Unveiling Gold: A Financial Analyst's PerspectiveIn the realm of finance, gold stands as a steadfast pillar, embodying stability and value. As a financial analyst, exploring the intricacies of gold reveals a wealth of insights into market dynamics and investment strategies.

Gold's enduring appeal lies in its dual role as both a commodity and a currency. Its scarcity, intrinsic value, and historical significance make it a sought-after asset, particularly during times of economic uncertainty.

Understanding the factors influencing gold prices requires a comprehensive analysis of global trends and macroeconomic indicators. Geopolitical tensions, central bank policies, and currency fluctuations all contribute to the volatility of the gold market.

Moreover, gold's versatility extends beyond traditional investment avenues. Its applications in jewelry, technology, and industry add layers of complexity to its demand profile, influencing market sentiment and price movements.

As financial analysts, navigating the complexities of the gold market involves diligent research and astute analysis. Examining historical trends, assessing supply and demand dynamics, and staying abreast of geopolitical developments are essential for making informed investment decisions.

In conclusion, gold remains a cornerstone asset in the financial world, offering stability and diversification benefits to investors. By viewing gold through the lens of a financial analyst, one can gain valuable insights into its role within the broader economic landscape and capitalize on emerging opportunities.

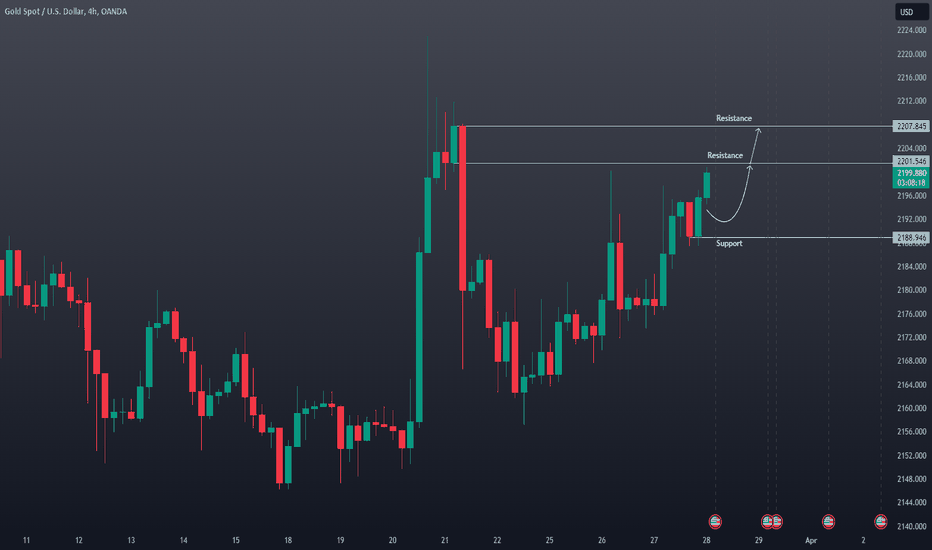

Xauusdsetup

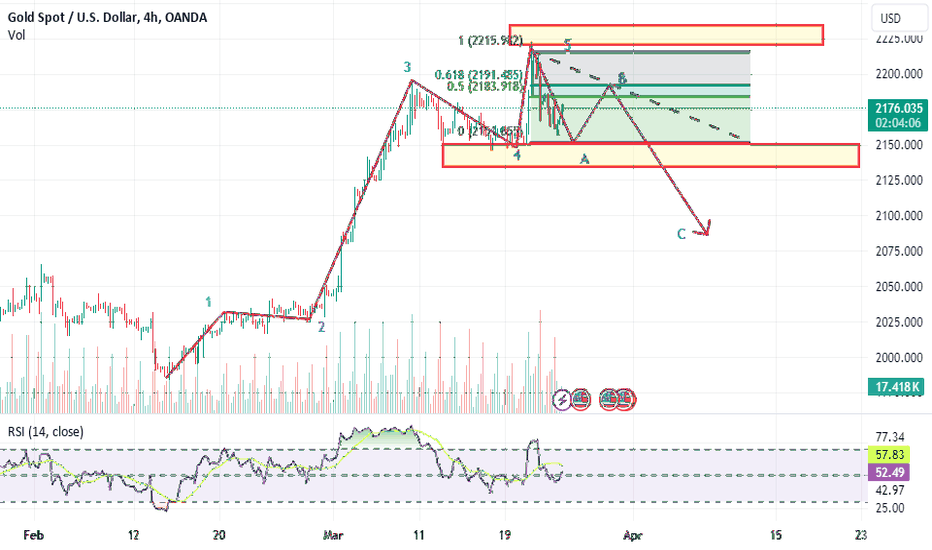

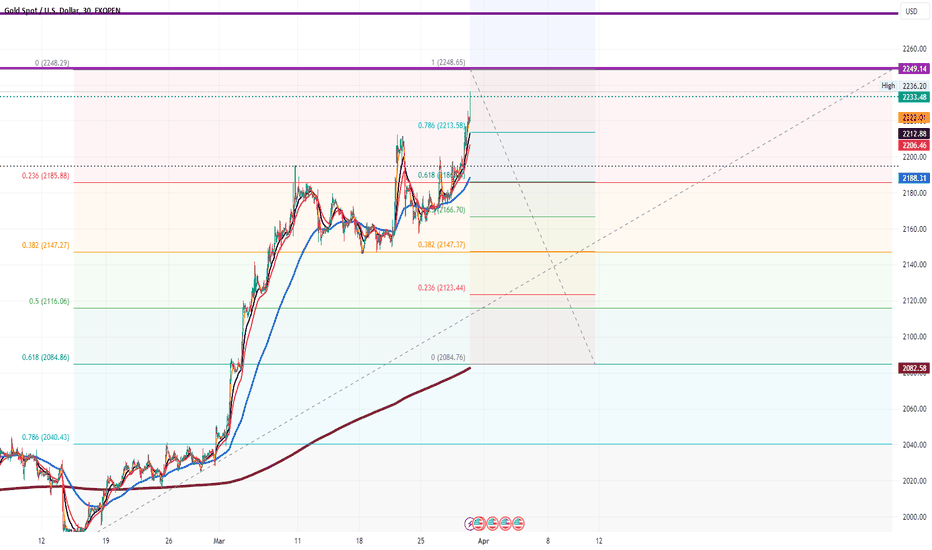

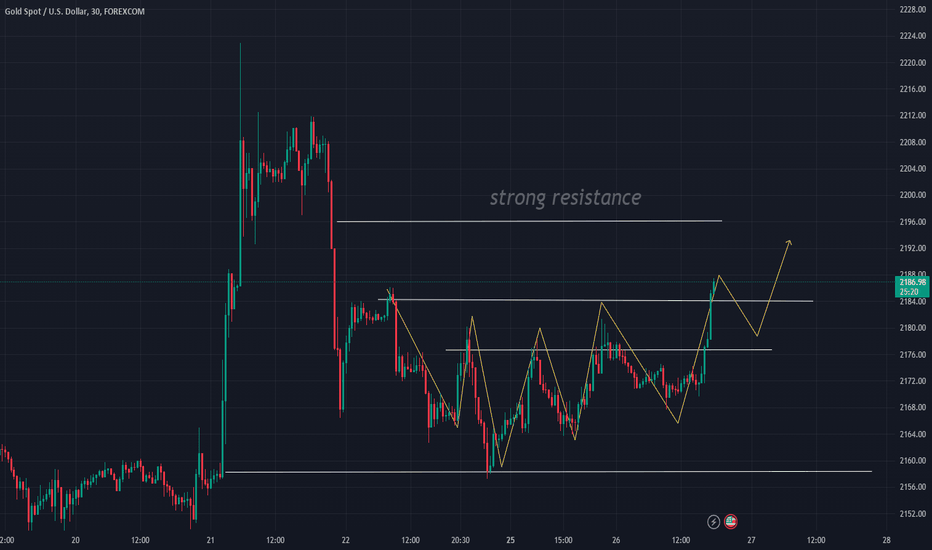

27/3. Will gold prices drop significantly? No, it will continue

26/3. The trend of gold is very science fiction. Like a roller coaster. When it went up, it killed the short sellers. When it fell, it killed the bulls. Dual phase harvester. But I made some profits in both directions yesterday. Friends who are paying attention know it. Yesterday, the gold market once again shot up to 2200 points and then fell back quickly. The reason is a boost in risk aversion. USD pullback. and ECB talk. It gave gold a big boost. However, gold did not stabilize when it rose to 2200, but fell back quickly. It closed near 2177.

There is no particularly big trend at the beginning of today's Asian game. Maintained within a narrow range around 2177. Observed at the daily level, the market is still consolidating at a high level. Observing the hourly line, gold bulls are eager to try. Want to continue to rise. I am more optimistic about the continued rise of gold. News: The Gaza ceasefire agreement is like a bomb, which may explode at any time and increase risk aversion. This keeps the lower support at 2165-2171. Personally, I prefer to buy during day trading.

XUAUSD:2172-2174 BUY

TP:2186

SL:2163

Remember to close the order in time to make profits when operating.

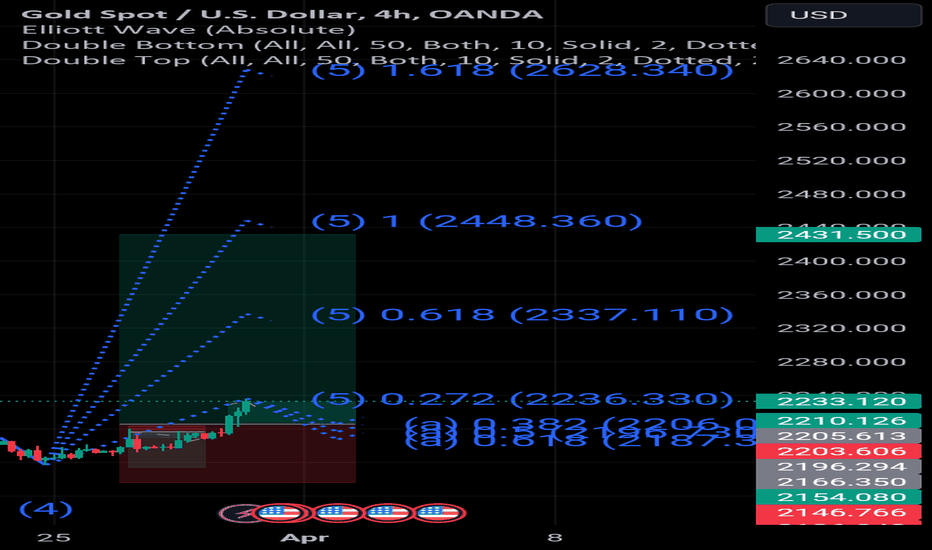

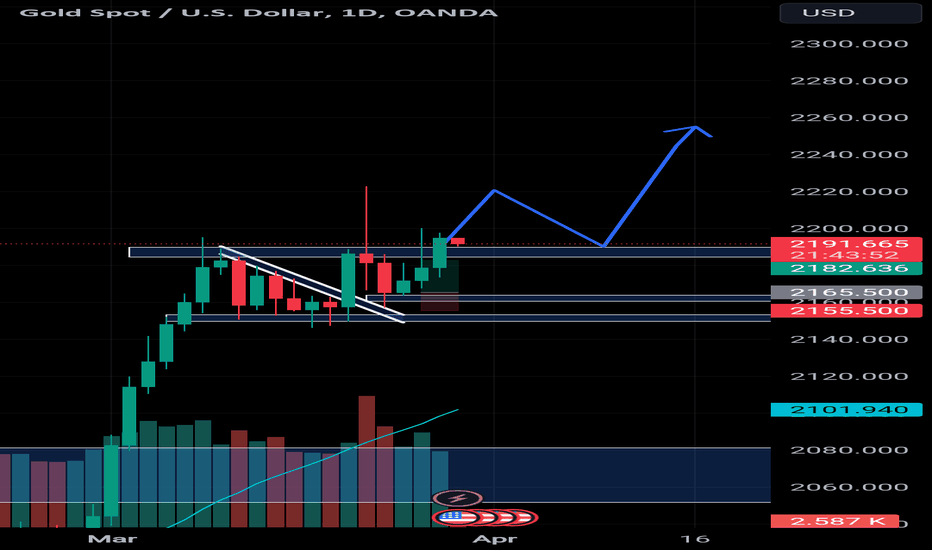

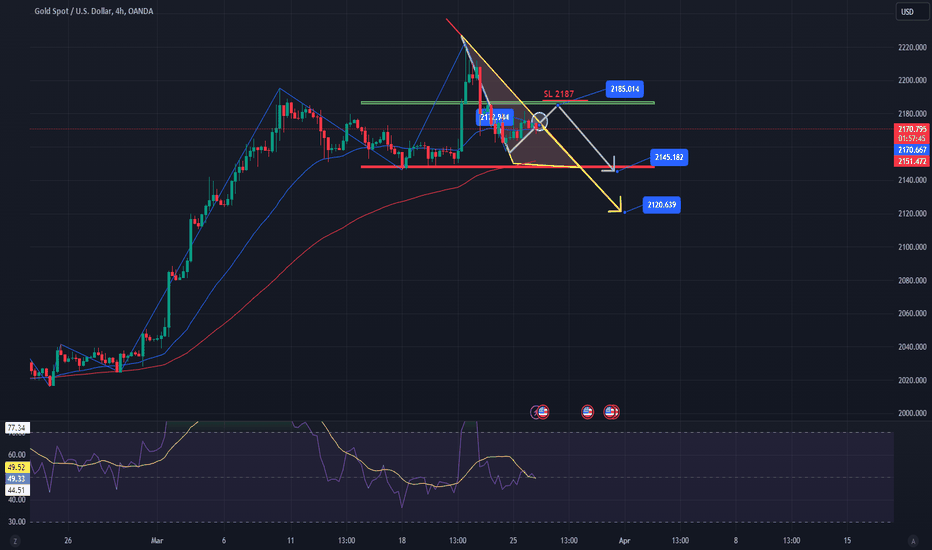

XAU/USD | GOLDSPOT | New perspective | follow-up detailsGold closed last week deeply entrenched in negative territory, facing strong headwinds from a resilient US Dollar (USD) which hindered XAU/USD from capitalizing on declining bond yields. The Federal Reserve's March meeting highlighted the urgency for policymakers to consider interest rate reductions, despite recent inflation reports suggesting a potential reacceleration. This initially propelled XAU/USD to reach new all-time highs, albeit briefly.

Presently, the US economy exhibits signs of resilience, with the Federal Open Market Committee (FOMC) projecting a growth rate of 2.1% for 2024, up from the previous estimate of 1.4%, while maintaining the Unemployment Rate at 4%. Attention now turns to inflation metrics, particularly the Personal Consumption Expenditures (PCE) index, favored by the Fed, which is anticipated to reach 2.4%, with core PCE projected at 2.6%, an increase from 2.4%.

As we prepare for the upcoming week, this video serves as a guide to navigating the current market dynamics, offering insights into potential strategies amid these shifting economic conditions.

XAUUSD Technical Overview:

In this video, we conducted a comprehensive analysis of the XAUUSD chart, utilizing both technical and fundamental perspectives. Our examination included an in-depth study of key levels, historical price movements, market behaviours, and the interplay between buyers and sellers, aiming to unveil potential trading opportunities.

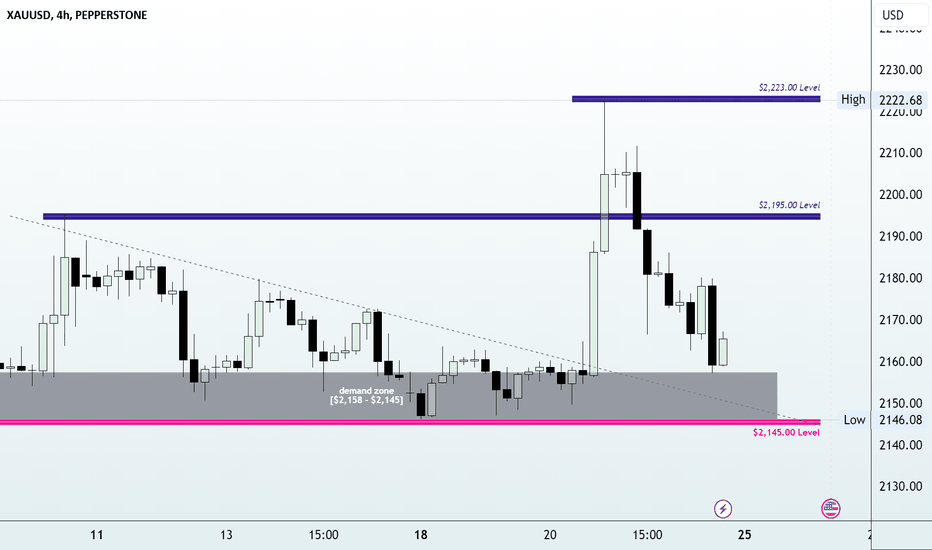

Our focal point for the week is the $2,145 zone, endowed with historical significance, rendering it a pivotal level. The sustainability of bullish momentum above this zone could pave the way for continued buying pressure, potentially propelling prices to new highs. Conversely, the appearance of a reversal pattern or a breach below the $2,145 level, coupled with persistent selling pressure, might signal a resurgence of bearish sentiment.

#GoldMarket #SafeHavenAssets 📺🔔💼

Disclaimer Notice:

Please be aware that margin trading in the foreign exchange market, including commodity trading, CFDs, stocks, and other instruments, carries a high level of risk and may not be suitable for all investors. The content of this speculative material, including all data, is provided by me for educational purposes only and to assist in making independent investment decisions. All information presented here is for reference purposes only, and I do not assume any responsibility for its accuracy.

It is important that you carefully evaluate your investment experience, financial situation, investment objectives, and risk tolerance level. Before making any investment, it is advisable to consult with your independent financial advisor to assess the suitability of your circumstances.

Please note that I cannot guarantee the accuracy of the information provided, and I am not liable for any loss or damage that may directly or indirectly result from the content or the receipt of any instructions or notifications associated with it.

Remember that past performance is not necessarily indicative of future results. Keep this in mind while considering any investment opportunities.

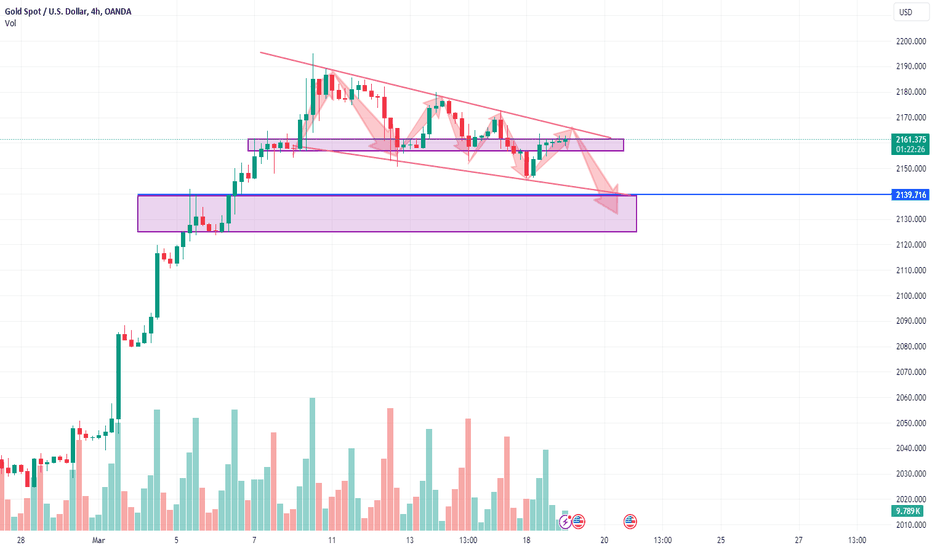

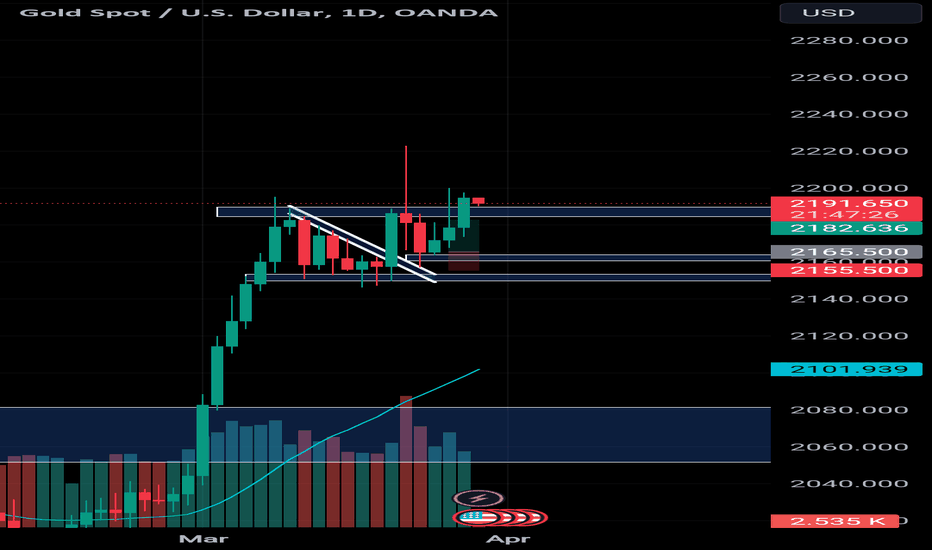

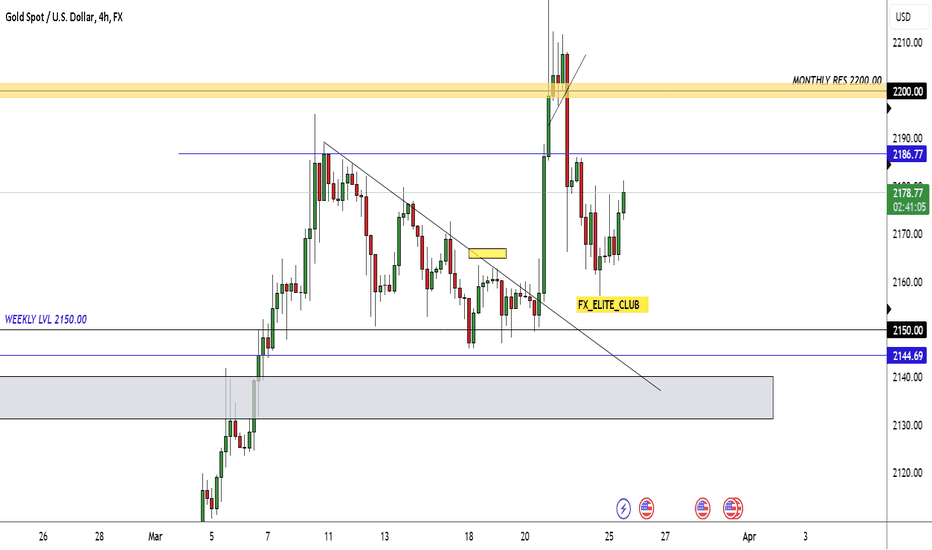

XAUUSD will continue to fall + attached trading instructions

XAUUSD follows huge profits last Friday. It closed at around 2154.5. Driven by the weekend's news, the market fell again on Monday and hit a new low, with strong short positions. After the Asian session started on Monday, the XAUUSD market hit the 2157 position, but did not stand firm. Then it plummeted to the 2146 line. After several hours of consolidation at the low level, the market quickly returned to above 2160. The highest reached a position near 2163.6. Finally, it closed near 2160.

Observed based on Monday's market, the market is obviously still in the stage of long and short competition.

News: Expectations for interest rate cuts have declined. Geopolitical weakness. As well as a small-scale recovery of the U.S. economy, these are the conditions for bears to take advantage. Looking back at the bulls: the probability of an interest rate cut has dropped to 50%, which undoubtedly reduces the resistance to the rise of the US dollar, and at the same time, the risk aversion caused by the war has cooled down. This gives gold a lot of resistance when it rises.

Technical aspect: The currently maintained vicinity of 2160 is still a very important level for the long and short competition. 2160 serves as the front support and pressure switching position. Currently, it is due to the rebound of gold yesterday that has driven the rise of the market, but I think the space above is not very big. . And the upper 2163 has not yet completely broken through. Even if the entity breaks through. The 2168-2172 above is also a very important short-term strong resistance position. In addition to the news, there is still nothing that can make gold rise sharply. So I think the market can still mainly sell gold.

Operation suggestions:

Sell near 2161-2164

TP:2148

SL:2176

When trading as a non-VIP member, remember to control trading risks. Control the number of transactions.

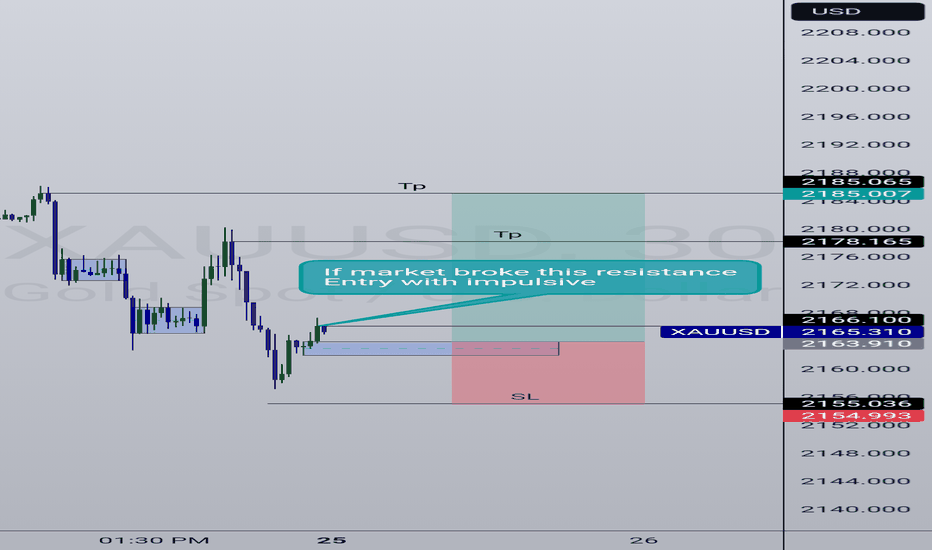

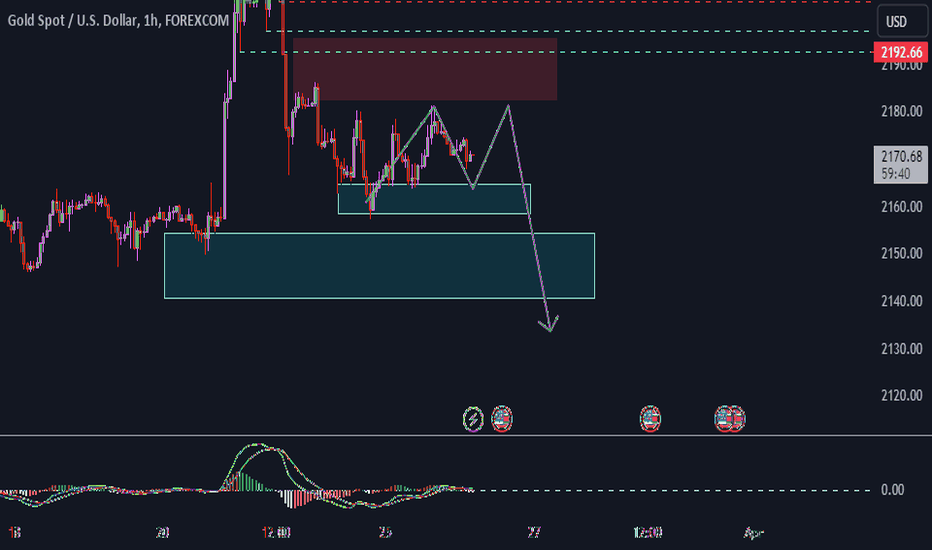

XAUUSD:Today’s Data Trading Strategies

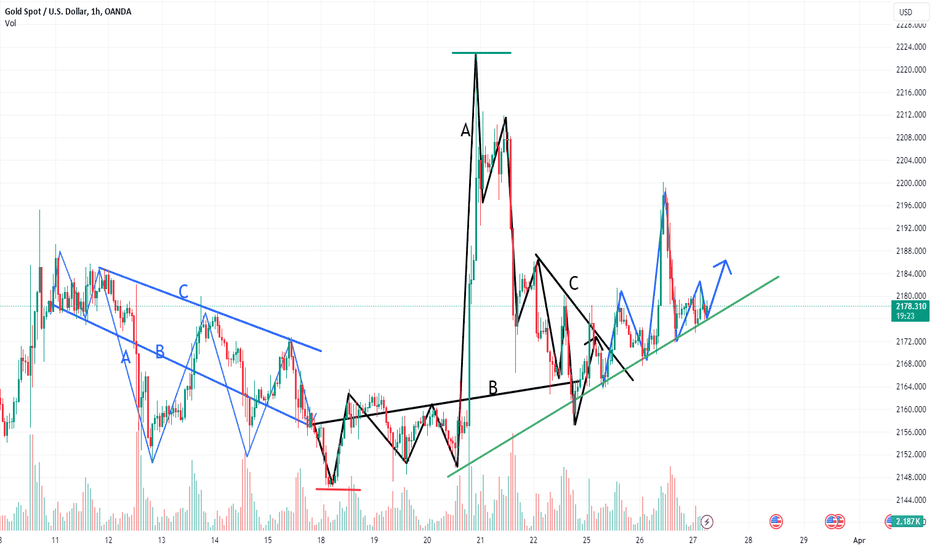

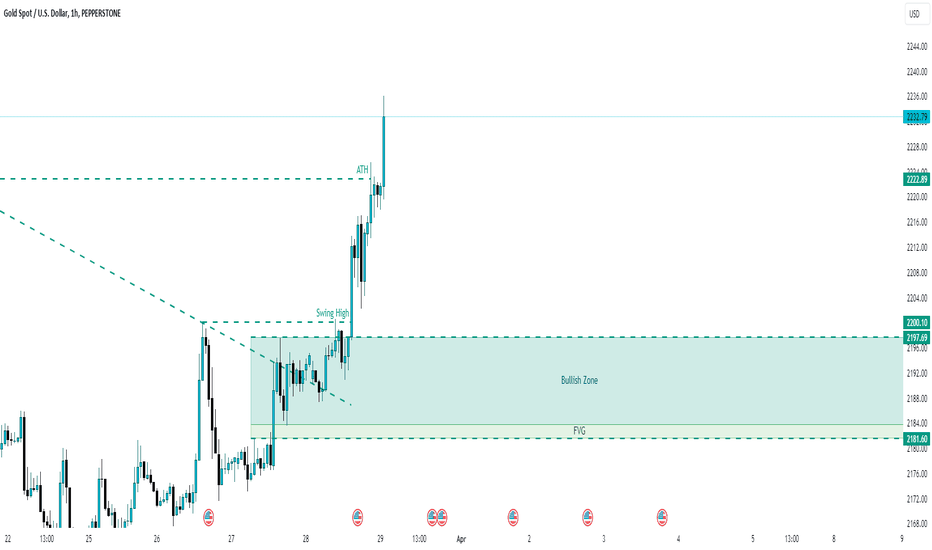

The indicators on the 1h chart are also trending towards the short side now. It depends on whether the support in the 2185-2181 range is effective. In my opinion, the probability of falling below is greater.

At the same time, there is data released today. Judging from the data released last week, today’s data has a higher probability of being beneficial to the bulls. If the market falls back to the 2174-2169 range before the data is released, you can trade longs first.

Pay attention to the resistance of 2186-2192. If there is no breakthrough, go short.

If the data does not match expectations, it will be beneficial to short sellers and go short directly.

Unlocking Opportunity on Gold (XAU/USD)💰1. **Trading Opportunity Alert**:

- Gold's at the **2185 resistance**—a fortress guarded by dragons. 🐉

- But wait! A break and retest? That's like a secret passage opening up. 🗝️

- Traders, grab your maps and compasses! 🗺️

2. **Geopolitical Scenarios and Gold**:

- Geopolitics? It's like gold's secret rendezvous with drama. 🌎

- When tensions rise (cue dramatic music), gold slips into its superhero cape. 🦸♂️

3. **Fed Rate Cuts and Gold Prices**:

- The **Federal Reserve (Fed)** wields its interest rate wand, and gold dances to its tune! 🪄

- When the Fed lowers rates, gold's allure sparkles brighter. Why? Because other assets suddenly seem less dazzling. 💫

- Imagine gold as a glamorous celebrity at a party. When rates drop, it's like the paparazzi swarming around, snapping pics. 📸

- **Conflict Mode**: Israel-Palestine, Russia-Ukraine—these plot twists send gold soaring. 🚀

- Picture gold as James Bond: cool, collected, and ready for action. 🕶️

Remember, in the financial saga, gold's the mysterious protagonist. Keep an eye on those plot twists! 😉📈🌟

Disclaimer: This is not financial advice, must make their own decisions.

Unlocking Golden Opportunities💰1. **Trading Opportunity Alert**:

- Gold's at the **2185 resistance**—a fortress guarded by dragons. 🐉

- But wait! A break and retest? That's like a secret passage opening up. 🗝️

- Traders, grab your maps and compasses! 🗺️

2. **Geopolitical Scenarios and Gold**:

- Geopolitics? It's like gold's secret rendezvous with drama. 🌎

- When tensions rise (cue dramatic music), gold slips into its superhero cape. 🦸♂️

3. **Fed Rate Cuts and Gold Prices**:

- The **Federal Reserve (Fed)** wields its interest rate wand, and gold dances to its tune! 🪄

- When the Fed lowers rates, gold's allure sparkles brighter. Why? Because other assets suddenly seem less dazzling. 💫

- Imagine gold as a glamorous celebrity at a party. When rates drop, it's like the paparazzi swarming around, snapping pics. 📸

- **Conflict Mode**: Israel-Palestine, Russia-Ukraine—these plot twists send gold soaring. 🚀

- Picture gold as James Bond: cool, collected, and ready for action. 🕶️

Remember, in the financial saga, gold's the mysterious protagonist. Keep an eye on those plot twists! 😉📈🌟

Disclaimer: This is not financial advice, must make their own decisions.

XAUUSD:2178-2174 support, go long

Today we successfully touched the resistance of 2183. There is a high probability that there will be a pullback near 2185-2189, but the bulls are not done yet. The pullback supports 2178-2174.

Go long again without falling below the support. The strong resistance this week is around 2192-2196. If there is news to cooperate, it should be able to touch around 2202, when shorts will dominate.

The Golden Thread: Insights from a Financial AnalystAs a financial analyst with a keen eye on market trends, I am often drawn to the timeless allure of gold and its intricate role within the global economy. In this discourse, I aim to unravel the multifaceted significance of gold as perceived through the lens of financial analysis.

Gold, with its lustrous sheen and unparalleled scarcity, has long captivated the human imagination. Beyond its aesthetic appeal, gold serves as a cornerstone of stability in the tumultuous world of finance. As a safe-haven asset, it offers investors a hedge against volatility and economic uncertainty, preserving wealth through times of crisis.

Moreover, gold's intrinsic value transcends cultural and historical boundaries, making it a universal symbol of wealth and prosperity. Its role as a store of value dates back centuries, underpinning the monetary systems of ancient civilizations and shaping the modern financial landscape.

From a portfolio management perspective, gold's low correlation with traditional assets presents compelling opportunities for diversification. Its ability to mitigate risk and enhance risk-adjusted returns makes it an invaluable component of well-balanced investment strategies.

Furthermore, gold's utility extends beyond its monetary value. With applications ranging from jewelry to electronics, gold plays a crucial role in various industrial sectors, ensuring sustained demand and market liquidity.

In the face of evolving economic dynamics and geopolitical uncertainties, gold remains a steadfast anchor in the investment universe. Its enduring allure as a tangible asset with intrinsic value underscores its resilience amidst changing market conditions.

As we navigate the complexities of the financial world, it's essential to recognize the significance of gold as more than just a commodity. It represents a timeless symbol of stability, wealth, and enduring value—a golden thread that weaves through the fabric of human history and financial markets alike.

In conclusion, gold stands as a testament to the enduring power of beauty and value in an ever-changing world. As a financial analyst, I encourage investors to embrace the insights gleaned from this timeless asset and to appreciate its role in shaping the landscape of modern finance.

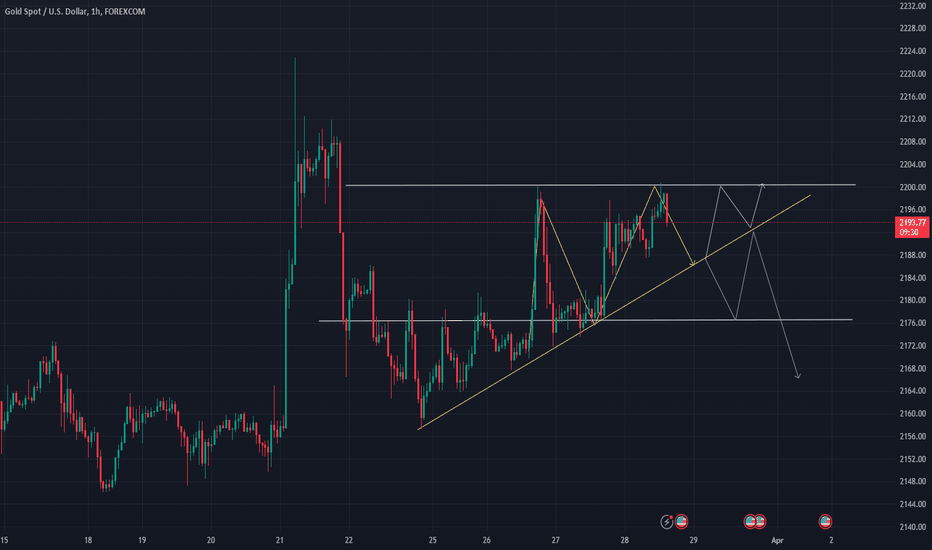

The bulls or bears have not yet shown their absolute strength-gold these days has no sturdy fluctuations in news, so we are able to nonetheless observe yesterday`s plan.

-GOLD complete residence Canh Sell across the location 2176>2180

SL 2182

TP 2166>215x.

(You can do not forget dividing the buying and selling extent and promoting from 217x-218x)

-It's essential to usually control your capital and feature SL.

-In my opinion, GOLD has now no longer but damaged thru the region I analyzed and it has now no longer but extended Strong, everyone. Take it slow with this plan, do not rush everyone!!

----NEWS------------

Prices for the yellow steel rose barely in early buying and selling as traders awaited key monetary records and feedback from US Federal Reserve (Fed) officers this week for in addition confirmation. loosening financial coverage of americaA Central Bank.

The marketplace is presently awaiting weekly preliminary jobless claims records to be launched on March 28 and center private intake expenditure index (PCE) records predicted to be launched. the day after that. However, due to the fact the marketplace could be closed this Friday because the US closes for the Good Friday holiday, PCE records will now no longer have an effect on gold till early subsequent week.

Research professional Kunal Shah of Nirmal Bang Commodities predicts that US inflation signs could have a substantial effect at the gold marketplace. According to him, any PCE parent decrease than predicted will weaken the USD and push up gold costs and vice versa.

However, Shah stated, the long-time period outlook for gold stays vivid because of expectancies of a coverage pivot this year, robust call for from principal banks and ongoing conflicts.

TD Securities commodity strategist Bart Melek predicts that gold should without problems hit $2,300/ounce or better withinside the 2nd area as buyers who've up to now been hesitant to go into the marketplace may also greater boldly while the opportunity of hobby fee cuts is confirmed. However, robust monetary records should ship gold costs decrease.

World gold costs set a brand new top final week after Fed Chairman Jerome Powell stated americaA Central Bank nevertheless has the capacity to lessen hobby quotes through three-quarters of a percent factor in 2024. Traders are pricing 70 % possibility that the Fed will reduce hobby quotes in June, expanded in comparison to earlier than the coverage meeting.

In addition, the statements of a chain of Fed officers this week also are awaited through the marketplace.

GOLD Near Selling Area , Is It A Good Place To Sell ?This Is An Educational + Analytic Content That Will Teach Why And How To Enter A Trade

Make Sure You Watch The Price Action Closely In Each Analysis As This Is A Very Important Part Of Our Method

Disclaimer : This Analysis Can Change At Anytime Without Notice And It Is Only For The Purpose Of Assisting Traders To Make Independent Investments Decisions.