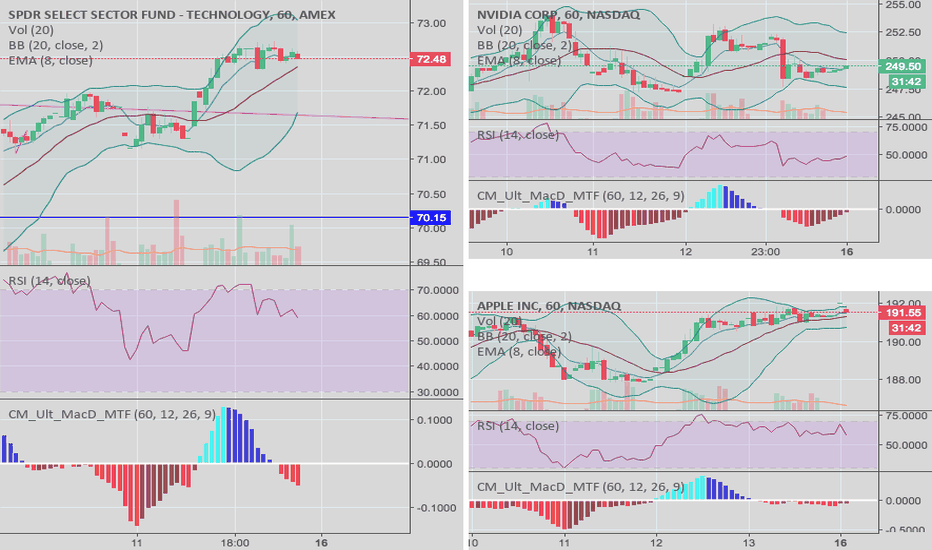

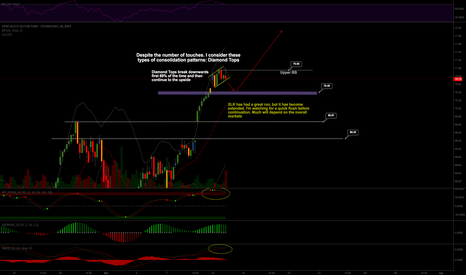

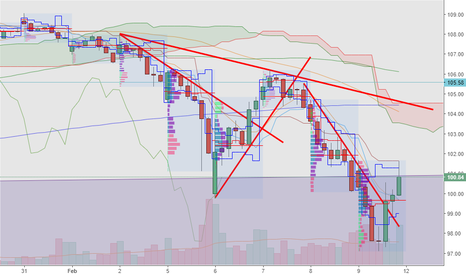

One for bull, one for bearSPY bulls came out Sunday night but are right back around flat with Friday's close now pre-market. If XLK breaks bullish out of it's tightening hourly equilibrium, I like XLK (TQQQ) and AAPL bullish as per daily charts. If XLK breaks bearish out of it's equilibrium, NVDA has been a much weaker name and I like it for a bear play with first support to break at 248.80. SQQQ the 3x bear would also be a play there on a bear break.

XLK

Death Crosses AboundA few sectors are signaling troubles ahead, with their 50 day MA's crossing below their 200 day MA's.

This chart picture shows SPY (upper left) as a broad gauge of market action. It has yet to experience the "death cross."

However, the industrial stocks measured by XLI (upper right), materials stocks measured by XLB, and financial stocks measured by XLF have all experienced the death cross. Given their importance as a proxy for future growth, this seems to bode poorly for broader markets.

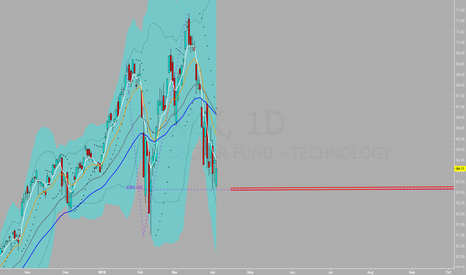

XLK technology. Idea for shorter termLast advance of technology set a new high. The big question is that THE TOP or just the first of 5 up waves to THE TOP. As usual I don't know. In the meantime I think there is a good chance the gaps will be closed. One is at the .62 retraction level. The other at the .78 level. Process your way.

1X bull XLK

2X bull etf: ROM. bear REW

3X bull etf: TECL. bear TECS

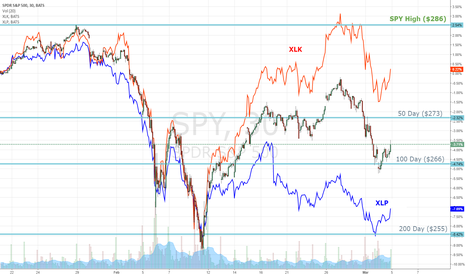

Relative Performance XLK-SPY-XLPThe XLK has largely erased losses since the correction while the Staples are still underperforming the broad market. SPY is showing strength despite concerns about steel tariffs and with the 10-year yields retracing, I see a higher likelihood of the SPY catching up with XLK than retesting the lows.

Bounce Monday set upWell, at least not all sectors in out right sell mod coming into Monday. There is some hope the accelerated down trend will take a reprieve. I did for get to show XLF and XLB. They both are still lagging other indices. Bottom line XLU, XLK and XLE looking better. XLY, XLI, and XLV ugly. IWM looks best for a trend reversal Monday.

Please leave comments below and follow me on the platform.

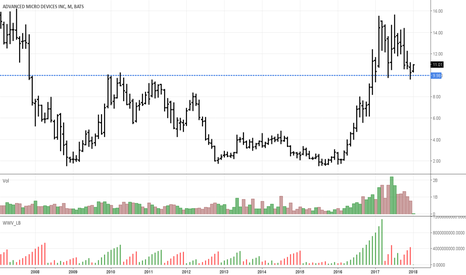

LVLT similar to AKAM review, new trend potential, 400-450$ areaTake profit and manage remaining amount till 400-450$ area.