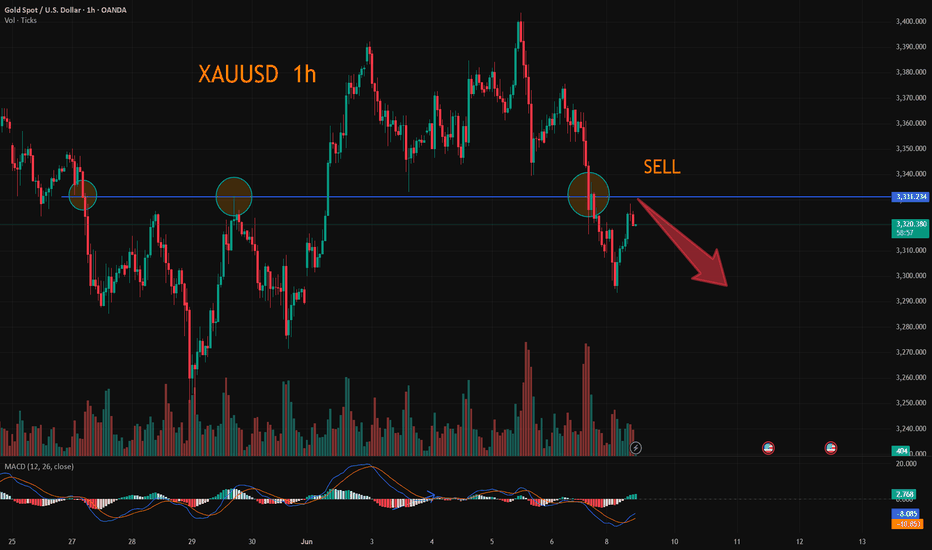

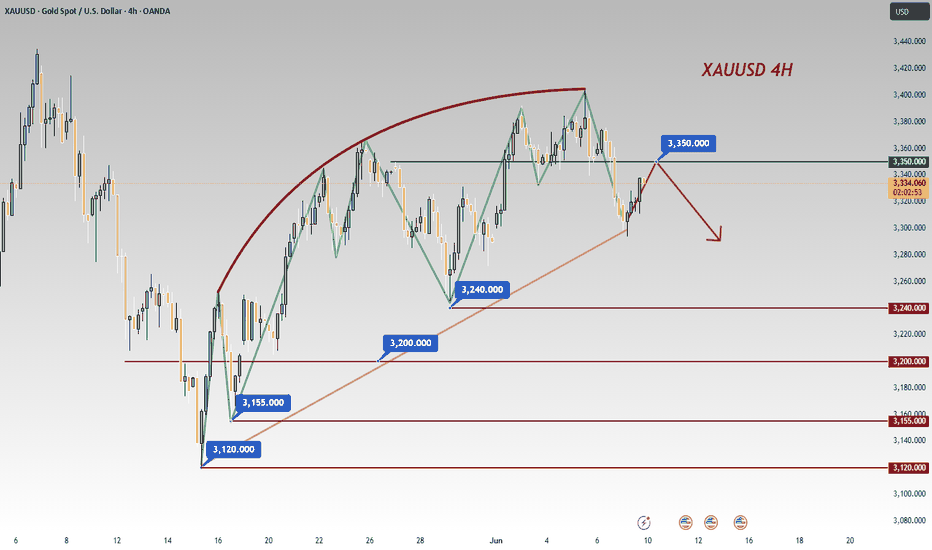

Xauusdshort

XAUUSD Analysis todayHello traders, this is a complete multiple timeframe analysis of this pair. We see could find significant trading opportunities as per analysis upon price action confirmation we may take this trade. Smash the like button if you find value in this analysis and drop a comment if you have any questions or let me know which pair to cover in my next analysis.

XAU/USD📰 Market Insight: What If the U.S. and China Strike a Deal?

If the United States and China reach a trade or geopolitical agreement, we could witness a significant shift in global market sentiment. Here’s why this development matters — and how it could impact major asset classes:

📈 Risk-On Environment Expected

A successful U.S.-China deal would reduce uncertainty and ease global trade tensions. Investors typically respond to such positive geopolitical news by rotating out of safe-haven assets and into riskier ones — such as equities, emerging markets, and high-yield assets. This behavior is what we refer to as a "risk-on" environment.

📉 Gold Likely to Decline

Gold, as a traditional safe-haven asset, thrives during times of uncertainty, war, or financial distress. But if a U.S.-China deal brings stability and boosts risk appetite, demand for gold could weaken, leading to a decline in gold prices. This is a typical inverse correlation between gold and investor sentiment.

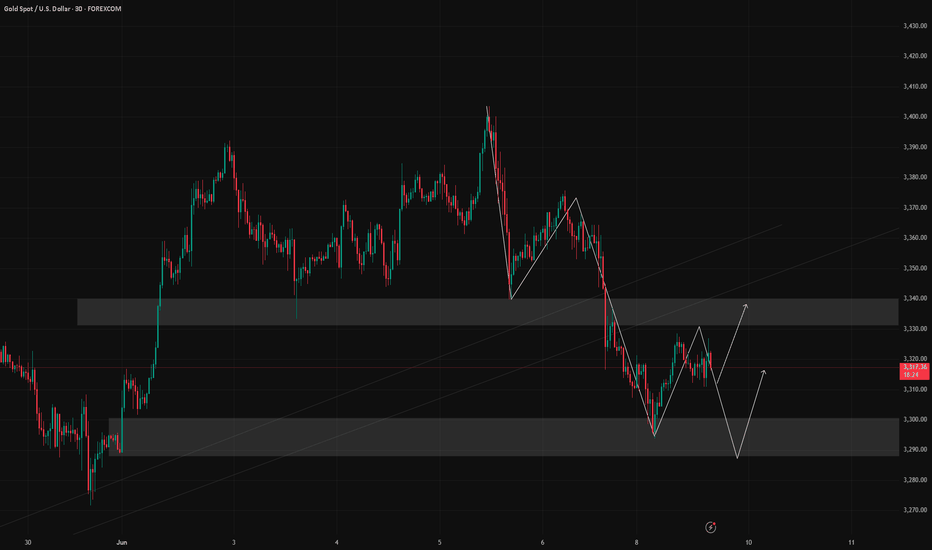

Gold rises and then falls, short at 3330📰 Impact of news:

1. Geopolitical situation

2. Impact of the US dollar trend on gold

📈 Market analysis:

Gold rebounded again after falling to 3301, but the upper 3330-3340 line still has strong suppression on gold. Judging from the current trend, because the gold price has risen in the short term and returned to the 3325-3327 line, the short-term resistance is still 3330-3335 and it is expected to fall under pressure. Look for the 3315-3310 position. If it falls below this support, look down to the 3300-3290 line.

🏅 Trading strategies:

SELL 3330-3340

TP 3315-3310-3300

If you agree with this view, or have a better idea, please leave a message in the comment area. I look forward to hearing different voices.

OANDA:XAUUSD FX:XAUUSD FOREXCOM:XAUUSD FXOPEN:XAUUSD TVC:GOLD

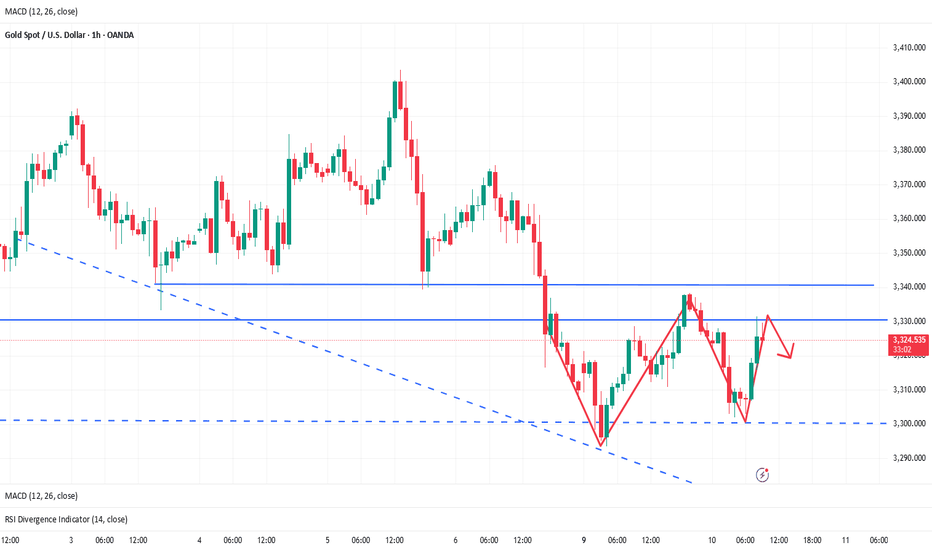

Gold is expected to continue to fall to 3280 or even 3250In the short term, the operation of gold is completely in line with my expectations. I clearly pointed out yesterday that gold will encounter resistance in the 3330-3340 area and will at least retest the area around 3315-3305 again. At present, gold has rebounded slightly after retesting the area around 3302 and is trading around 3309.

According to the strength of yesterday's rebound, gold did not effectively break through the 3300-3340 area. Gold is still weak in the short term, and the head and shoulders top structure is constructed in the 3328-3338-3328 position area in the short term, which suppresses gold to a certain extent and limits the rebound space of gold. After multiple tests, the area around 3300 may be more conducive to being broken. After gold has been under pressure and fallen many times, the current short-term resistance area has been reduced to the 3310-3320 area; so I think gold still has a good downward space in the short term, which may continue to 3280, or even around 3250.

So for short-term trading, I think it is possible to consider continuing to short gold.

XAUUSD:Wait for a short near 3330

Last week's data was negative for gold and silver. However, it should be noted that the actual announced value is lower than the previous value, in essence, the economic end did not release good, but the contraction speed is lower than the market expectation.

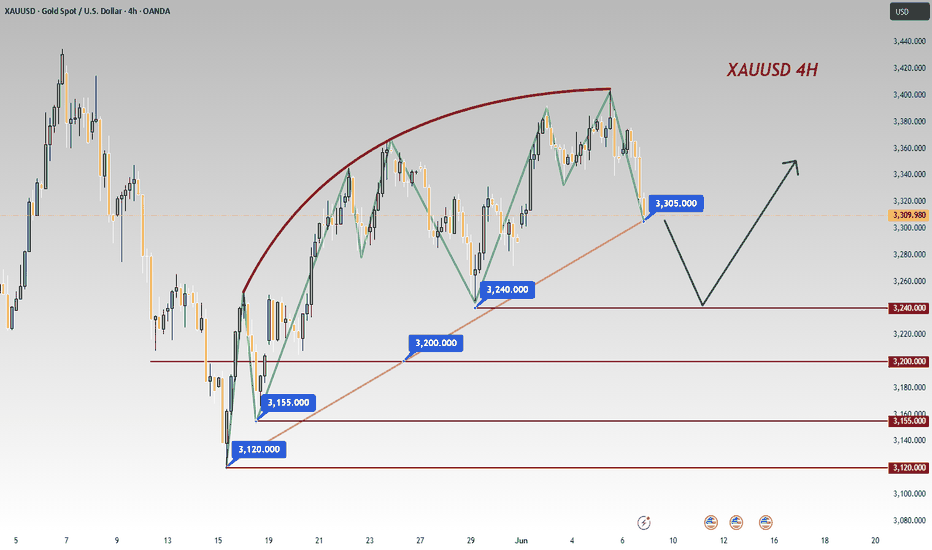

In terms of the large cycle, June is the continuation of May's wide shock, long rest storage stage, but also up and down back and forth pull, the main trend is still more, pay attention to seize the next wave of unilateral rise opportunities.

Now the fluctuation is still large, need to be patient and wait for the right position, short-term attention to 3330 resistance near to short, back to step near 3300 and then consider more.

Trading Strategy:

SELL@3330

TP:3310

↓↓↓ More detailed strategies and trading will be notified here ↗↗↗

↓↓↓ Keep updated, come to "get" ↗↗↗

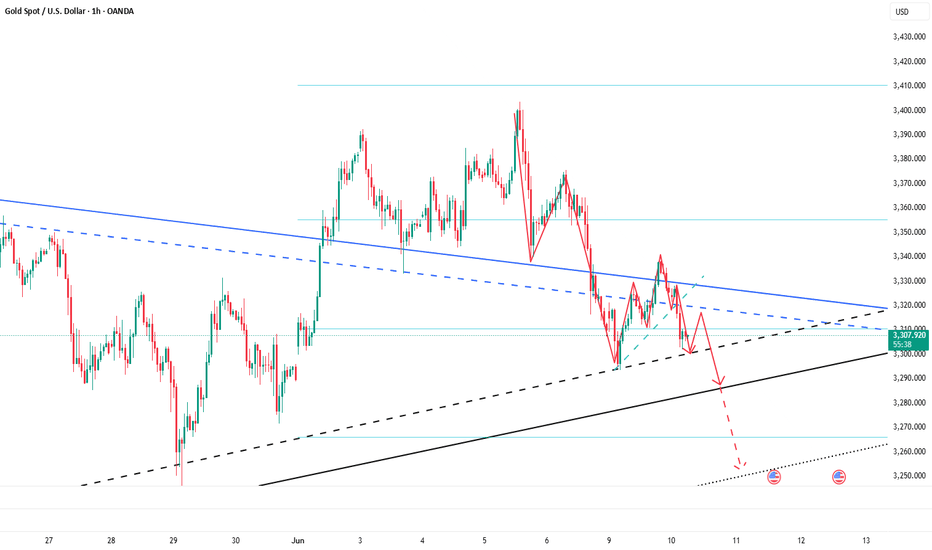

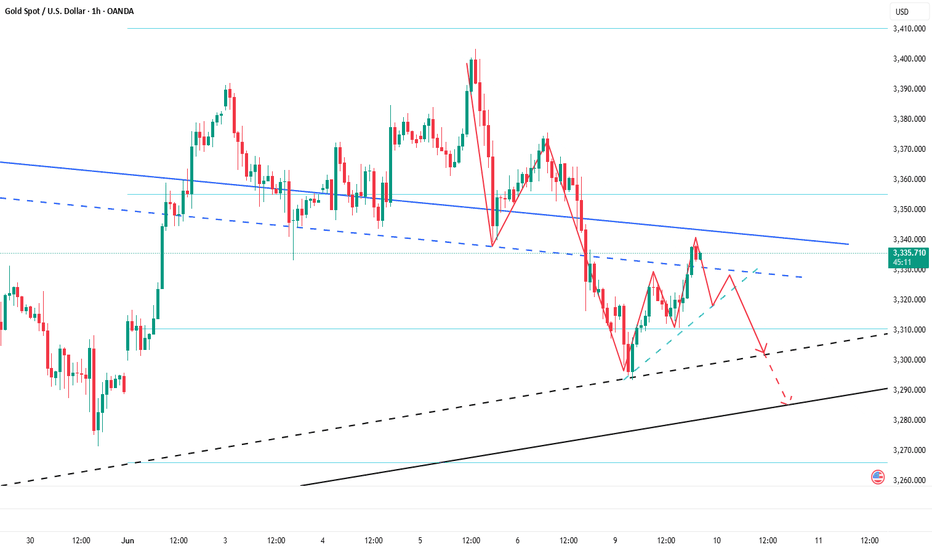

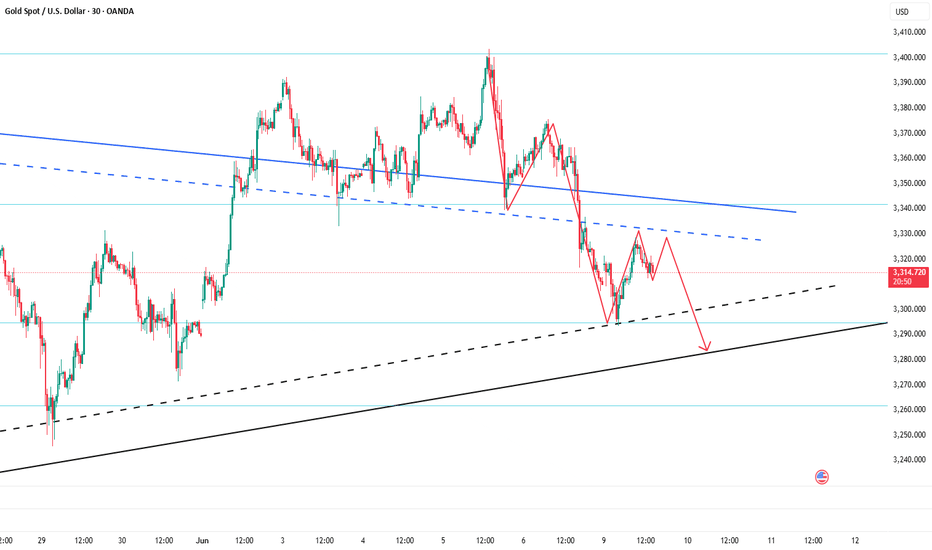

Weekly IDEA on Gold/XAUUSD 9-13 June 2025Technical Confluences:

Bearish FVG:

Fresh Fair Value Gap formed due to aggressive sell-off.

FVG = supply zone, acting as magnet for liquidity + rejection

Broken Channel Retest:

Price fell below the ascending channel

Now retesting the channel, a classic structure behavior before continuation.

Liquidity Below:

Clear clean lows visible around $3,290 → $3,250 → $3,120.

These levels could serve as liquidity targets for institutional movement

Rejection Candlestick Anticipated:

If a strong rejection candle (e.g., bearish engulfing / wick trap) forms inside FVG, entry confidence increases.

📌 Trade Idea (Signal)

Sell Limit Idea

Entry Zone: $3,332 – $3,344

SL: $3,355 (above FVG and channel invalidation)

TP1: $3,290

TP2: $3,250

TP3: $3,120

RR: Approx. 3R+

❗ Alternate Bullish Scenario:

If price reclaims and closes back inside the channel (above $3,355):

The current bearish setup is invalidated.

Bullish momentum could resume with possible push toward $3,400 → $3,445.

🧠 Final Thoughts:

This is a classic SMC + market structure confluence.

Wait for rejection confirmation inside the FVG for higher probability.

Avoid chasing the move — precision entry at supply is key.

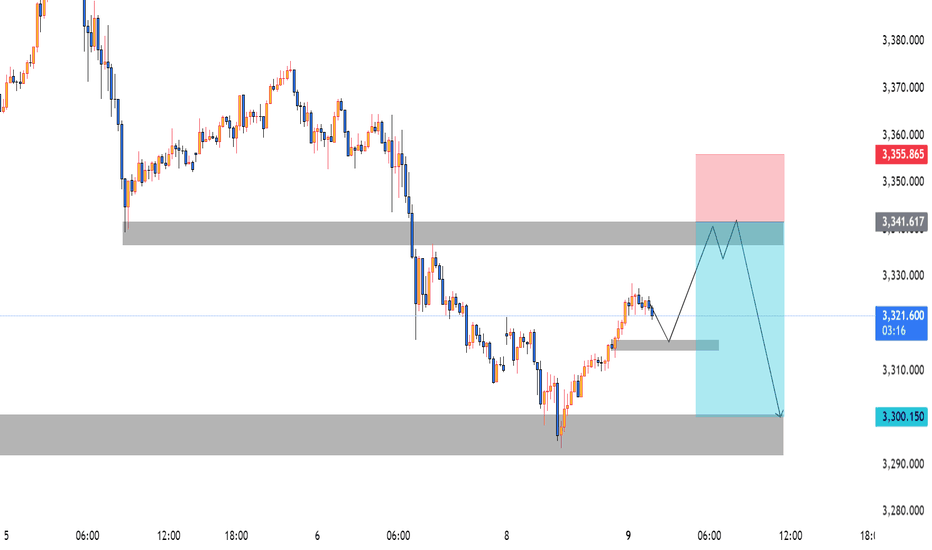

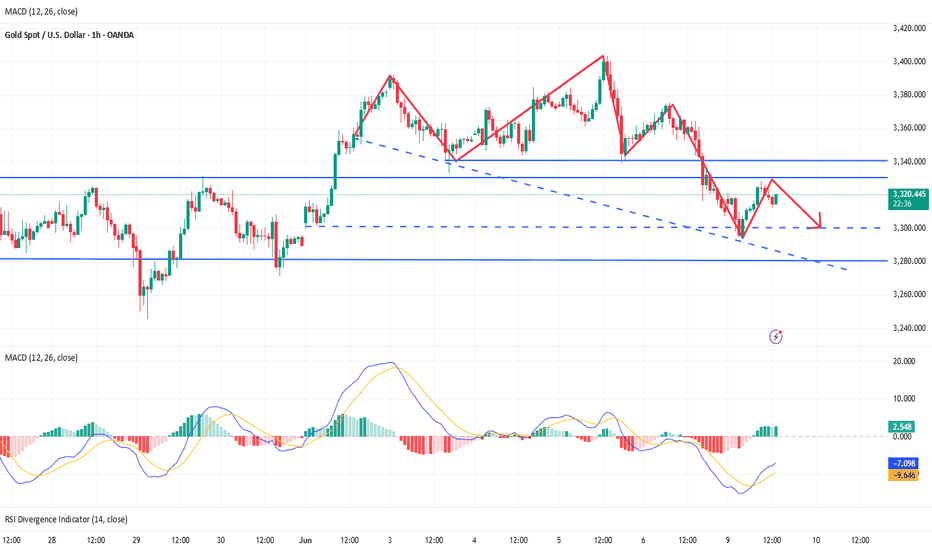

Gold XAUUSD Possible Move 9th June 2025Market Structure:

The overall trend remains bearish, with a series of lower highs and lower lows.

Recent bullish retracement is corrective and approaching a key supply zone (3340 region).

Zones of Interest:

Supply Zone (Sell Area): 3335–3340

This area acted as a previous area of institutional selling. Price is expected to tap into this zone before resuming the downward move.

Demand Zone (Target): 3295–3305

This level served as a previous strong demand zone and aligns with previous reaction zones.

Liquidity & Structure:

Liquidity grab expected above minor highs around 3330–3335 before a potential reversal.

Structure shows a liquidity sweep, followed by a market shift confirming the bearish move.

Key Confluences:

Bearish market structure

Return to supply

Clear risk-to-reward setup

Anticipated lower high formation

Clean FVG + OB alignment in supply zone

📉 Trade Idea / Signal

Type: Sell Limit

Entry: 3335–3340

Stop Loss: 3355 (above supply zone highs)

Take Profit: 3320

Take Profit: 3300

Risk–Reward: ~1:3

🧠 Trade Plan

Wait for price to enter 3335–3340 zone.

Look for confirmation (e.g., bearish engulfing, BOS, CHoCH on LTF).

Execute short with SL above the zone.

Target the 3300 handle which aligns with the HTF demand zone and price imbalance fill.

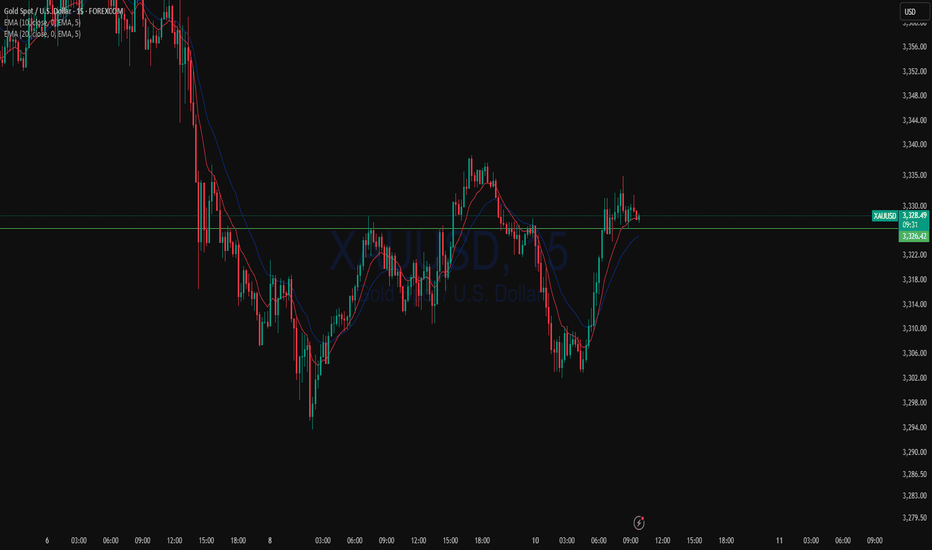

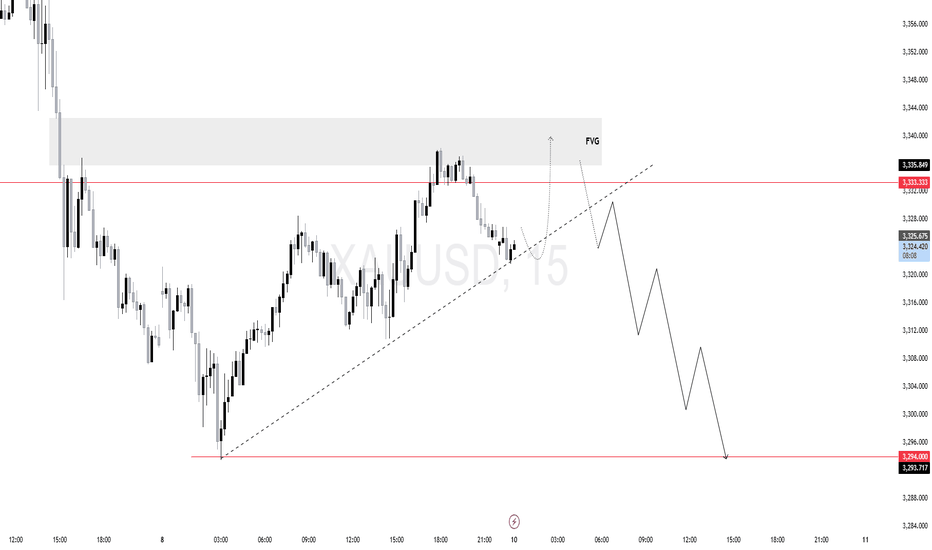

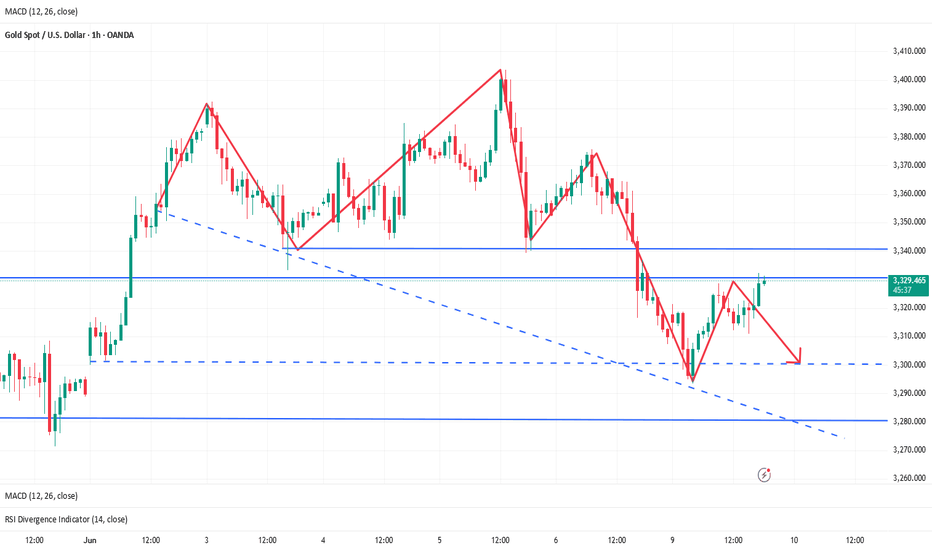

$XAU (GOLD) 15M AnalysisPrice rallied strongly into a bearish FVG (Fair Value Gap) around 3,335 after reclaiming demand...However, this rally lacked conviction and broke structure to the downside, forming a lower high and a weak low retest.

Ideal short setup:

Price returns into the FVG, rejects around 3,333–3,335, then shows signs of displacement downward.

First target: Break below 3,325.

Invalidation: Clean break and close above 3,336.

Bias: Short from FVG zone.

Target: 3,294 area of liquidity.

This is a classic liquidity sweep + FVG rejection setup.

Reclaim of the trendline after sweep.

Price to revisit the FVG zone around 3,335.

Final rejection and breakdown toward 3,294.

Rebound is a good opportunity to short goldGold gradually rebounded after touching 3295. The highest price has rebounded to 3338. Although the rebound has reached $43, the upward momentum is not strong during the rebound. Therefore, the current rebound cannot be confirmed as a reversal trend. Moreover, gold has not yet effectively broken through the 3330-3340 area. Gold is still weak in the short term. Gold still has the potential to fall after the rebound. It will at least retest the 3315-3305 area again.

Therefore, there is no need to fear the rebound of gold for the time being. The rebound of gold is a good opportunity to short gold. I think gold will at least retest the 3315-3305 area again, and even exceed expectations to the area around 3280. Shorting gold is the password for profit in the short term!

Sell@3335Technically, the first key support range is at 3,240-3,260. If this area holds as effective support, it may trigger a short-term rebound. Close attention should be paid to updates on U.S. tariff policies and the evolution of the situation in war-torn countries, as geopolitical risks may exacerbate market volatility ⚠️

⚡️⚡️⚡️ XAUUSD ⚡️⚡️⚡️

🚀 Sell@ 3360 - 3240

🚀 TP 3310 - 3290

🚀 Buy@ 3250 - 3260

🚀 TP 3290 - 3310

Accurate signals are updated every day 📈 If you encounter any problems during trading, these signals can serve as your reliable guide 🧭 Feel free to refer to them! I sincerely hope they'll be of great help to you 🌟 👇

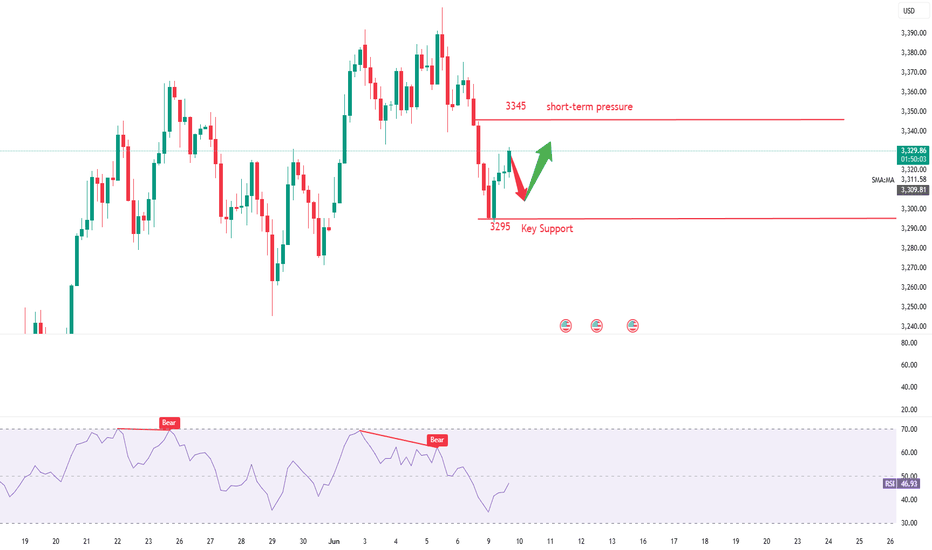

Short Gold,gold is expected to test 3300 or even 3280 againAlthough gold is currently above 3310, it does not mean that gold has stopped falling and stabilized. As long as gold remains below 3330-3340, gold is still in a weak state, so I think the decline of gold may not be over yet. Judging from the current trend, I think gold will have to retest 3300 at least again, or even around 3280 before it will have a chance to stop falling and rebound.

So for the grasp of short-term trading opportunities, I think you can consider shorting gold with 3330-3340 as resistance.

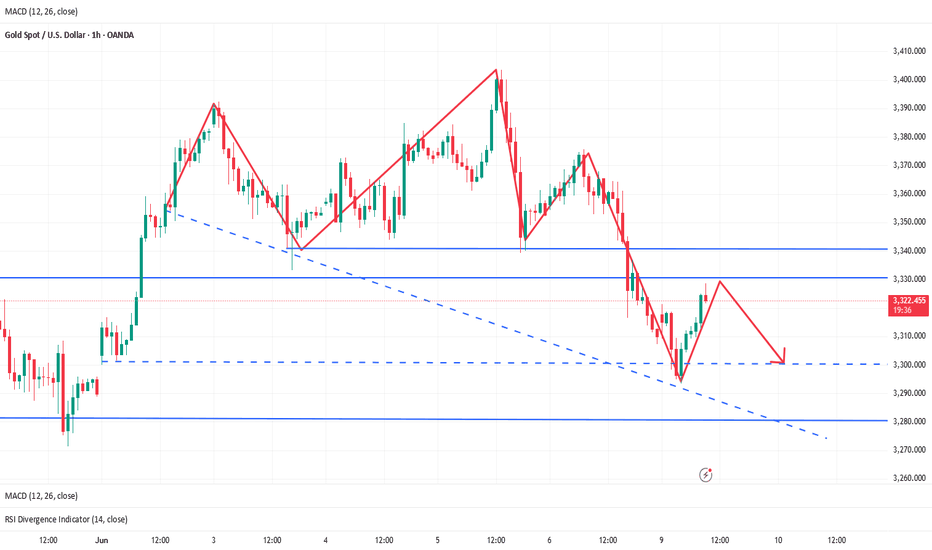

Gold rebound fails to change the trend and is still bearish?📰 Impact of news:

1. The streets of Los Angeles are full of "gunpowder smell"! Immigration protests escalate, and Trump sends troops to suppress them

2. Geopolitical situation

3. Federal Reserve political expectations

📈 Market analysis:

At the hourly level: the Bollinger Band opening is narrowing, the MACD technical indicator is running in a golden cross, and the RSI fluctuates frequently in the short term. There is a certain potential for short-term promotion. If the gold price stabilizes above 3315, it may trigger a rebound and touch 3330-3340 again. If the gold price continues to be below 3300 and the short position is strengthened, it may fall to a new low. Therefore, if it rebounds again to the 3330-3340 resistance line, short positions can still be considered.

🏅 Trading strategies:

BUY 3315-3318

TP 3330-3335

SELL 3330-3340

TP 3300-3290-3280

If you agree with this view, or have a better idea, please leave a message in the comment area. I look forward to hearing different voices.

OANDA:XAUUSD FX:XAUUSD FOREXCOM:XAUUSD FXOPEN:XAUUSD TVC:GOLD

Evening gold trend analysis and operation layout📰 Impact of news:

1. The streets of Los Angeles are full of "gunpowder smell"! Immigration protests escalate, and Trump sends troops to suppress them

2. Geopolitical situation

3. Federal Reserve political expectations

📈 Market analysis:

Gold rebounded as expected and touched the 3330 line. In the short term we need to pay attention to the 3335 line. On the one hand, it is the top and bottom, and on the other hand, the annual average line is also the pressure point of the upper track of the downward channel. Once it is suppressed below 3335, it will continue to fluctuate downward. If it unexpectedly breaks through 3335 or even 3340, then 3293 is likely to become the short-term bottom.

At present, the rise has slowed down after rising to 3330, and the technical side shows a top divergence signal, so in the short term, we still maintain the idea of shorting at a high level of fluctuation.

🏅 Trading strategies:

SELL 3335-3345-3355

TP 3310-3300

If you agree with this view, or have a better idea, please leave a message in the comment area. I look forward to hearing different voices.

TVC:GOLD FXOPEN:XAUUSD FOREXCOM:XAUUSD FX:XAUUSD OANDA:XAUUSD

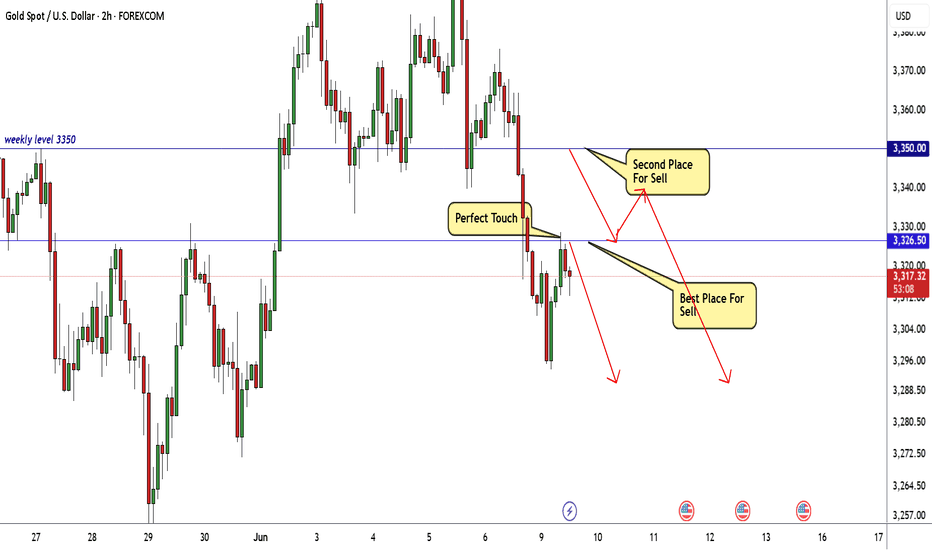

Continue the bearish trend.After the opening of gold, bullish and bearish forces fiercely contended, with prices falling first and then rising. After finding support at the key level of 3293, they rose again. During the Asian session, prices broke through the early session high of 3320 and surged toward 3330. However, the rally significantly slowed down after reaching this area, exposing signs of fatigue in bullish momentum. Technically, a top divergence signal has emerged. It is recommended to use the 3333-3343 range as resistance and lay out short positions on rallies. The first support below to monitor is 3305. If this level is breached, it may retest the early session low of 3293 from which the rally originated. During the US session, special attention should be paid to the risk of a breach of 3293, which could trigger a new downward trend.

Humans need to breathe, and perfect trading is like breathing—maintaining flexibility without needing to trade every market swing. The secret to profitable trading lies in implementing simple rules: repeating simple tasks consistently and enforcing them strictly over the long term.

Trading Strategy:

sell@3330-3340

TP:3305-3310

Gold: Market Analysis and Trading StrategiesSo far, although the price has risen, it has not yet broken through the upper resistance, and the lower support remains intact. Overall, the market is still in a narrow range of consolidation. From a technical perspective, the 2-hour chart shows a bullish bias, indicating a potential for continued upward movement in the short term.

However, if during this consolidation phase the price breaks below the key support at 3309, it is likely to further test the support zone around 3296–3288.

At this stage, traders can consider entering light long positions and gradually add to them on dips to reduce the average entry price. For more conservative traders, it's advisable to wait until a clear breakout occurs before taking action.

Watch the 3338–3352 area for potential short opportunities as it's a key resistance zone, and the 3303–3288 range for long entries as it offers strong support. Trading near these levels generally carries lower risk and a higher probability of profit.

gold on short bullish till 3340#XAUUSD price aiming 3340 for reverse, possible 3340 price close on D1 or middle close to continue bearish.

#Gold buy at 3326 breakout, target 3340, SL 3317.

We aim at H4 price close in next 2 hours, if possible it closes below bearish 3313 then bearish is possible to continue but buy at 3323-26 will take above 3340.

Gold May Rebound After Monday Dip; Watch Tariffs & GeopoliticsGold may continue to decline before rebounding on Monday📉. The first support level is currently near 3,240-3,260. When approaching this support area, considering going long is advisable👍. It is still crucial to closely monitor the latest developments regarding U.S. tariffs and the situation in war-torn countries, as significant volatility may occur at any time⚠️. If a rebound reaches 3,350-3,360, considering going short is an option📉

⚡️⚡️⚡️ XAUUSD ⚡️⚡️⚡️

🚀 Buy@ 3250 - 3260

🚀 TP 3290 - 3310

🚀 Sell@ 3360 - 3240

🚀 TP 3310 - 3290

Accurate signals are updated every day 📈 If you encounter any problems during trading, these signals can serve as your reliable guide 🧭 Feel free to refer to them! I sincerely hope they'll be of great help to you 🌟 👇

Gold weakness continues, bears continue to exert force📰 Impact of news:

1. The streets of Los Angeles are full of "gunpowder smell"! Immigration protests escalate, and Trump sends troops to suppress them

2. Geopolitical situation

3. Federal Reserve political expectations

📈 Market analysis:

At present, the hourly moving average of gold price is spreading downward. At the same time, the 4H chart has retreated from a high and lost the middle track, breaking through the rising trend line. The low point of the trend line coincides with the middle track. Today's operation uses the low point of 3330-3335 as the critical point of strength and weakness. If the market rebounds below this range, you can just go bearish. If it breaks through this dividing point, you need to be cautious. On the whole, the recommended short-term operation strategy for gold today is to mainly short on rebound. Focus on the resistance of 3330-3340 on the upper side in the short term, and focus on the support of 3290-3280 on the lower side in the short term. The market fluctuates greatly, and stop loss is strictly controlled!

🏅 Trading strategies:

SELL 3325-3335

TP 3300-3290-3280

If you agree with this view, or have a better idea, please leave a message in the comment area. I look forward to hearing different voices.

TVC:GOLD FXOPEN:XAUUSD FOREXCOM:XAUUSD FX:XAUUSD OANDA:XAUUSD

GOLD Best 2 Places For Sell Very Clear , Ready For 500 Pips ?Here is my opinion on gold on 2H T.F , we have a very good bearish price action and we have a very good retest for broken support and new res , so i think 3326.00 will be a very good place to sell and targeting 250 pips at least , also if the price go up a little 3350.00 will be the last place we can sell from it and targeting 500 pips .

GOLD: Bullish Bias Holds, But Mind the Unfilled GapGold dipped below 3300 today and bounced back, though the gap near 3289 remains unfilled.

This shows buying interest is active, but also reveals that some sideline capital is still waiting for a full retest.

Combined with selling pressure on the rebound, it’s clear that bullish strength is currently limited.

—

🔍 Two Possible Scenarios from Here:

1️⃣ If support proves firm during consolidation, bulls may regain momentum and push higher

2️⃣ If support fails, price is likely to fill the 3289 gap before launching the next leg up

📌 Current Trade Outlook:

✅ Bullish trend remains intact

✅ Regardless of the short-term path, the direction is upward

✅ Watch resistance at 3331, with a key zone near 3348

—

⚠️ Note: The daily chart structure still needs further correction.

If volume remains weak after a second dip and a failed bounce follows, bears may take over again — in that case, the next downside target would be around 3258–3228

📩 Conclusion: Stay long-biased, but react flexibly to support strength and volume shifts.

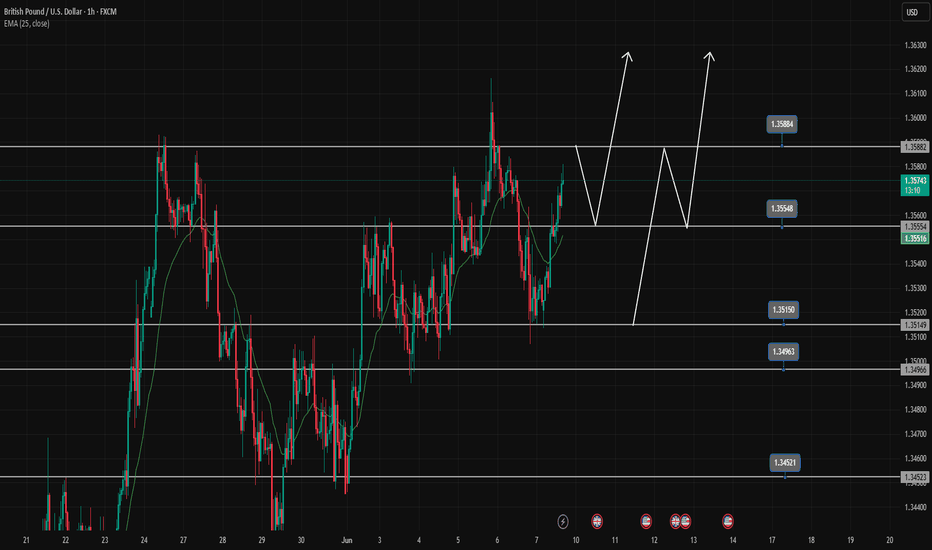

Buy opportunity when price retraces to break the topGBPUSD encounters resistance at 1.358, there is a high possibility that there will be a price reaction to 1.35500 to create a Dow break 1.358 towards higher levels.

GBPUSD is increasing very strongly again in the main trend, we wait for a retracement to the support zones, which is a strong buying opportunity.

1.358-1.355-1.351-1.345 are BUY zones when the price has a reaction of buying force at these price zones.

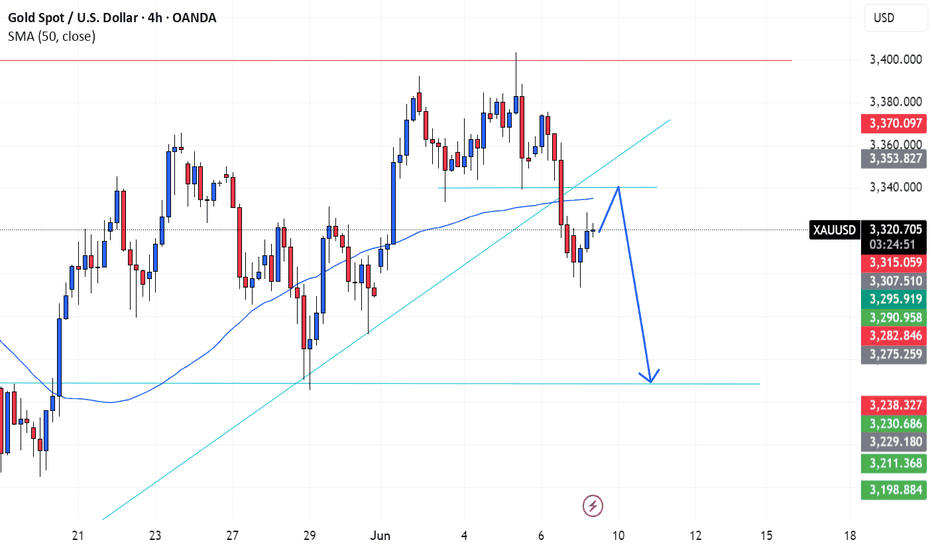

Gold Short Opportunity at $3340Gold is currently showing signs of Bearish market directionality on the 4 hour timeframe with price trading below the 50 SMA and RSI showing bearish sign trading below 45. This is a retracement in the context of the higher timeframe but price has the potential to continue all the way down to $3250. We could potentially see a retest of $3340 (potential break-and-retest level) before price down to $3250