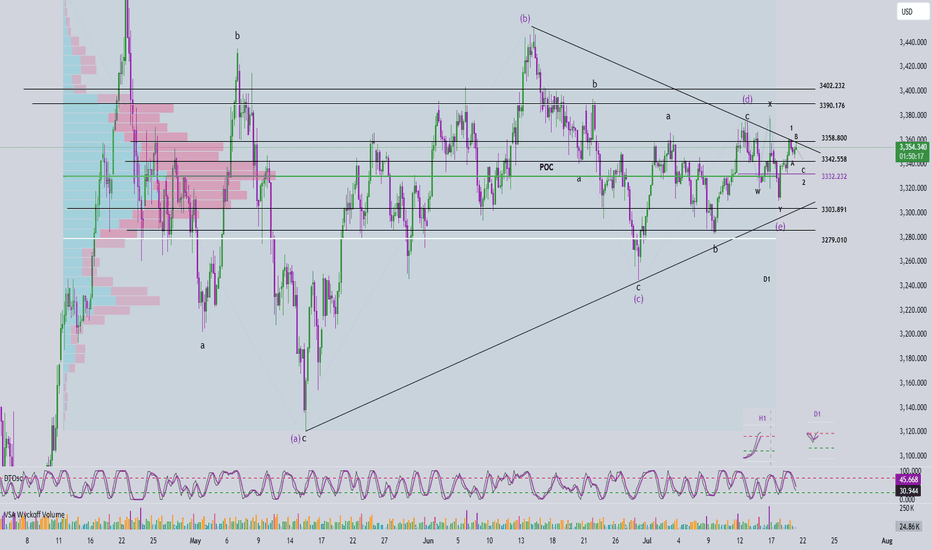

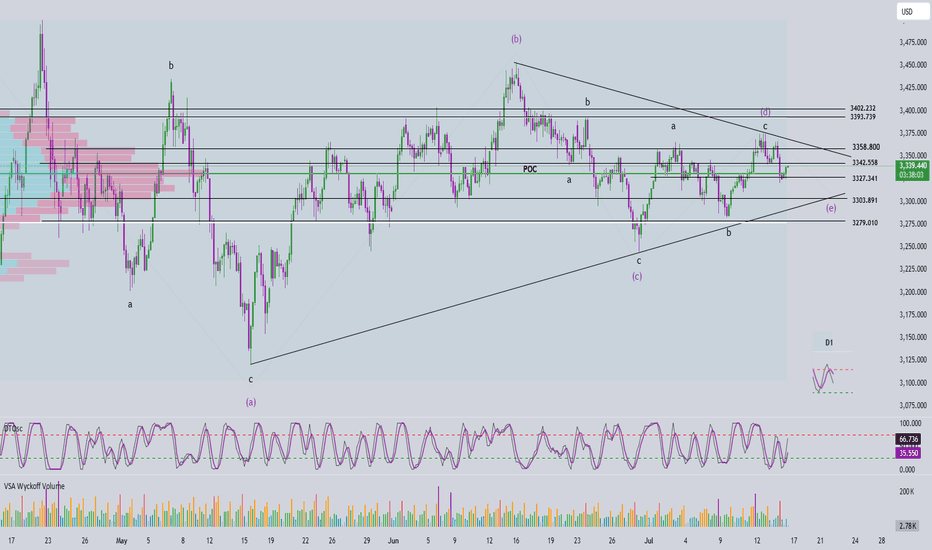

Elliott Wave Analysis – XAUUSD | July 21, 2025

🔍 Momentum Analysis

- D1 Timeframe: Momentum is currently rising → the dominant trend over the next 3 days is likely to remain bullish.

- H4 Timeframe: Momentum is approaching the oversold area → just one more bearish H4 candle could complete the entry into oversold territory.

- H1 Timeframe: Momentum is about to reverse downward → suggesting a short-term corrective pullback in the current session.

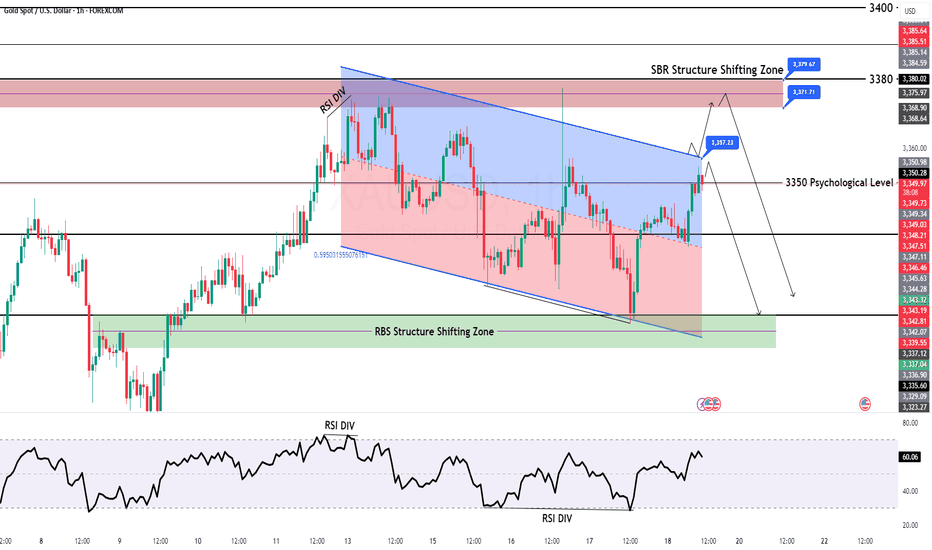

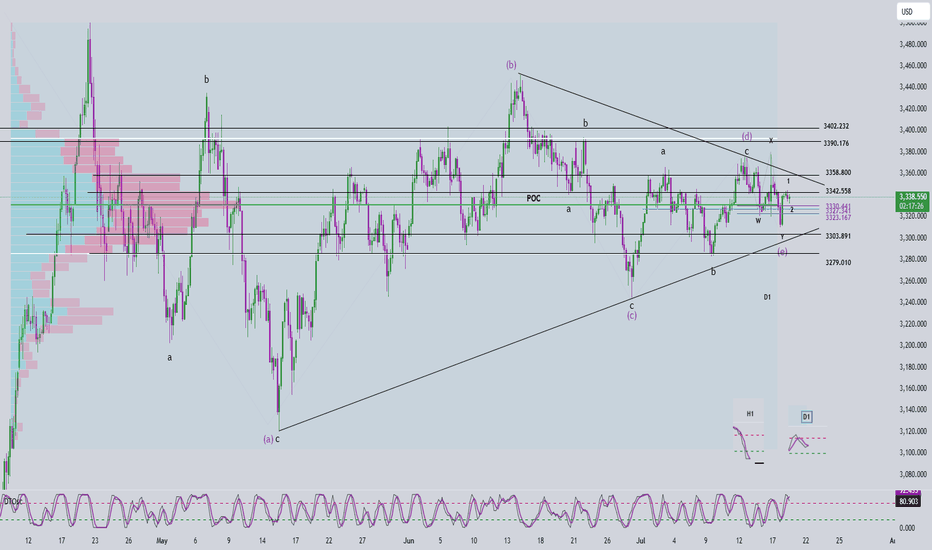

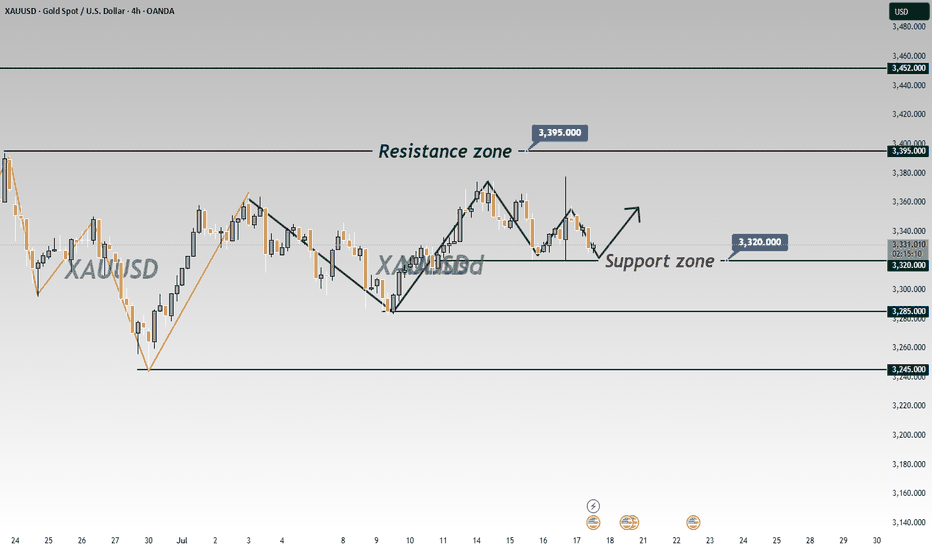

🌀 Elliott Wave Structure Update

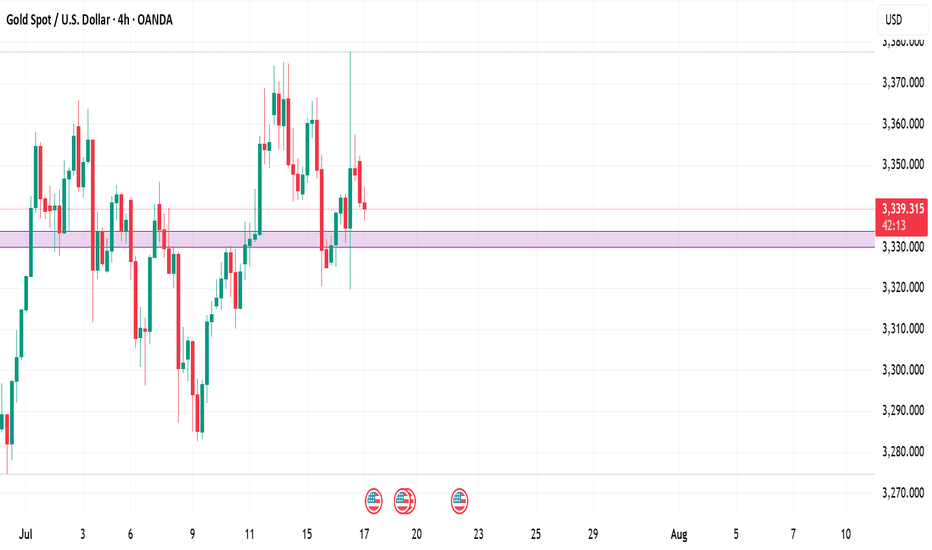

On the H4 chart, price continues to consolidate within a corrective triangle structure. According to our previous plan, price approached the 3358 zone, and we expect:

- Wave 1 (black) may have completed at the 3358 high.

- Currently, Wave 2 (black) is likely unfolding:

+ Wave A appears to have completed.

+ The current upward leg is part of Wave B.

+ A final drop in Wave C is expected, with two key target zones:

- Target 1: 3342

- Target 2: 3332

🔎 Combining Momentum & Wave Structure

- If price breaks above 3358, we want to see a sharp, impulsive, and steep rally to confirm the beginning of Wave 3.

- If price movement remains choppy or overlapping, the market is likely still in a corrective phase.

- Key resistance zone to monitor: 3390–3402 – a clean breakout above this range would significantly strengthen the Wave 3 scenario.

📌 Trade Plan

1️⃣ BUY Setup #1

Entry Zone: 3343 – 3341

Stop Loss: 3337

Take Profit 1: 3358

Take Profit 2: 3390

2️⃣ BUY Setup #2

Entry Zone: 3333 – 3331

Stop Loss: 3323

Take Profit 1: 3358

Take Profit 2: 3390

📎 Note: Prioritize entries that come with clear confirmation signals from price action and momentum. Avoid buying during choppy or indecisive market conditions.

Xauusdidea

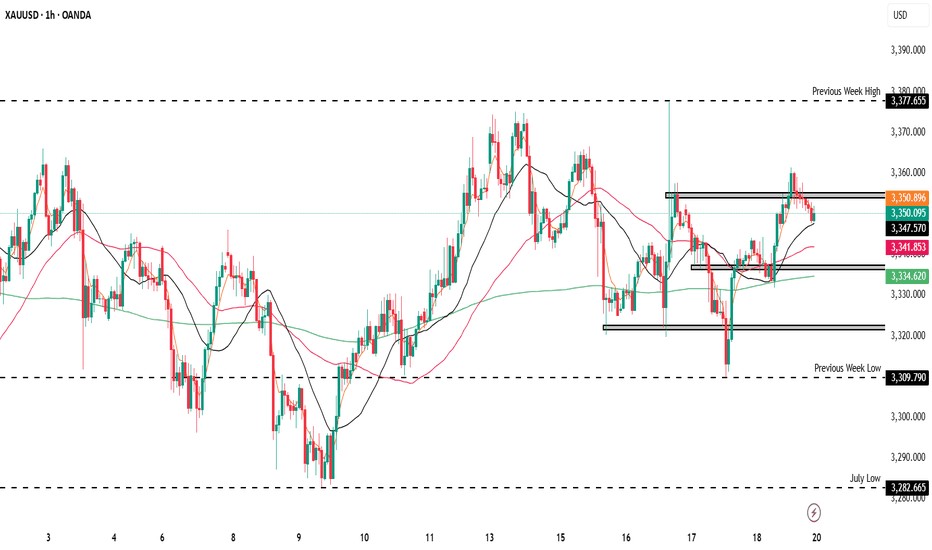

7/18: Watch 3343 Resistance, Guard Against Break Below 3323Good morning, everyone!

Yesterday, gold broke below the 3337 support after consolidating there, driven lower by bearish data, and eventually reached the 3323–3312 support zone. A rebound followed, and price has now returned above 3323, which also aligns with the daily MA60.

📌 Key Levels to Watch Today:

Resistance: 3343 / 3352–3358

→ A sustained break above 3343 opens the door for a potential move toward 3366 / 3372–3378;

Support: 3323 / 3312

→ If price remains capped below resistance and weekly close is under 3323, it will signal bearish structural pressure for the medium term.

📌 Trading Strategy:

Trade flexibly within the range of 3358–3343–3332–3323–3312

📌 Important Reminder:

If today’s closing price is below 3323, and you're planning to hold positions over the weekend, it’s safer to lean short. While we can’t predict weekend news, technically, bears have the upper hand, so risk control is essential.

Monday market forecast, pay attention to the 3339 retracement📰 News information:

1. The Trump administration puts pressure on the Federal Reserve to cut interest rates

2. The continued impact of tariffs and the responses of various countries

📈 Technical Analysis:

This week's basic judgment and forecast on the gold market trend were consistent, but on Friday, the overall gold fluctuations were not large. The overall trend of the daily line fluctuated around 3345, and the 3345 line also became a short-term long-short watershed. Although prices are likely to rise more easily than fall in the short term, it should be noted that the three-month adjustment cycle is coming to an end while the fundamentals of the bull market have not changed. It is recommended that you focus on preventing risks from short position operations next week. At the same time, the overall strong shock pattern, the anti-pulling momentum has not reached the top suppression position, and the area around 3339 below is the previous intensive trading area, which constitutes a certain support in the short term. If the market fails to effectively break below next week, it will greatly boost the bullish momentum, and it is not ruled out that there will be a possibility of refreshing the high point near 3380 next week.

On the whole, the short-term focus next week is the 3345-3335 area below. If it falls back to this point, you can consider arranging long orders. The short-term target is 3355-3365, and the strong trend is expected to continue to touch 3375-3385.

🎯 Trading Points:

BUY 3345-3335

TP 3355-3365-3375-3385

In addition to investment, life also includes poetry, distant places, and Allen. Facing the market is actually facing yourself, correcting your shortcomings, confronting your mistakes, and strictly disciplining yourself. I hope my analysis can help you🌐.

TVC:GOLD PEPPERSTONE:XAUUSD FOREXCOM:XAUUSD FX:XAUUSD OANDA:XAUUSD FXOPEN:XAUUSD

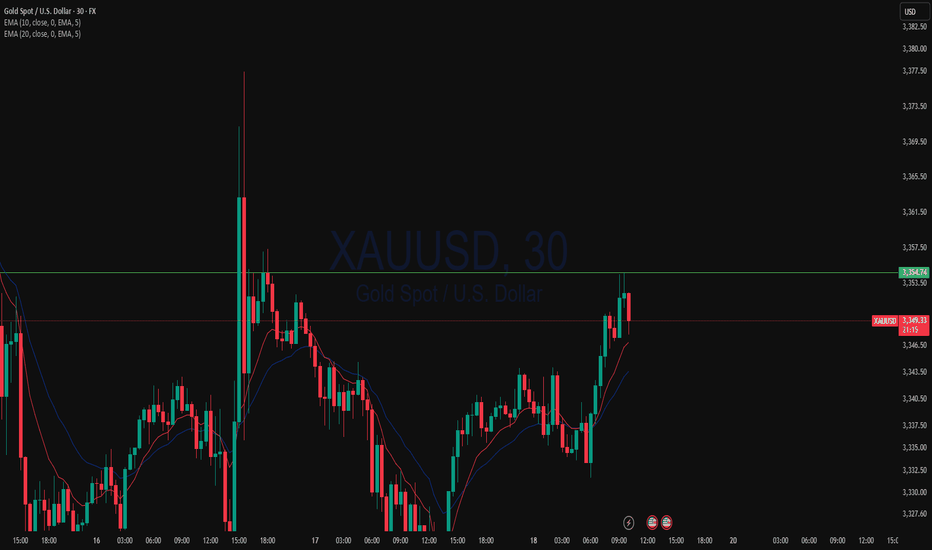

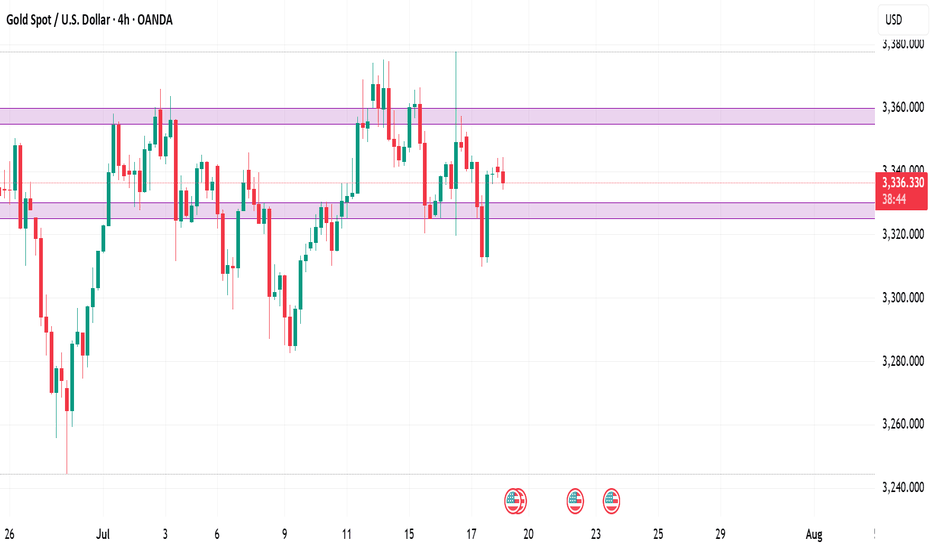

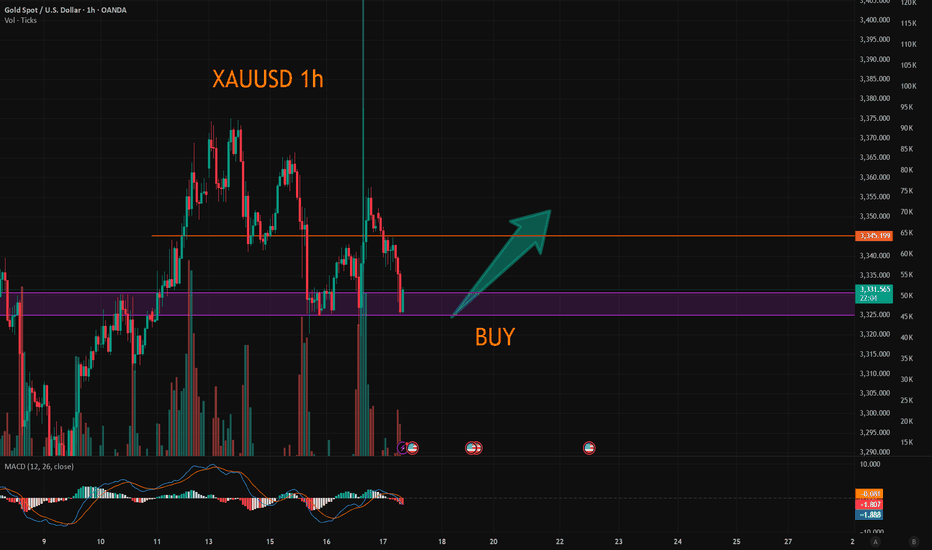

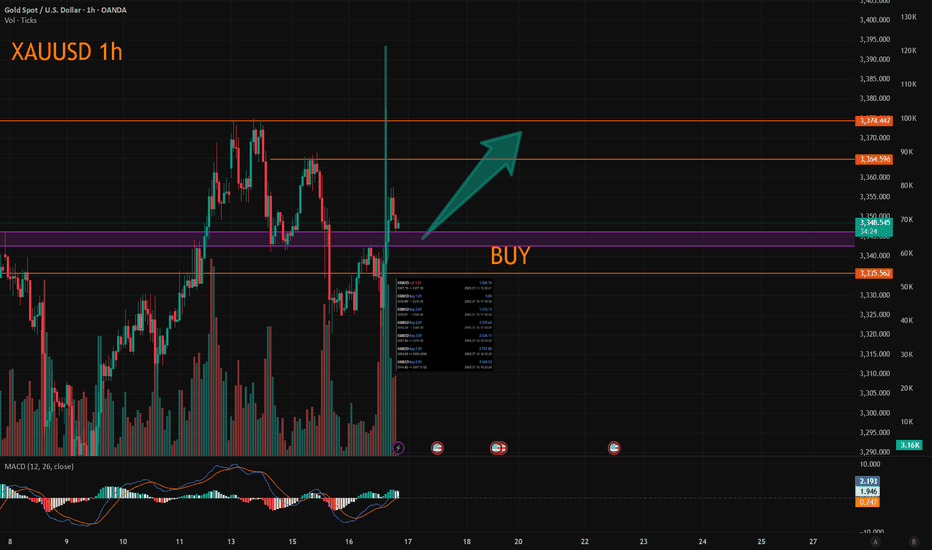

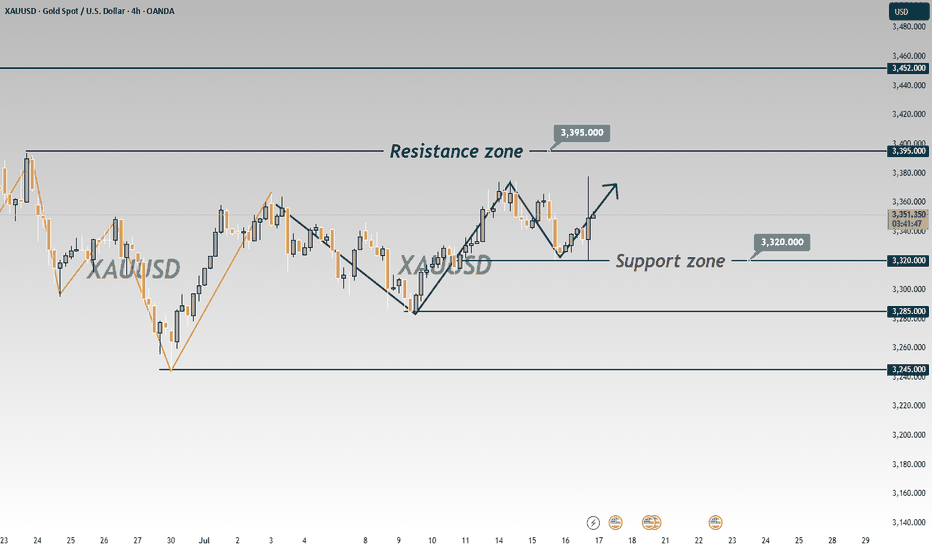

XAUUSD Outlook: Bullish Bias Hi Traders

I am a profitable full time trader with 7 Years experience and I would like to share my journey including profits analysis and signal indicators.

Attached is the XAUUSD chart showing current areas of interest above and below current price which can used to trade profitably.

I still have a bullish bias, but will wait patiently for a retracement into one of the support levels. I will assess price action at lower levels before looking for buy trades.

Key support levels

3,335–3,338

3,320–3,324

Key resistance levels

3,352–3,355

3,367–3,371

Price respected last week’s high (3,377) and is pulling back. The moving averages are also proving a confluence to support our bullish outlook.

Also, please take into account news releases throughout the week before placing any trades to avoid market volatility.

We will share updates throughout the week.

Please let me know your bias for gold this week in the comments.

If you found this helpful, please drop a like to support my work.

Thanks,

PrestigeGoldFX

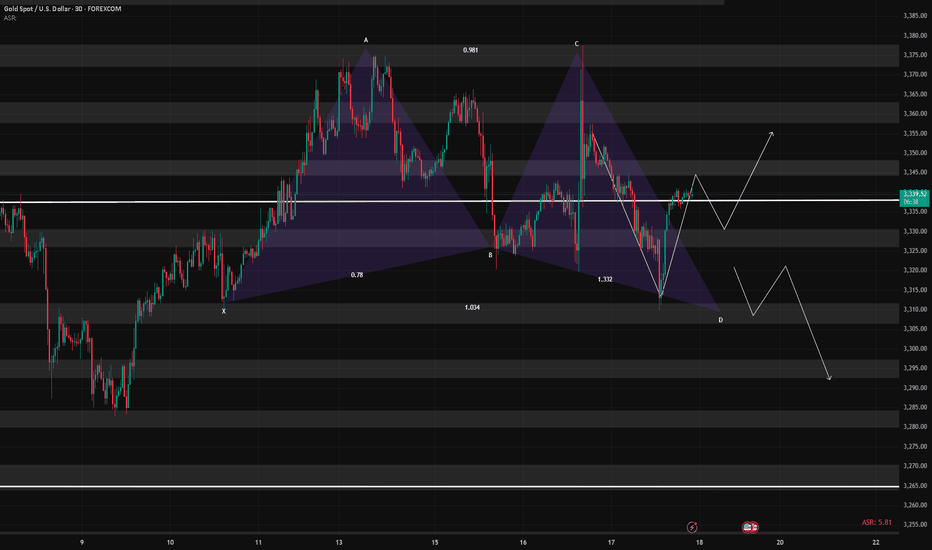

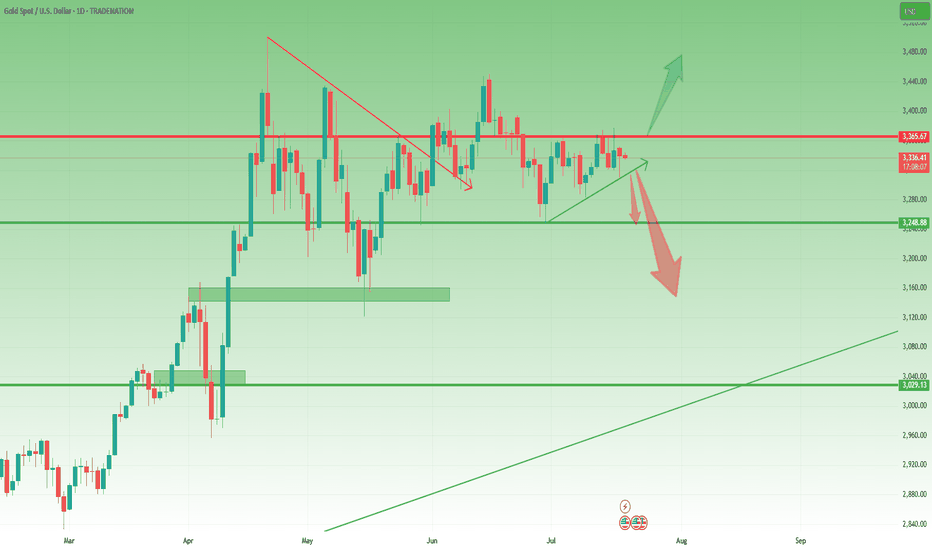

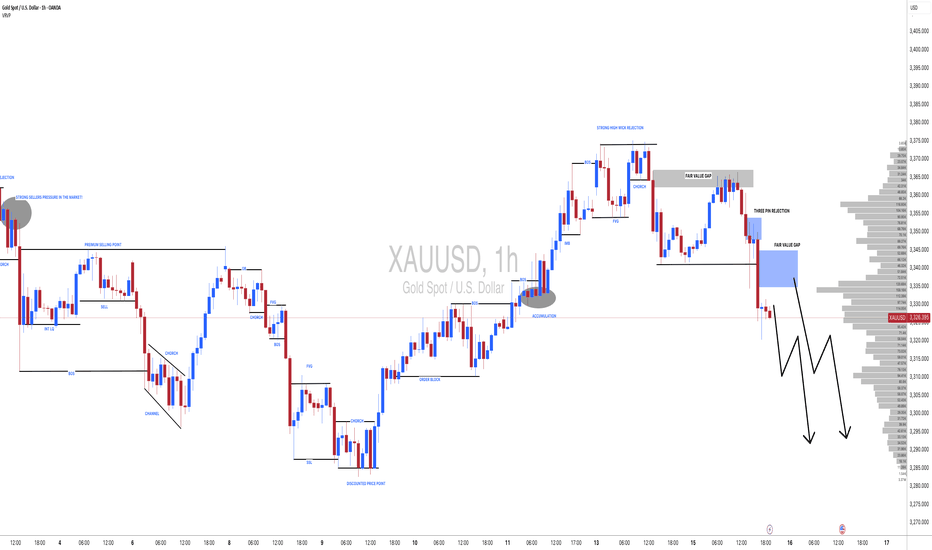

Gold- Still needs to resolve the range🔸 Still Rangebound, But Not for Long

In yesterday’s analysis, I mentioned that two scenarios are in play for Gold:

1. Bullish above 3375

2. Bearish under 3320

Throughout the session, price action leaned toward the bearish side, and I aligned with that by opening a short position. It ended with a minor loss — just 50 pips, which is negligible considering I'm looking for a potential 1,000 pip move in the bigger picture.

________________________________________

🔍 What's Next?

As the title says, Gold still needs to resolve the current range before a clear directional move unfolds.

The same key levels discussed yesterday remain valid and relevant.

And since it’s Friday, today’s daily and weekly candle close will be critical in shaping expectations for next week.

________________________________________

📈 Bullish Case: Close Above 3360

• A daily/weekly close around 3360 would bring strong pressure on the 3375 resistance.

• That could lead to a bullish breakout from the ascending triangle pattern.

• It would also leave behind a bullish weekly pin bar (last week was a bullish pin bar too).

• This scenario would bring 3450 into focus — with 3500 and even a new ATH on the table in the coming weeks.

________________________________________

📉 Bearish Case: Close Near 3300

• A close near 3300 would signal a failed rally attempt

• That would expose 3250 support short term, and 3150 medium term.

________________________________________

🧭 Final Thoughts

At the moment, I’m flat and waiting for clearer confirmation later in the day.

The next move big will be defined by the weekly close — it’s as simple as that.

P.S.: It’s just a hunch , but I’m still leaning toward a break under 3300 as the next major move.

Disclosure: I am part of TradeNation's Influencer program and receive a monthly fee for using their TradingView charts in my analyses and educational articles.

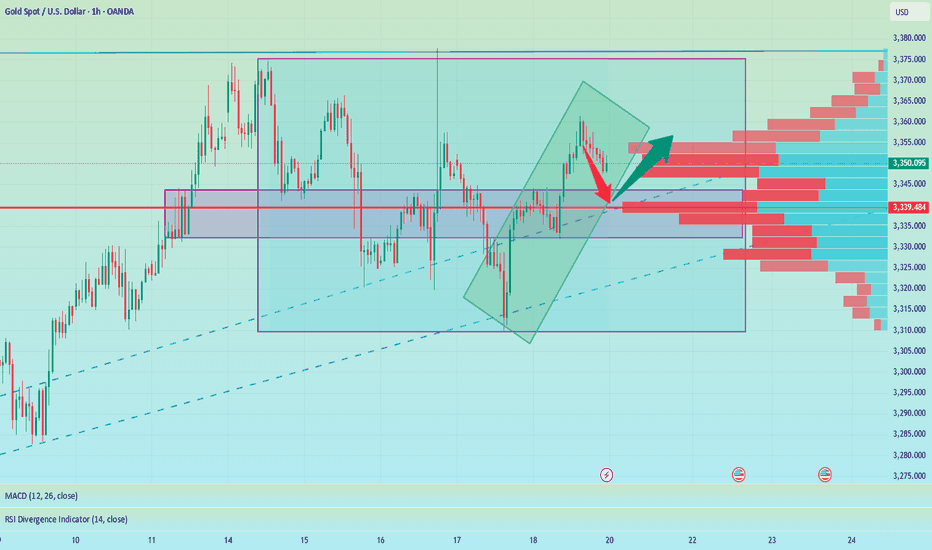

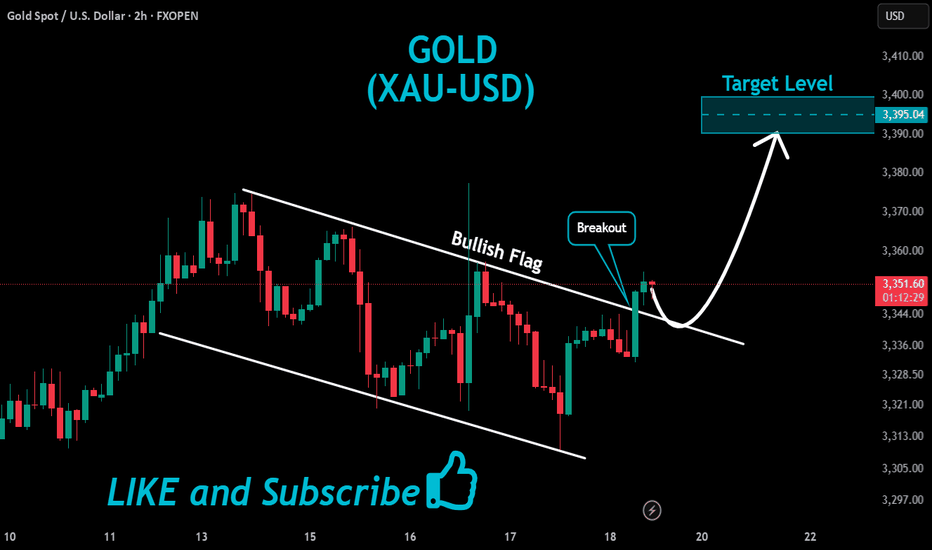

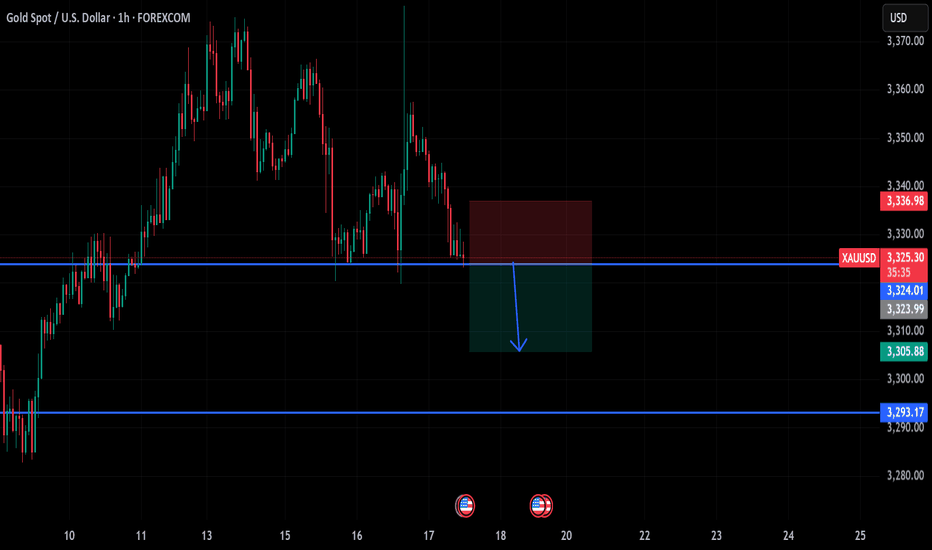

GOLD Intraday H1 Chart Update For 18 July 25Hello Trader, Today we have closing day

For now market is still in Bearish Channel range and try to sustains below 3350 Psychological Level

Further only market clear breakout of 3385 level then we will be on Bullish side other we are remains bearish for now

All eyes on Todays Closing

Disclaimer: Forex is Risky

XAUUSD Analysis todayHello traders, this is a complete multiple timeframe analysis of this pair. We see could find significant trading opportunities as per analysis upon price action confirmation we may take this trade. Smash the like button if you find value in this analysis and drop a comment if you have any questions or let me know which pair to cover in my next analysis.

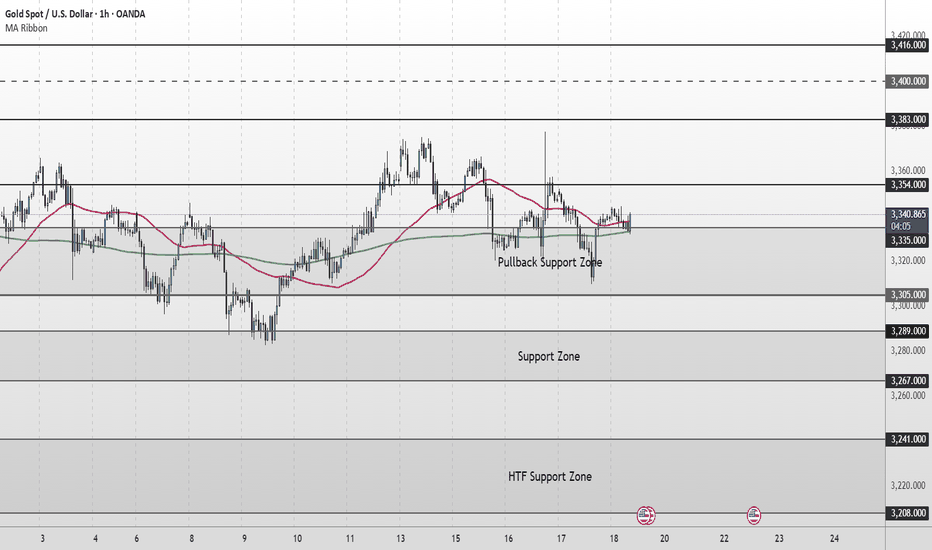

Gold Short Term Outlook Gold has held above the Pullback Support Zone (3,335–3,305) after yesterday’s volatility, with buyers stepping in to defend the zone.

Price is now trading around 3,338, caught between the 50MA and the 200MA.

Despite the recent dip, the structure remains supportive as long as price holds above 3,335.

A clean break and hold above 3,354 would confirm renewed bullish momentum, opening the path toward 3,383 and 3,400, with 3,416 as a higher‑timeframe target.

If price fails to clear 3,354 and turns lower again, watch for signs of exhaustion back into the Pullback Support Zone (3,335–3,305).

A decisive break below 3,305 would shift focus to the Support Zone (3,289–3,267), with further downside exposing the HTF Support Zone (3,241–3,208).

📌 Key Levels to Watch

Resistance:

‣ 3,354 ‣ 3,383 ‣ 3,400 ‣ 3,416

Support:

‣ 3,335 ‣ 3,305 ‣ 3,289 ‣ 3,267 ‣ 3,241

🔎Fundamental Focus

📌 4:00pm: UoM Sentiment & Inflation Expectations – can spark sharp USD/gold moves.

➡️ Expect volatility around releases.

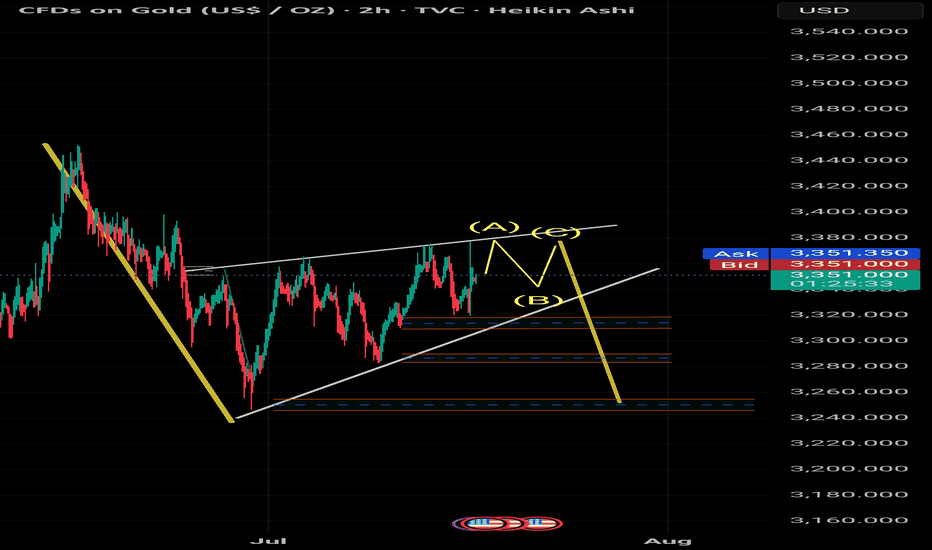

Elliott Wave Analysis – XAUUSD July 18, 2025📈 Elliott Wave Analysis – XAUUSD July 18, 2025

🔍 Momentum Analysis

D1 Timeframe: Momentum is showing signs of a bullish reversal. While we need to wait for today's D1 candle to close for confirmation, it's likely that yesterday’s upward move marks Wave 1, signaling the beginning of a new bullish trend.

H4 Timeframe: Momentum is preparing for a bearish reversal → suggesting a potential corrective pullback, likely forming Wave 2.

H1 Timeframe: Momentum is about to reverse upward → supporting the expectation of a short-term bullish move during the current session.

🌀 Elliott Wave Structure Update

On the H4 chart, the abcde triangle correction structure remains largely unchanged.

However, a strong H4 bullish candle appeared yesterday, indicating unusual market behavior that deserves attention.

There are two main scenarios:

- Wave 1 (black) has already completed, and the market is now entering Wave 2 correction.

- Alternatively, the current movement could be Wave 4 within Wave 1 (black).

🔎 Combining Momentum & Wave Structure

- With D1 momentum signaling a potential uptrend lasting the next 4–5 days, it suggests that Wave e (blue) may have completed.

- This opens the door for an impulsive 5-wave advance. Specifically:

+ If H1 continues its bullish reversal, the current move could be Wave 5 of Wave 1 (black), targeting the 3358 level.

+ Afterwards, a retracement toward the 3330–3323 zone would form Wave 2 (black).

+ Alternatively, price might drop directly to 3330–3323, implying Wave 1 has already finished and the current move is Wave 2.

🎯 => Both scenarios converge at the 3330–3323 price zone, making it a high-probability BUY ZONE.

🧭 Trade Plan

BUY ZONE: 3330 – 3327

Stop Loss: 3320

Take Profits:

TP1: 3342

TP2: 3358

TP3: 3402

📌 Note: Since this is a relatively wide entry zone, it's best to wait for price action confirmation at this level before entering.

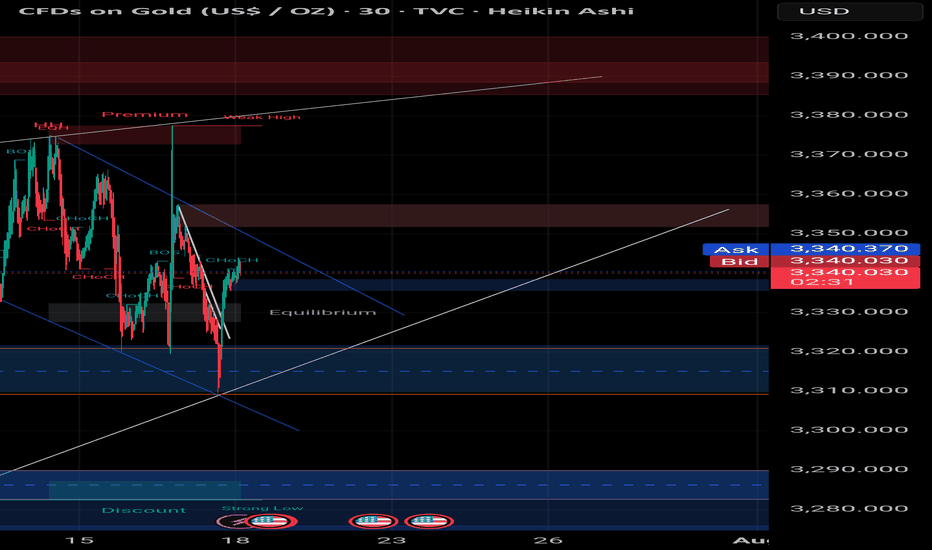

Gold (XAU/USD) Premium Technical Outlook - 18 July 2024As gold continues to trade near record highs, the market’s current price action around $3,336–3,340 demands a sharp, disciplined technical view. This premium analysis combines price action, Fibonacci techniques, institutional concepts (ICT and Smart Money Concepts), and advanced supply–demand dynamics to identify actionable trade opportunities.

We anchor on the 4-hour timeframe for directional bias and zoom into the 1-hour chart for precision intraday setups.

📊 4‑Hour Timeframe: Structure and Directional Bias

Gold remains in a clear bullish structure on the 4-hour chart, as evidenced by sustained higher highs and higher lows. The most recent bullish Break of Structure (BOS) occurred above the $3,320–3,325 level, confirming buyers’ control for now.

Currently, price hovers near equilibrium at the 61.8% Fibonacci retracement, testing prior resistance as potential support. This zone aligns with a small fair value gap (FVG), reinforcing it as an area of interest for smart money participants.

Key 4H Levels to Watch

Level Significance

$3,360–3,365 Major supply zone & bearish OB

$3,350–3,355 Minor resistance

$3,337–3,340 61.8% Fib / equilibrium

$3,330–3,333 BOS retest & key support

$3,300–3,310 Strong demand zone & bullish OB

$3,285–3,295 Secondary demand zone below BOS

The directional bias on 4H remains neutral-to-bullish, contingent on price holding above $3,300. A clean break and close above $3,360 could open a path to $3,400–3,420, while a sustained drop below $3,300 would mark a change of character (CHOCH) and shift bias to bearish.

🪙 Institutional Concepts in Play

Order Blocks (OB): Strong bullish OB sits at $3,300–3,310, while a bearish OB dominates at $3,355–3,365.

Fair Value Gaps (FVG): On the bullish side, $3,300–3,315 remains unfilled; on the bearish side, $3,330–3,345 caps rallies.

Liquidity Grabs: Dips toward $3,295–3,300 appear to sweep sell-side liquidity, while spikes above $3,360 tap into resting buy stops.

The area around $3,330 remains a key battleground where smart money likely accumulates positions before the next impulsive move.

⏳ 1‑Hour Timeframe: Intraday Trade Setups

On the 1-hour chart, the market is compressing between a bullish order block and bearish supply. Price action shows evidence of short-term liquidity sweeps and reactions to imbalances, offering two clear scenarios for intraday traders.

📈 Setup A – Bullish Zone Bounce

Entry: Buy limit at $3,332–3,333

Stop-loss: Below $3,328

Take-Profit 1: $3,345

Take-Profit 2: $3,355

Rationale: Confluence of 4H demand, Fib retracement, BOS retest, and 1H bullish order block.

📉 Setup B – Supply Rejection Short

Entry: Sell limit at $3,355–3,360

Stop-loss: Above $3,365

Take-Profit 1: $3,337

Take-Profit 2: $3,330

Rationale: Price into 4H bearish OB, aligning with supply and stop runs above recent highs.

🌟 The Golden Setup

Among these, the Bullish Zone Bounce at $3,332–3,333 stands out as the highest-probability trade. This level represents maximum confluence:

Retest of 4H BOS.

Bullish OB on 1H.

61.8% Fibonacci support.

Unmitigated fair value gap.

This setup offers a favorable risk–reward profile with clear invalidation and multiple upside targets.

🔎 Summary Table

Bias Key Support Zones Key Resistance Zones

Neutral-to-bullish $3,300–3,310, $3,330–3,333 $3,350–3,355, $3,360–3,365

Intraday Setups Entry Zone Stop-Loss Take-Profit Targets

Bullish Zone Bounce 🌟 $3,332–3,333 < $3,328 $3,345 / $3,355

Supply Rejection Short $3,355–3,360 > $3,365 $3,337 / $3,330

📣 Final Word

Gold maintains a structurally bullish outlook above $3,300, with strong institutional footprints evident in the $3,300–3,333 demand zones. Traders should remain vigilant around $3,360, where sell-side liquidity and supply are concentrated.

The Golden Setup — a bullish bounce from $3,332 — offers the best confluence and statistical edge intraday.

Smart Money Sell Setup on Gold (15-Min TF)# Smart Money Sell Setup on Gold (15-Min TF)

### 🔍 Market Context:

Gold has recently formed a strong bullish retracement after a sharp impulsive bearish move. Now, price has returned to a critical zone — the **Equilibrium level (EQ)** — which also aligns with a **valid supply zone** and **bearish trendline resistance**.

This zone is often considered the "decision point" where Smart Money evaluates whether to continue upward or resume the previous bearish trend.

---

## 📉 Strategy: Sell Limit Based on Structure + Liquidity

### ✅ Entry Zone:

**3341.500 – 3343.000**

(At the EQ zone + premium pricing area)

### 🛑 Stop Loss:

**Above 3345.000**

(Just beyond the last liquidity wick and top of supply)

### 🎯 Take Profit Targets:

- **TP1:** 3338.000 → First demand zone

- **TP2:** 3332.500 → Liquidity sweep target under previous lows

### 📐 Risk to Reward Ratio:

**1:3 or higher**, depending on execution precision.

---

## 🔎 Confluences Supporting the Setup:

| Factor | Confirmation |

|--------|--------------|

| EQ Zone (50% of previous move) | ✅ |

| Supply Zone | ✅ |

| Bearish Trendline Resistance | ✅ |

| Liquidity above EQ | ✅ |

| CHoCH + BOS (Market Structure Shift) | ✅ |

---

## 🧠 Why This Setup Works:

This is a classic **"Premium Price Rejection"** in a bearish environment, combining:

- Institutional logic (EQ level)

- Structural resistance (previous BOS)

- Liquidity traps above

---

## 🧵 Summary:

- **Sell Limit:** 3341.5 – 3343

- **SL:** 3345

- **TP1:** 3338

- **TP2:** 3332.5

- **RR:** 1:3+

- **Style:** Smart Money / Liquidity + Structure Based

---

🔔 **Disclaimer:** This is not financial advice. Always do your own analysis and manage risk accordingly.

#gold #XAUUSD #smartmoney #tradingview #liquidity #supplydemand #priceaction #forex #structure

Wait for the data release; do not chase short positions.The 4-hour timeframe remains in a range-bound consolidation. Only a decisive break below the 3320 level will truly open up substantial downward space. Let’s focus on today’s US Initial Jobless Claims data: while the indicator has been trending lower recently, the current market expectation is tilted toward a rebound.

Even though yesterday’s PPI data, after its release, was bullish for gold, its actual impact on prices was limited—far from comparable to core metrics like CPI.

In summary, all short positions have now closed out with profits. Waiting for the data release to trade in line with the trend is a more prudent approach: if prices hover around 3320 or 3310 ahead of the data and the figures come in bullish, you can decisively enter long positions once there’s a slight pullback. If the data turns bearish, avoid chasing the decline; instead, consider positioning around key integer levels such as 3290-3300, as a sharp bullish correction is likely to follow an oversold move. As for whether the bulls can achieve a full reversal, we’ll assess the broader picture then. Always remember: no market moves in one direction indefinitely—adaptability is key

🚀 Buy @3310 - 3320

🚀 TP 3330 - 3340 - 3350

Accurate signals are updated every day 📈 If you encounter any problems during trading, these signals can serve as your reliable guide 🧭 Feel free to refer to them! I sincerely hope they'll be of great help to you 🌟 👇

XAUUSD:Go long

Based on the 4-hour analysis, the short-term support below for today remains focused on the area around 3318-25, while the short-term resistance above focuses on the 3340-45 level. The key resistance above is at 3380. Overall, this range remains the main framework for our participation in the trade, with positions generally being cautious and waiting for key levels to enter. I will provide specific trading strategies during the session, so please stay tuned. Given that the current market has retraced to 3325 and then rebounded, we can go long in the 3325-30 range.

Trading Strategy:

BUY@3325-30

TP:3340-45

More detailed strategies and trading will be notified here ↗↗↗

Keep updated, come to "get" ↗↗↗

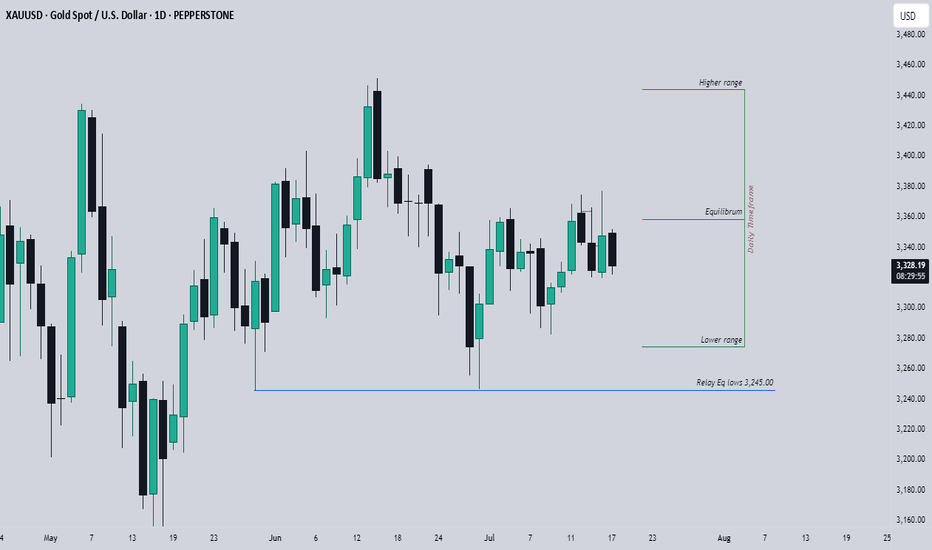

Expectations On GoldPEPPERSTONE:XAUUSD Looking at the daily Range, The market has reached the equilibrium level, is that a sign to go short? no, we could still see a drive to the upper side, but ultimately, the relative equal lows which are close to 3,245.00 big figure should likely be the draw.

I would love to see a drive below the 3,282.00 mark for perfect show to prove the obvious move below the 3,245.00, or seeing a consecutive break below each previous days low would also confirm the directive.

Seeing higher prices would of course negate this analysis, seeing a run into the 3,375.00 big figure yesterday makes me skeptical as this has also left some area of relatively equal highs, so I would give in to the idea of higher prices at least to that level to see what would like occur, but I strongly doubt that this would be the scenerio.

Generally, I am bearish on Gold till I see a run below that 3,245.00 big figure or prices closer to that level.

XAU/USD Chart Analysis: Volatility at a Yearly LowXAU/USD Chart Analysis: Volatility at a Yearly Low

The daily chart of XAU/USD shows that the Average Directional Index (ADX) has reached its lowest level since the beginning of 2025, indicating a significant decline in gold price volatility.

Yesterday’s release of the US Producer Price Index (PPI) initially triggered a sharp spike in gold prices, but the gains were short-lived, with the price quickly reverting to previous levels. This price action aligns with a broader market narrative of equilibrium—where supply and demand are in relative balance, and the market appears to be efficiently pricing in key influencing factors, including geopolitical tensions and tariff-related developments.

However, this fragile balance may soon be disrupted.

Technical Analysis of XAU/USD

From a broader technical perspective, gold remains within a long-term ascending channel (highlighted in blue) in 2025. Key observations include:

→ Attempts to rebound from the lower boundary of the channel (marked with arrows) lack conviction. Bulls are not capitalising on these opportunities to reignite the uptrend, suggesting a potential exhaustion of buying interest.

→ A trendline drawn across the major highs of 2025 has proven to be a strong resistance level. All recent breakout attempts have failed at this barrier.

As a result, the XAU/USD chart is showing signs of forming a large-scale triangle pattern, with its axis centred around the $3,333 level. If bulls continue to falter in extending the multi-month rally, it could encourage bears to challenge the lower boundary of the ascending channel, increasing the risk of a downside breakout.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Gold (XAU/USD) Technical Outlook: July 17, 2025🔷 Market Context and Current Price

As of July 17, 2025, gold (XAU/USD) is trading near $3,341, slightly above the week’s midpoint. The metal remains range-bound but shows signs of bullish resilience as it tests key structural support zones. Today’s analysis integrates advanced technical methodologies — including Price Action, Fibonacci tools, ICT and Smart Money Concepts — to present a clear directional bias and actionable trade ideas.

📊 4‑Hour Chart Analysis

1️⃣ Price Structure & Trend

Gold has maintained a sideways-to-upward bias, consolidating between $3,320 (support base) and $3,377 (range resistance). Higher lows since early July reinforce the short-term bullish narrative, though price remains capped by supply in the upper 3,370s.

No decisive Break of Structure (BOS) has yet occurred, keeping price within this range. However, minor bullish BOS signals have appeared near $3,332–$3,334, with a confirmed Change of Character (CHOCH) around $3,320–$3,324, as buyers repeatedly defended this level.

2️⃣ Smart Money Concepts & ICT Insights

Demand Zone / Order Block (OB): $3,332–$3,334. This zone aligns with a recent fair value gap and bullish order block.

Supply Zone / OB: $3,355–$3,359, corresponding to prior inefficiencies and institutional selling.

Liquidity Levels: Sell-side liquidity was swept near $3,320 earlier this week, suggesting smart money accumulation below prior lows.

Fair Value Gap (Imbalance): Present at $3,332–$3,333, partially filled and offering a strong risk-reward for long setups.

3️⃣ Fibonacci Levels

Using the recent swing low ($3,320) and swing high ($3,377), Fibonacci retracements show:

38.2%: ~$3,342 — currently being tested.

50%: ~$3,348 — an interim bullish target.

Fibonacci extensions project potential upside toward $3,401 if momentum strengthens beyond the range top.

4️⃣ Key Levels Summary (4H)

Zone Level

Demand / Buy Zone $3,332–$3,334

Structural Support $3,320

Interim Pivot $3,340–$3,342

Supply / Sell Zone $3,355–$3,359

Range Ceiling $3,375–$3,377

🔷 Directional Bias and Strategy

The 4-hour structure remains neutral-to-bullish, favoring upside so long as the $3,332–$3,334 demand zone holds. A confirmed BOS above $3,342–$3,344 could accelerate bullish momentum toward $3,355–$3,360 and even $3,375. Conversely, a breakdown below $3,332 risks revisiting $3,320 and potentially $3,300.

⏳ 1‑Hour Chart – Intraday Trade Setups

The 1-hour timeframe reveals tactical opportunities aligned with the broader bias:

Setup Direction Entry Stop Loss Take Profit

Setup A – Smart Money Long Long $3,334 $3,329 $3,348 / $3,355

Setup B – Breakout Long Long $3,344 (after breakout) $3,340 $3,355 / $3,375

Setup C – Range Short Short $3,355–$3,359 $3,362 $3,340 / $3,332

🏆 The Golden Setup

Setup A – Smart Money Long offers the highest statistical edge:

Entry: $3,334 (at demand OB / FVG)

Stop Loss: $3,329 (below structure)

Take Profits:

TP1: $3,348 (pivot)

TP2: $3,355 (supply zone)

R:R Ratio: ~2.8:1

This setup benefits from multi-timeframe confluences: demand zone, fair value gap, bullish CHOCH, and proximity to BOS, making it a high‑conviction trade.

🔷 External Consensus Check

An alignment scan of professional analyst views shows strong consensus:

Buy interest remains concentrated around $3,332–$3,335.

Profit-taking and caution advised as price approaches $3,355–$3,377.

No notable divergence in professional outlook — most remain cautiously bullish above $3,332.

📜 Summary Report

✅ Bias: Neutral-to-bullish above $3,332; downside risk below.

✅ Key Levels: $3,332–$3,334 (buy zone), $3,355–$3,359 (sell zone), $3,375–$3,377 (range ceiling).

✅ Top Trade: Long from $3,334 with stops under $3,329 and targets at $3,348/$3,355.

✅ Alternate Trades: Breakout long above $3,344 or short from supply near $3,355.

✅ Confidence Zones: Buyers dominate above $3,332; sellers reappear above $3,355.

Conclusion

Gold remains in a well‑defined range, with smart money likely accumulating near the lower boundary at $3,332. With structural supports intact and demand zones respected, the path of least resistance favors cautious upside toward $3,355 and possibly $3,375. Intraday traders are advised to focus on precise execution within the outlined confidence zones, maintaining discipline around stops and targets.

The current market structure rewards patience and alignment with institutional footprints — positioning ahead of breakout confirmation, while respecting range extremes.

GOLD 2H STRUCTURE ROADMAP – JULY 2025🧭 GOLD 2H STRUCTURE ROADMAP – JULY 2025

📉 Market Structure | 📊 Liquidity Zones | 🎯 Bearish Scenario

---

📌 🧱 Structure Analysis – Bigger Picture

The current macro structure on Gold is clearly bearish, confirmed by:

A sequence of Lower Highs (LH) and Lower Lows (LL)

Price respecting a descending channel / wedge structure

Failure to hold above key break-of-structure (BOS) zones on prior rallies

Recent rallies forming corrective patterns, not impulsive bullish structure

This indicates that smart money is distributing at higher levels and planning liquidity raids before final markdowns.

---

🔁 Wedge + ABC Trap Formation

The chart shows a classic bearish wedge (rising contraction pattern) with an embedded ABC correction, which can trap long-biased retail traders before reversal.

Wave (A): Short-term rejection at previous minor high

Wave (B): Shallow pullback to create illusion of strength

Wave (C): Final liquidity sweep above the wedge → Perfect trap zone

---

💧 Triple Liquidity Targets – Smart Money Blueprint

Smart money often targets liquidity in layers. Below are the three major zones:

1. 🔻 First Liquidity Pool (~$3,320 – $3,310):

Minor internal structure lows with previous BOS area

2. 🔻 Second Pool (~$3,285 – $3,275):

Strong liquidity cluster near order block formed after impulsive move

3. 🔻 Final Demand Zone (~$3,245 – $3,260):

Deep liquidity + unmitigated bullish OB = High Probability Reaction Zone

---

⚔️ Bias & Trading Insight

✅ Bias: Bearish unless price closes above $3,400 with strength

🚫 Avoid chasing longs during (B)-(C) unless clear breakout + volume

🧠 Patience pays — Wait for sweep of all three zones before any long-term bullish commitment

---

> 🧠 Precision Analysis by: Mohsen Mozafarinezhad

👑 Presented under: PERSIAUX KING — A Legacy of Persian Discipline in Markets

#XAUUSD(GOLD): Strong Sellers Hold, Further Drop Incoming! God dropped from our area of entry yesterday as we initially expected. However, since the massive drop, we are now seeing some short-term correction in the prices. In the coming time, we can expect further price drops around 3280 or 3250.

If you like our idea, please like and comment.

Team Setupsfx_

Gold: Bull-Bear Swings & Today's Trade Tips + AnalysisAnalysis of Gold News Drivers:

During the U.S. session on Wednesday (July 16th), spot gold surged sharply and is currently trading around 3,370 🚀. Trump stated that tariff letters will soon be sent to small countries, with rates likely slightly above 10%, providing safe-haven support for gold prices 🛡️.

Gold prices fell 0.5% on Tuesday, closing at 3,324.68, barely holding above the 55-day moving average of 3,222 📉. Earlier, the U.S. June CPI increase hit its highest level since January, pushing the U.S. dollar index to a nearly three-week high, while U.S. Treasury yields also climbed to a six-week peak, pressuring gold prices ⚖️. The dollar index has risen for four consecutive trading days, hitting a high of 98.70 on Tuesday, the highest since June 23rd 🆙. A stronger dollar makes dollar-denominated gold more expensive for investors holding other currencies, thereby weighing on gold prices 💸.

However, the market largely interprets the dollar's recent rally as a technical adjustment rather than a reversal of the long-term trend 🔄. Despite short-term pullbacks in gold prices, market sentiment has not fully turned pessimistic 😐. While gold is currently in a consolidation range since mid-May, uncertainties surrounding tariff policies may offer support 🔀. Overall, the long-term outlook for gold remains optimistic, with sustained market focus on tariff issues expected to drive a rebound in gold prices in the future 📈

Accurate signals are updated every day 📈 If you encounter any problems during trading, these signals can serve as your reliable guide 🧭 Feel free to refer to them! I sincerely hope they'll be of great help to you 🌟 👇

Elliott Wave Analysis – XAUUSD July 16, 2025🔄 Momentum Analysis

D1 timeframe: Momentum is currently reversing to the downside, suggesting that the price may continue to decline or move sideways in the short term.

H4 timeframe: Momentum is rising, indicating that the current recovery may continue. The next resistance zones to watch are 3342 and 3358.

🌀 Elliott Wave Structure

At present, price action is being compressed within a contracting triangle corrective pattern, with its range narrowing further—signaling market consolidation. We should closely monitor for signs of a breakout that could end this correction.

Based on the current wave structure, it is expected that wave d (green) has completed, and the current downward move is likely part of wave e (green).

The trading strategy focuses on waiting for the price to approach the lower boundary of the triangle—drawn from the low of wave a to the low of wave c—looking for confluent support areas near this trendline to identify a potential BUY opportunity.

🎯 Target & Trade Plan

BUY ZONE: 3303 – 3300

Stop Loss (SL): 3290

Take Profits (TP):

- TP1: 3327

- TP2: 3358

- TP3: 3402