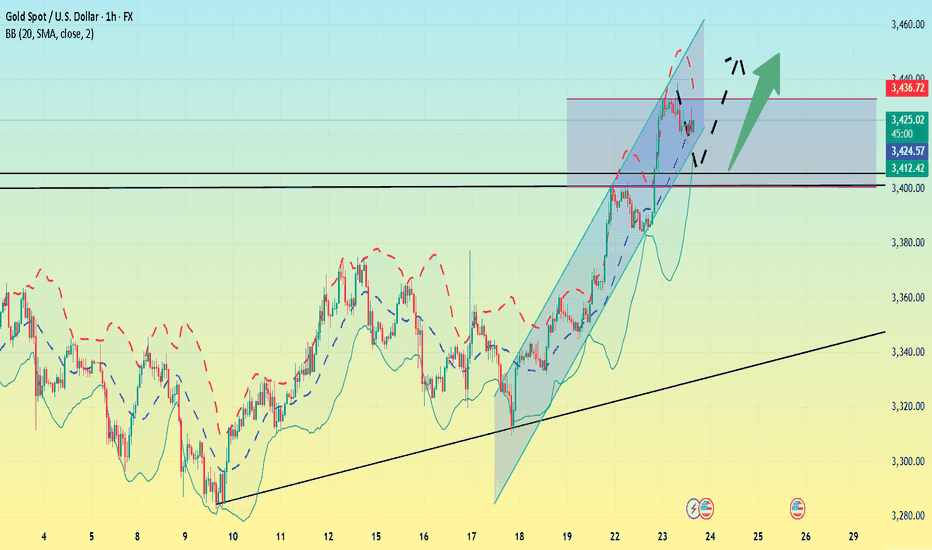

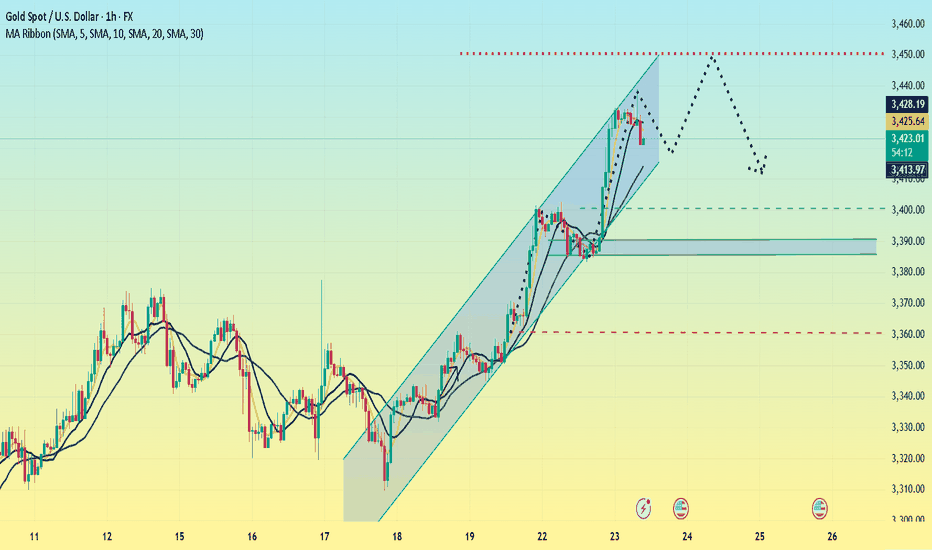

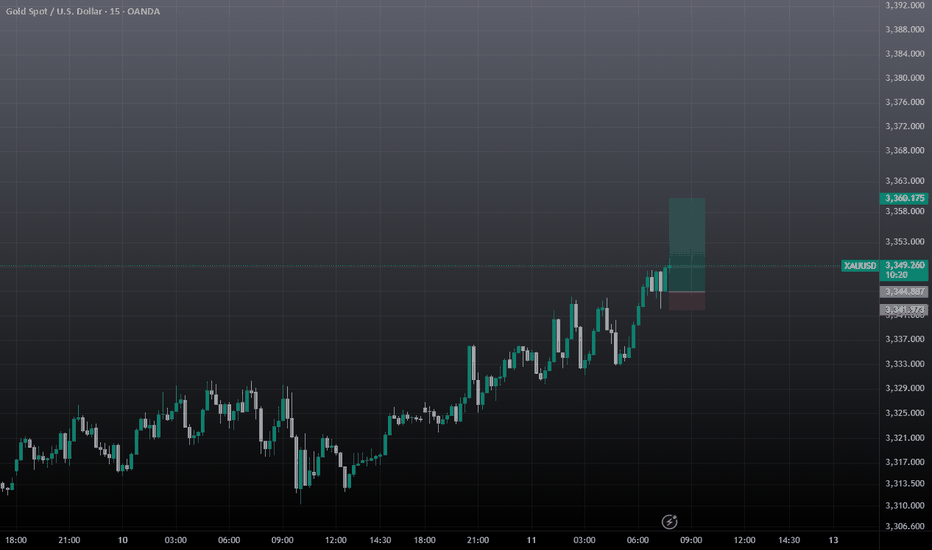

Gold bulls are on the offensive. Can they continue to chase?On Tuesday, as trade tensions and the conflict between the White House and the Federal Reserve continued, the US dollar index continued to fall, and continued to fall in the early US trading, once hitting a low of 97.28. Gold also continued to rise, once standing above the $3,430 mark, setting a new high in more than a month. From the current point of view of gold, this week has stood firm at two levels, 3,350 and 3,400. Next, it depends on whether it can continue to stand firm at the 3,450 level.

From the current hourly chart, Monday's high is around 3,400, and yesterday's low of the US market retracement on Tuesday was around 3,405. So theoretically, 3,400-3,405 has become a support position. And from the hourly chart range, the bottom trend line support is also about 3,400-3,405. Therefore, it is not ruled out that it will oscillate and retrace like yesterday, and then rise and stretch again.

Secondly, from the daily chart:

After gold stabilized at 3400, the current daily range has become 3400-3450. As we can see above, there have been three times of falling back after touching 3450. If it breaks and stabilizes above 3450 this time, the historical high of 3500 will most likely be refreshed. On the contrary, if it still cannot break through 3500 this time, the possibility of further pullback cannot be ruled out. For the next operation, I suggest paying attention to 3400-3405.

If it can retreat and stabilize at 3400-3405 during the European session, you can continue to enter the market and go long to around 3450. On the contrary, if it falls below 3400 today, then don't go long, as there may be a possibility of further retreat in the future.

Xauusdtrade

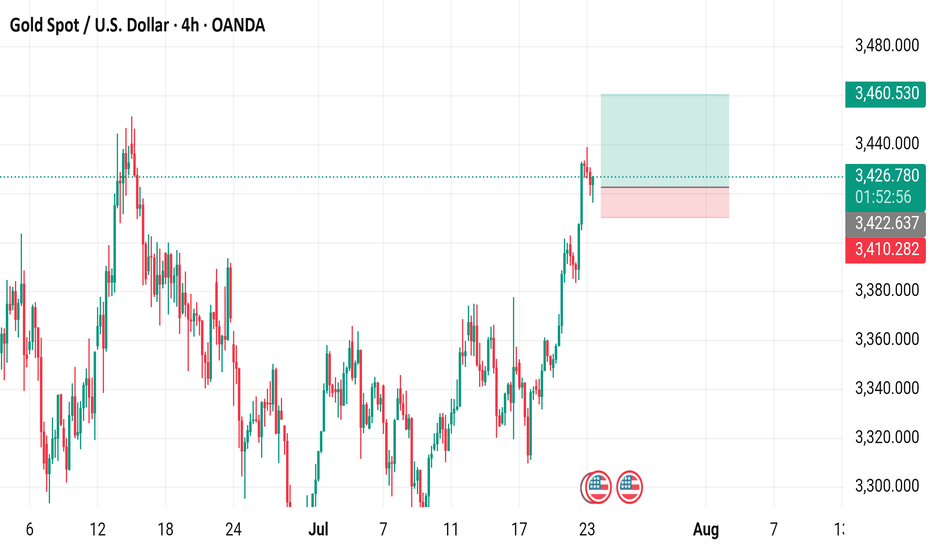

Gold Spot / U.S. Dollar (XAUUSD) - 4 Hour Chart (OANDA)4-hour chart from OANDA displays the price movement of Gold Spot (XAUUSD) from late July to early August 2025. The current price is 3,426.260, with a recent decrease of 5.185 (-0.15%). The chart shows a buy price of 3,426.580 and a sell price of 3,425.950, with a resistance level around 3,460.530 and support near 3,410.282. The data reflects trading activity as of 01:54:22 on July 23, 2025.

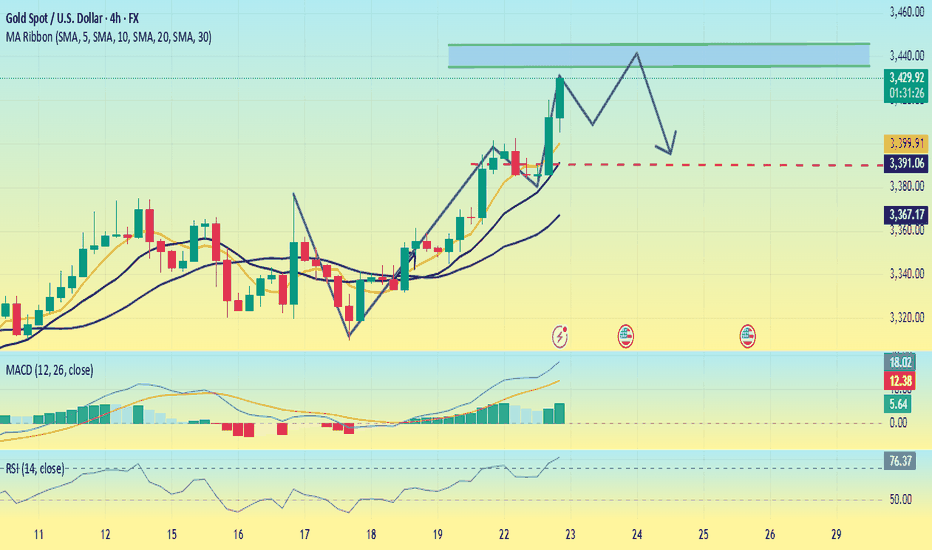

Gold is strong. Can it continue?On Tuesday, the overall gold price showed an upward trend. The highest price rose to 3433.32 on the day, and the lowest price fell to 3383.21, closing at 3431.46. On Tuesday, gold prices fluctuated during the early trading session and then corrected downward. During the European session, the price fluctuated mainly and fell weakly. It rose before the US session and hit the high point of the week again in the US session, and finally ended with a big positive line.

From the four-hour level, the technical adjustment needs, but the speculation of risk aversion suppressed this demand. There is a contradiction between the fundamentals and the technical aspects, and it is necessary to wait for the market sentiment to stabilize before clarifying the direction.

In the early Asian session, it hit a high of 3438 and then fell back. It is necessary to pay attention to the possibility of reaching the top. The support position is 3400-3405. If it falls to 3400, it may continue to adjust to around 3385. The probability of closing the negative line today is relatively high. If the price stabilizes above 3400, it is likely to maintain high fluctuations.

Today's market is complicated. Although the bullish trend has not changed, it is not advisable to be overly bullish. The operation is mainly shorting on rebounds, supplemented by long positions on pullbacks. The upper pressure position focuses on 3440-3450.

Operation strategy:

Short near 3440-3450, stop loss 3460, profit range 3420-3410.

Long near 3390, stop loss 3380, profit range 3420-3430.

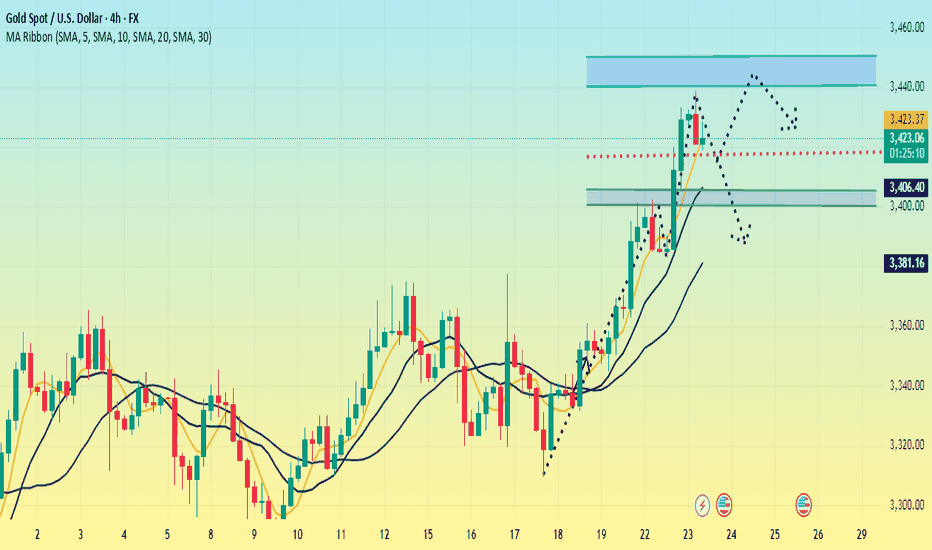

Gold (XAU/USD) 4‑Hour Technical Analysis: July 23, 2025Gold continues to trade in a bullish structure on the 4‑hour timeframe, holding above $3,420 after a steady advance from early July lows. At the time of writing, XAU/USD stands at $3,423.8, confirmed by Investing.com. This analysis employs a comprehensive blend of globally‑recognized technical tools — ranging from price action and classical indicators to institutional concepts — to identify the most probable trading zones and a high‑conviction setup.

Current Price Structure and Trend

On the 4‑hour chart, gold maintains a clear bullish market structure, consistently printing higher highs and higher lows since early July. The current price action unfolds within a well‑defined rising channel, bounded approximately between $3,400 on the lower side and $3,450 on the upper. Twice in the past week, price has tested and respected the channel’s lower boundary, confirming its validity.

Support and resistance levels are evident: immediate support lies at $3,410, coinciding with the 50% Fibonacci retracement of the July impulse wave. Below that, $3,390–$3,395 offers secondary support at the channel’s base and a longer‑term Fibonacci cluster. Resistance is concentrated at $3,445–$3,450, aligning with the channel top, upper Bollinger Band, and prior swing highs, while a secondary ceiling may emerge near $3,468–$3,470, corresponding to an Elliott Wave 3 extension target.

Candlestick, Volume, and Momentum

Recent price action has been supported by bullish candlestick formations. Notably, a strong bullish engulfing bar formed at $3,410 earlier this week, affirming institutional demand at that level. Volume profile analysis shows the heaviest transaction cluster between $3,410–$3,420, confirming this area as a smart money accumulation zone.

Volume‑weighted average price (VWAP ) currently runs near $3,418, with price holding above it, reflecting institutional positioning in favor of the bulls. Momentum indicators support the trend: MACD on the 4‑hour has just crossed bullish, RSI prints at 60 — strong but not overbought — and ADX climbs to 24, indicating a trend strengthening phase.

Indicators, Patterns, and Institutional Concepts

Trend indicators reinforce the bullish view. The 50‑ and 100‑period exponential moving averages converge around $3,415–$3,420, providing dynamic support. Ichimoku analysis shows price well above the Kumo (cloud), with a bullish Tenkan‑Kijun configuration. Bollinger Bands are widening, and price is leaning toward the upper band — a classic signal of volatility expansion in trend direction.

Classical and harmonic patterns offer further evidence. The current consolidation resembles a bull flag, suggesting continuation. Elliott Wave analysis points to a third wave in progress, with an upside projection into the $3,448–$3,468 area. Smart money concepts confirm that the recent break above $3,420 constituted a bullish break of structure (BOS), with price now retracing into a favorable gap (FVG) and a 4‑hour bullish order block anchored around $3,410–$3,415.

Liquidity and stop‑clusters likely sit above $3,445 and $3,468, making these logical targets for bullish campaigns.

Market Context and Sentiment

Gold is benefiting from a softening US dollar and a drop in volatility indexes. Seasonal tendencies also lean bullish into late summer. Sentiment on professional platforms aligns with this view: TradingView top authors and FXStreet analysts favor buying pullbacks into $3,410–$3,415 and targeting $3,450–$3,468, which harmonizes with this analysis. No major divergence from consensus is noted, adding to confidence.

Identified Trading Zones

Two strong buy zones emerge on the 4‑hour chart. The most immediate and highest‑confidence zone is $3,410–$3,415, supported by channel support, Fibonacci retracement, VWAP, moving averages, and an order block. Below this lies a secondary buy zone at $3,390–$3,395, tied to deeper Fibonacci support and the rising channel’s lower boundary.

On the other hand, clear sell zones are defined at $3,445–$3,450, where upper channel resistance, Bollinger bands, and prior highs converge, and a secondary zone at $3,468–$3,470, aligned with wave targets and round‑number psychological resistance. These areas are likely to attract profit‑taking and potential reversals.

The Golden Setup

Among the findings, one trade stands out as the highest‑conviction setup:

A long position at $3,415, with a stop loss at $3,405 and a take profit at $3,450.

This trade is backed by strong confluence: price pulling back into a well‑defined demand zone ($3,410–$3,415) that features order block support, Fibonacci retracement, VWAP alignment, EMA cluster support, and a rising channel boundary. The target sits just below the first significant resistance band ($3,445–$3,450), offering a favorable risk‑to‑reward ratio. The confidence level on this setup is rated at 8/10, given the multi‑method alignment and consistent sentiment from professional sources.

Summary Table

Category Levels / Details

Buy Zones $3,410–$3,415, $3,390–$3,395

Sell Zones $3,445–$3,450, $3,468–$3,470

Golden Setup Long @ $3,415 / SL $3,405 / TP $3,450 (Confidence: 8/10)

In conclusion, gold maintains a constructive technical outlook on the 4‑hour timeframe. The prevailing bullish structure, reinforced by classical and institutional methodologies, supports a continuation toward the $3,450–$3,468 region. The suggested Golden Setup provides a disciplined, high‑probability entry at a key inflection zone, consistent with both technical evidence and prevailing market sentiment.

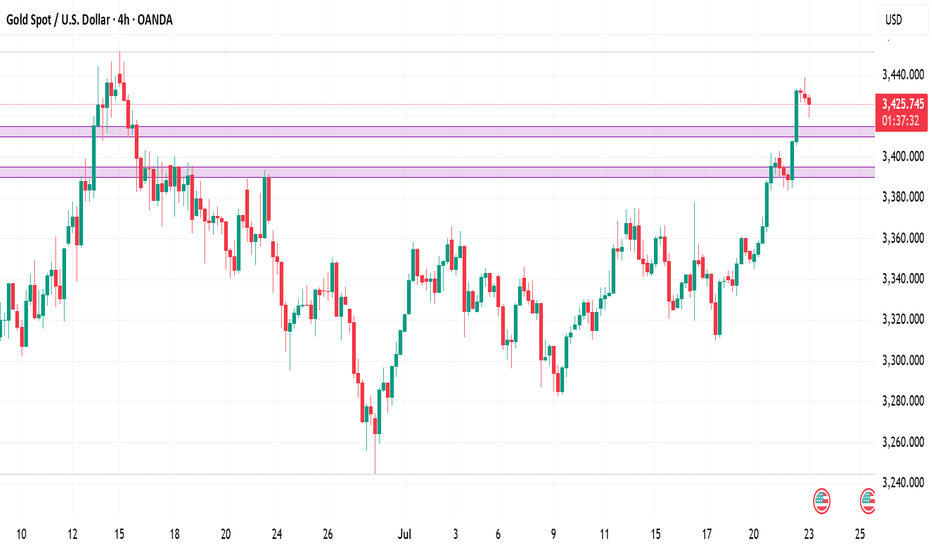

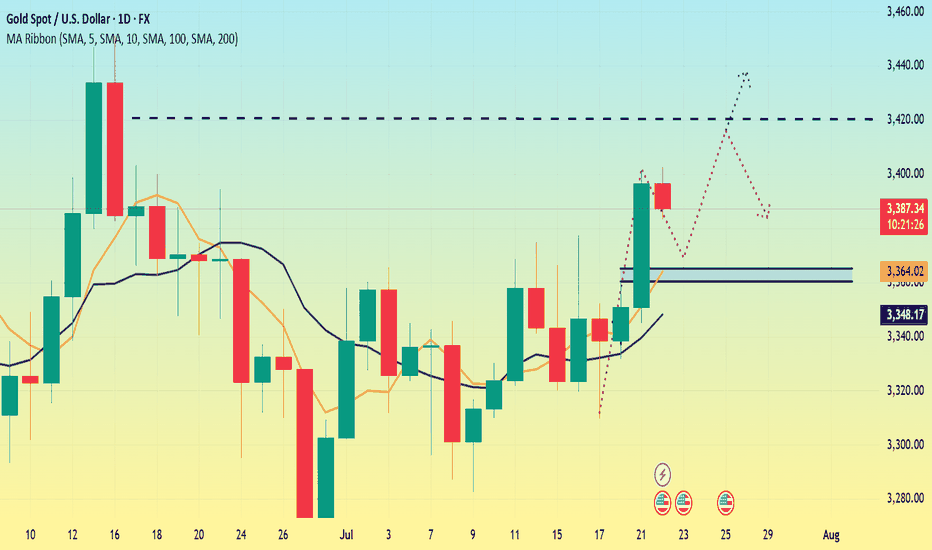

Gold stabilizes. Sets a new high?Gold continues to rise, with uncertainty in trade negotiations and the outcome of the Federal Reserve meeting being key variables. If no agreement is reached before August 1, the high tariffs imposed by the United States on major trading partners may trigger greater risk aversion demand, pushing gold prices further up; if the negotiations make a breakthrough, the market risk appetite will rebound, and gold prices may face correction pressure.

Gold has shown a strong upward trend recently. It closed with a small positive on Friday last week and closed with positive for two consecutive trading days this week, forming a three-day positive trend, with strong short-term momentum. In terms of indicators, the moving average diverges upward, with obvious bullish trend characteristics, and the support below needs to focus on the moving average performance. At present, the gold price has broken through the trend line formed by connecting the previous high points. The primary focus on the upside is near the previous high of 3452, which is an important short-term resistance level. The upper focus is on the previous high of 3452, which is an important short-term resistance level.

The first support below is the 3390-3385 area, which is close to yesterday's low and is also an early trading intensive area. The second support focuses on the vicinity of 3360.

In terms of operation, it is still mainly low-long, and short selling is not considered before the upward trend reaches 3450.

Operation strategy:

Short around 3450, stop loss 3460, profit range 3430-3310

Long around 3400, stop loss 3390, profit range 3420-3430

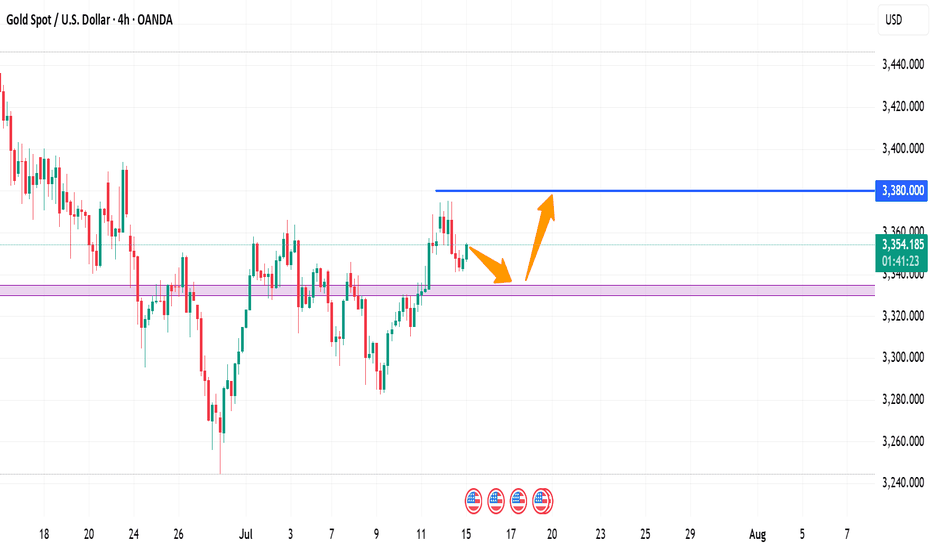

Gold is under pressure. Can it break through?Since the "W bottom" pattern was formed at the low of 3344 US dollars, the gold price broke through the neckline of 3380 and further stabilized at 3400 today, confirming the continuation of the medium-term upward trend. The moving average system is arranged in a bullish pattern, with the 5-day, 10-day and 20-day moving averages diverging upward in turn, and the support strength is stable.

The MACD indicator golden cross continues to expand, the upward momentum is enhanced, and no divergence occurs; the RSI indicator rises to around 76. Although it enters the overbought range, there is no obvious turn, indicating that the bullish momentum is still being released.

The current support level has risen to around 3390, and the support level has risen sharply. The resistance position needs to pay attention to 3430-3440. At present, several times have tested above 3430, but they have not stabilized above this position.

Operation suggestions:

3390-3400 light position to try more, stop loss 3360, profit range 3435-3445.

If it encounters resistance and falls back near 3435, you can consider short-term short orders with stop loss at 3445 and profit range at 3400-3380.

Although the upward momentum continues, some risk information still needs to be paid attention to; this week, we need to pay attention to the US June existing home sales data (July 23), the preliminary value of the second quarter GDP (July 25) and the core PCE price index (July 26). If the data is stronger than expected, it may trigger expectations of interest rate cuts.

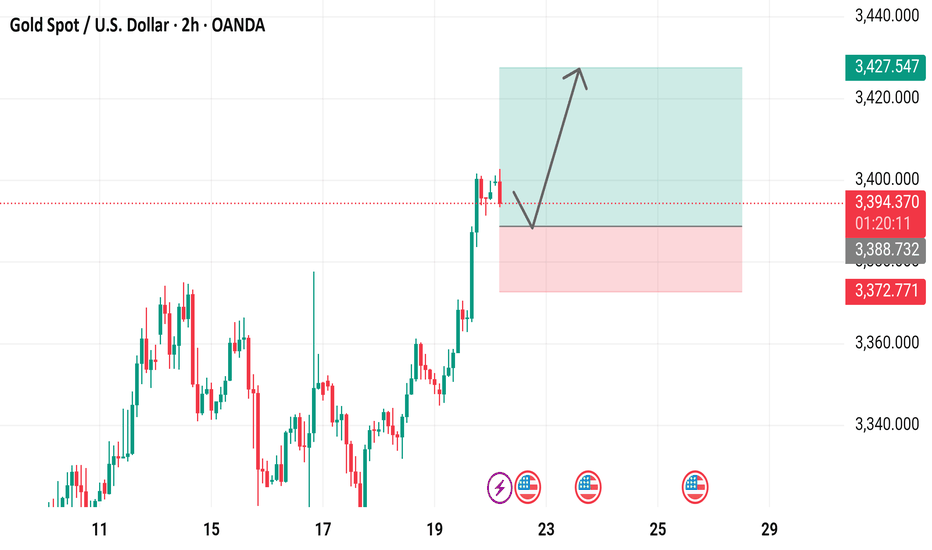

Gold Spot / U.S. Dollar (XAUUSD) 2-Hour Chart - OANDA2-hour candlestick chart displays the price movement of Gold Spot against the U.S. Dollar (XAUUSD) from OANDA, covering the period up to July 22, 2025. The current price is 3,395.285, reflecting a 1.775 (-0.05%) decrease. The chart includes buy/sell indicators (3,395.780 buy, 3,394.890 sell), a highlighted resistance zone around 3,400-3,425, and a support zone around 3,370-3,386. The chart also features technical analysis tools and annotations indicating potential price trends.

Gold is under pressure. There is hope for another rise.Today's important news:

At 8:30, Fed Chairman Powell delivered a welcome speech at a regulatory meeting; at 13:00, Fed Governor Bowman hosted a fireside chat session at the large bank capital framework meeting hosted by the Fed.

Market conditions:

The current daily trend is mainly "strong rise" (Monday closed positive and broke through the shock, and the moving average turned upward). The core logic is that short-term bullish momentum is dominant, and it is necessary to focus on the effectiveness of support and the rhythm of breaking through resistance.

Today, we need to focus on the support belt 3365-3360 area (this position is the 5-day moving average position and the low point of yesterday's European session). As a short-term moving average support, this area is the first line of defense for bulls today. If it can stabilize here, it can be regarded as a signal of short-term strong continuation.

The key pressure level is still around 3420. As a trend line resistance that has been under pressure many times in the early stage, if it can break through, it means that the bulls will break the shock suppression and open up more room for growth.

In terms of operation, it is still mainly low-long. The current gold is still strong. Operation strategy:

Short around 3420, stop loss 3430, profit range 3400-3380

Long around 3360, stop loss 3350, profit range 3380-3400

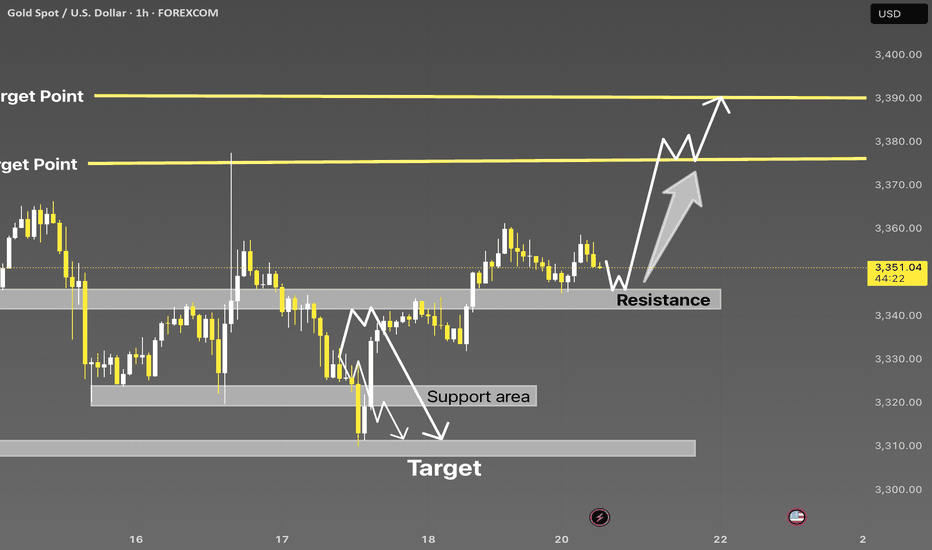

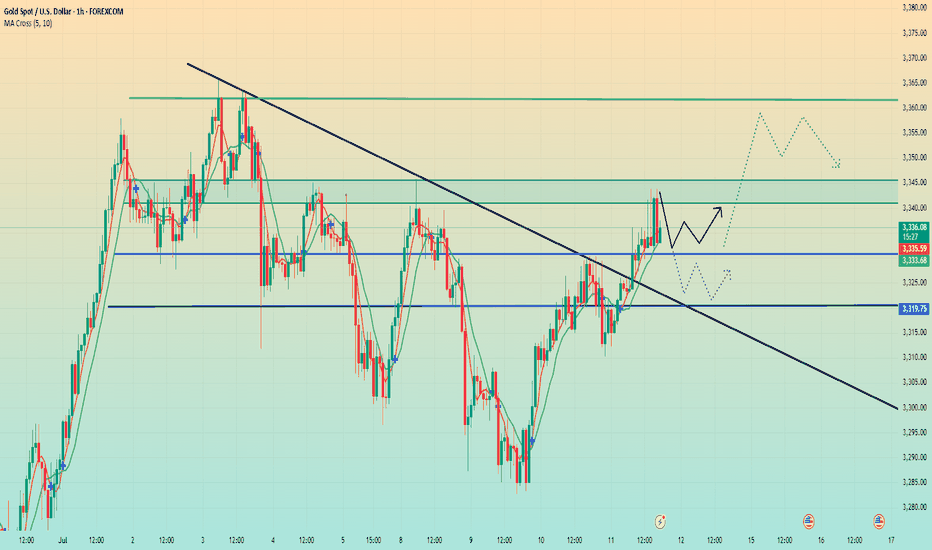

XAUUSD Bullish Setup | Liquidity Grab to Breakout📊 XAUUSD Bullish Breakout Plan | Price Action + Key Levels Analysis 🔥

Gold (XAUUSD) is currently holding above a strong support-turned-resistance zone around $3,340 - $3,345. After a clear rejection from the support area and a bullish structure forming, price is showing potential for a clean breakout toward higher targets.

🔍 Key Technical Highlights:

• Support Area: $3,310 - $3,320 held strongly

• Resistance Flip: $3,345 zone acting as new demand

• Target 1: $3,375

• Target 2: $3,390 major liquidity zone

• Structure: Bullish W pattern forming above demand

This setup favors buy on retracement, aiming for breakout above recent highs. Wait for a confirmation candle above resistance before entering.

📈 Watch for liquidity grab and strong bullish impulse.

#XAUUSD #GoldAnalysis #SmartMoney #BreakoutSetup #LiquidityHunt #ForexTrading #TechnicalAnalysis #BuySetup #PriceAction #TradingView #GoldSetup #ForYou

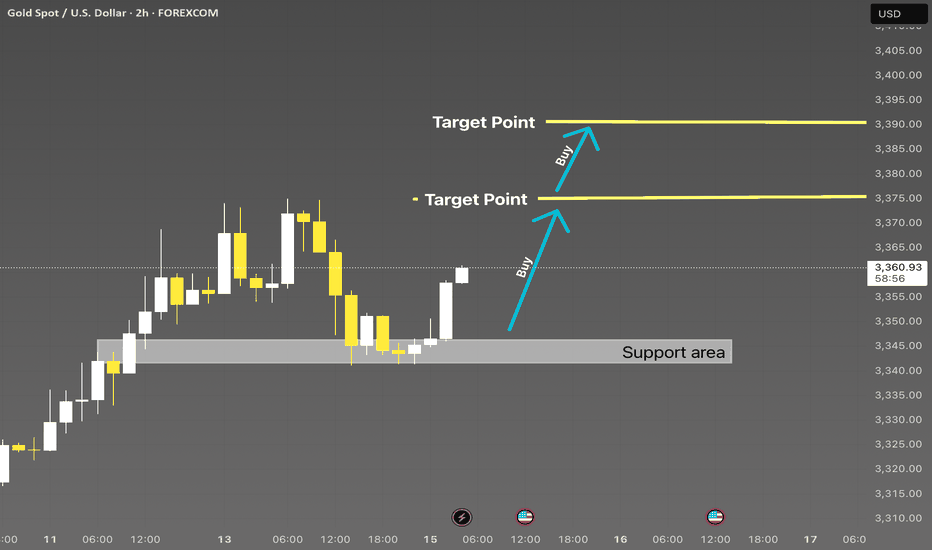

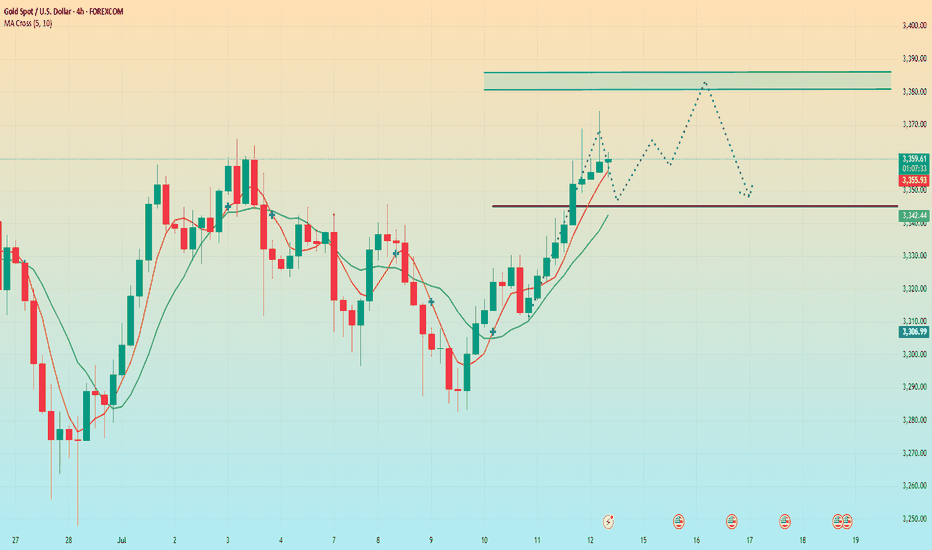

XAUUSD 2H | Smart Money Buy from Strong DemandXAUUSD 2H | Support Rejection with Upside Targets 🎯

Price respected the key support zone and is now showing bullish momentum. Two clear target levels are marked above. Ideal buy opportunity after rejection confirmation from demand zone. Watch for clean continuation toward 3370 and 3390.

#XAUUSD #GoldAnalysis #SmartMoneyConcepts #SMC #Forex #PriceAction #BuySetup

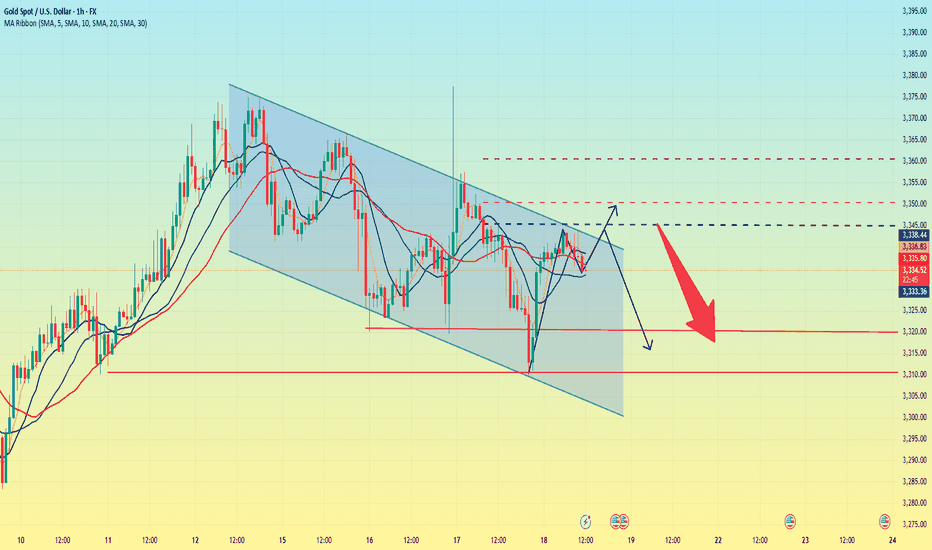

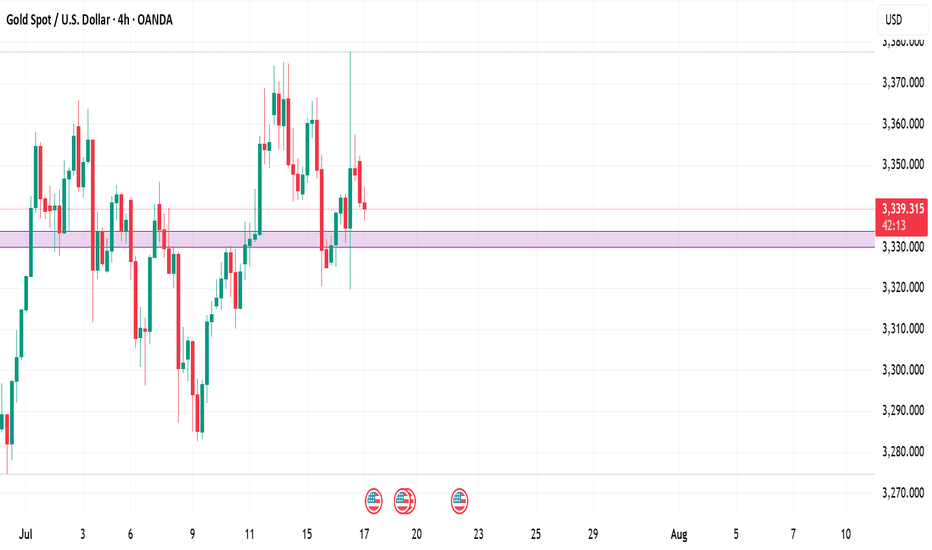

Gold is in danger. Could it fall?Gold started to fall slowly after the Asian market opened on Thursday, and continued to fluctuate and fall in the European market. The impact of the initial data in the US market fell sharply to around 3310, then stabilized and rose. It reached a high of around 3341 and then maintained a high sideways fluctuation, and the daily line closed with a negative line.

The price trend of gold this week was erratic. On Wednesday, it rose and fell, closing with a positive line, indicating that there was strong resistance above; on Thursday, it fell and rebounded, closing with a negative line, indicating that there was some support below. The current moving average system is chaotic, which further confirms that the overall situation is in a wide range of fluctuations.

Connecting the highs and lows of this week can form a fluctuating downward channel, which still has an important guiding role in the market. The current channel resistance is at 3345. If the gold price can break through this resistance level, it is expected to open up further upward space; and the channel support is around 3320. Once it falls below, it may trigger a new round of decline.

Overall, the upward resistance levels of gold are 3345, 3350, and 3360; the downward support levels are around 3320 and 3310. Operation strategy:

Short around 3350, stop loss at 3360, profit range 3330-3310.

Long near 3315, stop loss 3305, profit range 3330-3350.

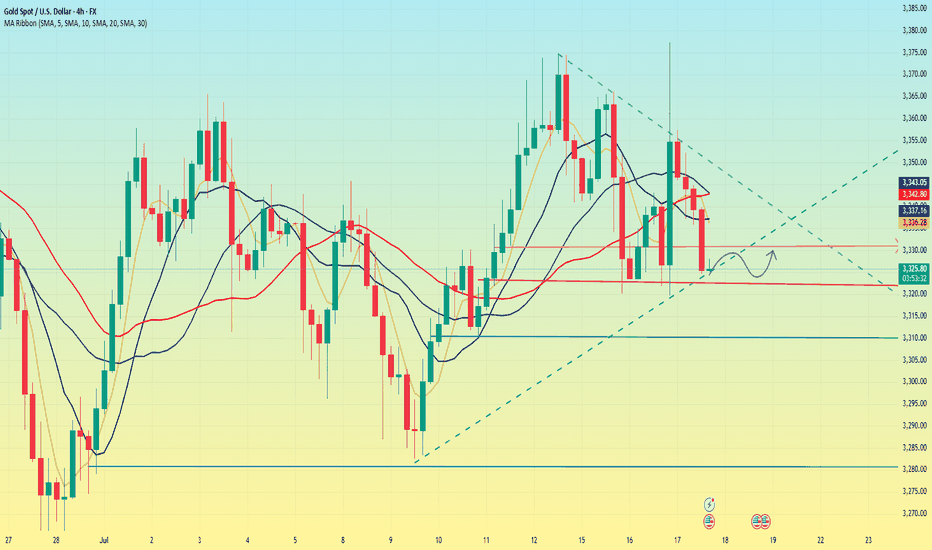

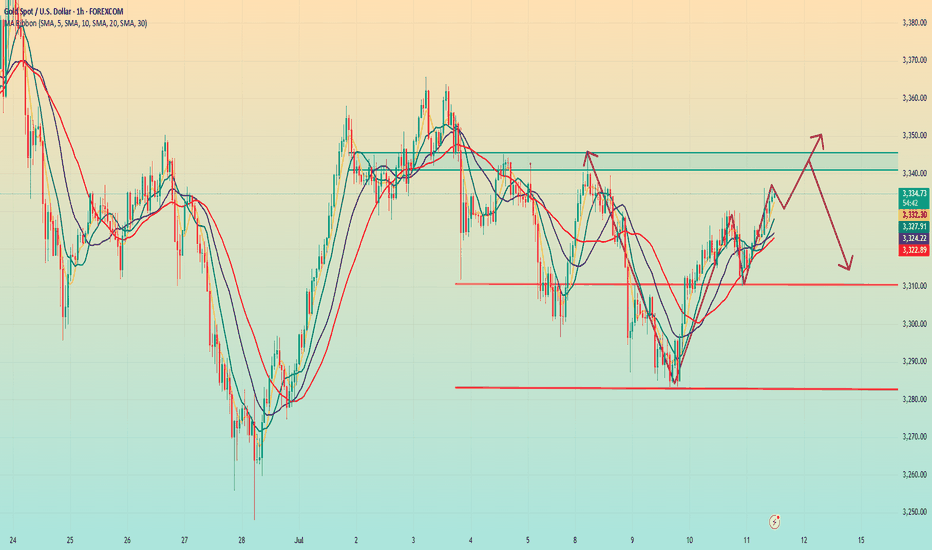

Gold fluctuated downward. Stuck in a stalemate.Information summary:

Global investors have experienced the longest night this year. There are reports that Trump has drafted a letter to fire Federal Reserve Chairman Powell. The incident triggered a strong reaction in the financial market. An hour later, Trump came out to clarify that "there is no plan to take any action" and denied drafting a letter to fire Powell.

Due to the impact of the incident, gold experienced a roller coaster market, soaring more than $50 at one time, hitting a three-week high of $3,377.17, and then narrowed its gains to 0.68%, and finally closed at $3,347.38. In today's Asian market, gold fell slightly and is currently hovering around $3,325.

Market analysis:

The current volatility pattern has not changed. In the short term, the market shows signs of weakness, which is also affected by CPI data, and expectations for interest rate cuts have weakened. In the current state where there is no break in the pattern, waiting and watching is still the best strategy.

The first support level is around 3,310, which is the starting point of last week's high. The second is around 3280, which is the historical low since July and also the starting point of the rise in the first week of July.

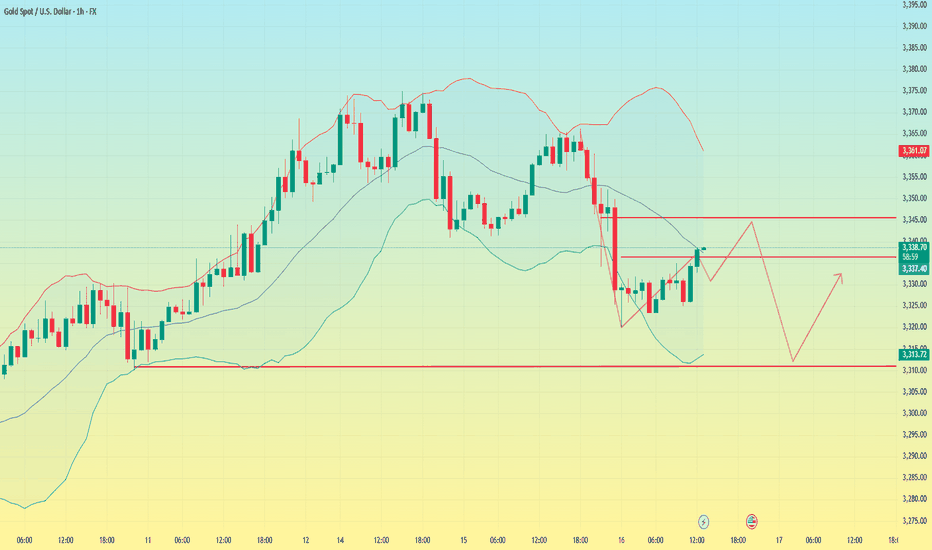

Gold (XAU/USD) Technical Outlook: July 17, 2025🔷 Market Context and Current Price

As of July 17, 2025, gold (XAU/USD) is trading near $3,341, slightly above the week’s midpoint. The metal remains range-bound but shows signs of bullish resilience as it tests key structural support zones. Today’s analysis integrates advanced technical methodologies — including Price Action, Fibonacci tools, ICT and Smart Money Concepts — to present a clear directional bias and actionable trade ideas.

📊 4‑Hour Chart Analysis

1️⃣ Price Structure & Trend

Gold has maintained a sideways-to-upward bias, consolidating between $3,320 (support base) and $3,377 (range resistance). Higher lows since early July reinforce the short-term bullish narrative, though price remains capped by supply in the upper 3,370s.

No decisive Break of Structure (BOS) has yet occurred, keeping price within this range. However, minor bullish BOS signals have appeared near $3,332–$3,334, with a confirmed Change of Character (CHOCH) around $3,320–$3,324, as buyers repeatedly defended this level.

2️⃣ Smart Money Concepts & ICT Insights

Demand Zone / Order Block (OB): $3,332–$3,334. This zone aligns with a recent fair value gap and bullish order block.

Supply Zone / OB: $3,355–$3,359, corresponding to prior inefficiencies and institutional selling.

Liquidity Levels: Sell-side liquidity was swept near $3,320 earlier this week, suggesting smart money accumulation below prior lows.

Fair Value Gap (Imbalance): Present at $3,332–$3,333, partially filled and offering a strong risk-reward for long setups.

3️⃣ Fibonacci Levels

Using the recent swing low ($3,320) and swing high ($3,377), Fibonacci retracements show:

38.2%: ~$3,342 — currently being tested.

50%: ~$3,348 — an interim bullish target.

Fibonacci extensions project potential upside toward $3,401 if momentum strengthens beyond the range top.

4️⃣ Key Levels Summary (4H)

Zone Level

Demand / Buy Zone $3,332–$3,334

Structural Support $3,320

Interim Pivot $3,340–$3,342

Supply / Sell Zone $3,355–$3,359

Range Ceiling $3,375–$3,377

🔷 Directional Bias and Strategy

The 4-hour structure remains neutral-to-bullish, favoring upside so long as the $3,332–$3,334 demand zone holds. A confirmed BOS above $3,342–$3,344 could accelerate bullish momentum toward $3,355–$3,360 and even $3,375. Conversely, a breakdown below $3,332 risks revisiting $3,320 and potentially $3,300.

⏳ 1‑Hour Chart – Intraday Trade Setups

The 1-hour timeframe reveals tactical opportunities aligned with the broader bias:

Setup Direction Entry Stop Loss Take Profit

Setup A – Smart Money Long Long $3,334 $3,329 $3,348 / $3,355

Setup B – Breakout Long Long $3,344 (after breakout) $3,340 $3,355 / $3,375

Setup C – Range Short Short $3,355–$3,359 $3,362 $3,340 / $3,332

🏆 The Golden Setup

Setup A – Smart Money Long offers the highest statistical edge:

Entry: $3,334 (at demand OB / FVG)

Stop Loss: $3,329 (below structure)

Take Profits:

TP1: $3,348 (pivot)

TP2: $3,355 (supply zone)

R:R Ratio: ~2.8:1

This setup benefits from multi-timeframe confluences: demand zone, fair value gap, bullish CHOCH, and proximity to BOS, making it a high‑conviction trade.

🔷 External Consensus Check

An alignment scan of professional analyst views shows strong consensus:

Buy interest remains concentrated around $3,332–$3,335.

Profit-taking and caution advised as price approaches $3,355–$3,377.

No notable divergence in professional outlook — most remain cautiously bullish above $3,332.

📜 Summary Report

✅ Bias: Neutral-to-bullish above $3,332; downside risk below.

✅ Key Levels: $3,332–$3,334 (buy zone), $3,355–$3,359 (sell zone), $3,375–$3,377 (range ceiling).

✅ Top Trade: Long from $3,334 with stops under $3,329 and targets at $3,348/$3,355.

✅ Alternate Trades: Breakout long above $3,344 or short from supply near $3,355.

✅ Confidence Zones: Buyers dominate above $3,332; sellers reappear above $3,355.

Conclusion

Gold remains in a well‑defined range, with smart money likely accumulating near the lower boundary at $3,332. With structural supports intact and demand zones respected, the path of least resistance favors cautious upside toward $3,355 and possibly $3,375. Intraday traders are advised to focus on precise execution within the outlined confidence zones, maintaining discipline around stops and targets.

The current market structure rewards patience and alignment with institutional footprints — positioning ahead of breakout confirmation, while respecting range extremes.

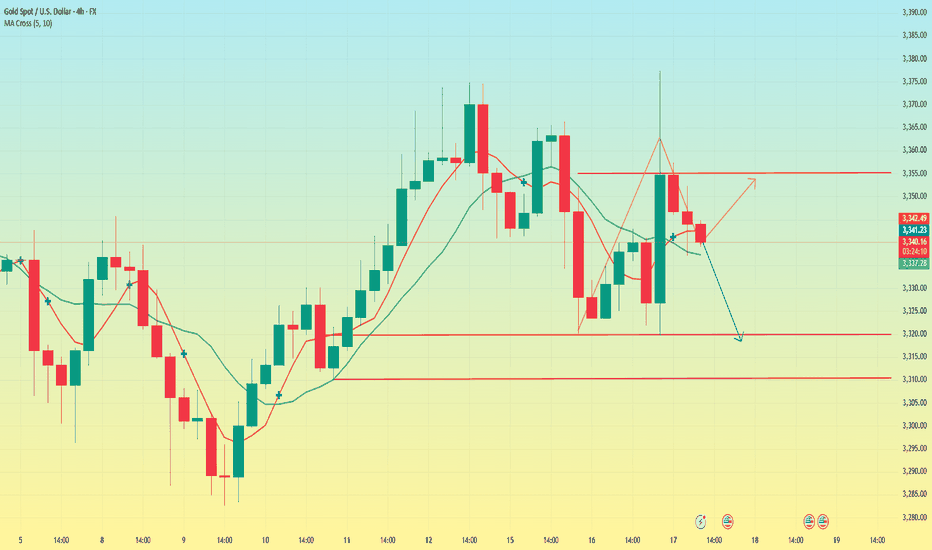

TACO trading reappears. Gold is down.The news that Trump intends to fire Powell caused a decline in US stocks and bonds, and gold prices soared in response. But then Trump denied the news, and the market subsequently fell back to stabilize.

On Wednesday, the Asian market began to fluctuate and rise in the early trading. It rose to a high of 3343 in the European market and then fell to 3319 in the US market. Then it rose sharply due to the news. It rose to a high of 3377 and then fell to 3336. It fluctuated around 3350 in the late trading. The daily line closed with a positive line with an upper shadow line.

The recent market trend fluctuated violently. Since last Wednesday, there have been three consecutive positive rises. This week, there have been two consecutive negative declines on Monday and Tuesday. On Wednesday, it closed positive after washing up and down. At present, the MA5 and 10-day moving averages have formed a golden cross, but the direction is unclear. The Asian market opened above the moving average on Thursday. The overall pattern needs to pay attention to the breakthrough of the key points of long and short positions.

Today, the focus below is on the support near the low point of 3320, followed by the support near 3315 and 3310. This position is the trend line support formed by the previous low point connection. If it breaks down, we need to pay attention to the position of 3280. The upper resistance level is mainly concerned with the resistance near 3355, which is the rebound high point after the US market hit 3377.

Today, the operation needs to adjust the strategy according to the breakthrough of key points. In the volatile market, we need to be vigilant about the sudden fluctuations caused by the news. After breaking the key support or resistance, the trend direction may be further clarified.

Gold fluctuates downward. Can it break through?The CPI data released is in line with expectations, the tariff storm is still continuing, inflation rebounds and the Fed's expectations of interest rate cuts have cooled. Gold rebounded to 3366 and then fell, and is currently fluctuating around 3330.

From the current trend, gold fell strongly and broke through the Bollinger middle rail and the moving average support. The daily line focuses on the Bollinger middle rail under pressure near 3340, and the short-term support is at 3310. At present, a staged top pattern has been formed and the K-line double top is around 3366. The Bollinger moves downward and the price is in a downward channel.

For short-term operations, Quaid believes that the strategy of rebound shorting can still be followed.

Short near 3345, stop loss 3355, profit range 3330-3310

Long near 3310, stop loss 3300, profit range 3330-3345

XAUUSD Structural Analysis & Confluence - 16 July 2025 4-Hour Bias & Structural Context

Gold has recently broken above a key structure level at $3,320, confirming a bullish market environment on the 4‑hour timeframe. This follows a Change of Character (CHOCH) around $3,300, signifying a shift from consolidation to an upward trend. The swing from the late-June low ($3,244) to mid-July’s high ($3,374) sets our Fibonacci context:

38.2% retrace ≈ $3,318

50% retrace ≈ $3,309

61.8% retrace ≈ $3,300

These fib levels also align with prior structure and key ICT/SMC zones, signaling strong areas of interest.

🧭 Key 4-Hour Confluence Zones

Demand / Order Block → $3,300 – 3,305

Multi-method support: BOS, CHOCH, 50–61.8% fib convergence.

Fair Value Gap (FVG) → $3,320 – 3,325

Volume deficient zone post-BOS, primed for a retest.

Supply / Resistance Area → $3,360 – 3,370

High-timeframe supply, likely to cap further upside.

🧠 Smart Money Concepts

BOS above $3,320 confirms bullish structure.

CHOCH at ~$3,300 marks structure flip.

Liquidity grab zones found between $3,335–3,340, validating the presence of institutional activity.

Order Block at $3,300–3,305 supports buy-side interest.

📊 1-Hour Intraday Trade Setups

🔸 Setup #1 – FVG Re-Test

Entry: At ~$3,325 on pullback into $3,320–3,325 zone

SL: Below $3,320

TP1: $3,345, TP2: $3,360

🔸 Setup #2 – Demand OB Bounce (“Golden Setup”)

Entry: In the $3,300–3,305 range

SL: Below $3,298

TP1: $3,325, TP2: $3,345, TP3: $3,360

Edge: Tight risk, high confluence (SMC + fib + structure)

🌟 The Golden Setup

Zone to Watch: $3,300–3,305

Why It Rates Highest:

BOS, CHOCH, fib, and OB all align

Offers tight stop placement and strong upside

Risk-to-reward ~1:3

📌 Daily Watchlist Summary

Directional Bias: Bullish (BOS above $3,320 intact)

Primary Entry Zones:

$3,300–3,305 (Demand OB + structure)

$3,320–3,325 (FVG retest for continuation)

Key Target Zones:

$3,345–3,350 – realistic intraday exit

$3,360–3,370 – major supply cap

Invalidation Level: 4‑hour candle close below $3,298 negates bullish outlook

Final Commentary

Stay disciplined—only trade reactive signals at these levels: clean bounces, pinbars, or bullish engulfing patterns. The $3,300–3,305 zone stands out as the prime ‘Golden Setup’ entry.

Gold (XAU/USD) 4H: Bullish Continuation Play- 15 July 20244‑Hour Technical Outlook — Bullish Bias Above Key BOS Zone

Gold remains in a strong structural uptrend on the 4‑hour chart, carving out a sequence of higher highs and higher lows. Price is consolidating just below recent swing highs around $3,360, suggesting accumulation after last week’s impulsive rally.

We saw a Break of Structure (BOS) above $3,340, confirming bullish control and establishing that area as a critical flip zone. Unless price closes decisively below that BOS, the directional bias remains bullish.

📐 Key Confluences & Zones on 4‑Hour

🔹 Fibonacci Retracement (Swing: $3,280 → $3,360):

38.2%: ~$3,331 — aligns perfectly with BOS & prior resistance turned support.

61.8%: ~$3,313 — deeper, but still within bullish context.

🔹 Supply & Demand Zones:

Supply (Resistance): $3,355–$3,360 — recent highs, likely containing resting sell‑side liquidity.

Demand (Support): $3,331–$3,335 — a bullish order block and fair value gap (imbalance) reside here.

Deeper Demand: $3,313–$3,315 — secondary buy zone if the market hunts liquidity deeper.

🔹 Liquidity Profile:

Buy‑side stops likely rest above $3,360 — breakout target.

Sell‑side liquidity below $3,331 could trigger a shakeout before higher.

🧠 ICT/SMC Concepts Observed:

✅ BOS confirmed at $3,340, favoring longs.

✅ FVG/imbalance between $3,338–$3,342 suggests price may “fill” before next impulse.

✅ Recent wick above $3,355 hints at minor buy‑side liquidity grab — but no confirmed CHoCH (change of character) yet.

✅ Bullish order block formed at $3,331–$3,333, acting as strong support.

📈 1‑Hour Intraday Playbook — Aligned With Bullish Bias

On the 1‑hour chart, momentum remains constructive above $3,331. Intraday traders can look for these setups:

1️⃣ Buy the Retest

Entry: $3,335 (within 4H OB & FVG)

Stop‑loss: $3,327 (below demand)

Targets:

🔸 T1: $3,355

🔸 T2: $3,380 (next resistance)

2️⃣ Breakout Long

Entry: Break and close above $3,360

Stop‑loss: $3,350

Targets:

🔸 T1: $3,380

🔸 T2: $3,406 (1.272 Fib ext.)

3️⃣ Deeper Pullback Buy

Entry: $3,313–$3,315 (61.8% Fib + deeper demand)

Stop‑loss: $3,305

Targets: back toward $3,355–$3,380

🎯 The Golden Setup:

✅ Long from $3,335, stop‑loss $3,327, targeting $3,355–$3,380.

Why? This setup aligns BOS, bullish OB, FVG, 38.2% Fib, and current trend structure — highest confluence and best risk/reward ratio (~1:3).

🔎 Summary Table — Key Levels for Today

📈 Bullish Continuation Above $3,331

🟢 Strong Buy Zone $3,331–$3,335

🟢 Deeper Demand $3,313–$3,315

🔴 Resistance / Supply $3,355–$3,360

🚨 Bullish Invalidation Below $3,331

Bias remains bullish as long as $3,331 holds. Look for reaction in the $3,331–$3,335 zone to join institutional flows.

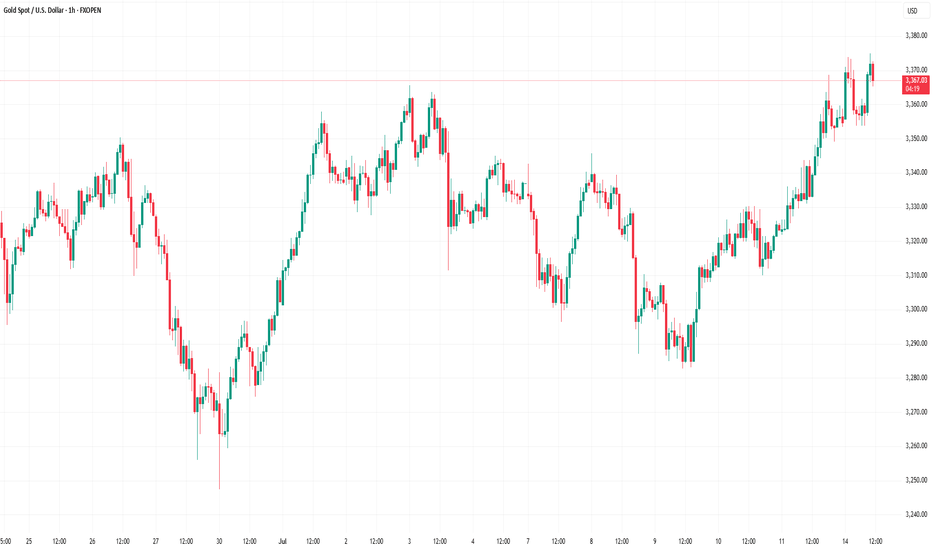

Market Analysis: Gold Climbs Higher Amid Market OptimismMarket Analysis: Gold Climbs Higher Amid Market Optimism

Gold price started a fresh increase above the $3,350 resistance level.

Important Takeaways for Gold Price Analysis Today

- The gold price started a fresh surge and traded above $3,330.

- A key bullish trend line is forming with support at $3,350 on the hourly chart of gold at FXOpen.

Gold Price Technical Analysis

On the hourly chart of Gold at FXOpen, the price formed a base near the $3,280 zone. The price started a steady increase above the $3,330 and $3,350 resistance levels.

There was a decent move above the 50-hour simple moving average and $3,360. The bulls pushed the price above the $3,365 resistance zone. A high was formed near $3,373 and the price is now consolidating.

On the downside, immediate support is near the $3,350 level and the 23.6% Fib retracement level of the upward move from the $3,282 swing low to the $3,373 high.

Besides, there is a key bullish trend line forming with support at $3,350. The next major support sits at $3,330 and the 50% Fib retracement level.

A downside break below the $3,330 support might send the price toward $3,300. Any more losses might send the price toward the $3,280 support zone.

Immediate resistance is near the $3,370 level. The next major resistance is near $3,380. An upside break above $3,380 could send Gold price toward $3,400. Any more gains may perhaps set the pace for an increase toward the $3,420 level.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

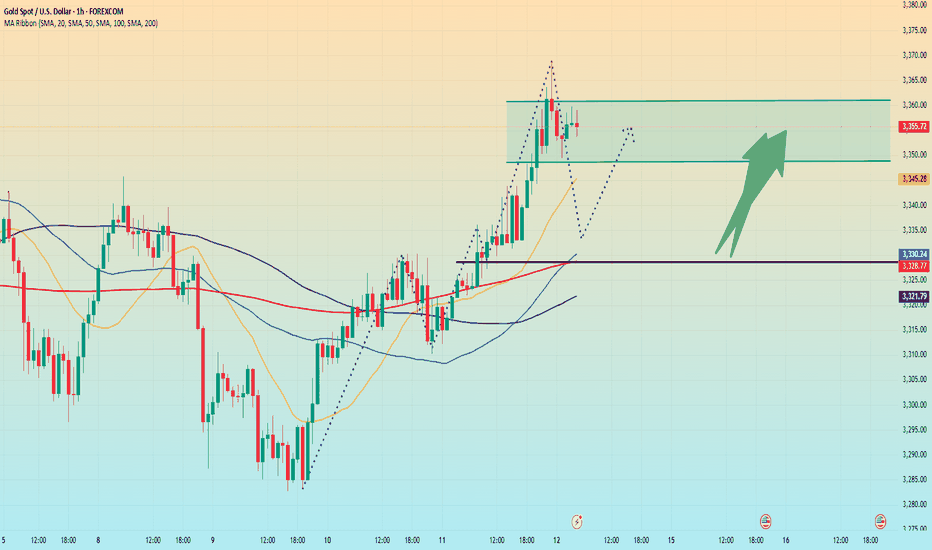

Affected by tariffs, gold rose again.On Saturday, Trump announced that he would impose a 30% tariff on goods imported from the European Union and Mexico from August 1. This news triggered a rise in risk aversion in the market. As a traditional safe-haven asset, gold was once again sought after. The price continued the rise on Friday and continued to open high in the early Asian session. As of now, the highest price reached around 3373.

From the current market point of view, after breaking through the triangle pattern last Friday, there was a sharp rise. The price successfully stood on the short-term moving average, showing an overall bullish trend. However, it should be noted that the short-term moving average has not yet formed an upward cross, which means that there is a high possibility of a confirmation process in the future. Looking back at the trend in the past two months, gold rarely opens high and then continues to rise. Most of them open high and go low. Therefore, under the current situation, although it is bullish overall, it is not advisable to blindly chase more. It is more suitable to wait for a decline before arranging more orders. The key lies in grasping the decline position.

From the perspective of pressure level, 3380-3385 is the first pressure level, and the second pressure level is 3395-3400. The support level below is around 3345, which is also the pressure level that has been emphasized in the early stage, and the top and bottom conversion position. For today's operation, Quaid recommends low-to-long.

Operation strategy:

Short near 3380, stop loss 3390, profit range 3360-3345

Long near 3345, stop loss 3335, profit range 3360-3380

Gold breaks through. Will it continue?After breaking through the position predicted by Quaid on Friday, gold rose strongly and finally maintained the fluctuation range of 3345-3360 that I predicted. Gold bulls are now strong. If there is no major change in the news over the weekend, the price will likely continue to rise after a slight decline at the beginning of next week. I think we can still follow the strategy of Dutou.

The 1-hour moving average of gold continues to diverge with a golden cross and upward bullish arrangement, and the bullish momentum of gold is still there. The current strong support level of gold has also moved up to around 3330. After gold broke through 3330 over the weekend, the price fell back to 3330 and stabilized and rose twice. In the short term, this position has formed a strong support.

There is a high probability that the price will have a small correction at the beginning of next week. We can continue the bullish strategy after the price falls back.

Market transactions should abandon personal preferences. Preconceived subjective consciousness will eventually be taught a lesson by the market. The market is always right. We should follow the fluctuations of the market. Instead of having a head full of random thoughts. There are always traces of market changes, and you need to have the ability to discover them or follow those who have the ability. The market changes rapidly, so pay attention to more timely changes.

The price fell back. Watch out for a breakthrough.After reaching the resistance position near 3345 predicted by Quaid, the price fell back slightly, and the price fluctuated around 3335 so far.

From the hourly chart, before the price stabilizes at 3345, it is likely to maintain a range of 3330-3345. 3330-3345 is a temporary range. If it stands firm and breaks above 3345 again, the fluctuation range will become 3345-3360.

On the contrary, if it falls below 3330, the range may drop to 3320-3330. However, as long as the downward trend does not fall below 3320, gold will still maintain a bullish trend. If the price breaks down below 3320, today’s trend will be reversed.

As long as it is above 3320, gold will maintain a bullish trend today.

On the last trading day of this week, I wish all traders a good harvest.

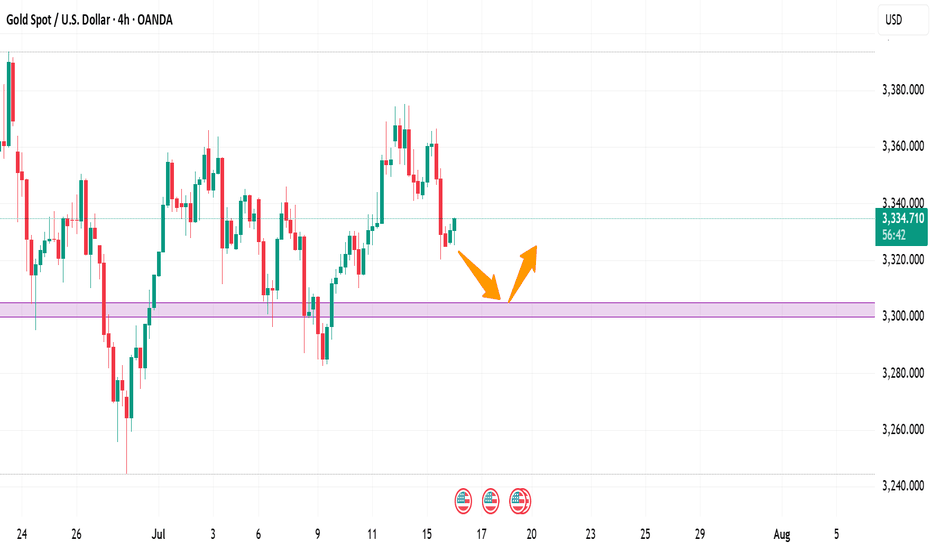

Gold is fluctuating. Can it break through?Since the price of gold rose to 3500 on April 22 and encountered resistance and fell back, it has shown a triangular convergence and fluctuation trend so far. From the short-term trend, after the decline adjustment on Tuesday, it bottomed out and rebounded on Wednesday to close with a positive line, and on Thursday it completed the shock consolidation with a small positive line. The current moving average system is in an intertwined state, and the short-term market tends to fluctuate.

Today, we need to pay attention to the resistance of the 3340-3345 range. This position is a high point concentration area that has suppressed the upward movement of gold prices many times in the early stage. If the gold price breaks through this range, the bullish trend is expected to continue.

From the current trend, after the gold price bottomed out and rebounded, it formed a short-term support at 3310. Secondly, we need to pay attention to the support strength near the low point of 3282 on Tuesday. In terms of operation, it is still necessary to operate around the range.

Operation strategy:

Short when the price rebounds to around 3345, stop loss at 3355, profit range 3320-3300

Long when the price falls back to around 3310, stop loss at 3300, profit range 3320-3340