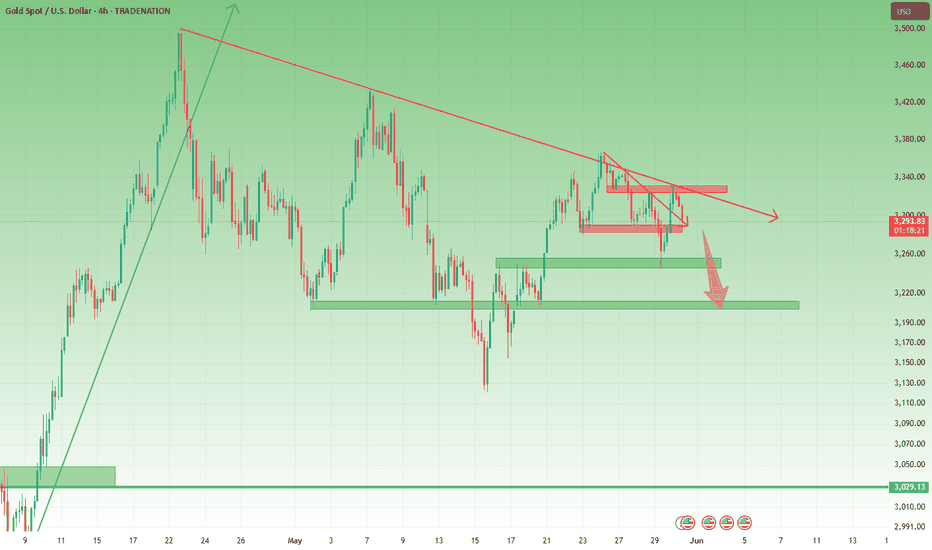

Gold Update – Has the Downside Ended or Just Taking a Break?📉 What happened yesterday on Gold (XAUUSD)

I started the day under a good omen – 🎯 my 3250 target being hit perfectly.

However, what initially looked like a standard correction turned into a stronger bounce.

Gold broke back above my re-selling zone and even pushed above 3310, triggering my stop loss, and worth nothing that we are now back under 3300- I take it like a man and move forward:).

❓ Has Gold finished with the downside, or is this just a pause before another drop?

🔍 Reasons to expect more downside:

- Although Gold reversed strongly from the 3250 support, the confluence resistance around 3330 capped the move, and sellers stepped in, dragging the price back under 3300.

- The fact that price returned to support so quickly signals weak bullish momentum – buyers couldn’t sustain the rally.

- Gold failed to stabilize above the 3330 zone, which would’ve been a key bullish sign – instead, it got rejected.

- And here’s the part that doesn’t sit right – Gold came back to the 3290 zone too easily, as if the market wanted to offer a second chance to buyers who missed the initial bounce. That usually doesn’t end well.

🧭 Trading Plan

I’m currently out of the market after the stop loss hit, but my bearish bias remains unchanged.

Watching the 3280–3290 area closely – if we drop back below, I’ll look to re-enter short trades.

🚀 Final thought

Yesterday’s move reminded me who’s boss – the market . But unless bulls break key resistance and hold above, the bearish case still has more to say.

Disclosure: I am part of TradeNation's Influencer program and receive a monthly fee for using their TradingView charts in my analyses and educational articles.

Xauusdsignal

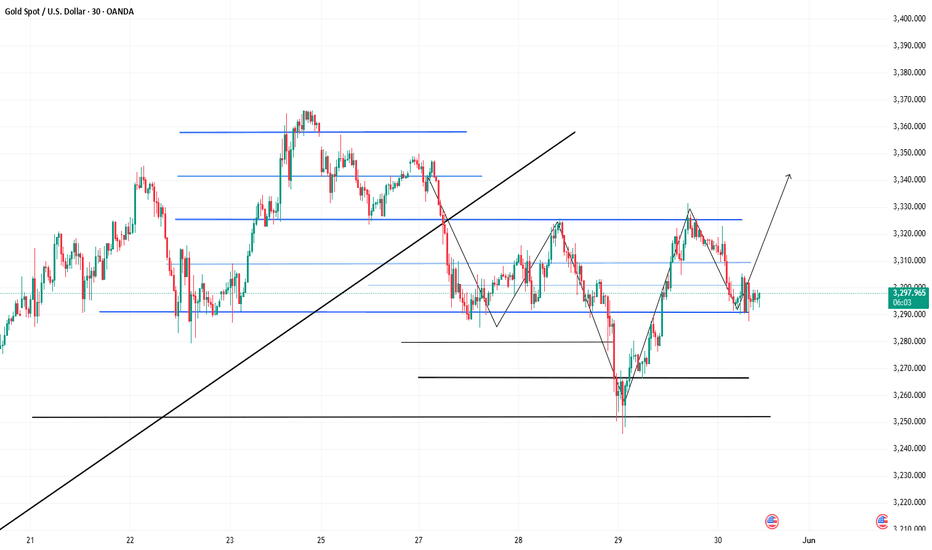

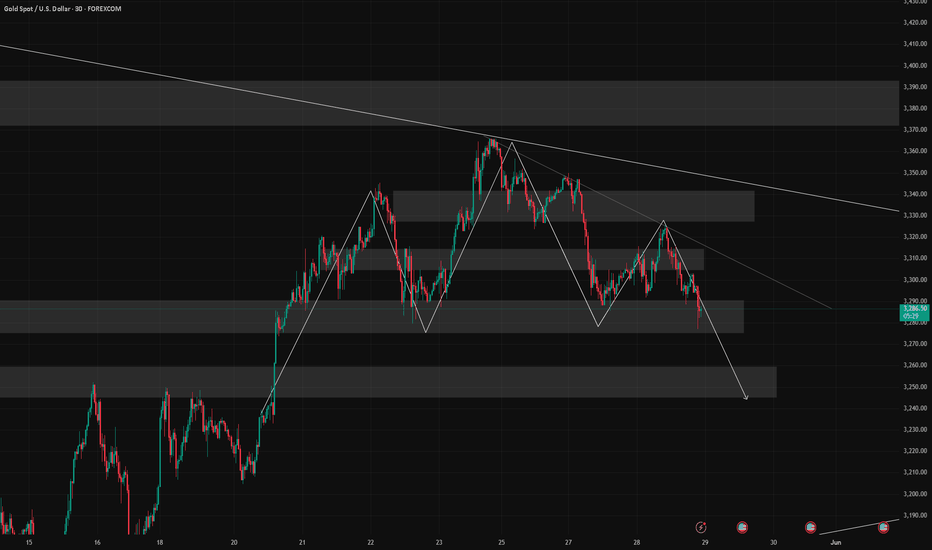

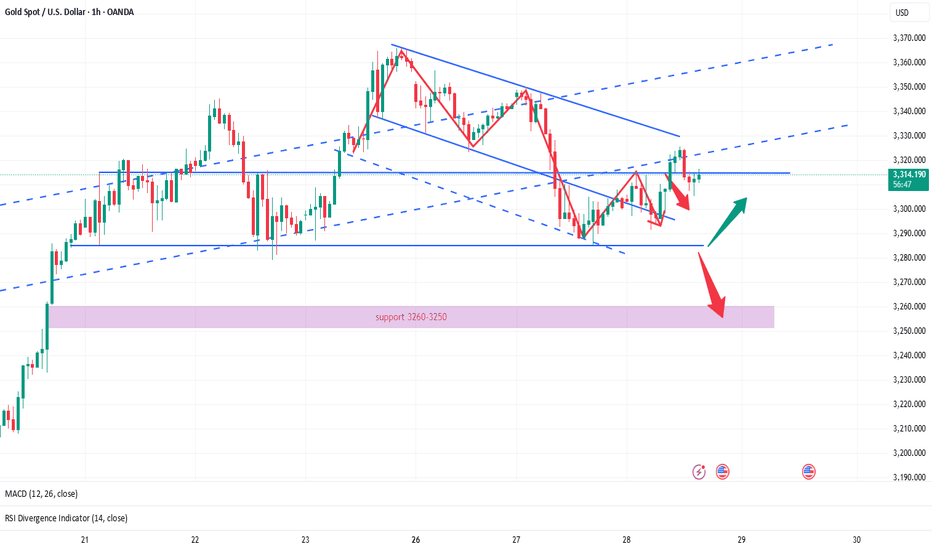

Gold Poised for a Breakout After Sideways ConsolidationGold has retraced to the 3300 level and remained range-bound for an extended period. This prolonged consolidation suggests that a sharp breakout may be imminent, with the next move — whether up or down — likely to be swift and volatile.

Looking at the 2-hour chart, the current price structure is complex. It could be interpreted as a potential double top, but it also resembles the early formation of an inverse head and shoulders, which makes trading decisions more challenging.

From a technical standpoint:

Moving averages are aligned in a bearish setup, and the area above remains densely packed with resistance.

MACD on the 2H chart shows a bearish crossover, signaling a potential continuation of the downtrend.

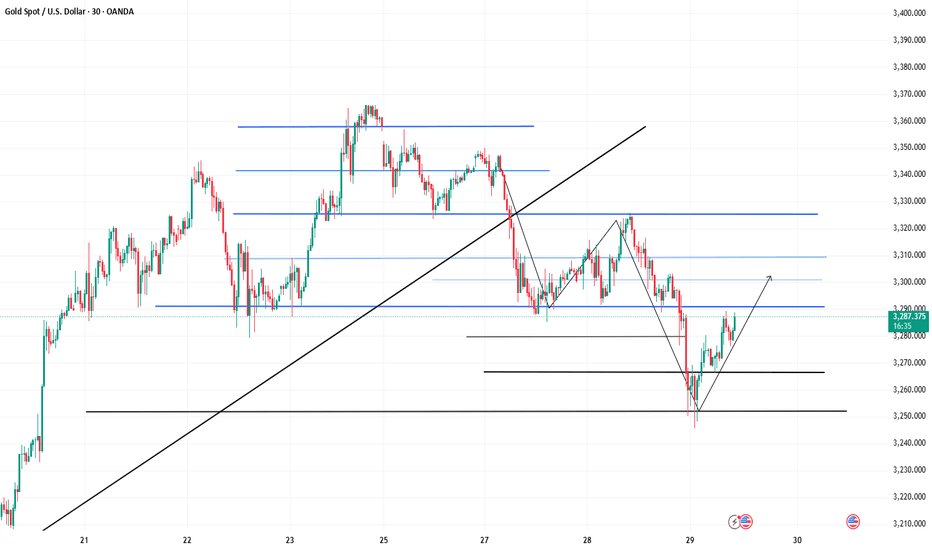

However, on the 30-minute chart, MACD shows some short-term bullish momentum, with the next resistance near 3306.

For bulls, if the price attempts to rise toward the 3306–3312 zone but then quickly pulls back, this would indicate weak buying pressure, and caution is advised.

In summary, short-term signals are bullish, but the medium-term trend remains bearish. With the market in a sideways range, it's best to remain patient and watch for breakout signals. The two trading opportunities shared yesterday remain valid and worth monitoring closely.

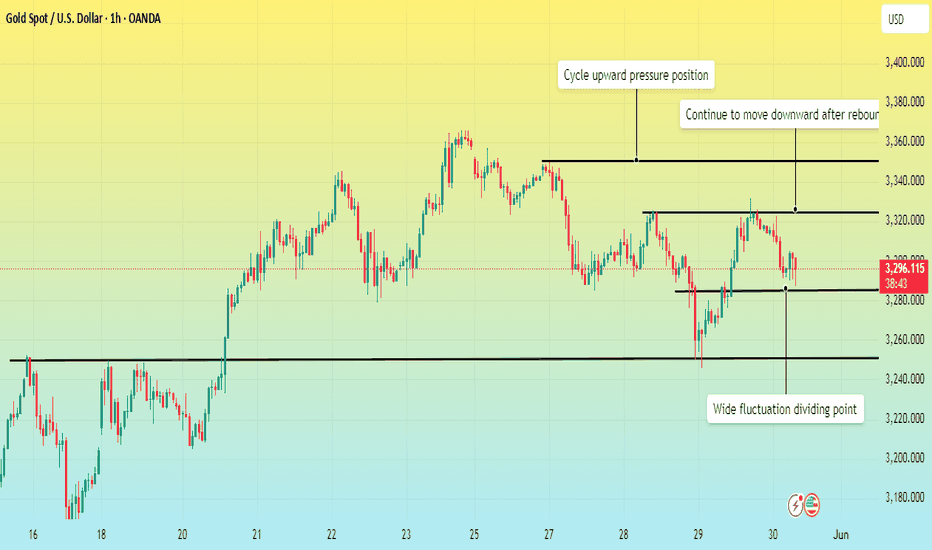

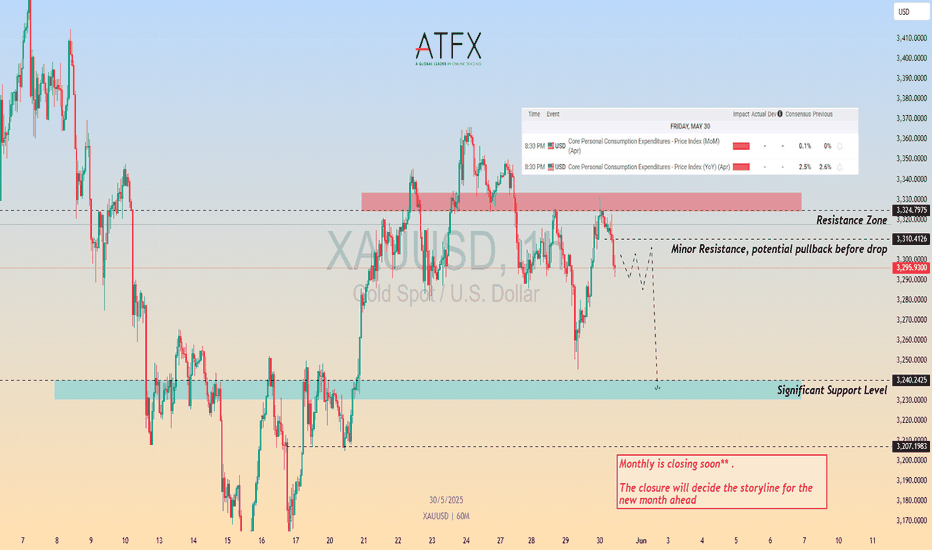

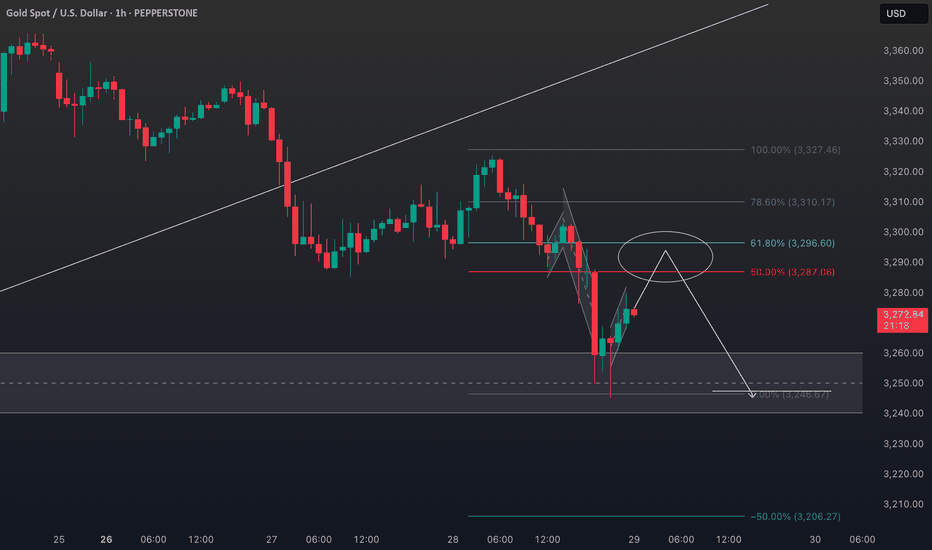

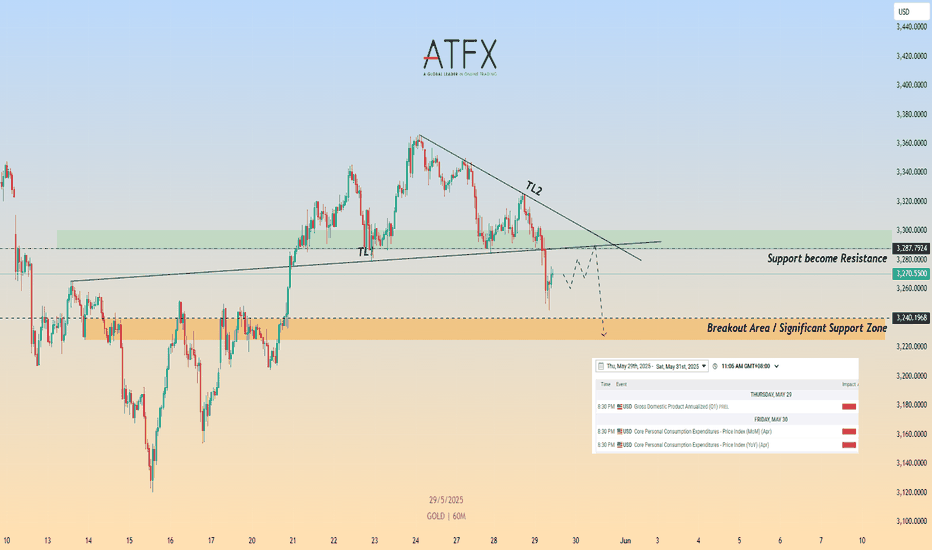

Monthly closing bet. Opening a falling gap?Information summary:

At 8:30 a.m. on Friday, U.S. time, the U.S. Bureau of Economic Analysis will release the personal consumption expenditure (PCE) price index for April. As the most favored inflation indicator of the Federal Reserve, the year-on-year change in the core PCE price index has a greater impact on policymakers.

If the data is released, the core PCE price index in April rises faster than expected, and the direct reaction of the market may lead investors to prefer the policy rate to remain unchanged in July. In this case, the U.S. dollar may gather strength, causing gold prices to fall before the weekend.

Market analysis:

Gold prices rose as high as 3322 in the early Asian session, and then fell without a dollar line. As of now, the lowest price has retreated to the 3290 U.S. dollar line. At present, it is not ruled out that gold will fluctuate widely; but the trend view is still biased towards the short side. The strength of the current rebound still depends on the strength of the European session. In the European session, the operation will focus on the vicinity of 3310 U.S. dollars first, and the pressure will still look down to 3280 U.S. dollars.

However, if the European session falls directly below $3,285, there is still room for decline, and the support is around 3,250. In addition, today is the last day of the monthly line closing, and the range of fluctuations has not yet left, so you can continue the short strategy.

Operation strategy:

Short around $3,310, stop loss at $3,320, and profit range around $3,250.

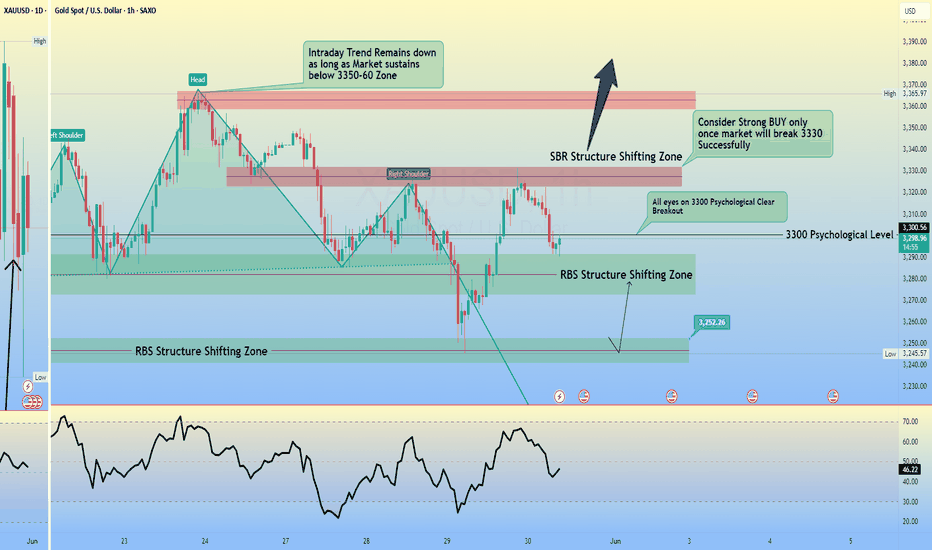

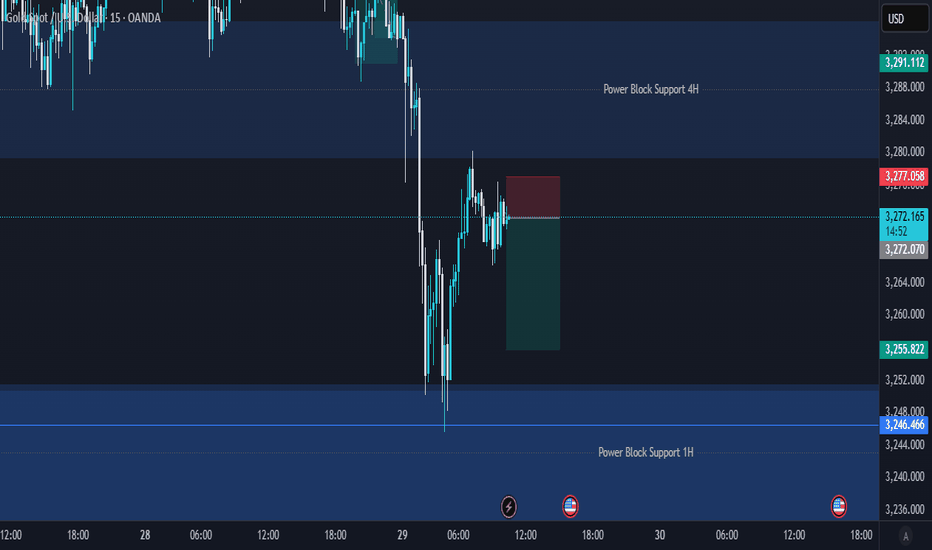

GOLD Intraday Chart For H1 30 May 2025Good Morning Traders,

As you can see that there are some strong zones mentioned on chart,

For Intraday all eyes between 3280-3300 zone,

If market clearly goes below 3280 then it will move towards 3250 else market sustains above 3280 it will move towards 3300 and after clear breakout of 3300 then move towards 3325 initially

Furthermore you can read the chart details carefully, Remember, Always Trade with SL

Today US PCE PRICE INDEX due today

Monthly Closing Due Today as well

Disclaimer: Forex in Risky

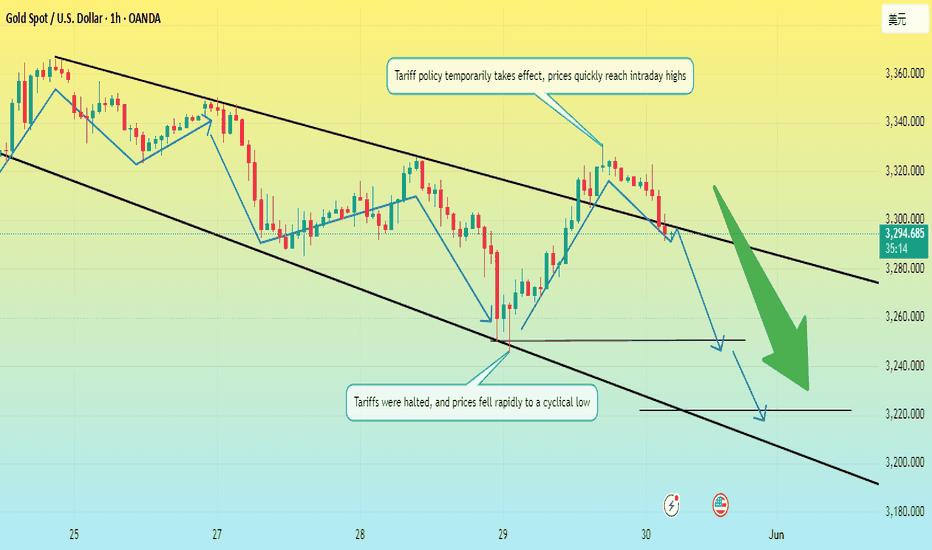

Tariff policy reversed again? Be careful on Friday.Yesterday, Trump and the US Trade Court ruled that the US International Trade Court had stopped the tariff policy. Gold once fell to a low of 3245, while the US dollar rushed all the way to a high of 100.5. Then it reversed, and gold began to rectify and rise. As of now, it has once touched a high of 3330, close to a rebound of $85.

Today, it reversed again. The US Court of Appeals allowed Trump's tariff policy to continue to take effect temporarily. And impose tariffs on most areas of the global economy, including allowing tariffs of up to 15% within 150 days to address trade imbalances with other countries. Compared with the tariff policy that was deemed illegal this week, this step is more legally defensible.

Looking at the current gold, it is likely that gold will fall sharply today. After gold fell yesterday, everyone wanted to short gold, but gold rebounded all the way.

So, today, Friday, is an opportunity for short-selling strategies. The short positions have been eliminated, so gold has every reason to fall, and it will fall sharply.

Once it falls below 3280 in the downward trend, it will test the low point of yesterday near 3250. If it breaks through 3250 again, it will go directly to the low point near 3200. The current short-selling strategy has little to do with technical analysis, it is completely a test of human nature.

XAU/USD Awaits PCE Catalyst – Rejection or Breakout?Gold prices are trading around $3,297 after rejecting the $3,324 resistance zone. The market is currently showing signs of exhaustion near a minor resistance, and price action suggests a potential short-term pullback. Attention now shifts to today's U.S. Core PCE data, a key inflation metric for the Fed, which may dictate near-term direction and shape the monthly close.

OANDA:XAUUSD TVC:GOLD Gold tested the $3,324 resistance area but failed to break higher, forming a lower high. A potential bearish setup is developing as price reacts to minor resistance around $3,310. If bears regain control, a drop toward the key support level at $3,240 is likely. A break below this level could open the door to further downside in the upcoming sessions. Conversely, if bulls manage to reclaim $3,324 and establish a strong daily close above, we could see a retest of $3,350 and higher.

Key Event Today:

At 8:30 PM GMT+8, the U.S. will release April's Core PCE Price Index – the Fed’s preferred inflation gauge:

MoM: Expected at 0.1%

YoY: Expected at 2.5% (Previous 2.6%)

A softer-than-expected reading could increase rate cut expectations and offer bullish momentum to gold. Stronger data, however, may renew USD strength and pressure XAU/USD lower.

Resistance: $3,310 , $3,324

Support: $3,240 , $3,207

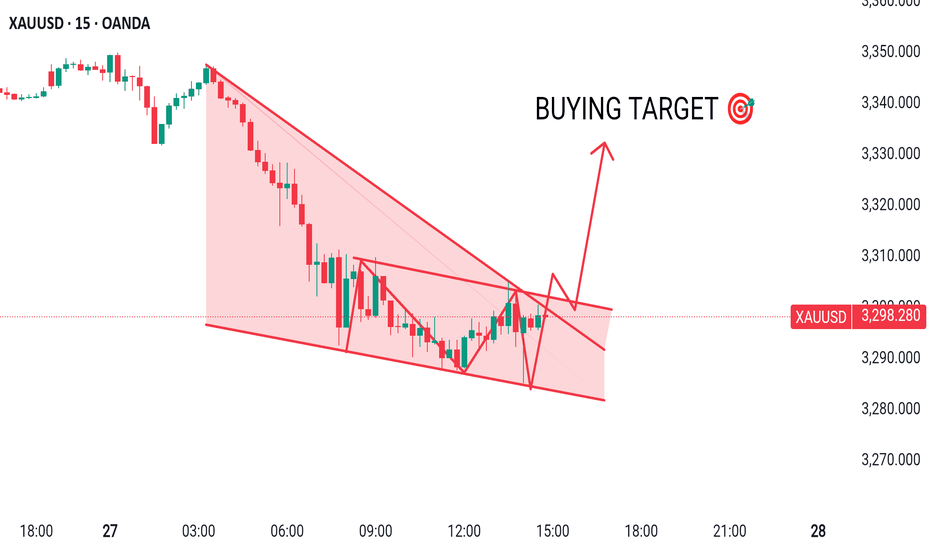

XAUUSD MADE FALLING WEDGE & DESCENDING PATTERNHere I Created This XAUUSD Chart Analysis

Pair : XAUUSD (Gold)

Timeframe: 15 - Minutes

Pattern: FALLING WEDGE

Momentum: BULLISH/ BUY

Entry Level : BUY 3297

SUPPORT zone : 3285

Target Will Be : 3330

Disclaimer : This signal is based on personal analysis for learning purposes. Trade at your own risk and always use proper risk management.

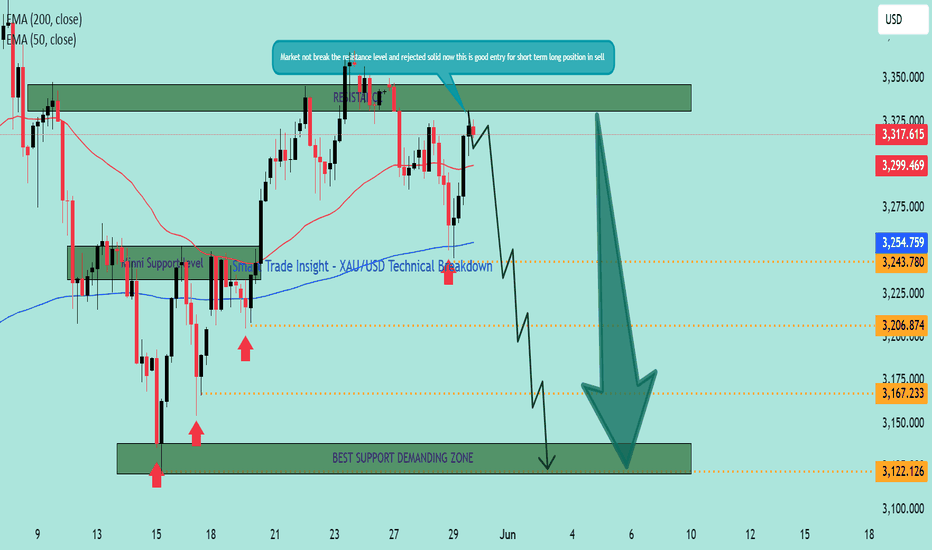

Smart Trade Insight – XAU/USD Technical BreakdownKey Levels & Technical Zones:

🔹 Resistance Zone (🔼 SELL Area):

📌 3,315 – 3,340

This area has been tested and rejected multiple times, as highlighted by the strong bearish wicks. The recent price action failed to break above it, triggering short interest.

🔹 Minor Support Zone:

📌 Around 3,243

Acted as intraday bounce area previously, now likely to offer weak support in the coming move down.

🔹 Major Demand Zone (💚 BUY Interest Zone):

📌 3,120 – 3,140

Labelled as "BEST SUPPORT DEMANDING ZONE" – historical demand visible with strong bounce history. Ideal for monitoring bullish reversal opportunities.

📈 EMA Levels:

🔴 50 EMA: 3,299

🔵 200 EMA: 3,254

Current price action is hovering near the EMAs. The rejection at the resistance while below the 50 EMA indicates weakening bullish momentum.

🔍 Market Structure Overview:

The double-top formation near the resistance shows exhaustion in buying.

Lower highs forming → structure turning bearish short-term.

Solid rejection confirms that this is a valid zone to initiate short positions 🛑📉.

📉 Forecast Path:

🔮 Projected Move:

Price is expected to break below minor support at 3,243.

Intermediate target: 3,206, then 3,167 🟠.

Final destination: Demand Zone at 3,120 – 3,140 🟩 for potential bounce 📈.

💬 "Market not break the resistance level and rejected solid — this is a good entry for short-term sell trades." ✅

✅ Trade Idea Summary:

🟥 Bias: Short

🎯 TP Targets: 3,206 → 3,167 → 3,122

📉 SL Suggestion: Above 3,340 resistance zone

🧭 Risk-Reward Setup: Favorable for short-term traders

Gold Price Action Update – Smart Dip Buy Pays Off!Yesterday, gold dipped to around 3290, followed by a minor rebound.

Today, as expected, it broke down through the 3280 level decisively—just as we discussed:

🔻 A break below 3280 likely means a gap fill toward 3259.

✅ For those who followed the plan and went long below 3266, the trade worked beautifully—

Gold dropped to a low of 3245, effectively filling the gap, and has since rebounded back to the 3280 area.

📈 What’s next?

Now that the gap is filled, gold is likely to retest the $3300 zone in the short term.

With price currently around 3280, there is still room to the upside.

➡️ If you're holding long positions, you can consider holding a bit longer for potential further gains.

🚨 BUT—this was only a single bottom test.

That means there's still a chance of a second dip before the trend fully reverses. So:

🛡 Risk management remains crucial.

If you're okay with some profit pullback, it's fine to stay in.

If not, consider securing partial profits and setting trailing stops.

🎯 Key levels to watch:

🔼 3300 – Main resistance zone; focus on whether it breaks or rejects;

🔽 3276–3263 – Support range on any pullback; good zones to watch for fresh entries if support holds.

📌 Trading Strategy Outlook:

For now, continue to buy on dips as long as support holds, and monitor 3300 resistance closely.

If price fails to break above, we may see a pullback—but as always, with proper planning, we stay profitable.

XAUUSD trading plan for the London market.After buying at a low level yesterday, the market rebounded and continued to fall. Today, the Asian market hit a low of 3208.

At present, geopolitical uncertainties are increasing. I think buying is still a reasonable choice. Buy near 3210-3200. The target is 3235-3248. It is necessary to observe whether the target is stabilized.

Remember to control trading risks when trading independently.

XAUUSD buying opportunitiesToday, I am adapting to low buy operation again. Yesterday, the lowest price in New York market reached 3278, and today the lowest price in Asian market hit the low near 3245. But with the addition of buy orders, the profit has expanded a lot again.

XAUUSD market quotation is 3298. This position can still be arranged for buying. Do not trade independently. Remember to leave me a message. Pay attention to the subsequent precise trading opportunities.

Gold Drops to 3250 – Sell-the-Spike Strategy Still in Play🕰️ What Happened Yesterday

In yesterday’s analysis, I argued that the 3320–3330 zone should act as a strong sell zone, with a target down at the 3250 support.

Gold respected the plan perfectly: it dropped from the 3325 area straight into 3250 during the Asia session, hitting the target with precision(700+ pips)

At the time of writing, Gold is now bouncing, which is normal, trading around 3280.

❓ Correction Done or More to Come?

While the bounce to 3280 may look promising for bulls, my opinion remains unchanged: this is still a market to sell rallies, not to buy dips.

🔎 Why I Still Expect a Deeper Drop

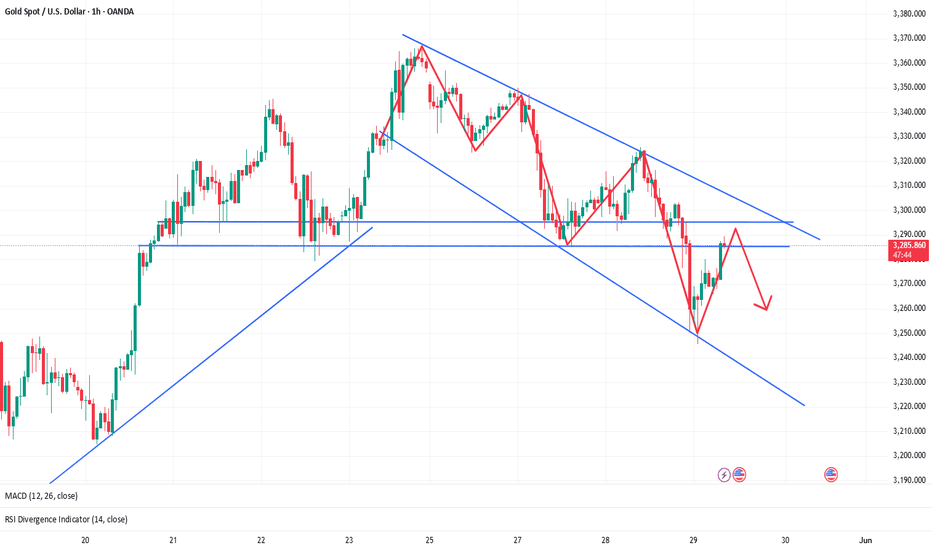

- Old support becomes resistance – The 3280–3285 zone, once support, is now acting as resistance. That zone is currently being tested.

- Double resistance near 3300 – Just above, we have the psychological 3300 level, reinforced by the falling trendline coming from recent highs.

- Momentum still favors the downside – Unless bulls can reclaim and hold above 3300, this rebound is nothing more than a dead-cat bounce.

📉 Trading Plan

I remain in sell-the-spike mode. Any move into 3285 or 3300 is an opportunity to enter short, with stops above the trend line or yesterday's high.

If price breaks back below 3265, the probability increases for a new local low under 3250, probably to the next one around 3215.

✅ Final Thoughts

Yesterday’s setup worked perfectly — and the plan doesn’t change just because of a small bounce.

The market needs to prove it can break key resistance before shifting bias.

Until then, this remains a sell-on-strength market. Let the trades come to you. 🚀

Disclosure: I am part of TradeNation 's Influencer program and receive a monthly fee for using their TradingView charts in my analyses and educational articles.

Top and bottom conversion, short position continues?📰 Impact of news:

1. The International Trade Court ruled that Trump exceeded his authority, and the previous tariffs may be suspended

2. Ukraine submitted a ceasefire document to Russia

3. Pay attention to the initial jobless claims data during the US trading session

📈 Market analysis:

The U.S. Court of International Trade in Manhattan blocked Trump’s “Liberation Day” trade measures, ruling that Trump had overstepped his authority by imposing sweeping tariffs on countries that export more to the United States than they import without authorization from Congress. This means that most of Trump's tariffs will be suspended. But at the same time, the recent geopolitical impact cannot be ignored. In addition, the initial jobless claims data will be released during the U.S. trading session today. Independent traders must set stop losses.

From a technical point of view, the 1H level chart of gold shows that the Bollinger Bands open downward, and the gold price is near the lower track, showing a weak pattern in the short term. Considering that 3285 is the previous low point, there is also a possibility of suppression at 3285. Therefore, we should pay close attention to the resistance range of 3285-3295. If the gold price in the Asian and European sessions can stabilize below 3295, then we can rely on the 3285-3295 range to enter the market and short. On the contrary, if the pullback today stands above 3300, then we should not chase the short easily.

🏅 Trading strategies:

SELL 3285-3295

TP 3270-3260-3250

If you agree with this view, or have a better idea, please leave a message in the comment area. I look forward to hearing different voices.

OANDA:XAUUSD FX:XAUUSD FOREXCOM:XAUUSD FOREXCOM:XAUUSD FXOPEN:XAUUSD TVC:GOLD

Analysis and layout of gold trend in the US market📰 Impact of news:

1. Initial jobless claims data is positive

2. The White House is tough on the court ruling: Trump will win! Three trade agreements are close to being reached

📈 Market analysis:

I think the current rebound should not be directly judged as a unilateral trend. From a technical point of view, in the 4H cycle, the upper 3320-3325 line has a certain suppression force in the short term. If the gold price runs below 3325, we need to be alert to the risk of a high rebound. We can try to arrange short orders based on the 3320-3325 range, and bet on the high selling opportunities in the volatile market. Independent trading with a good stop loss. However, it should be noted that if the price quickly breaks through the 3330 line in the short term and stands above it, it is expected to rise to the 3340-3350 area. At the same time, I think the support below can first look at the 3300 line, with a focus on the 3290-3285 line support.

🏅 Trading strategies:

SELL 3320-3325

TP 3310-3300

BUY 3295-3285

TP 3300-3310-3320

If you agree with this view, or have a better idea, please leave a message in the comment area. I look forward to hearing different voices.

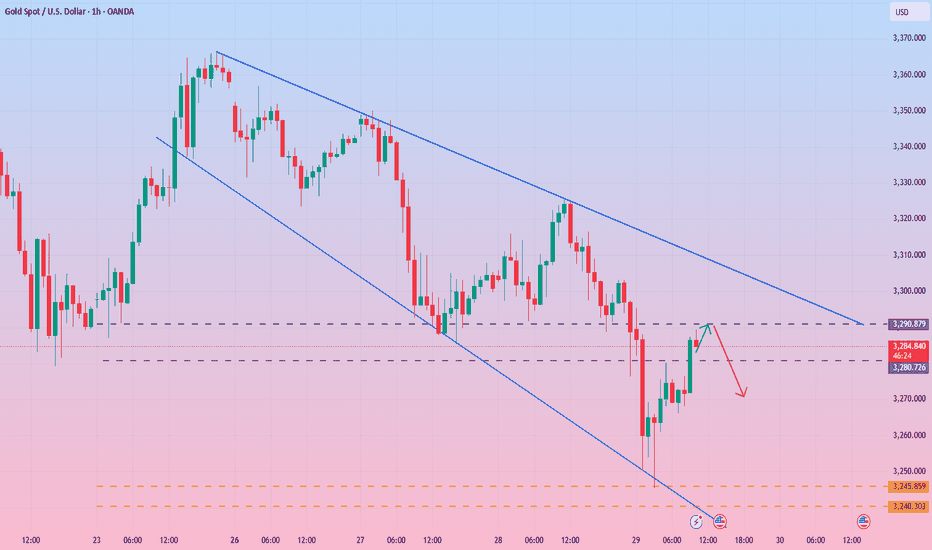

Gold Strategy Update — Professional Trading InsightGold dipped to around 3290, then rebounded to 3310, followed by another pullback toward the 3290–3280 region and bounced again. This price action perfectly aligned with our forecast and trading plan.

👉 If you followed today's strategy, you should be in solid profit once again!

📍 Current Market Structure Analysis:

🔹 Gold is now hovering near 3300, which is a key resistance zone.

Our previously identified support area at 3306–3318–3324 has been broken and is now acting as resistance.

🔹 Among these levels:

3306 is a weaker resistance,

While the 3316–3323 zone is the main barrier to watch.

📊 Based on the 30-minute chart, bullish momentum appears limited:

If the price rebounds in a single leg, it is likely capped around 3318–3324,

→ With an 80%+ probability of a pullback from that zone. A reasonable short-term target would be 3312;

However, if gold builds a double bottom or multiple bottom structure, it may gather more strength,

→ And a broader rebound could reach 3332–3338.

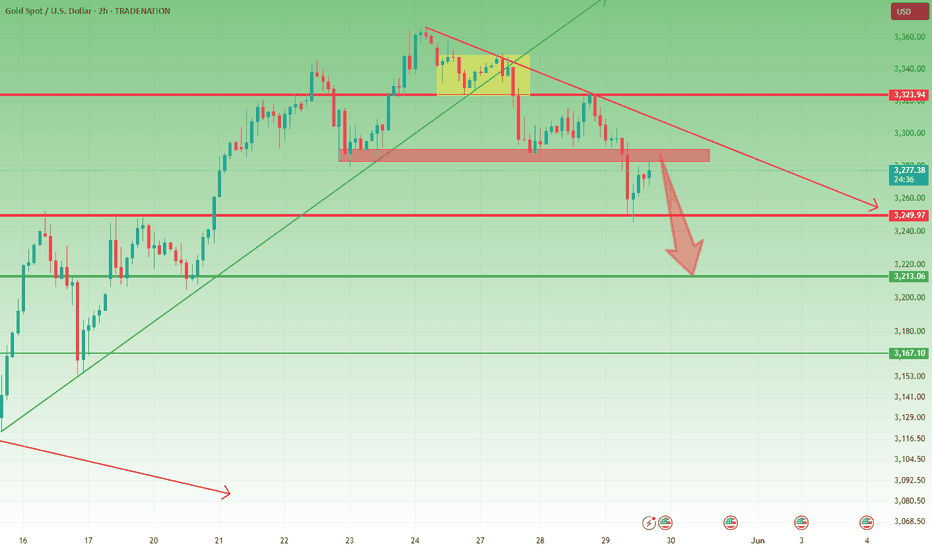

📉 Bearish Structure Repair (2H Chart):

On the 2-hour chart, the previous bearish structure has been mostly corrected by the recent drop;

The next key factor is whether bulls can break above 3320 to confirm a reversal.

🟥 If bulls fail to break 3320 and price drops below 3280, it may open the door for bears to close the gap around 3259.

→ In that case, levels below 3266 will present excellent buy opportunities.

📊 Trading Summary:

Although market volatility has slightly decreased in recent days, there are still plenty of solid trading opportunities, and we continue to profit steadily.

✅ As long as you stick to a proven strategy, strong discipline, and flexible execution, you’ll find that no matter how the market moves, our profit curve will keep climbing.

GOLD:The strategy of going short

Gold was stimulated by the news surface, out of a wave of accelerated decline, and then rebounded slightly into a small shock. Before around 3288 support long ideas have been perfect realization, at present 3288 this support has fallen below, so in the short term we can regard this position as pressure level, short term can be around this position to short mainly.

So the trading strategy :SELL@3288-94 TP@3260-50

↓↓↓ More detailed strategies and trading will be notified here →→→

↓↓↓ Keep updated, come to "get" →→→

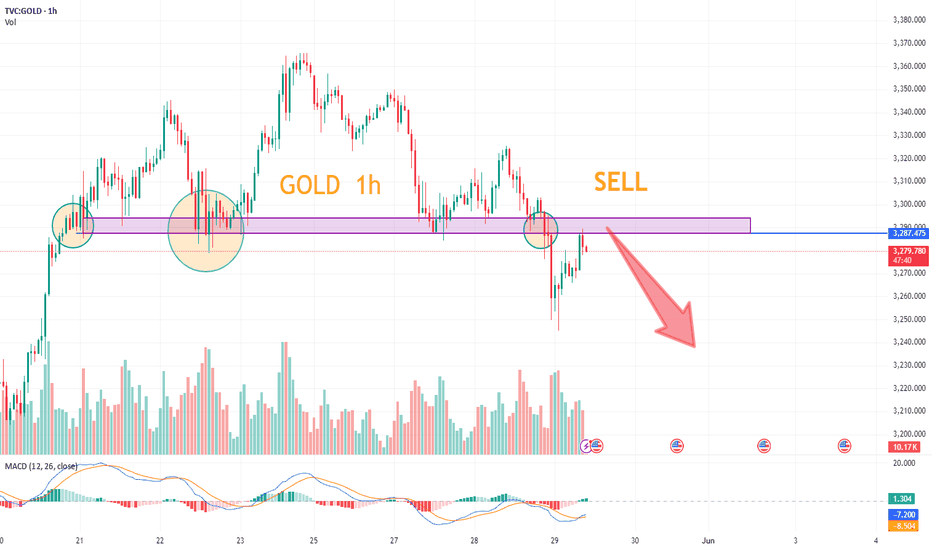

Gold's rebound is weak and the bearish trend is dominant.The 1-hour gold chart shows that the Bollinger Bands open downward, and the gold price is running near the lower track, with a weak short-term trend. If it fails to rebound effectively and break through the 3290 line, the support below will focus on the 3240-3230 area. Overall, the gold price fluctuates downward, the moving average system is in a short position, and the downward pressure is further revealed. It is currently recommended to continue to maintain a high-altitude thinking and focus on short-selling opportunities after the rebound.

In the short-term operation of gold during the day, rebound short-selling is the main focus. Pay attention to the pressure level of the 3290-3280 area above, and the support level of the 3240-3230 area below. In terms of operation strategy, it is recommended to arrange short orders when the gold price rebounds to the 3280-3290 range. This is a key pressure area, and it is necessary to pay attention to the market reaction in this range.

5/29 Gold Analysis and Trading SignalsGood morning everyone!

Yesterday, gold rose first and then declined. Our long positions targeting 3318–3326 were completed successfully, and we timely shifted to short positions, resulting in another round of solid profits.

📉 Technical Outlook:

Gold remains in a bearish trend, and is now very close to the 3275 support level. Based on the current price structure, a break below this level is highly probable.

If $3275 is breached, focus on key support at 3258–3238

Resistance levels to watch: 3298–3318

The daily (1D) chart is currently in an indicator correction phase, so today's trading bias is selling from higher levels

🗞 News Focus:

Watch for U.S. initial jobless claims data today. It may offer short-term support for gold, but is unlikely to reverse the broader bearish trend.

📈 Today’s Trade Plan:

📉 Sell in the 3316–3328 zone (resistance zone)

📈 Buy in the 3245–3232 zone (key support area)

🔁 Scalp/flexible trading levels:

3303 / 3288 / 3276 / 3258 / 3247

Stay adaptive and combine news with price action at key levels for best results.

Wishing everyone a successful and profitable trading day!

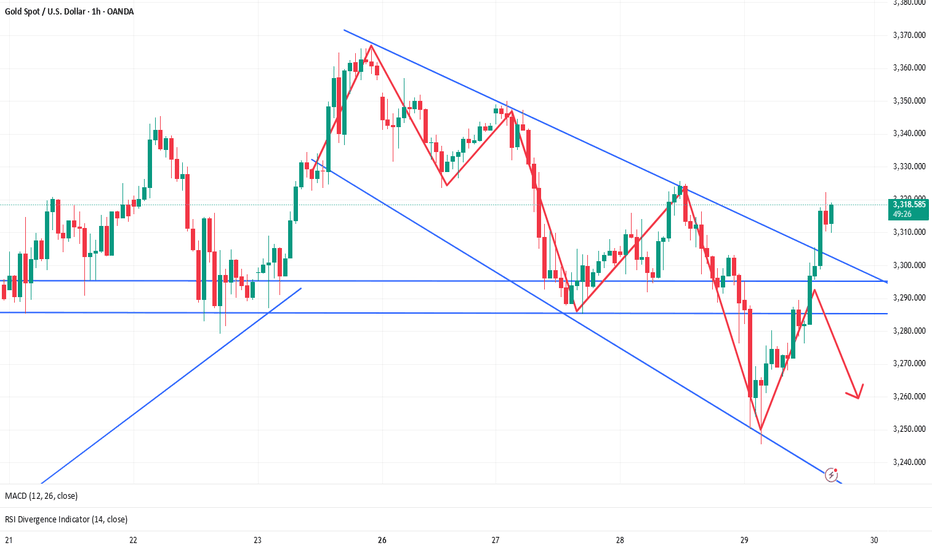

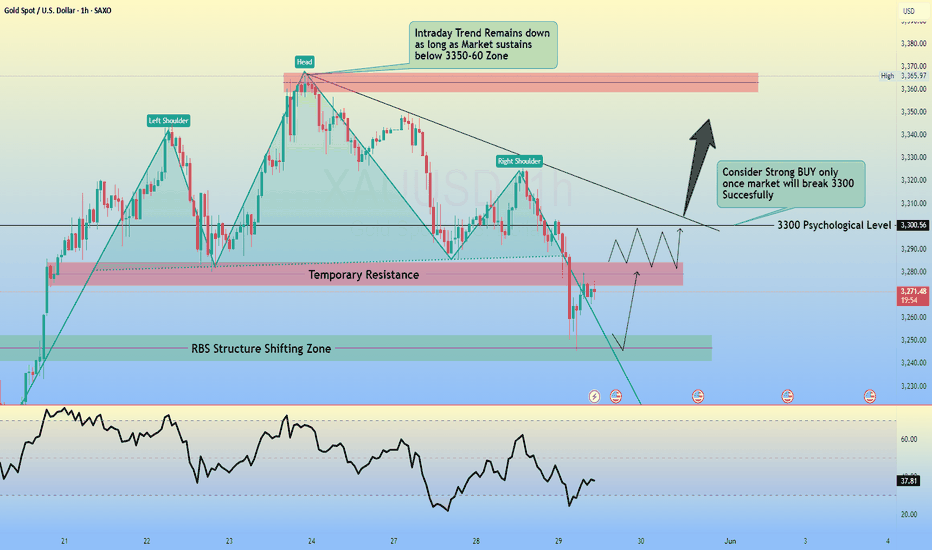

GOLD H1 Intraday Chart Update For 29 May 2025As you can see that there are some strong zones mentioned in chart

Intraday Trend remains down because market sustains below 3300 Psychological level

once market will break 3300 psychological level successfully then move towards 3335

Scalping Range is 3250-3280

if Market breaks 3250 level it will move towards 3200

Disclaimer: Forex is Risky

Gold shocks extreme pull, US market layout🗞News side:

1. Musk issued the "strongest" condemnation of Trump

2. Trump and Netanyahu failed to reach an agreement, and the US-Iran negotiations may be "disrupted" by Israel

📈Technical aspects:

The trading strategy we have given is still valid. The current gold price trend on the hourly chart shows a standard descending flag pattern. If this pattern continues to be effective, there is a high possibility that the gold price will fall below 3285-3280. Once it falls below this range, as we gave in the strategy this morning, it may fall to the 3260-3250 line. However, the premise for this expectation to be established is that the gold price cannot break through and stabilize on the upper track of the consolidation channel, otherwise the descending flag pattern will be invalid. Therefore, for US market operations, short positions can be arranged around the upper rail of 3325, paying attention to the suppression effect; for the lower rail, first pay attention to the support effect of 3300.

sell 3325-3330

TP 3310-3300

buy 3290-3280

TP 3310-3320

If you agree with this view, or have a better idea, please leave a message in the comment area. I look forward to hearing different voices.

FOREXCOM:XAUUSD FXOPEN:XAUUSD TVC:GOLD FX:XAUUSD OANDA:XAUUSD

XAUUSD Idea: Structure, Fibonacci Setup & S&P 500 Correlation📉 XAUUSD Trade Outlook 🧠🔍

Currently analyzing Gold (XAUUSD), and things are getting interesting. On the daily timeframe, we’ve seen a clear bearish break of market structure, and this shift is also evident on the 4-hour chart. 🕰️📉

I’m watching closely for a bullish retracement into my key Fibonacci 61.8% level, where I’ll be looking for confirmation of a bearish structural break to initiate a short position. 🎯🔽

When we compare this setup to the US500 (S&P 500), it becomes even more compelling. The indices have rallied hard and appear overextended — a correction seems likely. 📊🧾

If we do get that pullback in the indices, gold may rally temporarily, but my overall bias remains bearish. If the indices resume their uptrend after a pullback, I expect gold to weaken further, aligning with my current short-side outlook. ⚠️📉

🛑 This is not financial advice. Always do your own analysis and manage risk according to your trading plan.

💬 What are your thoughts on gold right now? Are you leaning bullish or bearish? Let me know in the comments! 👇

Fed Uncertainty and Rejected Trendline ResistanceOANDA:XAUUSD TVC:GOLD Gold trades around $3,270 after rebounding from the $3,240 support zone, but remains capped below the $3,287–$3,290 resistance zone, which now acts as resistance after the breakdown. Technically, the price is struggling under a descending trendline (TL2), and the $3,287 zone also aligns with previous support turned resistance.

Fundamentally, the rejection of Trump's “Liberation Day” tariffs by the U.S. trade court helped ease risk sentiment, reducing safe-haven demand and pressuring gold. At the same time, market focus shifts to today’s U.S. GDP data and Friday’s Core PCE inflation report—both of which may sway Fed expectations and drive short-term volatility.

If XAU/USD fails to break back above $3,287, a renewed test of the $3,240 breakout zone is likely. Sustained downside may open the path to $3,207 or lower. On the upside, reclaiming $3,290 would weaken the bearish bias and challenge the TL2 trendline.

Resistance : $3,287 , $3,302

Support : $3,240, $3,207