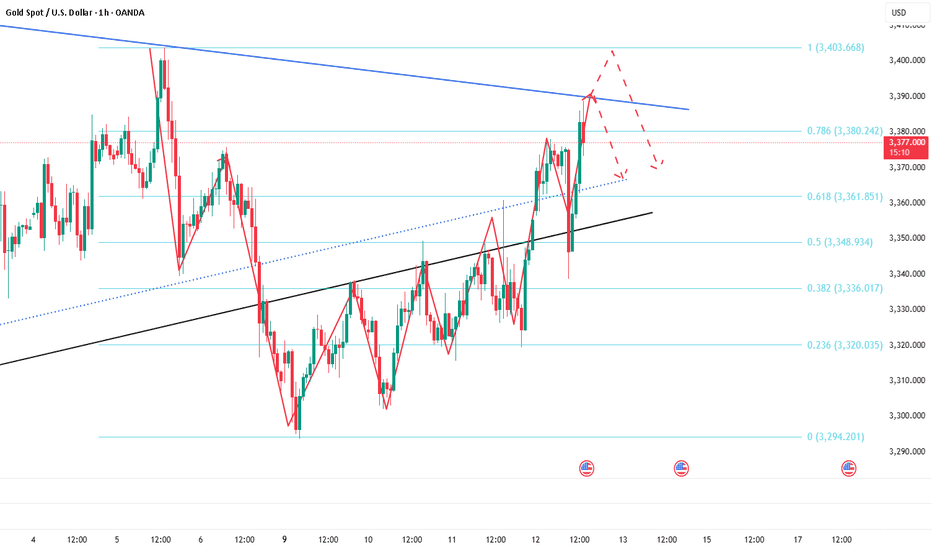

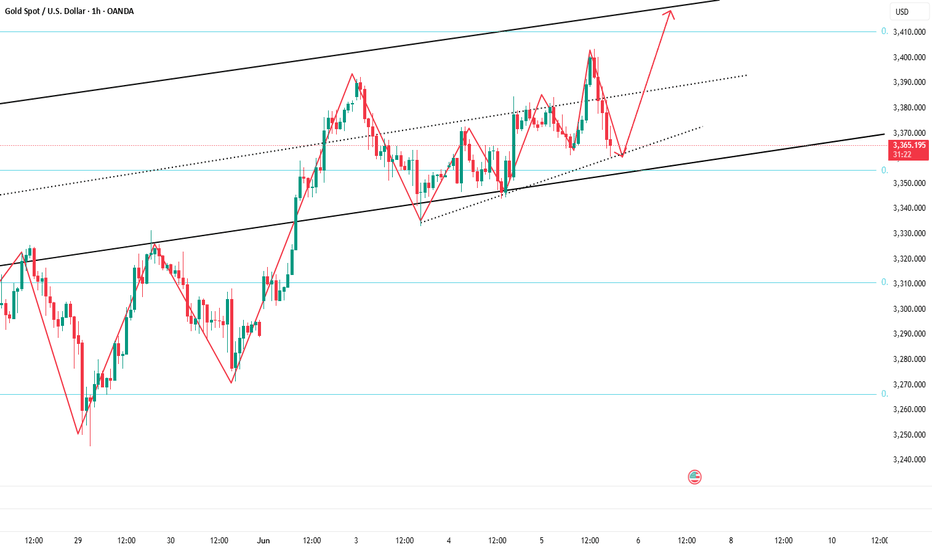

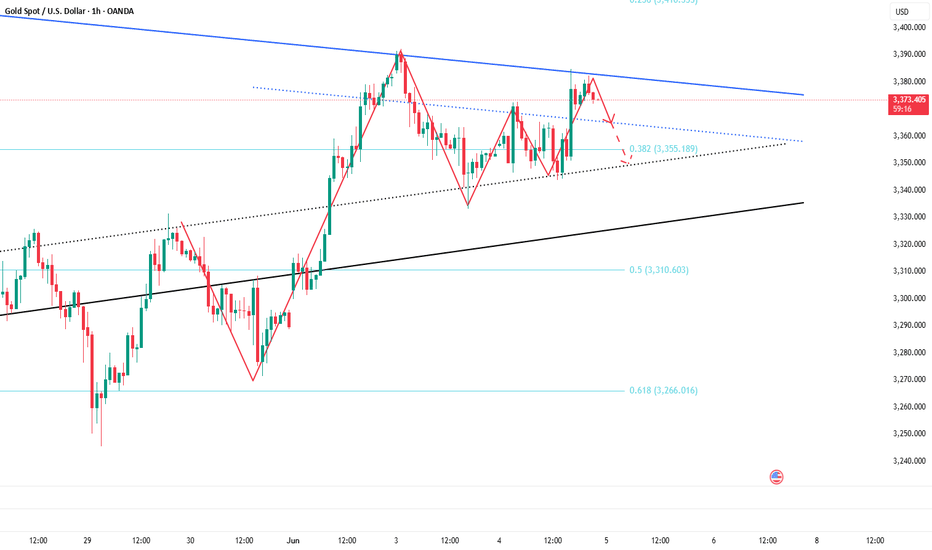

Short gold ,it is expected to retreatToday, we accurately seized the trading opportunity of long gold at 3350 according to the trading plan, and hit TP: 3380 in the process of rebounding. We firmly grasped the profit of 300pips in the short-term long trading. At present, gold maintains the trend of continued rise! Now I definitely do not advocate chasing gold in short-term trading. On the contrary, I will actively look for good opportunities for short-term short trading to earn profits from short-term retracement.

In the short term, the suppression area I focus on is the 3390-3395 area, because the gold trend is relatively strong during the European session, and the US session should continue. If gold cannot break through this area in the short term, gold will likely usher in a wave of retracement. I think it should not be difficult to test the 3370-3360 area downward; secondly, we must pay attention to the same suppression area as the short-term high of 3402: 3405-3415; if gold touches this area and stagflation occurs, then it may form a secondary high in the short term, thereby hitting the firmness of the bulls' confidence and ushering in a retracement.

So next, I will test the gold short trade around the two areas of 3390-3395 and 3405-3415. Relatively speaking, the profit and loss ratio is still very favorable to us! But in the process of trading, we must strictly set up protection, after all, it is a counter-trend trade in the short term!

Xauusdsignals

Gold is rising, beware of a pullback.Since last Friday, the daily line has shown an alternating trend of yin and yang. In the three trading days this week, the lows and highs have been rising continuously, which shows that the short-term trend is strong. Today's intraday trend also illustrates this point. At present, gold has risen directly to the 3388 line, directly refreshing the intraday high again.

From the hourly chart, we must be careful of the possibility of gold diving. From the previous rules, each rise is about 45 US dollars. This time it also started from 3340-3345, and the increase was close to 45 US dollars. Moreover, each time the rise is completed, the dive callback is 35 US dollars. Therefore, once it starts to fall from 3385-3390, it is very likely to reach 3350-3355.

In terms of short-term resistance, pay attention to the 3400 pressure level above; the support level is around 3340. the support level pays attention to the vicinity of 3340.

Operation strategy:

Short at 3385, stop loss at 3395, and profit range is 3360-3350.

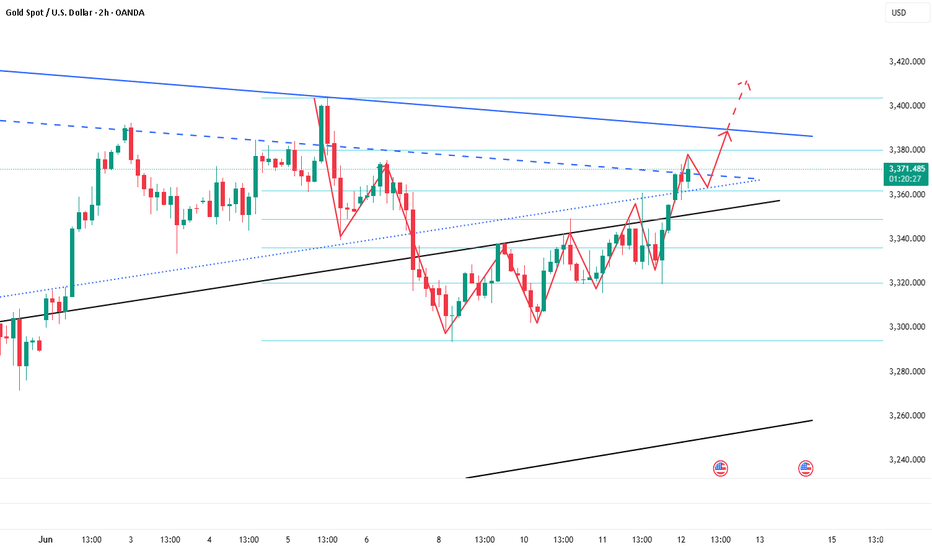

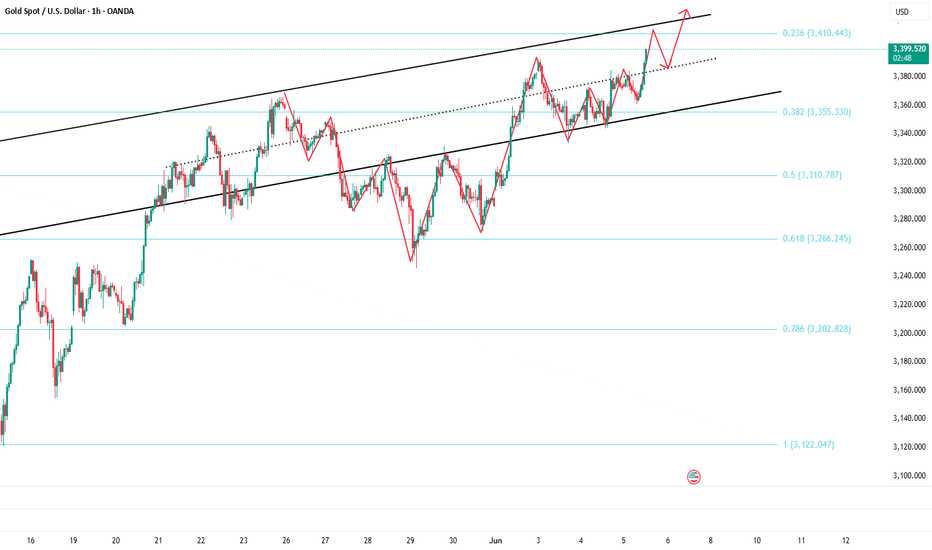

Buy gold, it is expected to continue to rise and test 3380-3390After the Asian session began, gold began to rise rapidly, and the original plan to short gold near 3355 had to be cancelled. After gold touched 3374, it fell back slightly, but after retreating to 3357, it rebounded again and broke through the short-term suppression near 3370 again. At present, gold still has the potential to rise further.

According to the current structure, gold has formed an oscillating upward structure, and the lows have been rising. After breaking through the short-term resistance area of 3360-3370, the willingness to rise has strengthened. Gold is expected to usher in a second rise and test the 3380-3390 area. If it breaks through this area, gold is even expected to continue to the 3410-3420 area. As gold rises, the gold support area rises to the 3360-3350 area.

So for short-term trading, we can try to go long on gold while controlling the risk after gold retreats to the 3360-3350 area!

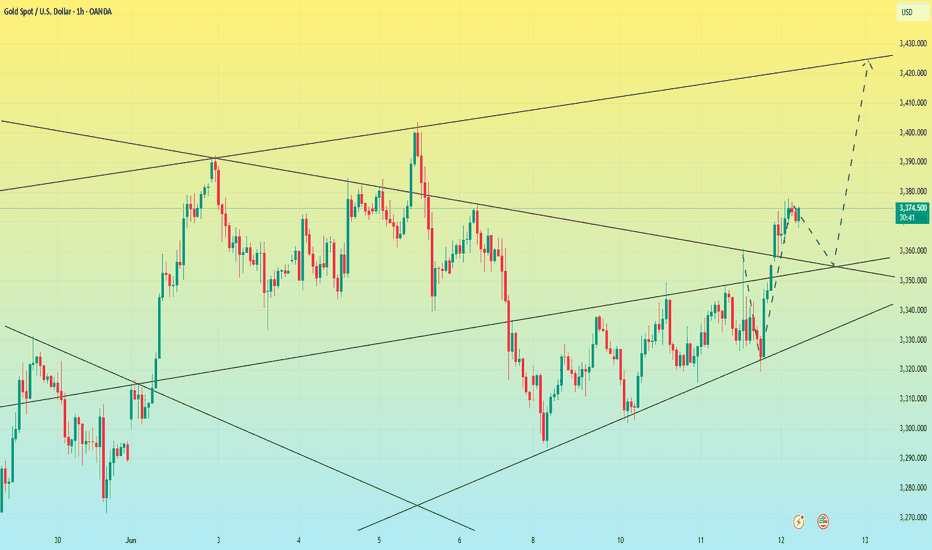

Gold surged, what will be the trend today?Information summary:

On Wednesday, the US dollar index plunged during the session as the CPI data that was lower than expected boosted the market's expectations of interest rate cuts. As of now, the lowest point is near 98.2.

After the release of the CPI data, gold rose in the short term and touched the 3360 US dollar mark, and then quickly gave up the gains and retreated to around 3320. However, it rose again due to the sharp escalation of the situation in the Middle East. As of now, the highest is around 3380.

Market analysis:

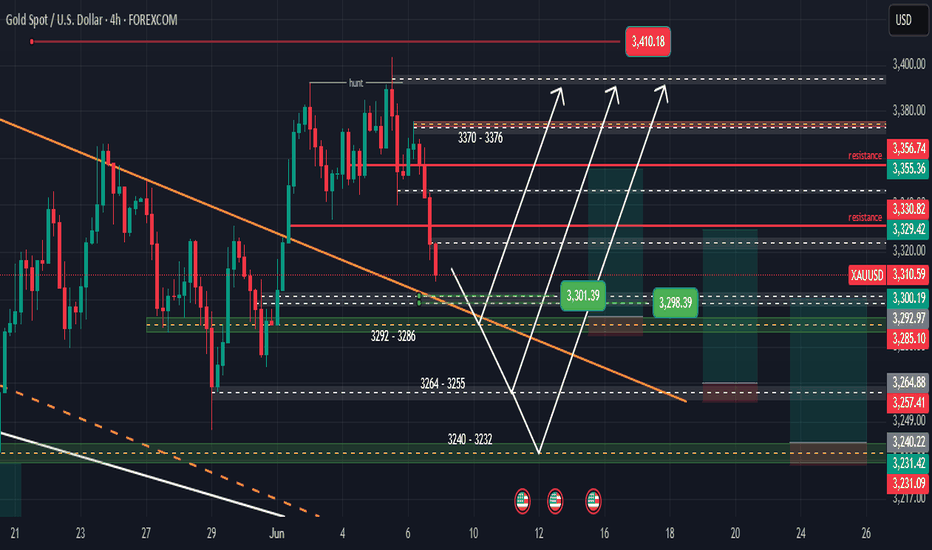

From the current 4-hour chart:

Yesterday's 3360 pressure level has been broken, and the Asian market has successfully stood above this position in the early trading. Then the suppression position of 3360 has turned into a support level. Therefore, the position we should pay close attention to next should be 3360-3350. If the price falls back to around 3350, it is possible to enter the market and do more. If the price rises again, it is very likely to break through 3400. Once it breaks through 3400, it will most likely reach around 3420.

Secondly, from the hourly chart, there are some signs of head and shoulders bottom. It would be perfect if it can fall back and then go up again. But gold cannot fall below 3345 again. If it falls below 3345 again, it cannot be long.

Operation strategy:

Go long when the price falls back to around 3350, stop loss at 3340, profit range 3375-3400.

Gold Weekly Chart May Form a Mid-Term Bearish Pattern (3142)Gold faced resistance near 3338 and has pulled back,

but the 2-hour chart still suggests that the rebound isn’t over yet, with short-term targets at 3340–3350.

—

📌 For Long Position Holders:

If you're stuck in long positions, consider adding near 3326–3316 support

to average down the cost and prepare for an exit on the next rebound.

⚠️ However, be mindful of your account risk —

If your position is deeply in the red or the account is under pressure, closing out early might be the smarter move.

—

📅 Key Focus This Week: Weekly Chart Signals Critical

🔸 Price is currently testing weekly MA10 — a break below it would target MA20 around 3142

🔸 On the daily chart, MA60 is at 3234, and if support near 3388 breaks,

combined with weak rebound volume, a bearish trend could be confirmed.

In that case, even the 3273 support may fail under bearish momentum.

—

📣 Bottom Line: The bullish setup isn’t invalidated yet,

but caution is crucial when trading long —

📉 If momentum fades, adjust your strategy quickly to protect capital.

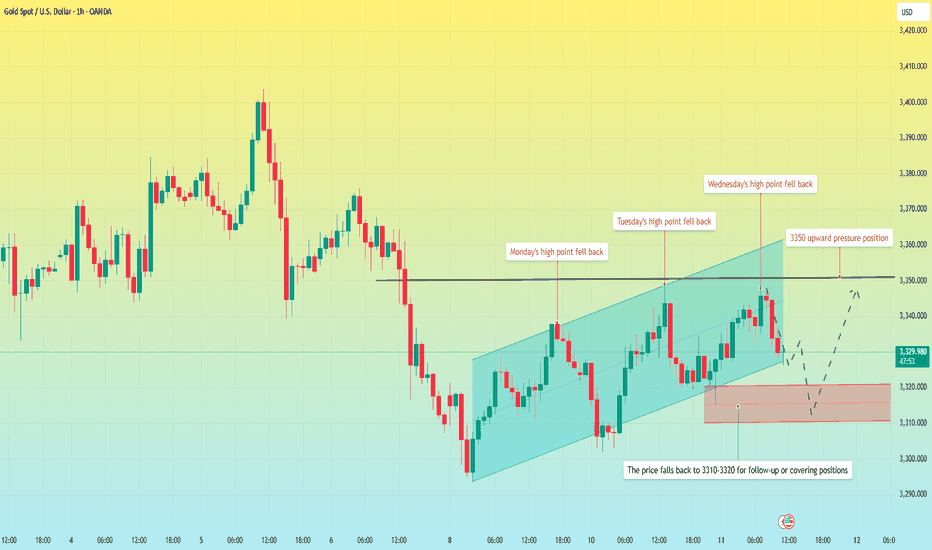

Gold fluctuates, awaiting CPI data.In Asian trading on Wednesday, traders are awaiting the release of the latest U.S. Consumer Price Index (CPI) data for May. Estimates suggest that prices are likely to rise as American households feel the impact of tariffs imposed by the Trump administration. But the easing between the world's two largest economies should have an adverse impact on safe-haven assets such as gold, and the lack of a downward trend in gold prices suggests that investors are waiting for more developments.

In terms of short-term trends, the gold 1-hour chart shows that gold prices remain in an upward channel with a low point. So from the trend, the current momentum for gold to rise will be stronger. The price pullback is giving opportunities to go long.

The change of thinking is actually following the trend. For the current operation, enter the market with the trend, and cover the position when it falls back or break through the profit position to cover the position. In a strong market, during the correction phase, the price is rising, and the amplitude of the correction is often small. The bulls retreated at the opening to accumulate momentum. Above is the pressure level of 3350-3360. Once it breaks through and stabilizes, it will accelerate the upward trend. Just follow the general trend of the market.

Operation strategy:

Go long when the price falls back to 3310-3320, stop loss at 3300, and profit range is 3345-3360.

Another try on the gold short tradeTo be honest, it was beyond my expectation that gold could continue to rebound above 3340. According to my original expectation, the upper limit of gold's rebound in the short term was around 3336-3338. However, gold has already touched around 3342 during the rebound, but because gold failed to close above 3345, I still advocate shorting gold in batches in the 3335-3345 area.

Recently, both the long and short sides of gold have not continued, and the overall market tends to be volatile. In the short term, as long as gold does not break through 3345, gold still has a chance to retrace, which also means that the rebound is an opportunity for us to short gold, but with the rebound of gold, we need to moderately reduce the expectation of gold retracement, so for short-term short gold, our primary retracement target is in the 3325-3320 area.

So for short-term trading, I think we can still try to short gold again!

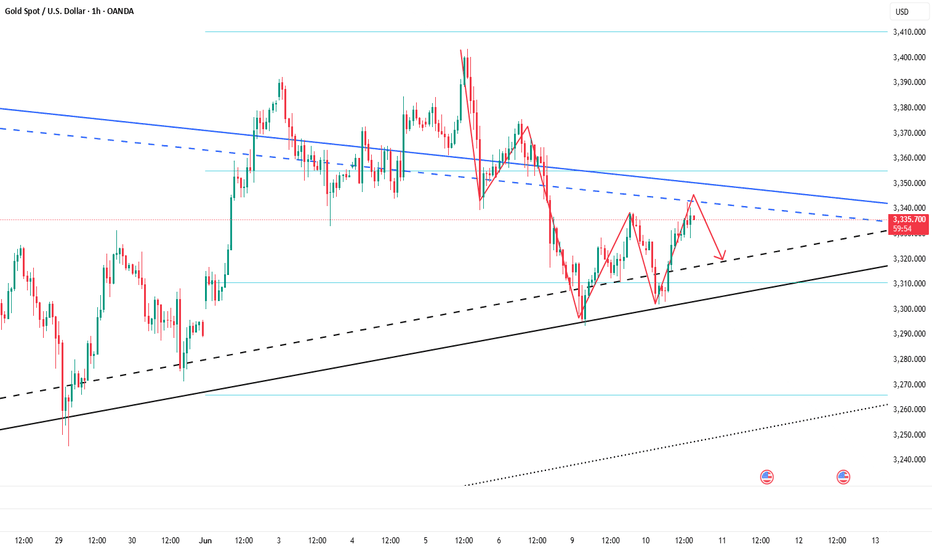

Gold is expected to continue to fall to 3280 or even 3250In the short term, the operation of gold is completely in line with my expectations. I clearly pointed out yesterday that gold will encounter resistance in the 3330-3340 area and will at least retest the area around 3315-3305 again. At present, gold has rebounded slightly after retesting the area around 3302 and is trading around 3309.

According to the strength of yesterday's rebound, gold did not effectively break through the 3300-3340 area. Gold is still weak in the short term, and the head and shoulders top structure is constructed in the 3328-3338-3328 position area in the short term, which suppresses gold to a certain extent and limits the rebound space of gold. After multiple tests, the area around 3300 may be more conducive to being broken. After gold has been under pressure and fallen many times, the current short-term resistance area has been reduced to the 3310-3320 area; so I think gold still has a good downward space in the short term, which may continue to 3280, or even around 3250.

So for short-term trading, I think it is possible to consider continuing to short gold.

Short Gold,gold is expected to test 3300 or even 3280 againAlthough gold is currently above 3310, it does not mean that gold has stopped falling and stabilized. As long as gold remains below 3330-3340, gold is still in a weak state, so I think the decline of gold may not be over yet. Judging from the current trend, I think gold will have to retest 3300 at least again, or even around 3280 before it will have a chance to stop falling and rebound.

So for the grasp of short-term trading opportunities, I think you can consider shorting gold with 3330-3340 as resistance.

Gold: Market Analysis and Trading StrategiesSo far, although the price has risen, it has not yet broken through the upper resistance, and the lower support remains intact. Overall, the market is still in a narrow range of consolidation. From a technical perspective, the 2-hour chart shows a bullish bias, indicating a potential for continued upward movement in the short term.

However, if during this consolidation phase the price breaks below the key support at 3309, it is likely to further test the support zone around 3296–3288.

At this stage, traders can consider entering light long positions and gradually add to them on dips to reduce the average entry price. For more conservative traders, it's advisable to wait until a clear breakout occurs before taking action.

Watch the 3338–3352 area for potential short opportunities as it's a key resistance zone, and the 3303–3288 range for long entries as it offers strong support. Trading near these levels generally carries lower risk and a higher probability of profit.

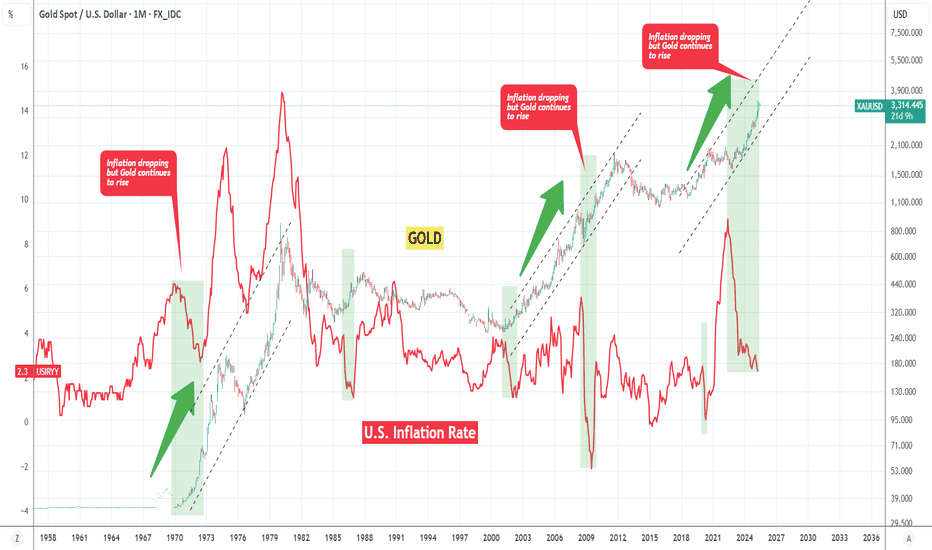

XAUUSD rising while Inflation dropping. Historically BULLISH!Gold (XAUUSD) has been practically on a non-stop aggressive rise since the late 2022 Low. What's more interesting is that during this 2.5-year Bull run, the U.S. Inflation Rate (red trend-line) has been on a sharp decline, which is something you wouldn't traditionally expect out of a save haven asset like Gold.

On the contrary, Gold has been historically used as a hedge against high inflation, so when Inflation drops, you would have technically expected for Gold to drop too (and vice versa).

Since 1970, there have only been another 4 (relatively long) time periods when Inflation declined while Gold increased. On all occasions, Gold extended the rise by at least 1 year even when Inflation reversed.

In our opinion, the current divergence looks more like 1970 - 1972 and 2008 - 2009. This suggests that Gold is still within a Bull Cycle and has some more room to rise before a new Bear Cycle starts. Long-term we remain bullish on Gold.

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

GOLD: Bullish Bias Holds, But Mind the Unfilled GapGold dipped below 3300 today and bounced back, though the gap near 3289 remains unfilled.

This shows buying interest is active, but also reveals that some sideline capital is still waiting for a full retest.

Combined with selling pressure on the rebound, it’s clear that bullish strength is currently limited.

—

🔍 Two Possible Scenarios from Here:

1️⃣ If support proves firm during consolidation, bulls may regain momentum and push higher

2️⃣ If support fails, price is likely to fill the 3289 gap before launching the next leg up

📌 Current Trade Outlook:

✅ Bullish trend remains intact

✅ Regardless of the short-term path, the direction is upward

✅ Watch resistance at 3331, with a key zone near 3348

—

⚠️ Note: The daily chart structure still needs further correction.

If volume remains weak after a second dip and a failed bounce follows, bears may take over again — in that case, the next downside target would be around 3258–3228

📩 Conclusion: Stay long-biased, but react flexibly to support strength and volume shifts.

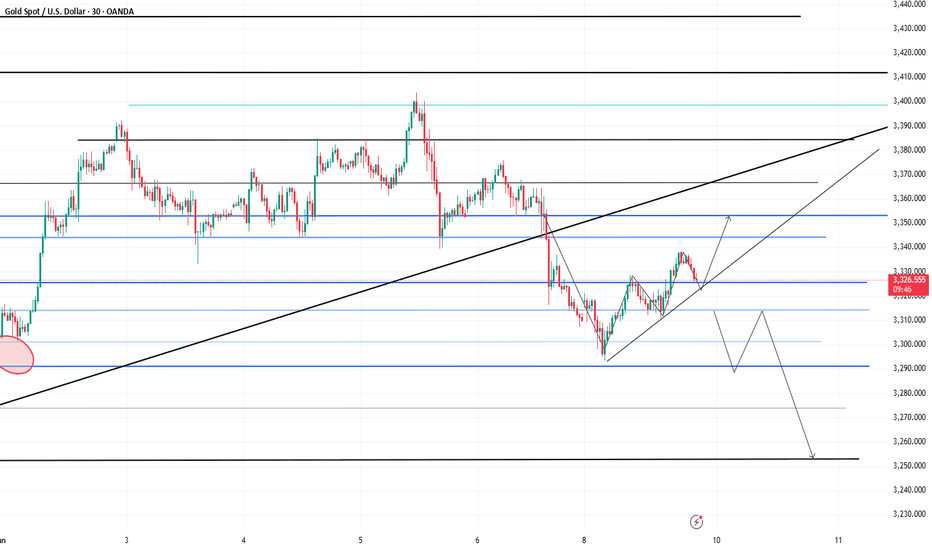

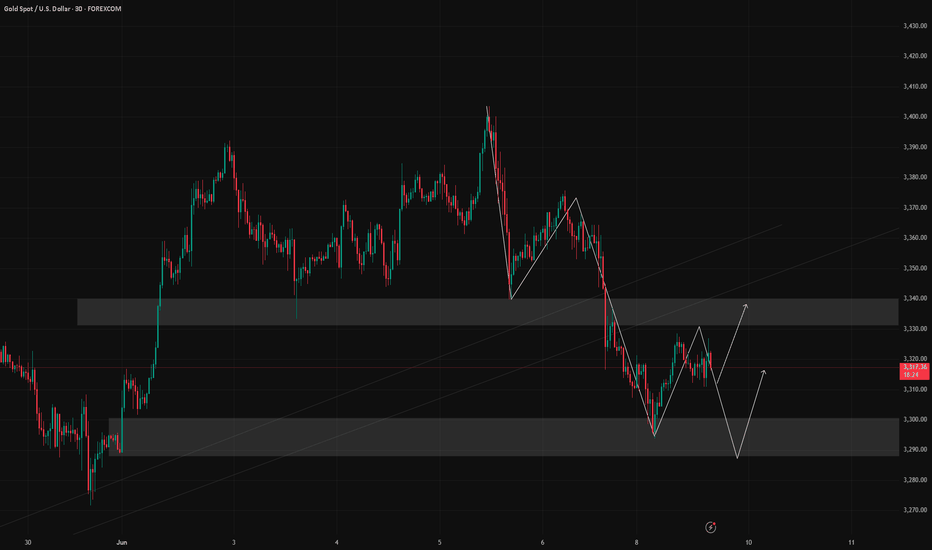

6/9 Gold Analysis and Trading SignalsLast Friday, gold experienced a sharp drop, briefly testing the 3300 level. From a technical standpoint, the market has started to show early signs of bottom formation, which could materialize either as a double bottom / multiple bottom pattern, or through a direct upside breakout.

If the former unfolds, we expect a stronger and more sustainable rebound.

If it turns into a straight bullish leg, traders should be cautious of potential exhaustion in the rally, which may invite a renewed bearish attack.

📊 Key Macro Focus This Week:

Markets will be primarily influenced by data releases on Wednesday through Friday, including:

Monthly CPI

Initial Jobless Claims

Inflation Expectations

As a result, Monday's trading will be dominated by technical patterns, with a bias toward a corrective rebound. The strategic focus should be on buying near support, with short-term opportunities to sell near key resistance.

📌 Monday Trading Plan:

✅ Buy in the 3303–3286 zone (early base-building area)

✅ Sell in the 3343–3353 zone (overhead resistance)

🔄 Intraday pivot levels for tactical entries:

3338 / 3326 / 3317 / 3309

Gold Analysis with Signals

For the beginning of the market, we expect the price correction to continue to the specified support levels (buy signals), which will be completed until the downward channel is broken, and after collecting liquidity, we will continue to see the price rise. The 4-hour minor ceiling still has buyers' liquidity that has not been settled.

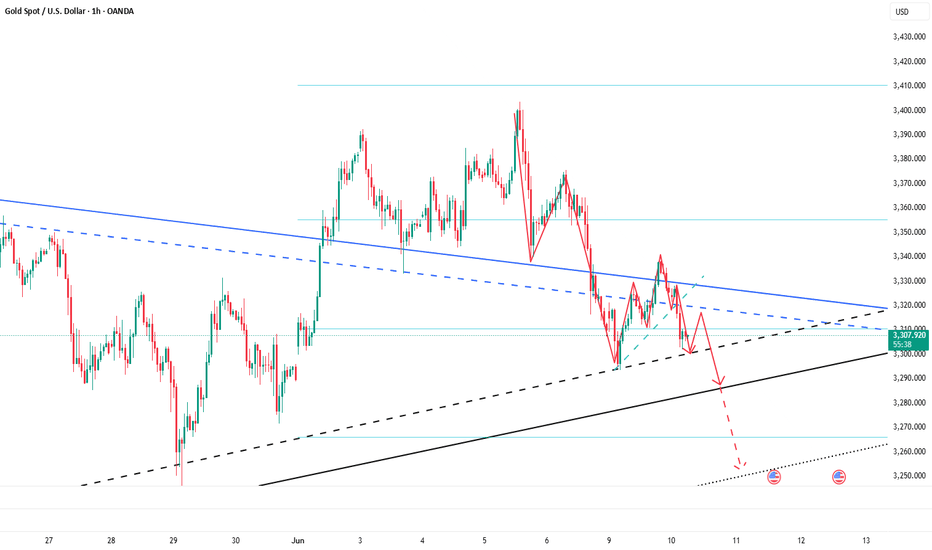

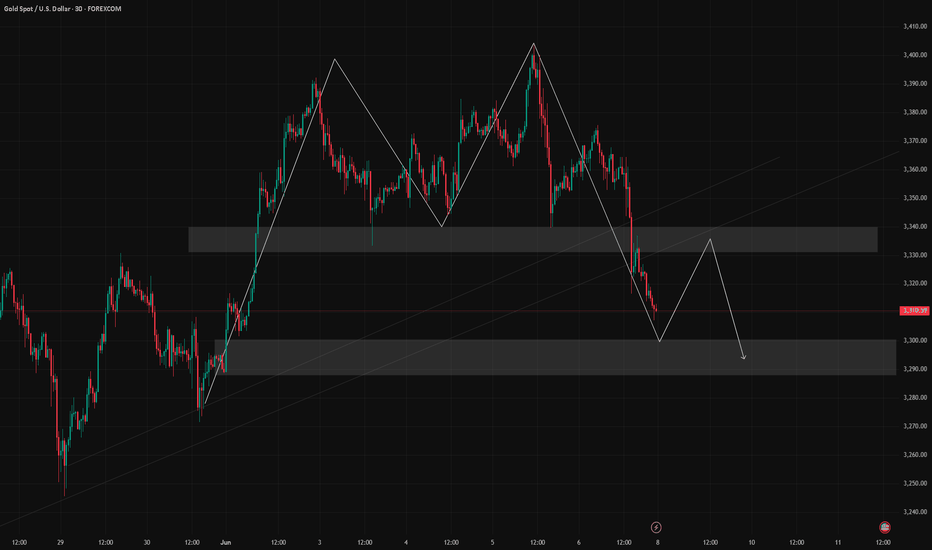

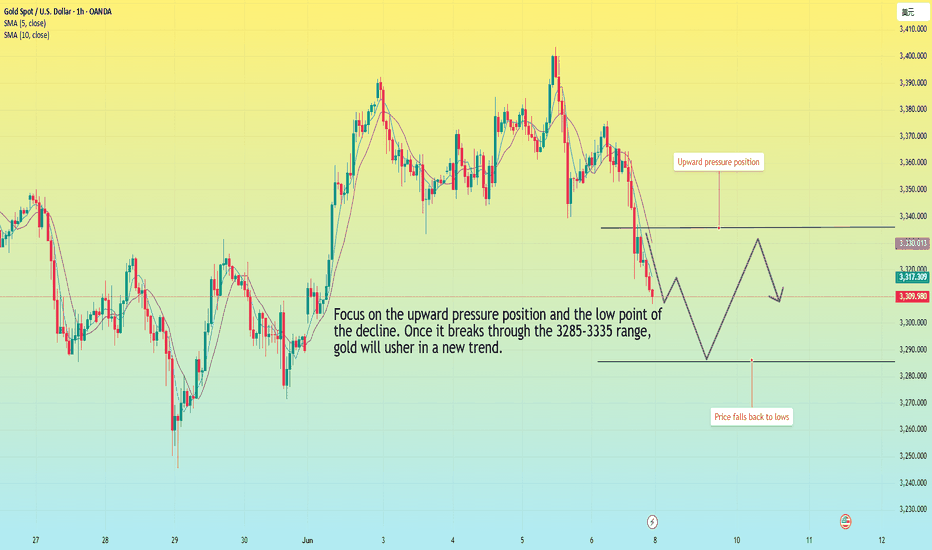

Gold plunges, what will be the trend next week?From the daily chart:

Since the last round of breaking the triangle convergence oscillation and breaking the trend line, gold has surged to 3400, but the upward momentum is insufficient and it has retreated. The low point of the retreat on Friday happened to be the support level of the previous triangle convergence trend line near 3300. If it falls below, the price will return to the triangle convergence oscillation range, and the gold price may fall further;

From the perspective of gold 1 hour, the MA5-day and 10-day moving averages have formed a dead cross downward, so gold still has downward momentum. After the gold 1-hour high box oscillation, gold finally broke through the box downward, indicating that the gold shorts are better, so the bottom of the gold box has now formed resistance, and the gold short-term resistance to gold has been formed near 3335. If gold is 3335 at the beginning of next week, then gold can continue to be short.

Next week's operation strategy is still around the 3285-3335 range.

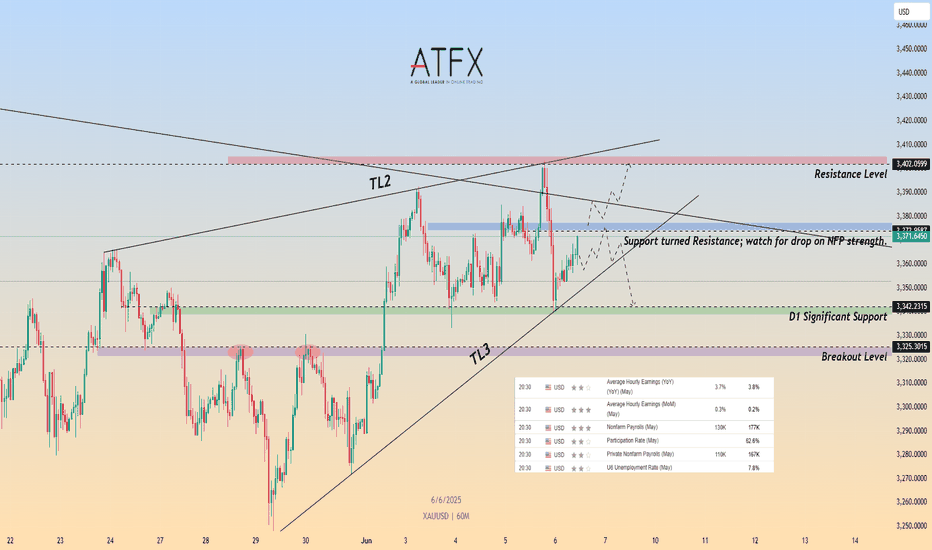

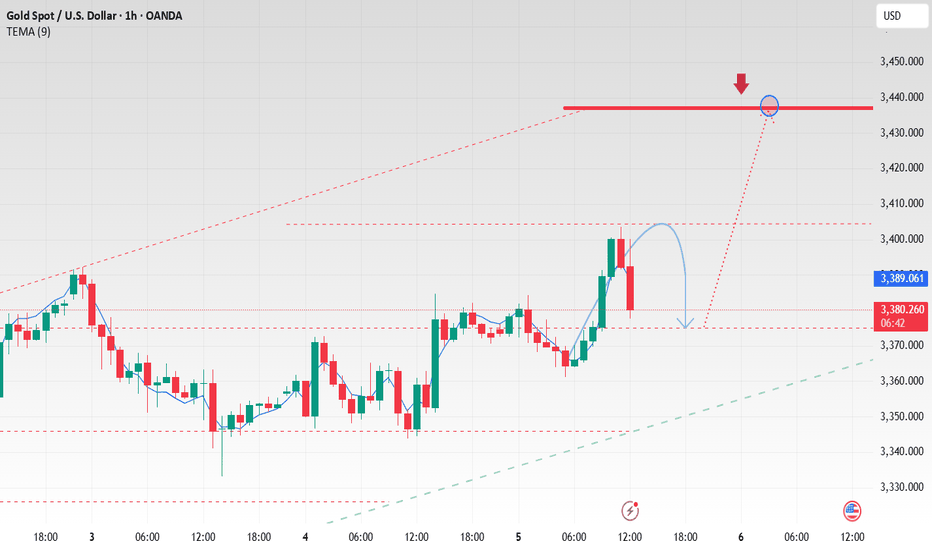

Geopolitical Undercurrents Support Gold as NFP LoomsTVC:GOLD OANDA:XAUUSD Gold hovers near $3,370 after failing to hold above $3,374, where previous support has turned into resistance. Price remains trapped between TL2 and TL3, with short-term direction hinging on tonight’s U.S. NFP data (130K jobs expected, 3.7% YoY wage growth). A strong report may trigger a drop toward the $3,342–$3,325 support zone, while weaker data could spark a bullish breakout toward $3,402.

Although Trump and Xi agreed to restart trade talks, deep fractures remain over export controls, Taiwan, and rare earth supply. These unresolved issues suggest geopolitical risk is far from over, offering medium-term support for CAPITALCOM:GOLD gold despite recent risk-on flows.

Resistance : 3,374 , 3,402

Support : 3,342 , 3,325

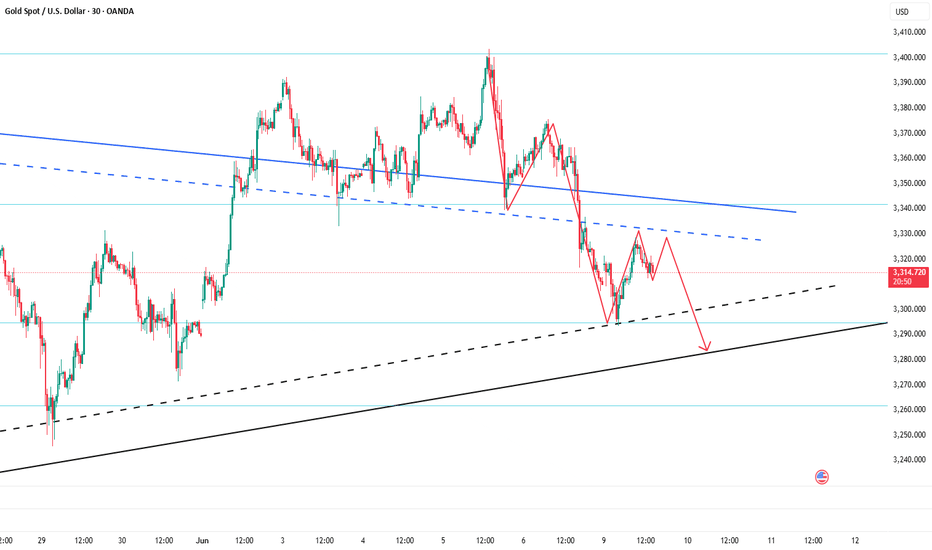

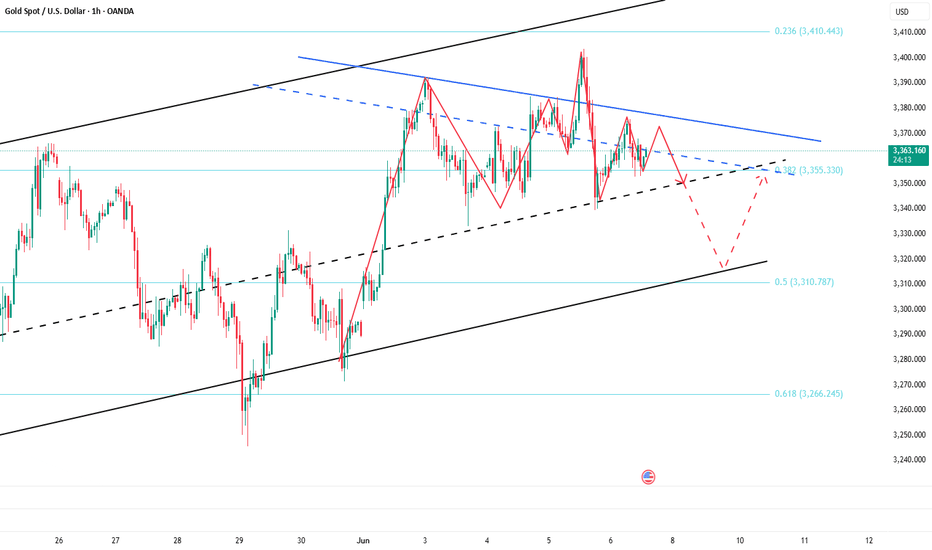

The rebound is not strong, and gold still has room to fallThere is no good entry point to participate in the transaction at present, but the highlight of today is the NFP market, so there is no need to rush to enter the market when there is no trading opportunity.

Although gold rebounded slightly after touching 3340 overnight, to be honest, the rebound strength is far less than expected, and as long as gold remains below 3365-3375, gold will remain weak in the short term, so I think gold still has room to fall. First, pay attention to the support near 3330, followed by the support near 3310. However, in trading, we must pay attention to guard against the trend of falling after rising in the NFP market.

Trading strategy:

1. Consider continuing to short gold in the 3375-3385 area, TP: 3360-3350;

2. Consider trying to go long gold in small batches in the 3325-3315 area, TP: 3340-3350

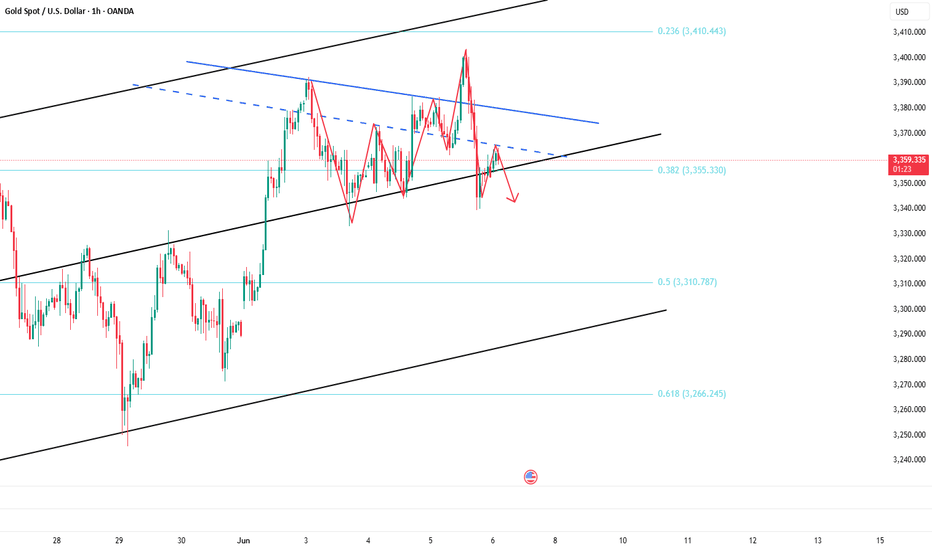

Short gold after reboundOvernight, gold broke through the 3400 mark due to the intensification of geopolitical risks, but plunged sharply due to the reduction of the risk of Sino-US trade decoupling. Because the news swept up and down, it brought certain difficulties to the transaction. Today, we will focus on the NFP market!

After overnight gold plunged to around 3340, it is currently maintaining a small rebound state. Relatively speaking, the rebound potential is weak, and with the sharp plunge of gold in the short term, the market bulls' confidence has been hit. At present, without major good news, it is difficult to make breakthrough progress based on technical support alone. The upper side faces short-term resistance of 3365-3375 area resistance. If gold cannot break through this area in the short term, gold will be weak!

Trading strategy:

Consider shorting gold in the 3370-3380 area, TP: 3355-3345

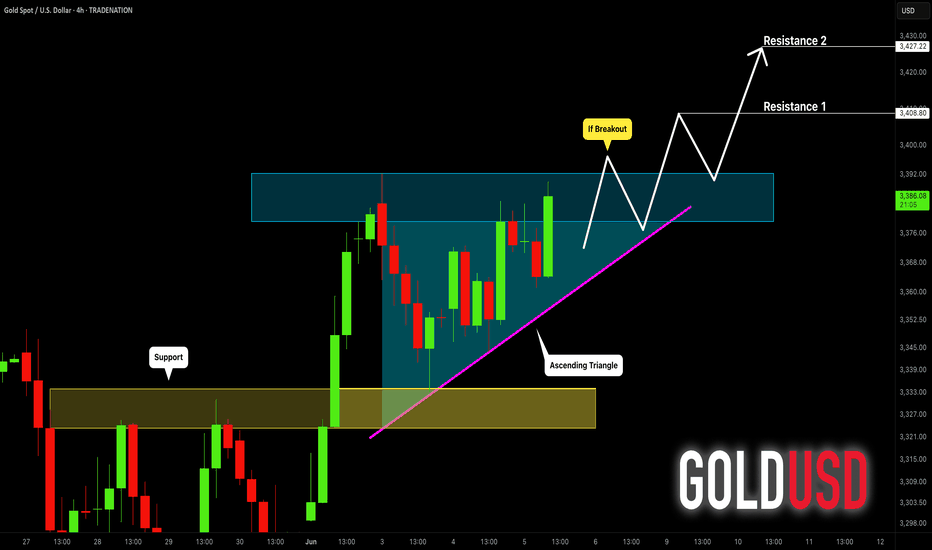

Buy gold, there is still potential to hit 3400Gold gradually fell after touching 3403, and the current lowest has fallen to 3364. Has the gold bull market ended? In fact, I think the gold retracement is a good time to buy, and I am not afraid of gold retracement.

From the overall perspective of the day, gold did not fall below the 3360 mark during today's retracement. This area has become the intraday strength and weakness dividing line. As long as gold can stay above 3360, I think gold still has the potential to continue to rebound. Moreover, the tariff issue and geopolitical conflicts have not been effectively resolved, which is still favorable for gold in terms of fundamentals. Moreover, gold has broken through 3400 twice. I think the bull market will not end easily, and there is still the potential to test 3400 again, and it may even rise to the 3410-3420 area.

Trading strategy:

Consider shorting gold in the 3365-3355 area, TP: 3390-3400

Gold is expected to continue to 3410-3420At present, gold has risen to around 3395 in the short term, breaking through the short-term high of around 3392, and there is no clear peak signal; and after breaking through the previous high of around 3392, there is no need to worry about the suppression of the technical double top structure for the time being. From this point of view, gold still has the potential to continue to rebound in the short term, and is even expected to reach the 3410-3420 area; this morning, gold has not fallen below 3360 during the adjustment process. As gold rises, the lower support area gradually moves up. The current short-term support area is in the 3385-3375 area.

Today's trading strategy:

1. Consider shorting gold when it first touches the 3410-3420 area, TP: 3395-3385

2. Consider trying to go long gold in small batches when gold falls back to the 3385-3375 area, TP: 3395-3405

US market fluctuates around 3400-3370, short first

📌 Driving events

Heightened tensions between China and the United States have also fueled the bullish momentum of gold prices. As the upcoming trade negotiations between Washington and Beijing are full of uncertainty, investors have sought safe-haven assets such as gold.

Adding to the market's nervousness, President Donald Trump signed an executive order to double the import tariffs on steel and aluminum from 25% to 50%, effective June 4. The move came a few days before Trump's much-anticipated call with Chinese President Xi Jinping, further fueling concerns about escalating trade frictions.

📊Commentary and analysis

Gold failed to fall back to 3353 during the day, and the lowest point was 3360, and it ushered in an increase, and the highest point was 3403. In the short term, 3403 was suppressed, or it may fall back, and then it fell into volatility again. The idea is to suppress short positions around 3403, stop loss at 3413, and stop profit at 3380-3372. Short-term trading, pay attention to risks.

June 5th US gold short-term trading: short near 3400, stop loss 3413, light position, take profit 3375

Short near 3372, stop loss 3360, take profit 3400

⭐️ Note: Labaron hopes that traders can properly manage their funds

- Choose the number of lots that matches your funds

GOLD (XAUUSD): Strong Bullish Pattern

Following my previous analysis, Gold in going up.

Your next signal to buy will be a bullish breakout

of a neckline of an ascending triangle pattern on a 4H time frame.

A 4H candle close above 3392 will confirm a violation.

Next resistances will be 3408 / 3428

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

I still have a short position.Although gold has risen sharply to above 3380 due to the intensification of the Russian-Ukrainian conflict, it has not made a substantial breakthrough, and has not stabilized above 3380. The bulls are not determined, which also shows that the technical suppression in the 3290-3295 area above is still strong. If gold does not break through in one fell swoop, gold is likely to usher in a wave of retracement in the short term.

Due to the fundamental impact of tariff issues and geopolitical conflicts, for short-term trading, we should not have too high expectations for the extent of the retracement for the time being, but it is expected to retrace to the 3365-3355 area. In terms of short-term trading, I still hold a short position executed near 3375, and I hope that gold can fall back and hit TP as expected.

Trading strategy:

Consider shorting gold in the 3375-3385 area, TP: 3365-3355