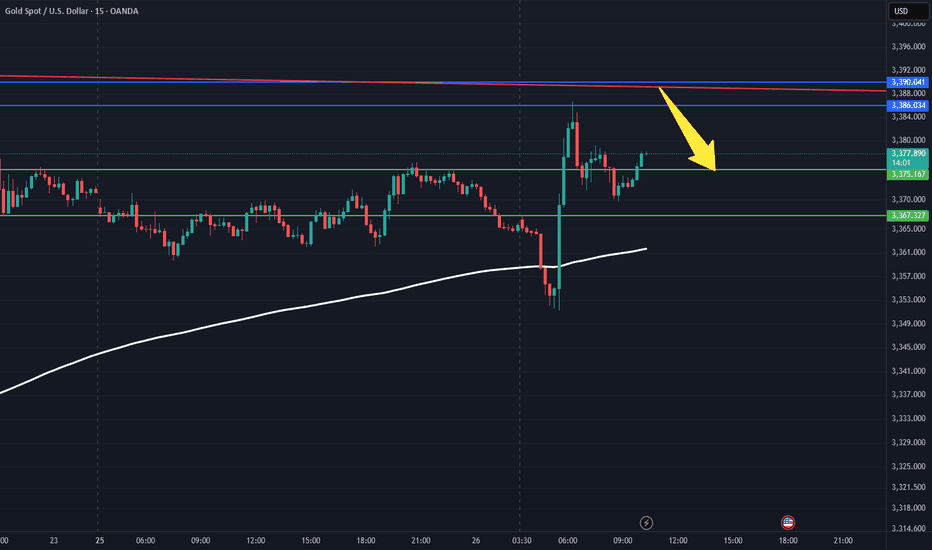

Gold Approaching Key Resistance | Sell-on-Rise Opportunity AheadGold (XAUUSD) is expected to face strong resistance between 3485 and 3492 — a prime zone where fresh sellers could step in and trigger a downside move. We're eyeing profit opportunities with a sell-on-rise setup.

🔻 Short Trade Setup – Fading the Strength

Entry: Sell at 3386

Add on Strength: 3392

Targets: See chart for marked zones

Invalidation: Daily close above 3402

📉 Risk-Reward Outlook

This setup presents a favorable risk-reward ratio, especially for short-term traders aiming to capitalize on a potential rejection at resistance. As always, keep your risk tight and position sizing disciplined.

Gold has had its run — now the odds may favor the contrarian. Keep an eye on momentum and price action at the resistance zone.

👍 If this idea aligns with your view, give it a like and drop your thoughts in the comments — let’s exchange ideas and insights!

🔔 Follow us for more actionable trade setups.

Happy Trading,

– The InvestPro Team

Xauusdsellsignal

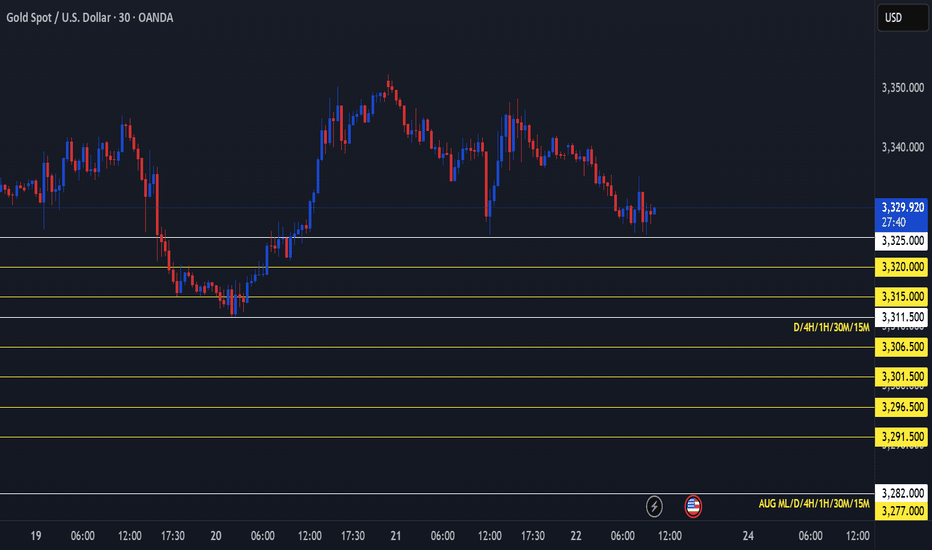

GOLD SELL IDEAI'm looking to sell Gold for 100 pips and if price breaks my zone at 3311.500, I'm looking to sell for a further 200 pips. Since reaching an ATH in April, long term price has been in a clear downtrend and I feel price has room to make a further correction before resuming bullish. Overall, I'm looking for 300 pips today! :)

maintain selling pressure around 3300, GOLD ⭐️GOLDEN INFORMATION:

Gold prices extended their slide for a fourth straight session, falling over 0.60%, as the U.S. and European Union reached a weekend trade agreement that halved proposed tariffs on EU goods—from 30% to 15%. XAU/USD is currently trading around $3,312, after earlier touching a high of $3,345.

The trade breakthrough lifted market sentiment, boosting risk appetite. Meanwhile, the U.S. Dollar is regaining strength, with the Dollar Index (DXY)—which measures the greenback against a basket of six major currencies—rising 0.99% to 98.64.

⭐️Personal comments NOVA:

Gold price maintains selling pressure around 3300, continuing the downtrend

⭐️SET UP GOLD PRICE:

🔥SELL GOLD zone: 3353- 3355 SL 3360

TP1: $3345

TP2: $3332

TP3: $3317

🔥BUY GOLD zone: $3287-$3285 SL $3280

TP1: $3295

TP2: $3307

TP3: $3320

⭐️Technical analysis:

Based on technical indicators EMA 34, EMA89 and support resistance areas to set up a reasonable SELL order.

⭐️NOTE:

Note: Nova wishes traders to manage their capital well

- take the number of lots that match your capital

- Takeprofit equal to 4-6% of capital account

- Stoplose equal to 2-3% of capital account

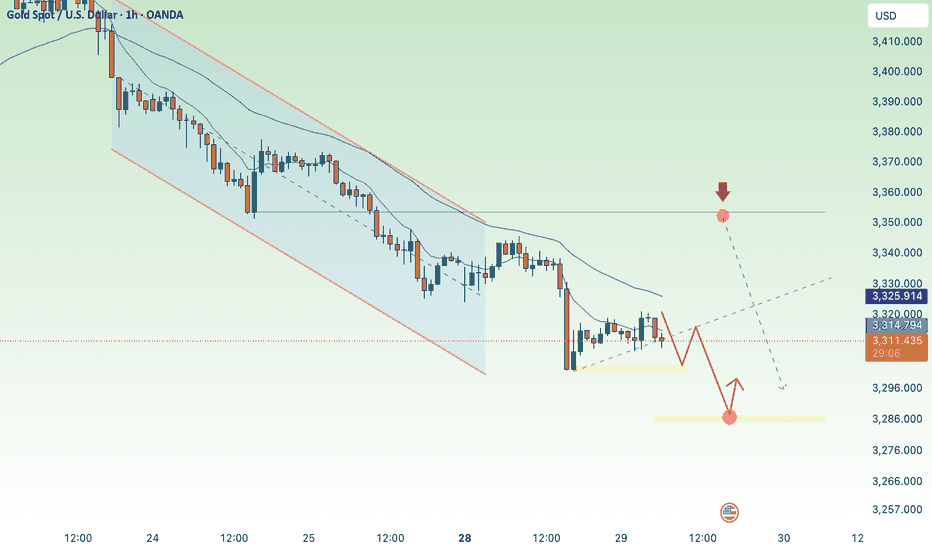

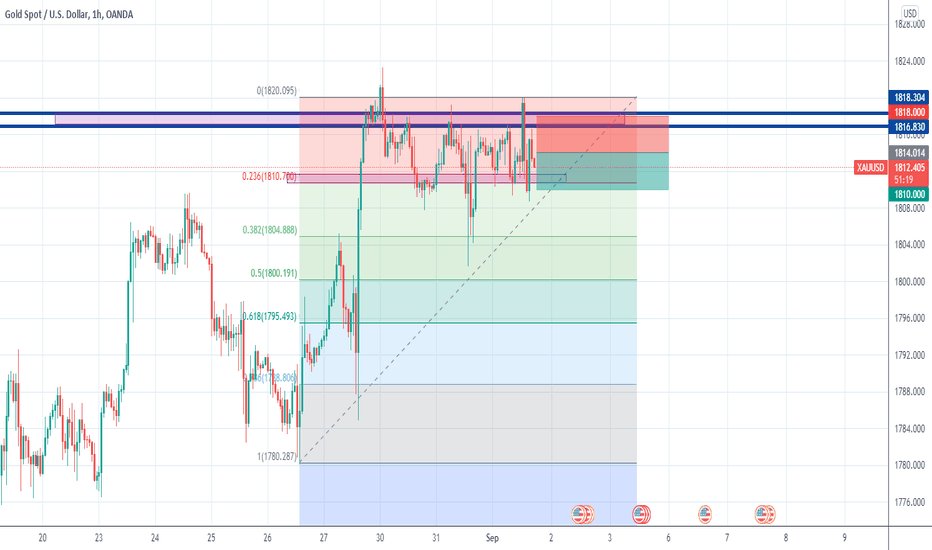

XAUUSD - Gold Bearish Bias Remains StrongXAU/USD remains under bearish pressure on the 4-hour timeframe. Until price breaks and closes above $3,336 with strength, selling the rallies remains a preferred strategy. However, watch for potential bounces near support zones, especially if momentum weakens or reversal candles appear. The price is currently trading below both the 50, 100 and 200 EMA, indicating a short-term downtrend. The recent price action has respected the trendline resistance and failed to break higher, reinforcing sellers’ control.

Price structure has formed a descending channel, which often signals a bearish continuation. However, if price finds a strong reaction from support, a temporary rebound could occur before further downside. Overall sentiment is cautious due to recent geopolitical de-escalation between Iran and Israel, which reduced gold’s safe-haven demand. Dollar strength, driven by hawkish Fed tone, continues to pressure gold.

Key Support Levels :

$3,295 – A minor support where previous candles showed buying interest.

$3,289 – Critical horizontal support and psychological level.

$3,270 – Next significant support if $3,289 breaks.

$3,240 – Major support zone, last line before larger downside moves.

Key Resistance Levels:

$3,310 – Near-term resistance and EMA zone.

$3,320 – Price rejection level from earlier 4H candles.

$3,336 – Strong resistance with previous swing highs.

Note

Please risk management in trading is a Key so use your money accordingly. If you like the idea then please like and boost. Thank you and Good Luck!

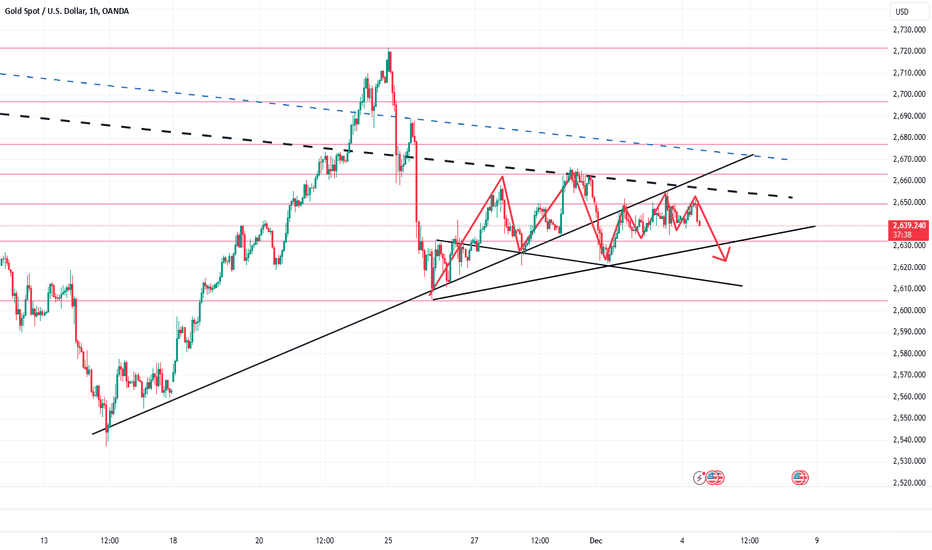

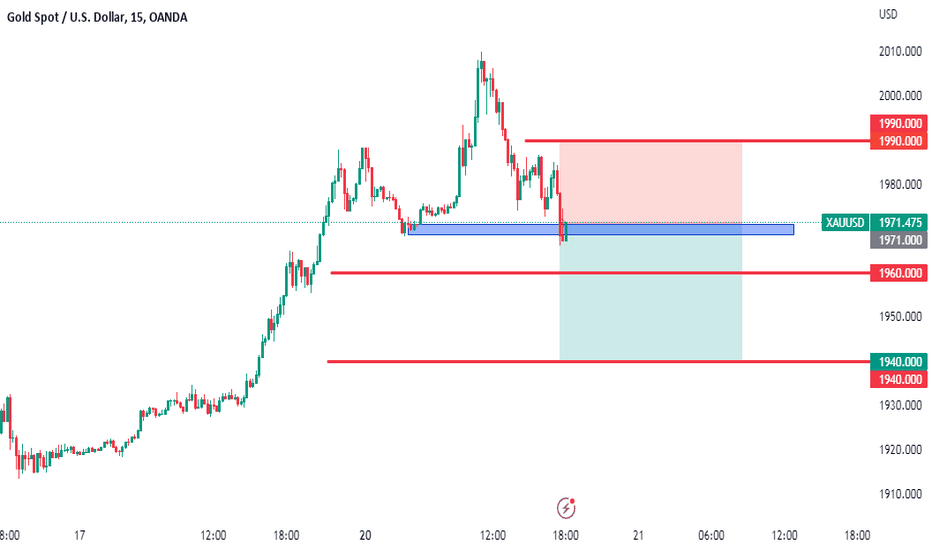

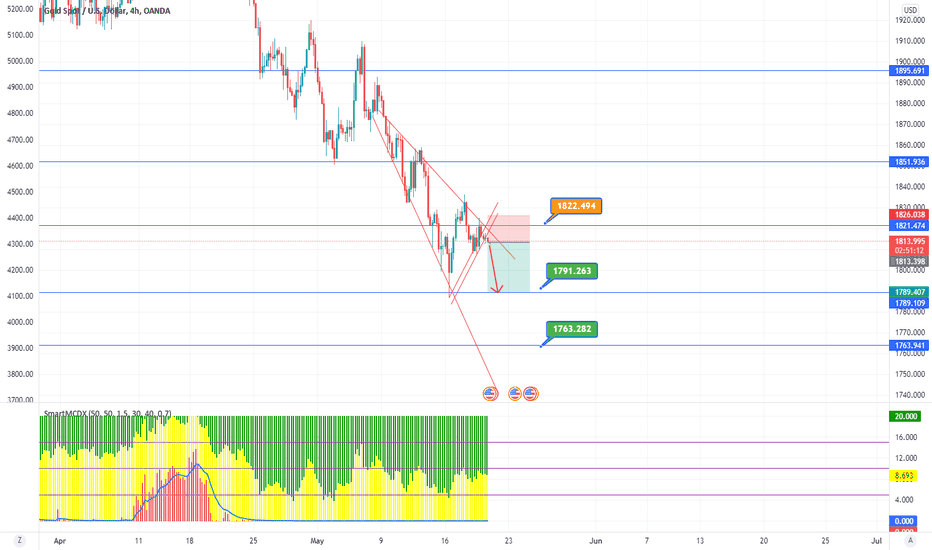

Waiting for opportunities to continue shorting goldBros, gold is still operating within the oscillating range of 2630-2655, and has not made any breakthrough moves. Gold is currently trading around the mid-range position of 2641. Currently, gold is trading around the mid-waist position of 2641. To be honest, the mid-waist position is not very easy to participate in trading, because gold has room for fluctuations up and down, at least it is not easy to set SL in the execution of transactions, so we can still wait patiently for trading opportunities.

From the perspective of gold structure, gold is still relatively weak, so I still prefer to short gold in trading, so if gold can rebound to the 2650-2655 area, I will continue to try to short gold.

Bros, do you know how to correctly grasp the trading rhythm of gold? If you want to learn more detailed trading ideas and get more trading signals, you can choose to join the channel at the bottom of the article to make trading no longer difficult and make making money a pleasure!

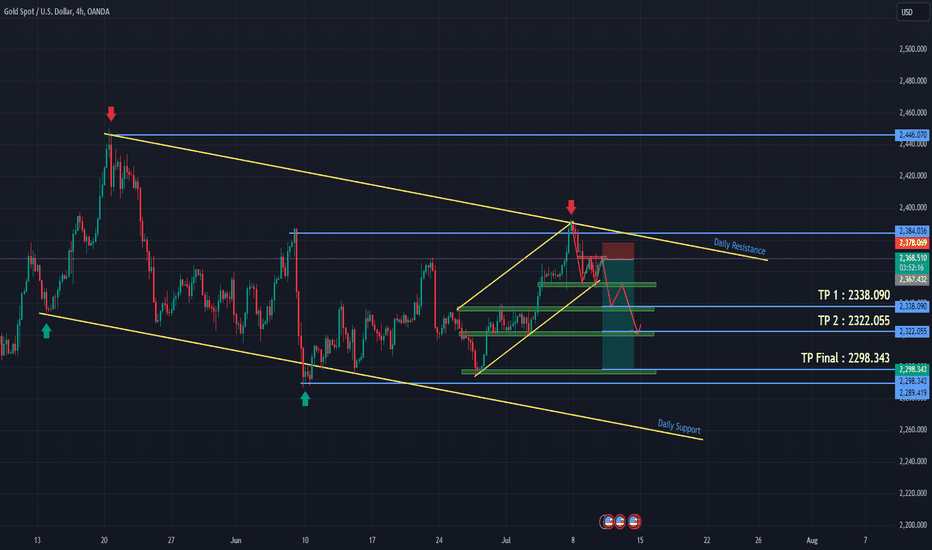

Top Resistance Points in XAUUSDOur XAUUSD market analysis highlights a key sell level at 2750-2756, with an extreme sell zone around 2772-2776, where we expect significant selling pressure to develop. These levels are critical for those looking to capitalize on potential resistance in XAUUSD.

On the buy side, our support area is set at 2702-2698 , suggesting a buy opportunity if the price revisits this range. However, given today's emphasis on the sell zones, these levels may see stronger market activity. Keep an eye out for any major USD news today, as it could impact these levels.

If this analysis adds value to your trading strategy, a boost would be greatly appreciated—it’s always motivating to know my insights are valuable!

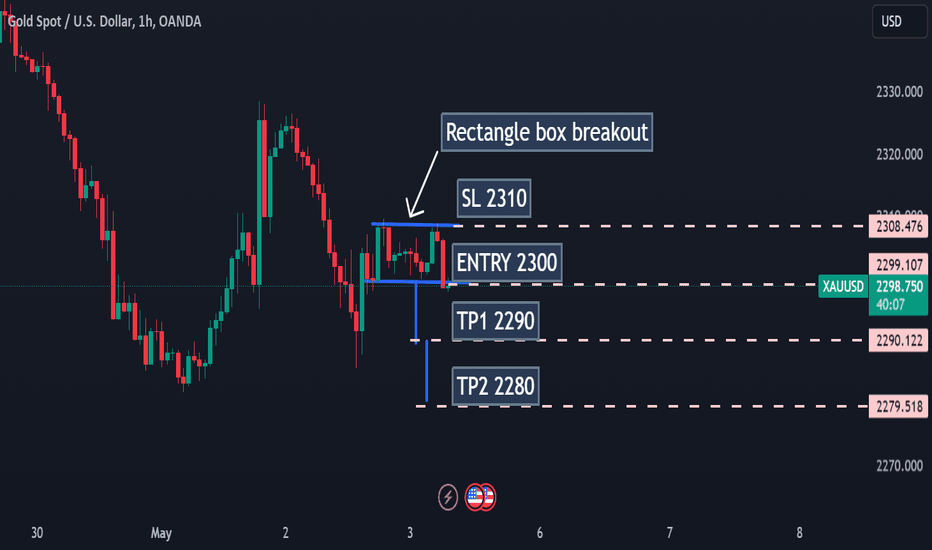

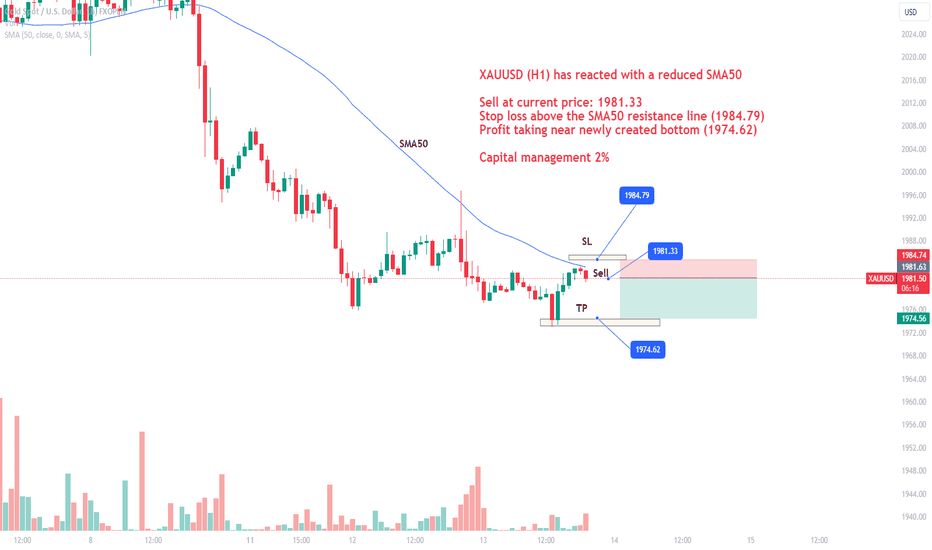

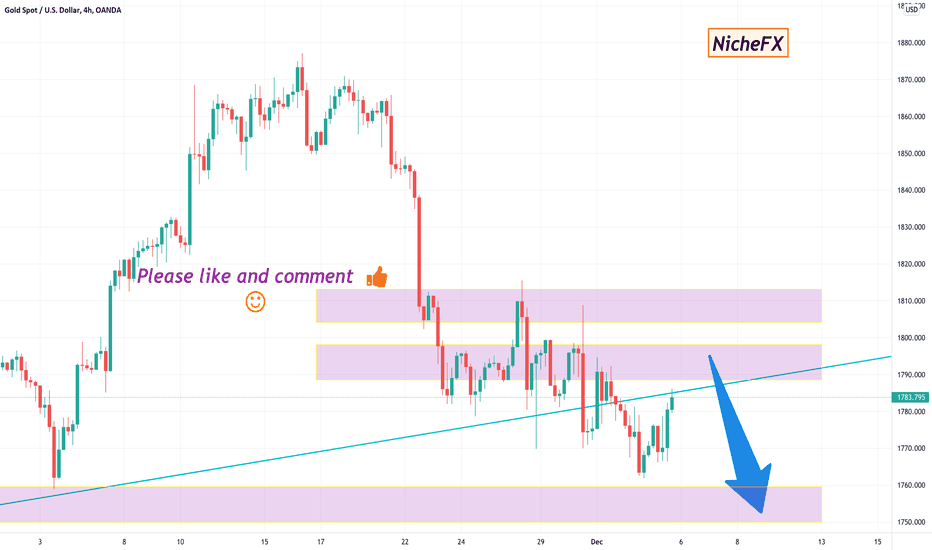

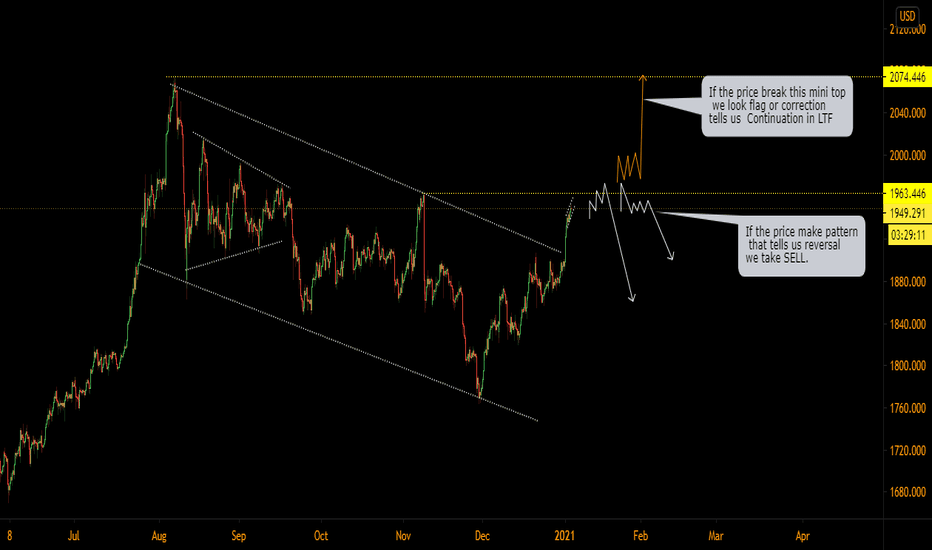

XAUUSD had a 2-input liquidity sweep last night but still returnGold This morning has Recovery Rate again to the 202x area.

With the fashion in H4 and D1 as I see it, at this charge Gold can nonetheless fall further. I nonetheless count on that there might be a deep decline in Gold to the 19xx area.

>Today`s model of the complete residence on the market across the area, priced 2022>2024

>SL 2026

TP2014>2000

Please plan this fee in line with H4 👌

Today is Friday weekend. I additionally propose investors to be cautious to keep away from dropping final week's profits.

---------------------------

Gold fee forecast

Many analysts trust that the Fed retaining excessive hobby quotes will push up the fee of making an investment in gold, lowering the enchantment of the valuable metal.

Another organization of analysts stated that withinside the lengthy term, gold fees will continue to be excessive, even growth sharply whilst the war withinside the Middle East has unfold to the Red Sea. So gold nonetheless creates a few call for for conventional safe-haven assets.

------

News:

Many professionals consider that falling oil charges and the growing USD are elements which might be negative to gold charges. However, gold charges nevertheless hold their present day rate degree because of the weak spot of the inventory market, in addition to the robust decline of Bitcoin. At the equal time, inflation and geopolitical dangers additionally make traders have a tendency to search for this secure haven tool.

George Milling-Stanley, leader gold strategist at State Street Global Advisors, analyzed that if inflation is contained, gold charges will stabilize above 2,000 USD/ounce for the duration of 2024.

However, all traders` interest is centered on the imminent economic coverage assembly of the United States Federal Reserve (Fed). Many forecasts say that the Fed will probably tighten coverage extra strongly to reduce excessive inflation.

Any symptoms and symptoms of recuperation withinside the US financial system will provide the Fed extra room to preserve hobby prices better for an extended time, analysts note.

In addition, many professionals are expecting that during the imminent assembly, valuable banks of numerous international locations will preserve hobby prices at the best degree in 23 years.

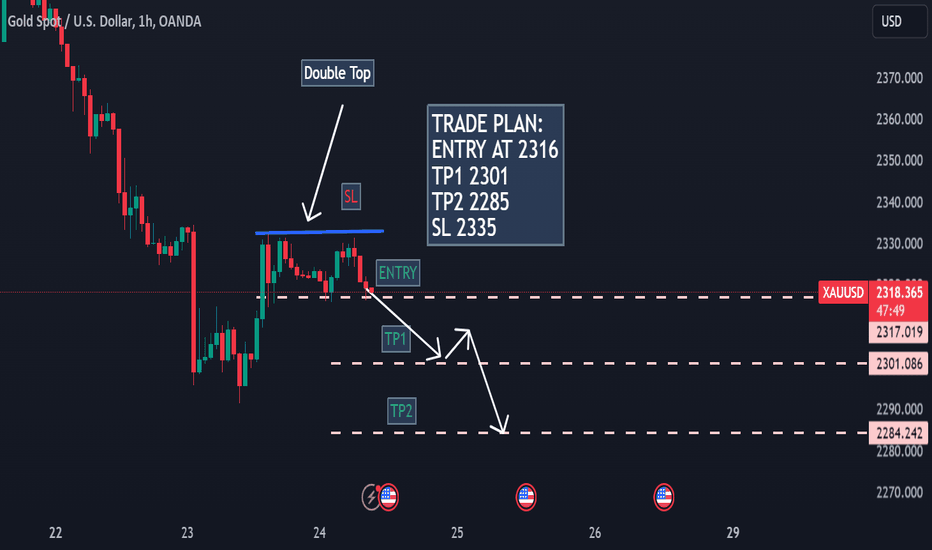

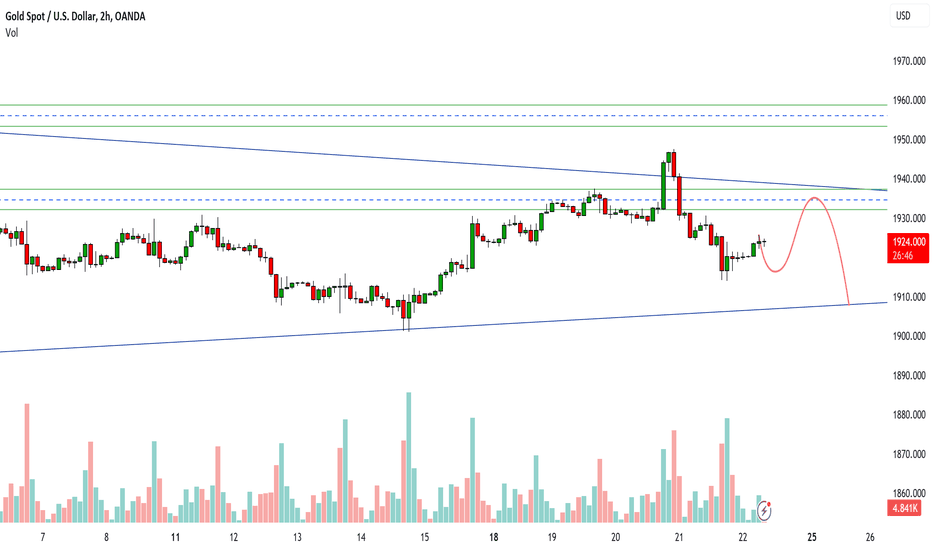

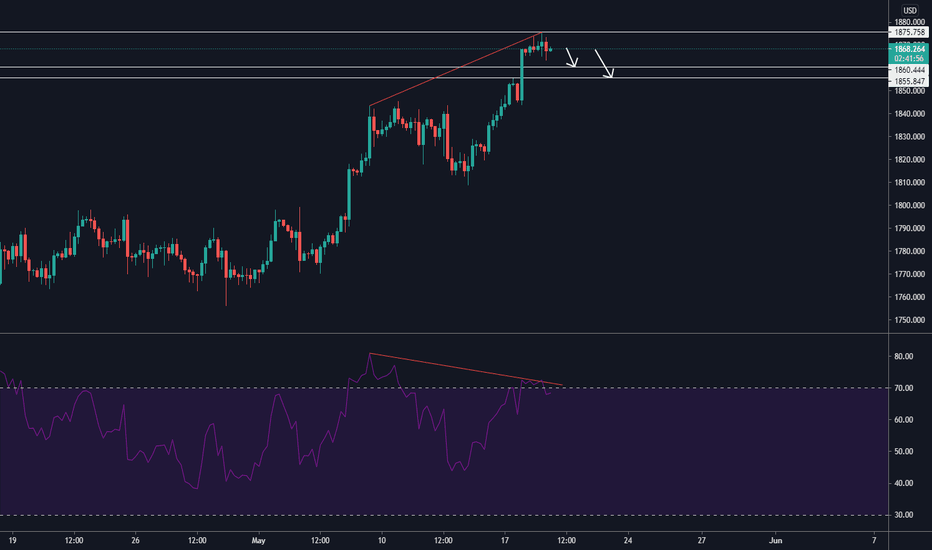

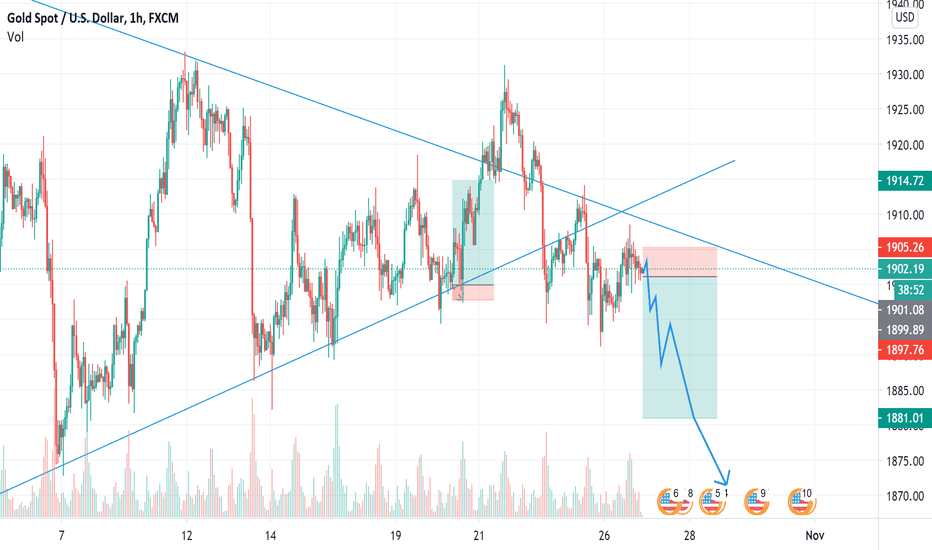

XAUUSD can restest resistance and fall, XAUUSD, GOLD SELL/SHORT Hey Hey Friends,

This FS with you with gold analysis. Yesterday we have witnssed a steap fall in gold 1914 and that was expected too but I was expecting a bounce to 1937 - 1942 1st before the fall.

Now XAUUSD trading below green channel in 2 hours chart seen between 1930 - 1938 that range is likely to act as resistance now and fall towards 1907 - 1900 can be expected.

Our target is 1914 and below 1914 we should expect 1907 - 1900.

Next Idea would be published for your once XAUUSD made these levels.

XAUUSD Short Tram SELL signal....NOW

AronnoFX will not accept any liability for loss or damage as a result of

reliance on the information contained within this channel including

data, quotes, charts and buy/sell signals.

If you like this idea, do not forget to support with a like and follow.

Traders, if you like this idea or have your own opinion about it,

write in the comments. I will be glad.

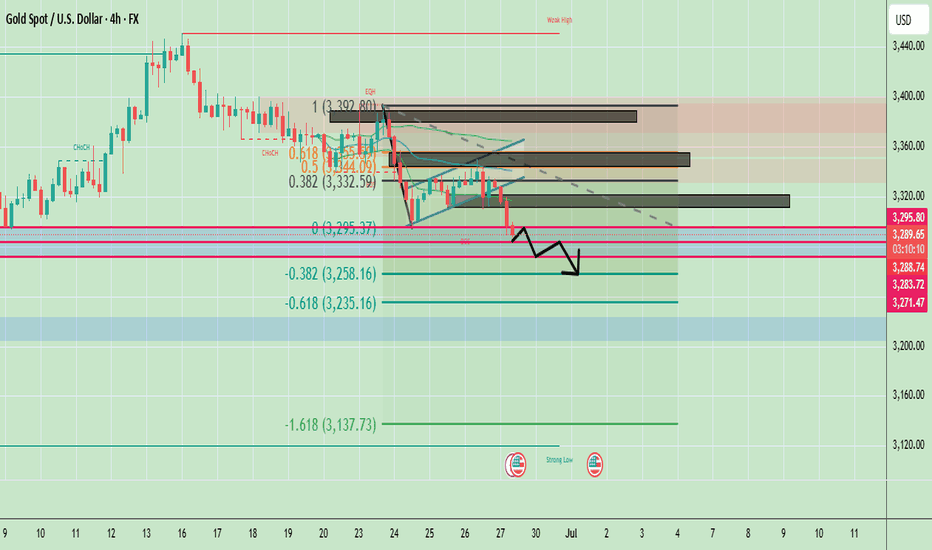

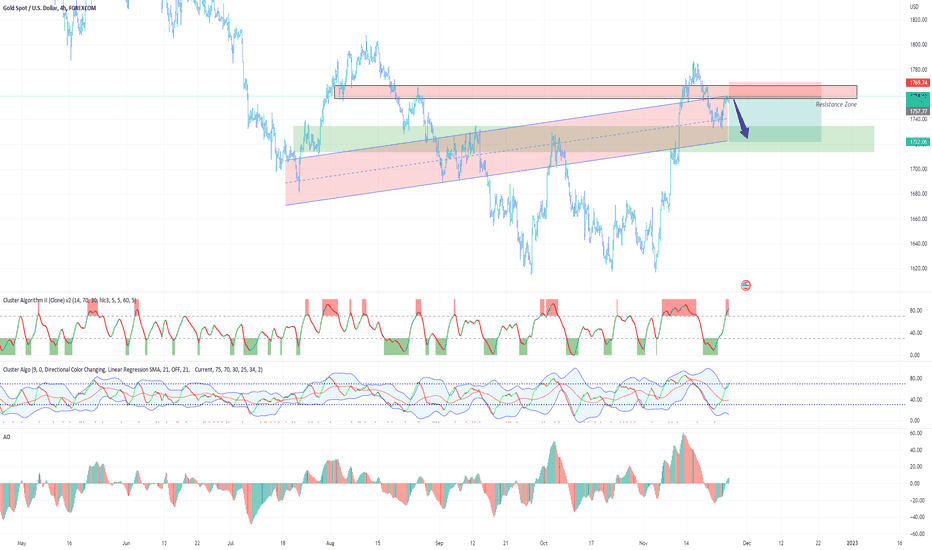

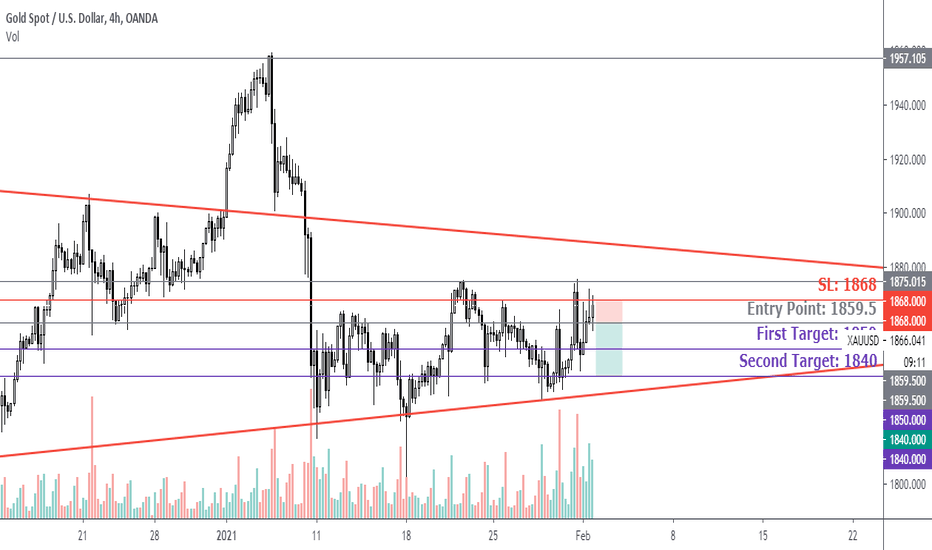

XAU/USD 4HR SELL SET UPHi TRADERS this is my trade set up for the XAU/USD for the new week ahead

XAU/USD has still got plenty of energy to keep moving to the downside, so i am expecting a pullback to the order block zones and will be looking for a sell trade

look for pullback to zones lined off on chart then if it meets your criteria for a trade then execute

This is my analysis only please trade with caution and risk management in place

good luck for this weeks trading

please like and comment both are welcome