Gold is strong. Can it continue?On Tuesday, the overall gold price showed an upward trend. The highest price rose to 3433.32 on the day, and the lowest price fell to 3383.21, closing at 3431.46. On Tuesday, gold prices fluctuated during the early trading session and then corrected downward. During the European session, the price fluctuated mainly and fell weakly. It rose before the US session and hit the high point of the week again in the US session, and finally ended with a big positive line.

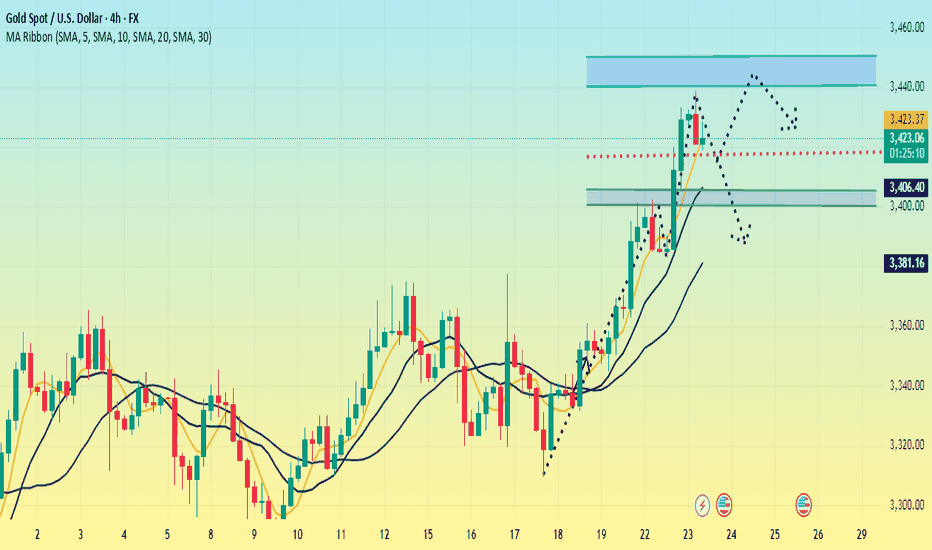

From the four-hour level, the technical adjustment needs, but the speculation of risk aversion suppressed this demand. There is a contradiction between the fundamentals and the technical aspects, and it is necessary to wait for the market sentiment to stabilize before clarifying the direction.

In the early Asian session, it hit a high of 3438 and then fell back. It is necessary to pay attention to the possibility of reaching the top. The support position is 3400-3405. If it falls to 3400, it may continue to adjust to around 3385. The probability of closing the negative line today is relatively high. If the price stabilizes above 3400, it is likely to maintain high fluctuations.

Today's market is complicated. Although the bullish trend has not changed, it is not advisable to be overly bullish. The operation is mainly shorting on rebounds, supplemented by long positions on pullbacks. The upper pressure position focuses on 3440-3450.

Operation strategy:

Short near 3440-3450, stop loss 3460, profit range 3420-3410.

Long near 3390, stop loss 3380, profit range 3420-3430.

Xauusdsignal

Gold stabilizes. Sets a new high?Gold continues to rise, with uncertainty in trade negotiations and the outcome of the Federal Reserve meeting being key variables. If no agreement is reached before August 1, the high tariffs imposed by the United States on major trading partners may trigger greater risk aversion demand, pushing gold prices further up; if the negotiations make a breakthrough, the market risk appetite will rebound, and gold prices may face correction pressure.

Gold has shown a strong upward trend recently. It closed with a small positive on Friday last week and closed with positive for two consecutive trading days this week, forming a three-day positive trend, with strong short-term momentum. In terms of indicators, the moving average diverges upward, with obvious bullish trend characteristics, and the support below needs to focus on the moving average performance. At present, the gold price has broken through the trend line formed by connecting the previous high points. The primary focus on the upside is near the previous high of 3452, which is an important short-term resistance level. The upper focus is on the previous high of 3452, which is an important short-term resistance level.

The first support below is the 3390-3385 area, which is close to yesterday's low and is also an early trading intensive area. The second support focuses on the vicinity of 3360.

In terms of operation, it is still mainly low-long, and short selling is not considered before the upward trend reaches 3450.

Operation strategy:

Short around 3450, stop loss 3460, profit range 3430-3310

Long around 3400, stop loss 3390, profit range 3420-3430

Gold Update – Strong Breaks, Strong BullsYesterday, after the break of the key 3370 resistance, Gold corrected slightly toward 3383, then consolidated briefly in that area. From there, it launched into a strong new leg up, closing the day once more near the highs, around 3430.

📌 What’s important here is that the price did not even come back to retest the broken resistance — now turned support. Combined with the strong daily close near the high of the range, this gives us a clear message:

➡️ Bulls are in full control.

________________________________________

🔍 This Week – Three Key Breaks

So far this week, Gold has delivered three major breakouts:

• ✅ A clean breakout from the box consolidation that kept price stuck and indecisive last week

• ✅ A decisive break above the 3400 psychological figure

• ✅ A breakout above the symmetrical triangle resistance, which had been forming since late April

Each of these is significant on its own. Together, they suggest a shift toward a more aggressive bullish scenario.

________________________________________

🔮 What’s Next?

All these breakouts point to the potential for more gains ahead.

In fact, the next logical step could be an attempt to mark a new All-Time High.

My view remains the same:

Buying dips remains the strategy of choice, with a focus on the 3400 zone as a key support area, and a swing target around 3500.

Disclosure: I am part of TradeNation's Influencer program and receive a monthly fee for using their TradingView charts in my analyses and educational articles.

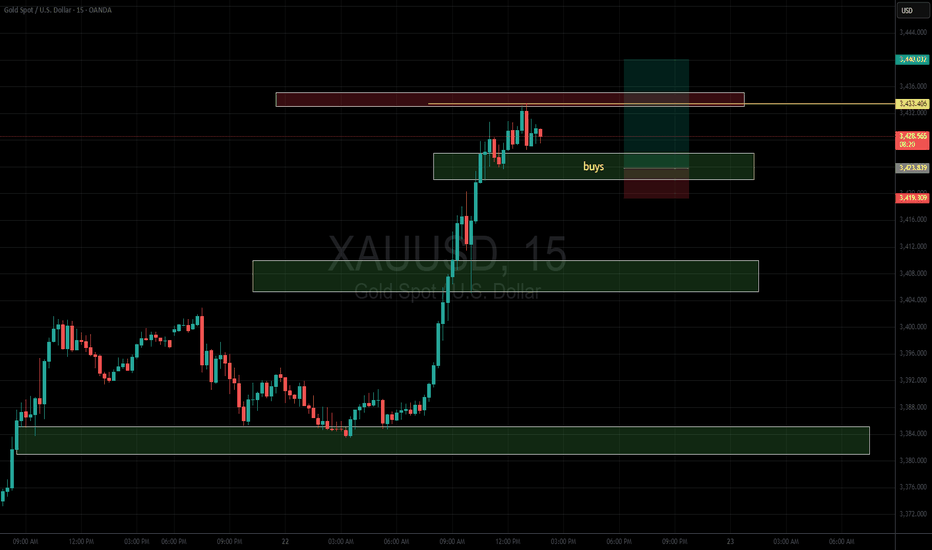

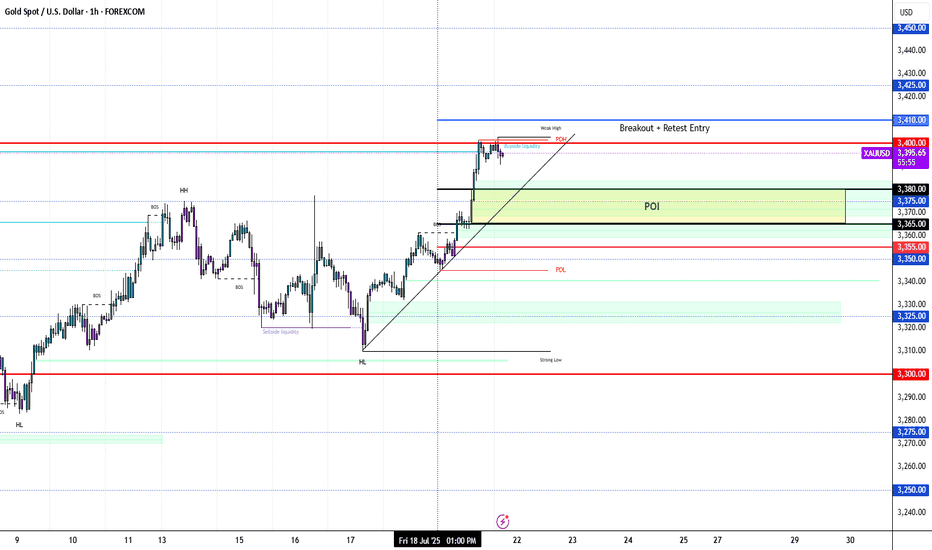

GOLD: Price Made A New HHLooking to buy gold, market structure is bullish on the H1 and H4. I went over 2 different scenarios in the video...

1. Pullback Entry (Preferred)

🟢Entry Zone: 3365–3380

TP1: 3432

TP2: 3450

TP3: 3475–3500 (extended target if momentum holds)

2. Breakout Buy (Aggressive)

Trigger: M15 breaks and closes above 3405–3410 with strong displacement.

Entry: Retest of breakout zone at 3402–3405

Same Targets

Don't forget to set those price alerts!

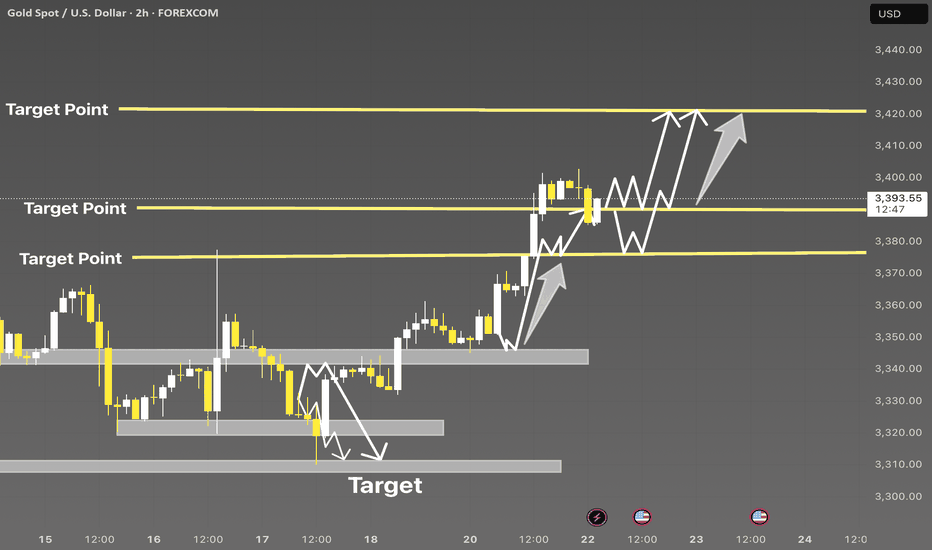

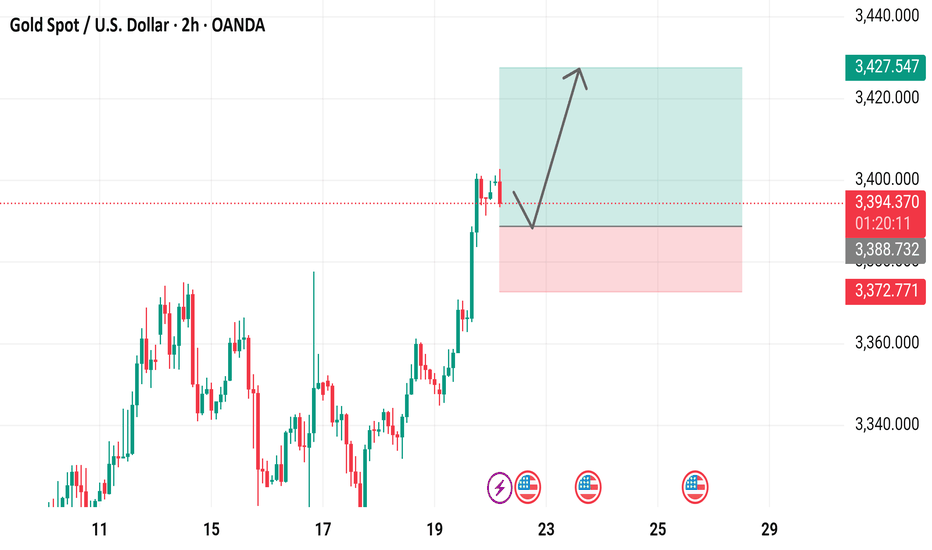

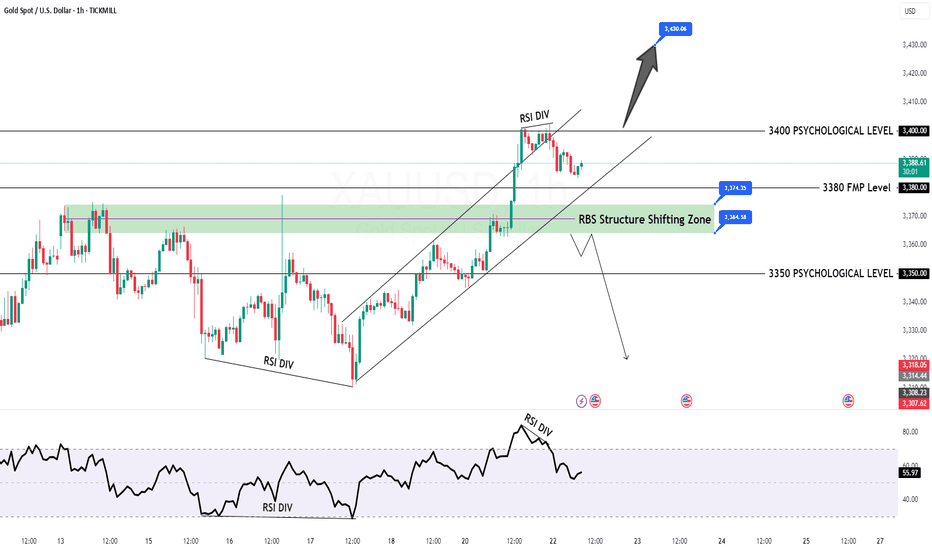

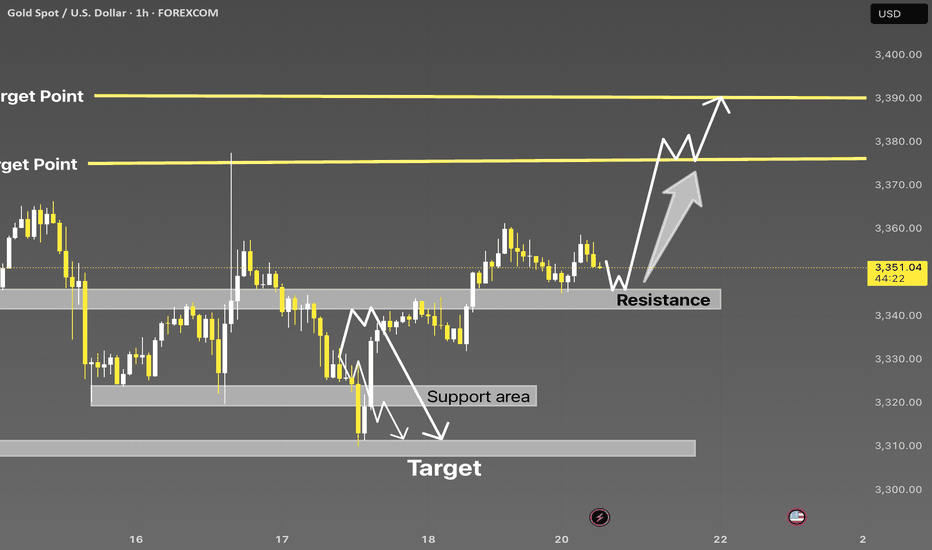

XAUUSD Breakout Structure | Smart Money Bullish Roadmap 🚨 XAUUSD 2H | Smart Money Concept Setup

Price perfectly tapped into demand zone and showed a strong bullish reaction — now forming a clear BOS (Break of Structure).

📍 Key Liquidity Zones:

• Price swept previous lows and is now targeting major liquidity levels marked as “Target Points.”

• Bullish momentum is expected to push price towards 3410 – 3425 range 📈

🔁 Expect possible consolidation before a continuation to upper targets.

💡 Strategy:

Wait for a minor pullback near the 3380–3390 level for confirmation, then ride the momentum to higher targets.

🎯 Target Levels:

1. 3398 ✅

2. 3410 🚀

3. 3425+ (Final Target)

📌 Like, Follow & Save if you caught this early 📊

#XAUUSD #SMC #LiquidityGrab #GoldSetup #TradingViewIdea #SmartMoney #Breakout

Bulls are still the main theme, 3400 is not the high point📰 News information:

1. Fed Chairman Powell delivers a welcome speech at a regulatory conference

2. The tariff deadline is approaching

📈 Technical Analysis:

Today's opening high reached around 3402, and did not effectively break through the upper resistance of 3405-3415. As I said yesterday, a decline and return to the moving average is an inevitable result. The tariff issue is still there, with the deadline on August 1, and the daily MACD indicator still shows a golden cross. The general direction of short-term bullishness has not changed, but from a technical point of view, gold still has room to fall to correct the overbought part.

Below the day, we first focus on the top and bottom conversion position of 3377-3375. As time goes by, the 4H middle track will probably resonate with the 50% position of the Fibonacci line at 3355, which is also a good long position I expect. Therefore, if the price falls back to 3380-3375 for the first time during the day, you can consider going long. If the price continues to fall, pay attention to the second opportunity to go long at 3355, with the target at 3390-3410.

🎯 Trading Points:

BUY 3380-3375

TP 3390-3410

BUY 3360-3350

TP 3370-3380

In addition to investment, life also includes poetry, distant places, and Allen. Facing the market is actually facing yourself, correcting your shortcomings, facing your mistakes, and exercising strict self-discipline. I share free trading strategies and analysis ideas every day for reference by brothers. I hope my analysis can help you.

TVC:GOLD PEPPERSTONE:XAUUSD FOREXCOM:XAUUSD FX:XAUUSD OANDA:XAUUSD FXOPEN:XAUUSD

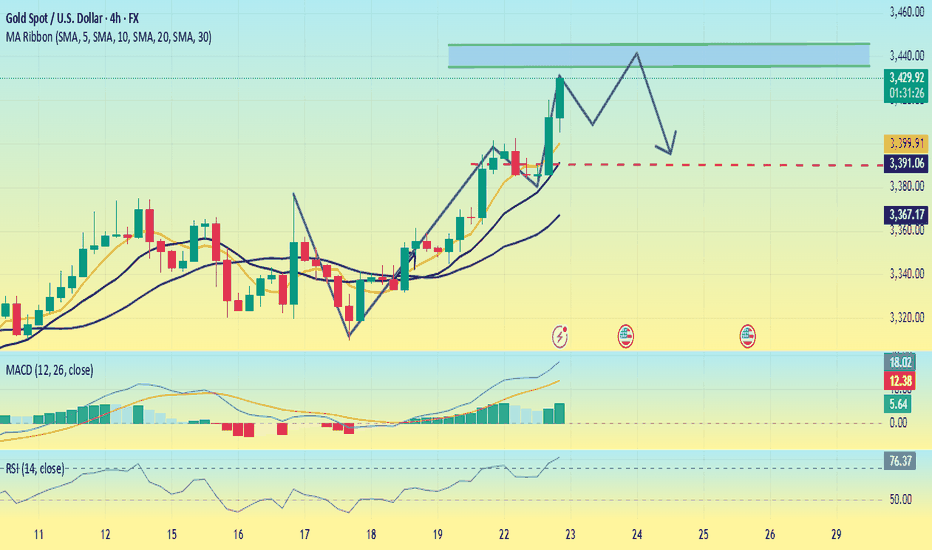

Gold is under pressure. Can it break through?Since the "W bottom" pattern was formed at the low of 3344 US dollars, the gold price broke through the neckline of 3380 and further stabilized at 3400 today, confirming the continuation of the medium-term upward trend. The moving average system is arranged in a bullish pattern, with the 5-day, 10-day and 20-day moving averages diverging upward in turn, and the support strength is stable.

The MACD indicator golden cross continues to expand, the upward momentum is enhanced, and no divergence occurs; the RSI indicator rises to around 76. Although it enters the overbought range, there is no obvious turn, indicating that the bullish momentum is still being released.

The current support level has risen to around 3390, and the support level has risen sharply. The resistance position needs to pay attention to 3430-3440. At present, several times have tested above 3430, but they have not stabilized above this position.

Operation suggestions:

3390-3400 light position to try more, stop loss 3360, profit range 3435-3445.

If it encounters resistance and falls back near 3435, you can consider short-term short orders with stop loss at 3445 and profit range at 3400-3380.

Although the upward momentum continues, some risk information still needs to be paid attention to; this week, we need to pay attention to the US June existing home sales data (July 23), the preliminary value of the second quarter GDP (July 25) and the core PCE price index (July 26). If the data is stronger than expected, it may trigger expectations of interest rate cuts.

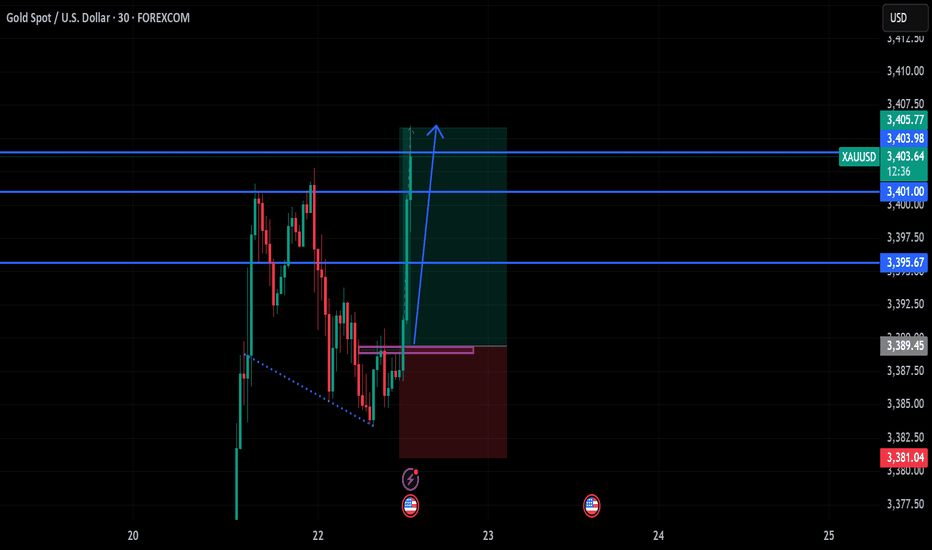

Gold Breaking Previous Highs — Bullish Trend ContinuesHello everybody!

Price is continuing its bullish trend and has broken some significant resistance.

According to the market structure, we’re looking for it to go higher, up to the 3430 area.

The break of the downward trendline is a confirmation for a buy position.

Manage your risk and trade safe!

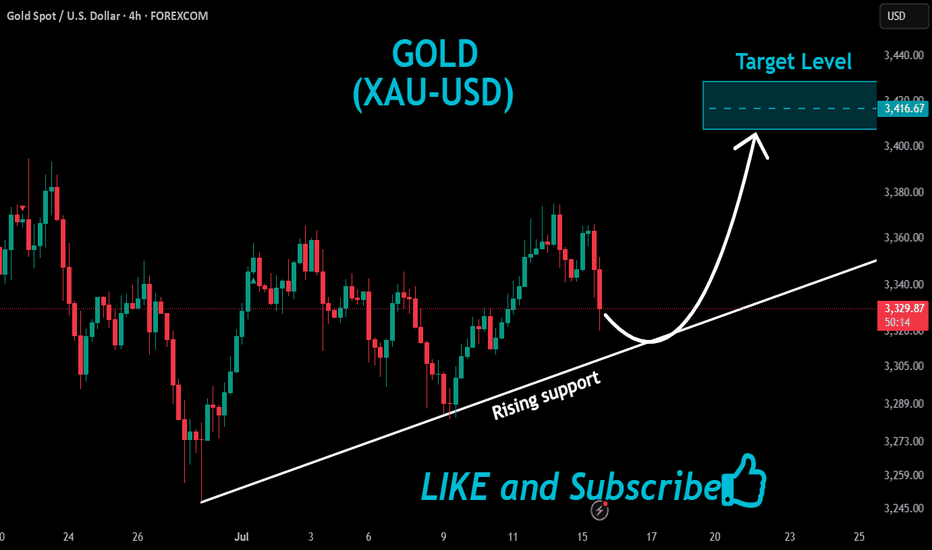

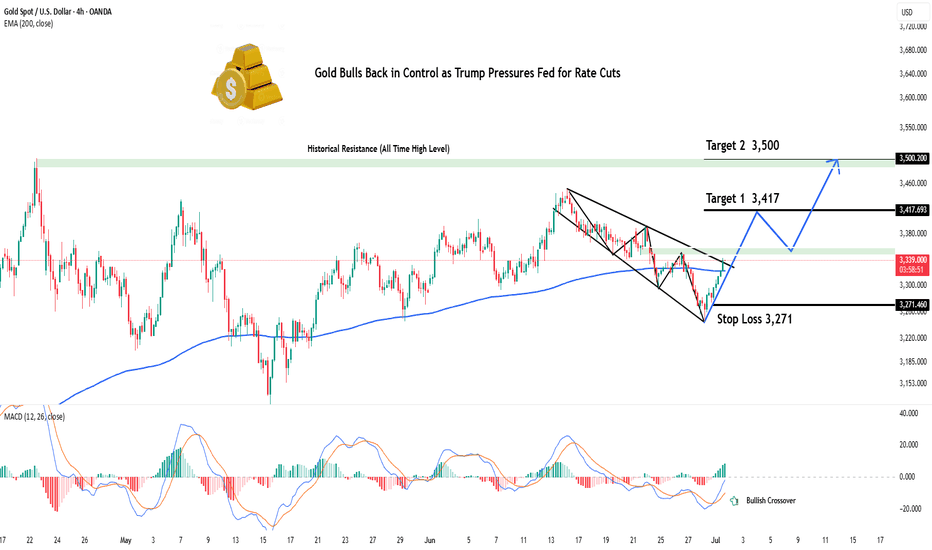

Gold Bulls Back in Control as Trump Pressures Fed for Rate CutsHey Realistic Traders!

President Trump is ramping up pressure on the Fed to cut interest rates , saying the U.S. is falling behind countries with looser policies. As several Fed officials begin to shift their stance, expectations for rate cuts are growing. That’s putting pressure on the dollar and giving gold a fresh boost.

We’ll take a closer look at what this means for OANDA:XAUUSD (Gold) through technical analysis and explore its upside potential.

Technical Analysis

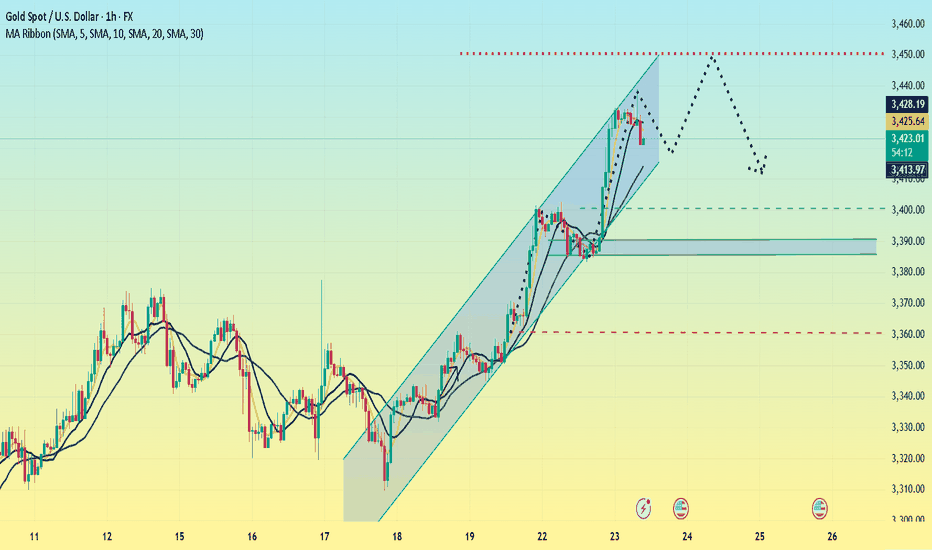

On the 4-hour chart, Gold has moved above the EMA-200, signaling a shift in momentum to the upside. Price has also broken out of a Descending Broadening Wedge (DBW) pattern, which often indicates the start of a bullish trend.

The breakout was confirmed by a Bullish Marubozu candle, reflecting strong buying pressure. To add further confirmation, the MACD has formed a bullish crossover, reinforcing the upward momentum.

Looking ahead, the first target is seen at 3417. If reached, a minor pullback toward the historical resistance zone (green area) may occur, with a potential continuation toward the second target at 3500.

This bullish outlook remains valid as long as the price stays above the stop-loss level at 3271 . A break below this level would invalidate the setup and shift the outlook back to neutral.

Support the channel by engaging with the content, using the rocket button, and sharing your opinions in the comments below.

Disclaimer: "Please note that this analysis is solely for educational purposes and should not be considered a recommendation to take a long or short position on XAUUSD.

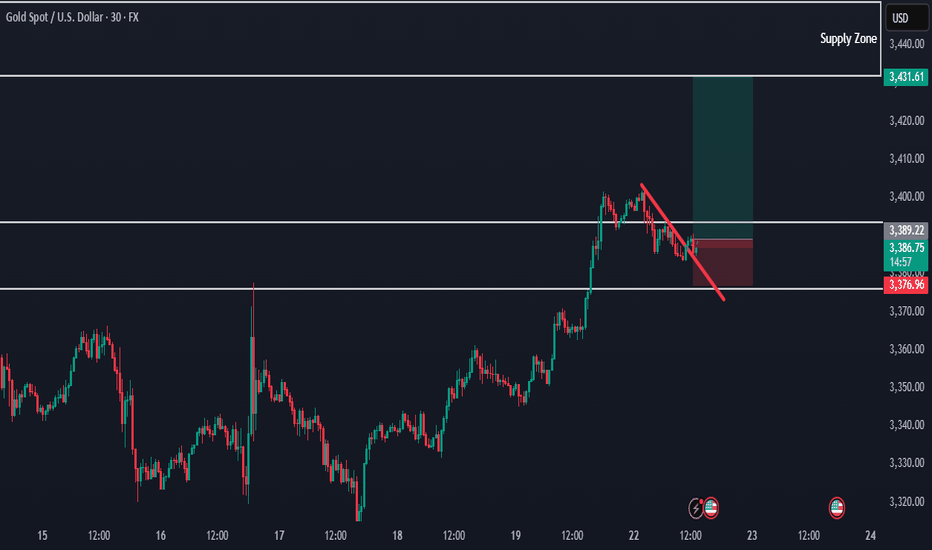

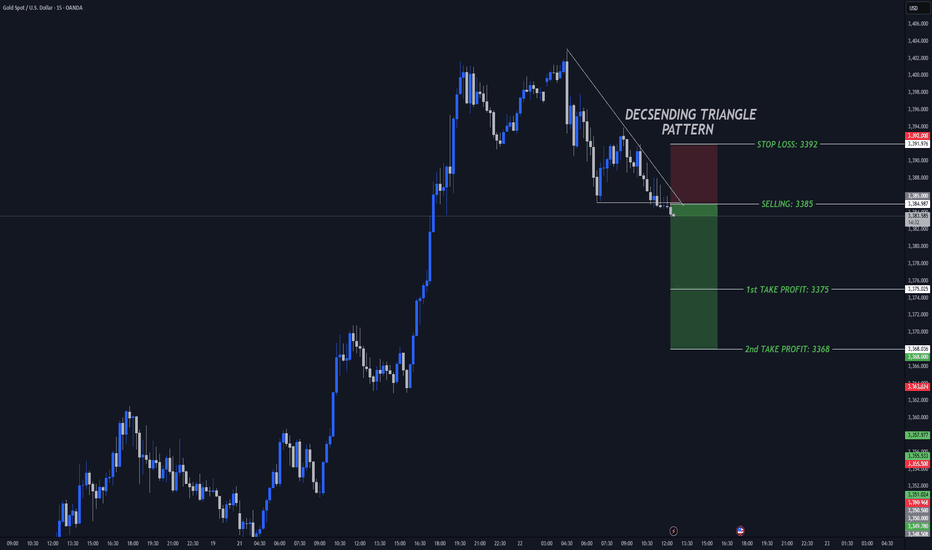

Don't chase the bullish trend,wait for the short position layout#XAUUSD

The tariff policy recently announced by the US government is undoubtedly the focus of the current gold market. Trump also tied the tariffs to the trial of former Brazilian President Jair Bolsonaro, adding to policy uncertainty. ⚖️

The implementation of the tariff policy may push up commodity prices, thereby exacerbating inflationary pressure, which is both an opportunity and a challenge for gold📊. On the one hand, rising inflation expectations may enhance the attractiveness of gold as an anti-inflation asset; on the other hand, the strengthening of the US dollar and US Treasury yields may offset this positive. 💡

At present, the lower support has moved up to the 3375-3365 area, where a top-bottom conversion position will be formed. The upper short-term resistance level is 3387-3393, the previous high. If the market touches this for the first time, you can try to see a double top fall.

🚀SELL 3385-3390

🚀TP 3365-3355

Gold Spot / U.S. Dollar (XAUUSD) 2-Hour Chart - OANDA2-hour candlestick chart displays the price movement of Gold Spot against the U.S. Dollar (XAUUSD) from OANDA, covering the period up to July 22, 2025. The current price is 3,395.285, reflecting a 1.775 (-0.05%) decrease. The chart includes buy/sell indicators (3,395.780 buy, 3,394.890 sell), a highlighted resistance zone around 3,400-3,425, and a support zone around 3,370-3,386. The chart also features technical analysis tools and annotations indicating potential price trends.

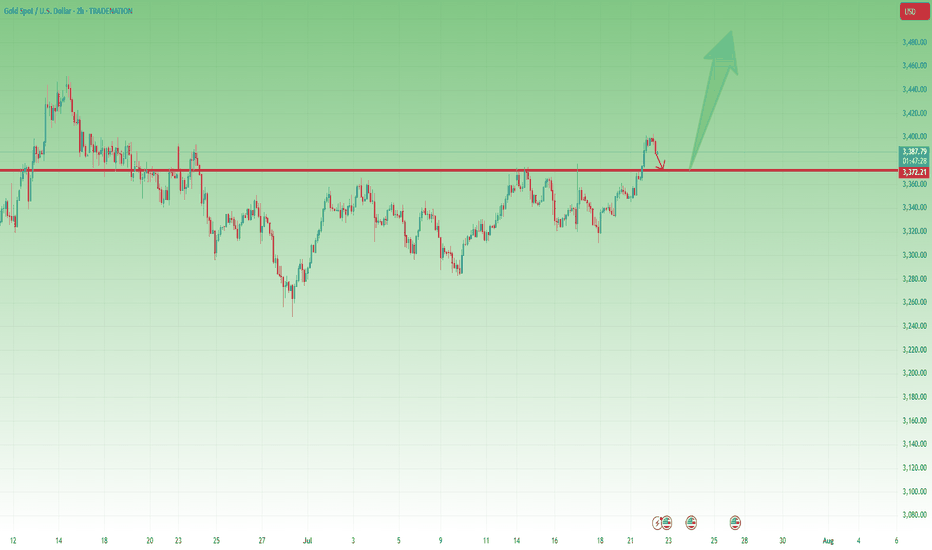

Gold - Above 3370 Is Bullish Territory – But 3360 Must Hold📆 What happened yesterday?

After more than a week of frustrating, sideways price action, Gold finally broke out above the key 3370 resistance zone.

The breakout was clean and impulsive, with TRADENATION:XAUUSD pushing to an intraday high around 3400.

Following that move, price printed a small double top near the high and began a modest correction — perfectly normal after such a breakout. At the time of writing, Gold trades at 3385, still holding above former resistance.

📈 Why this breakout matters:

The daily close at 3396 came in strong and near the top, leaving behind a clear Marubozu candle

This kind of price action signals conviction and momentum

The breakout confirms what I’ve been anticipating for days — the range is resolved, and the market is choosing the bullish path

🎯 What to expect next:

If price stabilizes above 3400, the road to 3450 opens — which is the target mentioned in my previous analyses

That area represents the next major resistance and likely magnet for price if bulls stay in control

🧭 Trading Plan:

For me, the plan is now simple:

✅ Buy the dips — especially on a potential retest of the 3370–3375 broken resistance, which now turns into support

❌ Negation comes only with a daily close below 3360, which would invalidate this breakout and raise questions

📌 Conclusion:

The breakout has finally come. After days of coiling, Gold chose the upside.

Momentum is building, structure is clean, and bulls are back in control — unless 3360 fails.

Until then, I remain bullish, looking to buy dips into strength. 🚀

Disclosure: I am part of TradeNation's Influencer program and receive a monthly fee for using their TradingView charts in my analyses and educational articles.

Gold is under pressure. There is hope for another rise.Today's important news:

At 8:30, Fed Chairman Powell delivered a welcome speech at a regulatory meeting; at 13:00, Fed Governor Bowman hosted a fireside chat session at the large bank capital framework meeting hosted by the Fed.

Market conditions:

The current daily trend is mainly "strong rise" (Monday closed positive and broke through the shock, and the moving average turned upward). The core logic is that short-term bullish momentum is dominant, and it is necessary to focus on the effectiveness of support and the rhythm of breaking through resistance.

Today, we need to focus on the support belt 3365-3360 area (this position is the 5-day moving average position and the low point of yesterday's European session). As a short-term moving average support, this area is the first line of defense for bulls today. If it can stabilize here, it can be regarded as a signal of short-term strong continuation.

The key pressure level is still around 3420. As a trend line resistance that has been under pressure many times in the early stage, if it can break through, it means that the bulls will break the shock suppression and open up more room for growth.

In terms of operation, it is still mainly low-long. The current gold is still strong. Operation strategy:

Short around 3420, stop loss 3430, profit range 3400-3380

Long around 3360, stop loss 3350, profit range 3380-3400

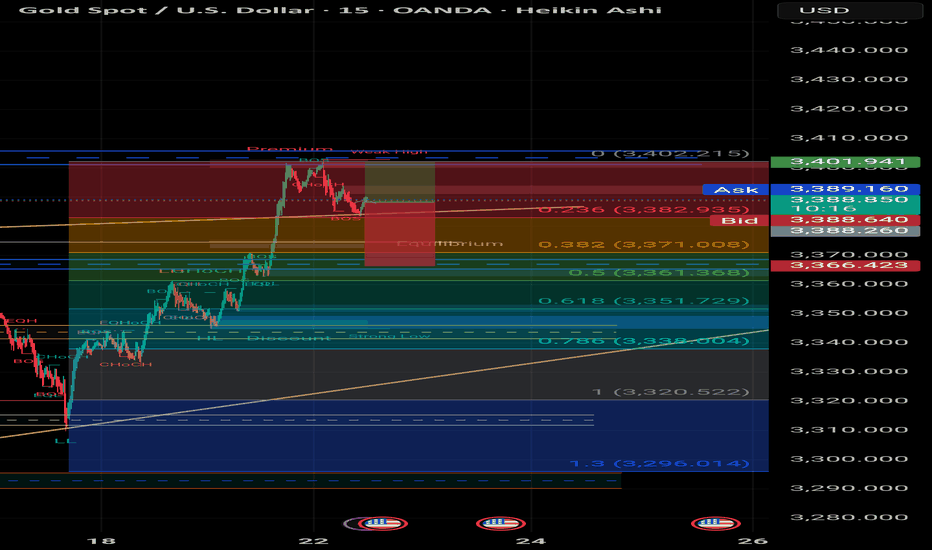

Absolutely! Here's a Scalping Analysis in English markdown forma## 🪙 Gold (XAU/USD) Scalping Plan – July 22, 2025

**Chart: 15-Minute (Heikin Ashi) – OANDA**

---

### 🔍 Market Structure:

- **Current Price**: 3,389.30 USD

- **Recent BOS (Break of Structure)** confirms bullish momentum up to the **3,402 level (Premium Zone)**.

- We’ve seen **CHOCHs** (Change of Character) confirming early exhaustion.

---

### 📐 Fibonacci Zones:

| Level | Price (USD) | Significance |

|--------------|---------------|------------------------|

| 0.236 | 3,382.93 | First minor support |

| 0.382 | 3,371.00 | Equilibrium zone |

| 0.5 | 3,361.36 | Institutional entry |

| 0.618 | 3,351.72 | Deep retracement zone |

| 0.786 | 3,338.80 | High-probability reversal |

| 1.0 | 3,320.52 | Final OB/Support base |

| 1.3 (forecast)| 3,296.01 | Extended target zone |

---

### 🧠 Scalping Setup:

- **Short-term Shorts** from the **Premium zone (3,402 → 3,382)** are already in play.

- Targeting the **0.382 retracement** initially, with continuation to 0.5 and **Order Block (OB)** near **3,351**.

- If price reaches 0.618 or 0.786, we enter **Buy Setup Zone** for intraday bullish bounce.

- Strong OB visible between **3,320–3,338**; ideal for scalping longs with tight SL.

---

### 🎯 Scalping Strategy:

#### ✅ Sell Setup:

- Entry: 3,398–3,402

- TP1: 3,382

- TP2: 3,371

- SL: 3,407

#### ✅ Buy Setup:

- Entry: 3,351–3,338

- TP1: 3,366

- TP2: 3,389

- SL: 3,329

---

### 🧭 Notes:

- Watch USD news events marked on the chart (🟦).

- Avoid entering trades near high-impact data drops.

- Focus on **reaction at OB zones + confluence with Fib** for sniper entries.

---

> ⚠️ **Reminder**: Scalping is all about precision & discipline. Stick to your SL and plan!

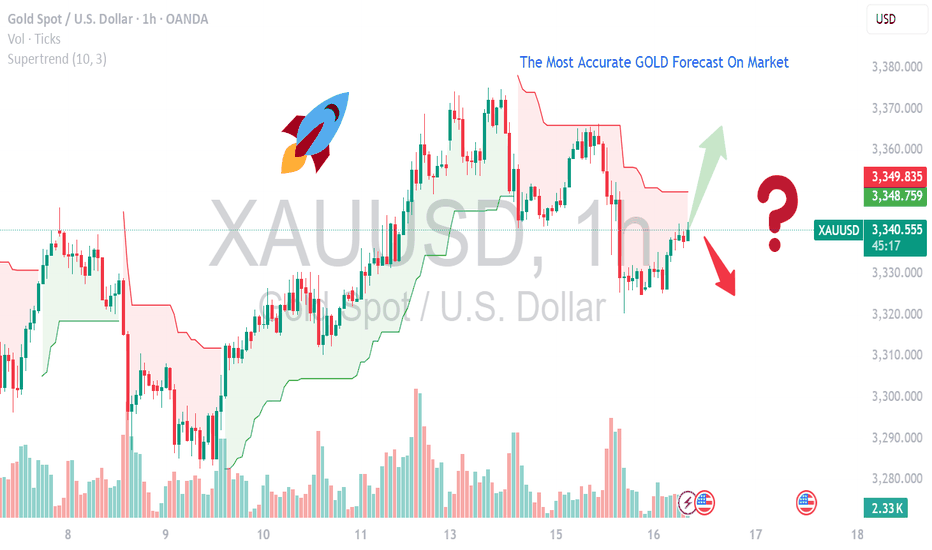

MOST ACCURATE XAUUSD GOLD FORECAST ANALYSIS MARKETCurrent Setup & Technical Outlook

Consolidation & Pennant Formation: Gold is building a bullish pennant and trading above its 50‑day MA — a classic continuation pattern suggesting a breakout toward new highs if momentum resumes .

Key Levels:

Support: $3,330–3,340 — confirmed by multiple technical sources .

Resistance/Breakout Zone: $3,360–3,375 — clearing this could trigger a rally toward $3,400+ .

Upside Targets: $3,390, then possibly $3,500–$3,535 per weekly forecast .

Alternate Bearish Scenario: A failure around the 0.618 Fibonacci resistance (~$3,374) and overbought RSI could spark a pullback to $3,356 or lower .

---

🧠 Fundamental Drivers

Inflation & U.S. Macro Data: Market awaits June CPI/PPI and Fed commentary — cooler inflation could boost gold via dovish expectations, while hotter data may strengthen the USD and weigh on bullion .

Geopolitical & Safe-Haven Demand: Trade tensions (e.g., tariffs) are keeping gold elevated near $3,350–$3,360 .

Central Bank & Real Yields Watch: Continued gold purchases and lower real rates are supportive, although mid-term easing in risks (like global trade) could curb momentum .

XAUUSD Bullish Setup | Liquidity Grab to Breakout📊 XAUUSD Bullish Breakout Plan | Price Action + Key Levels Analysis 🔥

Gold (XAUUSD) is currently holding above a strong support-turned-resistance zone around $3,340 - $3,345. After a clear rejection from the support area and a bullish structure forming, price is showing potential for a clean breakout toward higher targets.

🔍 Key Technical Highlights:

• Support Area: $3,310 - $3,320 held strongly

• Resistance Flip: $3,345 zone acting as new demand

• Target 1: $3,375

• Target 2: $3,390 major liquidity zone

• Structure: Bullish W pattern forming above demand

This setup favors buy on retracement, aiming for breakout above recent highs. Wait for a confirmation candle above resistance before entering.

📈 Watch for liquidity grab and strong bullish impulse.

#XAUUSD #GoldAnalysis #SmartMoney #BreakoutSetup #LiquidityHunt #ForexTrading #TechnicalAnalysis #BuySetup #PriceAction #TradingView #GoldSetup #ForYou

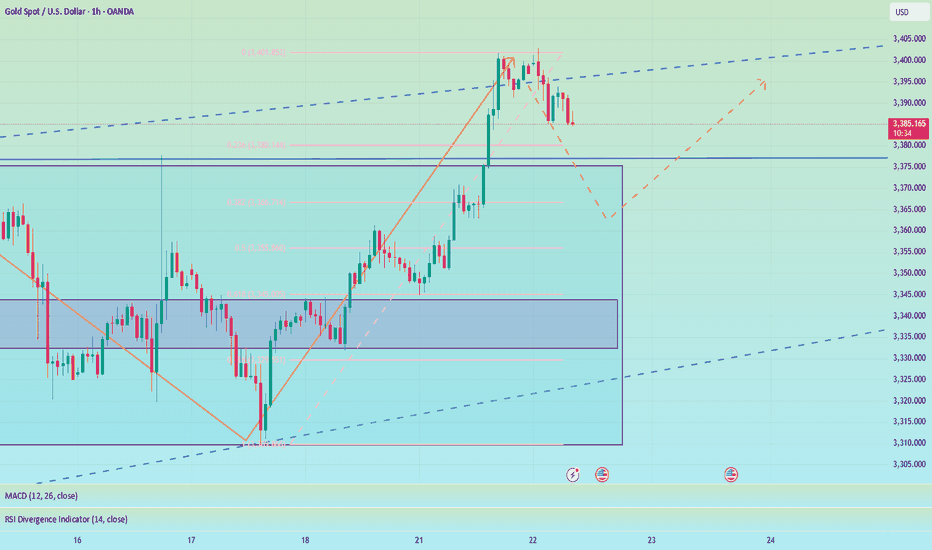

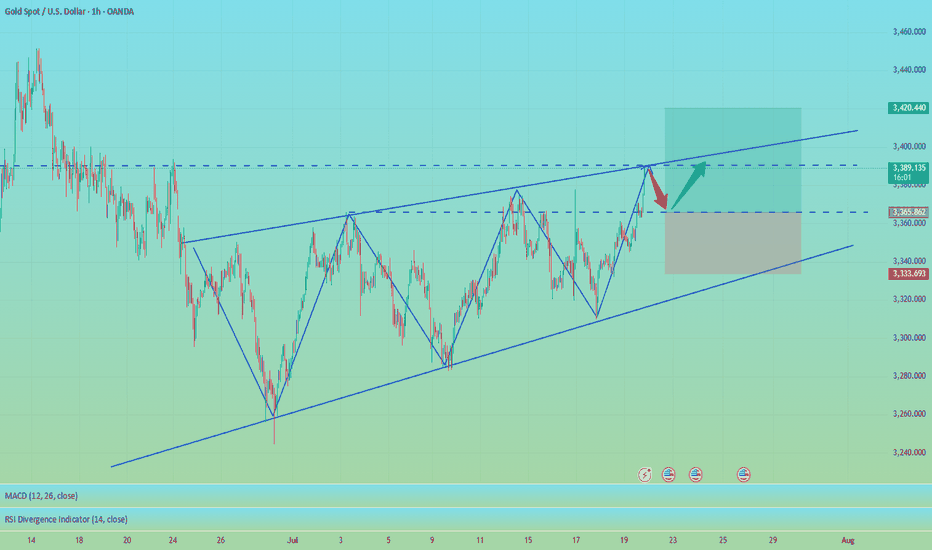

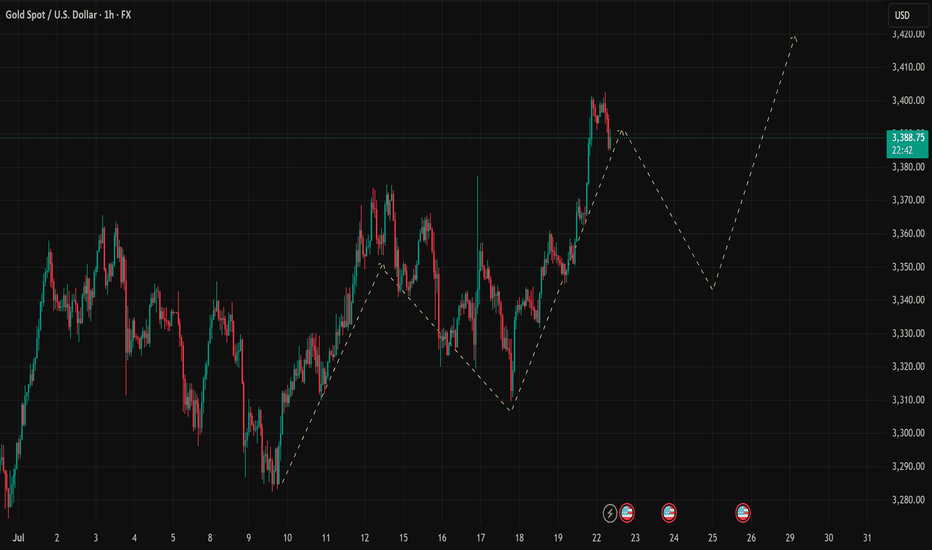

XAUUSD Continues Bullish Structure With Key Retracement OpportunTechnical Outlook – 22/07/2025

On the 1-hour chart, XAUUSD is maintaining a clear bullish market structure with a sequence of higher highs and higher lows. The projected price path drawn on the chart suggests a potential retracement before a continuation toward the 3,420 USD region. Let’s break down the key technical zones and strategies for today:

Key Levels to Watch

Immediate Resistance: 3,390 – 3,400 USD

This is the recent high. A breakout above this area could trigger momentum toward the projected 3,420 USD extension.

Support Zone: 3,345 – 3,350 USD

This zone aligns with the potential pullback as illustrated on the chart, offering a high-probability buy-the-dip opportunity. It coincides with previous structure resistance now turned support.

Trendline Support: The ascending yellow trendline has been respected multiple times and should act as dynamic support on any intraday retracements.

Indicators & Tools Used

EMA: Price is currently trading above the short-term EMA (not shown), suggesting intraday bullish bias remains intact.

RSI (Recommended Use): Look for RSI near 40–50 on the pullback for confluence at support.

Fibonacci Tool (suggested): If measuring from the swing low near 3,320 to the high of 3,390, the 0.618 Fib lies close to 3,345 – an ideal area to look for long entries.

Suggested Trading Strategies

🔹 Buy the Dip Strategy:

Wait for a corrective move into the 3,345–3,350 area. Confirm with bullish reversal candles or RSI support, then enter long targeting 3,400–3,420. Stop-loss ideally below 3,335 (structure break).

🔹 Breakout Continuation Strategy:

If price breaks cleanly above 3,390 with volume, a momentum trade toward 3,410–3,420 is viable. Use tight trailing stops to protect gains.

🔹 Avoid chasing highs – Patience at support zones or confirmation above resistance will offer better reward/risk setups.

Conclusion

Gold is respecting bullish market behavior on the 1H chart, and while a short-term correction is expected, the broader trend favors upside continuation. The 3,345–3,350 area will be critical for today's trading decisions.

Remember to follow for more updates and strategy insights. Save this post if you find it useful.

If you’d like, I can also add a version using RSI or Fib levels directly plotted. Let me know.

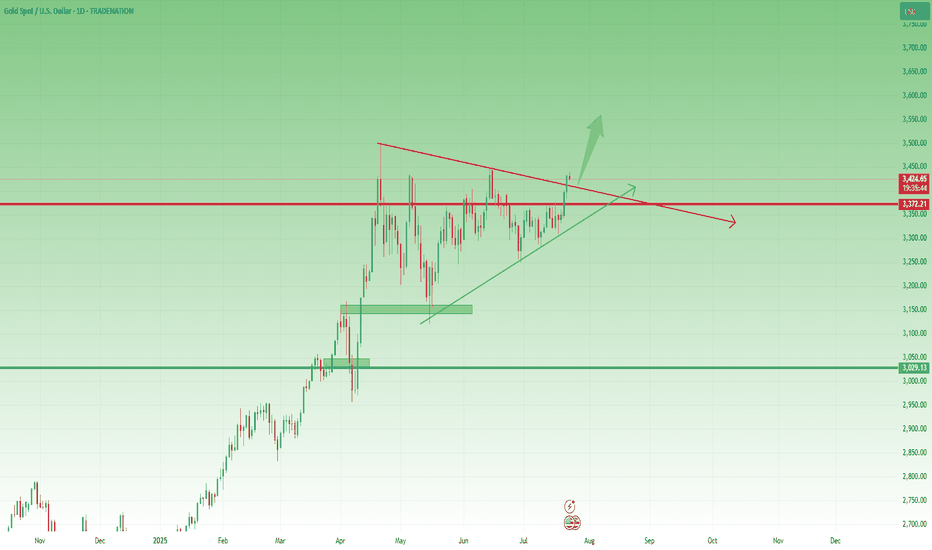

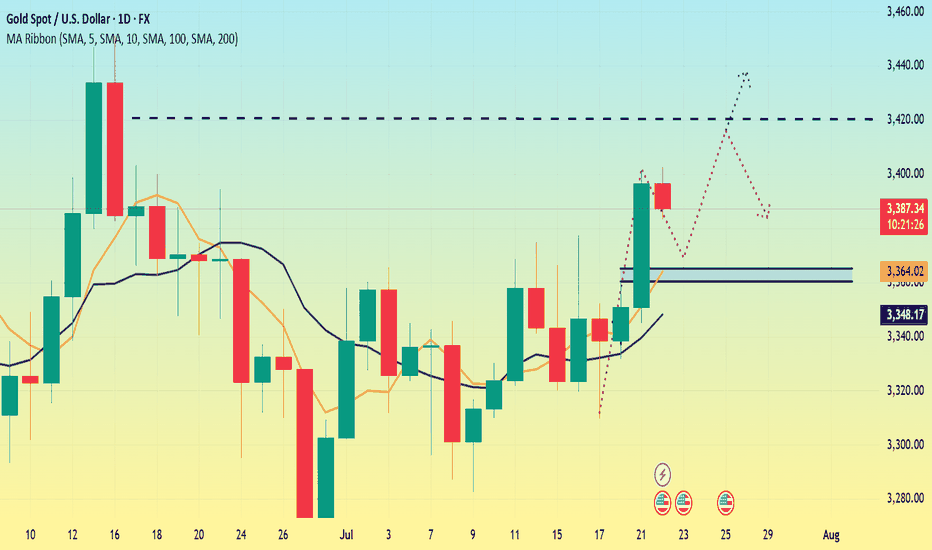

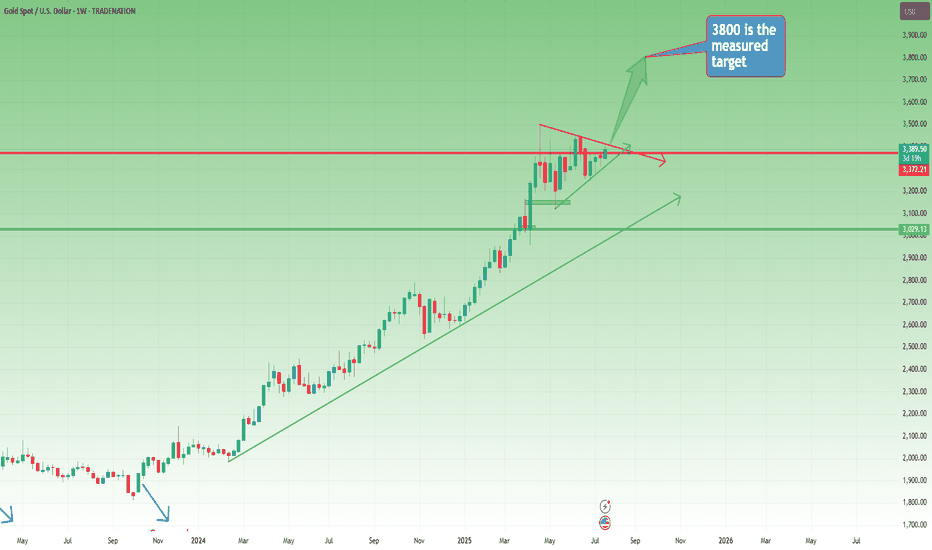

Weekly Outlook: Gold Builds Pressure – Is the Big Move Coming?📆 Big Picture View

Since the start of 2024, Gold has been moving in a well-defined long-term bullish trend.

Yes, there were meaningful pullbacks along the way — but the direction was never in doubt. Step by step, Gold climbed over 15,000 pips in just over a year, reaching a new all-time high in late April.

📉 Post-ATH: A Period of Stabilization

After peaking, Gold shifted into consolidation mode, with price gravitating around the 3300 zone.

This sideways movement has been ongoing for the past three months, but it’s not a sign of weakness — it’s the market catching its breath.

On the weekly chart, this consolidation is now forming a symmetrical triangle, a classic continuation pattern that often appears mid-trend.

📐 The Technical Setup

- The symmetrical triangle shows compression of volatility

- Buyers and sellers are slowly converging toward a decision point

- A breakout is approaching, and when it comes, it could be explosive

🎯 What’s the Trigger?

- A confirmed break above 3450 would validate the triangle breakout

- That opens the door to quickly test the 3500 round figure

- The measured target for the triangle sits at 3800

Given the time Gold has spent consolidating (3+ months), this target could realistically be reached by year’s end

🧭 Strategic Takeaway

- As long as Gold holds above 3300, the bullish structure remains valid

- Breakout above 3450 is the green light for the next leg up

- Until then, the consolidation continues, and smart money prepares

📌 Conclusion:

Gold is building pressure. The weekly triangle is maturing.

This isn’t the end — it’s the pause before the next move.

Stay patient. Stay focused.

Because if 3450 breaks… 3800 is not a dream — it’s a destination. 🚀

Disclosure: I am part of TradeNation's Influencer program and receive a monthly fee for using their TradingView charts in my analyses and educational articles.

P.S: Here you have a short term analysis on Gold