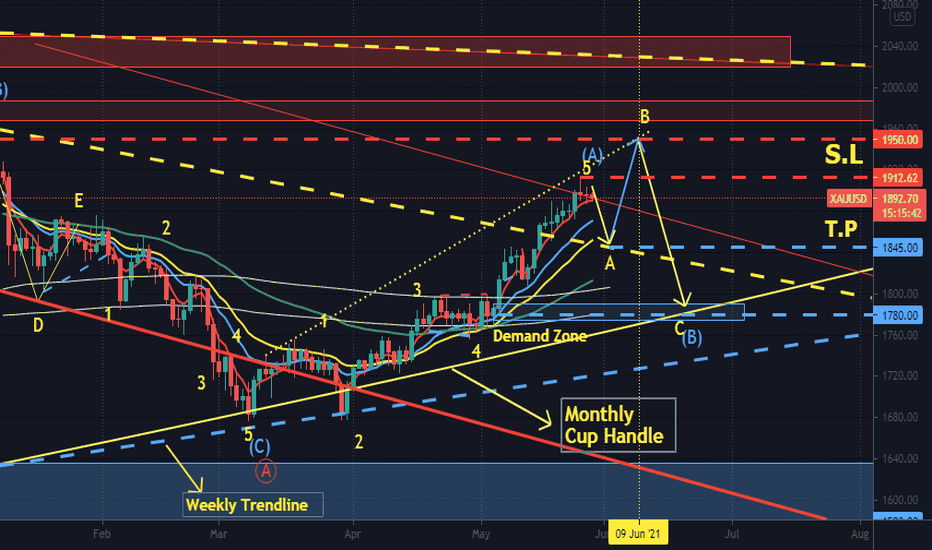

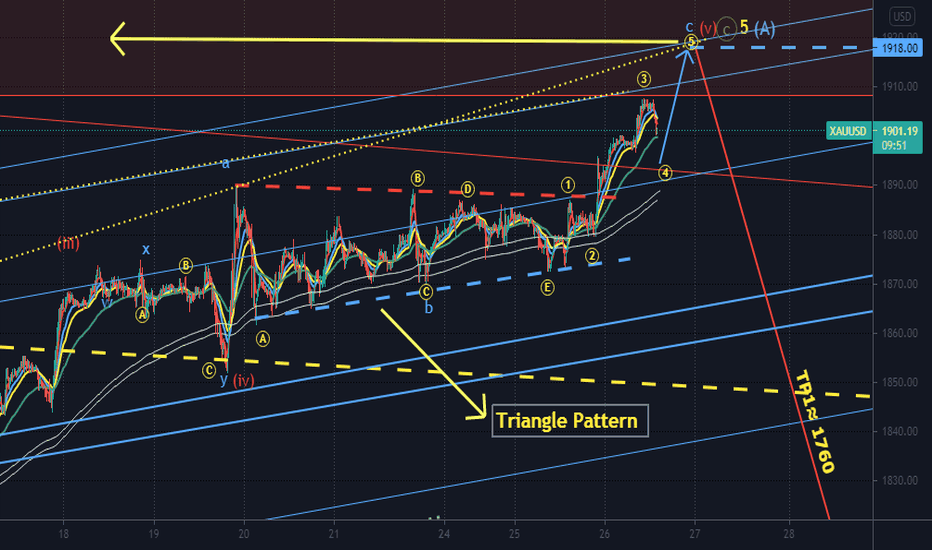

GOLD. Is Pullback done? Probably Not. 5 June 21Gold maybe is forming an expanding ending diagonal, Short at around 1900, ( where is an intersection of down trend line with pitchfork median line ). Stop Lost at 1910..Target Profit at around 1840 << where there is an intersection of 1) 4h 200 EMA 2)Pullback Zone of Long Term Down Trend line Breakout 3) Pitchfork lower support line..>>

Xyz3dtrading

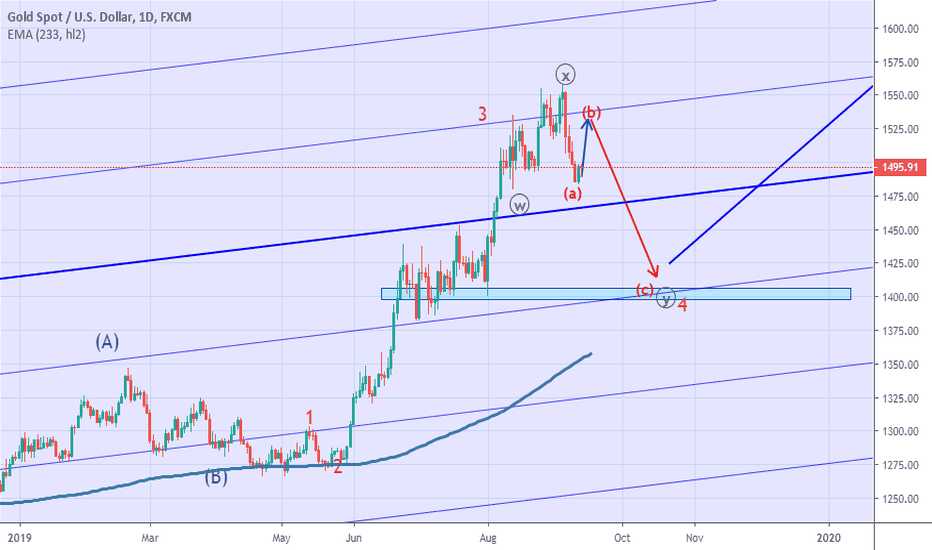

GOLD maybe an expanding flat pattern on wave (B)(cyan). 28/5/21GOLD possible is forming an expanding flat pattern on wave (B)(Cyan/light blue).. Maybe now we are at wave A (yellow) first leg down of the expanding flat pattern, where price could reach @ around 1845 ( which is support/resistance flip zone and the long term down trend lines breakout zone becoming support area ) .before resuming its uptrend @ around 1950 (major supply & Resistance zone ) for wave B (yellow) and finally last leg down for wave C (yellow) @ around 1780 which is daily 200 EMA deviation and demand zone..

xyz3dtrading

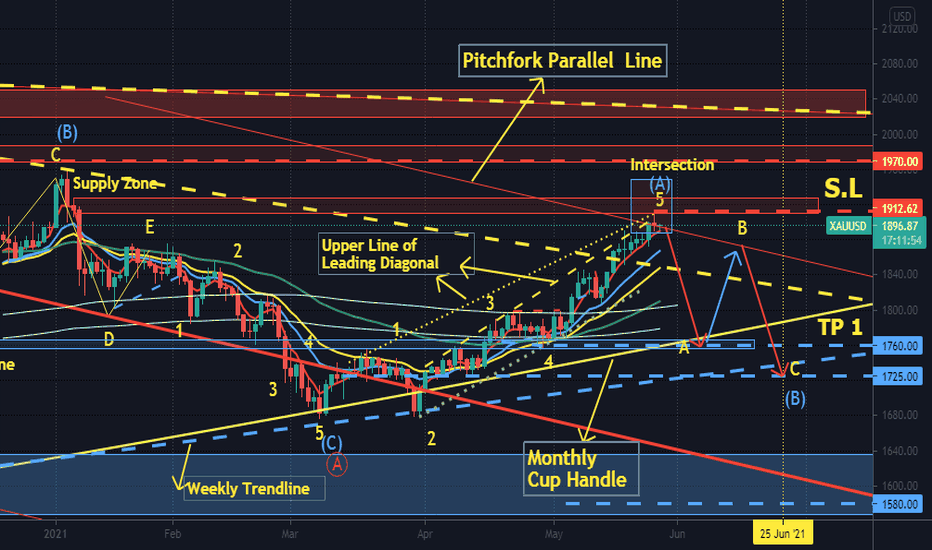

GOLD may completed leading diagonal pattern. 27/5/21Gold may completed its leading diagonal pattern. Price have reached the confluence area ( 2 Upper trend line of leading diagonal met with pitchfork parallel line PLUS the supply zone ).... Short at around 1902, TP1 @ around 1760. Stop lost at 1913..

xyz3dtrading