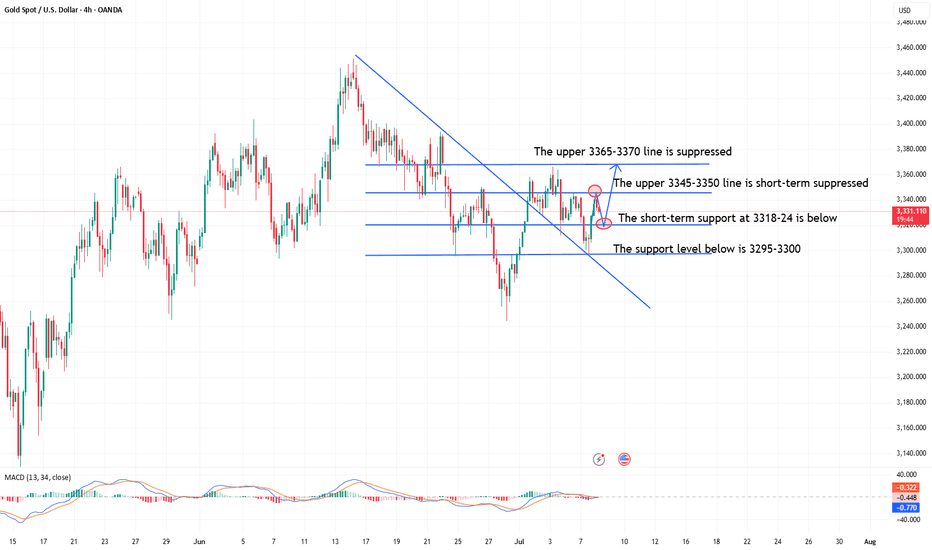

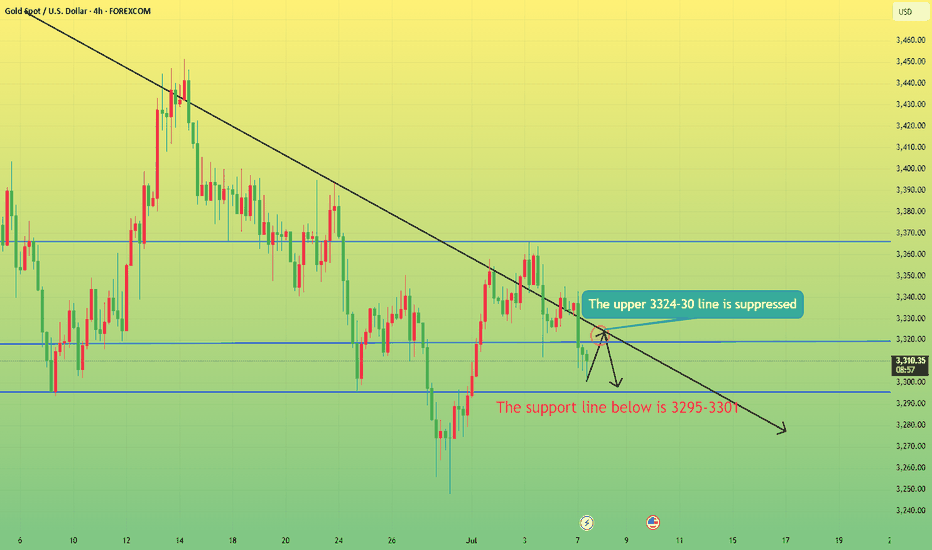

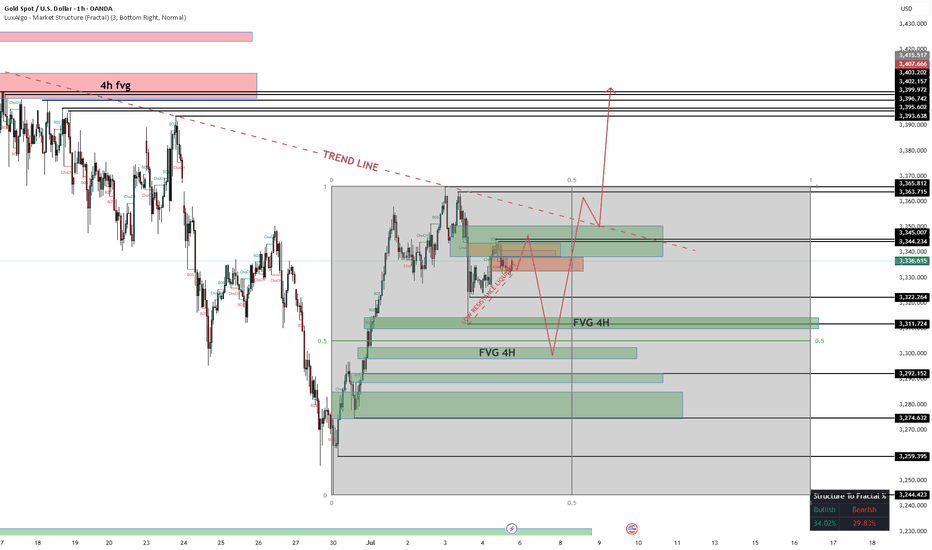

Gold falls back to 18-24 and goes longFrom the 4-hour analysis, pay attention to the short-term support of 3318-3324 below, pay attention to the short-term resistance of 3345-50 above, and focus on the suppression of 3365-70. The overall high-altitude low-multiple cycle participation theme remains unchanged. In the middle position, watch more and do less, and follow orders cautiously, and keep the main theme of participation in the trend. Be patient and wait for key points to participate. I will prompt the specific operation strategy in the link, please pay attention in time.

Gold operation strategy:

1. Go long at 3318-3324, stop loss at 3312, target at 3345-50, and continue to hold if it breaks;

2. Go short at 3345-50 when gold rebounds, stop loss at 3357, target at 3318-24, and continue to hold if it breaks;

Xauusdlong

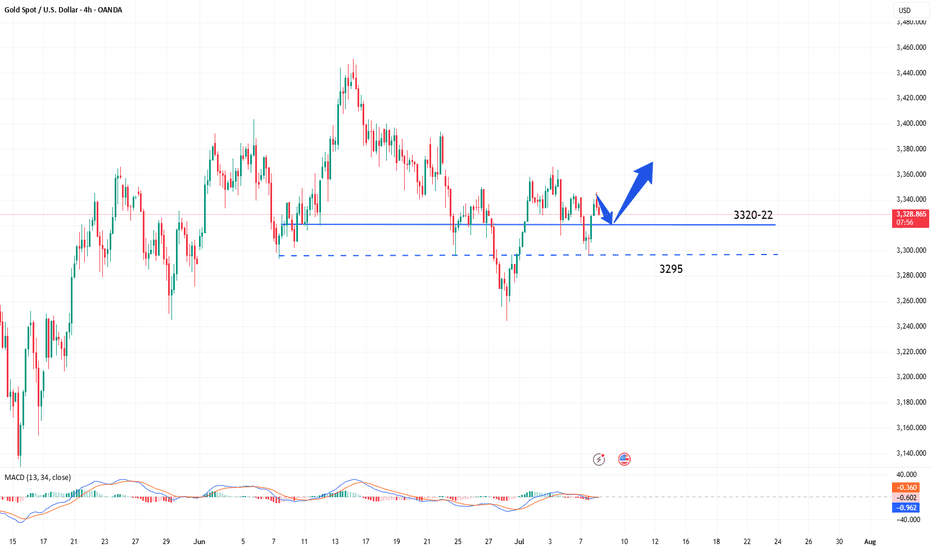

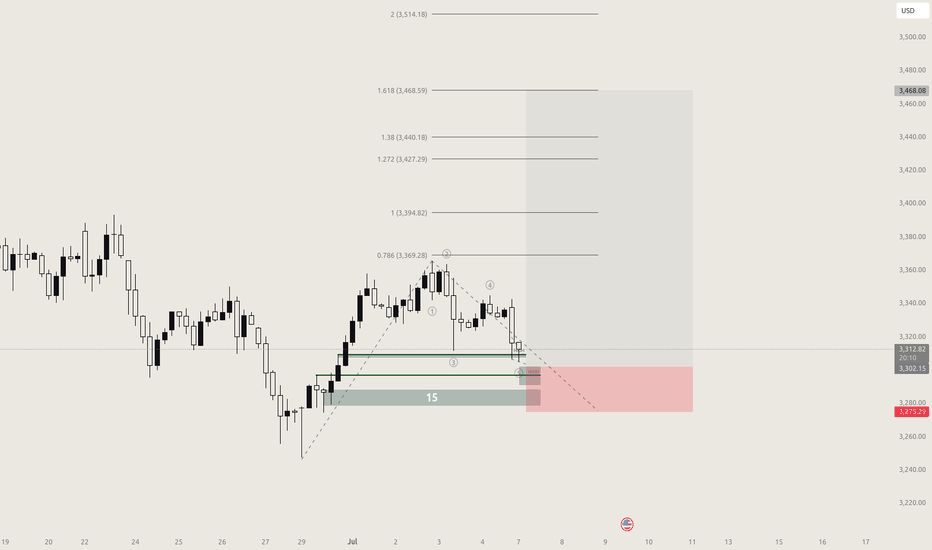

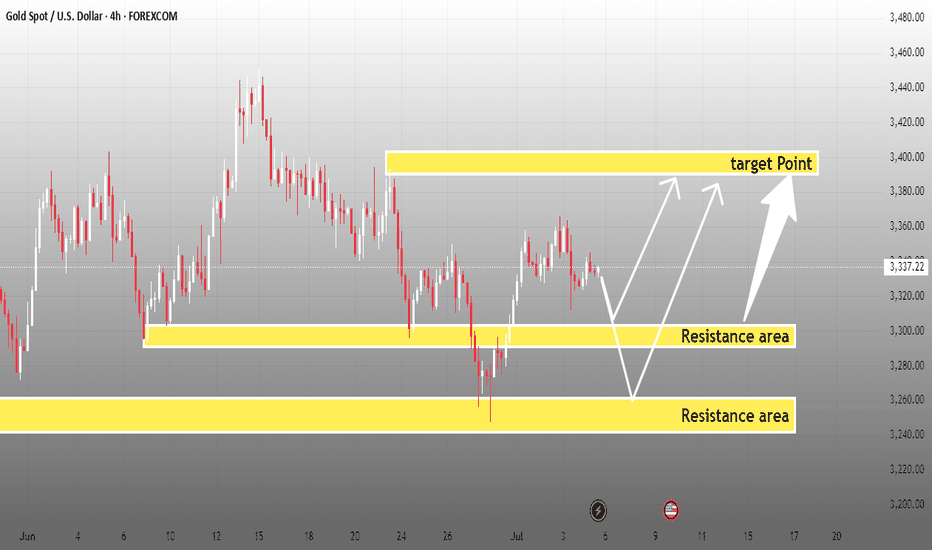

Can the gold bulls reverse?From the technical perspective of gold, the lowest price fell to 3295 on Monday and stopped falling. There is a lot of room for the rise, and the highest rose to around 3345. The overall trend was a "V" reversal of falling first and then rising. Therefore, it can be determined that the adjustment of gold has been completed, and the bullish force has emerged. The market outlook will continue to see room for growth. The upper side will maintain around 3365 to 3400, and the effective target of the rise this week is 3400. In the 4-hour chart, the technical pattern is also three consecutive positive days at a low level, and the Bollinger band is closing. Standing firmly above the middle track of the Bollinger band is absolutely strong. If it continues to rise, it will be around 3365. 3365 is the high point last week. If this point breaks and the Bollinger band opens, there is a possibility of a big rise to 3400 this week. Today's key point is the 3345 line above. Before the intraday breakout and stabilization at 3345, the rebound is an opportunity to go short. If it stabilizes above 3345, it means the formation of the bottom pattern, and the bulls will start to pull up. At that time, the bears can no longer hold on. The small cycle support is around 3320. Don't chase the long position in the Asia-Europe session, wait for it to fall back to the key support point and then go long.

Gold operation strategy: It is recommended to go long at 3320-3322, stop loss at 3314, and target 3330-3340; it is recommended to go short at 3342-3340 on the rebound, stop loss at 3350, and target 3330-3320;

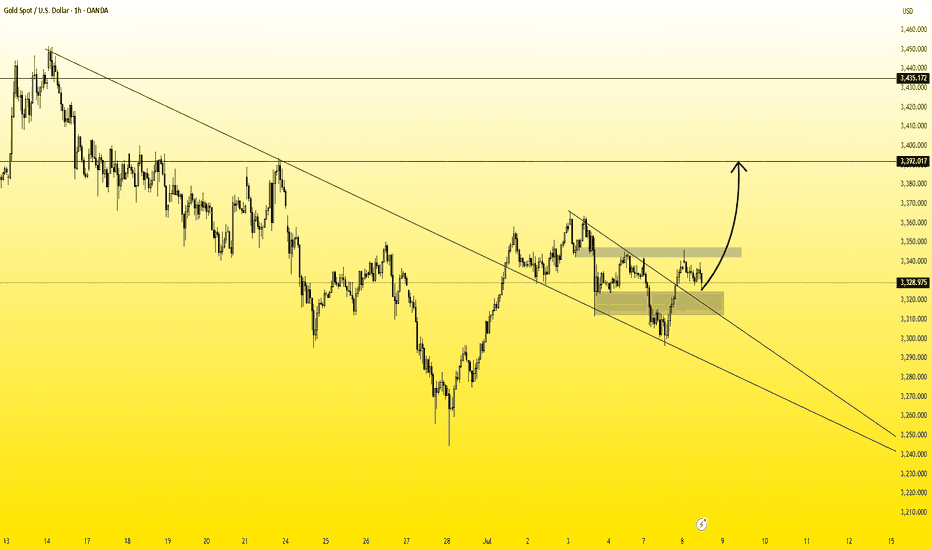

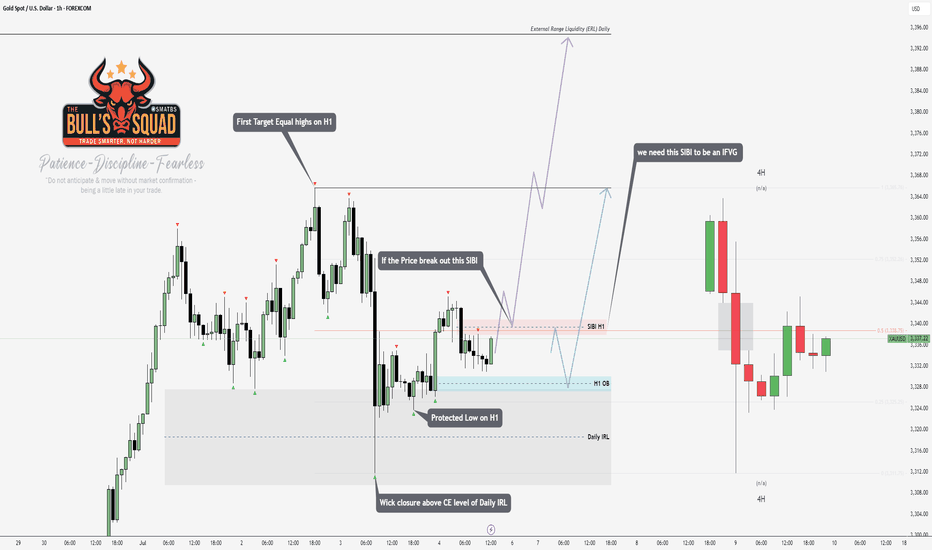

XAUUSDHello traders,

Today we're taking advantage of a great buying opportunity on the XAUUSD pair. This setup is ideal for both medium- and long-term positions. I anticipate that the price will rise toward the 3392.82 USD level in the coming weeks.

That’s why I’ve positioned this trade as a medium-term opportunity.

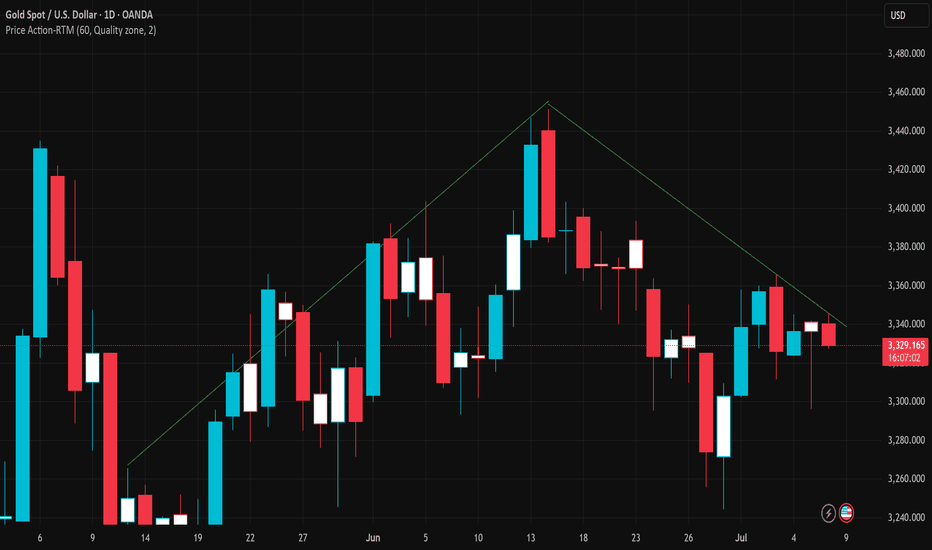

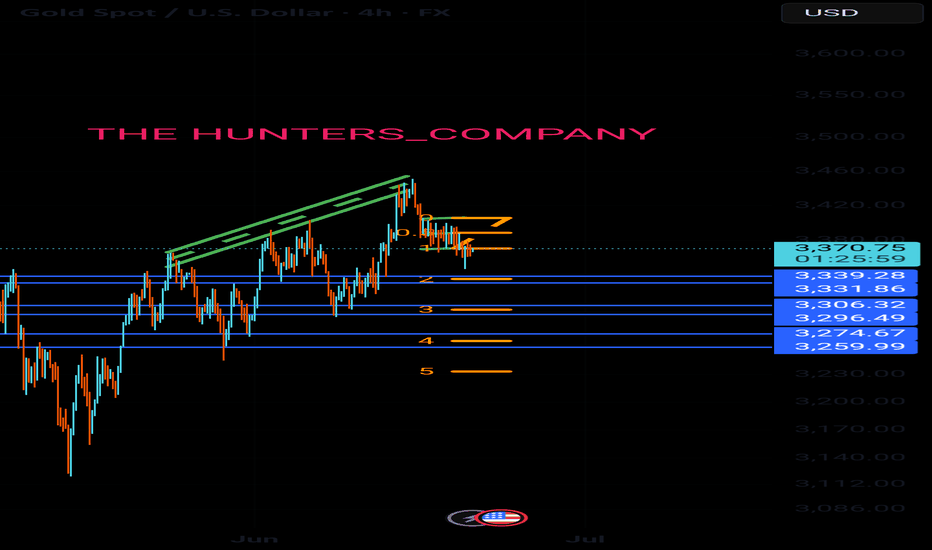

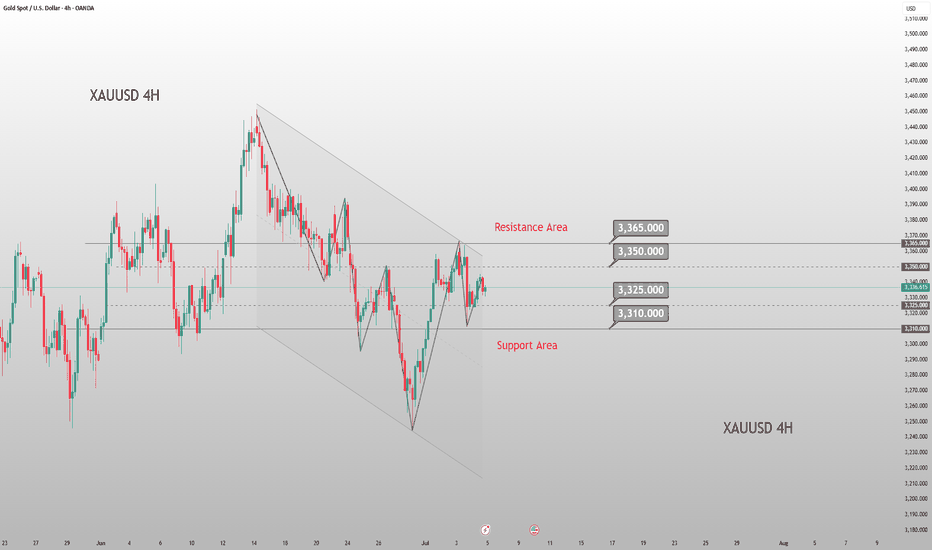

XAUUSD D1 – Gold Under Long-Term Bearish PressureGold is currently trading around 3,328 USD after failing to break above the descending trendline that started from the mid-June peak. On the chart, the price forms a series of lower highs and lower lows — a classic signal of a medium-term downtrend.

The descending trendline (green) acts as dynamic resistance. Each time price approaches it, strong selling pressure pushes it back down, showing sellers are in control.

In the short term, the 3,300 – 3,310 USD area serves as immediate support. If this zone is broken, price could drop further toward the major support zone around 3,260 – 3,270 USD.

Conversely, a confirmed reversal would only be valid if price breaks above the descending trendline and closes sustainably above 3,371 USD — a historically significant distribution zone.

The most recent daily candle is a small-bodied red candle with a long lower wick, indicating weak buying pressure and market indecision — typical in a consolidation phase before further downside.

Strategy Summary:

Favor short positions on pullbacks to the descending trendline.

Avoid bottom-fishing until a confirmed breakout above major resistance.

Traders should monitor the 3,300 USD zone closely in upcoming sessions.

Note: The analysis above is for informational purposes only and does not constitute investment advice. Stay tuned for further updates and adjust your trading plan accordingly.

What’s your take on the next move for gold? Share your thoughts in the comments!

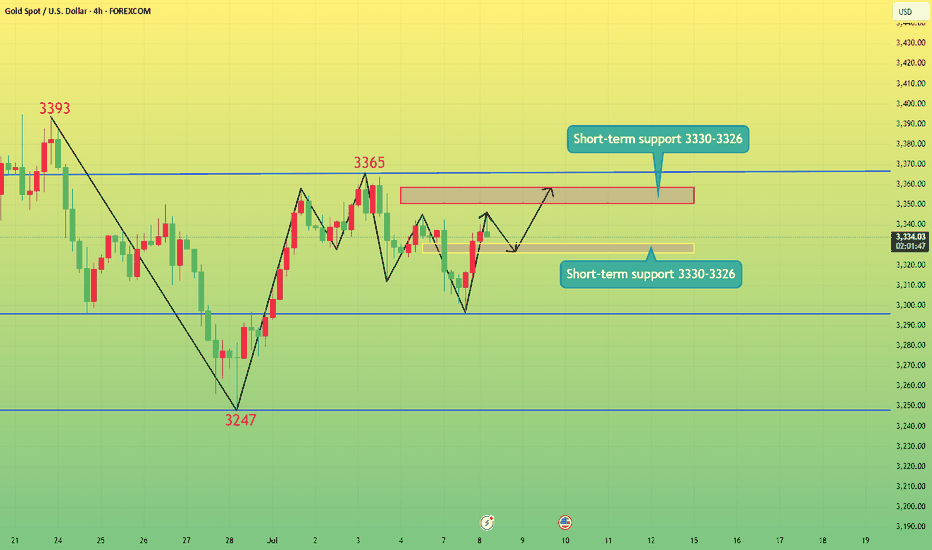

Gold is still in rangeGold, the general trend is as described in the continuous analysis. The price has fallen from the historical high of 3500 to 3120 in the first round this year. After rising to 3452, it is currently in the second round of downward cycle. The mid-term top idea is maintained, and the operating target is 3120;

The non-agricultural data at the end of last week was under pressure at 3365, and it dropped to 3296 on Monday and rebounded. It broke the high overnight, and the daily chart closed positive. The K-line combination is in a volatile arrangement. In the short term, it will maintain consolidation below 3365; short-term support is 3330-3326, and strong support is 3320-3316; short-term resistance is 3350-3358, and strong resistance is 3365;

GOLD TODAYHello friends🙌

🔊Due to the weakness of buyers and the strength of sellers, the price continues to fall...

We have identified two supports for you that will not be seen if the price continues to fall, and if the selling pressure increases, we will update you.

🔥Join us for more signals🔥

*Trade safely with us*

Gold: update hello friends✋️

According to the recent growth of gold, you can see that it is constantly resisting and forming a falling pattern.

For this reason, it can be a warning that the fall can continue and the price will fall to the specified limits.

🔥Follow us for more signals🔥

*Trade safely with us*

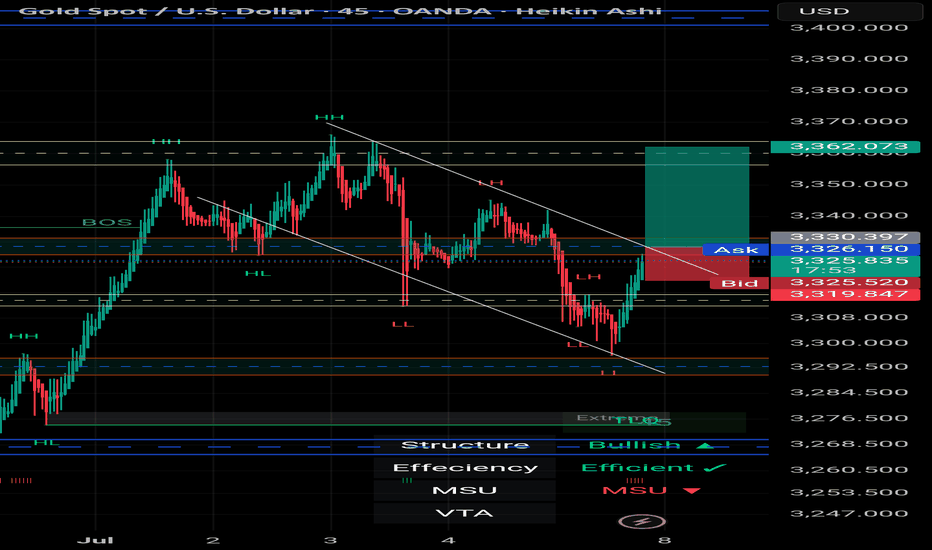

XAU/USD – 45-Minute Chart Breakdown **Date:** July 7, 2025 # 📊 XAU/USD – 45-Minute Chart Breakdown

**Date:** July 7, 2025

**Current Price:** $3,326.97

**Bias:** 📈 Bullish Breakout

---

## 🔹 Key Market Structure:

- **Trendline Breakout**: ✅

Price broke cleanly out of the descending trendline that had held since the $3,362 high.

- **LL → HL Shift**:

The structure is transitioning from Lower Lows to potential Higher Lows (HL) – a strong sign of **reversal**.

- **BOS Zone** (Break of Structure):

BOS has been confirmed; further upside is now **probable**.

---

## 🔸 Trade Zone:

| Type | Level | Description |

|------------|------------|--------------------------|

| **Entry** | ~$3,326 | Breakout confirmation 🔓 |

| **SL** | ~$3,319 | Below recent HL 🛡️ |

| **TP1** | $3,362 | Top of previous range 🎯 |

| **TP2** | $3,385+ | Momentum extension 📈 |

---

## 📌 Indicators & Labels:

- **Structure:** `Bullish` 🟢

- **Efficiency:** `Efficient` ✅

- **MSU:** Bearish (short-term countertrend, being invalidated)

- **VTA:** Active ⚡️

---

## 🧠 Strategy Note:

This breakout is occurring **after a full liquidity sweep** and a **strong bullish reaction** off the $3,290s. Volume is supporting the move and **confluence** builds toward continuation.

> 💬 *"The best trades come when structure, liquidity, and timing converge."* – Let's ride this wave with confidence.

---

### 👑 For Persian Princes of the Market 🇮🇷

We don’t guess. We **track, adapt, and lead**.

---

## 🟢 Potential Breakout from the Descending Channel

As observed in the **45-minute timeframe**, Gold (XAU/USD) has been respecting a classic **descending channel** formed by a sequence of Lower Highs (LH) and Lower Lows (LL), leading to an overall bearish structure.

However, in the latest candles, price has **broken above the upper boundary of the channel**, signaling a potential shift in market structure.

---

### 🔍 Technical Highlights:

- ✅ **Breakout above the channel** = First sign of bullish reversal

- ✅ **Formation of Higher Low (HL)** after a strong rally = Added confirmation

- ✅ **Efficient bullish move** with momentum pushing toward previous Highs

---

### 🎯 Forecast Scenario:

If price holds above the breakout zone (around **$3,327**), we can expect a bullish continuation toward:

- 🥇 **Target 1:** $3,362

- 🥈 **Target 2:** $3,385+

A **successful retest** of the broken channel would serve as a powerful confirmation for this setup.

---

> ⛳️ *This move reflects not just a breakout — but a disciplined journey through structure, liquidity, and price behavior. Pure technical elegance.*

> — *Mohsen Mozafari Nejad*

---

📈 **Structure:** Bullish

⚡️ **Momentum:** Efficient

🕰 **Timeframe:** 45 Min

💰 **Current Price:** ~$3,327

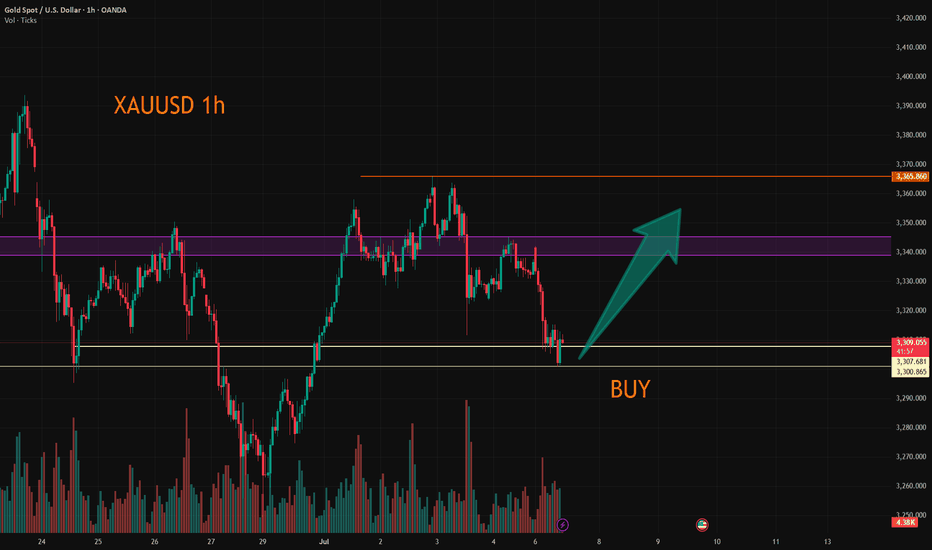

XAUUSD:Go long

Gold prices fell back in Asian trading on Monday, as they digested Friday's negative data. The short term may be partial shock, but the medium and long term news surface uncertainty or to provide support for gold prices, so trading ideas, retracement to do long can.

Trading Strategy:

Both 3300 and 3308 can be used to enter the long position, short-term traders can look at 3325-30, followed by 50 around.

For intermediate traders, the target sees 3365-70 unchanged, and the retracting of 3300/3310/3330 is an opportunity to go long.

More detailed strategies and trading will be notified here ↗↗↗

Keep updated, come to "get" ↗↗↗

7/7: Key Zone – 3320 to 3350Good morning, everyone!

Due to the U.S. market closure on Friday, price movement remained relatively subdued, and the week concluded with modest gains. As of this morning, gold opened higher but has since pulled back, and the price remains in a consolidation phase.

Key technical levels for today:

Resistance: around 3350

Support: near 3321

Short-term traders may focus on range-bound strategies between these levels. If a breakout occurs, follow the trend accordingly:

If price breaks above and stabilizes above 3338, the market may shift its focus toward the 3400 psychological level;

If price drops below and holds under 3332, there’s potential for a retest of the 3260 support zone.

In terms of broader trend analysis, the MA20 and MA60 on the daily chart should be watched closely, as they currently serve as key dynamic resistance and support levels.

Lastly, stay alert to any developments related to trade tariffs, as such news may significantly impact market sentiment and gold price direction.

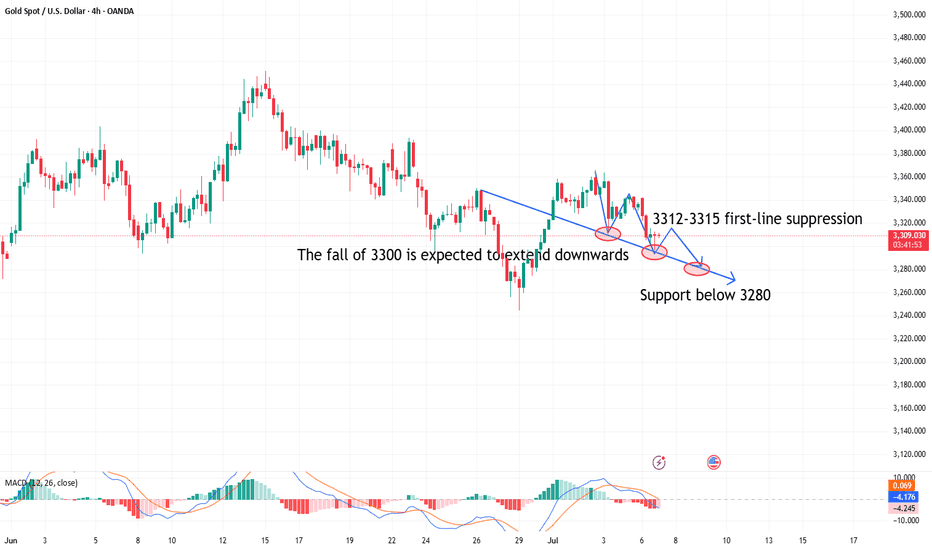

Gold falls below 3300, will it rebound or continue to fall?Gold opened lower in the morning today and then rebounded and fell again. This kind of jump market fluctuates quickly but is mostly short-term. I usually remind you to avoid chasing orders to prevent being washed. Gold rebounded weakly and failed to touch 3320 and began to fall continuously. This weak signal alerted me - it failed to rebound strongly after the gap and instead remained at a low level, suggesting that the downward momentum was very strong and fully released, and there was a risk of further weakening. In the afternoon, the gold price was still hovering around 3312-3307, confirming its weak pattern. Combined with the repeated pressure on the key support 3300, I judged that the trend has clearly turned to short.

Gold recommendation: short in the 3312-3315 range, stop loss 3320, target 3280

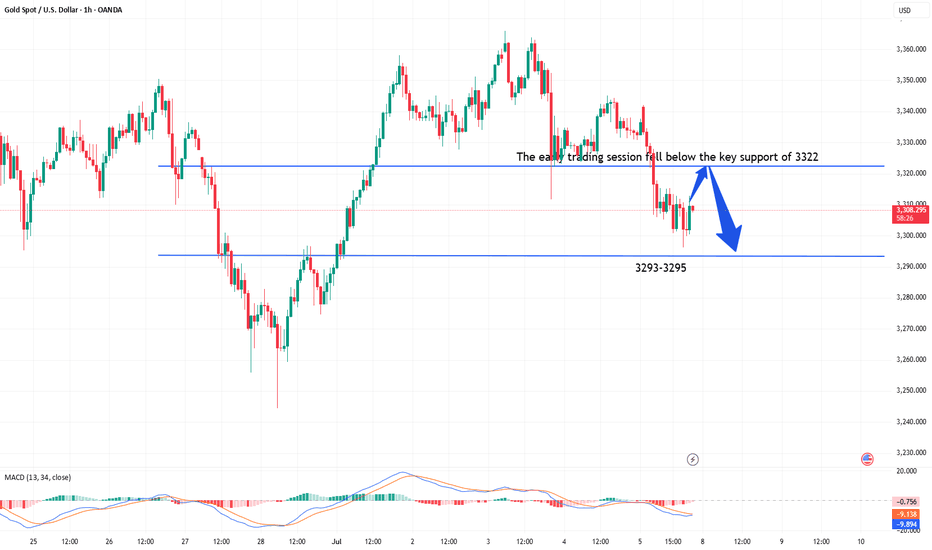

Gold shock pattern breaksGold prices rose rapidly at the opening of the morning, reaching a high of 3342 before falling back. This early morning sharp pull-up market needs special attention, because from the perspective of short-term trading, this is the trend pattern that needs the most vigilance. Looking back at the trend of last Thursday, there was also a situation where the early morning surge could not continue. Historical data shows that this kind of morning pull-up often lacks sustained momentum and has limited room for subsequent increases. Combined with the recent trend, although the price rebounded on Monday and Tuesday, it basically maintained a volatile pattern in the following trading days, but the fluctuation range changed. After repeated struggles in the 3345-3322 range on Friday, the gold price rose again in this trading day and fell below the key support level of 3322. This important change means: 1. The original 3322-3345 oscillation range has been broken; 2. After the range moves down, 3322 changes from a support level to a resistance level; 3. The short-term trend weakens, and it is recommended to adopt a high-sell strategy. It is recommended to short at highs near 3322, and focus on the 3295-3293 support area below.

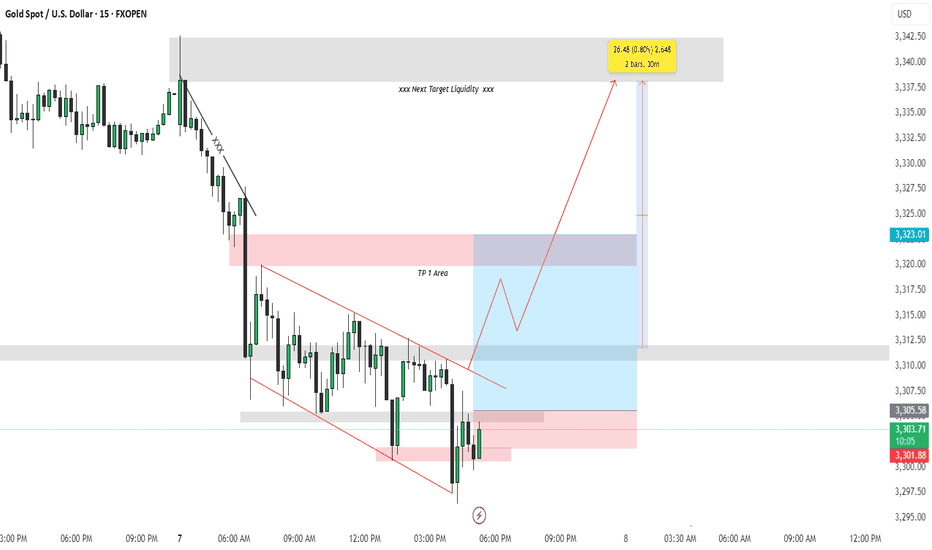

Trade Breakdown: XAUUSD 15-Min | Liquidity Grab + Reversal PlayOANDA:XAUUSD

Psychological Setup

This trade is rooted in the psychology of smart money and retail behavior. After a sharp drop in price, most retail traders expect continuation (trend-following). However, institutions often manipulate liquidity zones — hunting for stop-losses before a true reversal. This trade capitalizes on that behavior.

🔍 Technical Explanation:

🔻 1. Market Structure:

Price was previously in a downtrend, forming lower highs and lower lows.

A falling wedge pattern (red lines) formed after a strong bearish move, signaling potential bullish reversal.

Price broke the wedge to the upside — a classic reversal signal.

🔁 2. Liquidity Concept:

Below the wedge: The market grabbed liquidity by taking out stop losses of buyers who entered too early.

Above the wedge (TP Areas):

TP 1 Area (red box): This is the first logical resistance where previous supply sits — many sellers will enter here, providing buy-side liquidity.

Next Target Liquidity (grey box above): This is a major imbalance zone and likely where stop-losses of early short sellers are stacked.

Price is expected to grab liquidity from that area (marked by the red arrow).

✅ Entry & Trade Logic:

Entry Zone: After liquidity was swept at the bottom of the wedge, a bullish engulfing candle formed near demand — signaling institutional interest.

Risk-Reward Setup:

Targeting 0.80% move (approx. 26.48 points).

Trade is based on reversal from demand zone + wedge breakout + liquidity grab confirmation.

🎯 Target Projections:

TP1 Area: Conservative target, just above recent structure.

Final Target: High-probability liquidity zone where market is drawn to clean up resting orders (grey zone).

🧠 Why This Trade Matters (Trading Psychology Insight):

Most retail traders get trapped in emotional entries — entering shorts after a drop or longs too early in a wedge.

Smart money waits for liquidity sweeps before moving price in the desired direction.

This setup shows the importance of patience, structure, and understanding market psychology rather than reacting emotionally to price action.

📌 Key Takeaways:

📉 Trap: Falling wedge builds false bearish confidence.

🧠 Psychology: Stop hunts create fuel for reversal.

📈 Reaction: Smart money absorbs liquidity, moves price toward next inefficiency.

Hashtags:

#XAUUSD #SmartMoney #LiquidityHunt #TradingPsychology #GoldTrade #PriceAction #WedgeBreakout #FXOpen #TechnicalAnalysis #SupplyDemand

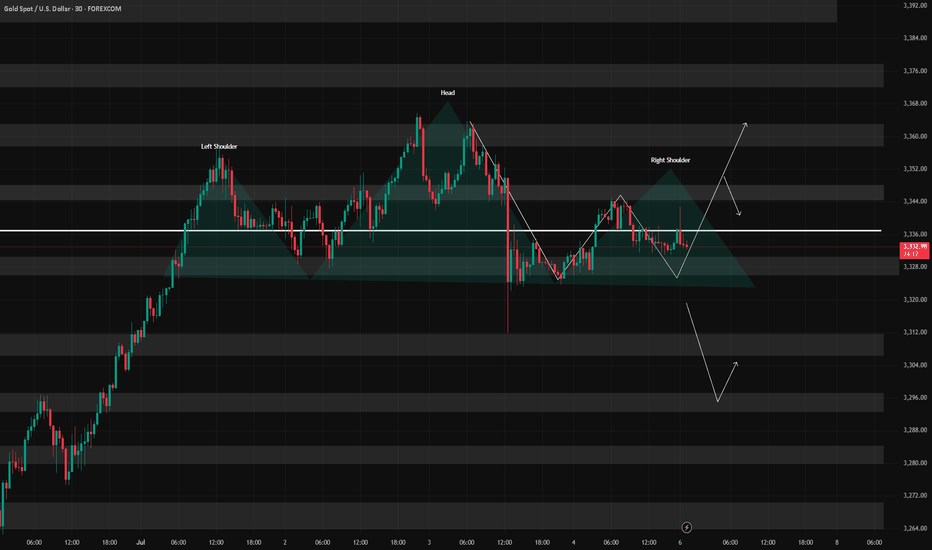

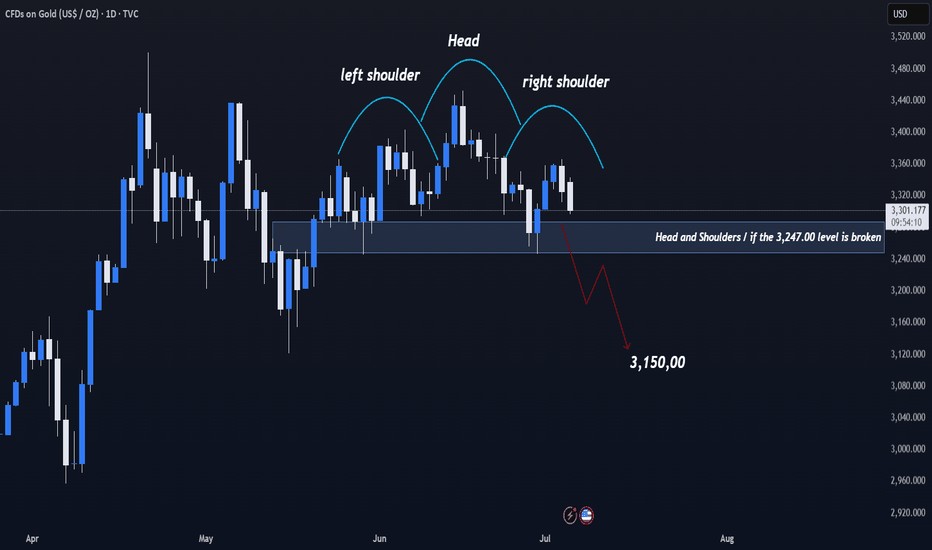

On Swing Traders’ Radar: Gold Pattern Alert on the Daily Chart!Dear Traders,

In my daily gold analysis, I’m observing a Head and Shoulders pattern nearing completion. The neckline is currently positioned around the 3,247.00 level.

If this neckline breaks to the downside, gold could potentially drop toward the 3,150.00 area.

Since this is a one-day analysis—aligned with a swing trading style—it may take some time for the setup to fully play out.

I meticulously prepare these analyses for you, and I sincerely appreciate your support through likes. Every like from you is my biggest motivation to continue sharing my analyses.

I’m truly grateful for each of you—love to all my followers💙💙💙

Where will the price of gold go under such strong pressure?From the 4-hour analysis, the support line of 3295-3301 is concerned below, the short-term resistance above is concerned about 3316, and the suppression line of 3345-50 is focused on. The overall main tone of high-altitude low-multiple cycle participation remains unchanged. In the middle position, watch more and do less, and follow orders cautiously, and maintain the main tone of participation in the trend. Wait patiently for key points to participate.

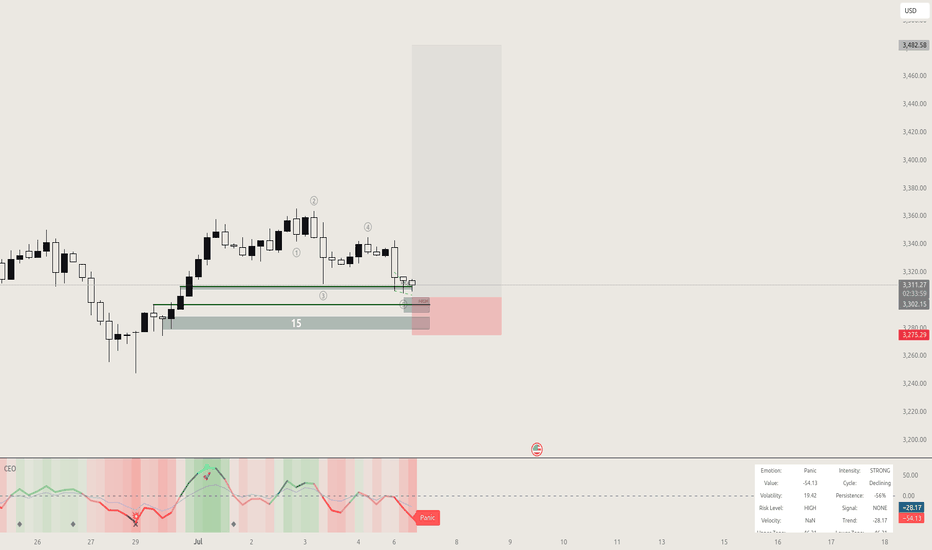

Gold new ATH soon?🟡 GOLD LONG SETUP: Buying the Fear at Key Support 📈

ICMARKETS:XAUUSD

"Be fearful when others are greedy, and greedy when others are fearful" - Warren Buffett

The oscillator we developed is showing some compelling signals on gold right now, and the market sentiment couldn't be more perfect for a contrarian play. 💎

Technical Analysis:

Our custom oscillator is painting a clear picture at the bottom - we're seeing those beautiful green zones emerging after extended red periods

Price action has found solid support around the 3,300 level, creating a strong foundation for the next leg up

The fear in the market is palpable, which historically has been an excellent buying opportunity for precious metals

Volume profile suggests accumulation is happening at these levels

Why This Setup Works: 🎯

The beauty of this oscillator lies in its ability to identify when institutional money starts flowing back into gold during periods of maximum pessimism. When retail traders are panicking and selling, smart money is quietly accumulating.

Key levels to watch:

• Support: 3,300 (current zone)

• First target: 3,350

• Extended target: 3,400+

Risk Management: ⚠️

• Stop loss below 3,275

• Position sizing: Never risk more than 2% of account

• Trail stops as momentum builds

The oscillator's fear signals have been remarkably accurate in identifying these reversal points. When fear reaches extremes, that's typically when the best opportunities present themselves.

This is not financial advice - always do your own research and manage risk appropriately.

What are your thoughts on this setup? Are you seeing similar signals on your charts? 🤔

#Gold #XAUUSD #TechnicalAnalysis #BuyTheFear #Oscillator

Monday Outlook on Gold (XAU/USD)My outlook for Monday is bearish at the start of the session, with price likely to drop toward the 3310–3300 area. This level aligns with a key discount zone inside the Gann box, and also overlaps with a 4H Fair Value Gap (FVG), making it a strong area of interest for potential long setups.

From that zone, I expect a bullish reaction, leading to a move back up to the trendline.

If the momentum continues, I anticipate a break of the trendline, followed by a retest, and then the beginning of a bullish trend.

I’ll be looking for confirmations around 3300 to position for the move higher.

Let’s see how Monday opens.

XAUUSD Weekly Chart Buying area📊 XAU/USD (Gold) Price Analysis – 4H Chart

🕒 Date: July 6, 2025

🔍 Technical Overview:

Gold is currently trading around the $3,337 level, showing signs of consolidation after a recent bounce.

🔸 Key Zones:

🟡 Resistance Area 1: $3,295 - $3,310

🟡 Resistance Area 2: $3,250 - $3,270

🟡 Target Zone: $3,390 - $3,410

📈 Possible Scenarios:

Price may retrace to the $3,295 - $3,310 resistance area, hold support, and aim for the $3,390 - $3,410 target zone.

A deeper pullback to the lower $3,250 - $3,270 resistance turned support area may occur before a stronger bullish move.

Breakout confirmation will come on a clean close above the $3,337 level with volume.

📌 Bias: Bullish above the $3,295 level

📌 Watch for: Bullish price action or liquidity grabs near support zones

💡 This setup is based on structure, liquidity zones, and institutional footprints.

Gold lacks downside momentum: Next week's analysis & adviceGold trading is relatively light today due to the U.S. Independence Day holiday. On the downside, we continue to focus on the short-term support at the 3325 level, while the key resistance above remains in the 3345-3350 range, which was yesterday's breakdown point. The market has closed early today, and price action has been stuck in a range-bound consolidation.

After plunging $40 on the back of bearish non-farm payroll data, gold stabilized and rebounded, recouping nearly half of the losses. This performance confirms that the downside space is limited. Currently, the market has returned to a oscillating upward pattern, and the weekly chart is likely to continue range-bound fluctuations. From a technical perspective, the 3325 level has formed a key support. The secondary retest overnight confirmed the bottom structure, and the gradual lifting of early session lows has also released a bullish signal. Looking ahead to next week, gold is expected to continue its bullish trend. If the 3325 support level below remains unbroken, one can look for opportunities to establish long positions.

XAUUSD

buy@3325-3330

tp:3340-3360-3380

Investment itself is not the source of risk; it is only when investment behavior escapes rational control that risks lie in wait. In the trading process, always bear in mind that restraining impulsiveness is the primary criterion for success. I share trading signals daily, and all signals have been accurate without error for a full month. Regardless of your past profits or losses, with my assistance, you have the hope to achieve a breakthrough in your investment.

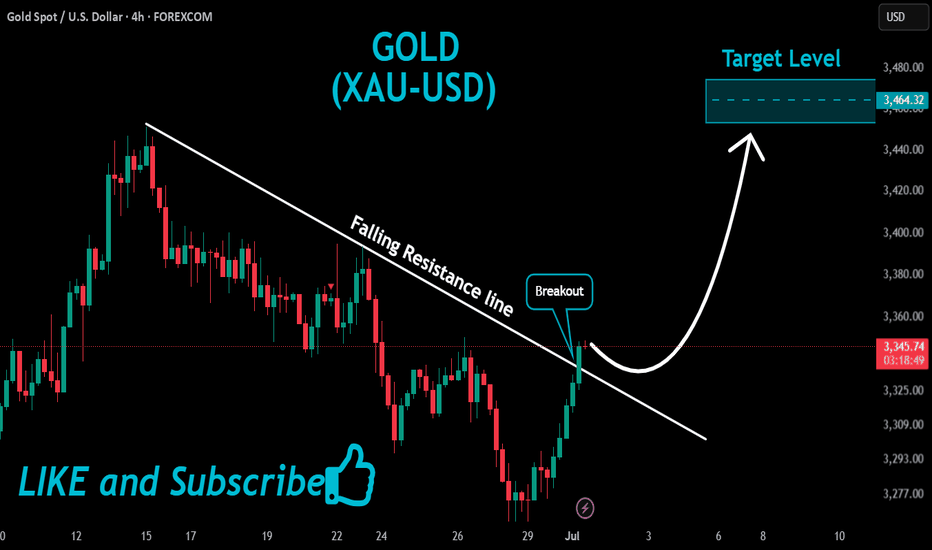

GOLD Massive Bullish Breakout!

HI,Traders !

#GOLD is trading in a strong

Uptrend and the price just

Made a massive bullish

Breakout of the falling

Resistance line and the

Breakout is confirmed

So after a potential pullback

We will be expecting a

Further bullish continuation !

Comment and subscribe to help us grow !

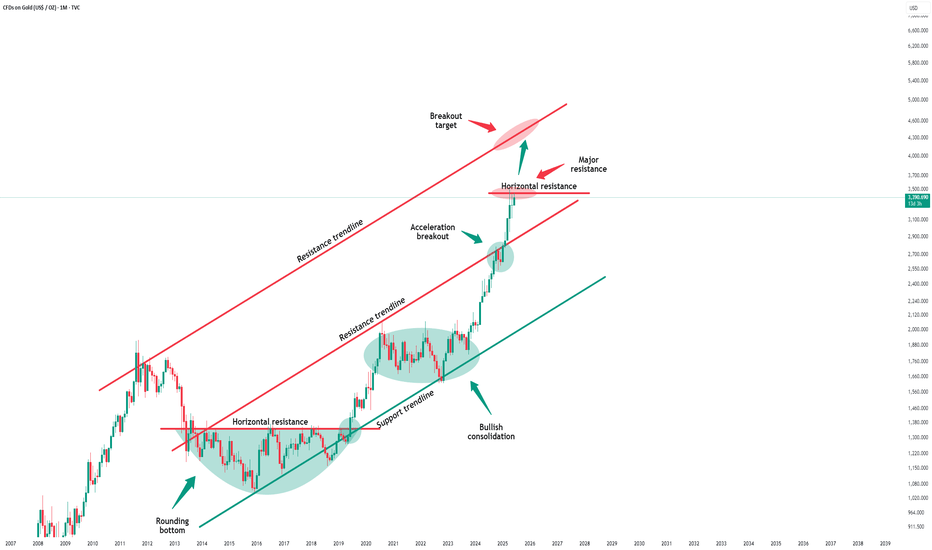

Gold - The final resistance breakout!Gold - TVC:GOLD - prepares a final rally:

(click chart above to see the in depth analysis👆🏻)

Over the past 12 months, Gold rallied more than +70%. However the past three months clearly rejected a major horizontal resistance. But price action on the smaller timeframe remains incredibly bullish. Therefore an all time high breakout will most likely follow.

Levels to watch: $3.500

Keep your long term vision!

Philip (BasicTrading)