XAUUSD - Trading strategy after CPI news on December 13World gold prices fluctuated slightly with spot gold down 1.3 USD to 1,979.5 USD/ounce. Gold futures last traded at 1,993.2 USD/ounce, down 0.5 USD compared to yesterday morning.

Although the world gold price this morning was listed close to the level of yesterday morning, it has decreased sharply compared to the increase during the day. Specifically, gold plunged and lost the previous 0.5% increase after a new report was released showing that consumer prices in the US did not decrease in November. Inflation data was released first. The Fed's final monetary policy meeting in 2023. The market is expecting the US Central Bank to maintain interest rates at its meeting on Wednesday.

The consumer price index (CPI) rose 3.1% year-on-year in November, in line with economists' expectations. November CPI increased 0.1% compared to the previous month. The dollar pared losses after the CPI data and made gold less attractive to holders of other currencies.

Economists note that the latest inflation data could cause a shift in market expectations for an interest rate cut as early as March. US Federal Reserve officials ( The Fed) has emphasized that it needs to see a sustained downward trend in inflation before starting to reduce interest rates.

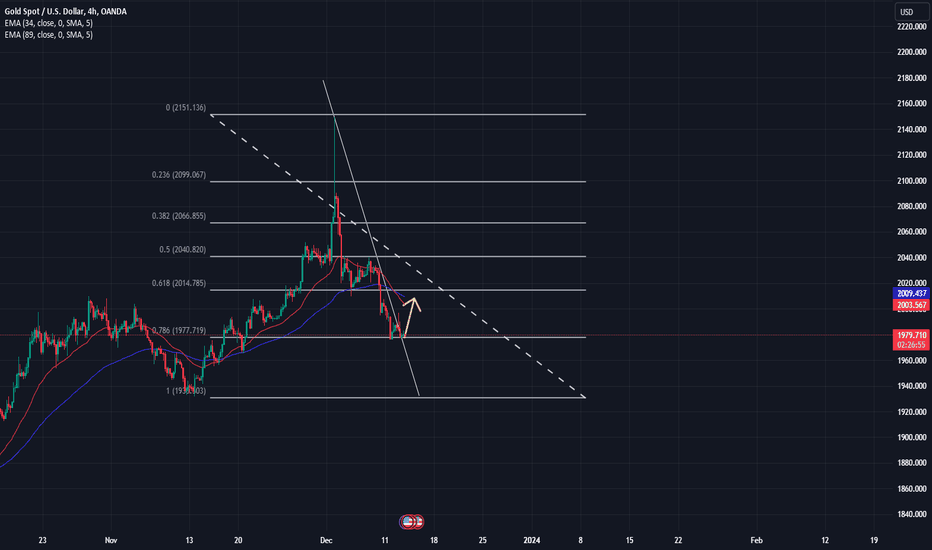

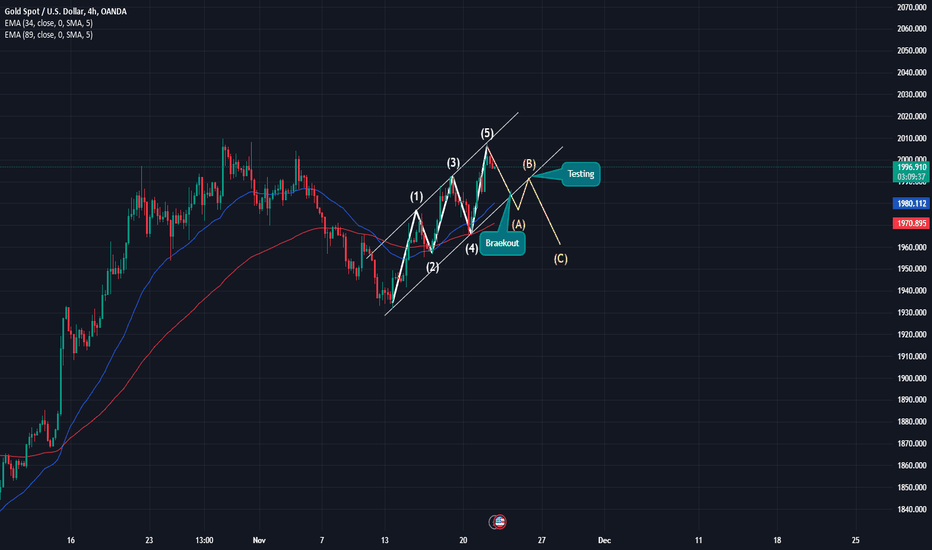

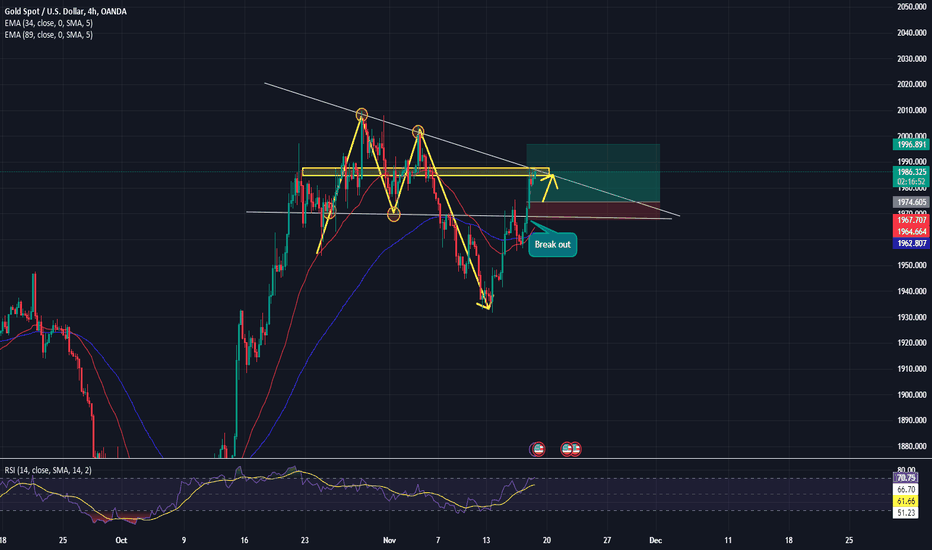

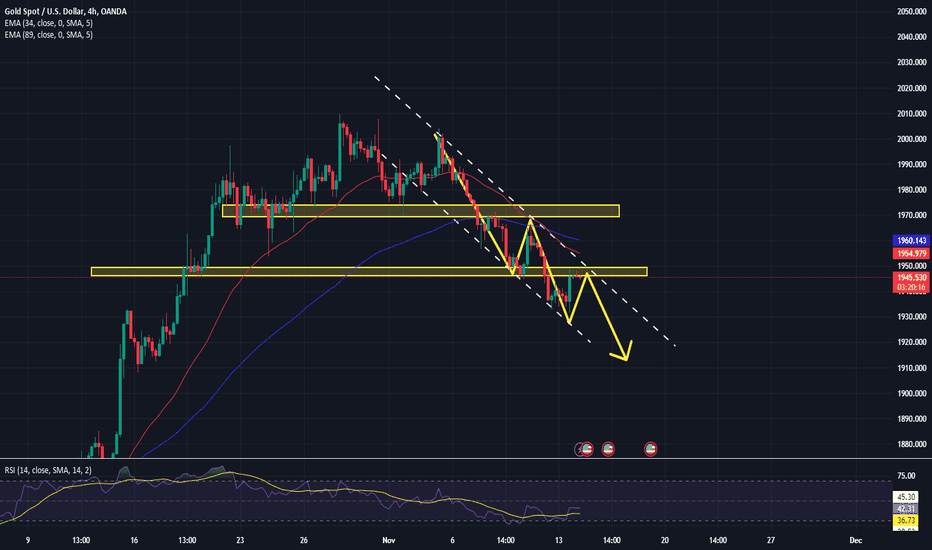

Xauusdtrend

PPI news trading strategyThe world's gold price today, December 13, continues to decrease when the US releases the latest emission data, creating motivation for the USD to increase in price.

Gold prices today have not stopped falling in the context of the US announcing the annual consumer price index (CPI) in November 2023 increased by 3.1%, 0.1 percentage point lower than the previous month of 3.2. %. At the same time, the US also announced that annual core inflation in November 2023 increased by 4%, unchanged from the previous month and in line with market forecasts.

Immediately, investors speculated that the US Federal Reserve would keep interest rates unchanged after concluding its meeting at dawn on December 14. In particular, many people have reduced their expectations that the FED will soon reduce interest rates in 2024.

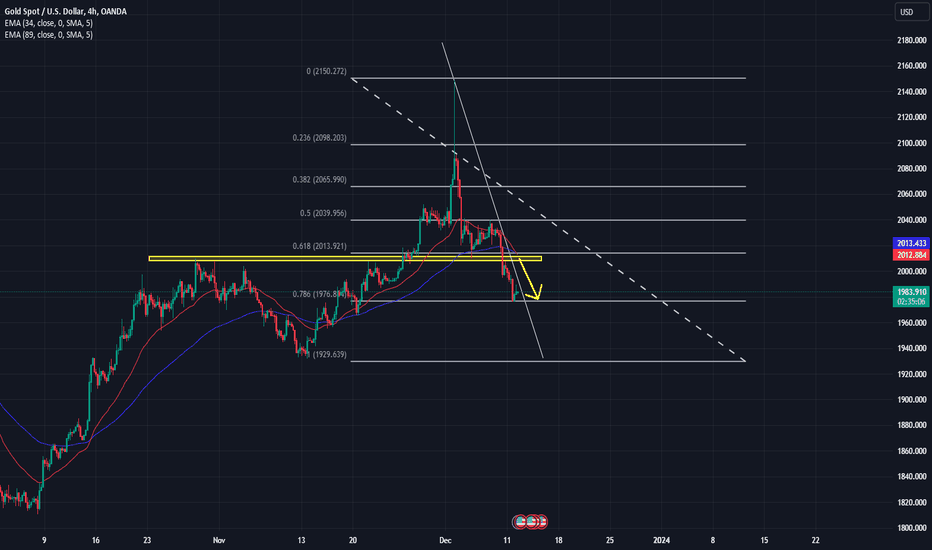

SELL XAUUSD 1990 - 1992

SL 2000

TP 1982

TP2 1973

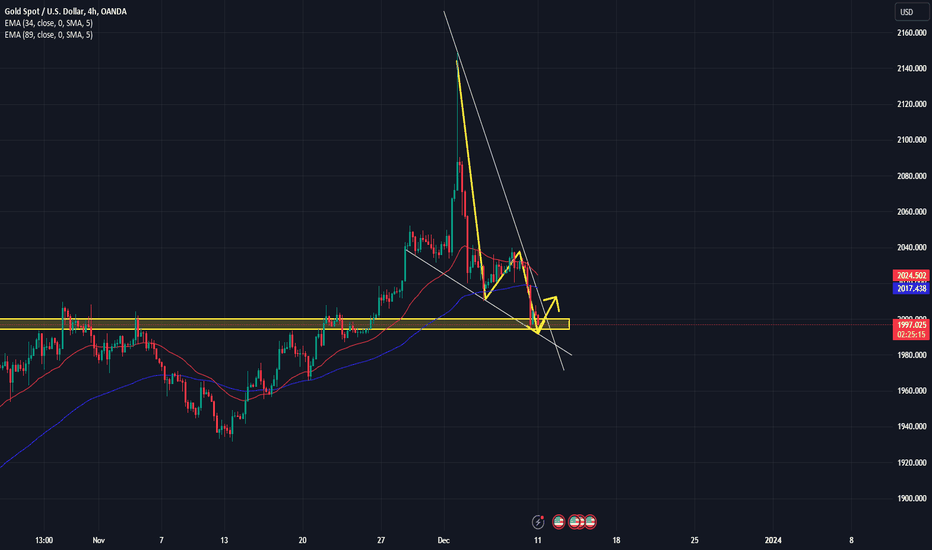

Trading strategy on December 12, priority to sellWorld gold prices dropped sharply with spot gold down 25.2 USD to 1,980.8 USD/ounce. Gold futures last traded at 1,997.3 USD/ounce, down 17.2 USD compared to yesterday morning.

World gold prices slid due to pressure from the recovery of the USD and rising bond yields. The USD rose 0.2%, making gold more expensive for holders of other currencies. US 10-year Treasury yields also rose higher, increasing the opportunity cost of holding gold.

Currently, investors wait for important meetings of several central banks. Specifically, the European Central Bank, Bank of England, Norges Bank and Swiss National Bank will also conduct policy meetings on Thursday. In addition, investors are also interested in data. US inflation data. This data is said to be able to influence the policy roadmap of the US Federal Reserve (Fed).

XAUUSD - Short-term gold trading strategy, Gold goes up and downWorld gold prices tend to increase with spot gold increasing by 1.5 USD compared to last week's closing level to 2,006 USD/ounce.

Last week, the yellow metal continuously plummeted after hitting an all-time high at the beginning of the week and anchoring nearly 2,000 USD/ounce. Kitco News' latest weekly gold survey shows most retail investors still expect prices to rise this week, while the majority of market analysts have turned bearish or neutral on the outlook. Short-term outlook for the yellow metal.

Specifically, among Wall Street analysts participating in Kitco News's latest gold survey, only 20% forecast that gold prices will be higher this week, with more than half of experts predicting prices will decrease. Meanwhile, 59% of retail investors expect gold to increase. Retail investors expect gold prices to trade around 2,056 USD/ounce this week.

This week, developments in monetary policy meetings of major central banks around the world will be closely watched by the market. Accordingly, the Federal Open Market Committee (FOMC) of the US Central Bank will meet on Wednesday, followed by the meeting of the Bank of England and the European Central Bank on Thursday. All three banks banks are forecast to keep interest rates unchanged, although investors will still be watching to see if there is a change in the tightening trend and their forecasts.

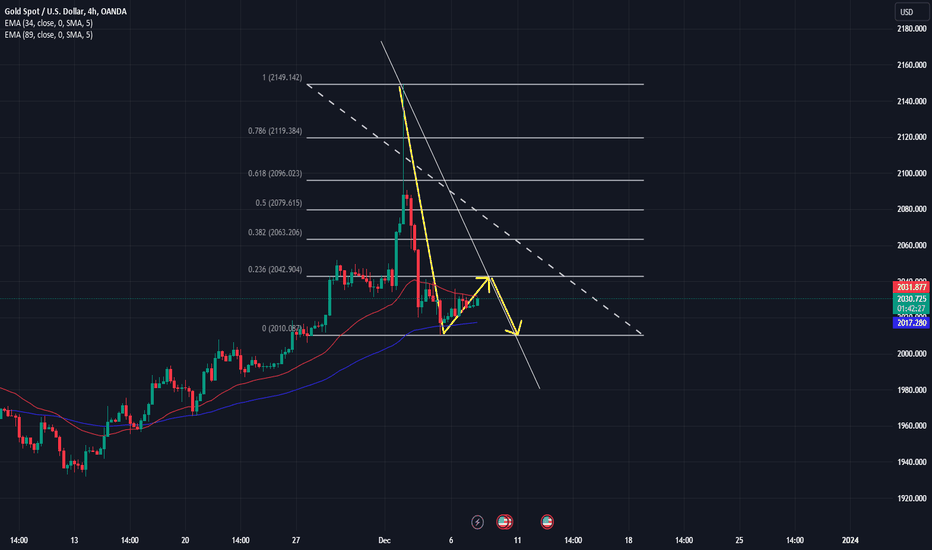

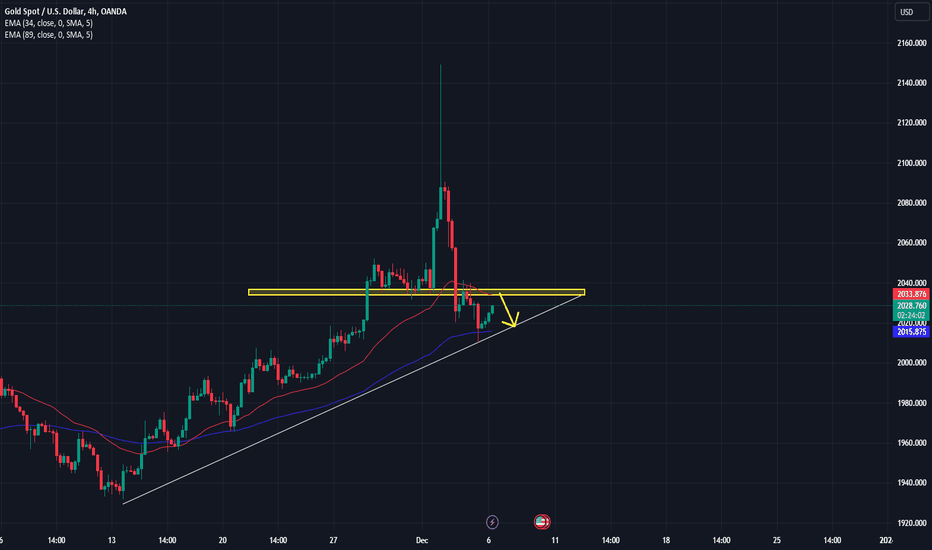

The trend is decreasing, the current reasonable entry pointGold prices rose after the release of weaker-than-expected US ADP jobs data.

Specifically, the US economy created 103,000 new jobs in November, much lower than the expected 130,000. The October figure was revised down to 106,000 from the previous estimate of 113,000.

These figures follow Tuesday's JOLTS US Job Openings survey, adding to evidence that restrictive monetary policy is starting to weigh on demand for workers.

On the other hand, the US ISM services PMI showed a larger-than-expected improvement, helping to negate a sharp slowdown in the US economy.

CME Group's FedWatch tool is pricing in a more than 50% chance that the US central bank will cut its benchmark interest rate by 25 basis points in March.

The market is in a moderately positive mood as investors grow increasingly confident that the major central bank tightening cycle is over.

XAUUSD - Gold continues to fall deeply, the moves weaken goldWorld gold price continues to decrease by 15 USD/ounce, down to 2,020 USD/ounce. This is the third consecutive day of decline for the precious metal since reaching a record high at the beginning of the week

The market waits for the US to release non-farm payroll data this weekend. The jobs report could affect the US interest rate outlook. Gold began to increase strongly when the market expected the US Federal Reserve (Fed) to cut interest rates as early as March. According to CME FedWatch Tool, markets forecast a 50% chance that the Fed will cut interest rates. rates in the first quarter of 2024. TD Securities experts said that market expectations for interest rate cuts may be premature and warned that gold's rally has exhausted itself.

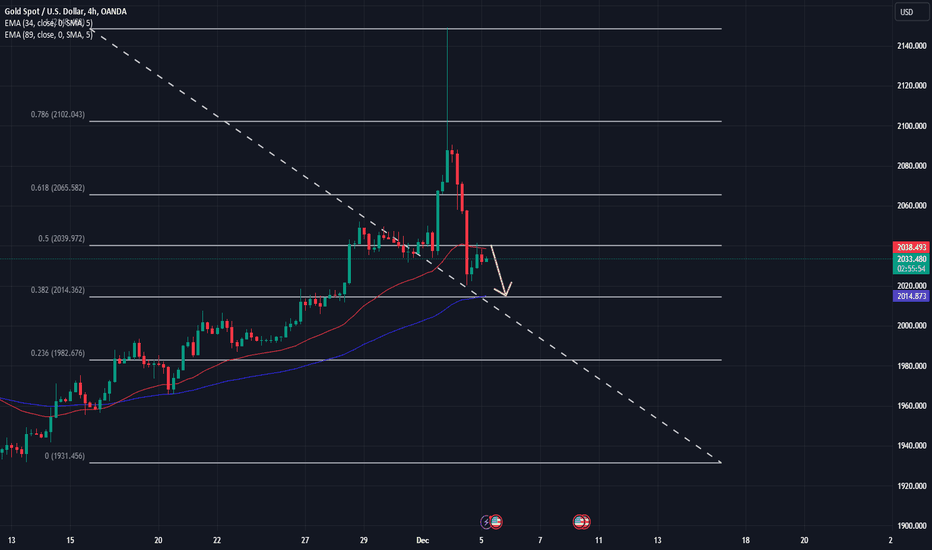

XAUUSD - Rising sharply then reversing with a shock declineGold price today dropped shockingly in the context of the USD Index increasing 0.37 points to 103.64 points. This causes the value of the USD to decline compared to many other strong currencies. The international gold market falls into a disadvantageous position.

On the other hand, gold prices dropped today when US bond interest rates increased to 4.4%/year. This factor has motivated many people to put capital into bonds. Meaning that money flowing into precious metals is limited. Since then, speculators speculated that the price of gold might go down, so they sold it to make a profit. The world gold price today at 6:00 a.m. on December 5 dropped to 2,030 USD/ounce.

Previously, at the beginning of December 4, the world gold price sometimes reached a record level of 2,147 USD/ounce. The main reason is that financial investors are afraid of risks, so they increased their need to shelter capital in gold when the US said missiles fired by Houthi rebels in Yemen attacked three commercial ships in the Red Sea.

Gold prices fell more than 2% after hitting an all-time high as currency futures traders increased bets the US Federal Reserve (FED) would cut interest rates next year.

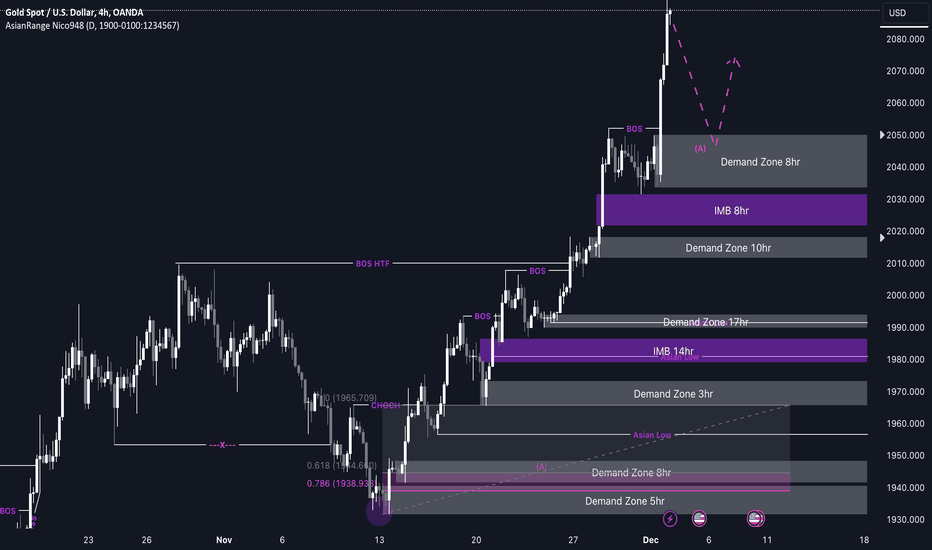

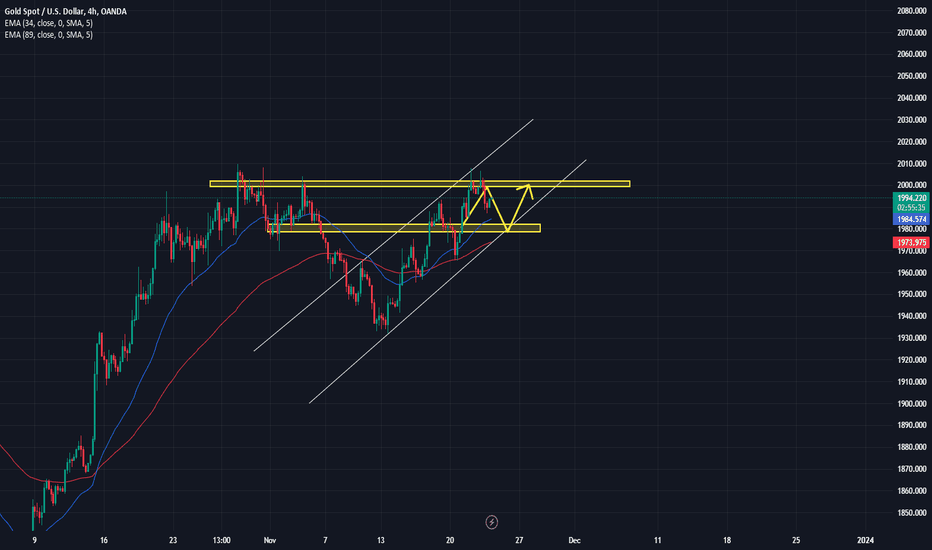

XAUUSD Longs from 2040.000 up towards 2080.000Effectively overpowering any attempts by sellers to intervene. Consequently, new all-time highs (ATHs) have been established, suggesting a continued upward trajectory for gold. Despite the possibility of a significant reversal due to reaching the ATH (a substantial liquidity point), the current presence of bullish candlesticks on the higher time frames indicates that a downturn is not imminent.

Considering the prevailing bullish sentiment, my inclination is to adopt a buying bias, particularly around the nearby demand zone near 2040, which has caused a BOS to the upside. With this setup in place, I anticipate a swift pullback to that region, creating opportunities for engaging in pro-trend trades on the upward movement.

Confluences for XAUUSD Longs are as follows:

- Price has been impulsively bullish to the upside carrying lots of momentum.

- Overall trend on the higher time frame and lower time frame both show a bullish trend.

- ATH's has been taken so I can see a minor correction occurring to fill imbalance below and then mitigate my 8hr demand zone I have marked out.

- Price has left a clean 8hr demand below that has caused a BOS to the upside.

- Dollar is also currently bearish so I can expect gold to keep on rising.

P.S. Given that a majority of individuals have now validated a comparable bullish inclination, I foresee the possibility of a price reversal at this point. The sweeping of significant liquidity, particularly at all-time highs (ATHs), could potentially mark the initiation of a short-term bearish trend. However, it is imperative to closely observe and await price movements to reveal its intentions, allowing us to determine our course of action.

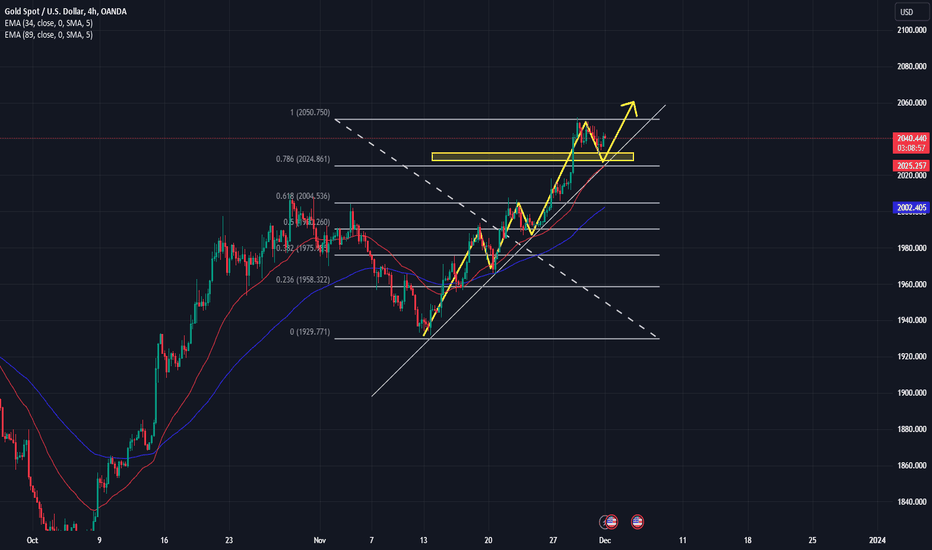

Gold risks are increasing, you need to be careful World gold prices have not changed much and are still anchored at the highest level in nearly 7 months. Earlier in the day, the precious metal was priced at 2,043.1 USD/ounce. For the whole month of November, gold prices increased by about 2.7%.

Yesterday, the US personal consumption expenditure (PCE) price index in November was announced with an increase of 3.5% over the same period last year, slower than the increase of 3.7% in October. This is the preferred inflation measure of the US Federal Reserve (Fed).

The PCE index is the latest in a series of positive inflation data recorded in November, making traders even more confident that the Fed may be done raising interest rates and may even begin to raise interest rates. lower interest rates in 2024.

Besides, the USD-Index has inched back above 103 points but still recorded the sharpest drop in November this year. This is the main reason driving gold prices up in recent days.

XAUUSD - Gold prices continue to increase sharplyWorld gold prices stabilized with spot gold increasing by 2.2 USD to 2,042.7 USD/ounce. February gold futures last traded at 2,065.2 USD/ounce, up 5 USD compared to yesterday morning.

The yellow metal was mildly volatile and had little reaction after the latest report showed the strength of the US economy in the third quarter. Specifically, according to the Bureau of Economic Analysis, US GDP in the third quarter increased by 5.2%, up from the estimate of 4.9%.

Stronger GDP data boosted the USD and put slight pressure on gold in mid-week trading. However, expectations that the US Federal Reserve (Fed) may cut interest rates in the first half of next year continue to keep bullion near a 7-month high.

Additionally, gold will still benefit from safe-haven demand due to concerns related to geopolitical tensions. Given those factors, SocGen analysts see a push above $2,000 as the start of a larger recovery that could keep gold prices at around $2,200 an ounce in 2024.

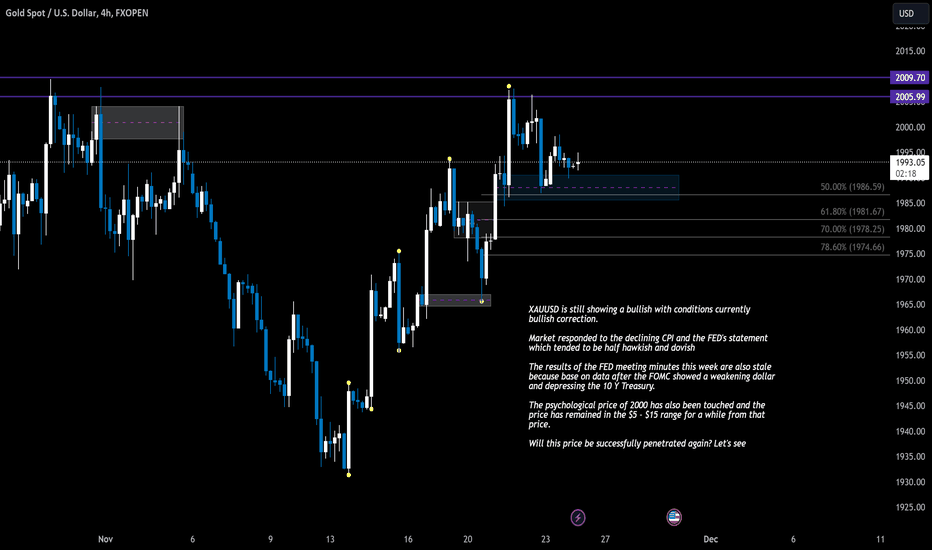

XAUUSD - Will gold continue to rise, strategy to buy GoldWorld gold prices increased slightly this morning with spot gold increasing by 2.5 USD to 1,992.1 USD/ounce. Gold futures last traded at 1,993.3 USD/ounce, up 0.5 USD compared to yesterday morning.

World gold prices in the evening session of November 23 (Vietnam time) were stable during the Thanksgiving holiday. Analysts do not expect to see many price increases for the rest of the week as most traders are currently focused on this holiday and the "Black Friday" shopping festival.

Entering the holiday season, the gold market could not maintain a new increase above 2,000 USD/ounce as the market continued to monitor the minutes of the latest policy meeting from the US Federal Reserve (Fed). Although the central bank left interest rates unchanged in its latest meeting, the minutes showed the committee was maintaining a hawkish stance as it expected to keep interest rates restrained for the foreseeable future.

Since late last week, gold has been strongly supported as expectations that the Fed has completed its interest rate hike cycle have been increasing after a series of published reports showing cooling inflation. Wednesday's hawkish Fed minutes and Wednesday's strong labor market data made investors hesitant to predict the Fed's next monetary policy move. Rising expectations that the Fed will keep interest rates “higher for longer” and a decline in the likelihood that it will begin cutting rates in the first half of 2024 have limited gold's gains.

Despite this, some experts still maintain optimism that gold prices will eventually move higher as seasonal factors could play a larger role in price action and be positive for gold.

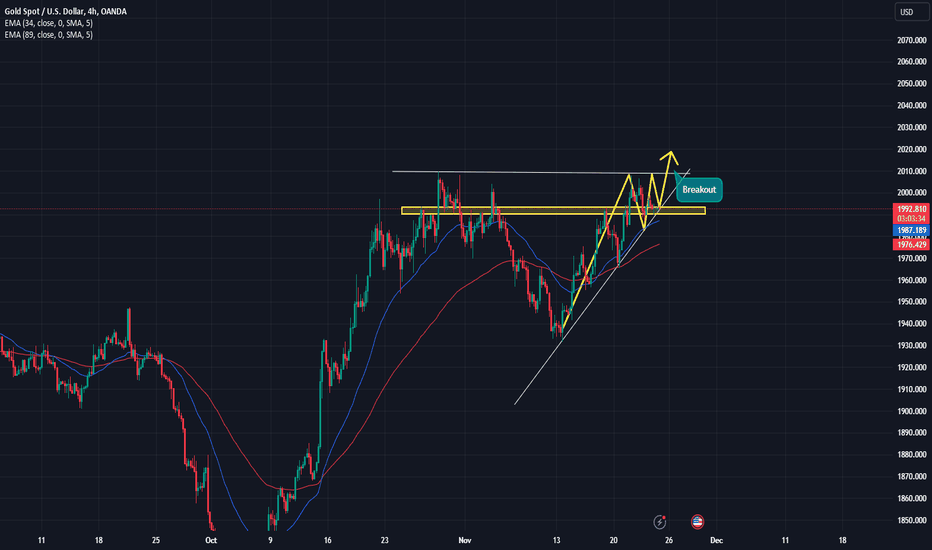

Wait n See Gold PriceXAUUSD is still showing a bullish with conditions currently bullish correction.

Market responded to the declining CPI and the FED's statement which tended to be half hawkish and dovish

The results of the FED meeting minutes this week are also stale because base on data after the FOMC showed a weakening dollar and depressing the 10 Y Treasury.

The psychological price of 2000 has also been touched and the price has remained in the $5 - $15 range for a while from that price.

Will this price be successfully penetrated again? Let's see

XAUUSD - On Bank Holiday, gold tends sidewaysWorld gold prices this morning decreased slightly with spot gold down 8.1 USD to 1,989.6 USD/ounce. Gold futures last traded at 1,991.8 USD/ounce, down 9.8 USD compared to yesterday morning.

The precious metals market in the trading session before the Thanksgiving holiday was under slight selling pressure when the latest report showed a surprise improvement in the US labor market. According to a report by the US Department of Labor, weekly applications for unemployment benefits decreased by 24,000 to 209,000 in the week ending November 18, down from the previous week's upwardly revised estimate of 233,000 applications. The latest labor market data was much better than expected as experts estimated 225,000 applications.

After the report, the dollar recovered from its lowest level and Treasury yields pared earlier losses, pushing gold off the key psychological threshold of $2,000 an ounce.

The US Dollar Index has risen to a daily high and that is limiting some gold buying demand, said senior analyst Jim Wyckoff at Kitco Metals.

However, experts say that gold's decline has been limited by recent expectations that the US Federal Reserve (Fed) has ended its interest rate hike cycle. Lower interest rates typically boost gold prices because they reduce the opportunity cost of holding non-yielding assets. Previously, gold bars reached a 2-week high of 2,007.29 USD/ounce.

XAUUSD - When the uptrend ends, Gold declines againGold price today (November 22), world gold increased sharply compared to the previous session's close, approaching the 2,000 USD/ounce mark. The US Federal Reserve (Fed) has released the minutes of its November monetary policy meeting, causing investors to buy gold when forecasting slow economic growth.

The Fed also said that economic growth slowed in other business sectors, so the Fed expects economic growth in the fourth quarter to "slow markedly" as third quarter gross domestic product increased by 4.9%. The Fed believes that risks to overall economic growth may be tilted to the downside, while risks to inflation are tilted to the upside. Current interest rate policy is restrictive and is putting downward pressure on economic activity and inflation.

However, inflation is still much higher than the target level, experts say it is likely that the Fed will maintain interest rates at the current level for a while until inflation clearly declines in a sustainable way. “The FOMC minutes were cautiously hawkish,” said BMO Capital Markets strategist.

Low sales in both the retail and housing sectors show that people are tightening their spending. The Fed also stated that economic growth will slow down in the fourth quarter of 2023, which is the reason why investors fear increased risks and boost gold purchases.

XAUUSD - Gold rebounded due to the Fund, is it possible to sell?On the night of November 20, today's spot gold price on the world market stood around 1,973 USD/ounce. Gold delivered in December on the Comex New York floor was at 1982 USD/ounce.

The world gold price on the night of November 20 was about 8.2% higher (149 USD/ounce) compared to the beginning of 2023.

World gold tends to continue last week's increase after inflation in the US cooled down. It is likely that the US Federal Reserve (Fed) will soon reverse monetary policy and reduce interest rates.

This week, the Fed will release the minutes of its monetary policy meeting. Market signals show that the Fed will almost certainly keep interest rates unchanged at its December policy meeting and will likely maintain it at 5.25% - 5.5% until June next year.

The USD on the world market decreased quite quickly. The DXY index - measuring the fluctuations of the greenback against a basket of 6 major currencies, dropped sharply from 104.1 points at the end of last week to 103.6 points at the beginning of the trading session on November 20 on the US market.

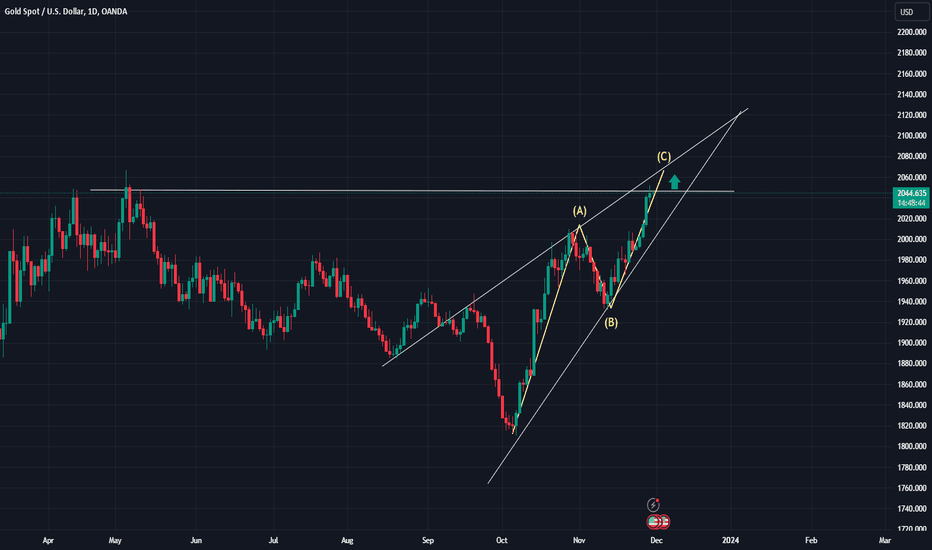

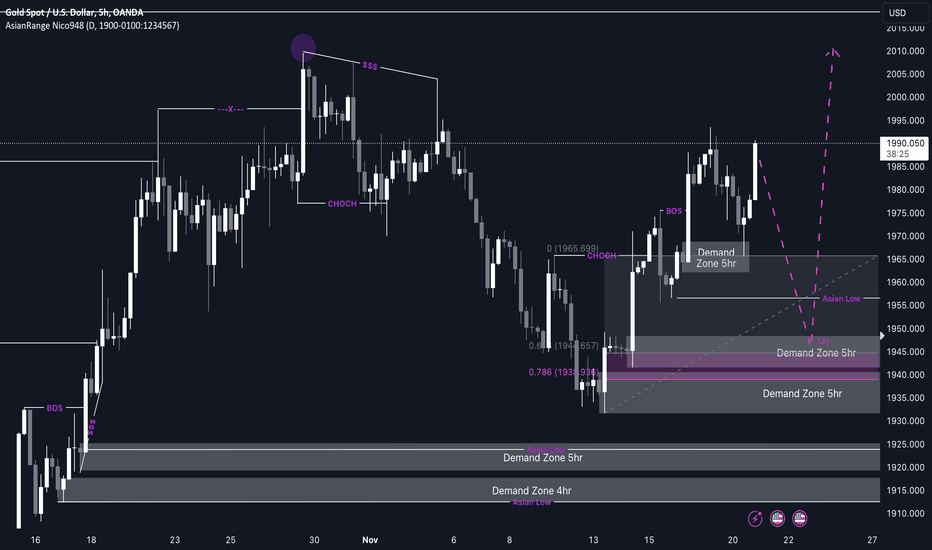

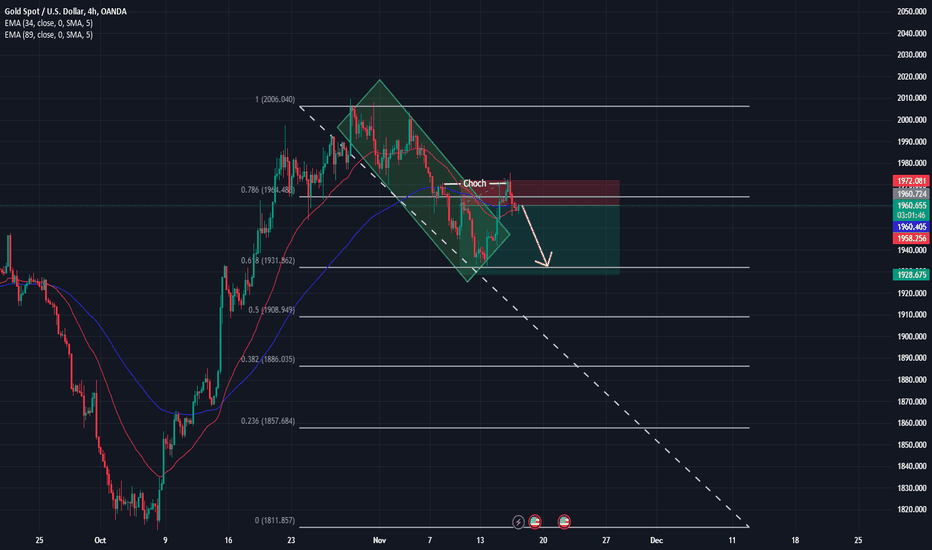

XAU/USD Long term Buys from 1945.000 up towards (2010.000)This is a long term move I am anticipating for the gold market, as the overall market is bullish on the higher time frame, this will be a pro trend trade that we can take up towards 2010 or even higher to make new ATH's (ALL TIME HIGHS.) To add, the internal structure is also very bullish now and we can be expecting an impulse move to the upside from these POIs marked out.

Currently, I want to see a pull back of some sort back to the demand zones around 1945 where price is at a much cheaper rate. This will give us an ideal entry model if we see a Wyckoff accumulation play out in this area as well as a clean CHOCH to the upside. Not only that but this zone has also caused a CHOCH already and it lays between the 0.78 fib range.

Confluences for Long term Gold Buys are as follows:

- XAUUSD is overall bullish on the HTF structure and LTF structure.

- Price has left a clean demand below that has caused a CHOCH to the upside and BOS.

- Lots of liquidity to the upside int the form of a trend line, asian highs and FVGs

- Price requires a pullback or a correction in order for price to continue going upwards.

- The zone also is inside the 0.78 fibonacci range and the zone has caused an impulse move.

- However, we are pending lower time frame confirmation as price is not near our POI as of yet.

- To add to this the Sentiment analysis also shows the gold market being VERY BULLISH.

P.S. I will be waiting for these zones for a buy unless price makes new demand zones then we will re evaluate our next move. Or we can wait for price to enter a new supply for us to sell back down towards these areas to then ultimately buy back up!

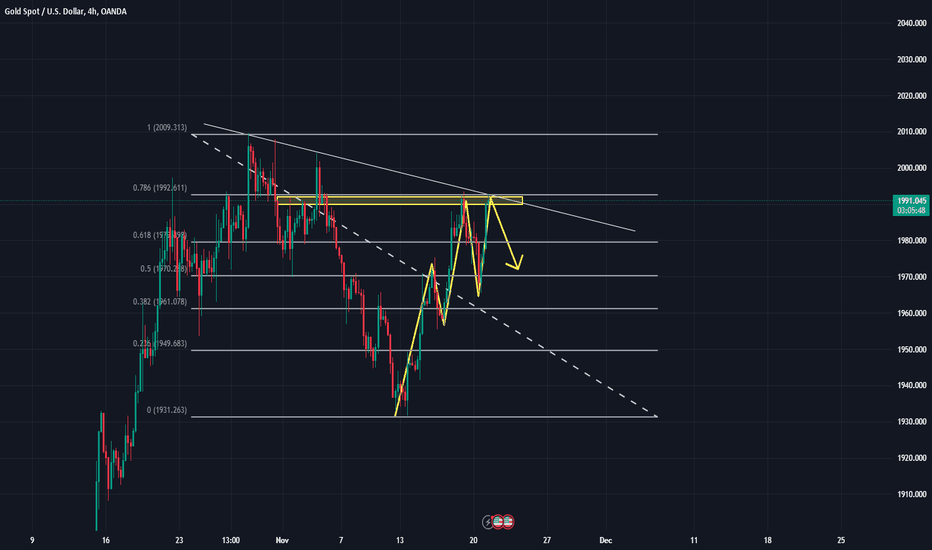

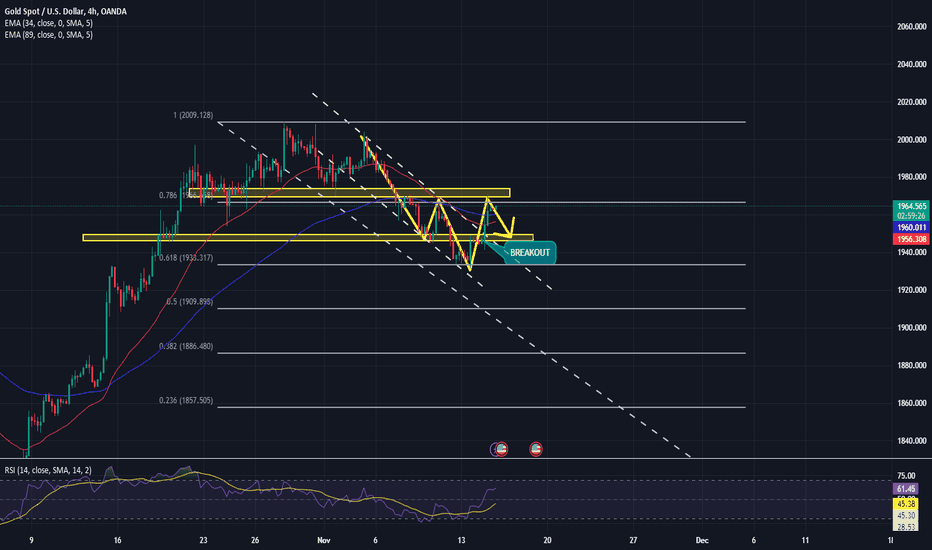

XAUUSD: Technical analysis and operational strategy

Gold came under selling pressure on Wednesday as US retail sales fell at a slower pace than expected in October. The reason for the pullback in spot gold after hitting a weekly high of 1975, failing to hold above $1970, is mainly due to the rebound in the US dollar and the rebound in US Treasury yields. Spot gold fell on Wednesday, retreating from a high of $1,973 to near $1,955. After the opening of this trading day, gold prices still continued to weaken, trading around $1966. On the 4-hour chart, gold remains above the 20-cycle SMA, suggesting upside potential. Technical indicators, however, give mixed signals. The Relative Strength Index (RSI) is trending down, momentum indicators are flattening, and MACD indicators show limited potential. A break below $1,955 would leave gold vulnerable in the short term. If it breaks through $1970 / oz, gold will test the key resistance level of $1975 / oz. In the short term, the operation tends to be in the 1955-1975 interval, waiting for the break of the weekly line interval tomorrow, and then make arrangements!

Spot gold operation recommendations:

Strategy one: Callback 1956-1958 near multiple single entry, stop loss of 6 dollars, the target 1970-1972 line;

Strategy two: Rebound 1972-1970 near the short entry, stop loss of $6, the target 1958-1956 line.

If you are confused about trading, please join me, I believe you will have a great harvest!

DXY keeps falling on recent news, Gold continues to riseWorld gold prices rose as the code hit a 2-week high as expectations that the Fed would cut interest rates in the spring increased.

World gold prices increased sharply this morning with spot gold increasing by 21.6 USD to 1,980.8 USD/ounce. Gold futures last traded at 1,987.3 USD/ounce, up 23 USD compared to yesterday morning.

Gold prices soared to a 2-week high as they were boosted by falling US Treasury bond yields amid the prospect that the US Federal Reserve (Fed) has completed its cycle of raising interest rates and will carry out interest rate cuts next spring increasingly.

Ole Hansen, commodity strategist at Saxo Bank, said that gold will maintain its recent strong gains as long as prices hold above $1,930 an ounce. He said the prospect of lower interest rates and demand from central banks will be strong enough support factors for gold to withstand any short-term strength from economic data.

Data on Wednesday showed US producer prices fell the most in 3.5 years in October, the latest sign that inflation pressures are easing, while retail sales fell for the first time. after 7 months. Previously on Tuesday, data showed that US pepper prices were unchanged compared to the level recorded in October.

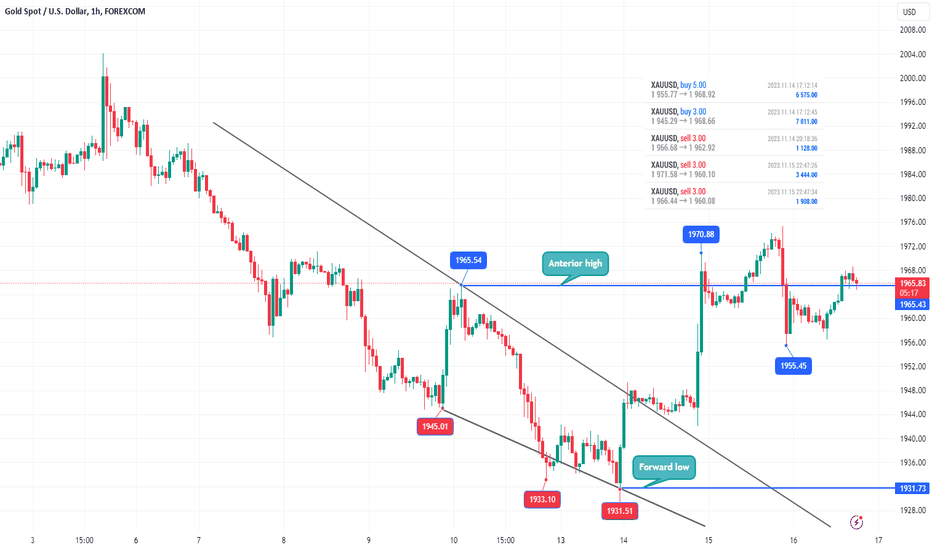

XAUUSD: SellInitial jobless claims are about to be announced. From a technical perspective, the trend of gold today is biased towards the short side, but there is uncertainty in the data.

If it is negative for gold, then it will follow the trend and have a sharp decline, and it is expected to fall below 1950.

If the data is bullish for gold, there is a high probability that it will fall back after rising, so today we focus on short trading.

If you don’t want to take risks, you can wait until the data is released before trading. Those who like risk-taking can trade short positions in advance to control risks.

Good day and good luck!

XAUUSD - After the PPI news, will gold fall?Continuing to accelerate from the previous session, the DXY index (the movement of the greenback compared to the balance of 6 major currencies) decreased sharply from 104.8 points to 104.1 points in the first trading session on the market.

The USD fell after US inflation was unexpectedly lower than forecast, reinforcing confidence that the US Federal Reserve (Fed) will not raise interest rates.

Specifically, US generation in October did not change compared to the previous month. The consumer price index (CPI) increased by 3.2% compared to 2022 and remained unchanged compared to September. Previously, economists consulting the Dow Jones survey predicted that this month's CPI would increase by 0.1 % compared to September.

This information gives hope that prices are easing pressure on the US economy. Investors believe interest rates have gained value.

Life on US Treasury bonds has also fallen sharply. Yields on 10-year notes fell to just over 4.4%, thus rebounding above 5% at the end of October.

Gold prices increased while countries still strongly imported gold and increased their reserves of this precious metal.

XAUUSD - Soared when the USD suddenly plummetedThe world's gold price today (November 15) soared when the US announced that the October consumer price index fell lower than forecast. The sudden drop in the USD helped investors return to buying gold when deposit and transaction costs decreased.

World gold prices continued to skyrocket this morning due to the USD suddenly plummeting. Specifically, the Dollar-Index - measuring the strength of the USD in a basket of 6 major currencies - dropped sharply by 1.49% to 104,060 points at 6:20 a.m. this morning (Hanoi time).

The USD fell sharply after the US announced the consumer price index (CPI) for October was lower than expected. Specifically, the CPI in the US in October increased by 3.2% over the same period last year, a sharper decrease than September's increase of 3.7% and lower than the forecast of 3.3%. This is the lowest level since March 2021.

The core CPI index in October in the US increased by 4% over the same period last year, lower than the 4.1% increase in September and the previous forecast. Experts say that a decrease in the CPI consumer price index will help The US Federal Reserve (Fed) cannot raise interest rates further at its upcoming December meeting.

Because the Fed's prediction that it will not raise interest rates any further has pushed the USD down, gold prices have benefited as a result. Because gold transaction and custody costs will decrease.

However, experts also warn investors to be cautious, because inflation has decreased but is still far from the target level of 2%. Previously, the Fed Chairman gave the message that the Fed will do everything to reduce inflation to the target level. Therefore, gold prices may still be under pressure if the Fed raises interest rates one more time.

XAUUSD - PPI today news trading strategyYesterday, the market received information about US inflation data, which more or less affected gold prices. Specifically, the US consumer price index remained unchanged in October and core inflation showed signs of slowing down. CPI increased by 3.2% compared to the same period last year. This level in September was 3.7%.

Accordingly, after the inflation report was published, the market predicted a 100% possibility that the US Central Bank would keep interest rates unchanged in December compared to 86% before the inflation report. Weaker-than-expected US consumer inflation data caused the USD and Treasury bond yields to fall, thereby helping gold prices recover.

Experts say that CPI data was significantly weaker than expected, which is quite supportive for precious metals. But at the same time, he believes that gold may drop another 4% back to 1,900 USD/ounce in the near future when it no longer benefits from the safe haven channel, due to concerns related to the Israel-Hamas conflict. This expert predicts that the average price in 2024 will be 1,883 USD/ounce and increase to an average of 1,918 USD/ounce in 2025.

XAUUSD- Intraday trading strategy before CPI news on November 14Gold prices today (November 14) in the world rebounded right before the US announced the October consumer price index today. The falling USD has supported the increase in gold prices.

World gold prices continued to increase this morning because the falling USD supported the increase in gold prices as transaction and custody costs decreased. Specifically, the Dollar-Index - measuring the strength of the USD in a basket of 6 major currencies, decreased by 0.19% to 105,660 points at 6:30 a.m. this morning (Hanoi time).

The USD fell before the US announced the consumer price index (CPI) for October today, October 14. It is forecast that the CPI in the US will increase by 3.7% over the same period last year, equal to the increase in September.

Previously, the US released the October employment report with non-farm payrolls only creating 150,000 jobs, much lower than the 180,000 jobs forecast and far ahead of the 297,000 jobs created in September. The unemployment rate also increased from 3.8% in August to 3.9% in October.

Experts say that poor employment data in the US and a stable CPI may help the US Federal Reserve (Fed) not be able to increase interest rates as previously forecast to ensure market stability. job school.

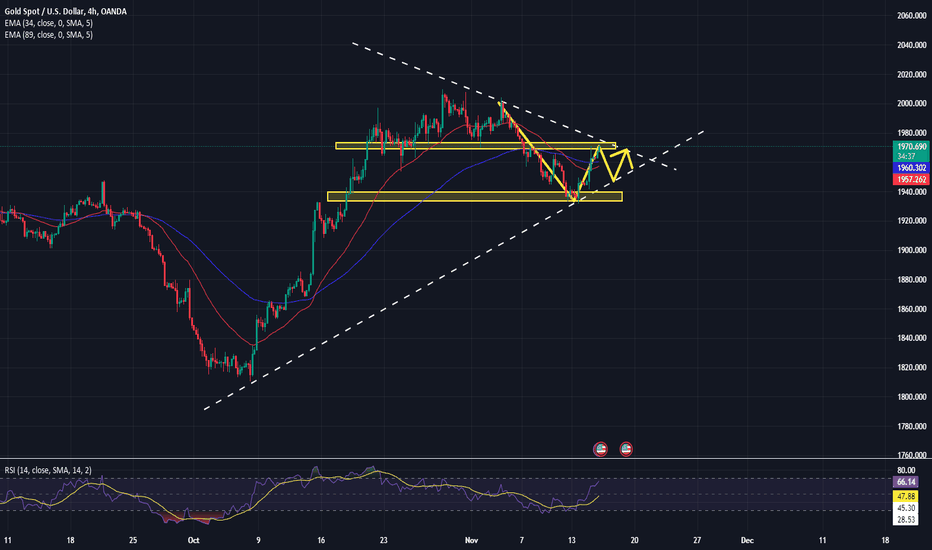

Gold is still in the bearish channel, so choose a suitable entry to enter the order while waiting for news