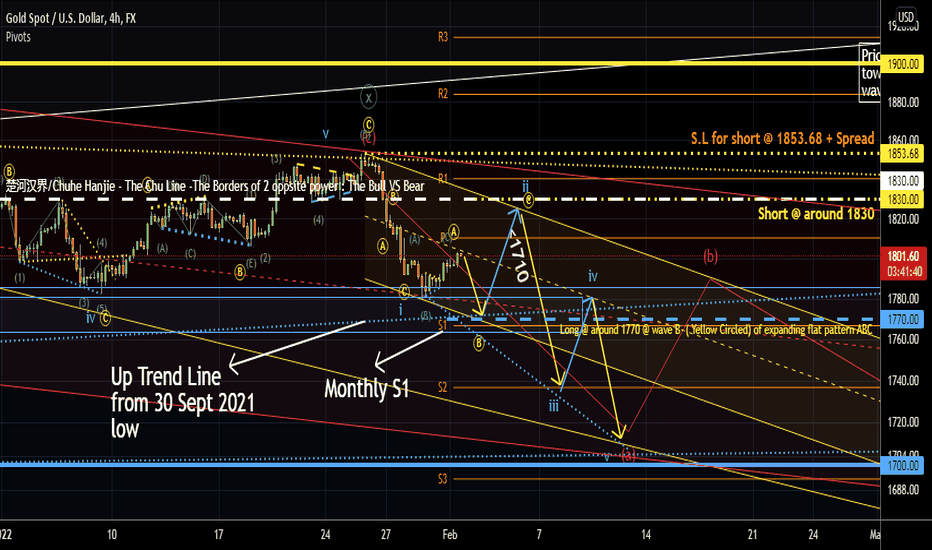

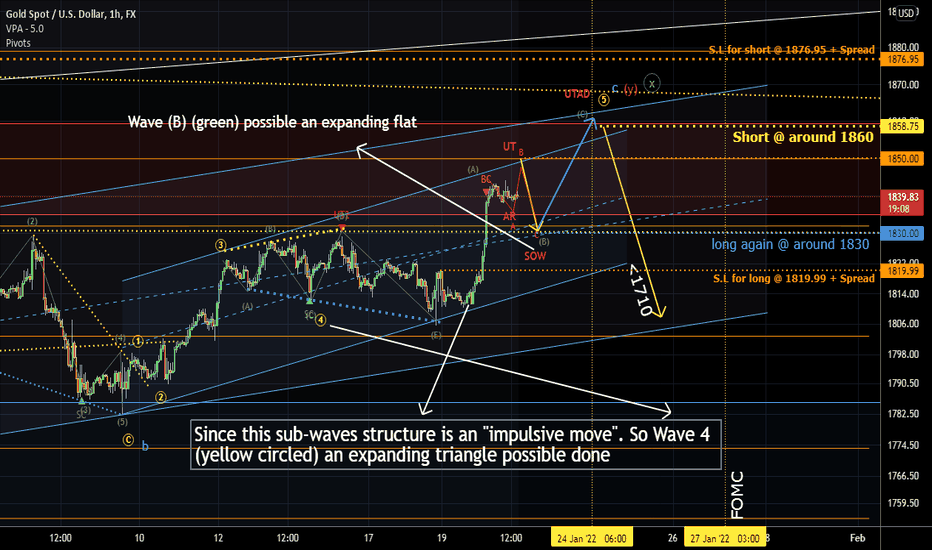

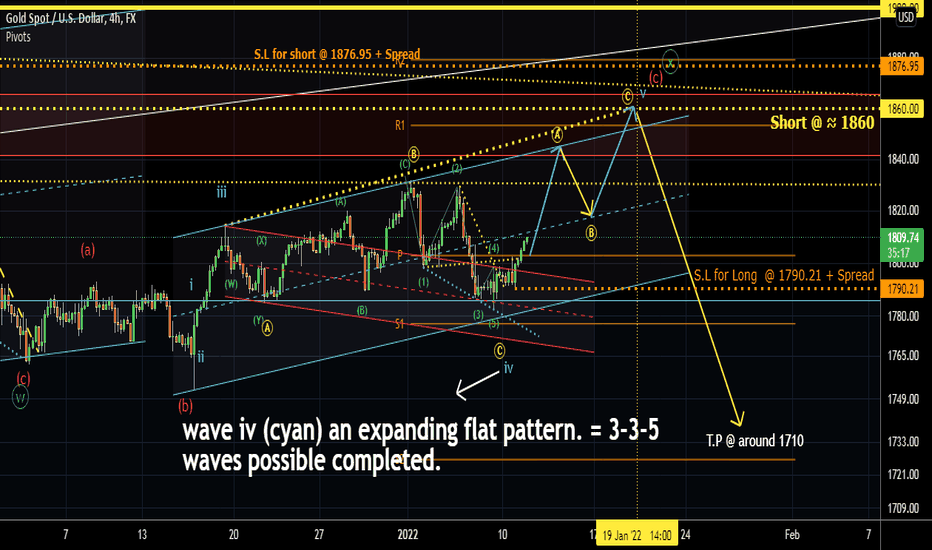

GOLD, We may @ wave A (Circled) ONLY of exp. flat. 1/Feb/22GOLD, we possible at wave A ( Yellow Circled) ONLY of the expanding flat ABC (Yellow Circled). ..P/S : On Elliot Wave / Market Structure : Unlike Textbook written rule : ALL Impulsive wave comprised of ONLY a-b-c sub-waves NOT 1,2,3,4,5 waves

Xyz3dtrading

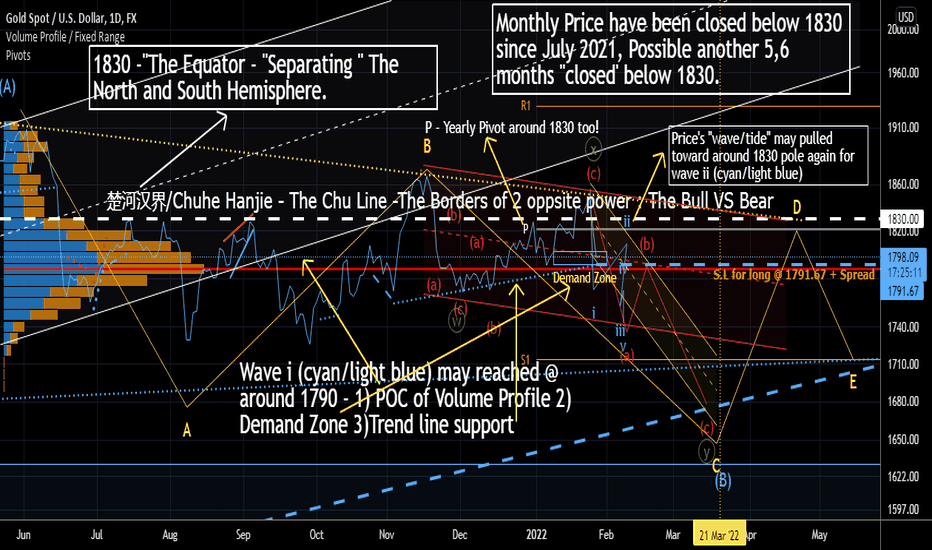

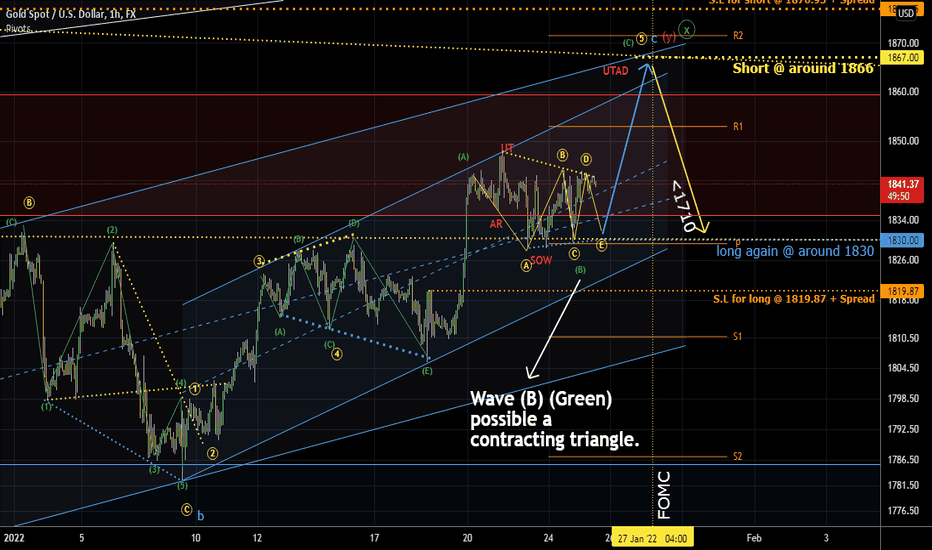

GOLD's 1830 -The Chu Line Separating the bull & bear. 28/Jan/22GOLD's 1830 -The Chu Line Separating the bull & bear. 28/Jan/22.. GOLD's price may found its temporary "base" for wave i (cyan) @ around 1790..Where 1790 are : 1) POC of volume profite 2) Demand Zone 3)Up trend line support. As we're catching the "falling knife".. Traders may have to "reduce" their position size to at least 1/3 of "normal size" as trading against current "down trend".

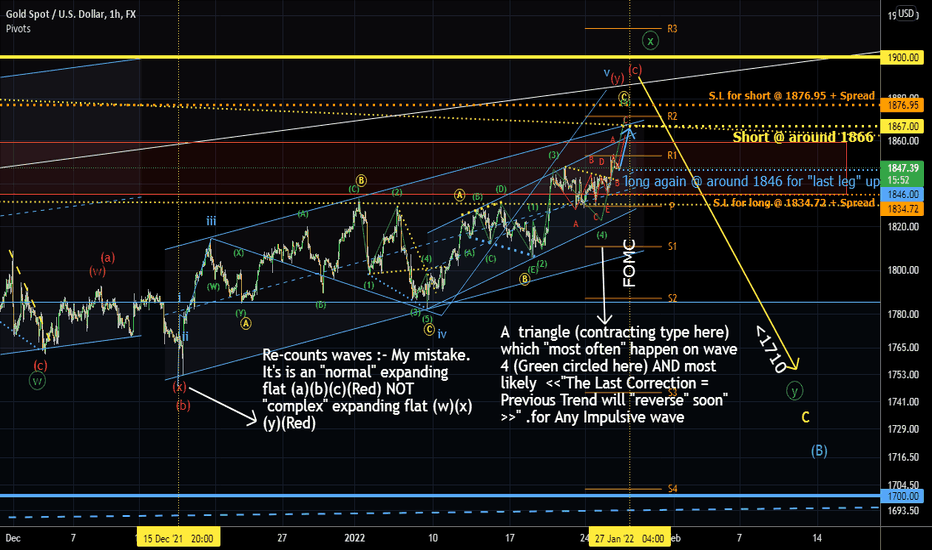

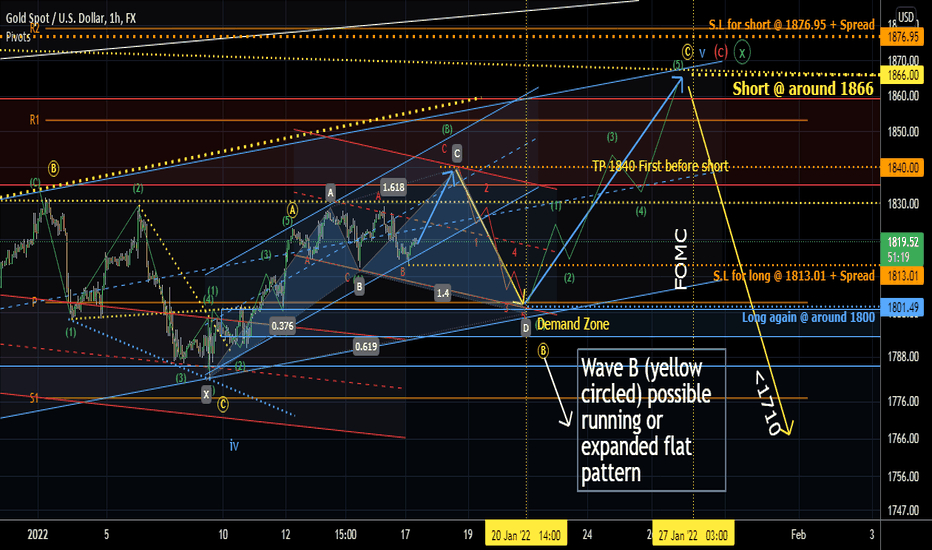

GOLD on last leg up for expanding flat (a)(b)(c)(Red). 26/Jan/22P/S. There is NO Alternative waves counts BUT either 1 and ONLY "Main" wave counts or "Wrong" waves counts.... Gold probably on the last leg up for the wave (c)(Red) Impulsive move since 15 Dec 2021 which is also the last leg of an expanding flat (a)(b)(c)(Red). Assuming the waves/ expanding flat pattern is valid. Price of GOLD "should be" Capped "Below" -- 1876.95 !!!

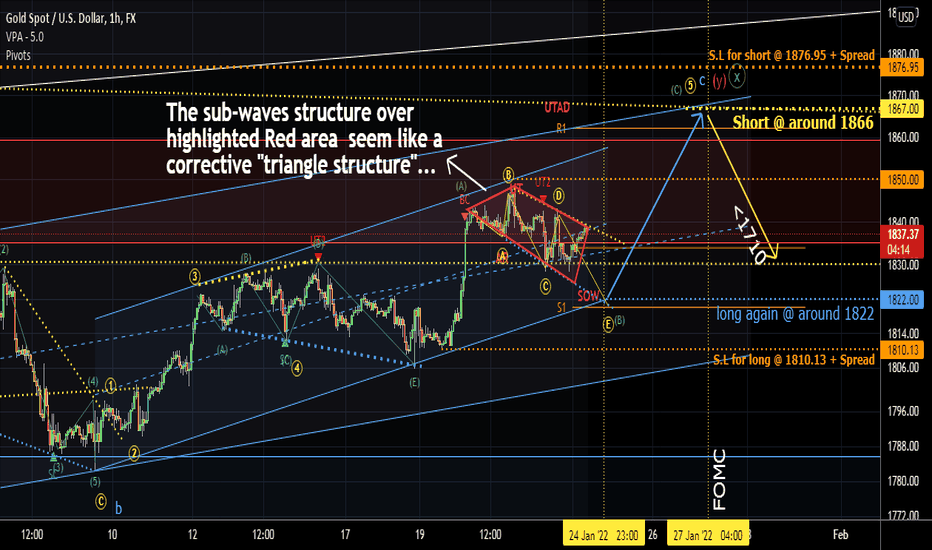

GOLD maybe a contracting triangle. 25/Jan/221)On Charts : Charts consist of 3-Dimensions - The X-factor ( Time or Cycle ), The Y- factor ( Price Geometry ), AND The Z-factor ( The Speed ).. 2)On Elliot Wave / Market Structure : Unlike Textbook written rule : ALL Impulsive wave comprise of ONLY a-b-c sub-waves NOT 1,2,3,4,5 waves.. AND there is NO Truncated 5th wave BUT ONLY wrong wave counts...

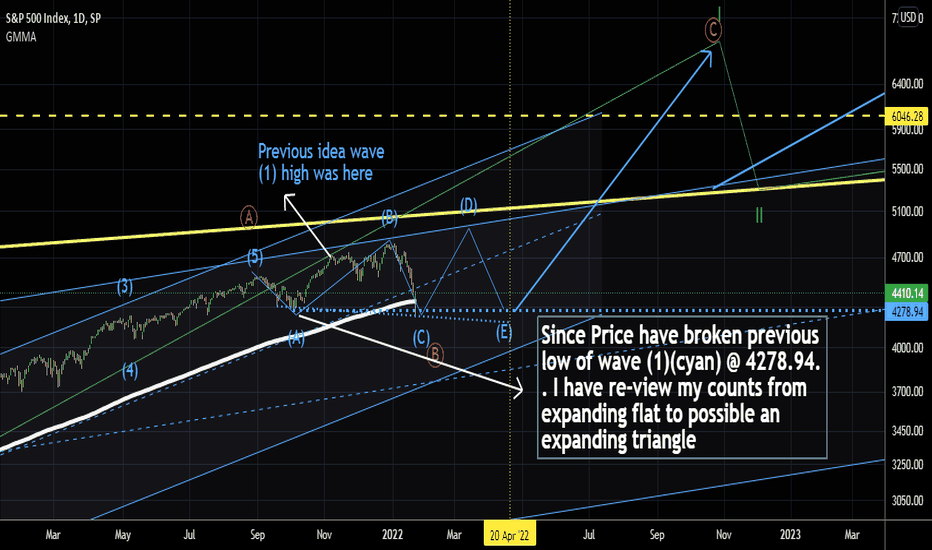

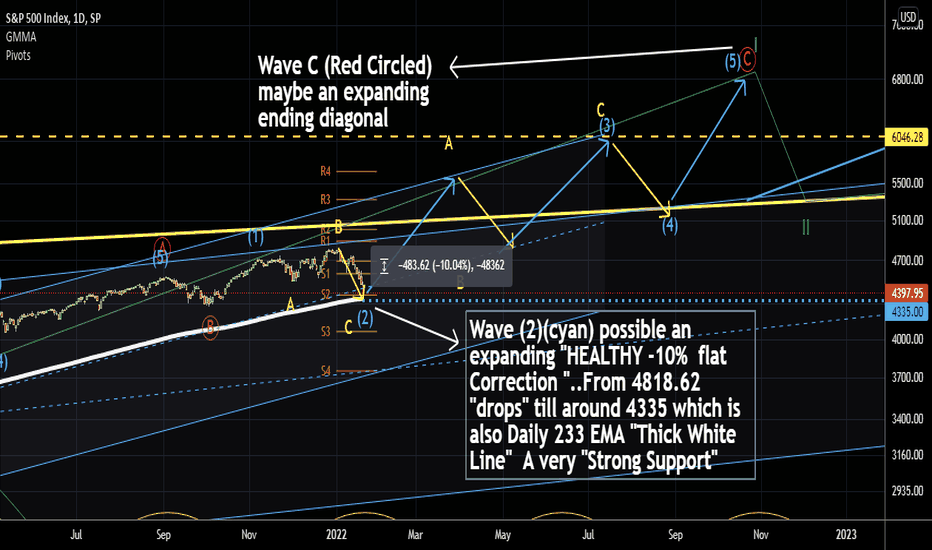

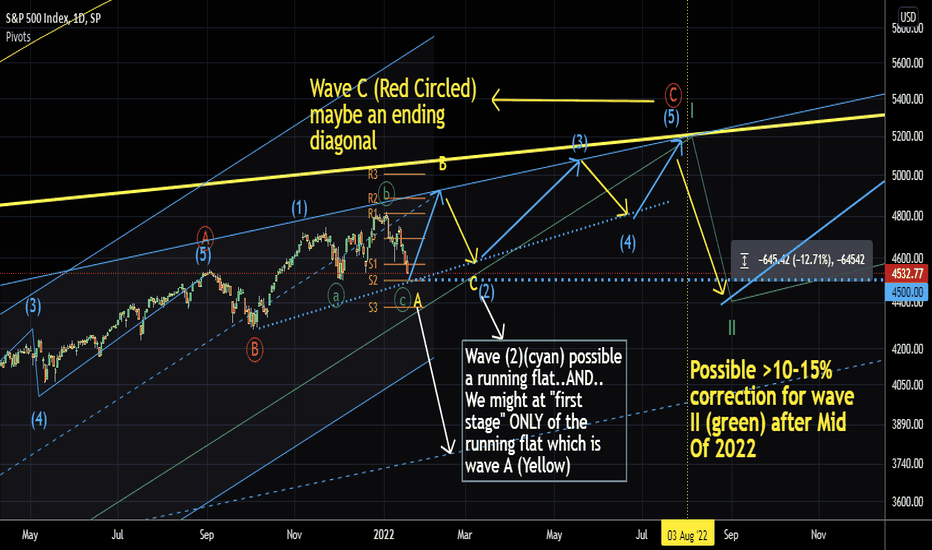

SPX may done " 10% correction" @ ≈4335. 24/Jan/22P/S : SPX. As I don't trade index nor do I need to "Hedge" against like those Fund Manages's "huge" long term stocks portfolio collection for the sake of "big draw down" .. I only "Follow-up" index Once a while as "a gauge" for "overall individuals stock" "healthy timing measurement" ..whether to "collect" or "dispose" individual stocks...

GOLD maybe a "bullish triangle " again. 24/Jan/22GOLD Seem like forming a "bullish triangle" pattern instead of expanding flat pattern post on last idea.. The sub-waves structure over highlighted Red area seem like a corrective "triangle structure"...AGAIN.. All "movement" seem like "waiting" for coming 27/Jan/2022 FOMC meeting...

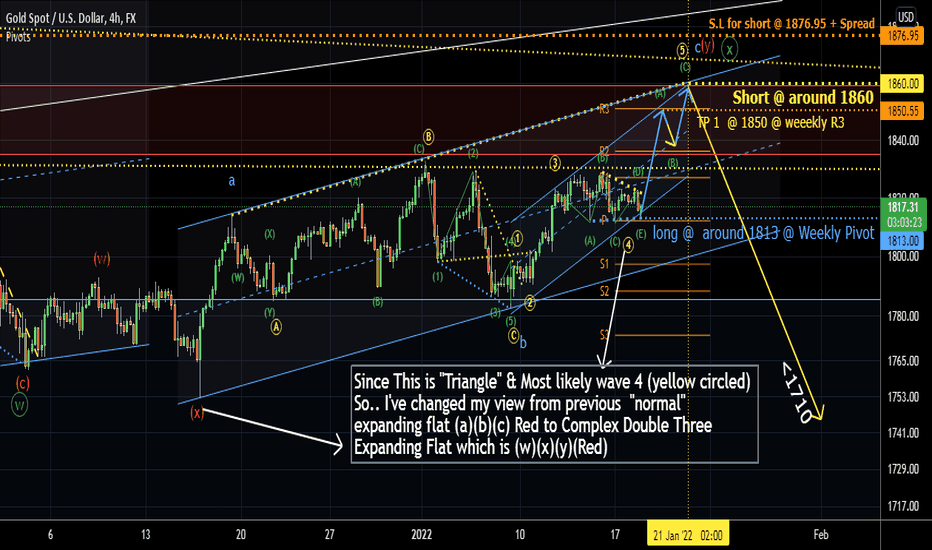

GOLD short term Elliott waves updated 18/Jan/22Gold. It seem like we're in "Bullish Triangle pattern now". AND most likely wave 4 (yellow circled). PLUS+++ a possible "stop hunt" on wave (E) (green) . So.. I've changed my view from previous "normal" expanding flat (a)(b)(c) Red to Complex Double Three Expanding Flat which is (w)(x)(y)(Red)

GOLD long TP ≈ 1840 first. Before Short to ≈ 1800. 17/Jan/221)On Charts : Charts consist of 3-Dimensions - The X-factor ( Time or Cycle ), The Y- factor ( Price Geometry ), AND The Z-factor ( The Speed ).. 2)On Elliot Wave / Market Structure : Unlike Textbook written rule : ALL Impulsive wave comprise of ONLY a-b-c sub-waves NOT 1,2,3,4,5 waves.. AND there is NO Truncated 5th wave BUT ONLY wrong wave counts...

GOLD short term updated 14/Jan/221)On Charts : Charts consist of 3-Dimensions - The X-factor ( Time or Cycle ), The Y- factor ( Price Geometry ), AND The Z-factor ( The Speed ).. 2)On Elliot Wave / Market Structure : Unlike Textbook written rule : ALL Impulsive wave comprise of ONLY a-b-c sub-waves NOT 1,2,3,4,5 waves.. AND there is NO Truncated 5th wave BUT ONLY wrong wave counts...

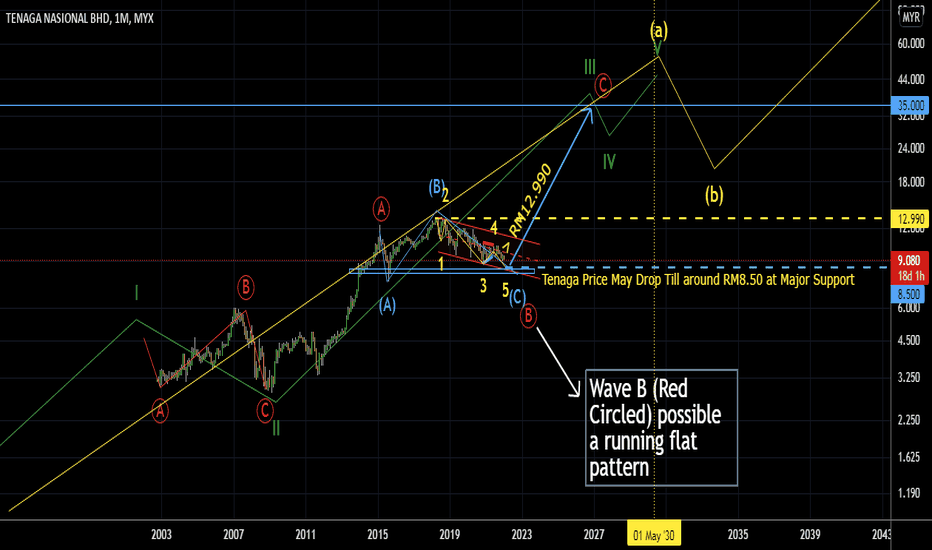

Tenaga Price may drop till around RM8.50. 13/Jan/221)On Charts : Charts consist of 3-Dimensions - The X-factor ( Time or Cycle ), The Y- factor ( Price Geometry ), AND The Z-factor ( The Speed ).. 2)On Elliot Wave / Market Structure : Unlike Textbook written rule : ALL Impulsive wave comprise of ONLY a-b-c sub-waves NOT 1,2,3,4,5 waves.. AND there is NO Truncated 5th wave BUT ONLY wrong wave counts...

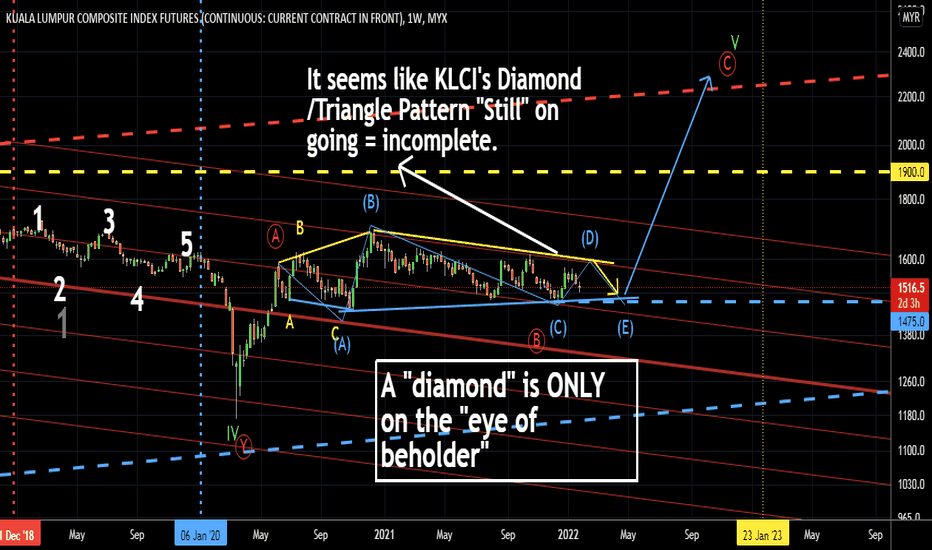

Malaysia Technology Index waves updated. 13/Jan/221)On Charts : Charts consist of 3-Dimensions - The X-factor ( Time or Cycle ), The Y- factor ( Price Geometry ), AND The Z-factor ( The Speed ).. 2)On Elliot Wave / Market Structure : Unlike Textbook written rule : ALL Impulsive wave comprise of ONLY a-b-c sub-waves NOT 1,2,3,4,5 waves.. AND there is NO Truncated 5th wave BUT ONLY wrong wave counts...

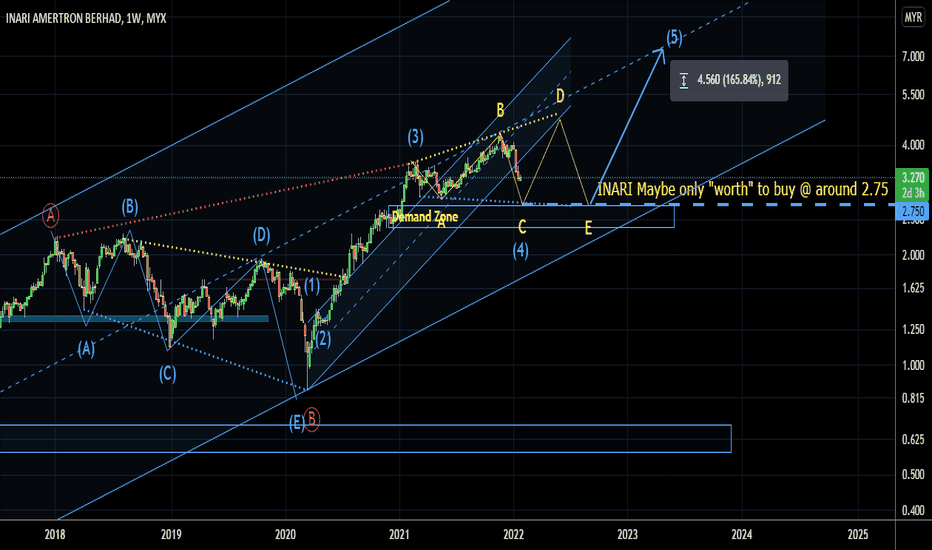

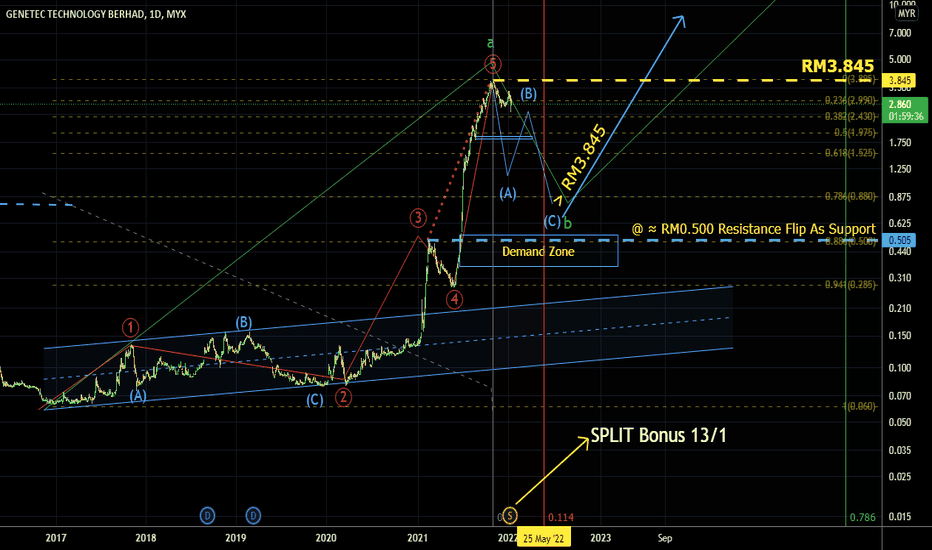

GENETEC possible drop to around RM0.50. 13/Jan/221)On Charts : Charts consist of 3-Dimensions - The X-factor ( Time or Cycle ), The Y- factor ( Price Geometry ), AND The Z-factor ( The Speed ).. 2)On Elliot Wave / Market Structure : Unlike Textbook written rule : ALL Impulsive wave comprise of ONLY a-b-c sub-waves NOT 1,2,3,4,5 waves.. AND there is NO Truncated 5th wave BUT ONLY wrong wave counts...

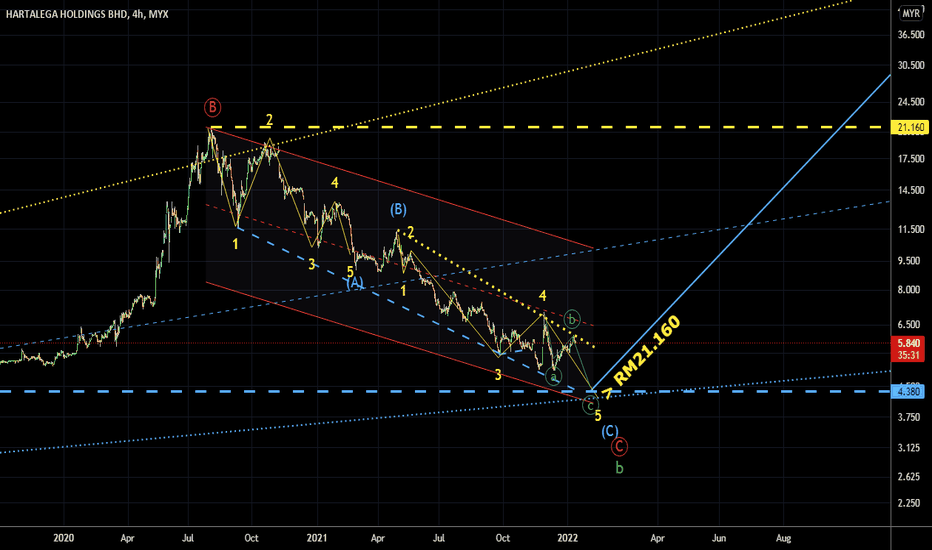

HARTA possible drop to around RM4.38.. 12/Jan/221)On Charts : Charts consist of 3-Dimensions - The X-factor ( Time or Cycle ), The Y- factor ( Price Geometry ), AND The Z-factor ( The Speed ).. 2)On Elliot Wave / Market Structure : Unlike Textbook written rule : ALL Impulsive wave comprise of ONLY a-b-c sub-waves NOT 1,2,3,4,5 waves.. AND there is NO Truncated 5th wave BUT ONLY wrong wave counts...

GOLD wave iv (cyan) an expanding flat pattern. Done! 11/1/22GOLD's wave iv (cyan/light blue) an expanding flat pattern. = 3-3-5 waves possible completed after "Stop Hunting"..Price otw to around 1860....

1)On Charts : Charts consist of 3-Dimensions - The X-factor ( Time or Cycle ), The Y- factor ( Price Geometry ), AND The Z-factor ( The Speed ).. 2)On Elliot Wave / Market Structure : Unlike Textbook written rule : ALL Impulsive wave comprise of ONLY a-b-c sub-waves NOT 1,2,3,4,5 waves.. AND there is NO Truncated 5th wave BUT ONLY wrong wave counts...