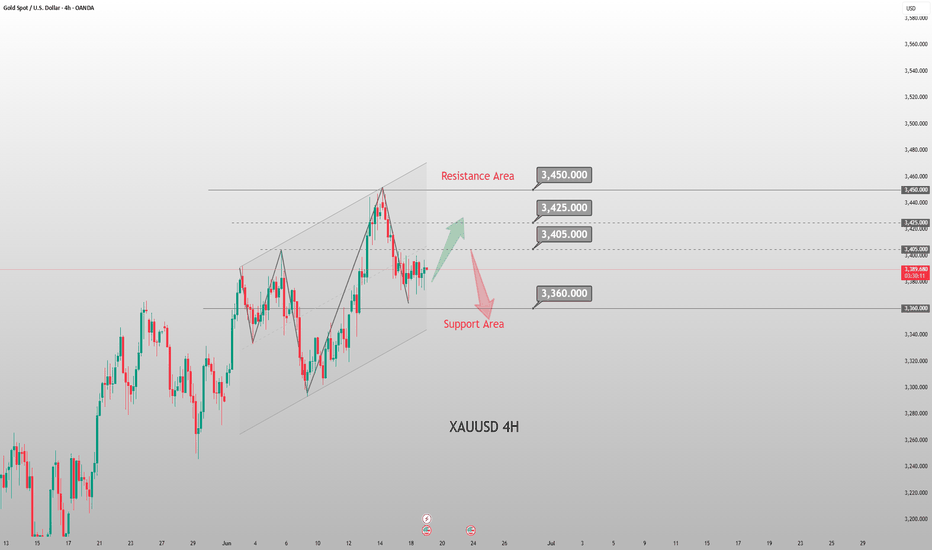

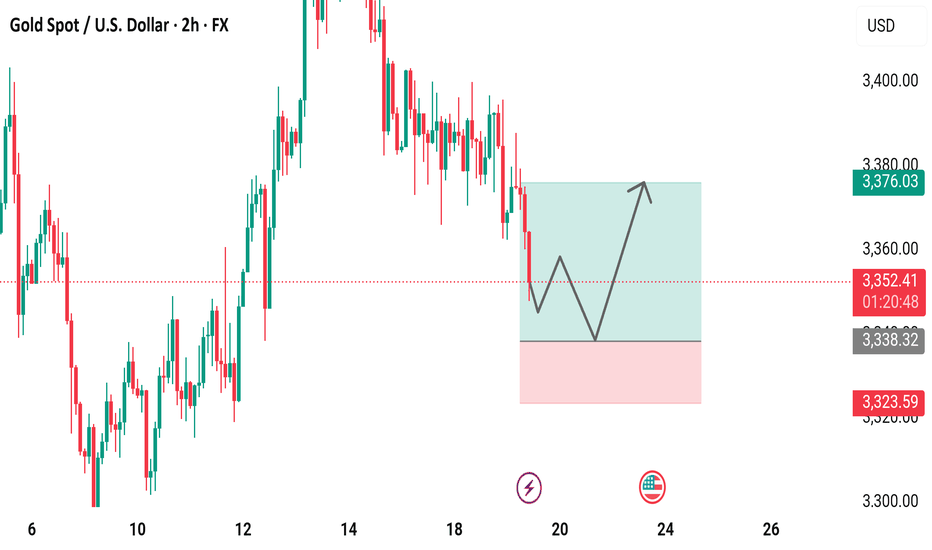

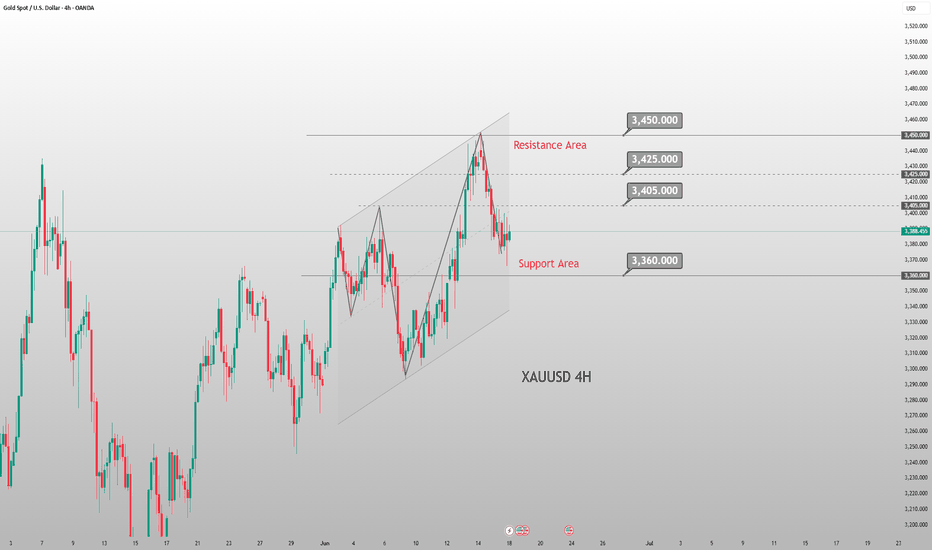

Gold Weekly Friday Trend Analysis and Trading RecommendationsOn Thursday, gold maintained a sideways trend, currently trading near $3,370. It hit a low of $3,347 and then rebounded immediately, while yesterday's Federal Reserve interest rate decision had little impact on market volatility. Since Monday, when bearish forces were stronger than bullish ones, the gold market has been seeing equalized bullish and bearish forces, consolidating as it waits for the next stimulus direction.

Once it stabilizes above $3,400 again, there is likely to be an inflection point, and it will gradually rise to test the upper track at $3,460–3,470. At the 4-hour level, it is currently under pressure at the middle track of $3,405, with support at $3,345.

Gold may break out of the current range on Friday. Intraday trading can focus on range operations between the support of $3,345 and the resistance of $3,400: when the gold price stabilizes above $3,360, you can lightly go long, with targets sequentially at $3,375 and $3,395; if it is resisted below $3,395, you can try to lightly go short.

XAUUSD

buy@3350-3360

tp:3380-3390-3400

Investment itself is not the source of risk; it is only when investment behavior escapes rational control that risks lie in wait. In the trading process, always bear in mind that restraining impulsiveness is the primary criterion for success. I share trading signals daily, and all signals have been accurate without error for a full month. Regardless of your past profits or losses, with my assistance, you have the hope to achieve a breakthrough in your investment.

XAUUSD:Go long before you go short

Yesterday's market is relatively fast, we pay attention to the stop profit point, today's Asian plate fell, technical point of view, this week after the big Yin, there is little strength of the rebound, often after the reverse draw will be recovered, the same down after the rapid counterattack, short-term overall performance for the shock downward trend, the center of gravity moving down.

The trading space is also gradually shrinking, within the day can be around 3340-3370 range to operate.

Trading Strategy:

BUY@3344-49

TP:3365-70

Consider going short at 3370-75

More detailed strategies and trading will be notified here ↗↗↗

Keep updated, come to "get" ↗↗↗

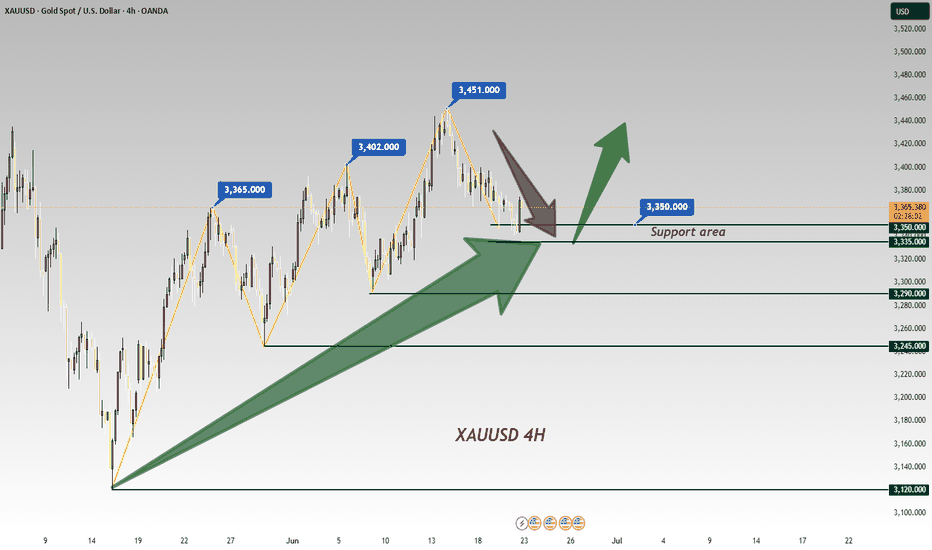

XAUUSD: Is Bullish Trend Ended? Or It is just beginning big moveAs we previously stated that price can reverse between 3340 to 3350 region, which was a pivotal point for bulls. Price smoothly moved currently trading at 3376 and possibly bullish move continuing towards 3400,3450 and ultimately reaching 3600.

Following the price’s all-time high at $3500, it experienced a sharp decline and failed to maintain that level. A substantial 2400 pips would have resulted in significant losses for many accounts. Initially, it was perceived as a minor correction, with the expectation of further price appreciation. However, this assumption proved incorrect. After reaching an even higher peak, the price invariably undergoes a more substantial correction.

At 3260, substantial bullish volume surged into the market, necessitated by the presence of a fair value gap. Subsequently, the price experienced a decline, reflecting the prevailing bearish trend, which favoured the bears. However, at 3200, a pivotal level representing a discounted price point, bull volume surged. This powerful bullish impulse propelled the price to 3432, ultimately confirming the bullish trend. AB=CD there recurring pattern emerged weekly. When the price reached the 3432 level as a fair value gap, the CD pattern commenced.

AB=CD we have identified a recurring pattern. It appears to be an equal move in any direction, and it has manifested precisely as anticipated. We were aware that the price would reject at 3120, and it did so accordingly. Currently, the market is in our favour. Upon market opening, it exhibited a positive gap, propelling the price to 3450. However, it subsequently declined, reaching 3384.

Presently, we find ourselves in the accumulation phase, poised for distribution. This distribution is anticipated to be substantial, potentially leading to another record high, potentially reaching 3650.

Moving forward, the price could continue towards our target from its current position. Alternatively, there exists a possibility that it may drain the sell-side liquidity and reverse from 3360-3370.

Our take-profit levels are set at 3450, 3490, 3520, and finally, 3600. When entering the market, it is advisable to employ a short time frame. It is important to note that this analysis is merely our opinion, and market conditions may deviate from expectations.

We extend our best wishes for success and safe trading. If you wish to demonstrate your support, you may consider liking, commenting, or sharing this analysis with others.

Sincerely,

Team Setupsfx_

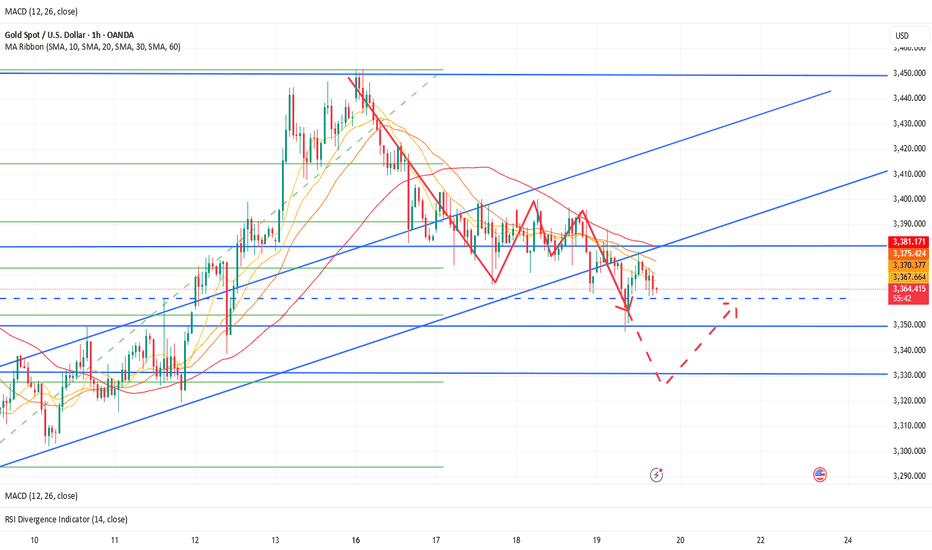

Gold Pullback: Bear Trap or Buy Dip?📊 Chart Analysis: A clear pullback within the established uptrend is visible, testing key support at —a healthy correction that reinforces the bullish structure.

🔍 News Contradiction🌍: Despite escalating Middle East tensions (typically a gold-positive catalyst), prices are trending lower—a classic bear trap scenario 🚫📉. This divergence underscores the importance of buying dips amid emotional sell-offs.

💡 Trading Framework:

Fed policy statement yesterday failed to spark volatility, as markets had already priced in dovish expectations 💨;

Weekly pattern: Asian sessions have consistently seen rallies 📈, followed by profit-taking pullbacks in later sessions 📉;

Tactical entry: Use intraday highs from Asian trading as resistance references for long positions 🎯.

Technical Confirmations:

Risk Warning: Geopolitical bullish signals being ignored suggests deliberate bearish manipulation (bear trap 🚫);

Timing Strategy: Asian session highs serve as ideal resistance markers—look to enter on retracements to 38.2% Fib levels 🎯

⚡️⚡️⚡️ XAUUSD ⚡️⚡️⚡️

🚀 Buy@ 3335 - 3345

🚀 TP 3360 - 3370

Accurate signals are updated every day 📈 If you encounter any problems during trading, these signals can serve as your reliable guide 🧭 Feel free to refer to them! I sincerely hope they'll be of great help to you 🌟 👇

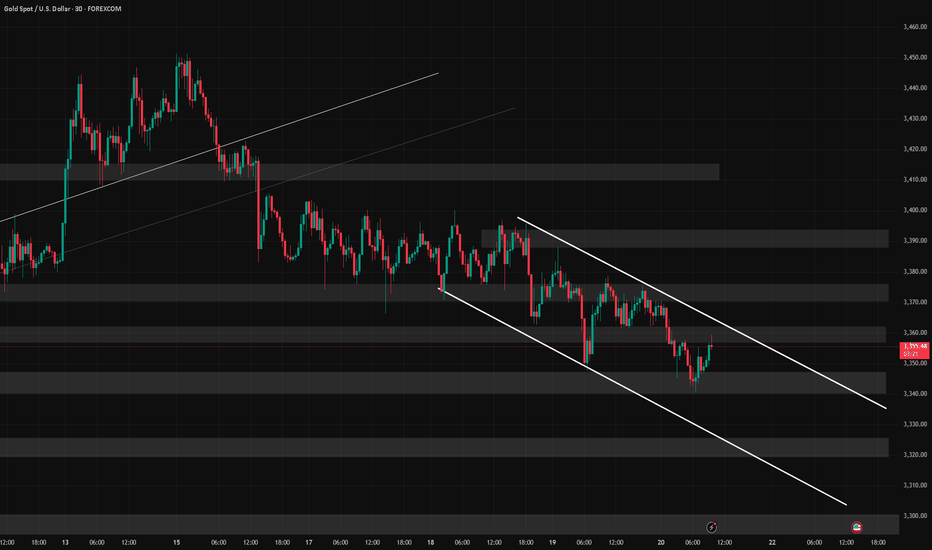

6/20 Gold Analysis and Trading SignalsGood evening, everyone!

After gold rallied to around 3388 yesterday, it began to retrace gradually, providing solid returns for our sell-side strategy.

As of now, gold has dipped to a session low near 3339. On the 30-minute chart, the MACD has formed a bullish crossover, and price has broken above the Bollinger mid-band, indicating short-term bullish momentum. The candle structure supports a potential rebound, but strong overhead resistance remains.

Key resistance comes from the 1H MA60 around 3371, and gold still trades within a broader bearish trend on the daily timeframe. While bulls may attempt a recovery, a complete trend reversal remains unlikely unless significant bullish catalysts emerge.

Hence, our strategy continues to favor selling near resistance levels, while cautiously considering long entries near well-defined supports.

📌 Trading Plan (VIP Focus):

✅ Sell Zone: 3370–3383

✅ Buy Zone: 3338–3321

✅ Flexible Trade Range: 3366-3349

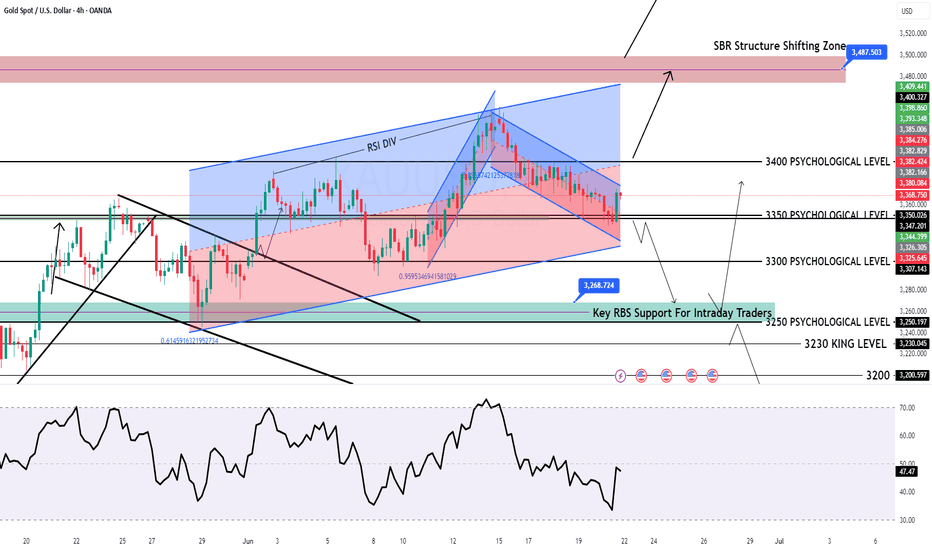

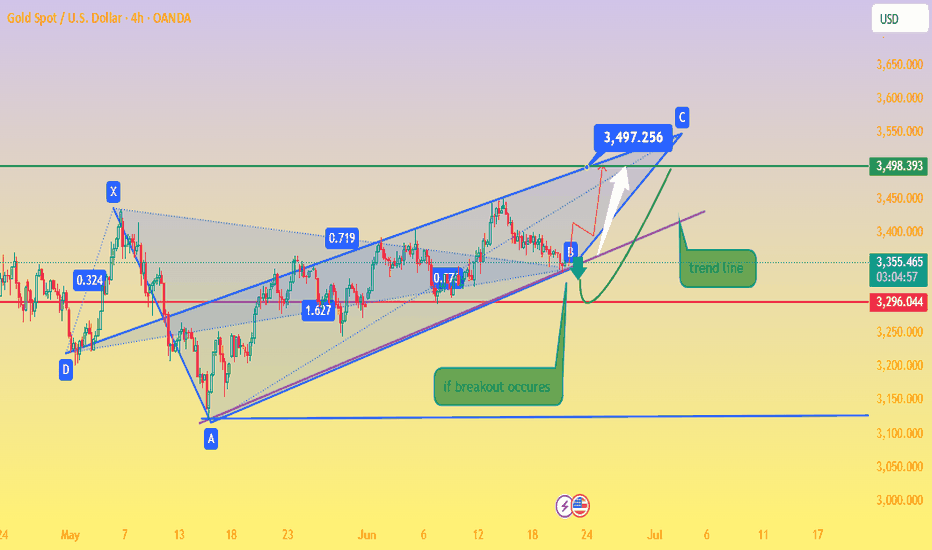

Gold Eyes Breakout from Ascending Channel Toward $3,500📈 Chart Analysis

1. Rising Channel Structure

Gold (XAU/USD) has been trading within an upward-sloping channel, marked by the blue trendlines connecting interior lows and highs, culminating at point C (~$3,497). The latest bounce off the lower channel near “B” reinforces bullish bias – if this trendline holds, another leg higher toward resistance around $3,497–$3,500 is likely.

2. Support & Resistance Confluence

The purple trendline and the dotted horizontal green level (~$3,498) converge near the projected breakout point. This synergy provides a strong pivot zone — a successful breakout would validate targets near channel highs.

3. Harmonic Pattern in Play

The chart displays a bullish harmonic structure (likely a Bat or Gartley formation), with retracement ratios (0.719, 1.627) anchoring reversal areas. These reinforce the bounce at B and the potential move toward point C.

4. Trade Scenarios

Bullish Scenario (primary): A bounce off the trendline triggers a rally to the channel top and resistance zone ($3,497–$3,500).

Bearish Caution: A drop below the trendline invalidates the pattern, potentially bringing prices back to horizontal support around $3,296 or even $3,120, as indicated at point A.

🛠️ Technical & Market Context

Technicals: Daily trend remains bullish as long as price holds above ~$3,340–$3,350, with resistance forming in the $3,380–$3,400 range

Fundamentals: Geopolitical tension (e.g., Middle East conflict) and safe-haven inflows continue to underpin gold — though Citi expects prices to eventually correct toward $3,300–$3,500 mid‑term

.

Sentiment: Some analysts advocate “selling the rallies,” especially into the $3,450–$3,500 zone . But central banks’ ongoing buying and potential Fed rate cuts support a stronger floor

.

✅ Trade Strategy

Scenario Entry Zone Target Stop Loss Placement

Play the Bounce ~$3,350–$3,360 $3,497–$3,500 Below trendline near B zone (~$3,320)

Breakout Trade On momentum above $3,400 $3,497–$3,550 Below breakout (sub-$3,380)

Bearish Trigger Break & close below trendline Back to $3,296 / 3,120 Just above trendline ($3,360)

🔍 Summary

Gold remains in a structurally bullish setup inside an ascending channel. The confluence of harmonic reversal, strong trendline support, and pending fundamental catalysts presents a high-probability opportunity to push toward the $3,500 area—provided the trendline and $3,340–$3,350 support hold. A drop below would invalidate the bullish outlook and favor deeper retracement.

Gold Pullback in Uptrend Amid Middle East Tensions: Buy the Dip?📊 Clearly visible on the chart: current pullback within an uptrend.

🔍 News paradox: Despite escalating Middle East tensions 🌍, gold is trending lower—a key reason to emphasize buying the dip recently (watch out for bear trap scenarios 🚫📉).

💡 Trading logic breakdown:

Fed statement yesterday caused minimal volatility (market expectations priced in 💨);

This week’s pattern: Asian session rallies 📈 followed by post-Asian pullbacks 📉;

Entry strategy: Use Asian session highs as resistance reference for entries 🎯.

Technical reinforcement:

Risk alert: Geopolitical bullishness ignored → classic bear trap signal (bear trap 🚫);

Timing: Asian session highs form intraday resistance 🎯—look to enter on retracement.

Chart says it all—normal pullback in an uptrend 📊. Ironically, while Middle East conflicts should be gold-positive 🌍, prices are moving lower—a textbook 'buy the panic' setup 🚀. Following this week’s playbook 📅 (Asian session highs followed by dips), focus on Asian session highs as a resistance anchor for entries

⚡️⚡️⚡️ XAUUSD ⚡️⚡️⚡️

🚀 Buy@ 3345 - 3355

🚀 TP 3370 - 3380

Accurate signals are updated every day 📈 If you encounter any problems during trading, these signals can serve as your reliable guide 🧭 Feel free to refer to them! I sincerely hope they'll be of great help to you 🌟 👇

The market is closed today. How to arrange gold in the evening?📰 Impact of news:

1. The interest rate remains unchanged and leads to new lows in the short term

2. Geopolitical tensions provide support for risk aversion

📈 Market analysis:

The market is expected to not fluctuate much today. Generally speaking, it is difficult to stand on one foot to form a short-term bottom. There should be a second wave of bottom exploration, a secondary low point, and then the bottom is explored and pulled up to break through the previous high point. Only then can the turning point be officially established and the decline end. Moreover, the 1H moving average is spreading downward. Therefore, in the short term, we still pay attention to the 3375-3385 line of resistance and the 3360-3355 line of support below.

🏅 Trading strategies:

SELL 3375-3385

TP 3365-3360-3355

BUY 3360-3355

TP 3370-3380-3405-3420

If you agree with this view, or have a better idea, please leave a message in the comment area. I look forward to hearing different voices.

TVC:GOLD FXOPEN:XAUUSD FOREXCOM:XAUUSD FX:XAUUSD OANDA:XAUUSD

Fed Rate Decision: Gold's 3,400 Threshold as Bull-Bear DivideToday, the market has consolidated in a range throughout the day, with neither price direction nor volatility breaking through the range. However, our trading approach proved accurate: short positions were initiated near 3,400 during rebounds, and long positions were entered near the key level of 3,370 during pullbacks. Investors following our strategy have achieved profits from both directions. With limited price movement currently, the Fed's interest rate decision due to land in an hour will become the core variable dominating the market trend for the rest of the month.

Currently, gold prices continue to trade below the 3,400 threshold, maintaining a weak market structure. The 3,400 level serves as a key watershed between bulls and bears, and the validity of its breakthrough will determine the trend inflection point: if prices effectively hold above 3,400 after the data release, it indicates that gold will break out of its weak pattern, with the potential for an accelerated rally ahead. Conversely, if prices remain suppressed below 3,400, it is highly likely to trigger further downward exploration. It is recommended to closely monitor the breakthrough signal at the 3,400 threshold after the data release, using this as the operational basis for trend switching.

XAUUSD

buy@3370-3380

tp:3400-3420-3450

Investment itself is not the source of risk; it is only when investment behavior escapes rational control that risks lie in wait. In the trading process, always bear in mind that restraining impulsiveness is the primary criterion for success. I share trading signals daily, and all signals have been accurate without error for a full month. Regardless of your past profits or losses, with my assistance, you have the hope to achieve a breakthrough in your investment.

XAUUSD:Today's Trading Strategy

Yesterday, gold prices fluctuated greatly in the US, and around 3400 has become an important pressure level at present. If you want to short, you can consider 3395-3400. At present, the price is near 3362, and the trading idea is mainly long first.

Trading Strategy:

BUY@3357-62

TP:3375-80

↓↓↓ More detailed strategies and trading will be notified here ↗↗↗

↓↓↓ Keep updated, come to "get" ↗↗↗

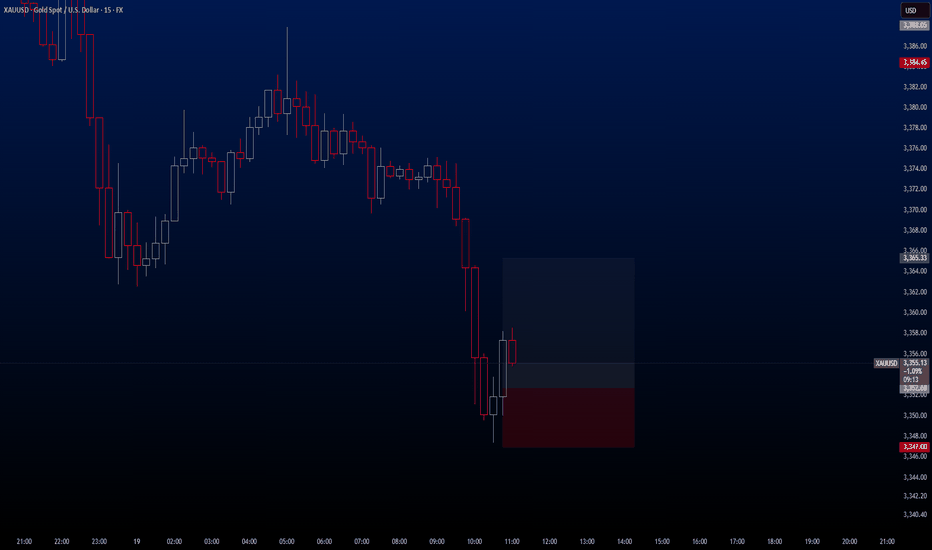

XAUUSDAnother trade for today is once again from Gold—no surprises there! 😊

My strategy has just signaled a buy opportunity on the precious metal, and I wanted to share this setup with you as well.

🔍 Trade Details

✔️ Timeframe: 15-Minute

✔️ Risk-to-Reward Ratio: 1:2

✔️ Trade Direction: Buy

✔️ Entry Price: 3374.92

✔️ Take Profit: 3384.32

✔️ Stop Loss: 3370.21

🔔 Disclaimer: This is not financial advice. I’m simply sharing a trade I’ve taken based on my personal trading system, strictly for educational and illustrative purposes.

📌 Interested in a systematic, data-driven trading approach?

💡 Follow the page and turn on notifications to stay updated on future trade setups and advanced market insights.

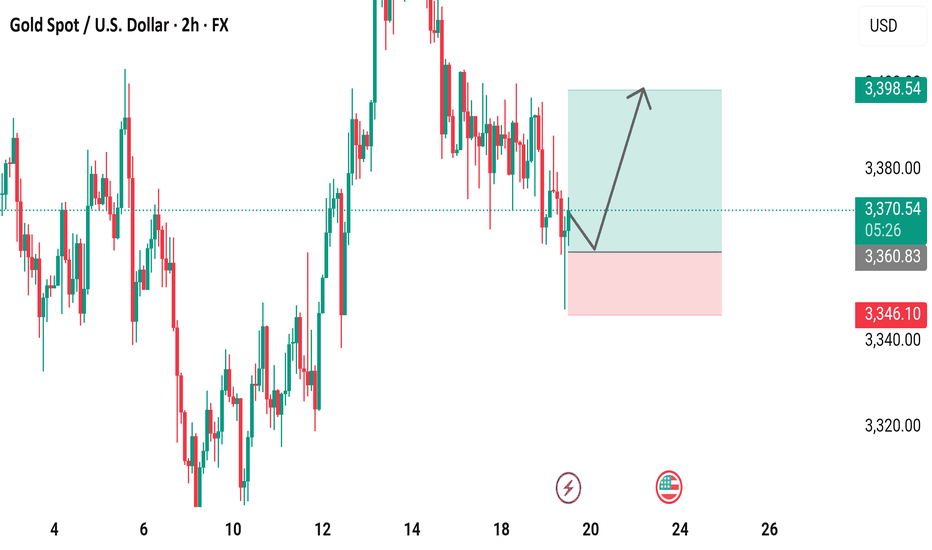

XAU/USD 2-Hour Chart Analysis: Bullish Breakout in Progress2-hour candlestick chart of the Gold Spot/U.S. Dollar (XAU/USD) currency pair, displayed on TradingView, a popular trading platform. The chart tracks price movements over a period from the 4th to the 26th, with each candlestick representing a 2-hour interval. The price levels, shown on the y-axis, range from 3,320.00 to 3,398.54 USD, while the x-axis marks the corresponding dates. The current price is 3,370.55 USD, up by 1.61 points (+0.05%), highlighted in green to indicate a positive change. Green candlesticks represent bullish (upward) price movements, while red ones indicate bearish (downward) trends, offering a clear view of market dynamics.

XAUUSD Hello traders,

There is a great opportunity for a buy trade on the XAUUSD pair, and I wanted to share it with you as well.

🔍 Trade Details

✔️ Timeframe: 15-Minute

✔️ Risk-to-Reward Ratio: 1:2

✔️ Trade Direction: Buy

✔️ Entry Price: 3352.68

✔️ Take Profit: 3365.33 / TP 2 / 3369.93

✔️ Stop Loss: 3347.00

🔔 Disclaimer: This is not financial advice. I’m simply sharing a trade I’ve taken based on my personal trading system, strictly for educational and illustrative purposes.

📌 Interested in a systematic, data-driven trading approach?

💡 Follow the page and turn on notifications to stay updated on future trade setups and advanced market insights.

Gold Spot / U.S. Dollar (XAUUSD) 2-Hour Chart2-hour chart displays the price movement of Gold Spot (XAUUSD) against the U.S. Dollar, showing a current price of $3,352.73 with a decrease of $16.20 (-0.48%) as of 01:22:11. The chart highlights a recent downward trend following a peak, with a shaded area indicating a potential support or resistance zone around $3,360 to $3,400. Key price levels are marked, including $3,400.00, $3,376.03, and $3,323.59, with candlestick patterns reflecting market volatility.

6/19 Gold Analysis and Trading SignalsGood morning!

Yesterday, the Federal Reserve's interest rate decision aligned with market expectations, bringing no major surprises. The market had already priced in bearish sentiment in advance, which led gold to trade within the Bollinger Bands' upper, middle, and lower bounds, with all three bands trending sideways, indicating limited intraday volatility.

🔍 Technical Overview:

On the 30-minute chart, the Bollinger Bands began to tilt downward near the close, with price currently pressured by the middle band;

However, MACD structure suggests the middle band may be broken, with potential for price to challenge the upper band resistance near 3392–3400;

More importantly, on the 1D chart, the MACD is showing signs of a bearish crossover (death cross). If confirmed, it may break the bullish structure, weakening support from the weekly MA5;

If gold sustains below the weekly MA10 at 3317, it could open the door for a broader correction, with a drop toward 3200 becoming increasingly likely.

📊 Fundamental Factors:

Today’s U.S. market holiday means fewer economic data releases. As such, gold will likely be driven by technical structure and geopolitical headlines, especially those related to the Middle East. If no new developments emerge, selling on rallies remains the preferred strategy.

📌 Trading Plan (VIP-Focused):

✅ Sell Zone: 3392–3409

✅ Buy Zone: 3338–3321

✅ Scalp/Flexible Zones: 3387 / 3373 / 3364 / 3356 / 3345

Current Gold Trend Analysis and Trading RecommendationsOn Wednesday, the morning strategy suggested going long on gold at 3,375-3,365, perfectly seizing the pullback low and rebounding to the 3,400 level as expected. Today, there is also the Fed interest rate decision. Before the data release, short positions can be taken if the 3,400-3,405 level remains unbroken. If the 3,405-3,410 level is broken, we will continue to be bullish. Gold is in short-term oscillation, so try not to chase the market. Wait for a good entry opportunity. The upper level has also been repeatedly contested recently, and the Fed data is likely to break the range after its release.

For gold, continue to adopt an oscillating approach. In the 4H cycle, it is operating below the middle band. The short-term range is 3,405-3,365. If it breaks above 3,405, it can continue to target 3,420 and 3,450. Conversely, if it breaks below 3,365, it can fall to 3,350. In operation, prioritize long positions with short positions as a supplement, and adjust the strategy when a breakout occurs.

XAUUSD

buy@3370-3375

tp:3390-3400-3420

sell@3395-3400

tp:3380-3370

Investment itself is not the source of risk; it is only when investment behavior escapes rational control that risks lie in wait. In the trading process, always bear in mind that restraining impulsiveness is the primary criterion for success. I share trading signals daily, and all signals have been accurate without error for a full month. Regardless of your past profits or losses, with my assistance, you have the hope to achieve a breakthrough in your investment.

Expect gold to break 3400 for 3430 post-FedIn recent years, after the U.S. economy was hit by a round of high inflation, inflation data has gradually shown signs of easing 📉. Logically, the weakening inflation pressure should have paved the way for the Federal Reserve (Fed) to cut interest rates, but surprisingly, the Fed has chosen to remain on the sidelines and maintain its high-interest-rate policy ⚖️. The Fed's decision to keep rates high has had a significant impact on gold prices and the U.S. dollar 💱. First, high interest rates typically push up the U.S. dollar exchange rate, thereby dampening gold demand 💰↓.

Gold's price movement this week deviated from market news or expectations 📉≠📢. Driven by geopolitical conflicts, gold rallied on Friday 📈, and the momentum continued to simmer over the weekend, leading to a gap-up opening on Monday followed by a steady decline 📉. On the hourly timeframe, the low points are gradually shifting downward, with 3,400 becoming a short-term resistance level 📊. Although gold fell from 3,452, it is clearly oscillating around 3,380 🔄

I think the Fed's interest rate decision this time may cause gold to directly break through 3400 and reach around 3430 🌟📈

⚡️⚡️⚡️ XAUUSD ⚡️⚡️⚡️

🚀 Buy@ 3380 - 3385

🚀 TP 3400 - 3430

Accurate signals are updated every day 📈 If you encounter any problems during trading, these signals can serve as your reliable guide 🧭 Feel free to refer to them! I sincerely hope they'll be of great help to you 🌟 👇

Long Trade Setup: XAUUSD 🟡 Trade Setup: XAUUSD (Gold Spot / U.S. Dollar)

Timeframe: 1H

Bias: Bullish Reversal

Type: Liquidity Trap Breakout

Instrument: Gold / USD

---

🧠 Step 1: Market Context

Gold has been in a downtrend, forming consistent lower lows. Recently, it broke below a key support level, making it appear like further downside is coming. However, price has since moved sideways, suggesting loss of bearish momentum.

---

🎯 Step 2: Liquidity Trap Detected

This breakdown below support seems to be a false move, possibly engineered to:

Trigger stop-losses below the previous low

Attract sellers expecting further downside

Create sell-side liquidity for institutions

This pattern is known as a liquidity trap or stop hunt.

---

📏 Step 3: Confirmation from Price Action

A descending trendline breakout is visible on the 1H timeframe.

Price broke out, retested the trendline, and is now showing bullish candles.

This signals potential accumulation and trend reversal.

---

💼 Step 4: Trade Details

Entry: 3,393.73

Target (TP): 3,500.41

Stop Loss (SL): 3,351.50

Risk to Reward Ratio: ~2.5:1

This trade offers a solid risk-managed setup, ideal for intraday to short-swing traders.

---

🔍 Step 5: What to Watch For

Watch for bullish continuation above 3,400.

If price closes above 3,420, breakout buyers may join in.

If price drops below 3,375, exit and reassess.

---

📌 Summary

This trade banks on the idea that smart money is accumulating positions while retail traders are trapped short. The risk-reward ratio is favorable, and technical signals align for a potential upside move.

XAUUSD, Gold analysis, Liquidity trap, Stop hunt, Trend reversal, Technical analysis, Gold breakout, Smart money move

#XAUUSD #Gold #Breakout #LiquidityTrap #TechnicalAnalysis #SmartMoney

#Forex #TradingView #GoldAnalysis #PriceAction #TrendReversal #RiskReward

Current Gold Trend Analysis and Trading RecommendationsOn Tuesday, gold dipped to around $3,374 in the early trading session, then rebounded to the intraday high. In the U.S. trading session, it is currently quoted at about $3,388, approaching the psychological level of $3,400. From the 4-hour chart of gold, the current upward momentum remains intact. The support below is focused on around $3,350, and the strong support is highlighted in the $3,350-$3,330 area, which is also the position of the 5-week moving average. Only by breaking the $3,350 area is there hope to reverse the trend and fall completely. If it does not break here, the bulls may still repeat.

Regarding the current trend, gold tends to continue to test the bottom and then rebound, maintaining a large range of sweeping. In terms of operation, it is recommended to go long when gold rebounds to the vicinity of 3370-3360, with the target looking at the 3490-3400 range. The short strategy is to go short near 3400, with the target looking at the 3370-3350 line.

XAUUSD

buy@3370-3360

tp:3390-3400

sell@3395-3400

tp:3370-3350

Investment itself is not the source of risk; it is only when investment behavior escapes rational control that risks lie in wait. In the trading process, always bear in mind that restraining impulsiveness is the primary criterion for success. I share trading signals daily, and all signals have been accurate without error for a full month. Regardless of your past profits or losses, with my assistance, you have the hope to achieve a breakthrough in your investment.

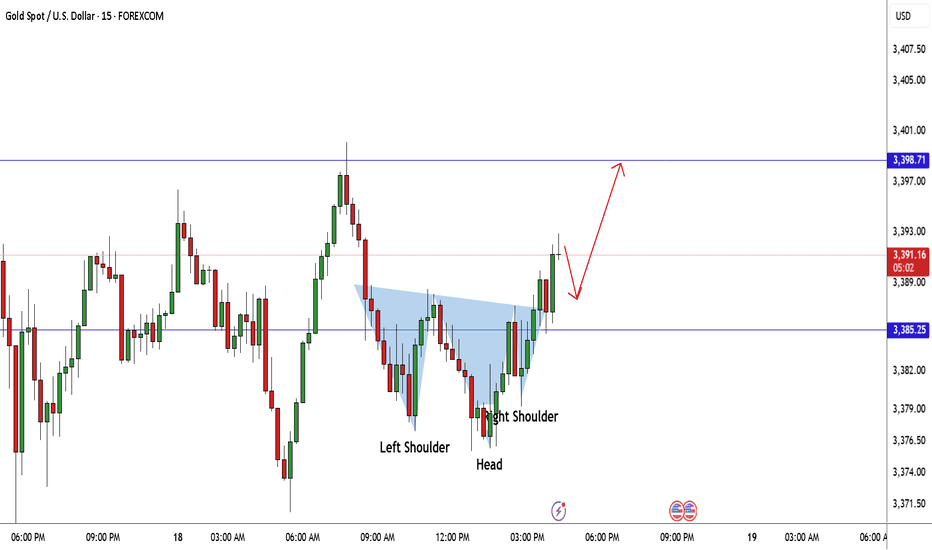

GOLD Made Inverted H&S Pattern , Long Scalping Ready !Here is my 15 mins chart on gold and we have a reversal pattern , ( inverted head & shoulders ) and we have a clear closure above our neckline so we can buy it to get the target and then wait for the news tonight and then decide the new direction after news effect .