XLE

Strangle on XLE (58% probability)With the strong move to the upside, I am betting that we are starting a new auction between 78 and the 71 levels. So with an Implied volatility Rank of 37, I sold a Strangle at the 30 deltas for a $1.36 credit. As long as the price stays between $78.35 and $71.65, we will be making money.

The Trade:

Short 73 Puts

Short 77 Calls

Credit $1.36 per contract

58% Probability of profit

Oil's analysis towards OPEC meeting (September 22nd)Oil is trading inside a weekly trading channel.

The price is testing the bottom of the channel and a weekly uptrend line.

The price was rejected by a weekly downtrend line

Bearish Scenario - In case of a bearish breakdown, Oil can reach to the 61.8 Fib level to complete a bullish AB=CD pattern

Bullish Scenario - In case of a bullish breakout, Oil will probably climb towards the top of the channel.

More analysis? More Trading Scenarios?

@themarketzone on Twitter/Facebook/Instagram

Short option for O&GERF has had a large run up relative to other companies in it's industry. There is a large wick with large volume, this is a sell signal to me. I'd pair this short off with some long XOP but either way I believe it should work.

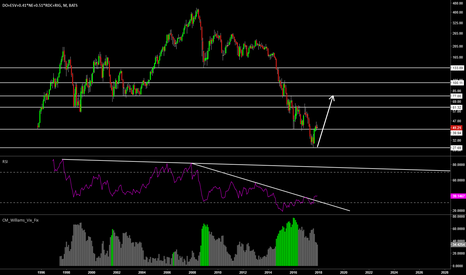

Head and Shoulders Vs. Bearish BatXLE is slowly making its way towards a very interesting weekly support zone - 60-62$

Notice that this price zone is the 61.8 Fibonacci level from 2009 low and from 2016.

Also notice that it is the neckline of a weekly H&S pattern.

If it will break, XLE can fall to 55$ and maybe even 50$

If it will hold as support, the extremely bullish scenario is that it will climb all the way up to complete a bearish Bat near 95$

Obviously it will have to re-test the MA lines as resistance levels first

Agree or Disagree?

It's Sunday.. you can read more about this setup and others in the newsletter

#WeeklyMarketsAnalysis (search on Twitter)