Breaking news is coming! How to trade XAUUSD/GOLD?XAUUSD/GOLD continued to fluctuate and rise in the New York market yesterday. It closed at around 3430, and today the Asian market opened at a high of 3438.75. For those who followed the buying yesterday, this profit is quite generous. The interest rate decision is about to be announced, how should we trade?

Two key points need to be paid attention to, namely: the continued fermentation of geopolitics, and the Federal Reserve interest rate decision in the New York time period.

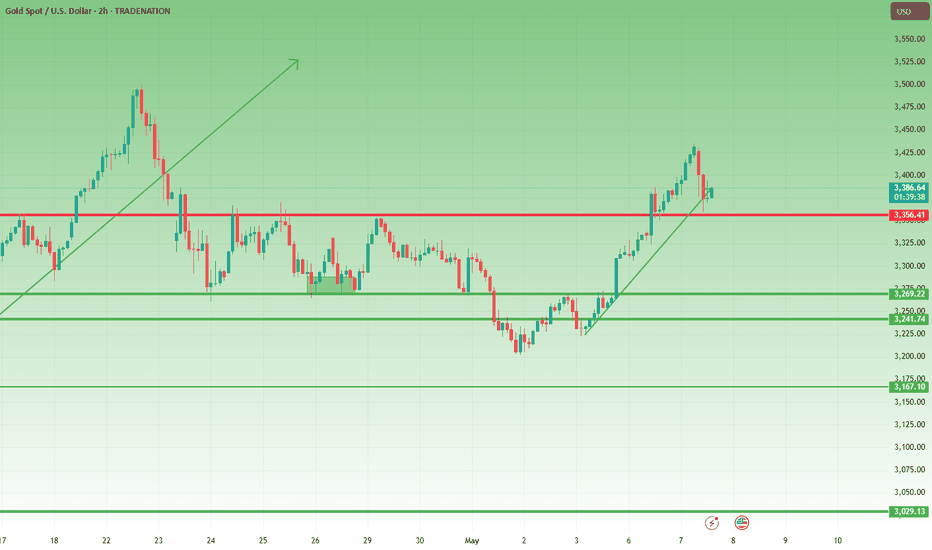

The geopolitical fermentation has eased since the Asian market began, and there is no greater news to provide momentum for the rise, so there has been a sharp drop after the opening, and the lowest reached around 3359. The decline is about 80 US dollars/ounce. The subsequent shock rebounded slightly, and the current quotation is 3387. From the trend observation, there is still an opportunity to buy on the left side of the swing trading.

The interest rate decision mentioned yesterday can be further divided into two results: unchanged interest rate and interest rate cut. The result of unchanged interest rate is that the US dollar index still maintains its value, and there is a suppression on XAUUSD/GOLD. At this time, we need to pay attention to which has a greater impact on geopolitics and the preservation of the US dollar index. The former is good for the rise of XAUUSD/GOLD. The latter has an impact on the decline of xauusd/gold. Secondly, the interest rate cut is good for xauusd/gold. If it is the latter, then it is better to do more at the same frequency.

Therefore, the trading logic is still mainly based on low-level longs. Members with larger funds can choose to buy near the current price of 3392. Members with smaller funds can pay attention to buying opportunities below 3375.

Pay attention to risk control when trading.

Xauusdidea

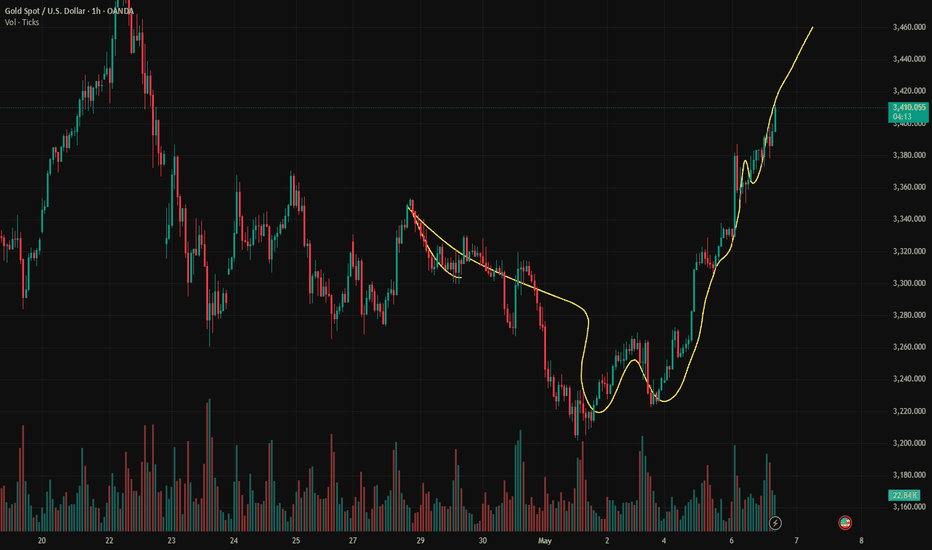

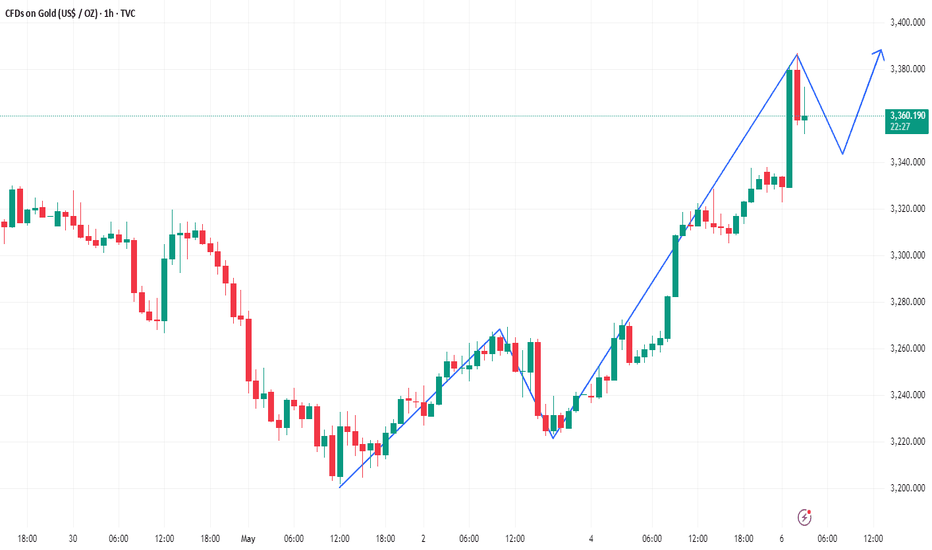

XAUUSD Update – +450 Pips Running SmoothPrice followed our mapped path beautifully, exploding past resistance zones and continuing the bullish trend.

Key breakout levels held strong and momentum stayed aligned with structure.

📈 Current Progress:

✅ +450 pips from entry

📍 Target zone in reach: 3420–3440

📊 Structure remains bullish above 3360–3375

🔔 Follow for precise entries, structure-based ideas, and clean momentum trading.

#XAUUSD #GoldTrading #450Pips #SmartMoneyMoves #FXGoldVision #PriceAction #IntradayTrader

Crazy trading opportunity. XAUUSD/goldSupplement the deficiencies in the previous article.

News from the New York market once again stimulated the rise of XAUUSD/gold, which is a sustained rise. Data news once again ignited the XAUUSD market, and the swing trading target is 3440. The current price is 3410, and there is still about 30 US dollars/ounce of fluctuation space for trading.

For details, please pay attention to the real-time trading opportunities announced by the swing trading center later.

New York market XAUUSD trading opportunities.The 3400 position has been broken. Short-term bulls are still strong. The swing buying we executed all day today has made continuous profits. Such one-sided market conditions in trading have good profits. But the premise needs to be executed. This requires execution and courage.

Teacher Ludvig pointed out that the probability of reaching the target 3440 before tomorrow's London market is more than 90.36%. So this is a good buying opportunity for traders who don't know how to trade now.

The precise trading points are released in the Swing Trading Center. If you don't know what to trade now. Then you can refer to it.

Control trading risks according to the capital situation when trading.

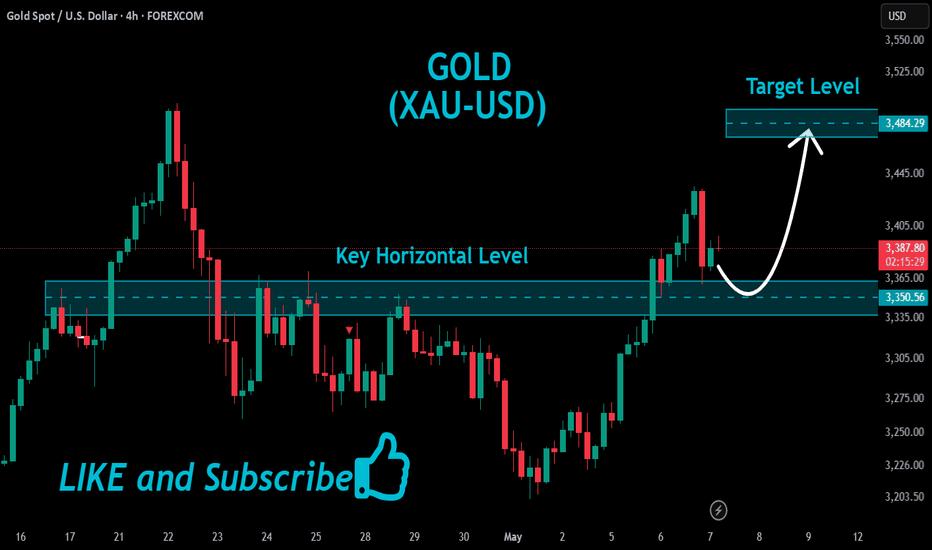

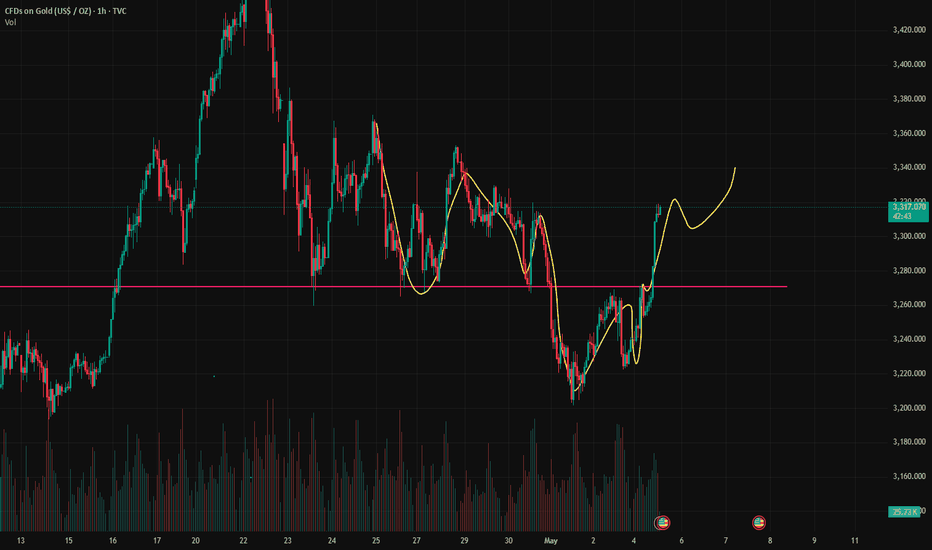

GOLD Shorter Term Chart Update for 7 May 2025Currently GOLD is in Bullish Trend, we might see some correction around 3330 level for downside in case market breaks 3350 Psychological Level Clearly

For upside move market must Breaks & sustain clearly above 3400 Psychological Level

Plan your trades Carefully

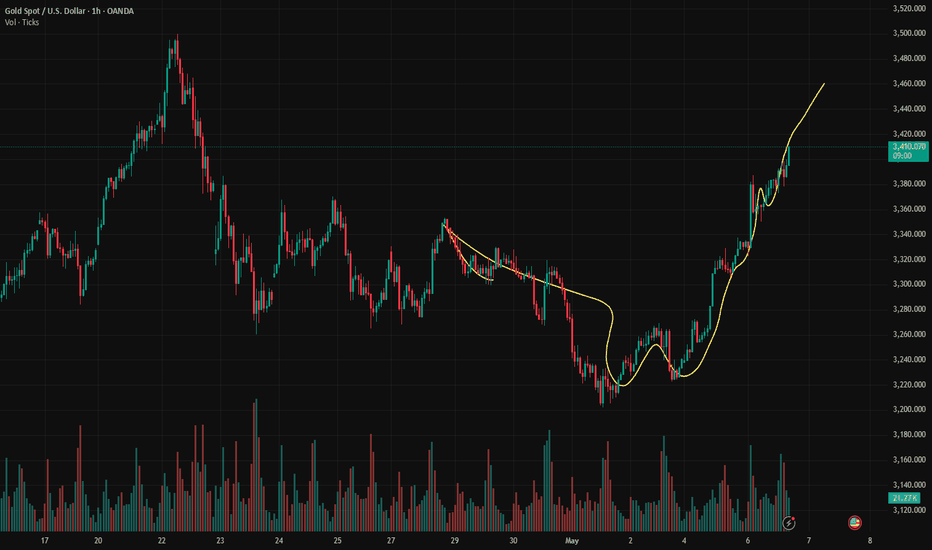

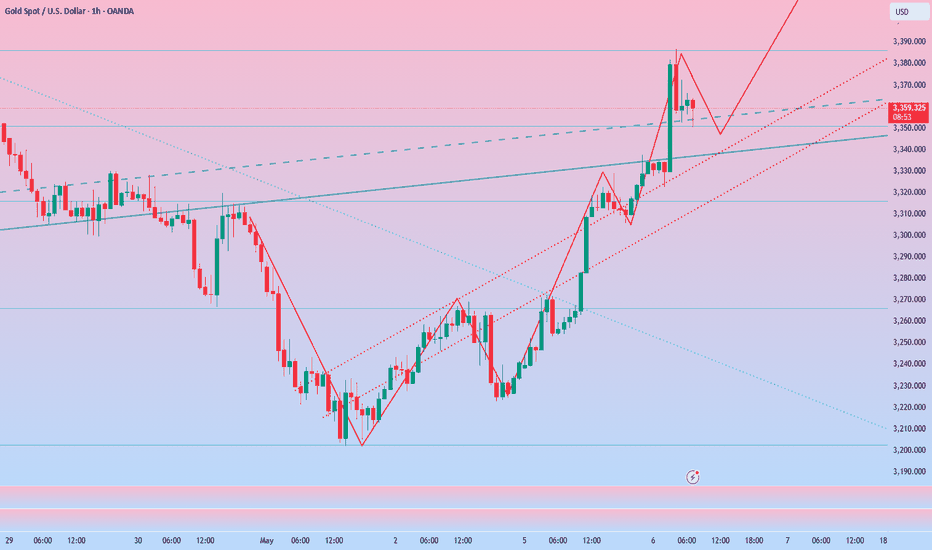

Gold – Bulls in Control, but Watch Key Support Gold remains extremely volatile. After finding support around 3200 at the beginning of the month, the price surged nearly 2500 pips within just three trading days, reaching above 3400.

Currently, the price has pulled back and has tested the 3360 zone over night– a former resistance turned support.

Two Scenarios to Watch:

- Bullish Case: If 3360 holds, bulls could push for a retest of the 3500 zone.

- Bearish Case: A clear break below 3360 would confirm a lower high, potentially opening the door for a deeper correction back to 3270.

For now, I’m on the sidelines, waiting for more clarity around this critical support.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analyses and educational articles.

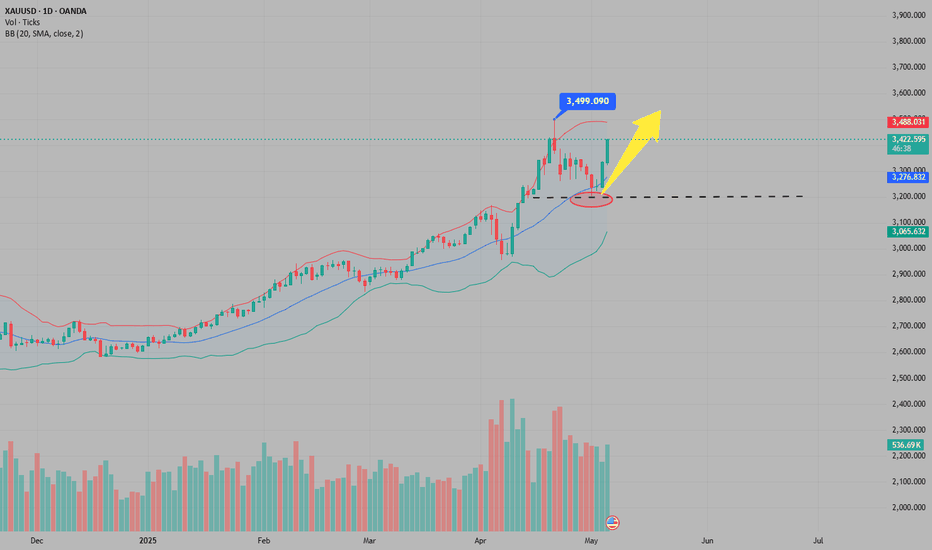

Gold is back on strong footing, follow me and make moneyFrom the daily chart, the gold price is breaking through the important resistance level and forming a strong upward trend. The price is currently trading around $3,400 and has successfully broken through the key resistance area of $3,330. The Bollinger Band indicator shows that the middle track is at 3231.01, the upper track is at 3485.06, and the lower track is at 2976.97, indicating that the current price is near the upper track of the Bollinger Band, showing strong upward momentum.

The RSI indicator shows that the current value is 64.07, which is in the neutral to strong area. It has not yet reached the overbought level and still has room to rise.

The gold price has maintained a steady upward channel since 2025, and has recently formed a short-term rising flag consolidation, which is usually regarded as a bullish continuation pattern. The key support is at $3,300 and $3,230 (corresponding to the rising trend line), while the resistance is at the psychological level of $3,400 and $3,500. If it can stand firm at $3,400 in the short term, it is expected to hit the historical high of $3,499.83, and once it breaks through, it will open up the possibility of higher prices.

To sum up, gold is still mainly based on falling back and going long

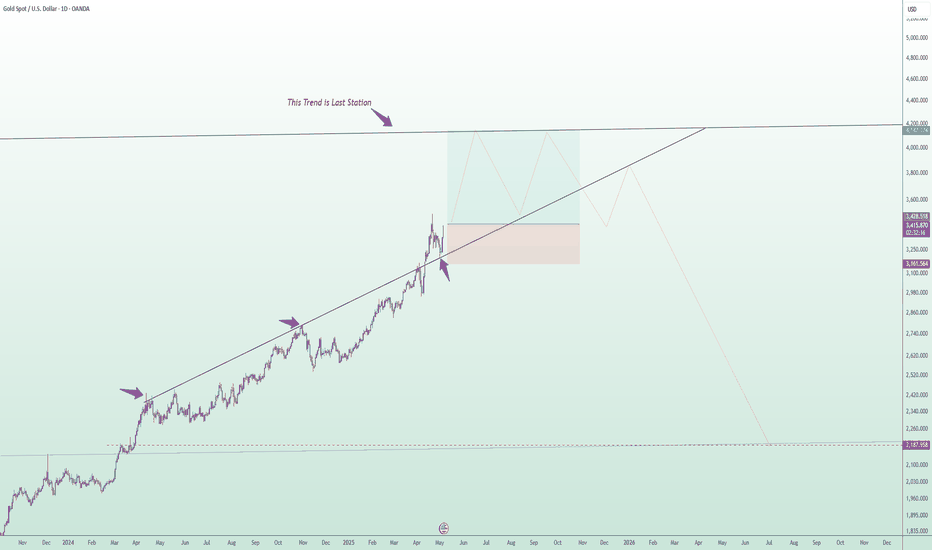

There's still a little more left to sip from gold’s cup

Weekly Outlook on Gold (XAUUSD)

Gold has formed a classic cup pattern on the weekly timeframe, indicating a strong bullish continuation setup. If the pattern completes successfully, we could see a move toward the top of the channel, targeting the 4039 – 4100 zone.

The recent pullback to 3208 was a retest of the previously broken daily structure, acting as a healthy correction before the next potential leg up.

For those looking to enter this move, an ideal strategy would be to place a buy stop order above the last high, as a breakout confirmation.

⚠️ Important note: If the black trendline on the daily chart (which represents the current bullish structure) gets broken to the downside, the trade setup would become invalid and a reassessment would be required.

✅ The best approach is to wait for a clean breakout above the 3495 resistance, then look for a pullback entry on lower timeframes with proper risk management.

📉 In the longer term, we still expect a potential retracement all the way back to the 2199.661 level — so be aware of the bigger picture and adapt as the structure evolves.

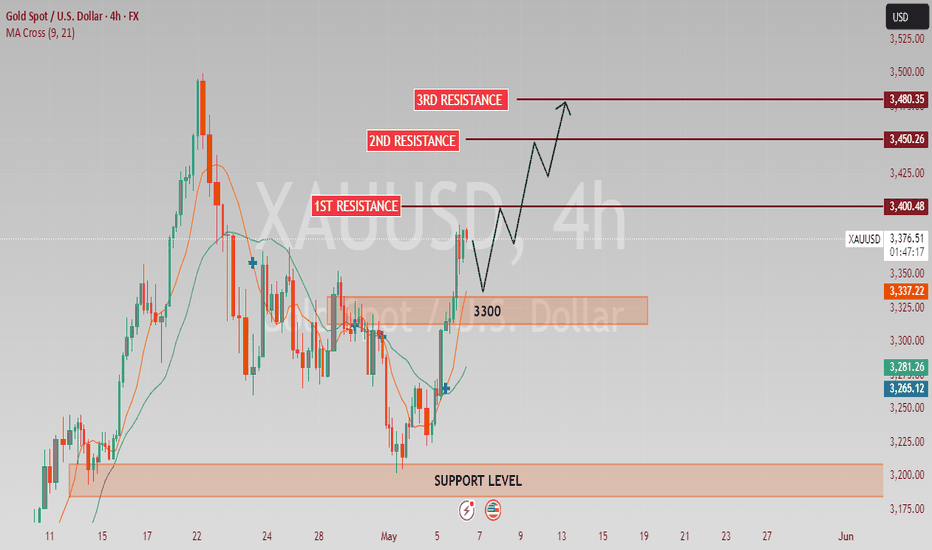

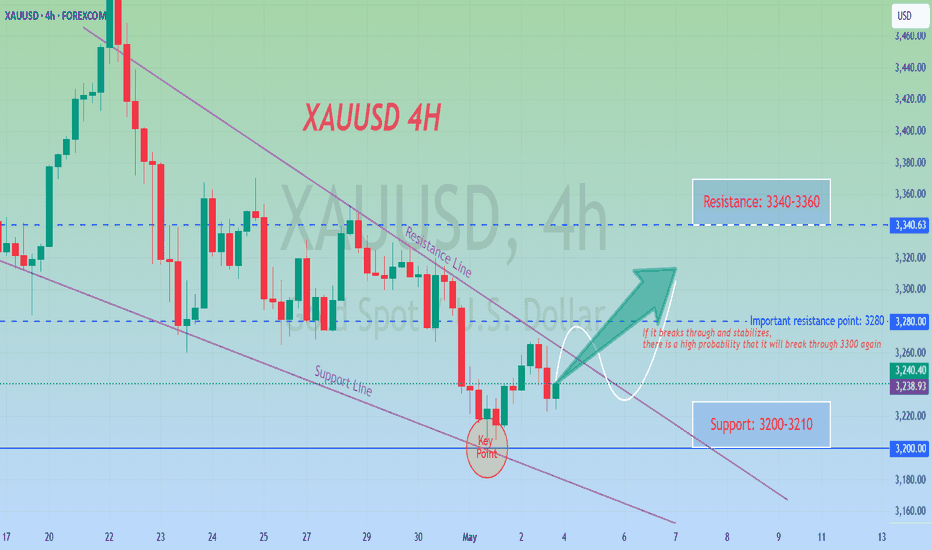

XAU/USD (GOLD) TRADE PLAN 6/5/2025XAU/USD (Gold) Trading Outlook

The current price of XAU/USD around 3380 to 3375. We are anticipating a pullback towards the 3300 level, at which point we will look for long (buy) entry opportunities.

Key Resistance/Target Level:

TARGET 1: 3400

TARGET 2: 3450

TARGET 3: 3480

Key Support Levels:

SUPPORT 1: 3200

SUPPORT 2: 3150

This Strategy is based on the expectation of a price retracement, providing a more favorable risk-reward setup for long positions.

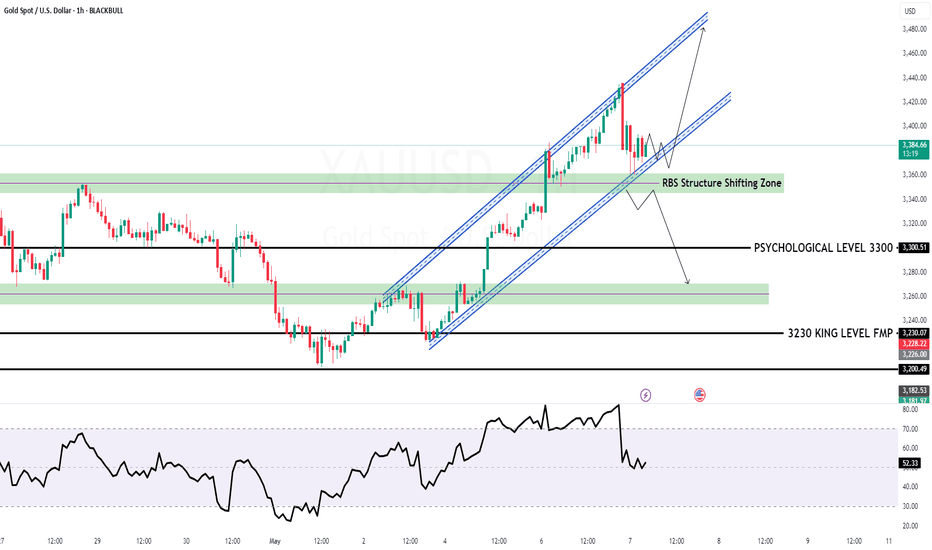

XAUUSD Analysis todayHello traders, this is a complete multiple timeframe analysis of this pair. We see could find significant trading opportunities as per analysis upon price action confirmation we may take this trade. Smash the like button if you find value in this analysis and drop a comment if you have any questions or let me know which pair to cover in my next analysis.

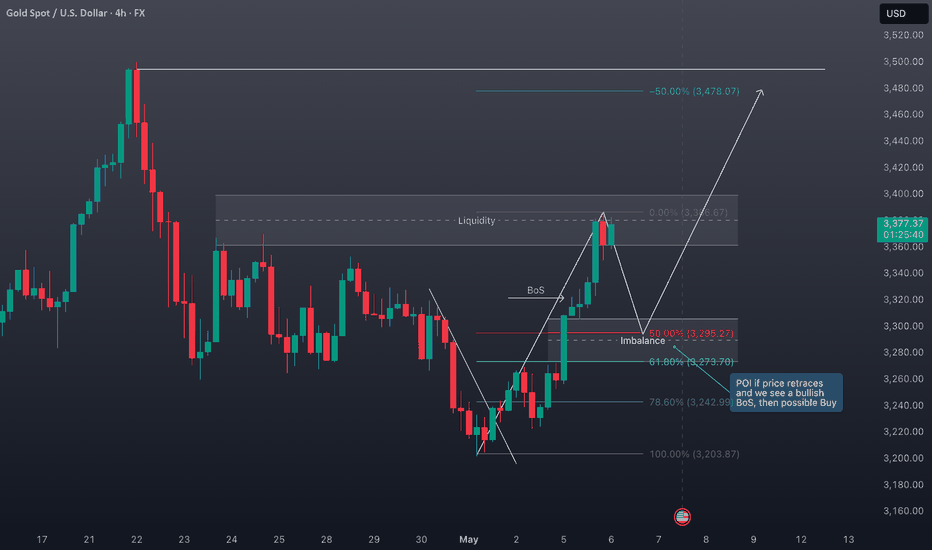

XAUUSD Price Action: Bullish Break + Liquidity Sweep Trade Idea🪙✨ Gold (XAUUSD) Technical Outlook ✨📈

I’m currently analyzing XAUUSD on both the daily and 4H timeframes, and here’s what I’m seeing:

🚀 Price has broken bullish structure and is now looking overextended, pushing into a buy-side liquidity zone—clearly visible to the left of current price action. 💰📊

It’s clearing buy stops, which could trigger a retracement soon. 🧲🔁

🎯 I’m watching closely for a pullback into the 50%–61.8% Fibonacci retracement zone on the current price swing—that’s my key point of interest for a potential long setup, provided we see a healthy pullback followed by another bullish break of structure. 🔍🔐

🧠 Not financial advice—just my personal analysis. Always manage risk. ⚠️📉

Buy gold, it may continue to rise to 3400-3420!Fundamentals:

Focus on Trump and the Fed’s dynamics;

Technical aspects:

Gold rose to the 3380 area as expected, and even exceeded expectations to 3387. Since gold rebounded near 3222, the willingness to retreat during the rebound was not strong. The lows were constantly raised, and the highs gradually broke upward, which was a very typical shock rise pattern. As the center of gravity of gold shifted upward, the short-term resistance moved up to the 3350-3340 area. Once gold hits this position and rebounds, it may continue to rise to the 3400-3420 area.

Trading strategy:

Consider the opportunity to go long on gold after gold retreats to the 3350-3340 area, TP: 3380

XAUUSD trading opportunities.6/5/2025The increase in uncertainty also caused the XAUUSD trend to continue to strengthen. The target position of 3330-3350 set yesterday is the short-term pressure position. In the Asian market, XAUUSD/GOLD hit the recent high again. After reaching 3387, it fell back. The current price is 3350. According to the momentum chart, the market is in a stage of bullish growth. Risk aversion has increased, which has led to more buying than selling.

In terms of trading, traders with large amounts of funds can buy at the current price, and those with small amounts of funds can wait until the market retreats below 3330 before choosing to join again.

The Swing Trading Center continues to update new real-time trading opportunities. If you don't know how to trade, or don't want to miss the next real-time trading opportunity, remember to follow me.

Swing Trading/XAUUSDband trading strategy points out. XAUUSD can be bought on the left side, TP3330-3350.

Aggressive traders can buy at the current price. Conservative traders can wait until the price retreats to around 3300 or below before buying.

The Swing Trading Strategy Center continues to announce trading opportunities. Stay tuned.

Gold is once again affected by tariffs and rises sharplyNews: Gold rose sharply, mainly because Trump announced a 100% tariff on all films produced abroad and entering the United States, which once again triggered global trade tensions. At the same time, the conflict between Russia and Ukraine is still ongoing, and the situation in the Middle East has become tense again. For example, Israel’s missile attacks retaliated against the Houthi armed forces in Yemen and Iran. These have stimulated gold’s safe-haven properties and pushed up gold prices.

Technical aspect: Gold bulls are strong, so there is a certain risk in shorting gold. The point of concern below is the low of 3323. If gold continues to maintain its strength, it is impossible to fall below the 3323 line again.

Trading ideas: Buy gold near 3338, stop loss 3330, target 3360

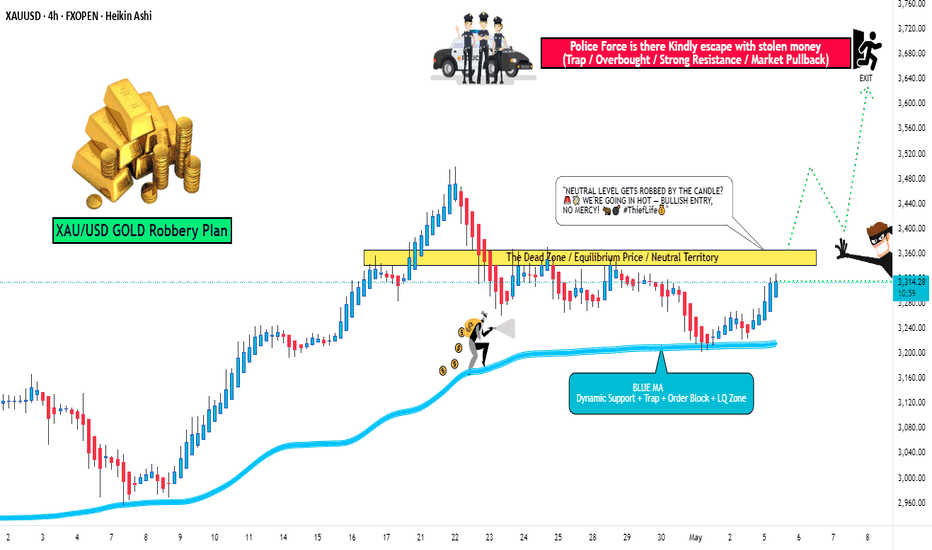

XAU/USD "The Gold" Metals Market Heist Plan (Swing/Day Trade)🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Robbers, 🤑 💰💸✈️

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the XAU/USD "The Gold" Metals Market. Please adhere to the strategy I've outlined in the chart, which emphasizes long entry. Our aim is to escape near the high-risk ATR Zone. Risky level, overbought market, consolidation, trend reversal, trap at the level where traders and bearish robbers are stronger. 🏆💸"Take profit and treat yourself, traders. You deserve it!💪🏆🎉

Entry 📈 : "The heist is on! Wait for the NEUTRAL LEVEL breakout (3400) then make your move - Bullish profits await!"

however I advise to Place Buy stop orders above the Moving average (or) Place buy limit orders within a 15 or 30 minute timeframe most recent or swing, low or high level for Pullback entries.

📌I strongly advise you to set an "alert (Alarm)" on your chart so you can see when the breakout entry occurs.

Stop Loss 🛑: "🔊 Yo, listen up! 🗣️ If you're lookin' to get in on a buy stop order, don't even think about settin' that stop loss till after the breakout 🚀. You feel me? Now, if you're smart, you'll place that stop loss where I told you to 📍, but if you're a rebel, you can put it wherever you like 🤪 - just don't say I didn't warn you ⚠️. You're playin' with fire 🔥, and it's your risk, not mine 👊."

📍 Thief SL placed at the recent/swing low level Using the 4H timeframe (3200) Day trade basis.

📍 SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

🏴☠️Target 🎯: 3680 (or) Escape Before the Target

🧲Scalpers, take note 👀 : only scalp on the Long side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

💰💵💴💸XAU/USD "The Gold" Metals Market Heist Plan (Day / Swing Trade) is currently experiencing a Neutral trend (there is a chance to move bullishness🐂).., driven by several key factors.👆👆👆

📰🗞️Get & Read the Fundamental, Macro economics, COT Report, Geopolitical and News Analysis, Sentimental Outlook, Intermarket Analysis, Index-Specific Analysis, Positioning and future trend targets with Overall Score...... go ahead to check👉👉👉🔗🔗🌎🌏🗺

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

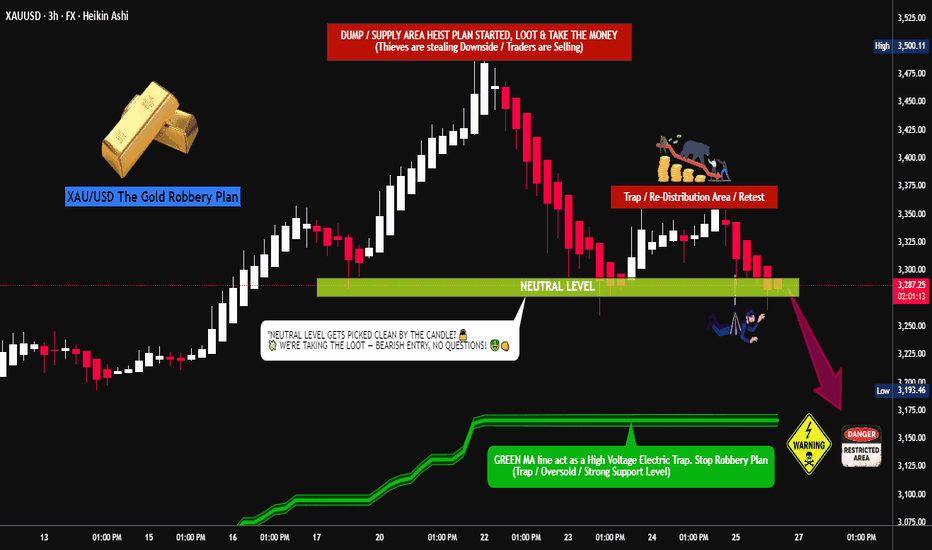

XAU/USD "The Gold" Metal Market Heist Plan (Day Trade)🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Robbers, 🤑💰✈️

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the XAU/USD "The Gold" Metal Market. Please adhere to the strategy I've outlined in the chart, which emphasizes short entry. Our aim is the high-risk GREEN MA Zone. Risky level, oversold market, consolidation, trend reversal, trap at the level where traders and bullish robbers are stronger. 🏆💸"Take profit and treat yourself, traders. You deserve it!💪🏆🎉

Entry 📈 : "The heist is on! Wait for the Neutral Level breakout then make your move at (3260.00) - Bearish profits await!"

however I advise to Place sell stop orders above the Moving average (or) after the Support level Place sell limit orders within a 15 (or) 30 minute timeframe most NEAREST (or) SWING low or high level for Pullback entries.

📌I strongly advise you to set an "alert (Alarm)" on your chart so you can see when the breakout entry occurs.

Stop Loss 🛑: "🔊 Yo, listen up! 🗣️ If you're lookin' to get in on a sell stop order, don't even think about settin' that stop loss till after the breakout 🚀. You feel me? Now, if you're smart, you'll place that stop loss where I told you to 📍, but if you're a rebel, you can put it wherever you like 🤪 - just don't say I didn't warn you ⚠️. You're playin' with fire 🔥, and it's your risk, not mine 👊."

📌Thief SL placed at the nearest/swing High or Low level Using the 3H timeframe (3360.00) Day/Scalping trade basis.

📌SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

Target 🎯: 3170.00 (or) Escape Before the Target

💰💵💸XAU/USD "The Gold" Metal Market Heist Plan (Scalping/Day Trade) is currently experiencing a Bearish trend.., driven by several key factors.👇👇👇

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

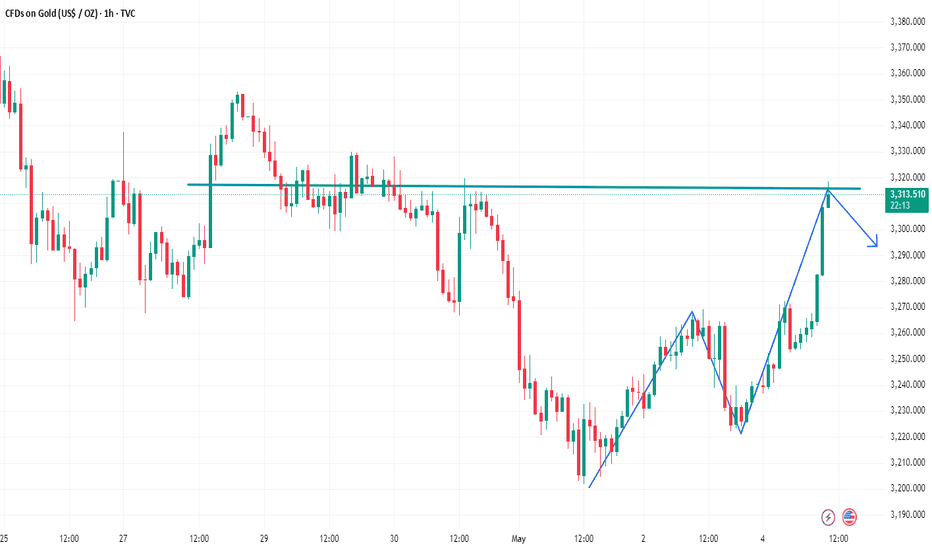

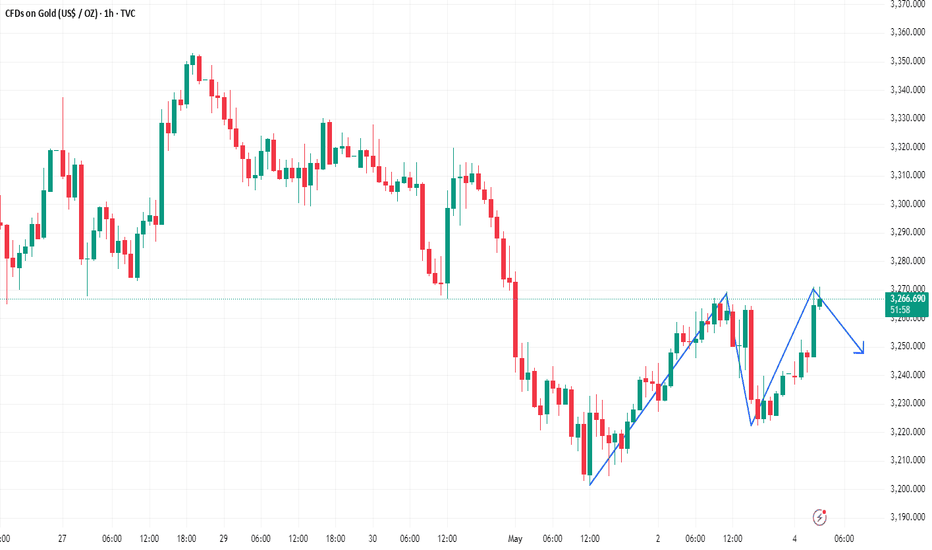

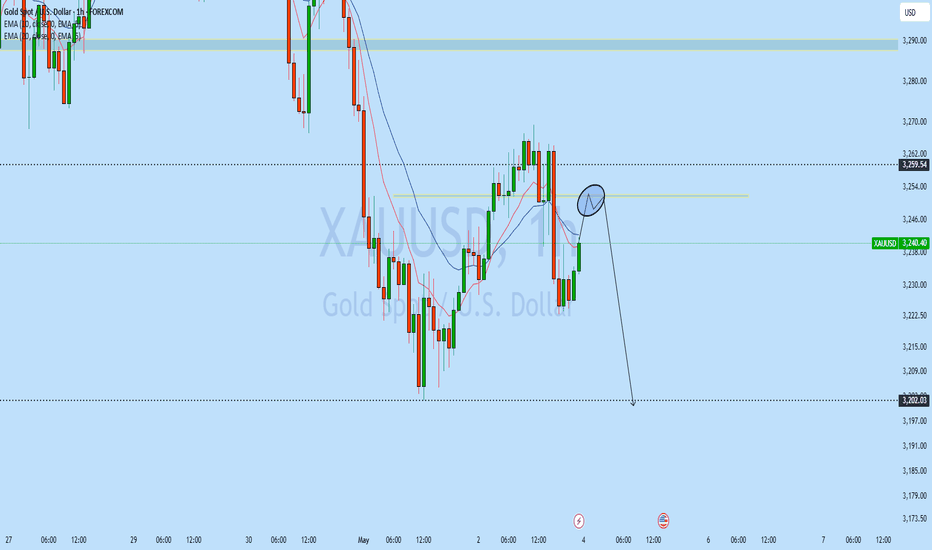

Continue to short gold when it rebounds to a high level

The 1-hour moving average of gold continues to form a downward short position, and there is still room for gold shorts. Gold came under pressure at the 3270 line last week and fell back. Currently, the 1-hour gold is still fluctuating within a range. It is still mainly short above the rebound of gold.

Trading ideas: Short gold near 3270, stop loss 3280, target 3240

XAUUSD Analysis todayHello traders, this is a complete multiple timeframe analysis of this pair. We see could find significant trading opportunities as per analysis upon price action confirmation we may take this trade. Smash the like button if you find value in this analysis and drop a comment if you have any questions or let me know which pair to cover in my next analysis.

Summary of the Gold Market This WeekThis week, the gold market showed a clear downward trend, with spot gold accumulating a 2.43% decline.👉👉👉

The economic data had a significant impact on the gold market this week. Data released by the US Department of Labor on the 2nd showed that the non - farm payroll employment in the US increased by 177,000 in April, much better than the expected 138,000, and the growth data for the previous two months were revised downwards. The US unemployment rate was 4.2% in April, in line with market expectations. The strong non - farm payroll data reduced the possibility of the Federal Reserve cutting interest rates in June. Under normal circumstances, the reduction in the interest rate hike expectation should be bullish for gold. However, the gold market did not rise sharply this time, mainly because the gold price had risen significantly in the early stage and the long - term investors had a strong sentiment of taking profits. At the same time, the relatively good employment data also reflected the resilience of the US economy to a certain extent, weakening the appeal of gold as a safe - haven asset. As a result, the gold price did not show an obvious upward trend immediately after the data was released. Instead, it remained volatile in the short term.

From a technical perspective, although the gold price has declined this week, the futures price still has certain technical advantages in the near term. On the daily chart, although a negative candlestick was recorded this week, the previous upward trend has made the moving average system still show a long - term arrangement. From the perspective of the RSI, the current value is hovering around 50, indicating that the market's long and short forces are temporarily relatively balanced, and neither side has an obvious advantage. Therefore, the gold price has entered a consolidation stage.

With the economic development in Asia and the changes in consumers' demand for gold investment and jewelry, Asia's influence in the global gold market has become increasingly prominent. If the demand in Asia remains strong in the future, it will provide strong support for the gold price. On the contrary, if the demand weakens, it may increase the downward pressure on the gold price.

Looking ahead to next week, the gold market still faces many uncertainties. On the one hand, the continuous changes in economic data and the direction of the Federal Reserve's monetary policy remain key factors. If the subsequently released data continue to show the resilience of the US economy, it may further reduce the market's expectation of a rate cut by the Federal Reserve, thereby suppressing the gold price. On the other hand, any new development in the international trade situation may trigger fluctuations in the market's risk - averse sentiment, thus affecting the supply - demand relationship and price trend of gold.

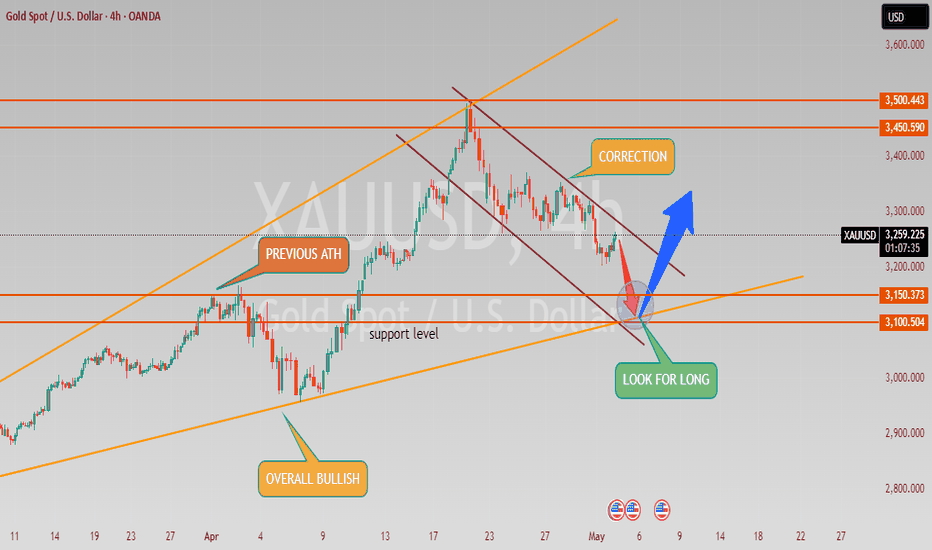

XAU/USD (Gold) Analysis 2/5/20251. XAU/USD recently recorded an all-time high (ATH) at the 3150 level.

2. Following a healthy retracement, we are now eyeing potential long opportunities near the 3100 zone.

3. The 3100 level presents a favorable risk-reward entry point, aligned with historical support.

4. Market sentiment remains bullish, supported by strong fundamentals and ongoing geopolitical tensions.

5. A breakout above the previous ATH could open the door for a continued rally toward higher resistance levels.

6. Our upside targets for this move are in the range of 3450 to 3500, offering considerable profit potential.

7. Price consolidation near 3100 indicates accumulation, reinforcing the long bias.

8. We anticipate renewed buying pressure as the market tests key psychological and technical levels.

9. Risk management will be crucial, with stops ideally placed just below the 3050 support region.

10. Overall, this setup offers a compelling long trade backed by technical structure and market momentum.