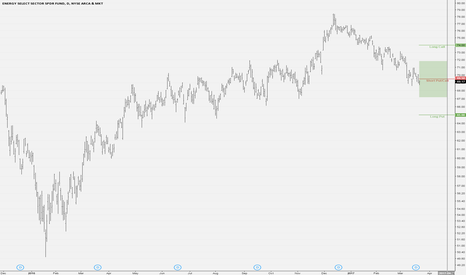

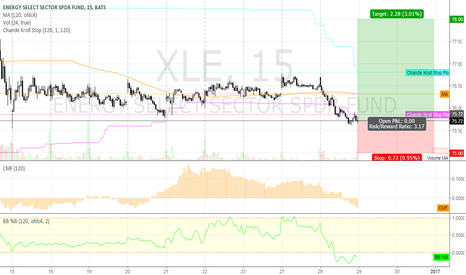

XLE

XLE Iron FlyTrade Setup:

-1 XLE Apr 21 65/69.5/69.5/74 Iron Fly @ $2.33

DTE: 30

Max Win: $233

Max Loss: $217

Breakevens: $67.17 & $71.83

Trade Management: 25% profit; Full loser, possibly roll the ITM side out in time if my bias is the same near expiration.

Green is profit zone; vertical black bar is expiration.

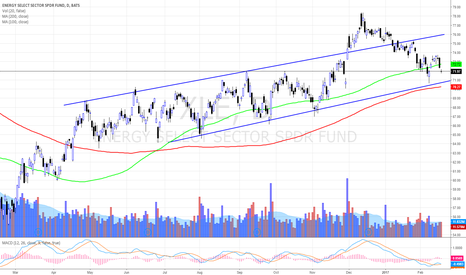

XLE about to prepare for a spurt to the north? See how price reacts at the centerline/slding/AR-Lines ?

The SWAP in Nov. 16 marked the range and of course it has to come back to breath out.

Lastly the weak hands got scared out by a very hard and final drop (red bar).

Now I can imagine that time is right to collect some premium on the downside.

Even a RiskReversal my be a good trade.

P!

XLE for SaleXLE is in a larger uptrend from last February

- it has pulled back to a consolidation range

- there is large volume on the recent down move, these are buyers to me

- this sector is lagging the over all market

- we are entering seasonally bullish period for oil

I'm a buyer here, now that can be buying the underline, leveraged buying the underline, or selling volatility in the underline. The way of getting long is up to the individual. This is not a short term position (multi year).

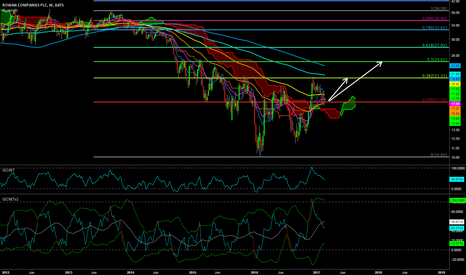

Long RowanBullish price structure. Ideal stop below 17. 4x ev/ebitda.

Healthy cash flow and balance sheet.

Joint venture with Saudi Aramco.

Long RDCRowan has a joint venture with Saudi Aramco. Cash flow is healthy and enough backlog to sustain through 2020 imo. 3.5x ev/ebitda.

$72.00level holding. (XLE) entering the buy zone.The pivot level at $72 is being tested and holding, for now.

I feel the line of least resistance is higher. I am looking for $84 eventually.

I will be looking to buy dips b/w 72-65.

A move under 65 and I would rethink my position.

No position at the moment.

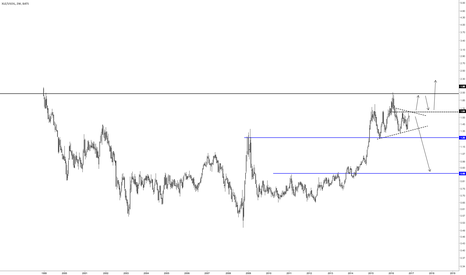

Energy stocks might be overvalues against oil pricesThe break of the pennant within the possible head and shoulders complex could be the deciding factor. In terms of risk/rewad I prefer to short energy stocks against oil. But the way the chart is forming on a daily metric leads me to believe the trend of stronger energy stocks against oil prices will continue in the long term.

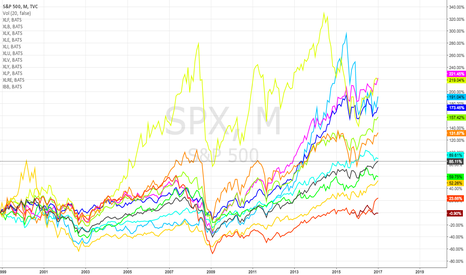

Long Term Sector RotationSPX vs Major Sectors. I added IBB to cover Biotech.

Please comment. My understanding at this point is to stay in sectors which have good fundamentals and have been relative laggards. The 3 bottom ones at this point seem to be Financials, Technology and XLU / XLP.

Since utilities is a risk-averse sector, so in a pro-growth environment I may want to go with the other 3. XLB is like the coyote / fox from Mickey mouse that runs a few meters off the cliff thinking its still running on solid ground before realizing that there's nothing below it and then falls like a rock. Great if you can time it right.