XRPUSDT

XRP’s Path to Dominance: A Forecasted Price Per TokenAs of March 30, 2025, XRP, the cryptocurrency powering the XRP Ledger (XRPL) and Ripple’s On-Demand Liquidity (ODL) solution, is poised for a potential surge in adoption and value. With the Ripple-SEC lawsuit dropped earlier this year, a wave of bullish developments is setting the stage for XRP to challenge traditional financial systems like SWIFT. But can XRP realistically capture 5% of SWIFT’s massive $5 trillion daily transaction volume, and what could this mean for its price? Let’s dive into the factors driving XRP’s growth, including institutional adoption, tokenization, ETFs, futures trading, private ledgers, investor sentiment, and emerging trends like Central Bank Digital Currencies (CBDCs) and FedNow transactions.

The Dropped Ripple-SEC Lawsuit: A Game-Changer

The Ripple-SEC lawsuit, which had cast a shadow over XRP since 2020, has been dismissed, removing a significant regulatory hurdle. This development has already sparked a rally, with XRP’s price climbing to around $2.50 from earlier lows, driven by renewed investor confidence. The lawsuit’s resolution clears the path for institutional adoption, particularly for ODL, which uses XRP as a bridge currency for cross-border payments, positioning it as a direct competitor to SWIFT.

XRP’s 5% SWIFT Ambition: Institutional Adoption Soars

SWIFT processes approximately $5 trillion in daily transactions, and capturing 5% of that—$250 billion/day—would be a monumental achievement for XRP. Recent developments suggest this goal is within reach. Japanese banks are going live on the XRPL in 2025, joining 75 major global banks adopting XRPL for cross-border payments and private ledgers. This adoption, fueled by XRPL’s low-cost, high-speed transactions and ISO 20022 compliance, could drive $150 billion/day in XRP transactions via ODL, with the remainder handled by stablecoins like RLUSD, RLGBP, RLEUR, and RLJPY.

Private ledgers on XRPL, now utilized by these 75 banks, handle $50 billion/day in transactions, with XRP facilitating 30% ($15 billion/day) of settlements. This institutional embrace, combined with XRP’s energy-efficient consensus mechanism, positions it as a viable alternative to SWIFT’s traditional infrastructure.

Tokenization Projects Boost XRPL’s Utility

Tokenization is another key driver for XRP’s growth. Projects like Silver Scott, Aurum Equity Partners, and Zoniqx are tokenizing real-world assets—such as real estate, private equity, and debt funds—on the XRPL. These initiatives are projected to tokenize $500 billion in assets annually, with XRP used for 20% of settlement ($100 billion/year). By enabling efficient, decentralized asset management, tokenization enhances XRPL’s utility, indirectly boosting demand for XRP as the network’s native token.

XRP ETFs, Futures Trading, and Investor Sentiment

Later in 2025, the SEC is expected to approve 10+ XRP exchange-traded funds (ETFs), following the precedent set by Bitcoin and Ethereum. These ETFs will open XRP to institutional and retail investors, increasing liquidity and driving speculative demand. Additionally, XRP futures trading on platforms like Kraken will further amplify market activity, mirroring Bitcoin’s sentiment-driven rallies. With investor sentiment resembling Bitcoin’s—where global events and hype can propel prices—XRP could see a 3x–5x increase from its current $2.50, potentially reaching $7.50–$12.50 in the short term.

Central Bank Digital Currencies (CBDCs) and FedNow

The rise of CBDCs adds another layer to XRP’s potential. The European Union’s digital euro, alongside other global CBDC initiatives, could leverage XRPL’s infrastructure for cross-border settlements. Ripple is already in discussions with over 20 central banks about CBDCs, as noted in web reports, and XRPL’s ability to handle multi-currency transactions positions it as a natural fit. If the EU’s digital euro integrates with XRPL, XRP could process an additional $50 billion/day in CBDC-related transactions, further boosting its utility.

Similarly, the U.S. Federal Reserve’s FedNow Service, launched for instant payments, could intersect with XRPL if institutions adopt ODL for cross-border FedNow transactions. While FedNow focuses on domestic U.S. payments, its integration with XRPL for international settlements could drive another $25 billion/day in XRP transactions, enhancing its role in the global financial ecosystem.

Private Ledgers: Tailored Solutions for Institutions

XRPL’s support for private ledgers allows banks to customize solutions for privacy and efficiency. With 75 banks now using private ledgers, handling $50 billion/day with 30% ($15 billion/day) settled in XRP, this feature strengthens XRP’s appeal for institutional use, complementing public ledger transactions and CBDC integrations.

Forecasting XRP’s Price: A Realistic Outlook

Given these developments, what’s a realistic price forecast for XRP if it captures 5% of SWIFT’s volume ($250 billion/day), plus additional volume from CBDCs, FedNow, tokenization, ETFs, futures, and private ledgers? Let’s model it conservatively:

Daily Transaction Value: $150 billion (ODL) + $15 billion (private ledgers) + $50 billion (CBDCs) + $25 billion (FedNow) = $240 billion/day.

Annual Value: $240 billion * 365 = $87.6 trillion/year.

Tokenization Contribution: $100 billion/year.

Total Annual Value: $87.7 trillion/year.

Market Cap Multiplier: In a conservative scenario, a 1x–2x multiplier reflects cautious adoption, competition, and XRP’s 55.5 billion supply:

At 1x: Market cap = $87.7 trillion, price = ~$1,580.

At 2x: Market cap = $175.4 trillion, price = ~$3,161.

Adjusted for Realism: A $175.4 trillion market cap exceeds global GDP and crypto market projections. Adjusting to 0.5x (conservative, reflecting competition and supply limits): $43.85 trillion, price = ~$790.

Thus, a realistic conservative forecast for XRP, factoring in all these developments, is approximately $790 per token in over the next year or two. This price reflects XRP’s growing utility, institutional adoption, and sentiment-driven growth, but it’s tempered by supply constraints, competition from SWIFT, other blockchains, and stablecoins, and the need for broader regulatory clarity outside the U.S.

Conclusion

XRP’s potential to capture 5% of SWIFT’s volume, combined with Japanese banks on XRPL, tokenization projects, ETF and futures approvals, private ledgers, CBDCs like the EU’s digital euro, and FedNow integrations, positions it for significant growth. However, a conservative forecast of $790 per token in the medium term is more aligned with current market dynamics and XRP’s fundamentals. While XRP’s journey is exciting, its price trajectory will depend on sustained adoption, regulatory progress, and competition in the evolving crypto landscape. Stay tuned as XRP continues to reshape global finance!

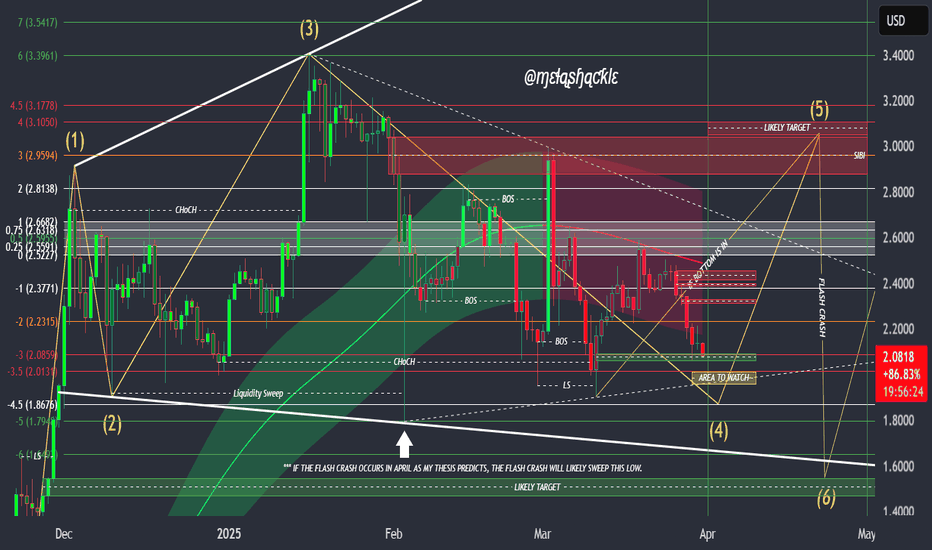

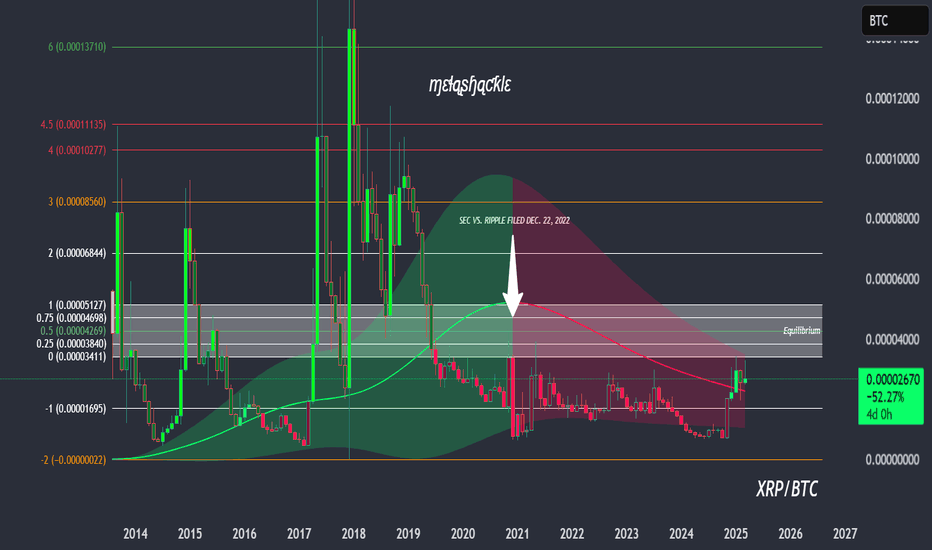

XRP in BIG TROUBLE | BearishXRP is known as the "PUMP and DUMP" alt for a reason.

If you look at this chart from the macro timeframe, it clearly shows how XRP dumps hard after every parabolic increase - and this isn't even the entire price history..

The lower highs and lower lows we currently observe are not helping its case, either.

Pulling up the technical indicator in the weekly timeframe and we see a clear SELL - indicating that the price/trend has turned bearish.

And from what we know of XRP - it's likely that the price will drop ALL the way back to the lows, aka the beginning of the parabolic rally - possibly even further down.

______________________

BINANCE:XRPUSDT

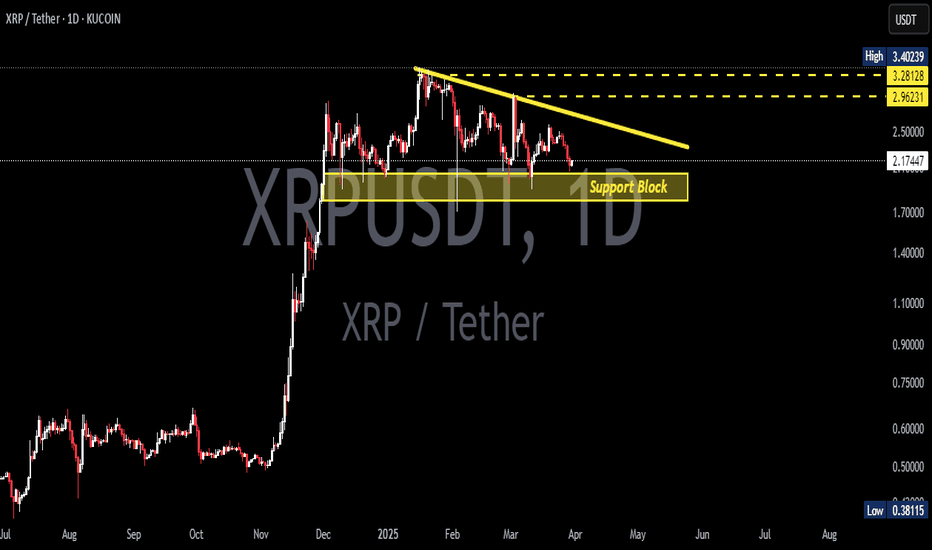

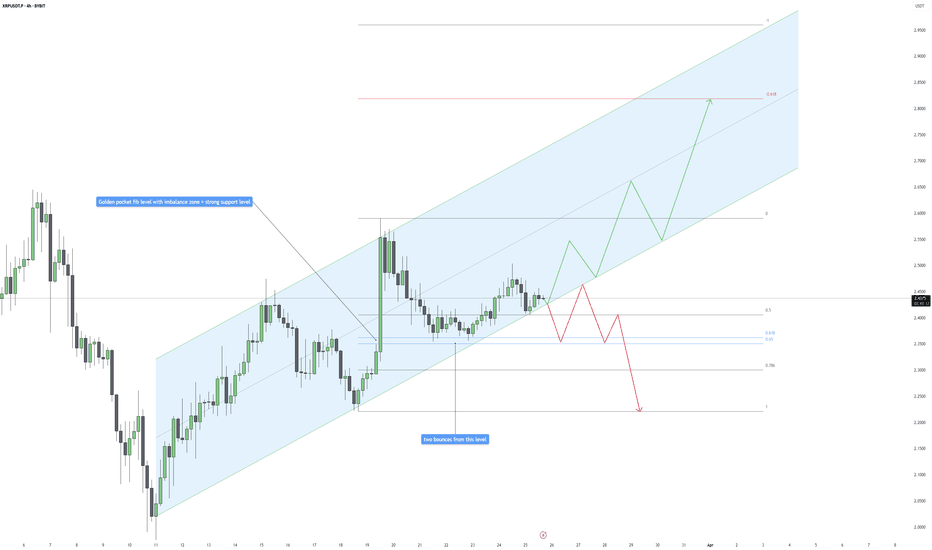

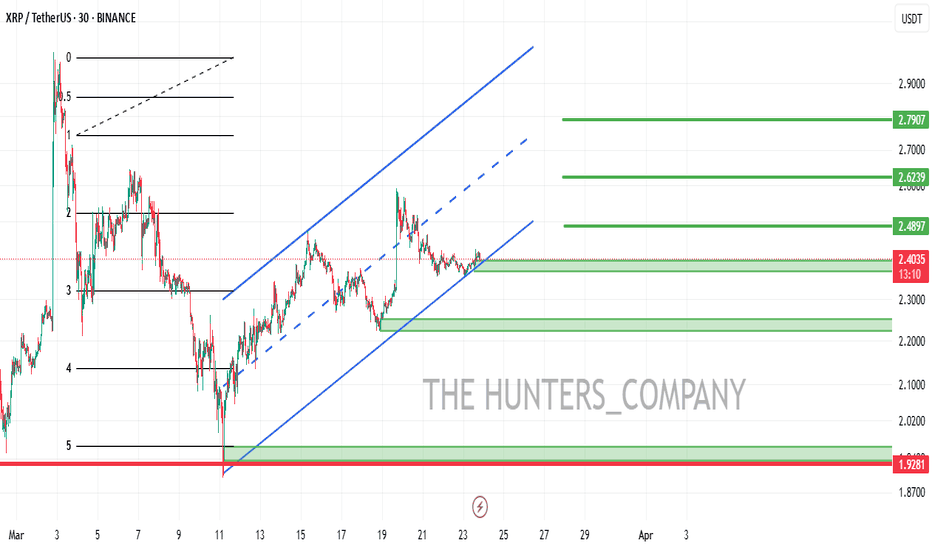

XRP - Ascending Channel: Will bulls stay in control?XRP continues to trade within a well-established ascending channel on the 4-hour timeframe, maintaining a bullish structure as long as it respects this formation. The price has consistently formed higher highs and higher lows, signaling that buyers are still in control. However, recent price action suggests that XRP is at a critical decision point, with strong support below and short-term resistance above.

4H Timeframe – Golden Pocket and Imbalance Providing Strong Support

One of the key areas to watch is the golden pocket Fibonacci retracement level (0.618 - 0.65), which aligns with a 4-hour imbalance zone. This confluence has already provided two strong bounces, confirming that buyers are actively defending this area.

The golden pocket is a key retracement zone where price often finds strong support before continuing the trend. Additionally, the imbalance zone represents an area of unfilled liquidity, which price often revisits before resuming its move. The fact that XRP has reacted twice from this level suggests that it remains a critical demand zone.

As long as price remains above this level, the bullish structure is intact, and XRP could continue pushing higher within the ascending channel. The next target for bulls would be the 0.618 Fibonacci extension level, which aligns with the upper boundary of the channel.

However, if this support fails and XRP breaks below the golden pocket and imbalance zone, the structure could shift bearish, leading to a potential breakdown toward lower support levels.

1H Timeframe – Bearish Rejection from Imbalance Zone

While the 4-hour structure remains bullish, the 1-hour timeframe presents a short-term bearish case. Recently, XRP was rejected from a significant imbalance zone, suggesting that sellers are stepping in. This rejection indicates a potential short-term pullback before the next major move.

When price fails to break through an imbalance zone, it often signals that there isn’t enough liquidity to sustain the uptrend. This could lead to a retracement back to lower levels, possibly retesting the golden pocket on the 4H timeframe before another push higher.

Key Levels to Watch

Support Zone: Golden pocket (0.618 - 0.65) + 4H imbalance

Resistance Zone: 1H imbalance rejection area

Bullish Target: 0.618 Fibonacci extension, aligning with the upper boundary of the channel

Bearish Breakdown Level: A break below the golden pocket and imbalance could trigger a deeper retracement

Final Thoughts – Bullish Structure, but Short-Term Weakness

The 4H ascending channel remains intact, and the golden pocket support has held twice, indicating that the uptrend is still in play. However, the 1H bearish rejection from an imbalance zone suggests that XRP could face short-term weakness, leading to a possible retest of support before the next major move.

If XRP holds the golden pocket, the bullish bias remains strong, and we could see a continuation towards 2.80 – 2.90 in the coming sessions. However, if support fails, the structure could shift bearish, bringing lower retracement levels into play.

This setup presents both bullish and bearish scenarios, making it crucial to monitor key levels and wait for confirmation before making a trading decision.

__________________________________________

Thanks for your support!

If you found this idea helpful or learned something new, drop a like 👍 and leave a comment, I’d love to hear your thoughts! 🚀

Make sure to follow me for more price action insights, free indicators, and trading strategies. Let’s grow and trade smarter together! 📈

Ripple Partners with Chipper Cash To Boost Cross-Border PaymentsRipple partners with Chipper Cash to expand cross-border payments in Africa, leveraging blockchain for faster, affordable transactions.

Ripple has announced a strategic collaboration with Chipper Cash to expand its payment solutions to Africa after securing a win against the US SEC earlier this week. Through Ripple Payments, the collaboration intends to foster cross border payments in the African regions.

Notably, the crypto platform’s alliance with Chipper Cash provides a fast, low-cost, and efficient payment system that unites international treaties.

Despite the partnership and important victory over the SEC, Ripples native coin ( CRYPTOCAP:XRP ) seems unbothered by the development with the asset maintaining the $2.3 price pivot. A break above the 38.2% Fibonacci retracement point might cement a bullish breakout for CRYPTOCAP:XRP with eyes set on $5 and beyond.

Similarly, in the case of a cool-off, CRYPTOCAP:XRP might find support in the 65% Fibonacci retracement level before picking liquidity up albeit the RSI is at 48 which is a strong sign of a bullish reversal lurking around the corners.

XRP Price Live Data

The live XRP price today is $2.35 USD with a 24-hour trading volume of $2,950,161,398 USD. XRP is down 0.54% in the last 24 hours. The current CoinMarketCap ranking is #4, with a live market cap of $137,073,610,487 USD. It has a circulating supply of 58,205,697,378 XRP coins and a max. supply of 100,000,000,000 XRP coins.

XRP ANALYSIS🔮#XRP Analysis 💰💰

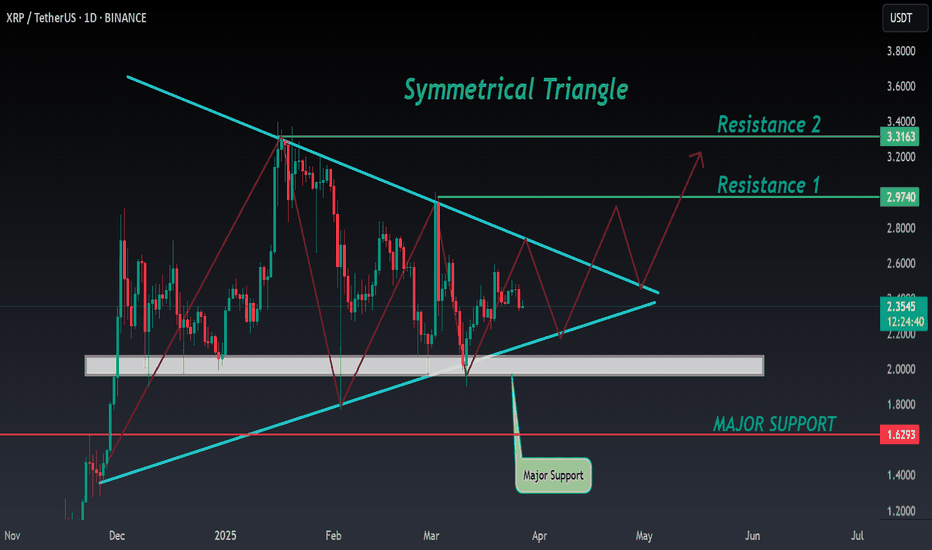

#XRP is trading in a symmetrical triangle in a weekly time frame and if it breakouts with high volume then we can see a bullish momentum in #XRP. Before that we will see little bit bearish movement towards its support zone and that a bullish movement.

🔖 Current Price: $2.3520

⏳ Target Price: $2.9740

⁉️ What to do?

- We can trade according to the chart and make some profits in #XRP. Keep your eyes on the chart, observe trading volume and stay accustom to market moves.💲💲

🏷Remember, the crypto market is dynamic in nature and changes rapidly, so always use stop loss and take proper knowledge before investments.

#XRP #Cryptocurrency #Pump #DYOR

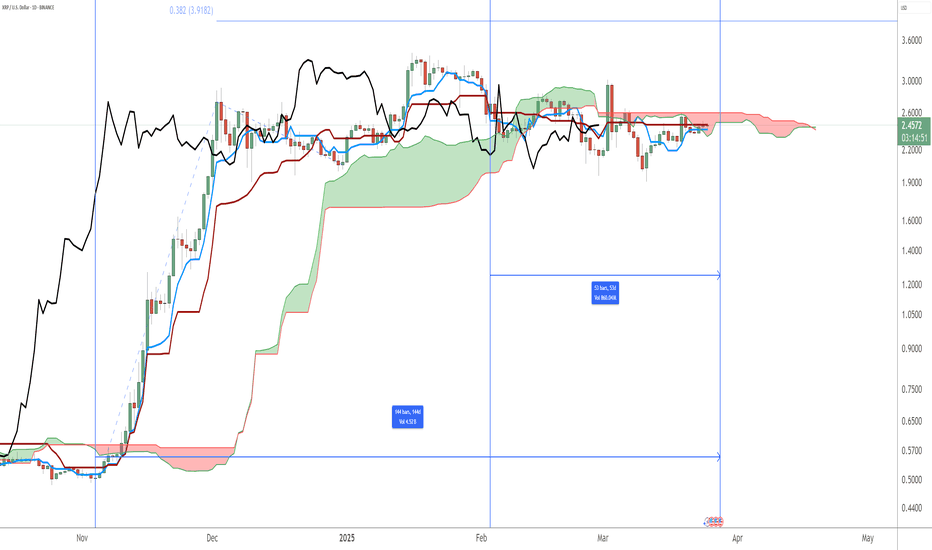

March 28 Is XRP's Big Day—Or At Least Better Be

Friday, March 28, 2025, marks exactly 144 days since XRP's breakout from November 4, 2024—right on cue with Gann’s "inner year" cycle, signaling a potential trend reversal (or at least a good excuse to tweet "I told you so").

Conveniently enough, March 28 is also exactly 52 days post the "flash crash" on February 3rd (if we're even calling that hiccup a crash).

The stars (or rather, candlesticks) align for Ichimoku’s Chikou Span to finally clear both the candlestick bodies and the Cloud, creating a bullish setup that even perma-bears might glance at sideways.

If XRP pulls off a daily close at or above $2.61 on March 28, expect Gann and Ichimoku fanboys to show up with wallets wide open and confidence suspiciously high.

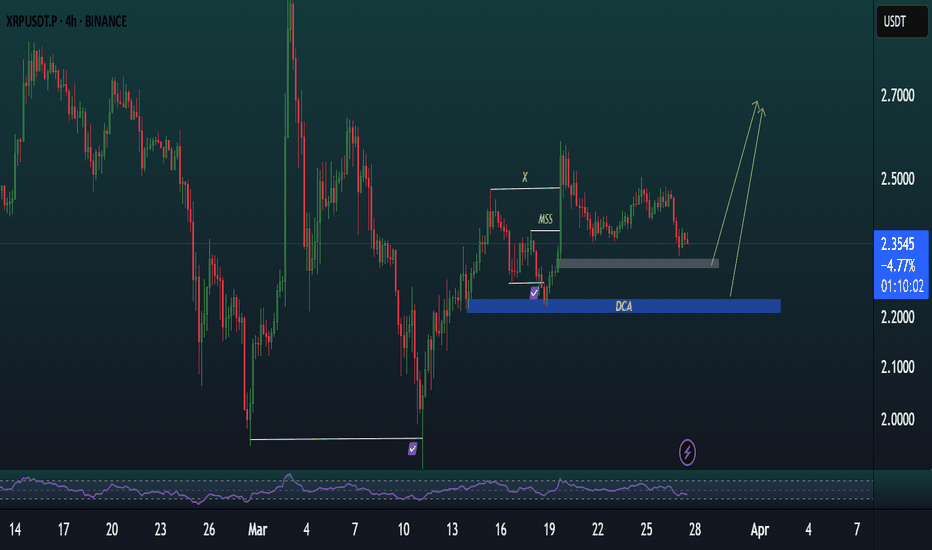

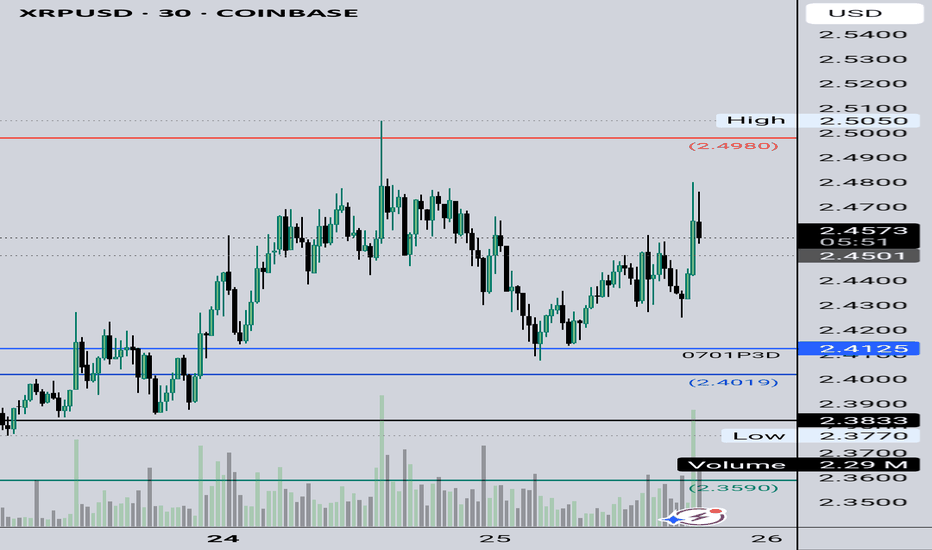

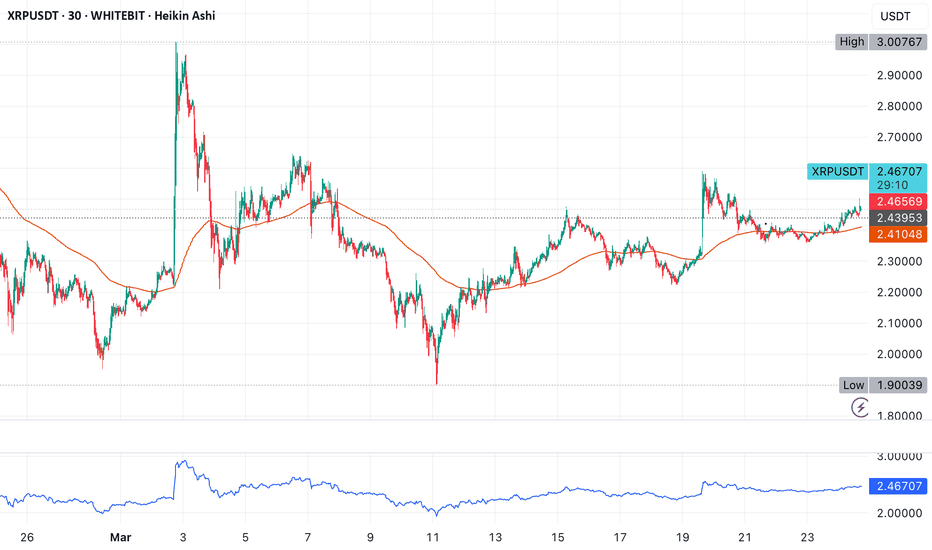

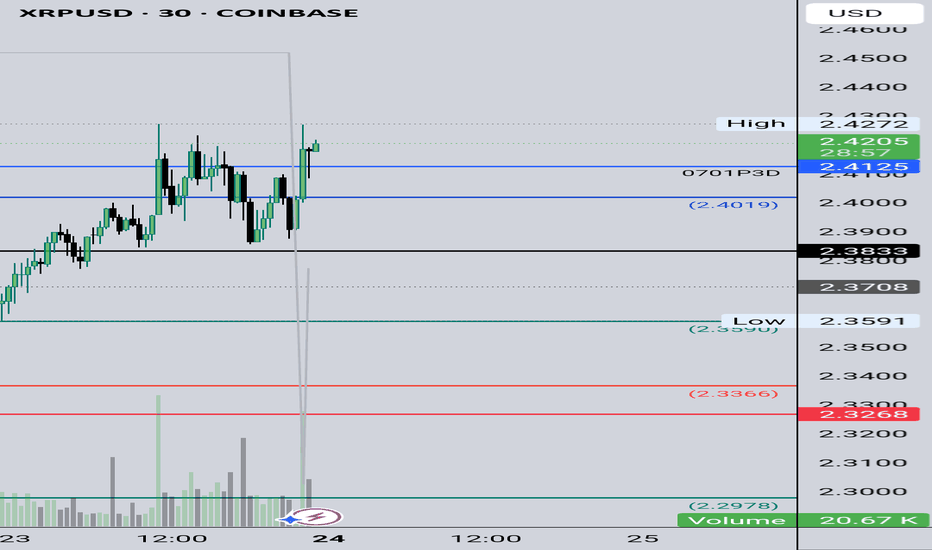

XRP Pounced on by the group! RIPPLE XrpUsd Ready to Go? Now if you NOTE exactly where PRICE was at the EXACT TIME that 🟢SeekingPips🟢 Shared the last XRP CHART.

You can see that was a PERFECT ALIGNMENT of both TIME & PRICE.👌

ℹ️ Many SHORT TERM & INTRADAY TRADERS paid themselves at 🟢SeekingPips🟢 pre defined 🔴RED🔴 level @ 2.4980 for a PAIN FREE TRADE with A GREAT REWARD TO RISK OUTCOME.

🌎 You can also NOTE TWO VERY IMPORTANT THINGS WITH THIS TRADE...

▪︎1) Our ORIGINAL Stop Loss has still been untouched even after the 100% retracement of our original ENTRY.

▪︎2) Now anyone who was not in the group or followed 🟢SeekingPips🟢 original chart share at the time of our entry and instead decided to jump in as price was already moving up would have made a poor choice.❗️

By waiting on the next 240m bar/candle to close you could have theoretically left a limit order at original entry area and would have been easily filled for a STRESS FREE trade so far.🚀🚀🚀

What's the lesson here❓️

Know what you want to see and do not act beforehand.

If you miss your FIRST entry have a PLAN for your SECOND ATTEMPT.

Note the word PLAN.

⚠️ As per 🟢SeekingPips🟢 BIO Without A PLAN it's NOT TRADING But GAMBLING.

🎲

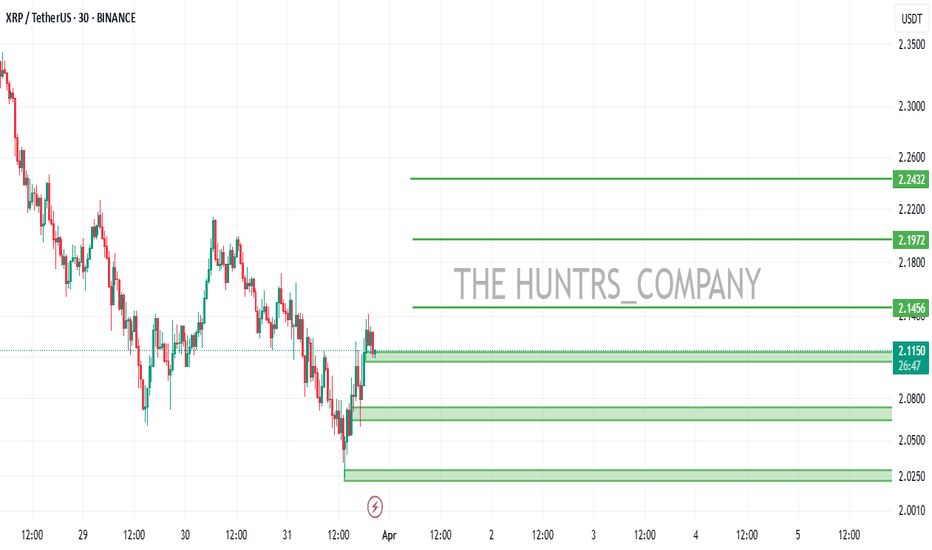

XRP/USDT:BUY LIMITHello friends

You can see that after the price fell in the specified support area, buyers came in and supported the price and created higher ceilings and floors.

Now we can buy at the specified levels with capital and risk management and move with it to the specified targets.

*Trade safely with us*

$XRP Eyes $10 as SEC Case ClosesAnalysts predict that XRP CRYPTOCAP:XRP could reach $10 by 2030 after the SEC officially dropped its lawsuit against Ripple. Ripple CEO Brad Garlinghouse confirmed that the regulator will not appeal the court’s decision, marking the end of the legal battle that began in 2020. As of March 24, 2025, XRP CRYPTOCAP:XRP trades at $2.46, up 2.17% in the past 24 hours, with a market cap of $143.29 billion.

Despite bullish prospects, challenges remain. Market volatility and competition from Ethereum and stablecoins could slow growth. Analysts at InvestingHaven believe XRP’s success depends on Ripple’s network expansion, though crypto market instability remains a key factor.

While a 306% rise to $10 by 2030 seems feasible, today’s market is less competitive than in 2017 when XRP CRYPTOCAP:XRP surged 64,000%. Investors are closely watching regulatory changes and macroeconomic conditions that could impact the coin’s future trajectory.

$XRP Adds $100 Billion to Its Market Cap in a YearShort-term charts depict XRP CRYPTOCAP:XRP as highly volatile and, at times, disappointing. Despite favorable external factors, the token has gained only 14.96% over the past year. However, the long-term outlook tells a different story—XRP is up 277.50% year-over-year and 385.54% since Donald Trump's pivotal re-election.

XRP’s market capitalization reflects this surge, skyrocketing by approximately $107.6 billion from $34.7 billion to $142.34 billion. The impact of Trump’s November victory is even more pronounced, with XRP’s market cap jumping $113.7 billion from 28$28.6 billion since November 5.

Most of these gains occurred before January 20, when the most crypto-friendly president in history took office, and SEC hardliner Gary Gensler stepped down—marking a turning point for regulatory sentiment toward digital assets.

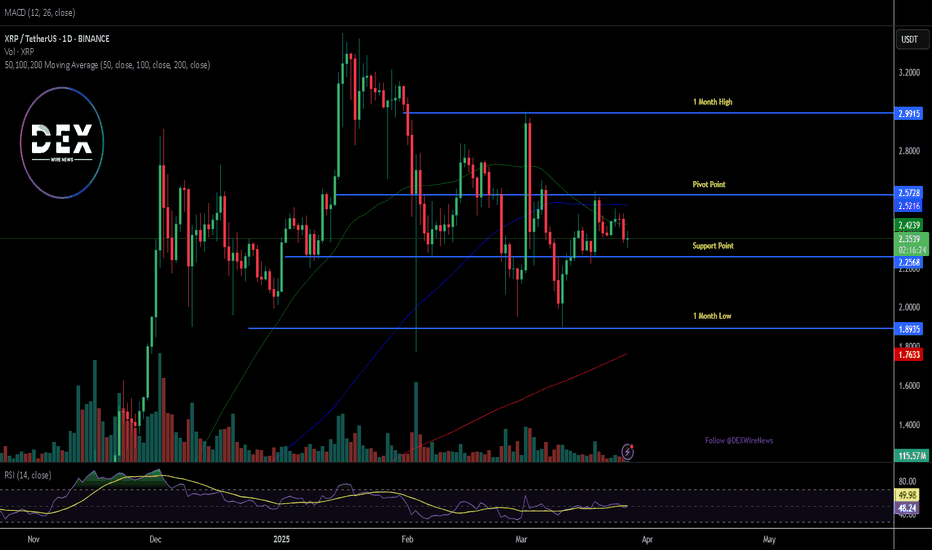

XRP/USDT📊 XRP/USDT Analysis – March 24, 2025 🚀

XRP is currently trading at $2.4585, showing a slight increase of +0.79%. The chart highlights a significant zone around the $2.50-$2.70 range, which could determine the next big move.

📈 Key Technical Levels:

🔹 Resistance: $2.70 - A breakout above this level could push XRP towards $2.90-$3.00.

🔹 Support: $2.30 - If XRP fails to hold, it may retest $2.20 or lower.

The price is approaching a major resistance zone, and the market will need strong volume to break higher. If rejected, a pullback toward the support zone is likely.

📊 Technical Outlook:

✅ Bullish Scenario: A break and close above $2.70 could trigger a rally toward $3.00 and beyond.

❌ Bearish Scenario: Failure to break resistance might lead to a drop back to the $2.30-$2.20 support area.

📢 Recent Fundamental Developments:

SEC Drops Case Against Ripple: The U.S. Securities and Exchange Commission (SEC) has withdrawn its lawsuit against Ripple Labs, ending a four-year legal battle. This decision has significantly boosted investor confidence in XRP.

Presidential Support for Crypto: President Donald Trump acknowledged XRP's potential inclusion in the U.S. government's crypto reserve and anticipates the approval of an XRP-tracking ETF this year. He emphasized his administration's commitment to positioning the U.S. as a leader in the crypto industry.

Analyst Predictions: Analysts are optimistic about XRP's future, with some forecasting a rise to double-digit values within the year. This bullish outlook is supported by increasing institutional interest and favorable regulatory developments.

Market Sentiment: The resolution of Ripple's legal issues and growing institutional adoption have improved market sentiment toward XRP, potentially attracting more investors.

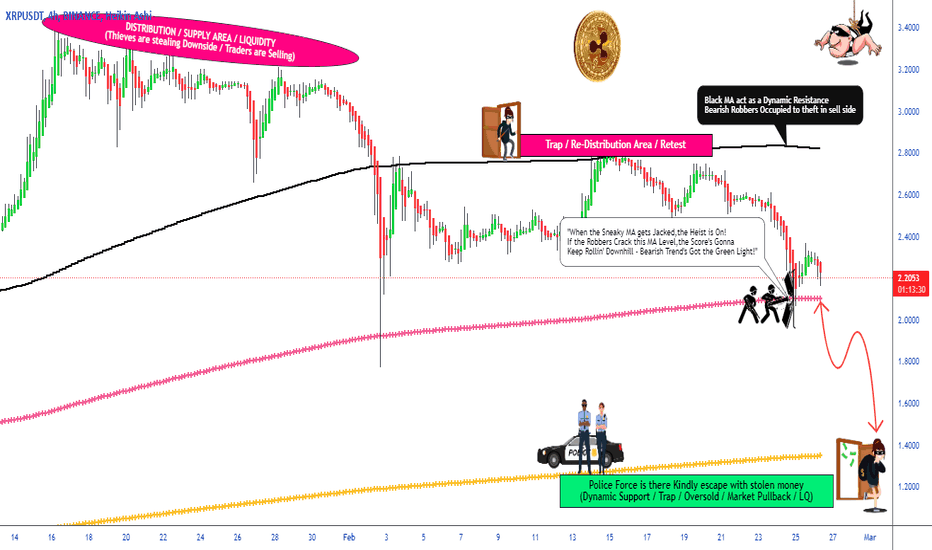

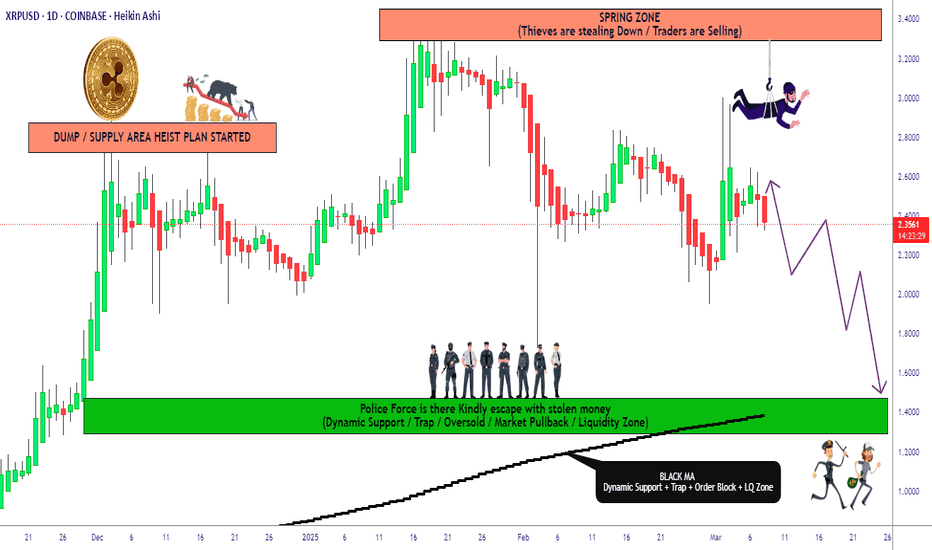

XRP/USDT "Ripple vs Tether" Crypto Market Heist Plan🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Thieves, 🤑 💰🐱👤🐱🏍

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the XRP/USDT "Ripple vs Tether" Crypto Market. Please adhere to the strategy I've outlined in the chart, which emphasizes short entry. Our aim is the high-risk Green Zone. Risky level, oversold market, consolidation, trend reversal, trap at the level where traders and bullish thieves are getting stronger. 🏆💸Book Profits Be wealthy and safe trade.💪🏆🎉

Entry 📈 : "The heist is on! Wait for the breakout (2.0500) then make your move - Bearish profits await!"

however I advise placing Sell Stop Orders below the breakout MA or Place Sell limit orders within a 15 or 30 minute timeframe. Entry from the most recent or closest low or high level should be in retest. I Highly recommended you to put alert in your chart.

Stop Loss 🛑: Thief SL placed at 2.4000 (swing Trade Basis) Using the 4H period, the recent / swing high or low level.

SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

Target 🎯: 1.4000 (or) Escape Before the Target

🧲Scalpers, take note 👀 : only scalp on the Short side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

📰🗞️Fundamental, Macro, COT, Sentimental, Positioning, Overall Outlook:

╰┈➤XRP/USDT "Ripple vs Tether" Crypto Market is currently experiencing a bearish trend,., driven by several key factors.

🌟⭐🌟Fundamental Analysis

Regulatory: Ripple’s SEC lawsuit remains unresolved; potential ETF approvals (e.g., Bitwise) could lift XRP, but legal risks persist—mixed impact.

Adoption: Ripple’s payment network grows (e.g., U.S. hiring up 75%, FXStreet), but XRP utility lags vs. stablecoins—mildly bullish.

Market Trends: Altcoin interest rises (XRP inflows $38.3M vs. BTC outflow $571M)—bullish.

Tech: XRP Ledger’s speed/low fees remain competitive—bullish.

Supply: 57.45B circulating, 100B total; Ripple’s escrow releases (e.g., 500M unlocked, FXStreet) add pressure—bearish.

🌟⭐🌟Macroeconomic Factors

U.S.: Fed rates at 3-3.5%, PCE 2.6%—USD strength caps XRP gains; weak PMI (50.4) may soften USD—neutral.

Global: China at 4.5%, Eurozone 1.2%, Japan 1%—slow growth boosts safe-havens, indirectly aiding XRP—mildly bullish.

Commodities: Oil at $70.44—stable, neutral for XRP.

Trump Policies: Tariffs (25% Mexico/Canada, 10% China) drive risk-off, potentially lifting XRP vs. USD—bullish.

🌟⭐🌟Commitments of Traders (COT) Data

Speculators: Net long ~40,000 contracts (down from 50,000 post-Jan peak), cooling but still bullish.

Hedgers: Net short ~45,000, steady as firms lock in highs—neutral.

Open Interest: ~90,000 contracts, rising—sustained U.S. interest—bullish.

🌟⭐🌟On-Chain Analysis

Volume: 24h trading volume ~$7.91B (TradingView)—declining buying pressure, bearish signal.

Active Addresses: ~81,000 (CoinRepublic)—stable engagement, neutral.

Dormant Supply: Spiked to 208M XRP ($467M, FXStreet) as long-term holders sell—bearish.

Exchange Supply: 41.75M XRP—high liquidity, potential sell-off risk—bearish.

🌟⭐🌟Market Sentiment Analysis

Retail: 60% short at 2.2000

contrarian upside risk—bullish potential.

Institutional: Mixed—bullish long-term (CoinCodex to $3.26 in 2027), cautious now—neutral.

Corporate: Ripple hedges at 2.50-2.80, neutral stance—stable.

🌟⭐🌟Positioning Analysis

Speculative: Longs target 3.00-3.40, shorts aim for 2.00-1.80

Retail: Shorts at 1.40-1.20—squeeze risk if price rebounds.

Institutional: Balanced, eyeing regulatory clarity.

Corporate: Hedging caps upside pressure.

🌟⭐🌟Overall Summary Outlook

XRP/USDT at 2.2000 shows mixed signals: bullish fundamentals (adoption, tariffs) clash with bearish on-chain (selling pressure) and sentiment (retail shorts, Social media bearishness). Short-term downside to 2.00 looms unless 2.20 holds, with medium-term upside to 2.90 possible if catalysts emerge.

📌Keep in mind that these factors can change rapidly, and it's essential to stay up-to-date with market developments and adjust your analysis accordingly.

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan will enable us to effortlessly make and steal money 💰💵 Tell your friends, Colleagues and family to follow, like, and share. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

XRP/USD "Ripple vs US Dollar" Crypto Market Heist Plan🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Robbers, 🤑💰✈️

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the XRP/USD "Ripple vs US Dollar" Crypto market. Please adhere to the strategy I've outlined in the chart, which emphasizes short entry. Our aim is the high-risk Green Zone. Risky level, oversold market, consolidation, trend reversal, trap at the level where traders and bullish robbers are stronger. 🏆💸Book Profits Be wealthy and safe trade.💪🏆🎉

Entry 📈 : "The vault is wide open! Swipe the Bearish loot at any price - the heist is on!

however I advise to Place buy limit orders within a 15 or 30 minute timeframe most recent or swing, low or high level. I Highly recommended you to put alert in your chart.

Stop Loss 🛑:

Thief SL placed at the recent / swing low level Using the 4H timeframe (2800) swing trade basis.

SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

Target 🎯: 1500 (or) Escape Before the Target

🧲Scalpers, take note 👀 : only scalp on the Short side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

📰🗞️Read Fundamental, Macro, COT Report, On Chain Analysis, Sentimental Outlook, Intermarket Analysis, Future Prediction:

XRP/USD "Ripple vs US Dollar" Crypto market is currently experiencing a Bearish Trend (Higher chance for Bullish in Future),., driven by several key factors.

1. Fundamental Analysis⚡⭐

Fundamental analysis assesses XRP’s intrinsic value by evaluating adoption, regulatory environment, technological developments, and market demand.

Adoption: XRP, developed by Ripple, is tailored for cross-border payments and liquidity management. By March 2025, expanded partnerships with financial institutions could enhance its utility, driving demand and supporting price growth.

Regulatory Environment: The SEC lawsuit against Ripple remains a pivotal factor. A favorable resolution by 2025 could eliminate uncertainty, boosting investor confidence and XRP’s price. Conversely, ongoing legal challenges might hinder growth.

Technological Developments: Improvements to the XRP Ledger, such as faster transaction speeds or new features, could reinforce its competitive advantage over other cryptocurrencies and traditional payment systems.

Market Demand: XRP’s ability to lower costs and accelerate international transfers increases its appeal. Growing global demand for efficient payment solutions could elevate its value.

Conclusion: The fundamental outlook is cautiously optimistic, with significant upside potential linked to regulatory clarity and increased adoption.

2. Macroeconomic Factors⚡⭐

Macroeconomic conditions shape investor risk appetite and influence cryptocurrency prices.

Global Economy: A stable or growing global economy in 2025 could encourage investment in risk assets like XRP. A recession, however, might trigger a shift to safer assets, pressuring XRP’s price downward.

Interest Rates: Low or declining rates could make XRP more appealing than yield-bearing assets. Rising rates might reduce its attractiveness.

Inflation: High inflation could position XRP as an inflation hedge, attracting investors. Deflationary trends might dampen demand for speculative assets.

Geopolitical Events: Stability in major markets (e.g., U.S., Asia) could foster bullish sentiment, while geopolitical tensions might heighten volatility.

Conclusion: Assuming a stable economy with low interest rates and moderate inflation in 2025, macroeconomic conditions could support XRP’s growth.

3. Commitments of Traders (COT) Data⚡⭐

COT data provides insights into market sentiment by showing the positions of large traders and institutions.

Large Traders (Non-Commercial): A net long position (e.g., a long-to-short ratio of 1.5:1) indicates bullish sentiment among institutional players, suggesting expectations of price appreciation.

Small Traders (Commercial): If retail traders are also predominantly long, this could amplify bullish momentum. A net short position might reflect caution or hedging strategies.

Conclusion: With large traders net long, COT data leans bullish, assuming retail sentiment aligns similarly.

4. On-Chain Analysis⚡⭐

On-chain metrics reveal network activity and user behavior, key indicators of XRP’s health and adoption.

Active Addresses: An increase in active addresses suggests growing usage and adoption, supporting price stability and potential growth.

Transaction Count: Higher transaction volumes indicate greater utility, possibly driven by real-world applications like remittances.

Validator Activity: Robust validator participation and network uptime signal a secure and reliable network.

Whale Activity: Accumulation by large holders (whales) reflects bullish intent, while distribution could indicate selling pressure.

Conclusion: Rising active addresses and transaction counts point to strong network activity, supporting a positive price outlook.

5. Intermarket Analysis⚡⭐

Intermarket analysis examines XRP’s correlations with other asset classes.

Stock Market: A positive correlation with tech-heavy indices like the NASDAQ suggests XRP could rise alongside tech sector strength.

US Dollar: A negative correlation with the US Dollar Index (DXY) implies that a weaker dollar might lift XRP prices.

Other Cryptocurrencies: XRP often tracks Bitcoin and Ethereum; a broader crypto bull run could propel XRP higher.

Conclusion: Favorable conditions—such as a robust tech sector and a weaker dollar—could align with bullish intermarket signals for XRP.

6. Market Sentiment Analysis⚡⭐

Sentiment analysis evaluates the mood across different investor groups.

Retail Investors: Positive sentiment on platforms like Twitter and Reddit (e.g., 70% bullish) reflects retail optimism, often fueling momentum.

Institutional Investors: Bullish sentiment, inferred from COT data, suggests confidence among sophisticated players.

Fear and Greed Index: A reading of 70 indicates greed, signaling strong bullishness but cautioning against potential overbought conditions.

Conclusion: Broadly positive sentiment, tempered by high greed levels, supports a bullish yet cautious perspective.

7. Next Trend Move and Future Trend Prediction⚡⭐

Projected price movements for XRP/USD are based on current trends and analysis:

Bullish Outlook:

Short-Term: $2.50–$2.60

Medium-Term: $3.00–$3.50

Long-Term: $4.00–$5.00

Key Drivers: Regulatory clarity, adoption growth, and supportive macro conditions.

Bearish Outlook:

Short-Term: $2.30–$2.20

Medium-Term: $2.00–$1.80

Long-Term: $1.50–$1.20

Key Risks: Regulatory setbacks, macroeconomic headwinds, or technological challenges.

Final Prediction: The analysis leans cautiously bullish, but bearish (short) scenarios remain credible if risks like regulatory uncertainty or economic shifts emerge. Investors should watch catalysts closely to determine XRP’s next move—upward or downward.

8. Overall Summary Outlook⚡⭐

The outlook for XRP/USD is cautiously bullish, supported by:

Strong Fundamentals: Adoption and technological utility provide a solid base.

Supportive Macro Conditions: Low rates and stable growth favor risk assets.

Bullish COT Data: Institutional optimism signals confidence.

Healthy On-Chain Metrics: Network activity reflects real demand.

Favorable Intermarket Signals: Correlations with tech and a weaker dollar are positive.

Positive Sentiment: Investor optimism drives momentum.

Risks: Regulatory uncertainty, macroeconomic shocks, or profit-taking could temper gains. On balance, the evidence favors growth.

📌Keep in mind that these factors can change rapidly, and it's essential to stay up-to-date with market developments and adjust your analysis accordingly.

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

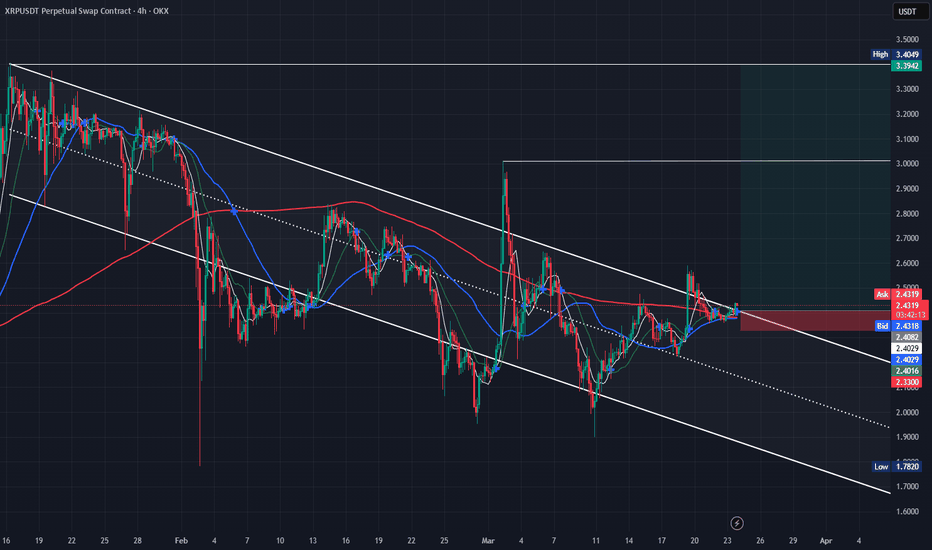

XRP Breakout Alert! Time for a 40% Move?OKX:XRPUSDT.P has been trading inside a parallel channel for 66 days since January 16, 2025. Now, the price is breaking out to the upside!

💡 The key strategy here is waiting for a retest if the price successfully flips the channel into support, it could be the perfect entry for a strong upward move.

📈 Potential upside? 40%+ if the breakout holds and momentum kicks in!

🔍 Watch for:

✅ Retest & confirmation of support

✅ RSI & momentum indicators aligning

✅ Heatmap support

✅ Gold cross of MA 200-D/50-D

Are you catching this move? Share your thoughts in the comments! 🚀🔥

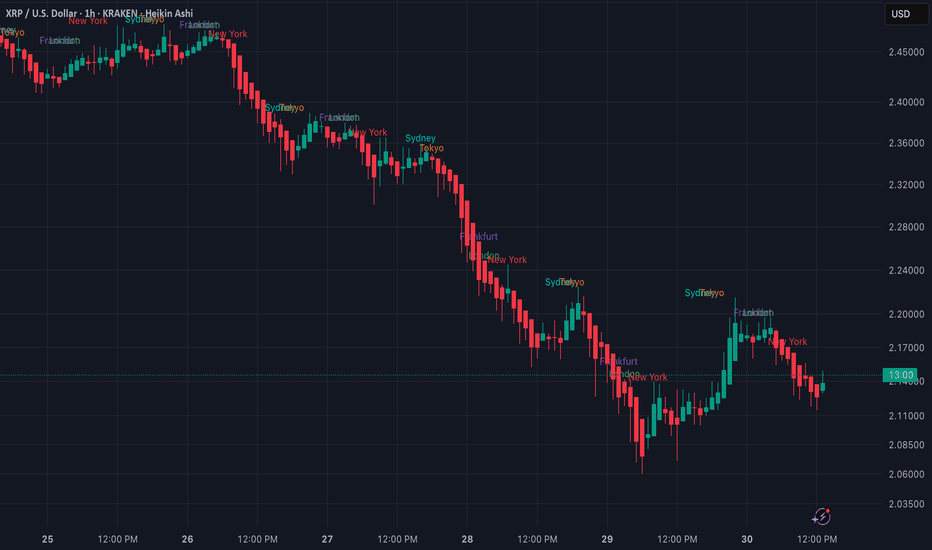

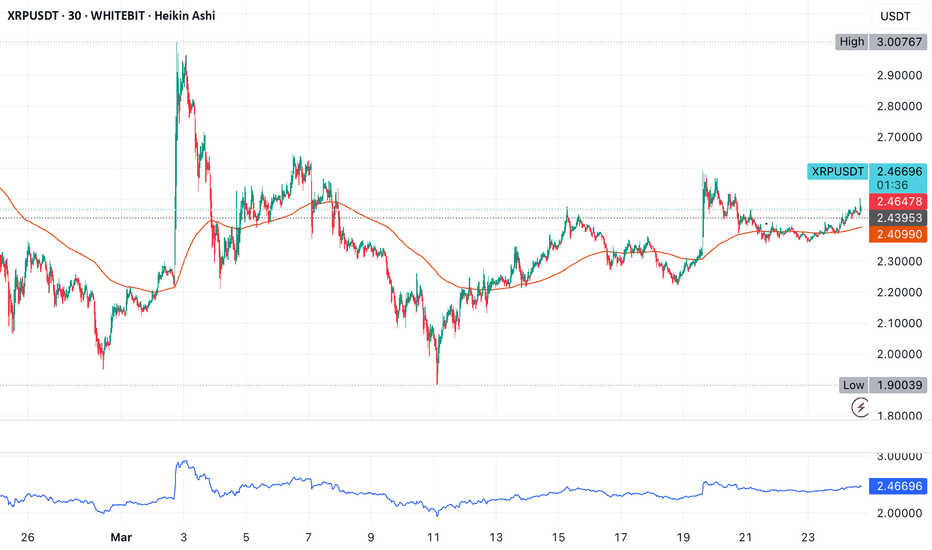

RIPPLE What Next? XRP To Make It's Next Move! XrpUsdT GO or NO? ⚠️ The next 240 minute bar could be key in decrypting what XRP is likely to do next.

ℹ️ The way is clear for it to begin building a BULLISH base from here however, the way 🟢SeekingPips🟢 sees it there still remains a fair amount of liquidity below current price in the form of stop orders and buyers stop losses.❗️

✅️ VOLUME viewed on the LOWER TIMEFRAMES may hold the clues from here.🚀

🟢SeekingPips🟢 pips has this on his RADAR and will be updating his thoughts on this CRYPTO regularly this week.📈

XRP Jumps 7% After Surge in Network Activity & Whale BuyingXRP, the digital asset associated with Ripple Labs, has recently experienced a notable price surge, climbing approximately 7% amidst a flurry of on-chain activity and substantial whale accumulation.1 This resurgence has reignited discussions within the crypto community regarding XRP's potential for further growth, particularly in light of a significant uptick in active addresses and evolving regulatory landscapes.

The recent price movement follows a period of relatively stagnant performance, prompting analysts to scrutinize the underlying factors driving the renewed interest in XRP. A key catalyst appears to be the dramatic increase in network activity, with active addresses reaching their highest level since April 2023.2 This surge in transactional volume suggests a heightened level of engagement and utility within the XRP ecosystem, potentially indicating growing adoption and demand.

Furthermore, reports of significant whale accumulation have fueled speculation that large-scale investors are positioning themselves for a potential price rally. These whales, often possessing substantial market influence, are known for their ability to trigger price movements through strategic buying and selling activities.3 Their recent accumulation of XRP suggests a strong conviction in the asset's future prospects.4

The combination of increased network activity and whale buying has created a bullish sentiment among many XRP holders. However, the question remains: will this surge in activity translate into sustained price appreciation? While the current momentum appears promising, several factors could influence XRP's trajectory in the coming weeks and months.

One of the most significant factors influencing XRP's price is the ongoing regulatory landscape, particularly concerning the Securities and Exchange Commission (SEC) lawsuit against Ripple Labs.5 While a partial victory was achieved in the summer of 2023, the SEC's case is not fully resolved. The ongoing legal battle has cast a shadow over XRP's price for several years, creating uncertainty and hindering its potential for wider adoption.

Recently, analysts have begun speculating that the SEC may ultimately drop its four-year lawsuit against Ripple Labs, citing the potential for a more crypto-friendly regulatory environment under a potential Trump administration. This perspective suggests that the market may have already "priced in" the expectation of a favorable resolution, given the potential for significant policy shifts.

The notion that the SEC's actions were anticipated based on potential political shifts adds another layer of complexity to XRP's price dynamics. The argument suggests that market participants have been anticipating a change in regulatory stance, leading to a gradual accumulation of XRP in anticipation of a favorable outcome. If this proves accurate, the recent price surge could represent the beginning of a more sustained upward trend.

However, it is crucial to acknowledge that the regulatory landscape remains fluid and subject to change. While a Trump administration might usher in a more lenient approach to cryptocurrency regulation, there is no guarantee that the SEC will definitively drop its lawsuit. The legal proceedings could continue, potentially leading to further volatility and uncertainty.

Beyond the regulatory environment, XRP's price is also influenced by broader market trends and investor sentiment.6 The cryptocurrency market is known for its volatility, and sudden shifts in sentiment can significantly impact asset prices.7 Therefore, even with positive developments in network activity and whale accumulation, XRP's price could still be affected by external factors.

The utility of XRP within the Ripple ecosystem also plays a crucial role in its long-term price potential. Ripple Labs has positioned XRP as a bridge currency for cross-border payments, aiming to facilitate faster and cheaper transactions.8 The adoption of XRP by financial institutions and payment providers could significantly increase its demand and drive its price higher.

However, widespread adoption has been hindered by the regulatory uncertainty surrounding XRP. As the legal battle with the SEC progresses, potential partners may hesitate to integrate XRP into their operations. A favorable resolution could remove this barrier, paving the way for wider adoption and increased utility.

In conclusion, XRP's recent 7% price jump, fueled by a surge in network activity and whale buying, reflects a renewed interest in the digital asset.9 While the potential for a more crypto-friendly regulatory environment under a potential Trump administration has fueled speculation of a favorable resolution to the SEC lawsuit, the legal landscape remains uncertain.

The increase in active addresses to the highest level since April 2023 indicates a growing level of engagement and utility within the XRP ecosystem.10 Coupled with significant whale accumulation; these factors suggest a potential for further price appreciation. However, the volatility of the cryptocurrency market and the ongoing regulatory uncertainty require a cautious approach.

Ultimately, XRP's long-term price potential will depend on a combination of factors, including regulatory clarity, broader market trends, and the continued adoption of its utility within the Ripple ecosystem. While the recent surge provides a glimmer of optimism, investors should remain vigilant and consider the various factors that could impact XRP's future performance.