Is XRP About to Rebound? Bullish Signals EmergeXRP Flashes Bullish Signal: Technical Indicator Hints at Imminent Rebound – 100x Gains Coming? The Future Is Closer Than You Think—Analyst

The cryptocurrency market is a volatile and often unpredictable space, where fortunes can be made and lost in the blink of an eye. Among the myriad of digital assets vying for attention, XRP, the cryptocurrency associated with Ripple Labs, has consistently been a topic of intense debate and speculation. While it has faced its fair share of challenges, including regulatory scrutiny and market fluctuations, XRP continues to hold the interest of investors and analysts alike.

Recently, XRP has been displaying what some experts are interpreting as bullish signals, suggesting a potential rebound in its price. These signals are primarily derived from technical analysis, a method of evaluating assets by analyzing statistical trends gathered from trading activity, such as price movement and volume. One particular technical indicator is hinting at an imminent upswing, leading some analysts to predict significant gains for XRP in the near future.

This article delves into the technical indicators flashing bullish signals for XRP, examines the factors that could contribute to a potential rebound, and explores the possibility of a 100x gain, a prospect that has captured the imagination of many XRP enthusiasts.

Technical Indicators Pointing Towards a Rebound

Technical analysis plays a crucial role in understanding potential price movements in the cryptocurrency market. Several indicators are currently suggesting a bullish outlook for XRP:

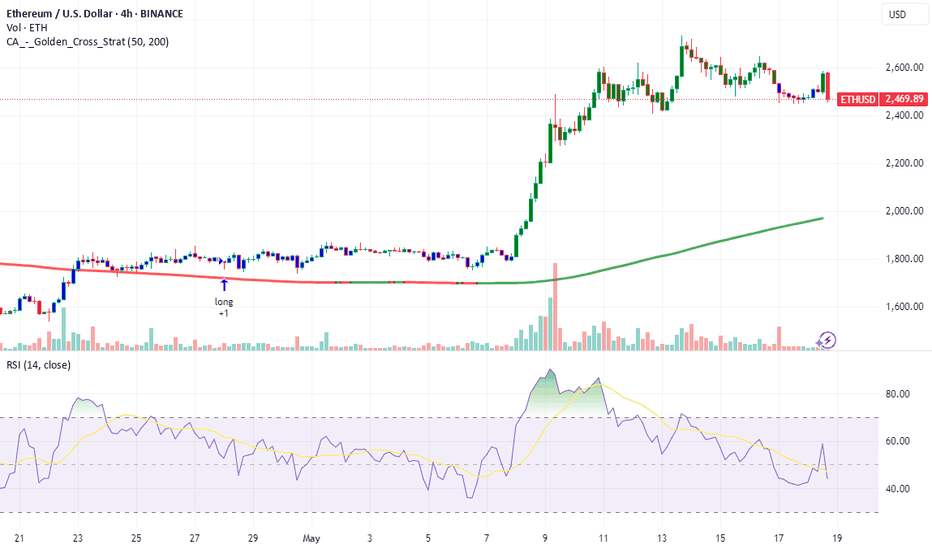

1. Moving Averages: Moving averages are commonly used to smooth out price data over a specific period, helping to identify trends. When a shorter-term moving average crosses above a longer-term moving average, it is often seen as a bullish signal, indicating that the price is likely to rise. XRP has recently exhibited this "golden cross" pattern on certain timeframes, suggesting a potential upward trend.

2. Relative Strength Index (RSI): The RSI is a momentum indicator that measures the magnitude of recent price changes to evaluate overbought or oversold conditions in the price of an asset. An RSI value below 30 typically indicates that an asset is oversold and may be due for a rebound. XRP's RSI has been hovering in oversold territory, suggesting that buying pressure could soon increase.

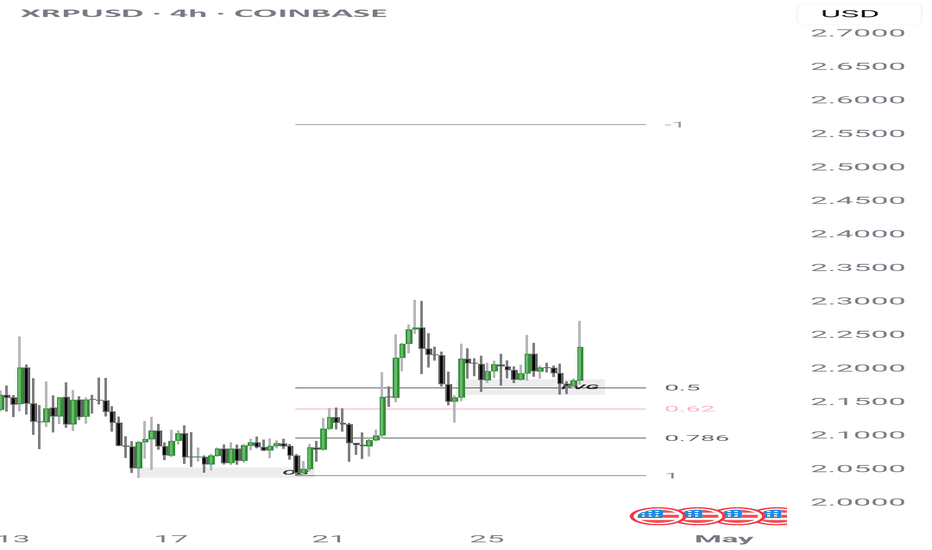

3. Fibonacci Retracement Levels: Fibonacci retracement levels are horizontal lines that indicate potential support and resistance levels based on the Fibonacci sequence. These levels are often used to predict where the price of an asset might find support during a downtrend or resistance during an uptrend. XRP has been testing key Fibonacci retracement levels, and a successful breakout above these levels could signal a significant price increase.

4. Chart Patterns: Technical analysts also look for specific chart patterns that can provide clues about future price movements. Some patterns, such as the "inverse head and shoulders" or the "double bottom," are considered bullish formations, suggesting that the price is likely to rise. XRP has been forming patterns that resemble these bullish formations, further supporting the possibility of a rebound.

Factors Contributing to a Potential XRP Rebound

While technical indicators can provide valuable insights, it is essential to consider the fundamental factors that could influence XRP's price. Several factors could contribute to a potential rebound:

1. Ripple's Ongoing Legal Battle with the SEC: The most significant factor weighing on XRP's price has been Ripple's legal battle with the U.S. Securities and Exchange Commission (SEC). The SEC alleges that Ripple sold XRP as an unregistered security, a claim that Ripple vehemently denies. A favorable outcome in this case could significantly boost XRP's price, as it would remove a major source of uncertainty and regulatory risk.

2. Growing Adoption of XRP for Cross-Border Payments: Ripple has been actively promoting XRP as a solution for cross-border payments, touting its speed, efficiency, and low cost compared to traditional methods. Increased adoption of XRP by financial institutions and payment providers could drive demand for the cryptocurrency, leading to a price increase.

3. Expansion of Ripple's Ecosystem: Ripple has been expanding its ecosystem by developing new products and services that utilize XRP. These include RippleNet, a network of financial institutions that use Ripple's technology for cross-border payments, and On-Demand Liquidity (ODL), a service that allows businesses to use XRP to source liquidity for cross-border transactions. A thriving ecosystem could attract more users and investors to XRP, further supporting its price.

4. Overall Cryptocurrency Market Sentiment: XRP's price is also influenced by the overall sentiment in the cryptocurrency market. A positive market sentiment, characterized by rising prices and increased investor confidence, could lift XRP along with other cryptocurrencies. Conversely, a negative market sentiment could put downward pressure on XRP's price.

The Possibility of a 100x Gain: A Realistic Scenario?

The prospect of a 100x gain in XRP's price has captured the imagination of many investors. While such a gain is certainly possible, it is essential to approach this scenario with a healthy dose of skepticism and realism.

To achieve a 100x gain, XRP's price would need to increase by a factor of 100 from its current level. This would require a massive influx of capital into XRP, driven by a combination of factors, such as a favorable outcome in the SEC case, widespread adoption of XRP for cross-border payments, and a significant increase in overall cryptocurrency market capitalization.

While these factors are not entirely out of the realm of possibility, they are by no means guaranteed. The cryptocurrency market is inherently unpredictable, and unforeseen events could derail any potential rally in XRP's price.

Analyst Perspective: The Future Is Closer Than You Think

Despite the inherent risks and uncertainties, some analysts remain optimistic about XRP's future. These analysts point to the potential for XRP to disrupt the traditional cross-border payments industry, the growing adoption of Ripple's technology, and the possibility of a favorable outcome in the SEC case as reasons for their bullish outlook.

One analyst, in particular, has stated that "the future is closer than you think" for XRP, suggesting that significant gains could be realized in the near future. This analyst believes that XRP is currently undervalued and that its price could surge once the regulatory uncertainty surrounding Ripple is resolved.

Conclusion: Navigating the XRP Landscape

XRP presents a complex and often contradictory picture. Technical indicators are flashing bullish signals, suggesting a potential rebound in its price. Factors such as Ripple's ongoing legal battle with the SEC, growing adoption of XRP for cross-border payments, and the overall cryptocurrency market sentiment could all play a role in determining XRP's future.

While the possibility of a 100x gain is enticing, it is essential to approach this scenario with caution and realism. The cryptocurrency market is inherently volatile, and unforeseen events could impact XRP's price.

Ultimately, whether XRP achieves its full potential remains to be seen. However, the recent bullish signals and the ongoing developments surrounding Ripple suggest that the future of XRP is closer than many might think. As always, investors should conduct their own research, assess their risk tolerance, and make informed decisions before investing in any cryptocurrency, including XRP.

Xrpusdanalysis

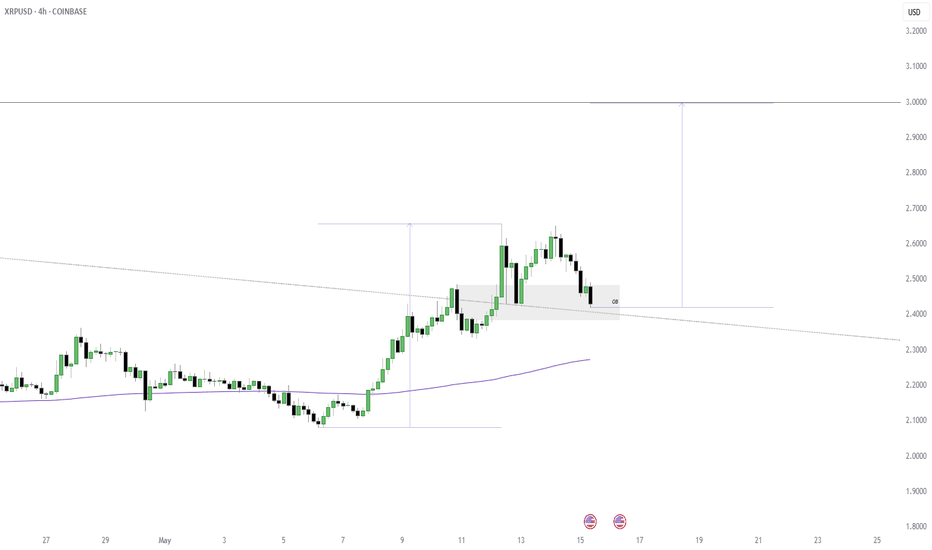

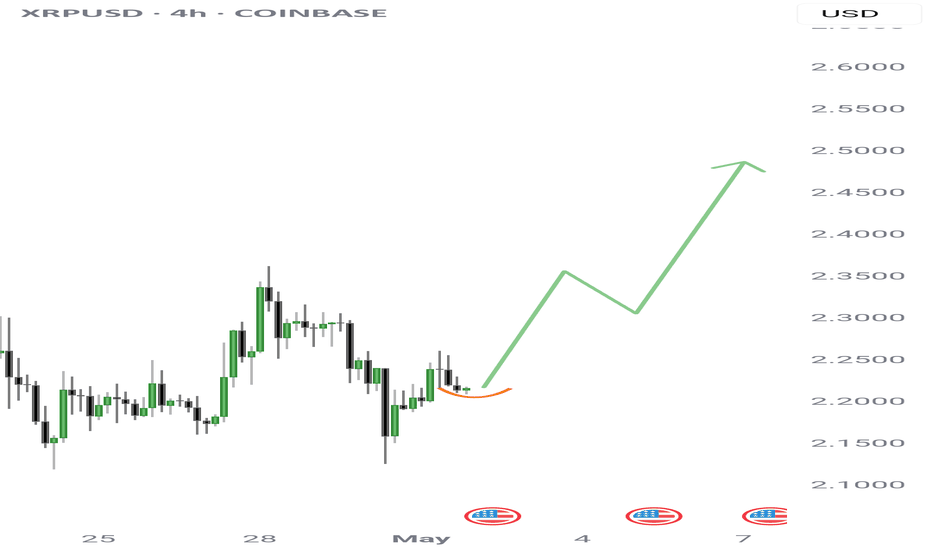

Is XRP the Next Crypto Rocket?$2,5 Breakout Targets $3.5 or moreI see a clear setup with actionable insights. The chart shows XRP forming a range and deviation at 1.77$, with a recent bullish breakout attempt. Here’s my breakdown:

Technical Analysis

Deviation of the global range points at potential consolidation(blue horizontal line)

Breakout Attempt: A sharp green candle pushed above the $2,36 resistance, but it’s yet to close convincingly above it. The red arrow projecting upward suggests optimism for a move toward $3–$3,5if the breakout holds.

Given today’s date (May 18, 2025, 03:40 PM EEST), this setup aligns with recent crypto market trends. XRP’s price action could be reacting to broader market sentiment, regulatory news, or Ripple-related developments, which have historically driven volatility.

This chart screams opportunity if the breakout holds. However, watch for a false breakout—crypto is notorious for shakeouts. A failure to close above $2,5 could see price retrace to $2,3 or lower. I’d monitor the next 2-3 weeksfor confirmation.

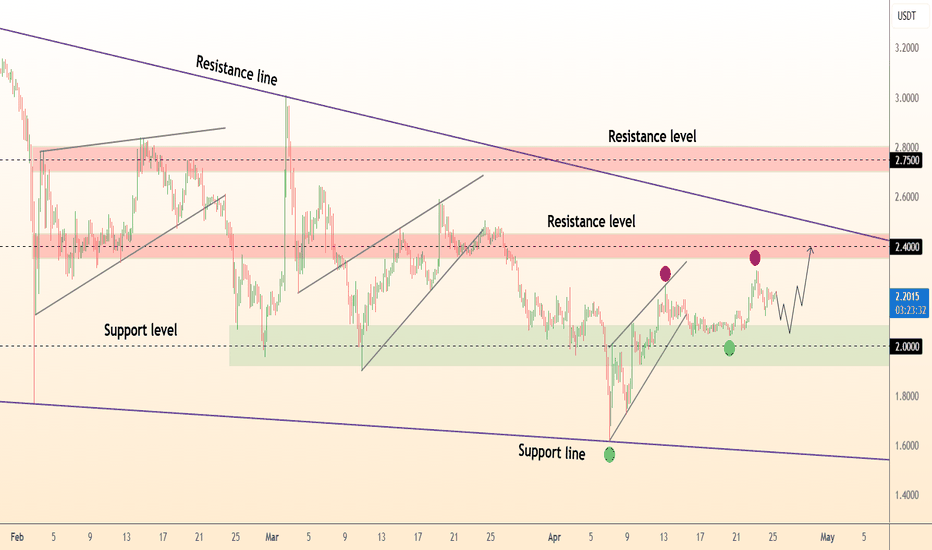

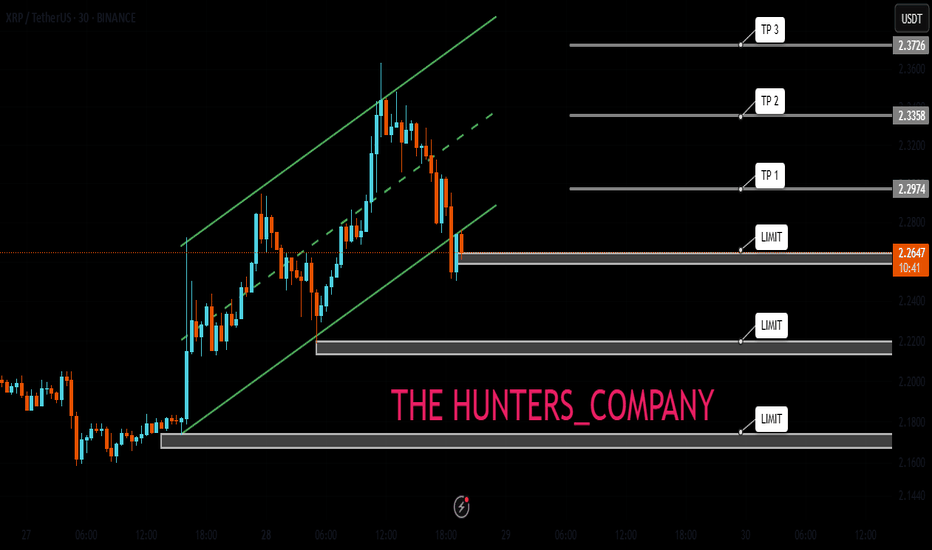

XRPHighly likely XRP retest $2.20 before moving higher.

Long-term investors are looking for lower prices before a tariff deal with China. A liquidity sweep is needed before we move higher, or we will continue moving lower.

We break $2.50 and we will see $3 quickly after. ETF going Live on the 19th, China deal, SEC case ending will all catapult price.

LOCK IN 🔐

XRPWe are fixing to witness a run to $3 in a hurry.

New outlets, governments, banks, institutions, are all diving into crypto. An ounce of great news for XRP sends us moving up in a HURRY.

Have an exit strategy in place to take profits, and cycle some profits into other assets to continue to build your wealth.

Lock In.

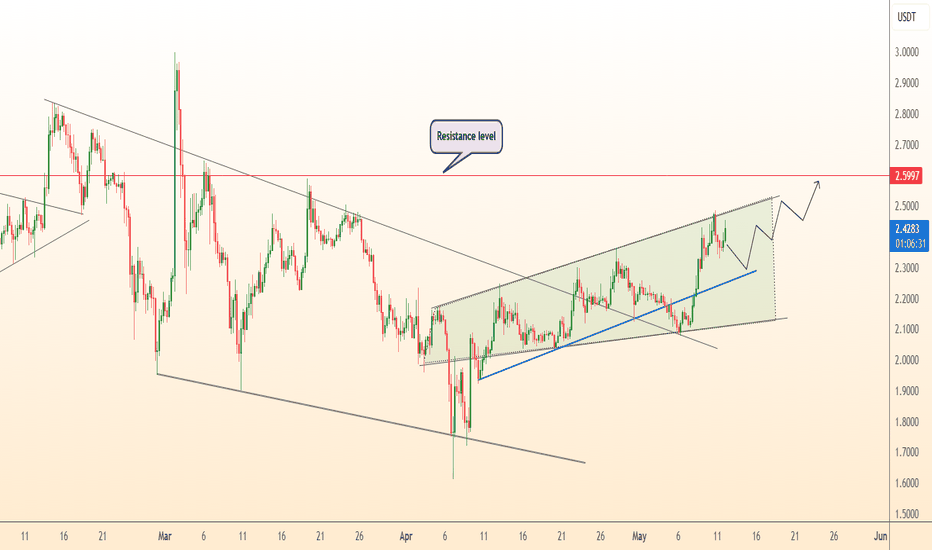

DeGRAM | XRPUSD volatility expansion📊 Technical Analysis

● XRP is climbing inside a rising channel (green) that has developed on top of the former $2.05‑2.15 demand zone; successive higher lows along the blue trend‑line confirm fresh bullish structure.

● Price has already cleared the long‑standing wedge roof; holding above the channel mid‑line keeps $2.60 resistance (red) in focus.

💡 Fundamental Analysis

● A U.S. judge has ordered the SEC and Ripple to enter a pre‑trial settlement conference before 31 May, fuelling speculation that the multi‑year case could end with a fine rather than a ban—boosting institutional appetite for XRP.

✨ Summary

Rising‑channel momentum plus hopes of a favourable Ripple‑SEC resolution support a push from $2.45 toward $2.60‑2.75.

-------------------

Share your opinion in the comments and support the idea with a like. Thanks for your support!

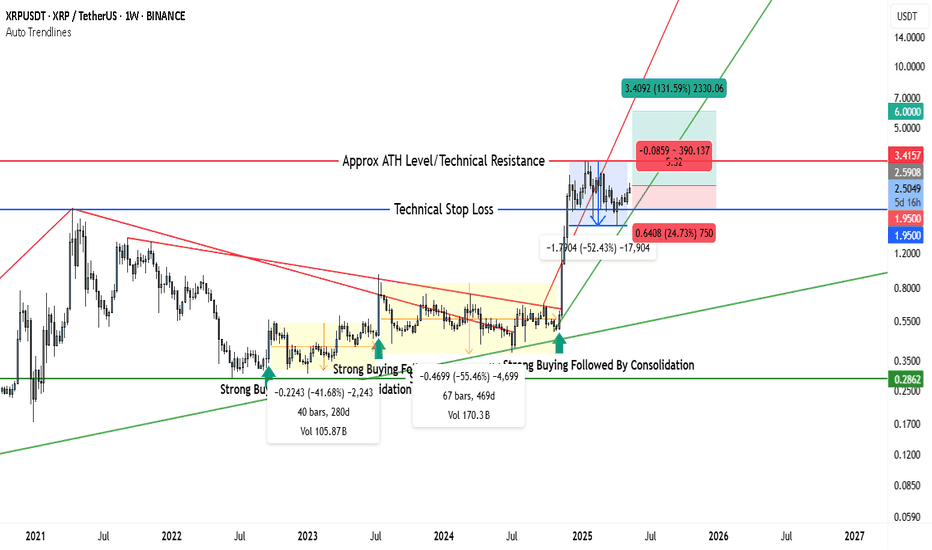

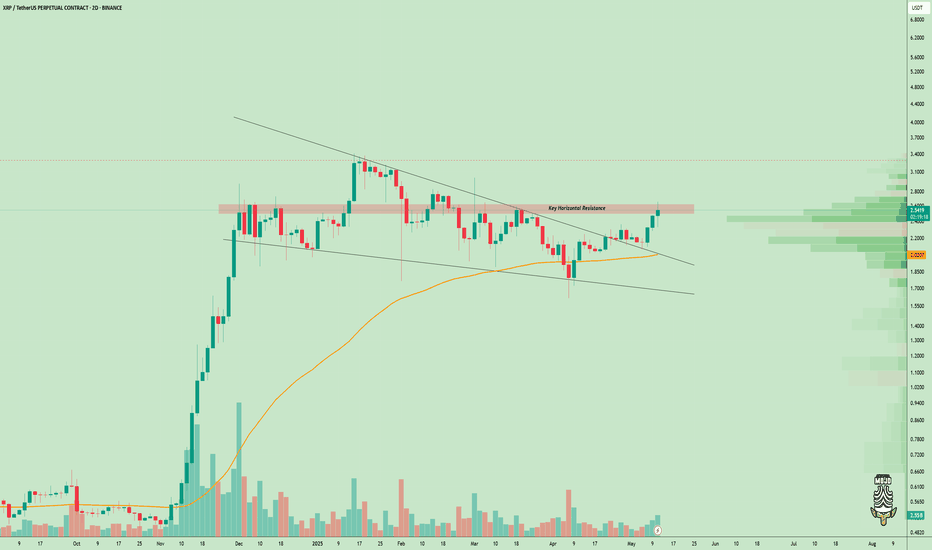

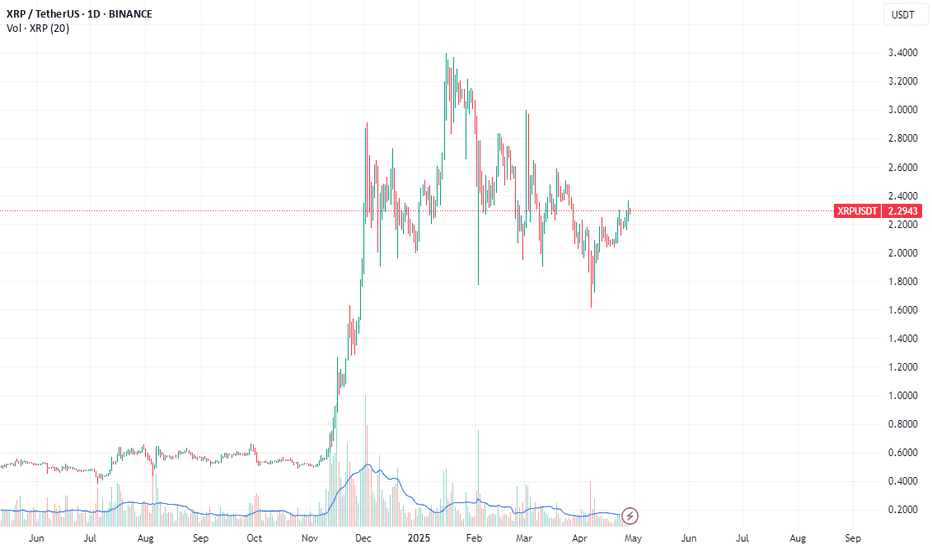

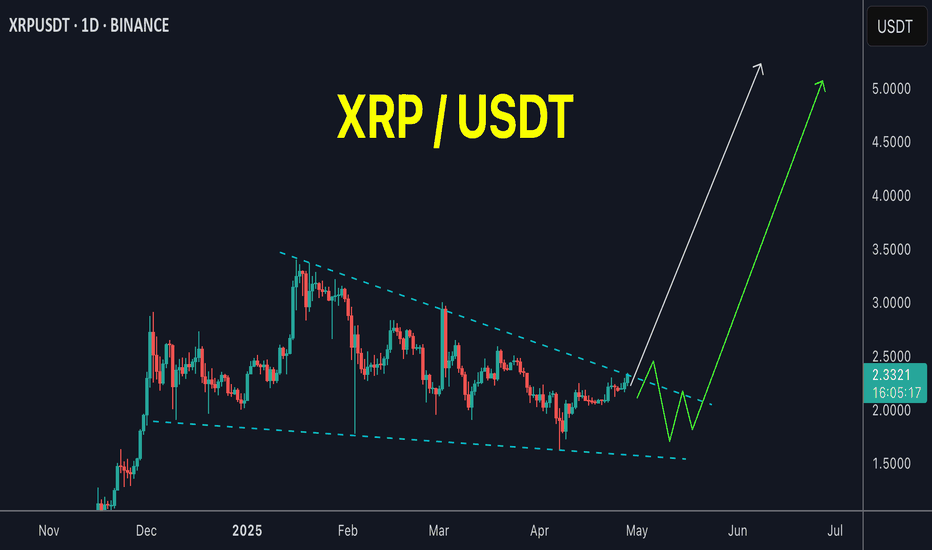

XRPUSDT Bullish Setup – Swing Trade Opportunity Toward $6.00XRP has shown a consistent pattern of strong bullish impulses followed by consolidation zones, and this rhythm has repeated multiple times on the weekly chart—signaling high confidence in pattern continuation.

Let's break it down

🔁 Repetitive Buying + Consolidation Patterns

19 Sep 2022: Strong buying candle triggered a short-term rally, followed by a multi-week consolidation period.

10 July 2023: Similar impulse move occurred—buying strength picked up, and then the price consolidated again.

4 Nov 2024: Most recent and strongest impulse—3 consecutive bullish candles that broke out of long-term descending resistance, confirming structural shift. This was again followed by consolidation—mirroring previous price behavior.

📈 Breakout Confirmation & Trend Structure

Breakout of Descending Trendline (Red): XRP broke out of its long-term bearish trendline decisively, confirming a trend reversal.

Support Zone Holding Firm (1.95 USDT): Price retraced slightly but respected the newly established support above 1.9500.

Consolidation Above Breakout: Post-breakout consolidation is forming a bullish continuation pattern.

Key Technical Levels

Entry Zone (Buy Area): Current zone between $2.10 and $2.50 (ideal accumulation zone for swing traders).

Technical Stop Loss: $1.9500 – key level that has acted as both resistance and now flipped to support.

Take Profit Targets

TP1: $3.4157 – previous resistance and a strong psychological level.

TP2: $6.000 – projected top of current trend channel (green line), aligns with 131.59% upside from current level.

Risk-Reward: Over 5:1 R:R on this setup, extremely favorable for mid-to-long-term swing trades.

Bearish Invalidations

If the price closes significantly below $1.95 on the weekly, the current bullish thesis weakens, and price may retest deeper supports around $1.25 or below. But as long as the structure holds, bulls are in control.

📊 Trade Setup Summary

📥 Entry 2.10 – 2.50

🛑 Stop Loss 1.9500

🎯 Take Profit 1 3.4157

🎯 Take Profit 2 6.0000

⚖️ R:R Ratio 5.32x

The chart tells a powerful story—repeated buying, breakout confirmation, support holds, and continuation setup. XRP is positioning itself for a major move, with $6.00 potentially on the table by the end of 2025.

This is an ideal zone for swing traders and position traders who are comfortable with multi-month holding periods and high R:R setups.

Momentum Rising – $XRP Bulls Eyeing Next Leg UpCRYPTOCAP:XRP is waking up 🔥

Price has broken out of the long-term downtrend and is now testing the important horizontal resistance area

A clean break above this range might spark the next big move. Volume is on the increase, and the structure is all good

Time to keep an eye on this one 👀

DeGRAM | XRPUSD Overcame $2.00 Level!📊 Technical Analysis

XRP/USDT broke out of a descending wedge, reclaiming $2.00 and eyeing the upper resistance level near $2.40.

💡 Fundamental Analysis

• Ripple’s partial court victory narrows the SEC case, lifting regulatory clouds.

• CME preparing XRP futures signals rising institutional appetite.

• Central-bank CBDC pilots explore Ripple tech, enlarging utility prospects.

• Ripple’s On-Demand Liquidity volumes keep setting records in 2025, and XRPL’s AMM upgrade is live, deepening liquidity.

• Whale wallets added 110 M XRP in April.

• ETF chatter and expanding Latin-American remittance use support demand.

• A softer USD after benign CPI fuels altcoin inflows.

✨ Summary

A wedge breakout plus legal clarity, institutional products, network upgrades and demand growth favor a climb toward $2.40; and then to $2.75.

-------------------

Share your opinion in the comments and support the idea with a like. Thanks for your support!

VWAPs Don't Lie—XRP Faces Judgment Day At Monthly Support

In the volatile world of cryptocurrency trading, technical indicators often serve as critical guideposts for investors seeking to navigate uncertain markets. Among these indicators, the Volume Weighted Average Price (VWAP) has emerged as a powerful tool for assessing market sentiment and potential price movements. For XRP, Ripple's native cryptocurrency, the VWAP is currently telling a compelling story as the digital asset faces a critical juncture at its monthly support level while simultaneously breaking through key resistance barriers.

Understanding VWAP and Its Significance for XRP

The Volume Weighted Average Price represents the ratio of the value traded to total volume traded over a specific time period. Unlike simple moving averages, VWAP gives more weight to price moves that occur on higher volume, providing a more accurate representation of a security's true average price. For traders, VWAP serves as a benchmark that can indicate potential support and resistance levels.

For XRP, the current VWAP analysis reveals a crucial moment in its price trajectory. After months of consolidation following the partial legal victory against the SEC, XRP's price action against its VWAP indicators suggests we're approaching what many analysts are calling a "judgment day" scenario at its monthly support level.

Historically, XRP has respected its monthly VWAP lines with remarkable consistency. When the price falls below this indicator, it often signals sustained downward pressure; conversely, when it trades above the VWAP, bullish momentum typically follows. What makes the current situation particularly compelling is that XRP is simultaneously testing its monthly support while breaking through a key resistance level that has capped its upward movement for weeks.

XRP's Technical Landscape: Breaking Key Resistance

The recent breakthrough above a significant resistance level has generated fresh excitement among XRP investors. This resistance zone, which had repeatedly rejected upward price movements since early this year, finally gave way amid increasing trading volumes and renewed market optimism.

Several factors contributed to this technical breakout:

1. Increased Trading Volume: A substantial surge in trading activity provided the necessary momentum to push through resistance.

2. Improving Market Sentiment: The broader cryptocurrency market has shown signs of recovery, lifting sentiment across most digital assets.

3. Institutional Interest: Reports of increasing institutional accumulation of XRP have bolstered confidence in its long-term prospects.

4. Technical Convergence: Multiple technical indicators, including the Relative Strength Index (RSI) and Moving Average Convergence Divergence (MACD), aligned to signal bullish momentum.

The breakthrough above this key resistance level has opened the path for XRP to potentially test higher price targets. Technical analysts have identified several important levels to watch in the coming weeks, with projections suggesting that XRP could reach significantly higher valuations if the current momentum is sustained.

Monthly Support: The Line in the Sand

While the resistance breakthrough is undoubtedly positive, XRP simultaneously faces a critical test at its monthly support level. This support zone has acted as a reliable floor for XRP prices during previous downturns, and maintaining this level is crucial for preserving bullish momentum.

The monthly VWAP serves as a key component of this support structure. As volumes have increased, the VWAP has begun to flatten and show early signs of turning upward—a potentially bullish signal. However, failure to hold this support could trigger a cascade of selling pressure, potentially erasing recent gains.

Market observers note that this monthly support level coincides with several other technical indicators, creating what traders call a "confluence zone." These areas, where multiple support factors align, often prove to be significant inflection points for price action. For XRP, the current confluence zone represents not just a technical support level but a psychological barrier that could determine market sentiment in the months ahead.

The Ripple Effect: Fundamental Catalysts Behind Price Action

While technical analysis provides valuable insights into potential price movements, fundamental factors continue to influence XRP's market performance. Ripple, the company closely associated with XRP, has maintained progress on several fronts despite ongoing legal challenges.

The company's cross-border payment network, RippleNet, continues to expand its global footprint, with new partnerships announced across financial sectors. These real-world applications provide a foundation for XRP utility beyond speculative trading, potentially supporting long-term value.

Additionally, developments in the regulatory landscape have created both challenges and opportunities. The SEC case against Ripple, which initially caused significant market uncertainty, has evolved in ways that many legal experts interpret as increasingly favorable for Ripple. Court rulings that distinguished XRP sales to institutional investors from sales on secondary markets have provided some regulatory clarity, though final resolutions remain pending.

The combination of expanding real-world utility and potential regulatory clarity has created an environment where technical breakouts may have stronger fundamental support than in previous cycles.

Global Market Context: External Influences on XRP

XRP's price action does not occur in isolation, and global market factors continue to exert significant influence. Several external factors currently impact XRP's technical outlook:

1. Dollar Strength: Fluctuations in the U.S. dollar index have historically shown inverse correlations with cryptocurrency prices, including XRP.

2. Institutional Capital Flows: Shifting patterns in institutional investment have created new dynamics in the cryptocurrency market.

3. Regulatory Developments: Beyond the Ripple case, the broader regulatory environment for cryptocurrencies continues to evolve globally.

4. Correlation with Bitcoin: Despite efforts to establish independent price action, XRP maintains significant correlation with Bitcoin's market movements.

These external factors create a complex backdrop against which the technical battle at XRP's monthly support is playing out. Traders are carefully monitoring these influences for signs of how they might affect XRP's ability to maintain support and extend its recent breakout.

Trading Strategies at the Inflection Point

For traders navigating the current technical landscape, the confluence of monthly support testing and resistance breakout creates both opportunities and risks. Several trading approaches have emerged:

1. Breakout Confirmation Strategy: Some traders are waiting for additional confirmation of the resistance breakout before establishing new positions, looking for sustained trading above the recently broken level with strong volume.

2. Support Bounce Plays: Others are focusing on the monthly support level, planning entries if the price successfully bounces from this zone with convincing volume patterns.

3. Scaling Strategies: More conservative traders are implementing scaling strategies, gradually building positions as technical confirmations emerge.

4. Options and Derivatives Plays: In the derivatives markets, strategies focused on volatility expectations have gained popularity as traders anticipate significant price movement following the resolution of the current technical standoff.

What unifies these varied approaches is recognition of the current juncture's significance. The convergence of monthly VWAP support testing and resistance breakthrough represents a relatively rare technical setup that typically precedes substantial price movement in one direction or another.

Historical Precedents: What Past VWAP Interactions Tell Us

Looking at historical instances where XRP faced similar technical conditions provides valuable context for the current situation. Several notable examples stand out:

In late 2020, XRP successfully defended its monthly VWAP support before beginning a rally that would eventually see prices increase by over 800% in the subsequent months. The successful defense of this support level, combined with increasing volume, preceded one of XRP's most significant bull runs.

Conversely, in May 2021, XRP's failure to maintain its position above the monthly VWAP coincided with a market-wide correction that saw the asset lose over 70% of its value. This historical instance demonstrates the potential downside risk when VWAP support fails.

More recently, in early 2023, XRP tested its monthly VWAP during a period of market uncertainty. The successful defense of this level led to a period of relative price stability before a measured upward movement. This example presents a more moderate outcome possibility for the current situation.

These historical precedents illustrate the range of potential outcomes following interactions with monthly VWAP levels, from dramatic rallies to severe corrections to more measured movements. What they consistently demonstrate is that these interactions tend to precede significant price action rather than continued consolidation.

Fresh Upside Momentum: Targets and Projections

With XRP breaking through key resistance and testing monthly support, attention naturally turns to potential upside targets if bullish momentum continues. Technical analysts have identified several significant levels:

1. Initial Resistance Zone: The first major resistance above current levels sits approximately 20-25% higher, representing previous local highs that briefly capped earlier rally attempts.

2. Psychological Barriers: Beyond technical levels, psychological price points represent important barriers that could temporarily slow momentum as profit-taking occurs.

3. Long-term Technical Targets: Some analysts have identified far more ambitious targets based on larger technical patterns, though these would likely require sustained momentum over a longer timeframe.

It's important to note that these projections assume XRP successfully defends its monthly support level. Failure to maintain this support would invalidate many of these upside targets and potentially trigger downside projections instead.

Volume patterns will be critical in determining whether upside momentum can be sustained. Thus far, volume has shown encouraging signs, with increasing participation during upward price movements—a classic sign of authentic buying pressure rather than technical-driven price action with limited participation.

Risk Factors and Potential Headwinds

Despite the promising technical setup, several risk factors could disrupt XRP's path forward:

1. Legal Uncertainties: Though Ripple has secured some favorable rulings, the ongoing legal case continues to present unpredictable risks.

2. Market Liquidity Concerns: Broader market liquidity conditions could impact XRP's ability to sustain momentum, particularly if institutional investors reduce risk exposure.

3. Technical Invalidation: A decisive break below monthly support would invalidate the bullish case and potentially trigger substantial selling.

4. Competitor Developments: Advances from competing blockchain payment solutions could impact market perception of XRP's utility and long-term value proposition.

Prudent investors acknowledge these risks while assessing the technical opportunity presented by the current setup. Risk management approaches, including clearly defined exit strategies if support fails, remain essential despite the optimistic technical outlook.

Conclusion: Judgment Day for XRP

The confluence of monthly VWAP support testing and key resistance breakthrough has created what many analysts describe as a judgment day scenario for XRP. The resolution of this technical standoff will likely determine the asset's price trajectory for weeks or even months to come.

The VWAP indicator, with its volume-weighted approach to price analysis, has historically provided reliable signals for XRP's major price movements. The current readings suggest we're at a critical inflection point where significant price discovery in one direction or the other appears imminent.

For investors and traders, this technical juncture represents both opportunity and risk. The resistance breakthrough provides a potentially bullish signal, but this outlook remains contingent on successfully defending the monthly support level where the VWAP currently resides.

As volume patterns evolve and price action develops around these key levels, market participants would be wise to remember the maxim that has proven reliable throughout XRP's trading

history: when it comes to identifying genuine market momentum and sustainable price trends, VWAPs don't lie. The coming weeks will reveal whether XRP can transform its technical promise into sustained upward momentum or if support failure will lead to renewed downside pressure.

The judgment day at monthly support has arrived for XRP. The market's verdict awaits.

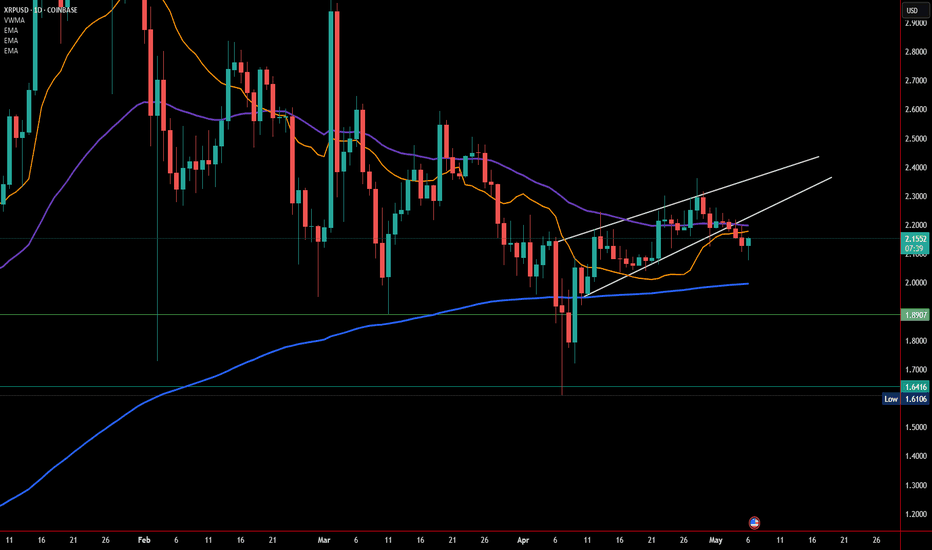

XRP Breaks Down from Rising Wedge – Is a Deeper Pullback Coming?XRP has officially broken down from a rising wedge pattern on the daily chart, closing below its lower trendline support. This could signal the beginning of a short-term bearish phase unless key support levels hold up.

Chart Breakdown

On the daily timeframe, XRP was trading within a rising wedge—a pattern typically considered bearish when it breaks to the downside. The breakdown came after price failed to reclaim the $2.30–$2.35 resistance zone, followed by a sharp move lower toward the $2.00 level.

Key technicals:

200-day EMA (blue line) is now acting as the first major support near $2.00

50-day EMA (purple) has turned into resistance

Price is hovering around $2.15, retesting the wedge from below

Bearish Price Targets

With the wedge breakdown confirmed, here are potential downside levels to watch:

$2.00 – Psychological level and strong dynamic support from the 200 EMA

$1.89 – Horizontal support from late March

$1.64–$1.61 – A critical support zone that marked the low before the last rally

If XRP fails to hold above $2.00 and closes below it, momentum could shift strongly in favor of the bears.

Bullish Scenario?

While the pattern suggests bearish momentum, bulls could still regain control if XRP closes back above $2.20 and re-enters the wedge. That would invalidate the breakdown and potentially open the door back toward $2.35 and higher.

Final Thoughts

The wedge breakdown is a warning sign for short-term traders. Unless XRP reclaims key levels quickly, it could be headed toward the $1.89–$1.64 support range. Keep an eye on volume and EMA support—these will likely determine if this is just a dip or the start of a larger correction.

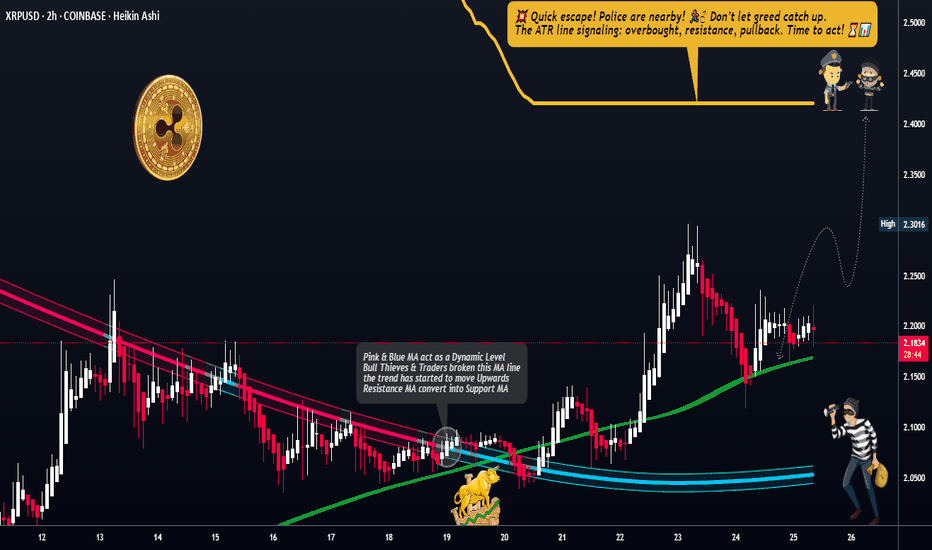

XRP/USD "Ripple vs U.S Dollar" Crypto Heist Plan (Scalping/Day)🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Robbers, 🤑 💰💸✈️

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the XRP/USD "Ripple vs U.S Dollar" Crypto Market. Please adhere to the strategy I've outlined in the chart, which emphasizes long entry. Our aim is the high-risk Red Zone. Risky level, overbought market, consolidation, trend reversal, trap at the level where traders and bearish robbers are stronger. 🏆💸"Take profit and treat yourself, traders. You deserve it!💪🏆🎉

Entry 📈 : "The vault is wide open! Swipe the Bullish loot at any price - the heist is on!

however I advise to Place buy limit orders within a 15 or 30 minute timeframe nearest or swing low or high level for pullback entries.

Stop Loss 🛑:

📍 Thief SL placed at the recent/swing low level Using the 1H timeframe (2.600) Day trade basis.

📍 SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

Target 🎯: 2.4200

💰💵💸XRP/USD "Ripple vs U.S Dollar" Crypto Market Heist Plan (Scalping/Day) is currently experiencing a bullishness,., driven by several key factors. .☝☝☝

📰🗞️Get & Read the Fundamental, Macro, COT Report, On Chain Analysis, Sentimental Outlook, Intermarket Analysis, Future trend targets... go ahead to check 👉👉👉🔗🔗🔗

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

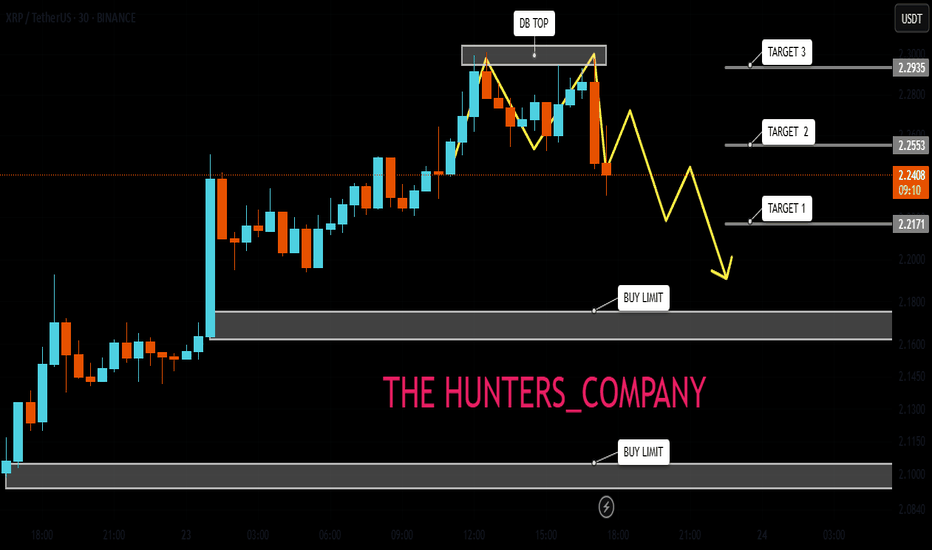

XRPPrice has swept the Weekly Lows of last week. Now, we should begin our climb towards $2.36, which was previous weeks high.

We may see a impulse move towards $2.26 mid week, followed by more buying heading into the weekend.

If we fail to break above $2.26 we may see more drawdown towards $2.08 support.

There are plenty of catalyst to propel us towards $2.50+, we should still be accumulating if possible.

Stay diligent, our time is coming!

XRPWe've found support around $2.20, institutions and banks are loaded up, next retail will ape into the next wave.

$2.50 is our first target, beyond that is $3 then $5 in a hurry. I expect news to begin rolling out around Reserves, SWIFT upgrading to the Ledger, acquiring Circle and much more..

Everything will move fast from here.

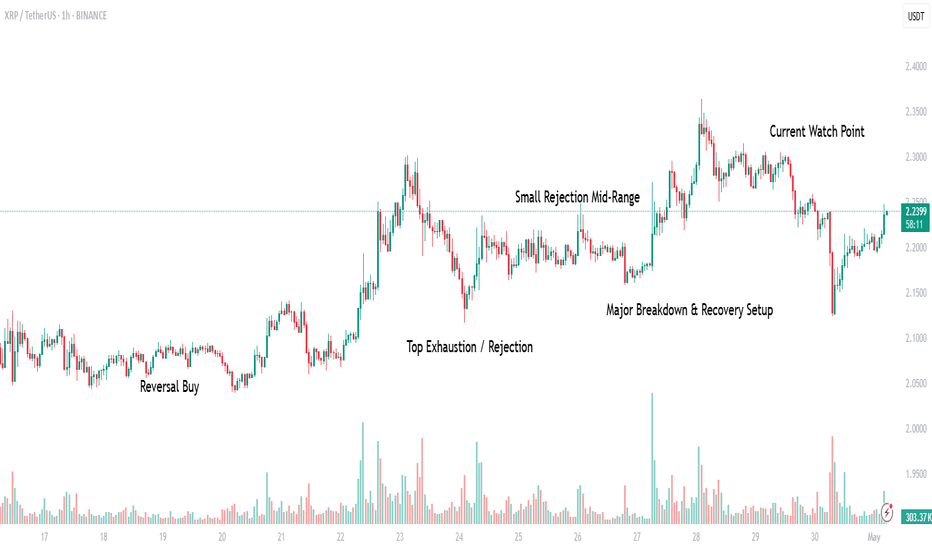

XRP/USDT — Structure-Driven Strategy (1H Chart)Just price, structure, and volume — tracked in real time.

🧠 Chart Breakdown:

✅ Reversal Buy — Price flushed, then snapped back into the range with follow-through. That became the base structure for everything that followed.

⛔ Top Exhaustion / Rejection — Clean reversal after a strong rally. Volume dropped off, candles showed hesitation, and sellers stepped in.

⚠️ Small Rejection Mid-Range — Structure failed to push higher. This area marked a trap — no volume confirmation, no continuation.

🚨 Major Breakdown & Recovery Setup — Price dropped hard but reclaimed key levels quickly. The recovery candle and volume spike were the first clues buyers were stepping in again.

👀 Current Watch Point — Price is now pressing back into that same resistance zone. The structure here is everything — a clean reclaim could mean trend continuation. But hesitation again? Fade it.

Always happy to be helpful.

How High Can Ripple Get? Analyzing Potential

The cryptocurrency market is a realm of dizzying highs, gut-wrenching lows, and perpetual speculation. Investors and enthusiasts constantly scan the horizon, seeking the next big wave, the digital asset poised for exponential growth. Among the most debated and closely watched cryptocurrencies is XRP, the digital asset native to the XRP Ledger, often associated with the company Ripple. Its unique proposition – aiming to revolutionize cross-border payments – sets it apart, yet its journey has been fraught with regulatory battles and intense market volatility.

As we look towards the end of the decade, the question looms large: How high can XRP realistically within 5 years? This isn't just idle speculation; it involves dissecting a complex web of technological potential, adoption hurdles, regulatory landscapes, competitive pressures, and overall market sentiment. Adding another layer of intrigue are the actions of large holders, or "whales," whose movements can sometimes signal shifts in market dynamics. The recent news of an XRP whale depositing a staggering $68.7 million worth of XRP to Coinbase, potentially coinciding with a price surge, naturally sparks questions: Are major players cashing in, or is this part of a larger strategy?

This article will delve into the factors that could propel XRP's price upwards by 2030, the challenges that might hinder its ascent, analyze the potential implications of significant whale movements, and explore various price prediction scenarios, while always emphasizing the inherent uncertainties of the crypto market.

Understanding XRP and Ripple: The Foundation

Before projecting the future, it's crucial to understand the present.

• XRP: XRP is the native digital asset of the XRP Ledger (XRPL), an open-source, decentralized blockchain technology. It was designed for speed, scalability, and low transaction costs. Transactions typically confirm in 3-5 seconds, costing fractions of a cent, and the ledger can handle thousands of transactions per second. XRP acts as a bridge currency, facilitating faster and cheaper cross-border payments by eliminating the need for pre-funded nostro/vostro accounts that traditional systems like SWIFT rely on.

• Ripple: Ripple is a private fintech company that utilizes XRP and the XRPL within its suite of enterprise solutions, most notably Ripple Payments (formerly known as On-Demand Liquidity or ODL). Ripple Payments allows financial institutions to source liquidity instantly using XRP, settling international payments in near real-time without tying up capital in foreign accounts. While Ripple is a major player in the XRPL ecosystem and holds a significant amount of XRP, the XRP Ledger itself is decentralized and operates independently of the company.

• Key Distinction: Unlike Bitcoin, which uses Proof-of-Work mining, the XRPL uses a unique Federated Consensus mechanism. All 100 billion XRP were pre-mined at its inception, with a large portion held by Ripple, released periodically from escrow. This structure has been a point of contention and central to regulatory scrutiny.

Historical Context: A Volatile Journey

XRP's price history is a rollercoaster:

• Early Growth: Launched in 2012, XRP saw gradual growth and periods of intense speculation.

• 2017-2018 Boom: Like much of the crypto market, XRP experienced a parabolic surge, reaching its all-time high of approximately $3.84 in January 2018.

• Prolonged Bear Market: Following the crash, XRP entered a multi-year bear market, exacerbated by regulatory uncertainty.

• The SEC Lawsuit (December 2020): The U.S. Securities and Exchange Commission filed a lawsuit against Ripple Labs and two of its executives, alleging that XRP was an unregistered security. This caused XRP's price to plummet and led to its delisting from several major US exchanges, including Coinbase.

• Partial Victory and Relisting (July 2023): A landmark ruling by Judge Analisa Torres declared that programmatic sales of XRP on exchanges did not constitute investment contracts (securities), while institutional sales did. This partial victory was seen as hugely positive, leading to relistings on US exchanges and a significant price rally, though the legal battle is not entirely over (potential appeals, institutional sales aspect).

This history underscores XRP's sensitivity to regulatory news, market cycles, and its unique position tied to Ripple's business endeavors.

Factors Fueling Potential Growth by 2030 (The Bull Case)

Several catalysts could drive significant XRP price appreciation by 2030:

1. Regulatory Clarity (Globally): The partial victory in the US was a major step, but achieving broader, definitive regulatory clarity worldwide is paramount. If major economies classify XRP clearly as a non-security or establish favorable frameworks for its use as a bridge asset, it would remove a significant overhang and boost confidence among institutional adopters. Clarity in jurisdictions like the UK, Singapore, Japan, and the EU would be particularly impactful.

2. Widespread Adoption of Ripple Payments (ODL): This is arguably the most crucial factor. If Ripple successfully onboards numerous banks, payment providers, and financial institutions onto Ripple Payments, leveraging XRP for real-time liquidity, the utility demand for XRP would increase substantially. Increased transaction volume flowing through the XRPL, requiring XRP for settlement, would naturally exert upward pressure on its price. Success hinges on demonstrating clear cost savings, speed advantages, and reliability compared to traditional systems and competitors.

3. Expansion of Partnerships: Ripple already boasts numerous partnerships. Expanding these relationships and forging new ones, particularly with major players in banking, remittance, and fintech, would validate the technology and increase network effects. Partnerships that translate into actual, high-volume XRP usage are key.

4. Technological Advancements on the XRP Ledger: The XRPL is not static. Ongoing development, including potential upgrades like sidechains, enhanced smart contract capabilities (Hooks amendment), native NFT support (XLS-20), and integration with Decentralized Finance (DeFi) protocols, could expand XRP's utility beyond payments. A thriving ecosystem built on the XRPL could attract developers and users, increasing demand for the native asset.

5. Overall Crypto Market Growth and Maturation: XRP's price is heavily correlated with the broader cryptocurrency market. A sustained bull market, driven by factors like Bitcoin Halving cycles, increased institutional investment (ETFs, etc.), and wider retail adoption, would likely lift XRP along with other major altcoins.

6. Use Cases Beyond Ripple Payments: While Ripple Payments is the primary focus, XRP could find utility in other areas like tokenization of assets, micropayments, identity verification, or even potentially playing a role in Central Bank Digital Currency (CBDC) interoperability projects (though this is highly speculative).

7. Supply Dynamics: While all XRP is pre-mined, Ripple releases a portion from escrow monthly. The rate of release versus the rate of adoption and potential token burns (transaction fees are burned) could influence supply-demand dynamics over the long term.

Factors Hindering Growth by 2030 (The Bear Case & Challenges)

Despite the potential, significant hurdles remain:

1. Lingering Regulatory Uncertainty: The SEC case isn't fully resolved. Appeals are possible, and the ruling on institutional sales still classifies those as securities transactions. Furthermore, regulatory landscapes can change, and crackdowns in other jurisdictions remain a risk. A negative outcome on appeal or unfavorable new regulations could severely dampen sentiment and adoption.

2. Intense Competition: The cross-border payments space is fiercely competitive. SWIFT isn't standing still (SWIFT GPI), stablecoins (like USDC, USDT) offer price stability for transfers, blockchain competitors like Stellar (XLM) target similar markets, and domestic instant payment systems (like FedNow in the US) are emerging. Ripple/XRP needs to demonstrably outperform these alternatives to gain significant market share. The potential rise of CBDCs could also either integrate with solutions like Ripple's or become direct competitors.

3. Slow Institutional Adoption: Banks and large financial institutions are notoriously conservative and slow to adopt new technologies, especially those involving volatile crypto assets and regulatory grey areas. Overcoming inertia, integrating new systems, and satisfying compliance requirements are major undertakings. Proving the value proposition decisively is critical.

4. Market Sentiment and Perception: The SEC lawsuit damaged XRP's reputation in some circles. Debates about its perceived "centralization" due to Ripple's large holdings persist. Overcoming negative sentiment and rebuilding trust, particularly in markets like the US, takes time.

5. Scalability and Technical Hurdles: While the XRPL is designed for high throughput, future demands of global-scale adoption could test its limits. Continuous development and upgrades are necessary to ensure it remains efficient and secure.

6. Macroeconomic Factors: Broader economic conditions significantly impact risk assets like cryptocurrencies. Recessions, high interest rates, or geopolitical instability could lead investors to safer havens, suppressing crypto prices, including XRP.

7. Dependence on Ripple's Success: While the XRPL is decentralized, XRP's price and utility narrative are heavily tied to Ripple's success in marketing and implementing its enterprise solutions. Any setbacks for Ripple could negatively impact XRP.

Analyzing the Whale Movement: $68.7 Million Coinbase Deposit

The recent deposit of nearly $69 million worth of XRP to Coinbase by a whale is noteworthy. Such large movements often trigger speculation:

• Profit-Taking ("Cashing In"): The most common interpretation, especially if it follows a price increase, is that the whale is moving XRP to an exchange to sell and realize profits. This could indicate a belief that the price has peaked locally or that they wish to de-risk.

• Repositioning/Diversification: The whale might be selling XRP to buy other assets (crypto or traditional) or to move into stablecoins.

• Providing Liquidity: Large holders sometimes move assets to exchanges to provide liquidity for trading pairs or participate in market-making activities.

• Custody/Security: Less likely for such a large amount to a hot wallet, but could be part of a change in custody arrangements.

• OTC Deals: The exchange deposit might be one leg of a larger Over-The-Counter (OTC) transaction.

• Unrelated Activity: It could simply be portfolio management unrelated to immediate market timing intentions.

Does it mean they are "cashing in on a price surge"? Possibly, but it's impossible to know the whale's true intent without more information. Whale movements can provide clues, but they are often opaque and shouldn't be the sole basis for investment decisions. A single large deposit, while significant, doesn't necessarily signal a market top or a mass exodus. It could simply be one large entity's specific financial maneuver. However, consistent, large inflows to exchanges from multiple whales could be interpreted more bearishly as increased selling pressure. Conversely, large outflows from exchanges can suggest accumulation and holding.

XRP Price Predictions for 2030: Scenarios and Possibilities

Predicting crypto prices nearly a decade out is inherently speculative. Numerous unforeseen events – technological breakthroughs, regulatory shifts, black swan events – can drastically alter trajectories. However, we can outline potential scenarios based on the factors discussed:

• Scenario 1: Bearish/Stagnant ($0.50 - $2.00)

o Conditions: Lingering regulatory battles or unfavorable rulings, slow adoption of Ripple Payments, strong competition from stablecoins and improved traditional systems, overall stagnant or bearish crypto market, failure of XRPL ecosystem to gain traction beyond payments.

o Outcome: XRP struggles to gain momentum, potentially trading sideways or slightly above current levels, failing to recapture previous highs sustainably. Utility demand remains limited.

• Scenario 2: Moderate/Base Case ($2.00 - $10.00)

o Conditions: Definitive positive regulatory clarity in key markets, steady and growing adoption of Ripple Payments by numerous small-to-medium sized institutions, successful XRPL upgrades enhancing utility, moderate overall crypto market growth, successful expansion into specific remittance corridors.

o Outcome: Increased utility drives demand. XRP breaks past previous resistance levels, establishing new highs. It becomes a recognized player in specific niches of cross-border payments but doesn't achieve ubiquitous adoption. Prices in the single-digit dollars become sustainable. Many mainstream analysts might place their base-case predictions within this range, perhaps clustering around $3-$7, contingent on significant adoption milestones being met.

• Scenario 3: Bullish/Optimistic ($10.00 - $50.00+)

o Conditions: Widespread global regulatory acceptance and clear frameworks, massive adoption of Ripple Payments by major banks and financial institutions globally, XRP becoming a standard tool for international settlement, significant transaction volume flowing through the XRPL daily, thriving ecosystem on XRPL (DeFi, NFTs, tokenization), major sustained crypto bull market, potential integration with CBDC infrastructure.

o Outcome: Utility demand explodes. Network effects take hold. XRP captures a significant share of the multi-trillion dollar cross-border payments market. Its price decouples somewhat from pure market speculation and reflects its fundamental utility value. Reaching double-digit dollar figures becomes plausible. More extreme predictions ($50+, sometimes even $100+) fall into this category, requiring near-perfect execution by Ripple, extremely favorable global conditions, and potentially unforeseen catalysts. These higher targets often rely on capturing a substantial percentage of global payment flows.

Important Caveats on Predictions:

• High Uncertainty: These are illustrative scenarios, not guarantees. The crypto market is notoriously unpredictable.

• Analyst Predictions Vary Wildly: You will find predictions across the entire spectrum, from near zero to hundreds of dollars. Treat specific price targets from analysts or prediction websites with extreme skepticism – they often rely on flawed models or are designed to generate clicks.

• Focus on Fundamentals: Long-term value will likely be driven by utility and adoption, not just hype. Track Ripple's progress in signing and activating clients for Ripple Payments, monitor regulatory developments, and watch the growth of the XRPL ecosystem.

Risks and Considerations for Investors

Investing in XRP, like any cryptocurrency, carries significant risks:

• Volatility: Prices can swing dramatically in short periods.

• Regulatory Risk: Future regulations remain a major unknown.

• Market Risk: Overall crypto market downturns will likely impact XRP.

• Competition Risk: Failure to out-innovate or outperform competitors could limit growth.

• Execution Risk: Ripple's ability to execute its business plan is crucial but not guaranteed.

Potential investors must conduct thorough due diligence (DYOR - Do Your Own Research), understand the technology and risks involved, invest only what they can afford to lose, and consider diversification.

Conclusion: A Future Dependent on Utility and Adoption

So, how high can XRP get by 2030? The honest answer is: nobody knows for sure. The potential for significant price appreciation exists, perhaps reaching into the $2-$10 range or even higher under optimal conditions. This potential is fundamentally tethered to the successful adoption of Ripple's solutions and the corresponding increase in XRP's utility as a bridge asset for cross-border payments. Achieving widespread regulatory clarity is a non-negotiable prerequisite for substantial institutional uptake.

The journey to 2030 will be shaped by Ripple's execution, the evolution of the XRP Ledger, the actions of competitors, the decisions of regulators worldwide, and the unpredictable currents of the global financial markets. While whale movements like the recent $68.7 million deposit offer intriguing snapshots, they are just one piece of a much larger, more complex puzzle. For XRP to reach lofty price targets, it needs to transition from a speculative asset fueled by hype and legal news to a fundamental tool integrated into the plumbing of international finance. The next few years will be critical in determining whether XRP can bridge the gap between its ambitious vision and tangible, global-scale reality.

XRP | Second Wind or PUMP AND DUMP !!XRP is on another bullish leg at the current moment, moving strongly towards the next resistance zone.

I would however trade with much caution, considering the extreme pump and dump nature of the coin. With high gains in short timeframes, but also massive losses in sort timeframes.

A sharp wick towards the 50d moving averages already shows the buying pressure has likely peaked, even if the price can push higher the BINANCE:XRPUSDT test of the 50d MA is an early sign that bullish pressure is on its last leg:

I will say this: short term, if you look at the chart, you simply must be bullish. But I still won't touch XRP with a ten foot pole at this price. Other altcoins such as TIA present much better, lower risk entries.

_____________________

BINANCE:XRPUSDT

Buying XRP Ripple long XRPUSDt Bias Trade! The Breakdown inside!Again we have a 🟢SeekingPips🟢 plan where ⏳️ TIME was the MAIN factor in the SUCCESSFUL OUTCOME of our TRADE PLAN.🚀

If you've been following 🟢SeekingPips🟢 for sometime already you will know that we ALWAYS FAVOUR 🕝TIME🕖 OVER PRICE.

🔥I would even go as far and say that PRICE comes a DISTANT 3rd place when compared to TIME & VOLUME.🤔

BUT WHY❓️

That is a Vvveeerrryyyy LONG STORY that will require it's very own very long CHAPTER when 🟢SeekingPips🟢 Finally gets around to the eagerly awaited super blog so stay tuned....

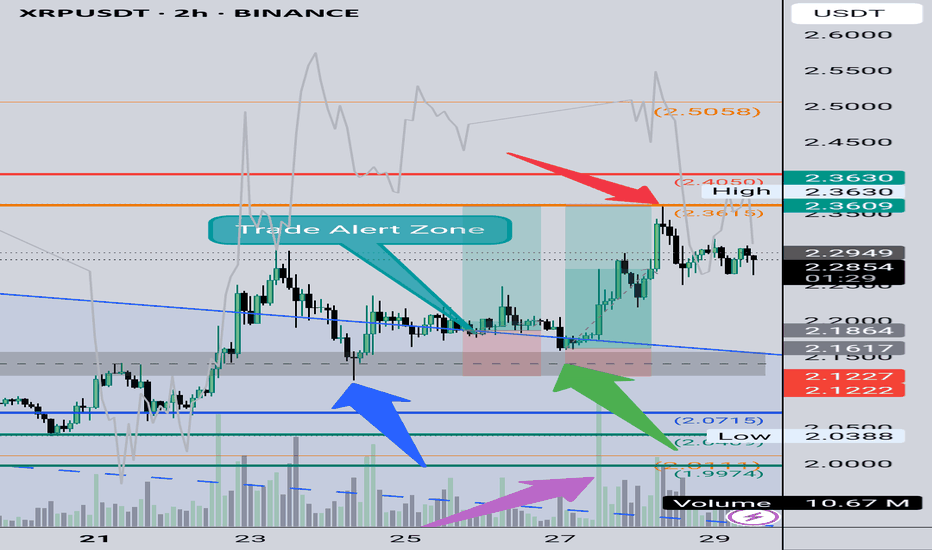

Having seen that the GREY ZONE identified as 🟢 SeekingPips 🟢 Bull & Bear Bias level worked very well, you can also see that the first level of resistance identified came in at the orange level at 2.3615 whilst the printed high up until now came in at 2.3630 (Accuracy👌)

48hrs was also our minimum time window for the grey zone to present some kind of trade opportunity which it did perfectly. ( It's MATH not MAGIC honestly😉)

Note the 🔵 BLUE ARROW LOW 🔵 significant swing point created before 🌍SeekingPips trade analysis signal and just below our GREY BIAS ZONE remained unvisited👌.

Wether or not you entered a bullish trade at MARKET PRICE at time of post ( I always suggest you use your own entry signal ) OR waited for a LIQUIDITY SWEEP at those local lows for the BUYERS to easily pair with at the 🟢GREEN ARROW🟢 you would have enjoyed anything from a 3.2 - 5.2 REWARD TO RISK TRADE by the time our FIRST HIGHLIGHTED zone of RESISTANCE was hit which came into play at the

2.3615 level 🔴RED ARROW🔴.

The 🟣PURPLE/MAGENTA🟣 arrow added CONFLUENCE to the BULLISH BIAS TOO .

🚥Stay tunned for MORE TRADE ANALYSIS as the week progresses.🚥

Crypto XRPUSD Bear Bull Zone! What is Ripple Xrp next Big move? 🌎 Crypto XRPUSD Bear Bull Zone! What is Ripple Xrp next Big move?

🟢SeekingPips🟢 Says...

"when levels are as clean as this we can always use one of our intermediate TIMEFRAMES".

In todays case that task falls onto the 📉 120 MINUTE CHART📈

The GREY ZONE is our BIAS going forward for at least the next 48 HOURS.

Therefore 🟢 SeekingPips 🟢 is strictly BULLISH ABOVE & BEARISH BELOW the GREY ZONE.

🚥 SIMPLICITY is a KEY ingredient to having LONGEVITY in the FINANCIAL MARKETS 🚥