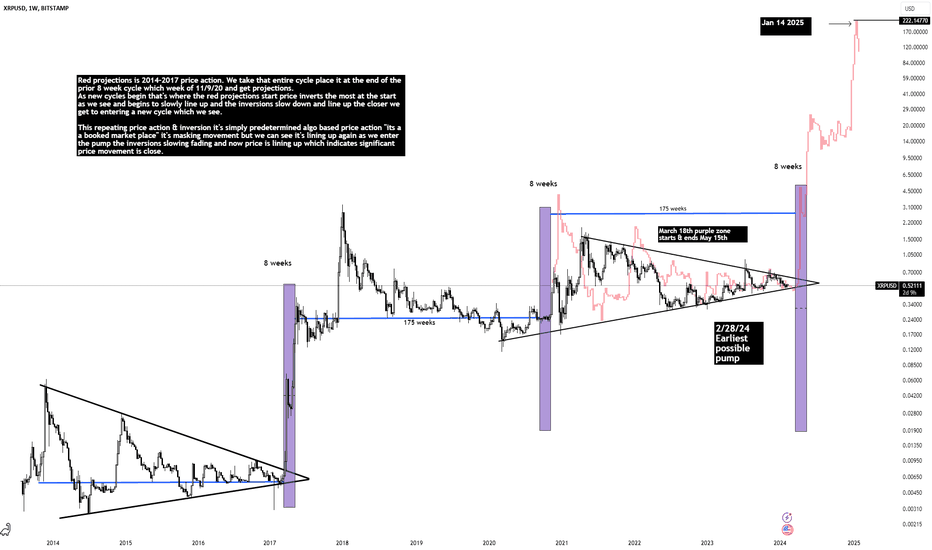

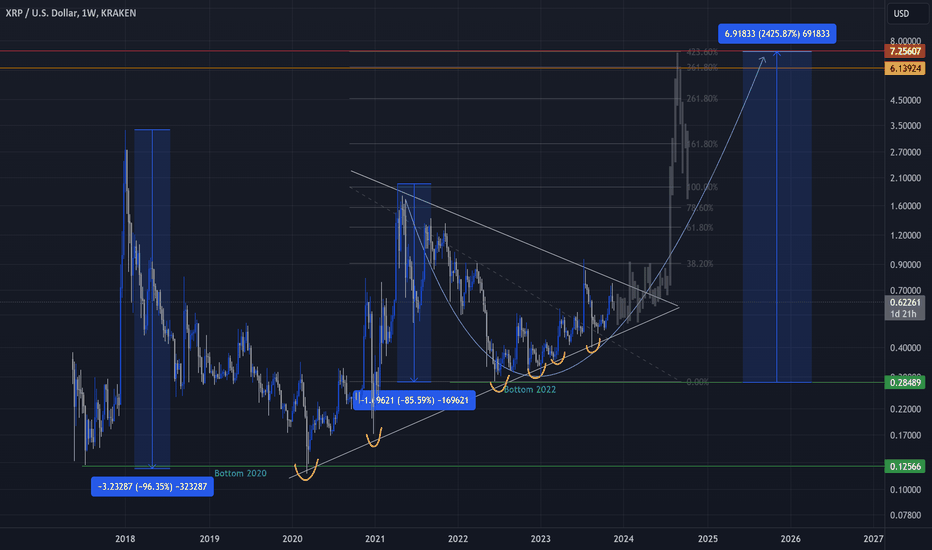

XRP Entering another 175 Week cycle. $220 EOY ExplainedRed projections is 2014-2017 price action. We take that entire cycle place it at the end of the prior 8 week cycle which week of 11/9/20 and get projections.

As new cycles begin that's where the red projections start price inverts the most at the start as we see and begins to slowly line up and the inversions slow down and line up the closer we get to entering a new cycle which we see.

This repeating price action & inversion it's simply predetermined algo based price action "its a a booked market place" it's masking movement but we can see it's lining up again as we enter the pump the inversions slowing fading and now price is lining up which indicates significant price movement is close.

"News is the excuse for the moves" - NeverWishing

-We have settlement approaching.

-Ripple IPO.

-Feb 7th 24 Congress wants to regulate Stable coins & the need for clear rules and federal regulatory oversight.

This is just naming a few events but the main focus is to remember the only digital asset with legal clarity in the United States is XRP. It has obtained a unique legal status being the only altcoin to enjoy such certainty. XRP is the only digital asset other then bitcoin with legal clarity in the U.S

-Neverwishing

Xrpusdanalysis

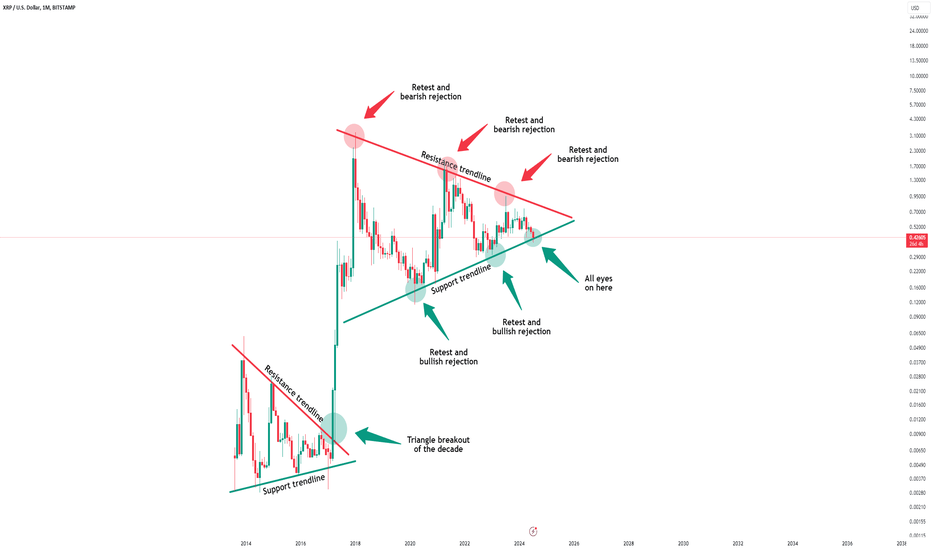

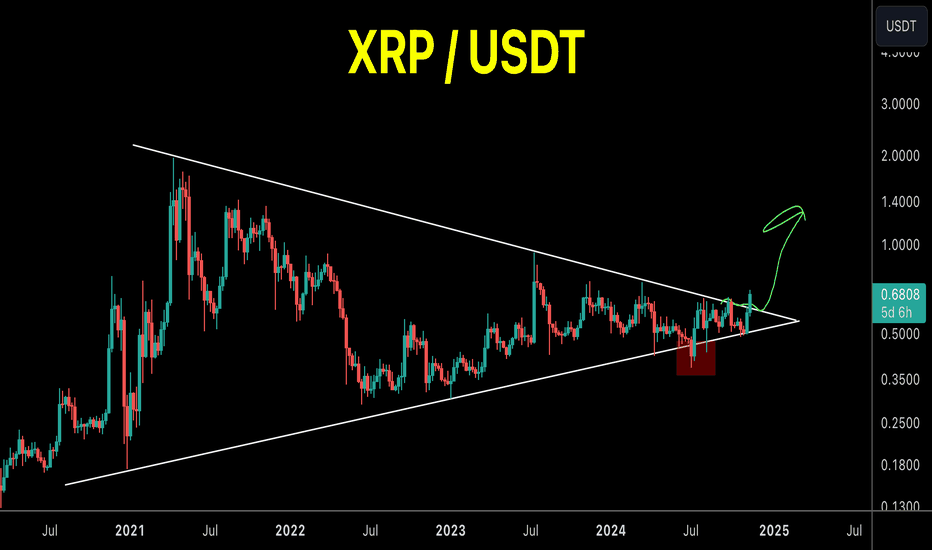

XrpUsd - The beginning of the end?BITSTAMP:XRPUSD is actually attempting to invalidate my long term bullish case scenario.

Trading cryptocurrencies in general is not easy. You always experience two digit moves in single days and drops of -10% are never easy to digest. Looking at the higher timeframes is key though, also on XrpUsd. XrpUsd is still trading in the triangle formation and retesting the last bullish inflection point. My general optimism tells me that we will see a bullish rejection here.

Levels to watch: $0.42

Keep your long term vision,

Philip - BasicTrading

XRP - Longs on the TPO belowXRP is going to rocket up again, fueling everything, ideal buys are from TPO marked in blue line - 2.4344 and then to the tops of 3.2.

People often take this as a bull flag but it usually falls below and goes as follows, Hence its quite necessary for it to fall a=the line marked and then go

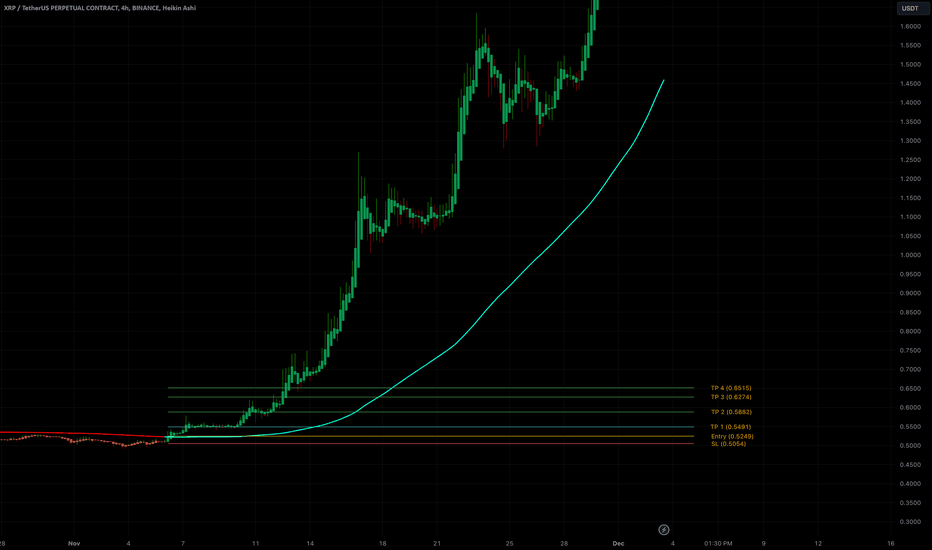

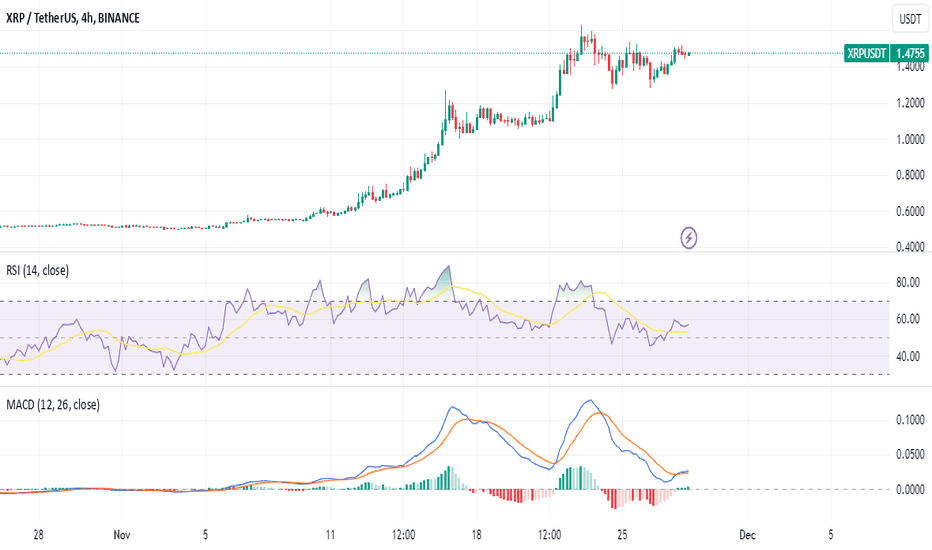

Ripple's Meteoric Rise: 4350% Gains Unleashed on Risological!Ripple (XRPUSDT) delivered an outstanding 4350% profit at 10x leverage, marking one of the most explosive long trade setups on the 4-hour timeframe. Ripple's performance exceeded all expectations with unmatched bullish momentum.

Key Levels:

TP1: 0.5491 ✅

TP2: 0.5882 ✅

TP3: 0.6274 ✅

TP4: 0.6515 ✅

Technical Analysis:

The trade initiated at an entry price of 0.5249, supported by clear bullish confirmations from the Risological Swing Trader. Ripple surpassed all defined targets effortlessly. The stop-loss at 0.5054 provided a safe risk-reward ratio while allowing the trade ample room to breathe.

Ripple's rally was powered by robust buying momentum and consistent price action, with no major reversals threatening the trend. Traders following this setup enjoyed seamless profits, backed by reliable and precise signals from the Risological trading system.

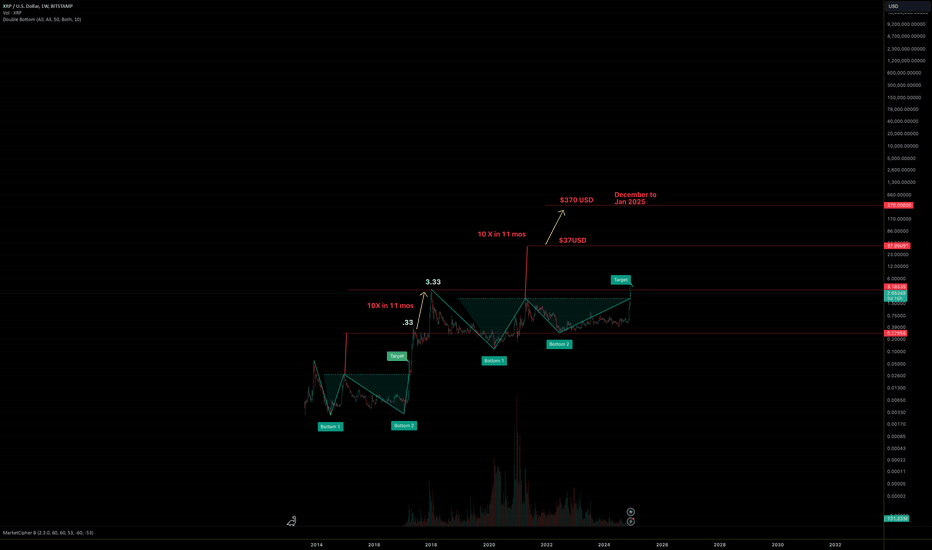

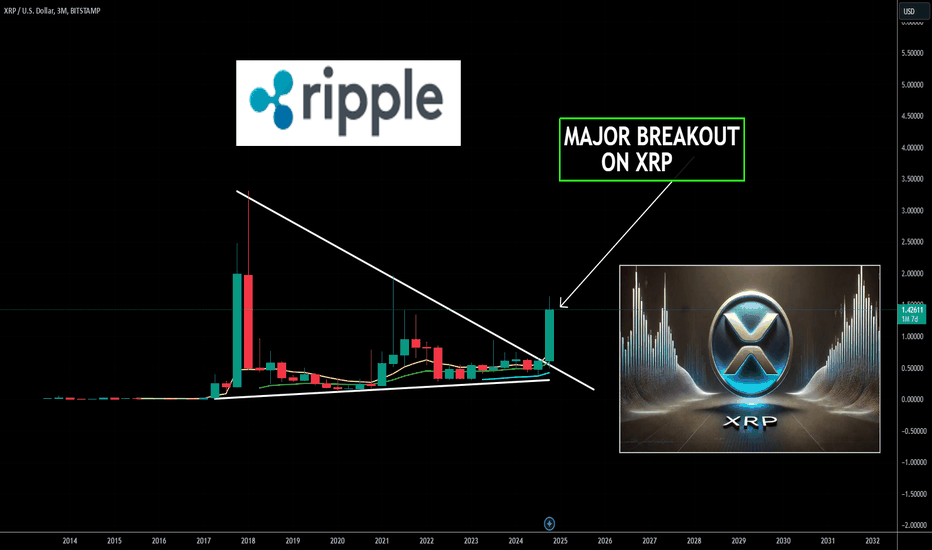

XRP massive Double Bottom With Potential of 370 USD target Before you tell me about market cap and impossibilities. You must consider the tokenization of assets that will be happening on the XRP ledger and the RLUSD stable coin launch. The removal of Gary Gentzler, the pro crypto regulations that are coming. XRP and XRP leisure will be used now. I want to show you the double bottom pattern for from 2013 to 2017 which on breakout ascended to the target of $.33 over the next year, the price 10 n times itself reaching $3.30 Ish. We have had a very similar almost identical pattern and now double bottom neck line breakout this year. This pattern forming from 2017 to 2024 end of year six or seven years. We are now above the neck line and if the target hits around $37 and we get an identical 10 X over the next year we could be seeing a potential $370 USD priced XRP by December 2025. Merry Christmas.

Identifying Entry Zones in Two Blue BoxesWhen analyzing XRP for potential trading opportunities, marking two key zones as "blue boxes" can help identify areas where price action is likely to reverse or continue in a favorable direction. These zones are usually based on technical analysis principles, such as:

Support and Resistance Levels

The lower blue box represents a strong support level, where the price has historically bounced back. This is a good entry zone for long positions, especially if the market structure confirms a reversal pattern like a double bottom or bullish engulfing candle.

The upper blue box often marks a resistance zone, but if price breaks through and retests this level, it can turn into a support level. This makes it a good entry for continuation trades.

Fibonacci Retracement Zones

Use Fibonacci retracement tools to identify areas within the 0.618–0.786 range, which often coincide with one of the blue boxes. These zones are high-probability areas for market reversals.

Order Blocks or Demand Zones

The lower blue box can also represent a demand zone, where institutional buyers are likely accumulating XRP. Look for sharp moves up from these levels in the past to confirm.

Volume Profile and Imbalance Zones

The blue boxes might align with high volume nodes or areas where price moved quickly, leaving a volume imbalance. When price returns to these zones, it often acts as a magnet for entries.

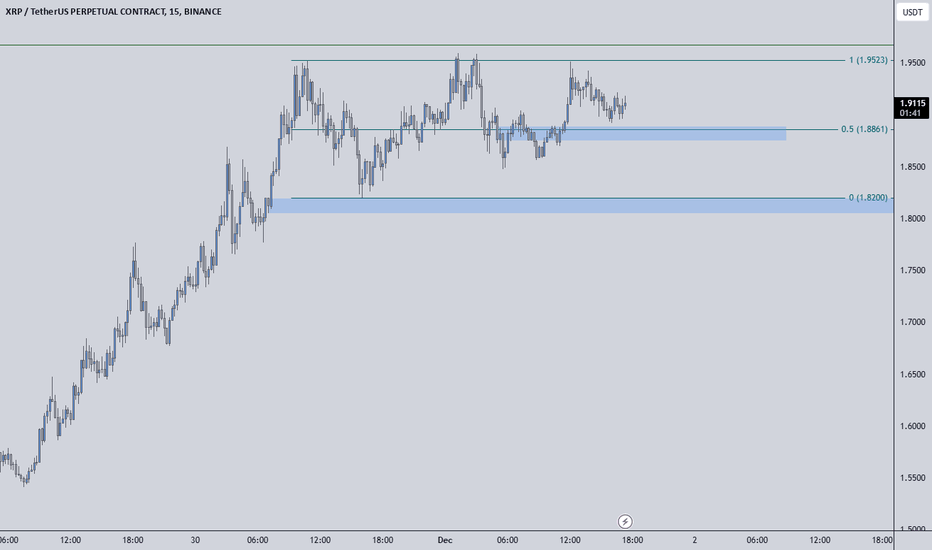

Trading the Blue Boxes

If price breaks above and retests the blue box as support, consider it a bullish entry for a breakout continuation.

I don't overcomplicate things and add a ton of dirty crap to my charts, but you can check out the success of my analysis below.

I approach trading with confidence backed by experience and past success in identifying high-probability setups.

While I don’t claim to be the best, my track record speaks for itself, and I strive to let my analysis and results do the talking. Watch these levels closely—markets can confirm what charts already whisper. Let’s see how this plays out together.

My Previous Hits

🐶 DOGEUSDT.P | 4 Reward for 1 Risk (or more if you’re bold).

DOGEUSDT.P: Next Move

🎨 RENDERUSDT.P | HTF Sniper Precision

RENDERUSDT.P: Opportunity of the Month

💎 ETHUSDT.P | Buyer Zone So Accurate You’ll Double Check

ETHUSDT.P: Where to Retrace

🟢 BNBUSDT.P | Buyer Zone Mastery (CZ vibes).

BNBUSDT.P: Potential Surge

📊 Bitcoin Dominance | Called it Like a Pro

BTC Dominance: Reaction Zone

🌊 WAVESUSDT.P | The Blue Box: A Demand Zone with Potential

WAVESUSDT.P: Demand Zone Potential

🟣 UNIUSDT.P | Long-Term Trade

UNIUSDT.P: Long-Term Trade

Now sit back, relax, and watch the market do its thing. Or don’t, FOMO is real. 😉

Unpacking XRP's Meteoric Rise: The Perfect Storm of Factors XRP,XRP, the cryptocurrency associated with Ripple, has been on a tear in recent weeks, surging to levels not seen in years. This unprecedented rally has ignited discussions and debates within the crypto community, with many speculating on the underlying factors driving this surge.

A confluence of positive developments seems to have propelled XRP to new heights. Several key factors, including potential regulatory clarity, a positive market sentiment, and a broader bullish trend in the crypto market, have likely contributed to this significant price increase.

A Possible Regulatory Breakthrough One of the most significant catalysts for XRP's rally has been the ongoing legal battle between Ripple and the Securities and Exchange Commission (SEC). The crypto community has been closely monitoring this case, and any positive development or potential settlement could profoundly impact XRP's price. While the outcome of this lawsuit remains uncertain, recent market movements suggest that investors may be growing increasingly optimistic about a favorable resolution.

A Surge in Market Sentiment Another factor contributing to XRP's upward trajectory is the broader bullish sentiment in the crypto market. As Bitcoin and other major cryptocurrencies have seen substantial gains, investors have been pouring money into the market, increasing demand for alternative digital assets like XRP. This increased demand has naturally pushed the price of XRP higher.

The Ripple Effect: Ripple, the company behind XRP, has also been making significant strides in the global payments industry. Its technology and partnerships with financial institutions have positioned Ripple as a potential game-changer in the cross-border payments space. Positive developments in this area can positively impact the perception of XRP and its value proposition.

The Road Ahead for XRP While XRP's recent surge has been impressive, it's important to exercise caution and consider potential risks. The cryptocurrency market is highly volatile, and prices can fluctuate significantly in a short period. Additionally, the regulatory landscape for cryptocurrencies is still evolving, and any negative regulatory developments could have a significant impact on XRP's price.

Despite these potential risks, XRP's long-term prospects remain bright. As Ripple continues to innovate and expand its global reach, the demand for XRP is likely to increase. If the company can successfully navigate the regulatory hurdles and deliver on its ambitious goals, XRP could potentially reach new heights.

Investors should conduct thorough research and consider their risk tolerance before investing in XRP or any other cryptocurrency. As always, it's crucial to diversify your investments and avoid putting all your eggs in one basket.

XRP to the Moon| Is Gensler Stepping Down the Secret Ingredient?XRP's price broke $1, marking a significant milestone for the cryptocurrency. Its market cap has climbed 26.76%, reaching $59 billion, while trading volume soared to $16 billion

Open interest in XRP derivatives increased by 12% to $1.5 billion, signaling growing speculative interest and potential institutional participation. Notably, over 320 million XRP were purchased within the last 72 hours

This surge follows a breakout from a symmetrical triangle pattern, often indicative of significant price shifts. Analysts have drawn parallels between XRP's current trajectory and its 2017 performance, when it hit an all-time high of $3.3. If the bullish trend persists, The rally may have been partly influenced by XRP’s listing on Robinhood. CryptoQuant's exchange reserves metric highlights growing confidence in the coin's long-term potential.

Ripple to Gensler: Don’t Let the Door Hit You on the Way Out!

Ripple Labs has also made headway in its legal dispute with the US Securities and Exchange Commission (SEC), securing a favorable court ruling and the approval of a joint motion for final judgment, boosting market optimism.With rumors circulating that Gary Gensler may step down—or potentially be ousted by a future Trump administration—Ripple is regaining the spotlight. As speculation about Gensler's possible departure gained traction in the market, XRP's price surged dramatically, reaching its highest level in 16 months.

Further speculation about Ripple’s development of a dirham-backed stablecoin has added to the upward momentum.

This comes after Ripple launched its RLUSD stablecoin, fully backed by the U.S. dollar. At the same time, Bitwise revealed plans to convert its Bitwise 10 Crypto Index Fund (BITW) into an ETF, which would include XRP. Ripple CEO Brad Garlinghouse shared his thoughts on these developments via X, amplifying market excitement.

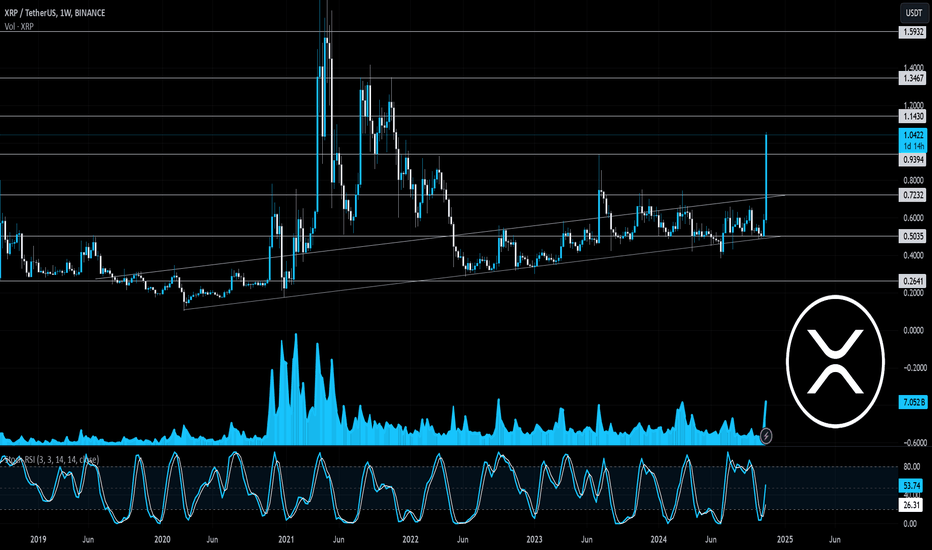

Ripple Stronger- Ok Ripple is back.

- Maybe the SEC will one day give up trying to perma-suppress XRP market to protect the big banks.

Little facts :

--------------------------------------------------------------------------------------------------------------

- XRP lost -96% from his 2018 ATH and bottomed hard around 0.12$.

- XRP lost only -86% from his 2021 last ATH to find a bottom around 0.28$.

- During those 2 years of bear market, XRP stayed most of the time very strong and resilient.

- Nothing was tremendous ( as it should be ), XRP just climbed with steady regularity.

- XRP stayed in the TOP5 of the Total Market.

- That's much better !

--------------------------------------------------------------------------------------------------------------

- So what we can expect for the next bull run ( if we don't have again a FUD at the bad time )

- We have to keep in mind that XRP have 100B Supplies.

- XRP price could grow at a maximum of 7$ at the end of the next rally.

- That would be around +2400% from the 2022 last bottom.

- His MarketCap could grow around 700B$ ( same as actual BTC MarketCap)

--------------------------------------------------------------------------------------------------------------

Happy Tr4Ding!

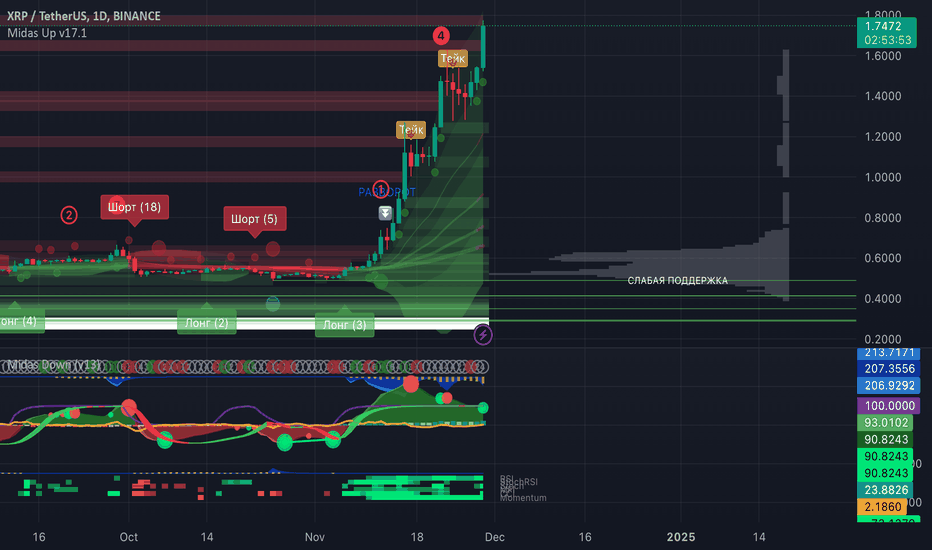

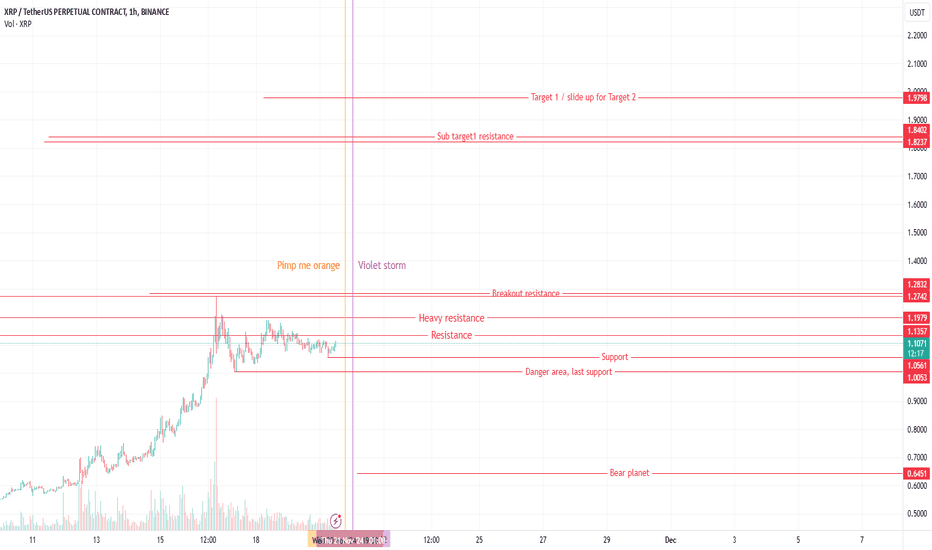

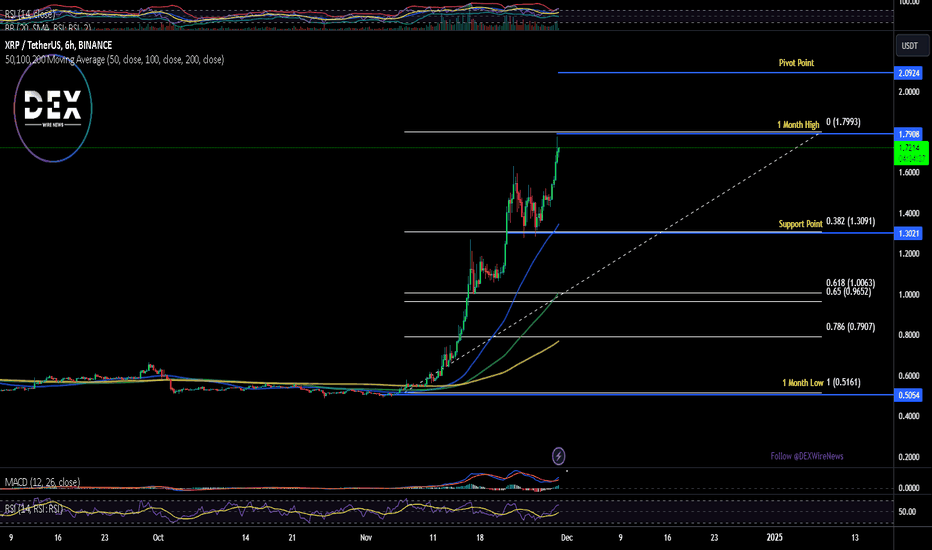

XRP is Exploding: Market Analysis and Near-Term Forecast🚀 The crypto market never ceases to amaze! Once again, XRP proves its strength with a dynamic rally that’s hard to ignore. Let’s dive into what’s happening with this coin and what to expect next.

Market Overview

The XRP/USDT chart today shows a powerful upward trend. Since late October, XRP has been climbing like a rocket preparing for launch. Currently, the price is holding strong at $1.60, with trading volumes indicating robust market interest. But this might just be the beginning.

🔴 Key resistance zones on the chart highlight areas where major players might start taking profits, creating downward pressure. Breaking through these levels could propel XRP to $1.80 or even higher.

🟢 Support zones in the $0.80–$0.40 range provide a safety net in case of a correction. These are strong levels backed by high volume, offering good entry points for those looking to invest during dips.

Technical Indicators: What Do They Say?

📈 Midas Up confidently signals a continuation of the bullish trend, showing strong buyer momentum and suggesting that any corrections will likely be short-lived.

📊 RSI and Momentum indicate XRP might be in overbought territory. While this could deter cautious investors, remember: during a bull run, RSI can remain high for extended periods. Don’t let fear of the peak make you miss the move.

💰 Volumes show most liquidity lies below the current price, providing a solid foundation for further growth.

Why Is XRP Rising?

1️⃣ Ripple’s Legal Wins: The Ripple vs. SEC saga is nearing its conclusion, with every positive update fueling XRP's growth.

2️⃣ Institutional Interest: XRP’s technology and potential in international payments are attracting attention from big players.

3️⃣ Market Sentiment: The crypto market is back in bullish mode, and XRP is riding the wave.

What’s Next?

The big question: what’s ahead for XRP?

If $1.60 is broken, the next target is $1.80. Breaking this resistance could open the path to $2.00 and beyond. For those already in the market, it’s wise to consider partial profit-taking around these levels.

For new investors, watch the $0.80–$0.40 support zones. These levels offer great opportunities to enter if a correction occurs.

Recommendations

For traders: Shorting is highly risky given the current market sentiment.

For long-term investors: If you’re already in, hold your position—XRP is far from its all-time highs. Diversify, but XRP deserves a solid share of your portfolio.

Conclusion

The crypto market is buzzing with energy, and XRP is at the forefront of this movement. Stay vigilant for key levels and be ready to act. Bull markets present opportunities but demand discipline.

🔑 Remember: Anything is possible in crypto. Those who analyze and act decisively are the ones who win. Stay updated and keep your finger on the pulse!

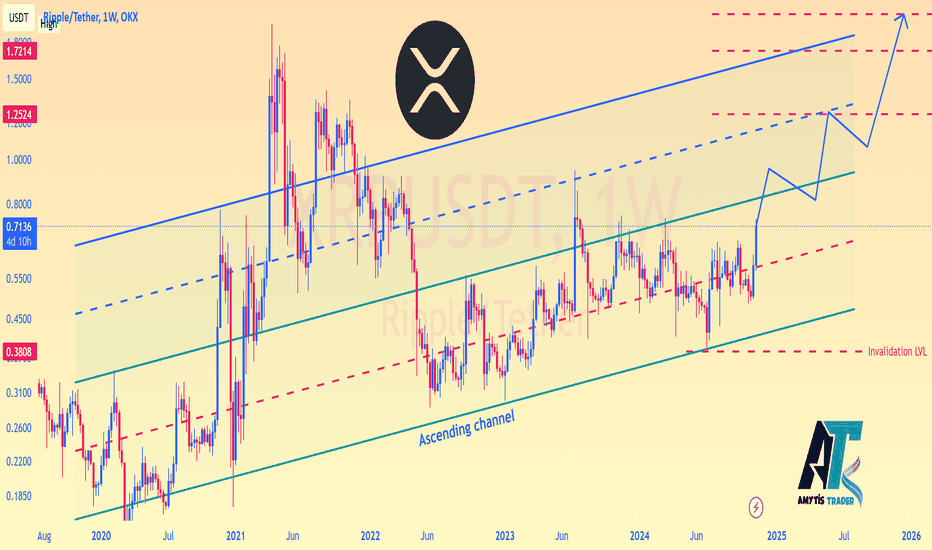

Alikze »» XRP | Wave 3 or C bullish scenario - 1D🔍 Technical analysis: Wave 3 or C bullish scenario - 1D

- Ripple is moving in an ascending channel in the weekly time frame.

According to the current momentum, it can touch the range of 93 cents in the first step, which is an important supply area.

- Before hitting the supply area, he can break the roof of the channel and after hitting the supply area, he can have a correction or pullback to the broken channel roof.

- According to the previous structure that had a zigzag modification; It currently has a zigzag reversal to the upside, which could touch the targets indicated on the chart.

⚠️ In addition, according to the current structure, the price should not enter the Invalidation LVL range, in which case it should be reviewed and updated again.⚠️

»»»«««»»»«««»»»«««

Please support this idea with a LIKE and COMMENT if you find it useful and Click "Follow" on our profile if you'd like these trade ideas delivered straight to your email in the future.

Thanks for your continued support.

Best Regards,❤️

Alikze.

»»»«««»»»«««»»»«««

OKX:XRPUSDT

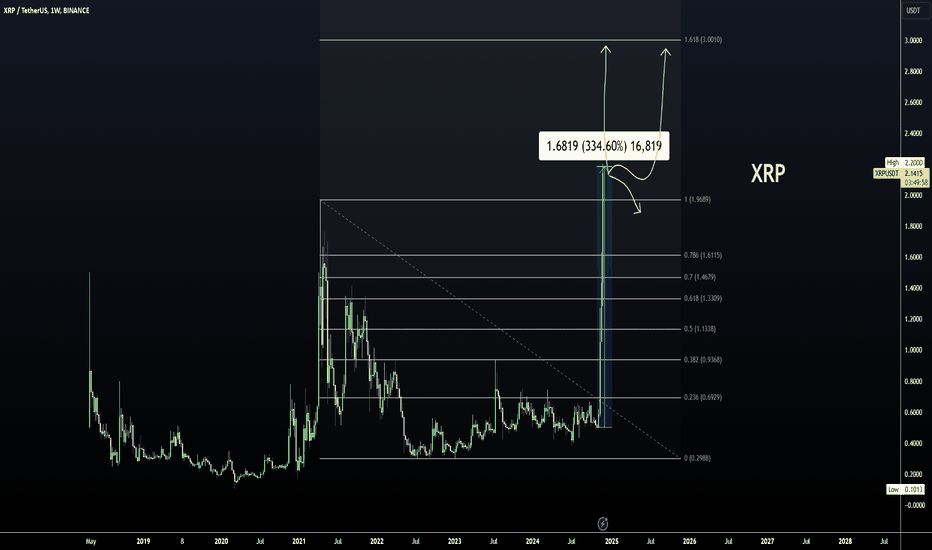

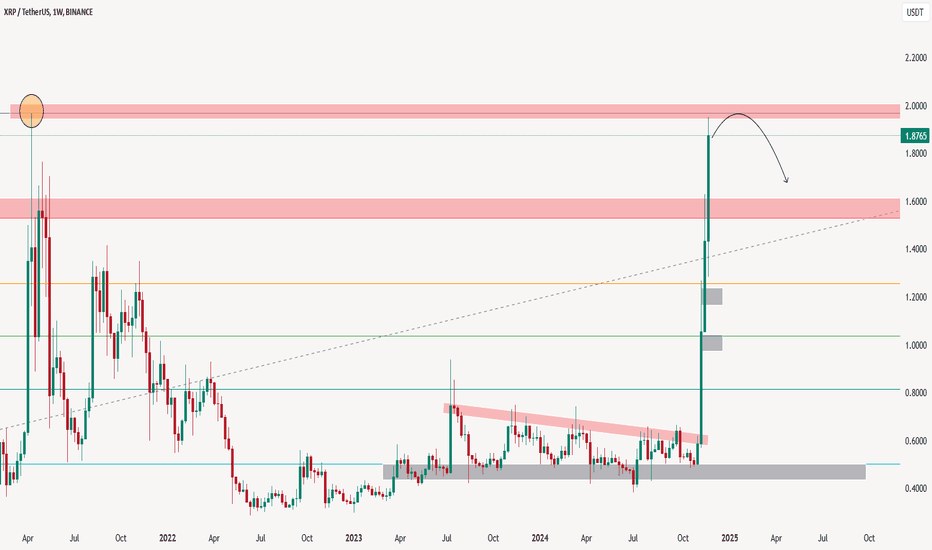

XRP - PUMP and DUMP SchemeThis is the moment that bag holders have been waiting for - XRP has crossed the $2 mark in an unexpected pump scheme.

Through the Fibonacci, we can establish likely short term targets , being the 1.618 Fib level.

XRP is notorious for hard dumps after the pump, so do be mindful of this possibility and remember that it is an extremely unpredictable, high risk altcoin.

Here's my take on Bitcoin, incase you are wondering what to watch for BTC:

_____________________

BINANCE:XRPUSDT

Analyzing XRP's Surge: Will the Momentum Continue or Fizzle Out?

XRP, the native cryptocurrency of the Ripple network, has recently experienced a significant price surge, reaching its highest level in over 43 months. This impressive rally has caught the attention of both retail and institutional investors, prompting questions about its sustainability and future trajectory.

The Drivers Behind XRP's Rally

Several factors have contributed to XRP's recent price surge:

1. Positive Legal Developments: The ongoing legal battle between Ripple Labs and the Securities and Exchange Commission (SEC) has been a major catalyst for XRP's price volatility. Positive developments in the case, such as favorable court rulings or settlements, can significantly impact XRP's price.

2. Increased Institutional Interest: Institutional investors, including hedge funds and venture capital firms, have shown increased interest in XRP, recognizing its potential as a digital asset with real-world use cases.

3. Growing Adoption of RippleNet: RippleNet, Ripple's blockchain-based payment network, has gained traction among financial institutions worldwide. As more banks and financial institutions adopt RippleNet, it could drive demand for XRP.

4. Positive Market Sentiment: The broader cryptocurrency market has experienced a period of relative stability and growth, which has benefited XRP and other altcoins.

Technical Analysis: A Cautionary Tale

While XRP's recent rally has been impressive, technical analysis suggests that the cryptocurrency may be due for a correction. Several technical indicators point to a potential 20% price decline in December:

1. Overbought Conditions: XRP's Relative Strength Index (RSI) has surged into overbought territory, indicating that the asset may be overvalued and due for a pullback.

2. Potential Resistance Levels: XRP may encounter significant resistance levels at certain price points, which could limit its upside potential.

3. Overleveraged Positions: The cryptocurrency market is prone to volatility, and overleveraged positions can exacerbate price swings. If a significant number of traders are heavily leveraged on XRP, a sudden price drop could trigger a cascade of liquidations, further driving the price down.

Is It Time to Buy XRP?

While XRP's recent rally has been impressive, investors should approach the cryptocurrency with caution. Before making any investment decisions, it is crucial to conduct thorough research and consider the following factors:

1. Risk Tolerance: Investing in cryptocurrencies, including XRP, involves significant risk. Investors should only allocate capital that they can afford to lose.

2. Diversification: Diversifying one's investment portfolio across various asset classes can help mitigate risk.

3. Long-Term Perspective: Investing in cryptocurrencies is a long-term endeavor. Short-term price fluctuations should not dictate investment decisions.

Conclusion

XRP's recent price surge has been fueled by a combination of factors, including positive legal developments, increased institutional interest, and growing adoption of RippleNet. However, technical analysis suggests that the cryptocurrency may be due for a correction in the near future. Investors should approach XRP with a balanced perspective, considering both the potential upside and downside risks.

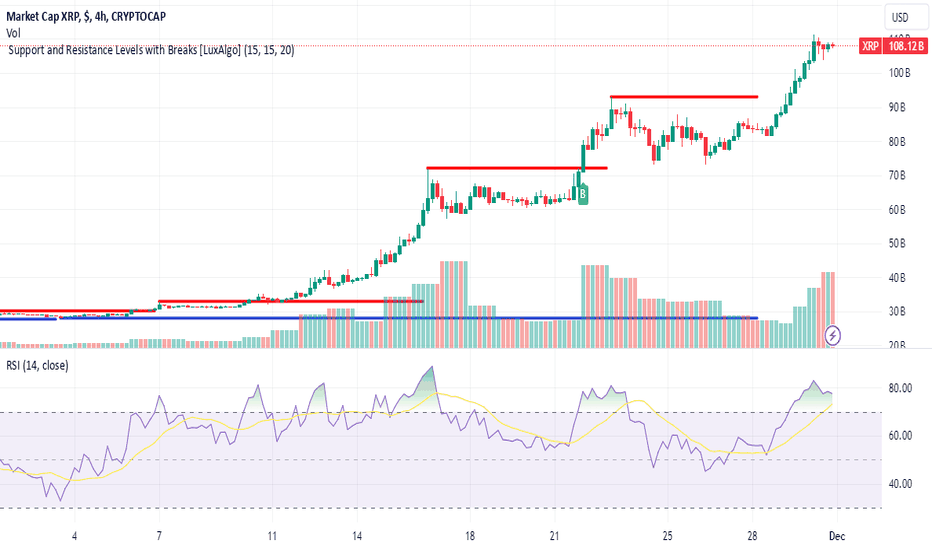

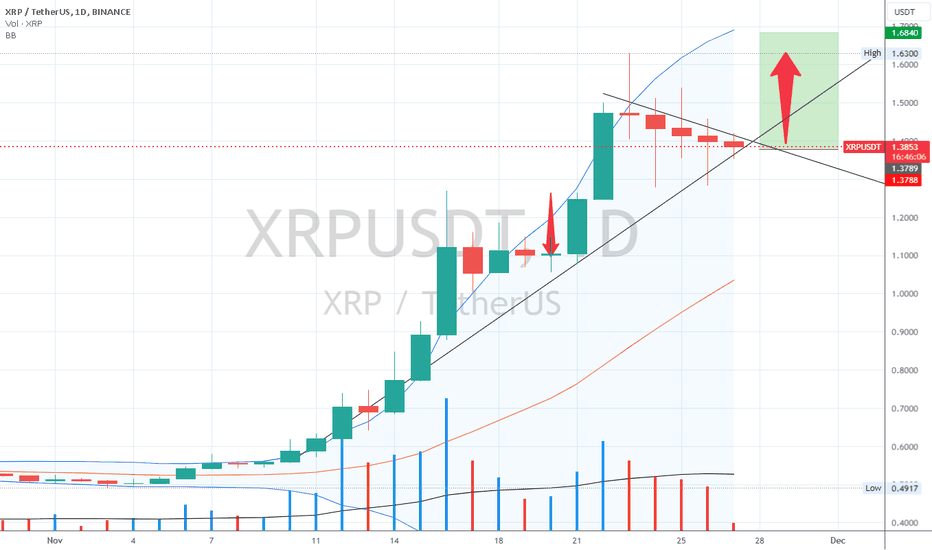

XRP COIN PRICE ANALYSIS AND NEXT POSSIBLE MOVES !!CRYPTOCAP:XRP Coin Update!!

• in Last few weeks we see massive relly in CRYPTOCAP:XRP Coin Price ✅

• But Right Now CRYPTOCAP:XRP Coin Price testing 2021 bull run all time high.. Thats also is a strong resistance.

• On the other hand Right Now CRYPTOCAP:XRP Coin look in overbought zone ( technically)

• So until Price trading below its trendine ... For short term correction expected in its price🫡

Lets see what happened❤️

XRP on the Verge of Breaking $2CRYPTOCAP:XRP has recently made headlines by outperforming Binance Coin (BNB) to claim the 5th position in market capitalization on CoinMarketCap. The cryptocurrency surged over 17% in a day, surpassing the $1.70 milestone and signaling strong bullish momentum. Let's delve into the key drivers and technical indicators pointing toward XRP's potential future trajectory.

Ripple's Role in Fintech

What is Ripple?

Ripple, a leading fintech company, powers its global payment network—RippleNet—using the XRP Ledger (XRPL). Unlike most cryptocurrencies, Ripple aims to connect banks, payment providers, and exchanges, enabling near-instant settlements and lower transaction costs. This institutional focus differentiates XRP from peer-to-peer-centric tokens, positioning it as a significant player in cross-border payments.

Key Metrics Driving Momentum:

- Market Capitalization: Currently at $97.3 billion, XRP's market cap reflects its increasing investor confidence.

- Trading Volume: XRP's daily trading volume surged 144% to $14.9 billion, indicating a sharp rise in market activity and liquidity.

- Global Position: Outperforming the global market (up 2.7% in 7 days), XRP has gained 17.6%, demonstrating its resilience and investor interest during this bull phase.

Technical Analysis

CRYPTOCAP:XRP is trading within a well-defined bullish trend channel, currently up 11%. The Relative Strength Index (RSI) sits at 74, indicating bullish strength without entering overbought territory, suggesting room for further upside.

Key Technical Levels:

- Immediate Resistance: Breaking past the $2 mark is crucial. A confirmed breakout could set the stage for a run toward $4, with potential to reach $10 in the long term.

- Support Levels: If a retracement occurs, CRYPTOCAP:XRP may find strong support at the 38.2% Fibonacci retracement level. This would offer a healthy cooldown before a potential major leap.

Outlook and Conclusion: Is $10 in Sight?

XRP's recent surge is backed by robust fundamentals and a favorable technical setup. Its unique position in the fintech sector, combined with increased trading activity and strong technical indicators, suggests that the cryptocurrency could break $2 soon. A sustained rally could even push XRP toward $4 in the short term, with $10 being a longer-term target if bullish momentum continues.

Investors should watch key resistance levels and broader market trends, particularly Bitcoin (BTC) and Ethereum (ETH), as they often influence altcoin movements. XRP's current position signals that it’s well-poised for further gains, making it a token to watch closely in this bullish cycle.

XRP Witnesses Significant Token Transfers so Predict Bull RunXRP, the native cryptocurrency of the Ripple network, has recently experienced a surge in large-scale token transfers, sparking speculation among analysts that a significant price rally may be on the horizon.

Massive Token Transfers

Blockchain data reveals that several substantial XRP transfers have taken place in recent weeks. These transactions, often involving millions of XRP tokens, have caught the attention of the crypto community. While the exact reasons behind these transfers remain speculative, analysts believe that they could signal increased institutional interest and potential bullish sentiment.

Analyst Predictions and Bullish Outlook

Crypto analysts and market experts have expressed optimism about XRP's future price performance, citing several factors that could contribute to a significant rally:

1. Positive Legal Developments:

o Ripple's ongoing legal battle with the SEC has been a major factor influencing XRP's price. Recent developments in the case, including favorable court rulings and expert opinions, have bolstered investor confidence.

o A positive resolution to the lawsuit could significantly reduce regulatory uncertainty surrounding XRP and potentially unlock its full potential.

2. Increased Institutional Interest:

o The growing interest from institutional investors in cryptocurrencies, including XRP, could drive demand and fuel price appreciation.

o These institutions often prefer established and regulated cryptocurrencies like XRP, which can benefit from their significant capital inflows.

3. Strong Fundamentals:

o XRP's underlying technology, the RippleNet, offers fast and efficient cross-border payments.

o The network's growing adoption by financial institutions worldwide can solidify XRP's position as a leading digital asset for global payments.

4. Technical Analysis:

o Technical analysis of XRP's price charts indicates a bullish trend, with key resistance levels being breached.

o A sustained break above these levels could trigger a significant price rally.

Potential Challenges and Risks

While the outlook for XRP appears promising, it's important to acknowledge potential challenges and risks:

1. Regulatory Uncertainty:

o Regulatory uncertainties, particularly in the United States, could impact XRP's price and adoption.

o Clear and favorable regulatory frameworks are essential for the long-term growth of the cryptocurrency industry.

2. Market Volatility:

o The cryptocurrency market is inherently volatile, and XRP's price can fluctuate significantly due to various factors, including market sentiment, economic conditions, and geopolitical events.

3. Competition from Other Cryptocurrencies:

o XRP faces competition from other cryptocurrencies, such as Bitcoin and Ethereum, which have established market positions and strong developer communities.o

Conclusion

XRP's recent surge in token transfers and positive analyst sentiment have ignited hopes for a significant price rally. However, investors should approach XRP with caution and conduct thorough research before making investment decisions. While the potential rewards are significant, the risks associated with cryptocurrency investments should not be underestimated.

XRP Whale Awakens: A Potential Catalyst for Price Surge?The cryptocurrency market has been excited as a significant whale movement involving XRP has been detected. A massive transaction worth $36.67 million has recently taken place, sparking speculation about a potential price surge for the digital asset.

The Whale's Move: A Bullish Signal?

Whale movements are often closely monitored by market analysts, as they can provide valuable insights into potential price trends. When large amounts of cryptocurrency are moved between wallets, it can indicate a variety of factors, including:

• Accumulation: Whales may be accumulating XRP in anticipation of a future price increase.

• Distribution: Conversely, whales may be distributing their holdings to take profits or reduce their exposure to the asset.

• Market Manipulation: In some cases, whale movements can be used to manipulate the market by creating artificial price swings.

While it's impossible to definitively determine the whale's intentions, the sheer size of the transaction has certainly caught the attention of the crypto community. Many analysts believe that this could be a bullish signal, suggesting that the whale may be preparing for a significant price move.

XRP's Recent Performance and Future Outlook

XRP has had a tumultuous journey in recent years, facing regulatory challenges and legal battles. However, the cryptocurrency has shown resilience and has managed to maintain its position as one of the top digital assets by market capitalization.

In the short term, the whale's recent move could provide a significant boost to XRP's price. However, the long-term outlook for the cryptocurrency will depend on several factors, including:

• Regulatory Clarity: A favorable regulatory environment is crucial for the growth of the cryptocurrency industry, including XRP.

• Technological Advancements: Continued innovation and development within the XRP ecosystem can attract new users and investors.

• Market Sentiment: Overall market sentiment and the performance of other major cryptocurrencies can also impact XRP's price.

Technical Analysis: A Bullish Perspective

Technical analysis of XRP's price chart suggests a bullish outlook. The cryptocurrency has formed a bullish pattern, indicating a potential upward trend. Additionally, key technical indicators such as the Relative Strength Index (RSI) and Moving Average Convergence Divergence1 (MACD) are signaling a bullish crossover, further supporting the bullish thesis.

Conclusion

The recent whale movement involving XRP has sparked excitement and speculation within the crypto community. While it's important to approach any investment with caution and conduct thorough research, the potential for a price surge cannot be ignored.

However, it's crucial to remember that the cryptocurrency market is highly volatile, and prices can fluctuate rapidly. Investors should carefully consider their risk tolerance and investment goals before making any investment decisions.

By staying informed about the latest market trends, conducting in-depth technical analysis, and diversifying your portfolio, you can increase your chances of success in the dynamic world of cryptocurrencies.

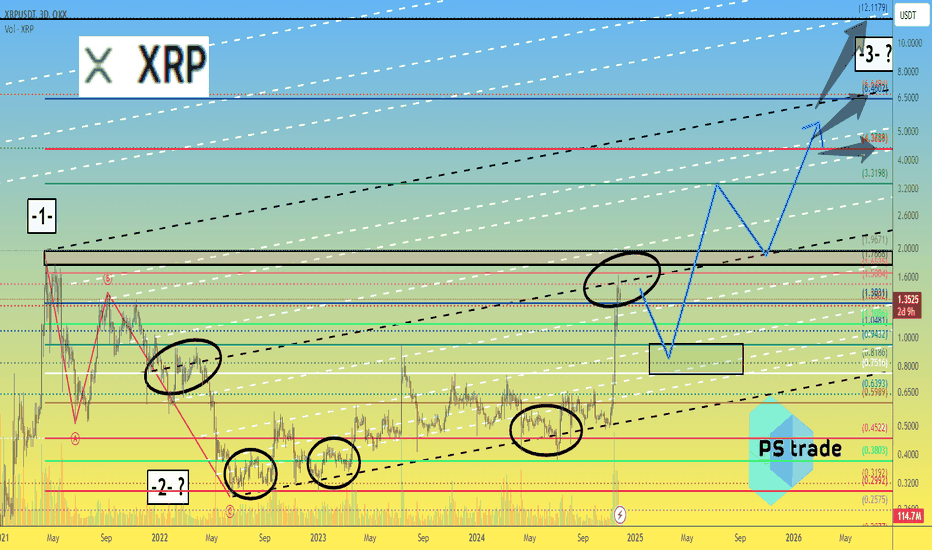

Ripple XRP price woke up after many years of hibernationIf we look at the global chart of OKX:XRPUSDT and conduct a wave analysis.

It turns out that it is purely theoretical and hypothetical and very fantastic, but the price of #Ripple can still reach $12

Although, a more realistic and down-to-earth target is $6.50 by mid-2026.

If we take a more localized situation , the #XRPUSD price can reach $1.76-1.96 by inertia, and that's enough.

A safe buy is in the range of $0.75-0.95

Confidence of continued growth after the #XRPUSDC price is able to gain a foothold above $2

Spread this idea across the Internet, let everyone know that CRYPTOCAP:XRP is reviving and preparing to rule the crypto world!)

Is Ripple's XRP ETF the Next Big Investment Opportunity?

The cryptocurrency market has been excited as Ripple's XRP token continues its upward trajectory. The recent surge in XRP's price, coupled with a significant development in a new ETF application, has fueled optimism among investors.

WisdomTree Joins the XRP ETF Race

WisdomTree Investments, a prominent asset management firm, has taken a bold step by applying with the U.S. Securities and Exchange Commission (SEC) to launch an XRP exchange-traded fund (ETF). This move is a significant development in the crypto industry, particularly for Ripple and its XRP token.

WisdomTree's decision to pursue an XRP ETF aligns with the growing interest in digital assets and the increasing institutional adoption of cryptocurrencies. By applying in Delaware, a state known for its business-friendly regulations, WisdomTree aims to streamline the regulatory process and potentially accelerate the launch of the ETF.

XRP's Stellar Performance

XRP has emerged as one of the top-performing altcoins in the recent crypto rally, experiencing a remarkable price surge. The token's value has soared to levels not seen since 2021, captivating the attention of investors and analysts alike.

Several factors have contributed to XRP's impressive performance:

1. Positive Legal Developments: Ripple's ongoing legal battle with the SEC has been a major catalyst for XRP's price movement. Positive developments in the case, such as favorable court rulings or settlements, can significantly impact the token's value.

2. Increased Institutional Interest: As more institutional investors recognize the potential of cryptocurrencies, XRP has gained traction. The growing interest from traditional finance players has led to increased demand for the token.

3. Strong Network and Utility: XRP's underlying technology, the RippleNet, offers fast and efficient cross-border payments. The network's growing adoption by financial institutions has solidified XRP's position as a valuable digital asset.

4. Positive Market Sentiment: The overall bullish sentiment in the crypto market has also benefited XRP. As investors become more optimistic about the future of digital assets, they are allocating funds to promising projects like Ripple.

The Future of XRP and Crypto ETFs

The filing of an XRP ETF application by WisdomTree is a testament to the growing institutional interest in cryptocurrencies. If approved, the ETF would provide investors with a convenient and regulated way to gain exposure to XRP.

However, it's important to note that the SEC has historically been cautious about approving crypto-related ETFs. Regulatory hurdles and concerns about market manipulation and investor protection have often delayed or prevented the launch of such products.

Despite the challenges, the increasing number of ETF applications for cryptocurrencies, including Bitcoin and Ethereum, suggests that the regulatory landscape is gradually evolving. As regulators better understand the crypto market and its potential benefits, we may see more approvals for crypto ETFs in the future.

Conclusion

Ripple's XRP has been on a remarkable journey, and the recent surge in its price, coupled with the filing of an ETF application by WisdomTree, has further solidified its position as a significant player in the crypto industry. While challenges and uncertainties remain, the future of XRP and cryptocurrencies appears bright. As the industry continues to mature and regulatory frameworks become more supportive, we can expect to witness further innovation and growth in the years to come.