Xyz3dtrading

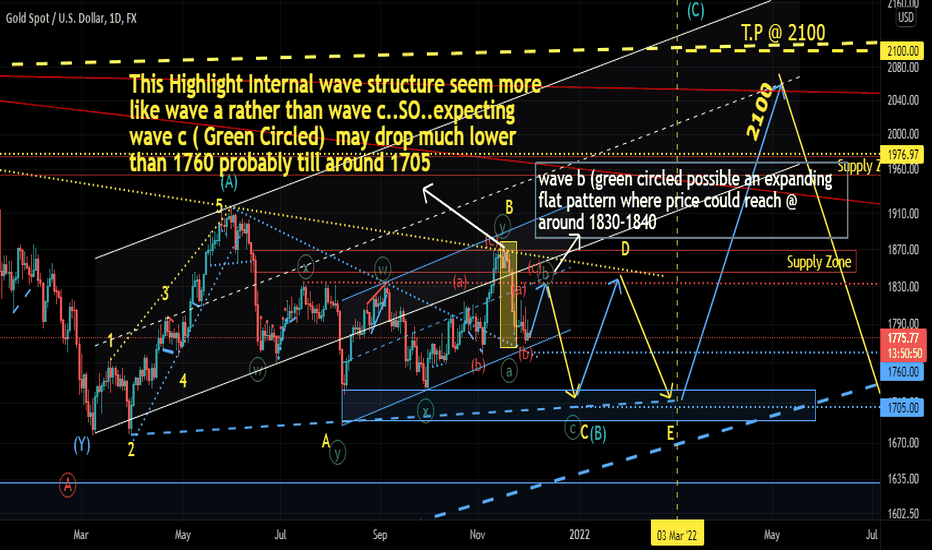

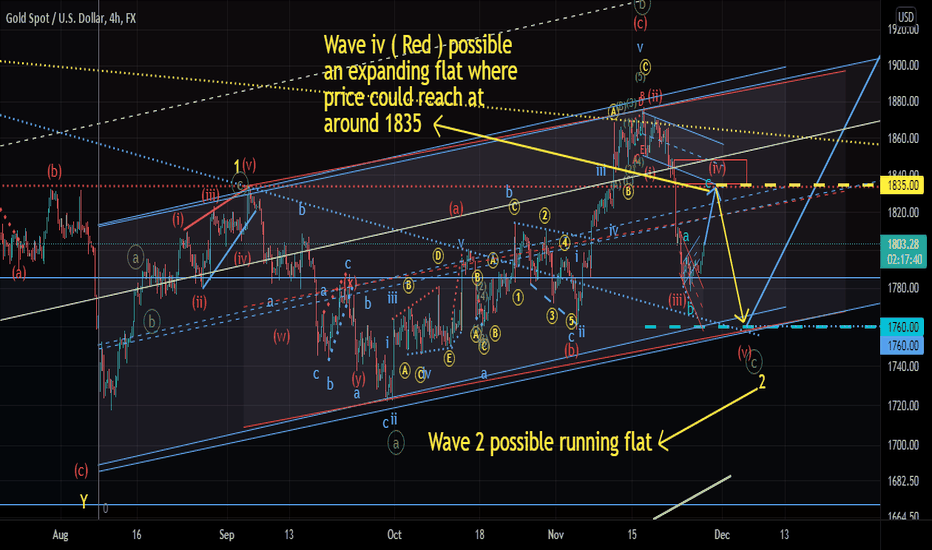

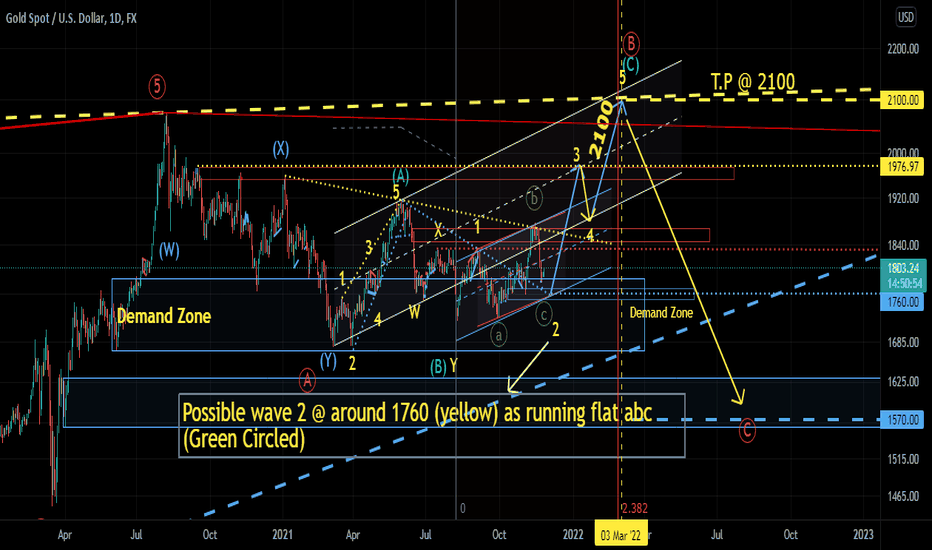

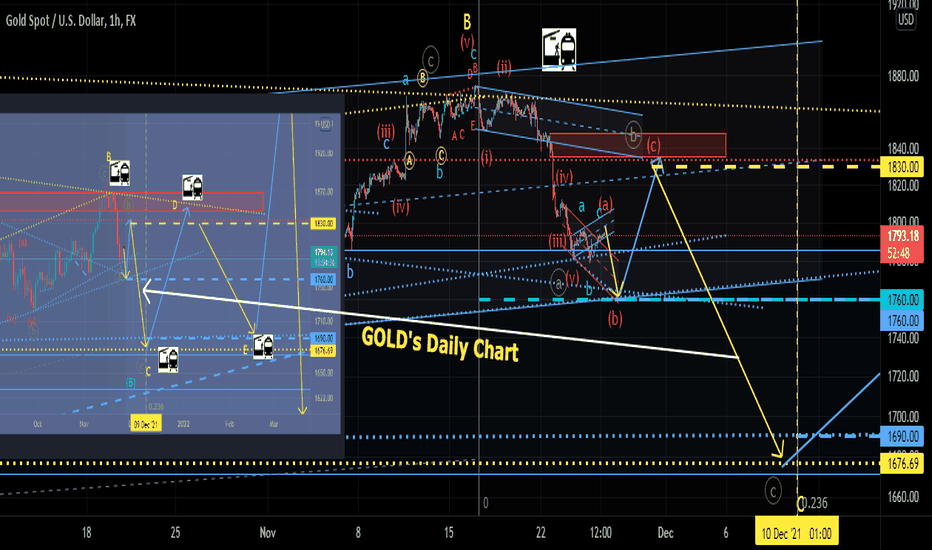

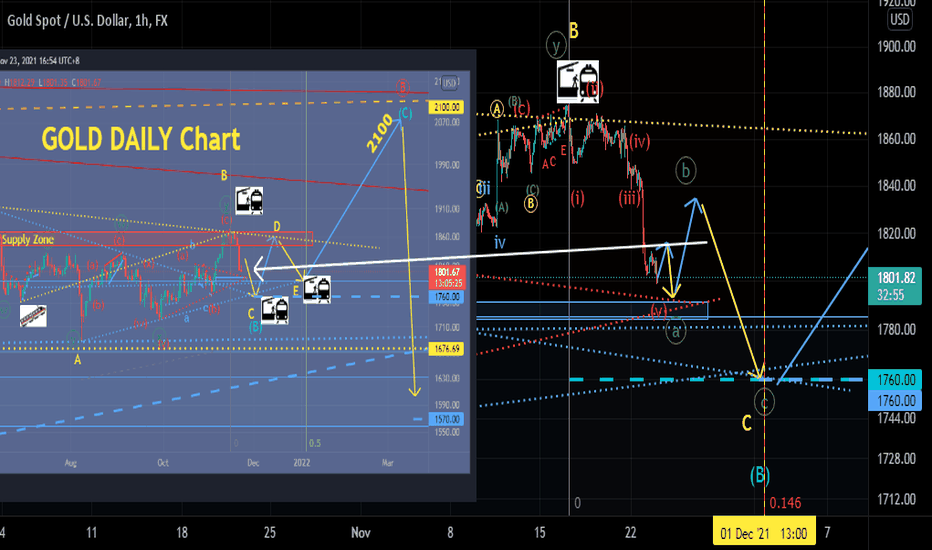

It's end. diagonal.Gold Multi Months Correction end soon!3/12/21GOLD downward internal wave structure since 16 Nov 2021 seem like an ending diagonal pattern which is "ONLY" happen on either wave 5 or wave c. As GOLD current price structure. it's is possible that now are @ the near end of wave 2 (Yellow) which is a running flat abc (green circled) pattern . So we're in "high probability" to end the multi months bearish correction of Gold before an impulsive move exceed above 1900-2000!

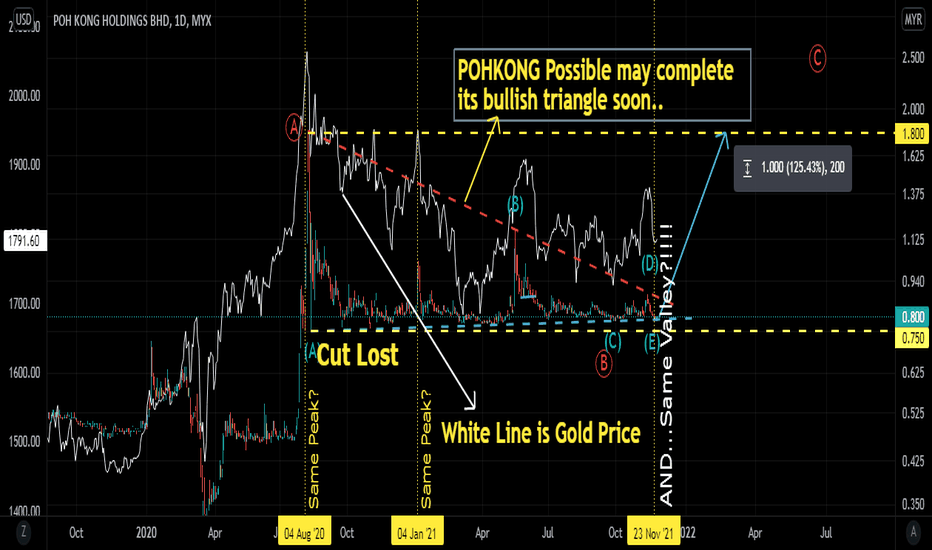

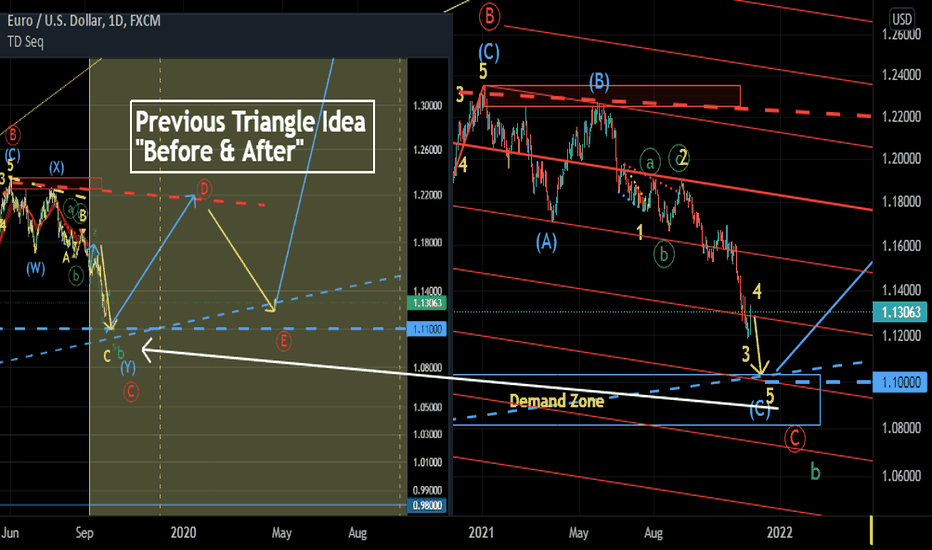

GOLD back to "triangle" ideas. 2/Dec/211)On Charts : Charts consist of 3-Dimensions - The X-factor ( Time or Cycle ), The Y- factor ( Price Geometry ), AND The Z-factor ( The Speed ).. 2)On Elliot Wave / Market Structure : Unlike Textbook written rule : ALL Impulsive wave comprise of ONLY a-b-c sub-waves NOT 1,2,3,4,5 waves.. AND there is NO Truncated 5th wave BUT ONLY wrong wave counts...

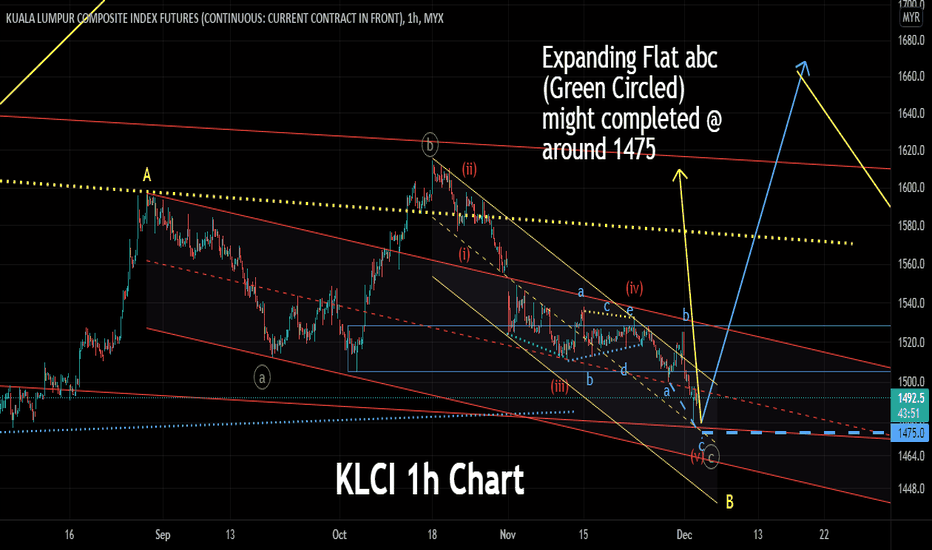

The Y/Price Factor of KLCI. Where Price meet Time. 2/Dec/21KLCI finally waiting for the Speed Z-factor = delta y / delta x ...to "move " price upward....

1)On Charts : Charts consist of 3-Dimensions - The X-factor ( Time or Cycle ), The Y- factor ( Price Geometry ), AND The Z-factor ( The Speed ).. 2)On Elliot Wave / Market Structure : Unlike Textbook written rule : ALL Impulsive wave comprise of ONLY a-b-c sub-waves NOT 1,2,3,4,5 waves.. AND there is NO Truncated 5th wave BUT ONLY wrong wave counts...

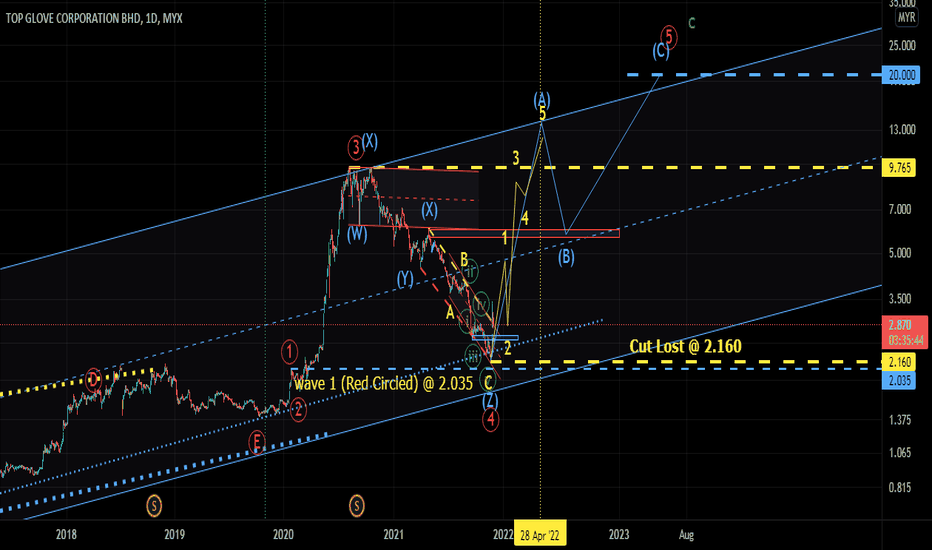

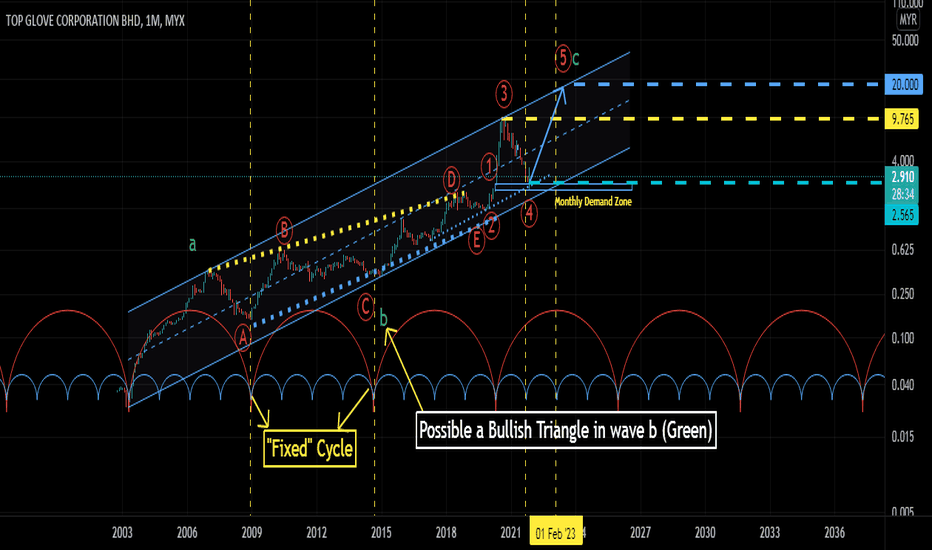

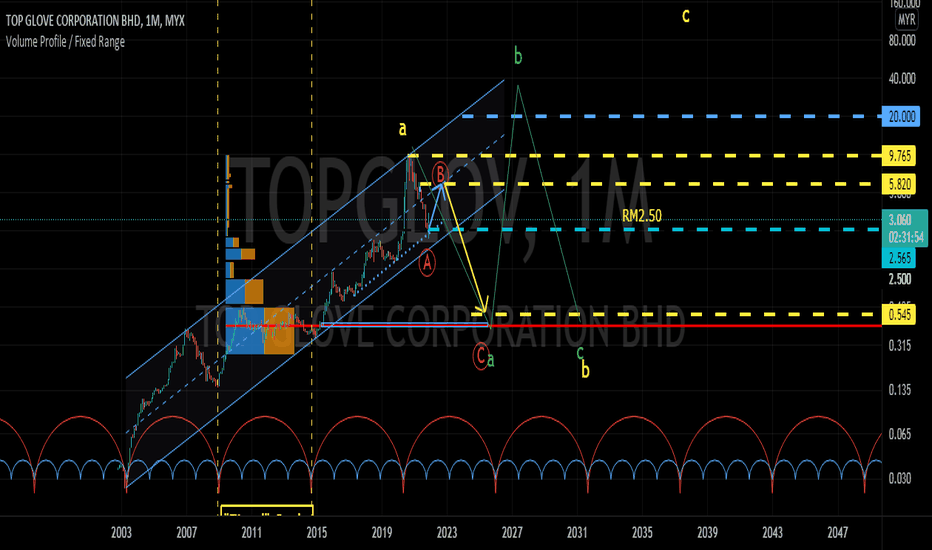

TOPGLOV short term updated 1/Dec/21It doesn't matter "omicron variant" gonna get "stronger" or "weaker" than "delta variant" Or Does it matter ASP ( Average Selling Price ) Gonna "cheaper". WHat do you think one of coming world worst inflation rate will make ASP go lower?...Glove's "Economic Cycle" Gonna to run and start the engine "making money"...

TOPGLOV "MAIN" view. 30/Nov/211)On Charts : Charts consist of 3-Dimensions - The X-factor ( Time or Cycle ), The Y- factor ( Price Geometry ), AND The Z-factor ( The Speed ).. 2)On Elliot Wave / Market Structure : Unlike Textbook written rule : ALL Impulsive wave comprise of ONLY a-b-c sub-waves NOT 1,2,3,4,5 waves.. AND there is NO Truncated 5th wave BUT ONLY wrong wave counts...

TOPGLOV alt view. Maybe ≈5.820 (only)..30/11/211)On Charts : Charts consist of 3-Dimensions - The X-factor ( Time or Cycle ), The Y- factor ( Price Geometry ), AND The Z-factor ( The Speed ).. 2)On Elliot Wave / Market Structure : Unlike Textbook written rule : ALL Impulsive wave comprise of ONLY a-b-c sub-waves NOT 1,2,3,4,5 waves.. AND there is NO Truncated 5th wave BUT ONLY wrong wave counts...

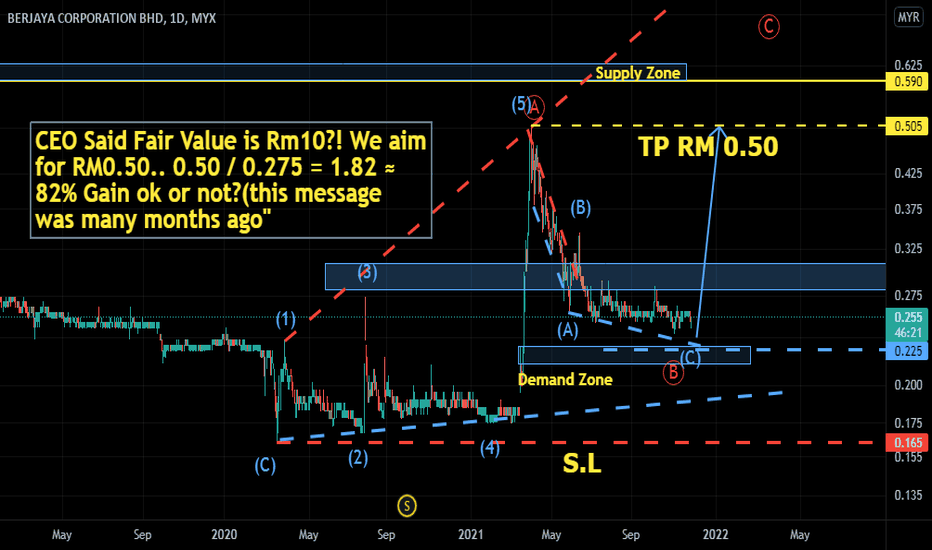

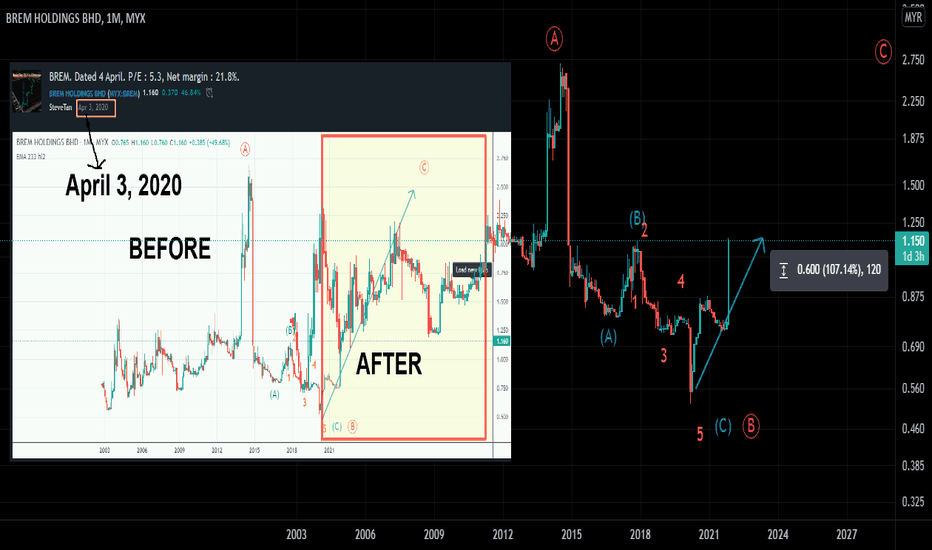

BREM. Missed the "Freight"? 29/Nov/21BREM have gained about 107% ( from RM0.560 till current price of RM1.160 ) since last post on April 3, 2020. News Announcement : They are going to "Private/ De-list " at the price of RM 1.20 ...

TOPGLOV Not every candlestick pattern "count". where/when.28/11/TopGlove.. Not every candlestick pattern "counts" Depend on where/when it was "found"...Is is a "valid" counts?. A "doji"? A "Pin Bar" A "Good" Morning Star? on not 1 minute but monthly chart..?..( Wait,, Not yet), wait until it closed monthly bar after 30/Nov/21

GOLD intraday outlook. 26/Nov/211)On Charts : Charts consist of 3-Dimensions - The X-factor ( Time or Cycle ), The Y- factor ( Price Geometry ), AND The Z-factor ( The Speed ).. 2)On Elliot Wave / Market Structure : Unlike Textbook written rule : ALL Impulsive wave comprise of ONLY a-b-c sub-waves NOT 1,2,3,4,5 waves.. AND there is NO Truncated 5th wave BUT ONLY wrong wave counts...

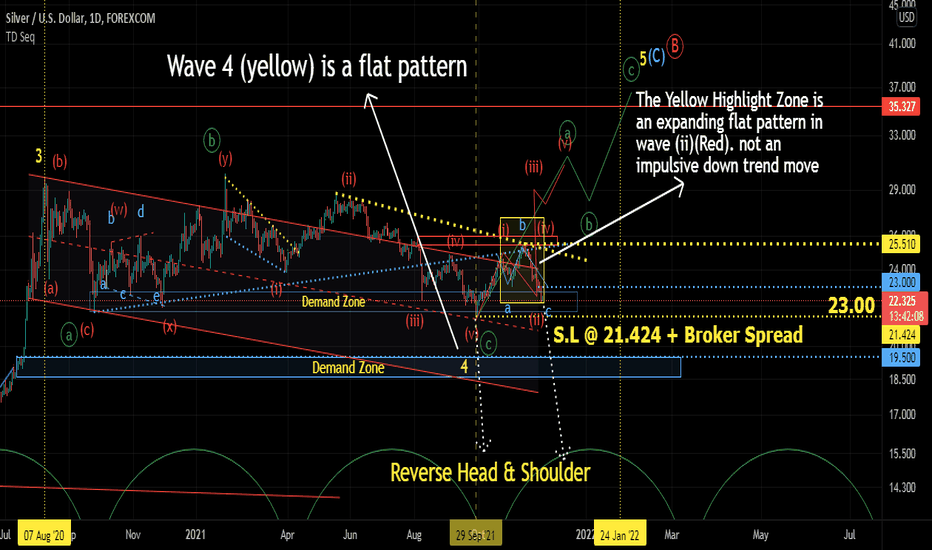

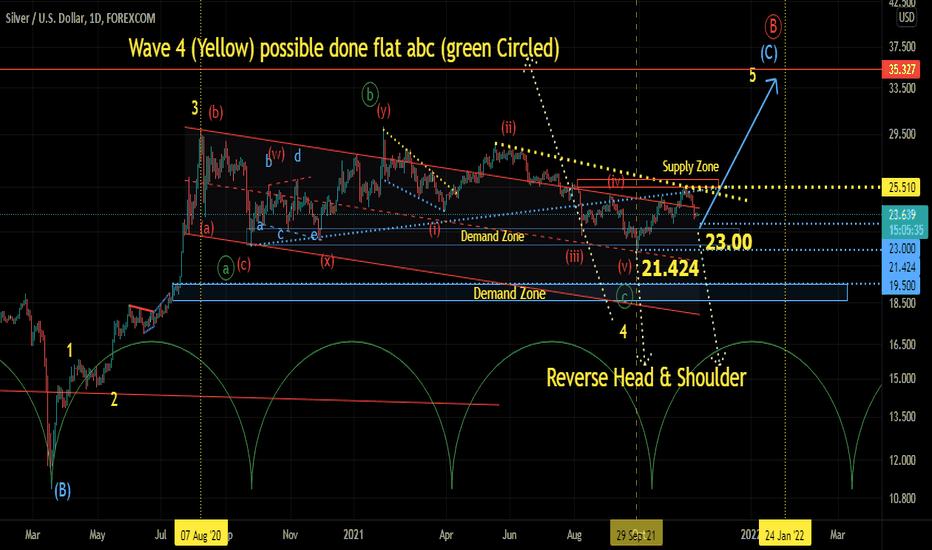

SILVER may done long term bearish correction. 26/Nov/21SILVER price possible completed its long term bearish ( slightly more than 1 year) correction @ 21.424 which is possible the head of reverse head and shoulder pattern. Price now could resume its impulsive up trend @ around 23.00 which is the "left" shoulder of the reverse head & shoulder pattern..

GOLD may dive much dipper than 1760. Maybe ≈ 1690. 25/11/21GOLD Price seem like "Just" formed wave a (Green Circled).. The wave (b)(Red) of expanding flat pattern (a)(b)(c)(Red) could reach at around 1760.. As wave a ( Green Circled) already closed to 1760. We might have a wave c (Green Circled) which might "divide down" to around 1690 at early December 2021...

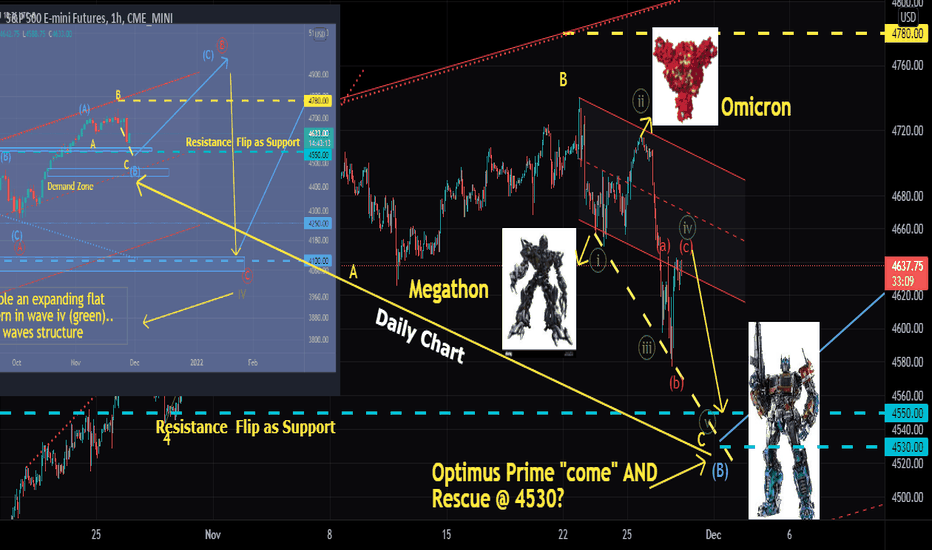

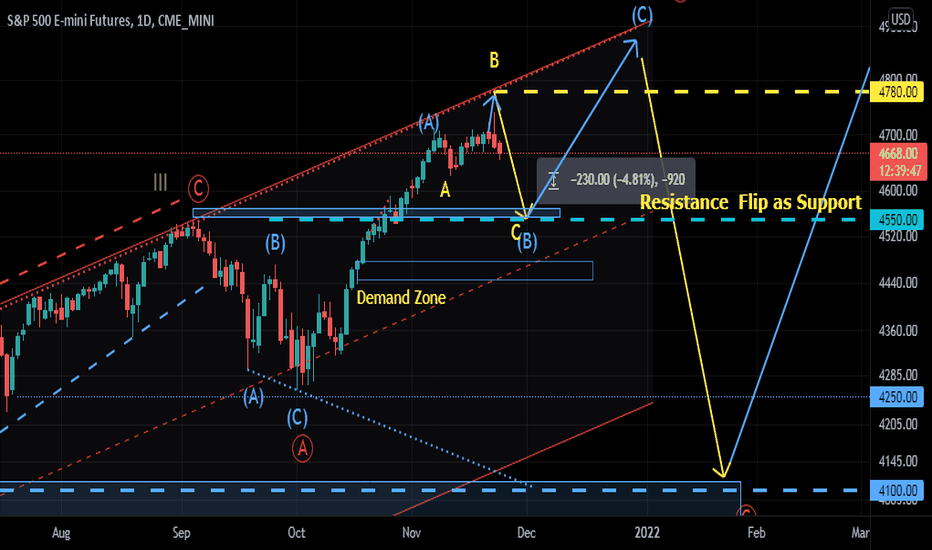

SPX may have pullback till around 45550. 23/11/211)On Charts : Charts consist of 3-Dimensions - The X-factor ( Time or Cycle ), The Y- factor ( Price Geometry ), AND The Z-factor ( The Speed ).. 2)On Elliot Wave / Market Structure : Unlike Textbook written rule : ALL Impulsive wave comprise of ONLY a-b-c sub-waves NOT 1,2,3,4,5 waves.. AND there is NO Truncated 5th wave BUT ONLY wrong wave counts...

GOLD Wave C (yellow) may reach at around 1760. 23/11/211)On Charts : Charts consist of 3-Dimensions - The X-factor ( Time or Cycle ), The Y- factor ( Price Geometry ), AND The Z-factor ( The Speed ).. 2)On Elliot Wave / Market Structure : Unlike Textbook written rule : ALL Impulsive wave comprise of ONLY a-b-c sub-waves NOT 1,2,3,4,5 waves.. AND there is NO Truncated 5th wave BUT ONLY wrong wave counts...