5/13 Gold Trading Signals🌞Good afternoon everyone!

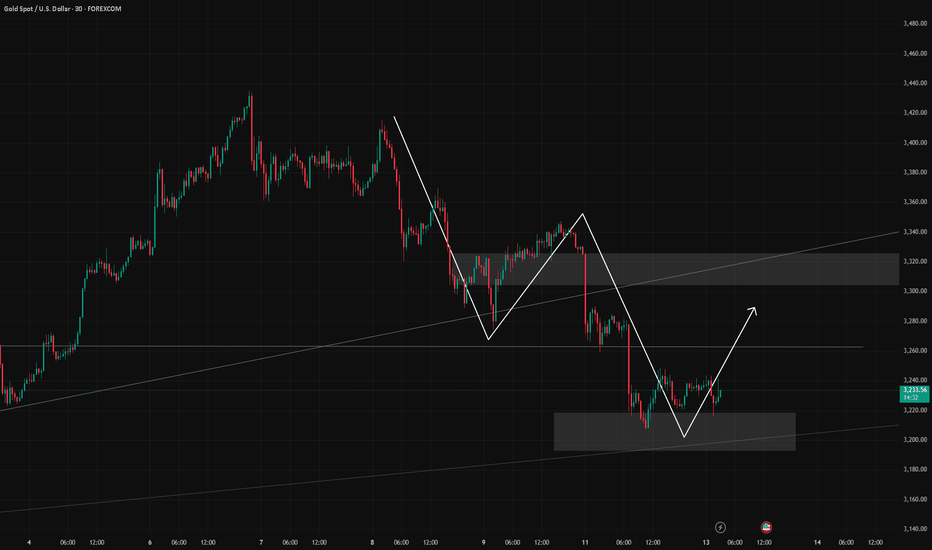

Yesterday, gold successfully entered the 3218–3198 buy zone, delivering notable profits.

So far, the price has tested both the 3218 support and the 3246 resistance multiple times, reflecting a fierce battle between bulls and bears. From a technical perspective, bulls appear slightly favored in the short term, with major resistance located between 3286–3320.

⚠️ However, if gold fails to break through this area and reverses, it may initiate a medium-term downtrend, potentially falling toward the 3169–3110 zone.

📌 Trading Recommendations for Today:

Sell Zone: 3305 – 3330

Buy Zone: 3208 – 3178

Flexible Trading Ranges:

▫️ 3218 – 3252

▫️ 3282 – 3248

▫️ 3252 – 3303

Xauusdsignal

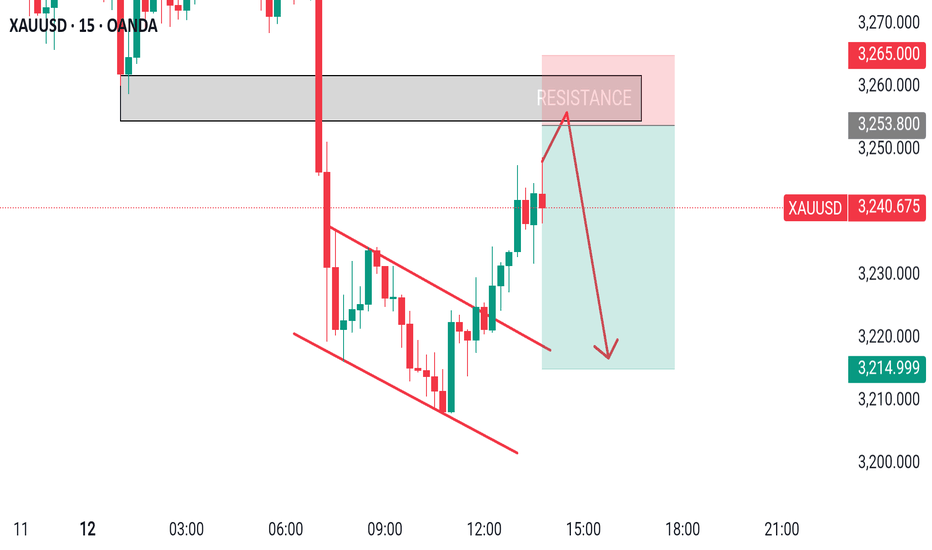

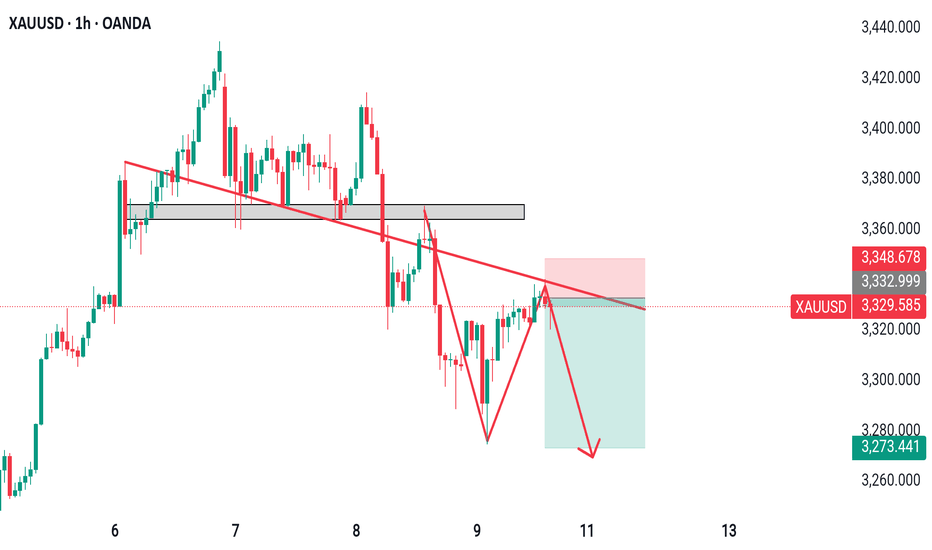

XAUUSD IS RECOMMENDED TO BE SOLDHere I Created This XAUUSD Chart Analysis

Pair : XAUUSD (Gold)

Timeframe: 15 - Minutes

Pattern: Resistance Level

Momentum: Bearish/ SELL

Entry Level : SELL 3247

Resistance zone : 3254

Target Will Be : 3220

Disclaimer : This signal is based on personal analysis for learning purposes. Trade at your own risk and always use proper risk management.

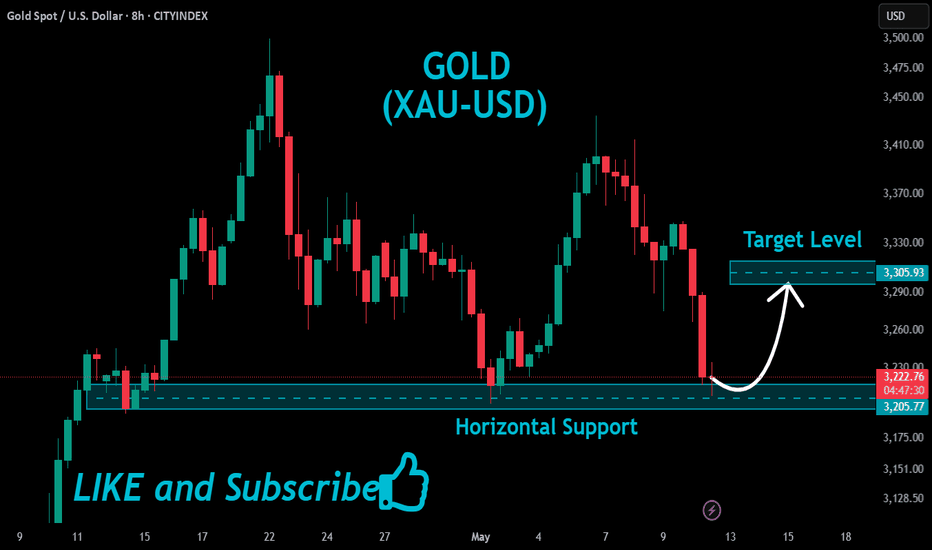

Gold is trading sideways, can the bearish trend continue?🗞News side:

1. China-US trade relations eased, suspending some tariffs and countermeasures

2. Russia and Ukraine suspended firing for 30 days, and the India-Pakistan conflict was temporarily mediated

📈Technical aspects:

The trading strategy given today, if brothers have reference and follow the trading strategy to participate in long orders, I think you should all have good gains on hand. At present, gold is in consolidation, the 4H moving average is in a short position, and the MACD dead cross continues to increase, so the short-term short momentum still exists. From a technical point of view, in the downward trend from last week's high of 3347 to the current low of 3207, 3260 is at a key position. Therefore, we pay attention to the possibility of gold rebounding to 3260 in the evening.

If you agree with this view, or have a better idea, please leave a message in the comment area. I look forward to hearing different voices.

OANDA:XAUUSD FX:XAUUSD TVC:GOLD FXOPEN:XAUUSD FOREXCOM:XAUUSD

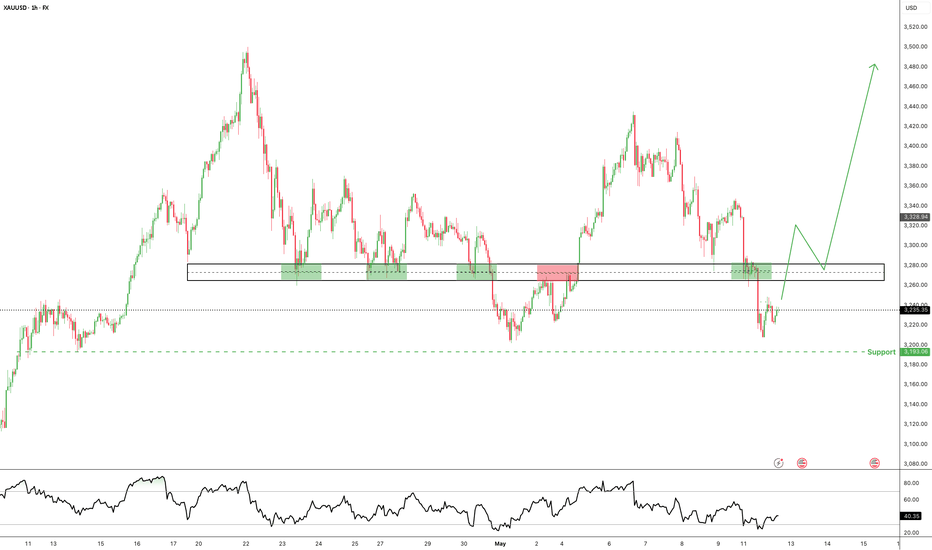

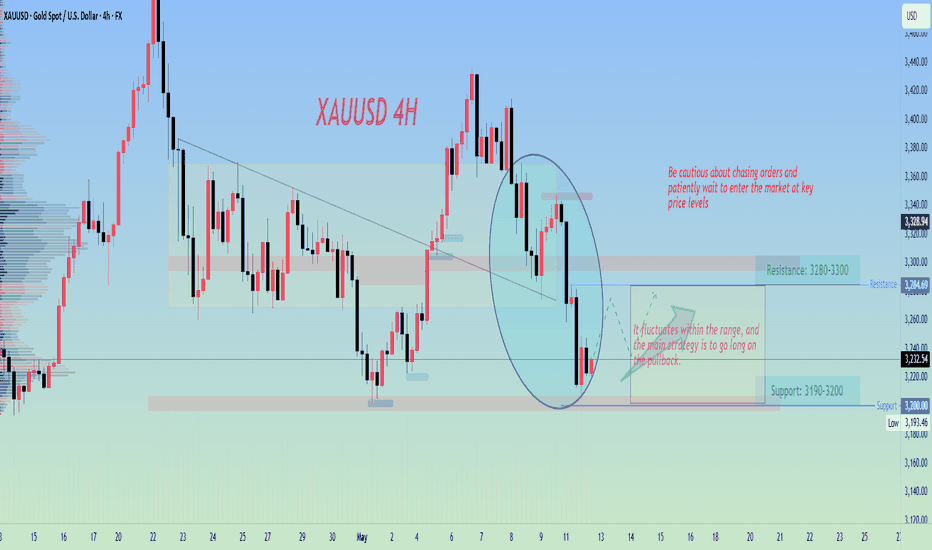

Today, gold fluctuated at a low level after its declineAfter the opening gap down to around 3275 on Monday, it rebounded to around 3292 at its highest and then started the downward trend. By the afternoon of Monday, gold touched around 3207 at its lowest and then fluctuated upwards. Yesterday's analysis was largely in line with the market trend. Through the observation and judgment of the market, with the strategy of combining long and short positions, the entry timing was quite good, and the trading results were also satisfactory. 👉👉👉

Judging from the current trend of gold, pay attention to the support level of 3215-3220 below. Focus on the support at the level of 3200. Regarding the resistance above, pay attention to the short-term suppression at the level of 3270-3280, and the strong resistance is around the 3300 mark.

In terms of operation, the main strategy is to go long on the pullback. At intermediate positions, it is advisable to observe more and trade less. Be cautious about chasing orders and patiently wait to enter the market at key price levels.

XAUUSD trading strategy

buy @ 3215-3220

sl 3200

tp 3230-3240

If you approve of my analysis, you can give it a thumbs-up as support. If you have different opinions, you can leave your thoughts in the comments.Thank you!👉👉👉

XAUUSD May 12 New York real-time trading strategy analysis.The normal plan is to trade in a unilateral falling market. However, Russia's negotiation agreement with Ukraine has not stopped. While the cashing sentiment has risen, the tax issues between the United States and China have declined. This is why the New York market continued to rebound to 3247 and then fell back to 3220.

If the price of the New York market cannot continue to break through the position of 3233 and stabilize. Then the price will continue to fall. The target is below 3190. There may be support at 3200, but it will not be too strong. But if the position of 3233 stabilizes and breaks through above 3348 again. Then we need to pay attention to the position of 3360-3375 again.

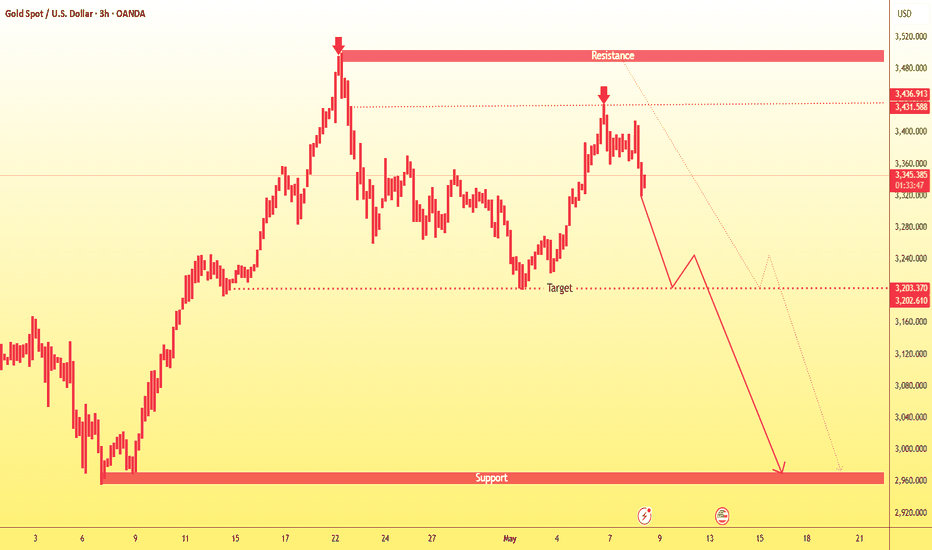

XAUUSD DOUBLE TOP BEARISH PATTERNKey Factors to Consider:

Breakout Confirmation – If price decisively breaks below the neckline of the double top, it strengthens the bearish outlook.

Volume Analysis – A surge in selling volume at resistance or during the breakdown can validate the pattern.

Momentum Indicators – RSI, MACD, and Stochastic Oscillator can help confirm bearish momentum.

Support Levels – Watch for intermediate support zones that could slow down the decline before reaching 3203.

Resistance: 3500

Target: 3203

On May 9, the London market XAUUSD real-time trading strategyXAUUSD's huge drop hit 3274. From the side news, there is no huge potential impact. Because almost all important data are updated. From the larger level of K-line cycle, the top structure appears, which is why I remind everyone to continue to sell.

In the trading process, it is very important to switch from long to short. Often some traders always suffer huge losses in their accounts due to misjudgment. This week, under my accurate prediction, the market trend is exactly the same as I expected.

Summary: There is no major news affecting the current situation. And it is the last trading day of this week. For XAUUSD, maintaining high selling is the current trading direction. There are signs of returning to the weekly opening price at the daily level. Observe whether the pressure range of 3330-3340 can stabilize during the day. If not, we can focus on the lower profit range. 3260-3220.

To prevent missing out on some good trading strategies and ideas, remember to continue to pay attention to the ideas of the swing trading center. If you want to get more and more accurate signals, you can leave me a message.

XAUUSD New York market trading strategy.The Russian-Ukrainian war sentiment has once again ignited the market's risk aversion sentiment. After the New York market opened, the US stock market opened higher, causing XAUUSD to fall to around 3200 and then rebound. After the New York market opened, XAUUSD continued to rise to 3248.

After the weekend news continued to be digested in the Asian market and the London market, the New York market once again boosted XAUUSD due to geopolitical news.

At present, we are paying attention to whether the position of 3255-3272 can be effectively broken through and stabilized. If it cannot continue to sell at a high level.

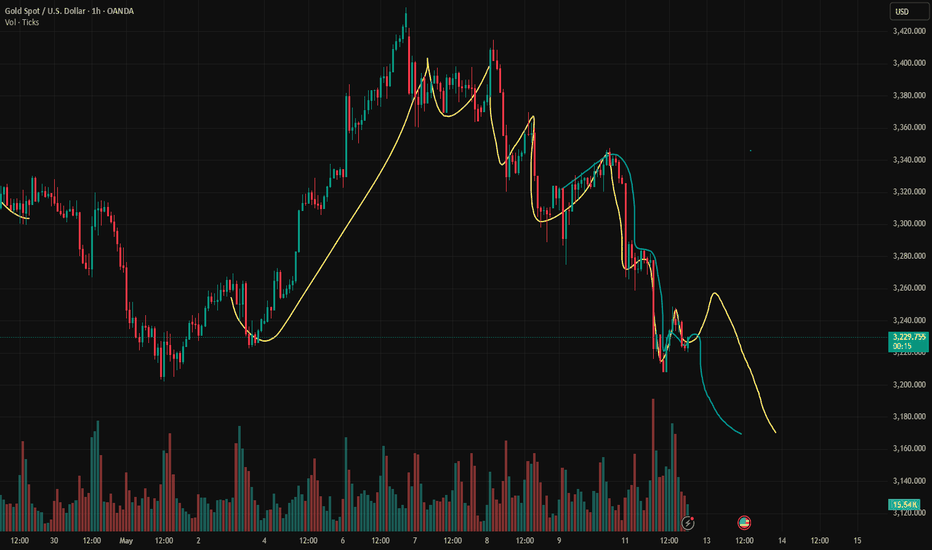

Gold plunged. Will it rebound?Market Summary:

Gold prices suddenly saw a new round of selling in Asian markets on Monday, and the price of gold just fell to $3,210/ounce, reaching today's low, a drop of nearly $110.

Gold prices weakened at the beginning of the new week as the latest optimism about the US-China trade agreement continued to weaken demand for traditional safe-haven assets.

At the same time, positive signals from the US-China negotiations eased market concerns about a US recession. This, coupled with the Fed's hawkish comments, helped the dollar stabilize near multi-week highs and put pressure on gold. The gold price trend seems quite fragile. Gold prices fell and broke below the main bullish trend line in the short term, which sent a bearish signal, indicating that the trend may change.

I think the US-China trade agreement will have an impact on gold prices for a period of time.

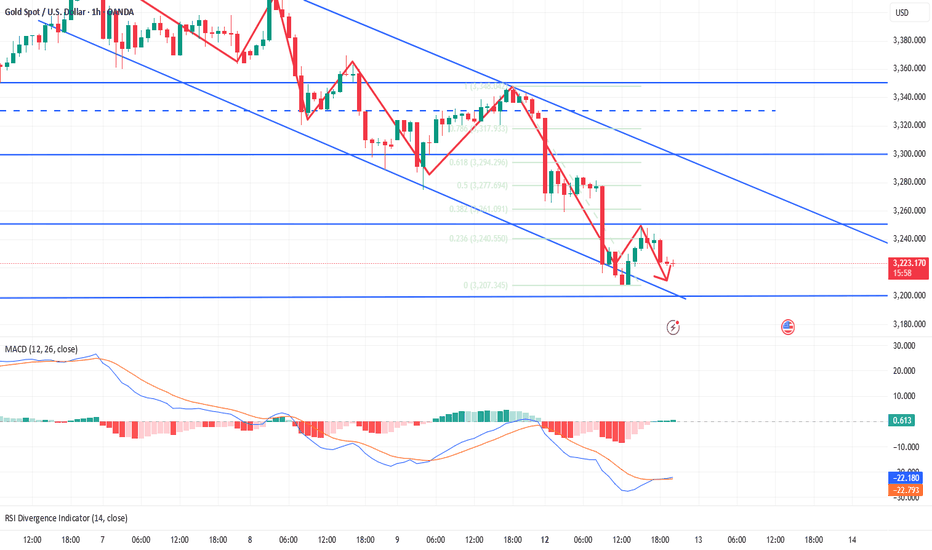

Technical Analysis:

Gold's 4-hour level oscillation downward trend is relatively obvious, and the shape is a step downward. After the gold gapped down, there was a large gap. The gold rebound was unable to continue to fall. It is not easy to cover it in the short term. It will be covered in the process of the market. On the whole, for the short-term operation of gold today, Quide suggested that the rebound should be shorted as the main strategy, and the retracement should be long as the auxiliary strategy. The short-term trading should focus on the upward resistance of 3240-3250 US dollars, and the downward resistance should focus on the support position of 3200-3190 US dollars.

Today's operation strategy:

Operation strategy 1: Short the price when it rebounds to around 3245 US dollars, stop loss at 3260 US dollars, and take profit near 3210.

Operation strategy 2: Long the price when it falls back to 3210 US dollars, stop loss at 3200 US dollars, and take profit near 3240.

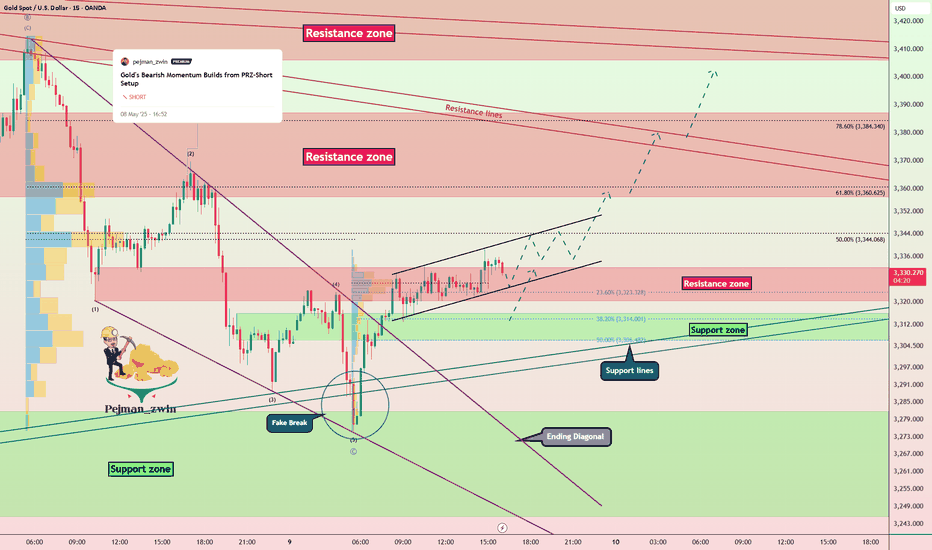

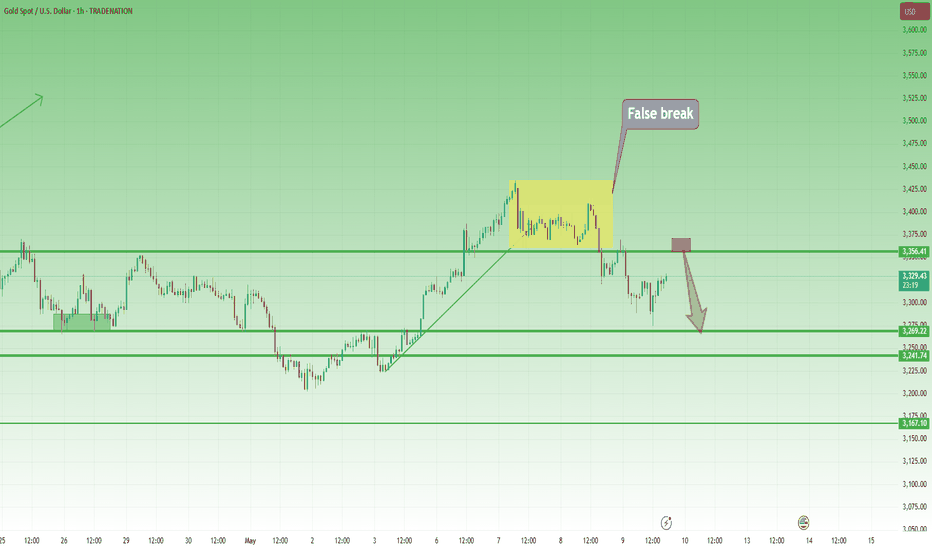

Gold Bounces After Fake Break — More Upside AheadGold ( OANDA:XAUUSD ) fell to the Support zone($3,280-$3,240) as I posted yesterday ( Full Target) .

Gold started to rise again after making a Fake Break below the Support lines .

Gold is trading above the Resistance zone($3,330-$3,320) .

In terms of Elliott Wave theory , it seems that Bitcoin completed the main wave C with the help of the Ending Diagonal .

Educational note : The Ending Diagonal in Classic Technical Analysis is the Falling Wedge Pattern .

I expect Gold to resume its bullish trend, at least for the short term , and to at least $3,356 .

Note: If Gold breaks the Support lines with high volume, we can expect further declines.

Note: Worst Stop Loss(SL) = $3,031

Gold Analyze ( XAUUSD ), 15-minute time frame.

Be sure to follow the updated ideas.

Do not forget to put a Stop loss for your positions (For every position you want to open).

Please follow your strategy; this is just my idea, and I will gladly see your ideas in this post.

Please do not forget the ✅' like '✅ button 🙏😊 & Share it with your friends; thanks, and Trade safe.

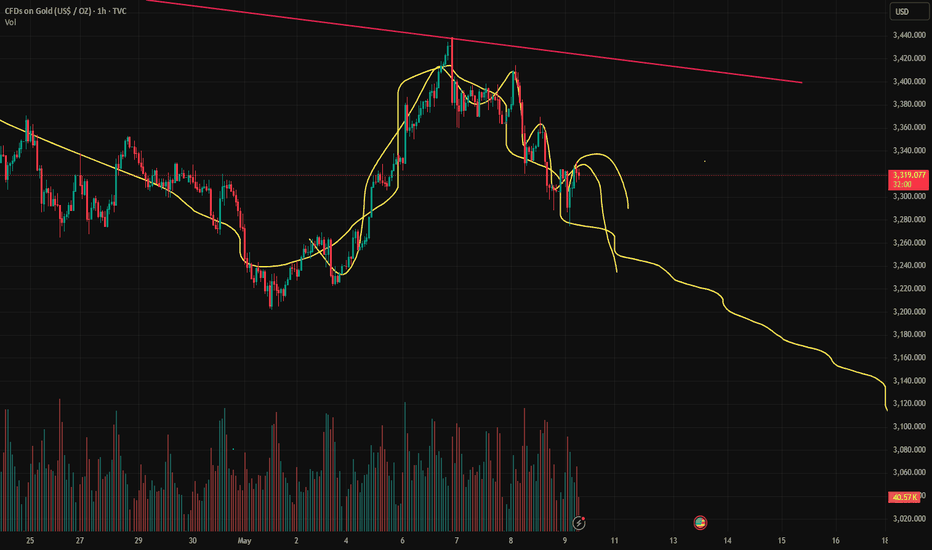

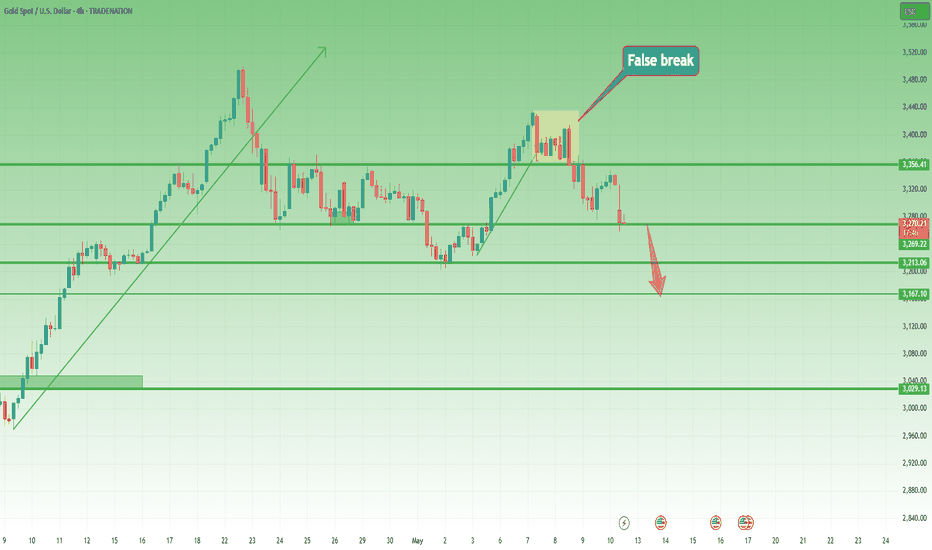

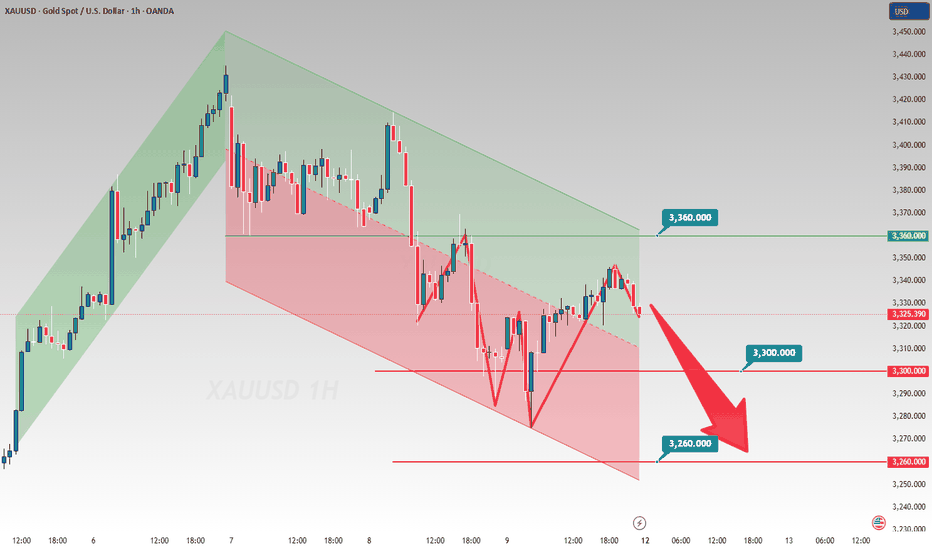

Gold Bears Aim for 3200 – Selling Rallies Remains the PlayIn my Friday analysis, I highlighted the potential for Gold to retest the 3270 support zone, and indeed, the Asian session and the opening of the new trading week confirmed this move, pushing Gold down to a low of 3255.

The overall chart structure remains strongly bearish following the false breakout above the 3370 resistance and the spike above 3400. This suggests that sellers are firmly in control, with a high probability of further downside.

I expect a break below 3270 support in the coming sessions, targeting the 3200 zone as the next major level for bears.

For now, the strategy remains clear:

Sell rallies as long as 3350 resistance remains intact. 🚀

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analyses and educational articles.

XAUUSD TAKE RESISTANCE FROM TRADE LINEHere I Created This XAUUSD Chart Analysis

Pair : XAUUSD (Gold)

Timeframe: 1- Hour

Pattern: Resistance Level

Momentum: Bearish/ SELL

Entry Level : SELL 3327

Resistance zone : 3335

Target Will Be : 3300 / 3272

Disclaimer : This signal is based on personal analysis for learning purposes. Trade at your own risk and always use proper risk management.

Could India-Pak ceasefire & China-US talks trigger gold's declinNews

From May 5th to 9th, trade tensions and geopolitical conflicts have driven the gold market to rise 📈. The spot gold price has once broken through 3,438. As the bullish momentum has waned, investors have taken profits at high levels, and the weekly increase has narrowed to about 3.1%. Trump's remarks on tariffs, uncertainties in trade negotiations, the conflict between Russia and Ukraine, and the military standoff between India and Pakistan have stimulated the demand for safe-haven assets, pushing up the gold price 💹. Technical indicators show that the short-term correction pressure has increased, and the market may enter a phase of volatile consolidation 🤔.

Gold Trend

At the beginning of this week, influenced by the safe-haven property of gold, its price has increased. However, this tariff news has less of an impact on the gold price than before, and the upward trend has stopped at 3,439. After the Federal Reserve maintained its interest rate policy unchanged, the gold price has declined for two consecutive days 📉, and yesterday's closing price was above 3,300.

Looking ahead, with the ceasefire of the conflict between India and Pakistan and the advancement of the China-US talks, the gold price is likely to drop significantly next week ⬇️. The ceasefire between India and Pakistan has alleviated the geopolitical tensions, weakening the driving force for gold to rise as a safe-haven asset. If the China-US talks achieve positive results, the market's risk appetite will increase, and investors are likely to shift their funds from gold to risky assets such as stocks. In the past, when there has been progress in trade negotiations, the gold price has dropped significantly. Overall, there is an obvious downward trend for the gold price next week 😟.

⚡️⚡️⚡️ XAUUSD ⚡️⚡️⚡️

🚀 Sell@3330

🚀 TP 3280 - 3260

Accurate signals are updated every day 📈 If you encounter any problems during trading, these signals can serve as your reliable guide 🧭 Feel free to refer to them! I sincerely hope they'll be of great help to you 🌟 👇

Gold Bears Back in Control – Targeting 3270 AgainIn my analysis yesterday, I noted that after the false break above 3370 resistance, there was a high likelihood of a reversal, potentially driving Gold back down to the 3270 support zone.

Market Reaction:

• As expected, Gold turned lower after retesting the broken 3370 support, now acting as resistance.

• The price dropped nearly 1000 pips, which has become the new norm for daily Gold fluctuations lately.

W hat’s Next?

• With the current rebound, the 3370 zone should once again act as a barrier.

• The strategy remains to sell rallies, targeting a fresh test of the 3270 support zone.

Until this support is broken, expect very volatile moves, but the broader trend remains bearish

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analyses and educational articles.

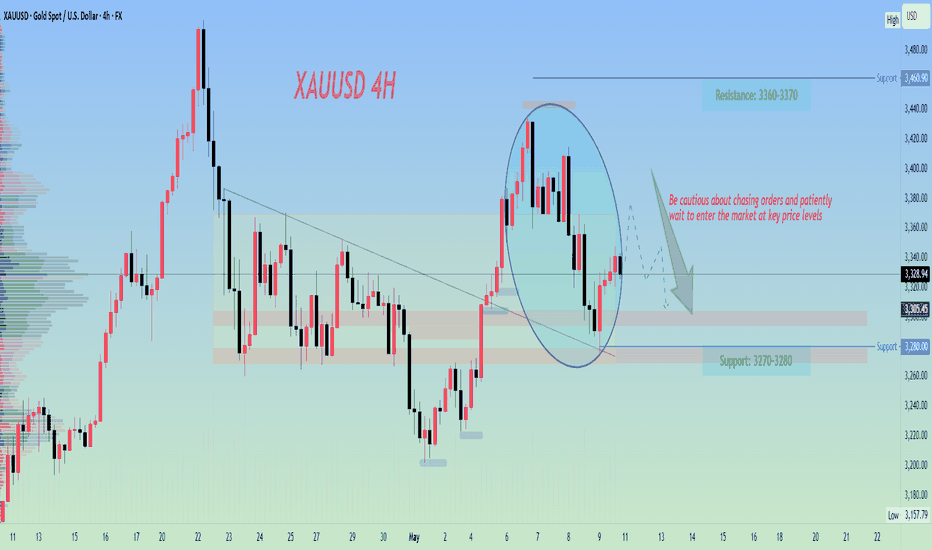

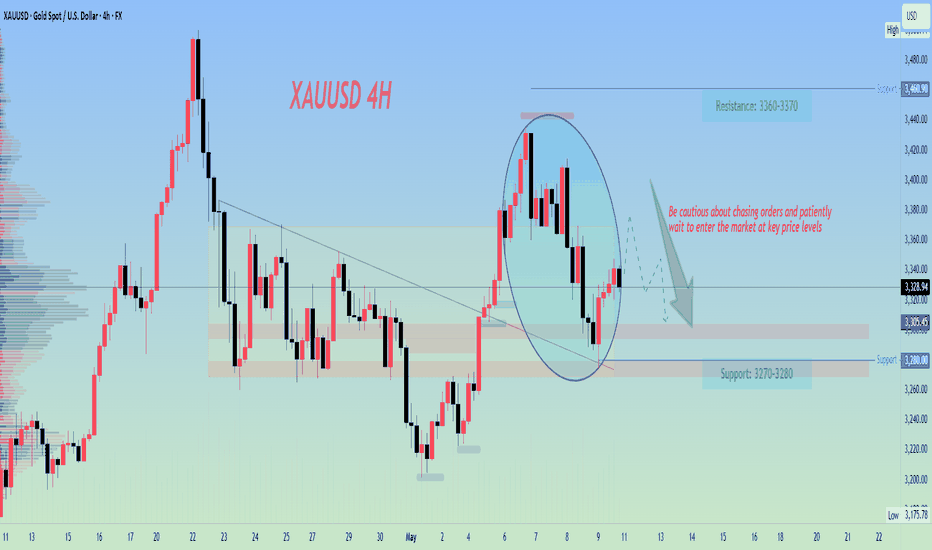

Strategic Analysis of Gold for Next WeekFrom the analysis of the 4-hour chart, the support level is around 3,270-3,280. The short-term resistance is at 3,360-3,370. In the daily chart, maintain the trading rhythm of shorting at highs and longing at lows. 👉👉👉

In terms of operation, the main strategy is to go long on the pullback. At intermediate positions, it is advisable to observe more and trade less. Be cautious about chasing orders and patiently wait to enter the market at key price levels.

XAUUSD trading strategy

buy @ 3305-3315

sl 3295

tp 3330-3340

If you approve of my analysis, you can give it a thumbs-up as support. If you have different opinions, you can leave your thoughts in the comments.Thank you!👉👉👉

Market Summary of Gold Last WeekAt the beginning of this week, the gold market has demonstrated strong upward momentum. The spot gold price has rapidly risen from around $3,314 at the start of the week. Boosted by risk aversion sentiment, it has advanced all the way and reached a peak of $3,438, precisely testing the resistance level of the upper band of the daily Bollinger Bands. This price has also refreshed the recent high record.👉👉👉

However, the good situation didn't last long, and the market situation took a sharp turn for the worse in the middle of the week. Due to the excessive increase in the early stage, a large amount of profit-taking from long positions poured out. Coupled with the concentrated release of the demand for a technical pullback, the gold price failed to hold firm at the high level and instead fell rapidly. By the close of trading on Friday, spot gold closed at $3,327.25, experiencing a significant decline compared to the intraday high, indicating that the intensity of the short-term battle between bulls and bears has further intensified.

If you approve of my analysis, you can give it a thumbs-up as support. If you have different opinions, you can leave your thoughts in the comments.Thank you!👉👉👉

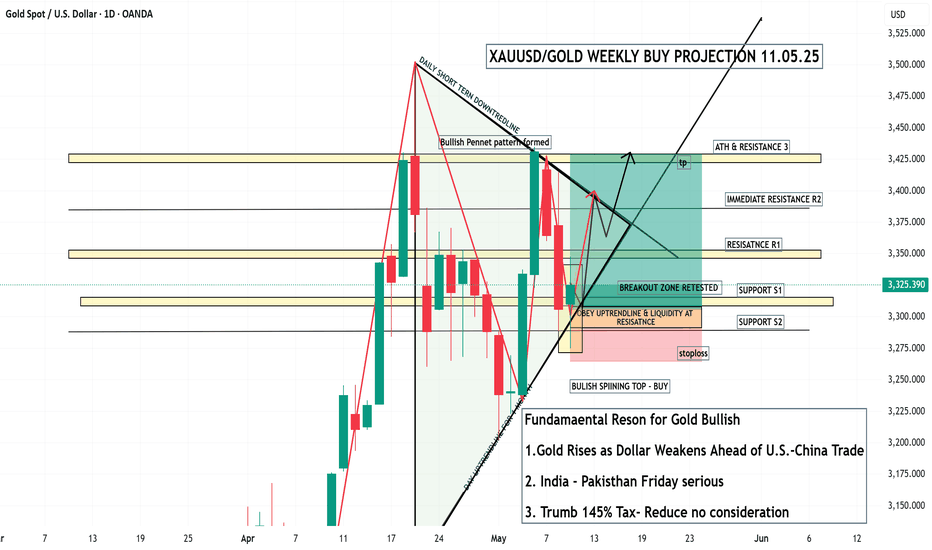

XAUUSD/GOLD WEEKLY BUY PROJECTION 11.05.25Pattern: A bullish pennant pattern has formed, signaling a potential upward continuation.

Breakout Confirmation: Price has broken the daily short-term downtrend line and is retesting the breakout zone, which suggests potential for a strong upward move.

Support & Resistance Zones:

Support Levels: S1 (≈ 3325), S2 (~3270)

Resistance Levels: R1 (~3350), R2 (~3375), ATH & Resistance 3 (~3425)

Entry Zone: Price is in a buy zone, reinforced by a bullish spinning top candlestick and alignment with an uptrend line.

Stop Loss: Placed just below Support S2 (~3270)

Take Profit (tp): Near ATH zone (~3425)

Gold waiting for TomorrowThe sell signal was issued on the last candle when the red zone broke down. But I don't know how it will react to the green support zone in a short distance.

If I insist on trading, I will enter a short sell trade at the opening of the next candle with a short stop loss above the red zone and I will be alert to the price reaction to the green zone.

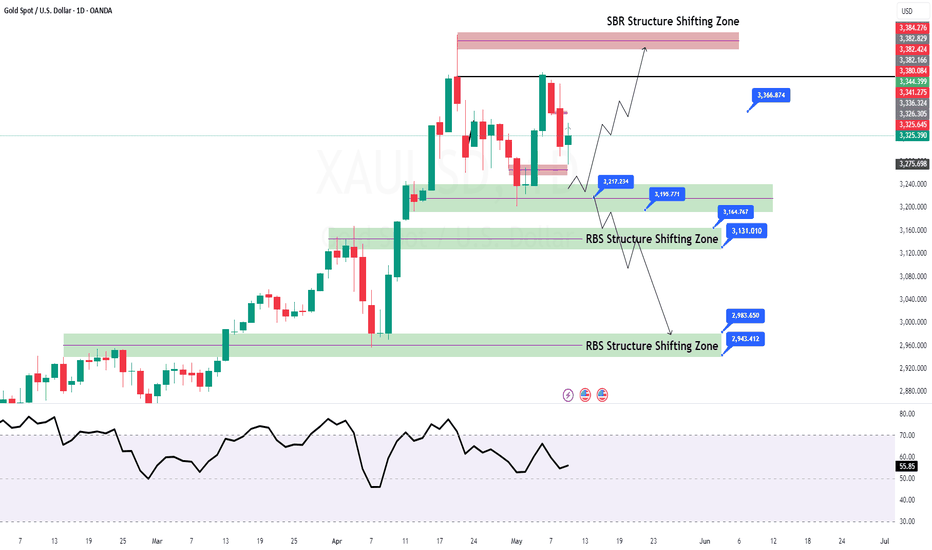

GOLD D1 Chart Analysis Update for 12 - 16 May 25 Hello everyone,

As you can see some levels mentioned in GOLD Chart for upcoming main focus in GOLD For Longer Term Buying 3000 - 3200 is good buying zone for longer term

however you can still follow-up time to time for 1 candle retracement zone on D1

3400 level remains crucial for now

Main events for the upcoming week US CPI & US PPI

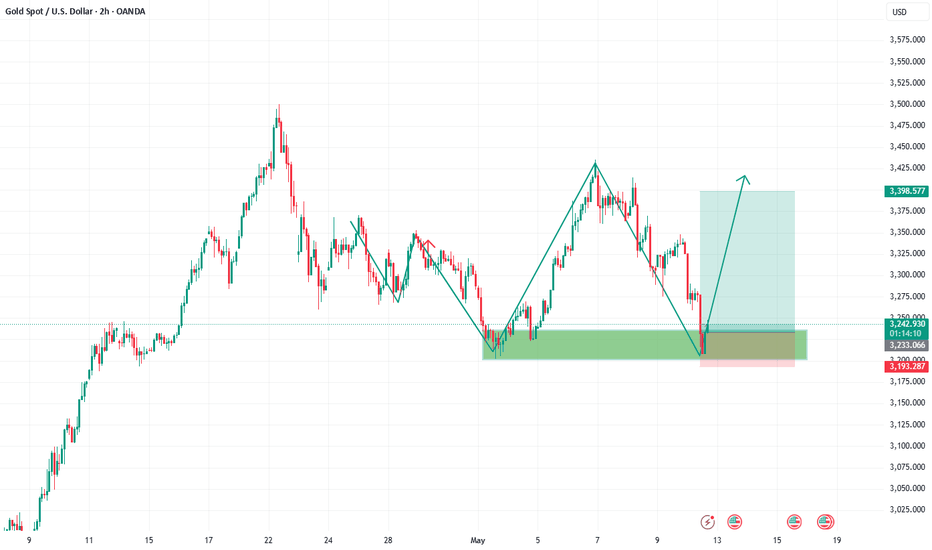

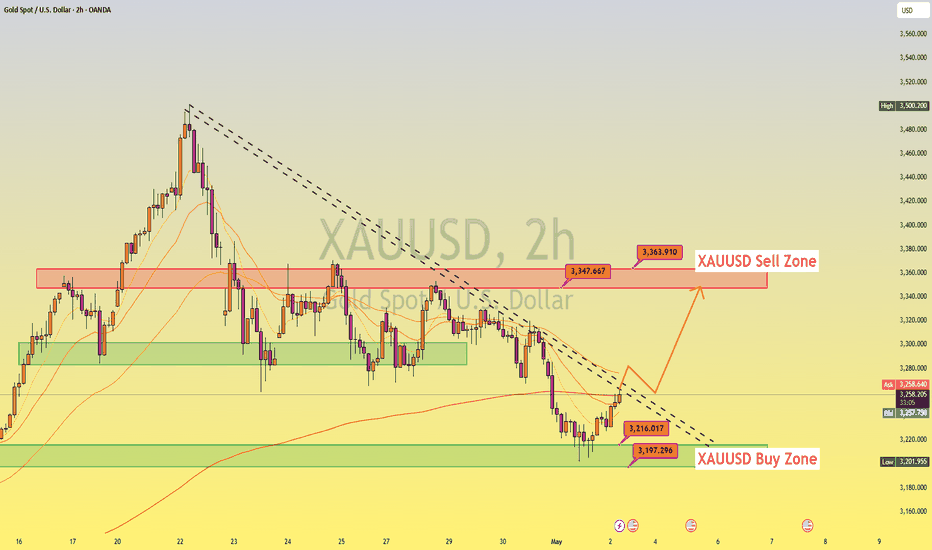

XAUUSD Gold Trade Setup – Buy & Sell Zones | 2H Chart AnalysisThis XAUUSD (Gold vs USD) 2-hour chart analysis outlines a short-term swing trading plan using key supply and demand zones. Price has reacted from the Buy Zone (3197–3216) and is showing signs of bullish reversal. The target is the Sell Zone (3347–3363).

✅ Trade Plan:

🔽 Buy Entry:

Zone: 3,197 – 3,216 USD

Trigger: Bullish candle breakout above the falling trendline

Confirmation: Retest of breakout with bullish price action

🎯 Targets:

TP1: 3,302 (mid-range level)

TP2: 3,347 (Sell Zone bottom)

TP3: 3,363 (Sell Zone top)

🛑 Stop Loss:

Below 3,190 or latest swing low

🔼 Sell Setup (optional):

Zone: 3,347 – 3,363 USD

Look for bearish reversal patterns (e.g., bearish engulfing, double top)

Target retrace back to 3,302 or 3,260 area