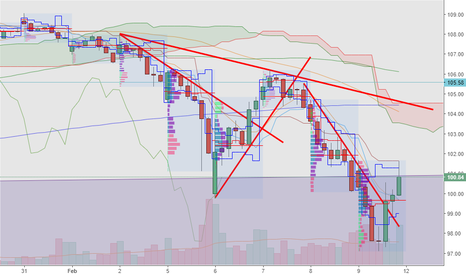

Indecisive S&P 500The SPY (SPX) is giving some mixed messages from various indicators. While the general feel seems to be a grind higher, it's important to note that we have stayed under the 61.8% retracement of the correction even after several attempts to push thru. Also, not depicted on this chart, but we failed to maintain the 100 day s.m.a. (I'll try to add that chart in the comment section.) We also formed an inside bar on the daily, so tomorrow's action should give insight for next week's trading. Of course, none of this is relevant if headlines or tweets of significance happen over the weekend.

I'm playing towards the long side, but hedged with calls in UVXY, and I did that mainly because VIX maintained and closed above 15, and short-term signals suggested we may see volatility surge even more.

Also, the Russell 2000 (RUT) is still strong, but it appears to be showing signs of exhaustion. Ditto the NASDAQ Composite (IXIC) and NASDAQ 100 (NDX).

I really want to short this market, but I'm not fighting the tape. When it says its time, then it'll be time. :)

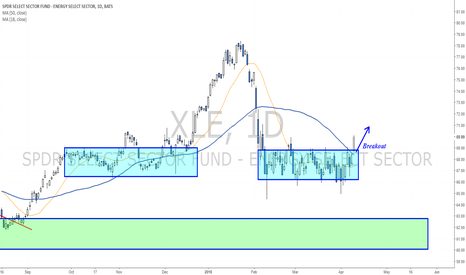

XLE

USDWTI - Price approaching major support for long setupsHey fellow traders, I am traveling for both personal and business over the next two weeks and will not be posted as frequently as usual. If you haven't been following me you have missed a number of accurate predictions in the last few weeks such as the AUDUSD bullish breakout, JPYUSD bull trap, SP500 breakout, Gold price pop, Macy's bullish price explosion and a number of other calls. If you would like accurate analysis to supplement your own, please follow me and watch/like my videos. Now onto oil. After an explosive move high the market has finally reached a point of exhaustion and has begun falling back to a key support level. While this trend remains intact we want to be long and only long . Picking up pennies in front of a steam roller is not a winning strategy. With that in mind we are watching for USDWTI to reach the key area of 69-70 and throw a high quality bullish candlestick signal such as a bullish pin bar, bullish engulfing bar, 2 bar reversal, or an inside bar. Be watching this level closely.

COP: Potential 240M 3-Drive completion Time for some mean reversion play. COP is the sore thumb sticking out amongst the oil plays with the stock making new highs post Feb crash. With results coming up and WTI completing its own 3-Drive formation as the pipes out of the Permian get clogged, it would be a good idea to put on some downside directional trade on COP. Given the out performance vs. the XLE, I would be inclined to look at a -COP/+XLE relative trade here.

OPENING: XLE JULY 20TH 67 LONG/APRIL 27TH 71 SHORT CALL DIAGONAL... for a 3.14/contract debit (78.5% width of spread).

Another neutral to bullish assumption setup with plenty of time to reduce cost basis. Currently, it looks like you could get a better fill than I did (mid currently at 3.00, 75% of the width of the spread, which is what you're looking for in these setups).

Here, I'm shooting for 20% of what I put the trade on for.

Metrics:

Max Profit: .86/contract*

Max Loss: 3.14/contract

Theta: .37

Delta: 32.33

* -- Assuming no rolls of the short call and finish of the underlying above the short call strike at expiry.

** -- Assuming no rolls of the short call and finish of the underlying below the long call strike at expiry.

Retest and breakoutWLL seems to be breaking higher today! If above 30 very constructive for further strength.

USOIL Trend AnalysisIt would appear that the intermediate term trend is going through an ABC correction.

Supply Zone exists in the $53.50-$57 range

Long Term Price Support exists at $54

50% Fibonacci retracement exists at $54

Measured Move exists at $55

Channel Resistance exists at $62

Long(er) Term Price Resistance exists at $63

Short Term trend bearish

I'll go long when I hear "NEW BEAR MARKET FOR OIL?" on the news

Bounce Monday set upWell, at least not all sectors in out right sell mod coming into Monday. There is some hope the accelerated down trend will take a reprieve. I did for get to show XLF and XLB. They both are still lagging other indices. Bottom line XLU, XLK and XLE looking better. XLY, XLI, and XLV ugly. IWM looks best for a trend reversal Monday.

Please leave comments below and follow me on the platform.

Oil Bounce PlayWe've gotten some good price action around the 63.45 area. A close above the downtrend resistance line and this becomes a longer term Bull play. It's important to wait for a confirmed "Bullish Reversal Candle". I'm expecting a bit more downside before this Long play plays out.

Happy trading,

Charles