NFP continues to ferment, short-term trend dominated by bears📰 News information:

1. 90-day tariffs are about to expire

2. New unilateral tariffs

3. Geopolitical situation

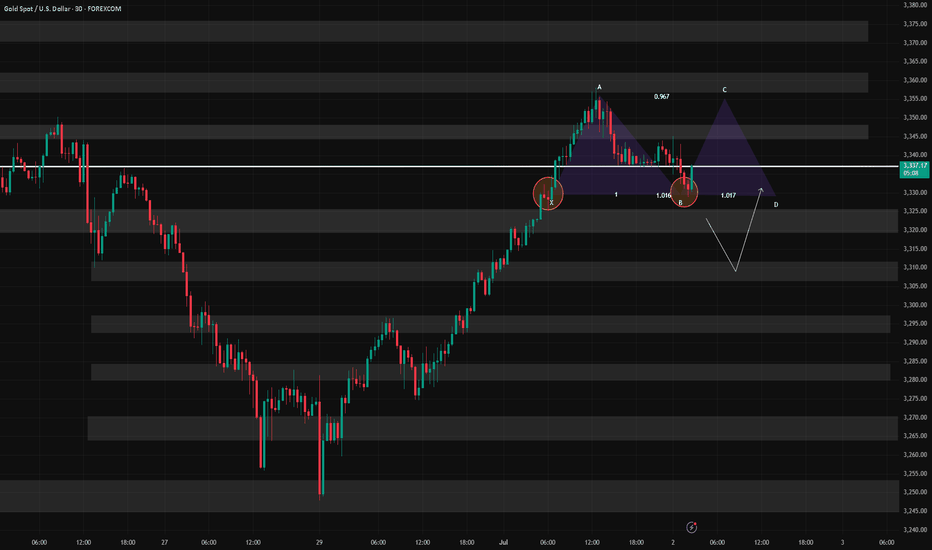

📈 Technical Analysis:

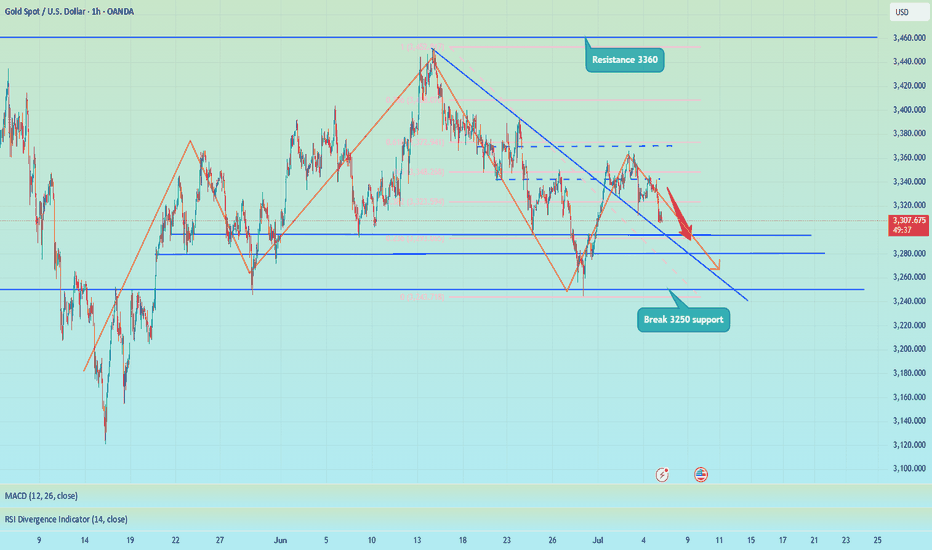

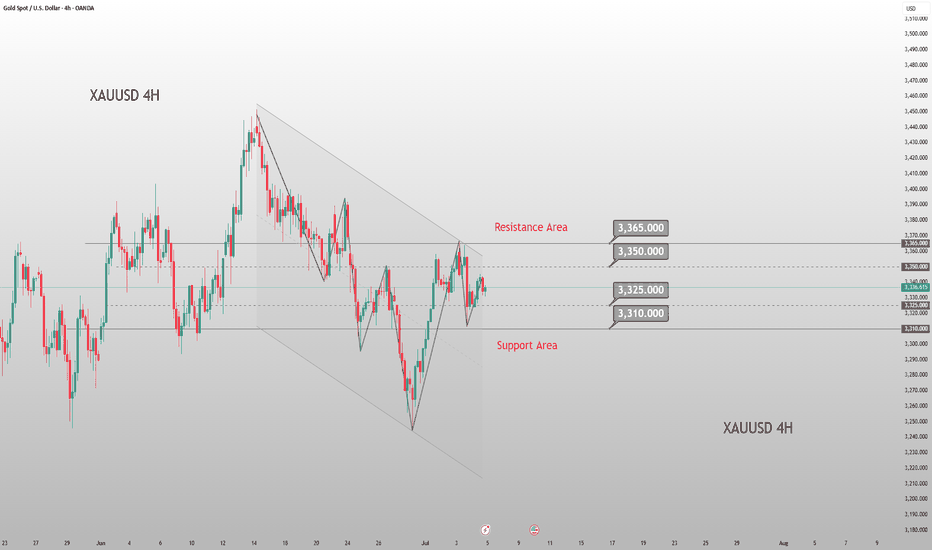

Good morning, bros. From a technical point of view, the overall trend of the daily line is a head and shoulders top. If the bulls do not recover 3360, the bears will still be the medium-term trend. The 4H MACD indicator is dead cross running. The best position for the day to deploy the short position again is 3330-3335, and the 1H chart keeps testing the 3305 first-line support, which may be broken in the short term. At present, 3295-3285 below is a relatively important short-term support. Once it falls below, it is expected to reach 3250, which is also the point I repeatedly emphasized in the morning. The intraday operation suggestion is to rebound shorting as the main, and to go long at lows as the auxiliary. Pay attention to the 3325-3335 support area on the upper side and the 3295-3285 support on the lower side.

🎯 Trading Points:

SELL 3325-3335

TP 3315-3305-3295

BUY 3295-3285

TP 3305-3315-3325

In addition to investment, life also includes poetry, distant places, and Allen. Facing the market is actually facing yourself, correcting your shortcomings, confronting your mistakes, and strictly disciplining yourself. I hope my analysis can help you🌐.

FXOPEN:XAUUSD PEPPERSTONE:XAUUSD FOREXCOM:XAUUSD FX:XAUUSD OANDA:XAUUSD TVC:GOLD

Xauusdbuy

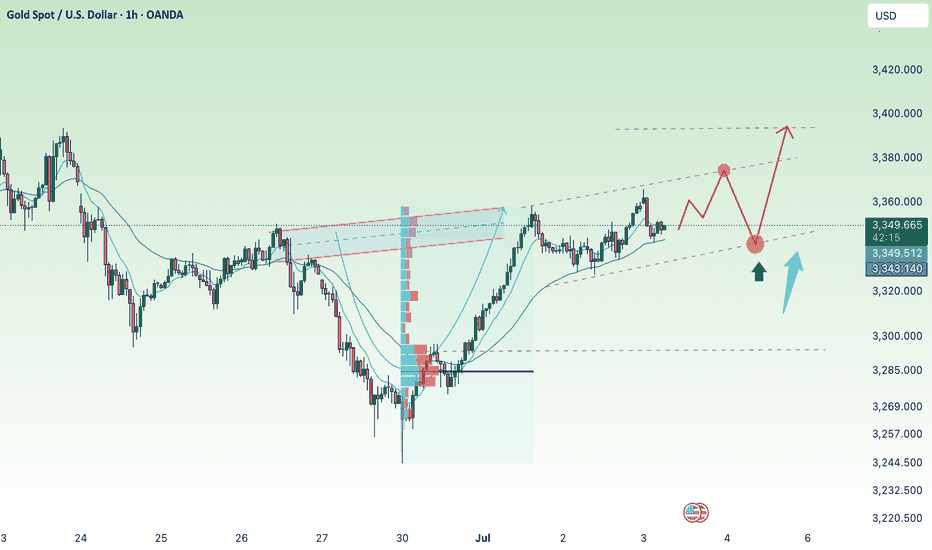

Trade Breakdown: XAUUSD 15-Min | Liquidity Grab + Reversal PlayOANDA:XAUUSD

Psychological Setup

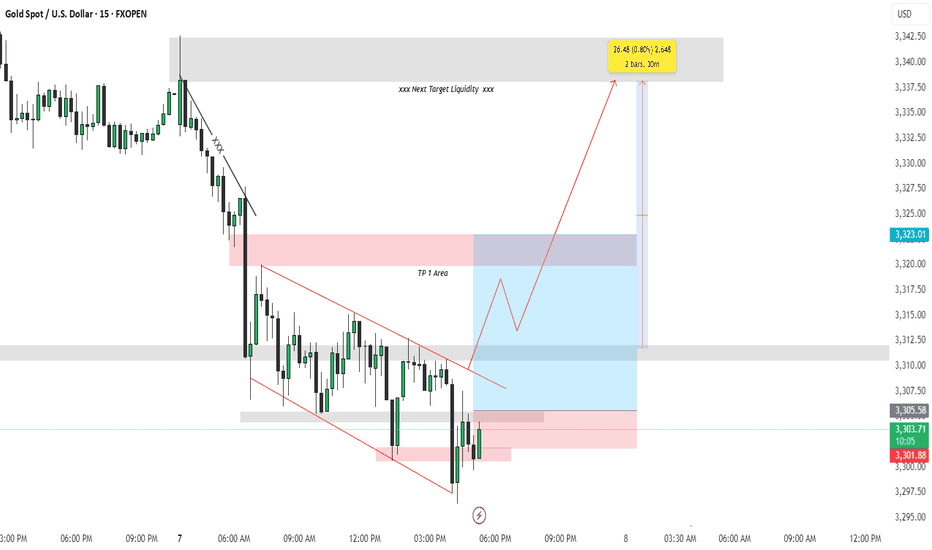

This trade is rooted in the psychology of smart money and retail behavior. After a sharp drop in price, most retail traders expect continuation (trend-following). However, institutions often manipulate liquidity zones — hunting for stop-losses before a true reversal. This trade capitalizes on that behavior.

🔍 Technical Explanation:

🔻 1. Market Structure:

Price was previously in a downtrend, forming lower highs and lower lows.

A falling wedge pattern (red lines) formed after a strong bearish move, signaling potential bullish reversal.

Price broke the wedge to the upside — a classic reversal signal.

🔁 2. Liquidity Concept:

Below the wedge: The market grabbed liquidity by taking out stop losses of buyers who entered too early.

Above the wedge (TP Areas):

TP 1 Area (red box): This is the first logical resistance where previous supply sits — many sellers will enter here, providing buy-side liquidity.

Next Target Liquidity (grey box above): This is a major imbalance zone and likely where stop-losses of early short sellers are stacked.

Price is expected to grab liquidity from that area (marked by the red arrow).

✅ Entry & Trade Logic:

Entry Zone: After liquidity was swept at the bottom of the wedge, a bullish engulfing candle formed near demand — signaling institutional interest.

Risk-Reward Setup:

Targeting 0.80% move (approx. 26.48 points).

Trade is based on reversal from demand zone + wedge breakout + liquidity grab confirmation.

🎯 Target Projections:

TP1 Area: Conservative target, just above recent structure.

Final Target: High-probability liquidity zone where market is drawn to clean up resting orders (grey zone).

🧠 Why This Trade Matters (Trading Psychology Insight):

Most retail traders get trapped in emotional entries — entering shorts after a drop or longs too early in a wedge.

Smart money waits for liquidity sweeps before moving price in the desired direction.

This setup shows the importance of patience, structure, and understanding market psychology rather than reacting emotionally to price action.

📌 Key Takeaways:

📉 Trap: Falling wedge builds false bearish confidence.

🧠 Psychology: Stop hunts create fuel for reversal.

📈 Reaction: Smart money absorbs liquidity, moves price toward next inefficiency.

Hashtags:

#XAUUSD #SmartMoney #LiquidityHunt #TradingPsychology #GoldTrade #PriceAction #WedgeBreakout #FXOpen #TechnicalAnalysis #SupplyDemand

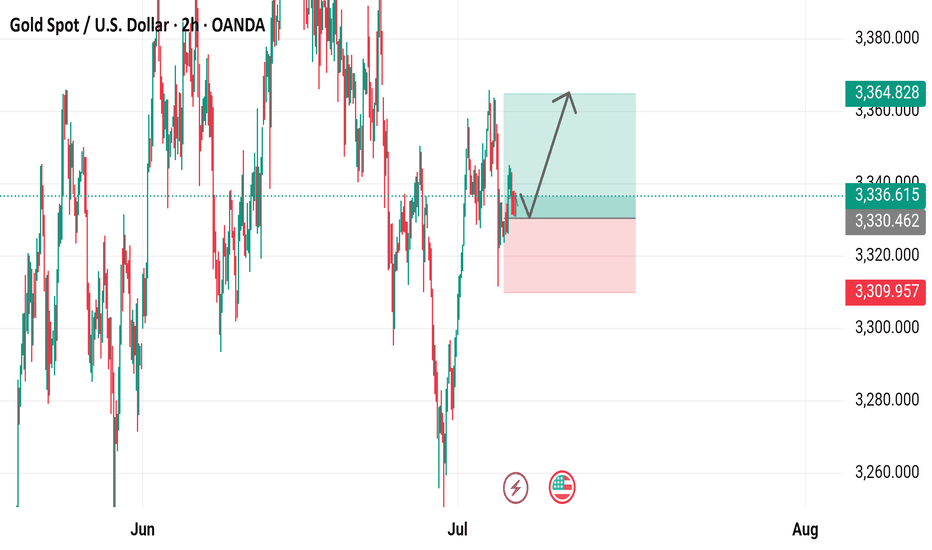

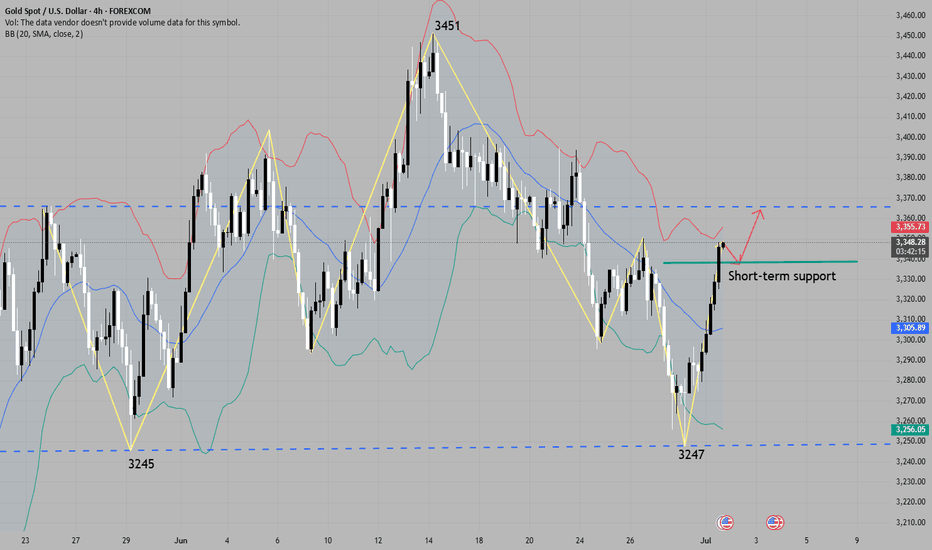

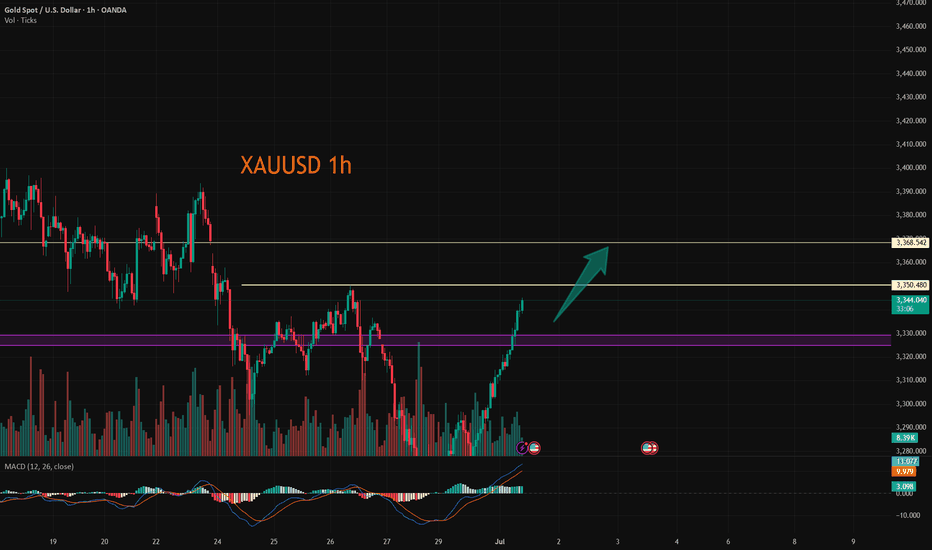

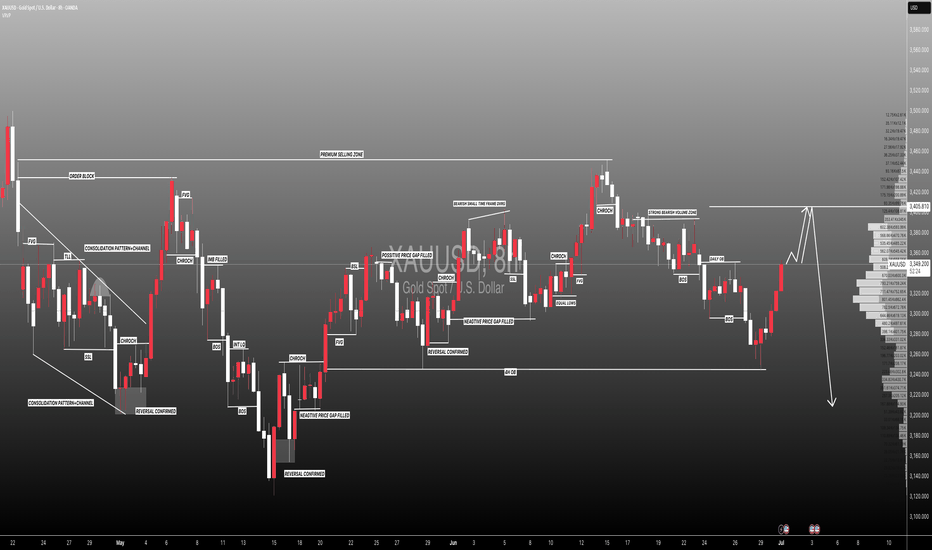

GOLD H2 Intraday Chart Update For 7 July 2025Welcome to the new week traders

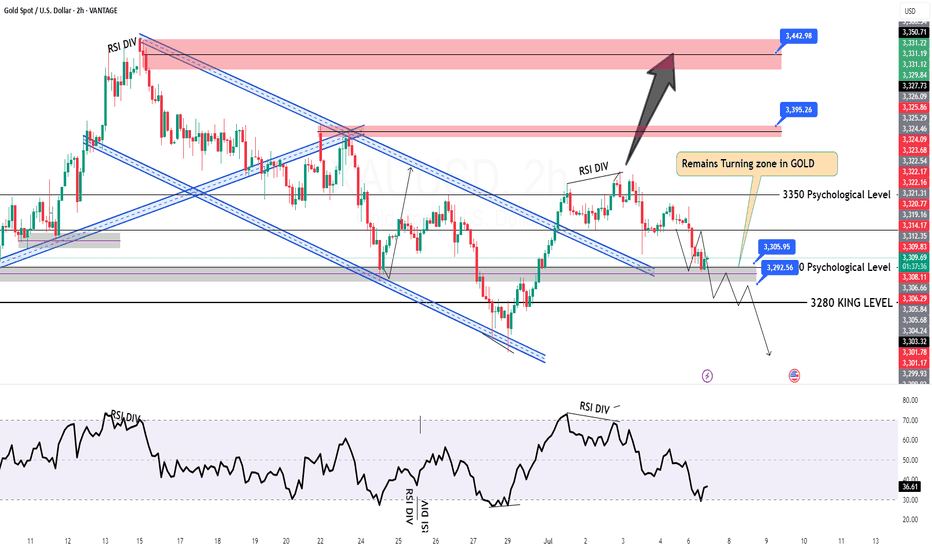

as we have FOMC meeting minutes report due this week so firs market is fell down from 3350 Psychological level now is testing 3300 psychological level

all eyes on breakout of 3300 level for now if market breaks 3300 level then it will move towards 3280 then 3350

only clear breakout of 3335 will clear path for towards 3368 level

Disclaimer: Forex is Risky

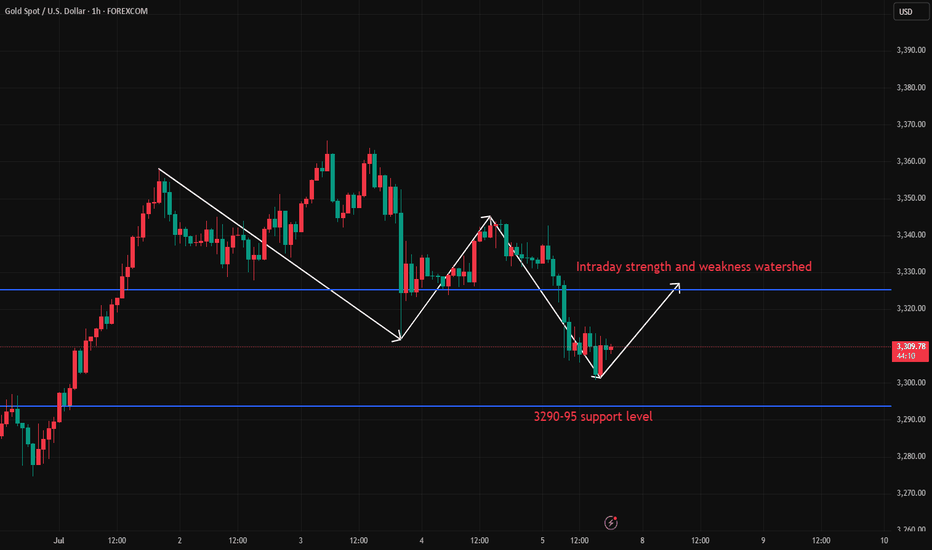

Gold price plunges by $30 at openingGold fell sharply at the opening of the morning session, with the intraday high and low price difference exceeding 30 US dollars. The positive factors over the weekend failed to reverse the bullish trend, and the bearish forces prevailed. Gold fell sharply in the last week of June, and bottomed out and rebounded in the first week of July. The market is in fierce competition between bulls and bears, and the volatile pattern has not changed. At present, gold has fallen below the non-agricultural low of 3311, and the market is weak. There is a high probability of a high and fall in the future. The short-term resistance is in the 3325-27 area, which is the intraday strength and weakness watershed; the 3343-45 area is the key boundary between bulls and bears. If it is not broken, it will fall back. If it breaks through, it is expected to hit 3365, 3380 or even 3400. The current support below is 3295-3290, and the resistance above is 3317-3323. It is recommended to do more in the callback.

Gold Spot / U.S. Dollar (XAUUSD) 2-Hour Chart2-hour chart from OANDA displays the recent price movement of Gold Spot (XAUUSD) against the U.S. Dollar. The current price is $3,336.615, up by $10.585 (+0.32%). The chart highlights a recent upward trend with a buy signal at $3,336.970 and a sell signal at $3,336.260. Key price levels include a resistance zone around $3,364.828 and a support zone near $3,309.957, with the price showing a potential breakout above the recent consolidation range.

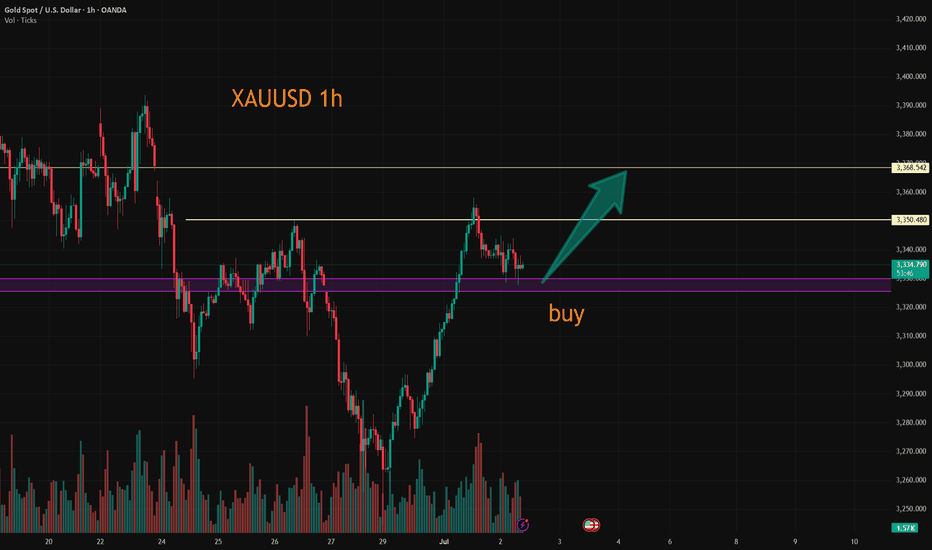

Gold lacks downside momentum: Next week's analysis & adviceGold trading is relatively light today due to the U.S. Independence Day holiday. On the downside, we continue to focus on the short-term support at the 3325 level, while the key resistance above remains in the 3345-3350 range, which was yesterday's breakdown point. The market has closed early today, and price action has been stuck in a range-bound consolidation.

After plunging $40 on the back of bearish non-farm payroll data, gold stabilized and rebounded, recouping nearly half of the losses. This performance confirms that the downside space is limited. Currently, the market has returned to a oscillating upward pattern, and the weekly chart is likely to continue range-bound fluctuations. From a technical perspective, the 3325 level has formed a key support. The secondary retest overnight confirmed the bottom structure, and the gradual lifting of early session lows has also released a bullish signal. Looking ahead to next week, gold is expected to continue its bullish trend. If the 3325 support level below remains unbroken, one can look for opportunities to establish long positions.

XAUUSD

buy@3325-3330

tp:3340-3360-3380

Investment itself is not the source of risk; it is only when investment behavior escapes rational control that risks lie in wait. In the trading process, always bear in mind that restraining impulsiveness is the primary criterion for success. I share trading signals daily, and all signals have been accurate without error for a full month. Regardless of your past profits or losses, with my assistance, you have the hope to achieve a breakthrough in your investment.

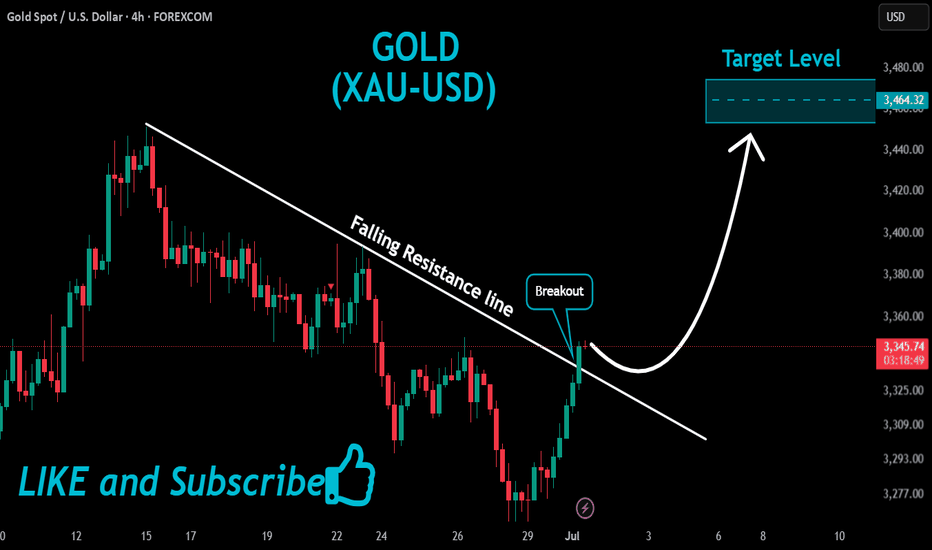

GOLD Massive Bullish Breakout!

HI,Traders !

#GOLD is trading in a strong

Uptrend and the price just

Made a massive bullish

Breakout of the falling

Resistance line and the

Breakout is confirmed

So after a potential pullback

We will be expecting a

Further bullish continuation !

Comment and subscribe to help us grow !

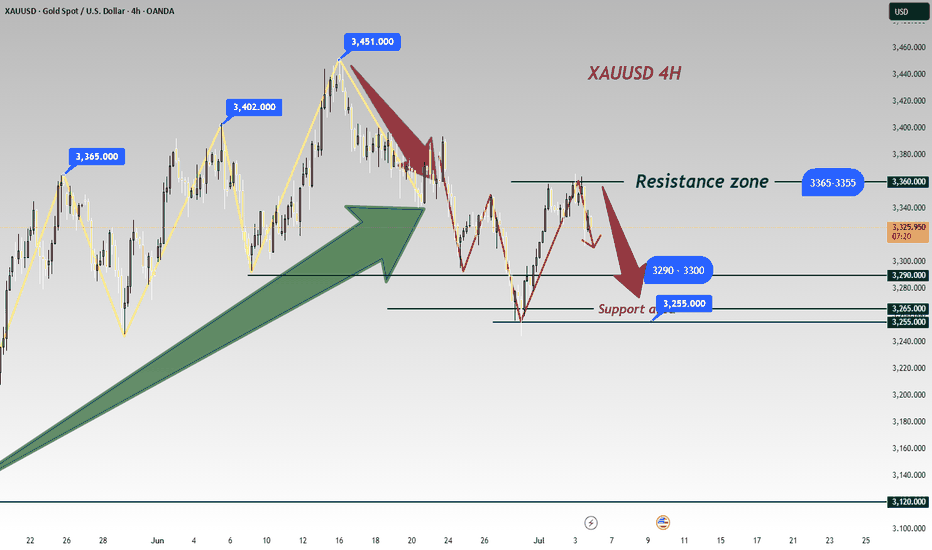

June Nonfarm Data: Gold PlungesThe US June nonfarm payrolls data is out: 147,000 jobs were added, exceeding the expected 106,000 and the previous 139,000, with slight upward revisions to the prior two months’ figures. The unemployment rate dipped from 4.2% to 4.1%, beating the forecast of 4.3%. While the US economy slows, the job market remains robust. 🌟

Post-data release, market bets on a July rate cut have evaporated, with the probability of a September cut dropping to around 75%. US stock futures extended gains, Treasury yields rose across the board, the US Dollar Index surged, and gold plunged nearly $40 in a short squeeze—signaling an unexpected major bearish hit to gold. Weng Fuhao advises trading with the trend, focusing on shorting on rebounds. 😲

Gold, jolted by the nonfarm data, slid sharply in the short term before a minor rebound, with bearish signals across all timeframes. The data triggered an immediate breakdown, shifting the short-term trend to downward: on the 3-hour chart, moving averages formed a death cross, MACD showed a death cross with expanding volume, and gold prices fell below the Bollinger Band lower track, confirming a clear bearish momentum. 📉

🚀 Sell@3355 - 3345

🚀 TP 3335 - 3325 - 3315

Accurate signals are updated every day 📈 If you encounter any problems during trading, these signals can serve as your reliable guide 🧭 Feel free to refer to them! I sincerely hope they'll be of great help to you 🌟 👇

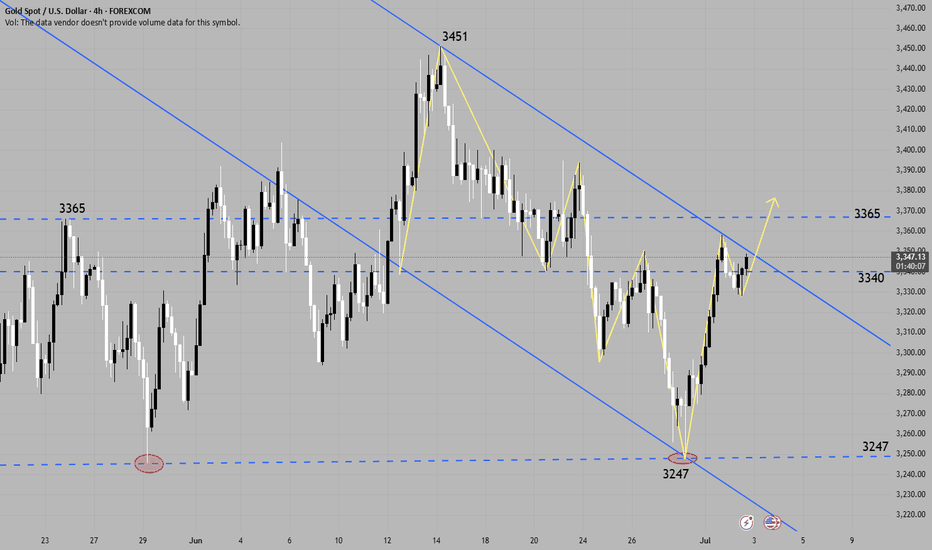

Tariff tensions heat up againGold, the price rebounded quickly after the parallel attack and defense at 3245 at the beginning of the week. The article emphasizes that the short-term strength will continue. The high point of the week may appear around Thursday's non-agricultural data. The medium-term top idea of 3500-3452 is still maintained; on Tuesday, it actually hit 3358, and the daily K-line combination showed a long arrangement. In the morning, it was emphasized that it was still possible to follow the trend and wait for the non-agricultural data to break through on Thursday night;

The actual retracement rebounded from 3327 and is now reported at 3343, which is in line with expectations; the short-term support in the evening is 3340-3336, and the strong support is 3330; the short-term resistance is 3348, and the strong resistance is 3352-3358. If it breaks, it will look at 3365-3400;

7/4: Trade Within the 3313–3346 RangeGood morning, everyone!

Yesterday’s intraday trades delivered solid profits. Since the U.S. market will be closed today, news-driven volatility is expected to be limited. Therefore, today’s trading focus will primarily revolve around technical setups.

Current structure:

Key support: 3321–3316

Immediate resistance: 3337–3342, followed by 3360

If support holds and resistance breaks, a potential inverse head-and-shoulders pattern may form on the 4H chart, with the next target near 3380

If support breaks, focus shifts to the 3303–3289 support zone

Given the likelihood of range-bound price action today, the suggested intraday range is 3313–3346, with a preference for selling near resistance and buying near support.

If an upside breakout occurs, consider using the MA20 on the 30-minute chart as a guide for pullback entries.

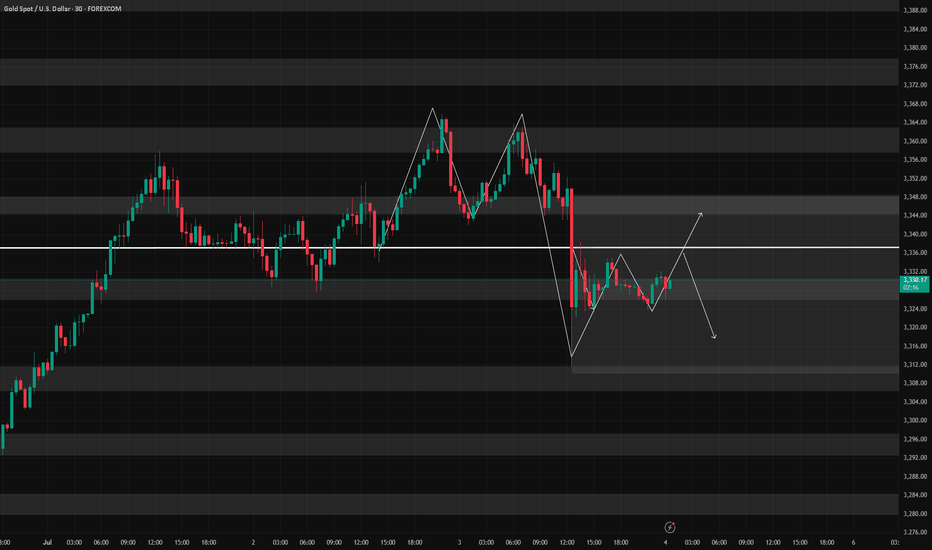

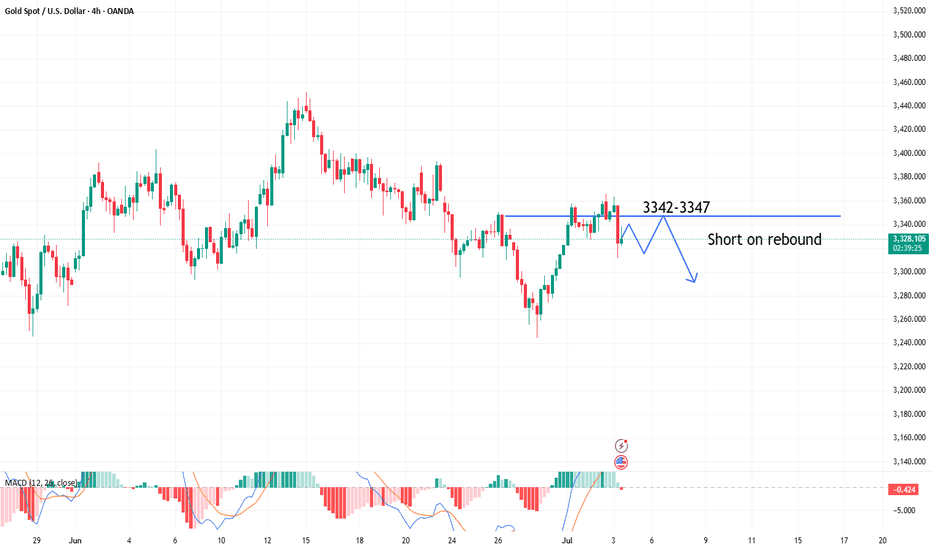

Gold prices plunge after non-farm payrolls surpriseGold was hit by non-agricultural data and fell rapidly in the short term. All cycles showed bearish signals, and there was a slight rebound after the sharp drop. After the release of non-agricultural data, the market broke down directly, and the short-term trend has turned to decline. Data shows that gold fell by $40, the moving average formed a dead cross on the 3-hour chart, the MACD indicator formed a dead cross and increased in volume, and the gold price has fallen below the lower track of the Bollinger Band. It is recommended to continue shorting when it rebounds to the middle track position. The upper pressure level is 3342-3347. The operation is mainly based on rebound shorting.

Operation strategy:

1. It is recommended to short gold near the rebound of 3342-3347, stop loss 3355, target 3330-3320

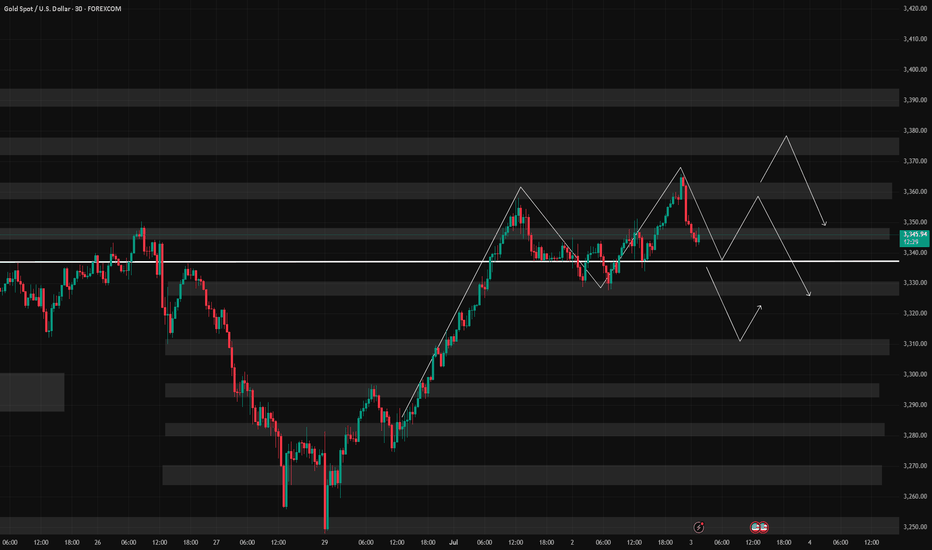

7/3: Focus on Short Positions, Watch Support Near 3320Good morning, everyone!

Yesterday, gold tested support near 3328 but failed to break below it effectively. The price then rebounded toward the 3350 level. At today’s open, gold briefly extended to around 3365 before pulling back.

Technically:

On the daily (1D) chart, the price remains capped by the MA20, with no confirmed breakout yet.

Support levels below are relatively dense, and moving averages are increasingly converging, suggesting a breakout in either direction is approaching.

Key intraday support lies in the 3321–3316 zone.

On the 2-hour chart, we are seeing the first signs of a bearish divergence, indicating a need for technical correction. Much like Tuesday’s setup, there are two possible scenarios:

If 3342–3334 holds, the price may extend slightly higher, intensifying divergence before pulling back;

If 3337 breaks, we could see a drop toward 3320, where correction would occur through a direct decline.

From a fundamental perspective, several high-impact U.S. data releases are scheduled for the New York session, which may increase volatility and make trading more challenging.

Trading suggestion:

For most traders, the safest approach is to wait for data to be released, then look for oversold rebounds or overbought corrections following sharp market reactions.

This style requires patience and strong risk control—avoid being overly aggressive or greedy, as such behavior can easily lead to trapped positions or even liquidation.

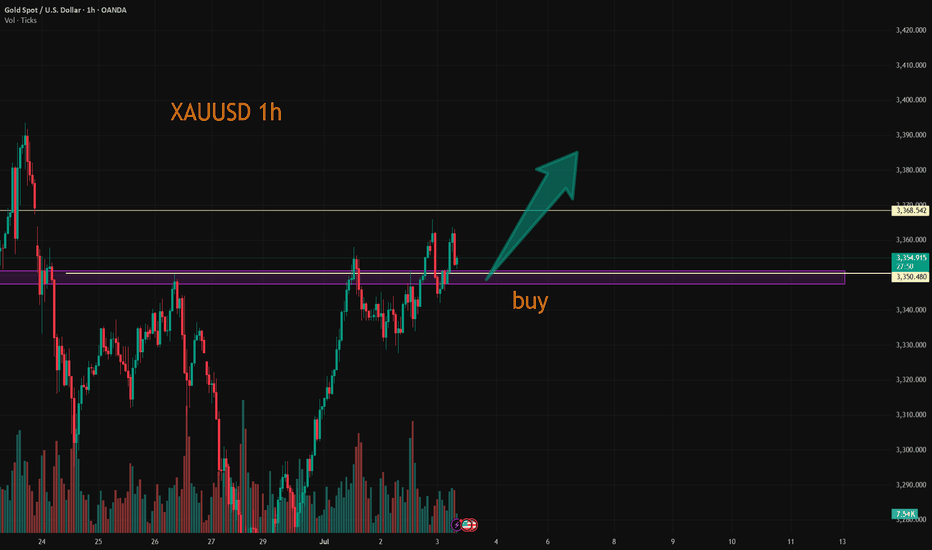

XAUUSD:A long trading strategy

The highest gold price in the Asian session reached 3365.4, which is already our mid-line target range. If you have completed and left the market, congratulations, because I personally set the TP point of 3368, so it did not touch, the trend of the past two days is appropriate rewithdrawal after strengthening, the high is also gradually rising, the overall long trend has not changed. For today's data, the probability will make gold prices continue to rise, trading ideas or to do the main.

Trading Strategy:

BUY@3347-51

TP:3365-70

This TP range is also the target range of the median trader, for friends who do not have automatic stop profit, you can take a profit manually at that time.

More detailed strategies and trading will be notified here ↗↗↗

Keep updated, come to "get" ↗↗↗

Gold is unilaterally upward during the dayGold, the general trend is as described in the morning analysis. The price fell from the 3452 high point in this round. On Monday, it rebounded quickly after parallel attack and defense near 3245. The article emphasizes that the short-term strength will continue. The high point of the week may appear around Thursday's non-agricultural data. The medium-term top idea of 3500-3452 is still maintained;

It actually opened unilaterally upward from 3303 during the day and is now reported at 3340; the bullish pattern of each cycle is good, and there will be a high in the evening; short-term support is 3338, strong support is 3332; short-term resistance is 3350-3356, strong resistance is 3365-3374;

XAUUSD:Today's Trading Strategy

Gold retreated in the sub-session, I have personally increased my long position near 3331, the overall trend is bullish unchanged, the median strategy is patient to rise. If you are trading short, you can go long at 3325-3330 and leave at 3340-45. The same can be said if you want to solve the problem; Trade according to your trading preferences and risk tolerance.

More detailed strategies and trading will be notified here ↗↗↗

Keep updated, come to "get" ↗↗↗

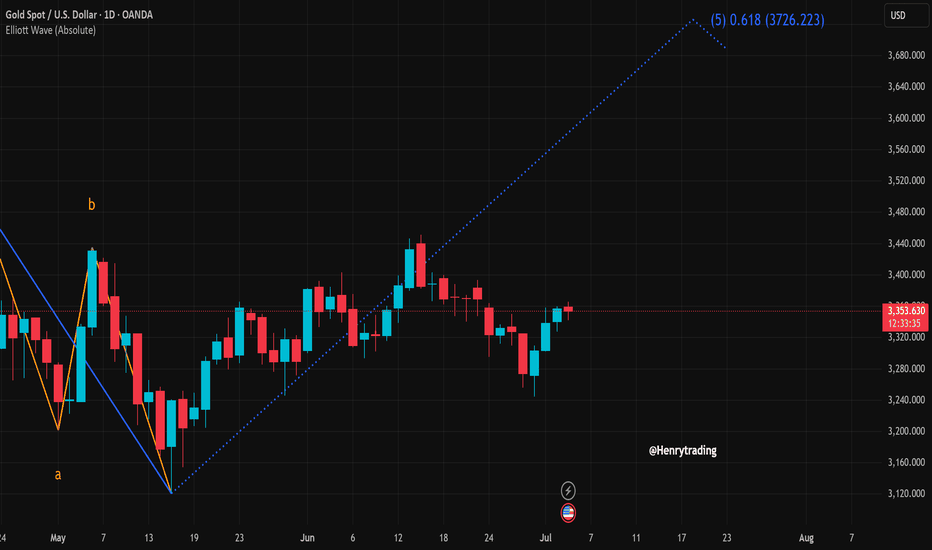

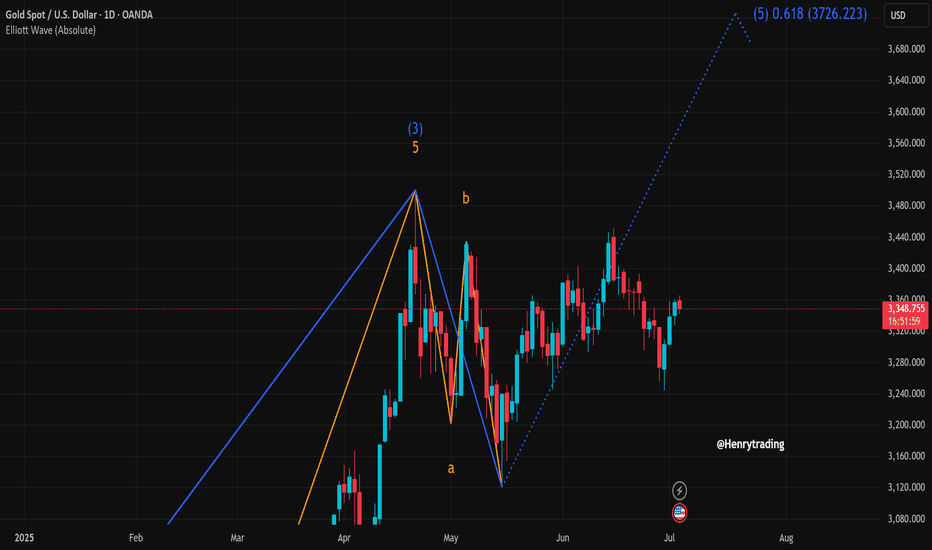

XAUUSD Set for Strong Bullish Wave – Targeting 3,726?Gold (XAUUSD) is showing signs of a bullish recovery after a recent correction between the 3,290–3,340 USD zone. On the daily chart, a clear Elliott Wave formation is unfolding, with the price potentially entering wave 5 aiming for the 0.618 Fibonacci extension at 3,726 USD.

Clear Wave Structure:

The a-b-c corrective wave appears to have completed in mid-May.

The price is now in wave 3 and preparing for a potential extension in wave 5.

Candlestick and Buying Momentum:

Recent candles show strong buying pressure with four consecutive bullish sessions.

The current upward momentum is testing the 3,352 resistance – a breakout could open the path to 3,450 and eventually 3,726 USD.

Support & Resistance Levels:

Immediate support: 3,320 – 3,330 USD

Key resistance: 3,450 USD (recent swing high)

Extended target: 3,726 USD (Fibonacci 0.618 from wave 2 low to wave 3 peak)

Suggested Trading Strategy:

Favor buy on dip strategy, waiting for a minor pullback to the 3,330–3,340 area before entering long.

Set stop-loss below 3,300, with targets at 3,450 and 3,726 USD respectively.

Conclusion:

The XAUUSD chart suggests a potential strong bullish wave according to the Elliott Wave framework, with a breakout likely leading to the 3,726 USD zone. Traders should closely monitor price action around the 3,350 level for confirmation of continued upward momentum.

What’s your view on this analysis? Drop a comment and let’s discuss your trading strategy together!

Gold growth, recovery 3393⭐️GOLDEN INFORMATION:

Gold prices edge higher during the North American session as investors turn their attention to the upcoming US Nonfarm Payrolls (NFP) report — a key indicator that could influence the Federal Reserve’s next policy move. At the time of writing, XAU/USD is trading at $3,348, up 0.29%.

Recent labor data from ADP revealed that companies are pausing hiring rather than resorting to layoffs, reflecting caution amid uncertain economic conditions. Meanwhile, Microsoft’s decision to cut 9,000 jobs has added to concerns about a softening labor market.

Traders now await Thursday’s official employment report from the Bureau of Labor Statistics, which is projected to show 110,000 new jobs added in June — a slowdown from May’s 139,000. The Unemployment Rate is expected to tick up slightly to 4.3%, still within the Fed’s projected range of 4.4% according to its latest Summary of Economic Projections.

⭐️Personal comments NOVA:

good buy, hold before NF news. Dollar continues to be under selling pressure from investors, worried about the Trump administration's unstable tariff policies.

⭐️SET UP GOLD PRICE:

🔥SELL GOLD zone: 3393- 3395 SL 3400

TP1: $3380

TP2: $3363

TP3: $3350

🔥BUY GOLD zone: $3296-$3294 SL $3289

TP1: $3308

TP2: $3318

TP3: $3330

⭐️Technical analysis:

Based on technical indicators EMA 34, EMA89 and support resistance areas to set up a reasonable BUY order.

⭐️NOTE:

Note: Nova wishes traders to manage their capital well

- take the number of lots that match your capital

- Takeprofit equal to 4-6% of capital account

- Stoplose equal to 2-3% of capital account

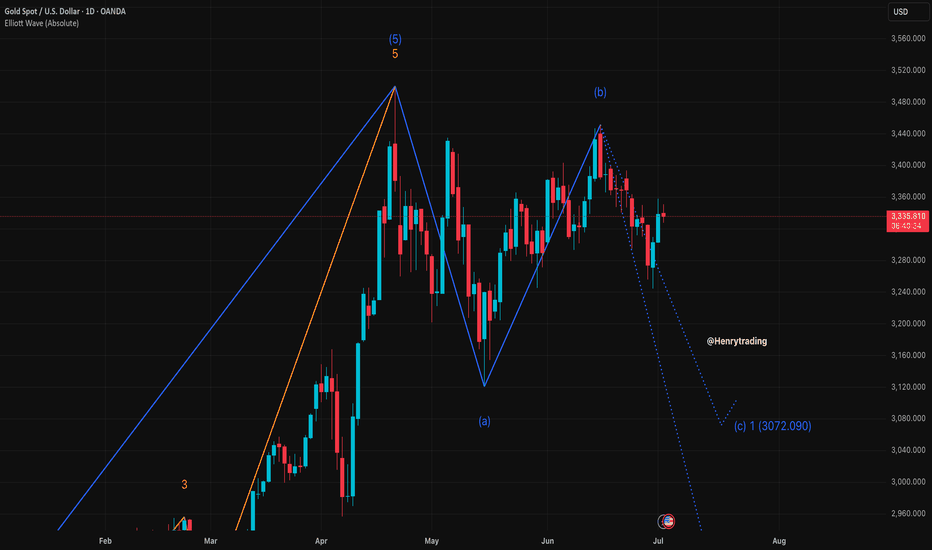

Elliott Wave Analysis of XAUUSDOn the daily chart of XAUUSD, we are witnessing a clearly defined Elliott Wave structure, with the potential formation of an extended wave (5) targeting the $3,726 region — aligned with the 0.618 Fibonacci extension. This is a key technical signal that could capture the attention of both long-term investors and strategic swing traders.

1. Elliott Wave Overview:

Wave (3) concluded at the peak around $3,365, followed by a textbook a-b-c corrective pattern.

Waves "a" and "b" are clearly identifiable, with wave "c" appearing to have completed.

The current price action suggests a rebound from the bottom of wave c — a strong indication of a possible start to wave (5).

2. Wave (5) Target Zone:

The Fibonacci 0.618 extension projects a target near $3,726 — a significant price level the market could approach if bullish momentum builds up.

This level also serves as a psychological resistance zone, so expect possible volatility as the price nears this area.

3. Price Behavior & Confirmation Signals:

Recent candlestick formations reveal renewed buying interest, with multiple bullish candles showing long bodies and lower wicks.

Holding above the key support around $3,300 is crucial for confirming the formation of an uptrend.

A breakout above the $3,365 high (wave (3) peak) would be a strong signal that wave (5) is in motion.

4. Suggested Trading Strategies:

Buy limit: Consider entries around the $3,310 – $3,320 support zone on a retest.

Buy breakout: Trigger entries if price breaks decisively above $3,365 with strong volume.

Take profit: Gradually scale out positions around the $3,680 – $3,726 area.

Stop loss: Place stops below the wave c bottom — under $3,245.

5. Conclusion:

XAUUSD is currently in a sensitive phase with a high probability of a bullish breakout. The Elliott Wave structure shows that there is still considerable upside potential. However, traders should maintain strict risk management, as wave (5) formations often involve significant price swings.

XAUUSD Analysis – July 2–3, 2025: Resistance Holds Gold is currently trading around 3,337 USD, having tested the 3,350 USD resistance zone without a successful breakout. The price remains under pressure from key macroeconomic factors:

- The Dollar Index (DXY) is stable above 106 – a sign of continued demand for the greenback, which weakens gold.

- U.S. 10-year Treasury yields hold around 4.35%, reinforcing the view that the Fed will keep interest rates high.

- The Core PCE report for June remains above the Fed’s 2% inflation target, decreasing expectations of a rate cut in Q3.

- Safe-haven demand is weak, as geopolitical tension in the Middle East and Eastern Europe remains subdued.

➡ Overall, these factors confirm that XAUUSD remains under bearish pressure in both the short and medium term, especially while key resistance remains intact.

1. Technical Analysis – XAUUSD on D1 Chart

- Price recently tested the 3,340 – 3,350 USD resistance zone, a confluence of:

Previous supply zone

- Fibonacci retracement 0.5–0.618 from 3,399 USD

- Key Change of Character (CHoCH) level

- RSI is forming a mild bearish divergence, signaling weakening bullish momentum.

- EMA20 and EMA50 are both sloping downward – confirming the prevailing bearish trend.

This setup is typical of a Sell on Rally pattern, with each retracement being rejected at strong resistance.

2. Key Technical Zones to Watch

Technical Role

- 3,350 – 3,340 Major resistance (Fibo 0.5–0.618 + supply + CHoCH)

- 3,294 – 3,285 Nearest support – previously a resistance-turned-support

- 3,255 – 3,235 Short-term target zone – June low

- 3,223 – 3,205 Strong medium-term support – April low + extended Fibo

3. Suggested Trade Setup

Preferred Scenario: SELL below 3,350

Entry: 3,345 – 3,347

Stop Loss: 3,351

Take Profit 1: 3,335

Take Profit 2: 3,330

Take Profit 3: 3,320

Ps : XAUUSD is retesting a major resistance zone without macro or technical catalysts for a sustained breakout. The best approach remains to sell at resistance and take profit near support, in alignment with the ongoing bearish trend.

The strategy will be updated regularly – don’t forget to save and follow to stay ahead of market opportunities.

The analysis was provided by @Henrybillion

XAUUSD:Go long

Gold continued to strengthen in the Asian session, mainly due to adverse signals from tariff talks, which spurred a sharp rebound in gold prices. At present in the 3340 near the shock, this position is a short - term small pressure, from the technical trend, is still a strong long arrangement, so I think continue to break up is inevitable. Above you can look at 3350 first, then 3368/3390.

My idea is to wait for a pullback after entering the long, at present, there is not much room for a pullback, and under the strong market, there are fewer opportunities, so you can consider the first 3336-40 direct layout of long orders. If there is a certain range of retracement to consider adding positions.

Trading Strategy:

BUY@3336-40

TP:3349-54

More detailed strategies and trading will be notified here ↗↗↗

Keep updated, come to "get" ↗↗↗

7/2 Trapped Orders from Yesterday Turned ProfitableGood morning, everyone!

Yesterday’s early-entry gold short position encountered some temporary drawdown, but thanks to flexible adjustments, the trade has now moved into profit overall.

Currently, the price is hovering near a key support area. Based on the 1H and 2H charts, there is still room for further downside. At this point, there are two strategic options:

Close the position to lock in current profits;

Hold the position and wait for further decline, keeping in mind that if support holds, the price may rebound back toward the 3350 level, introducing some risk.

You can decide whether to stay in the trade or exit, depending on your risk tolerance and trading plan.

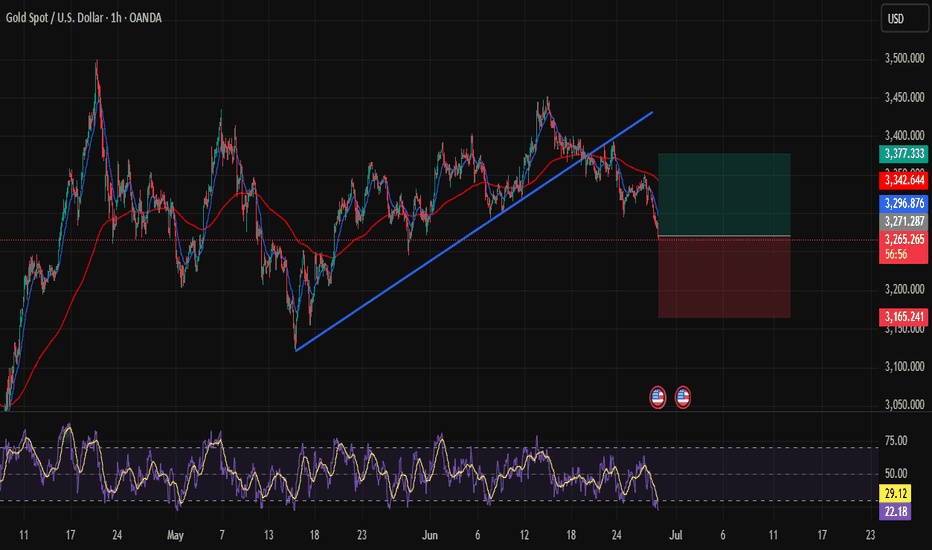

Catching the Perfect Rebound on XAUUSD!Hi traders! , Currently analyzing GOLD (XAUUSD) on the 1H timeframe.

Price has dropped aggressively but is now reacting strongly from a key support zone around 3,271.00, where buyers are stepping in. This area has previously shown significant bullish reactions.

I'm now buying from 3,271.00, expecting a bullish correction towards my target.

Take Profit: 3,377.00

Stop Loss: 3,165.00

RSI is in oversold, indicating potential exhaustion of sellers.

Price may have created a fake breakout below the trendline, trapping liquidity before bouncing back.

Currently managing the trade, watching how price develops around this key area.

Disclaimer : This is not financial advice. This is my personal analysis shared for educational purposes only.

#XAUUSD:First Buy, Then Sell Swing! Big Move In Making! Gold failed to decline further as previously predicted in our analysis. Instead, it continues to exhibit bullish sentiment. The current price trading in a critical region between 3350 and 3360, where significant resistance is observed. We anticipate that the price must pass through this region before it can clearly surpass the 3400 mark.

When this occurs, it is advisable to implement precise risk management strategies while trading gold due to its volatile nature. Additionally, the DXY index is experiencing a decline and currently trading at its all-time low since 1976. This development will likely have a substantial impact on the gold price.

We wish you the best of luck and ensure safe trading practices.

Kindly consider liking, commenting, and sharing this idea.

Team Setupsfx_

❤️🚀