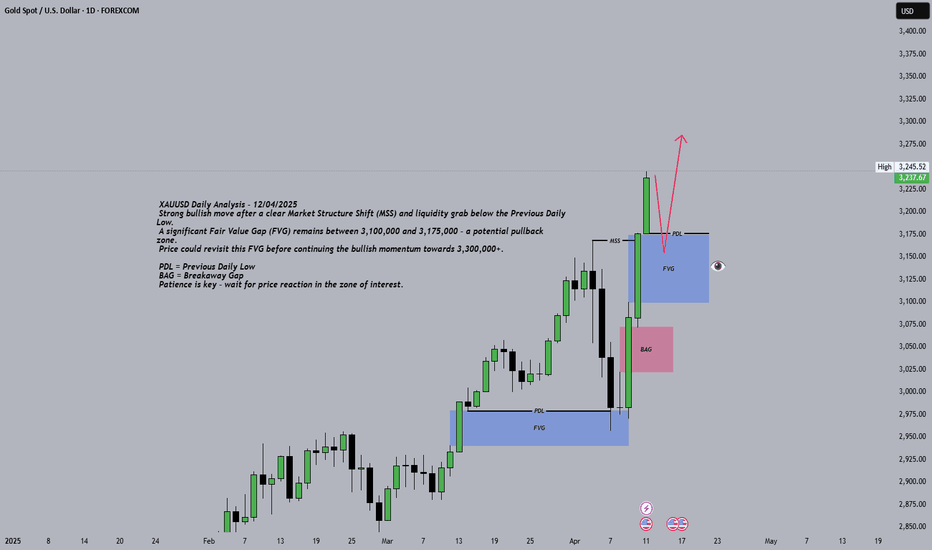

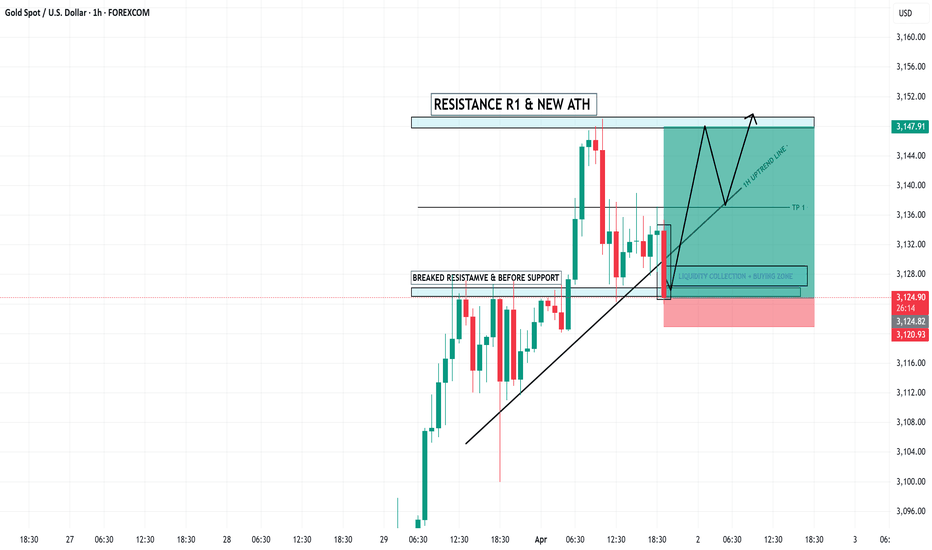

XAUUSD Daily Analysis📈 XAUUSD Daily Analysis – 12/04/2025

🔥 Strong bullish move after a clear Market Structure Shift (MSS) and liquidity grab below the Previous Daily Low.

📉 A significant Fair Value Gap (FVG) remains between 3,100,000 and 3,175,000 – a potential pullback zone.

📍 Price could revisit this FVG before continuing the bullish momentum towards 3,300,000+.

🔹 PDL = Previous Daily Low

🔴 BAG = Breakaway Gap

🧠 Patience is key – wait for price reaction in the zone of interest.

📌 For educational purposes only – not financial advice.

💬 Drop your thoughts in the comments ⬇️

🔁 Like if you found this helpful!

Xauusdsignals

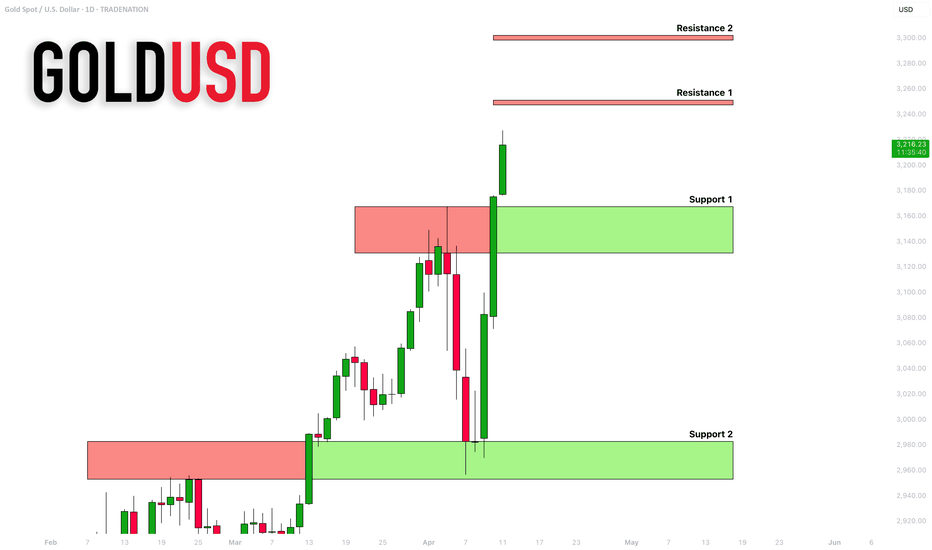

GOLD (XAUUSD): The Next Important Resistance Levels

Gold updated the All-Time High yesterday and trades

in the no-man's land again.

Here are the next potentially significant resistances

based on psychological levels.

Resistance 1: 3247 - 3252 area

Resistance 2: 3397 - 3302 area

Important historic supports:

Support 1: 3128 - 3167 area

Support 2: 2953 - 2982 area

Consider these structures for pullback/breakout trading.

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

XAUUSD: Investors are more interested in Gold than ever! Gold reversed successfully after touching our entry point, moving to over 1400 pips. We previously advised closing the idea, but now we see a strong bullish market likely to create another record high. The ongoing tariff war between China and the US will likely create more fear in the global market.

Like, comment, and support us.

Team Setupsfx_

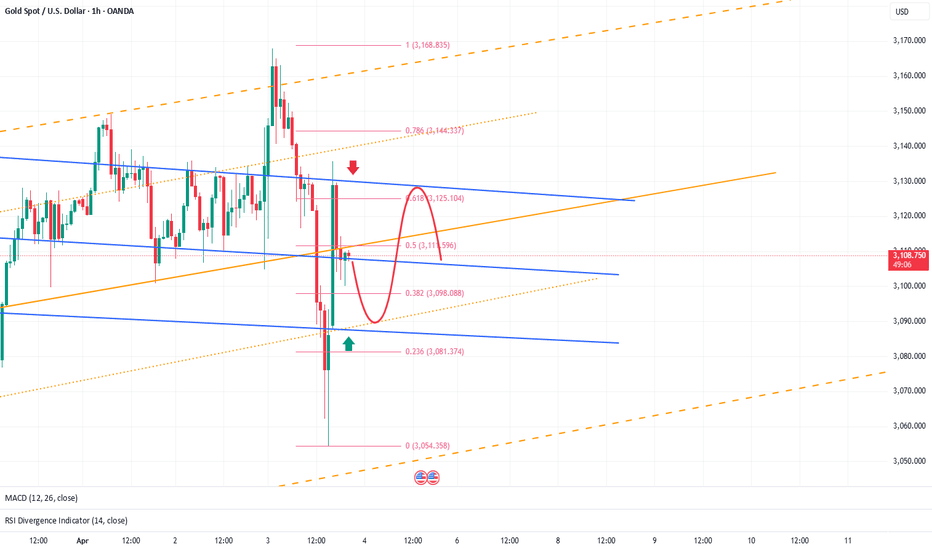

It is hard not to make a profit by trading CPI like thisI have to say that gold is indeed in a bullish pattern at present. After all, gold did not even fall below 3110 during the correction process. However, the current fluctuations are relatively cautious, and we are waiting for the guidance of CPI data, which may exacerbate short-term fluctuations!

To be honest, although gold is in a bullish pattern, the resistance above cannot be ignored, especially the 3150-3155 area and the previous high of 3167. It is not ruled out that gold will form a secondary high during the rise and form a double-top structure with the previous high of 3167, so I will not be a radical in the short term and set the target at 3200.

In addition, during the CPI data period, it is not ruled out that gold will rise and then fall back, so I do not advocate blindly chasing gold. On the contrary, I will definitely try to short gold in the 3050-3060 area. However, the market's long sentiment is high, and it is not advisable to have too high expectations for the magnitude of the correction in short-term trading. The first retracement target area is: 3105-3095, followed by 3080!

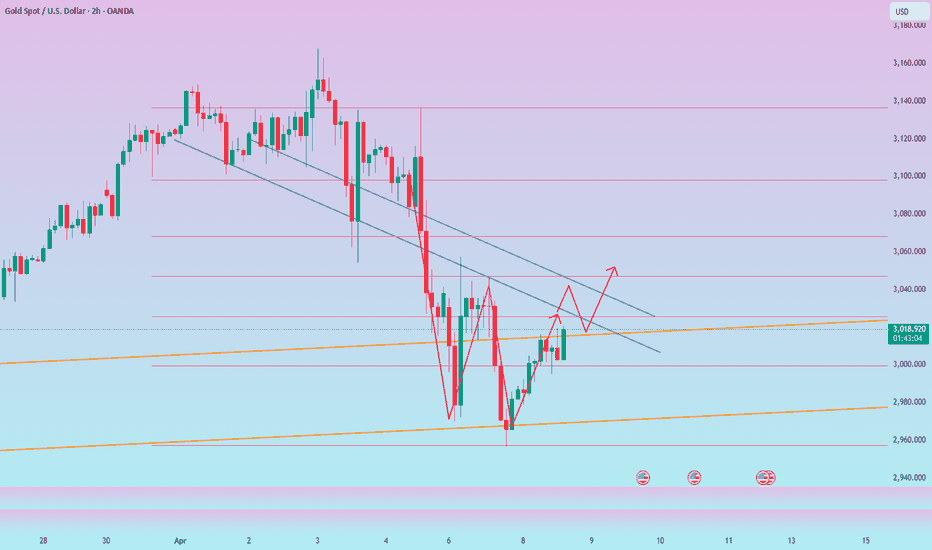

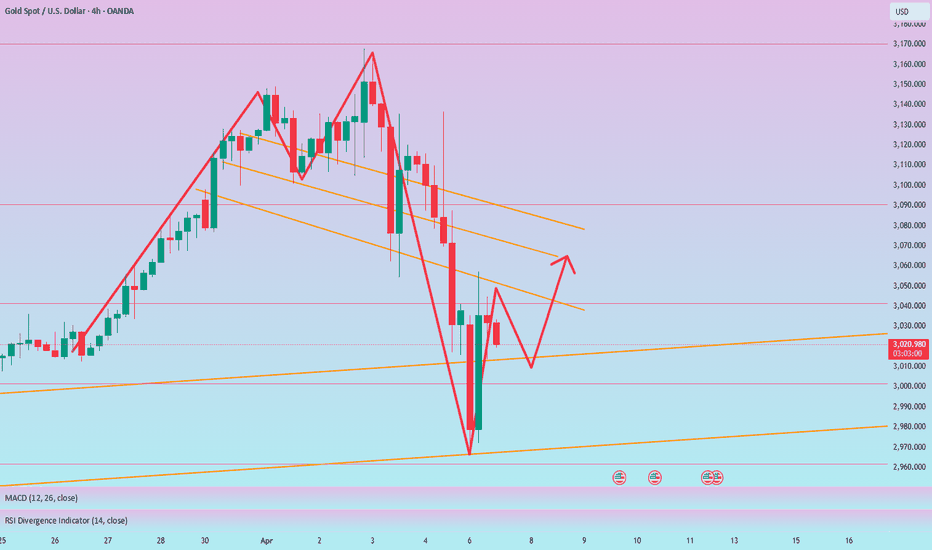

4/9 Gold Trading Strategies

Gold opened with a mild bullish tone yesterday but faced resistance near 3018 , pulling back briefly before attempting a second push toward 3023 . However, the rally failed to sustain, and price returned near the opening level. Compared to recent sessions, yesterday marked a clear contraction in volatility, suggesting either a bottoming formation or a setup for a directional breakout.

From both candlestick structure and indicator alignment, the market appears primed for a potential bullish push today. If momentum builds as expected, a test of the 3037–3043 resistance zone is highly probable.

On the downside, 2976 remains the key initial support , followed by 2952 , which was the previous local low.

On the fundamental side, no major data releases are scheduled today. However, updates related to tariff policies will likely be the main market driver, and could trigger intraday volatility.

🎯 【Trade Setup for Today】

🔻Sell Zone: 3047–3066

🔺Buy Zone: 2968–2942

🔄Flexible/Scalping Zone: 2978–3023

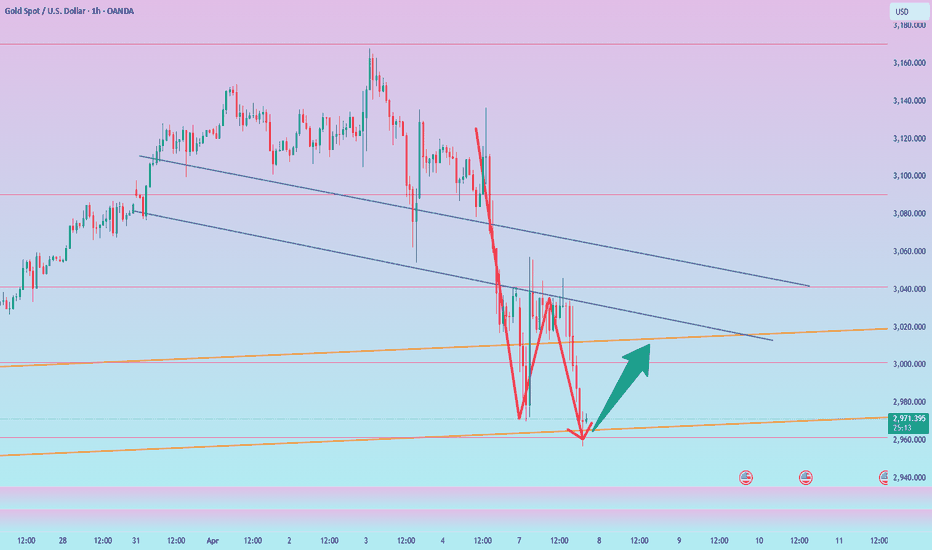

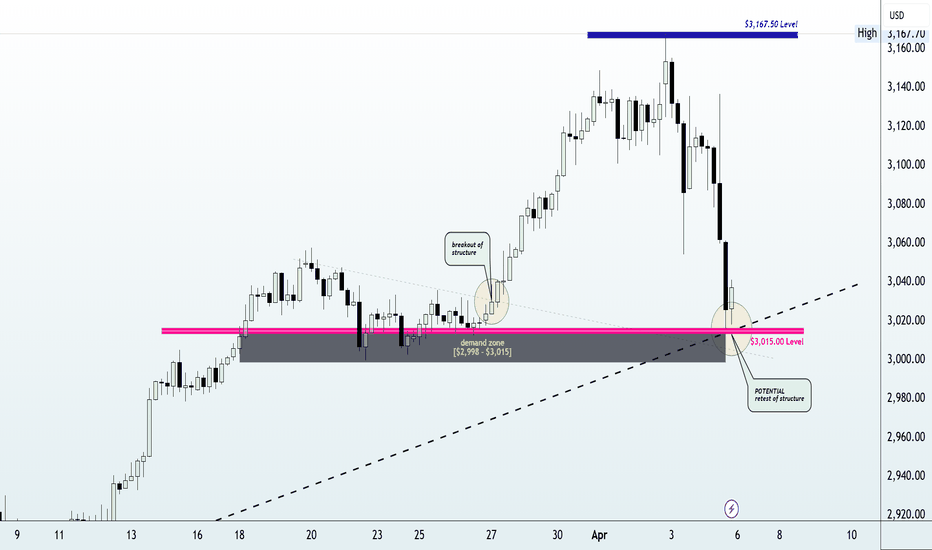

Get Rich: Buy Cheap GoldAfter a sharp decline, gold seems to have insufficient bullish momentum compared to before, but this is only in comparison. In fact, after gold hit the low point near 2957, the low and high points of gold are gradually rising. We can see that the bulls are gradually and implicitly picking up cheap chips.

So now we can't blindly short gold. According to the current gold structure, gold may continue to rebound above 3030, or even around 3050. These two positions will be the target areas for long traders and will also be the entry prices suitable for short traders.

So for short-term trading, I will adjust my trading strategy and plan in time. If gold falls back to the 3000-2990 area, I may first tend to go long on gold!

It must be noted that the current gold price fluctuates frequently and violently, so you must be particularly patient first. Because once there is no good entry price, it is difficult to set the psychological SL, and setting a relatively small SL is easy to be hit in market fluctuations!

The trading strategy verification accuracy rate is more than 90%; one step ahead, exclusive access to trading strategies and real-time trading settings

Buy gold, expect a rebound to 3000Gold just fell to 2958, but quickly rebounded to above 2965. The short-term support of 2965-2960 was not effectively broken. Gold quickly recovered above the short-term support, proving that bulls still have room to fight back. I expect gold to at least rebound and test the 3000 position again, so in short-term trading, we should not be too bearish on gold.

I actually reminded everyone in the last article update that we can buy gold when gold falls. In this extremely fierce market, with a cautious trading mentality, I actually do not expect too much about the rebound space of the bulls. Once gold touches around 3000, I will leave the market safely and lock in profits!

The trading strategy verification accuracy rate is more than 90%; one step ahead, exclusive access to trading strategies and real-time trading settings

Gold still has the potential to bounce back to 3070!Gold has been experiencing significant volatility driven by fundamental factors. While bearish sentiment appears to remain dominant, the recent downside move has already priced in much of the negative risk. As such, traders should avoid an overly one-sided bearish bias in the current environment.

After bottoming out near the 2970 level, gold staged a strong rebound. During the ensuing consolidation phase, the 3010–3000 zone has provided consistent support, signaling the emergence of a short-term demand zone. This indicates that the bulls have not completely capitulated and may attempt to stage a corrective rally toward the 3050 level, or potentially even as high as 3070.

From a short-term trading perspective, we may consider initiating long positions within the 3015–3005 range, aiming for an upside target of 3050, with a possible extension toward the 3070 resistance area.

The trading strategy verification accuracy rate is more than 90%; one step ahead, exclusive access to trading strategies and real-time trading settings

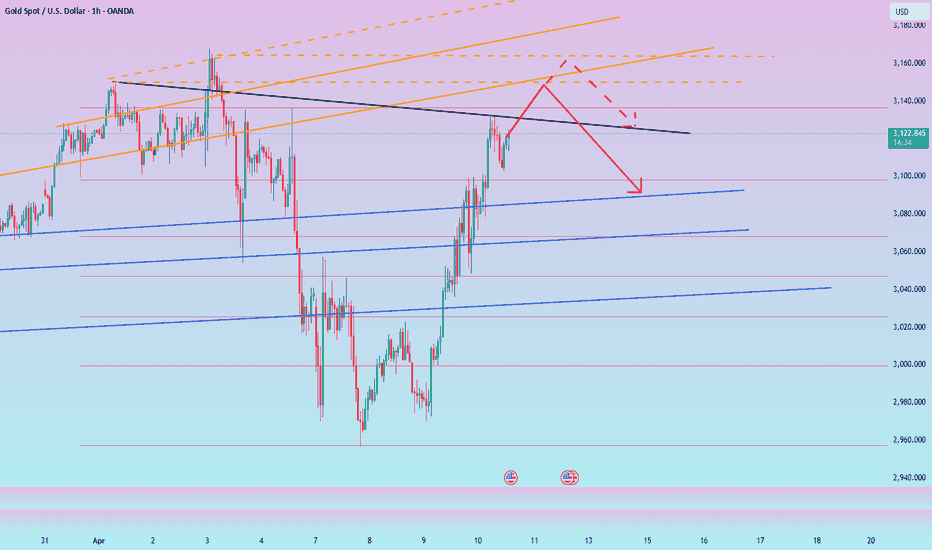

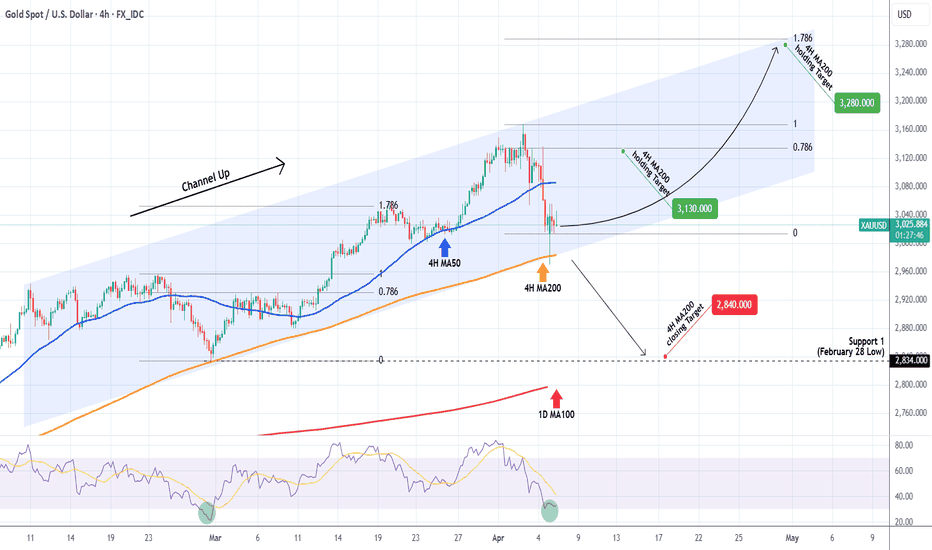

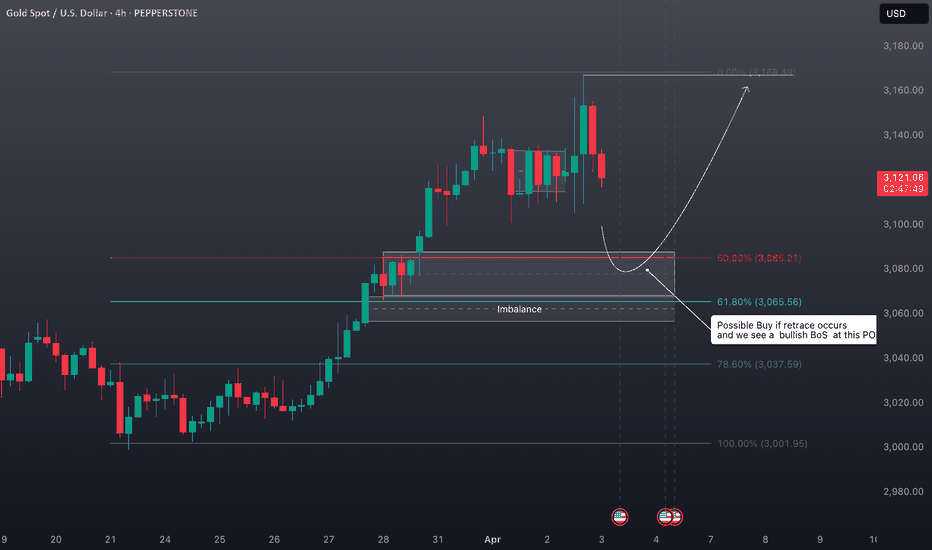

XAUUSD Channel Up holding but be ready to short if broken.Gold (XAUUSD) has been trading within a Channel Up on the 4H time-frame, hitting today its 4H MA200 (orange trend-line). That is the first time the price hits this trend-line since February 28 and the previous Higher Low of the pattern.

As long as it holds, expect a Bullish Leg similar to the previous one, to hit first the 0.786 Fibonacci retracement level at 3130 and then the 1.786 extension for a Higher High at 3280.

On the other hand, if we get a candle closing below the 4H MA200, we will be ready to take the loss and go short instead, targeting Support 1 (Feb 28 Low) at 2840, potentially also making contact with the 1D MA100 (red trend-line).

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

Master swing trading! Both long and short sides can profit!The current fundamental environment: tariff issues and geopolitical conflicts are on opposite sides, so there are both bearish and bullish factors for the gold market, which have triggered fierce competition between long and short forces to a certain extent, exacerbating market volatility!

At present, overall, the short forces have the upper hand, but the longs still have a certain ability to fight back! If the short energy is fully released during the process of gold falling to around 2970, then gold may still usher in a wave of rebound opportunities in the short term. First of all, the areas worthy of our participation in trading are mainly concentrated in the following:

1. The short-term support area below: 3010-3000; secondly, the important defensive area for bulls is: 2975-2965.

2. The short-term resistance area above: 3040-3050; secondly, the important defensive area for bears is: 3070-3080.

This is the key area that we must pay attention to in the short-term, and it is also an important reference for our next short-term trading!

The trading strategy verification accuracy rate is more than 90%; one step ahead, exclusive access to trading strategies and real-time trading settings

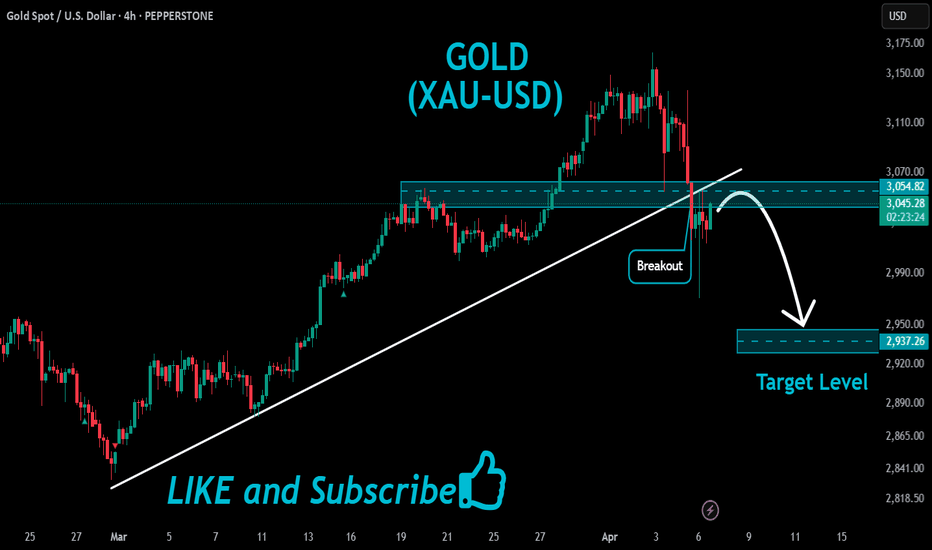

GOLD Price Analysis: Key Insights for Next Week Trading DecisionThe price of gold (XAUUSD) surged to a new all-time high last week following former President Trump’s announcement of reciprocal tariffs, only to face a strong retracement that plunged it to a 7-day low of around $3,015. The market then saw a recovery after Fed Chair Jerome Powell hinted that inflation could reaccelerate due to the economic impact of tariffs.

In this video, I break down:

✨ Gold price action and how markets are reacting to significant headlines

📉 A complete technical analysis of XAUUSD

📍 Key price levels, the current trend, and market structure

💡 Potential trade setups for the week ahead

We’re standing at a critical juncture in the gold market—and how traders respond could shape the next major move.

#XAUUSD #GoldAnalysis #GoldPrice #TechnicalAnalysis #ForexTrading #GoldForecast #FOMC #JeromePowell #TrumpTariffs #InflationData #MarketUpdate

Disclaimer:

Forex and other market trading involve high risk and may not be for everyone. This content is educational only—not financial advice. Always assess your situation and consult a professional before investing. Past performance doesn’t guarantee future results.

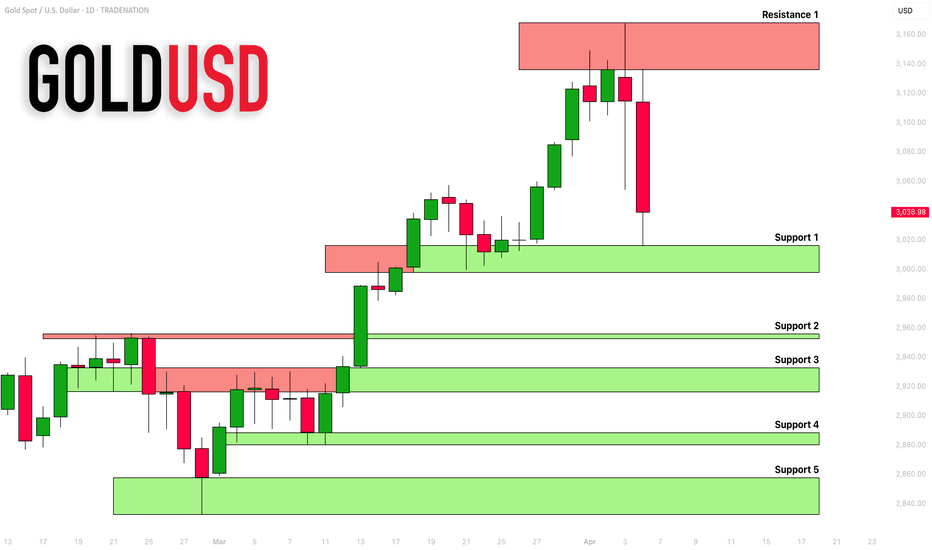

GOLD (XAUUSD): Updated Support & Resistance Analysis

Here is my latest structure analysis for Gold for next week.

Support 1: 2997 - 3015 area

Support 2: 2952 - 2955 area

Support 3: 2916 - 2933 area

Support 4: 2880 - 2890 area

Support 5: 2832 - 2858 area

Resistance 1: 3136 - 3167 area

Consider these structures for pullback/breakout trading next week.

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

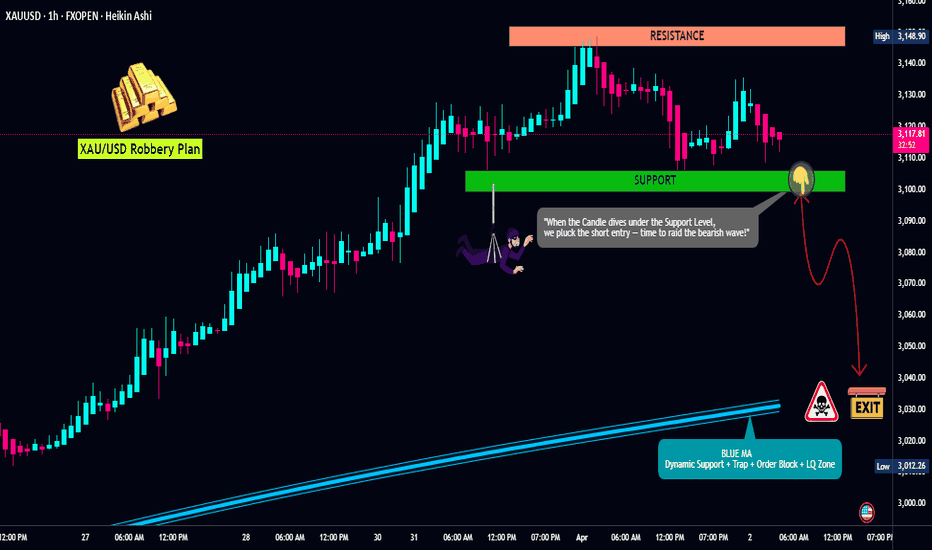

XAU/USD "The Gold" Metal Market Heist Plan (Scalping/Day Trade)🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Robbers, 🤑💰✈️

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the XRP/USD "Ripple vs U.S.Dollar" Crypto Market. Please adhere to the strategy I've outlined in the chart, which emphasizes short entry. Our aim is the high-risk Green Zone. Risky level, oversold market, consolidation, trend reversal, trap at the level where traders and bullish robbers are stronger. 🏆💸Book Profits Be wealthy and safe trade.💪🏆🎉

Entry 📈 : "The heist is on! Wait for the MA breakout then make your move at (3095) - Bearish profits await!"

however I advise to Place sell stop orders above the Moving average (or) after the Support level Place sell limit orders within a 15 or 30 minute timeframe most NEAREST (or) SWING low or high level.

📌I strongly advise you to set an "alert (Alarm)" on your chart so you can see when the breakout entry occurs.

Stop Loss 🛑: "🔊 Yo, listen up! 🗣️ If you're lookin' to get in on a sell stop order, don't even think about settin' that stop loss till after the breakout 🚀. You feel me? Now, if you're smart, you'll place that stop loss where I told you to 📍, but if you're a rebel, you can put it wherever you like 🤪 - just don't say I didn't warn you ⚠️. You're playin' with fire 🔥, and it's your risk, not mine 👊."

📌Thief SL placed at the nearest/swing High or Low level Using the 1H timeframe (3140) Day/Scalping trade basis.

📌SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

Target 🎯: 3030 (or) Escape Before the Target

🧲Scalpers, take note 👀 : only scalp on the Short side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

XAU/USD "The Gold" Metal Market Heist Plan (Scalping/Day Trade) is currently experiencing a Neutral trend (there is a chance to move bearishness),., driven by several key factors.👇

📰🗞️Get & Read the Fundamental, Macro, COT Report, Quantitative Analysis, Sentimental Outlook, Intermarket Analysis, Future trend targets.. go ahead to check 👉👉👉🔗

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

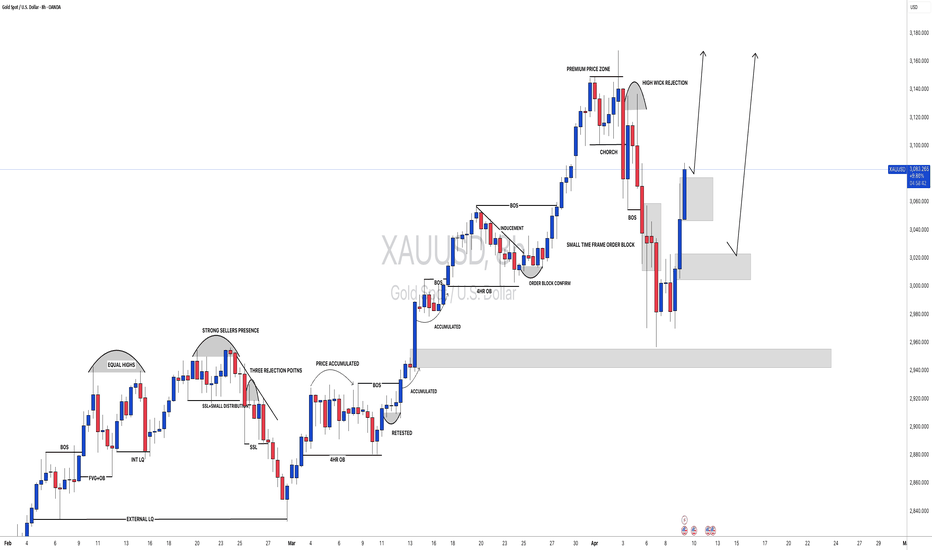

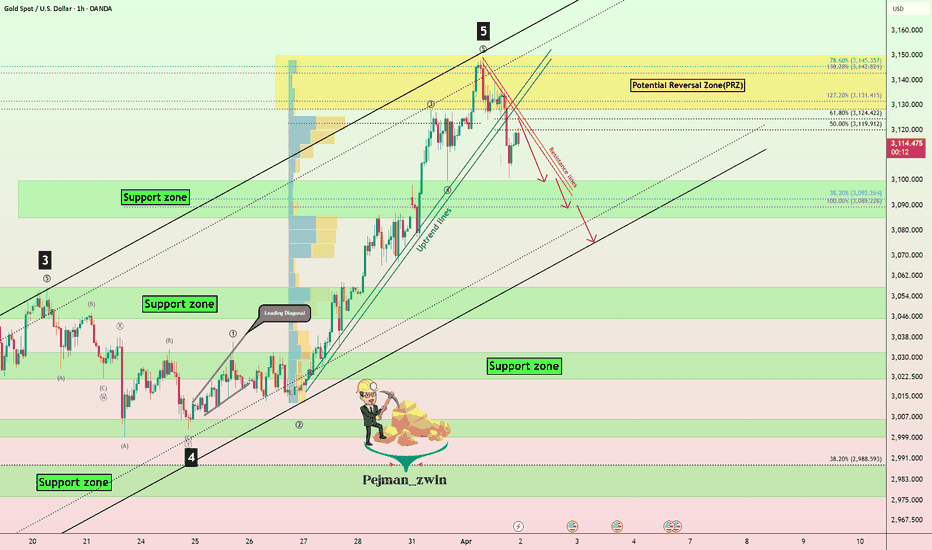

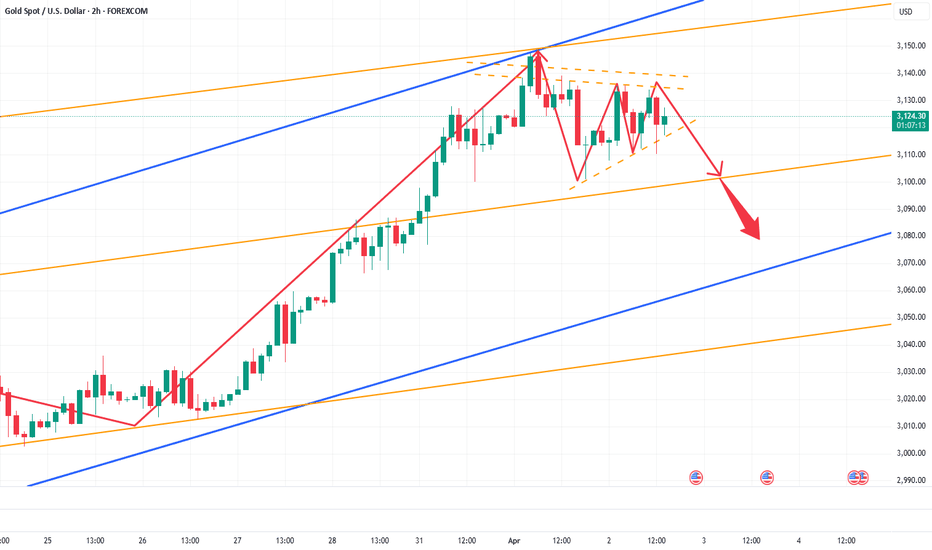

Gold’s Rally Pauses – Correction Incoming!!!Gold ( OANDA:XAUUSD ) started to correct at the Potential Reversal Zone(PRZ) and near the upper line of the Ascending Channel . The question is, will we have a minor correction or a major correction(main)?

Gold is moving near Resistance lines and Fibonacci levels and was able to breaks the Uptrend lines . I view the upward movement of the last few hours as an upward correction , which will likely cause gold to fall again.

In terms of Elliott waves , it looks like Gold has completed a major wave 5 and I expect Gold to start a major corrective wave . In Gold's history , major impulse waves have completed precisely near the upper lines of ascending channels .

I expect Gold to decline at least to the Support zone($3,100-$3,085) , if gold can break the lower line of the ascending channel, we can be more confident that we are in the main corrective waves .

Do you think Gold can create a new All-Time High(ATH) again?

Note: If Gold goes above $3,130, we can expect more pumps and a new All-Time High(ATH).

Gold Analyze ( XAUUSD ), 1-hour time frame.

Be sure to follow the updated ideas.

Do not forget to put a Stop loss for your positions (For every position you want to open).

Please follow your strategy; this is just my idea, and I will gladly see your ideas in this post.

Please do not forget the ✅' like '✅ button 🙏😊 & Share it with your friends; thanks, and Trade safe.

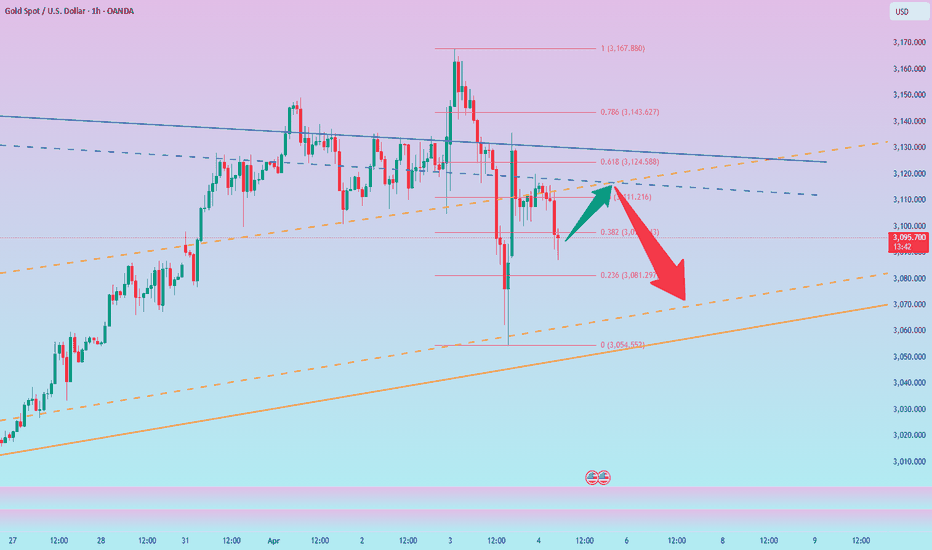

The bearish trend is just beginning: Short Gold!Good morning, bros! With the gold price falling by LSE:100H yesterday, there is no doubt that the market is currently dominated by bears! As the gold high gradually moves down, it is difficult to hold even 3100, further weakening the bullish momentum and exacerbating panic selling to a certain extent!

Obviously, as gold completes the regional conversion, the previous support has been transformed into an important resistance area in the short term, and the short-term resistance effect of the 3115-3125 zone is very obvious; and the current area near 3090 does not play a structural support role, so the area near 3090 is easy to be broken, and the short-term support below is in the 3075-3065 zone.

So in terms of short-term trading, before the NFP market, we can still short gold with the resistance of the 3115-3125 zone, with the first target pointing to the 3075-3065 zone, followed by the 3055-3045 zone.

The trading strategy verification accuracy rate is more than 90%; one step ahead, exclusive access to trading strategies and real-time trading settings

XAUUSD: Buy or Sell?Today's gold market can be said to have the largest intraday volatility since 2025! After experiencing violent fluctuations, the current trend of gold has once again become anxious.

However, from the perspective of range conversion, it is certain that gold is currently operating in a weak position, and after the brutal and violent fluctuations, the market also needs to recuperate. And there will be NFP tomorrow. It is expected that before NFP, it will be difficult for gold to form a new unilateral market again. So in the process of shock, I think both long and short sides have a certain profit space.

First of all, pay attention to the resistance of 3125-3135 area on the top. If gold touches this area during the shock process, we can still short gold;

And the first focus on the 3095-3085 area on the bottom is that if gold touches this area during the shock process, we can still consider going long on gold.

The trading strategy verification accuracy rate is more than 90%; one step ahead, exclusive access to trading strategies and real-time trading settings

XAUUSD Analysis: Why I’m Not Buying Gold at the Highs!Gold’s Rally: A Strategic Plan for the Next Buy Setup!

✨ Gold (XAUUSD) has experienced a strong rally recently, fueled by the stock market sell-off. However, I’m waiting for a better entry point rather than buying at the current highs, as price is trading at a premium. 📉 My focus is on a potential retracement on the daily and 4-hour timeframes, targeting a pullback into the swing low-to-high range. Specifically, I’m watching for price to return to the equilibrium zone around the 50% Fibonacci retracement level. 🔄 If price pulls back and we see a bullish break of market structure in this area, it could present a solid buying opportunity. Until then, patience is key! 🛠️

⚠️ This is not financial advice. Always trade responsibly and conduct your own analysis.

Continue to short gold after the rebound!Although gold did not fall due to the negative impact of ADP data, this does not mean that the risk of gold falling has been eliminated. As long as gold does not break through the recent highs, and in the fluctuations in recent days, the resistance strength of the 3135-3145 zone has been strengthened, gold still has a considerable risk of falling before breaking through the resistance area, and once gold falls below the 3110-3100 zone, it is bound to retreat to the 3095-3085 zone!

The trading strategy verification accuracy rate is more than 90%; one step ahead, exclusive access to trading strategies and real-time trading settings

A rebound is a good opportunity to short goldGold rebounds from 3100, but is the bullish momentum truly revived?

I don’t see it that way. Yesterday’s retracement to 3100 has already weakened the strong bullish structure to some extent, with 3150 likely acting as a key resistance level. I believe the current rebound is merely a technical retest of the 3150 zone, reinforcing it as a potential cycle high and paving the way for a double-top formation, which could provide a bearish technical setup for further downside.

Following the initial 3100 test, a second retest of this support level is likely. If gold fails to hold 3100 on the second attempt, a break lower towards 3095-3085 would become increasingly probable.

I will continue to scale into short positions within the 3132-3142 zone, with an initial target of 3120-3110. If gold approaches 3100, I will closely monitor the price action to assess the likelihood of a further breakdown.

The trading strategy verification accuracy rate is more than 90%; one step ahead, exclusive access to trading strategies and real-time trading settings

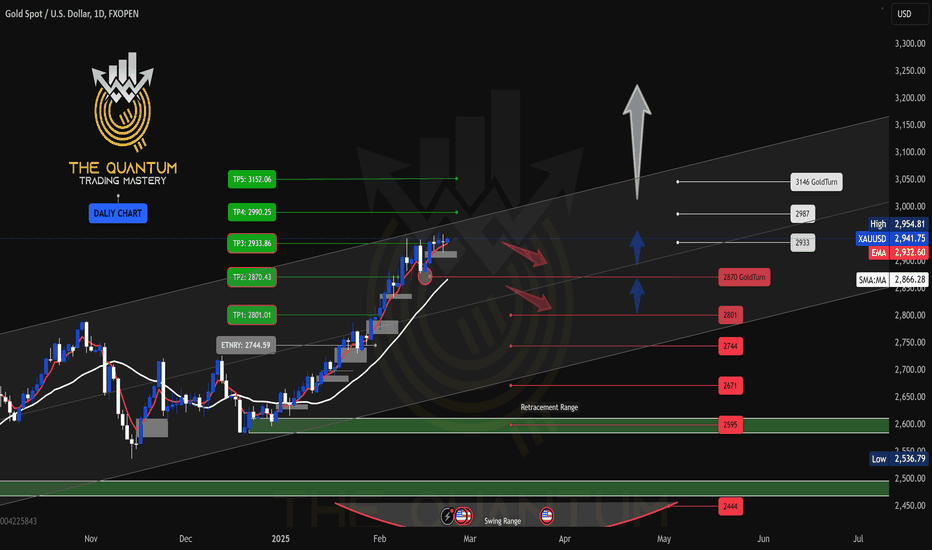

GOLD DAILY CHART MID/LONG TERM UPDATEGOLD Daily Chart Update: 24th FEB 2025

Hi Everyone,

Here’s the latest update on the GOLD daily chart, which we've been closely monitoring and trading. Below, we break down recent price movements, updated key levels, and provide actionable insights for the days ahead.

Recap of Recent Chart Success!

Gold recently achieved a record high of $2,954.80. Our analysis has consistently highlighted that after reaching each target level, prices tend to reverse by over 40+ pips to the GoldTurn level. This pattern was evident when, after hitting TP3 at $2,933, the price retraced more than 40+ pips to the GoldTurn level at 2870, which acted as a support, before rebounding bullishly to surpass resistance and reach the all-time high of $2,954.81.

Current Outlook: Bullish or Bearish?

Presently, gold's price is oscillating between a resistance gap at $2,990 and a support gap at $2,933. The $2,990 level serves as a key resistance, while $2,933 acts as support. Additionally, the Fair Value Gap (FVG) offers support at $2,920.

In summary, while the long-term outlook remains bullish due to factors like central bank demand and economic uncertainties, short-term fluctuations between the $2,933 support and $2,990 resistance levels are expected. Traders should monitor these key levels and indicators closely to inform their strategies.

KEY LEVEL: 2870

Resistance Levels: 2990, 3052

Support Levels (GoldTurn Levels): 2933, 2870, 2801, 2744, 2671, 2595

EMA5 Behavior:

* Or If EMA5 crosses and locks above 2933, it strengthens the bullish case.

* If EMA5 fails to hold above 2933, cross and lock below this level 2933, expect a pullback to key GOLDTURN levels below.

Recommendations:

* Capitalize on Dip Opportunities: Use smaller timeframes (1H, 4H) to trade around GOLDTURN levels, targeting 30–40 pips per trade.

* Stay focused on shorter trades in this range-bound market to manage volatility effectively.

Long-Term Bias:

Maintain a bullish outlook while viewing pullbacks as buying opportunities.

Accumulate positions near key support levels for a safer approach instead of chasing highs.

Final Note:

Trade with confidence and precision. Our analysis ensures you’re well-prepared to navigate the evolving market landscape. Stay updated with our daily insights across multiple timeframes for deeper clarity.

Thank you for your continued trust! Don’t forget to like, share, and comment to support our work.

Best regards,

The Quantum Trading Mastery Team

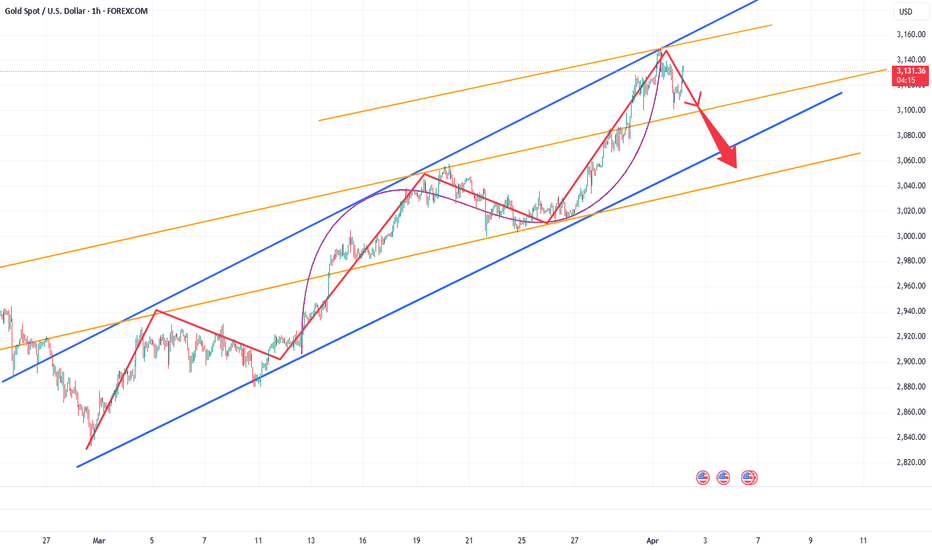

Short gold, profit target: 500pipsAfter reaching a fresh high of 3150, gold pulled back and has since been consolidating in a narrow range around 3132. While there is no denying that gold remains in a strong bullish trend, I believe it is now at its peak and could top out at any moment. This is why I continue to look for shorting opportunities rather than blindly chasing long positions—because I must first evaluate whether I have the risk tolerance to withstand a potential long-side drawdown.

Currently, gold is showing signs of exhaustion, retreating from 3150 and stalling near its ascending trend channel resistance. There is a strong possibility that this marks the end of the parabolic uptrend, leading to a rounded top correction, similar to the previous price cycle. A potential retracement zone aligns with a $50 pullback.

From a risk management perspective, going long at elevated levels presents significant challenges in setting a stop-loss (SL). A tight SL increases the probability of being stopped out due to market volatility, while a wider SL or no SL at all could expose long positions to severe drawdowns or liquidation if the market collapses.

On the contrary, short positions allow for better-defined SL placement, and gold tends to correct sharply after an extended rally, offering favorable exit opportunities. The worst-case scenario for short sellers is missing out on further upside gains, but in return, we significantly reduce the risk of capital destruction. This is the primary reason why I remain firmly bearish on gold at current levels!

Gold has retreated from its 3150 high, showing signs of momentum exhaustion. Given this price action, traders can consider initiating short positions within the 3135-3145 zone, aiming for a pullback toward the 3100 level. This setup offers a potential $50 profit per trade.