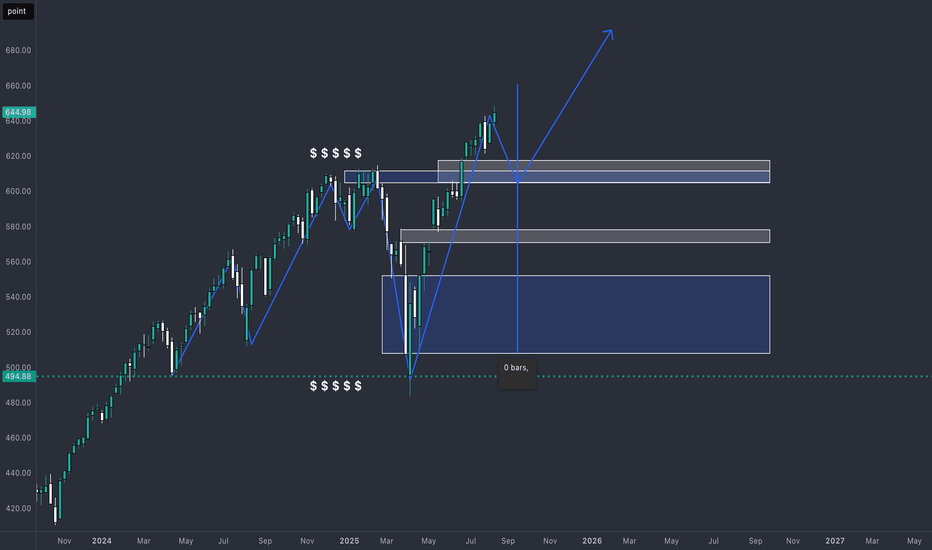

XSP Fed Rate Cut AnalysisCBOE:XSP AMEX:SPY

Based on the chart, since the additional liquidity from the 620 range has been collected, before the Federal Reserve meeting on September 16-17 we could see prices dip to fill the FVG (611-617) and if that doesn’t hold the supply zone (604-610). I am bullish on the rate cuts due to the worsening job market and moderate inflation numbers previously reported including those caused by businesses like Walmart choosing to eat the trumps Tariffs. If rates do get cut, I am targeting 650 (1.618 fib extension). If not we can see a sharp move to the downside, returning back to test the Supply Zone.

XSP

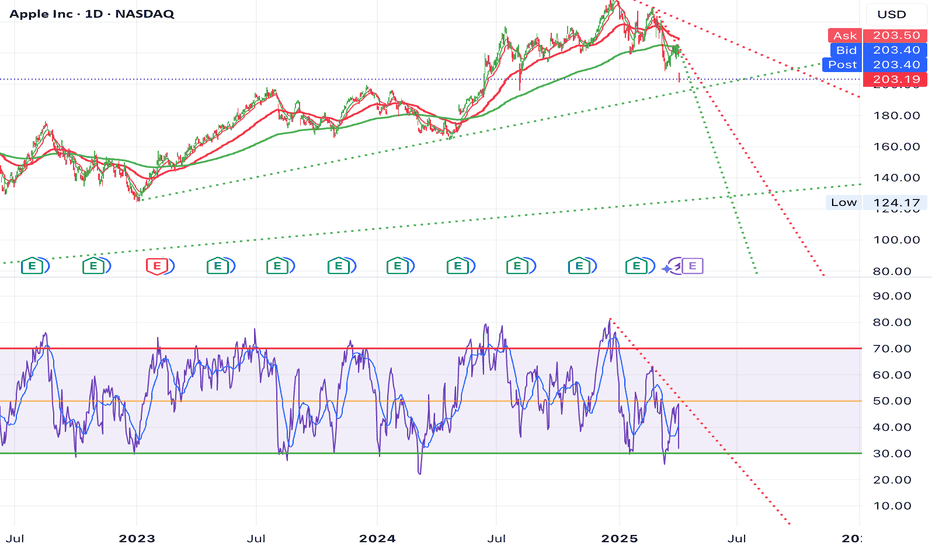

WILL APPLE (AAPL) BREAK SUPPORT ON 1 HOUR CHART? CRASH INCOMING?The California based AAPL is down nearly -18% since March. It appears to be approaching some key support trend lines. Will the support prices hold for this tech giant? Are Trump Tariff's fueling a sell off?

Disclaimer: Not financial advice.

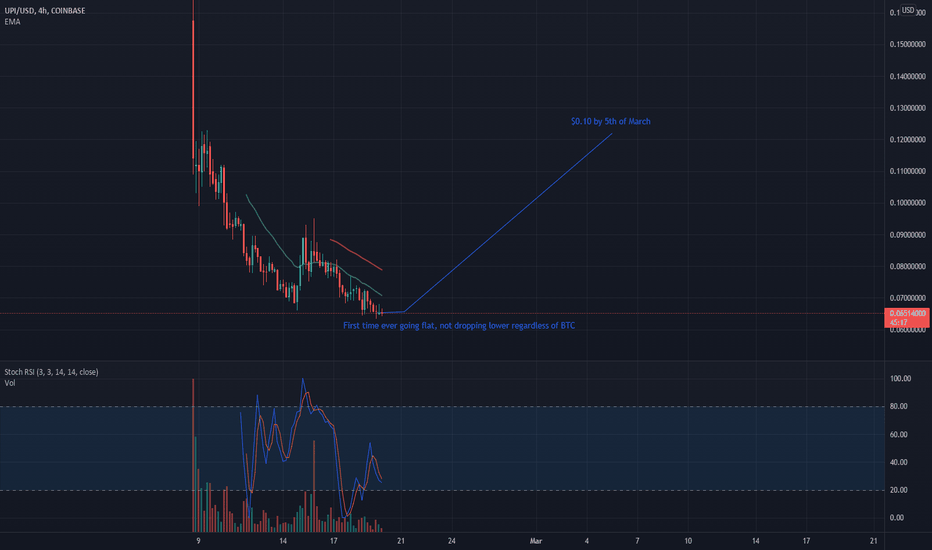

Hidden GemFirst time ever going flat, not dropping lower regardless of BTC , also has gone up a bit as BTC went down showing demand. New co about to take off IMO. I believe this is the hidden gem. 0.10 by the 5th of March. growing in popularity on Social. Hipsters love to chip pets and use an app to help shop, care and play for there pets. I bet this will be a winner. GL

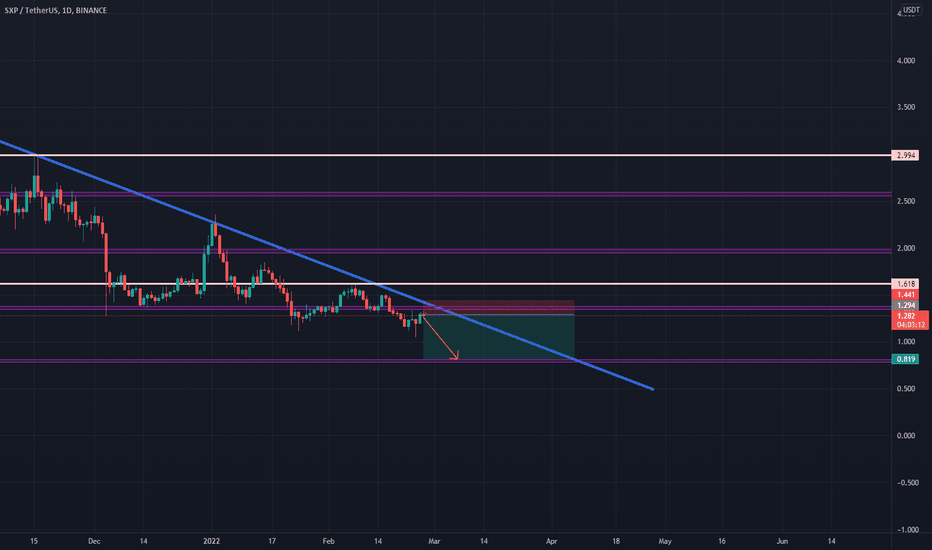

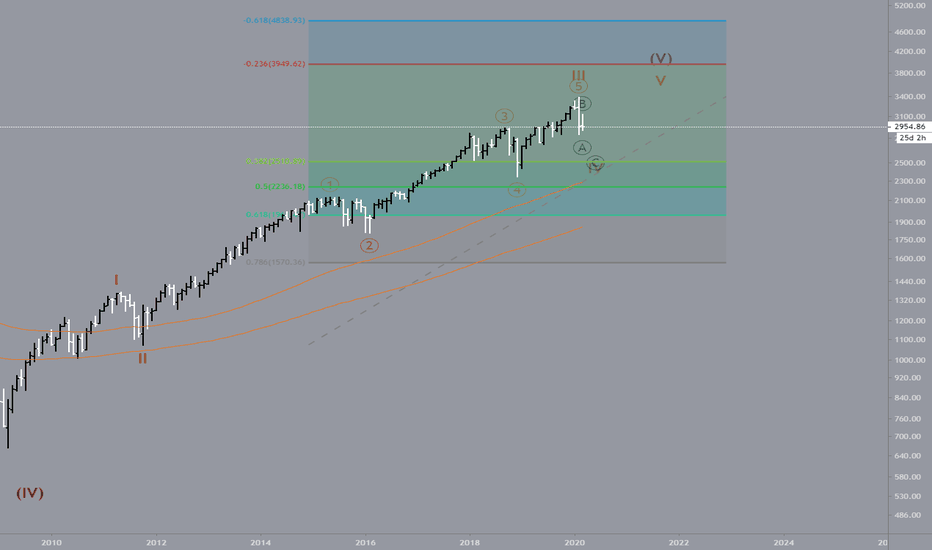

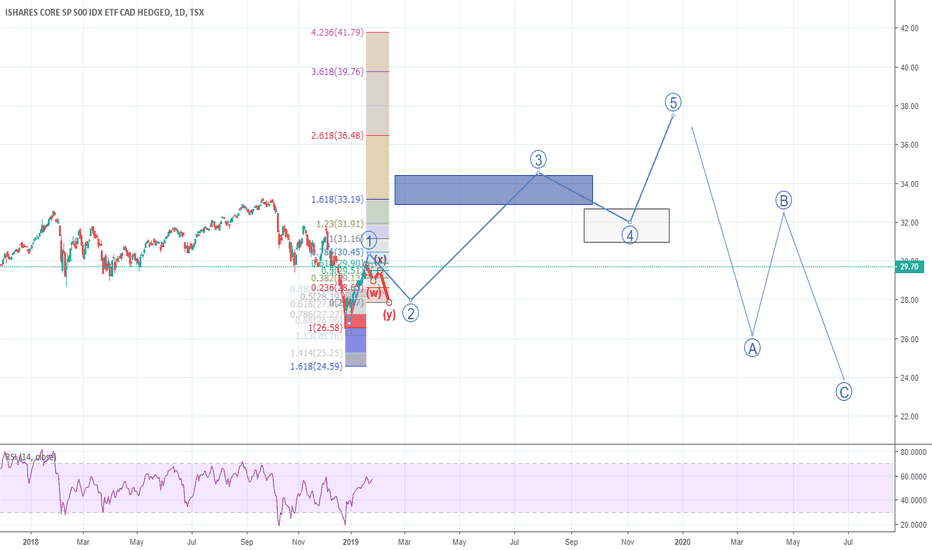

SPX 2510 SupportBack from a break. Seems as if the market wants to sell down in a C wave to complete a higher degree 4th correction which takes us down to a 38.2 projection from wave 2 lows. This is the most probable scenario before we V bottom and Rip higher to complete the higher degree impulse that starts basically when the SPX started trading. Either we sell impulsively or this market has the chance of going sideways due to confusion from smart money and algos. looking for SPX to break the lows for confirmation of selling down to 2510.