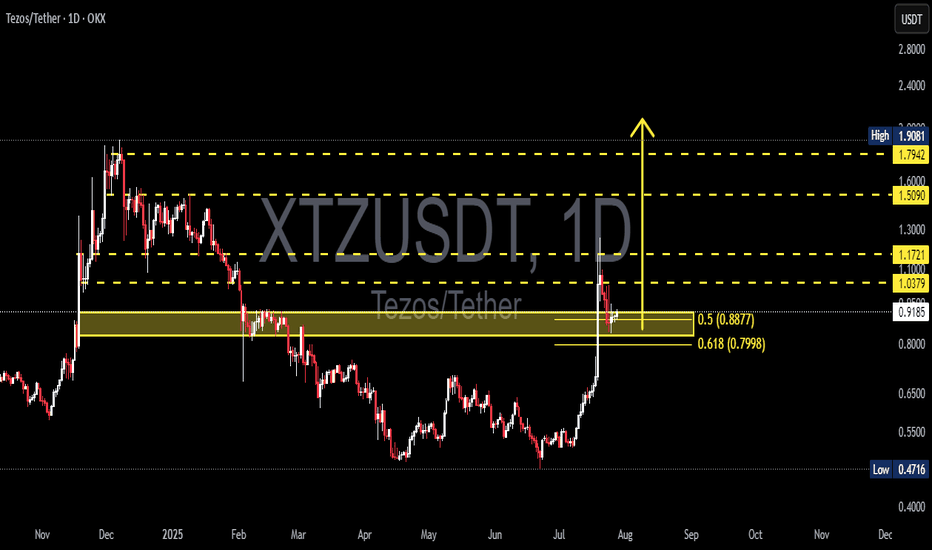

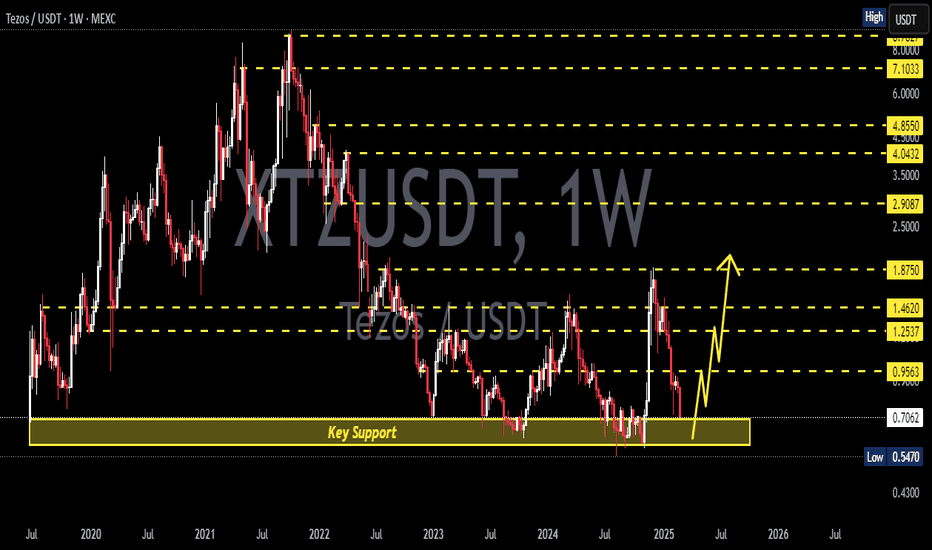

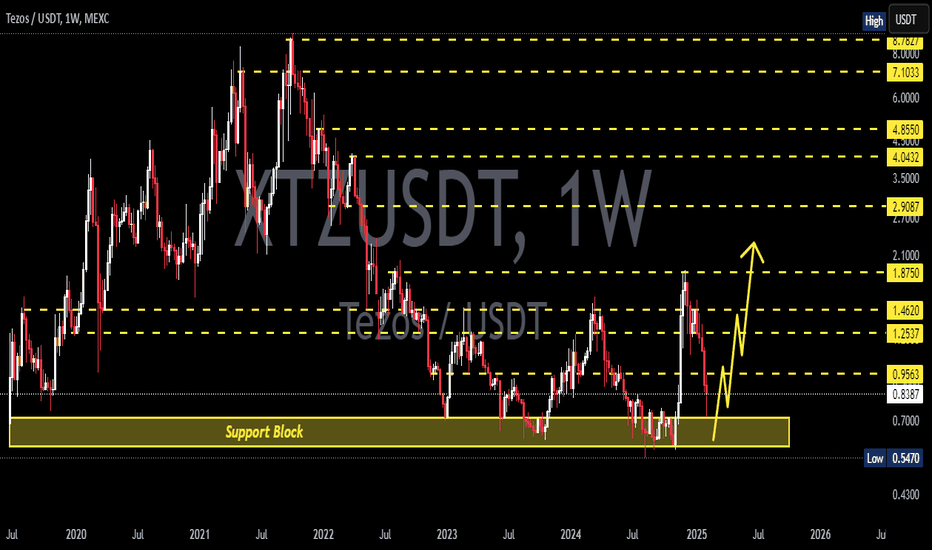

XTZUSDT Fibonacci Retest and Rebound Potential: Is Tezos Ready?Detailed Analysis of XTZ/USDT Chart (Daily Timeframe):

The XTZUSDT pair (Tezos vs USDT) has shown strong momentum following a breakout above previous support zones, with a sharp rally toward $1.17 before retracing.

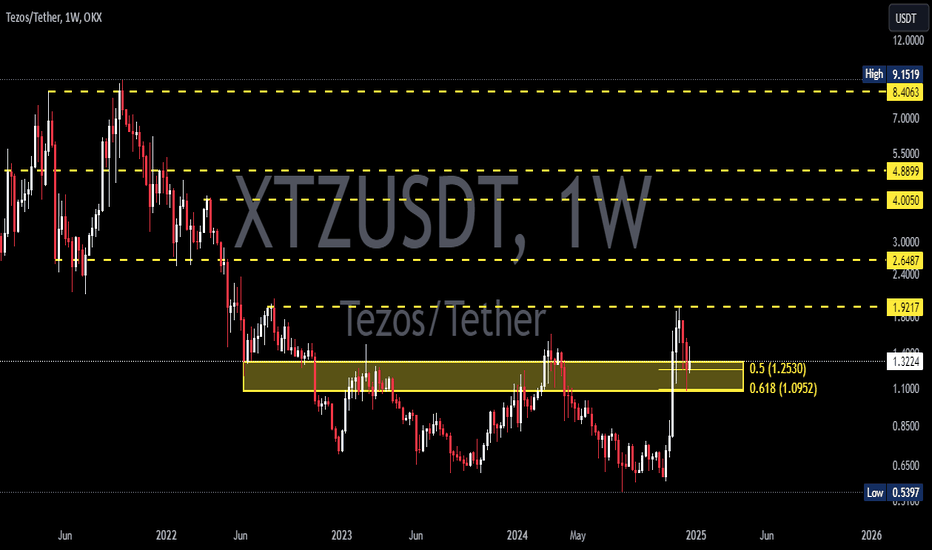

Currently, the price is testing the Fibonacci Retracement levels, specifically the 0.5 ($0.8877) and 0.618 ($0.7998) zones — which also align with a key previous demand zone. This zone is critical for determining the next directional move.

---

🟢 Bullish Scenario:

If the price holds above the $0.80–$0.88 zone (Fibonacci support area), this could confirm a valid breakout retest.

Potential upside targets include:

$1.0379 (minor resistance)

$1.1721 (recent local high)

Further targets: $1.5090 – $1.7942, and potentially the major high at $1.9081.

This structure may form a bullish continuation pattern, especially if supported by volume.

---

🔴 Bearish Scenario:

A breakdown below $0.7998 may trigger further selling pressure toward $0.70 – $0.65.

A deeper retracement could take price back into the previous accumulation zone between $0.55 – $0.50.

Failure to hold the Fibonacci levels may confirm a bull trap, invalidating the recent breakout.

---

📌 Pattern Insights:

The current price action resembles a Bullish Flag / Retest Structure.

The 0.5–0.618 Fibonacci levels serve as a key confluence area for potential trend continuation.

This is a common setup before a major upside move — if the support holds.

---

Conclusion: XTZ is at a decisive moment. As long as the price stays above $0.80, the bullish trend remains intact. However, a drop below could shift momentum back to the bears. Traders should watch this zone closely for confirmation.

#XTZUSDT #Tezos #CryptoAnalysis #AltcoinSeason #FibonacciRetracement #BreakoutRetest #TechnicalAnalysis #CryptoTrading #BullishScenario #BearishScenario

Xtzusdtsignals

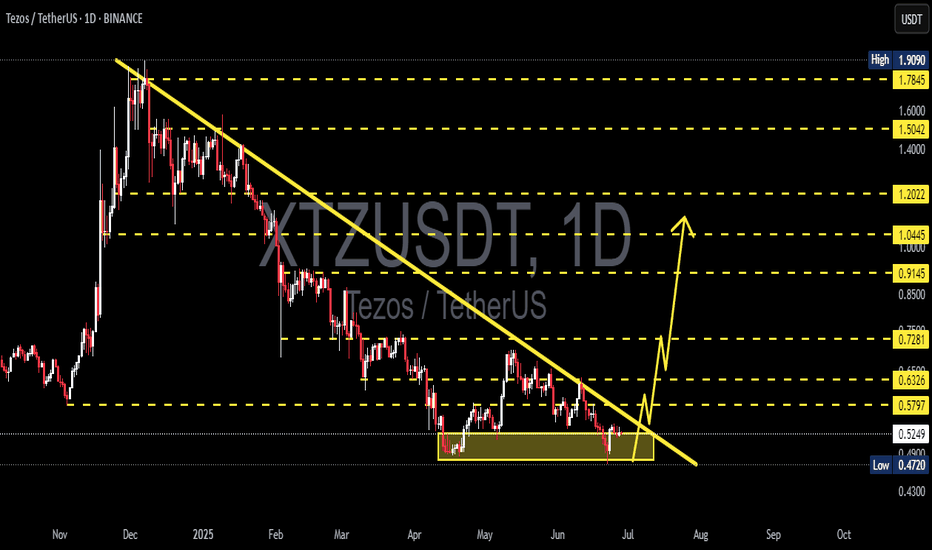

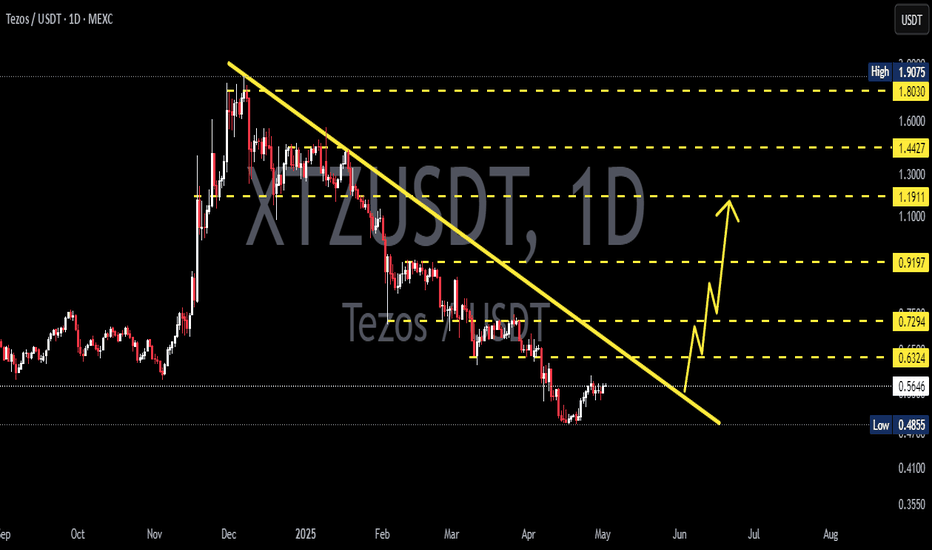

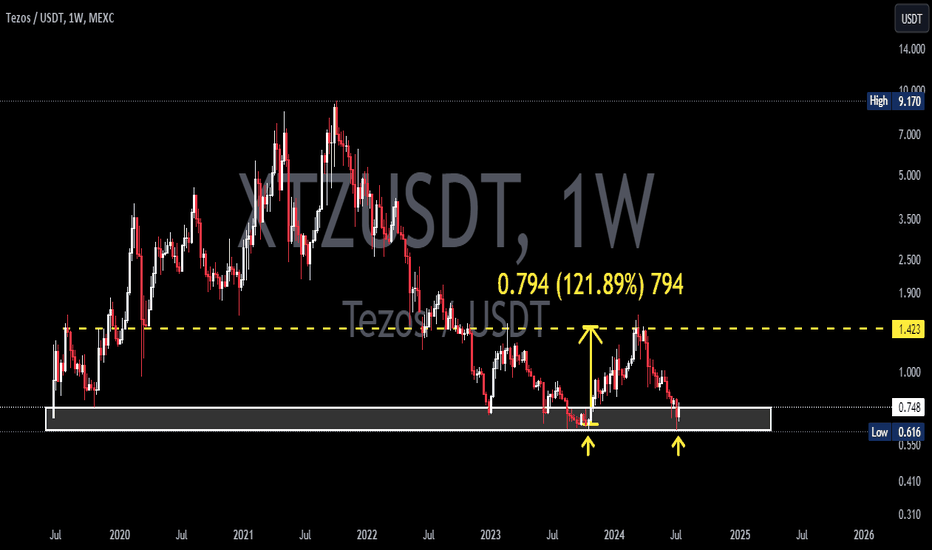

XTZ/USDT Ready for a Massive Breakout After Prolonged Downtrend!Technical Analysis (1D Timeframe):

The XTZ/USDT pair is forming a well-defined descending triangle pattern, with sustained selling pressure since late 2024. However, the price action is now signaling a potential breakout as it approaches the apex of the triangle, supported by a strong accumulation zone around $0.4720–$0.5247.

🔍 Analysis Details:

Descending Trendline Resistance: Price has repeatedly failed to break above the descending resistance line since December 2024. It is now testing the edge of the triangle, which typically precedes a significant breakout.

Strong Support Zone: The consolidation zone between $0.4720 and $0.5247 has acted as a key accumulation area, successfully holding off bearish momentum.

Potential Breakout: A breakout above the triangle resistance, especially with confirmation above $0.5797, could trigger a strong bullish rally toward the next resistance levels.

🎯 Target Resistances (Upon Confirmed Breakout):

1. $0.5797 – Initial breakout confirmation

2. $0.6326 – Minor resistance

3. $0.7281 – Significant resistance from previous structure

4. $0.9145 – Medium-term bullish target

5. $1.0445 – Strong resistance zone

6. $1.2022 – Final breakout target

⚠️ Note:

A valid breakout requires a daily candle close above the descending trendline, ideally supported by volume confirmation. A pullback to the breakout zone may occur and could offer a second entry opportunity.

#XTZ #Tezos #XTZUSDT #CryptoBreakout #DescendingTriangle #AltcoinAnalysis #TechnicalAnalysis #CryptoSignals #TrendReversal #BullishSetup

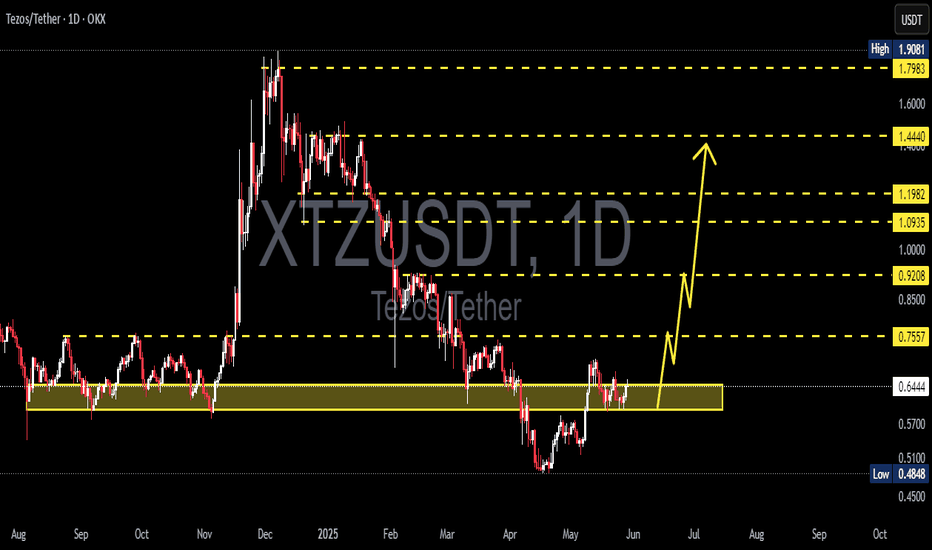

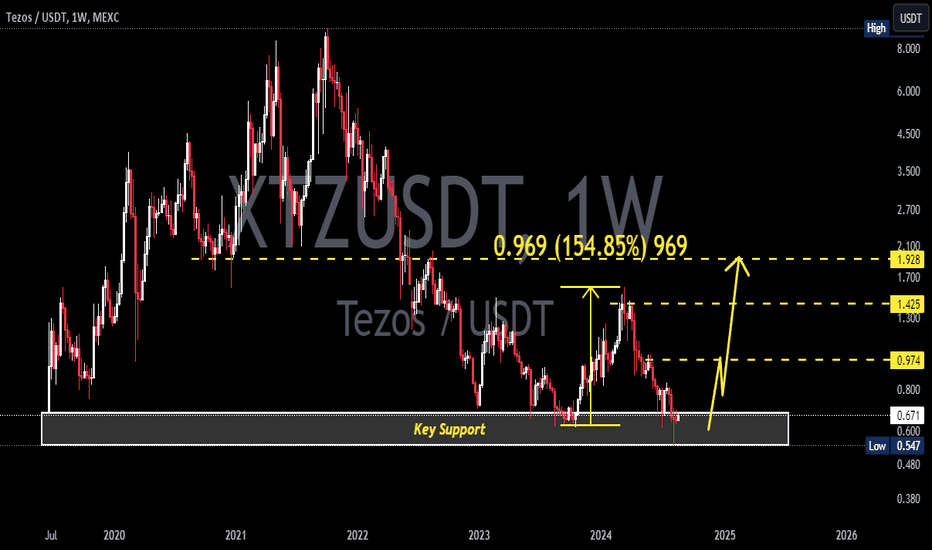

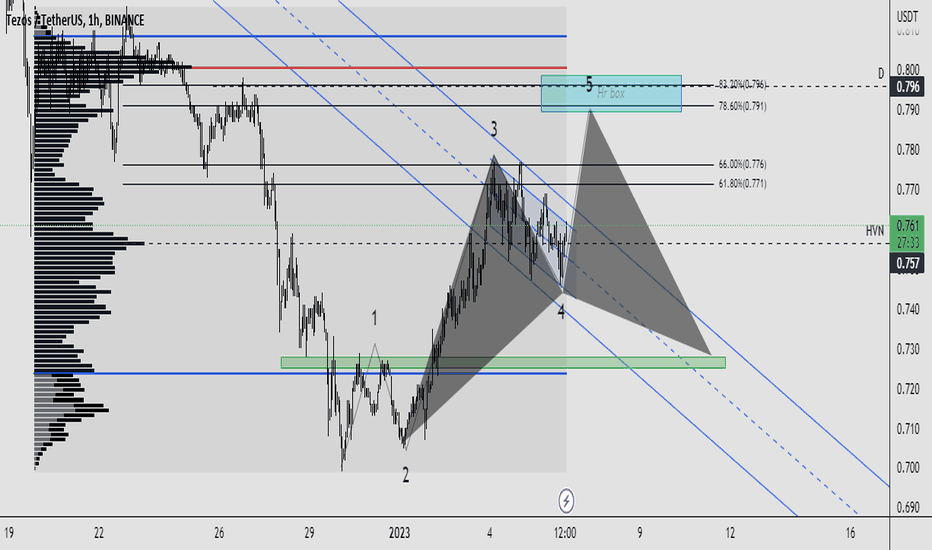

XTZUSDT Deep Analysis of Harmonic and ElliotwaveHello Guys,

So Far After Analyzing XTZUSDT Coin i found that its in an uptrend also following the Elliot wave theory very precisely so far.

as per the harmonic is concern if wave 5 hit our HR Target area then odds are high that this harmonic gonna play out.

also there is a Fibonacci time pivot in bitcoin coming at 14th of January so probably yes that matches the theory for the corrective move at that time.

We have untapped daily level above in xtz chart as well.

becarefull this is not a financial advice, also don't overexpose your self to unnecessary risk. do only paper trades untill you become master in the field.

Regards,

Hedgers.