5/22 Gold Trading SignalsGood afternoon everyone!

Yesterday's trading session was a bit bumpy, but in the end, we achieved considerable profits.

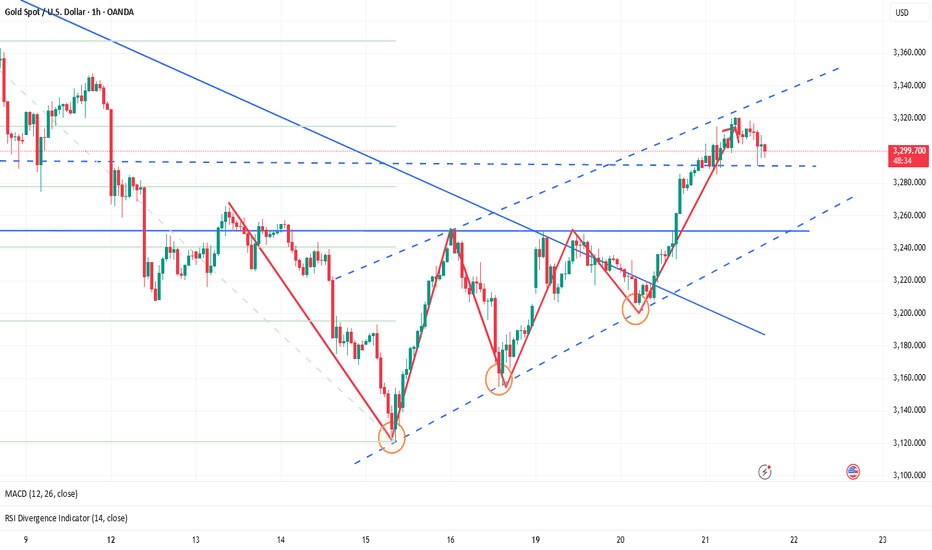

Today, gold rose to around 3346 and then began to pull back. It is now approaching the 3300 support level.

🔍 From a technical perspective, the candlestick structure and several indicators suggest that bears may still attempt further downside:

Primary support area: 3288–3276 — if this holds, a rebound is expected, with resistance around 3309–3316.

Secondary support area: 3263–3248 — if it breaks lower, watch for a short-term bounce around 3276-3282.

📰 On the news front, Initial Jobless Claims and PMI data will be released today. These could trigger short-term volatility.

📌 Trading strategy for today includes two key scenarios:

If the data is bearish for the dollar and gold drops to 3253, look for buy opportunities.

If the data is bullish and gold rises to 3358, it's a good spot to sell into strength.

📈 Today’s Trading Recommendations:

📉 Sell near 3358–3372 (Resistance zone)

📈 Buy near 3263–3248 (Support zone)

🔁 Flexible intraday levels: 3253 / 3268 / 3277 / 3286 / 3298 / 3309 / 3316 / 3328 / 3348

Wishing everyone a smooth trading day. Feel free to leave a comment if you have any questions—I’ll get back to you as soon as possible.

Xauusdbuy

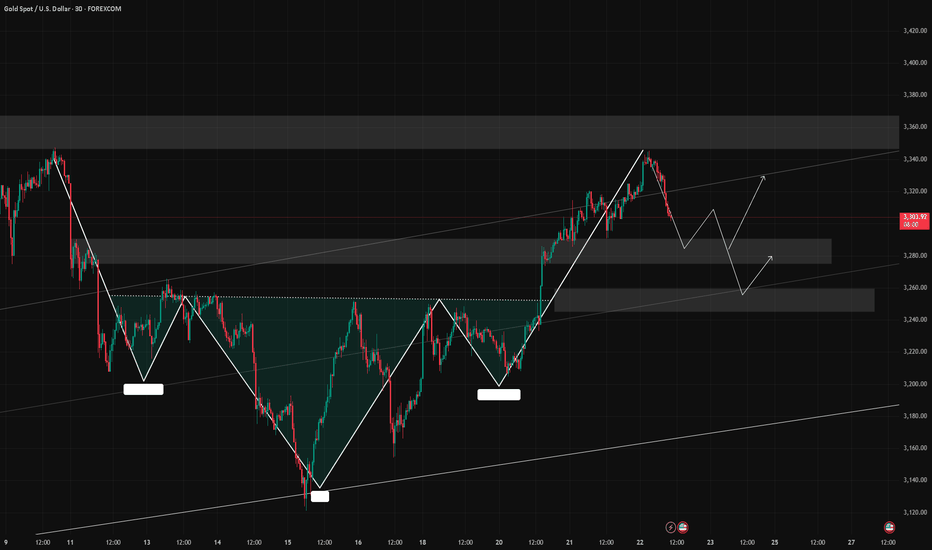

Intraday volatility,there is still chance to go long on pullback🗞News side:

1. The situation in Israel escalates

2. Initial jobless claims data

📈Technical aspects:

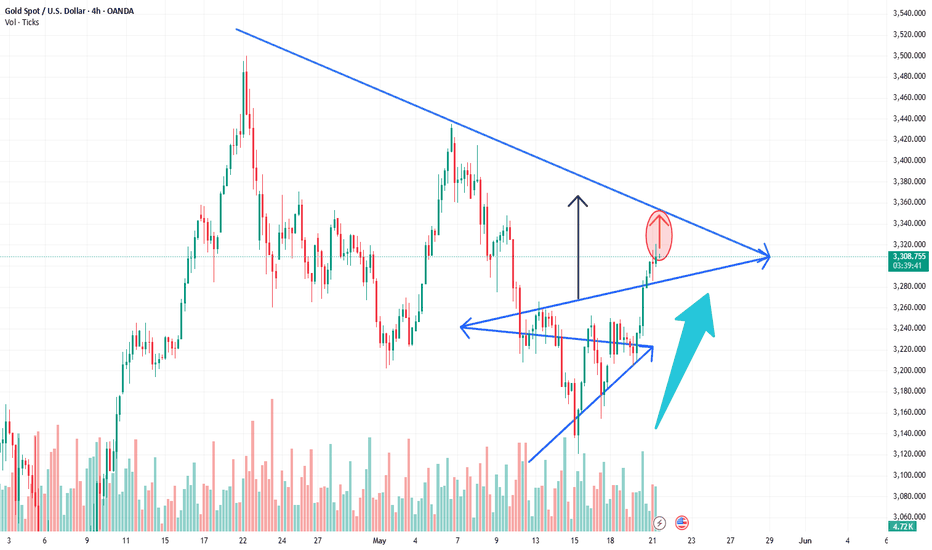

Influenced by recent news, gold showed a volatile rebound trend. Gold continued to rise in the early Asian session, r OANDA:XAUUSD eaching a high of around 3345. The 3290-3300 level below has absolute support in the short term. As long as it does not fall below 3290, you can go long at 3290-3300. In the 4H cycle, the Bollinger opening and the moving average diverge upwards. The upward momentum is sufficient, and it is not easy to guess the top. Pay attention to the 3310-3300 line of support below, and pay attention to the suppression of the 3340-3350 area above. If the gold price stabilizes at 3350, it is expected to further explore the resistance of 3360-3370. If the European session falls into volatility, maintain the range of high selling and low buying, and consider going long when it retreats to the support level of 3320-3310.

If you agree with this view, or have a better idea, please leave a message in the comment area. I look forward to hearing different voices.

FOREXCOM:XAUUSD FXOPEN:XAUUSD TVC:GOLD FX:XAUUSD

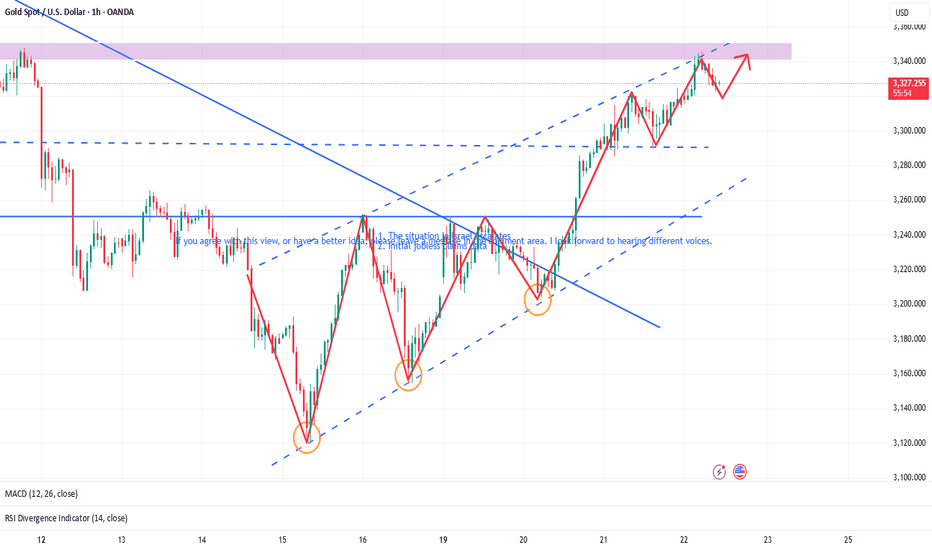

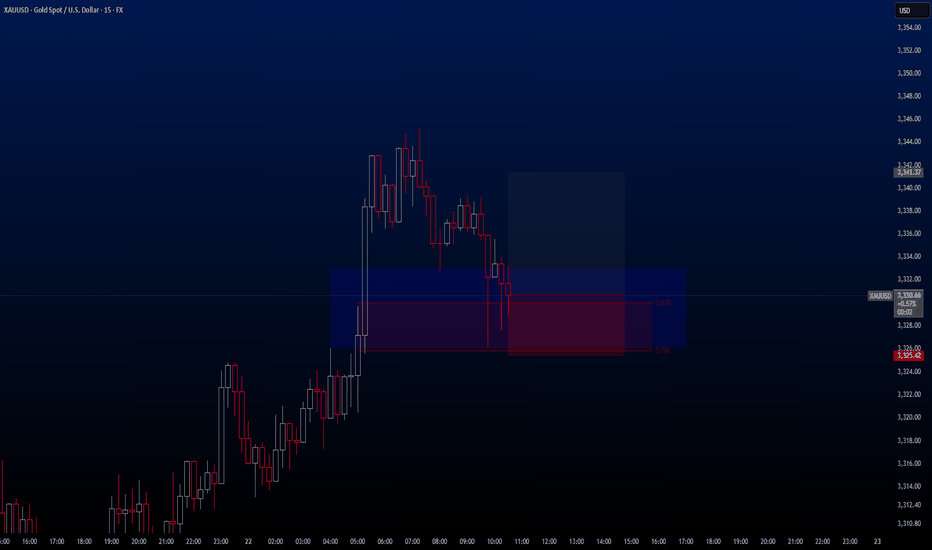

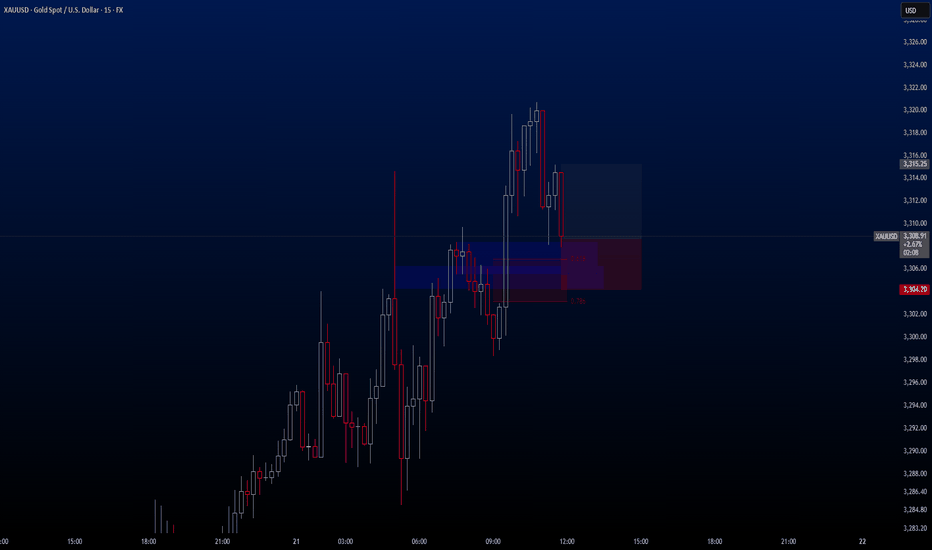

XAUUSD✅ Second Trade of the Day – XAUUSD

The second trade of the day comes from Gold (XAUUSD).

Just like BTC, gold has shown strong bullish momentum in recent days. I’m looking to take advantage of this minor pullback within the broader uptrend — a classic continuation setup on the 15-minute chart.

🔍 Trade Details:

✔️ Timeframe: 15-Minute

✔️ Risk-to-Reward Ratio: 1:2

✔️ Trade Direction: Buy

✔️ Entry Price: 3330.72

✔️ Take Profit: 3341.37

✔️ Stop Loss: 3325.42

🔔 Disclaimer: This is not financial advice. I'm simply sharing a trade I'm personally taking based on my own system, strictly for educational and illustrative purposes.

📌 If you're interested in a more systematic and data-driven trading approach:

💡 Follow the page and enable notifications to stay updated on future trade setups and advanced market insights.

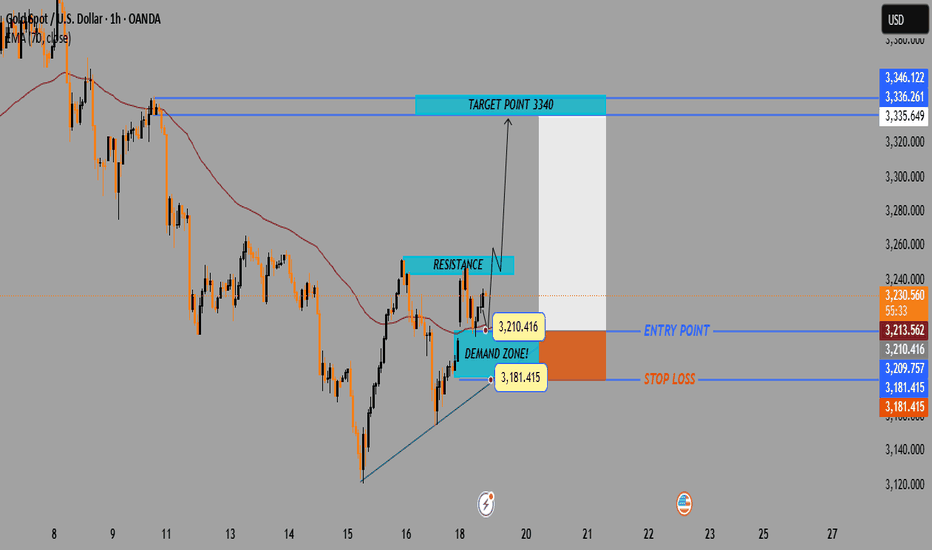

Gold 1-Hour Breakout Play • 3 210 3 340 • R : R 1 : 4🔍 Quick Chart Take

* 📉 Overall trend: down (still under the 200-MA)

* 🔺 Pattern forming: ascending triangle / wedge ➡️ potential breakout

📦 Zones

* 🟢 Demand / Entry: 3 181 – 3 210

* 🚧 Resistance cap: 3 235 – 3 250

* 🎯 Target: 3 340

⚔️ Trade idea

* ✨ Long at 3 210

* 🛑 Stop-loss 3 181

* 🏆 Take-profit 3 340

* 📏 R : R ≈ 1 : 4

👀 Watch for

* ✅ 1-h close above 3 250 ➡️ breakout confirmed

* ❌ Break of rising trendline or dip under 3 181 ➡️ idea dead

* 🗓️ Upcoming USD news (flag icon) & Dollar Index moves

🔑 Bottom line: Bullish pop inside a bigger bear trend—momentum play, keep the stop tight!

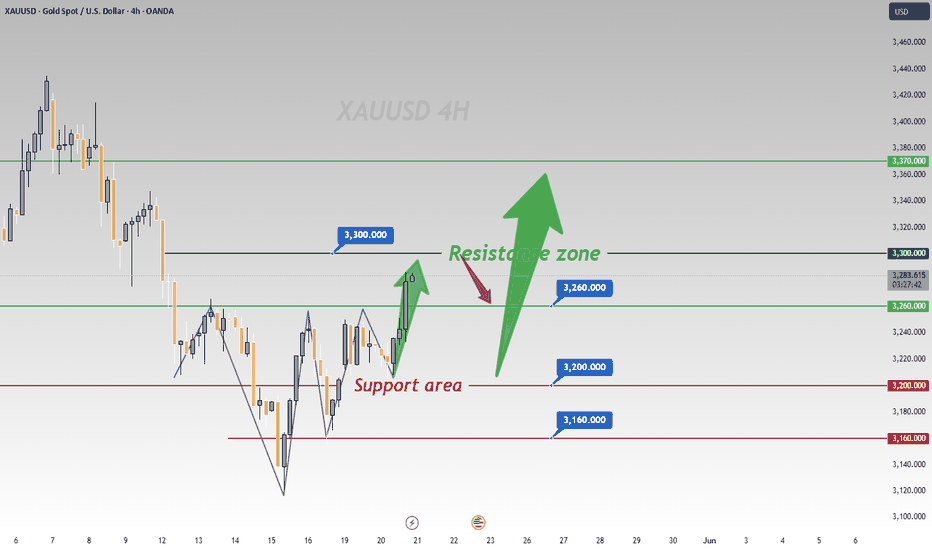

How to arrange after gold falls into consolidation🗞News side:

1. US officials said Trump's statement was related to the Golden Dome Project, which may affect the flow of funds

2. The tension in the Middle East has intensified, and the risk aversion sentiment has increased, which is good for gold

3. Although the withdrawal of Indian and Pakistani troops has eased the regional situation, geopolitical risks still exist

4. Trump mentioned the tax bill, which affected economic expectations and affected gold investment sentiment to a certain extent.

📈Technical aspects:

At present, gold is in consolidation, and the upward trend is slightly stagnant. From the hourly chart, there are signs of downward correction after the upward test of 3320. In the short term, the upper 3320 line has a certain suppression, so gold may test the support again and then rise after stabilizing. Then the first support below is the 3292 line, followed by the 3285 line. If it falls below, it may test the two key support points of 3273 and 3265. The current trend is not clear. In the future trading, we will wait patiently for the gold price to stabilize before entering the market.

If you agree with this view, or have a better idea, please leave a message in the comment area. I look forward to hearing different voices.

OANDA:XAUUSD FX:XAUUSD TVC:GOLD FXOPEN:XAUUSD FOREXCOM:XAUUSD

7 Gold Trades That Banked Over $2,500 LAST WEEK – Steal My StratMy strategy is straightforward: I trade order blocks, target premium/discount zones, and capitalize on liquidity sweeps. When these three signals align on the chart, I enter without hesitation.

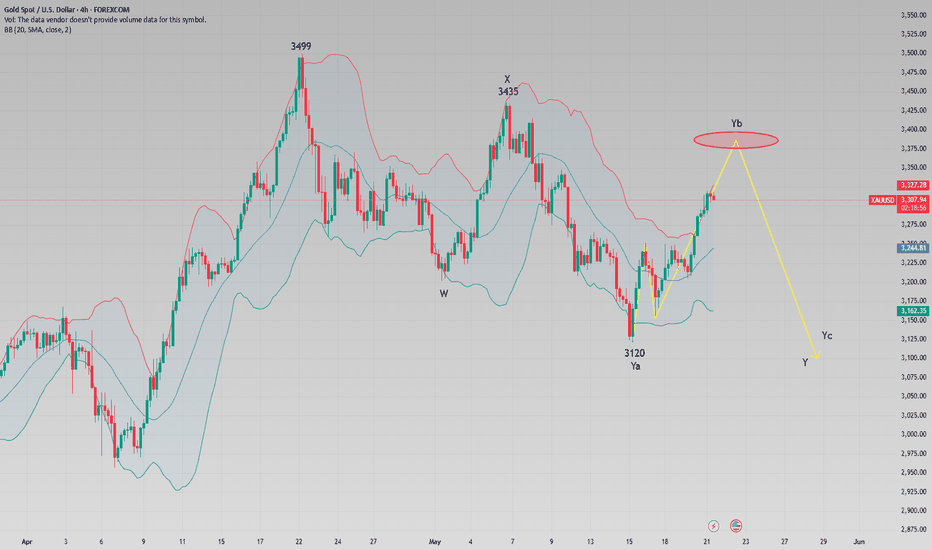

Gold triggered a strong reaction off a bullish order block at $3192-3120 after forming it on May 15th( also can be seen as STB), confirming a robust uptrend and a global reversal from a deep discount zone( can be seen on 4h time frame). For the bullish momentum to solidify, price must break and close above $3250

So i will keep an eye on GOLD chart and prefer long trader to shorts

Gold is rising strongly, can it retreat and go long today?🗞News side:

1. US officials said Trump's statement was related to the Golden Dome Project, which may affect the flow of funds

2. The tension in the Middle East has intensified, and the risk aversion sentiment has increased, which is good for gold

3. Although the withdrawal of Indian and Pakistani troops has eased the regional situation, geopolitical risks still exist

4. Trump mentioned the tax bill, which affected economic expectations and affected gold investment sentiment to a certain extent.

📈Technical aspects:

Yesterday we gave the view that there would be suppression at the 3290 level above, but affected by geopolitics, risk aversion sentiment rose again. Today, the moving average spread upward, and the Bollinger Bands opened and expanded, and the situation is still bullish. At present, we need to pay attention to the key short-term support level, focusing on the 3280-3285 support line. If the price retreats to this level and does not weaken, it can be considered as an opportunity for us to go long. If the resistance of 3320 is broken through strongly, the upper target will move up, and the lower support will also move up accordingly. 3300 will be converted into an entry opportunity for bulls to pull back. Therefore, we need to observe the price continuity in the European session. If the European session continues to break highs, the US session's correction will still be mainly based on long positions. During the day, it is recommended to wait for gold to retreat to 3290-3280 and try to arrange long positions, looking upward to 3320-3330.

If you agree with this view, or have a better idea, please leave a message in the comment area. I look forward to hearing different voices.

FOREXCOM:XAUUSD FXOPEN:XAUUSD TVC:GOLD FX:XAUUSD OANDA:XAUUSD

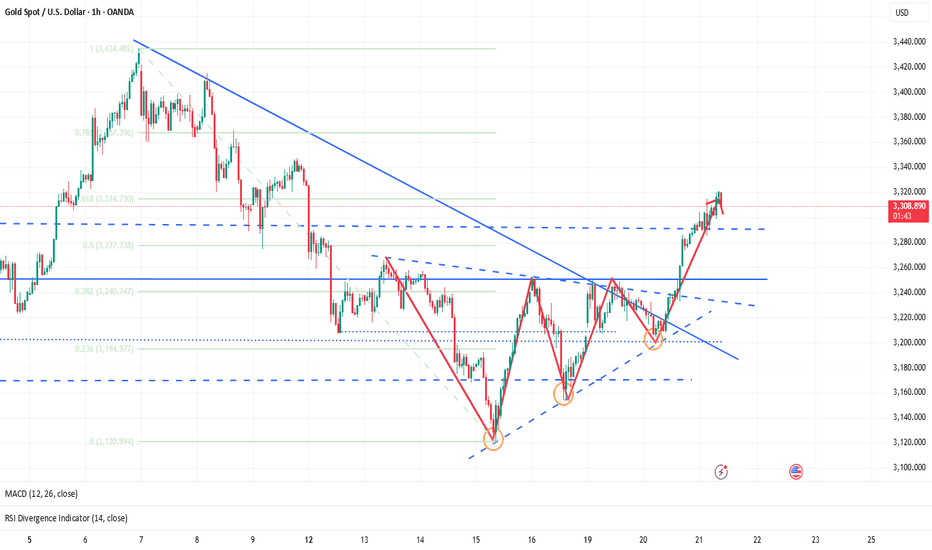

5/21 Gold Trading SignalsGood afternoon, everyone!

In yesterday’s trading, our buy-side positions performed well, but unfortunately, sell orders around 3280 weren't closed in time, resulting in a partial loss of profit.

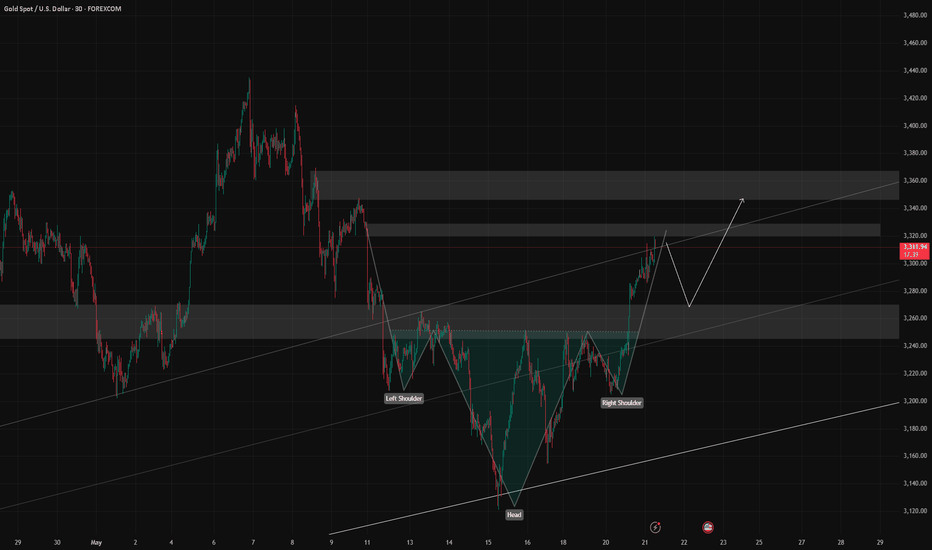

Today, gold has shown impressive strength, breaking above the 3300 level and forming an irregular inverse head-and-shoulders pattern. Technically, this implies further upside potential.

🔍 Based on price action and technical patterns, this rally could extend beyond 3330, and even test 3350+. However, the 3346–3369 zone marks a strong resistance band, making it an ideal zone for medium-term selling opportunities.

📉 On the downside, we identify the first major support at 3278, followed by the 3261–3246 zone.

📰 On the news front, several Fed officials expressed economic concerns in speeches early this morning. Meanwhile, reports of Israel preparing to strike Iran’s nuclear facilities fueled safe-haven demand, pushing gold strongly back above the 3300 mark.

📌 Today's Trading Strategy:

Sell between 3346–3373 (consider scaling in)

Buy between 3260–3243

Flexible trading in the zones: 3338 - 3326 - 3318 -3309 -3298 - 3288 - 3272

Lastly, a heartfelt thought:

Living in a peaceful country like China, it's truly heartbreaking to see so many innocent children suffering or even losing their lives due to war. Let us hope for peace soon—so all people may live safely, freely, and happily.

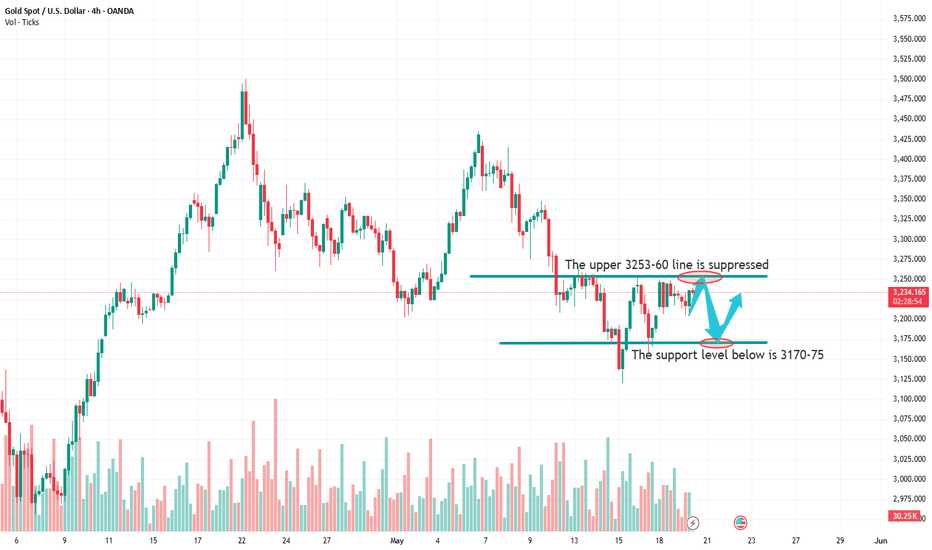

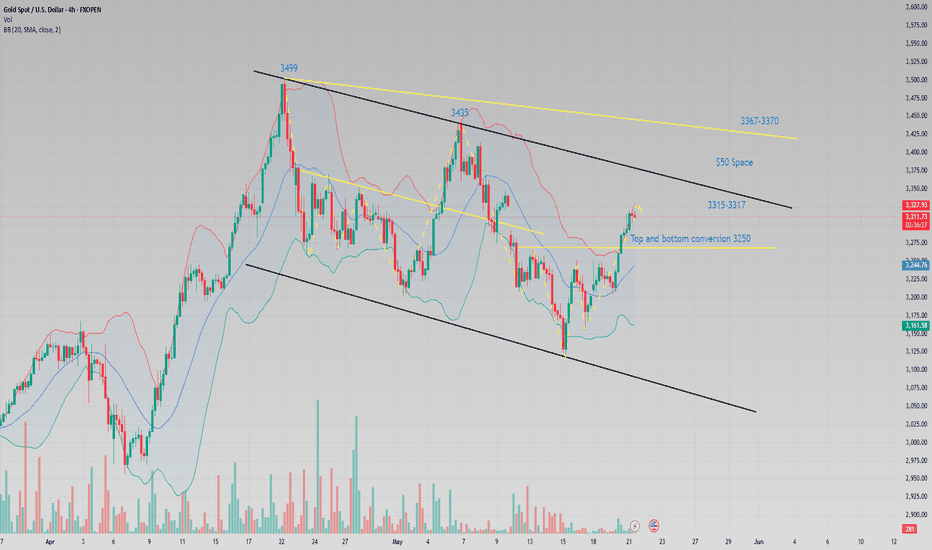

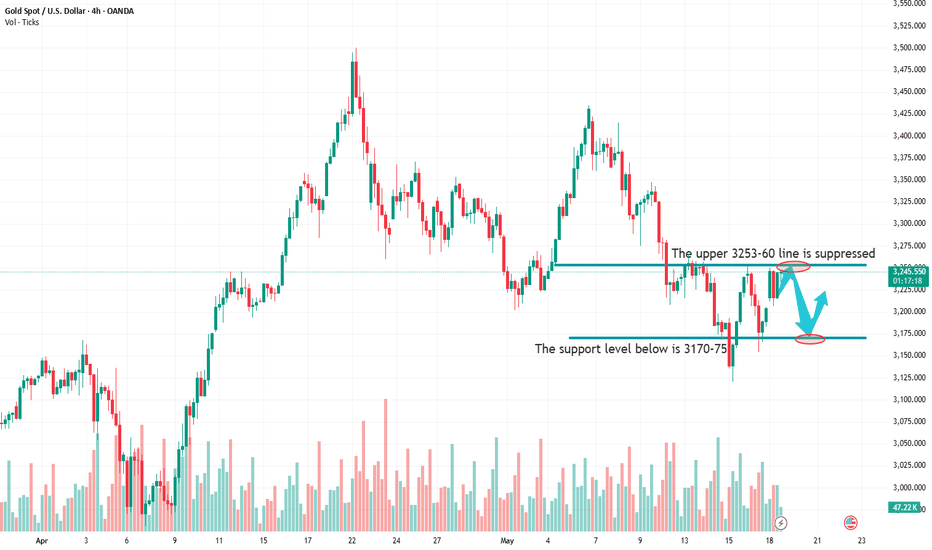

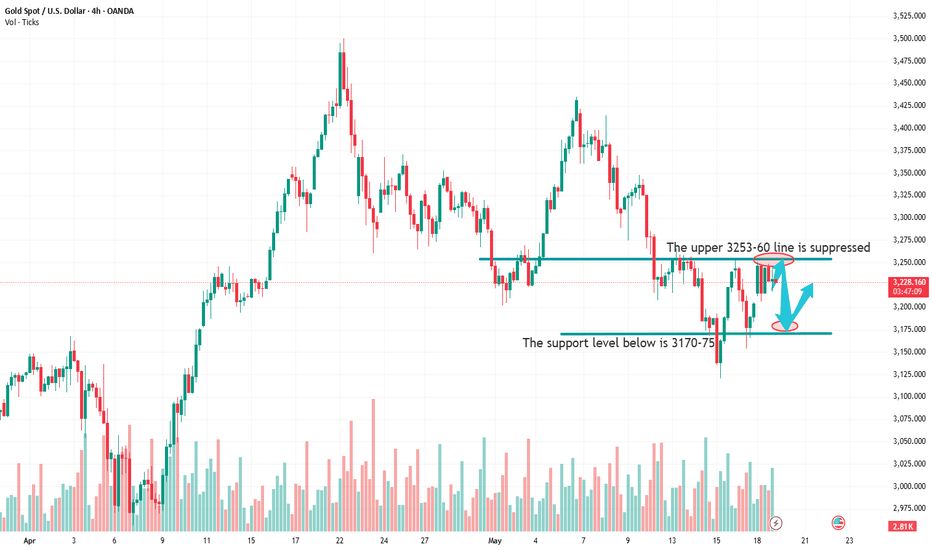

How to grasp the bottoming out and rebound of gold prices?Gold rebounded from 3229 today and then retreated from 3232. It rebounded from 3204. Gold fluctuated upward in the European session. So far, it has fluctuated from 3237. Our short position was successfully closed this morning. At present, we will focus on the short-term suppression at 3240-45 and the important suppression at 3253-60. If the rebound does not break, we will go short.

From the 4-hour line analysis, the support below continues to focus on 3170-75, with strong support at 3150. The short-term pressure above is at 3240-45, and the key pressure is around 3253-60. The overall support range is to maintain the main tone of high-altitude and low-multiple cycles. For the middle position, watch more and do less, and be cautious in chasing orders.

Gold operation strategy:

1. If gold rebounds to 3240-45, short it; if it rebounds to 3253-60, cover short position; stop loss 3266; target 3205-10; if it breaks, continue to hold;

2. If gold falls back to 3170-75, long it will be lightly long; if it falls back to 3150-55, cover long position; stop loss 3144; target 3226-3230; if it breaks, continue to hold

The latest gold operation strategyFrom a technical perspective, gold has been strong recently. Spot gold closed at $3,289.54 per ounce on Tuesday, and further broke through $3,300 in early trading on Wednesday, reaching a high of $3,304.06, a new high in more than a week. In the short term, gold prices need to break through the key resistance level of $3,370 to open up further upside space; $3,150 has formed a solid support below. If there are new variables in the geopolitical situation or economic data, gold prices may even challenge the $3,400 mark. Based on the current trend, the trading idea on Wednesday is clear: wait for the price to fall back and continue to intervene in long orders around 3,300, and maintain a bullish strategy.

Gold is recommended to go long in the 3300-3305 area, stop loss at 3292, target at 3315-3330

Gold trend analysis and operation ideasThe price of gold has been sweeping around the 3150-3250 area before, and then it repeatedly swept around the 3250-3200 range with 3250 as the suppression, and then directly hovered at a high level. The price continued to rise in the short term and rushed to the 3315 area, and then fell sharply by 30 US dollars to find 3285, and then continued to rise and break the high to the 3320 area. If it is strong, it will directly break through 3320 and further rise to find 3370. If it is a sweep, then the 3320 position will be tested repeatedly, and the pressure will fall back. This time the range is considered to be 50 US dollars, at least 30 US dollars. The space budget is around 50 US dollars, which is also the difficulty of the recent market. The start is 30-50 US dollars, and the process is not continued! At present, the price is hovering in the 3318-3320 area. The first pressure choice is here. We choose to use this as pressure to hold short orders, stop loss 3324, and suppress successfully to find 3300-3190, followed by 3170-3160.

Gold's short-term trend lays the foundation for an upward trendAfter breaking through 3280, gold has now risen to a high of 3320, and the expected trend and strength have all been completed. There is no need to overemphasize the trend of gold. The direction is definitely bullish, and the transaction is definitely long. The key is at what point to go long and where to go high.

Gold operation strategyGold can be said to be rather naughty today, Monday. It surged at the opening, hit the highest point of 3250 and then fell back to the lowest point of 3206. Many people in the market chased long positions at the highs of 3240-45. I believe the ending is also quite regrettable. Friends who follow me know that the 3240-53 above are all ideas for shorting. Don't chase long positions at high positions. After all, the important suppression of 3253-60 has not been broken. We shorted at 3230 and then covered our short positions near 3247. We have already taken all the profits out at 3234 and put them in the bag safely.

From the 4-hour line analysis, the lower support continues to focus on around 3170-75, the strong support is at the 3150 mark, and the upper pressure is around 3253-60. Relying on this range as a whole, the main tone of high-altitude and low-multiple cycles remains unchanged. In the middle position, watch more and do less, be cautious in chasing orders, and wait patiently for key points to enter the market.

1. Gold rebounds to 3253-60, short, stop loss 3266, target 3275-80, continue to hold if it breaks;

2. Gold falls back to 3170-75, long with light position if it does not break, fall back to 3150-55, long with cover position, stop loss 3144, target 3226-3230, continue to hold if it breaks

Rebound and short selling is still the main themeGold can be said to have fluctuated in a large range today, but the overall trend is more towards the short side. Although gold rose at the opening on Monday, it suddenly made a 360-degree turn at the 3250 line, which made those who were chasing the long position suddenly confused. We went short directly at the 3244 line and also went short near 3247 in the afternoon, and all of them made perfect profits. We have also analyzed gold. The pressure from above is relatively large, and the space above is relatively limited. On the contrary, the space below is relatively large, and rebound shorting is still the current short-term trend!

From the analysis of the 4-hour line, the support below continues to focus on the vicinity of 3170-75, the strong support is at the 3150 mark, and the pressure above is around 3253-60. The overall support range is to maintain the main tone of high-altitude low-multiple cycle participation. In the middle position, watch more and do less, and follow orders cautiously, and wait patiently for key points to enter the market.

Gold operation strategy:

1. Gold rebounds to 3243-50 line short, rebounds to 3255-60 line to cover short, stop loss 3266, target 3205-10 line, continue to hold if broken;

2. Gold falls back to 3170-75 line without breaking light position long, falls back to 3150-55 line to cover long, stop loss 3144, target 3226-3230 line, continue to hold if broken

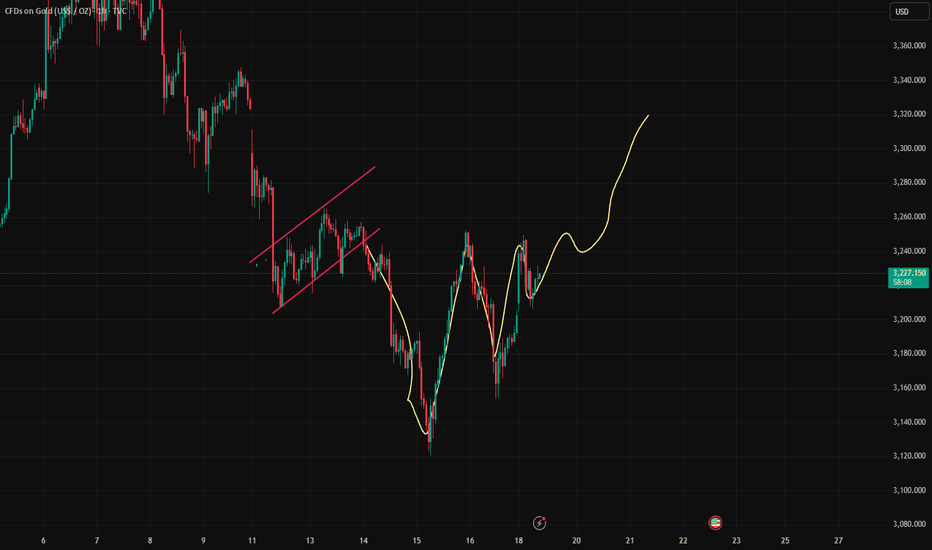

May 19. Trading opportunities in the London market.A new week of trading opportunities is about to begin.

There is a lot of news over the weekend. There is an increase in geopolitical uncertainty. This is undoubtedly a heavy news. At the same time, the instability of tariffs makes the trend of XAUUSD even stronger.

The current price around 3230 needs to be tested to see if it stabilizes. If not, choose a lower position to buy. If the current price can stabilize, buy directly.

Target 3245-3250

Share at least 4-5 accurate trading signals for trading every day.

More operating opportunities. Lower risk. Greater profit.

If you don’t know how to trade. Follow me.

XAUUSDGold kicks off the week with a strong bullish move — and the same applies to BTC, which is now getting very close to its all-time high.

Gold is also showing impressive strength, so despite being on a lower time frame, I’ve decided to activate a Buy position on XAUUSD.

🔍 Trade Details:

✔️ Timeframe: 15-Minute

✔️ Risk-to-Reward Ratio: 1:1.50

✔️ Trade Direction: Buy

✔️ Entry Price: 3308.62

✔️ Take Profit: 3315.25

✔️ Stop Loss: 3304.20

🔔 Disclaimer: This is not financial advice. I'm sharing a trade I'm personally taking based on my own strategy, strictly for educational and illustrative purposes.

📌 If you're interested in a systematic and data-driven approach to trading:

💡 Follow the page and enable notifications to stay updated on future setups, analysis, and strategic insights.

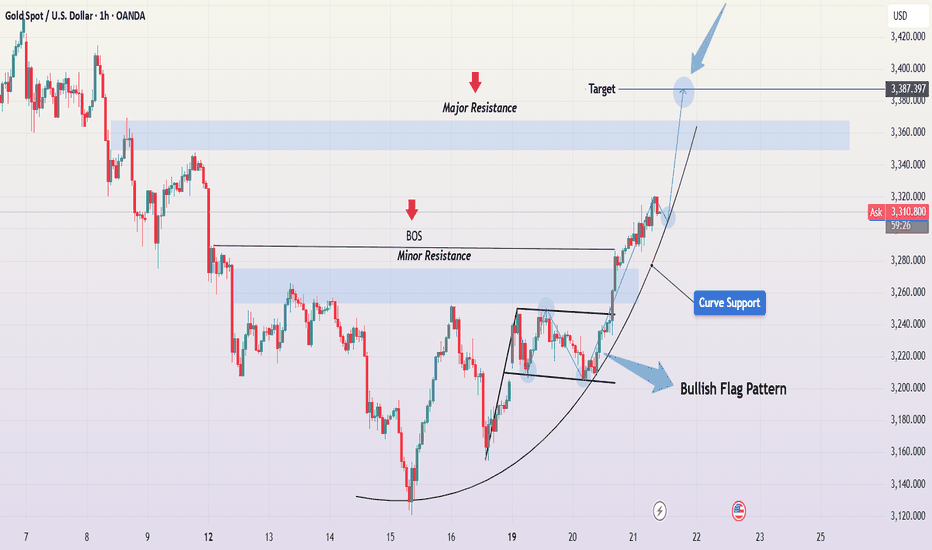

XAUUSD Breakout from Bullish Flag – Eyes on $3,387Gold (XAUUSD) on the 1H timeframe is exhibiting a strong bullish continuation setup, supported by multiple confluences that suggest the uptrend is far from over. The chart clearly shows the market breaking out from a Bullish Flag Pattern, respecting curve support, and targeting the major resistance zone near $3,387.

🔍 Technical Breakdown:

1. Bullish Flag Pattern Formation

After a sharp bullish impulse, price consolidated in a tight downward-sloping channel — the classic bullish flag. This pattern typically appears mid-trend and signals a healthy pause before the next leg higher. The breakout from the flag confirms bullish continuation, often offering a high-probability trade entry.

2. Break of Structure (BOS)

The breakout above minor resistance marked a Break of Structure (BOS), which is a key bullish signal. It indicates a shift in market sentiment and validates the end of the corrective phase (flag) and beginning of the next impulse wave.

3. Curve Support (Parabolic Trajectory)

A parabolic curve support is now guiding price upward, showing increasing bullish pressure and higher lows forming consistently. This type of dynamic support often appears in strong trending markets where buyers step in aggressively at every pullback.

4. Liquidity Sweep & Smart Money Behavior

Before the breakout, price dipped below recent lows within the flag, likely sweeping liquidity and triggering stop-losses. This move provided institutional players with the liquidity needed to push price higher — a classic smart money trap-and-break scenario.

5. Volume & Momentum Confirmation

The breakout occurred with strong bullish momentum and rising volume (if checked on the volume profile), reinforcing the credibility of this move. A momentum-based continuation is likely as long as price remains above previous resistance (now support).

🎯 Target & Resistance Levels:

Short-Term Target: $3,387 — aligned with the previous major resistance area

Support Zone: $3,260–$3,275 (previous flag breakout + structure support)

Major Resistance Zone: Around $3,360–$3,387 (historical supply zone)

🧠 Trade Idea / Strategy:

As long as price holds above the curve support and retests the previous breakout zone (flag top or minor resistance), bullish entries on pullbacks are favored.

✅ Buy on dips into curve support or minor resistance retests.

❌ Avoid shorting into a strong parabolic structure unless signs of exhaustion appear.

🎯 Potential RR setups: 1:2 and beyond if entry is timed well.

💬 Conclusion:

The market structure, pattern confirmation, and strong bullish momentum all point toward a continuation move toward the $3,387 level. This setup provides a solid technical case for bullish trades with multiple entry options and well-defined risk levels. Keep an eye on curve support and potential higher timeframe resistance reactions for dynamic trade management.

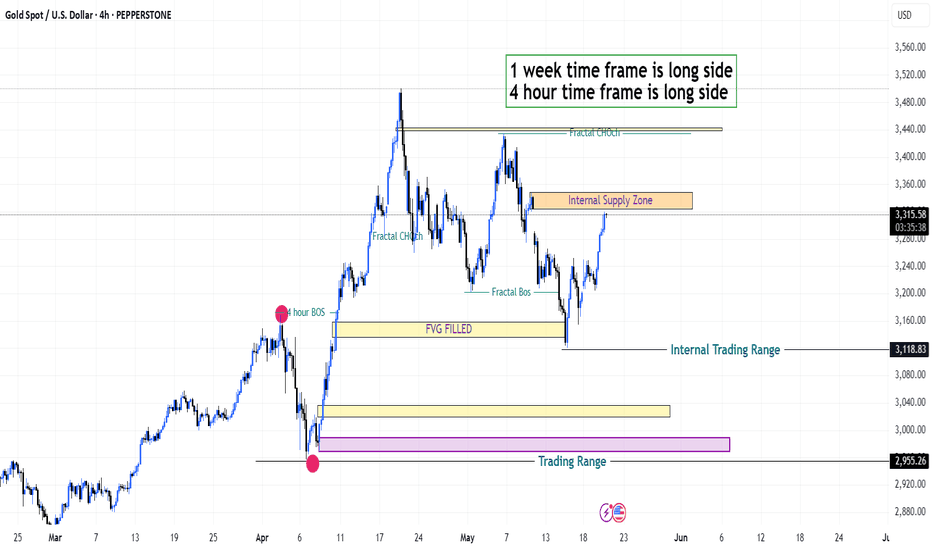

Gold is on bull or bear, let's see how it goes? {21/05/2025}Educational Analysis says that XAUUSD may give countertrend opportunities from this range, according to my technical analysis.

Broker - Pepperstone

So, my analysis is based on a top-down approach from weekly to trend range to internal trend range.

So my analysis comprises of two structures: 1) Break of structure on weekly range and 2) Trading Range to fill the remaining fair value gap

Let's see what this pair brings to the table for us in the future.

Please check the comment section to see how this turned out.

DISCLAIMER:-

This is not an entry signal. THIS IS FOR EDUCATIONAL PURPOSES ONLY.

I HAVE NO CONCERNS WITH YOUR PROFIT OR LOSS,

Happy Trading, Fx Dollars.

Gold Gains on US Credit Downgrade, Tax RiskTVC:GOLD OANDA:XAUUSD Gold (XAU/USD) surged to a one-week high of $3,306 on Tuesday, fueled by rising concerns over the U.S. economic outlook. The metal benefited from a weaker dollar, following Moody’s downgrade of the U.S. credit rating and renewed fears over President Trump’s proposed tax cuts, which could add $3–5 trillion to the national debt. Global risk sentiment also took a hit, with ongoing U.S.-Japan trade tensions and muted progress in U.S.-China talks.

Technically, gold is approaching key resistance at $3,306. A firm breakout above $3,306 would signal bullish continuation, while short-term support lies at $3,288 and $3,240. The RSI around 60 suggests consolidation may precede another push higher.

With central banks citing U.S. policy uncertainty and geopolitical risks lingering, gold’s safe-haven appeal remains intact.

Resistance : $3,306 , $3,364

Support : $3,288 , $3,240

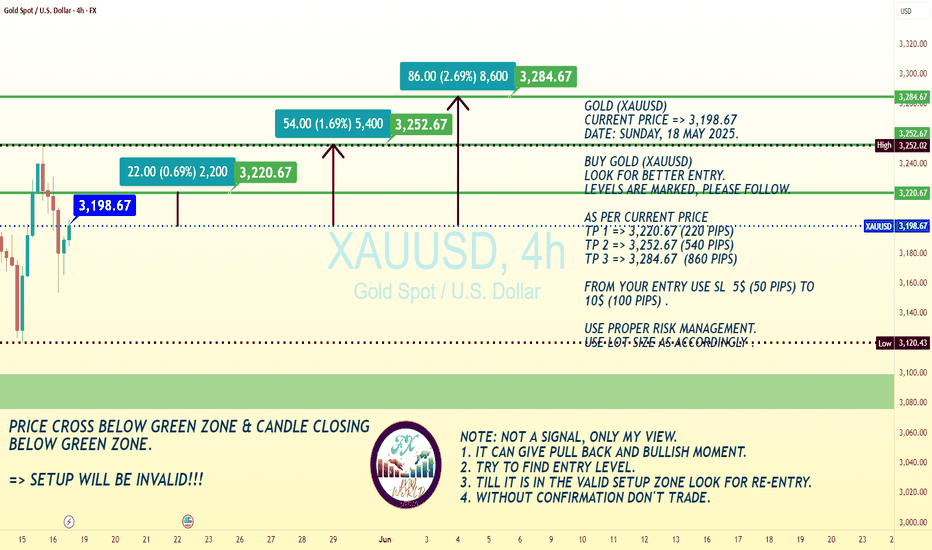

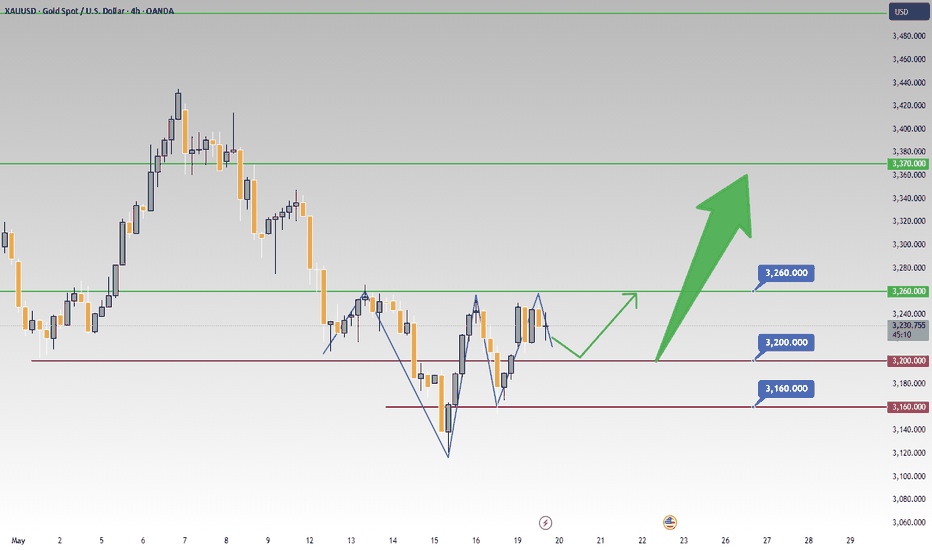

XAUUSD Chart 4H Analysis BUY GoldXAUUSD Chart 4H Analysis BUY Gold Doesn't Have To Be Hard Profit Surging!

The provided XAUUSD (Gold Spot/U.S. Dollar) 4-hour chart outlines a structured technical setup with clearly defined entry points, retracement zone, and multiple take-profit (TP) targets.

The current price at the time of analysis is **$3,198.67**, with the potential for a bullish continuation upon confirmation within the valid setup zone. Let’s break this down in detail:

**Current Price and Entry Strategy**

* **Current Price:** $3,198.67

* **Recommendation:** Look for better entry around or near the green support zone. The setup is bullish-biased, suggesting a buy-on-dip opportunity.

* **Support/Invalidation Zone:** If the price **closes below the green zone**, the setup will be **invalidated**. Hence, risk management and confirmation are crucial before taking any position.

**Target Levels Identified**

Three Take-Profit (TP) levels are established in the chart, each indicating potential upward momentum if the price respects the support and begins to rise again:

* **TP1: $3,220.67**

✔️ Gain of **22 USD (220 pips)** from current price

✔️ Represents an initial move post-entry confirmation

✔️ Ideal for short-term scalpers or conservative traders

* **TP2: $3,252.67**

✔️ Gain of **54 USD (540 pips)** from current price

✔️ Mid-level target indicating strong bullish continuation

✔️ Can be a good point for partial profit booking

* **TP3: $3,284.67**

✔️ Gain of **86 USD (860 pips)** from current price

✔️ Long-term or full swing trade target

✔️ Represents full bullish momentum with higher reward-to-risk ratio

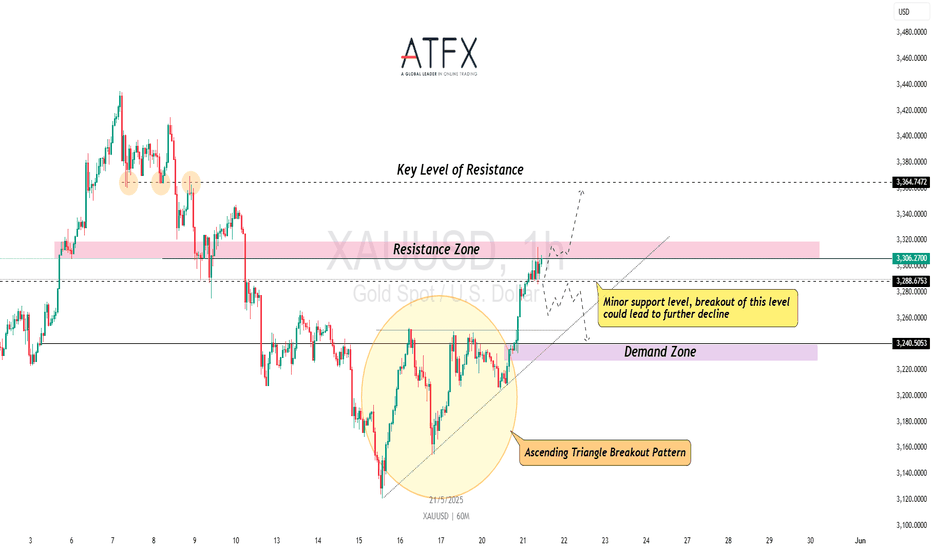

Possible Pullback to 3260 If 3300 Breakthrough Attempt FailsReview of the Day's Trends

Gold opened with a slight upward movement before turning bearish, dipping to a low of 3,204 before rebounding📈. It traded in a narrow range between 3,210 and 3,220, then surged during the U.S. trading session💹, hitting a high of around 3,285 and ultimately closing near 3,280📊.

Analysis of Rising Factors

Geopolitical Factors🌍:

Escalating conflicts—Israel’s ground offensive in Gaza, Russia’s airstrikes, and Iran’s uranium enrichment—heightened risk aversion. Gold’s safe-haven status drove demand📈.

Economic Data and Policy Expectations📊:

Moody’s U.S. credit downgrade fueled caution, while Fed rate-cut expectations (57bps in 2025) lowered gold’s opportunity cost, boosting appeal.

Technical Analysis📉📈:

Daily chart: MACD green bars shrinking toward zero, 5-day MA nearing a bullish cross with 10-day MA—signaling upward momentum🚀.

4-hour chart: Resistance at 3,250 (last Friday’s decline origin)⚠️. Failure to hold 3,285 could lead to a retracement to 3,260–3,240🔻; a break above 3,285 may target 3,300🔺

It is likely that a pullback will occur

⚡️⚡️⚡️ XAUUSD ⚡️⚡️⚡️

🚀 Sell@3285

🚀 TP 3270 - 3260

Accurate signals are updated every day 📈 If you encounter any problems during trading, these signals can serve as your reliable guide 🧭 Feel free to refer to them! I sincerely hope they'll be of great help to you 🌟 👇

Today's Gold Trading Strategy: Volatility ReturnsToday, gold volatility has returned to normal 🌟. With the long - term bullish trend remaining unchanged 📈, going long on dips is the simplest profitable strategy 💰. Currently, the support at 3,200 and resistance at 3,260 are relatively obvious 📊. You can directly go long near 3,200 - 3,210 📈. In the absence of any real - time news impact 📰, try to focus on bullish positions 📈

⚡️⚡️⚡️ XAUUSD ⚡️⚡️⚡️

🚀 Buy@3210 -3220

🚀 TP 3240 - 3260

Accurate signals are updated every day 📈 If you encounter any problems during trading, these signals can serve as your reliable guide 🧭 Feel free to refer to them! I sincerely hope they'll be of great help to you 🌟 👇