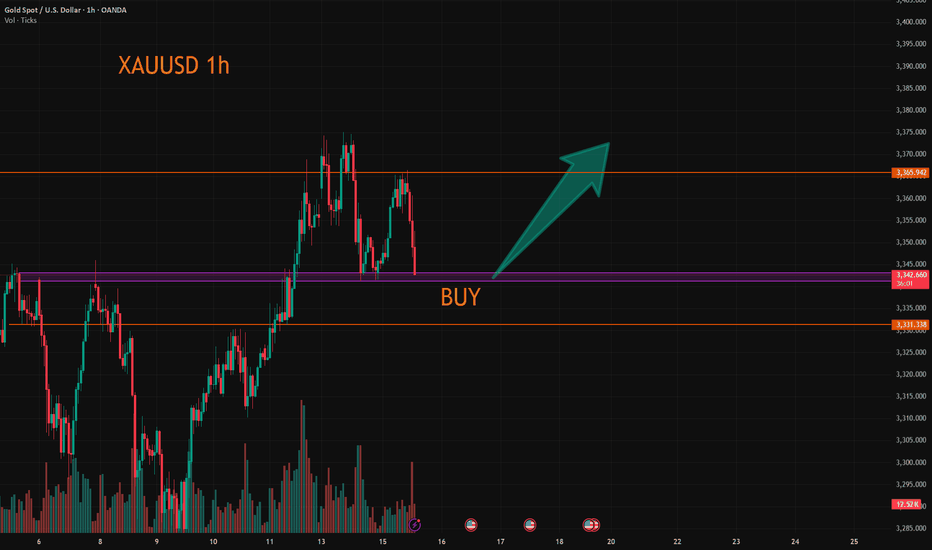

XAUUSD:Continue to go long

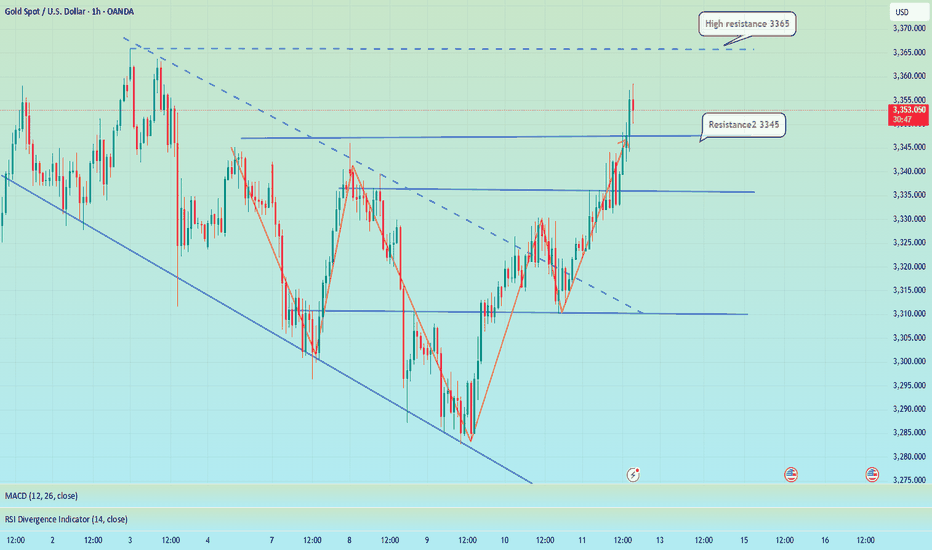

The gold price has just fallen after being pressured by the 3365 level. Currently, there are no obvious signs of a bottoming out. However, the 3340-43 range is the support position from the previous several declines. Here, one can lightly participate in the bullish orders. If going further down, the 3330 level is an important support point. Both of these positions can be utilized to go long.

Then the trading strategy:

BUY@3340-43

TP:3360-65

If the price retraces to the 3330 level, increase the position of the long bet. The goal remains the same. I will keep you informed if there are any changes.

More detailed strategies and trading will be notified here ↗↗↗

Keep updated, come to "get" ↗↗↗

Xauusdbuy

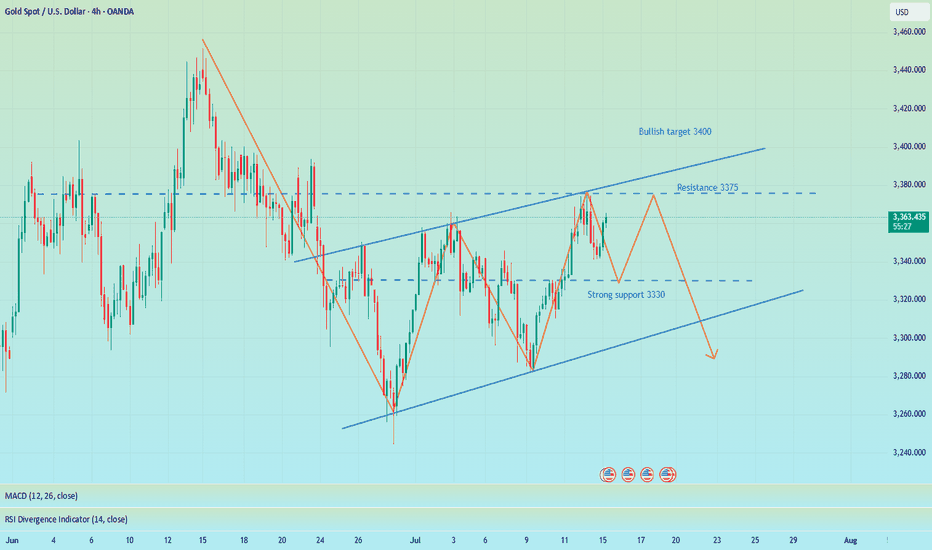

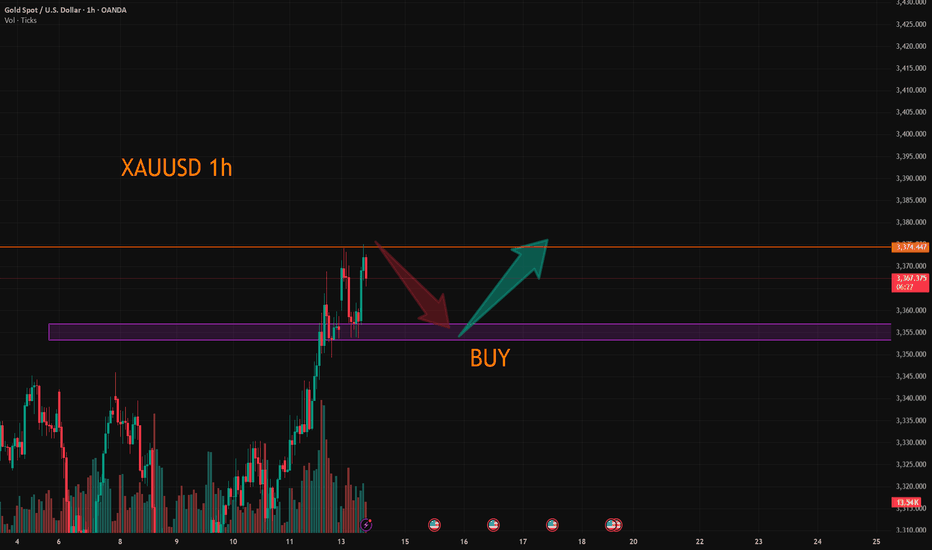

It is expected to fluctuate and fall before CPI data📰 News information:

1. Focus on tomorrow's CPI data

2. Bowman's speech at the Federal Reserve

3. Tariff information outflows and countries' responses to tariff issues

📈 Technical Analysis:

The 1H chart shows that the gold price continued to pull back last night and then fluctuated at the bottom, and continued the rebound trend this morning. The key pressure level is the top and bottom conversion level. The current rebound in gold is only a secondary confirmation of the top structure at the 30-minute level. After reaching 3365, it has shown signs of short-term pressure. In a volatile market, if the price begins to consolidate horizontally, it may indicate the end of this round of volatile upward trend, and it will enter a downward phase later. Considering the market sensitivity before the release of CPI data, it is recommended to focus on the volatile decline trend. After today's rebound, it is necessary to focus on the 3365-3368 area as a short-selling range, and the long-short defense position is set at yesterday's intraday high of 3375. The support below focuses on the 3350-3340 range.

🎯 Trading Points:

SELL 3358-3368

TP 3345-3333

In addition to investment, life also includes poetry, distant places, and Allen. Facing the market is actually facing yourself, correcting your shortcomings, facing your mistakes, and exercising strict self-discipline. I share free trading strategies and analysis ideas every day for reference by brothers. I hope my analysis can help you.

FXOPEN:XAUUSD TVC:GOLD FX:XAUUSD FOREXCOM:XAUUSD PEPPERSTONE:XAUUSD OANDA:XAUUSD

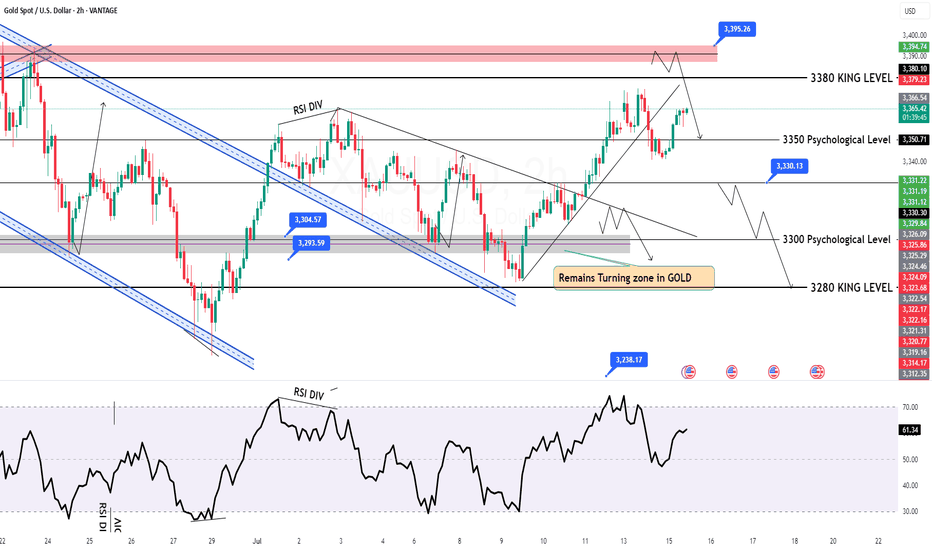

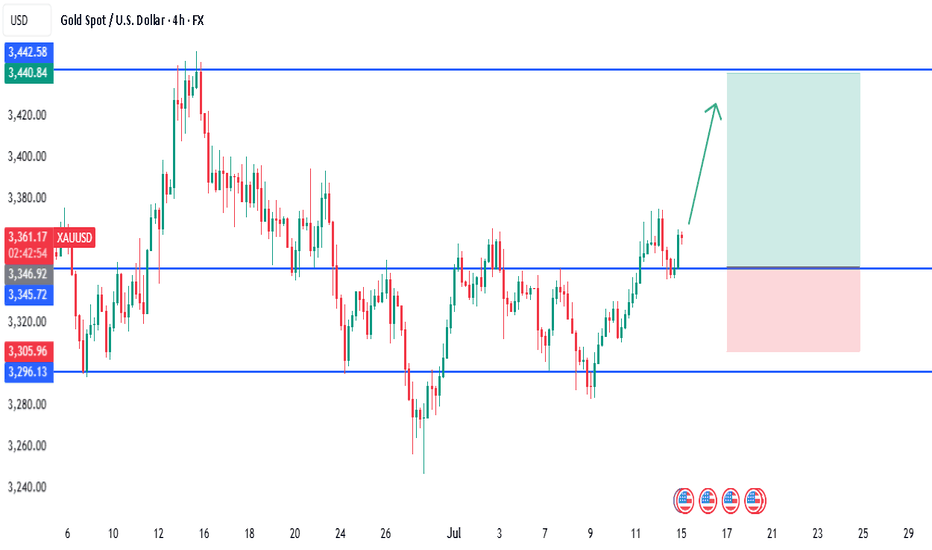

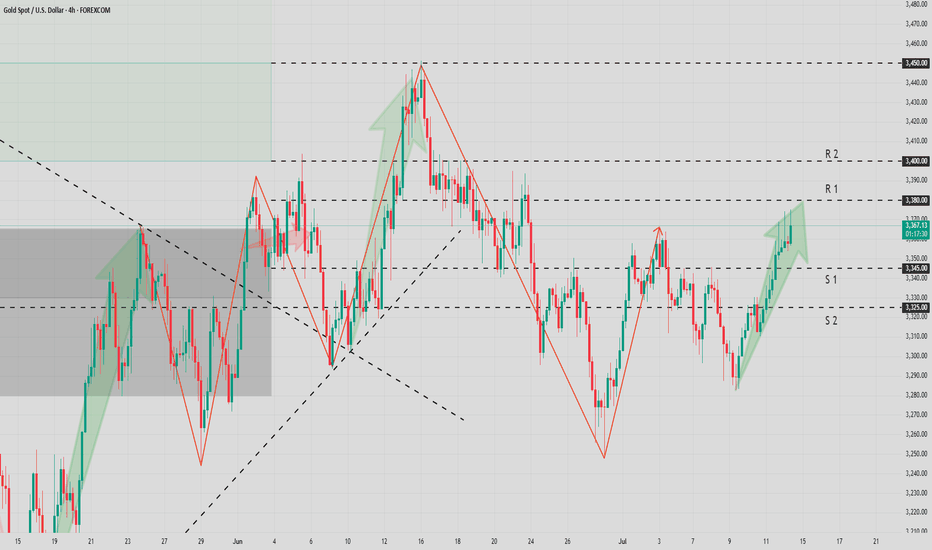

GOLD Intraday Chart Update For 15 July 2025Hello Traders,

Welcome to the US CPI Day, as you can see that market is in tight range for now and all eyes on the breakout for now

Only clear breakout of 3380 we will consider market will be bullish towards 3400 & 3425

If markets sustains below 3335 it will move towards 3305 or even 3285

All eyes on US CPI

Disclaimer: Forex is Risky

XAUUSD Gold price moves closer to three-week peak amid modest USD downtick

Gold price regains positive traction amid a modest USD pullback from a multi-week high. Persistent trade-related uncertainties also lend support to the safe-haven precious metal. Reduced Fed rate cut bets might cap the commodity ahead of the critical US CPI repo

Fundamental Overview

Amid US President Donald Trump’s fresh tariff threats announced late Monday and his latest criticism of Federal Reserve Chairman Jerome Powell, Gold traders resorted to profit-taking after the bright metal hit a three-week high of $3,375 while bracing for the US inflation report for June.

Trump threatened to impose 100% tariffs on Russia if President Vladimir Putin does not agree to a deal to end his invasion of Ukraine in 50 days, per Bloomberg.

Meanwhile, the US President renewed his attacks on Powell, noting that “interest rates should be at 1% or lower, rather than the 4.25% to 4.50% range the Fed has kept the key rate at so far this year.”

Markets now price in 50 basis points of Fed interest rate cuts by year-end, with the first reduction foreseen in September.

However, it remains to be seen if these expectations hold ground following the US CPI data publication.

Economists are expecting the US annual CPI and core CPI to accelerate 2.7% and 3% in June, reflecting the tariff impact feeding through prices. Meanwhile, the monthly CPI and core CPI inflation figures are set to rise to 0.3% in the same period.

Hotter-than-expected US CPI monthly or annual readings could reinforce the Fed’s patient outlook, pushing back against expectations of two Fed rate cuts this year.

This scenario could help the US Dollar (USD) extend its recovery at the expense of the non-yielding Gold price.

Alternatively, if the data come in below forecasts, it could provide a fresh tailwind to the Gold price on renewed bets that the Fed will remain on track for two rate cuts.

BAY TP

TP 1 3,371

TP 2 3,391

TP 3 3,412

SELL PT

TP 1 3,337

TP 2 3,311

TP 3 3,286

XAUUSD:Today's trading strategies for buying and selling

The gold price reached a peak of 3374.69 during the Asian trading session. Overall, it remains in a bullish uptrend. From the half-hour and hourly charts, the 30-day line provides support at around 3353. Therefore, when trading within this fluctuating range, it is important to note that in a situation where the bullish trend is strong, short selling should be conducted with a light position.

Trading Strategy:

BUY@3353-57

TP:3370-75

SELL@3375-80

TP:3360-63

More detailed strategies and trading will be notified here ↗↗↗

Keep updated, come to "get" ↗↗↗

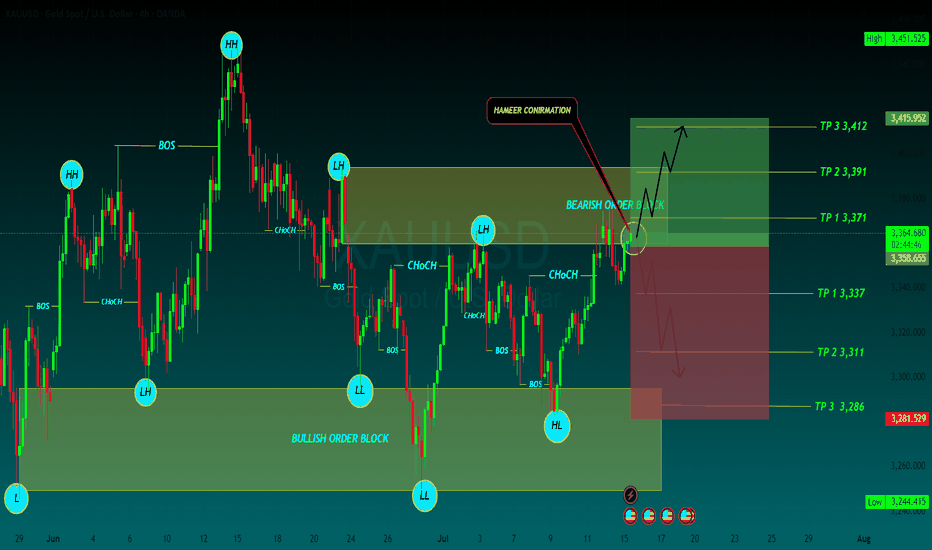

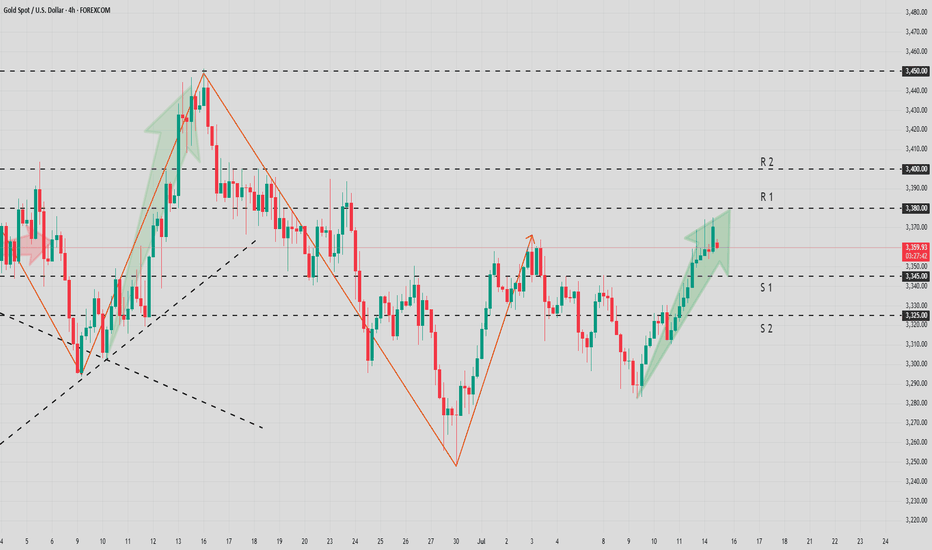

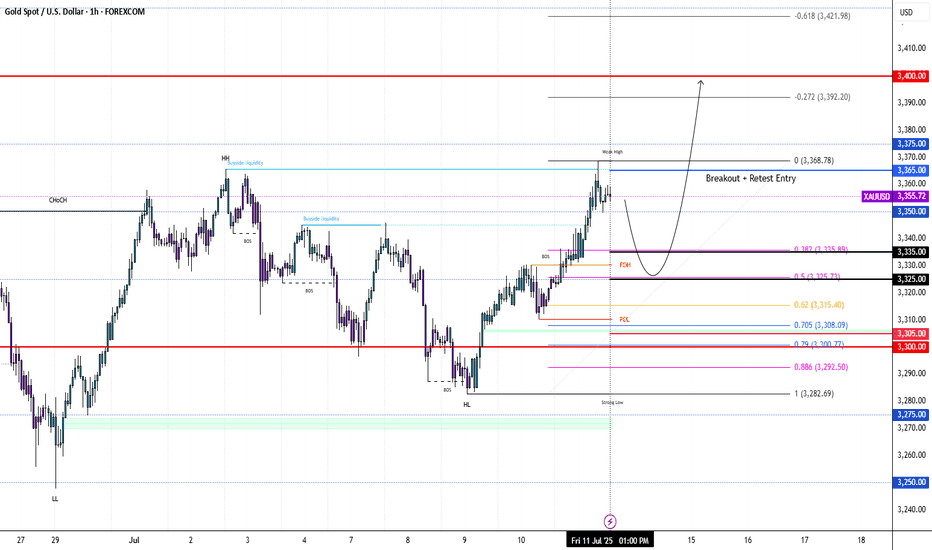

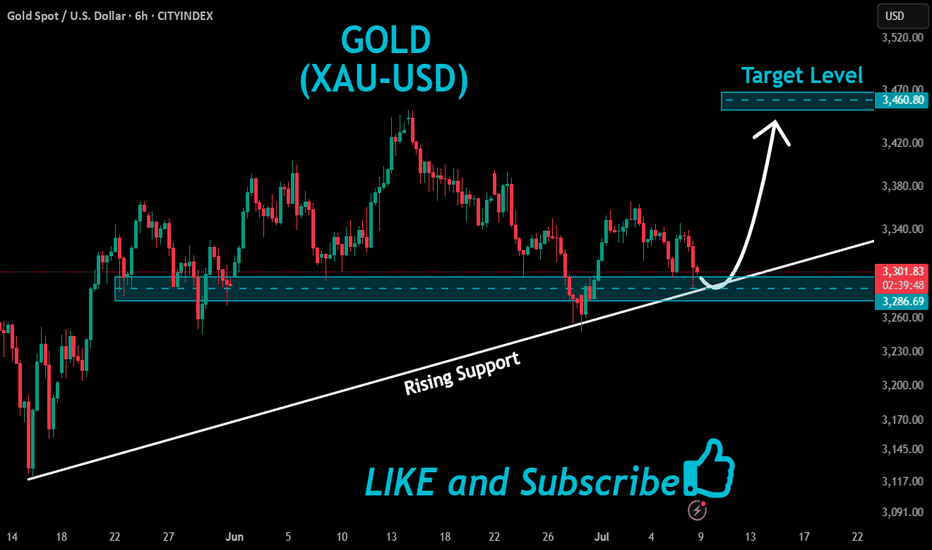

XAUUSD 4H – Break & Retest With Bullish Continuation | SMC🚨 Gold (XAUUSD) is setting up for a potential bullish move after a successful break and retest of a key resistance zone at 3346 – 3348, now turned into fresh support.

🔍 Technical Breakdown:

📌 Structure:

Gold previously formed a strong resistance near 3346, which aligned with multiple rejections in past sessions. After a liquidity sweep and break above this level, price retraced for a textbook break-and-retest setup.

📌 CHoCH & BOS (Break of Structure):

The market showed a bullish Change of Character followed by a clean Break of Structure to the upside, confirming bullish intent.

📌 Smart Money Perspective:

Institutional demand was respected at 3296–3305 zone.

Liquidity below this zone has been taken.

Current bullish candles are printing higher highs and higher lows.

📌 Confluences:

✅ Break & Retest of major structure

✅ Clean demand zone below

✅ Imbalance filled

✅ Bullish market structure

✅ SMC confirmation (CHoCH + BOS + Mitigation)

📈 Trade Idea (Long Setup):

💰 Buy Entry: 3359

🔻 Stop Loss: 3305 (below demand + structure)

🎯 Take Profit 1: 3400

🎯 Take Profit 2: 3440 – 3442 (major resistance)

🧮 Risk-to-Reward: 1:2+

This setup provides a strong bullish continuation opportunity targeting the upper resistance zone. Monitor candle confirmations and session volume for more precise entries.

📢 💬 Like this idea? Follow for more Smart Money trades on Gold, US30, NAS100, and V75!

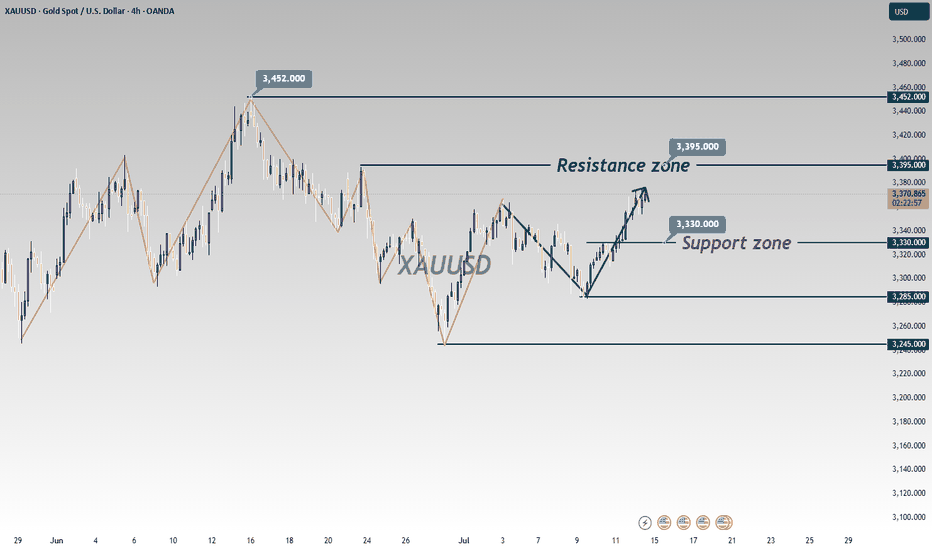

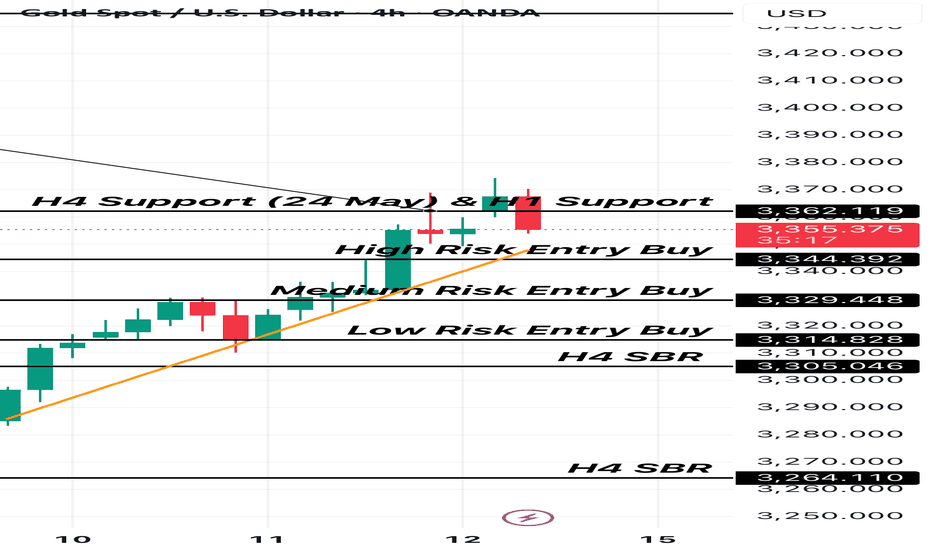

XAUUSD: Trading Strategy Before the US SessionAhead of the release of key US session data, gold is oscillating in a narrow range between $3340 and $3375. The daily chart shows a balance between bulls and bears. On the 4-hour chart, $3375, which coincides with the 61.8% Fibonacci retracement level, serves as a critical watershed for the market trend.

In terms of trading strategy, it's advisable to trade within the aforementioned range and follow the trend once there is a clear breakout. If gold stabilizes above $3360 and breaks through $3375, it could rally towards $3400. Conversely, if it falls below $3340 and loses the $3310 - $3320 range, it may test $3300. It's essential to confirm the direction in conjunction with fundamental news and avoid blind trading.

I am committed to sharing trading signals every day. Among them, real-time signals will be flexibly pushed according to market dynamics. All the signals sent out last week accurately matched the market trends, helping numerous traders achieve substantial profits. Regardless of your previous investment performance, I believe that with the support of my professional strategies and timely signals, I will surely be able to assist you in breaking through investment bottlenecks and achieving new breakthroughs in the trading field.

Gold's Bullish Momentum: Trading Strategy for TodayTechnically, gold prices continued their strong bullish rally to break new highs last Friday 😎. During the Asian and European sessions, prices broke through the 3320 mark and extended their upward momentum with sustained strength 💹. In the afternoon European session, gold prices kept surging, breaking through and standing above the 3340 mark, accelerating the upward trend 🔥. In the evening US session, the price further accelerated its rally, piercing the 3369 level before pulling back and closing strongly 📈. The daily K-line closed as a fluctuating and high-breaking bullish candle 🌞. On the daily chart, there has been a strong bullish rally breaking new highs for three consecutive trading days, and the overall price has returned to the 3360 mark, re-entering a strong bullish one-sided pattern.

This morning, gold prices opened with a further gap higher, piercing the 3370 mark and continuing to fluctuate strongly 😜. Today's trend should focus on buying on dips 🙌. Although gold gapped up and surged for a while, the momentum is not strong. There must be a pullback for adjustment; otherwise, it will be difficult to maintain the upward momentum 🚶♂️.

From the 4-hour chart analysis, the short-term support below today should focus on the hourly neckline around 3340-45 📍, with key attention to the 3325-30 support level. During the day, we should continue to take the opportunity of pullbacks to go long as the main strategy 😏. The key dividing line for the short-term bullish strength is the 3325 mark. As long as the daily chart stabilizes above this level, we will continue to maintain the strategy of buying on dips to follow the bullish trend. Before breaking below this level, we will keep the strategy of buying on dips to follow the trend 💪

Accurate signals are updated every day 📈 If you encounter any problems during trading, these signals can serve as your reliable guide 🧭 Feel free to refer to them! I sincerely hope they'll be of great help to you 🌟 👇

7/14: Sell High, Buy Low Within the 3400–3343 Range for GoldGood morning, everyone!

At the end of last week, renewed trade tariff concerns reignited risk-off sentiment, prompting a strong rally in gold after multiple tests of the 3321 support level. The breakout was largely driven by fundamental news momentum.

On the daily (1D) chart, the price has fully reclaimed the MA60 and broken above the MA20, signaling an emerging bullish trend. The key focus for this week includes:

Monitoring whether MA20 holds as support on any pullbacks

Watching the 3400 resistance zone for signs of exhaustion or continuation

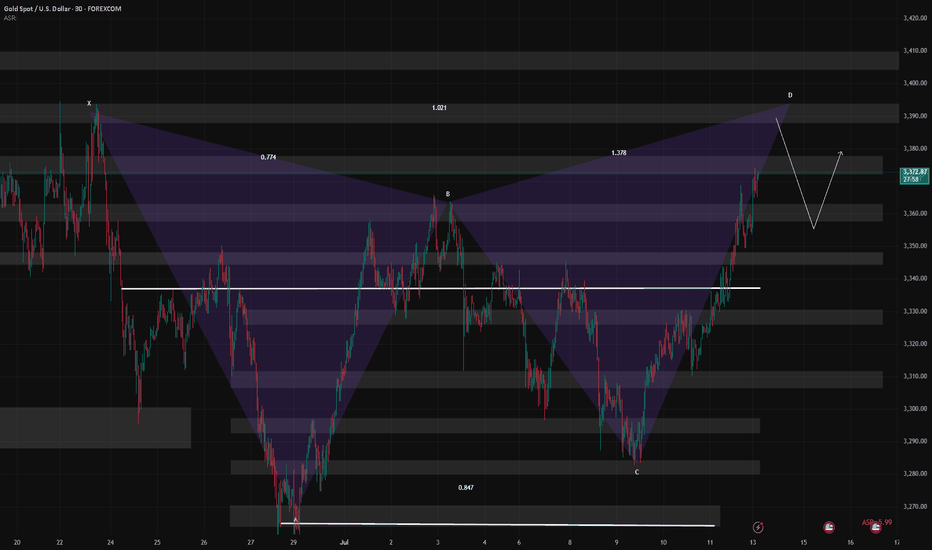

From a 30-minute technical perspective, gold is currently trading within a short-term resistance band of 3372–3378, with a stronger resistance zone between 3387–3392. Key support levels are:

Primary support: around 3358

Secondary support: 3343–3332 zone

Given the recent increase in volatility due to geopolitical and macroeconomic headlines, flexible intraday trading is recommended within the 3378–3343 range, while broader trades can be framed around the 3400–3325 zone, still favoring a sell-high, buy-low approach.

Lastly, as we move into the mid-year period, I may have more personal commitments, and strategy updates could be less frequent. I appreciate your understanding, and as always, feel free to leave a message if you have any questions or need trading guidance—I’ll respond as soon as I can.

XAU/USD: Analysis and Strategy Amid Trade ConflictsA rate cut this month is highly unlikely, with the earliest possible delay to September. Currently, the gold market trend is still dominated by tariff factors. Although the tariff war was extended for 90 days in April, the 10% base tariff imposed on all trading countries during this period has already made the total tax revenue of these three months reach 70% of that in previous years.

Trump's launch of the tariff war has clear core goals: first, to directly increase U.S. fiscal revenue; second, to boost exports through policy inclination, while helping enterprises increase profits to expand the tax base; third, to promote the growth of domestic employment. Just last weekend, his administration announced that it would impose a 30% tariff on the European Union and Mexico, and the new regulations will take effect on August 1.

Against this backdrop, the escalation of trade conflicts has become increasingly obvious. For gold, this means continuous and strong support, and the certainty of its upward logic has been further enhanced. From a long-term perspective, the gold market is not expected to see a deep correction in the second half of the year.

After pulling back to around $3,280 last week, the price has embarked on a sustained upward trajectory and now fluctuates within the range of $3,345-$3,380. For this interval, a strategy of buying low and selling high would be appropriate.

I am committed to sharing trading signals every day. Among them, real-time signals will be flexibly pushed according to market dynamics. All the signals sent out last week accurately matched the market trends, helping numerous traders achieve substantial profits. Regardless of your previous investment performance, I believe that with the support of my professional strategies and timely signals, I will surely be able to assist you in breaking through investment bottlenecks and achieving new breakthroughs in the trading field.

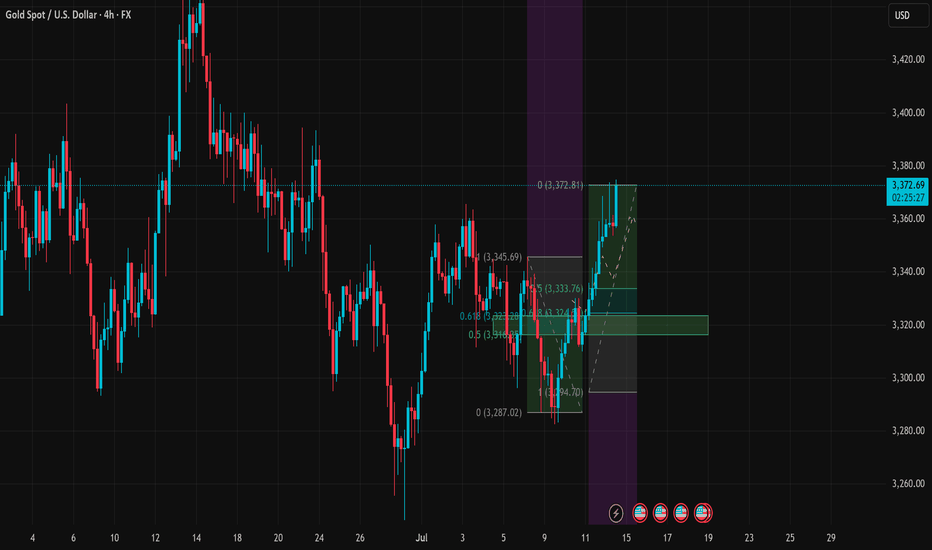

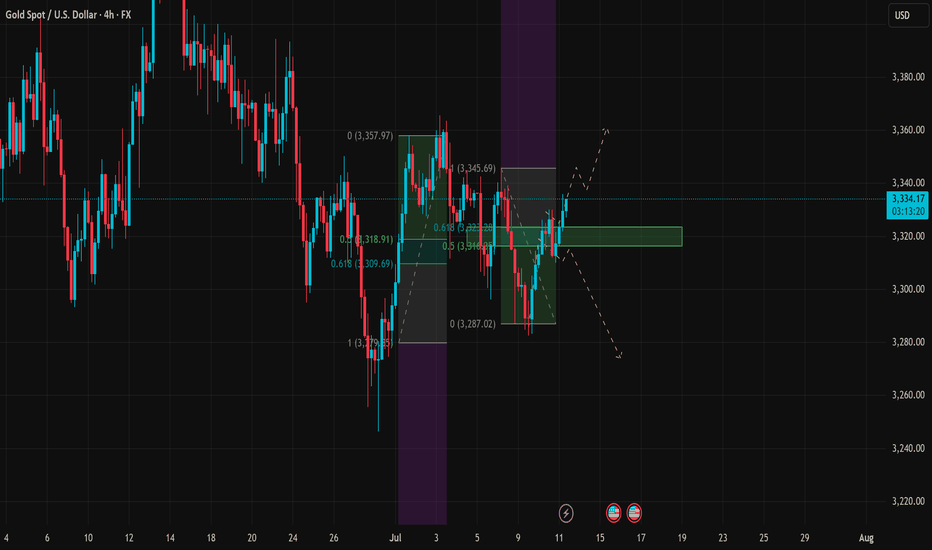

XAUUSD Analysis – July 14, 2025: Gold Tests Critical Resistance Gold (XAUUSD) is currently trading around $3,373, rebounding strongly from the recent low at $3,294. Price is now testing the key resistance zone at $3,372–3,375, which aligns with the 0.0 Fibonacci retracement of the previous downtrend and a significant supply zone on the H4 timeframe.

1. Technical Analysis (H4 Chart):

🔹 Fibonacci & Price Action:

The price found strong support at $3,294, where previous demand and Fibonacci levels converge.

A sharp bullish move has pushed price above the 0.5 (at $3,316) and 0.618 (at $3,322) Fibonacci levels – signaling strong buyer interest.

The $3,372 zone is now acting as short-term resistance, matching the previous swing high.

🔹 EMA & RSI:

EMAs are trending upward, confirming short-term bullish momentum.

RSI is approaching overbought territory, suggesting a potential pullback in the short term.

🔹 Trendline & Structure:

Price remains above the rising trendline, indicating sustained bullish momentum.

The nearest support zone is now at $3,322 – $3,333, which overlaps with key Fibonacci and previous structure levels.

2. Key Price Levels:

Price Zone

Significance:3,372 – 3,375

Short-term resistance – Fibo 0.0:3,345 – 3,333

First support – pullback zone:3,322 – 3,316

Strong support – EMA + Fibo 0.5:3,294 – 3,287

Major support – recent swing low

3. Suggested Trading Strategies:

Strategy 1 – Take Profit for Existing Longs:

If you entered long positions near $3,295–$3,300, consider taking partial profits at the current resistance zone ($3,372–$3,375).

Strategy 2 – Short-Term Sell Opportunity:

Consider a short entry near $3,372–$3,375, with a stop-loss above $3,383.

Target profit: $3,333 – $3,322

Strategy 3 – Buy on Dip (Trend Continuation):

If price pulls back to the $3,333 – $3,322 support and holds, this is a good zone to enter long.

Stop-loss below $3,316, with potential target back to $3,385 – $3,400 if a breakout occurs.

Gold is showing a solid recovery after a sharp decline, but it is now testing a key resistance zone around $3,373. Caution is advised in the short term, as a pullback may occur. Priority should be given to "Buy on Dip" strategies if support zones hold.

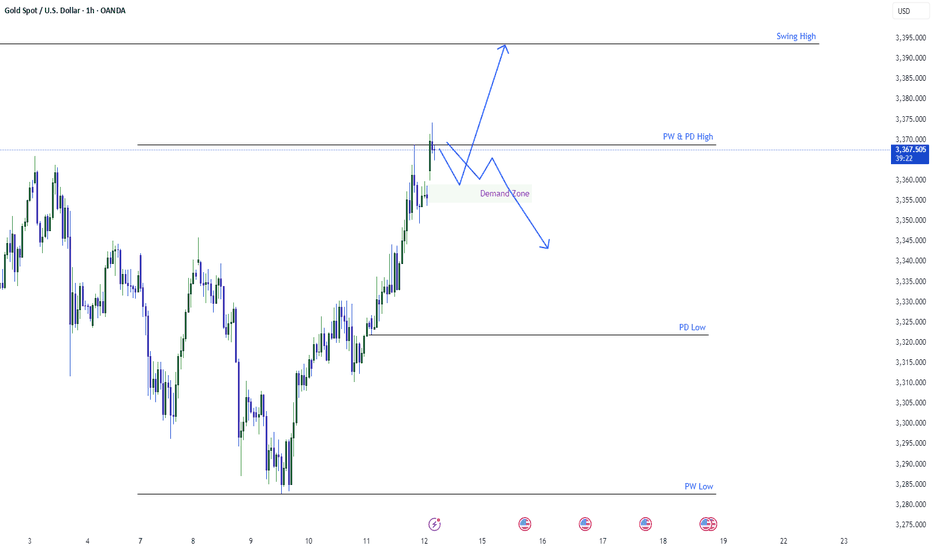

Gold trying to cross 3400Gold has show bullish momentum by crossing the previous week high which was residing around 3369. Filed the previous gap available. We expect gold to go higher and touch the 2293 level which is a swing high. Another possibility would the to after taking previous week liquidly may give us a deeper pullback. The possibilities for the gold are shown in the graph accordingly.

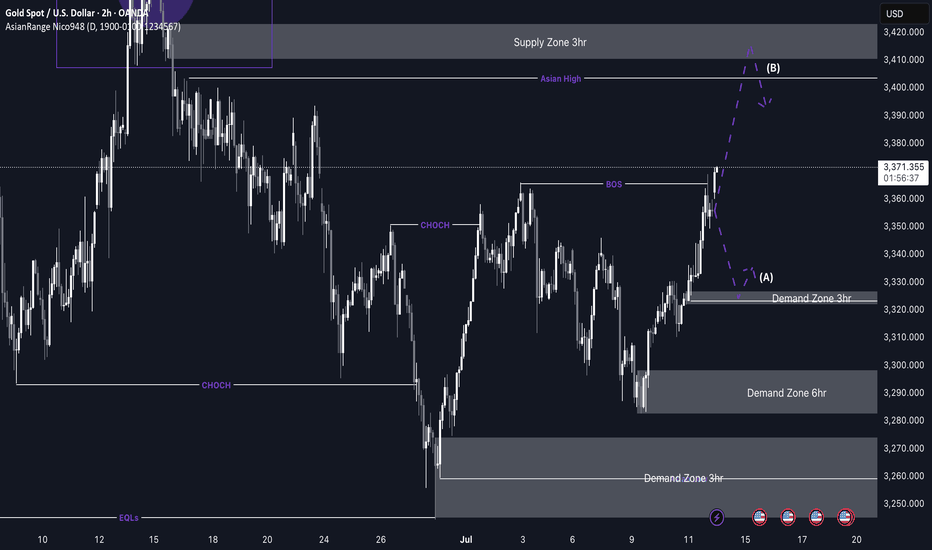

XAU/USD analysis & outlookWeekly Outlook: GOLD (XAUUSD)

This week, I’ll be monitoring different scenarios, as price is currently far from any of my key Points of Interest (POIs).

My nearest potential buy is around the 3-hour demand zone. While it's not the most ideal entry—since it isn’t located in a discounted area—I’ll still keep an eye on it.

That said, I would prefer to see a deeper retracement into the 6-hour demand zone, which is in a far more discounted region. This zone offers a stronger setup, and I could see price launching from there again if tapped.

We’ve already seen a strong bullish reaction from last week’s demand zone, and based on current momentum, I could see price continuing upward until it reaches my next sell opportunity—the 3-hour supply zone, which sits at a premium level.

Confluences for GOLD Buys:

✅ Bullish structure — price has broken to the upside and remains overall bullish.

✅ Fresh 3H and 6H demand zones formed, which price could return to.

✅ Liquidity above — including trendline liquidity and previous Asia highs.

✅ Fundamentals — potential tariff cuts could fuel long-term bullish momentum for gold.

✅ Bearish Dollar Index (DXY) aligns with the bullish gold outlook.

📌 If price doesn’t retrace and instead continues to push higher, I’ll wait for another break of structure to the upside on the way toward the supply zone before reassessing entries.

Let’s stay focused and let the market come to us. Wishing everyone a great trading week ahead! 👊📈

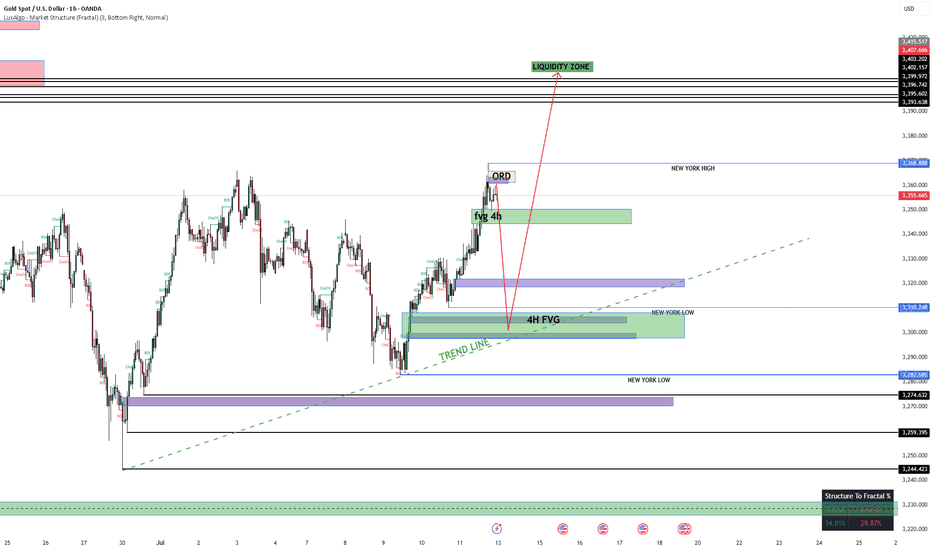

XAU/USD Setup THIS WEEK

Expecting a drop into the 3300–3310 zone, where we have:

4H Fair Value Gap

Trendline confluence

Liquidity below New York Low

From there, looking for a potential bullish reaction targeting:

📈 3405 – area with resting liquidity above recent highs.

📍 No confirmed bullish structure yet — waiting for a shift on the 5M/15M timeframe to confirm entry.

GOLD Remains BullishPrice made a HH at 3365, confirming structure shift back to bullish. The last HL is at 3305, making it the protected level for bulls.

H4 OB: 3305–3322 (origin of the recent impulsive leg — ideal pullback zone)

Supply Zone: 3432–3445 (next unmitigated supply target)

Bullish if price pulls into demand zone and holds, expect continuation to 3432+

H1 OB: 3325– 3335 (potential re-entry zone)

Watch for reaction on pull back

M15 Micro bullish flow is intact; price is consolidating around 3360

Breakout Buy: M15 BOS above 3365 with retest = entry trigger

🟢Entry Zone: 3325– 3335

SL: Below 3305

TP1: 3365

TP2: 3432

TP3: 3445

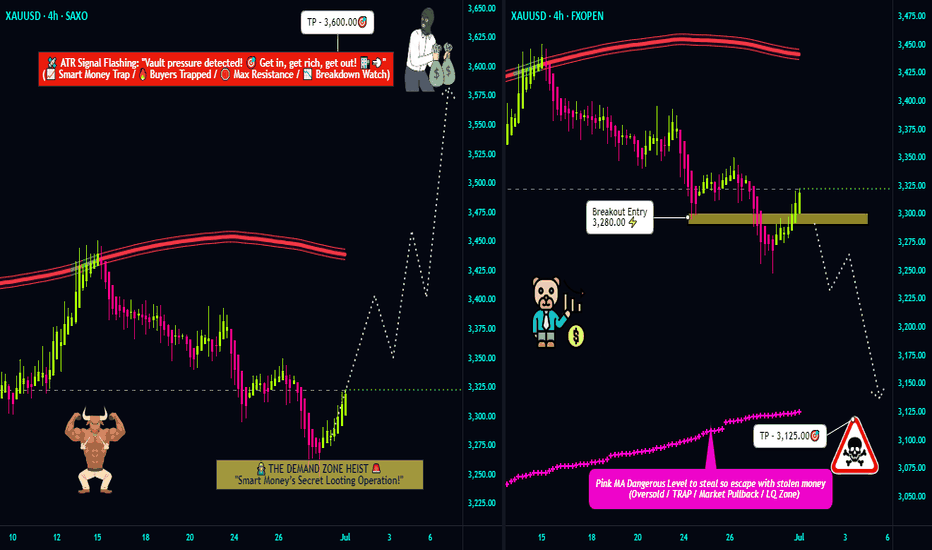

"Gold at a Crossroads! Bullish or Bearish? (Trade Plan)"🦹♂️💰 "Gold Heist Alert: XAU/USD Bullish Raid or Bearish Ambush?" 💰🦹♂️

🌍 Greetings, Market Pirates & Profit Raiders! 🌍

(Hola! Oi! Bonjour! Hallo! Marhaba!)

Based on the 🔥Thief Trading Method🔥, here’s our strategic heist plan for XAU/USD (Gold vs. Dollar). Follow the chart markings for high-probability loot zones—whether you're a bullish bandit or a bearish burglar! 🏴☠️💸

🎯 Entry Strategy (Where to Strike)

"The treasure is ripe for taking! Breakout = GO TIME!"

✅ Long Entry (Bullish Raid): Jump in at current levels if the uptrend holds.

✅ Short Entry (Bearish Ambush): Wait for a break & close below 3280.00 (confirms downtrend).

🛑 Stop Loss (Escape Route)

🚨 For Bulls: Bail out if price hits 3240.00 (SL tightens if trend strengthens).

🚨 For Bears: Retreat if price surges past 3360.00 (only activate SL post-breakout!).

🎯 Take Profit (Loot & Scoot!)

💰 Bullish Thieves: Aim for 3600.00 (or exit early if momentum fades).

💰 Bearish Bandits: Target 3125.00 (or escape before the cops—err, reversal—arrives).

📡 Market Intel (Why This Heist?)

Gold’s in a neutral zone (but bulls have the edge! 🐂📈). Key factors:

Macroeconomic shifts

COT data clues

Sentiment & seasonal trends

(Full breakdown in the chart notes—klick the 🔗! 🔍🌐)

⚠️ Danger Zones (News & Risk Control)

🚨 High-Impact News = NO NEW TRADES!

🚨 Protect open positions: Use trailing stops to lock in profits.

🚨 Adjust SLs if volatility spikes!

💥 Boost the Heist! 💥

Like & Share to fuel our next market robbery! 🚀💰

Follow for more lucrative trade setups—coming soon! 👀🔥

🎯 Trade Smart, Steal Smarter! 🦹♂️💎

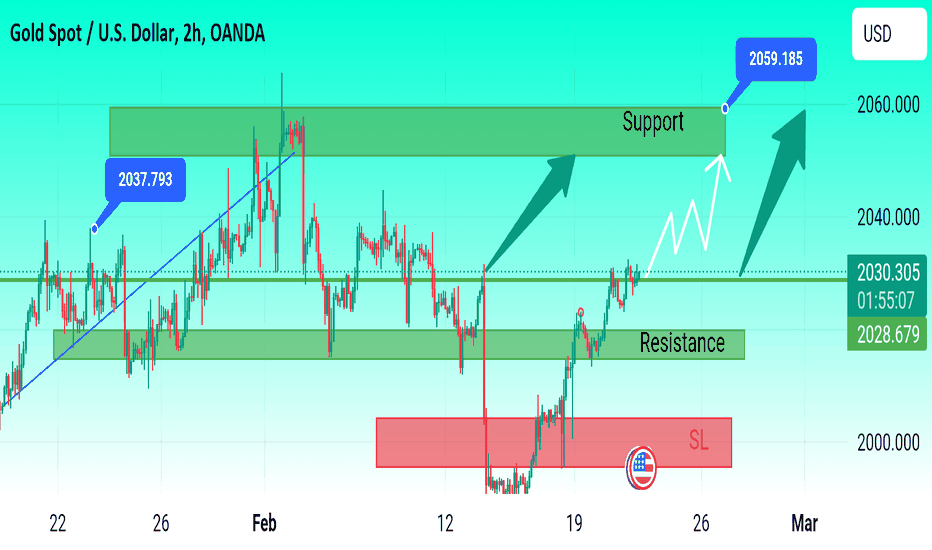

Xauusd Up Gold stabilizes near $2,030, eyes on FOMC Minutes

Gold clings to marginal daily gains at around $2,030 on Wednesday after closing the first two days of the week in positive territory. The benchmark 10-year US Treasury bond yield edges lower ahead of FOMC Minutes, helping XAU/USD hold its ground.

From a technical perspective, sustained strength and acceptance above the 50-day SMA will set the stage for an extension of the recent recovery from the $1,984 region, or a two-month low touched last week. Given that oscillators on the daily chart have been gaining positive traction, the Gold price might then accelerate the positive move towards an intermediate hurdle near the $2,044-2,045 region en route to the $2,065 supply zone.

Gold now 2028

Target 2032

Target 2036

Target 2050

Target 2059

SL 2015

FOMC signal confirm

Breaking through 3350, the bullish trend remains unchanged📰 News information:

1. Pay attention to the impact of Trump administration tariffs

📈 Technical Analysis:

Possible interest rate cuts and tariffs in the fall continue to stimulate risk aversion. Currently, the 3300-3285-3310 points form a head and shoulders bottom pattern. The bullish momentum is relatively strong in the short term. Our short trade near 41 has hit the stop loss. As I wrote before, gold may continue to rise to 3360 or 3365 after breaking through 3350. The current RSI indicator is seriously oversold, so be cautious when operating in a unilateral trend in the short term. The safe way is to wait for a pullback to 3345-3340 to go long

🎯 Trading Points:

BUY 3345-3340

TP 3360-3370-3400

In addition to investment, life also includes poetry, distant places, and Allen. Facing the market is actually facing yourself, correcting your shortcomings, facing your mistakes, and exercising strict self-discipline. I share free trading strategies and analysis ideas every day for reference by brothers. I hope my analysis can help you.

TVC:GOLD FXOPEN:XAUUSD

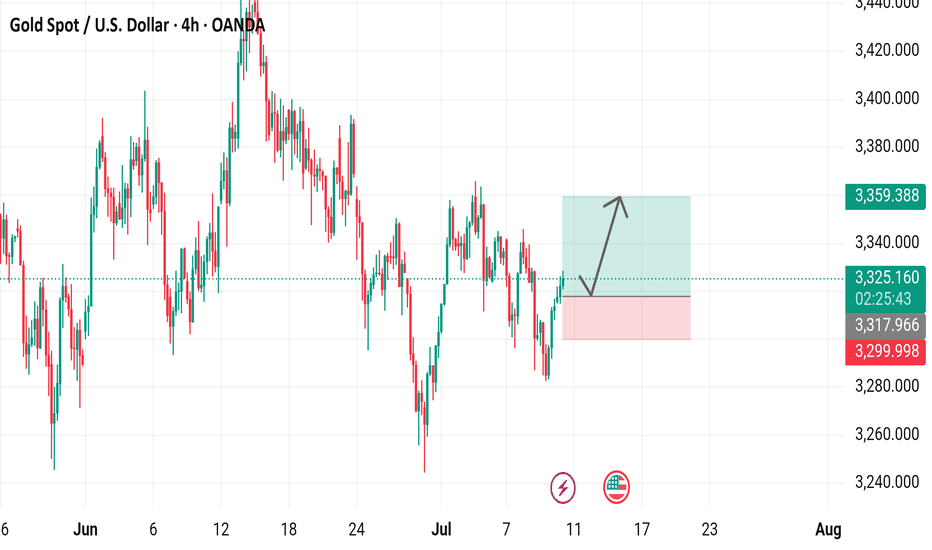

Gold Spot / U.S. Dollar (XAUUSD) 4-Hour Chart4-hour chart from OANDA shows the price movement of Gold Spot (XAUUSD) with a current value of $3,325.625, reflecting a $11.925 increase (+0.36%). The chart highlights key levels including a sell price of $3,325.290 and a buy price of $3,325.960, with a spread of 67 points. Technical analysis includes a resistance zone around $3,359.388 and a support zone near $3,317.966, with recent price action showing a potential upward trend from a low point. The chart spans from June to early August 2025.

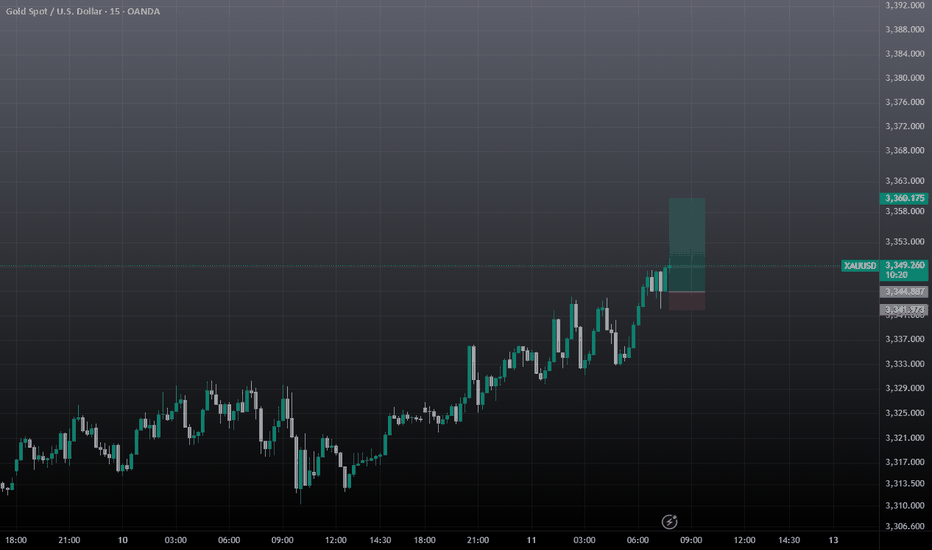

XAUUSD Approaches Key Resistance – Will 3,345 Hold or Break?As of July 11, 2025, gold (XAUUSD) is showing a mild recovery around 3,331 USD, following a rebound from the 3,318–3,322 USD support zone. This move comes amid a wave of macroeconomic data and global monetary policy expectations that continue to weigh heavily on gold’s intraday direction.

1. Key Fundamentals Impacting XAUUSD Today

Dollar Index (DXY) remains strong near 106.0 – sustaining pressure on gold due to a firm greenback.

U.S. 10-year Treasury yields are holding above 4.36%, reflecting persistent market expectations that the Fed may keep interest rates elevated in the near term.

June CPI data (YoY) came in at 2.4%, slightly below forecast (2.5%), increasing hopes for a potential rate cut in Q4 – a short-term bullish catalyst for gold

Geopolitical tensions remain subdued, limiting safe-haven inflows into gold in the medium term.

Upcoming U.S. PPI data this week could trigger volatility, depending on whether it surprises to the dovish or hawkish side.

2. Technical Analysis – XAUUSD on H4 Timeframe

Support zone: 3,316 – 3,322 USD, aligning with the 0.5–0.618 Fibonacci retracement of the latest bullish leg.

Resistance zone: 3,345 USD – a confluence of previous highs and 0.618 Fibonacci level of the prior correction wave.

EMA outlook: Short-term EMA is turning upward, indicating potential bullish momentum building.

RSI: Recovering toward 60 but not yet overbought – a sign of healthy upside potential, though confirmation is still needed.

3. Trade Scenarios to Consider

Bullish Breakout Scenario (if price breaks 3,345 USD):

Entry: Buy on H4 candle close above 3,345 USD

Target: 3,357 – 3,370 USD

Stop-loss: Below 3,322 USD

Bearish Rejection Scenario (if price fails at 3,345 USD):

Entry: Sell on bearish reversal candlestick (e.g., pin bar, engulfing) at 3,345 USD

Target: Revisit support at 3,318 – 3,309 USD

Stop-loss: Above 3,350 USD

Gold is trading in a decision zone between short-term support and a major resistance barrier. While macro fundamentals are slightly leaning bullish after soft CPI data, strong dollar strength and high bond yields still cap upside momentum. Traders are advised to wait for price confirmation at 3,345 USD before committing to directional setups.

Follow for more daily gold trading strategies, and save this analysis if you found it useful!