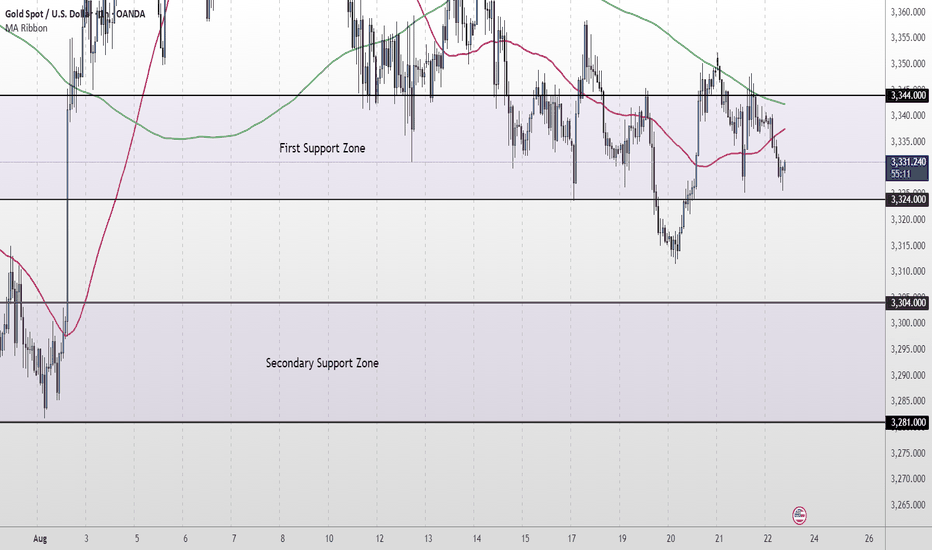

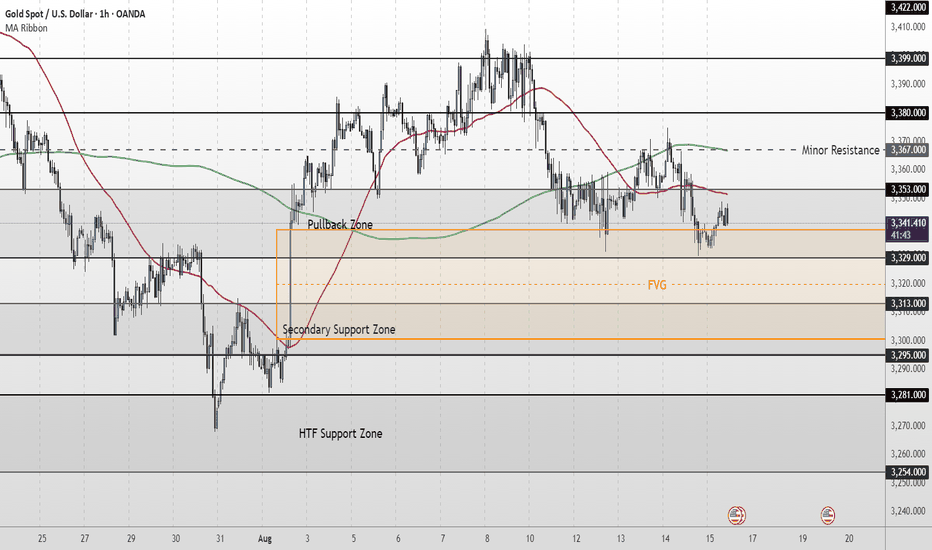

XAU/USD Intraday Plan | Support & Resistance to WatchGold is trading around $3,326, moving lower after repeated failures to reclaim the $3,344 resistance yesterday. Price is now testing the lower edge of the First Support Zone ($3,324–$3,344).

It remains capped below both the 50MA (pink) and 200MA (green), which have flattened out, indicating a bearish or indecisive market structure.

If sellers gain momentum and break below $3,324, focus shifts toward the Secondary Support Zone ($3,304–$3,281). A clean break under $3,281 would expose the HTF Support Zone ($3,254–$3,229).

For buyers, only a sustained move back above $3,344 and the 200MA would shift momentum, opening the path toward $3,364 and $3,386.

📌 Key Levels to Watch

Resistance:

$3,344

$3,364

$3,386

$3,406

Support:

$3,324

$3,304

$3,281

$3,254

$3,229

📌 Fundamental Focus – Friday, Aug 22

Today’s spotlight is on the Jackson Hole Symposium, with key speeches from Fed Chair Powell, FOMC members, and President Trump expected to drive volatility. Markets will be highly reactive to policy signals and geopolitical remarks.

⚠️ Friday Risk Warning: Expect higher volatility, potential intraday manipulations, and sharp position adjustments as markets head into the weekend close. Liquidity often thins in late Friday sessions, so manage exposure carefully and avoid holding unnecessary risk over the weekend.

Xauusdlevels

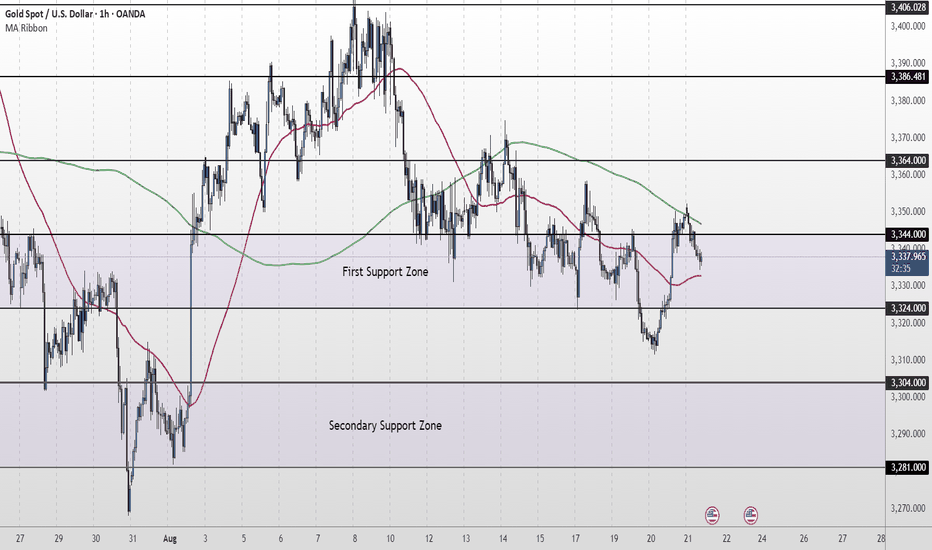

XAU/USD Intraday Plan | Support & Resistance to WatchYesterday, we highlighted the need for a sustained move above $3,344 for bulls to gain control. However, gold failed to hold that level, with the 200MA providing firm resistance.

Gold currently trading around $3,337, sitting just above the 50MA (pink) but still capped below the 200MA (green). This keeps the structure in a neutral-to-bearish stance, as short-term momentum has improved slightly, but the broader trend remains pressured under the 200MA.

Buyers need sustained momentum above $3,344, it would open the path toward $3,364 and $3,386. A decisive reclaim of the 200MA would further strengthen bullish momentum.

On the downside, failure to hold above $3,324 risks a move back into the Secondary Support Zone ($3,304–$3,281). A deeper breakdown would expose the HTF Support Zone ($3,254–$3,229).

📌 Key Levels to Watch

Resistance:

• $3,344

• $3,364

• $3,386

• $3,406

Support:

• $3,324

• $3,304

• $3,281

• $3,254

• $3,229

🔎 Fundamental Focus – Thursday, Aug 21

Today brings several key U.S. releases including Unemployment Claims, PMI data, and housing figures, alongside the start of the Jackson Hole Symposium. These events are likely to increase volatility in gold.

⚠️ Risk Management: Expect sharp intraday swings and possible fakeouts around data releases. Keep risk tight and wait for confirmation before committing to trades.

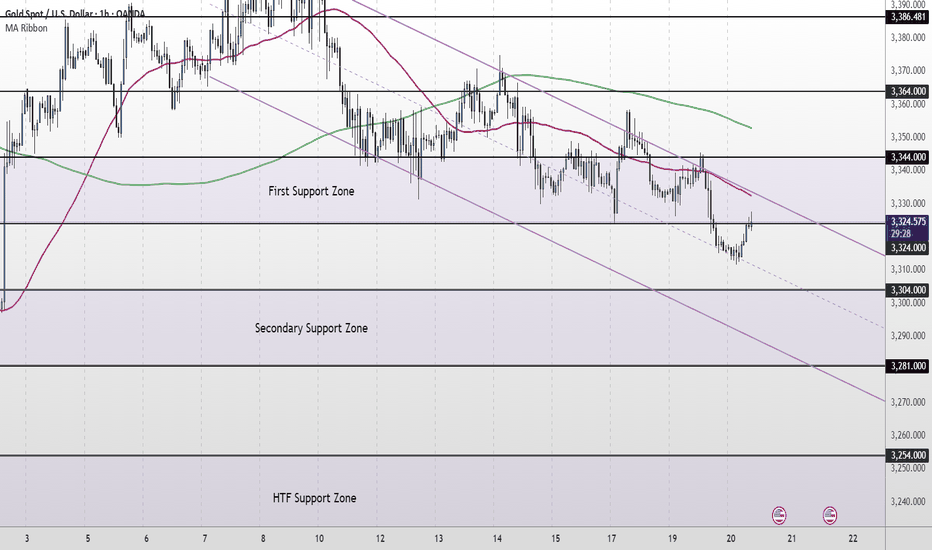

XAU/USD Intraday Plan | Support & Resistance to WatchPrice failed to break the $3,344 resistance yesterday, followed by a sharp move lower. It is currently trending just below the $3,324 resistance. Price remains capped under both moving averages, and the structure stays bearish.

The first resistance is at $3,324. A sustained move above $3,344 is needed to shift momentum, opening the path toward $3,364 and $3,386. If buyers fail to reclaim this level, the downside bias remains intact, with risk of a test into the Secondary Support Zone ($3,304–$3,281). A clean break below that would expose the HTF Support Zone ($3,254–$3,229).

📌Key Levels to Watch

Resistance:

‣ $3,324

‣ $3,344

‣ $3,364

‣ $3,386

‣ $3,406

Support:

‣ $3,304

‣ $3,281

‣ $3,254

‣ $3,229

🔎 Fundamental Focus:

The main event today is the FOMC Meeting Minutes , which could provide clearer signals on the Fed’s rate path and drive sharp moves in gold.

⚠️ Risk/Volatility Warning:

High-impact news flow begins today with the Fed minutes and continues into Thursday’s data and Friday’s Jackson Hole Symposium. Expect increased volatility and fakeouts – manage risk carefully and wait for confirmation before entering trades.

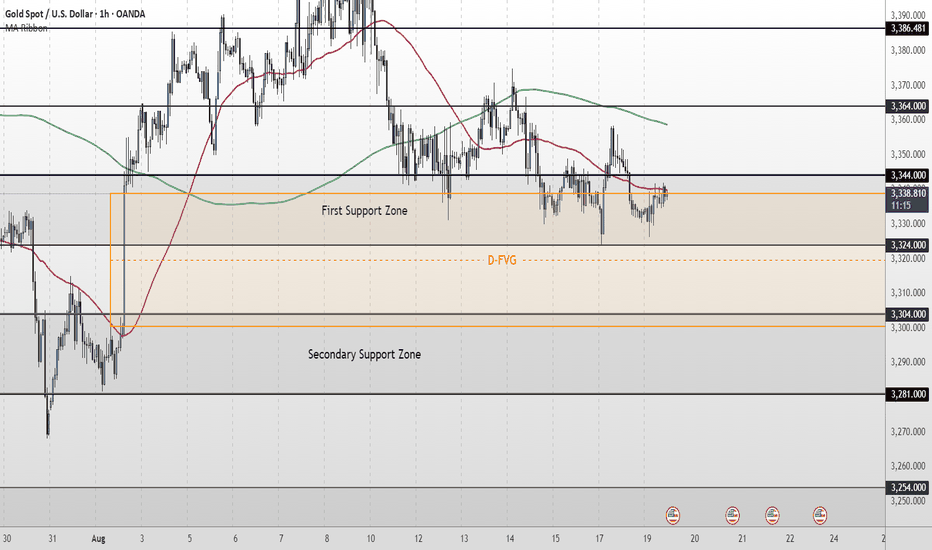

XAU/USD Intraday Plan | Support & Resistance to WatchGold is currently trading around $3,338, sitting just below the $3,344 resistance level. Price remains under both the 50MA (pink) and the 200MA (green), which continue to act as dynamic resistance and keep the short-term structure bearish.

The recent bounce from the First Support Zone ($3,324–$3,344) shows buyers are still defending this area, but momentum is weak. A clean break and hold above $3,344 would open the path toward $3,364, with $3,386 as the next resistance.

If price fails to reclaim $3,344, then a retest of the First Support Zone is likely. A deeper break could expose the Secondary Support Zone ($3,304–$3,281), and if selling pressure accelerates, the HTF Support Zone ($3,254–$3,229) comes into play.

📌 Key Levels to Watch:

Resistance:

‣ $3,344

‣ $3,364

‣ $3,386

‣ $3,406

Support:

‣ $3,324

‣ $3,304

‣ $3,281

‣ $3,254

‣ $3,229

⚠️ For now, structure favors range-bound to bearish price action unless gold can reclaim $3,344 and hold above the 50MA.

📌 Fundamental Overview

This week is event-heavy with multiple Fed speakers, Wednesday’s FOMC Minutes, and Thursday’s U.S. jobless claims & PMI data all set to drive volatility. The spotlight will be on Friday’s Jackson Hole Symposium, where Powell’s speech could shape expectations for upcoming rate cuts.

On the geopolitical side, Trump’s push for a Russia–Ukraine peace deal has raised uncertainty, with reports of territorial concessions being discussed. While no breakthrough has been reached, the headlines add to safe-haven demand for gold.

XAU/USD Intraday Plan | Support & Resistance to WatchGold is trading around $3,344 after failing to break $3,367 minor resistance and hold above the $3,353 level, with both the 50MA (pink) and 200MA (green) now sitting above price and acting as dynamic resistance.

A break and sustained hold back above $3,353 would be needed to regain short-term bullish momentum, opening the path to $3,367 (minor resistance) and $3,380. Failure to reclaim $3,353 keeps the bias tilted bearish, with downside pressure likely toward $3,329 and $3,313 - $3,295.

Current structure remains under pressure while price stays below the moving averages, with sellers holding the near-term advantage.

📋 Bullish Plan

The $3,329–$3,313 zone aligns with main buy-side liquidity and a fair value gap on both the 1H and 4H charts — making it a high-probability reaction area.

📌 Key Levels

Resistance:

‣ $3,353

‣ $3,367

‣ $3,380

‣ $3,399

Support:

‣ $3,329

‣ $3,313

‣ $3,295

‣ $3,281

🔎 Fundamental Focus – Fri, Aug 15

Busy session ahead with multiple high-impact US releases, including Core Retail Sales, Retail Sales, and Import Prices — key indicators for consumer demand and inflation trends that can directly affect USD and gold volatility.

Later, we have Prelim UoM Consumer Sentiment and Inflation Expectations, which may influence market expectations for Fed policy.

⚠️ It’s Friday — expect high volatility spikes. Manage risk carefully and avoid holding unnecessary exposure over the weekend.

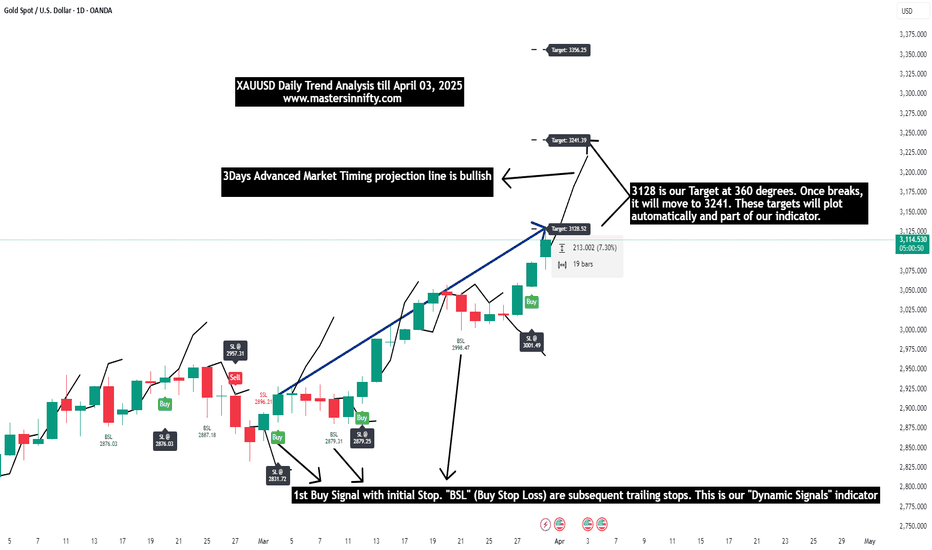

Gold Medium to Short Term Outlook Gold has shifted into a bullish structure after reclaiming key technical levels.

The strong impulsive move from below $3,300 into the $3,354–$3,370 resistance area reflects renewed buying interest, likely driven by improving sentiment and shifting macroeconomic expectations.

If bulls maintain control and price breaks and holds above $3,354, we could see continuation toward $3,383 and $3,400, with $3,416 marking the next major higher-timeframe resistance. These levels will be critical in determining whether gold resumes a broader bullish trend or begins to stall into a deeper correction.

On the flip side, if gold begins to fade below $3,354, then the $3,335–$3,305 pullback support zone will be key for potential bullish re-entry attempts.

A sustained break below this area would invalidate the current bullish leg and expose the market to a deeper retracement toward $3,289–$3,267, with $3,241–$3,208 acting as the higher-timeframe support floor.

📌 Key Levels to Watch

Resistance

‣ $3,370

‣ $3,383

‣ $3,400

‣ $3,416

Support

‣ $3,335

‣ $3,305

‣ $3,289

‣ $3,267

‣ $3,241

‣ $3,208

🔎 Fundamental Focus

Multiple high-impact U.S. data releases this week, including CPI, PPI, Retail Sales, and Unemployment Claims.

Expect elevated volatility across sessions.

⚠️ Manage your risk around news times. Stay sharp.