Gold, false decline, real wash

📊Comment analysis

The recent surge and plunge of gold has also led to many different opinions on the market trend. If it rises, look at the ceiling, and if it falls, look at the floor. Most of them are such remarks, and the misleading nature of such remarks can be imagined. The first time I chased more at 3500, it was okay. After the beginning of the month, I soon got the opportunity to get out of the trap. But those who chased higher at 3400 twice last week were not so lucky. Opportunities cannot always be there, and not every time you can survive.

Once you have the idea of standing guard or holding on, it means you will lose. In the face of huge fluctuations in prices, short-term card points, and few positions can be grasped. You can't just rely on a rumor on the Internet to chase shorts and look at bear markets when prices fall, and chase longs and look at bull markets when prices rise. Investing and trading are two different things. Investment is a direction, focusing on large cycles, large directions, long-term, and profiting by time. Trading, on the other hand, makes money by rhythm and fluctuations, which are completely two concepts.

I have always said that the general direction is bullish and the rhythm is to get on board after every retracement. The transaction is divided into short, medium and long. The short-term is limited to intraday. Whether it is right or wrong, it is settled on the same day. The medium-term wave band, after each large retracement, insist on getting on board in batches, and leave after a phased rise. For the long-term, after each large retracement, build positions in batches and hold for a long time. First, make the logic clear, and then talk about the operation. We can't achieve the lowest or highest, but as long as we achieve a relatively low or high position, it will be fine.

The core of investment is the cycle, and the core of trading is the rhythm. If the rhythm is right, everything is right.

In the face of the sharp rise and fall of gold, first, don't hold a heavy position, and second, as long as it is not a relatively high or relatively low chasing order, there is no need to panic. First, if you hold a heavy position, first of all, you can't withstand the fluctuations, you can only bet on the win or loss of one order, and there will be no next chance. Secondly, as long as you chase long at high positions and short at low positions, even if you have a light position, you will not have a chance to get out of the trap, and you can only make up for the loss through new transactions. There is no other way, but to achieve unity of knowledge and action, and don't think about it. Heavy positions, plus chasing back and forth, plus the world lock, will only die faster and will not get out of the trap. Take care of yourself.

Let's talk about the market. First of all, the bull is still there. Secondly, the sharp drop and surge are wash-outs and adjustments, not the peak, but the base is large and the amplitude is large, so you have to reduce your position. At present, it is a large-scale range shock wash-out adjustment at the daily level, and a weekly level retracement, not the peak. It will be very clear if you look at the big cycle, and you must not listen to the rumors flying all over the sky. If it rises, chase high to see new highs, and if it falls, chase short to see new lows. It is not advisable. Again, remember one thing, grasp the relative highs and lows, let the wind and waves rise, and sit on the fishing boat steadily.

After the U.S. market plummeted, it directly reversed and surged. This kind of market will not continue. Don't chase it. Don't see the plummet and then the surge, and then shout that the bottom has been reached. The plummet means the peak, and the surge means the bottom has been reached. Isn't it a life-and-death situation every day?

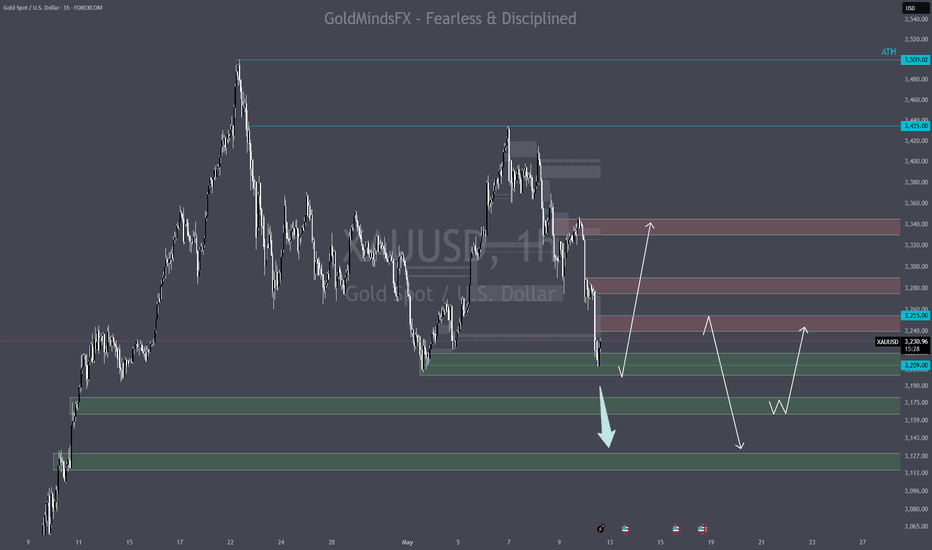

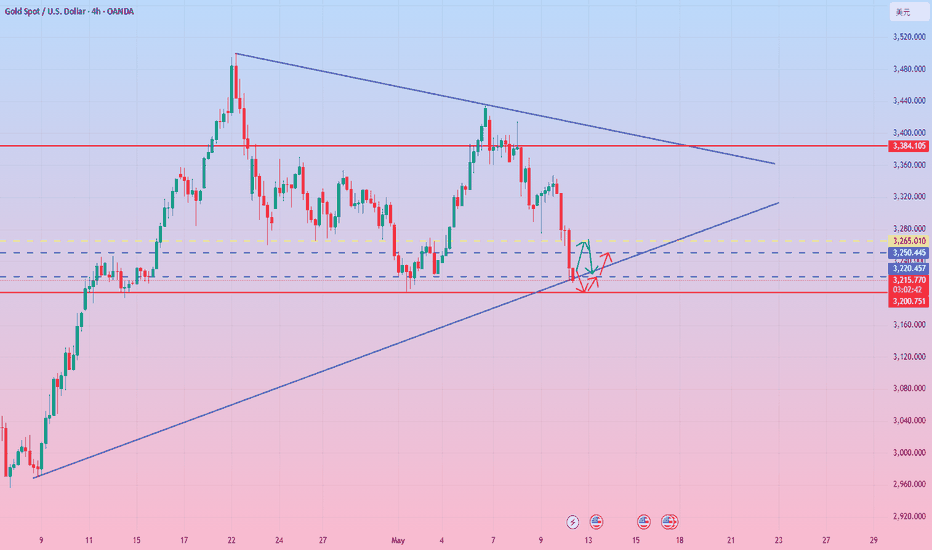

The U.S. market directly talked about the next area. After the sell-off, gold rebounded sharply yesterday, which gave the trapped orders an opportunity to escape, not a direct reversal. Next, gold will enter a large range of shocks and washes with 3260 as resistance and 3150-3120 as support. After the shock, it will finally experience a wave of sell-offs and break the new low, and then it will bottom out. The bottoming logic is the same as the May Day period. Before May Day, gold continued to maintain above 3260 for washing. After May Day, it directly broke below 3260 and touched 3200 and then rose. Next, it will be the same. After a period of washing and shock, it will fall below the low of 3120 again, hit a new low and bottom out, and start to rise. The rhythm is like this, it depends entirely on courage, patience and technology, chasing ups and downs is not advisable. The rhythm is like this, watch more and do less, hold tight, and fasten your seat belts.

⭐️ Note: Labaron hopes that traders can properly manage their funds

- Choose the number of lots that matches your funds

- Profit is 4-7% of the capital account

- Stop loss is 1-3% of the capital account

Xauusdtrading

Gold rebounded to the expected position, 3205 short!

📌 Driving Event

The announcement of a 90-day trade truce between the world's two largest economies also helped ease recession concerns in the United States, prompting investors to reduce expectations for aggressive monetary easing by the Federal Reserve (FED). This shift supports the continued rise in U.S. Treasury yields, further suppressing demand for interest-free gold.

📊 Commentary Analysis

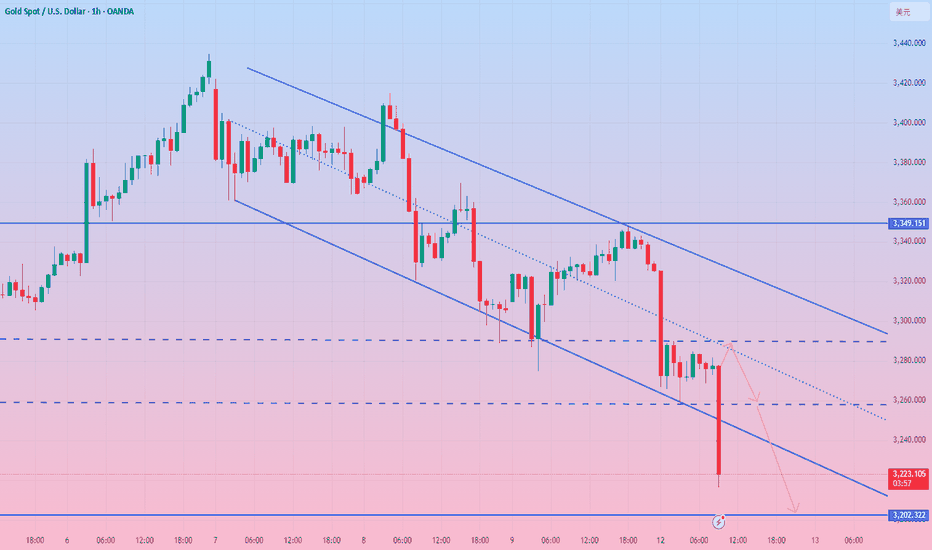

Today, the price of gold fell to its lowest point in more than a month. It once hit the lowest level since April 10 at 3120, and then rebounded to the 3200 line, and the volatility increased again!

💰 Strategy Package

Short position:

Actively participate in 3200-3203 points, with a profit target around 3120 points

⭐️ Note: Labaron hopes that traders can properly manage their funds

- Choose a lot size that matches your funds

- Profit is 4-7% of the fund account

- Stop loss is 1-3% of the fund account

Gold continues to fall seize the opportunity to enter the market

📌 Driving factors

China-US container shipping routes rose sharply - factories rushed to produce overnight, taking advantage of the tariff cooling-off period, those who should stock up are working overtime to complete the tasks. This is the situation seen on the first day after the tariff reduction, indicating the complementarity between China-US trade.

The long-awaited US-Japan and European and American tariffs have not yet ushered in substantial benefits, but Europe said that this is an unfair negotiation and has not been concluded yet.

Trump went to the Middle East and signed a 100 billion weapons order, stabilizing the Middle East before Europe.

📊Comment analysis

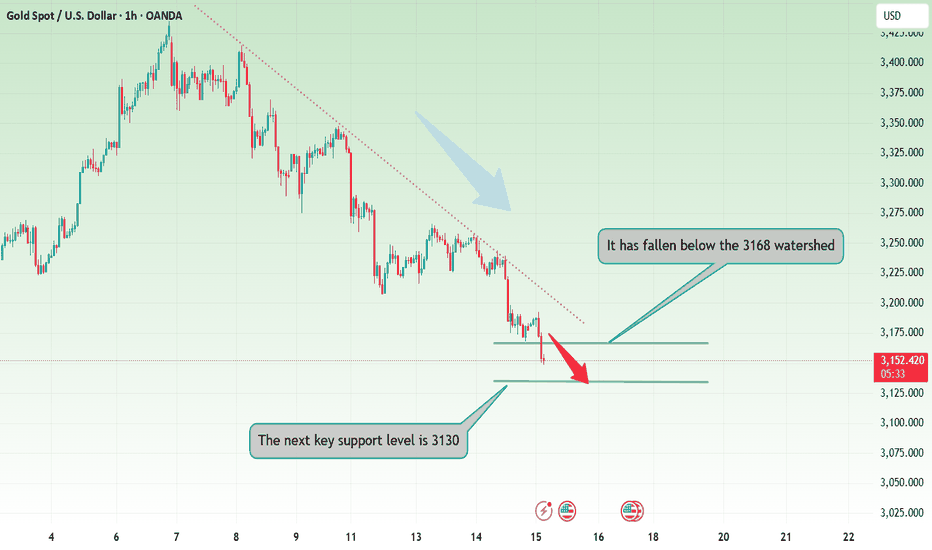

The Asian session fell in the morning, pay attention to a few points:

1. The upper watershed opened at 3193 in the morning, the short watershed.

2. Directly break the 3168 long watershed, the next support is at 3145, 3130.

3. For now, the Asian session will continue to fall in a cycle, the European session will pull back after breaking the bottom, and the US session will continue to retreat.

💰Strategy Package

For short-term operations, short selling can be done near 3166, stop loss 3169, target 3140, 3135.

Labaron believes

Guaranteeing the principal is the bottom line for survival, controlling risks is the armor for survival, earning profits is a stage medal, and long-term stable and continuous profits are the only proof of being able to stand up from the sea of blood and corpses.

Gold rebounds weakly, US market ideas for reference!

📌 Driving factors

As Sino-US trade tensions ease, market concerns about a global recession ease, investors' risk appetite rises, and gold's attractiveness as a safe-haven asset declines, gold prices fell on Wednesday (May 14). After the tariff truce announced over the weekend, the stock market rose sharply, weakening gold's safe-haven appeal in the short term, which was an important factor that pushed gold prices to new highs in the previous few months, and it is also the starting point for the current large-scale selling!

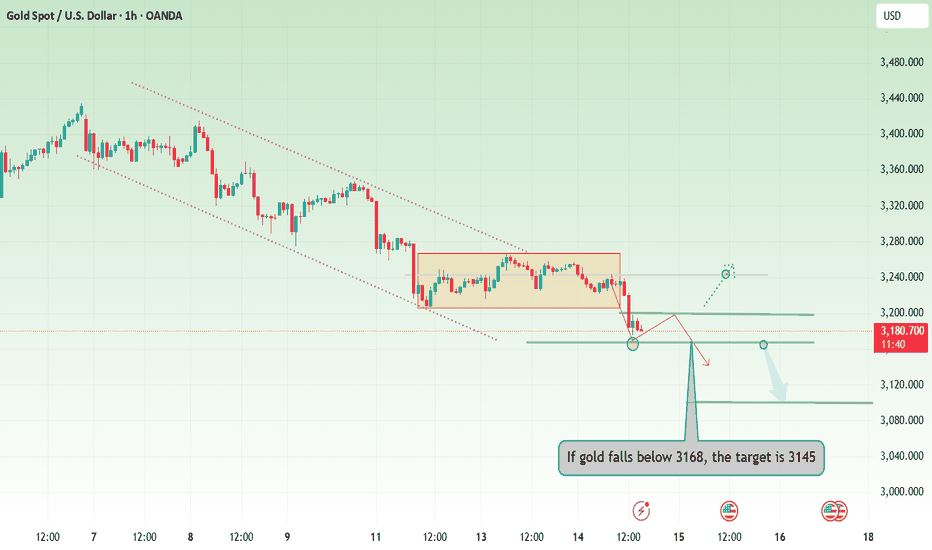

📊Commentary Analysis

After gold fell below 3200 in the US market, it rebounded to 3198 at its highest. This rebound was just an oversold rebound, and then continued to fall back. Although it has not refreshed the low for the time being, the pattern has weakened, and it is difficult to get up again in the early morning. Weak shorts can't even get past 3198, and the short-term support below is around 3160.

The daily cycle is constructed based on the M-head pattern. 3200 is the long defensive position. If it fails to close, there will be a fall. The technical side has already experienced a major break. Pay attention to the change of thinking. If the adjustment range is large, it may even reach 2900/3000. It rises fast and falls fast, but the long-term logic of gold's rise remains unchanged. It is also an opportunity to lay out more positions, but the position needs to follow the market observation, which is difficult to predict at present.

💰Strategy Package

In the short term, we will rely on 3198 for defensive short selling. After breaking 3200, please note that even if it rebounds, we should follow the trend and short. If it rebounds upward, we should short at the golden section resistance of 3265.

Good luck to everyone!

Labaron believes that

Guaranteeing the principal is the bottom line for survival, controlling risks is the armor for survival, earning income is a stage medal, and long-term stable and continuous profit is the only certificate to finally stand up from the sea of corpses and blood.

Gold falls below 3200, continues to look at 3100

📌 Driving factors

As Sino-US trade tensions ease, market concerns about a global recession ease, investors' risk appetite rises, and gold's attractiveness as a safe-haven asset declines, gold prices fell on Wednesday (May 14). After the tariff truce announced over the weekend, the stock market rose sharply, weakening gold's safe-haven appeal in the short term, which was an important factor that pushed gold prices to new highs in the previous few months, and it is also the starting point for the current large-scale selling!

📊Commentary Analysis

The price trend of gold on Tuesday showed a significant repeated shock feature. Although it ended up rising, it experienced two tortuous processes of first falling and then rising in the process, which led to a relatively limited overall increase. After the previous day's correction, the current 5-day moving average and the 10-day moving average formed a dead cross and continued to extend downward. From the perspective of intraday trading, the resistance level formed by these two moving averages has become the focus of market attention.

In the morning article, I repeatedly emphasized that gold is expected to break below 3200. Sure enough, it broke below without hesitation today. It is currently at 3185. The short position of gold near 3250 that we gave yesterday has expanded its profit again today, and it is easy to make a profit of nearly 100 points. Today, the US market operation is still mainly shorting, and it can continue to short near the rebound of 3200.

💰Strategy Package

Today, the US market operation is still mainly shorting, and it can continue to short near the rebound of 3200, with the target near 3170-3180.

Labaron believes

Guaranteeing the principal is the bottom line for survival, controlling risks is the armor for survival, earning income is a staged medal, and long-term stable and continuous profit is the only proof that it can finally stand up from the mountains of corpses and seas of blood.

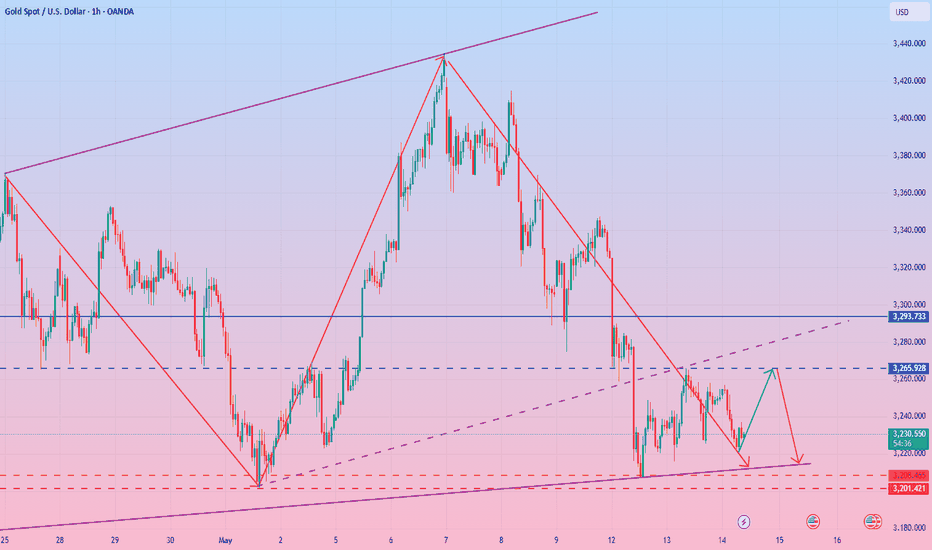

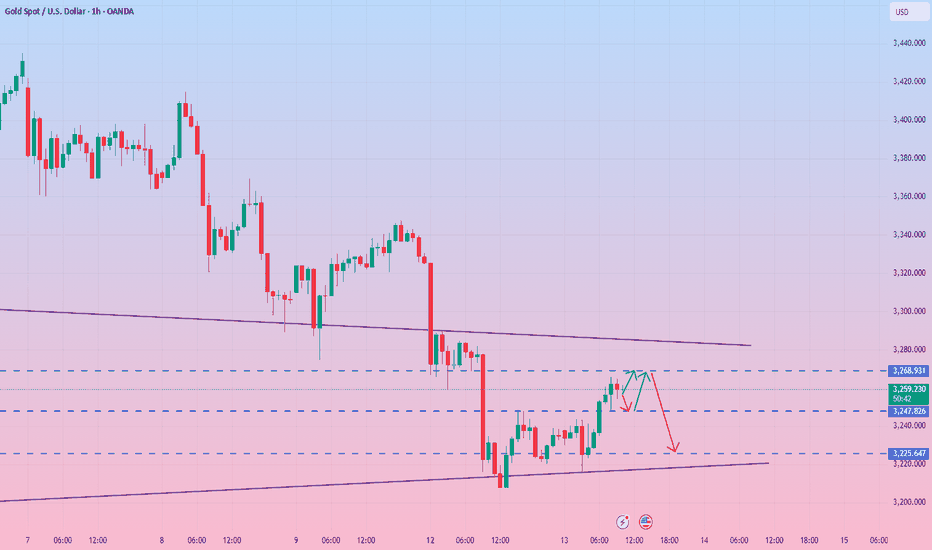

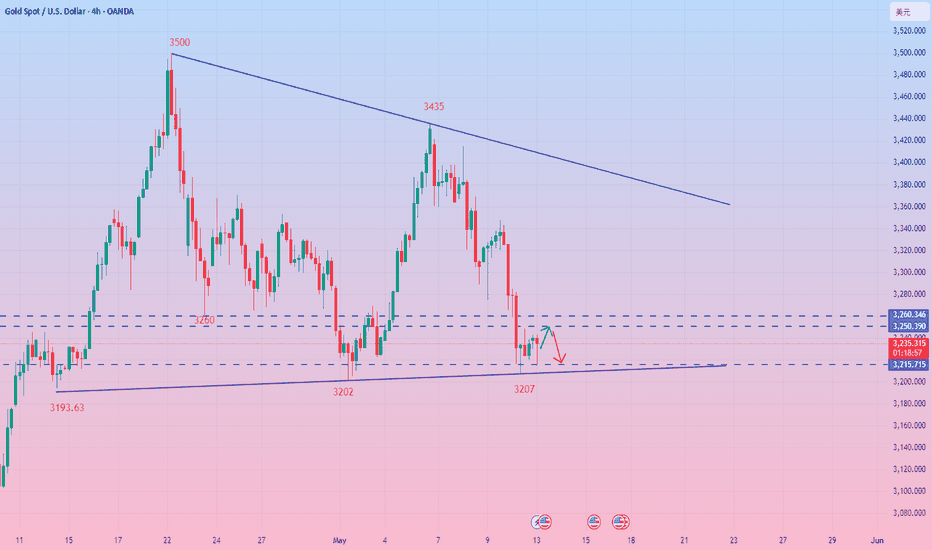

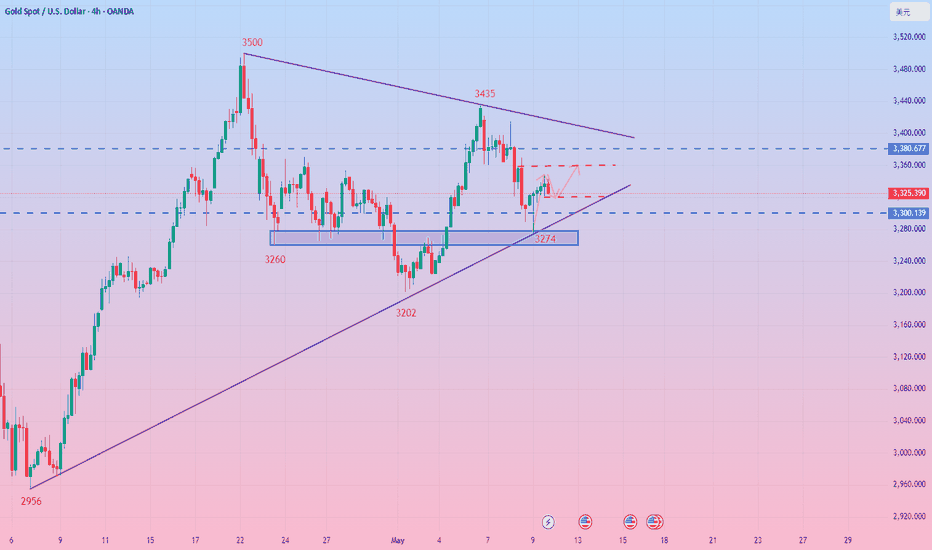

Gold comprehensive analysis summaryTechnical analysis of gold: In recent trading days, gold has experienced a rapid decline during the Asian session, then stabilized and rebounded, fluctuated during the European session, and rebounded after rising in the US session. Today, under pressure during the Asian session, the high point of yesterday's US session, 3258-60, has already experienced a rapid decline. It depends on whether it can stabilize and rebound next. Overall, continue to pay attention to the medium-term support of 3202-07. Before breaking down, once the bulls stabilize, they will fill the gap of Monday's gap in the area of 3320-25; if it breaks down, it will open up the downward space, further 3160-3120, and then gradually fall to 3060 and the starting point of this round of bulls, 3000. The M top or W bottom we emphasized is still waiting for the market to choose!

From the hourly chart, gold is currently facing some downward pressure, especially since the current price has fallen below the previous support range. After falling below the support level, the gold price rebounded again, but this rebound failed to break through the original support level and turned into resistance, indicating that the price has not recovered effectively. For now, multiple rebounds have hit around 3257 to form a double top pattern, and the scope of short-term long and short consolidation has been reduced. Including today's Asian session decline, it did not fall below the 3220 US dollar line. The short-term consolidation range temporarily refers to the 3257-3220 US dollar range, and the break will be adjusted. Today, the 1-hour SAR indicator 3246 pressure is referenced above. If it breaks above, it will look at the recent double top 3257 pressure short. Secondly, look at the 3265-78 range multi-directional suppression short. It is recommended to refer to the Asian session low near 3220 for long below. If it breaks below, it will look at the 3207-3200 range for long. On the whole, today's short-term operation strategy for gold is mainly to do more on the pullback and short on the rebound. The short-term focus on the upper side is the 3257-3265 line of resistance, and the short-term focus on the lower side is the 3215-3220 line of support.

Gold operation strategy reference: short gold near 3250-3260, target near 3240-3230. Gold pullback near 3225-3220 to do more, target near 3240-3250.

Start buying gold and wait for a rebound.At the 4-hour level, the overall market judgment remains unchanged. In terms of the lower support level, 3208-3207 is the key support area. This position is not only the low point on Monday, but also an important support level formed by the previous starting point line extending to the present. As for the upper resistance level, first of all, we need to focus on yesterday's high point of 3265, which is also the previous shock low point. Secondly, the 3290-3293 area formed by the rebound after the gap-down opening on Monday is also a resistance range that cannot be ignored. In the short term, pay attention to the resistance line of 3260-3270 above, and pay attention to the support line of 3220-3210 below in the short term. Further support focuses on the 3200 mark.

Gold operation strategy: 3220-3210 long, target 3230-3250; gold rebounds to 3260-3265 short, target 3240-3220.

Gold continues to trade sideways above the 3200 area

📌 Driving factors

The United States and China announced on Monday a 90-day suspension of tariff increases. According to statements made after the Geneva talks last weekend, the United States will reduce tariffs on Chinese imports from 145% to 30%, while China will reduce tariffs on US imports from 125% to 10%.

Meanwhile, on the geopolitical front, Russia and Ukraine are preparing for their first high-level face-to-face talks since 2022, scheduled to take place in Istanbul this week. The talks come as the international community is increasingly pressuring Moscow to accept a 30-day ceasefire. U.S. Secretary of State Marco Rubio and special envoys Steve Witkov and Keith Kellogg are expected to represent the United States in the talks.

Gold prices rebounded on Tuesday, driven by bargain hunting, while weaker-than-expected U.S. inflation data released that day also helped gold prices rise. However, trade optimism limited the strength of gold's rebound.

📊Comment Analysis

In the accumulation price zone, the gold price is sideways around 3200-3270, and the buyers and sellers are balanced

💰Strategy Package

🔥Selling gold area: 3282-3284 SL 3289

TP1: $3270

TP2: $3260

TP3: $3250

🔥Buying gold area: $3167-$3165 SL $3160

TP1: $3178

TP2: $3189

TP3: $3200!

Labaron believes

Guaranteeing the principal is the bottom line for survival, controlling risks is the armor for survival, earning profits is a stage medal, and long-term stable and continuous profits are the only proof that can finally stand up from the sea of corpses and blood.

5/14 Gold Trading Signals🌇Good afternoon, everyone!

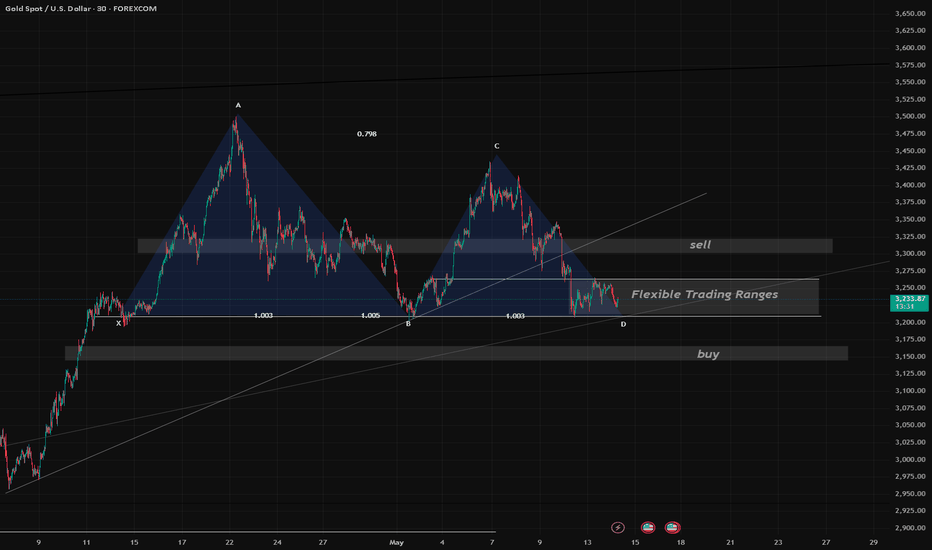

Yesterday, gold only entered the 3218–3252 flexible range , and did not touch the broader buy/sell zones, resulting in limited profits .

Currently, gold remains under resistance , and candlestick formations suggest an irregular double top . With ongoing sideways box-range movement , the market lacks a clear direction, so caution is advised .

📉 If bears take control, gold could drop toward 3169 .

📈 If bulls prevail , a rebound to 3300 is likely.

🔍 Key Technical Zones:

Bullish Resistance : 3246 – 3268

Support Area : 3218 – 3209

🗞 News Focus:

Speeches from Fed members Waller and Jefferson today may trigger directional momentum in the market.

📌 Trading Strategy for Today:

Sell Zone : 3301 – 3327

Buy Zone : 3170 – 3152

Flexible Trading Ranges :

▫️ 3210 – 3243

▫️ 3272 – 3259

▫️ 3247 – 3296

✅ Trade with discipline, manage position sizes carefully, and stay alert during key speeches.

The long and short gold competition continuesGold on Tuesday was more in line with our analysis ideas. We gave a short position at 3250-60, and the market conditions were also quite favorable for our entry opportunities. We notified the entry and exited with profits as gold fell back. The CPI was bullish and gold rebounded weakly, so our long positions were also safely exited with profits.

Pay attention to the stabilization of the two supports of 3215-3225, and take 3200 as the turning point of the Fengshui Ridge. Hold it to continue to maintain the bottom shock operation or gradually rebound; once it breaks through 3270, the rebound will be strengthened to test the 3300 mark; if it breaks through 3300 and stabilizes, the downward adjustment will end and return to the upward trend; Then as long as 3270-3300 is still not suppressed in the middle, it will repeatedly rise and fall to test the bottom support; if 3200 is accidentally lost, it will point to 3160-3150, and you need to be mentally prepared in advance, hoping that it will not happen; looking at the 4-hour chart of gold: at this time, the 5-day short-term golden cross is expected to cross the 10-day, then above 3240 will become a certain support performance, and the key strong support is the annual moving average moving up to 3200; one resistance is the big Yin high point in front of 3290, which is also the dividing pressure, and the strong pressure is the middle track 3293, or close to the 3300 mark; pay attention to the gains and losses between support and resistance. The short-term focus on the upper side is the 3270-3290 resistance, and the short-term focus on the lower side is the 3215-3225 support.

Gold fluctuates repeatedly and is expected to fall below 3,200

📌 Driving factors

The U.S. Department of Labor's Bureau of Labor Statistics announced on Tuesday that the U.S. Consumer Price Index (CPI) rose 0.2% month-on-month in April, lower than the 0.3% expected by economists. However, analysts warned that inflation may rise as tariffs gradually push up commodity prices.

The United States and China announced on Monday that they would suspend tariffs for 90 days. According to the statement made by both sides after the Geneva talks last weekend, the United States will reduce tariffs on Chinese imports from 145% to 30%, and China will reduce tariffs on U.S. imports from 125% to 10%.

Driven by bargain hunting, gold prices rebounded on Tuesday, and the weaker-than-expected U.S. inflation data released that day also helped gold prices rise. However, trade optimism limits the strength of gold's rebound.

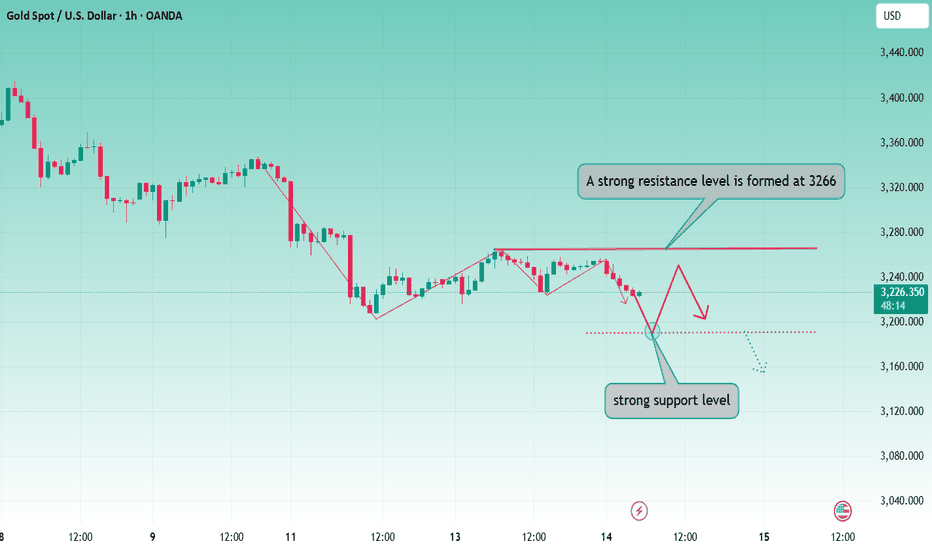

📊Commentary and analysis

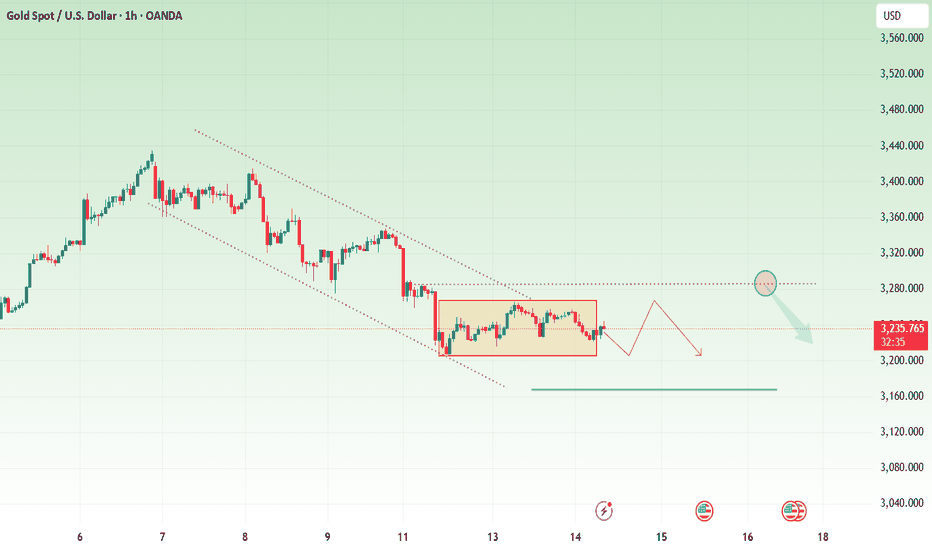

Gold fell and then rose yesterday, and the final rebound stopped at 3,266. The trend is in line with our bearish expectations. As for the repeated fluctuations in the market, it is just a futile effort! Yesterday, due to the influence of the US CPI data, although gold rose in the short term, it was still under pressure and weakened. Today, the Asian session continued to fall in the early trading. As the support position near 3210 points is approaching, aggressive shorting is no longer appropriate!

In terms of trend, the 4-hour level trend of gold is still under pressure. Yesterday, it was under pressure at the 3260 line, and then the market fell back. Recently, it has maintained a trend of continuously moving down lows, and the rebound highs are gradually decreasing. It can be seen that the bulls are less willing to attack, which is different from the previous surge. Gold adjustment has become inevitable.

💰Strategy Package

Rebound short: short near 3265, stop loss 3269, target near 3220!

Labaron believes that

Guaranteeing the principal is the bottom line for survival, controlling risks is the armor for survival, earning income is a stage medal, and long-term stable and continuous profit is the only certificate to finally stand up from the sea of corpses and blood.

How to plan a gold short selling strategyOn Monday, as China and the United States reached an agreement to reduce tariffs, market concerns about a U.S. recession eased, and the U.S. dollar index once approached 102, and finally closed up 1.37% at 101.80. U.S. bond yields both rose, and the interest rate market cut the Fed's pricing for rate cuts this year, boosting demand for the U.S. dollar. However, although the U.S. dollar is bullish in the short term, it faces key resistance, and the U.S. CPI data is coming. If inflation is lower than expected, bulls may take a break.

Today's market rose slightly first, then fell strongly to 3216, and then rose strongly to 3260 in the Asian session before being under pressure. The market is currently in the repair stage, and CPI data is attracting much attention. If the European session does not continue to rise but falls, the bulls may end at 3270. Technically, the upper resistance is 3268-3274, and the lower support is 3244-3237. In terms of operation, it is recommended to rebound high and short as the main, and to pull back and long as the auxiliary.

Operation strategy 1: It is recommended to short near the rebound 3268-3274, with a target of 15-20 points.

Operation strategy 2: It is recommended to pull back near 3244-3237 and long, with a target of 10-15 points.

5/12 Gold Trading SignalsGood morning everyone!

Gold opened lower and extended losses today, influenced by easing China–U.S. trade tensions and ceasefire news from India-Pakistan.

The recent rally was largely driven by safe-haven demand amid geopolitical concerns. As tensions ease, gold's retracement is a logical market reaction.

🔍 Technical Outlook:

Gold has now returned to a previous consolidation zone . While some support exists, current candlestick structure and most indicators show no clear bullish reversal yet.

Entering long positions too early may pose short-term risks, so trend trades should wait for stronger confirmation.

For flexible intraday trading, watch:

Support at 3263–3246: Holding this zone could trigger a rebound back toward 3309 resistance.

📌 Trading Recommendations:

✅ Sell Zone: 3306 – 3321

✅ Buy Zone: 3218 – 3198

🔁 Range for Scalp/Short-Term Trades: 3294 – 3263 / 3238 – 3269

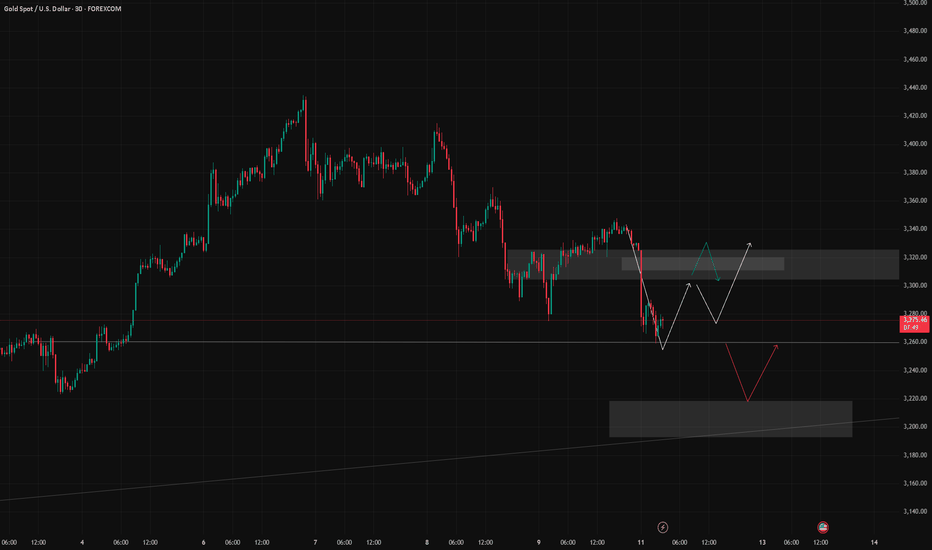

Gold rebound is a good time to shortGold has been in a volatile state since the opening today, opening at 3236 and reaching a high of 3243. It is currently fluctuating in the form of shocks. With the comprehensive ceasefire between India and Pakistan and the peace talks in the Sino-US tariff war, gold will still be in a downward trend. Although it is in a downward trend, we should not chase the short position directly. We can just treat the rebound as shorting. The main trend is still to short on the rebound. After all, the general trend is bearish.

In the 4-hour chart, the weak stage is oscillating downwards, and the resistance of the middle rail has moved down to the 3300 mark. At the same time, there is still a gap to be filled, and it is currently in shock above the neckline. There are two differentiated moves here. One is to go sideways and weakly consolidate and then directly break the neckline of 3200 and go for in-depth adjustments. The other is to rebound above 3200 to correct and build momentum, forming a wave of poised to break low. One is weak consolidation to break low, and the other is poised to break low. Overall, it is optimistic that the market will break through the low of 3200, but it reflects the various changes in the short-term form. The upper 3250-3260 range has gathered intensive trading resistance, forming short-term strong pressure. In short-term operation, first go short on rallies below 3260, and first look at the profit from this wave of correction! Next, we will look at the previous low support of 3200. If the position is broken, we will continue to see the downward continuation. If the position is not broken, we will place long orders on the backhand. At that time, we will choose the opportunity to lay out the long-term plan based on the support of 3200. On the whole, today's short-term operation strategy for gold is to short on rebounds and long on pullbacks. The upper short-term focus is on the 3248-3252 resistance line, and the lower short-term focus is on the 3200-3160 support line.

Gold operation suggestion: short gold near 3245-3255, target around 3220-3210. Gold will go long when it pulls back around 3210-3200, with the target around 3230-3250.

Tariff easing has just begun

📌 Driving factors

The historic easing of tariffs between China and the United States, the imminent peace talks between Russia and Ukraine, the ceasefire between India and Pakistan, and the market's pricing of geopolitical risks have obviously cooled down, which has further shrunk the demand for gold as a regional safe-haven tool. The situation in the Middle East is complicated, and it is necessary to monitor the latest developments in real time, focus on the latest developments in the follow-up news, and adjust strategies in real time.

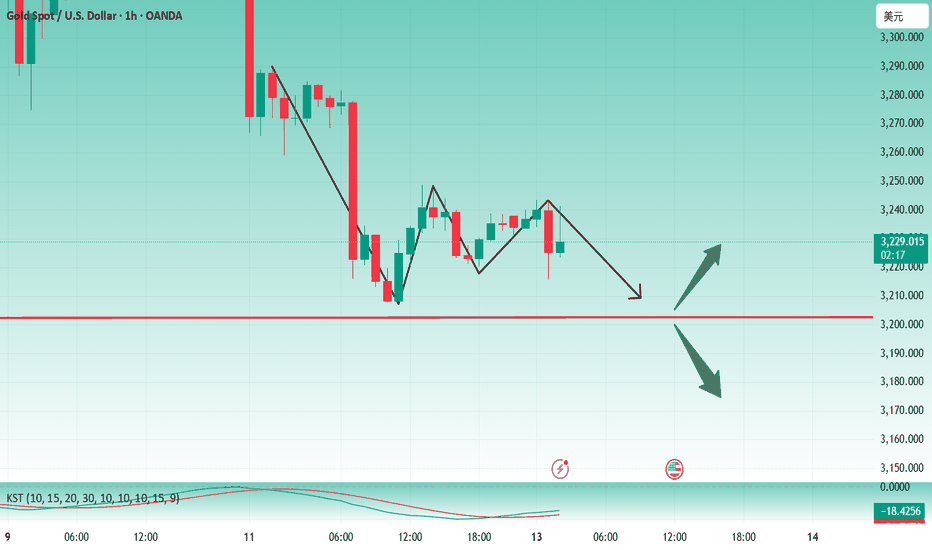

📊Comment analysis

In the Asian session, gold is concerned about the upper resistance at $3,250 today. The rebound relies on the resistance below to continue shorting. The lower point is $3,207. If it falls below, it will be $3,150. For specific operations, please pay attention to the free channel.

💰Strategy Package

Long position:

Actively participate at 3200 points, with a profit target of around 3230 points

Short position:

Actively participate at around 3245 points, with a profit target of around 3220 points

Labaron believes

Guaranteeing the principal is the bottom line for survival, controlling risks is the armor for survival, earning profits is a stage medal, and long-term stable and continuous profits are the only proof of being able to stand up from the mountains of corpses and seas of blood.

Gold rebound is weak, full analysis of high-altitude strategiesTechnically, gold faces the test of whether the double top pattern can be established. The progress of the trade agreement may exceed expectations. In the short term, the gold price is disturbed by the trade news, but in the long term, geopolitical, debt and interest rate cuts still support the upward trend of gold prices. Gold stabilized and rebounded after hitting a low of 3207 during the European session, and further rose to a high of 3248 during the US session. However, the rebound momentum was relatively limited, and the current price maintained a volatile pattern within the 3220-3248 range. At present, 3250 has become a key resistance level. If it can effectively break through and stand firm, the gold price is expected to further test the 3270-3288 area. However, from the perspective of short-term momentum, it is still facing downward correction pressure in the late trading period. Technically, the upper resistance is concentrated in the 3248-3252 range, and the lower support is around 3225-3217. In terms of operation, it is recommended to mainly do long positions on callbacks, supplemented by rebounds from high altitudes.

Operation strategy 1: It is recommended to do more on the pullback in the 3225-3217 area, with a target of 10-15 points.

Operation strategy 2: It is recommended to short at the rebound area of 3245-3252, with the target at 10-15 points.

Decisively start the short-selling layoutThe results of the China-US talks were significant and exceeded market expectations. China and the US issued a joint statement, the core of which was to end the tariff war and reduce the tariffs of both sides to 34%, of which 24% will be temporarily exempted within 90 days.

At present, there is still a demand for a rebound. For the US market, we should first look at the area around 3245-55. If the rebound is in place, continue to play short orders to look at the target position of 3200. If it breaks upward, find a new point layout. This week's data and news will have a further impact on gold.

Operation suggestion: Short gold when it rebounds to around 3245-3255, pay attention to 3220 and 3200

Gold Sniper Zones - XAUUSD May 12 Monday🔍 Key Intraday Demand Zones (Potential Bounce Areas)

🔵 3220–3200

Current area of interest with short-term absorption signs

May serve as temporary reaccumulation base if bulls defend this area

Ideal zone for intraday reaction → confirmation required before acting

🔵 3180-3165

Strong historical reaction level

Previously held structure before rally

If price breaks below 3209, this is likely where buyers will re-enter aggressively

🔺 First Major Intraday Resistance Zones

🔴 3240–3255

First clean lower high zone

Recent bearish pressure originated here

Any bounce toward this area may face sharp rejection

🔴 3275 - 3290

Former structure base, now flipped

Watch for potential NY spike into this region → rejection likely without a confirmed breakout

🧠 Final Words:

Gold isn’t in freefall. It’s moving between precision zones that traders either recognize — or get wrecked by.

At this stage:

Below 3209 = bearish pressure likely continues toward 3170s

Above 3255 = watch for liquidity sweeps and false confidence

🎯 Stay with structure. Ignore the noise. Let the market earn your entries.

Drop a 🚀 Follow, comment, and share with your trading crew — if this helps your trading; let’s build a sharp Gold team

📌 Important Notice!!!

The above analysis is for educational purposes only and does not constitute financial advice. Always compare with your plan and wait for confirmation before taking action.

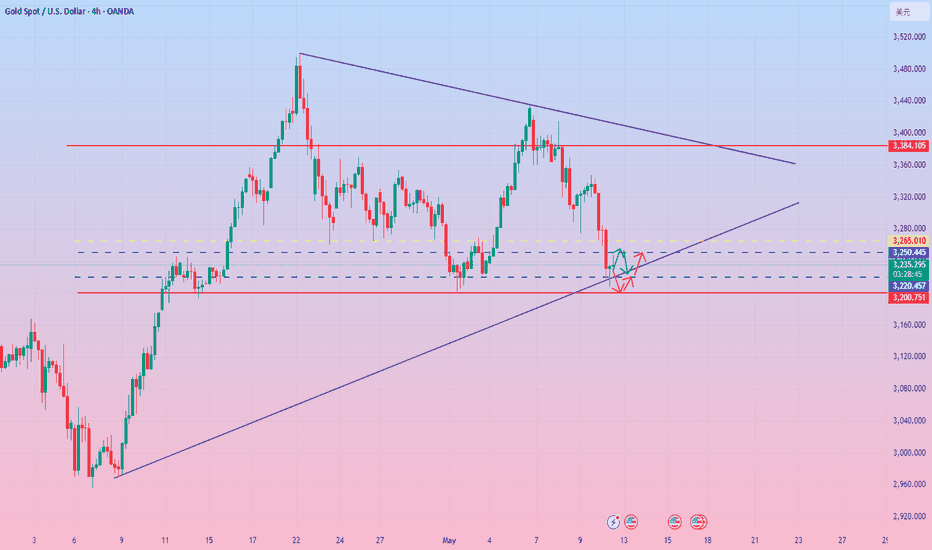

Seize the moment! The rebound is a good opportunity to shortGold was affected by the implementation of the China-US tariffs and the ceasefire between India and Pakistan, which weakened the market's risk aversion sentiment. The weekly line formed a double-needle top pattern, and continued to see downward adjustments this week. The daily line also has a double top structure, with 3500 and 3435 as double tops, and the neckline focuses on 3202. If it falls below, the double top pattern is confirmed. In terms of thinking, keep falling back and adjusting, with pressure focusing on 3260 and 3283, and support below focusing on 3200-3202. In terms of operation, rebound high and short are the main, and falling back is supplemented by long.

Operation suggestion: short gold when it rebounds to around 3255-65, and look at 3320 and 3200. long gold when it falls back to around 3210-3200, and look at 3320 and 3250.

Circular short selling is still the main themeGold has no power to rebound in the Asian session, and it keeps fluctuating and falling. The highest rebound was 3292, but it fell back under pressure, and the lowest touched 3217. The fluctuation and decline are still dominant, so we only need to short on the rebound. It is still difficult to fill the gap at the opening today, so don't have hope. Just keep shorting on the rebound. The weekend article also analyzes the bearish opening this week. After all, the international situation of India and Pakistan's comprehensive ceasefire and Russia-Ukraine ceasefire negotiations are mainly bearish for gold. Coupled with the technical shorts, it is reasonable for gold to jump short. Today, we will treat gold as rebound shorting. In terms of operation, we will mainly short on rebound and be a steady trader. Judging from the current trend of gold, the main short rhythm of the pullback will continue to remain unchanged before the daily level breaks through and stands at this position.

It’s the right time to go shortLast week, gold came under pressure at the key resistance of 3356 and then fluctuated downwards. The market jumped short and opened low, directly breaking through the support to a low of 3259, and the daily line continued the downward trend. The current market is in the daily level adjustment stage, but the downward momentum is strong and the risk of breaking continues to accumulate. From a technical perspective, 3280 constitutes a short-term upward resistance. If the rebound is blocked, you can still choose to arrange short orders; there is strong support near 3240 below, and it is necessary to pay attention to whether this position can be effectively broken to confirm the accelerated decline. On the news side, the easing of the Sino-US tariff situation has weakened the market's risk aversion sentiment. In addition, the bullish momentum of gold has been exhausted after the previous consecutive rises, and the recent weak and volatile pattern has become prominent.

Gold recommendation: short near 3280-3290, target 3270-3260.

Gold opening rise and fall prediction?The current gold market is in a range of fluctuations, maintaining a wide range of fluctuations. Technically, the key support level below is still focused on the 3270 area, while the 3450 price level above constitutes a significant double-top structural resistance level. Although the conclusion of the US-UK tariff agreement has a phased negative effect on precious metals at the geopolitical level and may provide a demonstration effect for other regional trade negotiations, the overall technical structure still maintains a downward trend. At the daily level, the recent K-line combination has completed a deep retracement from the 3500 mark with two long negative lines, directly breaking through an important support platform. The current daily K-line continues to close the adjustment pattern with an upper shadow line, and the alternating yin and yang oscillation rhythm conforms to the technical correction characteristics. It is worth noting that the 50-period moving average continues a clear downward trajectory, forming a resonance suppression with the double-top structure in the 3450 area.

The 1-hour gold chart shows that the short-term price trend presents a clear downward channel feature, and the seller's power continues to dominate the market. Combined with the Fibonacci extension level calculation, the first target below can still focus on the 3300 area. If this support platform is lost, the price will have a technical demand to further explore the 3320 integer mark. The current volume and price coordination shows that the market is brewing a new wave of trending market conditions. It is necessary to pay close attention to the breakthrough direction of the 3300-3380 range, which will determine the continuation or reversal of the medium-term trend. Taken together, the short-term operation of gold is recommended to be mainly longs on callbacks, supplemented by shorts on rebounds. The top short-term focus is on the first-line resistance of 3360-3380, and the bottom short-term focus is on the first-line support of 3320-3300.