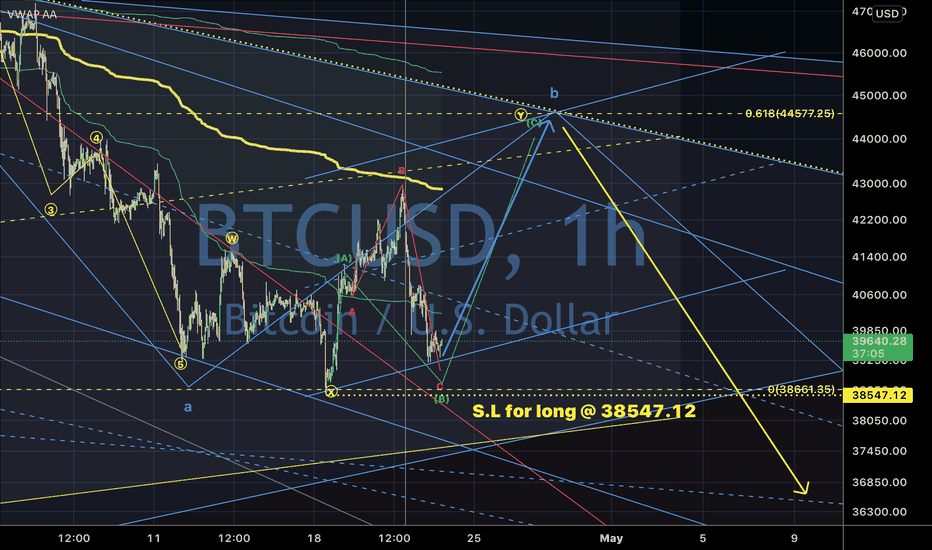

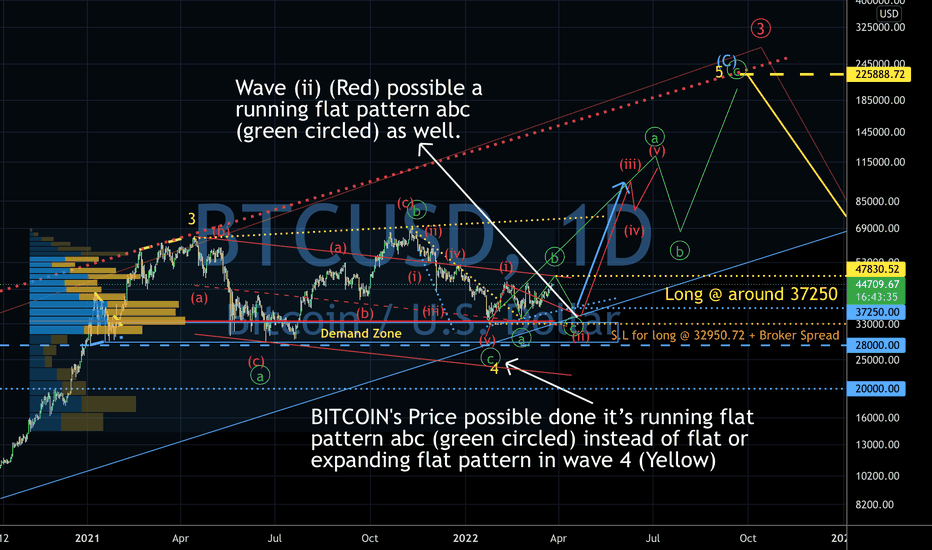

Bitcoin short term updated 23/April/221)On Charts : Charts consist of 3-Dimensions - The X-factor ( Time or Cycle ), The Y- factor ( Price Geometry ), AND The Z-factor ( The Speed ).. 2)On Elliot Wave / Market Structure : Unlike Textbook written rule : ALL Impulsive wave comprise of ONLY a-b-c sub-waves NOT 1,2,3,4,5 waves.. AND there is NO Truncated 5th wave BUT ONLY wrong wave counts...

Disclaimer

Xyz3dtrading

Gold. “Independent thinking” on trading. 22/ April/22We’re dealing with “evolving “ world. One things is “constant”..is “change”.... To have a “constantly, consistent “ trading result . Once probably have to “ adaptive “ to market’s or others opinions “subjectively”.. Even A A.I/ Suoercomputer Quants trading system need to “hear” the “voice from the market”....by “gathering “all “big data available “ on net etc...So as individuals traders by “listening “ to other’s ideas/ opinions “ subjective ly probably would make us a “good traders”..AND....there is no point “arguing “ with Mr. Market or others traders..At the end traders are the only one to “click” the buy/sell button not others! And to have “independent” thinking . traders should be listening to others’s / Mr. Market “evolving opinions “..

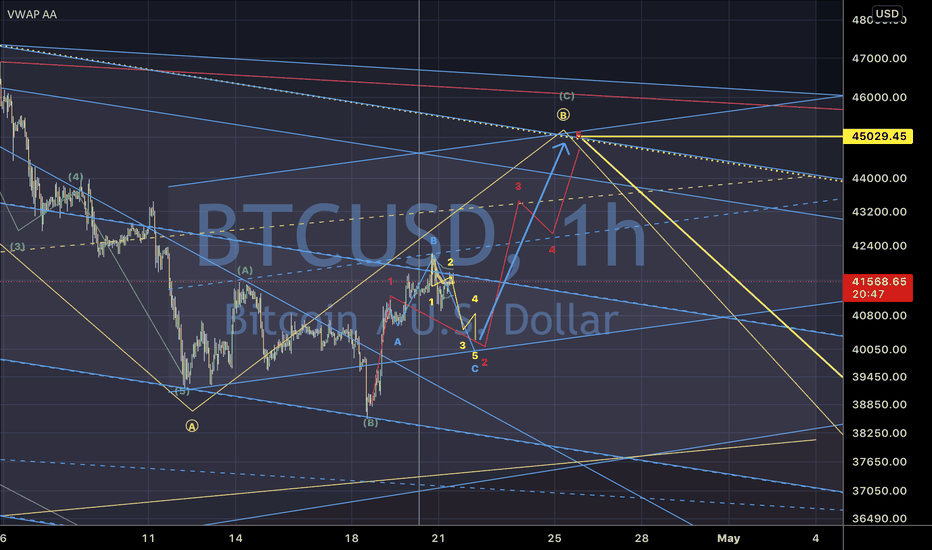

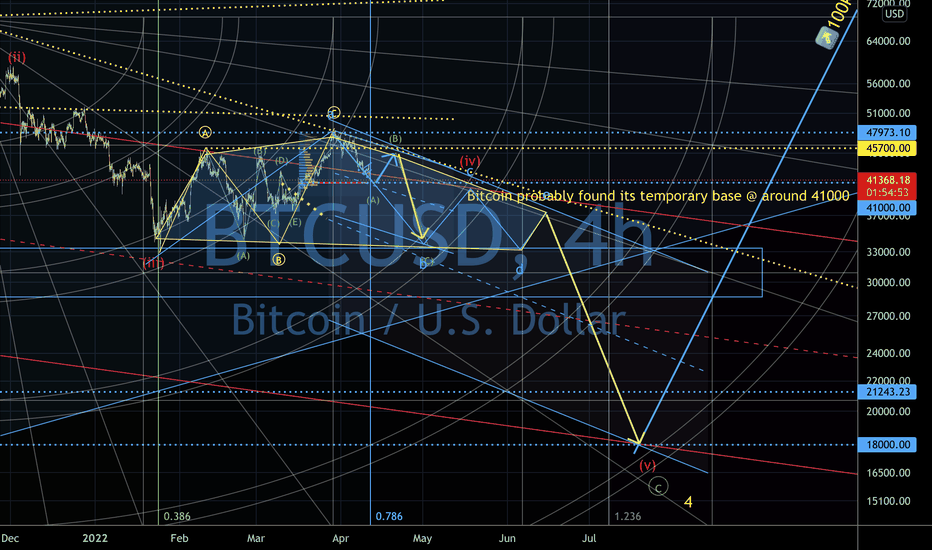

Bitcoin short term updated 21/April/22P/s : Although I don’t prefer trading on short term time frame charts e.g below 1 hours as they have more “whipsaw” and “uncertainty “ = Blind men touching an elephant can’t “see” the “big picture” = As human but not rat running inside the maze, don’t know “the way out”..But after “seeing” from the “higher time frame chart/ big picture “ ..Traders probably can only then go into “the maze “ with “compass” ..

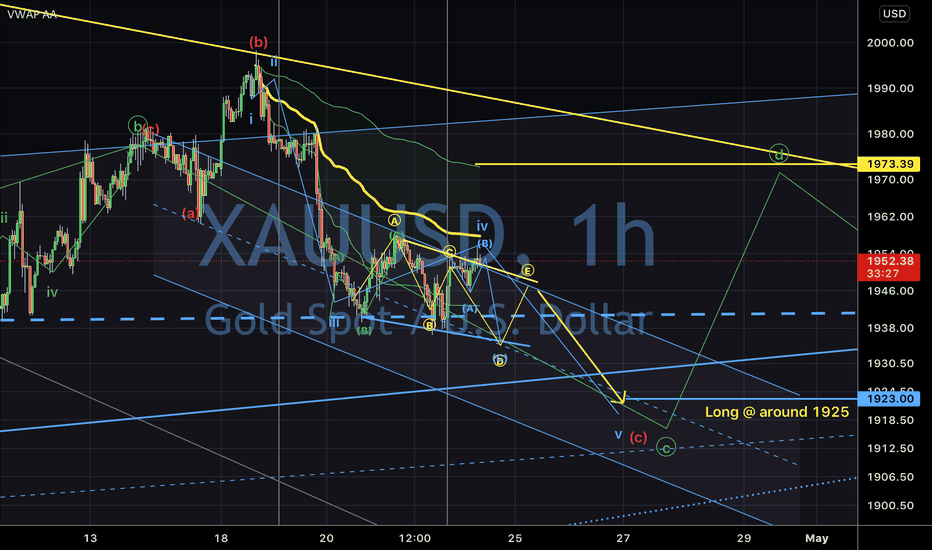

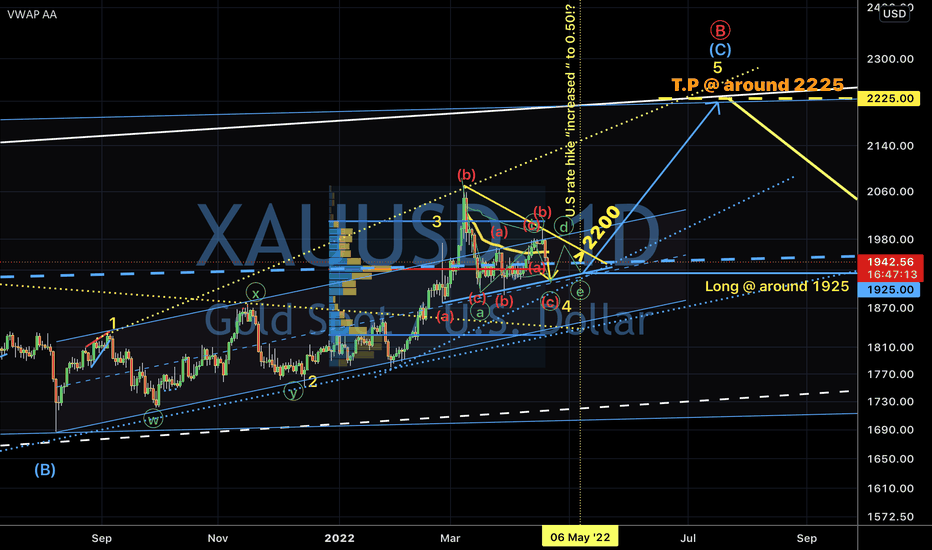

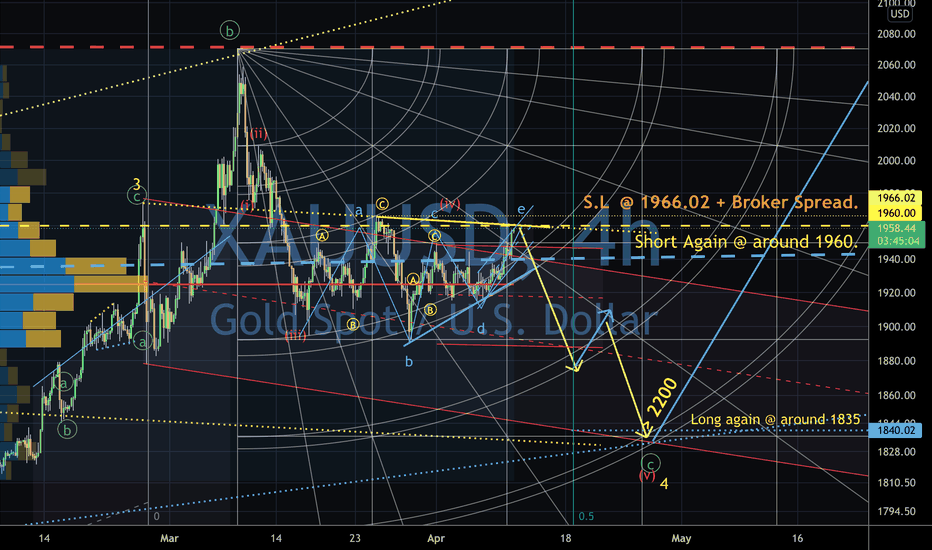

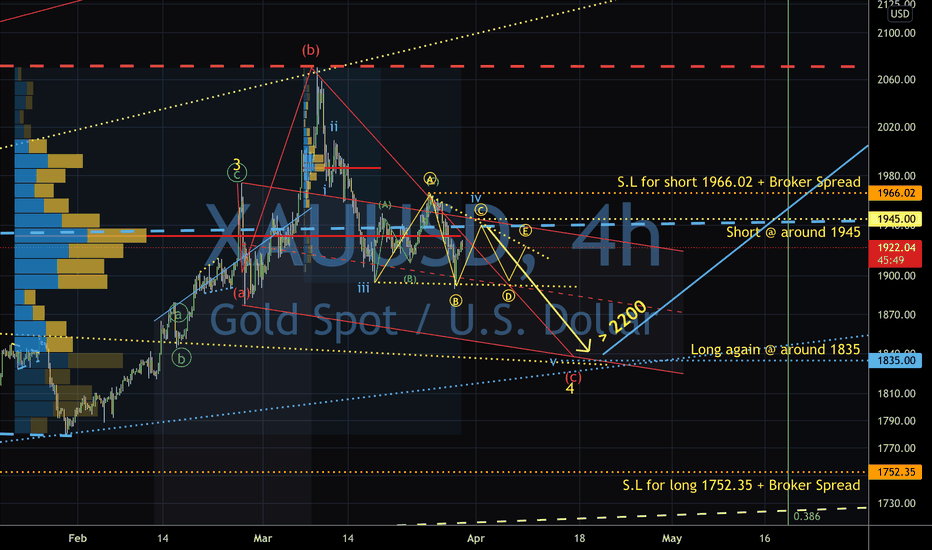

Gold maybe a triangle in wave 4 (yellow). 20/April/221)On Charts : Charts consist of 3-Dimensions - The X-factor ( Time or Cycle ), The Y- factor ( Price Geometry ), AND The Z-factor ( The Speed ).. 2)On Elliot Wave / Market Structure : Unlike Textbook written rule : ALL Impulsive wave comprise of ONLY a-b-c sub-waves NOT 1,2,3,4,5 waves.. AND there is NO Truncated 5th wave BUT ONLY wrong wave counts...

Disclaimer

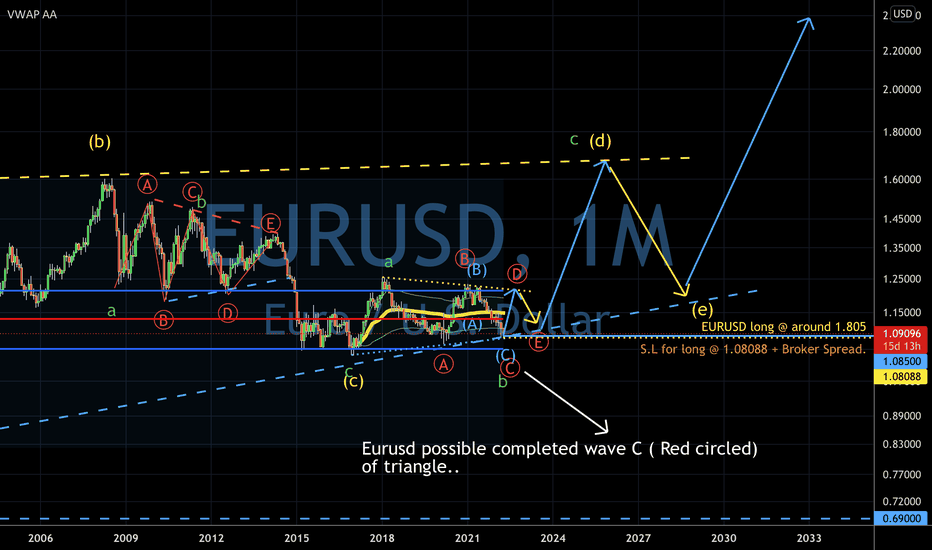

Bitcoin. A replacement of US dollar by F..D?! 20/April/22. 1)On Charts : Charts consist of 3-Dimensions - The X-factor ( Time or Cycle ), The Y- factor ( Price Geometry ), AND The Z-factor ( The Speed ).. 2)On Elliot Wave / Market Structure : Unlike Textbook written rule : ALL Impulsive wave comprise of ONLY a-b-c sub-waves NOT 1,2,3,4,5 waves.. AND there is NO Truncated 5th wave BUT ONLY wrong wave counts...

Bitcoin may only found its based @ 41000. 11/April/22Bitcoin may for a triangle in abcde (cyan/light blue) in wave (iv) (Red). .current down move may temporarily find its “ base” @ around 41000 which is wave (A) (green) of wave (c)(cyan/light blue) of triangle..before a pullback to wave (B) (green) at around 45700 and resuming its down trend for wave (C) (green)..

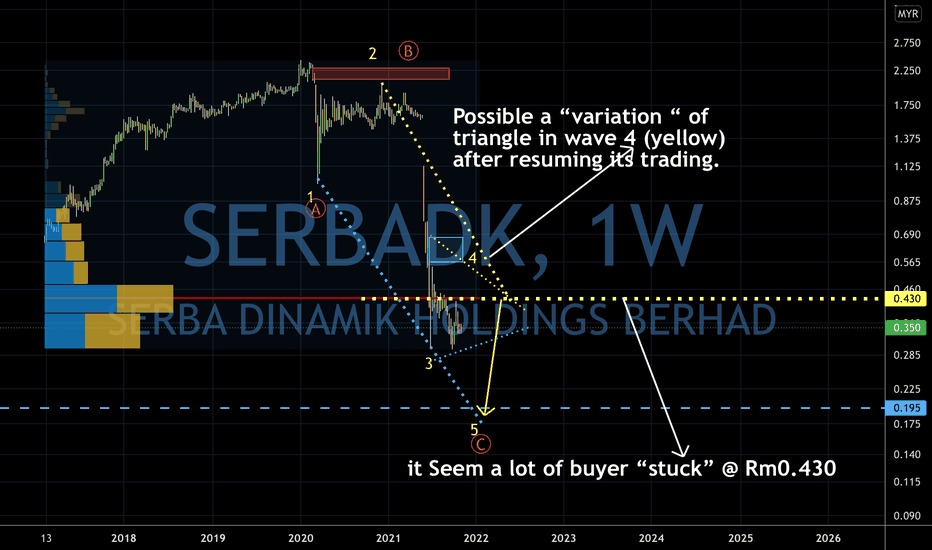

SERBADK T.A updated 11/ April/22While waiting Serbark “resuming” its trading activity.. It seem like previous (stalled ) pricestructure having a potential to form a triangle in wave 4 (yellow)..

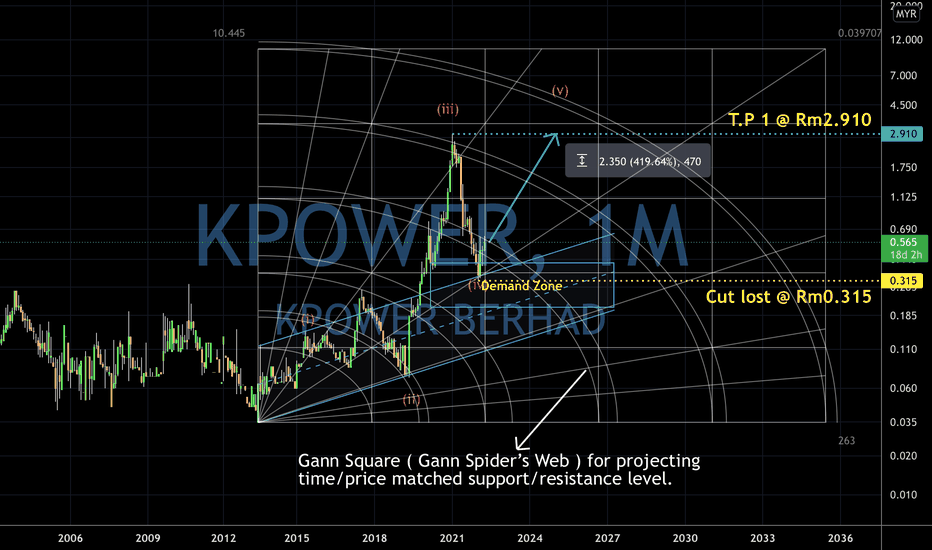

Kpower TA updated 11/ April/22Kpower possible found its “base” at Rm0.315 on demand zone. Price have potential growth of 419.64% from current Rm0.560 to Rm2.910...

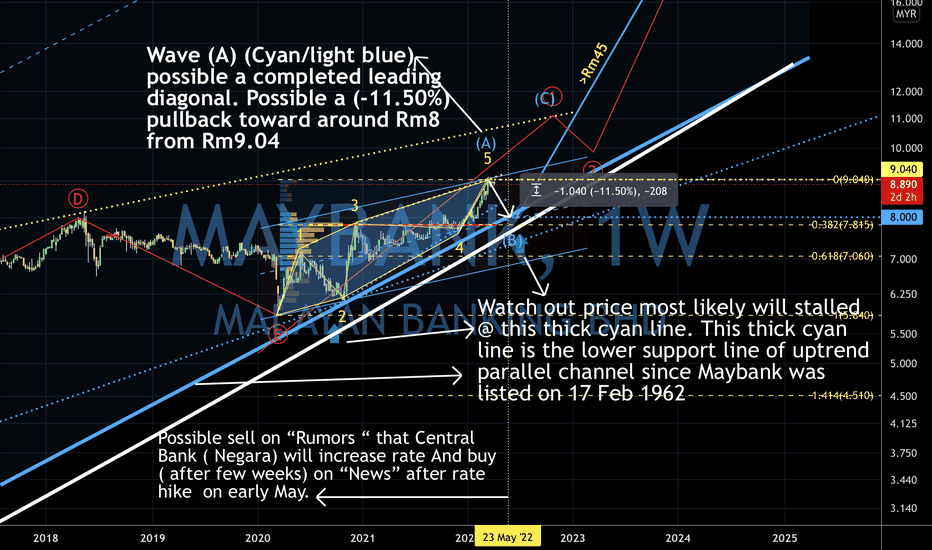

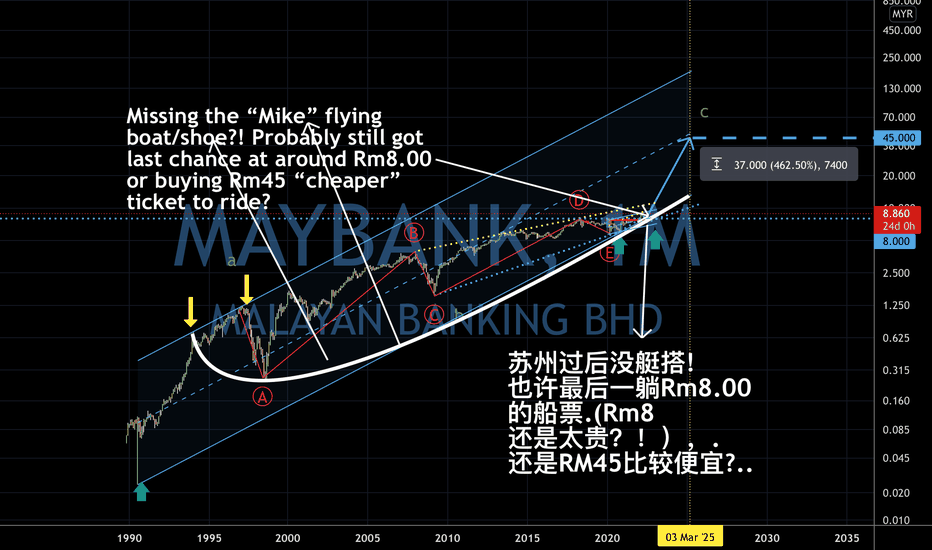

Maybank short term “avoiding FOMO” trade. 6/April/22Due to FOMO ( fear of missing out ) factor most traders/ investors always bought stock @ ( high price ) on “breakout trading strategy “ etc..To avoid such problem ..one of the methodology is waiting for “pullback” and buy at “retracement confluence zone” .. A “ confluence zone” @ 1) Parallel Channel 2)Fibonacci level etc...

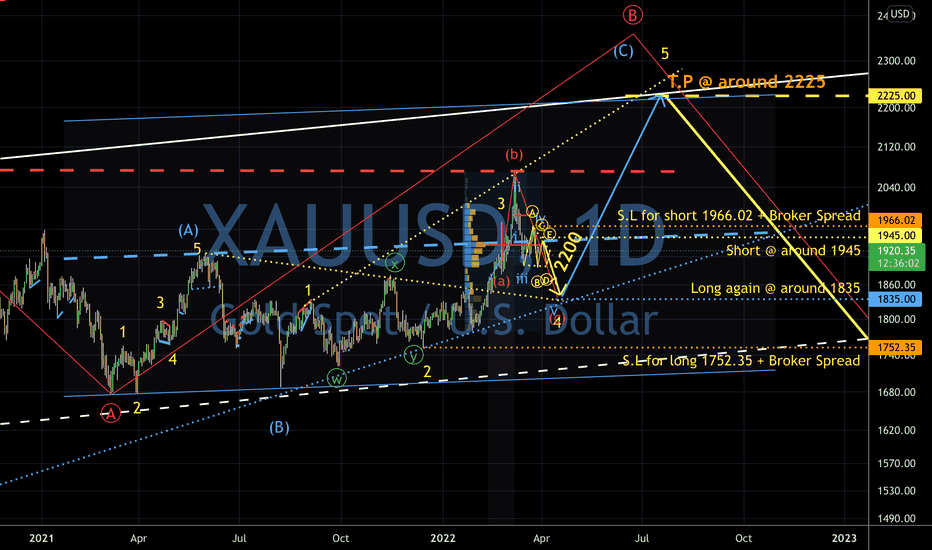

Gold medium term updated 30/Mar/22. Long @ around 18351)On Charts : Charts consist of 3-Dimensions - The X-factor ( Time or Cycle ), The Y- factor ( Price Geometry ), AND The Z-factor ( The Speed ).. 2)On Elliot Wave / Market Structure : Unlike Textbook written rule : ALL Impulsive wave comprise of ONLY a-b-c sub-waves NOT 1,2,3,4,5 waves.. AND there is NO Truncated 5th wave BUT ONLY wrong wave counts...

Disclaimer

Gold short term updated 30/Mar/22. Short @ around 19451)On Charts : Charts consist of 3-Dimensions - The X-factor ( Time or Cycle ), The Y- factor ( Price Geometry ), AND The Z-factor ( The Speed ).. 2)On Elliot Wave / Market Structure : Unlike Textbook written rule : ALL Impulsive wave comprise of ONLY a-b-c sub-waves NOT 1,2,3,4,5 waves.. AND there is NO Truncated 5th wave BUT ONLY wrong wave counts...

Disclaimer

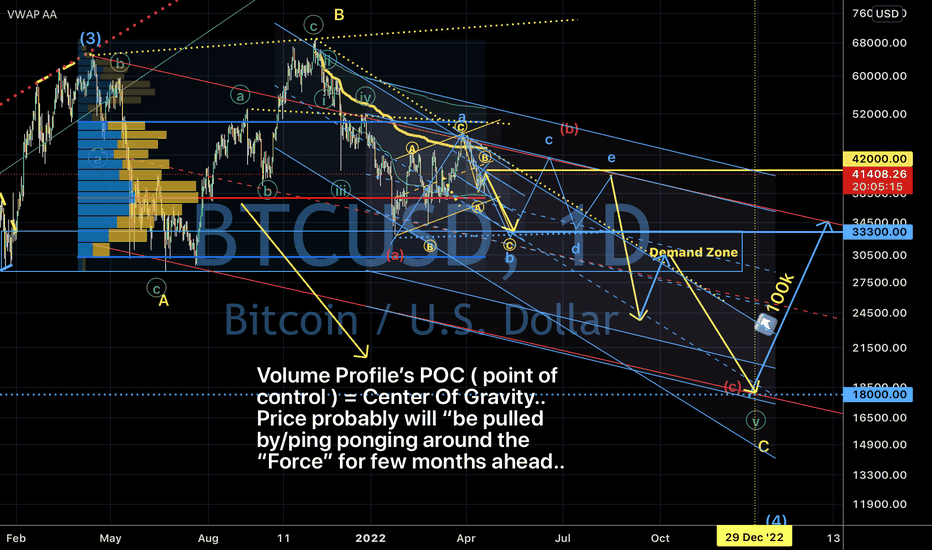

Bitcoin possible drop to around 18000..30/Mar/221)On Charts : Charts consist of 3-Dimensions - The X-factor ( Time or Cycle ), The Y- factor ( Price Geometry ), AND The Z-factor ( The Speed ).. 2)On Elliot Wave / Market Structure : Unlike Textbook written rule : ALL Impulsive wave comprise of ONLY a-b-c sub-waves NOT 1,2,3,4,5 waves.. AND there is NO Truncated 5th wave BUT ONLY wrong wave counts...

Disclaimer